More on Entrepreneurship/Creators

Antonio Neto

3 years ago

Should you skip the minimum viable product?

Are MVPs outdated and have no place in modern product culture?

Frank Robinson coined "MVP" in 2001. In the same year as the Agile Manifesto, the first Scrum experiment began. MVPs are old.

The concept was created to solve the waterfall problem at the time.

The market was still sour from the .com bubble. The tech industry needed a new approach. Product and Agile gained popularity because they weren't waterfall.

More than 20 years later, waterfall is dead as dead can be, but we are still talking about MVPs. Does that make sense?

What is an MVP?

Minimum viable product. You probably know that, so I'll be brief:

[…] The MVP fits your company and customer. It's big enough to cause adoption, satisfaction, and sales, but not bloated and risky. It's the product with the highest ROI/risk. […] — Frank Robinson, SyncDev

MVP is a complete product. It's not a prototype. It's your product's first iteration, which you'll improve. It must drive sales and be user-friendly.

At the MVP stage, you should know your product's core value, audience, and price. We are way deep into early adoption territory.

What about all the things that come before?

Modern product discovery

Eric Ries popularized the term with The Lean Startup in 2011. (Ries would work with the concept since 2008, but wide adoption came after the book was released).

Ries' definition of MVP was similar to Robinson's: "Test the market" before releasing anything. Ries never mentioned money, unlike Jobs. His MVP's goal was learning.

“Remove any feature, process, or effort that doesn't directly contribute to learning” — Eric Ries, The Lean Startup

Product has since become more about "what" to build than building it. What started as a learning tool is now a discovery discipline: fake doors, prototyping, lean inception, value proposition canvas, continuous interview, opportunity tree... These are cheap, effective learning tools.

Over time, companies realized that "maximum ROI divided by risk" started with discovery, not the MVP. MVPs are still considered discovery tools. What is the problem with that?

Time to Market vs Product Market Fit

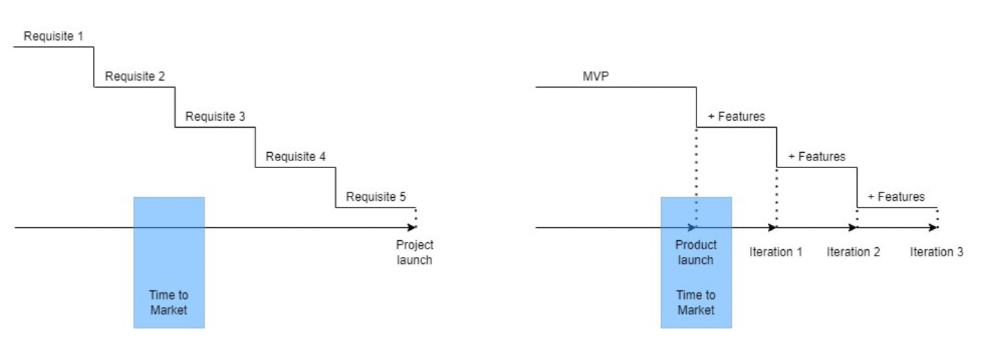

Waterfall's Time to Market is its biggest flaw. Since projects are sliced horizontally rather than vertically, when there is nothing else to be done, it’s not because the product is ready, it’s because no one cares to buy it anymore.

MVPs were originally conceived as a way to cut corners and speed Time to Market by delivering more customer requests after they paid.

Original product development was waterfall-like.

Time to Market defines an optimal, specific window in which value should be delivered. It's impossible to predict how long or how often this window will be open.

Product Market Fit makes this window a "state." You don’t achieve Product Market Fit, you have it… and you may lose it.

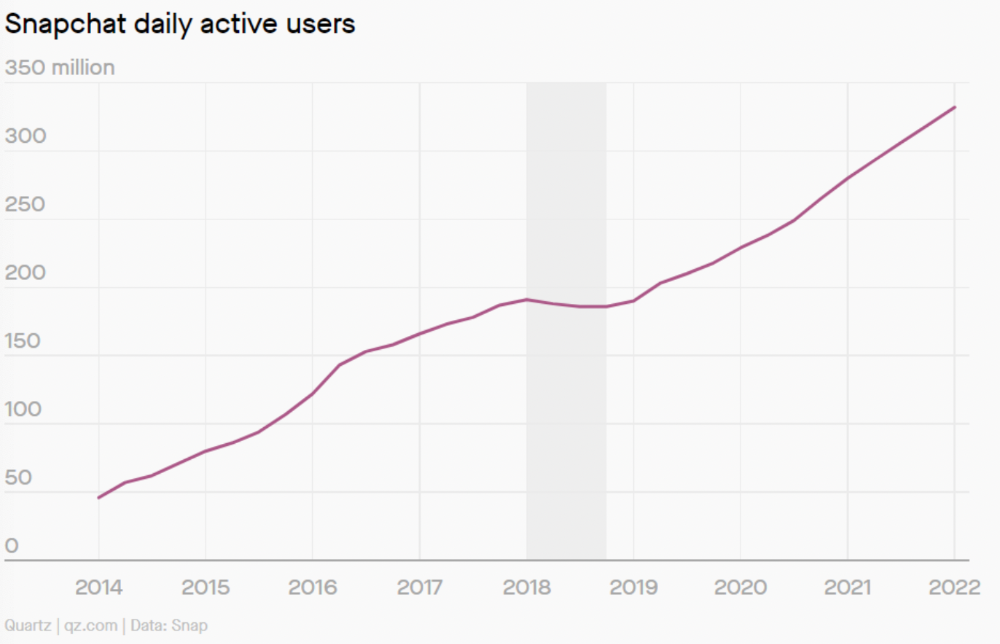

Take, for example, Snapchat. They had a great time to market, but lost product-market fit later. They regained product-market fit in 2018 and have grown since.

An MVP couldn't handle this. What should Snapchat do? Launch Snapchat 2 and see what the market was expecting differently from the last time? MVPs are a snapshot in time that may be wrong in two weeks.

MVPs are mini-projects. Instead of spending a lot of time and money on waterfall, you spend less but are still unsure of the results.

MVPs aren't always wrong. When releasing your first product version, consider an MVP.

