More on Leadership

Jano le Roux

3 years ago

Quit worrying about Twitter: Elon moves quickly before refining

Elon's rides start rough, but then...

Elon Musk has never been so hated.

They don’t get Elon.

He began using PayPal in this manner.

He began with SpaceX in a similar manner.

He began with Tesla in this manner.

Disruptive.

Elon had rocky starts. His creativity requires it. Just like writing a first draft.

His fastest way to find the way is to avoid it.

PayPal's pricey launch

PayPal was a 1999 business flop.

They were considered insane.

Elon and his co-founders had big plans for PayPal. They adopted the popular philosophy of the time, exchanging short-term profit for growth, and pulled off a miracle just before the bubble burst.

PayPal was created as a dollar alternative. Original PayPal software allowed PalmPilot money transfers. Unfortunately, there weren't enough PalmPilot users.

Since everyone had email, the company emailed payments. Costs rose faster than sales.

The startup wanted to get a million subscribers by paying $10 to sign up and $10 for each referral. Elon thought the price was fair because PayPal made money by charging transaction fees. They needed to make money quickly.

A Wall Street Journal article valuing PayPal at $500 million attracted investors. The dot-com bubble burst soon after they rushed to get financing.

Musk and his partners sold PayPal to eBay for $1.5 billion in 2002. Musk's most successful company was PayPal.

SpaceX's start-up error

Elon and his friends bought a reconditioned ICBM in Russia in 2002.

He planned to invest much of his wealth in a stunt to promote NASA and space travel.

Many called Elon crazy.

The goal was to buy a cheap Russian rocket to launch mice or plants to Mars and return them. He thought SpaceX would revive global space interest. After a bad meeting in Moscow, Elon decided to build his own rockets to undercut launch contracts.

Then SpaceX was founded.

Elon’s plan was harder than expected.

Explosions followed explosions.

Millions lost on cargo.

Millions lost on the rockets.

Investors thought Elon was crazy, but he wasn't.

NASA's biggest competitor became SpaceX. NASA hired SpaceX to handle many of its missions.

Tesla's shaky beginning

Tesla began shakily.

Clients detested their roadster.

They continued to miss deadlines.

Lotus would handle the car while Tesla focused on the EV component, easing Tesla's entry. The business experienced elegance creep. Modifying specific parts kept the car from getting worse.

Cost overruns, delays, and other factors changed the Elise-like car's appearance. Only 7% of the Tesla Roadster's parts matched its Lotus twin.

Tesla was about to die.

Elon saved the mess as CEO.

He fired 25% of the workforce to reduce costs.

Elon Musk transformed Tesla into the world's most valuable automaker by running it like a startup.

Tesla hasn't spent a dime on advertising. They let the media do the talking by investing in innovation.

Elon sheds. Elon tries. Elon learns. Elon refines.

Twitter doesn't worry me.

The media is shocked. I’m not.

This is just Elon being Elon.

Elon makes lean.

Elon tries new things.

Elon listens to feedback.

Elon refines.

Besides Twitter will always be Twitter.

Hunter Walk

2 years ago

Is it bad of me to want our portfolio companies to generate greater returns for outside investors than they did for us as venture capitalists?

Wishing for Lasting Companies, Not Penny Stocks or Goodwill Write-Downs

Get me a NASCAR-style company-logoed cremation urn (notice to the executor of my will, theres gonna be a lot of weird requests). I believe in working on projects that would be on your tombstone. As the Homebrew logo is tattooed on my shoulder, expanding the portfolio to my posthumous commemoration is easy. But this isn't an IRR victory lap; it's a hope that the firms we worked for would last beyond my lifetime.

![a little boy planting a dollar bill in the ground and pouring a watering can out on it, digital art [DALL-E]](https://storage.googleapis.com/int3grity/posts/V62hkReDx56S/images/vMwzqrYeXaYnUIMXAdTY9)

Venture investors too often take credit or distance themselves from startups based on circumstances. Successful companies tell stories of crucial introductions, strategy conversations, and other value. Defeats Even whether our term involves Board service or systematic ethical violations, I'm just a little investment, so there's not much I can do. Since I'm guilty, I'm tossing stones from within the glass home (although we try to own our decisions through the lifecycle).

