More on Entrepreneurship/Creators

Navdeep Yadav

3 years ago

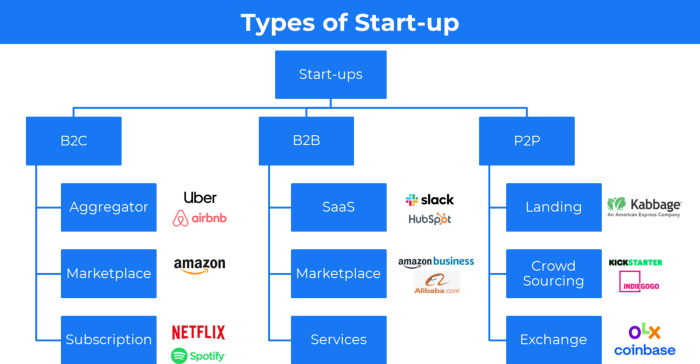

31 startup company models (with examples)

Many people find the internet's various business models bewildering.

This article summarizes 31 startup e-books.

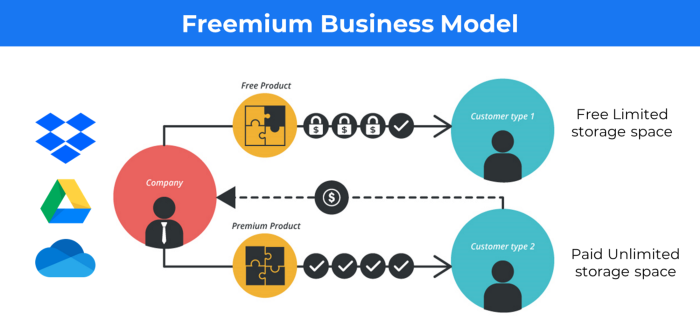

1. Using the freemium business model (free plus premium),

The freemium business model offers basic software, games, or services for free and charges for enhancements.

Examples include Slack, iCloud, and Google Drive

Provide a rudimentary, free version of your product or service to users.

Google Drive and Dropbox offer 15GB and 2GB of free space but charge for more.

Freemium business model details (Click here)

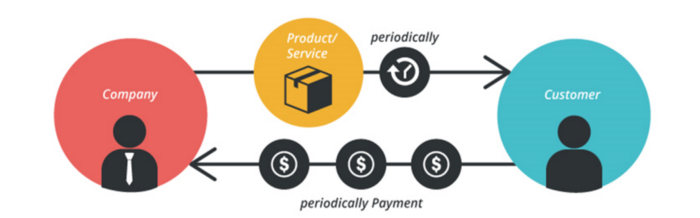

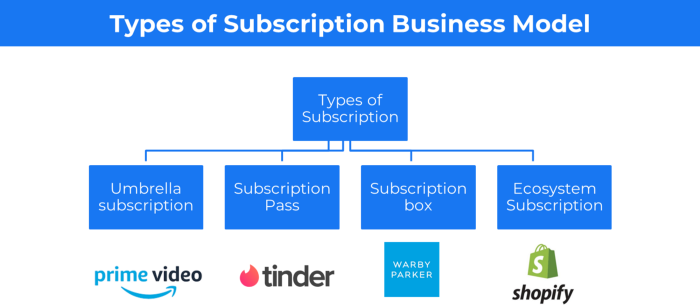

2. The Business Model of Subscription

Subscription business models sell a product or service for recurring monthly or yearly revenue.

Examples: Tinder, Netflix, Shopify, etc

It's the next step to Freemium if a customer wants to pay monthly for premium features.

Subscription Business Model (Click here)

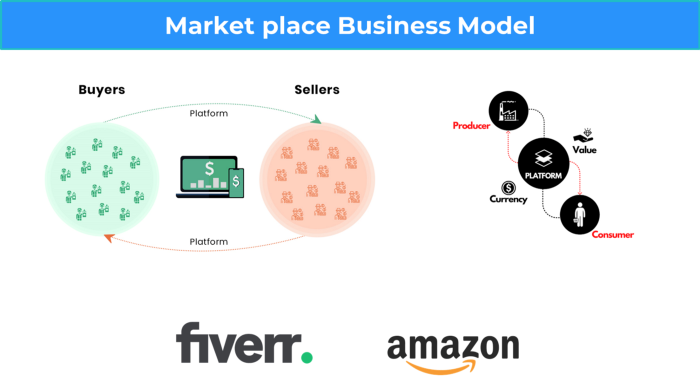

3. A market-based business strategy

It's an e-commerce site or app where third-party sellers sell products or services.

Examples are Amazon and Fiverr.

On Amazon's marketplace, a third-party vendor sells a product.

Freelancers on Fiverr offer specialized skills like graphic design.

Marketplace's business concept is explained.

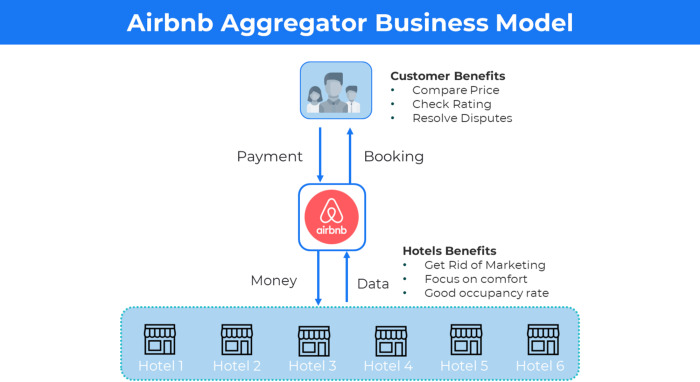

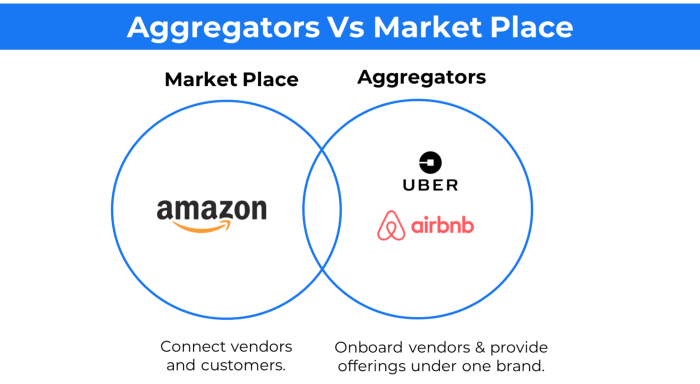

4. Business plans using aggregates

In the aggregator business model, the service is branded.

Uber, Airbnb, and other examples

Marketplace and Aggregator business models differ.

Amazon and Fiverr link merchants and customers and take a 10-20% revenue split.

Uber and Airbnb-style aggregator Join these businesses and provide their products.

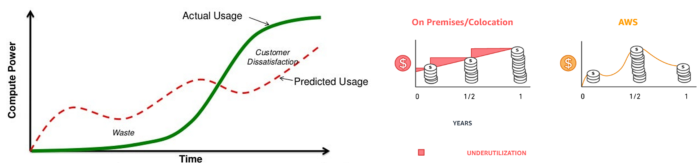

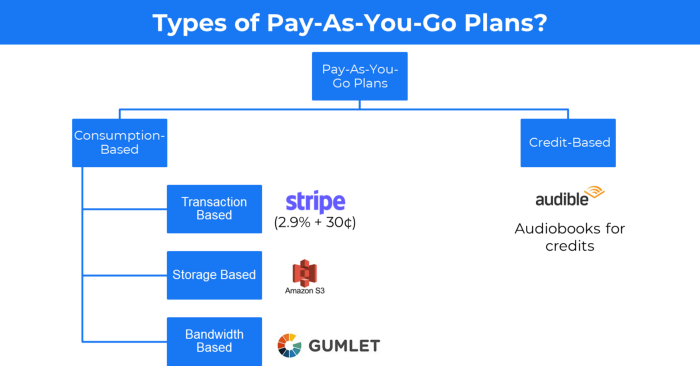

5. The pay-as-you-go concept of business

This is a consumption-based pricing system. Cloud companies use it.

Example: Amazon Web Service and Google Cloud Platform (GCP) (AWS)

AWS, an Amazon subsidiary, offers over 200 pay-as-you-go cloud services.

“In short, the more you use the more you pay”

When it's difficult to divide clients into pricing levels, pay-as-you is employed.

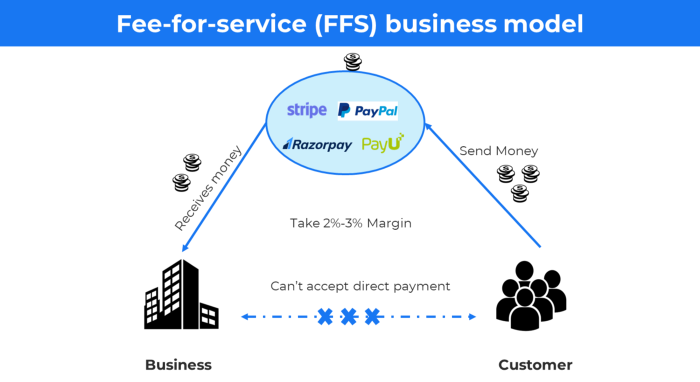

6. The business model known as fee-for-service (FFS)

FFS charges fixed and variable fees for each successful payment.

For instance, PayU, Paypal, and Stripe

Stripe charges 2.9% + 30 per payment.

These firms offer a payment gateway to take consumer payments and deposit them to a business account.

