More on Leadership

Nir Zicherman

3 years ago

The Great Organizational Conundrum

Only two of the following three options can be achieved: consistency, availability, and partition tolerance

Someone told me that growing from 30 to 60 is the biggest adjustment for a team or business.

I remember thinking, That's random. Each company is unique. I've seen teams of all types confront the same issues during development periods. With new enterprises starting every year, we should be better at navigating growing difficulties.

As a team grows, its processes and systems break down, requiring reorganization or declining results. Why always? Why isn't there a perfect scaling model? Why hasn't that been found?

The Three Things Productive Organizations Must Have

Any company should be efficient and productive. Three items are needed:

First, it must verify that no two team members have conflicting information about the roadmap, strategy, or any input that could affect execution. Teamwork is required.

Second, it must ensure that everyone can receive the information they need from everyone else quickly, especially as teams become more specialized (an inevitability in a developing organization). It requires everyone's accessibility.

Third, it must ensure that the organization can operate efficiently even if a piece is unavailable. It's partition-tolerant.

From my experience with the many teams I've been on, invested in, or advised, achieving all three is nearly impossible. Why a perfect organization model cannot exist is clear after analysis.

The CAP Theorem: What is it?

Eric Brewer of Berkeley discovered the CAP Theorem, which argues that a distributed data storage should have three benefits. One can only have two at once.

The three benefits are consistency, availability, and partition tolerance, which implies that even if part of the system is offline, the remainder continues to work.

This notion is usually applied to computer science, but I've realized it's also true for human organizations. In a post-COVID world, many organizations are hiring non-co-located staff as they grow. CAP Theorem is more important than ever. Growing teams sometimes think they can develop ways to bypass this law, dooming themselves to a less-than-optimal team dynamic. They should adopt CAP to maximize productivity.

Path 1: Consistency and availability equal no tolerance for partitions

Let's imagine you want your team to always be in sync (i.e., for someone to be the source of truth for the latest information) and to be able to share information with each other. Only division into domains will do.

Numerous developing organizations do this, especially after the early stage (say, 30 people) when everyone may wear many hats and be aware of all the moving elements. After a certain point, it's tougher to keep generalists aligned than to divide them into specialized tasks.

In a specialized, segmented team, leaders optimize consistency and availability (i.e. every function is up-to-speed on the latest strategy, no one is out of sync, and everyone is able to unblock and inform everyone else).

Partition tolerance suffers. If any component of the organization breaks down (someone goes on vacation, quits, underperforms, or Gmail or Slack goes down), productivity stops. There's no way to give the team stability, availability, and smooth operation during a hiccup.

Path 2: Partition Tolerance and Availability = No Consistency

Some businesses avoid relying too heavily on any one person or sub-team by maximizing availability and partition tolerance (the organization continues to function as a whole even if particular components fail). Only redundancy can do that. Instead of specializing each member, the team spreads expertise so people can work in parallel. I switched from Path 1 to Path 2 because I realized too much reliance on one person is risky.

What happens after redundancy? Unreliable. The more people may run independently and in parallel, the less anyone can be the truth. Lack of alignment or updated information can lead to people executing slightly different strategies. So, resources are squandered on the wrong work.

Path 3: Partition and Consistency "Tolerance" equates to "absence"

The third, least-used path stresses partition tolerance and consistency (meaning answers are always correct and up-to-date). In this organizational style, it's most critical to maintain the system operating and keep everyone aligned. No one is allowed to read anything without an assurance that it's up-to-date (i.e. there’s no availability).

Always short-lived. In my experience, a business that prioritizes quality and scalability over speedy information transmission can get bogged down in heavy processes that hinder production. Large-scale, this is unsustainable.

Accepting CAP

When two puzzle pieces fit, the third won't. I've watched developing teams try to tackle these difficulties, only to find, as their ancestors did, that they can never be entirely solved. Idealized solutions fail in reality, causing lost effort, confusion, and lower production.

