More on Personal Growth

Alex Mathers

3 years ago

12 habits of the zenith individuals I know

Calmness is a vital life skill.

It aids communication. It boosts creativity and performance.

I've studied calm people's habits for years. Commonalities:

Have mastered the art of self-humor.

Protectors take their job seriously, draining the room's energy.

They are fixated on positive pursuits like making cool things, building a strong physique, and having fun with others rather than on depressing influences like the news and gossip.

Every day, spend at least 20 minutes moving, whether it's walking, yoga, or lifting weights.

Discover ways to take pleasure in life's challenges.

Since perspective is malleable, they change their view.

Set your own needs first.

Stressed people neglect themselves and wonder why they struggle.

Prioritize self-care.

Don't ruin your life to please others.

Make something.

Calm people create more than react.

They love creating beautiful things—paintings, children, relationships, and projects.

Don’t hold their breath.

If you're stressed or angry, you may be surprised how much time you spend holding your breath and tightening your belly.

Release, breathe, and relax to find calm.

Stopped rushing.

Rushing is disadvantageous.

Calm people handle life better.

Are aware of their own dietary requirements.

They avoid junk food and eat foods that keep them healthy, happy, and calm.

Don’t take anything personally.

Stressed people control everything.

Self-conscious.

Calm people put others and their work first.

Keep their surroundings neat.

Maintaining an uplifting and clutter-free environment daily calms the mind.

Minimise negative people.

Calm people are ruthless with their boundaries and avoid negative and drama-prone people.

Scott Stockdale

3 years ago

A Day in the Life of Lex Fridman Can Help You Hit 6-Month Goals

The Lex Fridman podcast host has interviewed Elon Musk.

Lex is a minimalist YouTuber. His videos are sloppy. Suits are his trademark.

In a video, he shares a typical day. I've smashed my 6-month goals using its ideas.

Here's his schedule.

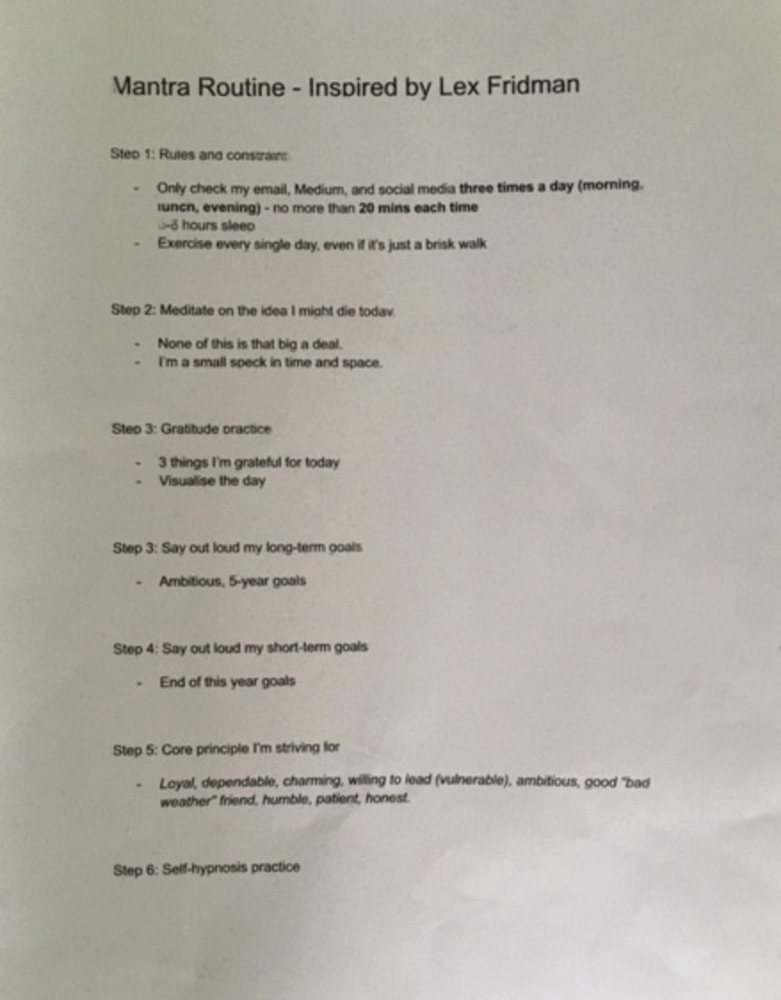

Morning Mantra

Not woo-woo. Lex's mantra reflects his practicality.

Four parts.