Fintech business model

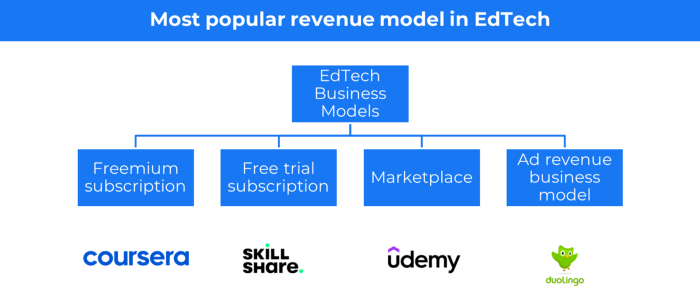

7. EdTech business strategy

In edtech, you generate money by selling material or teaching as a service.

edtech business models

Freemium When course content is free but certification isn't, e.g. Coursera

FREE TRIAL SkillShare offers free trials followed by monthly or annual subscriptions.

Self-serving marketplace approach where you pick what to learn.

Ad-revenue model The company makes money by showing adverts to its huge user base.

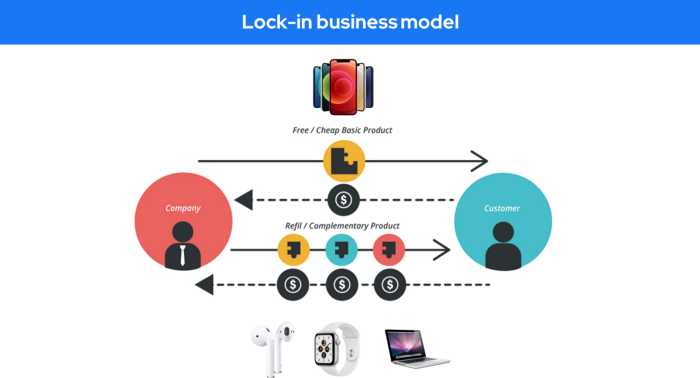

Lock-in business strategy

Lock in prevents customers from switching to a competitor's brand or offering.

It uses switching costs or effort to transmit (soft lock-in), improved brand experience, or incentives.

Apple, SAP, and other examples

Apple offers an iPhone and then locks you in with extra hardware (Watch, Airpod) and platform services (Apple Store, Apple Music, cloud, etc.).

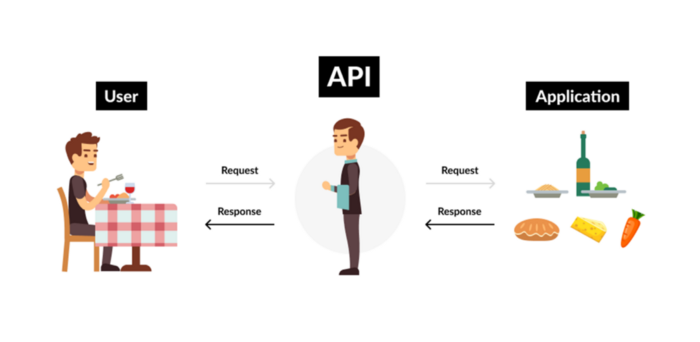

9. Business Model for API Licensing

APIs let third-party apps communicate with your service.

Uber and Airbnb use Google Maps APIs for app navigation.

Examples are Google Map APIs (Map), Sendgrid (Email), and Twilio (SMS).

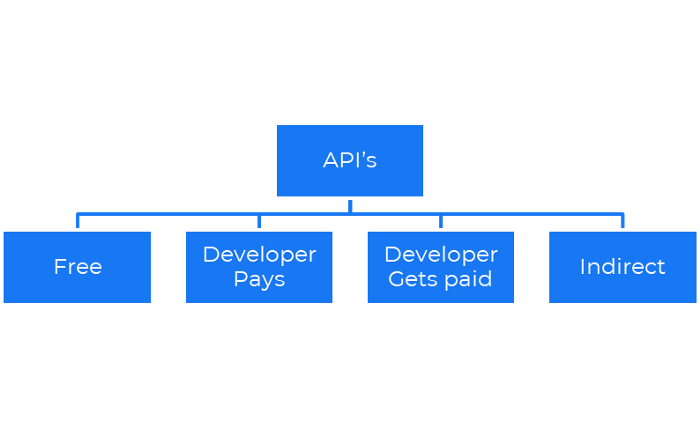

Business models for APIs

Free: The simplest API-driven business model that enables unrestricted API access for app developers. Google Translate and Facebook are two examples.

Developer Pays: Under this arrangement, service providers such as AWS, Twilio, Github, Stripe, and others must be paid by application developers.

The developer receives payment: These are the compensated content producers or developers who distribute the APIs utilizing their work. For example, Amazon affiliate programs

10. Open-source enterprise

Open-source software can be inspected, modified, and improved by anybody.

For instance, use Firefox, Java, or Android.

Google paid Mozilla $435,702 million to be their primary search engine in 2018.

Open-source software profits in six ways.

Paid assistance The Project Manager can charge for customization because he is quite knowledgeable about the codebase.

A full database solution is available as a Software as a Service (MongoDB Atlas), but there is a fee for the monitoring tool.

Open-core design R studio is a better GUI substitute for open-source applications.

sponsors of GitHub Sponsorships benefit the developers in full.

demands for paid features Earn Money By Developing Open Source Add-Ons for Current Products

Open-source business model

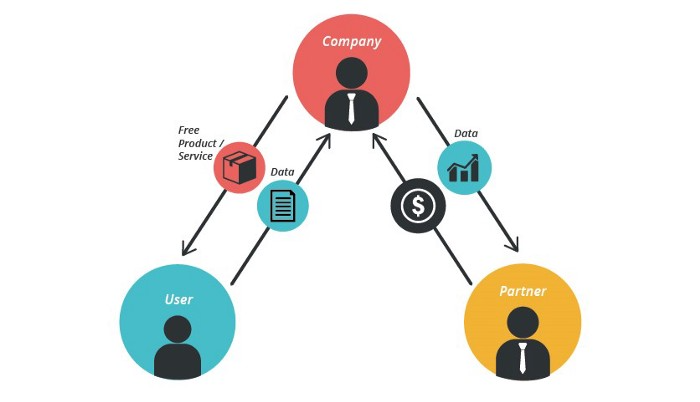

11. The business model for data

If the software or algorithm collects client data to improve or monetize the system.

Open AI GPT3 gets smarter with use.

Foursquare allows users to exchange check-in locations.

Later, they compiled large datasets to enable retailers like Starbucks launch new outlets.

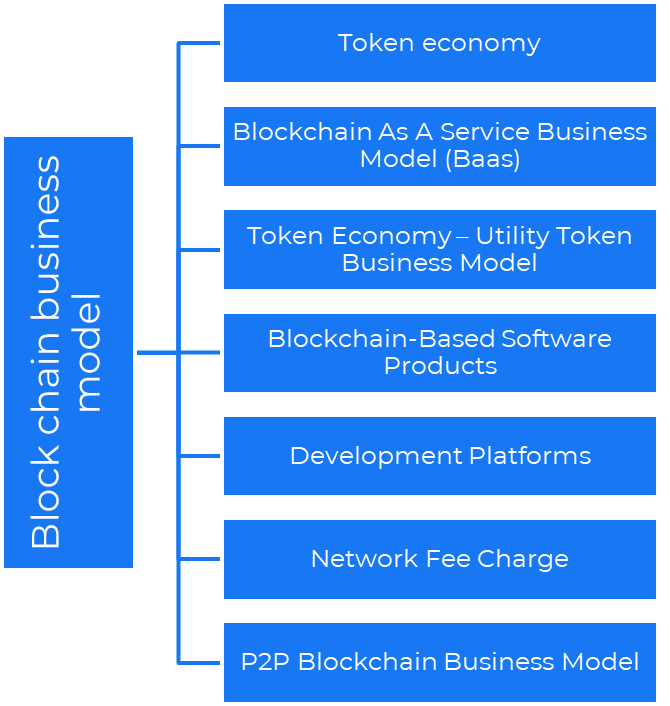

12. Business Model Using Blockchain

Blockchain is a distributed ledger technology that allows firms to deploy smart contracts without a central authority.

Examples include Alchemy, Solana, and Ethereum.

Business models using blockchain

Economy of tokens or utility When a business uses a token business model, it issues some kind of token as one of the ways to compensate token holders or miners. For instance, Solana and Ethereum

Bitcoin Cash P2P Business Model Peer-to-peer (P2P) blockchain technology permits direct communication between end users. as in IPFS

Enterprise Blockchain as a Service (Baas) BaaS focuses on offering ecosystem services similar to those offered by Amazon (AWS) and Microsoft (Azure) in the web 3 sector. Example: Ethereum Blockchain as a Service with Bitcoin (EBaaS).

Blockchain-Based Aggregators With AWS for blockchain, you can use that service by making an API call to your preferred blockchain. As an illustration, Alchemy offers nodes for many blockchains.

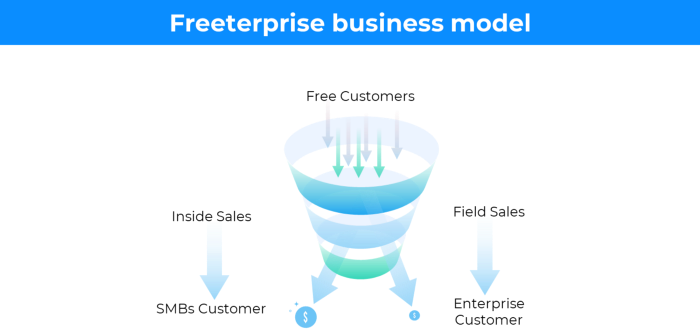

13. The free-enterprise model

In the freeterprise business model, free professional accounts are led into the funnel by the free product and later become B2B/enterprise accounts.

