More on Marketing

Mark Shpuntov

3 years ago

How to Produce a Month's Worth of Content for Social Media in a Day

New social media producers' biggest error

The Treadmill of Social Media Content

New creators focus on the wrong platforms.

They post to Instagram, Twitter, TikTok, etc.

They create daily material, but it's never enough for social media algorithms.

Creators recognize they're on a content creation treadmill.

They have to keep publishing content daily just to stay on the algorithm’s good side and avoid losing the audience they’ve built on the platform.

This is exhausting and unsustainable, causing creator burnout.

They focus on short-lived platforms, which is an issue.

Comparing low- and high-return social media platforms

Social media networks are great for reaching new audiences.

Their algorithm is meant to viralize material.

Social media can use you for their aims if you're not careful.

To master social media, focus on the right platforms.

To do this, we must differentiate low-ROI and high-ROI platforms:

Low ROI platforms are ones where content has a short lifespan. High ROI platforms are ones where content has a longer lifespan.

A tweet may be shown for 12 days. If you write an article or blog post, it could get visitors for 23 years.

ROI is drastically different.

New creators have limited time and high learning curves.

Nothing is possible.

First create content for high-return platforms.

ROI for social media platforms

Here are high-return platforms:

Your Blog - A single blog article can rank and attract a ton of targeted traffic for a very long time thanks to the power of SEO.

YouTube - YouTube has a reputation for showing search results or sidebar recommendations for videos uploaded 23 years ago. A superb video you make may receive views for a number of years.

Medium - A platform dedicated to excellent writing is called Medium. When you write an article about a subject that never goes out of style, you're building a digital asset that can drive visitors indefinitely.

These high ROI platforms let you generate content once and get visitors for years.

This contrasts with low ROI platforms:

Twitter

Instagram

TikTok

LinkedIn

Facebook

The posts you publish on these networks have a 23-day lifetime. Instagram Reels and TikToks are exceptions since viral content can last months.

If you want to make content creation sustainable and enjoyable, you must focus the majority of your efforts on creating high ROI content first. You can then use the magic of repurposing content to publish content to the lower ROI platforms to increase your reach and exposure.

How To Use Your Content Again

So, you’ve decided to focus on the high ROI platforms.

Great!

You've published an article or a YouTube video.

You worked hard on it.

Now you have fresh stuff.

What now?

If you are not repurposing each piece of content for multiple platforms, you are throwing away your time and efforts.

You've created fantastic material, so why not distribute it across platforms?

Repurposing Content Step-by-Step

For me, it's writing a blog article, but you might start with a video or podcast.

The premise is the same regardless of the medium.

Start by creating content for a high ROI platform (YouTube, Blog Post, Medium). Then, repurpose, edit, and repost it to the lower ROI platforms.

Here's how to repurpose pillar material for other platforms:

Post the article on your blog.

Put your piece on Medium (use the canonical link to point to your blog as the source for SEO)

Create a video and upload it to YouTube using the talking points from the article.

Rewrite the piece a little, then post it to LinkedIn.

Change the article's format to a Thread and share it on Twitter.

Find a few quick quotes throughout the article, then use them in tweets or Instagram quote posts.

Create a carousel for Instagram and LinkedIn using screenshots from the Twitter Thread.

Go through your film and select a few valuable 30-second segments. Share them on LinkedIn, Facebook, Twitter, TikTok, YouTube Shorts, and Instagram Reels.

Your video's audio can be taken out and uploaded as a podcast episode.

If you (or your team) achieve all this, you'll have 20-30 pieces of social media content.

If you're just starting, I wouldn't advocate doing all of this at once.

Instead, focus on a few platforms with this method.

You can outsource this as your company expands. (If you'd want to learn more about content repurposing, contact me.)

You may focus on relevant work while someone else grows your social media on autopilot.

You develop high-ROI pillar content, and it's automatically chopped up and posted on social media.

This lets you use social media algorithms without getting sucked in.

Thanks for reading!

Saskia Ketz

2 years ago

I hate marketing for my business, but here's how I push myself to keep going

Start now.

When it comes to building my business, I’m passionate about a lot of things. I love creating user experiences that simplify branding essentials. I love creating new typefaces and color combinations to inspire logo designers. I love fixing problems to improve my product.

Business marketing isn't my thing.

This is shared by many. Many solopreneurs, like me, struggle to advertise their business and drive themselves to work on it.

