More on Entrepreneurship/Creators

Desiree Peralta

3 years ago

Why Now Is Your Chance To Create A Millionaire Career

People don’t believe in influencers anymore; they need people like you.

Social media influencers have dominated for years. We've seen videos, images, and articles of *famous* individuals unwrapping, reviewing, and endorsing things.

This industry generates billions. This year, marketers spent $2.23 billion on Instagram, $1 million on Youtube, and $775 million on Tiktok. This marketing has helped start certain companies.

Influencers are dying, so ordinary people like us may take over this billion-dollar sector. Why?

Why influencers are perishing

Most influencers lie to their fans, especially on Instagram. Influencers' first purpose was to make their lives so flawless that others would want to buy their stuff.

In 2015, an Australian influencer with 600,000 followers went viral for revealing all her photos and everything she did to seem great before deleting her account.

“I dramatically edited the pictures, I manipulated the environements, and made my life look perfect in social media… I remember I obsessively checked the like count for a full week since uploading it, a selfie that now has close to 2,500 likes. It got 5 likes. This was when I was so hungry for social media validation … This was the reason why I quit social media: for me, personally, it consumed me. I wasn’t living in a 3D world.”

Influencers then lost credibility.

Influencers seem to live in a bubble, separate from us. Thanks to self-popularity love's and constant awareness campaigns, people find these people ridiculous.

Influencers are praised more for showing themselves as natural and common than for showing luxuries and lies.

Little by little, they are dying, making room for a new group to take advantage of this multi-million dollar business, which gives us (ordinary people) a big opportunity to grow on any content creation platform we want.

Why this is your chance to develop on any platform for creating content

In 2021, I wrote “Not everyone who talks about money is a Financial Advisor, be careful of who you take advice from,”. In it, I warned that not everyone with a large following is a reputable source of financial advice.

Other writers hated this post and said I was wrong.

People don't want Jeff Bezos or Elon Musk's counsel, they said. They prefer to hear about their neighbor's restroom problems or his closest friend's terrible business.

Real advice from regular folks.

And I found this was true when I returned to my independent YouTube channel and had more than 1000 followers after having abandoned it with fewer than 30 videos in 2021 since there were already many personal finance and travel channels and I thought mine wasn't special.

People appreciated my videos because I was a 20-something girl trying to make money online, and they believed my advice more than that of influencers with thousands of followers.

I think today is the greatest time to grow on any platform as an ordinary person. Normal individuals give honest recommendations about what works for them and look easier to make because they have the same options as us.

Nobody cares how a millionaire acquired a Lamborghini unless it's entertaining. Education works now. Real counsel from average people is replicable.

Many individuals don't appreciate how false influencers seem (unreal bodies and excessive surgery and retouching) since it makes them feel uneasy.

That's why body-positive advertisements have been so effective, but they've lost ground in places like Tiktok, where the audience wants more content from everyday people than influencers living amazing lives. More people will relate to your content if you appear genuine.

Last thoughts

Influencers are dwindling. People want more real people to give real advice and demonstrate an ordinary life.

People will enjoy anything you tell about your daily life as long as you provide value, and you can build a following rapidly if you're honest.

This is a millionaire industry that is getting more expensive and will go with what works, so stand out immediately.

Benjamin Lin

3 years ago

I sold my side project for $20,000: 6 lessons I learned

How I monetized and sold an abandoned side project for $20,000

The Origin Story

I've always wanted to be an entrepreneur but never succeeded. I often had business ideas, made a landing page, and told my buddies. Never got customers.

In April 2021, I decided to try again with a new strategy. I noticed that I had trouble acquiring an initial set of customers, so I wanted to start by acquiring a product that had a small user base that I could grow.

I found a SaaS marketplace called MicroAcquire.com where you could buy and sell SaaS products. I liked Shareit.video, an online Loom-like screen recorder.

Shareit.video didn't generate revenue, but 50 people visited daily to record screencasts.

Purchasing a Failed Side Project

I eventually bought Shareit.video for $12,000 from its owner.

$12,000 was probably too much for a website without revenue or registered users.

I thought time was most important. I could have recreated the website, but it would take months. $12,000 would give me an organized code base and a working product with a few users to monetize.

I considered buying a screen recording website and trying to grow it versus buying a new car or investing in crypto with the $12K.

Buying the website would make me a real entrepreneur, which I wanted more than anything.

