More on Personal Growth

Andy Murphy

3 years ago

Activating Your Vagus Nerve

11 science-backed ways to improve health, happiness, healing, relaxation, and mental clarity.

Vagus nerve is the main parasympathetic nervous system component.

It helps us rest and digest by slowing and stabilizing a resting heart rate, slowing and stabilizing the breath, promoting digestion, improving recovery and healing times, producing saliva, releasing endorphins and hormones like dopamine, oxytocin, and serotonin, and boosting the immune, digestive, and cardiovascular systems.

The vagus nerve sends anti-inflammatory signals to other parts of the body and is located behind the tongue, in the throat, neck, heart, lungs, abdomen, and brainstem.

Vagus means wandering in Latin. So, it's bold.

Here are 11 proven ways to boost health, happiness, and the vagus nerve.

1. Extend

“Yoga stimulates different nerves in your body, especially the vagus nerve that carries information from the brain to most of the body’s major organs, slows everything down and allows self-regulation. It’s the nerve that is associated with the parasympathetic system and emotions like love, joy, and compassion.” — Deepak Chopra

Stretching doesn't require a yoga background.

Listen to your body and ease into simple poses. This connects the mind and body.

If you're new to yoga or don't have access to an in-person class, try Yoga with Adrienne. Over 600 YouTube videos give her plenty of material.

2. Inhale

Because inhaling and exhaling activate the autonomic nervous system, we can breathe to relax.

Exhaling activates the parasympathetic nervous system (rest and digest). One inhales stress, the other exhales it.

So, faster or more intense breathing increases stress. Slower breathing relaxes us.

Breathe slowly, smoothly, and less.

Rhythmic breathing helps me relax.

What to do is as follows:

1. Take 4 smooth, forceless nose breaths.

2. Exhale smoothly and forcefully for 4 seconds

3. Don't pause at the inhale or exhale.

4. Continue for 5 minutes/40 breaths

5. Hold your breath as long as comfortable.

6. Breathe normally.

If four seconds is too long, try breathing in and out for two seconds, or in and out for three seconds, until your breath naturally relaxes. Once calmer, extend your breath.

Any consistent rhythm without force is good. Your heart will follow your lead and become coherent.

3. Chant/Hum

Singing, chanting, or humming activate the vagus nerve through the back of the throat.

Humming emits nitric oxide.

Nitric oxide improves blood circulation, blood flow, heart health, and blood pressure.

Antiviral, antibacterial, anti-inflammatory, antioxidant, and antimicrobial properties kill viruses and bacteria in the nose and throat.

Gargling water stimulates the vagus nerve.

Simple ways to heal, boost energy, and boost mood are often the healthiest. They're free and can be done anywhere.

4. Have more fun

Laughing stimulates the throat muscles, activating the vagus nerve. What's not to like? It releases dopamine.

Take time to enjoy life. Maybe it's a book, podcast, movie, socializing with friends, or laughing yoga.

Follow your bliss, as Joseph Campbell says.

Laugh at yourself

Actually. Really.

Gagging activates vagus nerve-connected muscles. Some doctors use the gag reflex to test the vagus nerve.

Grossness isn't required. While brushing, gag quickly. My girlfriend's brother always does it.

I'm done brushing when I gag, he says.

6. Take in the outdoors

Nature relaxes body and mind. Better if you can walk barefoot.

Earthing is associated with hippies dancing in daisies.

Science now supports hippies.

7. Enter some chilly water.

The diving reflex activates the vagus nerve when exposed to cold water.

The diving reflex involves holding your breath in cold water. Cold showers work best.

Within minutes of being in cold water, parasympathetic nervous system activity, which calms the body, increases.

8. Workout

Exercise increases dopamine, blood circulation, and breathing. So we feel energized, calm, and well-rested.

After resting, the parasympathetic nervous system engages.

It's worth waiting for, though.

9. Play music with brainwaves

Brainwave music harmonizes brainwave activity, boosts productivity and mental clarity, and promotes peace and relaxation by stimulating the vagus nerve.

Simply play a song.

My favorite.

10. Make gentle eyes

Eyes, like breath, often reflect inner state. Sharp, dilated, focused eyes indicate alertness.

Soft, open eyes reflect relaxation and ease. Soft eyes relax the nervous system.

This practice reduces stress, anxiety, and body tension. It's a quick and effective way to enter a calm, peaceful state.

Wild animals can be hunted one minute and graze the next.

Put it into action:

Relax while seated.

Gaze at a distant object

Use peripheral vision while looking straight ahead

Without moving your eyes, look up and down. Connect side spaces to your vision.

Focus on everything as your eyes soften.

Keep breathing

Stay as long as you like

11. Be intimate

We kiss, moan, and breathe deeper during love. We get dopamine, oxytocin, serotonin, and vagus nerve stimulation.

Why not?

To sum up

Here are 11 vagus nerve resets:

Stretch

Breathe

Hum/Chant

More humor

Amuse yourself

Spend time outdoors

Leap into chilly water

Exercise

Play music with brainwaves.

Make gentle eyes.

Be intimate

If these words have inspired you, try my favorite breathwork technique. Combining breathing, chanting, and brainwave music. Win-win-win :)

Tom Connor

3 years ago

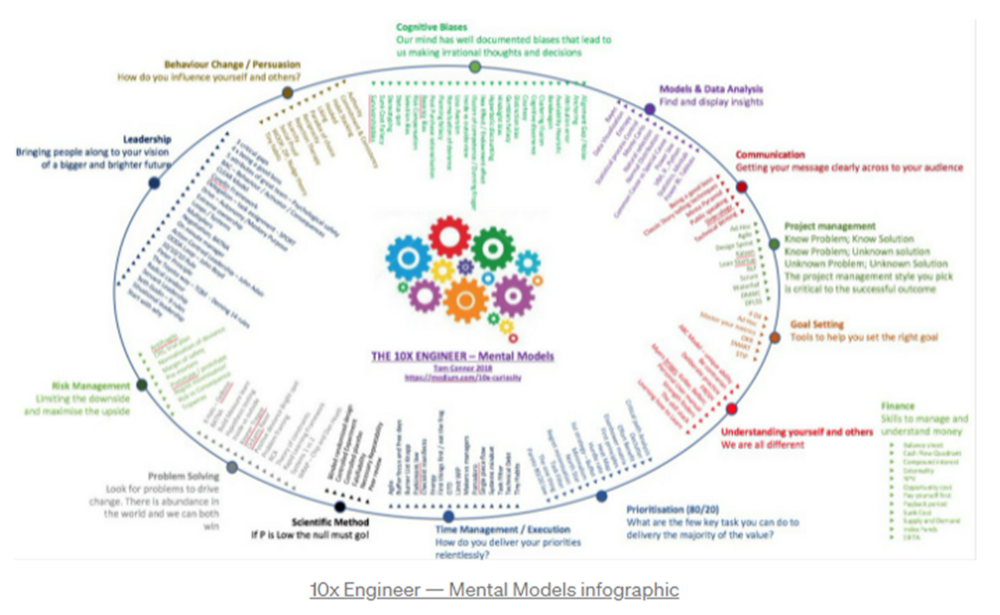

12 mental models that I use frequently

https://tomconnor.me/wp-content/uploads/2021/08/10x-Engineer-Mental-Models.pdf

I keep returning to the same mental models and tricks after writing and reading about a wide range of topics.

