More on Marketing

Jenn Leach

3 years ago

This clever Instagram marketing technique increased my sales to $30,000 per month.

No Paid Ads Required

I had an online store. After a year of running the company alongside my 9-to-5, I made enough to resign.

That day was amazing.

This Instagram marketing plan helped the store succeed.

How did I increase my sales to five figures a month without using any paid advertising?

I used customer event marketing.

I'm not sure this term exists. I invented it to describe what I was doing.

Instagram word-of-mouth, fan engagement, and interaction drove sales.

If a customer liked or disliked a product, the buzz would drive attention to the store.

I used customer-based events to increase engagement and store sales.

Success!

Here are the weekly Instagram customer events I coordinated while running my business:

Be the Buyer Days

Flash sales

Mystery boxes

Be the Buyer Days: How do they work?

Be the Buyer Days are exactly that.

You choose a day to share stock selections with social media followers.

This is an easy approach to engaging customers and getting fans enthusiastic about new releases.

First, pick a handful of items you’re considering ordering. I’d usually pick around 3 for Be the Buyer Day.

Then I'd poll the crowd on Instagram to vote on their favorites.

This was before Instagram stories, polls, and all the other cool features Instagram offers today. I think using these tools now would make this event even better.

I'd ask customers their favorite back then.

The growing comments excited customers.

Then I'd declare the winner, acquire the products, and start selling it.

How do flash sales work?

I mostly ran flash sales.

You choose a limited number of itemsdd for a few-hour sale.

We wanted most sales to result in sold-out items.

When an item sells out, it contributes to the sensation of scarcity and can inspire customers to visit your store to buy a comparable product, join your email list, become a fan, etc.

We hoped they'd act quickly.

I'd hold flash deals twice a week, which generated scarcity and boosted sales.

The store had a few thousand Instagram followers when I started flash deals.

Each flash sale item would make $400 to $600.

$400 x 3= $1,200

That's $1,200 on social media!

Twice a week, you'll make roughly $10K a month from Instagram.

$1,200/day x 8 events/month=$9,600

Flash sales did great.

We held weekly flash deals and sent social media and email reminders. That’s about it!

How are mystery boxes put together?

All you do is package a box of store products and sell it as a mystery box on TikTok or retail websites.

A $100 mystery box would cost $30.

You're discounting high-value boxes.

This is a clever approach to get rid of excess inventory and makes customers happy.

It worked!

Be the Buyer Days, flash deals, and mystery boxes helped build my company without paid advertisements.

All companies can use customer event marketing. Involving customers and providing an engaging environment can boost sales.

Try it!

Emma Jade

3 years ago

6 hacks to create content faster

Content gurus' top time-saving hacks.

I'm a content strategist, writer, and graphic designer. Time is more valuable than money.

Money is always available. Even if you're poor. Ways exist.

Time is passing, and one day we'll run out.

Sorry to be morbid.

In today's digital age, you need to optimize how you create content for your organization. Here are six content creation hacks.

1. Use templates

Use templates to streamline your work whether generating video, images, or documents.

Setup can take hours. Using a free resource like Canva, you can create templates for any type of material.

This will save you hours each month.

2. Make a content calendar

You post without a plan? A content calendar solves 50% of these problems.

You can prepare, organize, and plan your material ahead of time so you're not scrambling when you remember, "Shit, it's Mother's Day!"

3. Content Batching

Batching content means creating a lot in one session. This is helpful for video content that requires a lot of setup time.

Batching monthly content saves hours. Time is a valuable resource.

When working on one type of task, it's easy to get into a flow state. This saves time.

4. Write Caption

On social media, we generally choose the image first and then the caption. Writing captions first sometimes work better, though.

Writing the captions first can allow you more creative flexibility and be easier if you're not excellent with language.

Say you want to tell your followers something interesting.

Writing a caption first is easier than choosing an image and then writing a caption to match.

Not everything works. You may have already-created content that needs captioning. When you don't know what to share, think of a concept, write the description, and then produce a video or graphic.

Cats can be skinned in several ways..

5. Repurpose

Reuse content when possible. You don't always require new stuff. In fact, you’re pretty stupid if you do #SorryNotSorry.

Repurpose old content. All those blog entries, videos, and unfinished content on your desk or hard drive.

This blog post can be turned into a social media infographic. Canva's motion graphic function can animate it. I can record a YouTube video regarding this issue for a podcast. I can make a post on each point in this blog post and turn it into an eBook or paid course.

And it doesn’t stop there.

My point is, to think outside the box and really dig deep into ways you can leverage the content you’ve already created.

6. Schedule Them

If you're still manually posting content, get help. When you batch your content, schedule it ahead of time.

Some scheduling apps are free or cheap. No excuses.

Don't publish and ghost.

Scheduling saves time by preventing you from doing it manually. But if you never engage with your audience, the algorithm won't reward your material.

Be online and engage your audience.