As teams develop and change, they should embrace CAP, acknowledge there is a limit to productivity in a scaling business, and choose the best two-out-of-three path.

Jano le Roux

3 years ago

Quit worrying about Twitter: Elon moves quickly before refining

Elon's rides start rough, but then...

Elon Musk has never been so hated.

They don’t get Elon.

He began using PayPal in this manner.

He began with SpaceX in a similar manner.

He began with Tesla in this manner.

Disruptive.

Elon had rocky starts. His creativity requires it. Just like writing a first draft.

His fastest way to find the way is to avoid it.

PayPal's pricey launch

PayPal was a 1999 business flop.

They were considered insane.

Elon and his co-founders had big plans for PayPal. They adopted the popular philosophy of the time, exchanging short-term profit for growth, and pulled off a miracle just before the bubble burst.

PayPal was created as a dollar alternative. Original PayPal software allowed PalmPilot money transfers. Unfortunately, there weren't enough PalmPilot users.

Since everyone had email, the company emailed payments. Costs rose faster than sales.

The startup wanted to get a million subscribers by paying $10 to sign up and $10 for each referral. Elon thought the price was fair because PayPal made money by charging transaction fees. They needed to make money quickly.

A Wall Street Journal article valuing PayPal at $500 million attracted investors. The dot-com bubble burst soon after they rushed to get financing.

Musk and his partners sold PayPal to eBay for $1.5 billion in 2002. Musk's most successful company was PayPal.

SpaceX's start-up error

Elon and his friends bought a reconditioned ICBM in Russia in 2002.

He planned to invest much of his wealth in a stunt to promote NASA and space travel.

Many called Elon crazy.

The goal was to buy a cheap Russian rocket to launch mice or plants to Mars and return them. He thought SpaceX would revive global space interest. After a bad meeting in Moscow, Elon decided to build his own rockets to undercut launch contracts.

Then SpaceX was founded.

Elon’s plan was harder than expected.

Explosions followed explosions.

Millions lost on cargo.

Millions lost on the rockets.

Investors thought Elon was crazy, but he wasn't.

NASA's biggest competitor became SpaceX. NASA hired SpaceX to handle many of its missions.

Tesla's shaky beginning

Tesla began shakily.

Clients detested their roadster.

They continued to miss deadlines.

Lotus would handle the car while Tesla focused on the EV component, easing Tesla's entry. The business experienced elegance creep. Modifying specific parts kept the car from getting worse.

Cost overruns, delays, and other factors changed the Elise-like car's appearance. Only 7% of the Tesla Roadster's parts matched its Lotus twin.

Tesla was about to die.

Elon saved the mess as CEO.

He fired 25% of the workforce to reduce costs.

Elon Musk transformed Tesla into the world's most valuable automaker by running it like a startup.

Tesla hasn't spent a dime on advertising. They let the media do the talking by investing in innovation.

Elon sheds. Elon tries. Elon learns. Elon refines.

Twitter doesn't worry me.

The media is shocked. I’m not.

This is just Elon being Elon.

Elon makes lean.

Elon tries new things.

Elon listens to feedback.

Elon refines.

Besides Twitter will always be Twitter.

Joe Procopio

3 years ago

Provide a product roadmap that can withstand startup velocities

This is how to build a car while driving.

Building a high-growth startup is compared to building a car while it's speeding down the highway.

How to plan without going crazy? Or, without losing team, board, and investor buy-in?

I just delivered our company's product roadmap for the rest of the year. Complete. Thorough. Page-long. I'm optimistic about its chances of surviving as everything around us changes, from internal priorities to the global economy.

It's tricky. This isn't the first time I've created a startup roadmap. I didn't invent a document. It took time to deliver a document that will be relevant for months.

Goals matter.

Although they never change, goals are rarely understood.