Post-exit company trajectories are usually unconfounded. Off the cap table, no longer a shareholder (or a diminishing one as you sell off/distribute), eventually leaving the Board. You can cheer for the squad or forget about it, but you've freed the corporation and it's back to portfolio work.

As I look at the downward track of most SPACs and other tarnished IPOs from the last few years, I wonder how I would feel if those were my legacy. Is my job done? Yes. When investing in a business, the odds are against it surviving, let alone thriving and being able to find sunlight. SPAC sponsors, institutional buyers, retail investments. Free trade in an open market is their right. Risking and losing capital is the system working! But

We were lead or co-lead investors in our first three funds, but as additional VCs joined the company, we were pushed down the cap table. Voting your shares rarely matters; supporting the firm when they need it does. Being valuable, consistent, and helping the company improve builds trust with the founders.

I hope every startup we sponsor becomes a successful public company before, during, and after we benefit. My perspective of American capitalism. Well, a stock ticker has a lot of garbage, and I support all types of regulation simplification (in addition to being a person investor in the Long-Term Stock Exchange). Yet being owned by a large group of investors and making actual gains for them is great. Likewise does seeing someone you met when they were just starting out become a public company CEO without losing their voice, leadership, or beliefs.

I'm just thinking about what we can do from the start to realize value from our investments and build companies with bright futures. Maybe seed venture financing shouldn't impact those outcomes, but I'm not comfortable giving up that obligation.

Nir Zicherman

3 years ago

The Great Organizational Conundrum

Only two of the following three options can be achieved: consistency, availability, and partition tolerance

Someone told me that growing from 30 to 60 is the biggest adjustment for a team or business.

I remember thinking, That's random. Each company is unique. I've seen teams of all types confront the same issues during development periods. With new enterprises starting every year, we should be better at navigating growing difficulties.

As a team grows, its processes and systems break down, requiring reorganization or declining results. Why always? Why isn't there a perfect scaling model? Why hasn't that been found?

The Three Things Productive Organizations Must Have

Any company should be efficient and productive. Three items are needed:

First, it must verify that no two team members have conflicting information about the roadmap, strategy, or any input that could affect execution. Teamwork is required.

Second, it must ensure that everyone can receive the information they need from everyone else quickly, especially as teams become more specialized (an inevitability in a developing organization). It requires everyone's accessibility.

Third, it must ensure that the organization can operate efficiently even if a piece is unavailable. It's partition-tolerant.

From my experience with the many teams I've been on, invested in, or advised, achieving all three is nearly impossible. Why a perfect organization model cannot exist is clear after analysis.

The CAP Theorem: What is it?

Eric Brewer of Berkeley discovered the CAP Theorem, which argues that a distributed data storage should have three benefits. One can only have two at once.

The three benefits are consistency, availability, and partition tolerance, which implies that even if part of the system is offline, the remainder continues to work.

This notion is usually applied to computer science, but I've realized it's also true for human organizations. In a post-COVID world, many organizations are hiring non-co-located staff as they grow. CAP Theorem is more important than ever. Growing teams sometimes think they can develop ways to bypass this law, dooming themselves to a less-than-optimal team dynamic. They should adopt CAP to maximize productivity.

Path 1: Consistency and availability equal no tolerance for partitions

Let's imagine you want your team to always be in sync (i.e., for someone to be the source of truth for the latest information) and to be able to share information with each other. Only division into domains will do.

Numerous developing organizations do this, especially after the early stage (say, 30 people) when everyone may wear many hats and be aware of all the moving elements. After a certain point, it's tougher to keep generalists aligned than to divide them into specialized tasks.

In a specialized, segmented team, leaders optimize consistency and availability (i.e. every function is up-to-speed on the latest strategy, no one is out of sync, and everyone is able to unblock and inform everyone else).