Top 12 mental models

12.

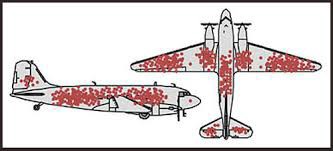

Survival bias - We perceive the surviving population as remarkable, yet they may have gotten there through sheer grit.

Survivorship bias affects us in many situations. Our retirement fund; the unicorn business; the winning team. We often study and imitate the last one standing. This can lead to genuine insights and performance improvements, but it can also lead us astray because the leader may just be lucky.

11.

The Helsinki Bus Theory - How to persevere Buss up!

Always display new work, and always be compared to others. Why? Easy. Keep riding. Stay on the fucking bus.

10.

Until it sticks… Turning up every day… — Artists teach engineers plenty. Quality work over a career comes from showing up every day and starting.

9.

WRAP decision making process (Heath Brothers)

Decision-making WRAP Model:

W — Widen your Options

R — Reality test your assumptions

A — Attain Distance

P — Prepare to be wrong or Right

8.

Systems for knowledge worker excellence - Todd Henry and Cal Newport write about techniques knowledge workers can employ to build a creative rhythm and do better work.

Todd Henry's FRESH framework:

Focus: Keep the start in mind as you wrap up.

Relationships: close a loop that's open.

Pruning is an energy.

Set aside time to be inspired by stimuli.

Hours: Spend time thinking.

7.

BBT is learning from mistakes. Science has transformed the world because it constantly updates its theories in light of failures. Complexity guarantees failure. Do we learn or self-justify?

6.

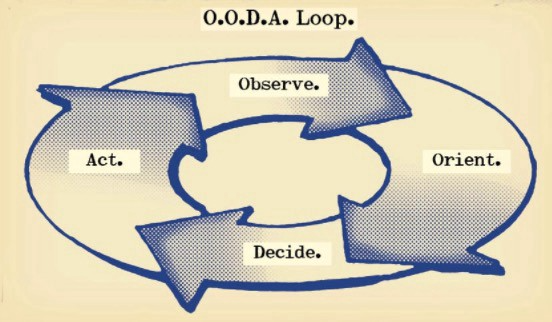

The OODA Loop - Competitive advantage

O: Observe: collect the data. Figure out exactly where you are, what’s happening.

O: Orient: analyze/synthesize the data to form an accurate picture.

D: Decide: select an action from possible options

A: Action: execute the action, and return to step (1)

Boyd's approach indicates that speed and agility are about information processing, not physical reactions. They form feedback loops. More OODA loops improve speed.

5.

Leaders who try to impose order in a complex situation fail; those who set the stage, step back, and allow patterns to develop win.

https://vimeo.com/640941172?embedded=true&source=vimeo_logo&owner=11999906

4.

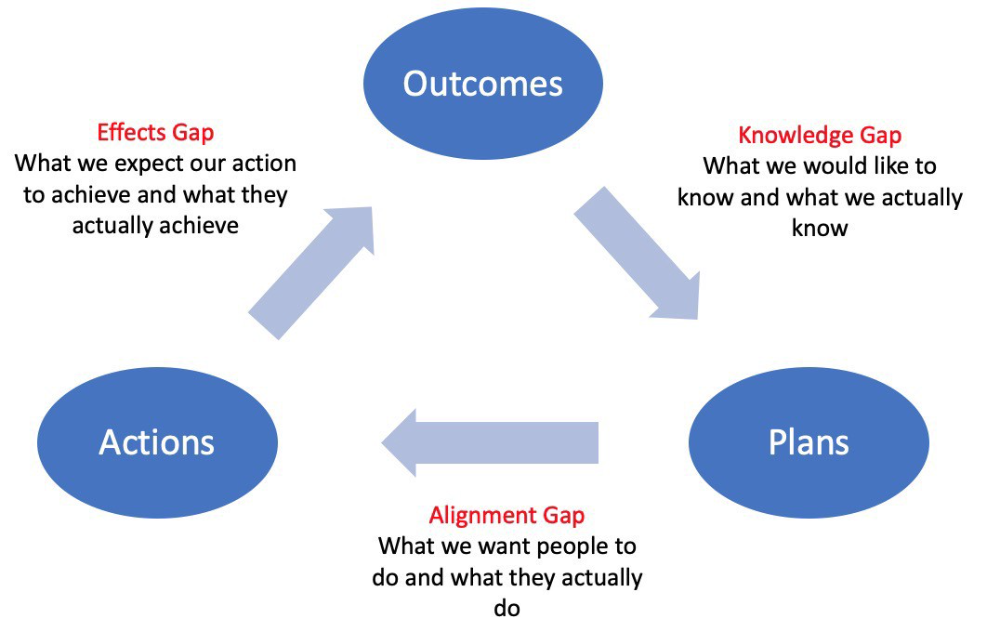

Information Gap - The discrepancy between what we know and what we would like to know

Gap in Alignment - What individuals actually do as opposed to what we wish them to do

Effects Gap - the discrepancy between our expectations and the results of our actions

3.

Theory of Constraints — The Goal - To maximize system production, maximize bottleneck throughput.

Goldratt creates a five-step procedure:

Determine the restriction

Improve the restriction.

Everything else should be based on the limitation.

Increase the restriction

Go back to step 1 Avoid letting inertia become a limitation.

Any non-constraint improvement is an illusion.

2.

Serendipity and the Adjacent Possible - Why do several amazing ideas emerge at once? How can you foster serendipity in your work?

You need specialized abilities to reach to the edge of possibilities, where you can pursue exciting tasks that will change the world. Few people do it since it takes a lot of hard work. You'll stand out if you do.

