More on Personal Growth

The woman

3 years ago

The best lesson from Sundar Pichai is that success and stress don't mix.

His regular regimen teaches stress management.

In 1995, an Indian graduate visited the US. He obtained a scholarship to Stanford after graduating from IIT with a silver medal. First flight. His ticket cost a year's income. His head was full.

Pichai Sundararajan is his full name. He became Google's CEO and a world leader. Mr. Pichai transformed technology and inspired millions to dream big.

This article reveals his daily schedule.

Mornings

While many of us dread Mondays, Mr. Pichai uses the day to contemplate.

A typical Indian morning. He awakens between 6:30 and 7 a.m. He avoids working out in the mornings.

Mr. Pichai oversees the internet, but he reads a real newspaper every morning.

Pichai mentioned that he usually enjoys a quiet breakfast during which he reads the news to get a good sense of what’s happening in the world. Pichai often has an omelet for breakfast and reads while doing so. The native of Chennai, India, continues to enjoy his daily cup of tea, which he describes as being “very English.”

Pichai starts his day. BuzzFeed's Mat Honan called the CEO Banana Republic dad.

Overthinking in the morning is a bad idea. It's crucial to clear our brains and give ourselves time in the morning before we hit traffic.

Mr. Pichai's morning ritual shows how to stay calm. Wharton Business School found that those who start the day calmly tend to stay that way. It's worth doing regularly.

And he didn't forget his roots.

Afternoons

He has a busy work schedule, as you can imagine. Running one of the world's largest firm takes time, energy, and effort. He prioritizes his work. Monitoring corporate performance and guaranteeing worker efficiency.

Sundar Pichai spends 7-8 hours a day to improve Google. He's noted for changing the company's culture. He wants to boost employee job satisfaction and performance.

His work won him recognition within the company.

Pichai received a 96% approval rating from Glassdoor users in 2017.

Mr. Pichai stresses work satisfaction. Each day is a new canvas for him to find ways to enrich people's job and personal lives.

His work offers countless lessons. According to several profiles and press sources, the Google CEO is a savvy negotiator. Mr. Pichai's success came from his strong personality, work ethic, discipline, simplicity, and hard labor.

Evenings

His evenings are spent with family after a busy day. Sundar Pichai's professional and personal lives are balanced. Sundar Pichai is a night owl who re-energizes about 9 p.m.

However, he claims to be most productive after 10 p.m., and he thinks doing a lot of work at that time is really useful. But he ensures he sleeps for around 7–8 hours every day. He enjoys long walks with his dog and enjoys watching NSDR on YouTube. It helps him in relaxing and sleep better.

His regular routine teaches us what? Work wisely, not hard, discipline, vision, etc. His stress management is key. Leading one of the world's largest firm with 85,000 employees is scary.

The pressure to achieve may ruin a day. Overworked employees are more likely to make mistakes or be angry with coworkers, according to the Family Work Institute. They can't handle daily problems, making the house more stressful than the office.

Walking your dog, having fun with friends, and having hobbies are as vital as your office.

Datt Panchal

3 years ago

The Learning Habit

The Habit of Learning implies constantly learning something new. One daily habit will make you successful. Learning will help you succeed.

Most successful people continually learn. Success requires this behavior. Daily learning.

Success loves books. Books offer expert advice. Everything is online today. Most books are online, so you can skip the library. You must download it and study for 15-30 minutes daily. This habit changes your thinking.

Typical Successful People

Warren Buffett reads 500 pages of corporate reports and five newspapers for five to six hours each day.

Each year, Bill Gates reads 50 books.

Every two weeks, Mark Zuckerberg reads at least one book.

According to his brother, Elon Musk studied two books a day as a child and taught himself engineering and rocket design.

Learning & Making Money Online

No worries if you can't afford books. Everything is online. YouTube, free online courses, etc.

How can you create this behavior in yourself?

1) Consider what you want to know

Before learning, know what's most important. So, move together.

Set a goal and schedule learning.

After deciding what you want to study, create a goal and plan learning time.