Content Machine

Use these six content creation hacks. They help you succeed and save time.

Jano le Roux

3 years ago

Here's What I Learned After 30 Days Analyzing Apple's Microcopy

Move people with tiny words.

Apple fanboy here.

Macs are awesome.

Their iPhones rock.

$19 cloths are great.

$999 stands are amazing.

I love Apple's microcopy even more.

It's like the marketing goddess bit into the Apple logo and blessed the world with microcopy.

I took on a 30-day micro-stalking mission.

Every time I caught myself wasting time on YouTube, I had to visit Apple’s website to learn the secrets of the marketing goddess herself.

We've learned. Golden apples are calling.

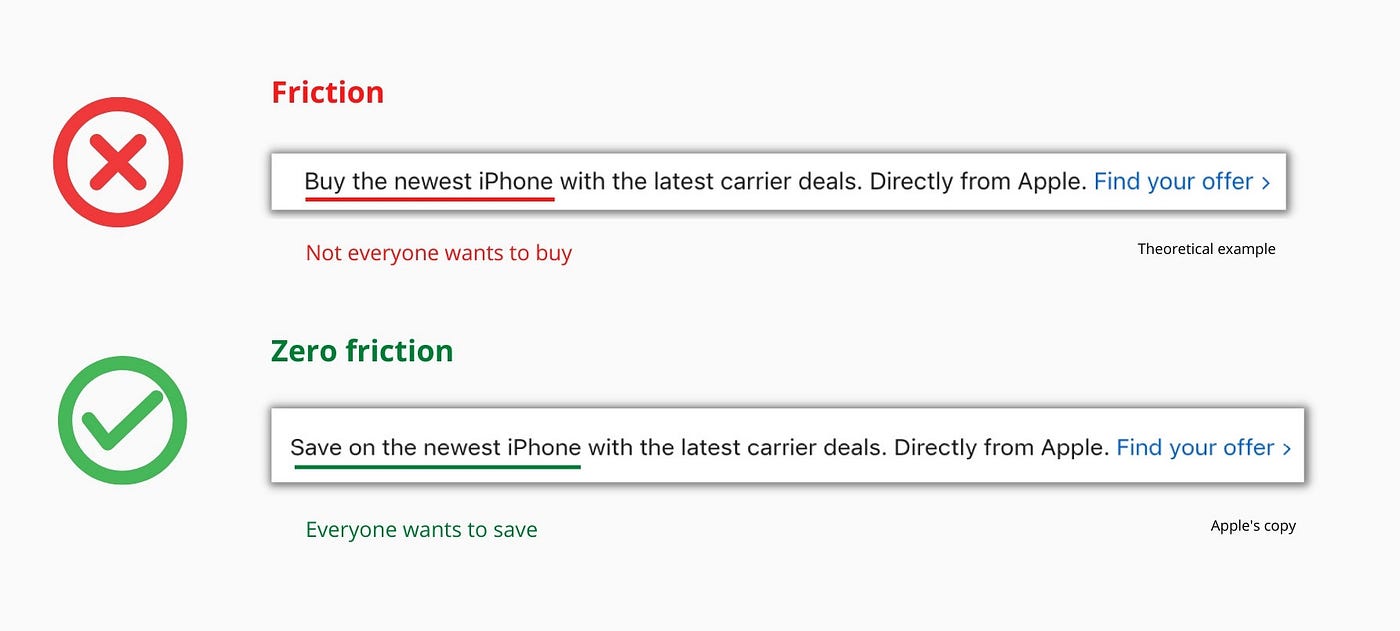

Cut the friction

Benefit-first, not commitment-first.

Brands lose customers through friction.

Most brands don't think like customers.

Brands want sales.

Brands want newsletter signups.

Here's their microcopy:

“Buy it now.”

“Sign up for our newsletter.”

Both are difficult. They ask for big commitments.

People are simple creatures. Want pleasure without commitment.

Apple nails this.

So, instead of highlighting the commitment, they highlight the benefit of the commitment.

Saving on the latest iPhone sounds easier than buying it. Everyone saves, but not everyone buys.

A subtle change in framing reduces friction.