Most people simply lack the comfort with discomfort required to tackle really hard things. At some point, in other words, there’s no way getting around the necessity to clear your calendar, shut down your phone, and spend several hard days trying to make sense of the damn proof.

1.

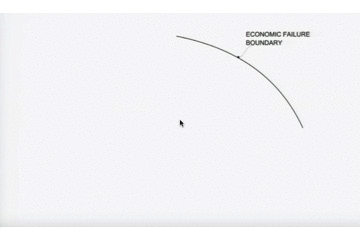

Boundaries of failure - Rasmussen's accident model.

Rasmussen modeled this. It has economic, workload, and performance boundaries.

The economic boundary is a company's profit zone. If the lights are on, you're within the economic boundaries, but there's pressure to cut costs and do more.

Performance limit reflects system capacity. Taking shortcuts is a human desire to minimize work. This is often necessary to survive because there's always more labor.

Both push operating points toward acceptable performance. Personal or process safety, or equipment performance.

If you exceed acceptable performance, you'll push back, typically forcefully.

Neeramitra Reddy

3 years ago

The best life advice I've ever heard could very well come from 50 Cent.

He built a $40M hip-hop empire from street drug dealing.

50 Cent was nearly killed by 9mm bullets.

Before 50 Cent, Curtis Jackson sold drugs.

He sold coke to worried addicts after being orphaned at 8.

Pursuing police. Murderous hustlers and gangs. Unwitting informers.

Despite his hard life, his hip-hop career was a success.

An assassination attempt ended his career at the start.

What sane producer would want to deal with a man entrenched in crime?

Most would have drowned in self-pity and drank themselves to death.

But 50 Cent isn't most people. Life on the streets had given him fearlessness.

“Having a brush with death, or being reminded in a dramatic way of the shortness of our lives, can have a positive, therapeutic effect. So it is best to make every moment count, to have a sense of urgency about life.” ― 50 Cent, The 50th Law

50 released a series of mixtapes that caught Eminem's attention and earned him a $50 million deal!

50 Cents turned death into life.

Things happen; that is life.

We want problems solved.

Every human has problems, whether it's Jeff Bezos swimming in his billions, Obama in his comfortable retirement home, or Dan Bilzerian with his hired bikini models.

All problems.

Problems churn through life. solve one, another appears.

It's harsh. Life's unfair. We can face reality or run from it.

The latter will worsen your issues.

“The firmer your grasp on reality, the more power you will have to alter it for your purposes.” — 50 Cent, The 50th Law

In a fantasy-obsessed world, 50 Cent loves reality.

Wish for better problem-solving skills rather than problem-free living.

Don't wish, work.

We All Have the True Power of Alchemy

Humans are arrogant enough to think the universe cares about them.

That things happen as if the universe notices our nanosecond existences.

Things simply happen. Period.

By changing our perspective, we can turn good things bad.

The alchemists' search for the philosopher's stone may have symbolized the ability to turn our lead-like perceptions into gold.

Negativity bias tints our perceptions.

Normal sparring broke your elbow? Rest and rethink your training. Fired? You can improve your skills and get a better job.

Consider Curtis if he had fallen into despair.

The legend we call 50 Cent wouldn’t have existed.

The Best Lesson in Life Ever?

Neither avoid nor fear your reality.

That simple sentence contains every self-help tip and life lesson on Earth.

When reality is all there is, why fear it? avoidance?

Or worse, fleeing?

To accept reality, we must eliminate the words should be, could be, wish it were, and hope it will be.

It is. Period.

Only by accepting reality's chaos can you shape your life.

“Behind me is infinite power. Before me is endless possibility, around me is boundless opportunity. My strength is mental, physical and spiritual.” — 50 Cent

You might also like

Jim Clyde Monge

3 years ago

Can You Sell Images Created by AI?

Some AI-generated artworks sell for enormous sums of money.

But can you sell AI-Generated Artwork?

Simple answer: yes.

However, not all AI services enable allow usage and redistribution of images.

Let's check some of my favorite AI text-to-image generators:

Dall-E2 by OpenAI

The AI art generator Dall-E2 is powerful. Since it’s still in beta, you can join the waitlist here.

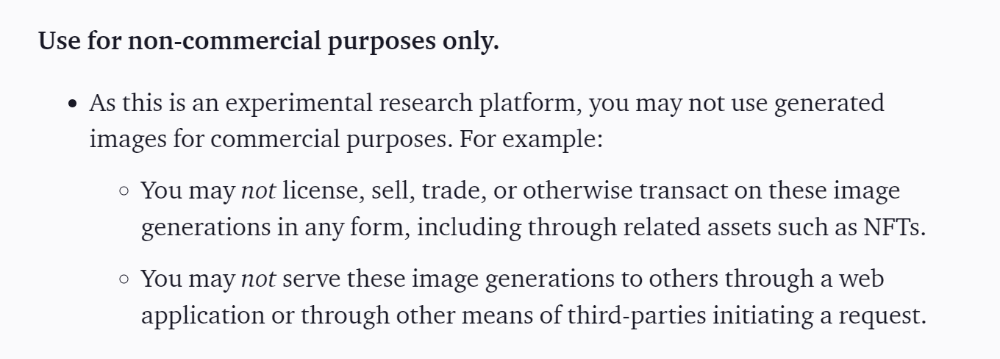

OpenAI DOES NOT allow the use and redistribution of any image for commercial purposes.

Here's the policy as of April 6, 2022.