Putting down so much money would force me to commit to the project and prevent me from quitting too soon.

A Year of Development

I rebranded the website to be called RecordJoy and worked on it with my cousin for about a year. Within a year, we made $5000 and had 3000 users.

We spent $3500 on ads, hosting, and software to run the business.

AppSumo promoted our $120 Life Time Deal in exchange for 30% of the revenue.

We put RecordJoy on maintenance mode after 6 months because we couldn't find a scalable user acquisition channel.

We improved SEO and redesigned our landing page, but nothing worked.

Despite not being able to grow RecordJoy any further, I had already learned so much from working on the project so I was fine with putting it on maintenance mode. RecordJoy still made $500 a month, which was great lunch money.

Getting Taken Over

One of our customers emailed me asking for some feature requests and I replied that we weren’t going to add any more features in the near future. They asked if we'd sell.

We got on a call with the customer and I asked if he would be interested in buying RecordJoy for 15k. The customer wanted around $8k but would consider it.

Since we were negotiating with one buyer, we put RecordJoy on MicroAcquire to see if there were other offers.

We quickly received 10+ offers. We got 18.5k. There was also about $1000 in AppSumo that we could not withdraw, so we agreed to transfer that over for $600 since about 40% of our sales on AppSumo usually end up being refunded.

Lessons Learned

First, create an acquisition channel

We couldn't discover a scalable acquisition route for RecordJoy. If I had to start another project, I'd develop a robust acquisition channel first. It might be LinkedIn, Medium, or YouTube.

Purchase Power of the Buyer Affects Acquisition Price

Some of the buyers we spoke to were individuals looking to buy side projects, as well as companies looking to launch a new product category. Individual buyers had less budgets than organizations.

Customers of AppSumo vary.

AppSumo customers value lifetime deals and low prices, which may not be a good way to build a business with recurring revenue. Designed for AppSumo users, your product may not connect with other users.

Try to increase acquisition trust

Acquisition often fails. The buyer can go cold feet, cease communicating, or run away with your stuff. Trusting the buyer ensures a smooth asset exchange. First acquisition meeting was unpleasant and price negotiation was tight. In later meetings, we spent the first few minutes trying to get to know the buyer’s motivations and background before jumping into the negotiation, which helped build trust.

Operating expenses can reduce your earnings.

Monitor operating costs. We were really happy when we withdrew the $5000 we made from AppSumo and Stripe until we realized that we had spent $3500 in operating fees. Spend money on software and consultants to help you understand what to build.

Don't overspend on advertising

We invested $1500 on Google Ads but made little money. For a side project, it’s better to focus on organic traffic from SEO rather than paid ads unless you know your ads are going to have a positive ROI.

Bernard Bado

3 years ago

Build This Before Someone Else Does!

Do you want to build and launch your own software company? To do this, all you need is a product that solves a problem.

Coming up with profitable ideas is not that easy. But you’re in luck because you got me!

I’ll give you the idea for free. All you need to do is execute it properly.

If you’re ready, let’s jump right into it! Starting with the problem.

Problem

Youtube has many creators. Every day, they think of new ways to entertain or inform us.

They work hard to make videos. Many of their efforts go to waste. They limit their revenue and reach.

Solution

Content repurposing solves this problem.

One video can become several TikToks. Creating YouTube videos from a podcast episode.

Or, one video might become a blog entry.

By turning videos into blog entries, Youtubers may develop evergreen SEO content, attract a new audience, and reach a non-YouTube audience.

Many YouTube creators want this easy feature.

Let's build it!

Implementation

We identified the problem, and we have a solution. All that’s left to do is see how it can be done.

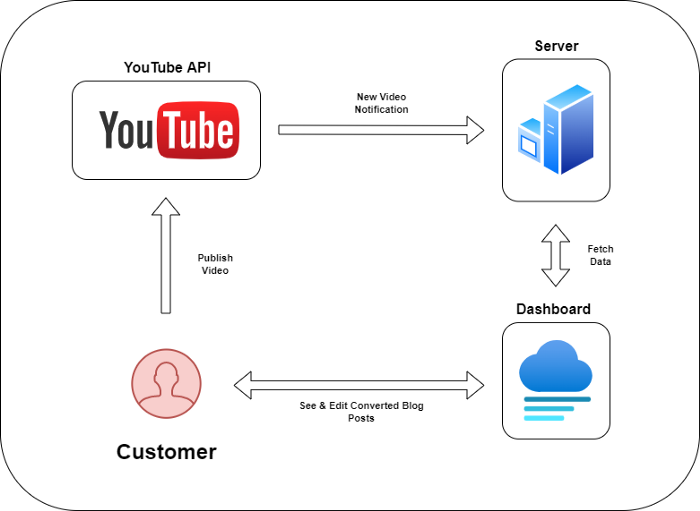

Monitoring new video uploads

First, watch when a friend uploads a new video. Everything should happen automatically without user input.

