More on Entrepreneurship/Creators

Mircea Iosif

3 years ago

How To Start An Online Business That Will Be Profitable Without Investing A Lot Of Time

Don't know how to start an online business? Here's a guide. By following these recommendations, you can build a lucrative and profitable online business.

What Are Online Businesses Used For?

Most online businesses are websites. A self-created, self-managed website. You may sell things and services online.

To establish an internet business, you must locate a host and set up accounts with numerous companies. Once your accounts are set up, you may start publishing content and selling products or services.

How to Make Money from Your Online Business

Advertising and marketing are the best ways to make money online. You must develop strategies to contact new customers and generate leads. Make sure your website is search engine optimized so people can find you online.

Top 5 Online Business Tips for Startups:

1. Know your target audience's needs.

2. Make your website as appealing as possible.

3. Generate leads and sales with marketing.

4. Track your progress and learn from your mistakes to improve.

5. Be prepared to expand into new markets or regions.

How to Launch a Successful Online Business Without Putting in a Lot of Work

Build with a solid business model to start a profitable online business. By using these tips, you can start your online business without paying much.

First, develop a user-friendly website. You can use an internet marketing platform or create your own website. Once your website is live, optimize it for search engines and add relevant content.

Second, sell online. This can be done through ads or direct sales to website visitors. Finally, use social media to advertise your internet business. By accomplishing these things, you'll draw visitors to your website and make money.

When launching a business, invest long-term. This involves knowing your goals and how you'll pay for them. Volatility can have several effects on your business. If you offer things online, you may need to examine if the market is ready for them.

Invest wisely

Investing all your money in one endeavor can lead to too much risk and little ROI. Diversify your investments to take advantage of all available chances. So, your investments won't encounter unexpected price swings and you'll be immune to economic upheavals.

Financial news updates

When launching or running a thriving online business, financial news is crucial. By knowing current trends and upcoming developments, you can keep your business lucrative.

Keeping up with financial news can also help you avoid potential traps that could harm your bottom line. If you don't know about new legislation that could affect your industry, potential customers may choose another store when they learn about your business's problems.

Volatility ahead

You should expect volatility in the financial sector. Without a plan for coping with volatility, you could run into difficulty. If your organization relies on client input, you may not be able to exploit customer behavior shifts.

Your company could go bankrupt if you don't understand how fickle the stock market can be. By preparing for volatility, you can ensure your organization survives difficult times and market crashes.

Conclusion

Many internet businesses can be profitable. Start quickly with a few straightforward steps. Diversify your investments, follow financial news, and be prepared for volatility to develop a successful business.

Thanks for reading!

Ben Chino

3 years ago

100-day SaaS buildout.

We're opening up Maki through a series of Medium posts. We'll describe what Maki is building and how. We'll explain how we built a SaaS in 100 days. This isn't a step-by-step guide to starting a business, but a product philosophy to help you build quickly.

Focus on end-users.