Without a lot of promotion, no company will succeed. Marketing is 80% of developing a firm, and when you're starting out, it's even more. Some believe that you shouldn't build anything until you've begun marketing your idea and found enough buyers.

Marketing your business without marketing experience is difficult. There are various outlets and techniques to learn. Instead of figuring out where to start, it's easier to return to your area of expertise, whether that's writing, designing product features, or improving your site's back end. Right?

First, realize that your role as a founder is to market your firm. Being a founder focused on product, I rarely work on it.

Secondly, use these basic methods that have helped me dedicate adequate time and focus to marketing. They're all simple to apply, and they've increased my business's visibility and success.

1. Establish buckets for every task.

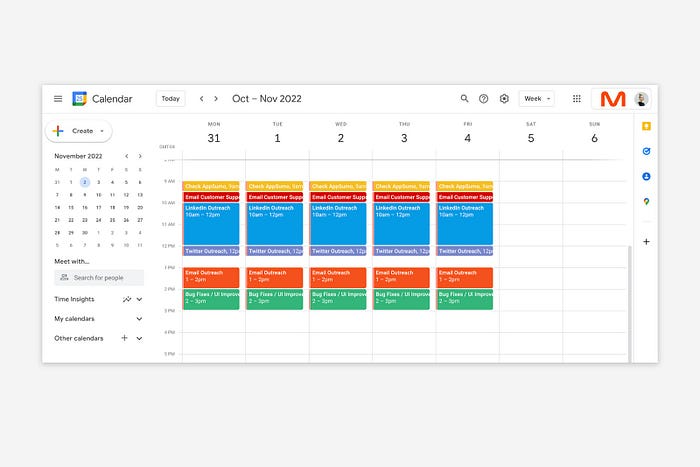

You've probably heard to schedule tasks you don't like. As simple as it sounds, blocking a substantial piece of my workday for marketing duties like LinkedIn or Twitter outreach, AppSumo customer support, or SEO has forced me to spend time on them.

Giving me lots of room to focus on product development has helped even more. Sure, this means scheduling time to work on product enhancements after my four-hour marketing sprint.

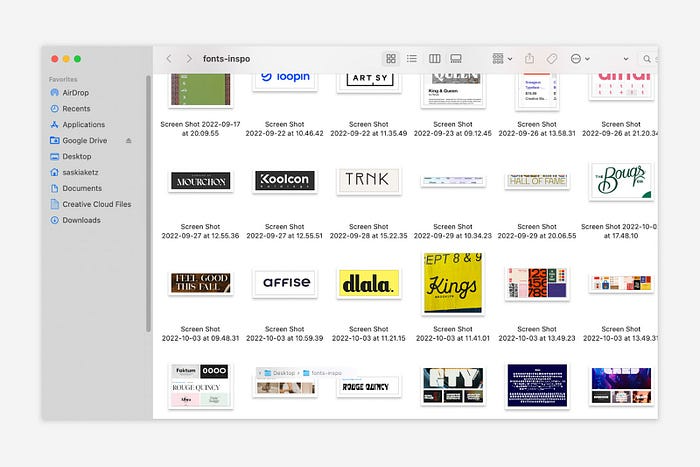

It also involves making space to store product inspiration and ideas throughout the day so I don't get distracted. This is like the advice to keep a notebook beside your bed to write down your insomniac ideas. I keep fonts, color palettes, and product ideas in folders on my desktop. Knowing these concepts won't be lost lets me focus on marketing in the moment. When I have limited time to work on something, I don't have to conduct the research I've been collecting, so I can get more done faster.

2. Look for various accountability systems

Accountability is essential for self-discipline. To keep focused on my marketing tasks, I've needed various streams of accountability, big and little.

Accountability groups are great for bigger things. SaaS Camp, a sales outreach coaching program, is mine. We discuss marketing duties and results every week. This motivates me to do enough each week to be proud of my accomplishments. Yet hearing what works (or doesn't) for others gives me benchmarks for my own marketing outcomes and plenty of fresh techniques to attempt.

… say, I want to DM 50 people on Twitter about my product — I get that many Q-tips and place them in one pen holder on my desk.

The best accountability group can't watch you 24/7. I use a friend's simple method that shouldn't work (but it does). When I have a lot of marketing chores, like DMing 50 Twitter users about my product, That many Q-tips go in my desk pen holder. After each task, I relocate one Q-tip to an empty pen holder. When you have a lot of minor jobs to perform, it helps to see your progress. You might use toothpicks, M&Ms, or anything else you have a lot of.