YouTube Webhooks make this easy. Our server listens for YouTube Webhook notifications.

After publishing a new video, we create a conversion job.

Creating a Blog Post from a Video

Next, turn a video into a blog article.

To convert, we must extract the video's audio (which can be achieved by using FFmpeg on the server).

Once we have the audio channel, we can use speech-to-text.

Services can accomplish this easily.

Speech-to-text on Google

Google Translate

Deepgram

Deepgram's affordability and integration make it my pick.

After conversion, the blog post needs formatting, error checking, and proofreading.

After this, a new blog post will appear in our web app's dashboard.

Completing a blog post

After conversion, users must examine and amend their blog posts.

Our application dashboard would handle all of this. It's a dashboard-style software where users can:

Link their Youtube account

Check out the converted videos in the future.

View the conversions that are ongoing.

Edit and format converted blog articles.

It's a web-based app.

It doesn't matter how it's made but I'd choose Next.js.

Next.js is a React front-end standard. Vercel serverless functions could conduct the conversions.

This would let me host the software for free and reduce server expenditures.

Taking It One Step Further

SaaS in a nutshell. Future improvements include integrating with WordPress or Ghost.

Our app users could then publish blog posts. Streamlining the procedure.

MVPs don't need this functionality.

Final Thoughts

Repurposing content helps you post more often, reach more people, and develop faster.

Many agencies charge a fortune for this service. Handmade means pricey.

Content creators will go crazy if you automate and cheaply solve this problem.

Just execute this idea!

You might also like

Ryan Weeks

3 years ago

Terra fiasco raises TRON's stablecoin backstop

After Terra's algorithmic stablecoin collapsed in May, TRON announced a plan to increase the capital backing its own stablecoin.

USDD, a near-carbon copy of Terra's UST, arrived on the TRON blockchain on May 5. TRON founder Justin Sun says USDD will be overcollateralized after initially being pegged algorithmically to the US dollar.

A reserve of cryptocurrencies and stablecoins will be kept at 130 percent of total USDD issuance, he said. TRON described the collateral ratio as "guaranteed" and said it would begin publishing real-time updates on June 5.

Currently, the reserve contains 14,040 bitcoin (around $418 million), 140 million USDT, 1.9 billion TRX, and 8.29 billion TRX in a burning contract.

Sun: "We want to hybridize USDD." We have an algorithmic stablecoin and TRON DAO Reserve.

algorithmic failure

USDD was designed to incentivize arbitrageurs to keep its price pegged to the US dollar by trading TRX, TRON's token, and USDD. Like Terra, TRON signaled its intent to establish a bitcoin and cryptocurrency reserve to support USDD in extreme market conditions.

Still, Terra's UST failed despite these safeguards. The stablecoin veered sharply away from its dollar peg in mid-May, bringing down Terra's LUNA and wiping out $40 billion in value in days. In a frantic attempt to restore the peg, billions of dollars in bitcoin were sold and unprecedented volumes of LUNA were issued.

Sun believes USDD, which has a total circulating supply of $667 million, can be backed up.

"Our reserve backing is diversified." Bitcoin and stablecoins are included. USDC will be a small part of Circle's reserve, he said.

TRON's news release lists the reserve's assets as bitcoin, TRX, USDC, USDT, TUSD, and USDJ.

All Bitcoin addresses will be signed so everyone knows they belong to us, Sun said.

Not giving in

Sun told that the crypto industry needs "decentralized" stablecoins that regulators can't touch.

Sun said the Luna Foundation Guard, a Singapore-based non-profit that raised billions in cryptocurrency to buttress UST, mismanaged the situation by trying to sell to panicked investors.

He said, "We must be ahead of the market." We want to stabilize the market and reduce volatility.