Rulebook

"I remember the game's rules," he says.

Among them:

Sleeping 6–8 hours nightly

1–3 times a day, he checks social media.

Every day, despite pain, he exercises. "I exercise uninjured body parts."

Visualize

He imagines his day. "Like Sims..."

He says three things he's grateful for and contemplates death.

"Today may be my last"

Objectives

Then he visualizes his goals. He starts big. Five-year goals.

Short-term goals follow. Lex says they're year-end goals.

Near but out of reach.

Principles

He lists his principles. Assertions. His goals.

He acknowledges his cliche beliefs. Compassion, empathy, and strength are key.

Here's my mantra routine:

Four-Hour Deep Work

Lex begins a four-hour deep work session after his mantra routine. Today's toughest.

AI is Lex's specialty. His video doesn't explain what he does.

Clearly, he works hard.

Before starting, he has water, coffee, and a bathroom break.

"During deep work sessions, I minimize breaks."

He's distraction-free. Phoneless. Silence. Nothing. Any loose ideas are typed into a Google doc for later. He wants to work.

"Just get the job done. Don’t think about it too much and feel good once it’s complete." — Lex Fridman

30-Minute Social Media & Music

After his first deep work session, Lex rewards himself.

10 minutes on social media, 20 on music. Upload content and respond to comments in 10 minutes. 20 minutes for guitar or piano.

"In the real world, I’m currently single, but in the music world, I’m in an open relationship with this beautiful guitar. Open relationship because sometimes I cheat on her with the acoustic." — Lex Fridman

Two-hour exercise

Then exercise for two hours.

Daily runs six miles. Then he chooses how far to go. Run time is an hour.

He does bodyweight exercises. Every minute for 15 minutes, do five pull-ups and ten push-ups. It's David Goggins-inspired. He aims for an hour a day.

He's hungry. Before running, he takes a salt pill for electrolytes.

He'll then take a one-minute cold shower while listening to cheesy songs. Afterward, he might eat.

Four-Hour Deep Work

Lex's second work session.

He works 8 hours a day.

Again, zero distractions.

Eating

The video's meal doesn't look appetizing, but it's healthy.

It's ground beef with vegetables. Cauliflower is his "ground-floor" veggie. "Carrots are my go-to party food."

Lex's keto diet includes 1800–2000 calories.

He drinks a "nutrient-packed" Atheltic Greens shake and takes tablets. It's:

One daily tablet of sodium.

Magnesium glycinate tablets stopped his keto headaches.

Potassium — "For electrolytes"

Fish oil: healthy joints

“So much of nutrition science is barely a science… I like to listen to my own body and do a one-person, one-subject scientific experiment to feel good.” — Lex Fridman

Four-hour shallow session

This work isn't as mentally taxing.

Lex planned to:

Finish last session's deep work (about an hour)

Adobe Premiere podcasting (about two hours).

Email-check (about an hour). Three times a day max. First, check for emergencies.

If he's sick, he may watch Netflix or YouTube documentaries or visit friends.

“The possibilities of chaos are wide open, so I can do whatever the hell I want.” — Lex Fridman

Two-hour evening reading

Nonstop work.

Lex ends the day reading academic papers for an hour. "Today I'm skimming two machine learning and neuroscience papers"

This helps him "think beyond the paper."

He reads for an hour.

“When I have a lot of energy, I just chill on the bed and read… When I’m feeling tired, I jump to the desk…” — Lex Fridman

Takeaways

Lex's day-in-the-life video is inspiring.

He has positive energy and works hard every day.

Schedule:

Mantra Routine includes rules, visualizing, goals, and principles.

Deep Work Session #1: Four hours of focus.

10 minutes social media, 20 minutes guitar or piano. "Music brings me joy"

Six-mile run, then bodyweight workout. Two hours total.

Deep Work #2: Four hours with no distractions. Google Docs stores random thoughts.

Lex supplements his keto diet.

This four-hour session is "open to chaos."

Evening reading: academic papers followed by fiction.

"I value some things in life. Work is one. The other is loving others. With those two things, life is great." — Lex Fridman

Matthew Royse

3 years ago

Ten words and phrases to avoid in presentations

Don't say this in public!

Want to wow your audience? Want to deliver a successful presentation? Do you want practical takeaways from your presentation?

Then avoid these phrases.

Public speaking is difficult. People fear public speaking, according to research.

"Public speaking is people's biggest fear, according to studies. Number two is death. "Sounds right?" — Comedian Jerry Seinfeld

Yes, public speaking is scary. These words and phrases will make your presentation harder.