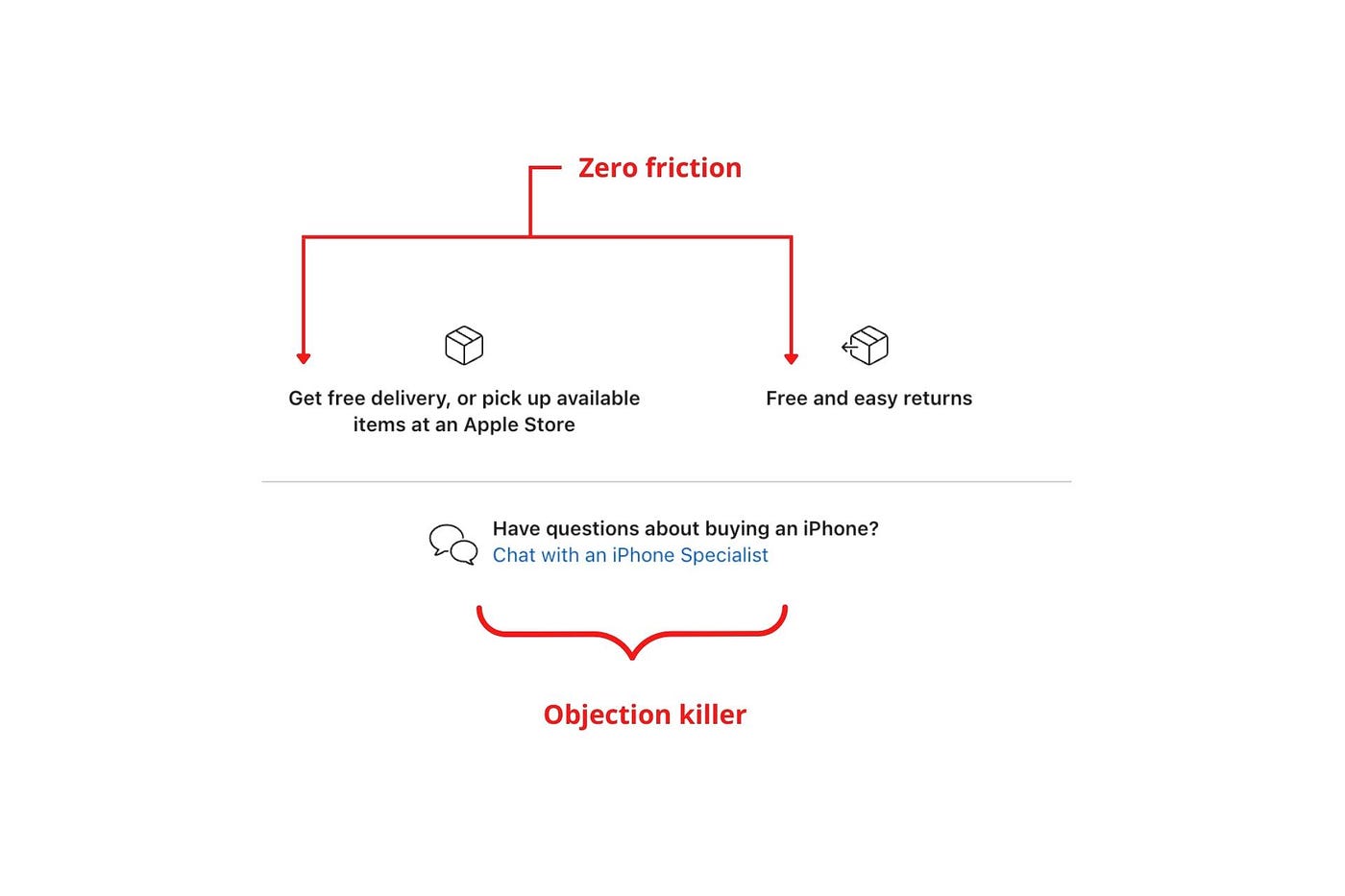

Apple eliminates customer objections to reduce friction.

Less customer friction means simpler processes.

Apple's copy expertly reassures customers about shipping fees and not being home. Apple assures customers that returning faulty products is easy.

Apple knows that talking to a real person is the best way to reduce friction and improve their copy.

Always rhyme

Learn about fine rhyme.

Poets make things beautiful with rhyme.

Copywriters use rhyme to stand out.

Apple’s copywriters have mastered the art of corporate rhyme.

Two techniques are used.

1. Perfect rhyme

Here, rhymes are identical.

2. Imperfect rhyme

Here, rhyming sounds vary.

Apple prioritizes meaning over rhyme.

Apple never forces rhymes that don't fit.

It fits so well that the copy seems accidental.

