More on Entrepreneurship/Creators

Khoi Ho

3 years ago

After working at seven startups, here are the early-stage characteristics that contributed to profitability, unicorn status or successful acquisition.

I've worked in a People role at seven early-stage firms for over 15 years (I enjoy chasing a dream!). Few of the seven achieved profitability, including unicorn status or acquisition.

Did early-stage startups share anything? Was there a difference between winners and losers? YES.

I support founders and entrepreneurs building financially sustainable enterprises with a compelling cause. This isn't something everyone would do. A company's success demands more than guts. Founders drive startup success.

Six Qualities of Successful Startups

Successful startup founders either innately grasped the correlation between strong team engagement and a well-executed business model, or they knew how to ask and listen to others (executive coaches, other company leaders, the team itself) to learn about it.

Successful startups:

1. Co-founders agreed and got along personally.

Multi-founder startups are common. When co-founders agree on strategic decisions and are buddies, there's less friction and politics at work.

As a co-founder, ask your team if you're aligned. They'll explain.

I've seen C-level leaders harbor personal resentments over disagreements. A co-departure founder's caused volatile leadership and work disruptions that the team struggled to manage during and after.

2. Team stayed.

Successful startups have low turnover. Nobody is leaving. There may be a termination for performance, but other team members will have observed the issues and agreed with the decision.

You don't want organizational turnover of 30%+, with leaders citing performance issues but the team not believing them. This breeds suspicion.

Something is wrong if many employees leave voluntarily or involuntarily. You may hear about lack of empowerment, support, or toxic leadership in exit interviews and from the existing team. Intellectual capital loss and resource instability harm success.

3. Team momentum.

A successful startup's team is excited about its progress. Consistently achieving goals and having trackable performance metrics. Some describe this period of productivity as magical, with great talents joining the team and the right people in the right places. Increasing momentum.

I've also seen short-sighted decisions where only some departments, like sales and engineering, had goals. Lack of a unified goals system created silos and miscommunication. Some employees felt apathetic because they didn't know how they contributed to team goals.

4. Employees advanced in their careers.

Even if you haven't created career pathing or professional development programs, early-stage employees will grow and move into next-level roles. If you hire more experienced talent and leaders, expect them to mentor existing team members. Growing companies need good performers.

New talent shouldn't replace and discard existing talent. This creates animosity and makes existing employees feel unappreciated for their early contributions to the company.

5. The company lived its values.

Culture and identity are built on lived values. A company's values affect hiring, performance management, rewards, and other processes. Identify, practice, and believe in company values. Starting with team values instead of management or consultants helps achieve this. When a company's words and actions match, it builds trust.

When company values are beautifully displayed on a wall but few employees understand them, the opposite is true. If an employee can't name the company values, they're useless.

6. Communication was clear.

When necessary information is shared with the team, they feel included, trusted, and like owners. Transparency means employees have the needed information to do their jobs. Disclosure builds trust. The founders answer employees' questions honestly.

Information accessibility decreases office politics. Without transparency, even basic information is guarded and many decisions are made in secret. I've seen founders who don't share financial, board meeting, or compensation and equity information. The founders' lack of trust in the team wasn't surprising, so it was reciprocated.

The Choices

Finally. All six of the above traits (leadership alignment, minimal turnover, momentum, professional advancement, values, and transparency) were high in the profitable startups I've worked at, including unicorn status or acquisition.

I've seen these as the most common and constant signals of startup success or failure.

These characteristics are the product of founders' choices. These decisions lead to increased team engagement and business execution.

Here's something to consider for startup employees and want-to-bes. 90% of startups fail, despite the allure of building something new and gaining ownership. With the emotional and time investment in startup formation, look for startups with these traits to reduce your risk.

Both you and the startup will thrive in these workplaces.

Jenn Leach

3 years ago

I created a faceless TikTok account. Six months later.

Follower count, earnings, and more

I created my 7th TikTok account six months ago. TikTok's great. I've developed accounts for Amazon products, content creators/brand deals education, website flipping, and more.

Introverted or shy people use faceless TikTok accounts.

Maybe they don't want millions of people to see their face online, or they want to remain anonymous so relatives and friends can't locate them.

Going faceless on TikTok can help you grow a following, communicate your message, and make money online.

