More on Entrepreneurship/Creators

Rachel Greenberg

3 years ago

The Unsettling Fact VC-Backed Entrepreneurs Don't Want You to Know

What they'll do is scarier.

My acquaintance recently joined a VC-funded startup. Money, equity, and upside possibilities were nice, but he had a nagging dread.

They just secured a $40M round and are hiring like crazy to prepare for their IPO in two years. All signals pointed to this startup's (a B2B IT business in a stable industry) success, and its equity-holding workers wouldn't pass that up.

Five months after starting the work, my friend struggled with leaving. We might overlook the awful culture and long hours at the proper price. This price plus the company's fate and survival abilities sent my friend departing in an unpleasant unplanned resignation before jumping on yet another sinking ship.

This affects founders. This affects VC-backed companies (and all businesses). This affects anyone starting, buying, or running a business.

Here's the under-the-table approach that's draining VC capital, leaving staff terrified (or jobless), founders rattled, and investors upset. How to recognize, solve, and avoid it

The unsettling reality behind door #1

You can't raise money off just your looks, right? If "looks" means your founding team's expertise, then maybe. In my friend's case, the founding team's strong qualifications and track records won over investors before talking figures.

They're hardly the only startup to raise money without a profitable customer acquisition strategy. Another firm raised money for an expensive sleep product because it's eco-friendly. They were off to the races with a few keywords and key players.

Both companies, along with numerous others, elected to invest on product development first. Company A employed all the tech, then courted half their market (they’re a tech marketplace that connects two parties). Company B spent millions on R&D to create a palatable product, then flooded the world with marketing.

My friend is on Company B's financial team, and he's seen where they've gone wrong. It's terrible.

Company A (tech market): Growing? Not quite. To achieve the ambitious expansion they (and their investors) demand, they've poured much of their little capital into salespeople: Cold-calling commission and salary salesmen. Is it working? Considering attrition and companies' dwindling capital, I don't think so.

Company B (green sleep) has been hiring, digital marketing, and opening new stores like crazy. Growing expenses should result in growing revenues and a favorable return on investment; if you grow too rapidly, you may neglect to check that ROI.

Once Company A cut headcount and Company B declared “going concerned”, my friend realized both startups had the same ailment and didn't recognize it.

I shouldn't have to ask a friend to verify a company's cash reserves and profitability to spot a financial problem. It happened anyhow.

The frightening part isn't that investors were willing to invest millions without product-market fit, CAC, or LTV estimates. That's alarming, but not as scary as the fact that startups aren't understanding the problem until VC rounds have dried up.

When they question consultants if their company will be around in 6 months. It’s a red flag. How will they stretch $20M through a 2-year recession with a $3M/month burn rate and no profitability? Alarms go off.

Who's in danger?

In a word, everyone who raised money without a profitable client acquisition strategy or enough resources to ride out dry spells.

Money mismanagement and poor priorities affect every industry (like sinking all your capital into your product, team, or tech, at the expense of probing what customer acquisition really takes and looks like).

This isn't about tech, real estate, or recession-proof luxury products. Fast, cheap, easy money flows into flashy-looking teams with buzzwords, trending industries, and attractive credentials.

If these companies can't show progress or get a profitable CAC, they can't raise more money. They die if they can't raise more money (or slash headcount and find shoestring budget solutions until they solve the real problem).

The kiss of death (and how to avoid it)

If you're running a startup and think raising VC is the answer, pause and evaluate. Do you need the money now?

I'm not saying VC is terrible or has no role. Founders have used it as a Band-Aid for larger, pervasive problems. Venture cash isn't a crutch for recruiting consumers profitably; it's rocket fuel to get you what and who you need.

Pay-to-play isn't a way to throw money at the wall and hope for a return. Pay-to-play works until you run out of money, and if you haven't mastered client acquisition, your cash will diminish quickly.

How can you avoid this bottomless pit? Tips:

Understand your burn rate

Keep an eye on your growth or profitability.

Analyze each and every marketing channel and initiative.

Make lucrative customer acquisition strategies and satisfied customers your top two priorities. not brand-new products. not stellar hires. avoid the fundraising rollercoaster to save time. If you succeed in these two tasks, investors will approach you with their thirsty offers rather than the other way around, and your cash reserves won't diminish as a result.

Not as much as your grandfather

My family friend always justified expensive, impractical expenditures by saying it was only monopoly money. In business, startups, and especially with money from investors expecting a return, that's not true.

More founders could understand that there isn't always another round if they viewed VC money as their own limited pool. When the well runs dry, you must refill it or save the day.

Venture financing isn't your grandpa's money. A discerning investor has entrusted you with dry powder in the hope that you'll use it wisely, strategically, and thoughtfully. Use it well.

Victoria Kurichenko

3 years ago

Here's what happened after I launched my second product on Gumroad.

One-hour ebook sales, affiliate relationships, and more.

If you follow me, you may know I started a new ebook in August 2022.

Despite publishing on this platform, my website, and Quora, I'm not a writer.

My writing speed is slow, 2,000 words a day, and I struggle to communicate cohesively.

