More on Entrepreneurship/Creators

Jayden Levitt

3 years ago

Billionaire who was disgraced lost his wealth more quickly than anyone in history

If you're not genuine, you'll be revealed.

Sam Bankman-Fried (SBF) was called the Cryptocurrency Warren Buffet.

No wonder.

SBF's trading expertise, Blockchain knowledge, and ability to construct FTX attracted mainstream investors.

He had a fantastic worldview, donating much of his riches to charity.

As the onion layers peel back, it's clear he wasn't the altruistic media figure he portrayed.

SBF's mistakes were disastrous.

Customer deposits were traded and borrowed by him.

With ten other employees, he shared a $40 million mansion where they all had polyamorous relationships.

Tone-deaf and wasteful marketing expenditures, such as the $200 million spent to change the name of the Miami Heat stadium to the FTX Arena

Democrats received a $40 million campaign gift.

And now there seems to be no regret.

FTX was a 32-billion-dollar cryptocurrency exchange.

It went bankrupt practically overnight.

SBF, FTX's creator, exploited client funds to leverage trade.

FTX had $1 billion in customer withdrawal reserves against $9 billion in liabilities in sister business Alameda Research.

Bloomberg Billionaire Index says it's the largest and fastest net worth loss in history.

It gets worse.

SBF's net worth is $900 Million, however he must still finalize FTX's bankruptcy.

SBF's arrest in the Bahamas and SEC inquiry followed news that his cryptocurrency exchange had crashed, losing billions in customer deposits.

A journalist contacted him on Twitter D.M., and their exchange is telling.

His ideas are revealed.

Kelsey Piper says they didn't expect him to answer because people under investigation don't comment.

Bankman-Fried wanted to communicate, and the interaction shows he has little remorse.

SBF talks honestly about FTX gaming customers' money and insults his competition.

Reporter Kelsey Piper was outraged by what he said and felt the mistakes SBF says plague him didn't evident in the messages.

Before FTX's crash, SBF was a poster child for Cryptocurrency regulation and avoided criticizing U.S. regulators.

He tells Piper that his lobbying is just excellent PR.

It shows his genuine views and supports cynics' opinions that his attempts to win over U.S. authorities were good for his image rather than Crypto.

SBF’s responses are in Grey, and Pipers are in Blue.

It's unclear if SBF cut corners for his gain. In their Twitter exchange, Piper revisits an interview question about ethics.

SBF says, "All the foolish sh*t I said"

SBF claims FTX has never invested customer monies.

Piper challenged him on Twitter.

While he insisted FTX didn't use customer deposits, he said sibling business Alameda borrowed too much from FTX's balance sheet.

He did, basically.

When consumers tried to withdraw money, FTX was short.

SBF thought Alameda had enough money to cover FTX customers' withdrawals, but life sneaks up on you.

SBF believes most exchanges have done something similar to FTX, but they haven't had a bank run (a bunch of people all wanting to get their deposits out at the same time).

SBF believes he shouldn't have consented to the bankruptcy and kept attempting to raise more money because withdrawals would be open in a month with clients whole.

If additional money came in, he needed $8 billion to bridge the creditors' deficit, and there aren't many corporations with $8 billion to spare.

Once clients feel protected, they will continue to leave their assets on the exchange, according to one idea.

Kevin OLeary, a world-renowned hedge fund manager, says not all investors will walk through the open gate once the company is safe, therefore the $8 Billion wasn't needed immediately.

SBF claims the bankruptcy was his biggest error because he could have accumulated more capital.

Final Reflections

Sam Bankman-Fried, 30, became the world's youngest billionaire in four years.

Never listen to what people say about investing; watch what they do.

SBF is a trader who gets wrecked occasionally.

Ten first-time entrepreneurs ran FTX, screwing each other with no risk management.

It prevents opposing or challenging perspectives and echo chamber highs.

Twitter D.M. conversation with a journalist is the final nail.

He lacks an experienced crew.

This event will surely speed up much-needed regulation.

It's also prompted cryptocurrency exchanges to offer proof of reserves to calm customers.

Sanjay Priyadarshi

3 years ago

Meet a Programmer Who Turned Down Microsoft's $10,000,000,000 Acquisition Offer

Failures inspire young developers

Jason citron created many products.

These products flopped.

Microsoft offered $10 billion for one of these products.

He rejected the offer since he was so confident in his success.

Let’s find out how he built a product that is currently valued at $15 billion.

Early in his youth, Jason began learning to code.

Jason's father taught him programming and IT.

His father wanted to help him earn money when he needed it.