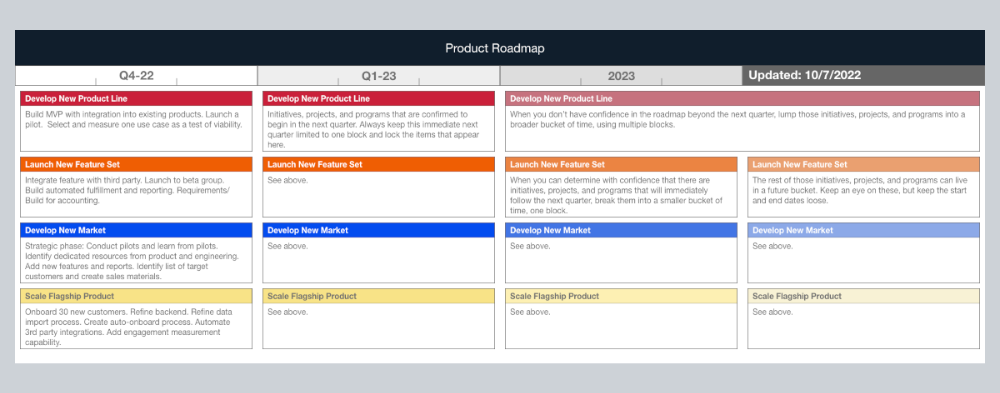

This is the third in a series about a startup's unique roadmapping needs. Velocity is the intensity at which a startup must produce to survive.

A high-growth startup moves at breakneck speed, which I alluded to when I said priorities and economic factors can change daily or weekly.

At that speed, a startup's roadmap must be flexible, bend but not break, and be brief and to the point. I can't tell you how many startups and large companies develop a product roadmap every quarter and then tuck it away.

Big, wealthy companies can do this. It's suicide for a startup.

The drawer thing happens because startup product roadmaps are often valid for a short time. The roadmap is a random list of features prioritized by different company factions and unrelated to company goals.

It's not because the goals changed that a roadmap is shelved or ignored. Because the company's goals were never communicated or documented in the context of its product.

In the previous post, I discussed how to turn company goals into a product roadmap. In this post, I'll show you how to make a one-page startup roadmap.

In a future post, I'll show you how to follow this roadmap. This roadmap helps you track company goals, something a roadmap must do.

Be vague for growth, but direct for execution.

Here's my plan. The real one has more entries and more content in each.

Let's discuss smaller boxes.

Product developers and engineers know that the further out they predict, the more wrong they'll be. When developing the product roadmap, this rule is ignored. Then it bites us three, six, or nine months later when we haven't even started.

Why do we put everything in a product roadmap like a project plan?

Yes, I know. We use it when the product roadmap isn't goal-based.

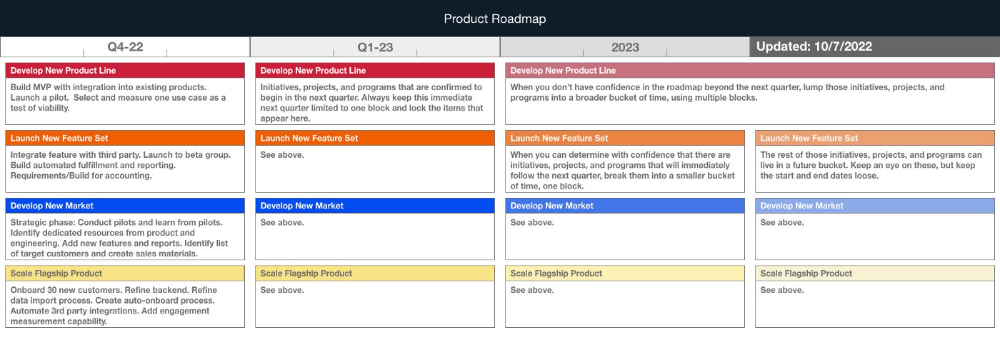

A goal-based roadmap begins with a document that outlines each goal's idea, execution, growth, and refinement.