Here are 6 steps I took to turn my Tik Tok account into a $60,000/year side gig.

From nothing to $60K in 6 months

It's clickbait, but it’s true. Here’s what I did to get here.

Quick context:

I've used social media before. I've spent years as a social creator and brand.

I've built Instagram, TikTok, and YouTube accounts to nearly 100K.

How I did it

First, select a niche.

If you can focus on one genre on TikTok, you'll have a better chance of success, however lifestyle creators do well too.

Niching down is easier, in my opinion.

Examples:

Travel

Food

Kids

Earning cash

Finance

You can narrow these niches if you like.

During the pandemic, a travel blogger focused on Texas-only tourism and gained 1 million subscribers.

Couponing might be a finance specialization.

One of my finance TikTok accounts gives credit tips and grants and has 23K followers.

Tons of ways you can get more specific.

Consider how you'll monetize your TikTok account. I saw many enormous TikTok accounts that lose money.

Why?

They can't monetize their niche. Not impossible to commercialize, but tough enough to inhibit action.

First, determine your goal.

In this first step, consider what your end goal is.

Are you trying to promote your digital products or social media management services?

You want brand deals or e-commerce sales.

This will affect your TikTok specialty.

This is the first step to a TikTok side gig.

Step 2: Pick a content style

Next, you want to decide on your content style.

Do you do voiceover and screenshots?

You'll demonstrate a product?

Will you faceless vlog?

Step 3: Look at the competition

Find anonymous accounts and analyze what content works, where they thrive, what their audience wants, etc.

This can help you make better content.

Like the skyscraper method for TikTok.

Step 4: Create a content strategy.

Your content plan is where you sit down and decide:

How many videos will you produce each day or each week?

Which links will you highlight in your biography?

What amount of time can you commit to this project?

You may schedule when to post videos on a calendar. Make videos.

5. Create videos.

No video gear needed.

Using a phone is OK, and I think it's preferable than posting drafts from a computer or phone.

TikTok prefers genuine material.

Use their app, tools, filters, and music to make videos.

And imperfection is preferable. Tik okers like to see videos made in a bedroom, not a film studio.

Make sense?

When making videos, remember this.

I personally use my phone and tablet.

Step 6: Monetize

Lastly, it’s time to monetize How will you make money? You decided this in step 1.

Time to act!

For brand agreements

Include your email in the bio.

Share several sites and use a beacons link in your bio.

Make cold calls to your favorite companies to get them to join you in a TikTok campaign.

For e-commerce

Include a link to your store's or a product's page in your bio.

For client work

Include your email in the bio.

Use a beacons link to showcase your personal website, portfolio, and other resources.

For affiliate marketing

Include affiliate product links in your bio.

Join the Amazon Influencer program and provide a link to your storefront in your bio.

$60,000 per year from Tik Tok?

Yes, and some creators make much more.

Tori Dunlap (herfirst100K) makes $100,000/month on TikTok.

My TikTok adventure took 6 months, but by month 2 I was making $1,000/month (or $12K/year).

By year's end, I want this account to earn $100K/year.

Imagine if my 7 TikTok accounts made $100K/year.

7 Tik Tok accounts X $100K/yr = $700,000/year

Edward Williams

3 years ago

I currently manage 4 profitable online companies. I find all the generic advice and garbage courses very frustrating. The only advice you need is this.

This is for young entrepreneurs, especially in tech.

People give useless success advice on TikTok and Reddit. Early risers, bookworms, etc. Entrepreneurship courses. Work hard and hustle.

False. These aren't successful traits.

I mean, organization is good. As someone who founded several businesses and now works at a VC firm, I find these tips to be clichés.

Based on founding four successful businesses and working with other successful firms, here's my best actionable advice:

1. Choose a sector or a niche and become an expert in it.

This is more generic than my next tip, but it's a must-do that's often overlooked. Become an expert in the industry or niche you want to enter. Discover everything.

Buy (future) competitors' products. Understand consumers' pain points. Market-test. Target keyword combos. Learn technical details.

The most successful businesses I've worked with were all formed by 9-5 employees. They knew the industry's pain points. They started a business targeting these pain points.

2. Choose a niche or industry crossroads to target.

How do you choose an industry or niche? What if your industry is too competitive?

List your skills and hobbies. Randomness is fine. Find an intersection between two interests or skills.

