Because of regulations, the $3 million Mercedes-AMG ONE will not (officially) be available in the United States or Canada.

We asked Mercedes to clarify whether "customers" refers to people who have expressed interest in buying the AMG ONE but haven't made a down payment or paid in full for a production slot, and a company spokesperson told that it's the latter – "Actual customers for AMG ONE in the United States and Canada."

The Mercedes-AMG ONE has finally arrived in manufacturing form after numerous delays. This may be the most complicated and magnificent hypercar ever created, but according to Mercedes, those roads will not be found in the United States or Canada.

Despite all of the well-deserved excitement around the gorgeous AMG ONE, there was no word on when US customers could expect their cars. Our Editor-in-Chief became aware of this and contacted Mercedes to clarify the matter. Mercedes-hypercar AMG's with the F1-derived 1,049 HP 1.6-liter V6 engine will not be homologated for the US market, they've confirmed.

Mercedes has informed its customers in the United States and Canada that the ONE will not be arriving to North America after all, as of today, June 1, 2022. The whole text of the letter is included below, so sit back and wait for Mercedes to explain why we (or they) won't be getting (or seeing) the hypercar. Mercedes claims that all 275 cars it wants to produce have already been reserved, with net pricing in Europe starting at €2.75 million (about US$2.93 million at today's exchange rates), before country-specific taxes.

"The AMG-ONE was created with one purpose in mind: to provide a straight technology transfer of the World Championship-winning Mercedes-AMG Petronas Formula 1 E PERFORMANCE drive unit to the road." It's the first time a complete Formula 1 drive unit has been integrated into a road car.

Every component of the AMG ONE has been engineered to redefine high performance, with 1,000+ horsepower, four electric motors, and a blazing top speed of more than 217 mph. While the engine's beginnings are in competition, continuous research and refinement has left us with a difficult choice for the US market.

We determined that following US road requirements would considerably damage its performance and overall driving character in order to preserve the distinctive nature of its F1 powerplant. We've made the strategic choice to make the automobile available for road use in Europe, where it complies with all necessary rules."

If this is the first time US customers have heard about it, which it shouldn't be, we understand if it's a bit off-putting. The AMG ONE could very probably be Mercedes' final internal combustion hypercar of this type.

Nonetheless, we wouldn't be surprised if a few make their way to the United States via the federal government's "Show and Display" exemption provision. This legislation permits the importation of automobiles such as the AMG ONE, but only for a total of 2,500 miles per year.

The McLaren Speedtail, the Koenigsegg One:1, and the Bugatti EB110 are among the automobiles that have been imported under this special rule. We just hope we don't have to wait too long to see the ONE in the United States.

More on Lifestyle

Peter Steven Ho

3 years ago

Thank You for 21 Fantastic Years, iPod

Apple's latest revelation may shock iPod fans and former owners.

Apple discontinued the iPod touch on May 11, 2022. After 21 years, Apple killed the last surviving iPod, a device Steve Jobs believed would revolutionize the music industry.

Jobs was used to making bold predictions, but few expected Apple's digital music player to change the music industry. It did.

This chaos created new business opportunities. Spotify, YouTube, and Amazon are products of that chaotic era.

As the digital landscape changes, so do consumers, and the iPod has lost favor. I'm sure Apple realizes the importance of removing an icon. The iPod was Apple like the Mac and iPhone. I think it's bold to retire such a key Apple cornerstone. What would Jobs do?

iPod evolution across the ages

Here's an iPod family tree for all you enthusiasts.

iPod vintage (Oct 2001 to Sep 2014, 6 generations)

The original iPod had six significant upgrades since 2001. Apple announced an 80 GB ($249) and 160 GB ($349) iPod classic in 2007.

Apple updated the 80 GB model with a 120 GB device in September 2008. Apple upgraded the 120 GB model with a 160 GB variant a year later (2009). This was the last iteration, and Apple discontinued the classic in September 2014.

iPod nano (Jan 2004 to Sep 2005, 2 generations)

Apple debuted a smaller, brightly-colored iPod in 2004. The first model featured 4 GB, enough for 1,000 songs.

Apple produced a new 4 GB or 6 GB iPod mini in February 2005 and discontinued it in September when they released a better-looking iPod nano.

iTouch nano (Sep 2005 to July 2017, 7 generations)

I loved the iPod nano. It was tiny and elegant with enough tech to please most music aficionados, unless you carry around your complete music collection.

