More on Web3 & Crypto

Jayden Levitt

3 years ago

The country of El Salvador's Bitcoin-obsessed president lost $61.6 million.

It’s only a loss if you sell, right?

Nayib Bukele proclaimed himself “the world’s coolest dictator”.

His jokes aren't clear.

El Salvador's 43rd president self-proclaimed “CEO of El Salvador” couldn't be less presidential.

His thin jeans, aviator sunglasses, and baseball caps like a cartel lord.

He's popular, though.

Bukele won 53% of the vote by fighting violent crime and opposition party corruption.

El Salvador's 6.4 million inhabitants are riding the cryptocurrency volatility wave.

They were powerless.

Their autocratic leader, a former Yamaha Motors salesperson and Bitcoin believer, wants to help 70% unbanked locals.

He intended to give the citizens a way to save money and cut the country's $200 million remittance cost.

Transfer and deposit costs.

This makes logical sense when the president’s theatrics don’t blind you.

El Salvador's Bukele revealed plans to make bitcoin legal tender.

Remittances total $5.9 billion (23%) of the country's expenses.

Anything that reduces costs could boost the economy.

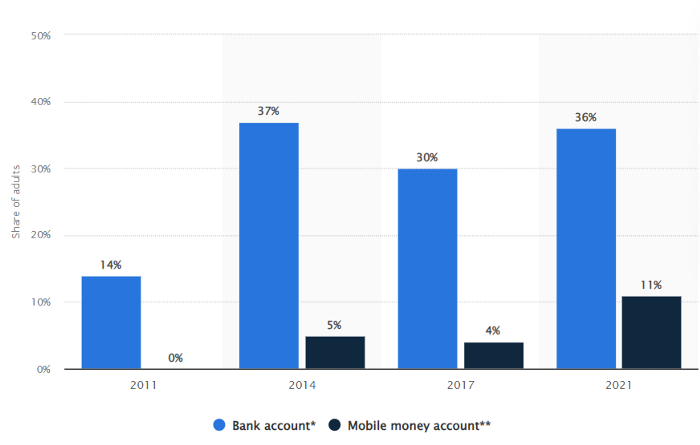

The country’s unbanked population is staggering. Here’s the data by % of people who either have a bank account (Blue) or a mobile money account (Black).

According to Bukele, 46% of the population has downloaded the Chivo Bitcoin Wallet.

In 2021, 36% of El Salvadorans had bank accounts.

Large rural countries like Kenya seem to have resolved their unbanked dilemma.

An economy surfaced where village locals would sell, trade and store network minutes and data as a store of value.

Kenyan phone networks realized unbanked people needed a safe way to accumulate wealth and have an emergency fund.

96% of Kenyans utilize M-PESA, which doesn't require a bank account.

The software involves human agents who hang out with cash and a phone.

These people are like ATMs.

You offer them cash to deposit money in your mobile money account or withdraw cash.

In a country with a faulty banking system, cash availability and a safe place to deposit it are important.

William Jack and Tavneet Suri found that M-PESA brought 194,000 Kenyan households out of poverty by making transactions cheaper and creating a safe store of value.

Mobile money, a service that allows monetary value to be stored on a mobile phone and sent to other users via text messages, has been adopted by most Kenyan households. We estimate that access to the Kenyan mobile money system M-PESA increased per capita consumption levels and lifted 194,000 households, or 2% of Kenyan households, out of poverty.

The impacts, which are more pronounced for female-headed households, appear to be driven by changes in financial behaviour — in particular, increased financial resilience and saving. Mobile money has therefore increased the efficiency of the allocation of consumption over time while allowing a more efficient allocation of labour, resulting in a meaningful reduction of poverty in Kenya.

Currently, El Salvador has 2,301 Bitcoin.

At publication, it's worth $44 million. That remains 41% of Bukele's original $105.6 million.

Unknown if the country has sold Bitcoin, but Bukeles keeps purchasing the dip.

It's still falling.

This might be a fantastic move for the impoverished country over the next five years, if they can live economically till Bitcoin's price recovers.

The evidence demonstrates that a store of value pulls individuals out of poverty, but others say Bitcoin is premature.

You may regard it as an aggressive endeavor to front run the next wave of adoption, offering El Salvador a financial upside.

Franz Schrepf

3 years ago

What I Wish I'd Known About Web3 Before Building

Cryptoland rollercoaster

I've lost money in crypto.