Partition tolerance suffers. If any component of the organization breaks down (someone goes on vacation, quits, underperforms, or Gmail or Slack goes down), productivity stops. There's no way to give the team stability, availability, and smooth operation during a hiccup.

Path 2: Partition Tolerance and Availability = No Consistency

Some businesses avoid relying too heavily on any one person or sub-team by maximizing availability and partition tolerance (the organization continues to function as a whole even if particular components fail). Only redundancy can do that. Instead of specializing each member, the team spreads expertise so people can work in parallel. I switched from Path 1 to Path 2 because I realized too much reliance on one person is risky.

What happens after redundancy? Unreliable. The more people may run independently and in parallel, the less anyone can be the truth. Lack of alignment or updated information can lead to people executing slightly different strategies. So, resources are squandered on the wrong work.

Path 3: Partition and Consistency "Tolerance" equates to "absence"

The third, least-used path stresses partition tolerance and consistency (meaning answers are always correct and up-to-date). In this organizational style, it's most critical to maintain the system operating and keep everyone aligned. No one is allowed to read anything without an assurance that it's up-to-date (i.e. there’s no availability).

Always short-lived. In my experience, a business that prioritizes quality and scalability over speedy information transmission can get bogged down in heavy processes that hinder production. Large-scale, this is unsustainable.

Accepting CAP

When two puzzle pieces fit, the third won't. I've watched developing teams try to tackle these difficulties, only to find, as their ancestors did, that they can never be entirely solved. Idealized solutions fail in reality, causing lost effort, confusion, and lower production.

As teams develop and change, they should embrace CAP, acknowledge there is a limit to productivity in a scaling business, and choose the best two-out-of-three path.

You might also like

Gareth Willey

3 years ago

I've had these five apps on my phone for a long time.

TOP APPS

Who survives spring cleaning?

Relax. Notion is off-limits. This topic is popular.

(I wrote about it 2 years ago, before everyone else did.) So).

These apps are probably new to you. I hope you find a new phone app after reading this.

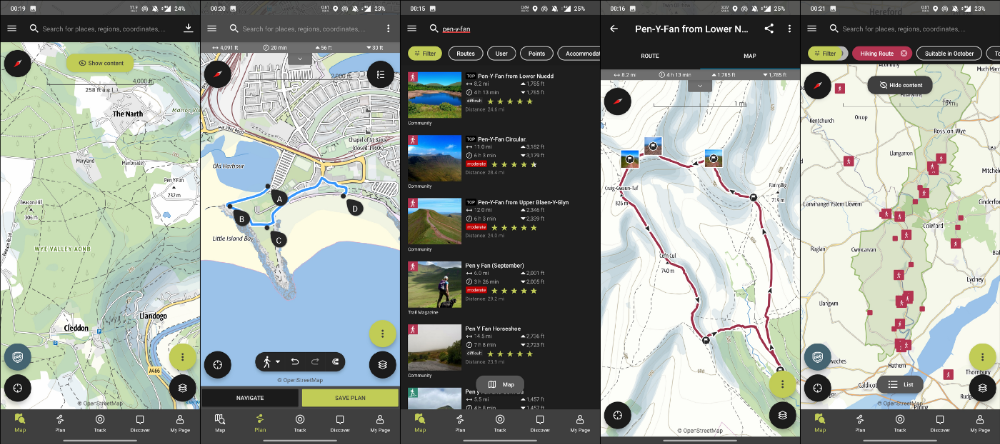

Outdooractive

ViewRanger is Google Maps for outdoor enthusiasts.

This app has been so important to me as a freedom-loving long-distance walker and hiker.

This app shows nearby trails and right-of-ways on top of an Open Street Map.

Helpful detail and data. Any route's distance,

You can download and follow tons of routes planned by app users.

This has helped me find new routes and places a fellow explorer has tried.