3) GATHER RESOURCES

Get the most out of your learning resources. Online or offline.

John Rampton

3 years ago

Ideas for Samples of Retirement Letters

Ready to quit full-time? No worries.

Baby Boomer retirement has accelerated since COVID-19 began. In 2020, 29 million boomers retire. Over 3 million more than in 2019. 75 million Baby Boomers will retire by 2030.

First, quit your work to enjoy retirement. Leave a professional legacy. Your retirement will start well. It all starts with a retirement letter.

Retirement Letter

Retirement letters are formal resignation letters. Different from other resignation letters, these don't tell your employer you're leaving. Instead, you're quitting.

Since you're not departing over grievances or for a better position or higher income, you may usually terminate the relationship amicably. Consulting opportunities are possible.

Thank your employer for their support and give them transition information.

Resignation letters aren't merely a formality. This method handles wages, insurance, and retirement benefits.

Retirement letters often accompany verbal notices to managers. Schedule a meeting before submitting your retirement letter to discuss your plans. The letter will be stored alongside your start date, salary, and benefits in your employee file.

Retirement is typically well-planned. Employers want 6-12 months' notice.

Summary

Guidelines for Giving Retirement Notice

Components of a Successful Retirement Letter

Template for Retirement Letter

Ideas for Samples of Retirement Letters

First Example of Retirement Letter

Second Example of Retirement Letter

Third Example of Retirement Letter

Fourth Example of Retirement Letter

Fifth Example of Retirement Letter

Sixth Example of Retirement Letter

Seventh Example of Retirement Letter

Eighth Example of Retirement Letter

Ninth Example of Retirement Letter

Tenth Example of Retirement Letter

Frequently Asked Questions

1. What is a letter of retirement?

2. Why should you include a letter of retirement?

3. What information ought to be in your retirement letter?

4. Must I provide notice?

5. What is the ideal retirement age?

Guidelines for Giving Retirement Notice

While starting a new phase, you're also leaving a job you were qualified for. You have years of experience. So, it may not be easy to fill a retirement-related vacancy.

Talk to your boss in person before sending a letter. Notice is always appreciated. Properly announcing your retirement helps you and your organization transition.

How to announce retirement:

Learn about the retirement perks and policies offered by the company. The first step in figuring out whether you're eligible for retirement benefits is to research your company's retirement policy.

Don't depart without providing adequate notice. You should give the business plenty of time to replace you if you want to retire in a few months.

Help the transition by offering aid. You could be a useful resource if your replacement needs training.

Contact the appropriate parties. The original copy should go to your boss. Give a copy to HR because they will manage your 401(k), pension, and health insurance.

Investigate the option of working as a consultant or part-time. If you desire, you can continue doing some limited work for the business.

Be nice to others. Describe your achievements and appreciation. Additionally, express your gratitude for giving you the chance to work with such excellent coworkers.

Make a plan for your future move. Simply updating your employer on your goals will help you maintain a good working relationship.

Use a formal letter or email to formalize your plans. The initial step is to speak with your supervisor and HR in person, but you must also give written notice.

Components of a Successful Retirement Letter

To write a good retirement letter, keep in mind the following:

A formal salutation. Here, the voice should be deliberate, succinct, and authoritative.

Be specific about your intentions. The key idea of your retirement letter is resignation. Your decision to depart at this time should be reflected in your letter. Remember that your intention must be clear-cut.

Your deadline. This information must be in resignation letters. Laws and corporate policies may both stipulate a minimum amount of notice.

A kind voice. Your retirement letter shouldn't contain any resentments, insults, or other unpleasantness. Your letter should be a model of professionalism and grace. A straightforward thank you is a terrific approach to accomplish that.

Your ultimate goal. Chaos may start to happen as soon as you turn in your resignation letter. Your position will need to be filled. Additionally, you will have to perform your obligations up until a successor is found. Your availability during the interim period should be stated in your resignation letter.

Give us a way to reach you. Even if you aren't consulting, your company will probably get in touch with you at some point. They might send you tax documents and details on perks. By giving your contact information, you can make this process easier.