For instance, Slack and Zoom

Freeterprise companies flourish through collaboration.

Start with a free professional account to build an enterprise.

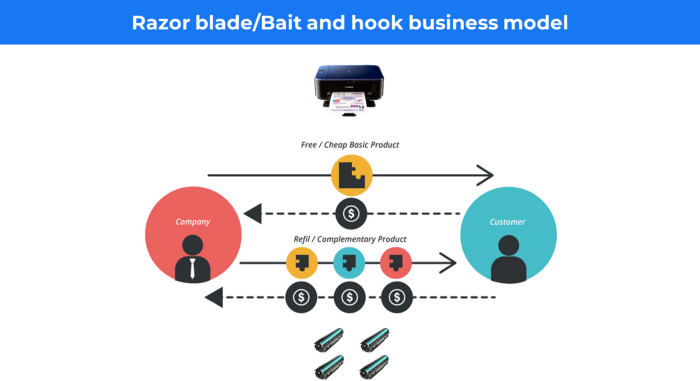

14. Business plan for razor blades

It's employed in hardware where one piece is sold at a loss and profits are made through refills or add-ons.

Gillet razor & blades, coffee machine & beans, HP printer & cartridge, etc.

Sony sells the Playstation console at a loss but makes up for it by selling games and charging for online services.

Advantages of the Razor-Razorblade Method

lowers the risk a customer will try a product. enables buyers to test the goods and services without having to pay a high initial investment.

The product's ongoing revenue stream has the potential to generate sales that much outweigh the original investments.

Razor blade business model

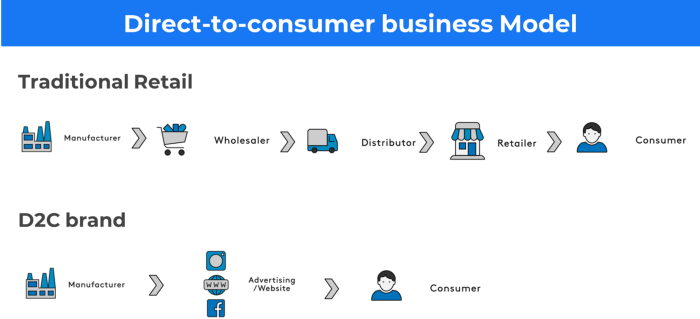

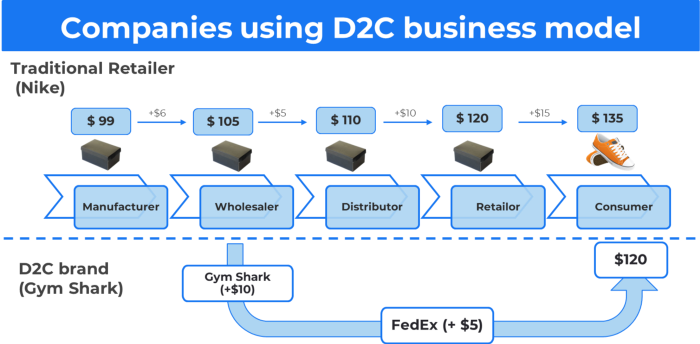

15. The business model of direct-to-consumer (D2C)

In D2C, the company sells directly to the end consumer through its website using a third-party logistic partner.

Examples include GymShark and Kylie Cosmetics.

D2C brands can only expand via websites, marketplaces (Amazon, eBay), etc.

D2C benefits

Lower reliance on middlemen = greater profitability

You now have access to more precise demographic and geographic customer data.

Additional space for product testing

Increased customisation throughout your entire product line-Inventory Less

16. Business model: White Label vs. Private Label

Private label/White label products are made by a contract or third-party manufacturer.

Most amazon electronics are made in china and white-labeled.

Amazon supplements and electronics.

Contract manufacturers handle everything after brands select product quantities on design labels.

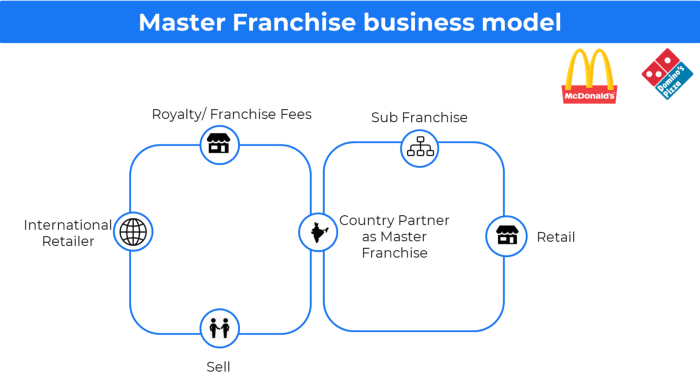

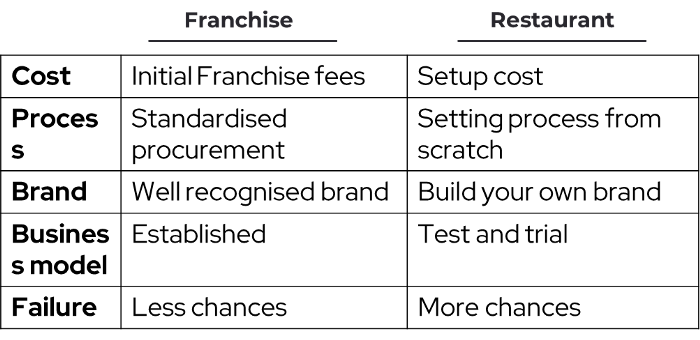

17. The franchise model

The franchisee uses the franchisor's trademark, branding, and business strategy (company).

For instance, KFC, Domino's, etc.

Subway, Domino, Burger King, etc. use this business strategy.

Many people pick a franchise because opening a restaurant is risky.

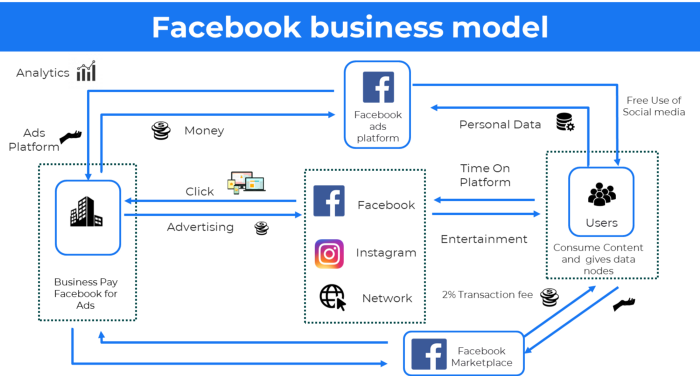

18. Ad-based business model

Social media and search engine giants exploit search and interest data to deliver adverts.

Google, Meta, TikTok, and Snapchat are some examples.

Users don't pay for the service or product given, e.g. Google users don't pay for searches.

In exchange, they collected data and hyper-personalized adverts to maximize revenue.

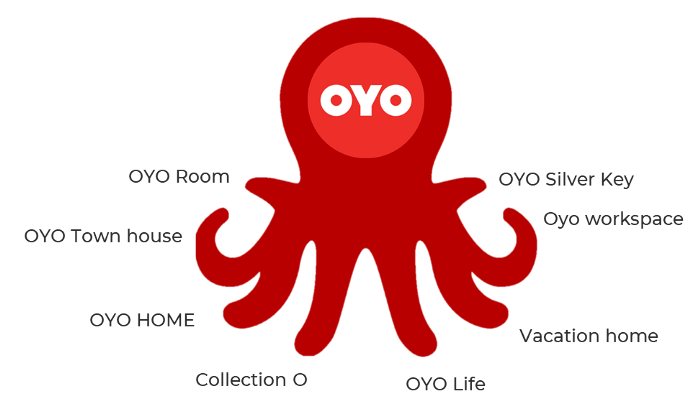

19. Business plan for octopuses

Each business unit functions separately but is connected to the main body.

Instance: Oyo

OYO is Asia's Airbnb, operating hotels, co-working, co-living, and vacation houses.

20, Transactional business model, number

Sales to customers produce revenue.

E-commerce sites and online purchases employ SSL.

Goli is an ex-GymShark.

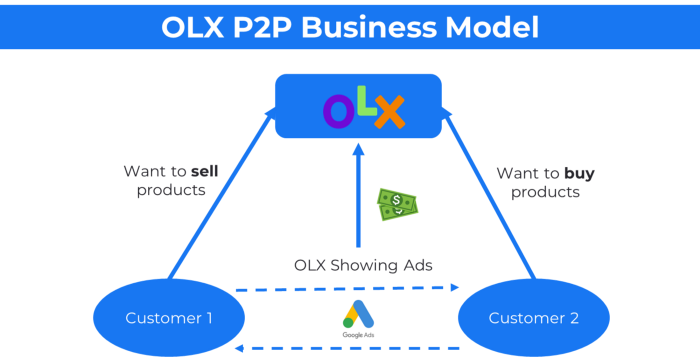

21. The peer-to-peer (P2P) business model

In P2P, two people buy and sell goods and services without a third party or platform.

Consider OLX.