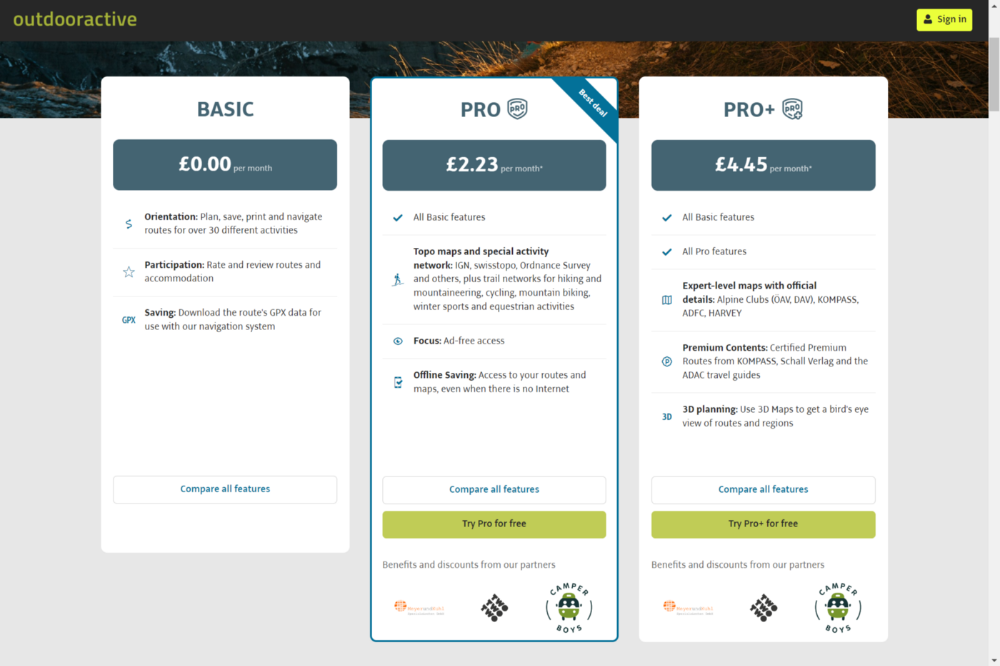

Free with non-intrusive ads. Years passed before I subscribed. Pro costs £2.23/month.

This app is for outdoor lovers.