Template for Retirement Letter

Identify

Title you held

Address

Supervisor's name

Supervisor’s position

Company name

HQ address

Date

[SUPERVISOR],

1.

Inform that you're retiring. Include your last day worked.

2.

Employer thanks. Mention what you're thankful for. Describe your accomplishments and successes.

3.

Helping moves things ahead. Plan your retirement. Mention your consultancy interest.

Sincerely,

[Signature]

First and last name

Phone number

Personal Email

Ideas for Samples of Retirement Letters

First Example of Retirement Letter

Martin D. Carey

123 Fleming St

Bloomfield, New Jersey 07003

(555) 555-1234

June 6th, 2022

Willie E. Coyote

President

Acme Co

321 Anvil Ave

Fairfield, New Jersey 07004

Dear Mr. Coyote,

This letter notifies Acme Co. of my retirement on August 31, 2022.

There has been no other organization that has given me that sense of belonging and purpose.

My fifteen years at the helm of the Structural Design Division have given me a strong sense of purpose. I’ve been fortunate to have your support, and I’ll be always grateful for the opportunity you offered me.

I had a difficult time making this decision. As a result of finding a small property in Arizona where we will be able to spend our remaining days together, my wife and I have decided to officially retire.

In spite of my regret at being unable to contribute to the firm we’ve built, I believe it is wise to move on.

My heart will always belong to Acme Co. Thank you for the opportunity and best of luck in the years to come.

Sincerely,

Martin D. Carey

Second Example of Retirement Letter

Gustavo Fring

Los Pollas Hermanos

12000–12100 Coors Rd SW,

Albuquerque, New Mexico 87045

Dear Mr. Fring,

I write this letter to announce my formal retirement from Los Pollas Hermanos as manager, effective October 15.

As an employee at Los Pollas Hermanos, I appreciate all the great opportunities you have given me. It has been a pleasure to work with and learn from my colleagues for the past 10 years, and I am looking forward to my next challenge.

If there is anything I can do to assist during this time, please let me know.

Sincerely,

Linda T. Crespo

Third Example of Retirement Letter

William M. Arviso

4387 Parkview Drive

Tustin, CA 92680

May 2, 2023

Tony Stark

Owner

Stark Industries

200 Industrial Avenue

Long Beach, CA 90803

Dear Tony:

I’m writing to inform you that my final day of work at Stark Industries will be May14, 2023. When that time comes, I intend to retire.

As I embark on this new chapter in my life, I would like to thank you and the entire Stark Industries team for providing me with so many opportunities. You have all been a pleasure to work with and I will miss you all when I retire.

I am glad to assist you with the transition in any way I can to ensure your new hire has a seamless experience. All ongoing projects will be completed until my retirement date, and all key information will be handed over to the team.

Once again, thank you for the opportunity to be part of the Stark Industries team. All the best to you and the team in the days to come.

Please do not hesitate to contact me if you require any additional information. In order to finalize my retirement plans, I’ll meet with HR and can provide any details that may be necessary.

Sincerely,

(Signature)

William M. Arviso

Fourth Example of Retirement Letter

Garcia, Barbara

First Street, 5432

New York City, NY 10001

(1234) (555) 123–1234

1 October 2022

Gunther

Owner

Central Perk

199 Lafayette St.

New York City, NY 10001

Mr. Gunther,

The day has finally arrived. As I never imagined, I will be formally retiring from Central Perk on November 1st, 2022.

Considering how satisfied I am with my current position, this may surprise you. It would be best if I retired now since my health has deteriorated, so I think this is a good time to do so.

There is no doubt that the past two decades have been wonderful. Over the years, I have seen a small coffee shop grow into one of the city’s top destinations.

It will be hard for me to leave this firm without wondering what more success we could have achieved. But I’m confident that you and the rest of the Central Perk team will achieve great things.

My family and I will never forget what you’ve done for us, and I am grateful for the chance you’ve given me. My house is always open to you.