Minimum viable product became less of a thing on its own and more interchangeable with Alpha Release or V.1 release over time.

Modern discovery technics are more assertive and predictable than the MVP, but clarity comes only when you reach the market.

MVPs aren't the starting point, but they're the best way to validate your product concept.

Rachel Greenberg

3 years ago

The Unsettling Fact VC-Backed Entrepreneurs Don't Want You to Know

What they'll do is scarier.

My acquaintance recently joined a VC-funded startup. Money, equity, and upside possibilities were nice, but he had a nagging dread.

They just secured a $40M round and are hiring like crazy to prepare for their IPO in two years. All signals pointed to this startup's (a B2B IT business in a stable industry) success, and its equity-holding workers wouldn't pass that up.

Five months after starting the work, my friend struggled with leaving. We might overlook the awful culture and long hours at the proper price. This price plus the company's fate and survival abilities sent my friend departing in an unpleasant unplanned resignation before jumping on yet another sinking ship.

This affects founders. This affects VC-backed companies (and all businesses). This affects anyone starting, buying, or running a business.

Here's the under-the-table approach that's draining VC capital, leaving staff terrified (or jobless), founders rattled, and investors upset. How to recognize, solve, and avoid it

The unsettling reality behind door #1

You can't raise money off just your looks, right? If "looks" means your founding team's expertise, then maybe. In my friend's case, the founding team's strong qualifications and track records won over investors before talking figures.

They're hardly the only startup to raise money without a profitable customer acquisition strategy. Another firm raised money for an expensive sleep product because it's eco-friendly. They were off to the races with a few keywords and key players.

Both companies, along with numerous others, elected to invest on product development first. Company A employed all the tech, then courted half their market (they’re a tech marketplace that connects two parties). Company B spent millions on R&D to create a palatable product, then flooded the world with marketing.

My friend is on Company B's financial team, and he's seen where they've gone wrong. It's terrible.

Company A (tech market): Growing? Not quite. To achieve the ambitious expansion they (and their investors) demand, they've poured much of their little capital into salespeople: Cold-calling commission and salary salesmen. Is it working? Considering attrition and companies' dwindling capital, I don't think so.

Company B (green sleep) has been hiring, digital marketing, and opening new stores like crazy. Growing expenses should result in growing revenues and a favorable return on investment; if you grow too rapidly, you may neglect to check that ROI.

Once Company A cut headcount and Company B declared “going concerned”, my friend realized both startups had the same ailment and didn't recognize it.

I shouldn't have to ask a friend to verify a company's cash reserves and profitability to spot a financial problem. It happened anyhow.

The frightening part isn't that investors were willing to invest millions without product-market fit, CAC, or LTV estimates. That's alarming, but not as scary as the fact that startups aren't understanding the problem until VC rounds have dried up.

When they question consultants if their company will be around in 6 months. It’s a red flag. How will they stretch $20M through a 2-year recession with a $3M/month burn rate and no profitability? Alarms go off.

Who's in danger?

In a word, everyone who raised money without a profitable client acquisition strategy or enough resources to ride out dry spells.

Money mismanagement and poor priorities affect every industry (like sinking all your capital into your product, team, or tech, at the expense of probing what customer acquisition really takes and looks like).

This isn't about tech, real estate, or recession-proof luxury products. Fast, cheap, easy money flows into flashy-looking teams with buzzwords, trending industries, and attractive credentials.

If these companies can't show progress or get a profitable CAC, they can't raise more money. They die if they can't raise more money (or slash headcount and find shoestring budget solutions until they solve the real problem).

The kiss of death (and how to avoid it)

If you're running a startup and think raising VC is the answer, pause and evaluate. Do you need the money now?

I'm not saying VC is terrible or has no role. Founders have used it as a Band-Aid for larger, pervasive problems. Venture cash isn't a crutch for recruiting consumers profitably; it's rocket fuel to get you what and who you need.

Pay-to-play isn't a way to throw money at the wall and hope for a return. Pay-to-play works until you run out of money, and if you haven't mastered client acquisition, your cash will diminish quickly.

How can you avoid this bottomless pit? Tips:

Understand your burn rate

Keep an eye on your growth or profitability.

Analyze each and every marketing channel and initiative.

Make lucrative customer acquisition strategies and satisfied customers your top two priorities. not brand-new products. not stellar hires. avoid the fundraising rollercoaster to save time. If you succeed in these two tasks, investors will approach you with their thirsty offers rather than the other way around, and your cash reserves won't diminish as a result.

Not as much as your grandfather

My family friend always justified expensive, impractical expenditures by saying it was only monopoly money. In business, startups, and especially with money from investors expecting a return, that's not true.

More founders could understand that there isn't always another round if they viewed VC money as their own limited pool. When the well runs dry, you must refill it or save the day.

Venture financing isn't your grandpa's money. A discerning investor has entrusted you with dry powder in the hope that you'll use it wisely, strategically, and thoughtfully. Use it well.

Eitan Levy

3 years ago

The Top 8 Growth Hacking Techniques for Startups

The Top 8 Growth Hacking Techniques for Startups

These startups, and how they used growth-hack marketing to flourish, are some of the more ethical ones, while others are less so.

Before the 1970 World Cup began, Puma paid footballer Pele $120,000 to tie his shoes. The cameras naturally focused on Pele and his Pumas, causing people to realize that Puma was the top football brand in the world.

Early workers of Uber canceled over 5,000 taxi orders made on competing applications in an effort to financially hurt any of their rivals.

PayPal developed a bot that advertised cheap goods on eBay, purchased them, and paid for them with PayPal, fooling eBay into believing that customers preferred this payment option. Naturally, Paypal became eBay's primary method of payment.

Anyone renting a space on Craigslist had their emails collected by AirBnB, who then urged them to use their service instead. A one-click interface was also created to list immediately on AirBnB from Craigslist.

To entice potential single people looking for love, Tinder developed hundreds of bogus accounts of attractive people. Additionally, for at least a year, users were "accidentally" linked.

Reddit initially created a huge number of phony accounts and forced them all to communicate with one another. It eventually attracted actual users—the real meaning of "fake it 'til you make it"! Additionally, this gave Reddit control over the tone of voice they wanted for their site, which is still present today.