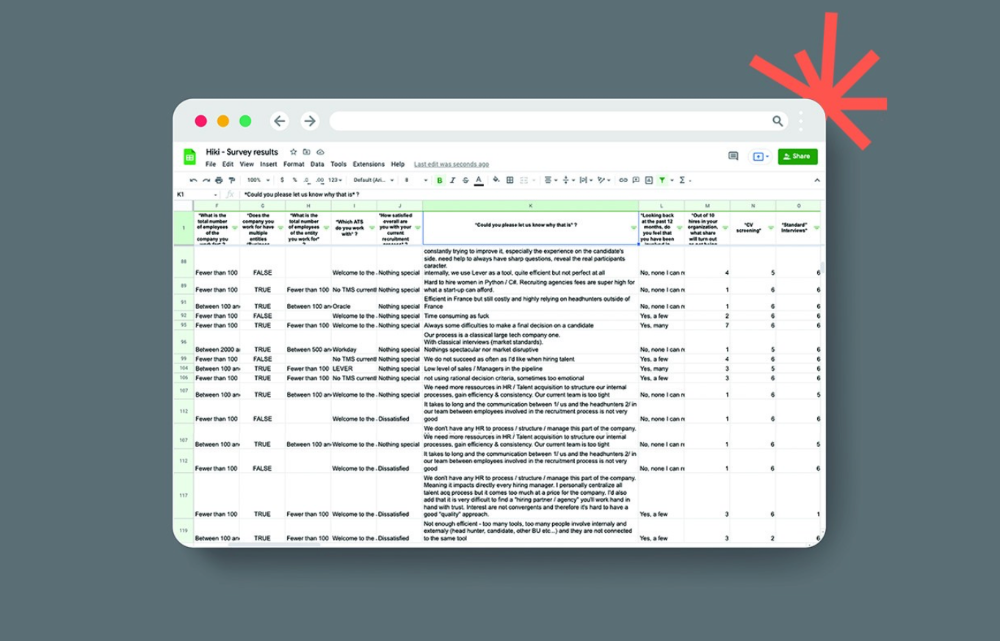

This may seem obvious, but it's important to talk to users first. When we started thinking about Maki, we interviewed 100 HR directors from SMBs, Next40 scale-ups, and major Enterprises to understand their concerns. We initially thought about the future of employment, but most of their worries centered on Recruitment. We don't have a clear recruiting process, it's time-consuming, we recruit clones, we don't support diversity, etc. And as hiring managers, we couldn't help but agree.

Co-create your product with your end-users.

We went to the drawing board, read as many books as possible (here, here, and here), and when we started getting a sense for a solution, we questioned 100 more operational HR specialists to corroborate the idea and get a feel for our potential answer. This confirmed our direction to help hire more objectively and efficiently.

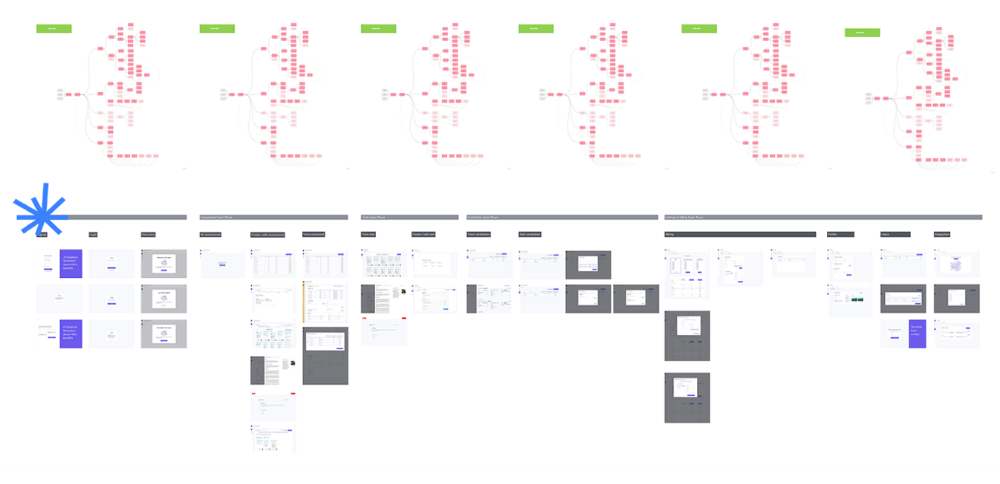

Back to the drawing board, we designed our first flows and screens. We organized sessions with certain survey respondents to show them our early work and get comments. We got great input that helped us build Maki, and we met some consumers. Obsess about users and execute alongside them.

Don’t shoot for the moon, yet. Make pragmatic choices first.

Once we were convinced, we began building. To launch a SaaS in 100 days, we needed an operating principle that allowed us to accelerate while still providing a reliable, secure, scalable experience. We focused on adding value and outsourced everything else. Example:

Concentrate on adding value. Reuse existing bricks.

When determining which technology to use, we looked at our strengths and the future to see what would last. Node.js for backend, React for frontend, both with typescript. We thought this technique would scale well since it would attract more talent and the surrounding mature ecosystem would help us go quicker.

We explored for ways to bootstrap services while setting down strong foundations that might support millions of users. We built our backend services on NestJS so we could extend into microservices later. Hasura, a GraphQL APIs engine, automates Postgres data exposing through a graphQL layer. MUI's ready-to-use components powered our design-system. We used well-maintained open-source projects to speed up certain tasks.