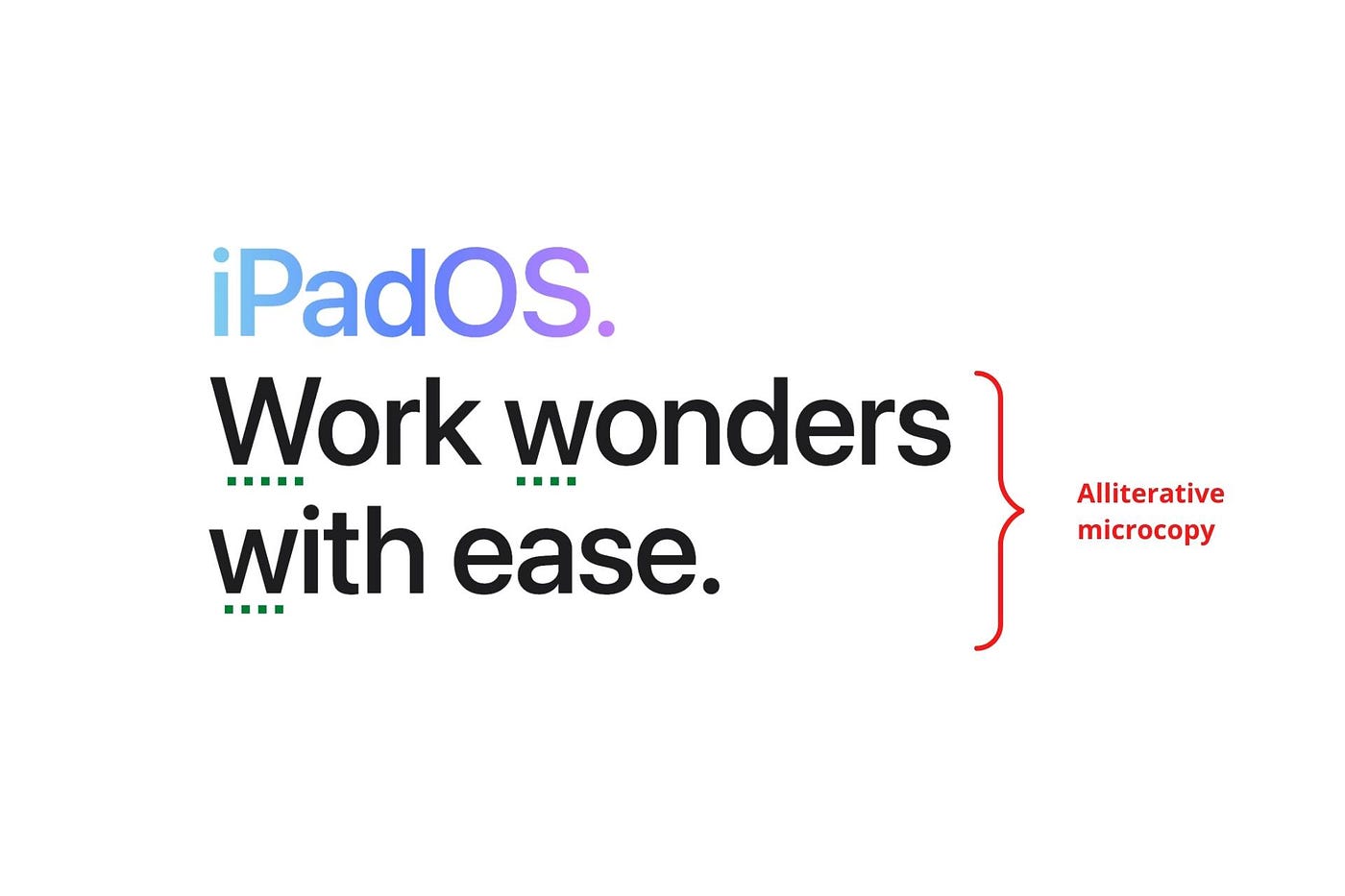

Add alliteration

Alliteration always entertains.

Alliteration repeats initial sounds in nearby words.

Apple's copy uses alliteration like no other brand I've seen to create a rhyming effect or make the text more fun to read.

For example, in the sentence "Sam saw seven swans swimming," the initial "s" sound is repeated five times. This creates a pleasing rhythm.

Microcopy overuse is like pouring ketchup on a Michelin-star meal.

Alliteration creates a memorable phrase in copywriting. It's subtler than rhyme, and most people wouldn't notice; it simply resonates.

I love how Apple uses alliteration and contrast between "wonders" and "ease".

Assonance, or repeating vowels, isn't Apple's thing.