To disrupt the conferences of their main rival, Salesforce recruited fictitious protestors. The founder then took over all of the event's taxis and gave a 45-minute pitch for his startup. No place to hide!

When a wholesaler required a minimum purchase of 10, Amazon CEO Jeff Bezos wanted a way to purchase only one book from them. A wholesaler would deliver the one book he ordered along with an apology for the other eight books after he discovered a loophole and bought the one book before ordering nine books about lichens. On Amazon, he increased this across all of the users.

Original post available here

You might also like

Sea Launch

3 years ago

📖 Guide to NFT terms: an NFT glossary.

NFT lingo can be overwhelming. As the NFT market matures and expands so does its own jargon, slang, colloquialisms or acronyms.

This ever-growing NFT glossary goal is to unpack key NFT terms to help you better understand the NFT market or at least not feel like a total n00b in a conversation about NFTs on Reddit, Discord or Twitter.

#

1:1 Art

Art where each piece is one of a kind (1 of 1). Unlike 10K projects, PFP or Generative Art collections have a cap of NFTs released that can range from a few hundreds to 10K.

1/1 of X

Contrary to 1:1 Art, 1/1 of X means each NFT is unique, but part of a large and cohesive collection. E.g: Fidenzas by Tyler Hobbs or Crypto Punks (each Punk is 1/1 of 10,000).

10K Project

A type of NFT collection that consists of approximately 10,000 NFTs (but not strictly).

A

AB

ArtBlocks, the most important platform for generative art currently.

AFAIK

As Far As I Know.

Airdrop

Distribution of an NFT token directly into a crypto wallet for free. Can be used as a marketing campaign or as scam by airdropping fake tokens to empty someone’s wallet.

Alpha

The first or very primitive release of a project. Or Investment term to track how a certain investment outdoes the market. E.g: Alpha of 1.0 = 1% improvement or Alpha of 20.0 = 20% improvement.

Altcoin

Any other crypto that is not Bitcoin. Bitcoin Maximalists can also refer to them as shitcoins.

AMA

Ask Me Anything. NFT creators or artists do sessions where anyone can ask questions about the NFT project, team, vision, etc. Usually hosted on Discord, but also on Reddit or even Youtube.

Ape

Someone can be aping, ape in or aped on an NFT meaning someone is taking a large position relative to its own portfolio size. Some argue that when someone apes can mean that they're following the hype, out of FOMO or without due diligence. Not related directly to the Bored Ape Yatch Club.

ATH

All-Time High. When a NFT project or token reaches the highest price to date.

Avatar project

An NFT collection that consists of avatars that people can use as their profile picture (see PFP) in social media to show they are part of an NFT community like Crypto Punks.

Axie Infinity

ETH blockchain-based game where players battle and trade Axies (digital pets). The main ERC-20 tokens used are Axie Infinity Shards (AXS) and Smooth Love Potions (formerly Small Love Potion) (SLP).

Axie Infinity Shards

AXS is an Eth token that powers the Axie Infinity game.

B

Bag Holder

Someone who holds its position in a crypto or keeps an NFT until it's worthless.

BAYC

Bored Ape Yacht Club. A very successful PFP 1/1 of 10,000 individual ape characters collection. People use BAYC as a Twitter profile picture to brag about being part of this NFT community.

Bearish

Borrowed finance slang meaning someone is doubtful about the current market and that it will crash.

Bear Market

When the Crypto or NFT market is going down in value.

Bitcoin (BTC)

First and original cryptocurrency as outlined in a whitepaper by the anonymous creator(s) Satoshi Nakamoto.

Bitcoin Maximalist

Believer that Bitcoin is the only cryptocurrency needed. All other cryptocurrencies are altcoins or shitcoins.

Blockchain

Distributed, decentralized, immutable database that is the basis of trust in Web 3.0 technology.

Bluechip

When an NFT project has a long track record of success and its value is sustained over time, therefore considered a solid investment.

BTD

Buy The Dip. A bear market can be an opportunity for crypto investors to buy a crypto or NFT at a lower price.

Bullish

Borrowed finance slang meaning someone is optimistic that a market will increase in value aka moon.

Bull market

When the Crypto or NFT market is going up and up in value.

Burn

Common crypto strategy to destroy or delete tokens from the circulation supply intentionally and permanently in order to limit supply and increase the value.

Buying on secondary

Whenever you don’t mint an NFT directly from the project, you can always buy it in secondary NFT marketplaces like OpenSea. Most NFT sales are secondary market sales.

C

Cappin or Capping

Slang for lying or faking. Opposed to no cap which means “no lie”.

Coinbase

Nasdaq listed US cryptocurrency exchange. Coinbase Wallet is one of Coinbase’s products where users can use a Chrome extension or app hot wallet to store crypto and NFTs.

Cold wallet

Otherwise called hardware wallet or cold storage. It’s a physical device to store your cryptocurrencies and/or NFTs offline. They are not connected to the Internet so are at less risk of being compromised.

Collection

A set of NFTs under a common theme as part of a NFT drop or an auction sale in marketplaces like OpenSea or Rarible.

Collectible

A collectible is an NFT that is a part of a wider NFT collection, usually part of a 10k project, PFP project or NFT Game.

Collector

Someone who buys NFTs to build an NFT collection, be part of a NFT community or for speculative purposes to make a profit.

Cope

The opposite of FOMO. When someone doesn’t buy an NFT because one is still dealing with a previous mistake of not FOMOing at a fraction of the price. So choosing to stay out.

Consensus mechanism

Method of authenticating and validating a transaction on a blockchain without the need to trust or rely on a central authority. Examples of consensus mechanisms are Proof of Work (PoW) or Proof of Stake (PoS).

Cozomo de’ Medici

Twitter alias used by Snoop Dogg for crypto and NFT chat.

Creator

An NFT creator is a person that creates the asset for the NFT idea, vision and in many cases the art (e.g. a jpeg, audio file, video file).