Sincerely Yours

Garcia, Barbara

Fifth Example of Retirement Letter

Pat Williams

618 Spooky Place

Monstropolis, 23221

123–555–0031

pwilliams@email.com

Feb. 16, 2022

Mike Wazowski

Co-CEO

Monters, Inc.

324 Scare Road

Monstropolis

Dear Mr. Wazowski,

As a formal notice of my upcoming retirement, I am submitting this letter. I will be leaving Monters, Inc. on April 13.

These past 10 years as a marketing associate have provided me with many opportunities. Since we started our company a decade ago, we have seen the face of harnessing screams change dramatically into harnessing laughter. During my time working with this dynamic marketing team, I learned a lot about customer behavior and marketing strategies. Working closely with some of our long-standing clients, such as Boo, was a particular pleasure.

I would be happy to assist with the transition following my retirement. It would be my pleasure to assist in the hiring or training of my replacement. In order to spend more time with my family, I will also be able to offer part-time consulting services.

After I retire, I plan to cash out the eight unused vacation days I’ve accumulated and take my pension as a lump sum.

Thank you for the opportunity to work with Monters, Inc. In the years to come, I wish you all the best!

Sincerely,

Paul Williams

Sixth Example of Retirement Letter

Dear Micheal,

As In my tenure at Dunder Mifflin Paper Company, I have given everything I had. It has been an honor to work here. But I have decided to move on to new challenges and retire from my position — mainly bears, beets, and Battlestar Galactia.

I appreciate the opportunity to work here and learn so much. During my time at this company, I will always remember the good times and memories we shared. Wishing you all the best in the future.

Sincerely,

Dwight K. Shrute

Your signature

May 16

Seventh Example of Retirement Letter

Greetings, Bill

I am announcing my retirement from Initech, effective March 15, 2023.

Over the course of my career here, I’ve had the privilege of working with so many talented and inspiring people.

In 1999, when I began working as a customer service representative, we were a small organization located in a remote office park.

The fact that we now occupy a floor of the Main Street office building with over 150 employees continues to amaze me.

I am looking forward to spending more time with family and traveling the country in our RV. Although I will be sad to leave.

Please let me know if there are any extra steps I can take to facilitate this transfer.

Sincerely,

Frankin, RenitaEighth Example of Retirement Letter

Height Example of Retirement Letter

Bruce,

Please accept my resignation from Wayne Enterprises as Marketing Communications Director. My last day will be August 1, 2022.

The decision to retire has been made after much deliberation. Now that I have worked in the field for forty years, I believe it is a good time to begin completing my bucket list.

It was not easy for me to decide to leave the company. Having worked at Wayne Enterprises has been rewarding both professionally and personally. There are still a lot of memories associated with my first day as a college intern.

My intention was not to remain with such an innovative company, as you know. I was able to see the big picture with your help, however. Today, we are a force that is recognized both nationally and internationally.

In addition to your guidance, the bold, visionary leadership of our company contributed to the growth of our company.

My departure from the company coincides with a particularly hectic time. Despite my best efforts, I am unable to postpone my exit.

My position would be well served by an internal solution. I have a more than qualified marketing manager in Caroline Crown. It would be a pleasure to speak with you about this.

In case I can be of assistance during the switchover, please let me know. Contact us at (555)555–5555. As part of my responsibilities, I am responsible for making sure all work is completed to Wayne Enterprise’s stringent requirements. Having the opportunity to work with you has been a pleasure. I wish you continued success with your thriving business.

Sincerely,

Cash, Cole

Marketing/Communications

Ninth Example of Retirement Letter

Norman, Jamie

2366 Hanover Street

Whitestone, NY 11357

555–555–5555

15 October 2022

Mr. Lippman

Head of Pendant Publishing

600 Madison Ave.

New York, New York

Respected Mr. Lippman,

Please accept my resignation effective November 1, 2022.

Over the course of my ten years at Pendant Publishing, I’ve had a great deal of fun and I’m quite grateful for all the assistance I’ve received.

It was a pleasure to wake up and go to work every day because of our outstanding corporate culture and the opportunities for promotion and professional advancement available to me.