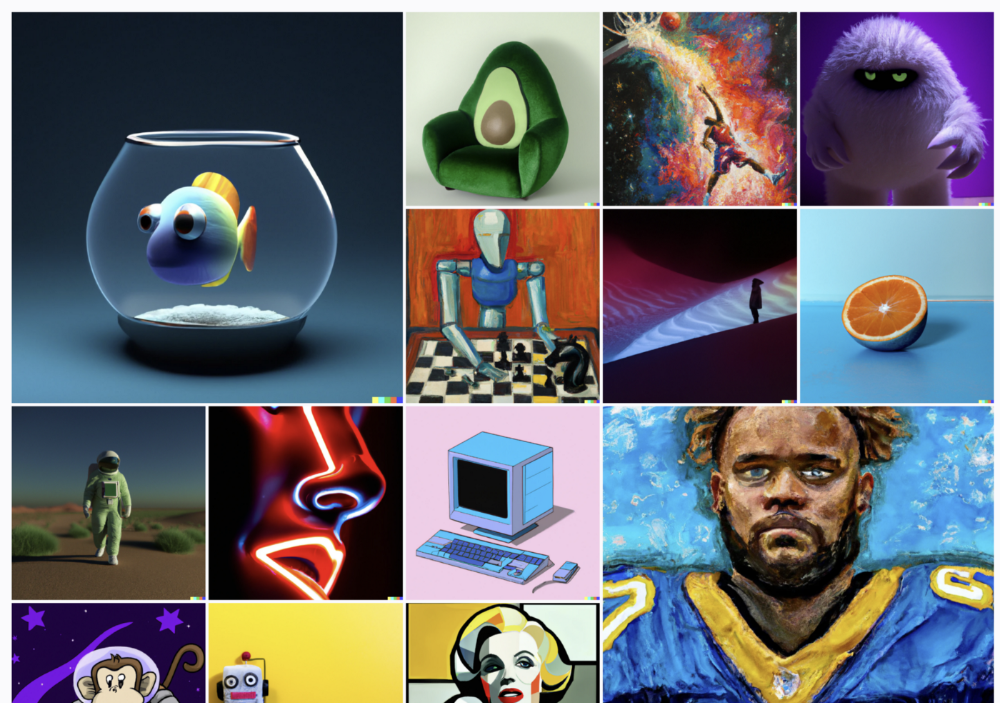

Here are some images from Dall-E2’s webpage to show its art quality.

Several Reddit users reported receiving pricing surveys from OpenAI.

This suggests the company may bring out a subscription-based tier and a commercial license to sell images soon.

MidJourney

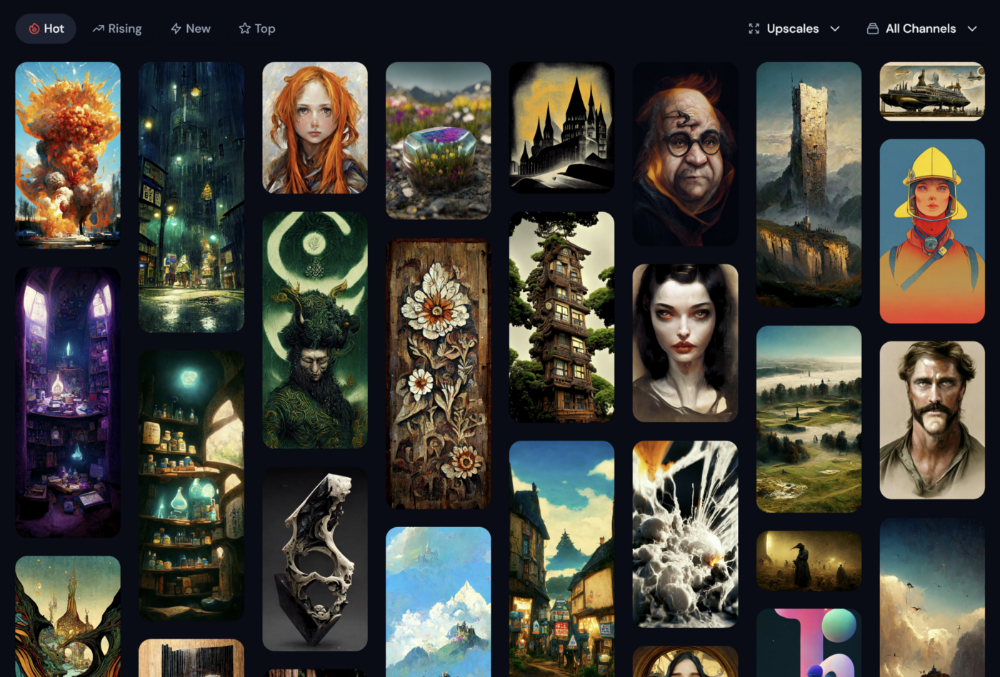

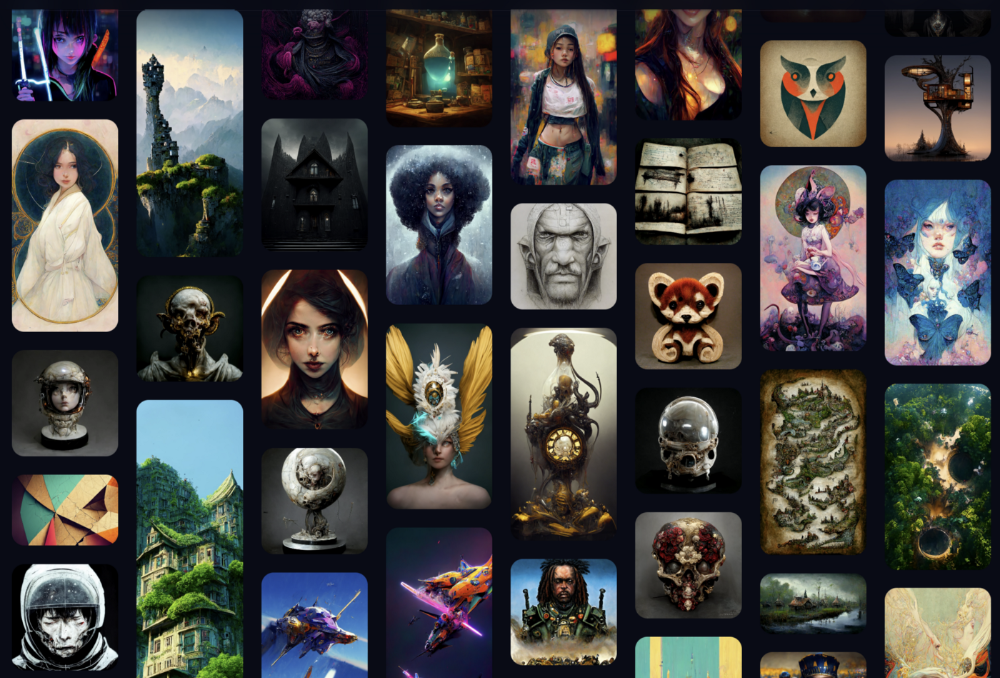

I like Midjourney's art generator. It makes great AI images. Here are some samples:

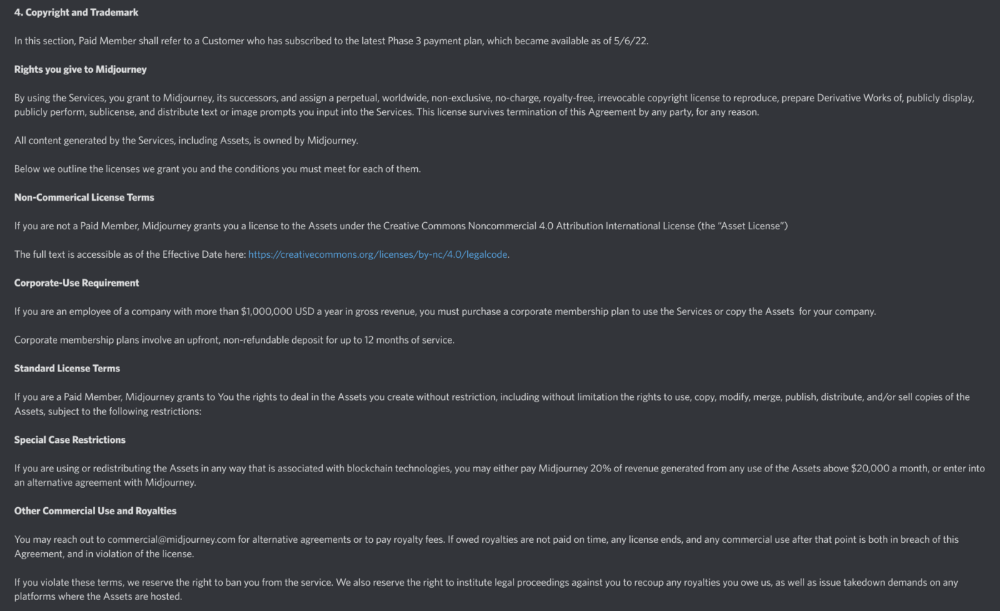

Standard Licenses are available for $10 per month.

Standard License allows you to use, copy, modify, merge, publish, distribute, and/or sell copies of the images, except for blockchain technologies.

If you utilize or distribute the Assets using blockchain technology, you must pay MidJourney 20% of revenue above $20,000 a month or engage in an alternative agreement.

Here's their copyright and trademark page.

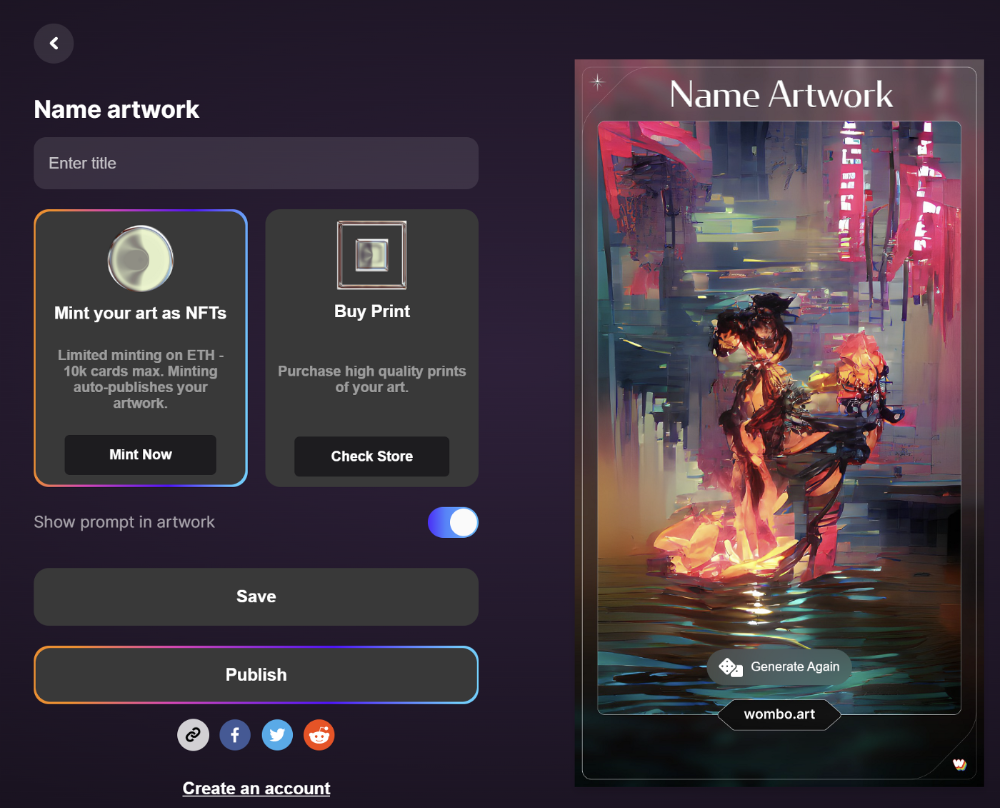

Dream by Wombo

Dream is one of the first public AI art generators.

This AI program is free, easy to use, and Wombo gives a royalty-free license to copy or share artworks.

Users own all artworks generated by the tool. Including all related copyrights or intellectual property rights.