Crowsale

Where a crowdsale is the sale of a token that will be used in the business, an Initial Coin Offering (ICO) is the sale of a token that’s linked to the value of the business. Buying an ICO token is akin to buying stock in the company because it entitles you a share of the earnings and profits. Also, some tokens give you voting rights similar to holding stock in the business. The US Securities and Exchange Commission recently ruled that ICOs, but not crowdselling, will be treated as the sale of a security. This basically means that all ICOs must be registered like IPOs and offered only to accredited investors. This dramatically increases the costs and limits the pool of potential buyers.

Crypto Bags/Bags

Refers to how much cryptocurrencies someone holds, as in their bag of coins.

Cryptocurrency

The native coin of a blockchain (or protocol coin), secured by cryptography to be exchanged within a Peer 2 Peer economic system. E.g: Bitcoin (BTC) for the Bitcoin blockchain, Ether (ETH) for the Ethereum blockchain, etc.

Crypto community

The community of a specific crypto or NFT project. NFT communities use Twitter and Discord as their primary social media to hang out.

Crypto exchange

Where someone can buy, sell or trade cryptocurrencies and tokens.

Cryptography

The foundation of blockchain technology. The use of mathematical theory and computer science to encrypt or decrypt information.

CryptoKitties

One of the first and most popular NFT based blockchain games. In 2017, the NFT project almost broke the Ethereum blockchain and increased the gas prices dramatically.

CryptoPunk

Currently one of the most valuable blue chip NFT projects. It was created by Larva Labs. Crypto Punk holders flex their NFT as their profile picture on Twitter.

CT

Crypto Twitter, the crypto-community on Twitter.

Cypherpunks

Movement in the 1980s, advocating for the use of strong cryptography and privacy-enhancing technologies as a route to social and political change. The movement contributed and shaped blockchain tech as we know today.

D

DAO

Stands for Decentralized Autonomous Organization. When a NFT project is structured like a DAO, it grants all the NFT holders voting rights, control over future actions and the NFT’s project direction and vision. Many NFT projects are also organized as DAO to be a community-driven project.

Dapp

Mobile or web based decentralized application that interacts on a blockchain via smart contracts. E.g: Dapp is the frontend and the smart contract is the backend.

DCA

Acronym for Dollar Cost Averaging. An investment strategy to reduce the impact of crypto market volatility. E.g: buying into a crypto asset on a regular monthly basis rather than a big one time purchase.

Ded

Abbreviation for dead like "I sold my Punk for 90 ETH. I am ded."

DeFi

Short for Decentralized Finance. Blockchain alternative for traditional finance, where intermediaries like banks or brokerages are replaced by smart contracts to offer financial services like trading, lending, earning interest, insure, etc.

Degen

Short for degenerate, a gambler who buys into unaudited or unknown NFT or DeFi projects, without proper research hoping to chase high profits.

Delist

No longer offer an NFT for sale on a secondary market like Opensea. NFT Marketplaces can delist an NFT that infringes their rules. Or NFT owners can choose to delist their NFTs (has long as they have sufficient funds for the gas fees) due to price surges to avoid their NFT being bought or sold for a higher price.

Derivative

Projects derived from the original project that reinforces the value and importance of the original NFT. E.g: "alternative" punks.

Dev

A skilled professional who can build NFT projects using smart contracts and blockchain technology.

Dex

Decentralised Exchange that allows for peer-to-peer trustless transactions that don’t rely on a centralized authority to take place. E.g: Uniswap, PancakeSwap, dYdX, Curve Finance, SushiSwap, 1inch, etc.

Diamond Hands

Someone who believes and holds a cryptocurrency or NFT regardless of the crypto or NFT market fluctuations.

Discord

Chat app heavily used by crypto and NFT communities for knowledge sharing and shilling.

DLT

Acronym for Distributed Ledger Technology. It’s a protocol that allows the secure functioning of a decentralized database, through cryptography. This technological infrastructure scraps the need for a central authority to keep in check manipulation or exploitation of the network.

Dog coin

It’s a memecoin based on the Japanese dog breed, Shiba Inu, first popularised by Dogecoin. Other notable coins are Shiba Inu or Floki Inu. These dog coins are frequently subjected to pump and dumps and are extremely volatile. The original dog coin DOGE was created as a joke in 2013. Elon Musk is one of Dogecoin's most famous supporters.

Doxxed/Doxed

When the identity of an NFT team member, dev or creator is public, known or verifiable. In the NFT market, when a NFT team is doxed it’s a usually sign of confidence and transparency for NFT collectors to ensure they will not be scammed for an anonymous creator.

Drop

The release of an NFT (single or collection) into the NFT market.

DYOR

Acronym for Do Your Own Research. A common expression used in the crypto or NFT community to disclaim responsibility for the financial/strategy advice someone is providing the community and to avoid being called out by others in theNFT or crypto community.

E

EIP-1559 EIP

Referring to Ethereum Improvement Proposal 1559, commonly known as the London Fork. It’s an upgrade to the Ethereum protocol code to improve the blockchain security and scalability. The major change consists in shifting from a proof-of-work consensus mechanism (PoW) to a low energy and lower gas fees proof-of-stake system (PoS).

ERC-1155

Stands for Ethereum Request for Comment-1155. A multi-token standard that can represent any number of fungible (ERC-20) and non-fungible tokens (ERC-721).

ERC-20

Ethereum Request for Comment-20 is a standard defining a fungible token like a cryptocurrency.

ERC-721

Ethereum Request for Comment-721 is a standard defining a non-fungible token (NFT).

ETH

Aka Ether, the currency symbol for the native cryptocurrency of the Ethereum blockchain.

ETH2.0

Also known as the London Fork or EIP-1559 EIP. It’s an upgrade to the Ethereum network to improve the network’s security and scalability. The most dramatic change is the shift from the proof-of-work consensus mechanism (PoW) to proof-of-stake system (PoS).

Ether

Or ETH, the native cryptocurrency of the Ethereum blockchain.

Ethereum

Network protocol that allows users to create and run smart contracts over a decentralized network.

F

FCFS

Acronym for First Come First Served. Commonly used strategy in a NFT collection drop when the demand surpasses the supply.

Few

Short for "few understand". Similar to the irony behind the "probably nothing" expression. Like X person bought into a popular NFT, because it understands its long term value.