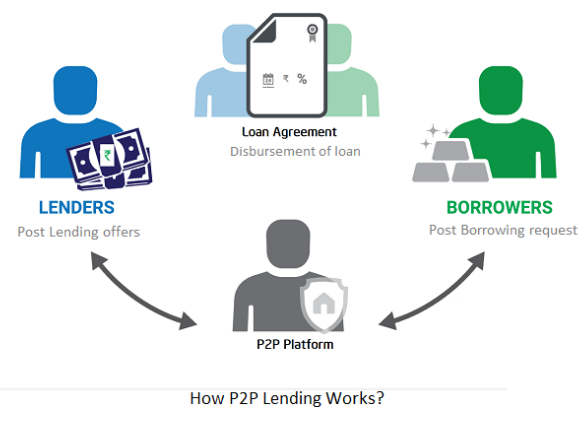

22. P2P lending as a manner of operation

In P2P lending, one private individual (P2P Lender) lends/invests or borrows money from another (P2P Borrower).

Instance: Kabbage

Social lending lets people lend and borrow money directly from each other without an intermediary financial institution.

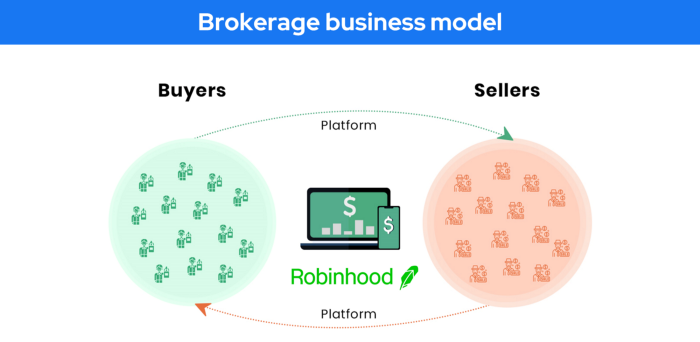

23. A business model for brokers

Brokerages charge a commission or fee for their services.

Examples include eBay, Coinbase, and Robinhood.

Brokerage businesses are common in Real estate, finance, and online and operate on this model.

Buy/sell similar models Examples include financial brokers, insurance brokers, and others who match purchase and sell transactions and charge a commission.

These brokers charge an advertiser a fee based on the date, place, size, or type of an advertisement. This is known as the classified-advertiser model. For instance, Craiglist

24. Drop shipping as an industry

Dropshipping allows stores to sell things without holding physical inventories.

When a customer orders, use a third-party supplier and logistic partners.

Retailer product portfolio and customer experience Fulfiller The consumer places the order.

Dropshipping advantages

Less money is needed (Low overhead-No Inventory or warehousing)

Simple to start (costs under $100)

flexible work environment

New product testing is simpler

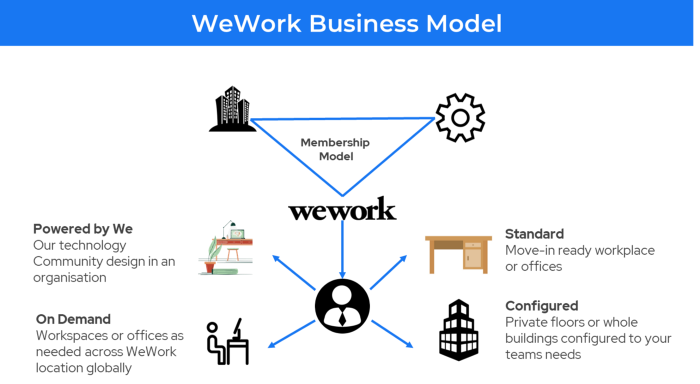

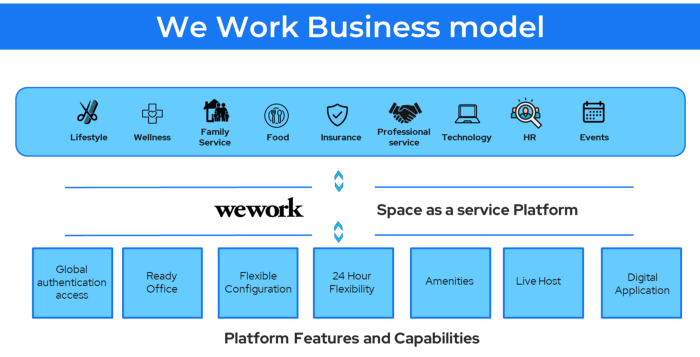

25. Business Model for Space as a Service

It's centered on a shared economy that lets millennials live or work in communal areas without ownership or lease.

Consider WeWork and Airbnb.

WeWork helps businesses with real estate, legal compliance, maintenance, and repair.

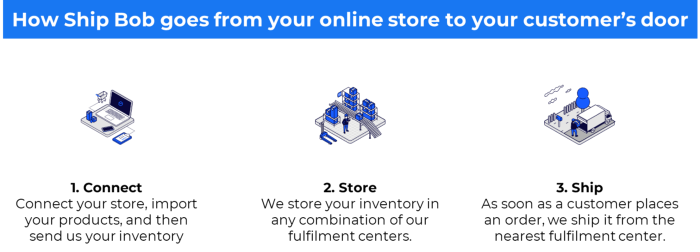

26. The business model for third-party logistics (3PL)

In 3PL, a business outsources product delivery, warehousing, and fulfillment to an external logistics company.

Examples include Ship Bob, Amazon Fulfillment, and more.

3PL partners warehouse, fulfill, and return inbound and outbound items for a charge.

Inbound logistics involves bringing products from suppliers to your warehouse.

Outbound logistics refers to a company's production line, warehouse, and customer.

27. The last-mile delivery paradigm as a commercial strategy

Last-mile delivery is the collection of supply chain actions that reach the end client.

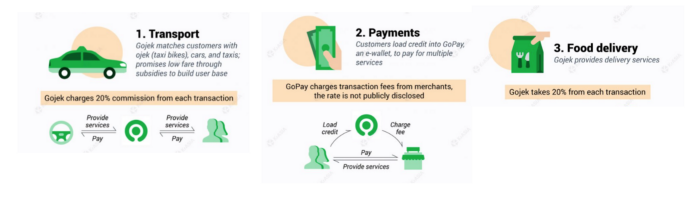

Examples include Rappi, Gojek, and Postmates.

Last-mile is tied to on-demand and has a nighttime peak.

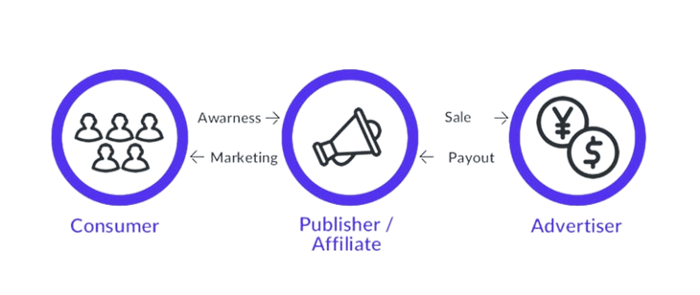

28. The use of affiliate marketing

Affiliate marketing involves promoting other companies' products and charging commissions.

Examples include Hubspot, Amazon, and Skillshare.

Your favorite youtube channel probably uses these short amazon links to get 5% of sales.

Affiliate marketing's benefits

In exchange for a success fee or commission, it enables numerous independent marketers to promote on its behalf.

Ensure system transparency by giving the influencers a specific tracking link and an online dashboard to view their profits.

Learn about the newest bargains and have access to promotional materials.

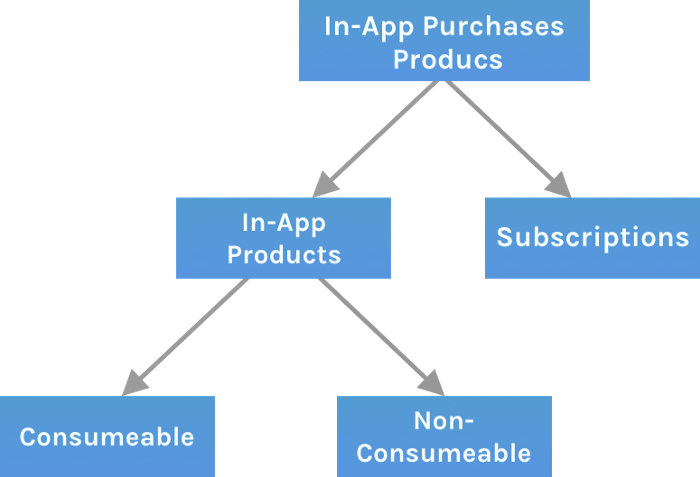

29. The business model for virtual goods

This is an in-app purchase for an intangible product.

Examples include PubG, Roblox, Candy Crush, etc.

Consumables are like gaming cash that runs out. Non-consumable products provide a permanent advantage without repeated purchases.

30. Business Models for Cloud Kitchens

Ghost, Dark, Black Box, etc.

Delivery-only restaurant.

These restaurants don't provide dine-in, only delivery.

For instance, NextBite and Faasos

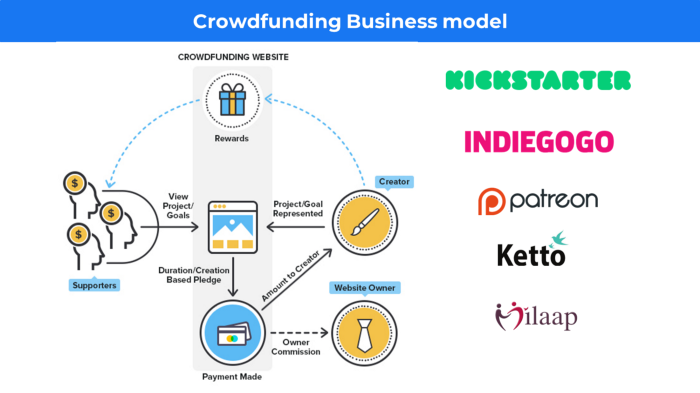

31. Crowdsourcing as a Business Model

Crowdsourcing = Using the crowd as a platform's source.