Say you build websites well. You like cars.

Web design is a *very* competitive industry. Cars and web design?

Instead of web design, target car dealers and mechanics. Build a few fake demo auto mechanic websites, then cold call shops with poor websites. Verticalize.

I've noticed a pattern:

Person works in a particular industry for a corporation.

Person gains expertise in the relevant industry.

Person quits their job and launches a small business to address a problem that their former employer was unwilling to address.

I originally posted this on Reddit and it seemed to have taken off so I decided to share it with you all.

Focus on the product. When someone buys from you, you convince them the product's value exceeds the price. It's not fair and favors the buyer.

Creating a superior product or service will win. Narrowing this helps you outcompete others.

You may be their only (lucky) option.

You might also like

joyce shen

4 years ago

Framework to Evaluate Metaverse and Web3

Everywhere we turn, there's a new metaverse or Web3 debut. Microsoft recently announced a $68.7 BILLION cash purchase of Activision.

Like AI in 2013 and blockchain in 2014, NFT growth in 2021 feels like this year's metaverse and Web3 growth. We are all bombarded with information, conflicting signals, and a sensation of FOMO.

How can we evaluate the metaverse and Web3 in a noisy, new world? My framework for evaluating upcoming technologies and themes is shown below. I hope you will also find them helpful.

Understand the “pipes” in a new space.

Whatever people say, Metaverse and Web3 will have to coexist with the current Internet. Companies who host, move, and store data over the Internet have a lot of intriguing use cases in Metaverse and Web3, whether in infrastructure, data analytics, or compliance. Hence the following point.

## Understand the apps layer and their infrastructure.

Gaming, crypto exchanges, and NFT marketplaces would not exist today if not for technology that enables rapid app creation. Yes, according to Chainalysis and other research, 30–40% of Ethereum is self-hosted, with the rest hosted by large cloud providers. For Microsoft to acquire Activision makes strategic sense. It's not only about the games, but also the infrastructure that supports them.

Follow the money

Understanding how money and wealth flow in a complex and dynamic environment helps build clarity. Unless you are exceedingly wealthy, you have limited ability to significantly engage in the Web3 economy today. Few can just buy 10 ETH and spend it in one day. You must comprehend who benefits from the process, and how that 10 ETH circulates now and possibly tomorrow. Major holders and players control supply and liquidity in any market. Today, most Web3 apps are designed to increase capital inflow so existing significant holders can utilize it to create a nascent Web3 economy. When you see a new Metaverse or Web3 application, remember how money flows.

What is the use case?

What does the app do? If there is no clear use case with clear makers and consumers solving a real problem, then the euphoria soon fades, and the only stakeholders who remain enthused are those who have too much to lose.

Time is a major competition that is often overlooked.

We're only busier, but each day is still 24 hours. Using new apps may mean that time is lost doing other things. The user must be eager to learn. Metaverse and Web3 vs. our time? I don't think we know the answer yet (at least for working adults whose cost of time is higher).

I don't think we know the answer yet (at least for working adults whose cost of time is higher).

People and organizations need security and transparency.

For new technologies or apps to be widely used, they must be safe, transparent, and trustworthy. What does secure Metaverse and Web3 mean? This is an intriguing subject for both the business and public sectors. Cloud adoption grew in part due to improved security and data protection regulations.

The following frameworks can help analyze and understand new technologies and emerging technological topics, unless you are a significant investment fund with the financial ability to gamble on numerous initiatives and essentially form your own “index fund”.

I write on VC, startups, and leadership.

More on https://www.linkedin.com/in/joycejshen/ and https://joyceshen.substack.com/

This writing is my own opinion and does not represent investment advice.

Hudson Rennie

3 years ago

Meet the $5 million monthly controversy-selling King of Toxic Masculinity.

Trigger warning — Andrew Tate is running a genius marketing campaign

Andrew Tate is a 2022 internet celebrity.

Kickboxing world champion became rich playboy with controversial views on gender roles.

Andrew's get-rich-quick scheme isn't new. His social media popularity is impressive.

He’s currently running one of the most genius marketing campaigns in history.

He pulls society's pendulum away from diversity and inclusion and toward diversion and exclusion. He's unstoppable.

Here’s everything you need to know about Andrew Tate. And how he’s playing chess while the world plays checkers.