In April 2022, I wrote a successful guide on How to Write Google-Friendly Blog Posts.

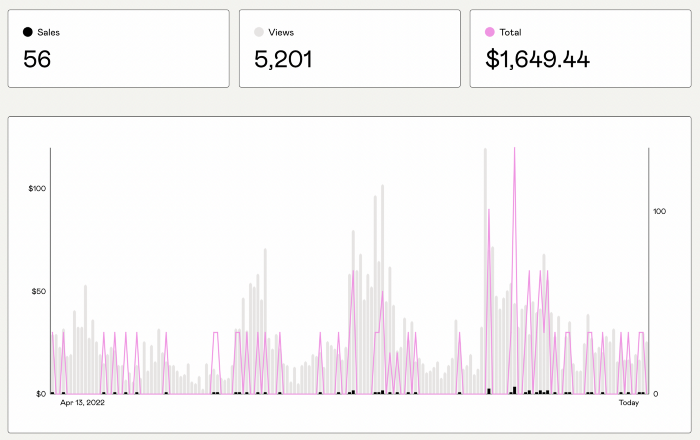

I had no email list or social media presence. I've made $1,600+ selling ebooks.

Evidence:

My first digital offering isn't a book.

It's an actionable guide with my tried-and-true process for writing Google-friendly content.

I'm not bragging.

Established authors like Tim Denning make more from my ebook sales with one newsletter.

This experience taught me writing isn't a privilege.

Writing a book and making money online doesn't require expertise.

Many don't consult experts. They want someone approachable.

Two years passed before I realized my own limits.

I have a brain, two hands, and Internet to spread my message.

I wrote and published a second ebook after the first's success.

On Gumroad, I released my second digital product.

Here's my complete Gumroad evaluation.

Gumroad is a marketplace for content providers to develop and sell sales pages.

Gumroad handles payments and client requests. It's helpful when someone sends a bogus payment receipt requesting an ebook (actual story!).

You'll forget administrative concerns after your first ebook sale.

After my first ebook sale, I did this: I made additional cash!

After every sale, I tell myself, "I built a new semi-passive revenue source."

This thinking shift helps me become less busy while increasing my income and quality of life.

Besides helping others, folks sell evergreen digital things to earn passive money.

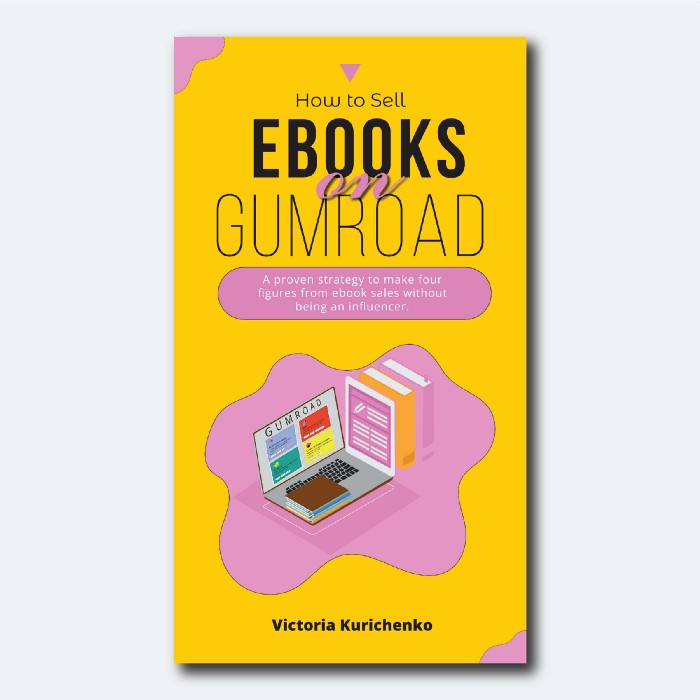

It's in my second ebook.

I explain how I built and sold 50+ copies of my SEO writing ebook without being an influencer.

I show how anyone can sell ebooks on Gumroad and automate their sales process.

This is my ebook.

After publicizing the ebook release, I sold three copies within an hour.

Wow, or meh?

I don’t know.

The answer is different for everyone.

These three sales came from a small email list of 40 motivated fans waiting for my ebook release.

I had bigger plans.

I'll market my ebook on Medium, my website, Quora, and email.

I'm testing affiliate partnerships this time.

One of my ebook buyers is now promoting it for 40% commission.

Become my affiliate if you think your readers would like my ebook.

My ebook is a few days old, but I'm interested to see where it goes.

My SEO writing book started without an email list, affiliates, or 4,000 website visitors. I've made four figures.

I'm slowly expanding my communication avenues to have more impact.

Even a small project can open doors you never knew existed.

So began my writing career.

In summary

If you dare, every concept can become a profitable trip.

Before, I couldn't conceive of creating an ebook.

How to Sell eBooks on Gumroad is my second digital product.

Marketing and writing taught me that anything can be sold online.

Startup Journal

3 years ago

The Top 14 Software Business Ideas That Are Sure To Succeed in 2023

Software can change any company.