Fiat Currencies or Money

National government-issued currencies like the US Dollar (USD), Euro (EUR) or Great British Pound (GBP) that are not backed by a commodity like silver or gold. FIAT means an authoritative or arbitrary order like a government decree.

Flex

Slang for showing off. In the crypto community, it’s a Lamborghini or a gold Rolex. In the NFT world, it’s a CryptoPunk or BAYC PFP on Twitter.

Flip

Quickly buying and selling crypto or NFTs to make a profit.

Flippening

Colloquial expression coined in 2017 for when Ethereum’s market capitalisation surpasses Bitcoin’s.

Floor Price

It means the lowest asking price for an NFT collection or subset of a collection on a secondary market like OpenSea.

Floor Sweep

Refers when a NFT collector or investor buys all the lowest listed NFTs on a secondary NFT marketplace.

FOMO

Acronym for Fear Of Missing Out. Buying a crypto or NFT out of fear of missing out on the next big thing.

FOMO-in

Buying a crypto or NFT regardless if it's at the top of the market for FOMO.

Fractionalize

Turning one NFT like a Crypto Punk into X number of fractions ERC-20 tokens that prove ownership of that Punk. This allows for i) collective ownership of an NFT, ii) making an expensive NFT affordable for the common NFT collector and iii) adds more liquidity to a very illiquid NFT market.

FR

Abbreviation for For Real?

Fren

Means Friend and what people in the NFT community call each other in an endearing and positive way.

Foundation

An exclusive, by invitation only, NFT marketplace that specializes in NFT art.

Fungible

Means X can be traded for another X and still hold the same value. E.g: My dollars = your dollars. My 1 ether = your 1 ether. My casino chip = your casino chip. On Ethereum, fungible tokens are defined by the ERC-20 standard.

FUD

Acronym for Fear Uncertainty Doubt. It can be a) when someone spreads negative and sometimes false news to discredit a certain crypto or NFT project. Or b) the overall negative feeling regarding the future of the NFT/Crypto project or market, especially when going through a bear market.

Fudder

Someone who has FUD or engages in FUD about a NFT project.

Fudding your own bags

When an NFT collector or crypto investor speaks negatively about an NFT or crypto project he/she has invested in or has a stake in. Usually negative comments about the team or vision.

G

G

Means Gangster. A term of endearment used amongst the NFT Community.

Gas/Gas fees/Gas prices

The fee charged to complete a transaction in a blockchain. These gas prices vary tremendously between the blockchains, the consensus mechanism used to validate transactions or the number of transactions being made at a specific time.

Gas war

When a lot of NFT collectors (or bots) are trying to mint an NFT at once and therefore resulting in gas price surge.

Generative art

Artwork that is algorithmically created by code with unique traits and rarity.

Genesis drop

It refers to the first NFT drop a creator makes on an NFT auction platform.

GG

Interjection for Good Game.

GM

Interjection for Good Morning.

GMI

Acronym for Going to Make It. Opposite of NGMI (NOT Going to Make It).

GOAT

Acronym for Greatest Of All Time.

GTD

Acronym for Going To Dust. When a token or NFT project turns out to be a bad investment.

GTFO

Get The F*ck Out, as in “gtfo with that fud dude” if someone is talking bull.

GWEI

One billionth of an Ether (ETH) also known as a Shannon / Nanoether / Nano — unit of account used to price Ethereum gas transactions.

H

HEN (Hic Et Nunc)

A popular NFT art marketplace for art built on the Tezos blockchain. Big NFT marketplace for inexpensive NFTs but not a very user-friendly UI/website.

HODL

Misspelling of HOLD coined in an old Reddit post. Synonym with “Hold On for Dear Life” meaning hold your coin or NFT until the end, whether that they’ll moon or dust.

Hot wallet

Wallets connected to the Internet, less secure than cold wallet because they’re more susceptible to hacks.

Hype

Term used to show excitement or anticipation about an upcoming crypto project or NFT.

I

ICO

Acronym for Initial Coin Offering. It’s the crypto equivalent to a stocks’ IPO (Initial Public Offering) but with far less scrutiny or regulation (leading to a lot of scams). ICO’s are a popular way for crypto projects to raise funds.

IDO

Acronym for Initial Dex Offering. To put it simply it means to launch NFTs or tokens via a decentralized liquidity exchange. It’s a common fundraising method used by upcoming crypto or NFT projects. Many consider IDOs a far better fundraising alternative to ICOs.

IDK

Acronym for I Don’t Know.

IDEK

Acronym for I Don’t Even Know.

Imma

Short for I’m going to be.

IRL

Acronym for In Real Life. Refers to the physical world outside of the online/virtual world of crypto, NFTs, gaming or social media.

IPFS

Acronym for Interplanetary File System. A peer-to-peer file storage system using hashes to recall and preserve the integrity of the file, commonly used to store NFTs outside of the blockchain.

It’s Money Laundering

Someone can use this expression to suggest that NFT prices aren’t real and that actually people are using NFTs to launder money, without providing much proof or explanation on how it works.

IYKYK

Stands for If You Know, You Know This. Similar to the expression "few", used when someone buys into a popular crypto or NFT project, slightly because of FOMO but also because it believes in its long term value.

J

JPEG/JPG

File format typically used to encode NFT art. Some people also use Jpeg to mock people buying NFTs as in “All that money for a jpeg”.

K

KMS

Short for Kill MySelf.

L

Larva Labs/ LL

NFT Creators behind the popular NFT projects like Cryptopunks,Meebits or Autoglyphs.

Laser eyes

Bitcoin meme signalling support for BTC and/or it will break the $100k per coin valuation.

LFG

Acronym for Let’s F*cking Go! A common rallying call used in the crypto or NFT community to lead people into buying an NFT or a crypto.

Liquidity

Term that means that a token or NFT has a high volume activity in the crypto/NFT market. It’s easily sold and resold. But usually the NFT market it’s illiquid when compared to the general crypto market, due to the non-fungibility nature of an NFT (there are less buyers for every NFTs out there).

LMFAO

Stands for Laughing My F*cking Ass Off.