Cobra Tate is the name he goes by.

American-born, English-raised entrepreneur Andrew Tate lives in Romania.

Romania? Says Andrew,

“I prefer a country in which corruption is available to everyone.”

Andrew was a professional kickboxer with the ring moniker Cobra before starting Hustlers University.

Before that, he liked chess and worshipped his father.

Emory Andrew Tate III is named after his grandmaster chess player father.

Emory was the first black-American chess champion. He was military, martial arts-trained, and multilingual. A superhuman.

He lived in his car to make ends meet.

Andrew and Tristan relocated to England with their mother when their parents split.

It was there that Andrew began his climb toward becoming one of the internet’s greatest villains.

Andrew fell in love with kickboxing.

Andrew spent his 20s as a professional kickboxer and reality TV star, featuring on Big Brother UK and The Ultimate Traveller.

These 3 incidents, along with a chip on his shoulder, foreshadowed Andrews' social media breakthrough.

Chess

Combat sports

Reality television

A dangerous trio.

Andrew started making money online after quitting kickboxing in 2017 due to an eye issue.

Andrew didn't suddenly become popular.

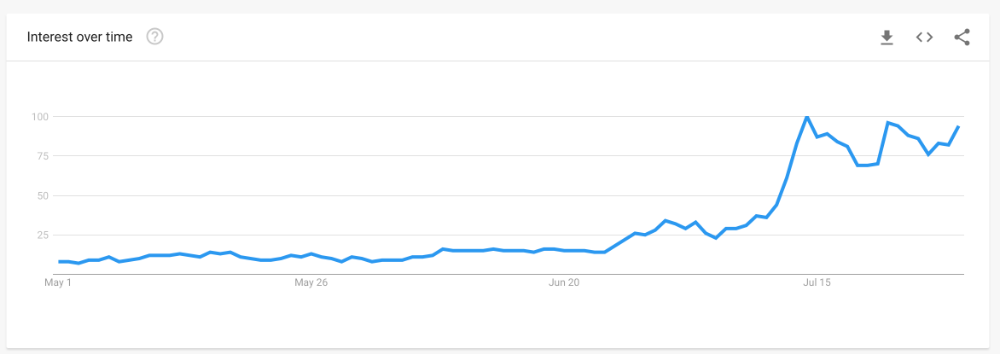

Andrew's web work started going viral in 2022.

Due to his contentious views on patriarchy and gender norms, he's labeled the King of Toxic Masculinity. His most contentious views (trigger warning):

“Women are intrinsically lazy.”

“Female promiscuity is disgusting.”

“Women shouldn’t drive cars or fly planes.”

“A lot of the world’s problems would be solved if women had their body count tattooed on their foreheads.”

Andrew's two main beliefs are:

“These are my personal opinions based on my experiences.”

2. “I believe men are better at some things and women are better at some things. We are not equal.”

Andrew intentionally offends.

Andrew's thoughts began circulating online in 2022.

In July 2022, he was one of the most Googled humans, surpassing:

Joe Biden

Donald Trump

Kim Kardashian

Andrews' rise is a mystery since no one can censure or suppress him. This is largely because Andrew nor his team post his clips.

But more on that later.

Andrew's path to wealth.

Andrew Tate is a self-made millionaire. His morality is uncertain.

Andrew and Tristan needed money soon after retiring from kickboxing.

“I owed some money to some dangerous people. I had $70K and needed $100K to stay alive.”

Andrews lost $20K on roulette at a local casino.

Andrew had one week to make $50,000, so he started planning. Andrew locked himself in a chamber like Thomas Edison to solve an energy dilemma.

He listed his assets.

Physical strength (but couldn’t fight)

a BMW (worth around $20K)

Intelligence (but no outlet)

A lightbulb.

He had an epiphany after viewing a webcam ad. He sought aid from women, ironically. His 5 international girlfriends are assets.

Then, a lightbulb.

Andrew and Tristan messaged and flew 7 women to a posh restaurant. Selling desperation masked as opportunity, Andrew pitched his master plan:

A webcam business — with a 50/50 revenue split.

5 women left.

2 stayed.

Andrew Tate, a broke kickboxer, became Top G, Cobra Tate.

The business model was simple — yet sad.

Andrew's girlfriends moved in with him and spoke online for 15+ hours a day. Andrew handled ads and equipment as the women posed.