Once the goals are broken down into epics, initiatives, projects, and programs, only the idea and execution phases should be modeled. Any goal growth or refinement items should be vague and loosely mapped.

Why? First, any idea or execution-phase goal will result in growth initiatives that are unimaginable today. Second, internal priorities and external factors will change, but the goals won't. Locking items into calendar slots reduces flexibility and forces deviation from the single source of truth.

No soothsayers. Predicting the future is pointless; just prepare.

A map is useless if you don't know where you're going.

As we speed down the road, the car and the road will change. Goals define the destination.

This quarter and next quarter's roadmap should be set. After that, you should track destination milestones, not how to get there.

When you do that, even the most critical investors will understand the roadmap and buy in. When you track progress at the end of the quarter and revise your roadmap, the destination won't change.

You might also like

Frederick M. Hess

2 years ago

The Lessons of the Last Two Decades for Education Reform

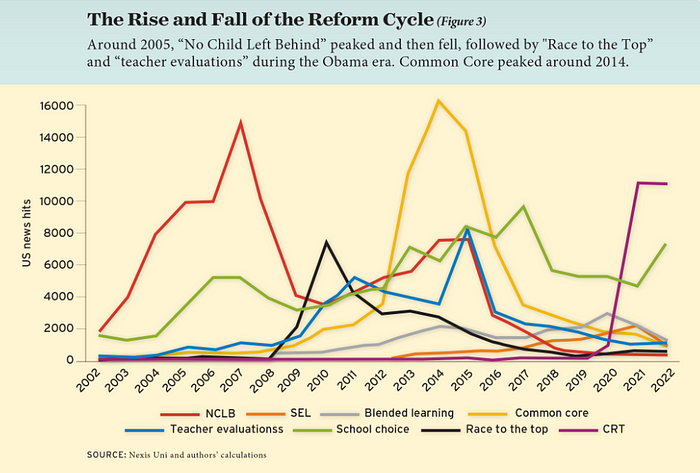

My colleague Ilana Ovental and I examined pandemic media coverage of education at the end of last year. That analysis examined coverage changes. We tracked K-12 topic attention over the previous two decades using Lexis Nexis. See the results here.

I was struck by how cleanly the past two decades can be divided up into three (or three and a half) eras of school reform—a framing that can help us comprehend where we are and how we got here. In a time when epidemic, political unrest, frenetic news cycles, and culture war can make six months seem like a lifetime, it's worth pausing for context.

If you look at the peaks in the above graph, the 21st century looks to be divided into periods. The decade-long rise and fall of No Child Left Behind began during the Bush administration. In a few years, NCLB became the dominant K-12 framework. Advocates and financiers discussed achievement gaps and measured success with AYP.

NCLB collapsed under the weight of rigorous testing, high-stakes accountability, and a race to the bottom by the Obama years. Obama's Race to the Top garnered attention, but its most controversial component, the Common Core State Standards, rose quickly.

Academic standards replaced assessment and accountability. New math, fiction, and standards were hotly debated. Reformers and funders chanted worldwide benchmarking and systems interoperability.

We went from federally driven testing and accountability to government encouraged/subsidized/mandated (pick your verb) reading and math standardization. Last year, Checker Finn and I wrote The End of School Reform? The 2010s populist wave thwarted these objectives. The Tea Party, Occupy Wall Street, Black Lives Matter, and Trump/MAGA all attacked established institutions.

Consequently, once the Common Core fell, no alternative program emerged. Instead, school choice—the policy most aligned with populist suspicion of institutional power—reached a half-peak. This was less a case of choice erupting to prominence than of continuous growth in a vacuum. Even with Betsy DeVos' determined, controversial efforts, school choice received only half the media attention that NCLB and Common Core did at their heights.

Recently, culture clash-fueled attention to race-based curriculum and pedagogy has exploded (all playing out under the banner of critical race theory). This third, culture war-driven wave may not last as long as the other waves.