While I am excited about retiring, I am going to miss being part of our team. It’s my hope that I’ll be able to maintain the friendships I’ve formed here for a long time to come.

In case I can be of assistance prior to or following my departure, please let me know. If I can assist in any way to ensure a smooth transfer to my successor, I would be delighted to do so.

Sincerely,

Signed (hard copy letter)

Norman, Jamie

Tenth Example of Retirement Letter

17 January 2023

Greg S. Jackson

Cyberdyne Systems

18144 El Camino Real,

Sunnyvale, CA

Respected Mrs. Duncan,

I am writing to inform you that I will be resigning from Cyberdyne Systems as of March 1, 2023. I’m grateful to have had this opportunity, and it was a difficult decision to make.

My development as a programmer and as a more seasoned member of the organization has been greatly assisted by your coaching.

I have been proud of Cyberdyne Systems’ ethics and success throughout my 25 years at the company. Starting as a mailroom clerk and currently serving as head programmer.

The portfolios of our clients have always been handled with the greatest care by my colleagues. It is our employees and services that have made Cyberdyne Systems the success it is today.

During my tenure as head of my division, I’ve increased our overall productivity by 800 percent, and I expect that trend to continue after I retire.

In light of the fact that the process of replacing me may take some time, I would like to offer my assistance in any way I can.

The greatest contender for this job is Troy Ledford, my current assistant.

Also, before I leave, I would be willing to teach any partners how to use the programmer I developed to track and manage the development of Skynet.

Over the next few months, I’ll be enjoying vacations with my wife as well as my granddaughter moving to college.

If Cyberdyne Systems has any openings for consultants, please let me know. It has been a pleasure working with you over the last 25 years. I appreciate your concern and care.

Sincerely,

Greg S, Jackson

Questions and Answers

1. What is a letter of retirement?

Retirement letters tell your supervisor you're retiring. This informs your employer that you're departing, like a letter. A resignation letter also requests retirement benefits.

Supervisors frequently receive retirement letters and verbal resignations. Before submitting your retirement letter, meet to discuss your plans. This letter will be filed with your start date, salary, and benefits.

2. Why should you include a letter of retirement?

Your retirement letter should explain why you're leaving. When you quit, your manager and HR department usually know. Regardless, a retirement letter might help you leave on a positive tone. It ensures they have the necessary papers.

In your retirement letter, you tell the firm your plans so they can find your replacement. You may need to stay in touch with your company after sending your retirement letter until a successor is identified.

3. What information ought to be in your retirement letter?

Format it like an official letter. Include your retirement plans and retirement-specific statistics. Date may be most essential.

In some circumstances, benefits depend on when you resign and retire. A date on the letter helps HR or senior management verify when you gave notice and how long.

In addition to your usual salutation, address your letter to your manager or supervisor.

The letter's body should include your retirement date and transition arrangements. Tell them whether you plan to help with the transition or train a new employee. You may have a three-month time limit.

Tell your employer your job title, how long you've worked there, and your biggest successes. Personalize your letter by expressing gratitude for your career and outlining your retirement intentions. Finally, include your contact info.

4. Must I provide notice?

Two-week notice isn't required. Your company may require it. Some state laws contain exceptions.

Check your contract, company handbook, or HR to determine your retirement notice. Resigning may change the policy.

Regardless of your company's policy, notification is standard. Entry-level or junior jobs can be let go so the corporation can replace them.

Middle managers, high-level personnel, and specialists may take months to replace. Two weeks' notice is a courtesy. Start planning months ahead.

You can finish all jobs at that period. Prepare transition documents for coworkers and your replacement.

5. What is the ideal retirement age?

Depends on finances, state, and retirement plan. The average American retires at 62. The average retirement age is 66, according to Gallup's 2021 Economy and Personal Finance Survey.

Remember:

Before the age of 59 1/2, withdrawals from pre-tax retirement accounts, such as 401(k)s and IRAs, are subject to a penalty.

Benefits from Social Security can be accessed as early as age 62.