In crowdsourcing, you get support from people around the world without hiring them.

Crowdsourcing sites

Open-Source Software gives access to the software's source code so that developers can edit or enhance it. Examples include Firefox browsers and Linux operating systems.

Crowdfunding The oculus headgear would be an example of crowdfunding in essence, with no expectations.

MAJESTY AliNICOLE WOW!

3 years ago

YouTube's faceless videos are growing in popularity, but this is nothing new.

I've always bucked social media norms. YouTube doesn't compare. Traditional video made me zig when everyone zagged. Audio, picture personality animation, thought movies, and slide show videos are most popular and profitable.

YouTube's business is shifting. While most video experts swear by the idea that YouTube success is all about making personal and professional Face-Share-Videos, those who use YouTube for business know things are different.

In this article, I will share concepts from my mini master class Figures to Followers: Prioritizing Purposeful Profits Over Popularity on YouTube to Create the Win-Win for You, Your Audience & More and my forthcoming publication The WOWTUBE-PRENEUR FACTOR EVOLUTION: The Basics of Powerfully & Profitably Positioning Yourself as a Video Communications Authority to Broadcast Your WOW Effect as a Video Entrepreneur.

I've researched the psychology, anthropology, and anatomy of significant social media platforms as an entrepreneur and social media marketing expert. While building my YouTube empire, I've paid particular attention to what works for short, mid, and long-term success, whether it's a niche-focused, lifestyle, or multi-interest channel.

Most new, semi-new, and seasoned YouTubers feel vlog-style or live-on-camera videos are popular. Faceless, animated, music-text-based, and slideshow videos do well for businesses.

Buyer-consumer vs. content-consumer thinking is totally different when absorbing content. Profitability and popularity are closely related, however most people become popular with traditional means but not profitable.

In my experience, Faceless videos are more profitable, although it depends on the channel's style. Several professionals are now teaching in their courses that non-traditional films are making the difference in their business success and popularity.

Face-Share-Personal-Touch videos make audiences feel like they know the personality, but they're not profitable.

Most spend hours creating articles, videos, and thumbnails to seem good. That's how most YouTubers gained their success in the past, but not anymore.

Looking the part and performing a typical role in videos doesn't convert well, especially for newbie channels.

Working with video marketers and YouTubers for years, I've noticed that most struggle to be consistent with content publishing since they exclusively use formats that need extensive development. Camera and green screen set ups, shooting/filming, and editing for post productions require their time, making it less appealing to post consistently, especially if they're doing all the work themselves.

Because they won't make simple format videos or audio videos with an overlay image, they overcomplicate the procedure (even with YouTube Shorts), and they leave their channels for weeks or months. Again, they believe YouTube only allows specific types of videos. Even though this procedure isn't working, they plan to keep at it.

A successful YouTube channel needs multiple video formats to suit viewer needs, I teach. Face-Share-Personal Touch and Faceless videos are both useful.

How people engage with YouTube content has changed over the years, and the average customer is no longer interested in an all-video channel.

Face-Share-Personal-Touch videos are great

Google Live

Online training

Giving listeners a different way to access your podcast that is being broadcast on sites like Anchor, BlogTalkRadio, Spreaker, Google, Apple Store, and others Many people enjoy using a video camera to record themselves while performing the internet radio, Facebook, or Instagram Live versions of their podcasts.

Video Blog Updates

even more

Faceless videos are popular for business and benefit both entrepreneurs and audiences.

For the business owner/entrepreneur…

Less production time results in time dollar savings.

enables the business owner to demonstrate the diversity of content development

For the Audience…

The channel offers a variety of appealing content options.

The same format is not monotonous or overly repetitive for the viewers.

Below are a couple videos from YouTube guru Make Money Matt's channel, which has over 347K subscribers.

Enjoy

24 Best Niches to Make Money on YouTube Without Showing Your Face

Make Money on YouTube Without Making Videos (Free Course)

In conclusion, you have everything it takes to build your own YouTube brand and empire. Learn the rules, then adapt them to succeed.

Please reread this and the other suggested articles for optimal benefit.

I hope this helped. How has this article helped you? Follow me for more articles like this and more multi-mission expressions.

Edward Williams

3 years ago

I currently manage 4 profitable online companies. I find all the generic advice and garbage courses very frustrating. The only advice you need is this.

This is for young entrepreneurs, especially in tech.

People give useless success advice on TikTok and Reddit. Early risers, bookworms, etc. Entrepreneurship courses. Work hard and hustle.

False. These aren't successful traits.

I mean, organization is good. As someone who founded several businesses and now works at a VC firm, I find these tips to be clichés.

Based on founding four successful businesses and working with other successful firms, here's my best actionable advice:

1. Choose a sector or a niche and become an expert in it.

This is more generic than my next tip, but it's a must-do that's often overlooked. Become an expert in the industry or niche you want to enter. Discover everything.

Buy (future) competitors' products. Understand consumers' pain points. Market-test. Target keyword combos. Learn technical details.

The most successful businesses I've worked with were all formed by 9-5 employees. They knew the industry's pain points. They started a business targeting these pain points.

2. Choose a niche or industry crossroads to target.

How do you choose an industry or niche? What if your industry is too competitive?

List your skills and hobbies. Randomness is fine. Find an intersection between two interests or skills.

Say you build websites well. You like cars.

Web design is a *very* competitive industry. Cars and web design?

Instead of web design, target car dealers and mechanics. Build a few fake demo auto mechanic websites, then cold call shops with poor websites. Verticalize.

I've noticed a pattern:

Person works in a particular industry for a corporation.

Person gains expertise in the relevant industry.

Person quits their job and launches a small business to address a problem that their former employer was unwilling to address.

I originally posted this on Reddit and it seemed to have taken off so I decided to share it with you all.

Focus on the product. When someone buys from you, you convince them the product's value exceeds the price. It's not fair and favors the buyer.

Creating a superior product or service will win. Narrowing this helps you outcompete others.

You may be their only (lucky) option.

You might also like

Shawn Mordecai

3 years ago

The Apple iPhone 14 Pill is Easier to Swallow

Is iPhone's Dynamic Island invention or a marketing ploy?

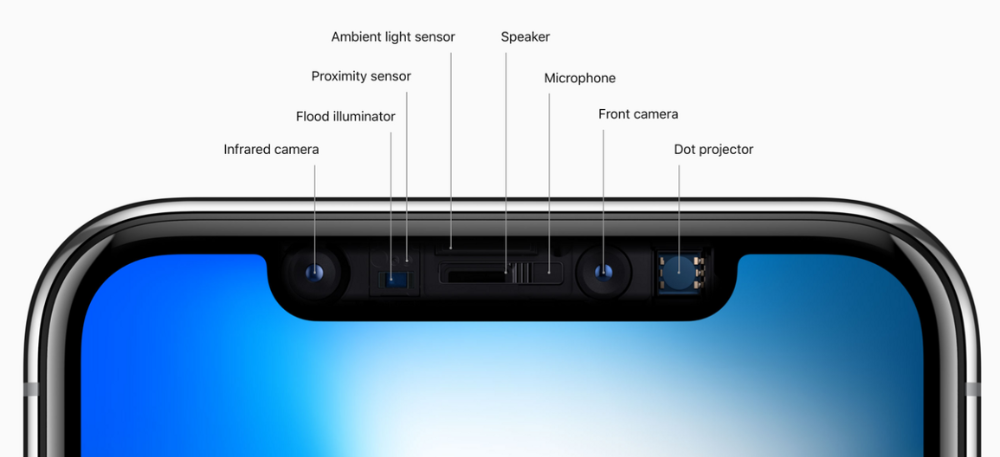

First of all, why the notch?

When Apple debuted the iPhone X with the notch, some were surprised, confused, and amused by the goof. Let the Brits keep the new meaning of top-notch.

Apple removed the bottom home button to enhance screen space. The tides couldn't overtake part of the top. This section contained sensors, a speaker, a microphone, and cameras for facial recognition. A town resisted Apple's new iPhone design.

From iPhone X to 13, the notch has gotten smaller. We expected this as technology and engineering progressed, but we hated the notch. Apple approved. They attached it to their other gadgets.

Apple accepted, owned, and ran with the iPhone notch, it has become iconic (or infamous); and that’s intentional.

The Island Where Apple Is

Apple needs to separate itself, but they know how to do it well. The iPhone 14 Pro finally has us oohing and aahing. Life-changing, not just higher pixel density or longer battery.

Dynamic Island turned a visual differentiation into great usefulness, which may not be life-changing. Apple always welcomes the controversy, whether it's $700 for iMac wheels, no charging block with a new phone, or removing the headphone jack.

Apple knows its customers will be loyal, even if they're irritated. Their odd design choices often cause controversy. It's calculated that people blog, review, and criticize Apple's products. We accept what works for them.

While the competition zigs, Apple zags. Sometimes they zag too hard and smash into a wall, but we talk about it anyways, and that’s great publicity for them.

Getting Dependent on the drug

The notch became a crop. Dynamic Island's design is helpful, intuitive, elegant, and useful. It increases iPhone usability, productivity (slightly), and joy. No longer unsightly.

The medication helps with multitasking. It's a compact version of the iPhone's Live Activities lock screen function. Dynamic Island enhances apps and activities with visual effects and animations whether you engage with it or not. As you use the pill, its usefulness lessens. It lowers user notifications and consolidates them with live and permanent feeds, delivering quick app statuses. It uses the black pixels on the iPhone 14's display, which looked like a poor haircut.