3. Continue to monitor your feedback loops

Knowing which marketing methods work best requires monitoring results. As an entrepreneur with little go-to-market expertise, every tactic I pursue is an experiment. I need to know how each trial is doing to maximize my time.

I placed Google and Facebook advertisements on hold since they took too much time and money to obtain Return. LinkedIn outreach has been invaluable to me. I feel that talking to potential consumers one-on-one is the fastest method to grasp their problem areas, figure out my messaging, and find product market fit.

Data proximity offers another benefit. Seeing positive results makes it simpler to maintain doing a work you don't like. Why every fitness program tracks progress.

Marketing's goal is to increase customers and revenues, therefore I've found it helpful to track those metrics and celebrate monthly advances. I provide these updates for extra accountability.

Finding faster feedback loops is also motivating. Marketing brings more clients and feedback, in my opinion. Product-focused founders love that feedback. Positive reviews make me proud that my product is benefitting others, while negative ones provide me with suggestions for product changes that can improve my business.

The best advice I can give a lone creator who's afraid of marketing is to just start. Start early to learn by doing and reduce marketing stress. Start early to develop habits and successes that will keep you going. The sooner you start, the sooner you'll have enough consumers to return to your favorite work.

Francesca Furchtgott

3 years ago

Giving customers what they want or betraying the values of the brand?

A J.Crew collaboration for fashion label Eveliina Vintage is not a paradox; it is a solution.

Eveliina Vintage's capsule collection debuted yesterday at J.Crew. This J.Crew partnership stopped me in my tracks.

Eveliina Vintage sells vintage goods. Eeva Musacchia founded the shop in Finland in the 1970s. It's recognized for its one-of-a-kind slip dresses from the 1930s and 1940s.

I wondered why a vintage brand would partner with a mass shop. Fast fashion against vintage shopping? Will Eveliina Vintages customers be turned off?

But Eveliina Vintages customers don't care about sustainability. They want Eveliina's Instagram look. Eveliina Vintage collaborated with J.Crew to give customers what they wanted: more Eveliina at a lower price.

Vintage: A Fashion Option That Is Eco-Conscious

Secondhand shopping is a trendy response to quick fashion. J.Crew releases hundreds of styles annually. Waste and environmental damage have been criticized. A pair of jeans requires 1,800 gallons of water. J.Crew's limited-time deals promote more purchases. J.Crew items are likely among those Americans wear 7 times before discarding.

Consumers and designers have emphasized sustainability in recent years. Stella McCartney and Eileen Fisher are popular eco-friendly brands. They've also flocked to ThredUp and similar sites.

Gap, Levis, and Allbirds have listened to consumer requests. They promote recycling, ethical sourcing, and secondhand shopping.

Secondhand shoppers feel good about reusing and recycling clothing that might have ended up in a landfill.

Eco-conscious fashionistas shop vintage. These shoppers enjoy the thrill of the hunt (that limited-edition Chanel bag!) and showing off a unique piece (nobody will have my look!). They also reduce their environmental impact.

Is Eveliina Vintage capitalizing on an aesthetic or is it a sustainable brand?

Eveliina Vintage emphasizes environmental responsibility. Vogue's Amanda Musacchia emphasized sustainability. Amanda, founder Eeva's daughter, is a company leader.

But Eveliina's press message doesn't address sustainability, unlike Instagram. Scarcity and fame rule.

Eveliina Vintages Instagram has see-through dresses and lace-trimmed slip dresses. Celebrities and influencers are often photographed in Eveliina's apparel, which has 53,000+ followers. Vogue appreciates Eveliina's style. Multiple publications discuss Alexa Chung's Eveliina dress.

Eveliina Vintage markets its one-of-a-kind goods. It teases future content, encouraging visitors to return. Scarcity drives demand and raises clothing prices. One dress is $1,600+, but most are $500-$1,000.

The catch: Eveliina can't monetize its expanding popularity due to exorbitant prices and limited quantity. Why?

Most people struggle to pay for their clothing. But Eveliina Vintage lacks those more affordable entry-level products, in contrast to other luxury labels that sell accessories or perfume.

Many people have trouble fitting into their clothing. The bodies of most women in the past were different from those for which vintage clothing was designed. Each Eveliina dress's specific measurements are mentioned alongside it. Be careful, you can fall in love with an ill-fitting dress.