Jason created video games and websites in high school.

Jason realized early on that his IT and programming skills could make him money.

Jason's parents misjudged his aptitude for programming.

Jason frequented online programming communities.

He looked for web developers. He created websites for those people.

His parents suspected Jason sold drugs online. When he said he used programming to make money, they were shocked.

They helped him set up a PayPal account.

Florida higher education to study video game creation

Jason never attended an expensive university.

He studied game design in Florida.

“Higher Education is an interesting part of society… When I work with people, the school they went to never comes up… only thing that matters is what can you do…At the end of the day, the beauty of silicon valley is that if you have a great idea and you can bring it to the life, you can convince a total stranger to give you money and join your project… This notion that you have to go to a great school didn’t end up being a thing for me.”

Jason's life was altered by Steve Jobs' keynote address.

After graduating, Jason joined an incubator.

Jason created a video-dating site first.

Bad idea.

Nobody wanted to use it when it was released, so they shut it down.

He made a multiplayer game.

It was released on Bebo. 10,000 people played it.

When Steve Jobs unveiled the Apple app store, he stopped playing.

The introduction of the app store resembled that of a new gaming console.

Jason's life altered after Steve Jobs' 2008 address.

“Whenever a new video game console is launched, that’s the opportunity for a new video game studio to get started, it’s because there aren’t too many games available…When a new PlayStation comes out, since it’s a new system, there’s only a handful of titles available… If you can be a launch title you can get a lot of distribution.”

Apple's app store provided a chance to start a video game company.

They released an app after 5 months of work.

Aurora Feint is the game.

Jason believed 1000 players in a week would be wonderful. A thousand players joined in the first hour.

Over time, Aurora Feints' game didn't gain traction. They don't make enough money to keep playing.

They could only make enough for one month.

Instead of buying video games, buy technology

Jason saw that they established a leaderboard, chat rooms, and multiplayer capabilities and believed other developers would want to use these.

They opted to sell the prior game's technology.

OpenFeint.

Assisting other game developers

They had no money in the bank to create everything needed to make the technology user-friendly.

Jason and Daniel designed a website saying:

“If you’re making a video game and want to have a drop in multiplayer support, you can use our system”

TechCrunch covered their website launch, and they gained a few hundred mailing list subscribers.

They raised seed funding with the mailing list.

Nearly all iPhone game developers started adopting the Open Feint logo.

“It was pretty wild… It was really like a whole social platform for people to play with their friends.”

What kind of a business model was it?

OpenFeint originally planned to make the software free for all games. As the game gained popularity, they demanded payment.

They later concluded it wasn't a good business concept.

It became free eventually.

Acquired for $104 million

Open Feint's users and employees grew tremendously.

GREE bought OpenFeint for $104 million in April 2011.

GREE initially committed to helping Jason and his team build a fantastic company.

Three or four months after the acquisition, Jason recognized they had a different vision.

He quit.

Jason's Original Vision for the iPad

Jason focused on distribution in 2012 to help businesses stand out.

The iPad market and user base were growing tremendously.

Jason said the iPad may replace mobile gadgets.

iPad gamers behaved differently than mobile gamers.

People sat longer and experienced more using an iPad.

“The idea I had was what if we built a gaming business that was more like traditional video games but played on tablets as opposed to some kind of mobile game that I’ve been doing before.”

Unexpected insight after researching the video game industry

Jason learned from studying the gaming industry that long-standing companies had advantages beyond a single release.

Previously, long-standing video game firms had their own distribution system. This distribution strategy could buffer time between successful titles.

Sony, Microsoft, and Valve all have gaming consoles and online stores.

So he built a distribution system.

He created a group chat app for gamers.

He envisioned a team-based multiplayer game with text and voice interaction.

His objective was to develop a communication network, release more games, and start a game distribution business.

Remaking the video game League of Legends

Jason and his crew reimagined a League of Legends game mode for 12-inch glass.

They adapted the game for tablets.

League of Legends was PC-only.

So they rebuilt it.

They overhauled the game and included native mobile experiences to stand out.

Hammer and Chisel was the company's name.

18 people worked on the game.

The game was funded. The game took 2.5 years to make.

Was the game a success?

July 2014 marked the game's release. The team's hopes were dashed.

Critics initially praised the game.

Initial installation was widespread.

The game failed.

As time passed, the team realized iPad gaming wouldn't increase much and mobile would win.

Jason was given a fresh idea by Stan Vishnevskiy.

Stan Vishnevskiy was a corporate engineer.

He told Jason about his plan to design a communication app without a game.