Software is becoming essential. Everyone should consider how software affects their lives and others'.

Software on your phone, tablet, or computer offers many new options. We're experts in enough ways now.

Software Business Ideas will be popular by 2023.

ERP Programs

ERP software meets rising demand.

ERP solutions automate and monitor tasks that large organizations, businesses, and even schools would struggle to do manually.

ERP software could reach $49 billion by 2024.

CRM Program

CRM software is a must-have for any customer-focused business.

Having an open mind about your business services and products allows you to change platforms.

Another company may only want your CRM service.

Medical software

Healthcare facilities need reliable, easy-to-use software.

EHRs, MDDBs, E-Prescribing, and more are software options.

The global medical software market could reach $11 billion by 2025, and mobile medical apps may follow.

Presentation Software in the Cloud

SaaS presentation tools are great.

They're easy to use, comprehensive, and full of traditional Software features.

In today's cloud-based world, these solutions make life easier for people. We don't know about you, but we like it.

Software for Project Management

People began working remotely without signs or warnings before the 2020 COVID-19 pandemic.

Many organizations found it difficult to track projects and set deadlines.

With PMP software tools, teams can manage remote units and collaborate effectively.

App for Blockchain-Based Invoicing

This advanced billing and invoicing solution is for businesses and freelancers.

These blockchain-based apps can calculate taxes, manage debts, and manage transactions.

Intelligent contracts help blockchain track transactions more efficiently. It speeds up and improves invoice generation.

Software for Business Communications

Internal business messaging is tricky.

Top business software tools for communication can share files, collaborate on documents, host video conferences, and more.

Payroll Automation System

Software development also includes developing an automated payroll system.

These software systems reduce manual tasks for timely employee payments.

These tools help enterprise clients calculate total wages quickly, simplify tax calculations, improve record-keeping, and support better financial planning.

System for Detecting Data Leaks

Both businesses and individuals value data highly. Yahoo's data breach is dangerous because of this.

This area of software development can help people protect their data.

You can design an advanced data loss prevention system.

AI-based Retail System

AI-powered shopping systems are popular. The systems analyze customers' search and purchase patterns and store history and are equipped with a keyword database.

These systems offer many customers pre-loaded products.

AI-based shopping algorithms also help users make purchases.

Software for Detecting Plagiarism

Software can help ensure your projects are original and not plagiarized.

These tools detect plagiarized content that Google, media, and educational institutions don't like.

Software for Converting Audio to Text

Machine Learning converts speech to text automatically.

These programs can quickly transcribe cloud-based files.

Software for daily horoscopes

Daily and monthly horoscopes will continue to be popular.

Software platforms that can predict forecasts, calculate birth charts, and other astrology resources are good business ideas.

E-learning Programs

Traditional study methods are losing popularity as virtual schools proliferate and physical space shrinks.

Khan Academy online courses are the best way to keep learning.

Online education portals can boost your learning. If you want to start a tech startup, consider creating an e-learning program.

Conclusion

Software is booming. There's never been a better time to start a software development business, with so many people using computers and smartphones. This article lists eight business ideas for 2023. Consider these ideas if you're just starting out or looking to expand.

You might also like

Dr. Linda Dahl

3 years ago

We eat corn in almost everything. Is It Important?

Corn Kid got viral on TikTok after being interviewed by Recess Therapy. Tariq, called the Corn Kid, ate a buttery ear of corn in the video. He's corn crazy. He thinks everyone just has to try it. It turns out, whether we know it or not, we already have.

Corn is a fruit, veggie, and grain. It's the second-most-grown crop. Corn makes up 36% of U.S. exports. In the U.S., it's easy to grow and provides high yields, as proven by the vast corn belt spanning the Midwest, Great Plains, and Texas panhandle. Since 1950, the corn crop has doubled to 10 billion bushels.

You say, "Fine." We shouldn't just grow because we can. Why so much corn? What's this corn for?

Why is practical and political. Michael Pollan's The Omnivore's Dilemma has the full narrative. Early 1970s food costs increased. Nixon subsidized maize to feed the public. Monsanto genetically engineered corn seeds to make them hardier, and soon there was plenty of corn. Everyone ate. Woot! Too much corn followed. The powers-that-be had to decide what to do with leftover corn-on-the-cob.

They are fortunate that corn has a wide range of uses.

First, the edible variants. I divide corn into obvious and stealth.

Obvious corn includes popcorn, canned corn, and corn on the cob. This form isn't always digested and often comes out as entire, polka-dotting poop. Cornmeal can be ground to make cornbread, polenta, and corn tortillas. Corn provides antioxidants, minerals, and vitamins in moderation. Most synthetic Vitamin C comes from GMO maize.

Corn oil, corn starch, dextrose (a sugar), and high-fructose corn syrup are often overlooked. They're stealth corn because they sneak into practically everything. Corn oil is used for frying, baking, and in potato chips, mayonnaise, margarine, and salad dressing. Baby food, bread, cakes, antibiotics, canned vegetables, beverages, and even dairy and animal products include corn starch. Dextrose appears in almost all prepared foods, excluding those with high-fructose corn syrup. HFCS isn't as easily digested as sucrose (from cane sugar). It can also cause other ailments, which we'll discuss later.