Unimportant.

The real issue: I didn’t understand how.

I'm surrounded with winners. To learn more, I created my own NFTs, currency, and DAO.

Web3 is a hilltop castle. Everything is valuable, decentralized, and on-chain.

The castle is Disneyland: beautiful in images, but chaotic with lengthy lines and kids spending too much money on dressed-up animals.

When the throng and businesses are gone, Disneyland still has enchantment.

The Real Story of Web3

NFTs

Scarcity. Scarce NFTs. That's their worth.

Skull. Rare-looking!

Nonsense.

Bored Ape Yacht Club vs. my NFTs?

Marketing.

BAYC is amazing, but not for the reasons people believe. Apecoin and Otherside's art, celebrity following, and innovation? Stunning.

No other endeavor captured the zeitgeist better. Yet how long did you think it took to actually mint the NFTs?

1 hour? Maybe a week for the website?

Minting NFTs is incredibly easy. Kid-friendly. Developers are rare. Think about that next time somebody posts “DevS dO SMt!?”

NFTs will remain popular. These projects are like our Van Goghs and Monets. Still, be wary. It still uses exclusivity and wash selling like the OG art market.

Not all NFTs are art-related.

Soulbound and anonymous NFTs could offer up new use cases. Property rights, privacy-focused ID, open-source project verification. Everything.

NFTs build online trust through ownership.

We just need to evolve from the apes first.

NFTs' superpower is marketing until then.

Crypto currency

What the hell is a token?

99% of people are clueless.

So I invested in both coins and tokens. Same same. Only that they are not.

Coins have their own blockchain and developer/validator community. It's hard.

Creating a token on top of a blockchain? Five minutes.

Most consumers don’t understand the difference, creating an arbitrage opportunity: pretend you’re a serious project without having developers on your payroll.

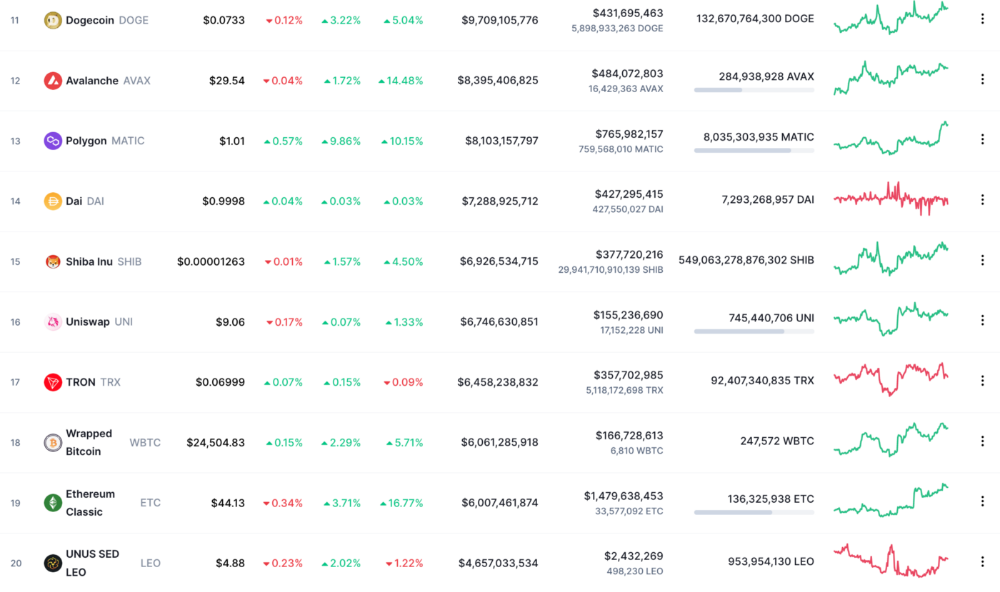

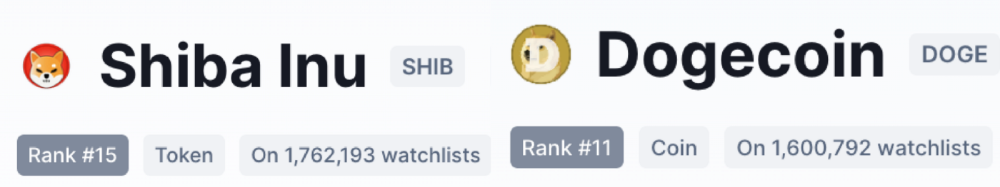

Few market sites help. Take a look. See any tokens?