We outsourced important components of our platform (Auth0 for authentication, Stripe for billing, SendGrid for notifications) because, let's face it, we couldn't do better. We choose to host our complete infrastructure (SQL, Cloud run, Logs, Monitoring) on GCP to simplify our work between numerous providers.

Focus on your business, use existing bricks for the rest. For the curious, we'll shortly publish articles detailing each stage.

Most importantly, empower people and step back.

We couldn't have done this without the incredible people who have supported us from the start. Since Powership is one of our key values, we provided our staff the power to make autonomous decisions from day one. Because we believe our firm is its people, we hired smart builders and let them build.

Nicolas left Spendesk to create scalable interfaces using react-router, react-queries, and MUI. JD joined Swile and chose Hasura as our GraphQL engine. Jérôme chose NestJS to build our backend services. Since then, Justin, Ben, Anas, Yann, Benoit, and others have followed suit.

If you consider your team a collective brain, you should let them make decisions instead of directing them what to do. You'll make mistakes, but you'll go faster and learn faster overall.

Invest in great talent and develop a strong culture from the start. Here's how to establish a SaaS in 100 days.

Jenn Leach

3 years ago

How Much I Got Paid by YouTube for a 68 Million Views Video

My nameless, faceless channel case study

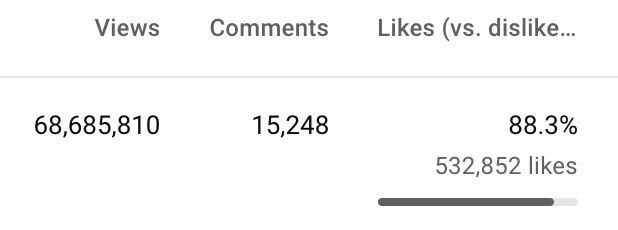

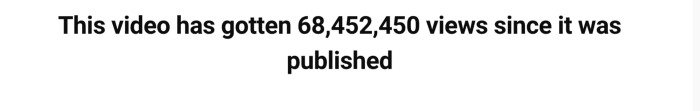

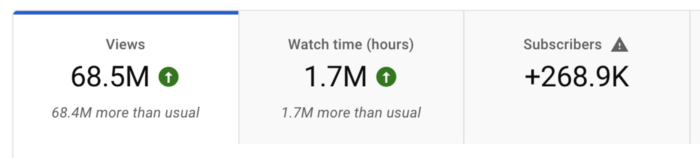

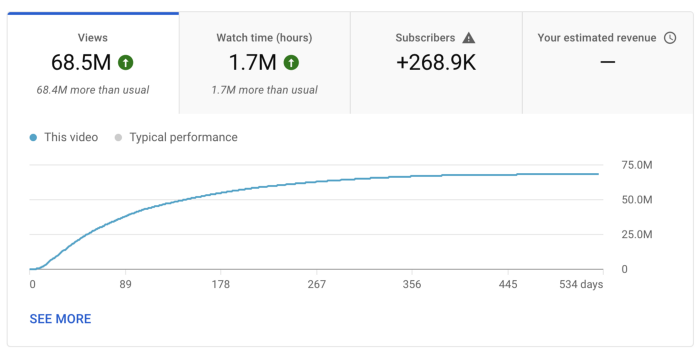

The Numbers

I anonymize this YouTube channel.

It's in a trendy, crowded niche. Sharing it publicly will likely enhance competition.

I'll still share my dashboard numbers:

A year ago, the video was released.

What I earned

I'll stop stalling. Here's a screenshot of my YouTube statistics page displaying Adsense profits.

YouTube Adsense made me ZERO dollars.

OMG!

How is this possible?

YouTube Adsense can't monetize my niche. This is typical in faceless niches like TikTok's rain videos. If they were started a while ago, I'm sure certain rain accounts are monetized, but not today.

I actually started a soothing sounds faceless YouTube channel. This was another account of mine.

I looped Pexels films for hours. No background music, just wind, rain, etc.

People could watch these videos to relax or get ready for bed. They're ideal for background noise and relaxation.

They're long-lasting, too. It's easy to make a lot from YouTube Adsense if you insert ads.