Andrew eventually took over their keyboards, believing he knew what men wanted more than women.

Andrew detailed on the Full Send Podcast how he emotionally manipulated men for millions. They sold houses, automobiles, and life savings to fuel their companionship addiction.

When asked if he felt bad, Andrew said,

“F*ck no.“

Andrew and Tristan wiped off debts, hired workers, and diversified.

Tristan supervised OnlyFans models.

Andrew bought Romanian casinos and MMA league RXF (Real Xtreme Fighting).

Pandemic struck suddenly.

Andrew couldn't run his 2 businesses without a plan. Another easy moneymaker.

He banked on Hustlers University.

The actual cause of Andrew's ubiquity.

On a Your Mom’s House episode Andrew's 4 main revenue sources:

Hustler’s University

2. Owning casinos in Romania

3. Owning 10% of the Romanian MMA league “RXF”

4. “The War Room” — a society of rich and powerful men

When the pandemic hit, 3/4 became inoperable.

So he expanded Hustlers University.

But what is Hustler’s University?

Andrew says Hustlers University teaches 18 wealth-building tactics online. Examples:

Real estate

Copywriting

Amazon FBA

Dropshipping

Flipping Cryptos

How to swiftly become wealthy.

Lessons are imprecise, rudimentary, and macro-focused, say reviews. Invest wisely, etc. Everything is free online.

You pay for community. One unique income stream.

The only money-making mechanism that keeps the course from being a scam.

The truth is, many of Andrew’s students are actually making money. Maybe not from the free YouTube knowledge Andrew and his professors teach in the course, but through Hustler’s University’s affiliate program.

Affiliates earn 10% commission for each new student = $5.

Students can earn $10 for each new referral in the first two months.

Andrew earns $50 per membership per month.

This affiliate program isn’t anything special — in fact, it’s on the lower end of affiliate payouts. Normally, it wouldn’t be very lucrative.

But it has one secret weapon— Andrew and his viral opinions.

Andrew is viral. Andrew went on a media tour in January 2022 after appearing on Your Mom's House.

And many, many more…

He chatted with Twitch streamers. Hustlers University wanted more controversy (and clips).

Here’s the strategy behind Hustler’s University that has (allegedly) earned students upwards of $10K per month:

Make a social media profile with Andrew Tates' name and photo.

Post any of the online videos of Andrews that have gone viral.

Include a referral link in your bio.

Effectively simple.

Andrew's controversy attracts additional students. More student clips circulate as more join. Andrew's students earn more and promote the product as he goes viral.

A brilliant plan that's functioning.

At the beginning of his media tour, Hustler’s University had 5,000 students. 6 months in, and he now has over 100,000.

One income stream generates $5 million every month.

Andrew's approach is not new.

But it is different.

In the early 2010s, Tai Lopez dominated the internet.

His viral video showed his house.

“Here in my garage. Just bought this new Lamborghini.”

Tais' marketing focused on intellect, not strength, power, and wealth to attract women.

How reading quicker leads to financial freedom in 67 steps.

Years later, it was revealed that Tai Lopez rented the mansion and Lamborghini as a marketing ploy to build social proof. Meanwhile, he was living in his friend’s trailer.

Faked success is an old tactic.

Andrew is doing something similar. But with one major distinction.

Andrew outsources his virality — making him nearly impossible to cancel.

In 2022, authorities searched Andrews' estate over human trafficking suspicions. Investigation continues despite withdrawn charges.

Andrew's divisive nature would normally get him fired. Andrew's enterprises and celebrity don't rely on social media.

He doesn't promote or pay for ads. Instead, he encourages his students and anyone wishing to get rich quick to advertise his work.

Because everything goes through his affiliate program. Old saying:

“All publicity is good publicity.”

Final thoughts: it’s ok to feel triggered.

Tate is divisive.

His emotionally charged words are human nature. Andrews created the controversy.

It's non-personal.

His opinions are those of one person. Not world nor generational opinion.

Briefly:

It's easy to understand why Andrews' face is ubiquitous. Money.

The world wide web is a chessboard. Misdirection is part of it.

It’s not personal, it’s business.

Controversy sells

Sometimes understanding the ‘why’, can help you deal with the ‘what.’