Apple owed much of the iPod nano's small form and success to solid-state flash memory. Flash memory doesn't need power because it has no moving parts. This makes the iPod nano more durable than the iPod classic and mini, which employ hard drives.

Apple manufactured seven generations of the iPod nano, improving its design, display screen, memory, battery, and software, but abandoned it in July 2017 due to dwindling demand.

Shuffle iPod (Jan 2005 to Jul 2017, 4 generations)

The iPod shuffle was entry-level. It was a simple, lightweight, tiny music player. The iPod shuffle was perfect for lengthy bike trips, runs, and hikes.

Apple sold 10 million iPod shuffles in the first year and kept making them for 12 years, through four significant modifications.

iOS device (Sep 2007 to May 2022, 7 generations)

The iPod touch's bigger touchscreen interface made it a curious addition to the iPod family. The iPod touch resembled an iPhone more than the other iPods, making them hard to tell apart.

Many were dissatisfied that Apple removed functionality from the iPod touch to avoid making it too similar to the iPhone. Seven design improvements over 15 years brought the iPod touch closer to the iPhone, but not completely.

The iPod touch uses the same iOS operating system as the iPhone, giving it access to many apps, including handheld games.

The iPod touch's long production run is due to the next generation of music-loving gamers.

What made the iPod cool

iPod revolutionized music listening. It was the first device to store and play MP3 music, allowing you to carry over 1,000 songs anywhere.

The iPod changed consumer electronics with its scroll wheel and touchscreen. Jobs valued form and function equally. He showed people that a product must look good to inspire an emotional response and ignite passion.

The elegant, tiny iPod was a tremendous sensation when it arrived for $399 in October 2001. Even at this price, it became a must-have for teens to CEOs.

It's hard to identify any technology that changed how music was downloaded and played like the iPod. Apple iPod and iTunes had 63% of the paid music download market in the fourth quarter of 2012.

The demise of the iPod was inevitable

Apple discontinuing the iPod touch after 21 years is sad. This ends a 00s music icon.

Jobs was a genius at anticipating market needs and opportunities, and Apple launched the iPod at the correct time.

Few consumer electronics items have had such a lasting impact on music lovers and the music industry as the iPod.

Smartphones and social media have contributed to the iPod's decline. Instead of moving to the music, the new generation of consumers is focused on social media. They're no longer passive content consumers; they're active content creators seeking likes and followers. Here, the smartphone has replaced the iPod.

It's hard not to feel a feeling of loss, another part of my adolescence now forgotten by the following generation.

So, if you’re lucky enough to have a working iPod, hang on to that relic and enjoy the music and the nostalgia.