Medicare isn't available to you till you're 65,

Depending on the year of your birth, your Full Retirement Age (FRA) will be between 66 and 67 years old.

If you haven't taken them already, your Social Security benefits increase by 8% annually between ages 6 and 77.

You might also like

B Kean

3 years ago

Russia's greatest fear is that no one will ever fear it again.

When everyone laughs at him, he's powerless.

1-2-3: Fold your hands and chuckle heartily. Repeat until you're really laughing.

We're laughing at Russia's modern-day shortcomings, if you hadn't guessed.

Watch Good Fellas' laughing scene on YouTube. Ray Liotta, Joe Pesci, and others laugh hysterically in a movie. Laugh at that scene, then think of Putin's macho guy statement on February 24 when he invaded Ukraine. It's cathartic to laugh at his expense.

Right? It makes me feel great that he was convinced the military action will be over in a week. I love reading about Putin's morning speech. Many stupid people on Earth supported him. Many loons hailed his speech historic.

Russia preys on the weak. Strong Ukraine overcame Russia. Ukraine's right. As usual, Russia is in the wrong.

A so-called thought leader recently complained on Russian TV that the West no longer fears Russia, which is why Ukraine is kicking Russia's ass.

Let's simplify for this Russian intellectual. Except for nuclear missiles, the West has nothing to fear from Russia. Russia is a weak, morally-empty country whose DNA has degraded to the point that evolution is already working to flush it out.

The West doesn't fear Russia since he heads a prominent Russian institution. Russian universities are intellectually barren. I taught at St. Petersburg University till June (since February I was virtually teaching) and was astounded by the lack of expertise.

Russians excel in science, math, engineering, IT, and anything that doesn't demand critical thinking or personal ideas.

Reflecting on many of the high-ranking individuals from around the West, Satanovsky said: “They are not interested in us. We only think we’re ‘big politics’ for them but for those guys we’re small politics. “We’re small politics, even though we think of ourselves as the descendants of the Russian Empire, of the USSR. We are not the Soviet Union, we don’t have enough weirdos and lunatics, we practically don’t have any (U.S. Has Stopped Fearing Us).”

Professor Dmitry Evstafiev, president of the Institute of the Middle East, praised Nikita Khrushchev's fiery nature because he made the world fear him, which made the Soviet Union great. If the world believes Putin is crazy, then Russia will be great, says this man. This is crazy.

Evstafiev covered his cowardice by saluting Putin. He praised his culture and Ukraine patience. This weakling professor ingratiates himself to Putin instead of calling him a cowardly, demonic shithead.

This is why we don't fear Russia, professor. Because you're all sycophantic weaklings who sold your souls to a Leningrad narcissist. Putin's nothing. He lacks intelligence. You've tied your country's fate and youth's future to this terrible monster. Disgraceful!

How can you loathe your country's youth so much to doom them to decades or centuries of ignominy? My son is half Russian and must now live with this portion of him.

We don't fear Russia because you don't realize that it should be appreciated, not frightened. That would need lobotomizing tens of millions of people like you.

Sadman. You let a Leningrad weakling castrate you and display your testicles. He shakes the container, saying, "Your balls are mine."

Why is Russia not feared?

Your self-inflicted national catastrophe is hilarious. Sadly, it's laugh-through-tears.