Currently, TRON finances most of its reserve directly, but Sun says the company hopes to add external capital soon.

Before its demise, UST holders could park the stablecoin in Terra's lending platform Anchor Protocol to earn 20% interest, which many deemed unsustainable. TRON's JustLend is similar. Sun hopes to raise annual interest rates from 17.67% to "around 30%."

This post is a summary. Read full article here

Shalitha Suranga

3 years ago

The Top 5 Mathematical Concepts Every Programmer Needs to Know

Using math to write efficient code in any language

Programmers design, build, test, and maintain software. Employ cases and personal preferences determine the programming languages we use throughout development. Mobile app developers use JavaScript or Dart. Some programmers design performance-first software in C/C++.

A generic source code includes language-specific grammar, pre-implemented function calls, mathematical operators, and control statements. Some mathematical principles assist us enhance our programming and problem-solving skills.

We all use basic mathematical concepts like formulas and relational operators (aka comparison operators) in programming in our daily lives. Beyond these mathematical syntaxes, we'll see discrete math topics. This narrative explains key math topics programmers must know. Master these ideas to produce clean and efficient software code.

Expressions in mathematics and built-in mathematical functions

A source code can only contain a mathematical algorithm or prebuilt API functions. We develop source code between these two ends. If you create code to fetch JSON data from a RESTful service, you'll invoke an HTTP client and won't conduct any math. If you write a function to compute the circle's area, you conduct the math there.

When your source code gets more mathematical, you'll need to use mathematical functions. Every programming language has a math module and syntactical operators. Good programmers always consider code readability, so we should learn to write readable mathematical expressions.

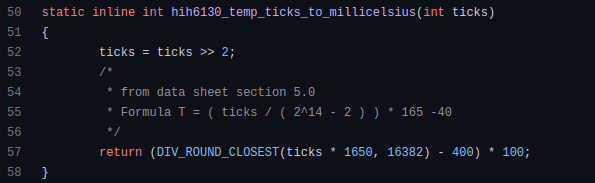

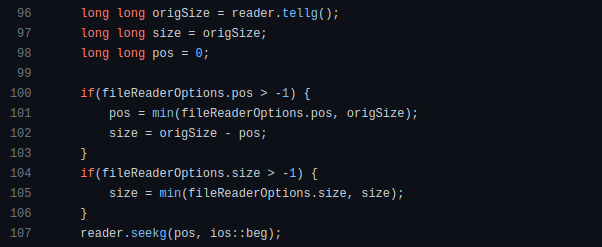

Linux utilizes clear math expressions.

Inbuilt max and min functions can minimize verbose if statements.

How can we compute the number of pages needed to display known data? In such instances, the ceil function is often utilized.

import math as m

results = 102

items_per_page = 10

pages = m.ceil(results / items_per_page)

print(pages)Learn to write clear, concise math expressions.

Combinatorics in Algorithm Design

Combinatorics theory counts, selects, and arranges numbers or objects. First, consider these programming-related questions. Four-digit PIN security? what options exist? What if the PIN has a prefix? How to locate all decimal number pairs?

Combinatorics questions. Software engineering jobs often require counting items. Combinatorics counts elements without counting them one by one or through other verbose approaches, therefore it enables us to offer minimum and efficient solutions to real-world situations. Combinatorics helps us make reliable decision tests without missing edge cases. Write a program to see if three inputs form a triangle. This is a question I commonly ask in software engineering interviews.

Graph theory is a subfield of combinatorics. Graph theory is used in computerized road maps and social media apps.

Logarithms and Geometry Understanding

Geometry studies shapes, angles, and sizes. Cartesian geometry involves representing geometric objects in multidimensional planes. Geometry is useful for programming. Cartesian geometry is useful for vector graphics, game development, and low-level computer graphics. We can simply work with 2D and 3D arrays as plane axes.

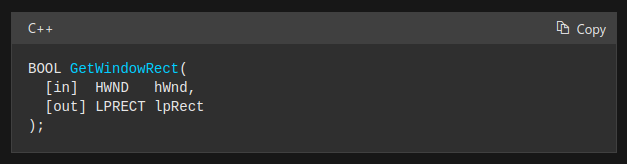

GetWindowRect is a Windows GUI SDK geometric object.

High-level GUI SDKs and libraries use geometric notions like coordinates, dimensions, and forms, therefore knowing geometry speeds up work with computer graphics APIs.