The pill may be a gimmick to entice customers to use more Apple products and services. Apps may promote to their users like a live billboard.

Be prepared to get a huge dose of Dynamic Island’s “pill” like you never had before with the notch. It might become so satisfying and addicting to use, that every interaction with it will become habit-forming, and you’re going to forget that it ever existed.

WARNING: A Few Potential Side Effects

Vision blurred Dynamic Island's proximity to the front-facing camera may leave behind grease that blurs photos. Before taking a selfie, wipe the camera clean.

Strained thumb To fully use Dynamic Island, extend your thumb's reach 6.7 inches beyond your typical, comfortable range.

Happiness, contentment The Dynamic Island may enhance Endorphins and Dopamine. Multitasking, interactions, animations, and haptic feedback make you want to use this function again and again.

Motion-sickness Dynamic Island's motions and effects may make some people dizzy. If you can disable animations, you can avoid motion sickness.

I'm not a doctor, therefore they aren't established adverse effects.

Does Dynamic Island Include Multiple Tasks?

Dynamic Islands is a placebo for multitasking. Apple might have compromised on iPhone multitasking. It won't make you super productive, but it's a step up.

iPhone is primarily for personal use, like watching videos, messaging friends, sending money to friends, calling friends about the money you were supposed to send them, taking 50 photos of the same leaf, investing in crypto, driving for Uber because you lost all your money investing in crypto, listening to music and hailing an Uber from a deserted crop field because while you were driving for Uber your passenger stole your car and left you stranded, so you used Apple’s new SOS satellite feature to message your friend, who still didn’t receive their money, to hail you an Uber; now you owe them more money… karma?

We won't be watching videos on iPhones while perusing 10,000-row spreadsheets anytime soon. True multitasking and productivity aren't priorities for Apple's iPhone. Apple doesn't to preserve the iPhone's experience. Like why there's no iPad calculator. Apple doesn't want iPad users to do math, but isn't essential for productivity?

Digressing.

Apple will block certain functions so you must buy and use their gadgets and services, immersing yourself in their ecosystem and dictating how to use their goods.

Dynamic Island is a poor man’s multi-task for iPhone, and that’s fine it works for most iPhone users. For substantial productivity Apple prefers you to get an iPad or a MacBook. That’s part of the reason for restrictive features on certain Apple devices, but sometimes it’s based on principles to preserve the integrity of the product, according to Apple’s definition.

Is Apple using deception?

Dynamic Island may be distracting you from a design decision. The answer is kind of. Elegant distraction

When you pull down a smartphone webpage to refresh it or minimize an app, you get seamless animations. It's not simply because it appears better; it's due to iPhone and smartphone processing speeds. Such limits reduce the system's response to your activity, slowing the experience. Designers and developers use animations and effects to distract us from the time lag (most of the time) and sometimes because it looks cooler and smoother.

Dynamic Island makes apps more useable and interactive. It shows system states visually. Turn signal audio and visual cues, voice assistance, physical and digital haptic feedbacks, heads-up displays, fuel and battery level gauges, and gear shift indicators helped us overcome vehicle design problems.

Dynamic Island is a wonderfully delightful (and temporary) solution to a design “problem” until Apple or other companies can figure out a way to sink the cameras under the smartphone screen.

Apple Has Returned to Being an Innovative & Exciting Company

Now Apple's products are exciting. Next, bring back real Apple events, not pre-recorded demos.

Dynamic Island integrates hardware and software. What will this new tech do? How would this affect device use? Or is it just hype?

Dynamic Island may be an insignificant improvement to the iPhone, but it sure is promising for the future of bridging the human and computer interaction gap.

Yusuf Ibrahim

4 years ago

How to sell 10,000 NFTs on OpenSea for FREE (Puppeteer/NodeJS)

So you've finished your NFT collection and are ready to sell it. Except you can't figure out how to mint them! Not sure about smart contracts or want to avoid rising gas prices. You've tried and failed with apps like Mini mouse macro, and you're not familiar with Selenium/Python. Worry no more, NodeJS and Puppeteer have arrived!

Learn how to automatically post and sell all 1000 of my AI-generated word NFTs (Nakahana) on OpenSea for FREE!

My NFT project — Nakahana |

NOTE: Only NFTs on the Polygon blockchain can be sold for free; Ethereum requires an initiation charge. NFTs can still be bought with (wrapped) ETH.

If you want to go right into the code, here's the GitHub link: https://github.com/Yusu-f/nftuploader

Let's start with the knowledge and tools you'll need.

What you should know

You must be able to write and run simple NodeJS programs. You must also know how to utilize a Metamask wallet.

Tools needed

- NodeJS. You'll need NodeJs to run the script and NPM to install the dependencies.

- Puppeteer – Use Puppeteer to automate your browser and go to sleep while your computer works.

- Metamask – Create a crypto wallet and sign transactions using Metamask (free). You may learn how to utilize Metamask here.

- Chrome – Puppeteer supports Chrome.

Let's get started now!

Starting Out

Clone Github Repo to your local machine. Make sure that NodeJS, Chrome, and Metamask are all installed and working. Navigate to the project folder and execute npm install. This installs all requirements.

Replace the “extension path” variable with the Metamask chrome extension path. Read this tutorial to find the path.

Substitute an array containing your NFT names and metadata for the “arr” variable and the “collection_name” variable with your collection’s name.

Run the script.

After that, run node nftuploader.js.

Open a new chrome instance (not chromium) and Metamask in it. Import your Opensea wallet using your Secret Recovery Phrase or create a new one and link it. The script will be unable to continue after this but don’t worry, it’s all part of the plan.

Next steps

Open your terminal again and copy the route that starts with “ws”, e.g. “ws:/localhost:53634/devtools/browser/c07cb303-c84d-430d-af06-dd599cf2a94f”. Replace the path in the connect function of the nftuploader.js script.

const browser = await puppeteer.connect({ browserWSEndpoint: "ws://localhost:58533/devtools/browser/d09307b4-7a75-40f6-8dff-07a71bfff9b3", defaultViewport: null });

Rerun node nftuploader.js. A second tab should open in THE SAME chrome instance, navigating to your Opensea collection. Your NFTs should now start uploading one after the other! If any errors occur, the NFTs and errors are logged in an errors.log file.

Error Handling

The errors.log file should show the name of the NFTs and the error type. The script has been changed to allow you to simply check if an NFT has already been posted. Simply set the “searchBeforeUpload” setting to true.

We're done!

If you liked it, you can buy one of my NFTs! If you have any concerns or would need a feature added, please let me know.

Thank you to everyone who has read and liked. I never expected it to be so popular.

Jano le Roux

3 years ago

Here's What I Learned After 30 Days Analyzing Apple's Microcopy

Move people with tiny words.

Apple fanboy here.

Macs are awesome.

Their iPhones rock.

$19 cloths are great.

$999 stands are amazing.

I love Apple's microcopy even more.

It's like the marketing goddess bit into the Apple logo and blessed the world with microcopy.

I took on a 30-day micro-stalking mission.

Every time I caught myself wasting time on YouTube, I had to visit Apple’s website to learn the secrets of the marketing goddess herself.

We've learned. Golden apples are calling.

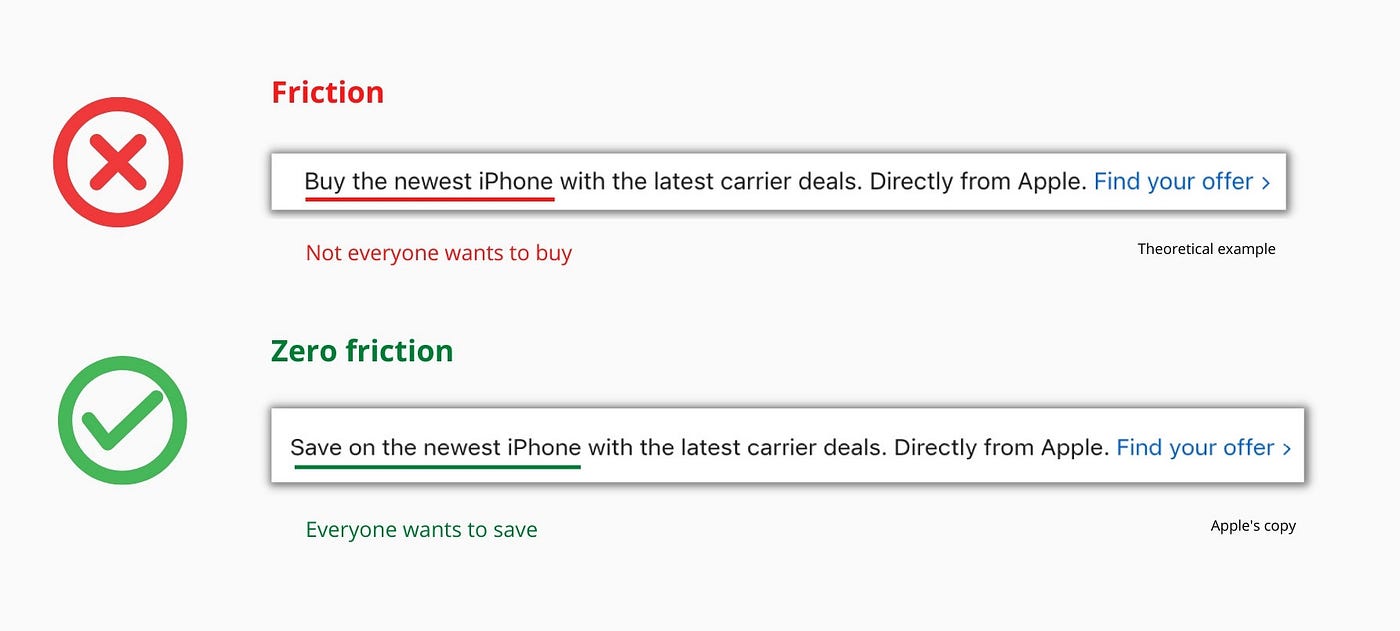

Cut the friction

Benefit-first, not commitment-first.