There's a hint one click deeper.

Some tokens are legitimate. Some coins are bad investments.

Tokens are utilized for DAO governance and DApp payments. Still, know who's behind a token. They might be 12 years old.

Coins take time and money. The recent LUNA meltdown indicates that currency investing requires research.

DAOs

Decentralized Autonomous Organizations (DAOs) don't work as you assume.

Yes, members can vote.

A productive organization requires more.

I've observed two types of DAOs.

Total decentralization total dysfunction

Centralized just partially. Community-driven.

A core team executes the DAO's strategy and roadmap in successful DAOs. The community owns part of the organization, votes on decisions, and holds the team accountable.

DAOs are public companies.

Amazing.

A shareholder meeting's logistics are staggering. DAOs may hold anonymous, secure voting quickly. No need for intermediaries like banks to chase up every shareholder.

Successful DAOs aren't totally decentralized. Large-scale voting and collaboration have never been easier.

And that’s all that matters.

Scale, speed.

My Web3 learnings

Disneyland is enchanting. Web3 too.

In a few cycles, NFTs may be used to build trust, not clout. Not speculating with coins. DAOs run organizations, not themselves.

Finally, some final thoughts:

NFTs will be a very helpful tool for building trust online. NFTs are successful now because of excellent marketing.

Tokens are not the same as coins. Look into any project before making a purchase. Make sure it isn't run by three 9-year-olds piled on top of one another in a trench coat, at the very least.

Not entirely decentralized, DAOs. We shall see a future where community ownership becomes the rule rather than the exception once we acknowledge this fact.

Crypto Disneyland is a rollercoaster with loops that make you sick.

Always buckle up.

Have fun!

Faisal Khan

2 years ago

4 typical methods of crypto market manipulation

Market fraud

Due to its decentralized and fragmented character, the crypto market has integrity difficulties.

Cryptocurrencies are an immature sector, therefore market manipulation becomes a bigger issue. Many research have attempted to uncover these abuses. CryptoCompare's newest one highlights some of the industry's most typical scams.

Why are these concerns so common in the crypto market? First, even the largest centralized exchanges remain unregulated due to industry immaturity. A low-liquidity market segment makes an attack more harmful. Finally, market surveillance solutions not implemented reduce transparency.

In CryptoCompare's latest exchange benchmark, 62.4% of assessed exchanges had a market surveillance system, although only 18.1% utilised an external solution. To address market integrity, this measure must improve dramatically. Before discussing the report's malpractices, note that this is not a full list of attacks and hacks.

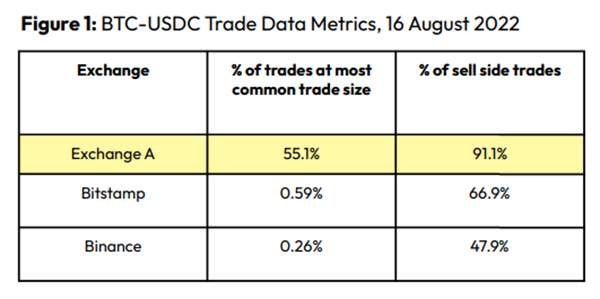

Clean Trading

An investor buys and sells concurrently to increase the asset's price. Centralized and decentralized exchanges show this misconduct. 23 exchanges have a volume-volatility correlation < 0.1 during the previous 100 days, according to CryptoCompares. In August 2022, Exchange A reported $2.5 trillion in artificial and/or erroneous volume, up from $33.8 billion the month before.

Spoofing

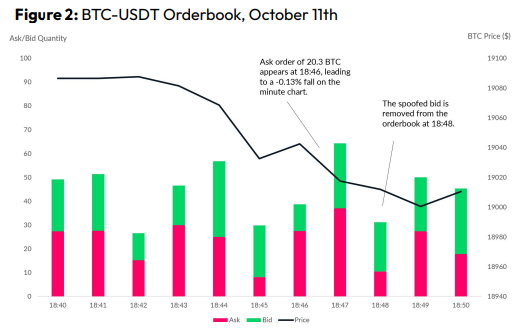

Criminals create and cancel fake orders before they can be filled. Since manipulators can hide in larger trading volumes, larger exchanges have more spoofing. A trader placed a 20.8 BTC ask order at $19,036 when BTC was trading at $19,043. BTC declined 0.13% to $19,018 in a minute. At 18:48, the trader canceled the ask order without filling it.