Anyway, I tried to monetize it and couldn’t. This was about a year ago. That’s why I doubt new accounts in this genre would be able to get approved for ads.

Back to my faceless channel with 68 million views.

I received nothing from YouTube Adsense, but I made money elsewhere.

Getting paid by the gods of affiliate marketing

Place links in the video and other videos on the channel to get money. Visitors that buy through your affiliate link earn you a commission.

This video earned many clicks on my affiliate links.

I linked to a couple of Amazon products, a YouTube creator tool, my kofi link, and my subscribe link.

Sponsorships

Brands pay you to include ads in your videos.

This video led to many sponsorships.

I've done dozens of sponsorship campaigns that paid $40 to $50 for an end screen to $450 for a preroll ad.

Last word

Overall, I made less than $3,000.

If I had time, I'd be more proactive with sponsorships. You can pitch brand sponsorships. This actually works.

I'd do that if I could rewind time.

I still can, but I think the reaction rate would be higher closer to the viral video's premiere date.

You might also like

Crypto Zen Monk

2 years ago

How to DYOR in the world of cryptocurrency

RESEARCH

We must create separate ideas and handle our own risks to be better investors. DYOR is crucial.

The only thing unsustainable is your cluelessness.

DYOR: Why

On social media, there is a lot of false information and divergent viewpoints. All of these facts might be accurate, but they might not be appropriate for your portfolio and investment preferences.

You become a more knowledgeable investor thanks to DYOR.

DYOR improves your portfolio's risk management.

My DYOR resources are below.

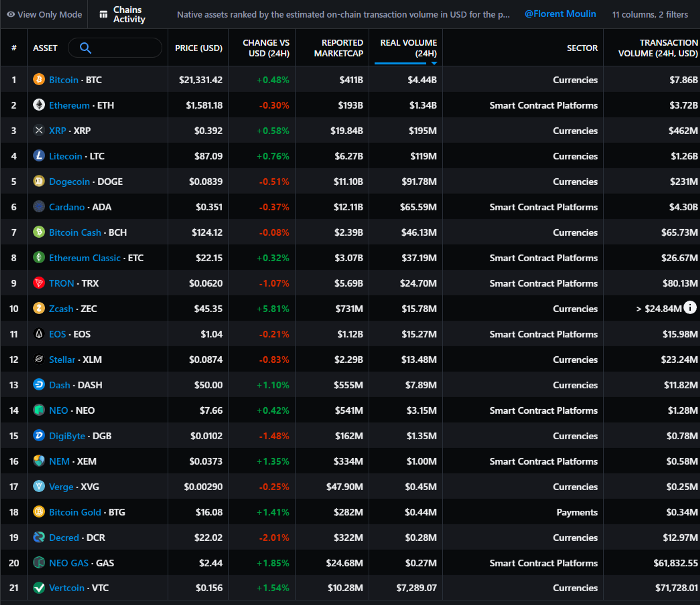

Messari: Major Blockchains' Activities

New York-based Messari provides cryptocurrency open data libraries.

Major blockchains offer 24-hour on-chain volume. https://messari.io/screener/most-active-chains-DB01F96B

What to do

Invest in stable cryptocurrencies. Sort Messari by Real Volume (24H) or Reported Market Cap.

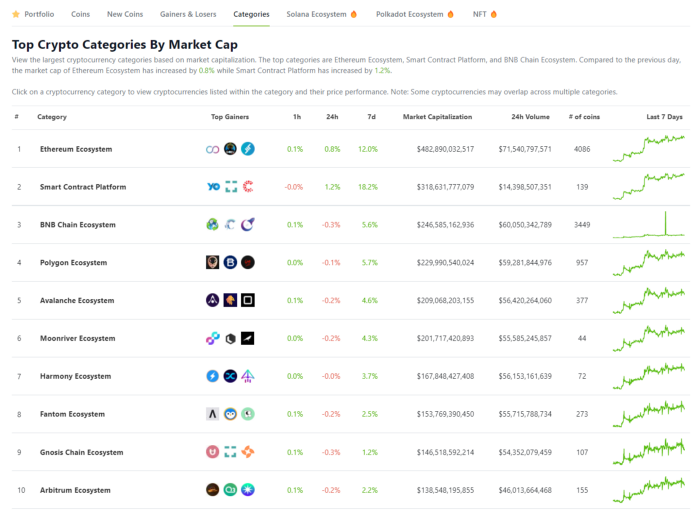

Coingecko: Research on Ecosystems

Top 10 Ecosystems by Coingecko are good.