Using unnecessary words can weaken your message.

You may have prepared well for your presentation and feel confident. During your presentation, you may freeze up. You may blank or forget.

Effective delivery is even more important than skillful public speaking.

Here are 10 presentation pitfalls.

1. I or Me

Presentations are about the audience, not you. Replace "I or me" with "you, we, or us." Focus on your audience. Reward them with expertise and intriguing views about your issue.

Serve your audience actionable items during your presentation, and you'll do well. Your audience will have a harder time listening and engaging if you're self-centered.

2. Sorry if/for

Your presentation is fine. These phrases make you sound insecure and unprepared. Don't pressure the audience to tell you not to apologize. Your audience should focus on your presentation and essential messages.

3. Excuse the Eye Chart, or This slide's busy

Why add this slide if you're utilizing these phrases? If you don't like this slide, change it before presenting. After the presentation, extra data can be provided.

Don't apologize for unclear slides. Hide or delete a broken PowerPoint slide. If so, divide your message into multiple slides or remove the "business" slide.

4. Sorry I'm Nervous

Some think expressing yourself will win over the audience. Nerves are horrible. Even public speakers are nervous.

Nerves aren't noticeable. What's the point? Let the audience judge your nervousness. Please don't make this obvious.

5. I'm not a speaker or I've never done this before.

These phrases destroy credibility. People won't listen and will check their phones or computers.

Why present if you use these phrases?

Good speakers aren't necessarily public speakers. Be confident in what you say. When you're confident, many people will like your presentation.

6. Our Key Differentiators Are

Overused term. It's widely utilized. This seems "salesy," and your "important differentiators" are probably like a competitor's.

This statement has been diluted; say, "what makes us different is..."

7. Next Slide

Many slides or stories? Your presentation needs transitions. They help your viewers understand your argument.

You didn't transition well when you said "next slide." Think about organic transitions.

8. I Didn’t Have Enough Time, or I’m Running Out of Time

The phrase "I didn't have enough time" implies that you didn't care about your presentation. This shows the viewers you rushed and didn't care.

Saying "I'm out of time" shows poor time management. It means you didn't rehearse enough and plan your time well.

9. I've been asked to speak on

This phrase is used to emphasize your importance. This phrase conveys conceit.

When you say this sentence, you tell others you're intelligent, skilled, and appealing. Don't utilize this term; focus on your topic.

10. Moving On, or All I Have

These phrases don't consider your transitions or presentation's end. People recall a presentation's beginning and end.

How you end your discussion affects how people remember it. You must end your presentation strongly and use natural transitions.

Conclusion

10 phrases to avoid in a presentation. I or me, sorry if or sorry for, pardon the Eye Chart or this busy slide, forgive me if I appear worried, or I'm really nervous, and I'm not good at public speaking, I'm not a speaker, or I've never done this before.

Please don't use these phrases: next slide, I didn't have enough time, I've been asked to speak about, or that's all I have.

We shouldn't make public speaking more difficult than it is. We shouldn't exacerbate a difficult issue. Better public speakers avoid these words and phrases.

“Remember not only to say the right thing in the right place, but far more difficult still, to leave unsaid the wrong thing at the tempting moment.” — Benjamin Franklin, Founding Father

This is a summary. See the original post here.

You might also like

Jeff Scallop

3 years ago

The Age of Decentralized Capitalism and DeFi

DeCap is DeFi's killer app.

“Software is eating the world.” Marc Andreesen, venture capitalist

DeFi. Imagine a blockchain-based alternative financial system that offers the same products and services as traditional finance, but with more variety, faster, more secure, lower cost, and simpler access.

Decentralised finance (DeFi) is a marketplace without gatekeepers or central authority managing the flow of money, where customers engage directly with smart contracts running on a blockchain.

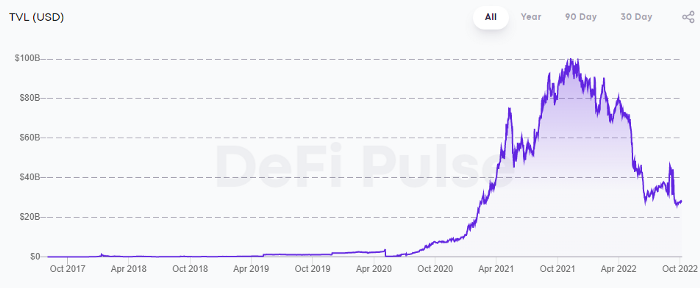

DeFi grew exponentially in 2020/21, with Total Value Locked (an inadequate estimate for market size) topping at $100 billion. After that, it crashed.