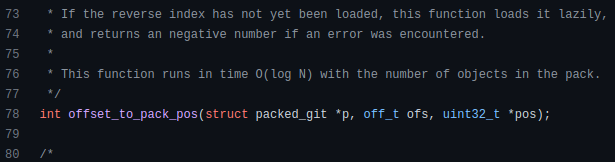

How does exponentiation's inverse function work? Logarithm is exponentiation's inverse function. Logarithm helps programmers find efficient algorithms and solve calculations. Writing efficient code involves finding algorithms with logarithmic temporal complexity. Programmers prefer binary search (O(log n)) over linear search (O(n)). Git source specifies O(log n):

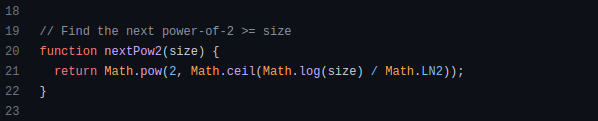

Logarithms aid with programming math. Metas Watchman uses a logarithmic utility function to find the next power of two.

Employing Mathematical Data Structures

Programmers must know data structures to develop clean, efficient code. Stack, queue, and hashmap are computer science basics. Sets and graphs are discrete arithmetic data structures. Most computer languages include a set structure to hold distinct data entries. In most computer languages, graphs can be represented using neighboring lists or objects.

Using sets as deduped lists is powerful because set implementations allow iterators. Instead of a list (or array), store WebSocket connections in a set.

Most interviewers ask graph theory questions, yet current software engineers don't practice algorithms. Graph theory challenges become obligatory in IT firm interviews.

Recognizing Applications of Recursion

A function in programming isolates input(s) and output(s) (s). Programming functions may have originated from mathematical function theories. Programming and math functions are different but similar. Both function types accept input and return value.

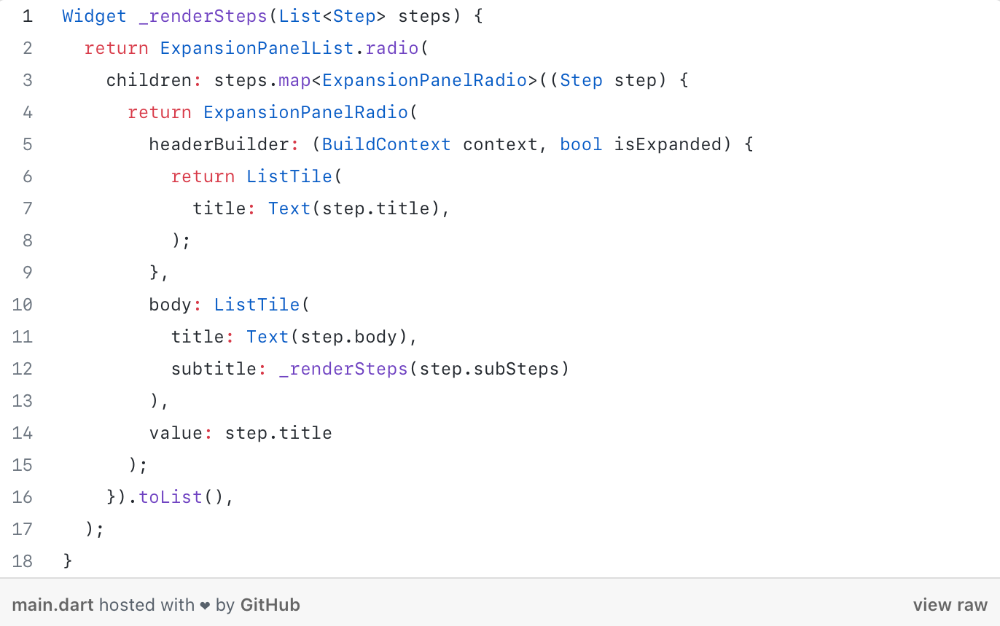

Recursion involves calling the same function inside another function. In its implementation, you'll call the Fibonacci sequence. Recursion solves divide-and-conquer software engineering difficulties and avoids code repetition. I recently built the following recursive Dart code to render a Flutter multi-depth expanding list UI:

Recursion is not the natural linear way to solve problems, hence thinking recursively is difficult. Everything becomes clear when a mathematical function definition includes a base case and recursive call.