Front-Running

Most cryptocurrency front-running involves inside trading. Traditional stock markets forbid this. Since most digital asset information is public, this is harder. Retailers could utilize bots to front-run.

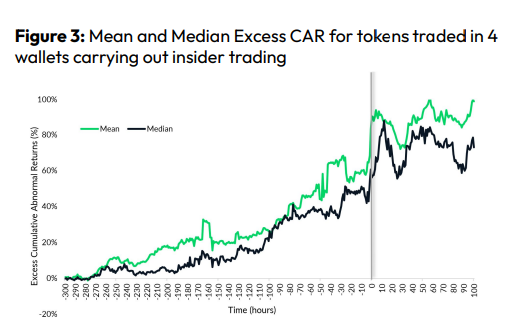

CryptoCompare found digital wallets of people who traded like insiders on exchange listings. The figure below shows excess cumulative anomalous returns (CAR) before a coin listing on an exchange.

Finally, LAYERING is a sequence of spoofs in which successive orders are put along a ladder of greater (layering offers) or lower (layering bids) values. The paper concludes with recommendations to mitigate market manipulation. Exchange data transparency, market surveillance, and regulatory oversight could reduce manipulative tactics.

You might also like

Jano le Roux

3 years ago

My Top 11 Tools For Building A Modern Startup, With A Free Plan

The best free tools are probably unknown to you.

Modern startups are easy to build.

Start with free tools.

Let’s go.

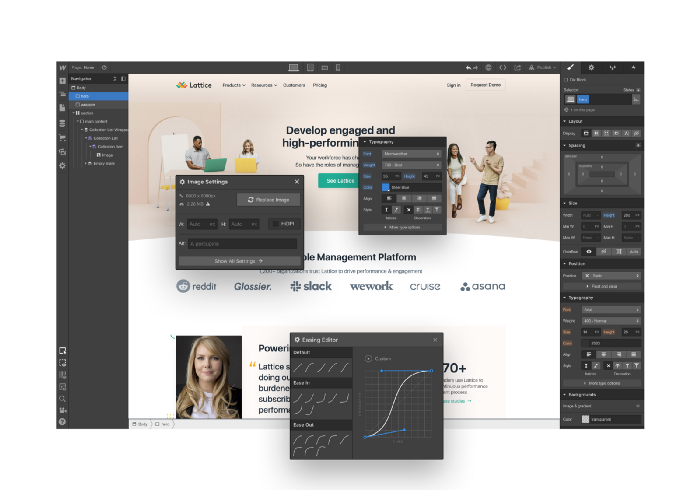

Web development — Webflow

Code-free HTML, CSS, and JS.

Webflow isn't like Squarespace, Wix, or Shopify.

It's a super-fast no-code tool for professionals to construct complex, highly-responsive websites and landing pages.

Webflow can help you add animations like those on Apple's website to your own site.

I made the jump from WordPress a few years ago and it changed my life.

No damn plugins. No damn errors. No damn updates.

The best, you can get started on Webflow for free.

Data tracking — Airtable

Spreadsheet wings.

Airtable combines spreadsheet flexibility with database power without code.

Airtable is modern.

Airtable has modularity.

Scaling Airtable is simple.

Airtable, one of the most adaptable solutions on this list, is perfect for client data management.

Clients choose customized service packages. Airtable consolidates data so you can automate procedures like invoice management and focus on your strengths.

Airtable connects with so many tools that rarely creates headaches. Airtable scales when you do.

Airtable's flexibility makes it a potential backend database.

Design — Figma

Better, faster, easier user interface design.

Figma rocks!

It’s fast.

It's free.

It's adaptable

First, design in Figma.

Iterate.

Export development assets.

Figma lets you add more team members as your company grows to work on each iteration simultaneously.

Figma is web-based, so you don't need a powerful PC or Mac to start.

Task management — Trello

Unclock jobs.

Tacky and terrifying task management products abound. Trello isn’t.

Those that follow Marie Kondo will appreciate Trello.

Everything is clean.

Nothing is complicated.

Everything has a place.

Compared to other task management solutions, Trello is limited. And that’s good. Too many buttons lead to too many decisions lead to too many hours wasted.

Trello is a must for teamwork.

Domain email — Zoho

Free domain email hosting.

Professional email is essential for startups. People relied on monthly payments for too long. Nope.