This concept seeded modern strife.

“The insight that he really had was to put a couple of dots together… we’re seeing our customers communicating around our own game with all these different apps and also ourselves when we’re playing on PC… We should solve that problem directly rather than needing to build a new game…we should start making it on PC.”

So began Discord.

Online socializing with pals was the newest trend.

Jason grew up playing video games with his friends.

He never played outside.

Jason had many great moments playing video games with his closest buddy, wife, and brother.

Discord was about providing a location for you and your group to speak and hang out.

Like a private cafe, bedroom, or living room.

Discord was developed for you and your friends on computers and phones.

You can quickly call your buddies during a game to conduct a conference call. Put the call on speaker and talk while playing.

Discord wanted to give every player a unique experience. Because coordinating across apps was a headache.

The entire team started concentrating on Discord.

Jason decided Hammer and Chisel would focus on their chat app.

Jason didn't want to make a video game.

How Discord attracted the appropriate attention

During the first five months, the entire team worked on the game and got feedback from friends.

This ensures product improvement. As a result, some teammates' buddies started utilizing Discord.

The team knew it would become something, but the result was buggy. App occasionally crashed.

Jason persuaded a gamer friend to write on Reddit about the software.

New people would find Discord. Why not?

Reddit users discovered Discord and 50 started using it frequently.

Discord was launched.

Rejecting the $10 billion acquisition proposal

Discord has increased in recent years.

It sends billions of messages.

Discord's users aren't tracked. They're privacy-focused.

Purchase offer

Covid boosted Discord's user base.

Weekly, billions of messages were transmitted.

Microsoft offered $10 billion for Discord in 2021.

Jason sold Open Feint for $104m in 2011.

This time, he believed in the product so much that he rejected Microsoft's offer.

“I was talking to some people in the team about which way we could go… The good thing was that most of the team wanted to continue building.”

Last time, Discord was valued at $15 billion.

Discord raised money on March 12, 2022.

The $15 billion corporation raised $500 million in 2021.

Sammy Abdullah

3 years ago

SaaS payback period data

It's ok and even desired to be unprofitable if you're gaining revenue at a reasonable cost and have 100%+ net dollar retention, meaning you never lose customers and expand them. To estimate the acceptable cost of new SaaS revenue, we compare new revenue to operating loss and payback period. If you pay back the customer acquisition cost in 1.5 years and never lose them (100%+ NDR), you're doing well.

To evaluate payback period, we compared new revenue to net operating loss for the last 73 SaaS companies to IPO since October 2017. (55 out of 73). Here's the data. 1/(new revenue/operating loss) equals payback period. New revenue/operating loss equals cost of new revenue.

Payback averages a year. 55 SaaS companies that weren't profitable at IPO got a 1-year payback. Outstanding. If you pay for a customer in a year and never lose them (100%+ NDR), you're establishing a valuable business. The average was 1.3 years, which is within the 1.5-year range.

New revenue costs $0.96 on average. These SaaS companies lost $0.96 every $1 of new revenue last year. Again, impressive. Average new revenue per operating loss was $1.59.

Loss-in-operations definition. Operating loss revenue COGS S&M R&D G&A (technical point: be sure to use the absolute value of operating loss). It's wrong to only consider S&M costs and ignore other business costs. Operating loss and new revenue are measured over one year to eliminate seasonality.

Operating losses are desirable if you never lose a customer and have a quick payback period, especially when SaaS enterprises are valued on ARR. The payback period should be under 1.5 years, the cost of new income < $1, and net dollar retention 100%.

You might also like

Jayden Levitt

3 years ago

Starbucks' NFT Project recently defeated its rivals.

The same way Amazon killed bookstores. You just can’t see it yet.

Shultz globalized coffee. Before Starbucks, coffee sucked.

All accounts say 1970s coffee was awful.

Starbucks had three stores selling ground Indonesian coffee in the 1980s.

What a show!

A year after joining the company at 29, Shultz traveled to Italy for R&D.

He noticed the coffee shops' sense of theater and community and realized Starbucks was in the wrong business.

Integrating coffee and destination created a sense of community in the store.

Brilliant!

He told Starbucks' founders about his experience.

They disapproved.

For two years.

Shultz left and opened an Italian coffee shop chain like any good entrepreneur.

Starbucks ran into financial trouble, so the founders offered to sell to Shultz.

Shultz bought Starbucks in 1987 for $3.8 million, including six stores and a payment plan.

Starbucks is worth $100.79Billion, per Google Finance.