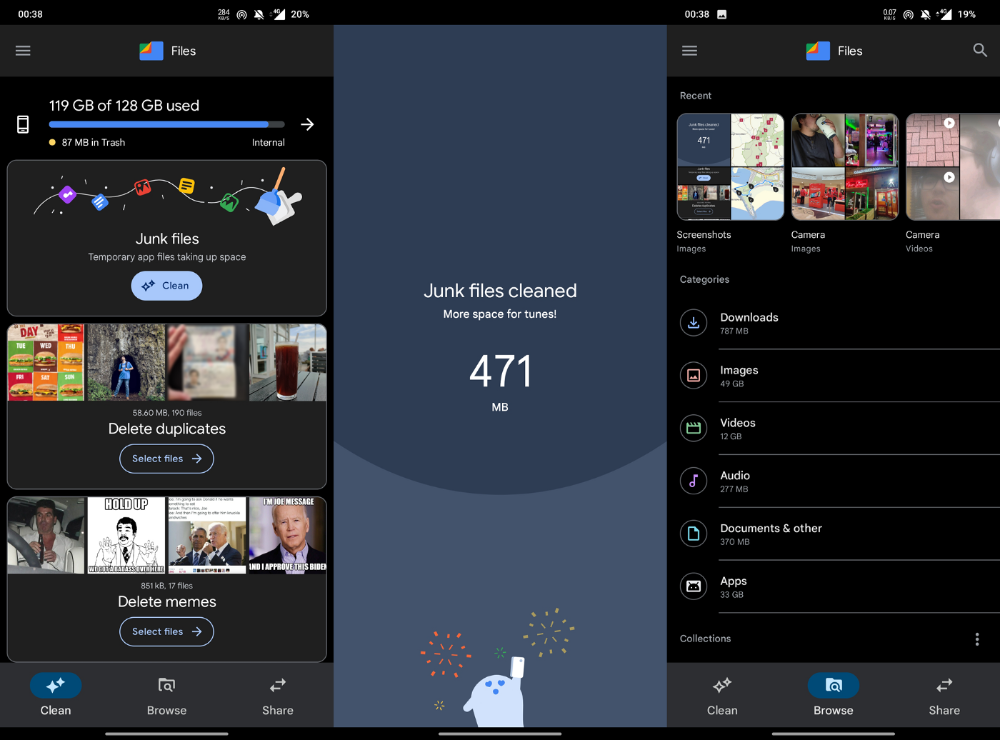

Google Files

New phones come with bloatware. These rushed apps are frustrating.

We must replace these apps. 2017 was Google's year.

Files is a file manager. It's quick, innovative, and clean. They've given people what they want.

It's easy to organize files, clear space, and clear cache.

I recommend Gallery by Google as a gallery app alternative. It's quick and easy.

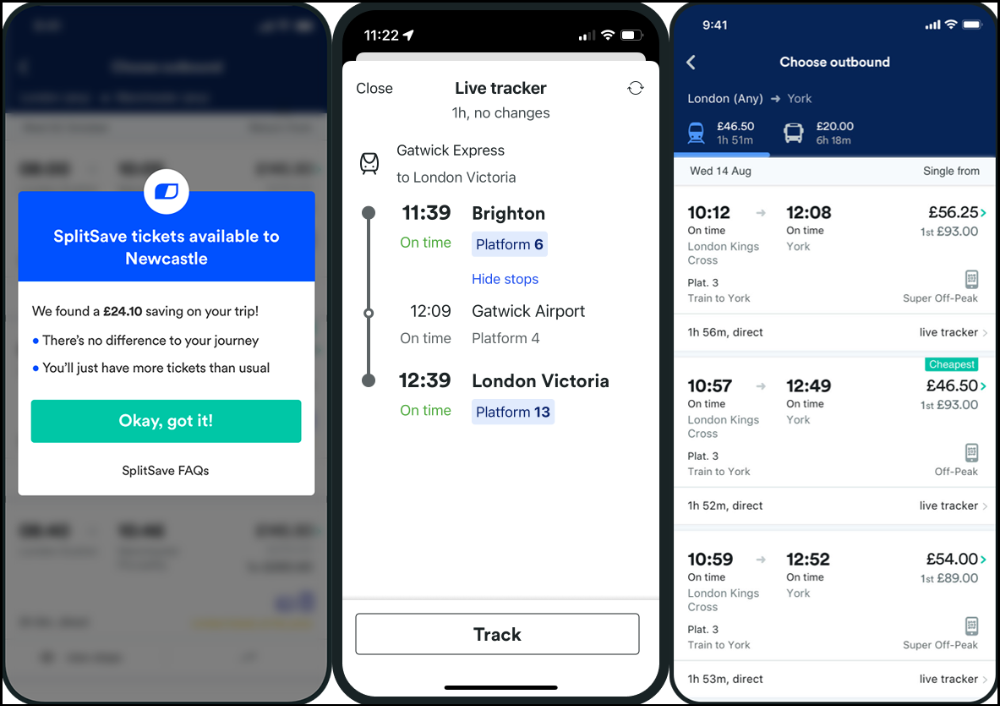

Trainline

App for trains, buses, and coaches.

I've used this app for years. It did the basics well when I first used it.

Since then, it's improved. It's constantly adding features to make traveling easier and less stressful.

Split-ticketing helps me save hundreds a year on train fares. This app is only available in the UK and Europe.

This service doesn't link to a third-party site. Their app handles everything.

Not all train and coach companies use this app. All the big names are there, though.

Here's more on the app.

Battlefield: Mobile

Play Store has 478,000 games. Few can turn my phone into a console.

Call of Duty Mobile and Asphalt 8/9 are examples.

Asphalt's loot boxes and ads make it unplayable. Call of Duty opens with a few ads. Close them to play without hassle.

This game uses all your phone's features to provide a high-quality, seamless experience. If my internet connection is good, I never experience lag or glitches.