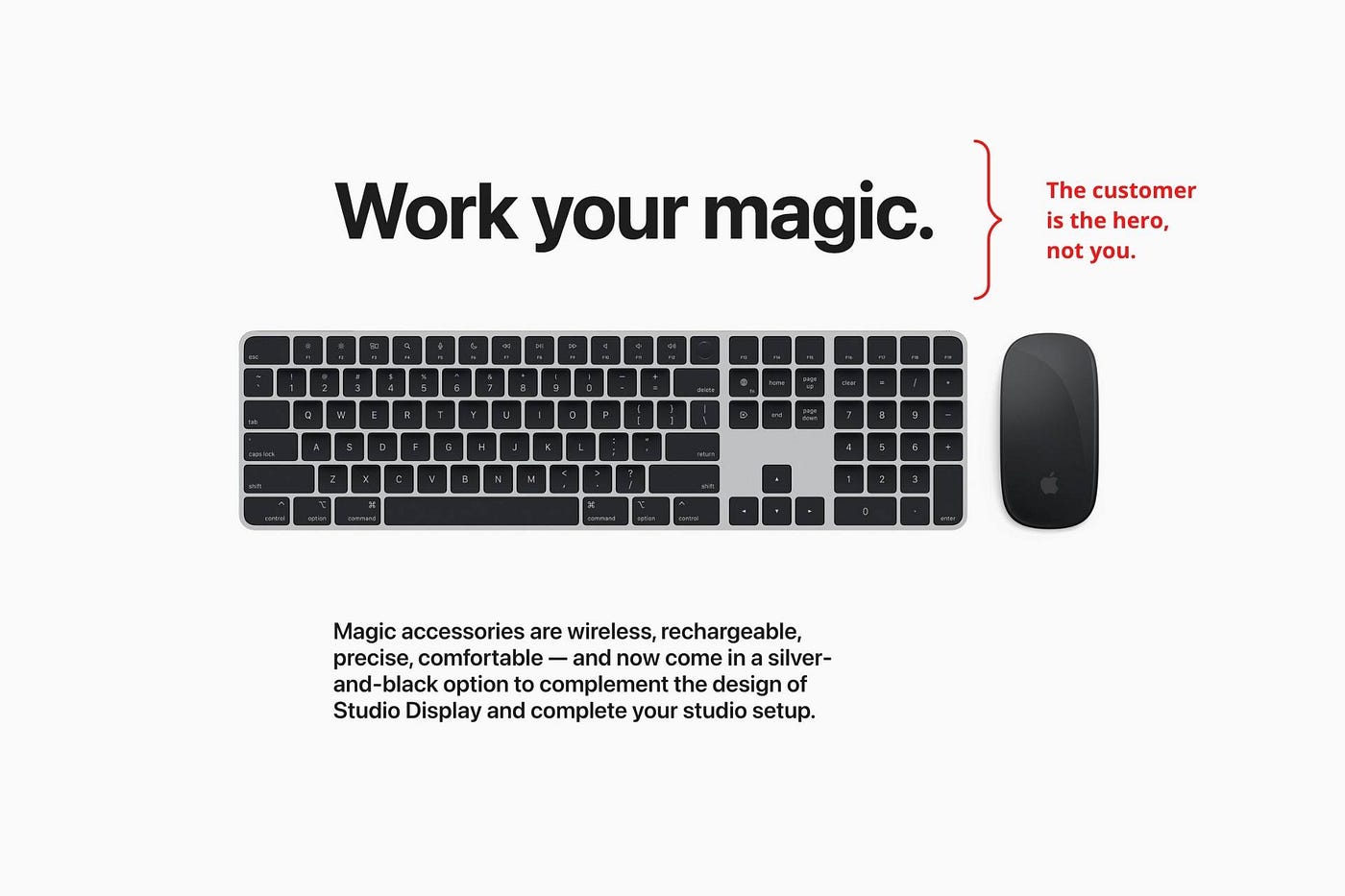

You ≠ Hero, Customer = Hero

Your brand shouldn't be the hero.

Because they'll be using your product or service, your customer should be the hero of your copywriting. With your help, they should feel like they can achieve their goals.

I love how Apple emphasizes what you can do with the machine in this microcopy.

It's divine how they position their tools as sidekicks to help below.

This one takes the cake:

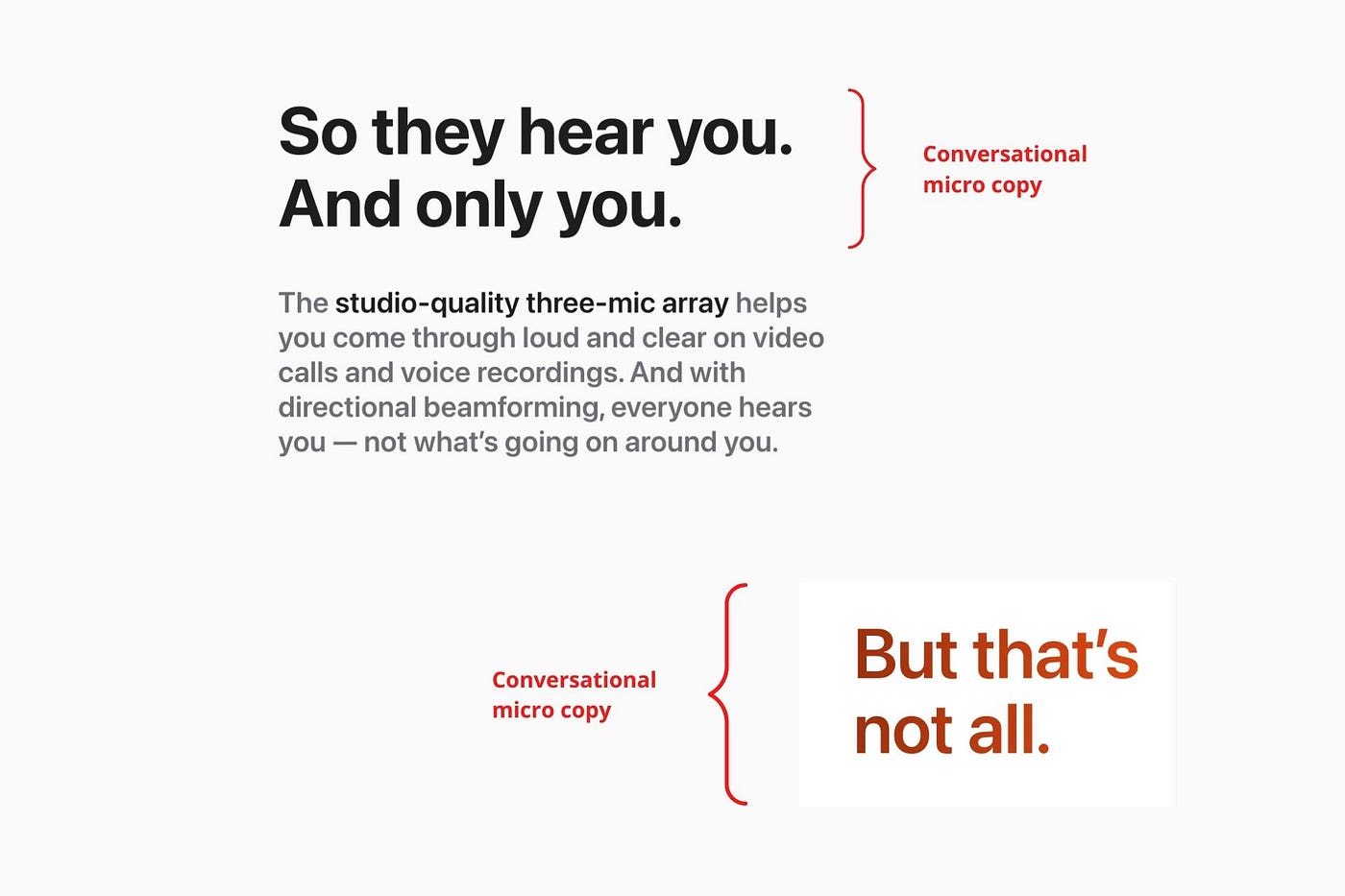

Dialogue-style writing

Conversational copy engages.

Excellent copy Like sharing gum with a friend.

This helps build audience trust.

Apple does this by using natural connecting words like "so" and phrases like "But that's not all."

Snowclone-proof

The mother of all microcopy techniques.

A snowclone uses an existing phrase or sentence to create a new one. The new phrase or sentence uses the same structure but different words.

It’s usually a well know saying like:

To be or not to be.

This becomes a formula:

To _ or not to _.

Copywriters fill in the blanks with cause-related words. Example:

To click or not to click.

Apple turns "survival of the fittest" into "arrival of the fittest."

It's unexpected and surprises the reader.

So this was fun.

But my fun has just begun.

Microcopy is 21st-century poetry.

I came as an Apple fanboy.

I leave as an Apple fanatic.

Now I’m off to find an apple tree.

Cause you know how it goes.

(Apples, trees, etc.)

This post is a summary. Original post available here.

You might also like

Tanya Aggarwal

3 years ago

What I learned from my experience as a recent graduate working in venture capital

Every week I meet many people interested in VC. Many of them ask me what it's like to be a junior analyst in VC or what I've learned so far.

Looking back, I've learned many things as a junior VC, having gone through an almost-euphoric peak bull market, failed tech IPOs of 2019 including WeWorks' catastrophic fall, and the beginnings of a bearish market.

1. Network, network, network!

VCs spend 80% of their time networking. Junior VCs source deals or manage portfolios. You spend your time bringing startups to your fund or helping existing portfolio companies grow. Knowing stakeholders (corporations, star talent, investors) in your particular areas of investment helps you develop your portfolio.

Networking was one of my strengths. When I first started in the industry, I'd go to startup events and meet 50 people a month. Over time, I realized these relationships were shallow and I was only getting business cards. So I stopped seeing networking as a transaction. VC is a long-term game, so you should work with people you like. Now I know who I click with and can build deeper relationships with them. My network is smaller but more valuable than before.

2. The Most Important Metric Is Founder

People often ask how we pick investments. Why some companies can raise money and others can't is a mystery. The founder is the most important metric for VCs. When a company is young, the product, environment, and team all change, but the founder remains constant. VCs bet on the founder, not the company.

How do we decide which founders are best after 2-3 calls? When looking at a founder's profile, ask why this person can solve this problem. The founders' track record will tell. If the founder is a serial entrepreneur, you know he/she possesses the entrepreneur DNA and will likely succeed again. If it's his/her first startup, focus on industry knowledge to deliver the best solution.

3. A company's fate can be determined by macrotrends.

Macro trends are crucial. A company can have the perfect product, founder, and team, but if it's solving the wrong problem, it won't succeed. I've also seen average companies ride the wave to success. When you're on the right side of a trend, there's so much demand that more companies can get a piece of the pie.