26,500 times Shultz's initial investment

Starbucks is releasing its own NFT Platform under Shultz and his early Vision.

This year, Starbucks Odyssey launches. The new digital experience combines a Loyalty Rewards program with NFT.

The side chain Polygon-based platform doesn't require a Crypto Wallet. Customers can earn and buy digital assets to unlock incentives and experiences.

They've removed all friction, making it more immersive and convenient than a coffee shop.

Brilliant!

NFTs are the access coupon to their digital community, but they don't highlight the technology.

They prioritize consumer experience by adding non-technical users to Web3. Their collectables are called journey stamps, not NFTs.

No mention of bundled gas fees.

Brady Brewer, Starbucks' CMO, said;

“It happens to be built on blockchain and web3 technologies, but the customer — to be honest — may very well not even know that what they’re doing is interacting with blockchain technology. It’s just the enabler,”

Rewards members will log into a web app using their loyalty program credentials to access Starbucks Odyssey. They won't know about blockchain transactions.

Starbucks has just dealt its rivals a devastating blow.

It generates more than ten times the revenue of its closest competitor Costa Coffee.

The coffee giant is booming.

Starbucks is ahead of its competitors. No wonder.

They have an innovative, adaptable leadership team.

Starbucks' DNA challenges the narrative, especially when others reject their ideas.

I’m off for a cappuccino.

William Anderson

3 years ago

When My Remote Leadership Skills Took Off

4 Ways To Manage Remote Teams & Employees

The wheels hit the ground as I landed in Rochester.

Our six-person satellite office was now part of my team.

Their manager only reported to me the day before, but I had my ticket booked ahead of time.

I had managed remote employees before but this was different. Engineers dialed into headquarters for every meeting.

So when I learned about the org chart change, I knew a strong first impression would set the tone for everything else.

I was either their boss, or their boss's boss, and I needed them to know I was committed.

Managing a fleet of satellite freelancers or multiple offices requires treating others as more than just a face behind a screen.

You must comprehend each remote team member's perspective and daily interactions.

The good news is that you can start using these techniques right now to better understand and elevate virtual team members.

1. Make Visits To Other Offices

If budgeted, visit and work from offices where teams and employees report to you. Only by living alongside them can one truly comprehend their problems with communication and other aspects of modern life.

2. Have Others Come to You

• Having remote, distributed, or satellite employees and teams visit headquarters every quarter or semi-quarterly allows the main office culture to rub off on them.

When remote team members visit, more people get to meet them, which builds empathy.

If you can't afford to fly everyone, at least bring remote managers or leaders. Hopefully they can resurrect some culture.

3. Weekly Work From Home

No home office policy?

Make one.

WFH is a team-building, problem-solving, and office-viewing opportunity.

For dial-in meetings, I started working from home on occasion.

It also taught me which teams “forget” or “skip” calls.

As a remote team member, you experience all the issues first hand.

This isn't as accurate for understanding teams in other offices, but it can be done at any time.

4. Increase Contact Even If It’s Just To Chat

Don't underestimate office banter.

Sometimes it's about bonding and trust, other times it's about business.

If you get all this information in real-time, please forward it.

Even if nothing critical is happening, call remote team members to check in and chat.

I guarantee that building relationships and rapport will increase both their job satisfaction and yours.

Isaiah McCall

3 years ago

Is TikTok slowly destroying a new generation?

It's kids' digital crack

TikTok is a destructive social media platform.

The interface shortens attention spans and dopamine receptors.

TikTok shares more data than other apps.

Seeing an endless stream of dancing teens on my glowing box makes me feel like a Blade Runner extra.

TikTok did in one year what MTV, Hollywood, and Warner Music tried to do in 20 years. TikTok has psychotized the two-thirds of society Aldous Huxley said were hypnotizable.

Millions of people, mostly kids, are addicted to learning a new dance, lip-sync, or prank, and those who best dramatize this collective improvisation get likes, comments, and shares.

TikTok is a great app. So what?

The Commercial Magnifying Glass TikTok made me realize my generation's time was up and the teenage Zoomers were the target.

I told my 14-year-old sister, "Enjoy your time under the commercial magnifying glass."

TikTok sells your every move, gesture, and thought. Data is the new oil. If you tell someone, they'll say, "Yeah, they collect data, but who cares? I have nothing to hide."

It's a George Orwell novel's beginning. Look up Big Brother Award winners to see if TikTok won.

TikTok shares your data more than any other social media app, and where it goes is unclear. TikTok uses third-party trackers to monitor your activity after you leave the app.