Justin Kuepper

3 years ago

Day Trading Introduction

Historically, only large financial institutions, brokerages, and trading houses could actively trade in the stock market. With instant global news dissemination and low commissions, developments such as discount brokerages and online trading have leveled the playing—or should we say trading—field. It's never been easier for retail investors to trade like pros thanks to trading platforms like Robinhood and zero commissions.

Day trading is a lucrative career (as long as you do it properly). But it can be difficult for newbies, especially if they aren't fully prepared with a strategy. Even the most experienced day traders can lose money.

So, how does day trading work?

Day Trading Basics

Day trading is the practice of buying and selling a security on the same trading day. It occurs in all markets, but is most common in forex and stock markets. Day traders are typically well educated and well funded. For small price movements in highly liquid stocks or currencies, they use leverage and short-term trading strategies.

Day traders are tuned into short-term market events. News trading is a popular strategy. Scheduled announcements like economic data, corporate earnings, or interest rates are influenced by market psychology. Markets react when expectations are not met or exceeded, usually with large moves, which can help day traders.

Intraday trading strategies abound. Among these are:

- Scalping: This strategy seeks to profit from minor price changes throughout the day.

- Range trading: To determine buy and sell levels, range traders use support and resistance levels.

- News-based trading exploits the increased volatility around news events.

- High-frequency trading (HFT): The use of sophisticated algorithms to exploit small or short-term market inefficiencies.

A Disputed Practice

Day trading's profit potential is often debated on Wall Street. Scammers have enticed novices by promising huge returns in a short time. Sadly, the notion that trading is a get-rich-quick scheme persists. Some daytrade without knowledge. But some day traders succeed despite—or perhaps because of—the risks.

Day trading is frowned upon by many professional money managers. They claim that the reward rarely outweighs the risk. Those who day trade, however, claim there are profits to be made. Profitable day trading is possible, but it is risky and requires considerable skill. Moreover, economists and financial professionals agree that active trading strategies tend to underperform passive index strategies over time, especially when fees and taxes are factored in.

Day trading is not for everyone and is risky. It also requires a thorough understanding of how markets work and various short-term profit strategies. Though day traders' success stories often get a lot of media attention, keep in mind that most day traders are not wealthy: Many will fail, while others will barely survive. Also, while skill is important, bad luck can sink even the most experienced day trader.

Characteristics of a Day Trader

Experts in the field are typically well-established professional day traders.

They usually have extensive market knowledge. Here are some prerequisites for successful day trading.

Market knowledge and experience

Those who try to day-trade without understanding market fundamentals frequently lose. Day traders should be able to perform technical analysis and read charts. Charts can be misleading if not fully understood. Do your homework and know the ins and outs of the products you trade.

Enough capital

Day traders only use risk capital they can lose. This not only saves them money but also helps them trade without emotion. To profit from intraday price movements, a lot of capital is often required. Most day traders use high levels of leverage in margin accounts, and volatile market swings can trigger large margin calls on short notice.

Strategy

A trader needs a competitive advantage. Swing trading, arbitrage, and trading news are all common day trading strategies. They tweak these strategies until they consistently profit and limit losses.

Strategy Breakdown:

Type | Risk | Reward

Swing Trading | High | High

Arbitrage | Low | Medium

Trading News | Medium | Medium

Mergers/Acquisitions | Medium | High

Discipline

A profitable strategy is useless without discipline. Many day traders lose money because they don't meet their own criteria. “Plan the trade and trade the plan,” they say. Success requires discipline.

Day traders profit from market volatility. For a day trader, a stock's daily movement is appealing. This could be due to an earnings report, investor sentiment, or even general economic or company news.

Day traders also prefer highly liquid stocks because they can change positions without affecting the stock's price. Traders may buy a stock if the price rises. If the price falls, a trader may decide to sell short to profit.

A day trader wants to trade a stock that moves (a lot).

Day Trading for a Living

Professional day traders can be self-employed or employed by a larger institution.

Most day traders work for large firms like hedge funds and banks' proprietary trading desks. These traders benefit from direct counterparty lines, a trading desk, large capital and leverage, and expensive analytical software (among other advantages). By taking advantage of arbitrage and news events, these traders can profit from less risky day trades before individual traders react.