Conclusion

Every codebase uses arithmetic operators, relational operators, and expressions. To build mathematical expressions, we typically employ log, ceil, floor, min, max, etc. Combinatorics, geometry, data structures, and recursion help implement algorithms. Unless you operate in a pure mathematical domain, you may not use calculus, limits, and other complex math in daily programming (i.e., a game engine). These principles are fundamental for daily programming activities.

Master the above math fundamentals to build clean, efficient code.

James Brockbank

3 years ago

Canonical URLs for Beginners

Canonicalization and canonical URLs are essential for SEO, and improper implementation can negatively impact your site's performance.

Canonical tags were introduced in 2009 to help webmasters with duplicate or similar content on multiple URLs.

To use canonical tags properly, you must understand their purpose, operation, and implementation.

Canonical URLs and Tags

Canonical tags tell search engines that a certain URL is a page's master copy. They specify a page's canonical URL. Webmasters can avoid duplicate content by linking to the "canonical" or "preferred" version of a page.

How are canonical tags and URLs different? Can these be specified differently?

Tags

Canonical tags are found in an HTML page's head></head> section.

<link rel="canonical" href="https://www.website.com/page/" />These can be self-referencing or reference another page's URL to consolidate signals.

Canonical tags and URLs are often used interchangeably, which is incorrect.

The rel="canonical" tag is the most common way to set canonical URLs, but it's not the only way.

Canonical URLs

What's a canonical link? Canonical link is the'master' URL for duplicate pages.

In Google's own words:

A canonical URL is the page Google thinks is most representative of duplicate pages on your site.

— Google Search Console Help

You can indicate your preferred canonical URL. For various reasons, Google may choose a different page than you.

When set correctly, the canonical URL is usually your specified URL.

Canonical URLs determine which page will be shown in search results (unless a duplicate is explicitly better for a user, like a mobile version).

Canonical URLs can be on different domains.

Other ways to specify canonical URLs

Canonical tags are the most common way to specify a canonical URL.

You can also set canonicals by:

Setting the HTTP header rel=canonical.

All pages listed in a sitemap are suggested as canonicals, but Google decides which pages are duplicates.

Redirects 301.

Google recommends these methods, but they aren't all appropriate for every situation, as we'll see below. Each has its own recommended uses.

Setting canonical URLs isn't required; if you don't, Google will use other signals to determine the best page version.

To control how your site appears in search engines and to avoid duplicate content issues, you should use canonicalization effectively.

Why Duplicate Content Exists

Before we discuss why you should use canonical URLs and how to specify them in popular CMSs, we must first explain why duplicate content exists. Nobody intentionally duplicates website content.

Content management systems create multiple URLs when you launch a page, have indexable versions of your site, or use dynamic URLs.

Assume the following URLs display the same content to a user:

A search engine sees eight duplicate pages, not one.

URLs #1 and #2: the CMS saves product URLs with and without the category name.

#3, #4, and #5 result from the site being accessible via HTTP, HTTPS, www, and non-www.

#6 is a subdomain mobile-friendly URL.

URL #7 lacks URL #2's trailing slash.

URL #8 uses a capital "A" instead of a lowercase one.

Duplicate content may also exist in URLs like:

https://www.website.com

https://www.website.com/index.php

Duplicate content is easy to create.

Canonical URLs help search engines identify different page variations as a single URL on many sites.

SEO Canonical URLs

Canonical URLs help you manage duplicate content that could affect site performance.

Canonical URLs are a technical SEO focus area for many reasons.

Specify URL for search results

When you set a canonical URL, you tell Google which page version to display.

Which would you click?

https://www.domain.com/page-1/

https://www.domain.com/index.php?id=2

First, probably.

Canonicals tell search engines which URL to rank.

Consolidate link signals on similar pages

When you have duplicate or nearly identical pages on your site, the URLs may get external links.

Canonical URLs consolidate multiple pages' link signals into a single URL.

This helps your site rank because signals from multiple URLs are consolidated into one.

Syndication management

Content is often syndicated to reach new audiences.

Canonical URLs consolidate ranking signals to prevent duplicate pages from ranking and ensure the original content ranks.

Avoid Googlebot duplicate page crawling

Canonical URLs ensure that Googlebot crawls your new pages rather than duplicated versions of the same one across mobile and desktop versions, for example.