The gameplay is energizing and intense, just like on consoles. Sometimes I'm too involved. I've thrown my phone in anger. I'm totally absorbed.

Customizability is my favorite. Since phones have limited screen space, we should only have the buttons we need, placed conveniently.

Size, opacity, and position are modifiable. Adjust audio, graphics, and textures. It's customizable.

This game has been on my phone for three years. It began well and has gotten better. When I think the creators can't do more, they do.

If you play, read my tips for winning a Battle Royale.

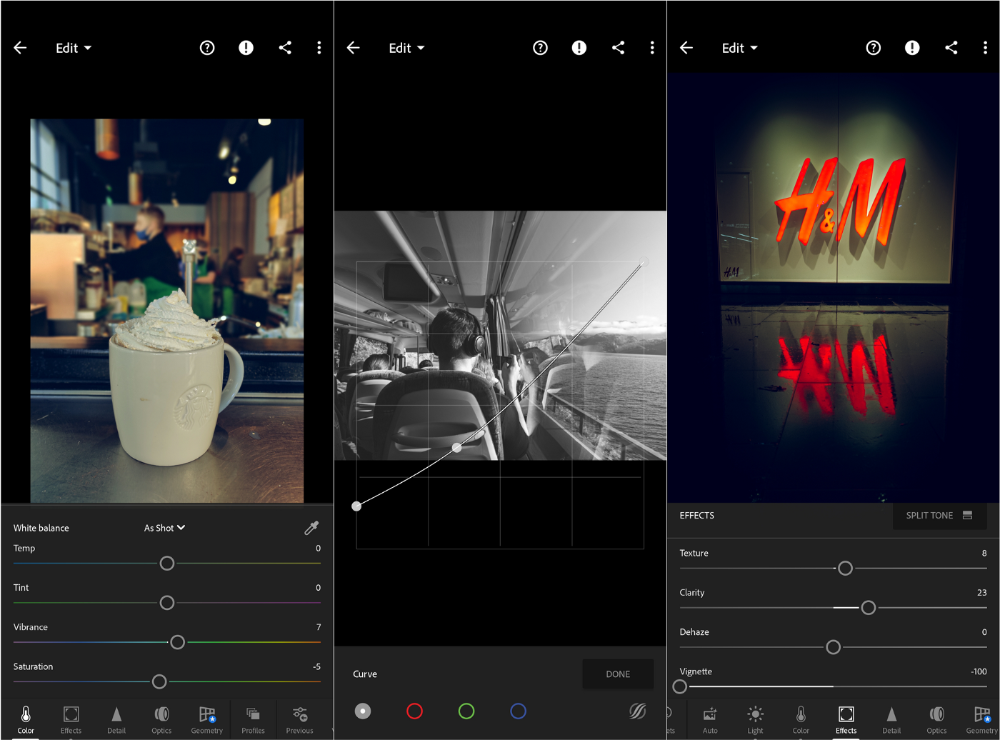

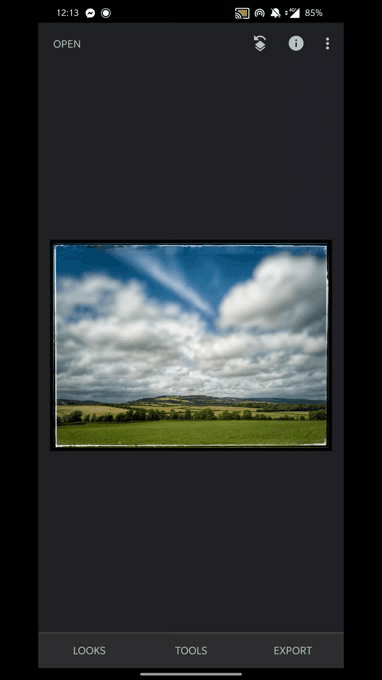

Lightroom

As a photographer, I believe your best camera is on you. The phone.

2017 was a big year for this app. I've tried many photo-editing apps since then. This always wins.