Even though I don't understand it, the move from slow-building policy debate to fast cultural confrontation over two decades is notable. I don't know if it's cyclical or permanent, or if it's about schooling, media, public discourse, or all three.

One final thought: After doing this work for decades, I've noticed how smoothly advocacy groups, associations, and other activists adapt to the zeitgeist. In 2007, mission statements focused on accomplishment disparities. Five years later, they promoted standardization. Language has changed again.

Part of this is unavoidable and healthy. Chasing currents can also make companies look unprincipled, promote scepticism, and keep them spinning the wheel. Bearing in mind that these tides ebb and flow may give educators, leaders, and activists more confidence to hold onto their values and pause when they feel compelled to follow the crowd.

Trevor Stark

3 years ago

Economics is complete nonsense.

Mainstream economics haven't noticed.

What come to mind when I say the word "economics"?

Probably GDP, unemployment, and inflation.

If you've ever watched the news or listened to an economist, they'll use data like these to defend a political goal.

The issue is that these statistics are total bunk.

I'm being provocative, but I mean it:

The economy is not measured by GDP.

How many people are unemployed is not counted in the unemployment rate.

Inflation is not measured by the CPI.

All orthodox economists' major economic statistics are either wrong or falsified.

Government institutions create all these stats. The administration wants to reassure citizens the economy is doing well.

GDP does not reflect economic expansion.

GDP measures a country's economic size and growth. It’s calculated by the BEA, a government agency.

The US has the world's largest (self-reported) GDP, growing 2-3% annually.

If GDP rises, the economy is healthy, say economists.

Why is the GDP flawed?

GDP measures a country's yearly spending.

The government may adjust this to make the economy look good.

GDP = C + G + I + NX

C = Consumer Spending

G = Government Spending

I = Investments (Equipment, inventories, housing, etc.)

NX = Exports minus Imports

GDP is a country's annual spending.

The government can print money to boost GDP. The government has a motive to increase and manage GDP.

Because government expenditure is part of GDP, printing money and spending it on anything will raise GDP.

They've done this. Since 1950, US government spending has grown 8% annually, faster than GDP.

In 2022, government spending accounted for 44% of GDP. It's the highest since WWII. In 1790-1910, it was 3% of GDP.

Who cares?

The economy isn't only spending. Focus on citizens' purchasing power or quality of life.

Since GDP just measures spending, the government can print money to boost GDP.

Even if Americans are poorer than last year, economists can say GDP is up and everything is fine.

How many people are unemployed is not counted in the unemployment rate.

The unemployment rate measures a country's labor market. If unemployment is high, people aren't doing well economically.

The BLS estimates the (self-reported) unemployment rate as 3-4%.

Why is the unemployment rate so high?

The US government surveys 100k persons to measure unemployment. They extrapolate this data for the country.

They come into 3 categories:

Employed

People with jobs are employed … duh.

Unemployed

People who are “jobless, looking for a job, and available for work” are unemployed

Not in the labor force

The “labor force” is the employed + the unemployed.

The unemployment rate is the percentage of unemployed workers.

Problem is unemployed definition. You must actively seek work to be considered unemployed.

You're no longer unemployed if you haven't interviewed in 4 weeks.

This shit makes no goddamn sense.

Why does this matter?

You can't interview if there are no positions available. You're no longer unemployed after 4 weeks.

In 1994, the BLS redefined "unemployed" to exclude discouraged workers.

If you haven't interviewed in 4 weeks, you're no longer counted in the unemployment rate.

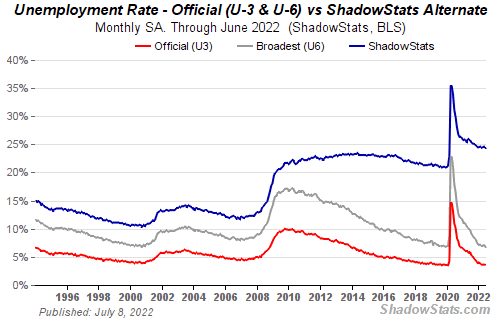

If unemployment were measured by total unemployed, it would be 25%.