The accumulation of funds by individuals with high discretionary income during the epidemic, the novelty of crypto trading, and the high yields given (5% APY for stablecoins on established platforms to 100%+ for risky assets) are among the primary elements explaining this exponential increase.

No longer your older brothers DeFi

Since transactions are anonymous, borrowers had to overcollateralize DeFi 1.0. To borrow $100 in stablecoins, you must deposit $150 in ETH. DeFi 1.0's business strategy raises two problems.

Why does DeFi offer interest rates that are higher than those of the conventional financial system?;

Why would somebody put down more cash than they intended to borrow?

Maxed out on their own resources, investors took loans to acquire more crypto; the demand for those loans raised DeFi yields, which kept crypto prices increasing; as crypto prices rose, investors made a return on their positions, allowing them to deposit more money and borrow more crypto.

This is a bull market game. DeFi 1.0's overcollateralization speculation is dead. Cryptocrash sank it.

The “speculation by overcollateralisation” world of DeFi 1.0 is dead

At a JP Morgan digital assets conference, institutional investors were more interested in DeFi than crypto or fintech. To me, that shows DeFi 2.0's institutional future.

DeFi 2.0 protocols must handle KYC/AML, tax compliance, market abuse, and cybersecurity problems to be institutional-ready.

Stablecoins gaining market share under benign regulation and more CBDCs coming online in the next couple of years could help DeFi 2.0 separate from crypto volatility.

DeFi 2.0 will have a better footing to finally decouple from crypto volatility

Then we can transition from speculation through overcollateralization to DeFi's genuine comparative advantages: cheaper transaction costs, near-instant settlement, more efficient price discovery, faster time-to-market for financial innovation, and a superior audit trail.

Akin to Amazon for financial goods

Amazon decimated brick-and-mortar shops by offering millions of things online, warehouses by keeping just-in-time inventory, and back-offices by automating invoicing and payments. Software devoured retail. DeFi will eat banking with software.

DeFi is the Amazon for financial items that will replace fintech. Even the most advanced internet brokers offer only 100 currency pairings and limited bonds, equities, and ETFs.

Old banks settlement systems and inefficient, hard-to-upgrade outdated software harm them. For advanced gamers, it's like driving an F1 vehicle on dirt.

It is like driving a F1 car on a dirt road, for the most sophisticated players

Central bankers throughout the world know how expensive and difficult it is to handle cross-border payments using the US dollar as the reserve currency, which is vulnerable to the economic cycle and geopolitical tensions.

Decentralization is the only method to deliver 24h global financial markets. DeFi 2.0 lets you buy and sell startup shares like Google or Tesla. VC funds will trade like mutual funds. Or create a bundle coverage for your car, house, and NFTs. Defi 2.0 consumes banking and creates Global Wall Street.

Defi 2.0 is how software eats banking and delivers the global Wall Street

Decentralized Capitalism is Emerging

90% of markets are digital. 10% is hardest to digitalize. That's money creation, ID, and asset tokenization.

90% of financial markets are already digital. The only problem is that the 10% left is the hardest to digitalize

Debt helped Athens construct a powerful navy that secured trade routes. Bonds financed the Renaissance's wars and supply chains. Equity fueled industrial growth. FX drove globalization's payments system. DeFi's plans:

If the 20th century was a conflict between governments and markets over economic drivers, the 21st century will be between centralized and decentralized corporate structures.

Offices vs. telecommuting. China vs. onshoring/friendshoring. Oil & gas vs. diverse energy matrix. National vs. multilateral policymaking. DAOs vs. corporations Fiat vs. crypto. TradFi vs.

An age where the network effects of the sharing economy will overtake the gains of scale of the monopolistic competition economy

This is the dawn of Decentralized Capitalism (or DeCap), an age where the network effects of the sharing economy will reach a tipping point and surpass the scale gains of the monopolistic competition economy, further eliminating inefficiencies and creating a more robust economy through better data and automation. DeFi 2.0 enables this.

DeFi needs to pay the piper now.

DeCap won't be Web3.0's Shangri-La, though. That's too much for an ailing Atlas. When push comes to shove, DeFi folks want to survive and fight another day for the revolution. If feasible, make a tidy profit.

Decentralization wasn't meant to circumvent regulation. It circumvents censorship. On-ramp, off-ramp measures (control DeFi's entry and exit points, not what happens in between) sound like a good compromise for DeFi 2.0.