The app is dull. I've never seen better photo editing on a phone.

Adjusting settings and sliders doesn't damage or compress photos. It's detailed.

This is important for phone photos, which are lower quality than professional ones.

Some tools are behind a £4.49/month paywall. Adobe must charge a subscription fee instead of selling licenses. (I'm still bitter about Creative Cloud's price)

Snapseed is my pick. Lightroom is where I do basic editing before moving to Snapseed. Snapseed review:

These apps are great. They cover basic and complex editing needs while traveling.

Final Reflections

I hope you downloaded one of these. Share your favorite apps. These apps are scarce.

Vanessa Karel

3 years ago

10 hard lessons from founding a startup.

Here is the ugly stuff, read this if you have a founder in your life or are trying to become one. Your call.

#1 You'll try to talk yourself to sleep, but it won't always work.

As founders, we're all driven. Good and bad, you're restless. Success requires resistance and discipline. Your startup will be on your mind 24/7, and not everyone will have the patience to listen to your worries, ideas, and coffee runs. You become more self-sufficient than ever before.

#2 No one will understand what you're going through unless they've been a founder.

Some of my closest friends don't understand the work that goes into starting a business, and we can't blame them.

#3 You'll feel alienated.

Your problems aren't common; calling your bestie won't help. You must search hard for the right resources. It alienates you from conversations you no longer relate to. (No 4th of July, no long weekends!)

#4 Since you're your "own boss," people assume you have lots of free time.

Do you agree? I was on a webinar with lots of new entrepreneurs, and one woman said, "I started my own business so I could have more time for myself." This may be true for some lucky people, and you can be flexible with your schedule. If you want your business to succeed, you'll probably be its slave for a while.

#5 No time for illness or family emergencies.

Both last month. Oh, no! Physically and emotionally withdrawing at the worst times will give you perspective. I learned this the hard way because I was too stubborn to postpone an important interview. I thought if I rested all day and only took one call, I'd be fine. Nope. I had a fever and my mind wasn't as sharp, so my performance and audience interaction suffered. Nope. Better to delay than miss out.

Oh, and setting a "OoO" makes you cringe.

#6 Good luck with your mental health, perfectionists.

When building a startup, it's difficult to accept that there won't be enough time to do everything. You can't make them all, not perfectly. You must learn to accept things that are done but not perfect.

#7 As a founder, you'll make mistakes, but you'll want to make them quickly so you can learn.

Hard lessons are learned quicker. You'll need to pivot and try new things often; some won't work, and it's best to discover them sooner rather than later.

#8 Pyramid schemes abound.

I didn't realize how bad it was until I started a company. You must spy and constantly research. As a founder, you'll receive many emails from people claiming to "support" you. Be wary and keep your eyes open. When it's too good to be true. Some "companies" will try to get you to pay for "competitions" to "pitch at events." Don't do it.

#9 Keep your competitor research to a minimum.

Actually, competition is good. It means there's a market for those solutions. However, this can be mentally exhausting too. Learn about their geography and updates, but that's it.

#10 You'll feel guilty taking vacation.

I don't know what to say, but I no longer enjoy watching TV, and that's okay. Pay attention to things that enrich you, bring you joy, and have fun. It boosts creativity.

Being a startup founder may be one of the hardest professional challenges you face, but it's also a great learning experience. Your passion will take you places you never imagined and open doors to opportunities you wouldn't have otherwise. You'll meet amazing people. No regrets, no complaints. It's a roller coaster, but the good days are great.

Miss anything? Comment below

xuanling11

3 years ago

Reddit NFT Achievement

Reddit's NFT market is alive and well.

NFT owners outnumber OpenSea on Reddit.

Reddit NFTs flip in OpenSea in days:

Fast-selling.

NFT sales will make Reddit's current communities more engaged.

I don't think NFTs will affect existing groups, but they will build hype for people to acquire them.

The first season of Collectibles is unique, but many missed the first season.

Second-season NFTs are less likely to be sold for a higher price than first-season ones.

If you use Reddit, it's fun to own NFTs.