No matter how many people can afford it and fit into it, there is only one item to sell. To get the item before someone else does, those people must be on the Eveliina Vintage website as soon as it becomes available.

A Way for Eveliina Vintage to Make Money (and Expand) with J.Crew Its following

Eveliina Vintages' cooperation with J.Crew makes commercial sense.

This partnership spreads Eveliina's style. Slightly better pricing The $390 outfits have multicolored slips and gauzy cotton gowns. Sizes range from 00 to 24, which is wider than vintage racks.

Eveliina Vintage customers like the combination. Excited comments flood the brand's Instagram launch post. Nobody is mocking the 50-year-old vintage brand's fast-fashion partnership.

Vintage may be a sustainable fashion trend, but that's not why Eveliina's clients love the brand. They only care about the old look.

And that is a tale as old as fashion.

You might also like

Will Leitch

3 years ago

Don't treat Elon Musk like Trump.

He’s not the President. Stop treating him like one.

Elon Musk tweeted from Qatar, where he was watching the World Cup Final with Jared Kushner.

Musk's subsequent Tweets were as normal, basic, and bland as anyone's from a World Cup Final: It's depressing to see the world's richest man looking at his phone during a grand ceremony. Rich guy goes to rich guy event didn't seem important.

Before Musk posted his should-I-step-down-at-Twitter poll, CNN ran a long segment asking if it was hypocritical for him to reveal his real-time location after defending his (very dumb) suspension of several journalists for (supposedly) revealing his assassination coordinates by linking to a site that tracks Musks private jet. It was hard to ignore CNN's hypocrisy: It covered Musk as Twitter CEO like President Trump. EVERY TRUMP STORY WAS BASED ON HIM SAYING X, THEN DOING Y. Trump would do something horrific, lie about it, then pretend it was fine, then condemn a political rival who did the same thing, be called hypocritical, and so on. It lasted four years. Exhausting.

It made sense because Trump was the President of the United States. The press's main purpose is to relentlessly cover and question the president.

It's strange to say this out. Twitter isn't America. Elon Musk isn't a president. He maintains a money-losing social media service to harass and mock people he doesn't like. Treating Musk like Trump, as if he should be held accountable like Trump, shows a startling lack of perspective. Some journalists treat Twitter like a country.

The compulsive, desperate way many journalists utilize the site suggests as much. Twitter isn't the town square, despite popular belief. It's a place for obsessives to meet and converse. Journalists say they're breaking news. Their careers depend on it. They can argue it's a public service. Nope. It's a place lonely people go to speak all day. Twitter. So do journalists, Trump, and Musk. Acting as if it has a greater purpose, as if it's impossible to break news without it, or as if the republic is in peril is ludicrous. Only 23% of Americans are on Twitter, while 25% account for 97% of Tweets. I'd think a large portion of that 25% are journalists (or attention addicts) chatting to other journalists. Their loudness makes Twitter seem more important than it is. Nope. It's another stupid website. They were there before Twitter; they will be there after Twitter. It’s just a website. We can all get off it if we want. Most of us aren’t even on it in the first place.

Musk is a website-owner. No world leader. He's not as accountable as Trump was. Musk is cable news's primary character now that Trump isn't (at least for now). Becoming a TV news anchor isn't as significant as being president. Elon Musk isn't as important as we all pretend, and Twitter isn't even close. Twitter is a dumb website, Elon Musk is a rich guy going through a midlife crisis, and cable news is lazy because its leaders thought the entire world was on Twitter and are now freaking out that their playground is being disturbed.

I’ve said before that you need to leave Twitter, now. But even if you’re still on it, we need to stop pretending it matters more than it does. It’s a site for lonely attention addicts, from the man who runs it to the journalists who can’t let go of it. It’s not a town square. It’s not a country. It’s not even a successful website. Let’s stop pretending any of it’s real. It’s not.

Maddie Wang

3 years ago

Easiest and fastest way to test your startup idea!

Here's the fastest way to validate company concepts.

I squandered a year after dropping out of Stanford designing a product nobody wanted.

But today, I’m at 100k!

Differences:

I was designing a consumer product when I dropped out.

I coded MVP, got 1k users, and got YC interview.

Nice, huh?

WRONG!

Still coding and getting users 12 months later

WOULD PEOPLE PAY FOR IT? was the riskiest assumption I hadn't tested.