In COVID-19, macro trends made or broke a company. Ed-tech and health-tech companies gained unicorn status and raised funding at inflated valuations due to sudden demand. With the easing of pandemic restrictions and the start of a bear market, many of these companies' valuations are in question.

4. Look for methods to ACTUALLY add value.

You only need to go on VC twitter (read: @vcstartterkit and @vcbrags) for 5 minutes or look at fin-meme accounts on Instagram to see how much VCs claim to add value but how little they actually do. VC is a long-term game, though. Long-term, founders won't work with you if you don't add value.

How can we add value when we're young and have no network? Leaning on my strengths helped me. Instead of viewing my age and limited experience as a disadvantage, I realized that I brought a unique perspective to the table.

As a VC, you invest in companies that will be big in 5-7 years, and millennials and Gen Z will have the most purchasing power. Because you can relate to that market, you can offer insights that most Partners at 40 can't. I added value by helping with hiring because I had direct access to university talent pools and by finding university students for product beta testing.

5. Develop your personal brand.

Generalists or specialists run most funds. This means that funds either invest across industries or have a specific mandate. Most funds are becoming specialists, I've noticed. Top-tier founders don't lack capital, so funds must find other ways to attract them. Why would a founder work with a generalist fund when a specialist can offer better industry connections and partnership opportunities?

Same for fund members. Founders want quality investors. Become a thought leader in your industry to meet founders. Create content and share your thoughts on industry-related social media. When I first started building my brand, I found it helpful to interview industry veterans to create better content than I could on my own. Over time, my content attracted quality founders so I didn't have to look for them.

These are my biggest VC lessons. This list isn't exhaustive, but it's my industry survival guide.

Jano le Roux

3 years ago

The Real Reason Adobe Just Paid $20 billion for Figma

Sketch or Figma?

Designers are pissed.

The beast ate the beauty.

Figma deserves $20B.

Do designers deserve Adobe?

Adobe devours new creative tools and spits them out with a slimy Adobe aftertaste.

Frame.io — $1.3B

Magento — $1.7B

Macromedia — $3.6B

Nothing compares to the risky $20B acquisition.

If they can't be beaten, buy them.

And then make them boring.

Adobe's everywhere.

Like that friend who dabbles in everything creatively, there's not enough time to master one thing.

Figma was Adobe's thigh-mounted battle axe.

a UX design instrument with a sizable free tier.

a UX design tool with a simple and quick user interface.

a tool for fluid collaboration in user experience design.

a web-based UX design tool that functions well.

a UX design tool with a singular goal of perfection.

UX design software that replaced Adobe XD.

Adobe XD could do many of Figma's things, but it didn't focus on the details. This is a major issue when working with detail-oriented professionals.

UX designers.

Design enthusiasts first used Figma. More professionals used it. Institutions taught it. Finally, major brands adopted Figma.

Adobe hated that.

Adobe dispatched a team of lawyers to resolve the Figma issue, as big companies do. Figma didn’t bite for months.

Oh no.

Figma resisted.

Figma helped designers leave Adobe. Figma couldn't replace Photoshop, but most designers used it to remove backgrounds.

Online background removal tools improved.

The Figma problem grew into a thorn, a knife, and a battle ax in Adobe's soft inner thigh.

Figma appeared to be going public. Adobe couldn’t allow that. It bought Figma for $20B during the IPO drought.

Adobe has a new issue—investors are upset.

The actual cause of investors' ire toward Adobe

Spoiler: The math just doesn’t add up.

According to Adobe's press release, Figma's annual recurring revenue (ARR) is $400M and growing rapidly.

The $20B valuation requires a 50X revenue multiple, which is unheard of.

Venture capitalists typically use:

10% to 29% growth per year: ARR multiplied by 1 to 5

30% to 99% growth per year: ARR multiplied by 6 to 10

100% to 400% growth per year: ARR multiplied by 10 to 20

Showing an investor a 50x multiple is like telling friends you saw a UFO. They'll think you're crazy.

Adobe's stock fell immediately after the acquisition because it didn't make sense to a number-cruncher.

Designers started a Tweet storm in the digital town hall where VCs and designers often meet.

Adobe acquired Workfront for $1.5 billion at the end of 2020. This purchase made sense for investors.

Many investors missed the fact that Adobe is acquiring Figma not only for its ARR but also for its brilliant collaboration tech.

Adobe could use Figmas web app technology to make more products web-based to compete with Canva.

Figma's high-profile clients could switch to Adobe's enterprise software.

However, questions arise:

Will Adobe make Figma boring?

Will Adobe tone down Figma to boost XD?

Would you ditch Adobe and Figma for Sketch?

Miguel Saldana

3 years ago

Crypto Inheritance's Catch-22

Security, privacy, and a strategy!