What to do

Invest in quality.

Leading ten Ecosystems by Market Cap

There are a lot of coins in the ecosystem (second last column of above chart)

CoinGecko's Market Cap Crypto Categories Market capitalization-based cryptocurrency categories. Ethereum Ecosystem www.coingecko.com

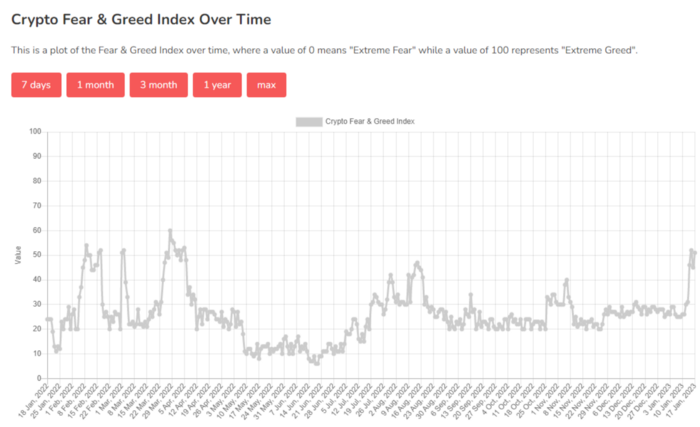

Fear & Greed Index for Bitcoin (FGI)

The Bitcoin market sentiment index ranges from 0 (extreme dread) to 100. (extreme greed).

How to Apply

See market sentiment:

Extreme fright = opportunity to buy

Extreme greed creates sales opportunity (market due for correction).

Glassnode

Glassnode gives facts, information, and confidence to make better Bitcoin, Ethereum, and cryptocurrency investments and trades.

Explore free and paid metrics.

Stock to Flow Ratio: Application

The popular Stock to Flow Ratio concept believes scarcity drives value. Stock to flow is the ratio of circulating Bitcoin supply to fresh production (i.e. newly mined bitcoins). The S/F Ratio has historically predicted Bitcoin prices. PlanB invented this metric.

Utilization: Ethereum Hash Rate

Ethereum miners produce an estimated number of hashes per second.

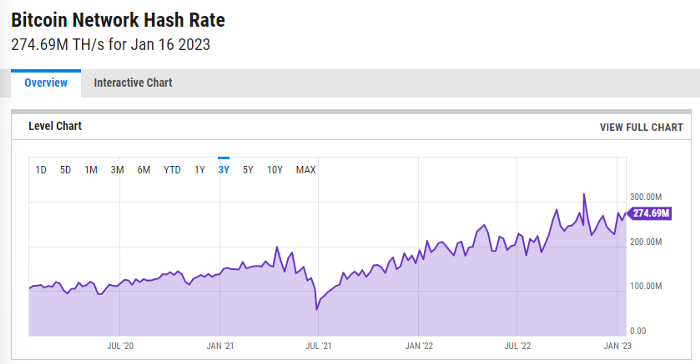

ycharts: Hash rate of the Bitcoin network

TradingView

TradingView is your go-to tool for investment analysis, watch lists, technical analysis, and recommendations from other traders/investors.

Research for a cryptocurrency project

Two key questions every successful project must ask: Q1: What is this project trying to solve? Is it a big problem or minor? Q2: How does this project make money?

Each cryptocurrency:

Check out the white paper.

check out the project's internet presence on github, twitter, and medium.

the transparency of it

Verify the team structure and founders. Verify their LinkedIn profile, academic history, and other qualifications. Search for their names with scam.

Where to purchase and use cryptocurrencies Is it traded on trustworthy exchanges?

From CoinGecko and CoinMarketCap, we may learn about market cap, circulations, and other important data.

The project must solve a problem. Solving a problem is the goal of the founders.

Avoid projects that resemble multi-level marketing or ponzi schemes.

Your use of social media

Use social media carefully or ignore it: Twitter, TradingView, and YouTube

Someone said this before and there are some truth to it. Social media bullish => short.