When asked why I didn't verify payment, I said,

Not-ready products. Now, nobody cares. The website needs work. Include this. Increase usage…

I feared people would say no.

After 1 year of pushing it off, my team told me they were really worried about the Business Model. Then I asked my audience if they'd buy my product.

So?

No, overwhelmingly.

I felt like I wasted a year building a product no one would buy.

Founders Cafe was the opposite.

Before building anything, I requested payment.

40 founders were interviewed.

Then we emailed Stanford, YC, and other top founders, asking them to join our community.

BOOM! 10/12 paid!

Without building anything, in 1 day I validated my startup's riskiest assumption. NOT 1 year.

Asking people to pay is one of the scariest things.

I understand.

I asked Stanford queer women to pay before joining my gay sorority.

I was afraid I'd turn them off or no one would pay.

Gay women, like those founders, were in such excruciating pain that they were willing to pay me upfront to help.

You can ask for payment (before you build) to see if people have the burning pain. Then they'll pay!

Examples from Founders Cafe members:

😮 Using a fake landing page, a college dropout tested a product. Paying! He built it and made $3m!

😮 YC solo founder faked a Powerpoint demo. 5 Enterprise paid LOIs. $1.5m raised, built, and in YC!

😮 A Harvard founder can convert Figma to React. 1 day, 10 customers. Built a tool to automate Figma -> React after manually fulfilling requests. 1m+

Bad example:

😭 Stanford Dropout Spends 1 Year Building Product Without Payment Validation

Some people build for a year and then get paying customers.

What I'm sharing is my experience and what Founders Cafe members have told me about validating startup ideas.

Don't waste a year like I did.

After my first startup failed, I planned to re-enroll at Stanford/work at Facebook.

After people paid, I quit for good.

I've hit $100k!

Hope this inspires you to request upfront payment! It'll change your life

Sofien Kaabar, CFA

2 years ago

Innovative Trading Methods: The Catapult Indicator

Python Volatility-Based Catapult Indicator

As a catapult, this technical indicator uses three systems: Volatility (the fulcrum), Momentum (the propeller), and a Directional Filter (Acting as the support). The goal is to get a signal that predicts volatility acceleration and direction based on historical patterns. We want to know when the market will move. and where. This indicator outperforms standard indicators.

Knowledge must be accessible to everyone. This is why my new publications Contrarian Trading Strategies in Python and Trend Following Strategies in Python now include free PDF copies of my first three books (Therefore, purchasing one of the new books gets you 4 books in total). GitHub-hosted advanced indications and techniques are in the two new books above.

The Foundation: Volatility

The Catapult predicts significant changes with the 21-period Relative Volatility Index.

The Average True Range, Mean Absolute Deviation, and Standard Deviation all assess volatility. Standard Deviation will construct the Relative Volatility Index.

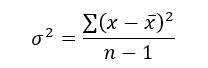

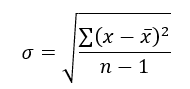

Standard Deviation is the most basic volatility. It underpins descriptive statistics and technical indicators like Bollinger Bands. Before calculating Standard Deviation, let's define Variance.

Variance is the squared deviations from the mean (a dispersion measure). We take the square deviations to compel the distance from the mean to be non-negative, then we take the square root to make the measure have the same units as the mean, comparing apples to apples (mean to standard deviation standard deviation). Variance formula:

As stated, standard deviation is:

# The function to add a number of columns inside an array

def adder(Data, times):

for i in range(1, times + 1):

new_col = np.zeros((len(Data), 1), dtype = float)

Data = np.append(Data, new_col, axis = 1)

return Data

# The function to delete a number of columns starting from an index

def deleter(Data, index, times):

for i in range(1, times + 1):

Data = np.delete(Data, index, axis = 1)

return Data

# The function to delete a number of rows from the beginning

def jump(Data, jump):

Data = Data[jump:, ]

return Data

# Example of adding 3 empty columns to an array

my_ohlc_array = adder(my_ohlc_array, 3)

# Example of deleting the 2 columns after the column indexed at 3

my_ohlc_array = deleter(my_ohlc_array, 3, 2)

# Example of deleting the first 20 rows

my_ohlc_array = jump(my_ohlc_array, 20)

# Remember, OHLC is an abbreviation of Open, High, Low, and Close and it refers to the standard historical data file

def volatility(Data, lookback, what, where):

for i in range(len(Data)):

try:

Data[i, where] = (Data[i - lookback + 1:i + 1, what].std())

except IndexError:

pass

return Data

The RSI is the most popular momentum indicator, and for good reason—it excels in range markets. Its 0–100 range simplifies interpretation. Fame boosts its potential.