Most foods contain corn. It's fed to almost all food animals. 96% of U.S. animal feed is corn. 39% of U.S. corn is fed to livestock. But animals prefer other foods. Omnivore chickens prefer insects, worms, grains, and grasses. Captive cows are fed a total mixed ration, which contains corn. These animals' products, like eggs and milk, are also corn-fed.

There are numerous non-edible by-products of corn that are employed in the production of items like:

fuel-grade ethanol

plastics

batteries

cosmetics

meds/vitamins binder

carpets, fabrics

glutathione

crayons

Paint/glue

How does corn influence you? Consider quick food for dinner. You order a cheeseburger, fries, and big Coke at the counter (or drive-through in the suburbs). You tell yourself, "No corn." All that contains corn. Deconstruct:

Cows fed corn produce meat and cheese. Meat and cheese were bonded with corn syrup and starch (same). The bun (corn flour and dextrose) and fries were fried in maize oil. High fructose corn syrup sweetens the drink and helps make the cup and straw.

Just about everything contains corn. Then what? A cornspiracy, perhaps? Is eating too much maize an issue, or should we strive to stay away from it whenever possible?

As I've said, eating some maize can be healthy. 92% of U.S. corn is genetically modified, according to the Center for Food Safety. The adjustments are expected to boost corn yields. Some sweet corn is genetically modified to produce its own insecticide, a protein deadly to insects made by Bacillus thuringiensis. It's safe to eat in sweet corn. Concerns exist about feeding agricultural animals so much maize, modified or not.

High fructose corn syrup should be consumed in moderation. Fructose, a sugar, isn't easily metabolized. Fructose causes diabetes, fatty liver, obesity, and heart disease. It causes inflammation, which might aggravate gout. Candy, packaged sweets, soda, fast food, juice drinks, ice cream, ice cream topping syrups, sauces & condiments, jams, bread, crackers, and pancake syrup contain the most high fructose corn syrup. Everyday foods with little nutrients. Check labels and choose cane sugar or sucrose-sweetened goods. Or, eat corn like the Corn Kid.

Joseph Mavericks

3 years ago

Apples Top 100 Meeting: Steve Jobs's Secret Agenda's Lessons

Jobs' secret emails became public due to a litigation with Samsung.

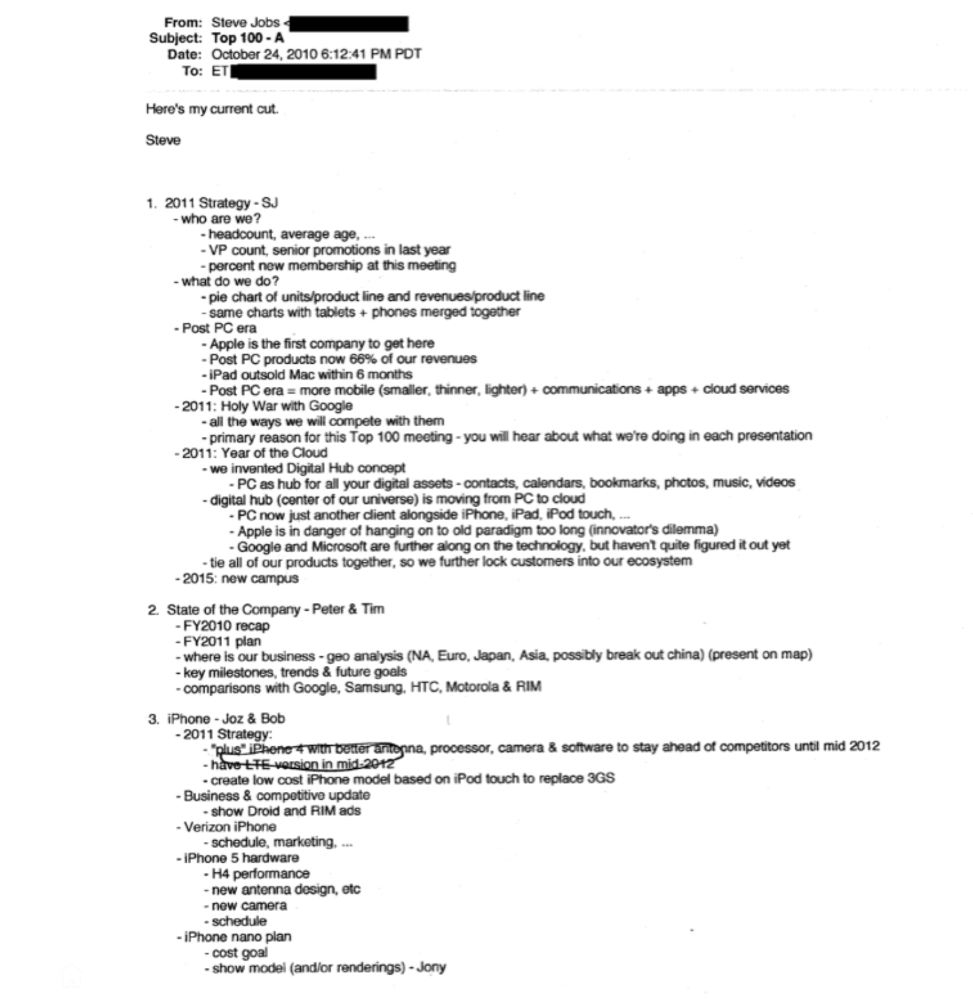

Steve Jobs sent Phil Schiller an email at the end of 2010. Top 100 A was the codename for Apple's annual Top 100 executive meetings. The 2011 one was scheduled.