Looks Rare

Ironic expression commonly used in the NFT Community. Rarity is a driver of an NFT’s value.

London Hard Fork

Known as EIP-1559, was an Ethereum code upgrade proposal designed to improve the blockchain security and scalability. It’s major change is to shift from PoW to PoS consensus mechanism.

Long run

Means someone is committed to the NFT market or an NFT project in the long term.

M

Maximalist

Typically refers to Bitcoin Maximalists. People who only believe that Bitcoin is the most secure and resilient blockchain. For Maximalists, all other cryptocurrencies are shitcoins therefore a waste of time, development and money.

McDonald's

Common and ironic expression amongst the crypto community. It means that Mcdonald’s is always a valid backup plan or career in the case all cryptocurrencies crash and disappear.

Meatspace

Synonymous with IRL - In Real Life.

Memecoin

Cryptocurrency like Dogecoin that is based on an internet joke or meme.

Metamask

Popular crypto hot wallet platform to store crypto and NFTs.

Metaverse

Term was coined by writer Neal Stephenson in the 1992 dystopian novel “Snow Crash”. It’s an immersive and digital place where people interact via their avatars. Big tech players like Meta (formerly known as Facebook) and other independent players have been designing their own version of a metaverse. NFTs can have utility for users like buying, trading, winning, accessing, experiencing or interacting with things inside a metaverse.

Mfer

Short for “mother fker”.

Miners

Single person or company that mines one or more cryptocurrencies like Bitcoin or Ethereum. Both blockchains need computing power for their Proof of Work consensus mechanism. Miners provide the computing power and receive coins/tokens in return as payment.

Mining

Mining is the process by which new tokens enter in circulation as for example in the Bitcoin blockchain. Also, mining ensures the validity of new transactions happening in a given blockchain that uses the PoW consensus mechanism. Therefore, the ones who mine are rewarded by ensuring the validity of a blockchain.

Mint/Minting

Mint an NFT is the act of publishing your unique instance to a specific blockchain like Ethereum or Tezos blockchain. In simpler terms, a creator is adding a one-of-kind token (NFT) into circulation in a specific blockchain.

Once the NFT is minted - aka created - NFT collectors can i) direct mint, therefore purchase the NFT by paying the specified amount directly into the project’s wallet. Or ii) buy it via an intermediary like an NFT marketplace (e.g: OpenSea, Foundation, Rarible, etc.). Later, the NFT owner can choose to resell the NFT, most NFT creators set up a royalty for every time their NFT is resold.

Minting interval

How often an NFT creator can mint or create tokens.

MOAR

A misspelling that means “more”.

Moon/Mooning

When a coin (e.g. ETH), or token, like an NFT goes exponential in price and the price graph sees a vertical climb. Crypto or NFT users then use the expression that “X token is going to the moon!”.

Moon boys

Slang for crypto or NFT holders who are looking to pump the price dramatically - taking a token to the moon - for short term gains and with no real long term vision or commitment.

N

Never trust, always verify

Treat everyone or every project like something potentially malicious.

New coiner

Crypto slang for someone new to the cryptocurrency space. Usually newcomers can be more susceptible to FUD or scammers.

NFA

Acronym for Not Financial Advice.

NFT

Acronym for Non-Fungible Token. The type of token that can be created, bought, sold, resold and viewed in different dapps. The ERC-721 smart contract standard (Ethereum blockchain) is the most popular amongst NFTs.

NFT Marketplace / NFT Auction platform

Platforms where people can sell and buy NFTs, either via an auction or pay the seller’s price. The largest NFT marketplace is OpenSea. But there are other popular NFT marketplace examples like Foundation, SuperRare, Nifty Gateway, Rarible, Hic et Nunc (HeN), etc.

NFT Whale

A NFT collector or investor who buys a large amount of NFTs.

NGMI

Acronym for Not Going to Make It. For example, something said to someone who has paper hands.

NMP

Acronym for Not My Problem.

Nocoiner

It can be someone who simply doesn’t hold cryptocurrencies, mistrust the crypto market or believes that crypto is either a scam or a ponzi scheme.

Noob/N00b/Newbie

Slang for someone new or not experienced in cryptocurrency or NFTs. These people are more susceptible to scams, drawn into pump and dumps or getting rekt on bad coins.

Normie/Normy

Similar expression for a nocoiner.

NSFW

Acronym for Not Suitable For Work. Referring to online content inappropriate for viewing in public or at work. It began as mostly a tag for sexual content, nudity, or violence, but it has envolved to range a number of other topics that might be delicate or trigger viewers.

Nuclear NFTs

An NFT or collectible with more than 1,000 owners. For the NFT to be sold or resold, every co-owners must give their permission beforehand. Otherwise, the NFT transaction can’t be made.

O

OG

Acronym for Original Gangster and it popularized by 90s Hip Hop culture. It means the first, the original or the person who has been around since the very start and earned respect in the community. In NFT terms, Cryptopunks are the OG of NFTs.

On-chain vs Off-chain

An on-chain NFT is when the artwork (like a jpeg, video or music file) is stored directly into the blockchain making it more secure and less susceptible to being stolen. But, note that most blockchains can only store small amounts of data.

Off-chain NFTs means that the high quality image, music or video file is not stored in the blockchain. But, the NFT data is stored on an external party like a) a centralized server, highly vulnerable to the server being shut down/exploited. Or b) an InterPlanetary File System (IPFS), also an external party but more secure way of finding data because it utilizes a distributed, decentralized system.

OpenSea

By far the largest NFT marketplace in the world, currently.

P

Paper Hands

A crypto or NFT holder who is permeable to negative market sentiment or FUD. And does not hold their crypto or NFT for long. Expression used to describe someone who sells as soon as NFTs enter a bear market.

PFP

Stands for Picture For Profile. Twitter users who hold popular NFTs like Crypto Punk or BAYC use their punk or monkey avatar as their profile picture.

POAP NFT

Stands for Proof of Attendance Protocol. These types of NFTs are awarded to attendees of events, regardless if they’re physical or virtual, as proof you attended.