Because the government wants to keep the unemployment rate low, they modify the definition.

If every US resident was unemployed and had no job interviews, economists would declare 0% unemployment. Excellent!

Inflation is not measured by the CPI.

The BLS measures CPI. This month was the highest since 1981.

CPI measures the cost of a basket of products across time. Food, energy, shelter, and clothes are included.

A 9.1% CPI means the basket of items is 9.1% more expensive.

What is the CPI problem?

Here's a more detailed explanation of CPI's flaws.

In summary, CPI is manipulated to be understated.

Housing costs are understated to manipulate CPI. Housing accounts for 33% of the CPI because it's the biggest expense for most people.

This signifies it's the biggest CPI weight.

Rather than using actual house prices, the Bureau of Labor Statistics essentially makes shit up. You can read more about the process here.

Surprise! It’s bullshit

The BLS stated Shelter's price rose 5.5% this month.

House prices are up 11-21%. (Source 1, Source 2, Source 3)

Rents are up 14-26%. (Source 1, Source 2)

Why is this important?

If CPI included housing prices, it would be 12-15 percent this month, not 9.1 percent.

9% inflation is nuts. Your money's value halves every 7 years at 9% inflation.

Worse is 15% inflation. Your money halves every 4 years at 15% inflation.

If everyone realized they needed to double their wage every 4-5 years to stay wealthy, there would be riots.

Inflation drains our money's value so the government can keep printing it.

The Solution

Most individuals know the existing system doesn't work, but can't explain why.

People work hard yet lag behind. The government lies about the economy's data.

In reality:

GDP has been down since 2008

25% of Americans are unemployed

Inflation is actually 15%

People might join together to vote out kleptocratic politicians if they knew the reality.

Having reliable economic data is the first step.

People can't understand the situation without sufficient information. Instead of immigrants or billionaires, people would blame liar politicians.

Here’s the vision:

A decentralized, transparent, and global dashboard that tracks economic data like GDP, unemployment, and inflation for every country on Earth.

Government incentives influence economic statistics.

ShadowStats has already started this effort, but the calculations must be transparent, decentralized, and global to be effective.

If interested, email me at trevorstark02@gmail.com.

Here are some links to further your research:

Boris Müller

3 years ago

Why Do Websites Have the Same Design?

My kids redesigned the internet because it lacks inventiveness.

Internet today is bland. Everything is generic: fonts, layouts, pages, and visual language. Microtypography is messy.

Web design today seems dictated by technical and ideological constraints rather than creativity and ideas. Text and graphics are in containers on every page. All design is assumed.

Ironically, web technologies can design a lot. We can execute most designs. We make shocking, evocative websites. Experimental typography, generating graphics, and interactive experiences are possible.

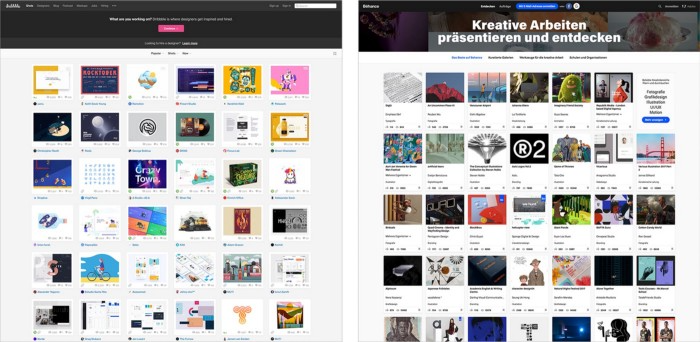

Even designer websites use containers in containers. Dribbble and Behance, the two most popular creative websites, are boring. Lead image.

How did this happen?

Several reasons. WordPress and other blogging platforms use templates. These frameworks build web pages by combining graphics, headlines, body content, and videos. Not designs, templates. These rules combine related data types. These platforms don't let users customize pages beyond the template. You filled the template.