Everything about this gathering is secret, even attendance. The location is hidden, and attendees can't even drive themselves. Instead, buses transport them to a 2-3 day retreat.

Due to a litigation with Samsung, this Top 100 meeting's agenda was made public in 2014. This was a critical milestone in Apple's history, not a Top 100 meeting. Apple had many obstacles in the 2010s to remain a technological leader. Apple made more money with non-PC goods than with its best-selling Macintosh series. This was the last Top 100 gathering Steve Jobs would attend before passing, and he wanted to make sure his messages carried on before handing over his firm to Tim Cook.

In this post, we'll discuss lessons from Jobs' meeting agenda. Two sorts of entrepreneurs can use these tips:

Those who manage a team in a business and must ensure that everyone is working toward the same goals, upholding the same principles, and being inspired by the same future.

Those who are sole proprietors or independent contractors and who must maintain strict self-discipline in order to stay innovative in their industry and adhere to their own growth strategy.

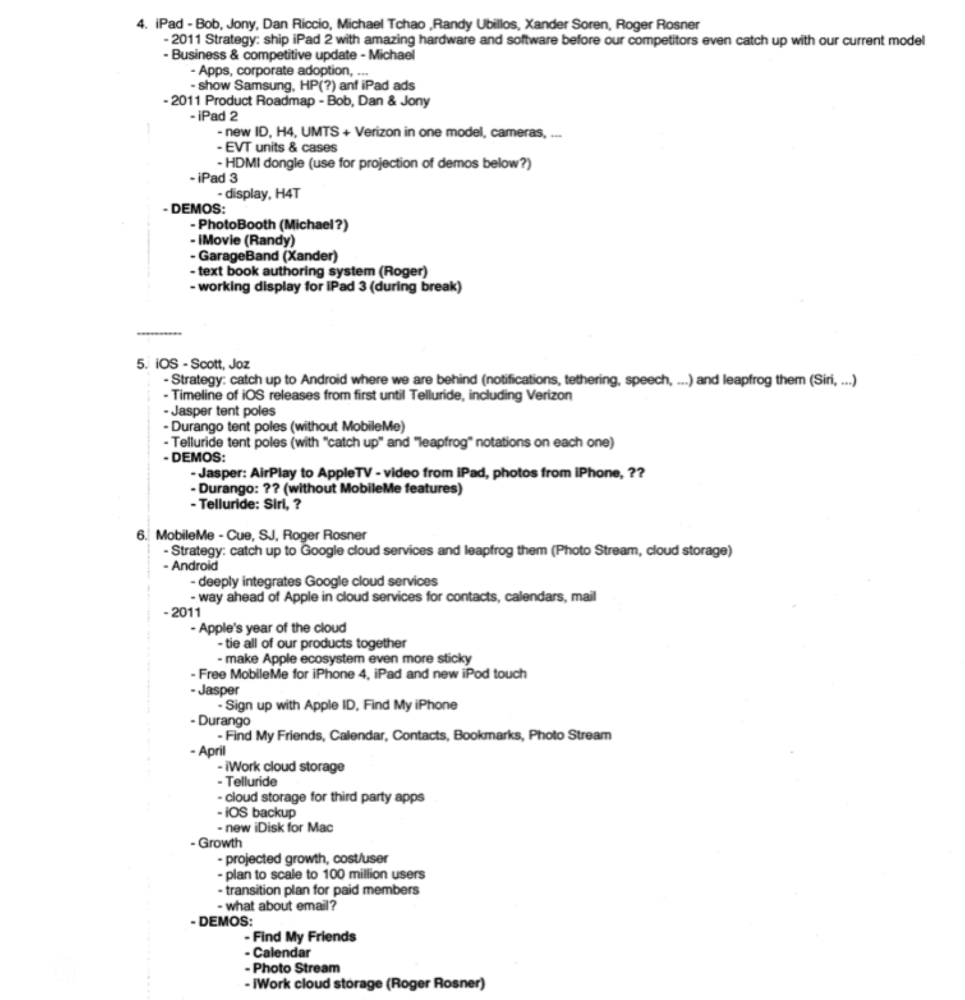

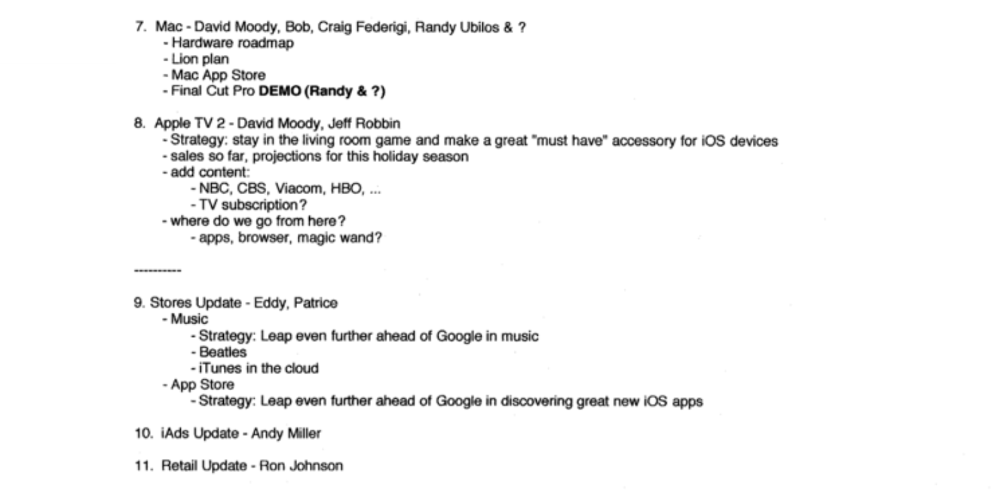

Here's Steve Jobs's email outlining the annual meeting agenda. It's an 11-part summary of the company's shape and strategy.

Steve Jobs outlines Apple's 2011 strategy, 10/24/10

1. Correct your data

Business leaders must comprehend their company's metrics. Jobs either mentions critical information he already knows or demands slides showing the numbers he wants. These numbers fall under 2 categories:

Metrics for growth and strategy

As we will see, this was a crucial statistic for Apple since it signaled the beginning of the Post PC era and required them to make significant strategic changes in order to stay ahead of the curve. Post PC products now account for 66% of our revenues.

Within six months, iPad outsold Mac, another sign of the Post-PC age. As we will see, Jobs thought the iPad would be the next big thing, and item number four on the agenda is one of the most thorough references to the iPad.

Geographical analysis: Here, Jobs emphasizes China, where the corporation has a slower start than anticipated. China was dominating Apple's sales growth with 16% of revenue one year after this meeting.

Metrics for people & culture

The individuals that make up a firm are more significant to its success than its headcount or average age. That holds true regardless of size, from a 5-person startup to a Fortune 500 firm. Jobs was aware of this, which is why his suggested agenda begins by emphasizing demographic data.

Along with the senior advancements in the previous year's requested statistic, it's crucial to demonstrate that if the business is growing, the employees who make it successful must also grow.