The more traders and portfolio managers look at the RSI, the more people will react to its signals, pushing market prices. Technical Analysis is self-fulfilling, therefore this theory is obvious yet unproven.

RSI is determined simply. Start with one-period pricing discrepancies. We must remove each closing price from the previous one. We then divide the smoothed average of positive differences by the smoothed average of negative differences. The RSI algorithm converts the Relative Strength from the last calculation into a value between 0 and 100.

def ma(Data, lookback, close, where):

Data = adder(Data, 1)

for i in range(len(Data)):

try:

Data[i, where] = (Data[i - lookback + 1:i + 1, close].mean())

except IndexError:

pass

# Cleaning

Data = jump(Data, lookback)

return Data

def ema(Data, alpha, lookback, what, where):

alpha = alpha / (lookback + 1.0)

beta = 1 - alpha

# First value is a simple SMA

Data = ma(Data, lookback, what, where)

# Calculating first EMA

Data[lookback + 1, where] = (Data[lookback + 1, what] * alpha) + (Data[lookback, where] * beta)

# Calculating the rest of EMA

for i in range(lookback + 2, len(Data)):

try:

Data[i, where] = (Data[i, what] * alpha) + (Data[i - 1, where] * beta)

except IndexError:

pass

return Datadef rsi(Data, lookback, close, where, width = 1, genre = 'Smoothed'):

# Adding a few columns

Data = adder(Data, 7)

# Calculating Differences

for i in range(len(Data)):

Data[i, where] = Data[i, close] - Data[i - width, close]

# Calculating the Up and Down absolute values

for i in range(len(Data)):

if Data[i, where] > 0:

Data[i, where + 1] = Data[i, where]

elif Data[i, where] < 0:

Data[i, where + 2] = abs(Data[i, where])

# Calculating the Smoothed Moving Average on Up and Down

absolute values

lookback = (lookback * 2) - 1 # From exponential to smoothed

Data = ema(Data, 2, lookback, where + 1, where + 3)

Data = ema(Data, 2, lookback, where + 2, where + 4)

# Calculating the Relative Strength

Data[:, where + 5] = Data[:, where + 3] / Data[:, where + 4]

# Calculate the Relative Strength Index

Data[:, where + 6] = (100 - (100 / (1 + Data[:, where + 5])))

# Cleaning

Data = deleter(Data, where, 6)

Data = jump(Data, lookback)

return Data

def relative_volatility_index(Data, lookback, close, where):

# Calculating Volatility

Data = volatility(Data, lookback, close, where)

# Calculating the RSI on Volatility

Data = rsi(Data, lookback, where, where + 1)

# Cleaning

Data = deleter(Data, where, 1)