Marcus Lu

3 years ago

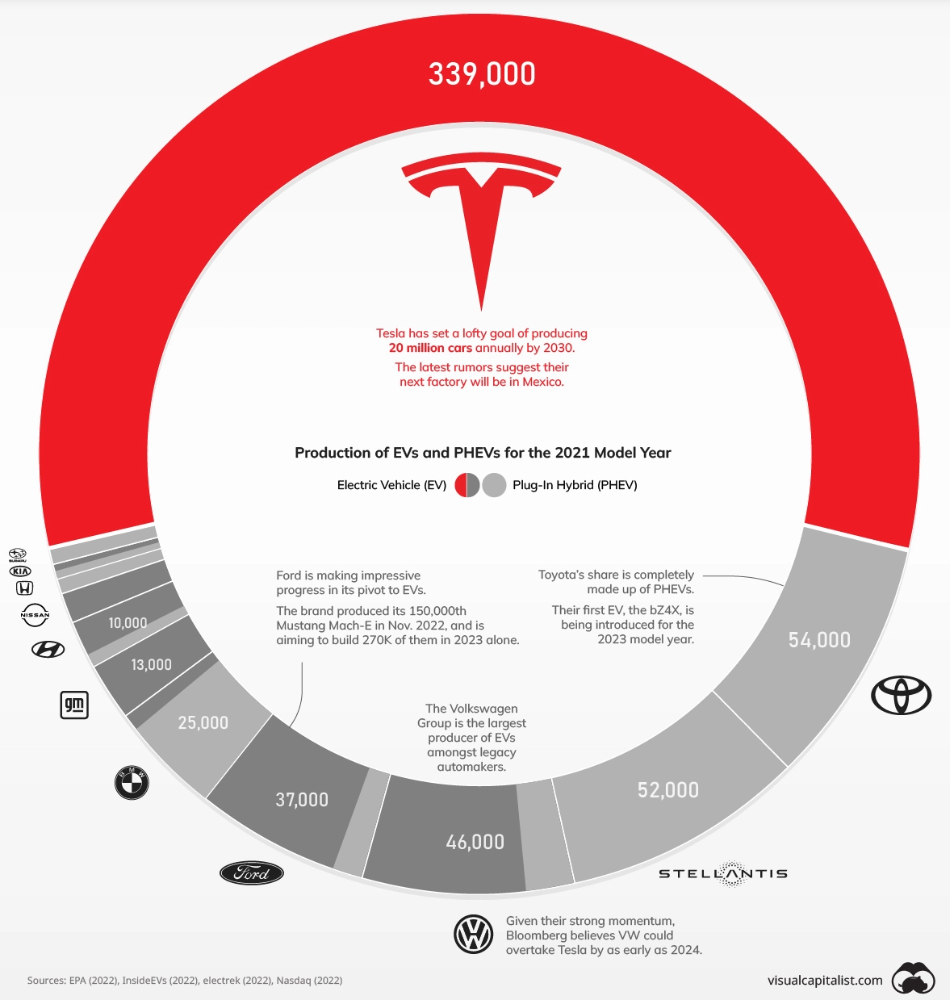

The Brand Structure of U.S. Electric Vehicle Production

Will Tesla be able to maintain its lead in the EV market for very long?

This is one of the most pressing issues in the American auto sector today. One positive aspect of Tesla is the company's devoted customer base and recognizable name recognition (similar to Apple). It also invests more in research and development per vehicle than its rivals and has a head start in EV production.

Conversely, established automakers like Volkswagen are actively plotting their strategy to surpass Tesla. As the current market leaders, they have decades of experience in the auto industry and are spending billions to catch up.

We've visualized data from the EPA's 2022 Automotive Trends Report to bring you up to speed on this developing story.

Info for the Model Year of 2021

The full production data used in this infographic is for the 2021 model year, but it comes from a report for 2022.

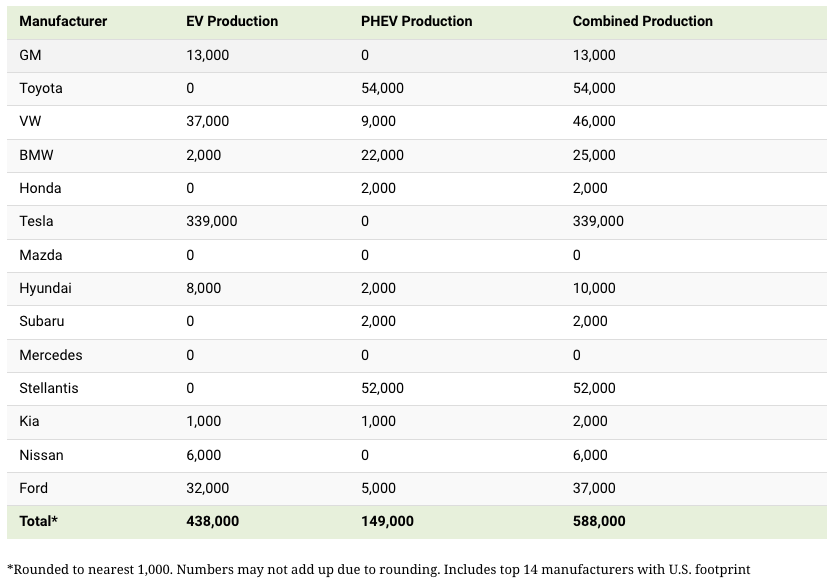

Combined EV and PHEV output is shown in the table below (plug-in hybrid electric vehicle).

It is important to note that Toyota and Stellantis, the two largest legacy automakers in this dataset, only produced PHEVs. Toyota's first electric vehicle, the bZ4X, won't hit the market until 2023.

Stellantis seems to be falling even further behind, despite having enormous unrealized potential in its Jeep and Ram brands. Stellantis CEO Carlos Tavares said in a recent interview that the firm has budgeted $36 billion for electrification and software.

Legacy Brands with the Most Momentum

In the race to develop electric vehicles, some long-standing manufacturers have gotten the jump on their rivals.