2. Recognize the vulnerabilities and strengths of your rivals

Steve Jobs was known for attacking his competition in interviews and in his strategies and roadmaps. This agenda mentions 18 competitors, including:

Google 7 times

Android 3 times

Samsung 2 times

Jobs' agenda email was issued 6 days after Apple's Q4 results call (2010). On the call, Jobs trashed Google and Android. His 5-minute intervention included:

Google has acknowledged that the present iteration of Android is not tablet-optimized.

Future Android tablets will not work (Dead On Arrival)

While Google Play only has 90,000 apps, the Apple App Store has 300,000.

Android is extremely fragmented and is continuing to do so.

The App Store for iPad contains over 35,000 applications. The market share of the latest generation of tablets (which debuted in 2011) will be close to nil.

Jobs' aim in blasting the competition on that call was to reassure investors about the upcoming flood of new tablets. Jobs often criticized Google, Samsung, and Microsoft, but he also acknowledged when they did a better job. He was great at detecting his competitors' advantages and devising ways to catch up.

Jobs doesn't hold back when he says in bullet 1 of his agenda: "We further lock customers into our ecosystem while Google and Microsoft are further along on the technology, but haven't quite figured it out yet tie all of our goods together."

The plan outlined in bullet point 5 is immediately clear: catch up to Android where we are falling behind (notifications, tethering, and speech), and surpass them (Siri,). It's important to note that Siri frequently let users down and never quite lived up to expectations.

Regarding MobileMe, see Bullet 6 Jobs admits that when it comes to cloud services like contacts, calendars, and mail, Google is far ahead of Apple.

3. Adapt or perish

Steve Jobs was a visionary businessman. He knew personal computers were the future when he worked on the first Macintosh in the 1980s.

Jobs acknowledged the Post-PC age in his 2010 D8 interview.

Will the tablet replace the laptop, Walt Mossberg questioned Jobs? Jobs' response:

“You know, when we were an agrarian nation, all cars were trucks, because that’s what you needed on the farm. As vehicles started to be used in the urban centers and America started to move into those urban and suburban centers, cars got more popular and innovations like automatic transmission and things that you didn’t care about in a truck as much started to become paramount in cars. And now, maybe 1 out of every 25 vehicles is a truck, where it used to be 100%. PCs are going to be like trucks. They’re still going to be around, still going to have a lot of value, but they’re going to be used by one out of X people.”