PoS

Stands for Proof of Stake. A consensus mechanism used by blockchains like Bitcoin or Ethereum to achieve agreement, trust and security in every transaction and keep the integrity of the blockchain intact. PoS mechanisms are considered more environmentally friendly than PoW as they’re lower energy and in emissions.

PoW

Stands for Proof of Work. A consensus mechanism used by blockchains like Bitcoin to achieve agreement, trust and security and keep the transactional integrity of the blockchain intact. PoW mechanism requires a lot of computational power, therefore uses more energy resources and higher CO2 emissions than the PoS mechanism.

Private Key

It can be similar to a password. It’s a secret number that allows users to access their cold or hot wallet funds, prove ownership of a certain address and sign transactions on the blockchain.

It’s not advisable to share a private key with anyone as it makes a person vulnerable to thefts. In case someone loses or forgets its private key, it can use a recovery phrase to restore access to a crypto or NFT wallet.

Pre-mine

A term used in crypto to refer to the act of creating a set amount of tokens before their public launch. It can also be known as a Genesis Sale and is usually associated with Initial Coin Offerings (ICOs) in order to compensate founders, developers or early investors.

Probably nothing

It’s an ironic expression used by NFT enthusiasts to refer to an important or soon to be big news, project or person in the NFT space. Meaning when someone says probably nothing it actually means that it is probably something.

Protocol Coin

Stands for the native coin of a blockchain. As in Ether for the Ethereum blockchain or BTC on the Bitcoin blockchain.

Pump & Dump

The term pump means when a person or a group of people buy or convince others to buy large quantities of a crypto or an NFT with the single goal to drive the price to a peak. When the price peaks, these people sell their position high and for a hefty profit, therefore dumping the price and leaving other slower investors or newbies rekt or at a loss.

R

Rarity

Rarity in NFT terms refers to how rare an NFT is. The rarity can be defined by the number of traits, scarcity or properties of an NFT.

Reaching

Slang for an exaggeration over something to make it sound worse than what it actually is or to take a point/scenario too far.

Recovery phrase

A 12-word phrase that acts like backup for your crypto private keys. A person can recover all of the crypto wallet accounts’ private keys from the recovery phrase. Is not advisable to share the recovery phrase with anyone.

Rekt

Slang for wrecked. When a crypto or NFT project goes wrong or down in value sharply. Or more broadly, when something goes wrong like a person is price out by the gas surge or an NFT floor price goes down.

Right Click Save As

An Ironic expression used by people who don’t understand the value or potential unlocked by NFTs. Person who makes fun that she/he can easily get a digital artwork by Right Click Save As and mock the NFT space and its hype.

Roadmap

The strategy outlined by an NFT project. A way to explain to the NFT community or a potential NFT investor, the different stages, value and the long term vision of the NFT project.

Royalties

NFT creators can set up their NFT so each time their NFT is resold, the creator gets paid a percentage of the sale price.

RN

Acronym for Right Now.

Rug Pull/Rugged

Slang for a scam when the founders, team or developers suddenly leave a crypto project and run away with all the investors’ funds leaving them with nothing.

S

Satoshi Nakamoto

The anonymous creator of the Bitcoin whitepaper and whose identity has never been verified.

Scammer

Someone actively trying to steal other people’s crypto or NFTs.

Secondary

Secondary refers to secondary NFT marketplaces, where NFT collectors or investors can resell NFTs after they’ve been minted. The price of an NFT or NFT collection is determined by those who list them.

Seed phrase

Another name for recovery phrase is the 12-word phrase that allows you to recover all of the crypto wallet accounts’ private keys and regain control of the wallet. Is not advisable to share the seed phrase with anyone.

Seems legit

When an NFT project or a person in the NFT community looks promising and the real deal, meaning seems legitimate. Depending on the context can also be used ironically.

Seems rare

An ironic expression or dismissive comment used by the NFT community. For example, It can be used sarcastically when someone asks for feedback on an NFT they own or created.

Ser

Slang for sir and a polite way of addressing others in an NFT community.

Shill

Expression when someone wants to promote or get exposure to an NFT they own or created.

Shill Thread

It’s a common Twitter strategy to gain traction by encouraging NFT creators to share a link to their NFT project in the hopes of getting bought or noticed by the NFT Community and potential buyers.

Simp/Simping

A NFT holder or creator who comes off as trying to hard impress an NFT whale or investor.

Sh*tposter

A person who mostly posts meme content on Twitter for fun.

SLP

Acronym for Smooth Love Potion. It’s a token players can earn as a reward in the NFT game Axie Infinity.

Smart Contract

A self-executing contract where the terms of the agreement between buyer and seller are directly written into the code and without third party or human intervention. Ethereum is a blockchain that can execute smart contracts, on the contrary to Bitcoin which does not have that capability.

SMFH

Acronym for Shaking My F*cking Head. Common reply to a person showing unbelievable idiocy.

Sock Puppet

Scam account used to lure noob investors into fake investment services.

Snag

It means to buy an NFT quickly and for a very low price. Can also be known as sniping.

Sotheby’s

Very famous auction house that has recently auctioned Beeple’s NFTs or Bored Ape Yacht Club and Crypto Punks’ NFT collections.

Stake

Crypto term for locking up a certain amount of crypto tokens for a set period of time to earn interest. In the NFT space, there are popping up a lot of projects or services that allow NFT holders to earn interest for holding a certain NFT.

Szn

Stands for season referring to crypto or NFT market cycles.

T

TINA

Acronym for There Is No Alternative. Example: someone asks “why are you investing in BTC?”, to which the reply is “TINA”.

TINA RIF

Acronym for There Is No Alternative Resistance Is Futile.

This is the way

A commendation for positive behavior by someone in the NFT Community.

Tokenomics

Referring to the economics of cryptocurrencies, DeFi or NFT projects.

V

Valhalla

Ironic use of the Viking “heaven”. Meaning someone’s NFT collection is either going to be a profitable and blue chip project, therefore they can ascend to Valhalla or is going to tank and that person will have to work at a Mcdonald’s.

Vibe

Term used to express a positive emotional state.

Volatile/Volatility

Term used to describe rapid market fluctuations and crypto or NFT prices go up and down quickly in a short period.