Grace Huang

3 years ago

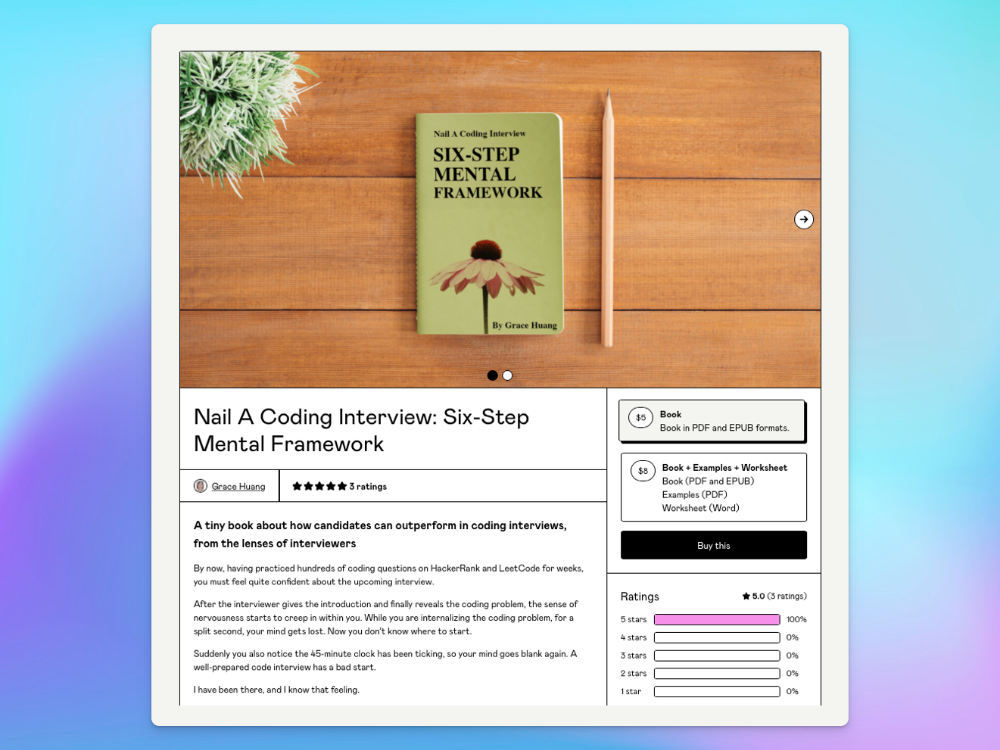

I sold 100 copies of my book when I had anticipated selling none.

After a decade in large tech, I know how software engineers were interviewed. I've seen outstanding engineers fail interviews because their responses were too vague.

So I wrote Nail A Coding Interview: Six-Step Mental Framework. Give candidates a mental framework for coding questions; help organizations better prepare candidates so they can calibrate traits.

Recently, I sold more than 100 books, something I never expected.

In this essay, I'll describe my publication journey, which included self-doubt and little triumphs. I hope this helps if you want to publish.

It was originally a Medium post.

How did I know to develop a coding interview book? Years ago, I posted on Medium.

Six steps to ace a coding interview Inhale. blog.devgenius.io

This story got a lot of attention and still gets a lot of daily traffic. It indicates this domain's value.

Converted the Medium article into an ebook

The Medium post contains strong bullet points, but it is missing the “flesh”. How to use these strategies in coding interviews, for example. I filled in the blanks and made a book.

I made the book cover for free. It's tidy.

Shared the article with my close friends on my social network WeChat.

I shared the book on Wechat's Friend Circle (朋友圈) after publishing it on Gumroad. Many friends enjoyed my post. It definitely triggered endorphins.

In Friend Circle, I presented a 100% off voucher. No one downloaded the book. Endorphins made my heart sink.

Several days later, my Apple Watch received a Gumroad notification. A friend downloaded it. I majored in finance, he subsequently said. My brother-in-law can get it? He downloaded it to cheer me up.

I liked him, but was disappointed that he didn't read it.

The Tipping Point: Reddit's Free Giving

I trusted the book. It's based on years of interviewing. I felt it might help job-hunting college students. If nobody wants it, it can still have value.

I posted the book's link on /r/leetcode. I told them to DM me for a free promo code.

Momentum shifted everything. Gumroad notifications kept coming when I was out with family. Following orders.

As promised, I sent DMs a promo code. Some consumers ordered without asking for a promo code. Some readers finished the book and posted reviews.

My book was finally on track.

A 5-Star Review, plus More

A reader afterwards DMed me and inquired if I had another book on system design interviewing. I said that was a good idea, but I didn't have one. If you write one, I'll be your first reader.

Later, I asked for a book review. Yes, but how? That's when I learned readers' reviews weren't easy. I built up an email pipeline to solicit customer reviews. Since then, I've gained credibility through ratings.