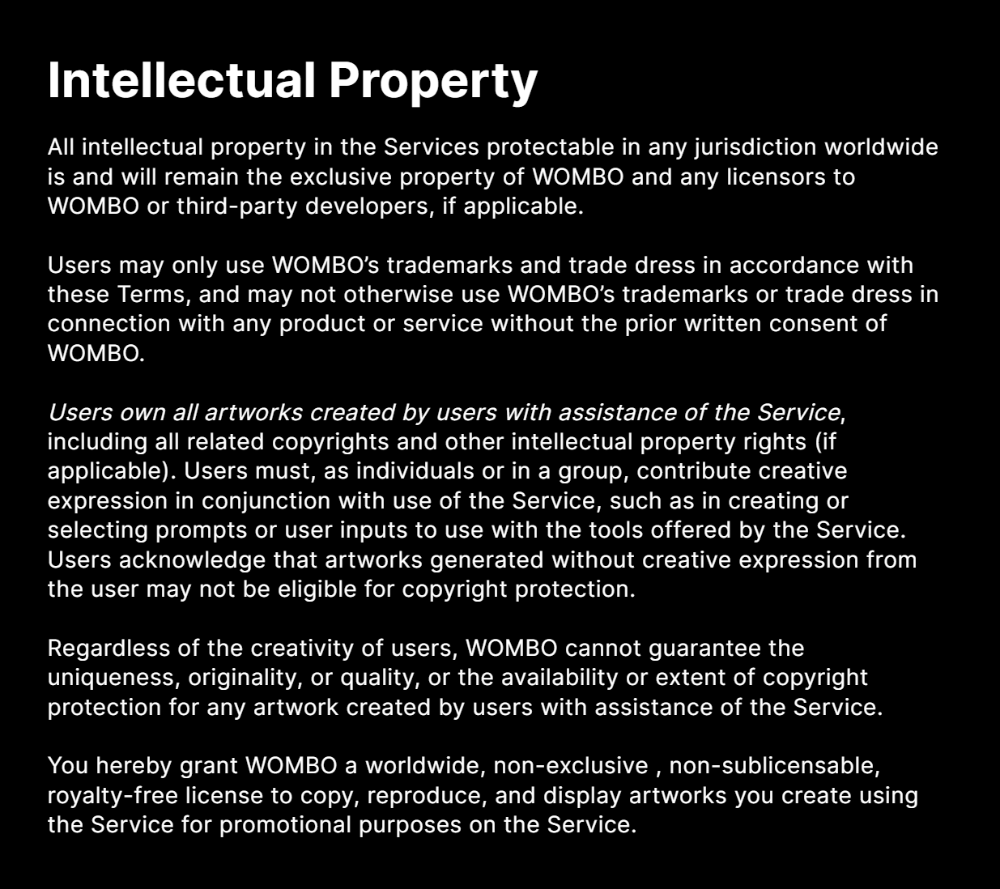

Here’s Wombos' intellectual property policy.

Final Reflections

AI is creating a new sort of art that's selling well. It’s becoming popular and valued, despite some skepticism.

Now that you know MidJourney and Wombo let you sell AI-generated art, you need to locate buyers. There are several ways to achieve this, but that’s for another story.

Aure's Notes

3 years ago

I met a man who in just 18 months scaled his startup to $100 million.

A fascinating business conversation.

This week at Web Summit, I had mentor hour.

Mentor hour connects startups with experienced entrepreneurs.

The YC-selected founder who mentored me had grown his company to $100 million in 18 months.

I had 45 minutes to question him.

I've compiled this.

Context

Founder's name is Zack.

After working in private equity, Zack opted to acquire an MBA.

Surrounded by entrepreneurs at a prominent school, he decided to become one himself.

Unsure how to proceed, he bet on two horses.

On one side, he received an offer from folks who needed help running their startup owing to lack of time. On the other hand, he had an idea for a SaaS to start himself.

He just needed to validate it.

Validating

Since Zack's proposal helped companies, he contacted university entrepreneurs for comments.

He contacted university founders.

Once he knew he'd correctly identified the problem and that people were willing to pay to address it, he started developing.

He earned $100k in a university entrepreneurship competition.

His plan was evident by then.

The other startup's founders saw his potential and granted him $400k to launch his own SaaS.

Hiring

He started looking for a tech co-founder because he lacked IT skills.

He interviewed dozens and picked the finest.

As he didn't want to wait for his program to be ready, he contacted hundreds of potential clients and got 15 letters of intent promising they'd join up when it was available.

YC accepted him by then.

He had enough positive signals to raise.

Raising

He didn't say how many VCs he called, but he indicated 50 were interested.

He jammed meetings into two weeks to generate pressure and encourage them to invest.

Seed raise: $11 million.

Selling

His objective was to contact as many entrepreneurs as possible to promote his product.

He first contacted startups by scraping CrunchBase data.

Once he had more money, he started targeting companies with ZoomInfo.

His VC urged him not to hire salespeople until he closed 50 clients himself.

He closed 100 and hired a CRO through a headhunter.

Scaling

Three persons started the business.

He primarily works in sales.

Coding the product was done by his co-founder.

Another person performing operational duties.

He regretted recruiting the third co-founder, who was ineffective (could have hired an employee instead).

He wanted his company to be big, so he hired two young marketing people from a competing company.

After validating several marketing channels, he chose PR.

$100 Million and under

He developed a sales team and now employs 30 individuals.

He raised a $100 million Series A.

Additionally, he stated

He’s been rejected a lot. Like, a lot.

Two great books to read: Steve Jobs by Isaacson, and Why Startups Fail by Tom Eisenmann.

The best skill to learn for non-tech founders is “telling stories”, which means sales. A founder’s main job is to convince: co-founders, employees, investors, and customers. Learn code, or learn sales.

Conclusion

I often read about these stories but hardly take them seriously.

Zack was amazing.

Three things about him stand out:

His vision. He possessed a certain amount of fire.

His vitality. The man had a lot of enthusiasm and spoke quickly and decisively. He takes no chances and pushes the envelope in all he does.

His Rolex.

He didn't do all this in 18 months.

Not really.

He couldn't launch his company without private equity experience.

These accounts disregard entrepreneurs' original knowledge.

Hormozi will tell you how he founded Gym Launch, but he won't tell you how he had a gym first, how he worked at uni to pay for his gym, or how he went to the gym and learnt about fitness, which gave him the idea to open his own.

Nobody knows nothing. If you scale quickly, it's probable because you gained information early.

Lincoln said, "Give me six hours to chop down a tree, and I'll spend four sharpening the axe."

Sharper axes cut trees faster.

Scott Galloway

3 years ago

Text-ure

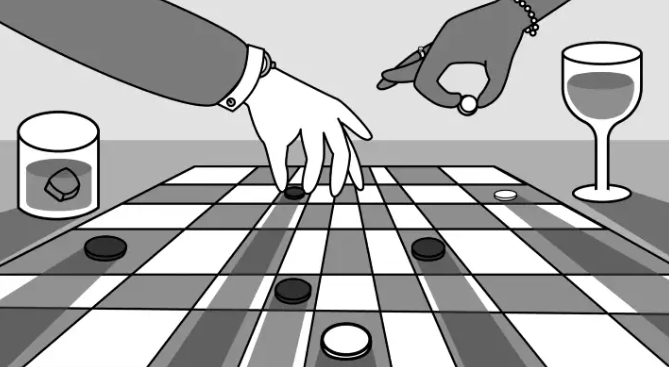

While we played checkers, we thought billionaires played 3D chess. They're playing the same game on a fancier board.

Every medium has nuances and norms. Texting is authentic and casual. A smaller circle has access, creating intimacy and immediacy. Most people read all their texts, but not all their email and mail. Many of us no longer listen to our voicemails, and calling your kids ages you.