Consumers can't see what data is shared or how it will be used. — Genius URL

32.5 percent of Tiktok's users are 10 to 19 and 29.5% are 20 to 29.

TikTok is the greatest digital marketing opportunity in history, and they'll use it to sell you things, track you, and control your thoughts. Any of its users will tell you, "I don't care, I just want to be famous."

TikTok manufactures mental illness

TikTok's effect on dopamine and the brain is absurd. Dopamine controls the brain's pleasure and reward centers. It's like a switch that tells your brain "this feels good, repeat."

Dr. Julie Albright, a digital culture and communication sociologist, said TikTok users are "carried away by dopamine." It's hypnotic, you'll keep watching."

TikTok constantly releases dopamine. A guy on TikTok recently said he didn't like books because they were slow and boring.

The US didn't ban Tiktok.

Biden and Trump agree on bad things. Both agree that TikTok threatens national security and children's mental health.

The Chinese Communist Party owns and operates TikTok, but that's not its only problem.

There’s borderline child porn on TikTok

It's unsafe for children and violated COPPA.

It's also Chinese spyware. I'm not a Trump supporter, but I was glad he wanted TikTok regulated and disappointed when he failed.

Full-on internet censorship is rare outside of China, so banning it may be excessive. US should regulate TikTok more.

We must reject a low-quality present for a high-quality future.

TikTok vs YouTube

People got mad when I wrote about YouTube's death.

They didn't like when I said TikTok was YouTube's first real challenger.

Indeed. TikTok is the fastest-growing social network. In three years, the Chinese social media app TikTok has gained over 1 billion active users. In the first quarter of 2020, it had the most downloads of any app in a single quarter.

TikTok is the perfect social media app in many ways. It's brief and direct.

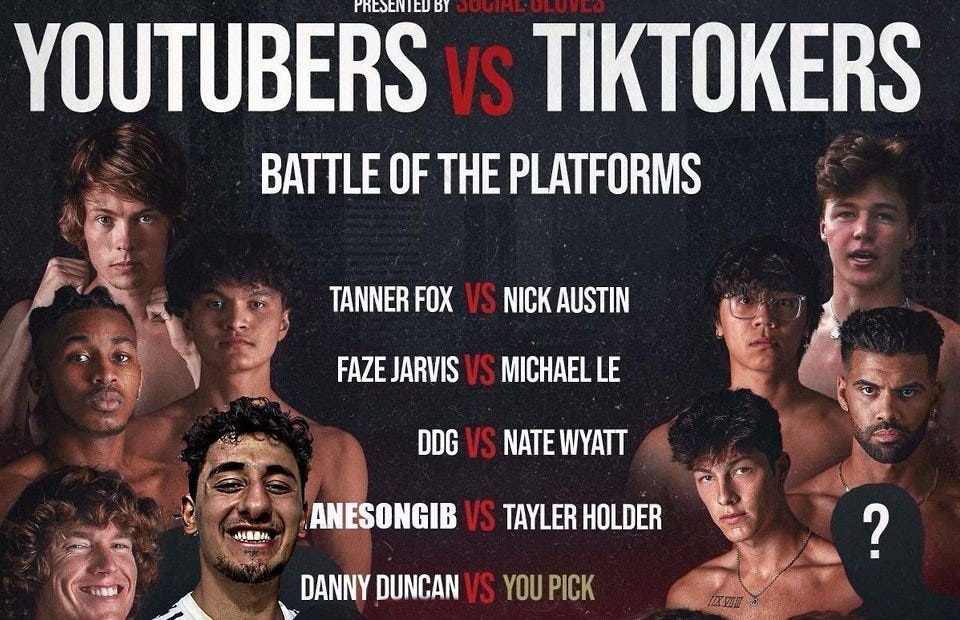

Can you believe they had a YouTube vs TikTok boxing match? We are doomed as a species.

YouTube hosts my favorite videos. That’s why I use it. That’s why you use it. New users expect more. They want something quicker, more addictive.

TikTok's impact on other social media platforms frustrates me. YouTube copied TikTok to compete.

It's all about short, addictive content.

I'll admit I'm probably wrong about TikTok. My friend says his feed is full of videos about food, cute animals, book recommendations, and hot lesbians.

Whatever.

TikTok makes us bad

TikTok is the opposite of what the Ancient Greeks believed about wisdom.

It encourages people to be fake. It's like a never-ending costume party where everyone competes.

It does not mean that Gen Z is doomed.

They could be the saviors of the world for all I know.

TikTok feels like a step towards Mike Judge's "Idiocracy," where the average person is a pleasure-seeking moron.