Crawl budgets aren't an issue for most sites unless they have 100,000+ pages.

How to Correctly Implement the rel=canonical Tag

Using the header tag rel="canonical" is the most common way to specify canonical URLs.

Adding tags and HTML code may seem daunting if you're not a developer, but most CMS platforms allow canonicals out-of-the-box.

These URLs each have one product.

How to Correctly Implement a rel="canonical" HTTP Header

A rel="canonical" HTTP header can replace canonical tags.

This is how to implement a canonical URL for PDFs or non-HTML documents.

You can specify a canonical URL in your site's.htaccess file using the code below.

<Files "file-to-canonicalize.pdf"> Header add Link "< http://www.website.com/canonical-page/>; rel=\"canonical\"" </Files>301 redirects for canonical URLs

Google says 301 redirects can specify canonical URLs.

Only the canonical URL will exist if you use 301 redirects. This will redirect duplicates.

This is the best way to fix duplicate content across:

HTTPS and HTTP

Non-WWW and WWW

Trailing-Slash and Non-Trailing Slash URLs

On a single page, you should use canonical tags unless you can confidently delete and redirect the page.

Sitemaps' canonical URLs

Google assumes sitemap URLs are canonical, so don't include non-canonical URLs.

This does not guarantee canonical URLs, but is a best practice for sitemaps.

Best-practice Canonical Tag

Once you understand a few simple best practices for canonical tags, spotting and cleaning up duplicate content becomes much easier.

Always include:

One canonical URL per page

If you specify multiple canonical URLs per page, they will likely be ignored.

Correct Domain Protocol

If your site uses HTTPS, use this as the canonical URL. It's easy to reference the wrong protocol, so check for it to catch it early.

Trailing slash or non-trailing slash URLs

Be sure to include trailing slashes in your canonical URL if your site uses them.

Specify URLs other than WWW

Search engines see non-WWW and WWW URLs as duplicate pages, so use the correct one.

Absolute URLs

To ensure proper interpretation, canonical tags should use absolute URLs.

So use:

<link rel="canonical" href="https://www.website.com/page-a/" />And not:

<link rel="canonical" href="/page-a/" />If not canonicalizing, use self-referential canonical URLs.

When a page isn't canonicalizing to another URL, use self-referencing canonical URLs.

Canonical tags refer to themselves here.

Common Canonical Tags Mistakes

Here are some common canonical tag mistakes.

301 Canonicalization

Set the canonical URL as the redirect target, not a redirected URL.

Incorrect Domain Canonicalization

If your site uses HTTPS, don't set canonical URLs to HTTP.

Irrelevant Canonicalization

Canonicalize URLs to duplicate or near-identical content only.

SEOs sometimes try to pass link signals via canonical tags from unrelated content to increase rank. This isn't how canonicalization should be used and should be avoided.

Multiple Canonical URLs

Only use one canonical tag or URL per page; otherwise, they may all be ignored.

When overriding defaults in some CMSs, you may accidentally include two canonical tags in your page's <head>.

Pagination vs. Canonicalization

Incorrect pagination can cause duplicate content. Canonicalizing URLs to the first page isn't always the best solution.

Canonicalize to a 'view all' page.

How to Audit Canonical Tags (and Fix Issues)

Audit your site's canonical tags to find canonicalization issues.

SEMrush Site Audit can help. You'll find canonical tag checks in your website's site audit report.

Let's examine these issues and their solutions.

No Canonical Tag on AMP

Site Audit will flag AMP pages without canonical tags.

Canonicalization between AMP and non-AMP pages is important.

Add a rel="canonical" tag to each AMP page's head>.

No HTTPS redirect or canonical from HTTP homepage

Duplicate content issues will be flagged in the Site Audit if your site is accessible via HTTPS and HTTP.

You can fix this by 301 redirecting or adding a canonical tag to HTTP pages that references HTTPS.

Broken canonical links

Broken canonical links won't be considered canonical URLs.

This error could mean your canonical links point to non-existent pages, complicating crawling and indexing.

Update broken canonical links to the correct URLs.

Multiple canonical URLs

This error occurs when a page has multiple canonical URLs.

Remove duplicate tags and leave one.

Canonicalization is a key SEO concept, and using it incorrectly can hurt your site's performance.

Once you understand how it works, what it does, and how to find and fix issues, you can use it effectively to remove duplicate content from your site.