Individual traders often manage other people’s money or simply trade with their own. They rarely have access to a trading desk, but they frequently have strong ties to a brokerage (due to high commissions) and other resources. However, their limited scope prevents them from directly competing with institutional day traders. Not to mention more risks. Individuals typically day trade highly liquid stocks using technical analysis and swing trades, with some leverage.

Day trading necessitates access to some of the most complex financial products and services. Day traders usually need:

Access to a trading desk

Traders who work for large institutions or manage large sums of money usually use this. The trading or dealing desk provides these traders with immediate order execution, which is critical during volatile market conditions. For example, when an acquisition is announced, day traders interested in merger arbitrage can place orders before the rest of the market.

News sources

The majority of day trading opportunities come from news, so being the first to know when something significant happens is critical. It has access to multiple leading newswires, constant news coverage, and software that continuously analyzes news sources for important stories.

Analytical tools

Most day traders rely on expensive trading software. Technical traders and swing traders rely on software more than news. This software's features include:

-

Automatic pattern recognition: It can identify technical indicators like flags and channels, or more complex indicators like Elliott Wave patterns.

-

Genetic and neural applications: These programs use neural networks and genetic algorithms to improve trading systems and make more accurate price predictions.

-

Broker integration: Some of these apps even connect directly to the brokerage, allowing for instant and even automatic trade execution. This reduces trading emotion and improves execution times.

-

Backtesting: This allows traders to look at past performance of a strategy to predict future performance. Remember that past results do not always predict future results.

Together, these tools give traders a competitive advantage. It's easy to see why inexperienced traders lose money without them. A day trader's earnings potential is also affected by the market in which they trade, their capital, and their time commitment.

Day Trading Risks

Day trading can be intimidating for the average investor due to the numerous risks involved. The SEC highlights the following risks of day trading:

Because day traders typically lose money in their first months of trading and many never make profits, they should only risk money they can afford to lose.

Trading is a full-time job that is stressful and costly: Observing dozens of ticker quotes and price fluctuations to spot market trends requires intense concentration. Day traders also spend a lot on commissions, training, and computers.

Day traders heavily rely on borrowing: Day-trading strategies rely on borrowed funds to make profits, which is why many day traders lose everything and end up in debt.

Avoid easy profit promises: Avoid “hot tips” and “expert advice” from day trading newsletters and websites, and be wary of day trading educational seminars and classes.

Should You Day Trade?

As stated previously, day trading as a career can be difficult and demanding.

- First, you must be familiar with the trading world and know your risk tolerance, capital, and goals.

- Day trading also takes a lot of time. You'll need to put in a lot of time if you want to perfect your strategies and make money. Part-time or whenever isn't going to cut it. You must be fully committed.

- If you decide trading is for you, remember to start small. Concentrate on a few stocks rather than jumping into the market blindly. Enlarging your trading strategy can result in big losses.

- Finally, keep your cool and avoid trading emotionally. The more you can do that, the better. Keeping a level head allows you to stay focused and on track.

If you follow these simple rules, you may be on your way to a successful day trading career.

Is Day Trading Illegal?

Day trading is not illegal or unethical, but it is risky. Because most day-trading strategies use margin accounts, day traders risk losing more than they invest and becoming heavily in debt.

How Can Arbitrage Be Used in Day Trading?

Arbitrage is the simultaneous purchase and sale of a security in multiple markets to profit from small price differences. Because arbitrage ensures that any deviation in an asset's price from its fair value is quickly corrected, arbitrage opportunities are rare.

Why Don’t Day Traders Hold Positions Overnight?

Day traders rarely hold overnight positions for several reasons: Overnight trades require more capital because most brokers require higher margin; stocks can gap up or down on overnight news, causing big trading losses; and holding a losing position overnight in the hope of recovering some or all of the losses may be against the trader's core day-trading philosophy.

What Are Day Trader Margin Requirements?

Regulation D requires that a pattern day trader client of a broker-dealer maintain at all times $25,000 in equity in their account.

How Much Buying Power Does Day Trading Have?

Buying power is the total amount of funds an investor has available to trade securities. FINRA rules allow a pattern day trader to trade up to four times their maintenance margin excess as of the previous day's close.

The Verdict

Although controversial, day trading can be a profitable strategy. Day traders, both institutional and retail, keep the markets efficient and liquid. Though day trading is still popular among novice traders, it should be left to those with the necessary skills and resources.