return DataThe Arm Section: Speed

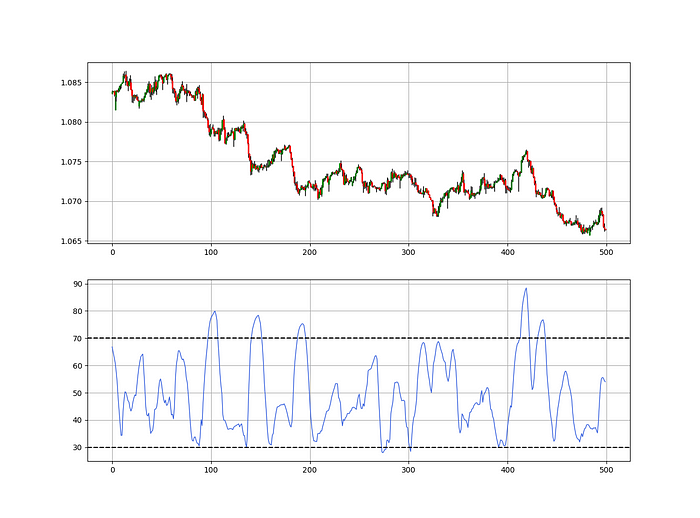

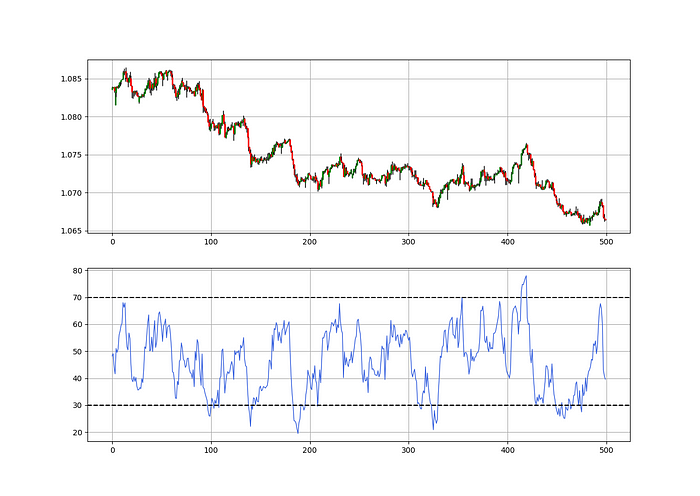

The Catapult predicts momentum direction using the 14-period Relative Strength Index.

As a reminder, the RSI ranges from 0 to 100. Two levels give contrarian signals:

A positive response is anticipated when the market is deemed to have gone too far down at the oversold level 30, which is 30.

When the market is deemed to have gone up too much, at overbought level 70, a bearish reaction is to be expected.

Comparing the RSI to 50 is another intriguing use. RSI above 50 indicates bullish momentum, while below 50 indicates negative momentum.

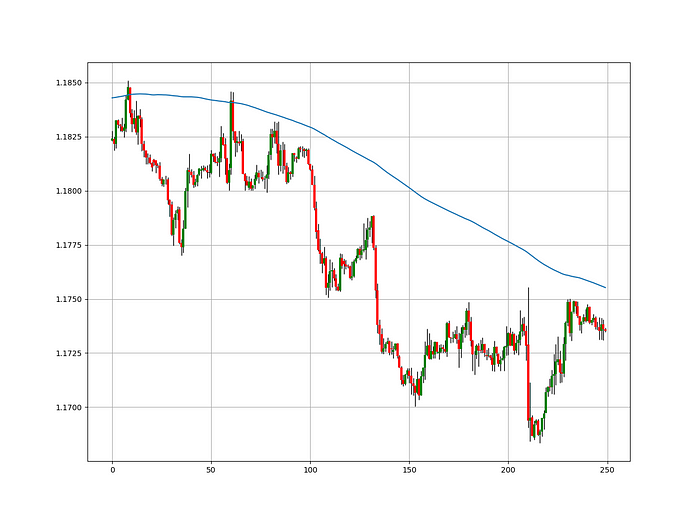

The direction-finding filter in the frame

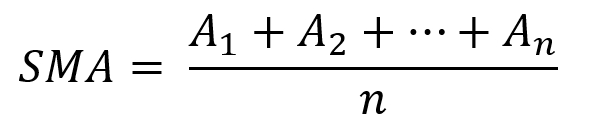

The Catapult's directional filter uses the 200-period simple moving average to keep us trending. This keeps us sane and increases our odds.

Moving averages confirm and ride trends. Its simplicity and track record of delivering value to analysis make them the most popular technical indicator. They help us locate support and resistance, stops and targets, and the trend. Its versatility makes them essential trading tools.

This is the plain mean, employed in statistics and everywhere else in life. Simply divide the number of observations by their total values. Mathematically, it's:

We defined the moving average function above. Create the Catapult indication now.

Indicator of the Catapult

The indicator is a healthy mix of the three indicators:

The first trigger will be provided by the 21-period Relative Volatility Index, which indicates that there will now be above average volatility and, as a result, it is possible for a directional shift.

If the reading is above 50, the move is likely bullish, and if it is below 50, the move is likely bearish, according to the 14-period Relative Strength Index, which indicates the likelihood of the direction of the move.