Volkswagen, one of these storied manufacturers, has made a significant investment in electric vehicles (EVs) in the wake of the Dieselgate scandal. The company plans to roll out multiple EV models, including the ID.3 hatchback, ID.4 SUV, and ID. Buzz, with the goal of producing 22 million EVs by 2028. (an electric revival of the classic Microbus).

Even Ford is keeping up, having just announced an EV investment of $22 billion between 2021 and 2025. In November of 2022, the company manufactured their 150,000th Mustang Mach-E, and by the end of 2023, they hoped to have 270,000 of them in circulation.

Additionally, over 200,000 F-150 Lightnings have been reserved since Ford announced the truck. The Lightning is scheduled to have a production run of 15,000 in 2022, 55,000 in 2023, and 80,000 in 2024. Ford's main competitor in the electric pickup truck segment, Rivian, is on track to sell 25,000 vehicles by 2022.

Michael Le

3 years ago

Union LA x Air Jordan 2 “Future Is Now” PREVIEW

With the help of Virgil Abloh and Union LA‘s Chris Gibbs, it's now clear that Jordan Brand intended to bring the Air Jordan 2 back in 2022.

The “Future Is Now” collection includes two colorways of MJ's second signature as well as an extensive range of apparel and accessories.

“We wanted to juxtapose what some futuristic gear might look like after being worn and patina'd,”

Union stated on the collaboration's landing page.

“You often see people's future visions that are crisp and sterile. We thought it would be cool to wear it in and make it organic...”

The classic co-branding appears on short-sleeve tees, hoodies, and sweat shorts/sweat pants, all lightly distressed at the hems and seams.

Also, a filtered black-and-white photo of MJ graces the adjacent long sleeves, labels stitch into the socks, and the Jumpman logo adorns the four caps.

Liner jackets and flight pants will also be available, adding reimagined militaria to a civilian ensemble.

The Union LA x Air Jordan 2 (Grey Fog and Rattan) shares many of the same beats. Vintage suedes show age, while perforations and detailing reimagine Bruce Kilgore's design for the future.

The “UN/LA” tag across the modified eye stays, the leather patch across the tongue, and the label that wraps over the lateral side of the collar complete the look.

The footwear will also include a Crater Slide in the “Grey Fog” color scheme.

BUYING

On 4/9 and 4/10 from 9am-3pm, Union LA will be giving away a pair of Air Jordan 2s at their La Brea storefront (110 S. LA BREA AVE. LA, CA 90036). The raffle is only open to LA County residents with a valid CA ID. You must enter by 11:59pm on 4/10 to win. Winners will be notified via email.

You might also like

Anton Franzen

3 years ago

This is the driving force for my use of NFTs, which will completely transform the world.

Its not a fuc*ing fad.

It's not about boring monkeys or photos as nfts; that's just what's been pushed up and made a lot of money. The technology underlying those ridiculous nft photos will one day prove your house and automobile ownership and tell you where your banana came from. Are you ready for web3? Soar!

People don't realize that absolutely anything can and will be part of the blockchain and smart contracts, making them even better. I'll tell you a secret: it will and is happening.

Why?

Why is something blockchain-based a good idea? So let’s speak about cars!

So a new Tesla car is manufactured, and when you buy it, it is bound to an NFT on the blockchain that proves current ownership. The NFT in the smart contract can contain some data about the current owner of the car and some data about the car's status, such as the number of miles driven, the car's overall quality, and so on, as well as a reference to a digital document bound to the NFT that has more information.

Now, 40 years from now, if you want to buy a used automobile, you can scan the car's serial number to view its NFT and see all of its history, each owner, how long they owned it, if it had damages, and more. Since it's on the blockchain, it can't be tampered with.

When you're ready to buy it, the owner posts it for sale, you buy it, and it's sent to your wallet. 5 seconds to change owner, 100% safe and verifiable.

Incorporate insurance logic into the car contract. If you crashed, your car's smart contract would take money from your insurance contract and deposit it in an insurance company wallet.

It's limitless. Your funds may be used by investors to provide insurance as they profit from everyone's investments.

Or suppose all car owners in a country deposit a fixed amount of money into an insurance smart contract that promises if something happens, we'll take care of it. It could be as little as $100-$500 per year, and in a country with 10 million people, maybe 3 million would do that, which would be $500 000 000 in that smart contract and it would be used by the insurance company to invest in assets or take a cut, literally endless possibilities.