Templates are content-neutral. Thus, the issue.

Form should reflect and shape content, which is a design principle. Separating them produces content containers. Templates have no design value.

One of the fundamental principles of design is a deep and meaningful connection between form and content.

Web design lacks imagination for many reasons. Most are pragmatic and economic. Page design takes time. Large websites lack the resources to create a page from scratch due to the speed of internet news and the frequency of new items. HTML, JavaScript, and CSS continue to challenge web designers. Web design can't match desktop publishing's straightforward operations.

Designers may also be lazy. Mobile-first, generic, framework-driven development tends to ignore web page visual and contextual integrity.

How can we overcome this? How might expressive and avant-garde websites look today?

Rediscovering the past helps design the future.

'90s-era web design

At the University of the Arts Bremen's research and development group, I created my first website 23 years ago. Web design was trendy. Young web. Pages inspired me.

We struggled with HTML in the mid-1990s. Arial, Times, and Verdana were the only web-safe fonts. Anything exciting required table layouts, monospaced fonts, or GIFs. HTML was originally content-driven, thus we had to work against it to create a page.

Experimental typography was booming. Designers challenged the established quo from Jan Tschichold's Die Neue Typographie in the twenties to April Greiman's computer-driven layouts in the eighties. By the mid-1990s, an uncommon confluence of technological and cultural breakthroughs enabled radical graphic design. Irma Boom, David Carson, Paula Scher, Neville Brody, and others showed it.

Early web pages were dull compared to graphic design's aesthetic explosion. The Web Design Museum shows this.

Nobody knew how to conduct browser-based graphic design. Web page design was undefined. No standards. No CMS (nearly), CSS, JS, video, animation.

Now is as good a time as any to challenge the internet’s visual conformity.

In 2018, everything is browser-based. Massive layouts to micro-typography, animation, and video. How do we use these great possibilities? Containerized containers. JavaScript-contaminated mobile-first pages. Visually uniform templates. Web design 23 years later would disappoint my younger self.

Our imagination, not technology, restricts web design. We're too conformist to aesthetics, economics, and expectations.

Crisis generates opportunity. Challenge online visual conformity now. I'm too old and bourgeois to develop a radical, experimental, and cutting-edge website. I can ask my students.

I taught web design at the Potsdam Interface Design Programme in 2017. Each team has to redesign a website. Create expressive, inventive visual experiences on the browser. Create with contemporary web technologies. Avoid usability, readability, and flexibility concerns. Act. Ignore Erwartungskonformität.

The class outcome pleased me. This overview page shows all results. Four diverse projects address the challenge.

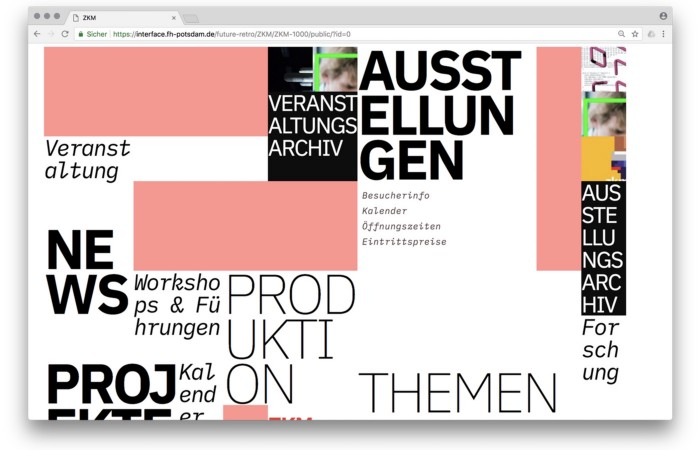

1. ZKM by Frederic Haase and Jonas Köpfer

Frederic and Jonas began their experiments on the ZKM website. The ZKM is Germany's leading media art exhibition location, but its website remains conventional. It's useful but not avant-garde like the shows' art.