How to manage digital assets in worst-case scenarios is a perennial crypto concern. Since blockchain and bitcoin technology is very new, this hasn't been a major issue. Many early developers are still around, and many groups created around this technology are young and feel they have a lot of life remaining. This is why inheritance and estate planning in crypto should be handled promptly. As cryptocurrency's intrinsic worth rises, many people in the ecosystem are holding on to assets that might represent generational riches. With that much value, it's crucial to have a plan. Creating a solid plan entails several challenges.

the initial hesitation in coming up with a plan

The technical obstacles to ensuring the assets' security and privacy

the passing of assets from a deceased or incompetent person

Legal experts' lack of comprehension and/or understanding of how to handle and treat cryptocurrency.

This article highlights several challenges, a possible web3-native solution, and how to learn more.

The Challenge of Inheritance:

One of the biggest hurdles to inheritance planning is starting the conversation. As humans, we don't like to think about dying. Early adopters will experience crazy gains as cryptocurrencies become more popular. Creating a plan is crucial if you wish to pass on your riches to loved ones. Without a plan, the technical and legal issues I barely mentioned above would erode value by requiring costly legal fees and/or taxes, and you could lose everything if wallets and assets are not distributed appropriately (associated with the private keys). Raising awareness of the consequences of not having a plan should motivate people to make one.

Controlling Change:

Having an inheritance plan for your digital assets is crucial, but managing the guts and bolts poses a new set of difficulties. Privacy and security provided by maintaining your own wallet provide different issues than traditional finances and assets. Traditional finance is centralized (say a stock brokerage firm). You can assign another person to handle the transfer of your assets. In crypto, asset transfer is reimagined. One may suppose future transaction management is doable, but the user must consent, creating an impossible loop.

I passed away and must send a transaction to the person I intended to deliver it to.

I have to confirm or authorize the transaction, but I'm dead.

In crypto, scheduling a future transaction wouldn't function. To transfer the wallet and its contents, we'd need the private keys and/or seed phrase. Minimizing private key exposure is crucial to protecting your crypto from hackers, social engineering, and phishing. People have lost private keys after utilizing Life Hack-type tactics to secure them. People that break and hide their keys, lose them, or make them unreadable won't help with managing and/or transferring. This will require a derived solution.

Legal Challenges and Implications

Unlike routine cryptocurrency transfers and transactions, local laws may require special considerations. Even in the traditional world, estate/inheritance taxes, how assets will be split, and who executes the will must be considered. Many lawyers aren't crypto-savvy, which complicates the matter. There will be many hoops to jump through to safeguard your crypto and traditional assets and give them to loved ones.

Knowing RUFADAA/UFADAA, depending on your state, is vital for Americans. UFADAA offers executors and trustees access to online accounts (which crypto wallets would fall into). RUFADAA was changed to limit access to the executor to protect assets. RUFADAA outlines how digital assets are administered following death and incapacity in the US.

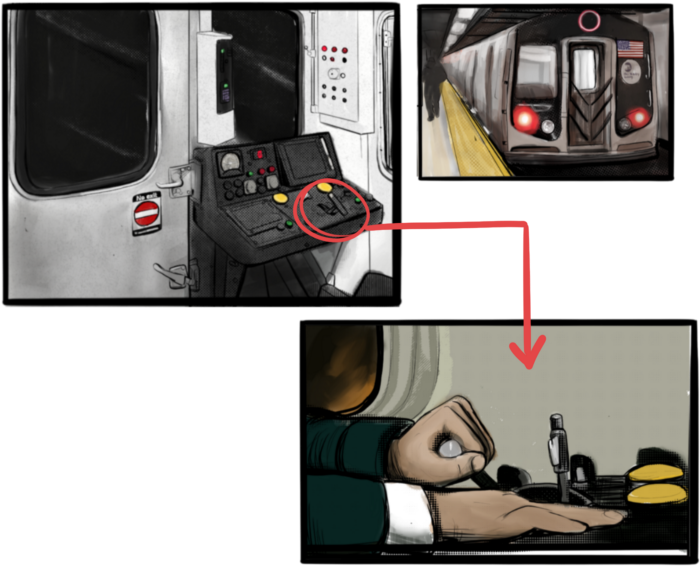

A Succession Solution

Having a will and talking about who would get what is the first step to having a solution, but using a Dad Mans Switch is a perfect tool for such unforeseen circumstances. As long as the switch's controller has control, nothing happens. Losing control of the switch initiates a state transition.

Subway or railway operations are examples. Modern control systems need the conductor to hold a switch to keep the train going. If they can't, the train stops.

Enter Sarcophagus

Sarcophagus is a decentralized dead man's switch built on Ethereum and Arweave. Sarcophagus allows actors to maintain control of their possessions even while physically unable to do so. Using a programmable dead man's switch and dual encryption, anything can be kept and passed on. This covers assets, secrets, seed phrases, and other use cases to provide authority and control back to the user and release trustworthy services from this work. Sarcophagus is built on a decentralized, transparent open source codebase. Sarcophagus is there if you're unprepared.