Zoho offers 5 free professional emails.

It doesn't have Google's UI, but it works.

VPN — Proton VPN

Fast Swiss VPN protects your data and privacy.

Proton VPN is secure.

Proton doesn't record any data.

Proton is based in Switzerland.

Swiss privacy regulation is among the most strict in the world, therefore user data are protected. Switzerland isn't a 14 eye country.

Journalists and activists trust Proton to secure their identities while accessing and sharing information authoritarian governments don't want them to access.

Web host — Netlify

Free fast web hosting.

Netlify is a scalable platform that combines your favorite tools and APIs to develop high-performance sites, stores, and apps through GitHub.

Serverless functions and environment variables preserve API keys.

Netlify's free tier is unmissable.

100GB of free monthly bandwidth.

Free 125k serverless operations per website each month.

Database — MongoDB

Create a fast, scalable database.

MongoDB is for small and large databases. It's a fast and inexpensive database.

Free for the first million reads.

Then, for each million reads, you must pay $0.10.

MongoDB's free plan has:

Encryption from end to end

Continual authentication

field-level client-side encryption

If you have a large database, you can easily connect MongoDB to Webflow to bypass CMS limits.

Automation — Zapier

Time-saving tip: automate repetitive chores.

Zapier simplifies life.

Zapier syncs and connects your favorite apps to do impossibly awesome things.

If your online store is connected to Zapier, a customer's purchase can trigger a number of automated actions, such as:

The customer is being added to an email chain.

Put the information in your Airtable.

Send a pre-programmed postcard to the customer.

Alexa, set the color of your smart lights to purple.

Zapier scales when you do.

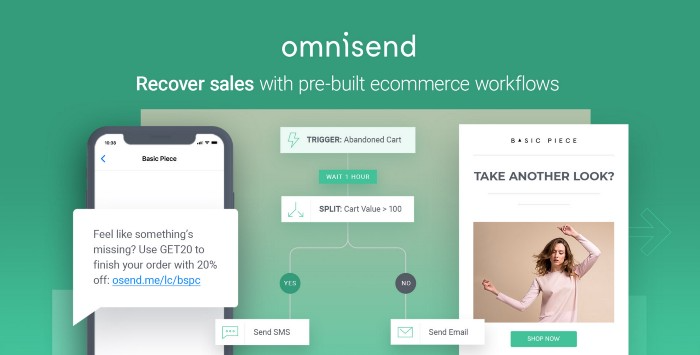

Email & SMS marketing — Omnisend

Email and SMS marketing campaigns.

This is an excellent Mailchimp option for magical emails. Omnisend's processes simplify email automation.

I love the interface's cleanliness.

Omnisend's free tier includes web push notifications.

Send up to:

500 emails per month

60 maximum SMSs

500 Web Push Maximum

Forms and surveys — Tally

Create flexible forms that people enjoy.

Typeform is clean but restricting. Sometimes you need to add many questions. Tally's needed sometimes.

Tally is flexible and cheaper than Typeform.

99% of Tally's features are free and unrestricted, including:

Unlimited forms

Countless submissions

Collect payments

File upload

Tally lets you examine what individuals contributed to forms before submitting them to see where they get stuck.

Airtable and Zapier connectors automate things further. If you pay, you can apply custom CSS to fit your brand.

See.

Free tools are the greatest.

Let's use them to launch a startup.

Jay Peters

3 years ago

Apple AR/VR heaset

Apple is said to have opted for a standalone AR/VR headset over a more powerful tethered model.

It has had a tumultuous history.

Apple's alleged mixed reality headset appears to be the worst-kept secret in tech, and a fresh story from The Information is jam-packed with details regarding the device's rocky development.

Apple's decision to use a separate headgear is one of the most notable aspects of the story. Apple had yet to determine whether to pursue a more powerful VR headset that would be linked with a base station or a standalone headset. According to The Information, Apple officials chose the standalone product over the version with the base station, which had a processor that later arrived as the M1 Ultra. In 2020, Bloomberg published similar information.

That decision appears to have had a long-term impact on the headset's development. "The device's many processors had already been in development for several years by the time the choice was taken, making it impossible to go back to the drawing board and construct, say, a single chip to handle all the headset's responsibilities," The Information stated. "Other difficulties, such as putting 14 cameras on the headset, have given hardware and algorithm engineers stress."