Frederic and Jonas designed the ZKM site's concept, aesthetic language, and technical configuration to reflect the museum's progressive approach. A generative design engine generates new layouts for each page load.

ZKM redesign.

2. Streem by Daria Thies, Bela Kurek, and Lucas Vogel

Street art magazine Streem. It promotes new artists and societal topics. Streem includes artwork, painting, photography, design, writing, and journalism. Daria, Bela, and Lucas used these influences to develop a conceptual metropolis. They designed four neighborhoods to reflect magazine sections for their prototype. For a legible city, they use powerful illustrative styles and spatial typography.

Streem makeover.

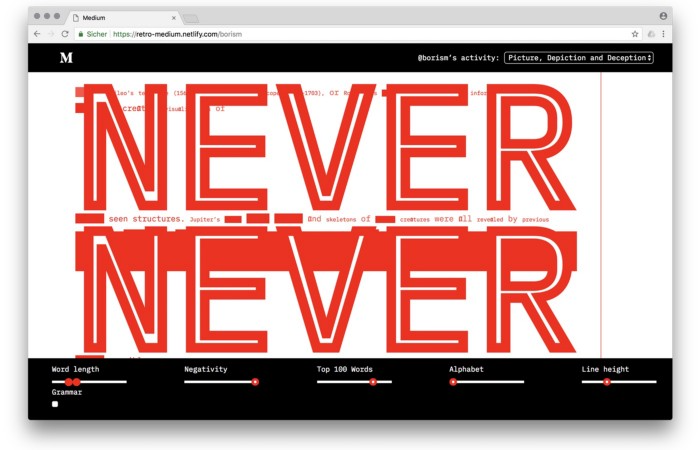

3. Medium by Amelie Kirchmeyer and Fabian Schultz

Amelie and Fabian structured. Instead of developing a form for a tale, they dissolved a web page into semantic, syntactical, and statistical aspects. HTML's flexibility was their goal. They broke Medium posts into experimental typographic space.

Medium revamp.

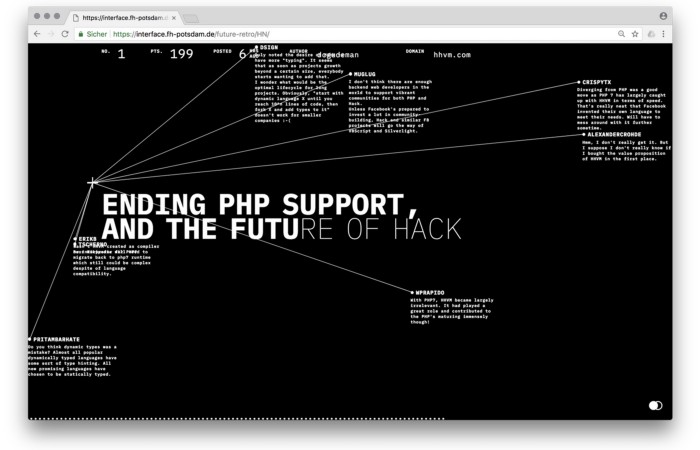

4. Hacker News by Fabian Dinklage and Florian Zia

Florian and Fabian made Hacker News interactive. The social networking site aggregates computer science and IT news. Its voting and debate features are extensive despite its simple style. Fabian and Florian transformed the structure into a typographic timeline and network area. News and comments sequence and connect the visuals. To read Hacker News, they connected their design to the API. Hacker News makeover.

Communication is not legibility, said Carson. Apply this to web design today. Modern websites must be legible, usable, responsive, and accessible. They shouldn't limit its visual palette. Visual and human-centered design are not stereotypes.

I want radical, generative, evocative, insightful, adequate, content-specific, and intelligent site design. I want to rediscover web design experimentation. More surprises please. I hope the web will appear different in 23 years.

Update: this essay has sparked a lively discussion! I wrote a brief response to the debate's most common points: Creativity vs. Usability