Your Behavior

Investigate. Spend time. You decide. Worth it!

Only you have the best interest in your financial future.

Shruti Mishra

3 years ago

How to get 100k profile visits on Twitter each month without spending a dime

As a marketer, I joined Twitter on August 31, 2022 to use it.

Growth has been volatile, causing up-and-down engagements. 500 followers in 11 days.

I met amazing content creators, marketers, and people.

Those who use Twitter may know that one-liners win the algorithm, especially if they're funny or humorous, but as a marketer I can't risk posting content that my audience won't like.

I researched, learned some strategies, and A/B tested; some worked, some didn't.

In this article, I share what worked for me so you can do the same.

Thanks for reading!

Let's check my Twitter stats.

Tweets: how many tweets I sent in the first 28 days.

A user may be presented with a Tweet in their timeline or in search results.

In-person visits how many times my Twitter profile was viewed in the first 28 days.

Mentions: the number of times a tweet has mentioned my name.

Number of followers: People who were following me

Getting 500 Twitter followers isn't difficult.

Not easy, but doable.

Follow these steps to begin:

Determine your content pillars in step 1.

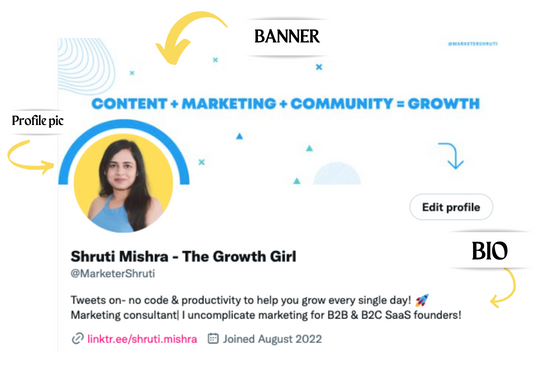

My formula is Growth = Content + Marketing + Community.

I discuss growth strategies.

My concept for growth is : 1. Content = creating / writing + sharing content in my niche. 2. Marketing = Marketing everything in business + I share my everyday learnings in business, marketing & entrepreneurship. 3. Community = Building community of like minded individuals (Also,I share how to’s) + supporting marketers to build & grow through community building.

Identify content pillars to create content for your audience.

2. Make your profile better

Create a profile picture. Your recognition factor is this.

Professional headshots are worthwhile.

This tool can help you create a free, eye-catching profile pic.

Use a niche-appropriate avatar if you don't want to show your face.

2. Create a bio that converts well mainly because first impressions count.

what you're sharing + why + +social proof what are you making

Be brief and precise. (155 characters)

3. Configure your banner

Banners complement profile pictures.

Use this space to explain what you do and how Twitter followers can benefit.

Canva's Twitter header maker is free.

Birdy can test multiple photo, bio, and banner combinations to optimize your profile.

Versions A and B of your profile should be completed.

Find the version that converts the best.

Use the profile that converts the best.

4. Special handle

If your username/handle is related to your niche, it will help you build authority and presence among your audience. Mine on Twitter is @marketershruti.

5. Participate expertly

Proficiently engage while you'll have no audience at first. Borrow your dream audience for free.

Steps:

Find a creator who has the audience you want.

Activate their post notifications and follow them.

Add a valuable comment first.

6. Create fantastic content

Use:

Medium (Read articles about your topic.)

Podcasts (Listen to experts on your topics)

YouTube (Follow channels in your niche)

Tweet what?

Listicle ( Hacks, Books, Tools, Podcasts)

Lessons (Teach your audience how to do 1 thing)

Inspirational (Inspire people to take action)

Consistent writing?

You MUST plan ahead and schedule your Tweets.

Use a scheduling tool that is effective for you; hypefury is mine.

Lastly, consistency is everything that attracts growth. After optimizing your profile, stay active to gain followers, engagements, and clients.

If you found this helpful, please like and comment below.

Katrine Tjoelsen

3 years ago

8 Communication Hacks I Use as a Young Employee

Learn these subtle cues to gain influence.

Hate being ignored?

As a 24-year-old, I struggled at work. Attention-getting tips How to avoid being judged by my size, gender, and lack of wrinkles or gray hair?