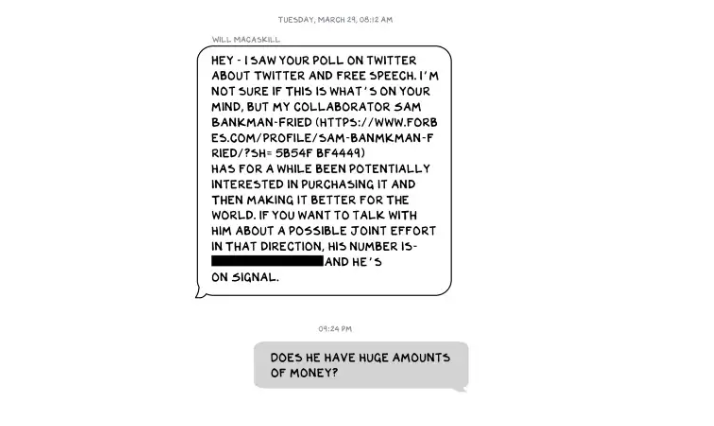

Live interviews and testimony under oath inspire real moments, rare in a world where communications departments sanitize everything powerful people say. When (some of) Elon's text messages became public in Twitter v. Musk, we got a glimpse into tech power. It's bowels.

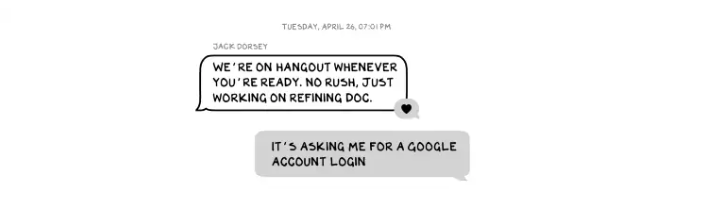

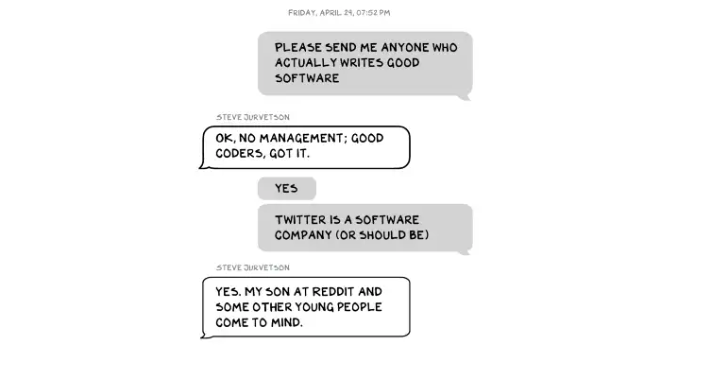

These texts illuminate the tech community's upper caste.

Checkers, Not Chess

Elon texts with Larry Ellison, Joe Rogan, Sam Bankman-Fried, Satya Nadella, and Jack Dorsey. They reveal astounding logic, prose, and discourse. The world's richest man and his followers are unsophisticated, obtuse, and petty. Possibly. While we played checkers, we thought billionaires played 3D chess. They're playing the same game on a fancier board.

They fumble with their computers.

They lean on others to get jobs for their kids (no surprise).

No matter how rich, they always could use more (money).

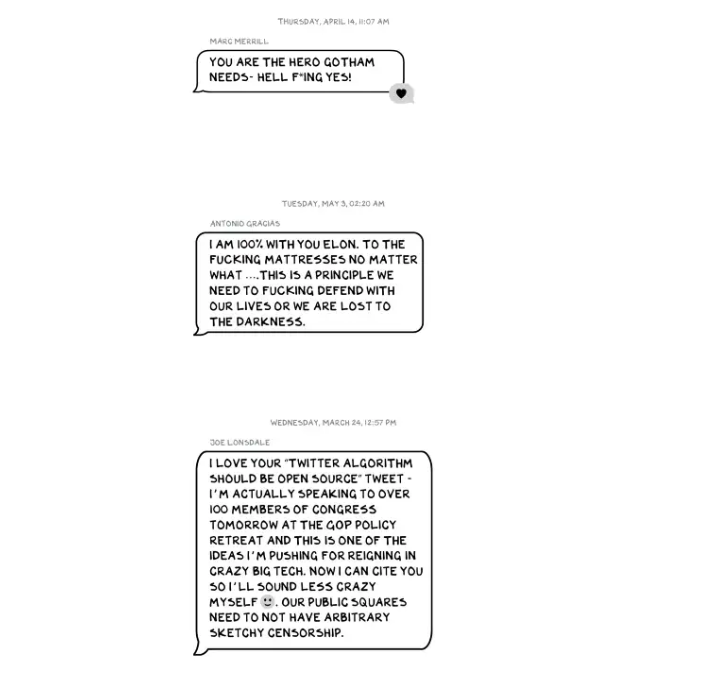

Differences A social hierarchy exists. Among this circle, the currency of deference is... currency. Money increases sycophantry. Oculus and Elon's "friends'" texts induce nausea.

Autocorrect frustrates everyone.

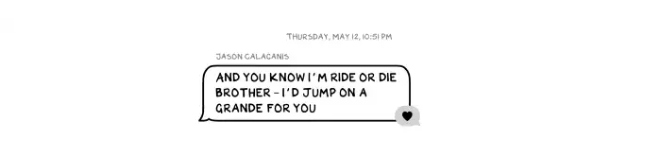

Elon doesn't stand out to me in these texts; he comes off mostly OK in my view. It’s the people around him. It seems our idolatry of innovators has infected the uber-wealthy, giving them an uncontrollable urge to kill the cool kid for a seat at his cafeteria table. "I'd grenade for you." If someone says this and they're not fighting you, they're a fan, not a friend.

Many powerful people are undone by their fake friends. Facilitators, not well-wishers. When Elon-Twitter started, I wrote about power. Unchecked power is intoxicating. This is a scientific fact, not a thesis. Power causes us to downplay risk, magnify rewards, and act on instincts more quickly. You lose self-control and must rely on others.

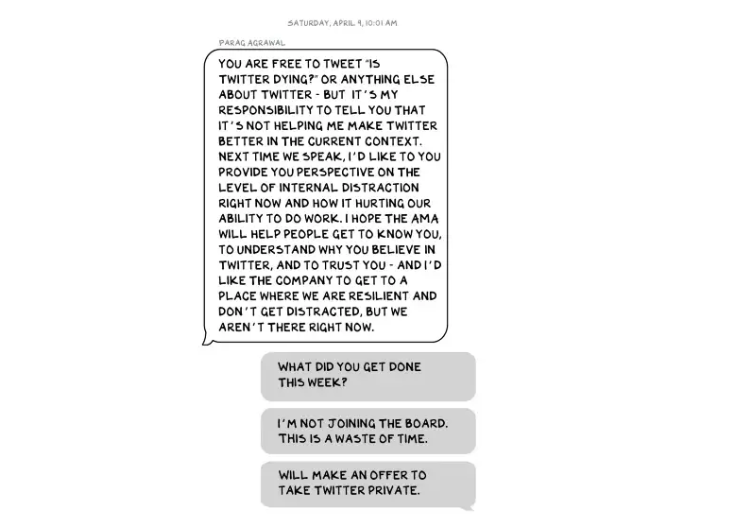

You'd hope the world's richest person has advisers who push back when necessary (i.e., not yes men). Elon's reckless, childish behavior and these texts show there is no truth-teller. I found just one pushback in the 151-page document. It came from Twitter CEO Parag Agrawal, who, in response to Elon’s unhelpful “Is Twitter dying?” tweet, let Elon know what he thought: It was unhelpful. Elon’s response? A childish, terse insult.