The sooner authorities realize that DeFi regulation is made ex-ante by writing code and constructing smart contracts with rules, the faster DeFi 2.0 will become the more efficient and safe financial marketplace.

More crucially, we must boost system liquidity. DeFi's financial stability risks are downplayed. DeFi must improve its liquidity management if it's to become mainstream, just as banks rely on capital constraints.

This reveals the complex and, frankly, inadequate governance arrangements for DeFi protocols. They redistribute control from tokenholders to developers, which is bad governance regardless of the economic model.

But crypto can only ride the existing banking system for so long before forming its own economy. DeFi will upgrade web2.0's financial rails till then.

Boris Müller

3 years ago

Why Do Websites Have the Same Design?

My kids redesigned the internet because it lacks inventiveness.

Internet today is bland. Everything is generic: fonts, layouts, pages, and visual language. Microtypography is messy.

Web design today seems dictated by technical and ideological constraints rather than creativity and ideas. Text and graphics are in containers on every page. All design is assumed.

Ironically, web technologies can design a lot. We can execute most designs. We make shocking, evocative websites. Experimental typography, generating graphics, and interactive experiences are possible.

Even designer websites use containers in containers. Dribbble and Behance, the two most popular creative websites, are boring. Lead image.

How did this happen?

Several reasons. WordPress and other blogging platforms use templates. These frameworks build web pages by combining graphics, headlines, body content, and videos. Not designs, templates. These rules combine related data types. These platforms don't let users customize pages beyond the template. You filled the template.

Templates are content-neutral. Thus, the issue.

Form should reflect and shape content, which is a design principle. Separating them produces content containers. Templates have no design value.

One of the fundamental principles of design is a deep and meaningful connection between form and content.

Web design lacks imagination for many reasons. Most are pragmatic and economic. Page design takes time. Large websites lack the resources to create a page from scratch due to the speed of internet news and the frequency of new items. HTML, JavaScript, and CSS continue to challenge web designers. Web design can't match desktop publishing's straightforward operations.

Designers may also be lazy. Mobile-first, generic, framework-driven development tends to ignore web page visual and contextual integrity.

How can we overcome this? How might expressive and avant-garde websites look today?

Rediscovering the past helps design the future.

'90s-era web design

At the University of the Arts Bremen's research and development group, I created my first website 23 years ago. Web design was trendy. Young web. Pages inspired me.

We struggled with HTML in the mid-1990s. Arial, Times, and Verdana were the only web-safe fonts. Anything exciting required table layouts, monospaced fonts, or GIFs. HTML was originally content-driven, thus we had to work against it to create a page.

Experimental typography was booming. Designers challenged the established quo from Jan Tschichold's Die Neue Typographie in the twenties to April Greiman's computer-driven layouts in the eighties. By the mid-1990s, an uncommon confluence of technological and cultural breakthroughs enabled radical graphic design. Irma Boom, David Carson, Paula Scher, Neville Brody, and others showed it.

Early web pages were dull compared to graphic design's aesthetic explosion. The Web Design Museum shows this.

Nobody knew how to conduct browser-based graphic design. Web page design was undefined. No standards. No CMS (nearly), CSS, JS, video, animation.

Now is as good a time as any to challenge the internet’s visual conformity.

In 2018, everything is browser-based. Massive layouts to micro-typography, animation, and video. How do we use these great possibilities? Containerized containers. JavaScript-contaminated mobile-first pages. Visually uniform templates. Web design 23 years later would disappoint my younger self.

Our imagination, not technology, restricts web design. We're too conformist to aesthetics, economics, and expectations.

Crisis generates opportunity. Challenge online visual conformity now. I'm too old and bourgeois to develop a radical, experimental, and cutting-edge website. I can ask my students.

I taught web design at the Potsdam Interface Design Programme in 2017. Each team has to redesign a website. Create expressive, inventive visual experiences on the browser. Create with contemporary web technologies. Avoid usability, readability, and flexibility concerns. Act. Ignore Erwartungskonformität.

The class outcome pleased me. This overview page shows all results. Four diverse projects address the challenge.