Brands lose customers through friction.

Most brands don't think like customers.

Brands want sales.

Brands want newsletter signups.

Here's their microcopy:

“Buy it now.”

“Sign up for our newsletter.”

Both are difficult. They ask for big commitments.

People are simple creatures. Want pleasure without commitment.

Apple nails this.

So, instead of highlighting the commitment, they highlight the benefit of the commitment.

Saving on the latest iPhone sounds easier than buying it. Everyone saves, but not everyone buys.

A subtle change in framing reduces friction.

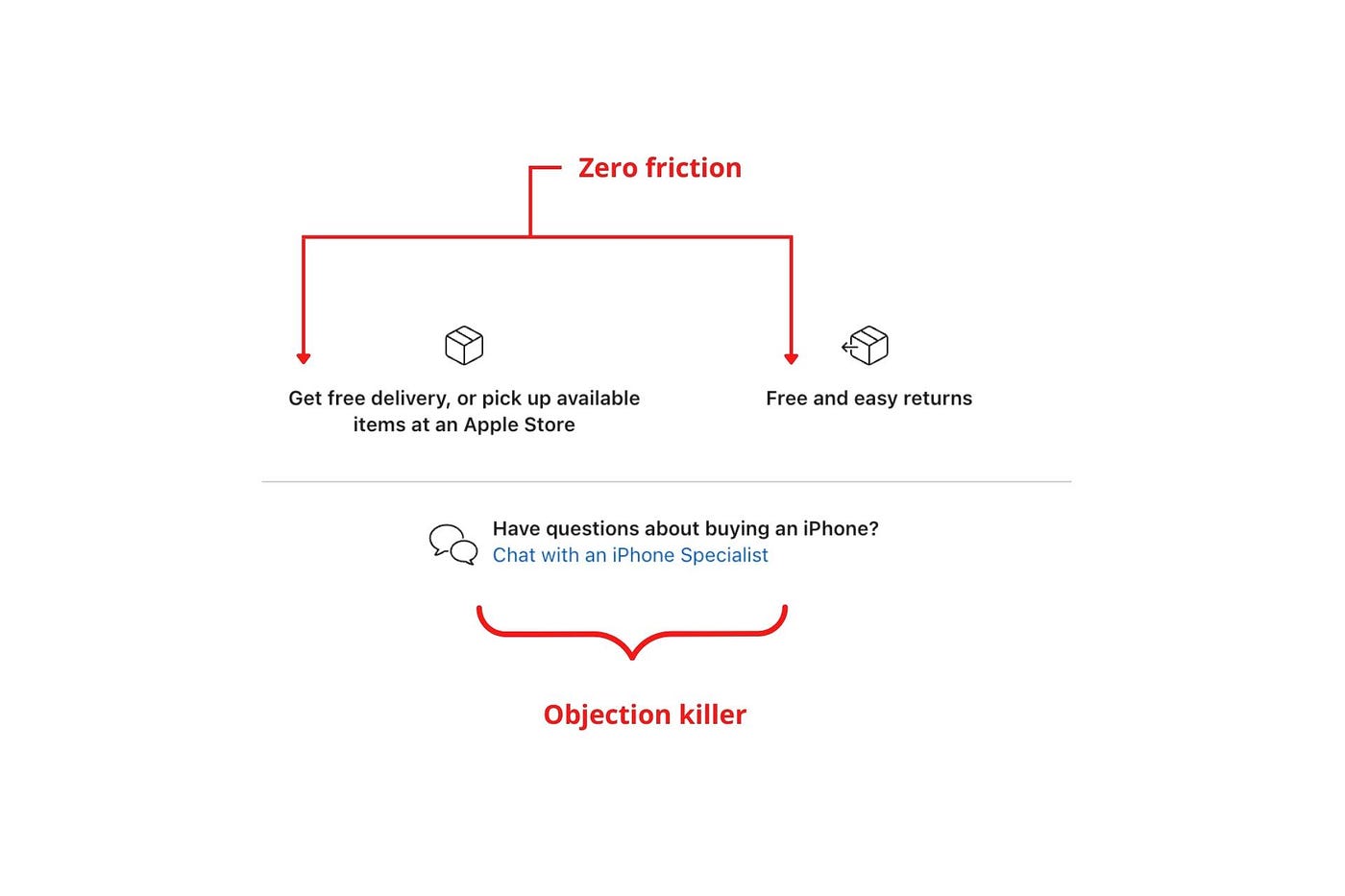

Apple eliminates customer objections to reduce friction.

Less customer friction means simpler processes.

Apple's copy expertly reassures customers about shipping fees and not being home. Apple assures customers that returning faulty products is easy.

Apple knows that talking to a real person is the best way to reduce friction and improve their copy.

Always rhyme

Learn about fine rhyme.

Poets make things beautiful with rhyme.

Copywriters use rhyme to stand out.

Apple’s copywriters have mastered the art of corporate rhyme.

Two techniques are used.

1. Perfect rhyme

Here, rhymes are identical.

2. Imperfect rhyme

Here, rhyming sounds vary.

Apple prioritizes meaning over rhyme.

Apple never forces rhymes that don't fit.

It fits so well that the copy seems accidental.

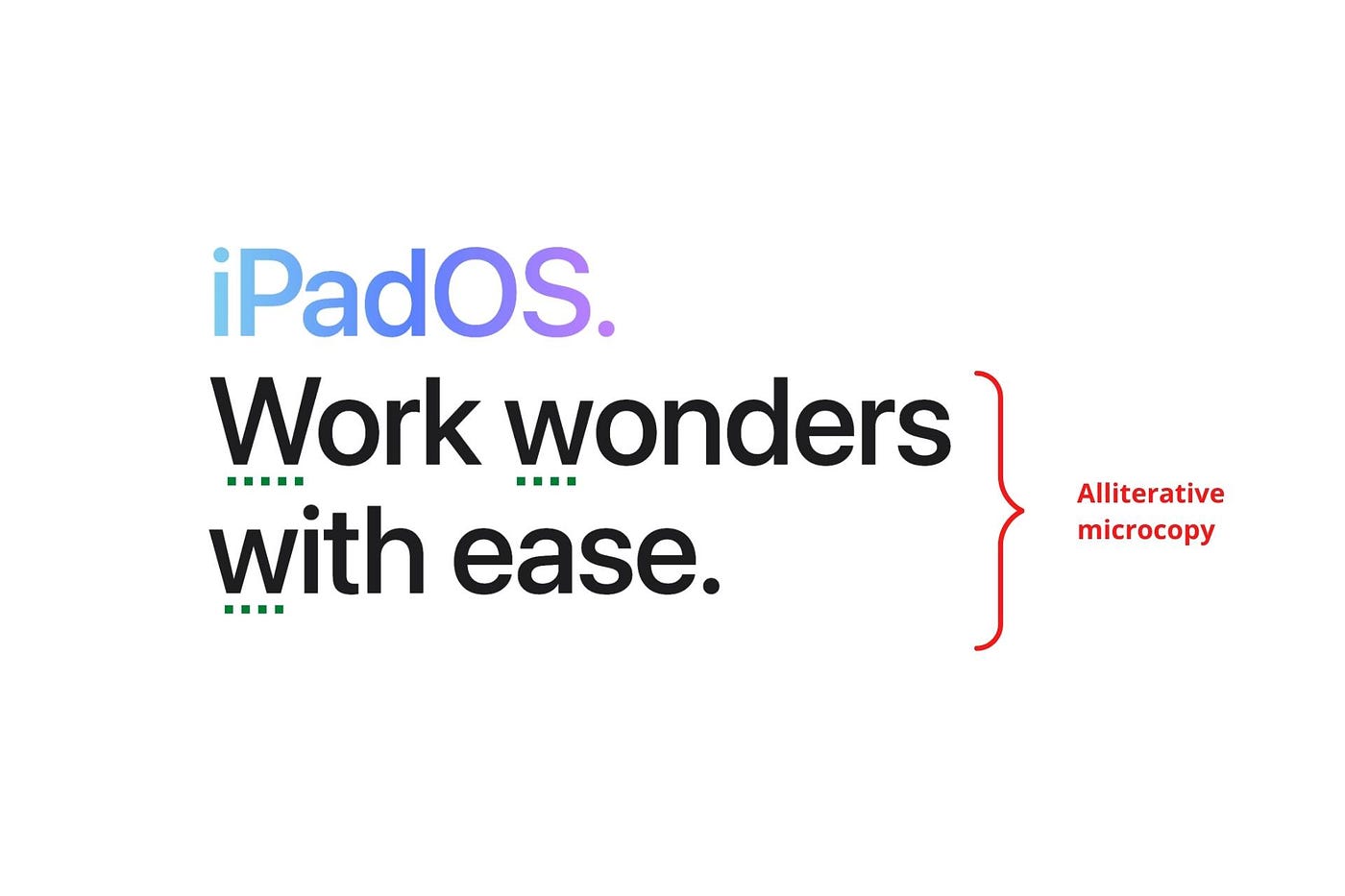

Add alliteration

Alliteration always entertains.

Alliteration repeats initial sounds in nearby words.