Imagine how forward-thinking that was in 2010, especially for the Macintosh creator. You have to be willing to recognize that things were changing and that it was time to start over and focus on the next big thing.

Post-PC is priority number 8 in his 2010 agenda's 2011 Strategy section. Jobs says Apple is the first firm to get here and that Post PC items account about 66% of our income. The iPad outsold the Mac in 6 months, and the Post-PC age means increased mobility (smaller, thinner, lighter). Samsung had just introduced its first tablet, while Apple was working on the iPad 3. (as mentioned in bullet 4).

4. Plan ahead (and different)

Jobs' agenda warns that Apple risks clinging to outmoded paradigms. Clayton Christensen explains in The Innovators Dilemma that huge firms neglect disruptive technologies until they become profitable. Samsung's Galaxy tab, released too late, never caught up to Apple.

Apple faces a similar dilemma with the iPhone, its cash cow for over a decade. It doesn't sell as much because consumers aren't as excited about new iPhone launches and because technology is developing and cell phones may need to be upgraded.

Large companies' established consumer base typically hinders innovation. Clayton Christensen emphasizes that loyal customers from established brands anticipate better versions of current products rather than something altogether fresh and new technologies.

Apple's marketing is smart. Apple's ecosystem is trusted by customers, and its products integrate smoothly. So much so that Apple can afford to be a disruptor by doing something no one has ever done before, something the world's largest corporation shouldn't be the first to try. Apple can test the waters and produce a tremendous innovation tsunami, something few corporations can do.

In March 2011, Jobs appeared at an Apple event. During his address, Steve reminded us about Apple's brand:

“It’s in Apple’s DNA, that technology alone is not enough. That it’s technology married with liberal arts, married with the humanities that yields us the results that make our hearts sink. And nowhere is that more true that in these Post-PC devices.“

More than a decade later, Apple remains one of the most innovative and trailblazing companies in the Post-PC world (industry-disrupting products like Airpods or the Apple Watch came out after that 2011 strategy meeting), and it has reinvented how we use laptops with its M1-powered line of laptops offering unprecedented performance.

A decade after Jobs' death, Apple remains the world's largest firm, and its former CEO had a crucial part in its expansion. If you can do 1% of what Jobs did, you may be 1% as successful.

Not bad.

Tim Smedley

2 years ago

When Investment in New Energy Surpassed That in Fossil Fuels (Forever)

A worldwide energy crisis might have hampered renewable energy and clean tech investment. Nope.

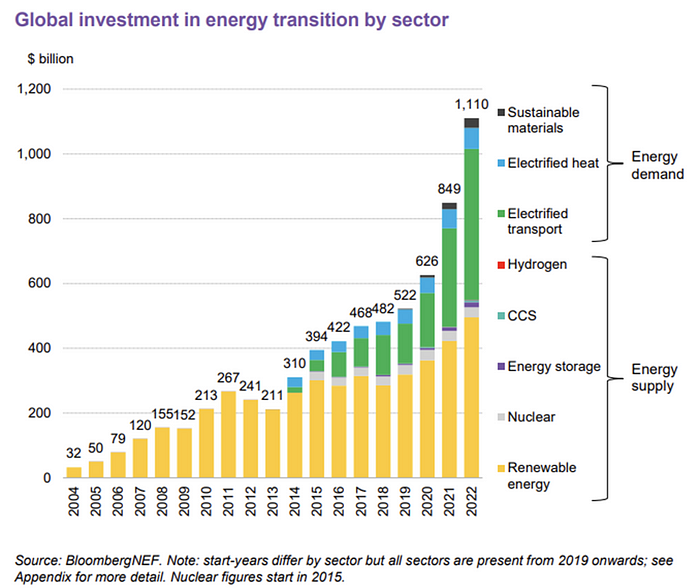

BNEF's 2023 Energy Transition Investment Trends study surprised and encouraged. Global energy transition investment reached $1 trillion for the first time ($1.11t), up 31% from 2021. From 2013, the clean energy transition has come and cannot be reversed.

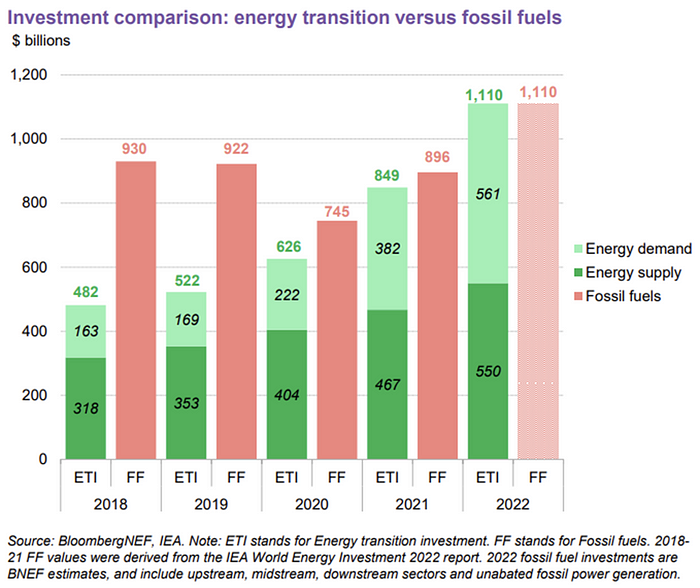

BNEF Head of Global Analysis Albert Cheung said our findings ended the energy crisis's influence on renewable energy deployment. Energy transition investment has reached a record as countries and corporations implement transition strategies. Clean energy investments will soon surpass fossil fuel investments.