The likelihood of the move's direction will be strengthened by the 200-period simple moving average. When the market is above the 200-period moving average, we can infer that bullish pressure is there and that the upward trend will likely continue. Similar to this, if the market falls below the 200-period moving average, we recognize that there is negative pressure and that the downside is quite likely to continue.

lookback_rvi = 21

lookback_rsi = 14

lookback_ma = 200

my_data = ma(my_data, lookback_ma, 3, 4)

my_data = rsi(my_data, lookback_rsi, 3, 5)

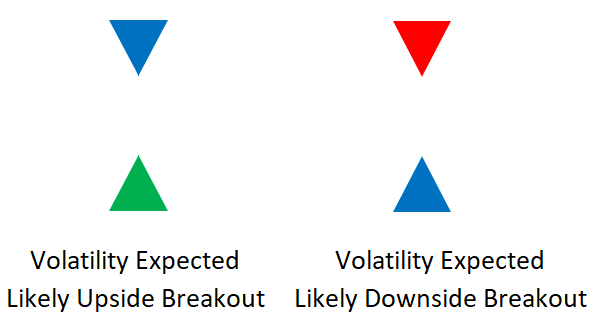

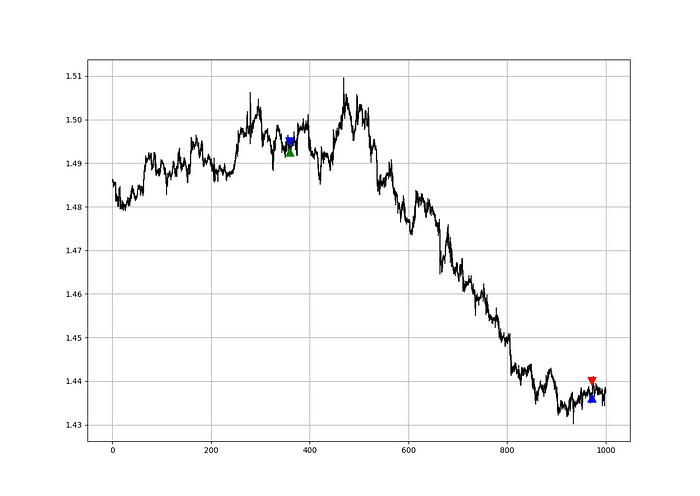

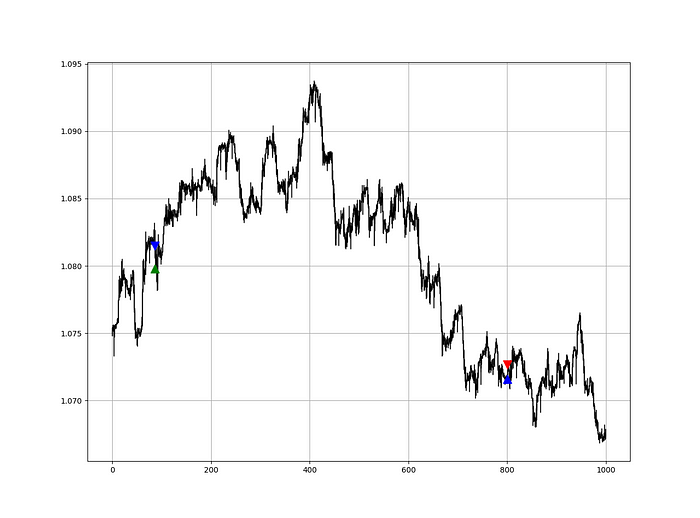

my_data = relative_volatility_index(my_data, lookback_rvi, 3, 6)Two-handled overlay indicator Catapult. The first exhibits blue and green arrows for a buy signal, and the second shows blue and red for a sell signal.

The chart below shows recent EURUSD hourly values.

def signal(Data, rvi_col, signal):

Data = adder(Data, 10)

for i in range(len(Data)):

if Data[i, rvi_col] < 30 and \

Data[i - 1, rvi_col] > 30 and \

Data[i - 2, rvi_col] > 30 and \

Data[i - 3, rvi_col] > 30 and \

Data[i - 4, rvi_col] > 30 and \

Data[i - 5, rvi_col] > 30:

Data[i, signal] = 1

return Data

Signals are straightforward. The indicator can be utilized with other methods.

my_data = signal(my_data, 6, 7)

Lumiwealth shows how to develop all kinds of algorithms. I recommend their hands-on courses in algorithmic trading, blockchain, and machine learning.

Summary

To conclude, my goal is to contribute to objective technical analysis, which promotes more transparent methods and strategies that must be back-tested before implementation. Technical analysis will lose its reputation as subjective and unscientific.

After you find a trading method or approach, follow these steps:

Put emotions aside and adopt an analytical perspective.

Test it in the past in conditions and simulations taken from real life.

Try improving it and performing a forward test if you notice any possibility.

Transaction charges and any slippage simulation should always be included in your tests.

Risk management and position sizing should always be included in your tests.

After checking the aforementioned, monitor the plan because market dynamics may change and render it unprofitable.