Scale

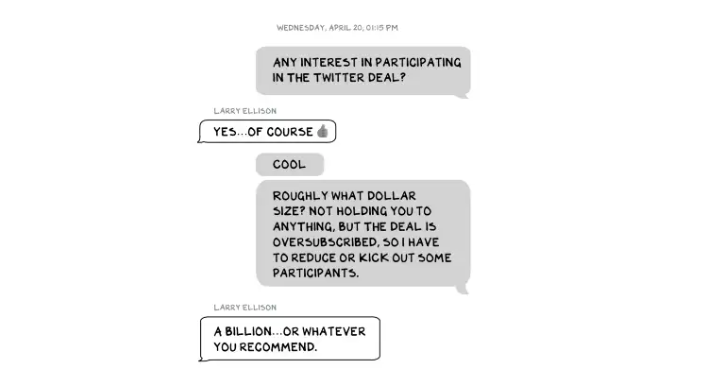

The texts are mostly unremarkable. There are some, however, that do remind us the (super-)rich are different. Specifically, the discussions of possible equity investments from crypto-billionaire Sam Bankman-Fried (“Does he have huge amounts of money?”) and this exchange with Larry Ellison:

Ellison, who co-founded $175 billion Oracle, is wealthy. Less clear is whether he can text a billion dollars. Who hasn't been texted $1 billion? Ellison offered 8,000 times the median American's net worth, enough to buy 3,000 Ferraris or the Chicago Blackhawks. It's a bedrock principle of capitalism to have incredibly successful people who are exponentially wealthier than the rest of us. It creates an incentive structure that inspires productivity and prosperity. When people offer billions over text to help a billionaire's vanity project in a country where 1 in 5 children are food insecure, isn't America messed up?

Elon's Morgan Stanley banker, Michael Grimes, tells him that Web3 ventures investor Bankman-Fried can invest $5 billion in the deal: “could do $5bn if everything vision lock... Believes in your mission." The message bothers Elon. In Elon's world, $5 billion doesn't warrant a worded response. $5 billion is more than many small nations' GDP, twice the SEC budget, and five times the NRC budget.

If income inequality worries you after reading this, trust your gut.

Billionaires aren't like the rich.

As an entrepreneur, academic, and investor, I've met modest-income people, rich people, and billionaires. Rich people seem different to me. They're smarter and harder working than most Americans. Monty Burns from The Simpsons is a cartoon about rich people. Rich people have character and know how to make friends. Success requires supporters.

I've never noticed a talent or intelligence gap between wealthy and ultra-wealthy people. Conflating talent and luck infects the tech elite. Timing is more important than incremental intelligence when going from millions to hundreds of millions or billions. Proof? Elon's texting. Any man who electrifies the auto industry and lands two rockets on barges is a genius. His mega-billions come from a well-regulated capital market, enforceable contracts, thousands of workers, and billions of dollars in government subsidies, including a $465 million DOE loan that allowed Tesla to produce the Model S. So, is Mr. Musk a genius or an impressive man in a unique time and place?

The Point

Elon's texts taught us more? He can't "fix" Twitter. For two weeks in April, he was all in on blockchain Twitter, brainstorming Dogecoin payments for tweets with his brother — i.e., paid speech — while telling Twitter's board he was going to make a hostile tender offer. Kimbal approved. By May, he was over crypto and "laborious blockchain debates." (Mood.)

Elon asked the Twitter CEO for "an update from the Twitter engineering team" No record shows if he got the meeting. It doesn't "fix" Twitter either. And this is Elon's problem. He's a grown-up child with all the toys and no boundaries. His yes-men encourage his most facile thoughts, and shitposts and errant behavior diminish his genius and ours.

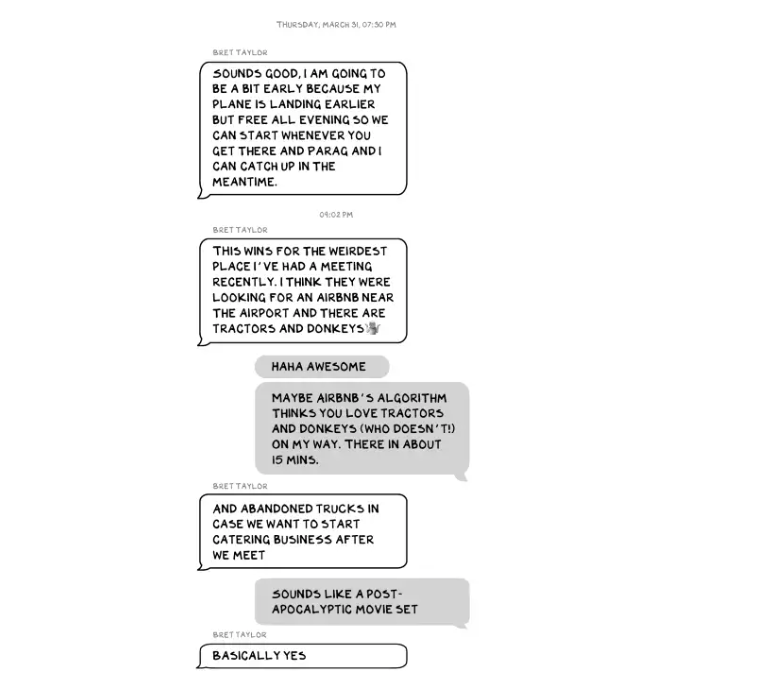

Post-Apocalyptic

The universe's titans have a sense of humor.

Every day, we must ask: Who keeps me real? Who will disagree with me? Who will save me from my psychosis, which has brought down so many successful people? Elon Musk doesn't need anyone to jump on a grenade for him; he needs to stop throwing them because one will explode in his hand.