The table below indicates the tripping point, which means the energy shift is occuring today.

BNEF calls money invested on clean technology including electric vehicles, heat pumps, hydrogen, and carbon capture energy transition investment. In 2022, electrified heat received $64b and energy storage $15.7b.

Nonetheless, $495b in renewables (up 17%) and $466b in electrified transport (up 54%) account for most of the investment. Hydrogen and carbon capture are tiny despite the fanfare. Hydrogen received the least funding in 2022 at $1.1 billion (0.1%).

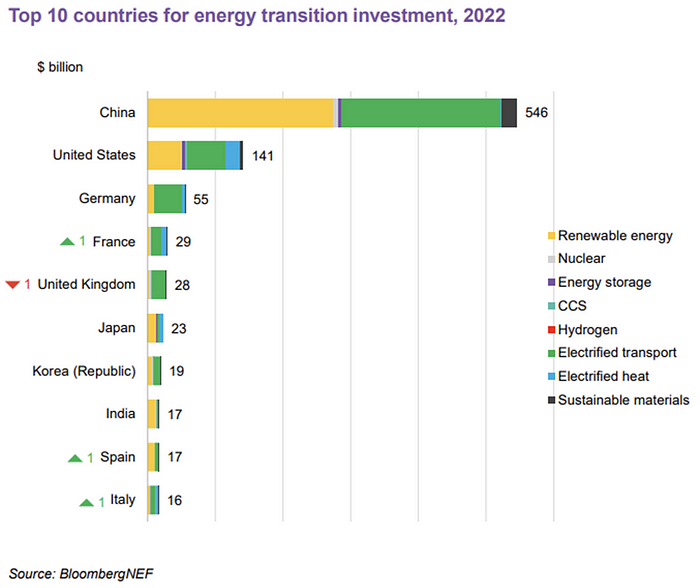

China dominates investment. China spends $546 billion on energy transition, half the global amount. Second, the US total of $141 billion in 2022 was up 11% from 2021. With $180 billion, the EU is unofficially second. China invested 91% in battery technologies.

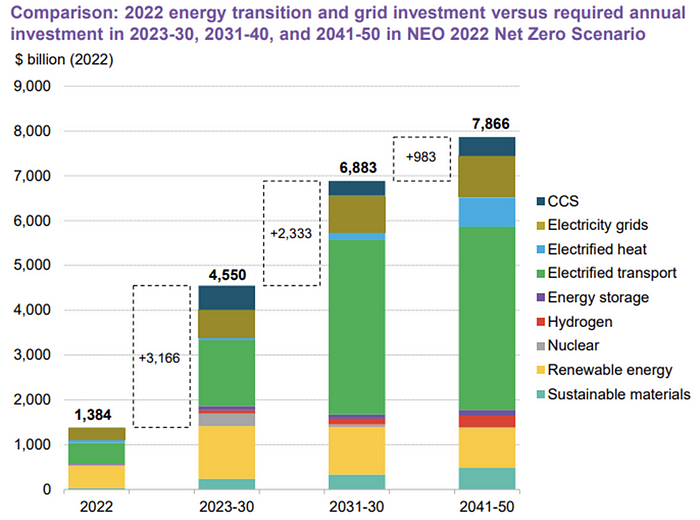

The 2022 transition tipping point is encouraging, but the BNEF research shows how far we must go to get Net Zero. Energy transition investment must average $4.55 trillion between 2023 and 2030—three times the amount spent in 2022—to reach global Net Zero. Investment must be seven times today's record to reach Net Zero by 2050.

BNEF 2023 Energy Transition Investment Trends.

As shown in the graph above, BNEF experts have been using their crystal balls to determine where that investment should go. CCS and hydrogen are still modest components of the picture. Interestingly, they see nuclear almost fading. Active transport advocates like me may have something to say about the massive $4b in electrified transport. If we focus on walkable 15-minute cities, we may need fewer electric automobiles. Though we need more electric trains and buses.

Albert Cheung of BNEF emphasizes the challenge. This week's figures promise short-term job creation and medium-term energy security, but more investment is needed to reach net zero in the long run.

I expect the BNEF Energy Transition Investment Trends report to show clean tech investment outpacing fossil fuels investment every year. Finally saying that is amazing. It's insufficient. The planet must maintain its electric (not gas) pedal. In response to the research, Christina Karapataki, VC at Breakthrough Energy Ventures, a clean tech investment firm, tweeted: Clean energy investment needs to average more than 3x this level, for the remainder of this decade, to get on track for BNEFs Net Zero Scenario. Go!