Instead of $300 per month, you may pay $300 per year to be covered if something goes wrong, and that may include multiple insurances.

What about your grocery store banana, though?

Yes that too.

You can scan a banana to learn its complete history. You'll be able to see where it was cultivated, every middleman in the supply chain, and hopefully the banana's quality, farm, and ingredients used.

If you want locally decent bananas, you can only buy them, offering you transparency and options. I believe it will be an online marketplace where farmers publish their farms and products for trust and transparency. You might also buy bananas from the farmer.

And? Food security to finish the article. If an order of bananas included a toxin, you could easily track down every banana from the same origin and supply chain and uncover the root cause. This is a tremendous thing that will save lives and have a big impact; did you realize that 1 in 6 Americans gets poisoned by food every year? This could lower the number.

To summarize:

Smart contracts can issue nfts as proof of ownership and include functionality.

Will Lockett

3 years ago

The world will be changed by this molten salt battery.

Four times the energy density and a fraction of lithium-cost ion's

As the globe abandons fossil fuels, batteries become more important. EVs, solar, wind, tidal, wave, and even local energy grids will use them. We need a battery revolution since our present batteries are big, expensive, and detrimental to the environment. A recent publication describes a battery that solves these problems. But will it be enough?

Sodium-sulfur molten salt battery. It has existed for a long time and uses molten salt as an electrolyte (read more about molten salt batteries here). These batteries are cheaper, safer, and more environmentally friendly because they use less eco-damaging materials, are non-toxic, and are non-flammable.

Previous molten salt batteries used aluminium-sulphur chemistries, which had a low energy density and required high temperatures to keep the salt liquid. This one uses a revolutionary sodium-sulphur chemistry and a room-temperature-melting salt, making it more useful, affordable, and eco-friendly. To investigate this, researchers constructed a button-cell prototype and tested it.

First, the battery was 1,017 mAh/g. This battery is four times as energy dense as high-density lithium-ion batteries (250 mAh/g).

No one knows how much this battery would cost. A more expensive molten-salt battery costs $15 per kWh. Current lithium-ion batteries cost $132/kWh. If this new molten salt battery costs the same as present cells, it will be 90% cheaper.

This room-temperature molten salt battery could be utilized in an EV. Cold-weather heaters just need a modest backup battery.

The ultimate EV battery? If used in a Tesla Model S, you could install four times the capacity with no weight gain, offering a 1,620-mile range. This huge battery pack would cost less than Tesla's. This battery would nearly perfect EVs.

Or would it?

The battery's capacity declined by 50% after 1,000 charge cycles. This means that our hypothetical Model S would suffer this decline after 1.6 million miles, but for more cheap vehicles that use smaller packs, this would be too short. This test cell wasn't supposed to last long, so this is shocking. Future versions of this cell could be modified to live longer.

This affordable and eco-friendly cell is best employed as a grid-storage battery for renewable energy. Its safety and affordable price outweigh its short lifespan. Because this battery is made of easily accessible materials, it may be utilized to boost grid-storage capacity without causing supply chain concerns or EV battery prices to skyrocket.

Researchers are designing a bigger pouch cell (like those in phones and laptops) for this purpose. The battery revolution we need could be near. Let’s just hope it isn’t too late.

Nick Nolan

3 years ago

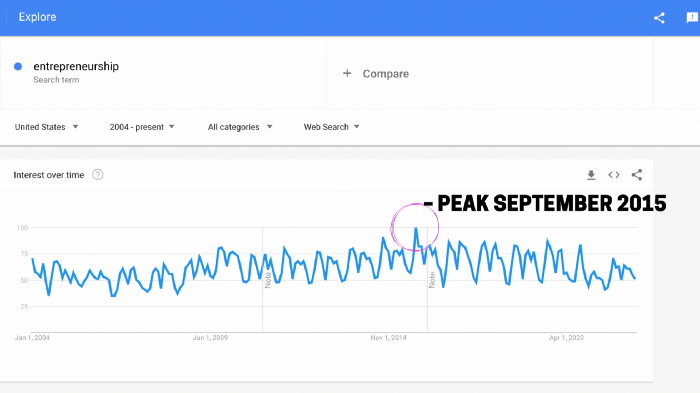

In five years, starting a business won't be hip.

People are slowly recognizing entrepreneurship's downside.

Growing up, entrepreneurship wasn't common. High school class of 2012 had no entrepreneurs.