Learnings

I wouldn't have gotten 100 if I gave up when none of my pals downloaded. Here are some lessons.

Your friends are your allies, but they are not your clients.

Be present where your clients are

Request ratings and testimonials

gain credibility gradually

I did it, so can you. Follow me on Twitter @imgracehuang for my publishing and entrepreneurship adventure.

Recep İnanç

3 years ago

Effective Technical Book Reading Techniques

Technical books aren't like novels. We need a new approach to technical texts. I've spent years looking for a decent reading method. I tried numerous ways before finding one that worked. This post explains how I read technical books efficiently.

What Do I Mean When I Say Effective?

Effectiveness depends on the book. Effective implies I know where to find answers after reading a reference book. Effective implies I learned the book's knowledge after reading it.

I use reference books as tools in my toolkit. I won't carry all my tools; I'll merely need them. Non-reference books teach me techniques. I never have to make an effort to use them since I always have them.

Reference books I like:

Design Patterns: Elements of Reusable Object-Oriented Software

Refactoring: Improving the Design of Existing Code

You can also check My Top Takeaways from Refactoring here.

Non-reference books I like:

The Approach

Technical books might be overwhelming to read in one sitting. Especially when you have no idea what is coming next as you read. When you don't know how deep the rabbit hole goes, you feel lost as you read. This is my years-long method for overcoming this difficulty.

Whether you follow the step-by-step guide or not, remember these:

Understand the terminology. Make sure you get the meaning of any terms you come across more than once. The likelihood that a term will be significant increases as you encounter it more frequently.

Know when to stop. I've always believed that in order to truly comprehend something, I must delve as deeply as possible into it. That, however, is not usually very effective. There are moments when you have to draw the line and start putting theory into practice (if applicable).

Look over your notes. When reading technical books or documents, taking notes is a crucial habit to develop. Additionally, you must regularly examine your notes if you want to get the most out of them. This will assist you in internalizing the lessons you acquired from the book. And you'll see that the urge to review reduces with time.

Let's talk about how I read a technical book step by step.

0. Read the Foreword/Preface

These sections are crucial in technical books. They answer Who should read it, What each chapter discusses, and sometimes How to Read? This is helpful before reading the book. Who could know the ideal way to read the book better than the author, right?

1. Scanning

I scan the chapter. Fast scanning is needed.

I review the headings.

I scan the pictures quickly.

I assess the chapter's length to determine whether I might divide it into more manageable sections.

2. Skimming

Skimming is faster than reading but slower than scanning.

I focus more on the captions and subtitles for the photographs.

I read each paragraph's opening and closing sentences.

I examined the code samples.

I attempt to grasp each section's basic points without getting bogged down in the specifics.

Throughout the entire reading period, I make an effort to make mental notes of what may require additional attention and what may not. Because I don't want to spend time taking physical notes, kindly notice that I am using the term "mental" here. It is much simpler to recall. You may think that this is more significant than typing or writing “Pay attention to X.”

I move on quickly. This is something I considered crucial because, when trying to skim, it is simple to start reading the entire thing.

3. Complete reading

Previous steps pay off.

I finished reading the chapter.

I concentrate on the passages that I mentally underlined when skimming.

I put the book away and make my own notes. It is typically more difficult than it seems for me. But it's important to speak in your own words. You must choose the right words to adequately summarize what you have read. How do those words make you feel? Additionally, you must be able to summarize your notes while you are taking them. Sometimes as I'm writing my notes, I realize I have no words to convey what I'm thinking or, even worse, I start to doubt what I'm writing down. This is a good indication that I haven't internalized that idea thoroughly enough.

I jot my inquiries down. Normally, I read on while compiling my questions in the hopes that I will learn the answers as I read. I'll explore those issues more if I wasn't able to find the answers to my inquiries while reading the book.

Bonus!

Best part: If you take lovely notes like I do, you can publish them as a blog post with a few tweaks.

Conclusion

This is my learning journey. I wanted to show you. This post may help someone with a similar learning style. You can alter the principles above for any technical material.