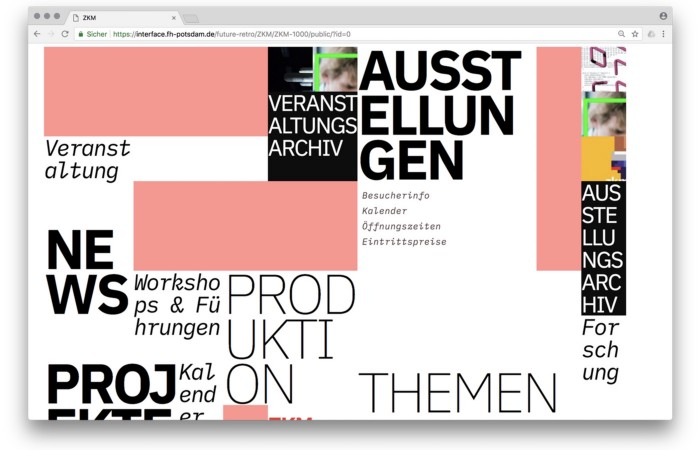

1. ZKM by Frederic Haase and Jonas Köpfer

Frederic and Jonas began their experiments on the ZKM website. The ZKM is Germany's leading media art exhibition location, but its website remains conventional. It's useful but not avant-garde like the shows' art.

Frederic and Jonas designed the ZKM site's concept, aesthetic language, and technical configuration to reflect the museum's progressive approach. A generative design engine generates new layouts for each page load.

ZKM redesign.

2. Streem by Daria Thies, Bela Kurek, and Lucas Vogel

Street art magazine Streem. It promotes new artists and societal topics. Streem includes artwork, painting, photography, design, writing, and journalism. Daria, Bela, and Lucas used these influences to develop a conceptual metropolis. They designed four neighborhoods to reflect magazine sections for their prototype. For a legible city, they use powerful illustrative styles and spatial typography.

Streem makeover.

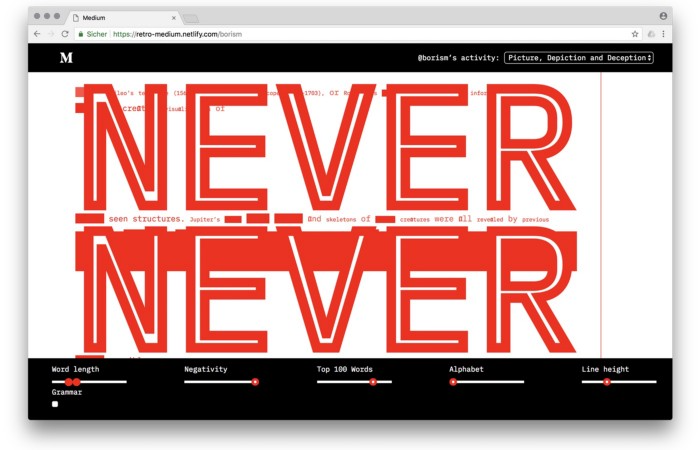

3. Medium by Amelie Kirchmeyer and Fabian Schultz

Amelie and Fabian structured. Instead of developing a form for a tale, they dissolved a web page into semantic, syntactical, and statistical aspects. HTML's flexibility was their goal. They broke Medium posts into experimental typographic space.

Medium revamp.

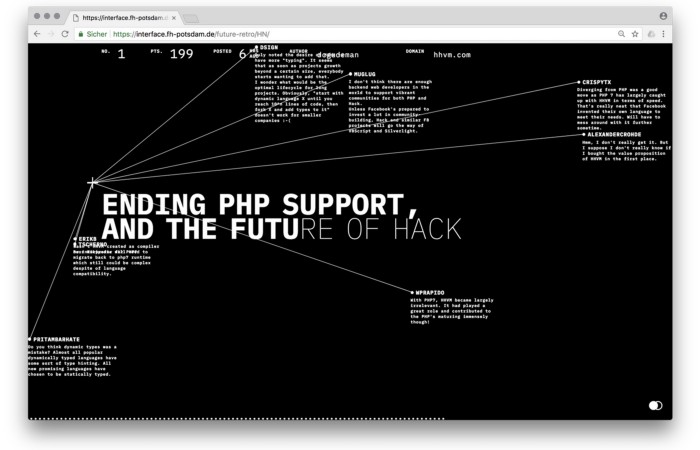

4. Hacker News by Fabian Dinklage and Florian Zia

Florian and Fabian made Hacker News interactive. The social networking site aggregates computer science and IT news. Its voting and debate features are extensive despite its simple style. Fabian and Florian transformed the structure into a typographic timeline and network area. News and comments sequence and connect the visuals. To read Hacker News, they connected their design to the API. Hacker News makeover.

Communication is not legibility, said Carson. Apply this to web design today. Modern websites must be legible, usable, responsive, and accessible. They shouldn't limit its visual palette. Visual and human-centered design are not stereotypes.