Apple's copy uses alliteration like no other brand I've seen to create a rhyming effect or make the text more fun to read.

For example, in the sentence "Sam saw seven swans swimming," the initial "s" sound is repeated five times. This creates a pleasing rhythm.

Microcopy overuse is like pouring ketchup on a Michelin-star meal.

Alliteration creates a memorable phrase in copywriting. It's subtler than rhyme, and most people wouldn't notice; it simply resonates.

I love how Apple uses alliteration and contrast between "wonders" and "ease".

Assonance, or repeating vowels, isn't Apple's thing.

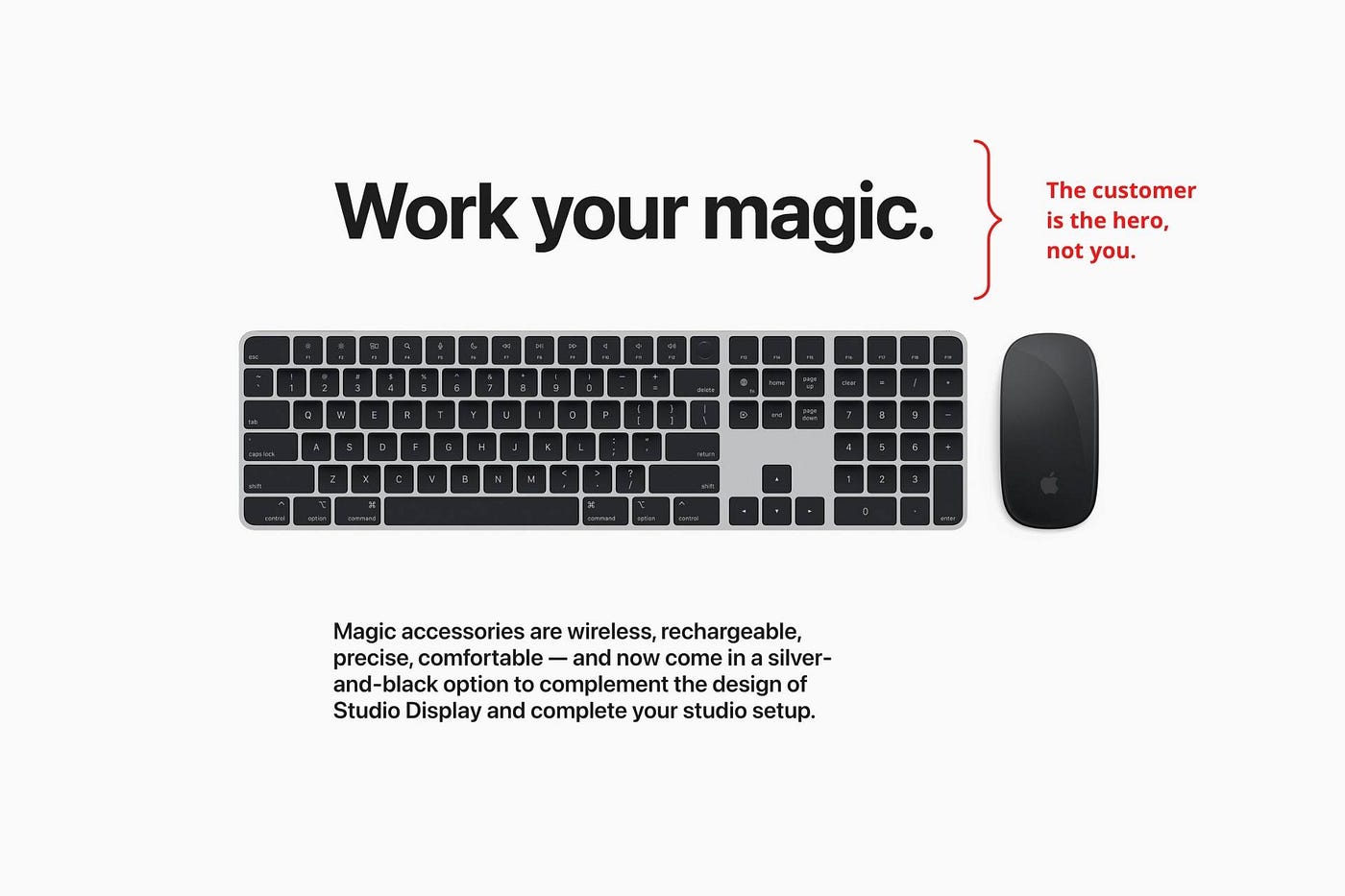

You ≠ Hero, Customer = Hero

Your brand shouldn't be the hero.

Because they'll be using your product or service, your customer should be the hero of your copywriting. With your help, they should feel like they can achieve their goals.

I love how Apple emphasizes what you can do with the machine in this microcopy.

It's divine how they position their tools as sidekicks to help below.

This one takes the cake:

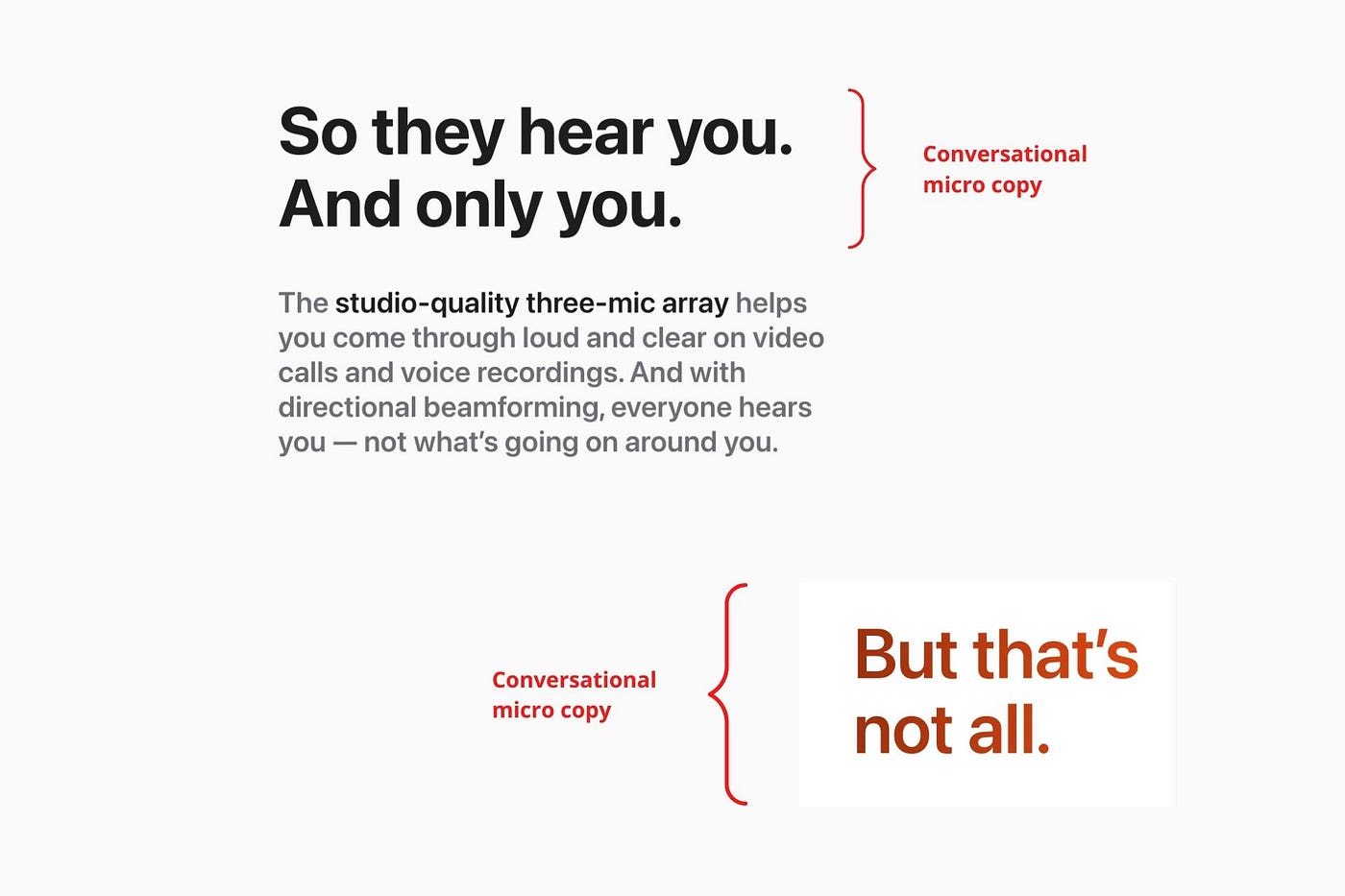

Dialogue-style writing

Conversational copy engages.

Excellent copy Like sharing gum with a friend.

This helps build audience trust.

Apple does this by using natural connecting words like "so" and phrases like "But that's not all."

Snowclone-proof

The mother of all microcopy techniques.

A snowclone uses an existing phrase or sentence to create a new one. The new phrase or sentence uses the same structure but different words.

It’s usually a well know saying like:

To be or not to be.

This becomes a formula:

To _ or not to _.

Copywriters fill in the blanks with cause-related words. Example:

To click or not to click.

Apple turns "survival of the fittest" into "arrival of the fittest."

It's unexpected and surprises the reader.

So this was fun.

But my fun has just begun.

Microcopy is 21st-century poetry.

I came as an Apple fanboy.

I leave as an Apple fanatic.

Now I’m off to find an apple tree.

Cause you know how it goes.

(Apples, trees, etc.)

This post is a summary. Original post available here.