W

WAGMI

Acronym for We Are Going to Make It. Rally cry to build momentum for a crypto or NFT project and lead even more people into buying, shilling or supporting a specific project.

Wallet

There can be a hot or cold wallet, but both are a place where someone can store their cryptocurrency and tokens. Hot wallets are always connected to the Internet like MetaMask, Trust wallet or Phantom. On the contrary cold wallets are hardware wallets to store crypto or NFTs offline like Nano Ledger.

Weak Hands

Synonymous with Paper Hands. Someone who immediately sells their crypto or NFT because of a bear market, FUD or any other negative sentiment.

Web 1.0

Refers to the beginning of the Web. A period from around 1990 to 2005, also known as the read-only web.

Web 2.0

Refers to an iteration of Web 1.0. From 2005 to the present moment, where social media platforms like Facebook, Instagram, TikTok, Google, Twitter, etc reshaped the web, therefore becoming the read-write web.

Web 3.0

A term coined by Ethereum co-founder Gavin Wood and it’s an idea of what the future of the web could look like. Most peoples’ data, info or content would no longer be centralized in Web 2.0 giants - the Big Tech - but decentralized, mostly thanks to blockchain technology. Web 3.0 could be known as read-write-trust web.

Wen

As in When.

Wen Moon

Popular expression from crypto Twitter not so much in the NFT space. Refers to the still distant future when a token will moon.

Whitepaper

Document released by a crypto or NFT project where it lays the technical information behind the concept, vision, roadmap and plans to grow a certain project.

Whale

Someone who owns a large position on a specific or many cryptos or NFTs.

Y

Yodo

Acronym for You Only Die Once. The opposite of Yolo.

Yolo

Acronym for You Only Live Once. A person can use this when they just realized they bought a shitcoin or crap NFT and they’re getting rekt.

Original post

wordsmithwriter

3 years ago

2023 Will Be the Year of Evernote and Craft Notetaking Apps.

Note-taking is a vital skill. But it's mostly learned.

Recently, innovative note-taking apps have flooded the market.

In the next few years, Evernote and Craft will be important digital note-taking companies.

Evernote is a 2008 note-taking program. It can capture ideas, track tasks, and organize information on numerous platforms.

It's one of the only note-taking app that lets users input text, audio, photos, and videos. It's great for collecting research notes, brainstorming, and remaining organized.

Craft is a popular note-taking app.

Craft is a more concentrated note-taking application than Evernote. It organizes notes into subjects, tags, and relationships, making it ideal for technical or research notes.

Craft's search engine makes it easy to find what you need.

Both Evernote and Craft are likely to be the major players in digital note-taking in the years to come.

Their concentration on gathering and organizing information lets users generate notes quickly and simply. Multimedia elements and a strong search engine make them the note-taking apps of the future.

Evernote and Craft are great note-taking tools for staying organized and tracking ideas and projects.

With their focus on acquiring and organizing information, they'll dominate digital note-taking in 2023.

Pros

Concentrate on gathering and compiling information

special features including a strong search engine and multimedia components

Possibility of subject, tag, and relationship structuring

enables users to incorporate multimedia elements

Excellent tool for maintaining organization, arranging research notes, and brainstorming

Cons

Software may be difficult for folks who are not tech-savvy to utilize.

Limited assistance for hardware running an outdated operating system

Subscriptions could be pricey.

Data loss risk because of security issues

Evernote and Craft both have downsides.

The risk of data loss as a result of security flaws and software defects comes first.

Additionally, their subscription fees could be high, and they might restrict support for hardware that isn't running the newest operating systems.

Finally, folks who need to be tech-savvy may find the software difficult.

Evernote versus. Productivity Titans Evernote will make Notion more useful. medium.com

Yogesh Rawal

3 years ago

Blockchain to solve growing privacy challenges

Most online activity is now public. Businesses collect, store, and use our personal data to improve sales and services.

In 2014, Uber executives and employees were accused of spying on customers using tools like maps. Another incident raised concerns about the use of ‘FaceApp'. The app was created by a small Russian company, and the photos can be used in unexpected ways. The Cambridge Analytica scandal exposed serious privacy issues. The whole incident raised questions about how governments and businesses should handle data. Modern technologies and practices also make it easier to link data to people.

As a result, governments and regulators have taken steps to protect user data. The General Data Protection Regulation (GDPR) was introduced by the EU to address data privacy issues. The law governs how businesses collect and process user data. The Data Protection Bill in India and the General Data Protection Law in Brazil are similar.

Despite the impact these regulations have made on data practices, a lot of distance is yet to cover.

Blockchain's solution

Blockchain may be able to address growing data privacy concerns. The technology protects our personal data by providing security and anonymity. The blockchain uses random strings of numbers called public and private keys to maintain privacy. These keys allow a person to be identified without revealing their identity. Blockchain may be able to ensure data privacy and security in this way. Let's dig deeper.

Financial transactions

Online payments require third-party services like PayPal or Google Pay. Using blockchain can eliminate the need to trust third parties. Users can send payments between peers using their public and private keys without providing personal information to a third-party application. Blockchain will also secure financial data.

Healthcare data

Blockchain technology can give patients more control over their data. There are benefits to doing so. Once the data is recorded on the ledger, patients can keep it secure and only allow authorized access. They can also only give the healthcare provider part of the information needed.

The major challenge

We tried to figure out how blockchain could help solve the growing data privacy issues. However, using blockchain to address privacy concerns has significant drawbacks. Blockchain is not designed for data privacy. A ‘distributed' ledger will be used to store the data. Another issue is the immutability of blockchain. Data entered into the ledger cannot be changed or deleted. It will be impossible to remove personal data from the ledger even if desired.

MIT's Enigma Project aims to solve this. Enigma's ‘Secret Network' allows nodes to process data without seeing it. Decentralized applications can use Secret Network to use encrypted data without revealing it.

Another startup, Oasis Labs, uses blockchain to address data privacy issues. They are working on a system that will allow businesses to protect their customers' data.

Conclusion

Blockchain technology is already being used. Several governments use blockchain to eliminate centralized servers and improve data security. In this information age, it is vital to safeguard our data. How blockchain can help us in this matter is still unknown as the world explores the technology.