I want radical, generative, evocative, insightful, adequate, content-specific, and intelligent site design. I want to rediscover web design experimentation. More surprises please. I hope the web will appear different in 23 years.

Update: this essay has sparked a lively discussion! I wrote a brief response to the debate's most common points: Creativity vs. Usability

Nick

3 years ago

This Is How Much Quora Paid Me For 23 Million Content Views

You’ll be surprised; I sure was

Blogging and writing online as a side income has now been around for a significant amount of time. Nowadays, it is a continuously rising moneymaker for prospective writers, with several writing platforms existing online. At the top of the list are Medium, Vocal Media, Newsbreak, and the biggest one of them, Quora, with 300 million active users.

Quora, unlike Medium, is a question-and-answer format platform. On Medium you are permitted to write what you want, while on Quora, you answer questions on topics that you have expertise about. Quora, like Medium, now compensates its authors for the answers they provide in comparison to the previous, in which you had to be admitted to the partner program and were paid to ask questions.

Quora just recently went live with this new partner program, Quora Plus, and the way it works is that it is a subscription for $5 a month which provides you access to metered/monetized stories, in turn compensating the writers for part of that subscription for their answers.

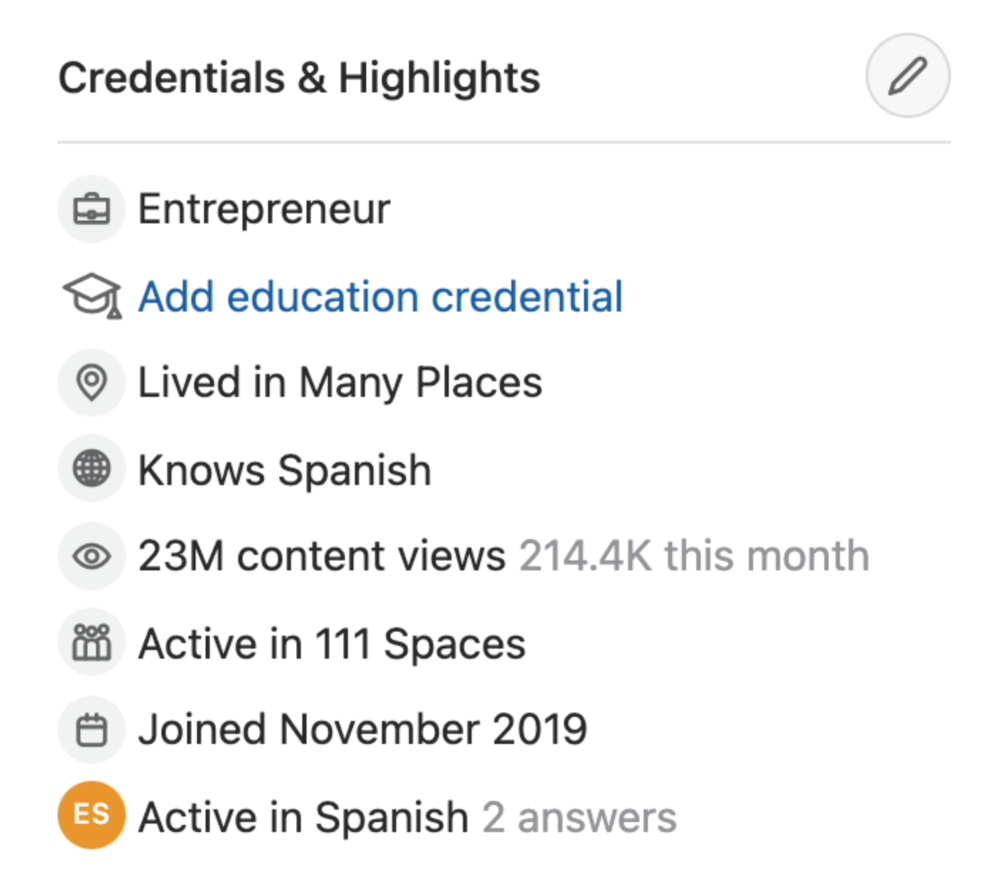

I too on Quora have found a lot of success on the platform, gaining 23 Million Content Views, and 300,000 followers for my space, which is kind of the Quora equivalent of a Medium article. The way in which I was able to do this was entirely thanks to a hack that I uncovered to the Quora algorithm.

In this article, I plan on discussing how much money I received from 23 million content views on Quora, and I bet you’ll be shocked; I know I was.