Jony Ive remained to consult on the project's design even after his official departure from Apple, according to the story. Ive "prefers" a wearable battery, such as that offered by Magic Leap. Other prototypes, according to The Information, placed the battery in the headset's headband, and it's unknown which will be used in the final design.

The headset was purportedly shown to Apple's board of directors last week, indicating that a public unveiling is imminent. However, it is possible that it will not be introduced until later this year, and it may not hit shop shelves until 2023, so we may have to wait a bit to try it.

For further down the line, Apple is working on a pair of AR spectacles that appear like Ray-Ban wayfarer sunglasses, but according to The Information, they're "still several years away from release." (I'm interested to see how they compare to Meta and Ray-Bans' true wayfarer-style glasses.)

Recep İnanç

3 years ago

Effective Technical Book Reading Techniques

Technical books aren't like novels. We need a new approach to technical texts. I've spent years looking for a decent reading method. I tried numerous ways before finding one that worked. This post explains how I read technical books efficiently.

What Do I Mean When I Say Effective?

Effectiveness depends on the book. Effective implies I know where to find answers after reading a reference book. Effective implies I learned the book's knowledge after reading it.

I use reference books as tools in my toolkit. I won't carry all my tools; I'll merely need them. Non-reference books teach me techniques. I never have to make an effort to use them since I always have them.

Reference books I like:

Design Patterns: Elements of Reusable Object-Oriented Software

Refactoring: Improving the Design of Existing Code

You can also check My Top Takeaways from Refactoring here.

Non-reference books I like:

The Approach

Technical books might be overwhelming to read in one sitting. Especially when you have no idea what is coming next as you read. When you don't know how deep the rabbit hole goes, you feel lost as you read. This is my years-long method for overcoming this difficulty.

Whether you follow the step-by-step guide or not, remember these:

Understand the terminology. Make sure you get the meaning of any terms you come across more than once. The likelihood that a term will be significant increases as you encounter it more frequently.

Know when to stop. I've always believed that in order to truly comprehend something, I must delve as deeply as possible into it. That, however, is not usually very effective. There are moments when you have to draw the line and start putting theory into practice (if applicable).

Look over your notes. When reading technical books or documents, taking notes is a crucial habit to develop. Additionally, you must regularly examine your notes if you want to get the most out of them. This will assist you in internalizing the lessons you acquired from the book. And you'll see that the urge to review reduces with time.

Let's talk about how I read a technical book step by step.

0. Read the Foreword/Preface

These sections are crucial in technical books. They answer Who should read it, What each chapter discusses, and sometimes How to Read? This is helpful before reading the book. Who could know the ideal way to read the book better than the author, right?

1. Scanning

I scan the chapter. Fast scanning is needed.

I review the headings.

I scan the pictures quickly.

I assess the chapter's length to determine whether I might divide it into more manageable sections.

2. Skimming

Skimming is faster than reading but slower than scanning.

I focus more on the captions and subtitles for the photographs.

I read each paragraph's opening and closing sentences.

I examined the code samples.

I attempt to grasp each section's basic points without getting bogged down in the specifics.

Throughout the entire reading period, I make an effort to make mental notes of what may require additional attention and what may not. Because I don't want to spend time taking physical notes, kindly notice that I am using the term "mental" here. It is much simpler to recall. You may think that this is more significant than typing or writing “Pay attention to X.”

I move on quickly. This is something I considered crucial because, when trying to skim, it is simple to start reading the entire thing.

3. Complete reading

Previous steps pay off.

I finished reading the chapter.

I concentrate on the passages that I mentally underlined when skimming.

I put the book away and make my own notes. It is typically more difficult than it seems for me. But it's important to speak in your own words. You must choose the right words to adequately summarize what you have read. How do those words make you feel? Additionally, you must be able to summarize your notes while you are taking them. Sometimes as I'm writing my notes, I realize I have no words to convey what I'm thinking or, even worse, I start to doubt what I'm writing down. This is a good indication that I haven't internalized that idea thoroughly enough.

I jot my inquiries down. Normally, I read on while compiling my questions in the hopes that I will learn the answers as I read. I'll explore those issues more if I wasn't able to find the answers to my inquiries while reading the book.

Bonus!

Best part: If you take lovely notes like I do, you can publish them as a blog post with a few tweaks.

Conclusion

This is my learning journey. I wanted to show you. This post may help someone with a similar learning style. You can alter the principles above for any technical material.