Businesses were different.

They had staff and a lengthy history of achievement.

I never wanted a business. It felt unattainable. My friends didn't care.

Weird.

People desired degrees to attain good jobs at big companies.

When graduated high school:

9 out of 10 people attend college

Earn minimum wage (7%) working in a restaurant or retail establishment

Or join the military (3%)

Later, entrepreneurship became a thing.

2014-ish

I was in the military and most of my high school friends were in college, so I didn't hear anything.

Entrepreneurship soared in 2015, according to Google Trends.

Then more individuals were interested. Entrepreneurship went from unusual to cool.

In 2015, it was easier than ever to build a website, run Facebook advertisements, and achieve organic social media reach.

There were several online business tools.

You didn't need to spend years or money figuring it out. Most entry barriers were gone.

Everyone wanted a side gig to escape the 95.

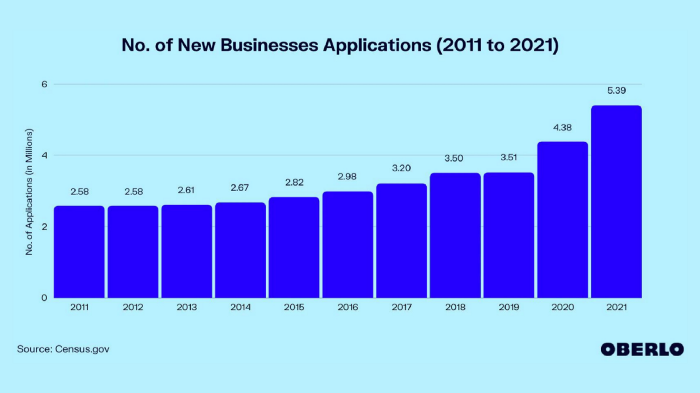

Small company applications have increased during the previous 10 years.

2011-2014 trend continues.

2015 adds 150,000 applications. 2016 adds 200,000. Plus 300,000 in 2017.

The graph makes it look little, but that's a considerable annual spike with no indications of stopping.

By 2021, new business apps had doubled.

Entrepreneurship will return to its early 2010s level.

I think we'll go backward in 5 years.

Entrepreneurship is half as popular as it was in 2015.

In the late 2020s and 30s, entrepreneurship will again be obscure.

Entrepreneurship's decade-long splendor is fading. People will cease escaping 9-5 and launch fewer companies.

That’s not a bad thing.

I think people have a rose-colored vision of entrepreneurship. It's fashionable. People feel that they're missing out if they're not entrepreneurial.

Reality is showing up.

People say on social media, "I knew starting a business would be hard, but not this hard."

More negative posts on entrepreneurship:

Luke adds:

Is being an entrepreneur ‘healthy’? I don’t really think so. Many like Gary V, are not role models for a well-balanced life. Despite what feel-good LinkedIn tells you the odds are against you as an entrepreneur. You have to work your face off. It’s a tough but rewarding lifestyle. So maybe let’s stop glorifying it because it takes a lot of (bleepin) work to survive a pandemic, mental health battles, and a competitive market.

Entrepreneurship is no longer a pipe dream.

It’s hard.

I went full-time in March 2020. I was done by April 2021. I had a good-paying job with perks.

When that fell through (on my start date), I had to continue my entrepreneurial path. I needed money by May 1 to pay rent.

Entrepreneurship isn't as great as many think.

Entrepreneurship is a serious business.

If you have a 9-5, the grass isn't greener here. Most people aren't telling the whole story when they post on social media or quote successful entrepreneurs.

People prefer to communicate their victories than their defeats.

Is this a bad thing?

I don’t think so.

Over the previous decade, entrepreneurship went from impossible to the finest thing ever.

It peaked in 2020-21 and is returning to reality.

Startups aren't for everyone.

If you like your job, don't quit.

Entrepreneurship won't amaze people if you quit your job.

It's irrelevant.

You're doomed.

And you'll probably make less money.

If you hate your job, quit. Change jobs and bosses. Changing jobs could net you a greater pay or better perks.

When you go solo, your paycheck and perks vanish. Did I mention you'll fail, sleep less, and stress more?

Nobody will stop you from pursuing entrepreneurship. You'll face several challenges.

Possibly.

Entrepreneurship may be romanticized for years.

Based on what I see from entrepreneurs on social media and trends, entrepreneurship is challenging and few will succeed.