A Brief Explanation of How I Got 23 Million Views and How You Can Do It Too

On Quora, everything in terms of obtaining views is about finding the proper question, which I only understood quite late into the game. I published my first response in 2019 but never actually wrote on Quora until the summer of 2020, and about a month into posting consistently I found out how to find the perfect question. Here’s how:

The Process

Go to your Home Page and start scrolling… While browsing, check for the following things…

Answers from people you follow or your followers.

Advertisements

These two things are the two things you want to ignore, you don’t want to answer those questions or look at the ads. You should now be left with a couple of recommended answers. To discover which recommended answer is the best to answer as well, look at these three important aspects.

Date of the answer: Was it in the past few days, preferably 2–3 days, even better, past 24 hours?

Views: Are they in the ten thousands or hundred thousands?

Upvotes: Are they in the hundreds or thousands?

Now, choose an answer to a question which you think you could answer as well that satisfies the requirements above. Once you click on it, as all answers on Quora works, it will redirect you to the page for that question, in which you will have to select once again if you should answer the question.

Amount of answers: How many responses are there to the given question? This tells you how much competition you have. My rule is beyond 25 answers, you shouldn’t answer, but you can change it anyway you’d like.

Answerers: Who did the answering for the question? If the question includes a bunch of renowned, extremely well-known people on Quora, there’s a good possibility your essay is going to get drowned out.

Views: Check for a constant quantity of high views on each answer for the question; this is what will guarantee that your answer gets a lot of views!

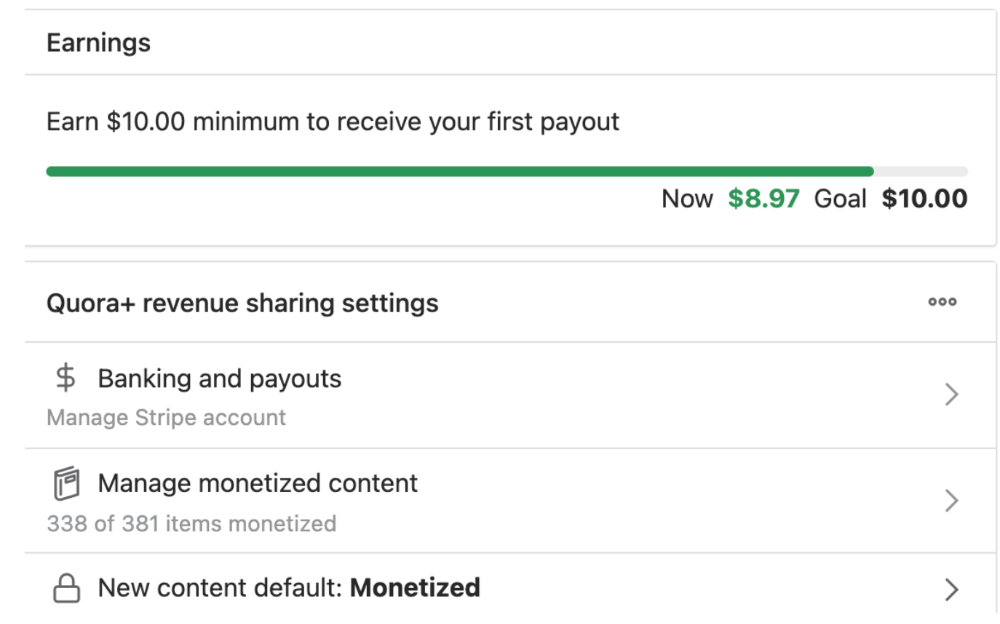

The Income Reveal! How Much I Made From 23 Million Content Views

DRUM ROLL, PLEASE!

8.97 USD. Yes, not even ten dollars, not even nine. Just eight dollars and ninety-seven cents.

Possible Reasons for My Low Earnings

Quora Plus and the answering partner program are newer than my Quora views.

Few people use Quora+, therefore revenues are low.

I haven't been writing much on Quora, so I'm only making money from old answers and a handful since Quora Plus launched.

Quora + pays poorly...

Should You Try Quora and Quora For Money?

My answer depends on your needs. I never got invited to Quora's question partner program due to my late start, but other writers have made hundreds. Due to Quora's new and competitive answering partner program, you may not make much money.

If you want a fun writing community, try Quora. Quora was fun when I only made money from my space. Quora +'s paywalls and new contributors eager to make money have made the platform less fun for me.

This article is a summary to save you time. You can read my full, more detailed article, here.