I've learned seniority hacks. Influence. Within two years as a product manager, I led a team. I'm a Stanford MBA student.

These communication hacks can make you look senior and influential.

1. Slowly speak

We speak quickly because we're afraid of being interrupted.

When I doubt my ideas, I speak quickly. How can we slow down? Jamie Chapman says speaking slowly saps our energy.

Chapman suggests emphasizing certain words and pausing.

2. Interrupted? Stop the stopper

Someone interrupt your speech?

Don't wait. "May I finish?" No pause needed. Stop interrupting. I first tried this in Leadership Laboratory at Stanford. How quickly I gained influence amazed me.

Next time, try “May I finish?” If that’s not enough, try these other tips from Wendy R.S. O’Connor.

3. Context

Others don't always see what's obvious to you.

Through explanation, you help others see the big picture. If a senior knows it, you help them see where your work fits.

4. Don't ask questions in statements

“Your statement lost its effect when you ended it on a high pitch,” a group member told me. Upspeak, it’s called. I do it when I feel uncertain.

Upspeak loses influence and credibility. Unneeded. When unsure, we can say "I think." We can even ask a proper question.

Someone else's boasting is no reason to be dismissive. As leaders and colleagues, we should listen to our colleagues even if they use this speech pattern.

Give your words impact.

5. Signpost structure

Signposts improve clarity by providing structure and transitions.

Communication coach Alexander Lyon explains how to use "first," "second," and "third" He explains classic and summary transitions to help the listener switch topics.

Signs clarify. Clarity matters.

6. Eliminate email fluff

“Fine. When will the report be ready? — Jeff.”

Notice how senior leaders write short, direct emails? I often use formalities like "dear," "hope you're well," and "kind regards"

Formality is (usually) unnecessary.

7. Replace exclamation marks with periods

See how junior an exclamation-filled email looks:

Hi, all!

Hope you’re as excited as I am for tomorrow! We’re celebrating our accomplishments with cake! Join us tomorrow at 2 pm!

See you soon!

Why the exclamation points? Why not just one?

Hi, all.

Hope you’re as excited as I am for tomorrow. We’re celebrating our accomplishments with cake. Join us tomorrow at 2 pm!

See you soon.

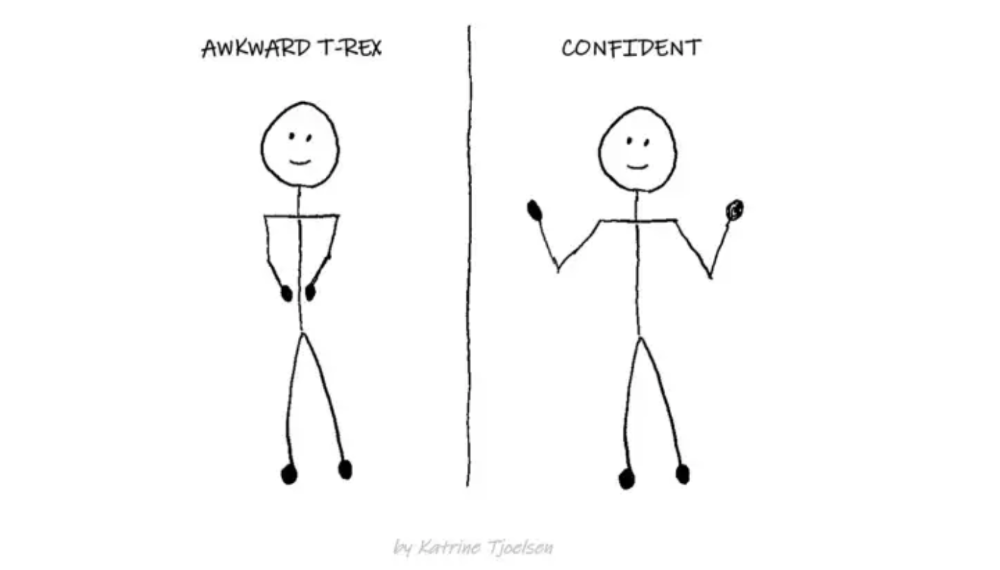

8. Take space

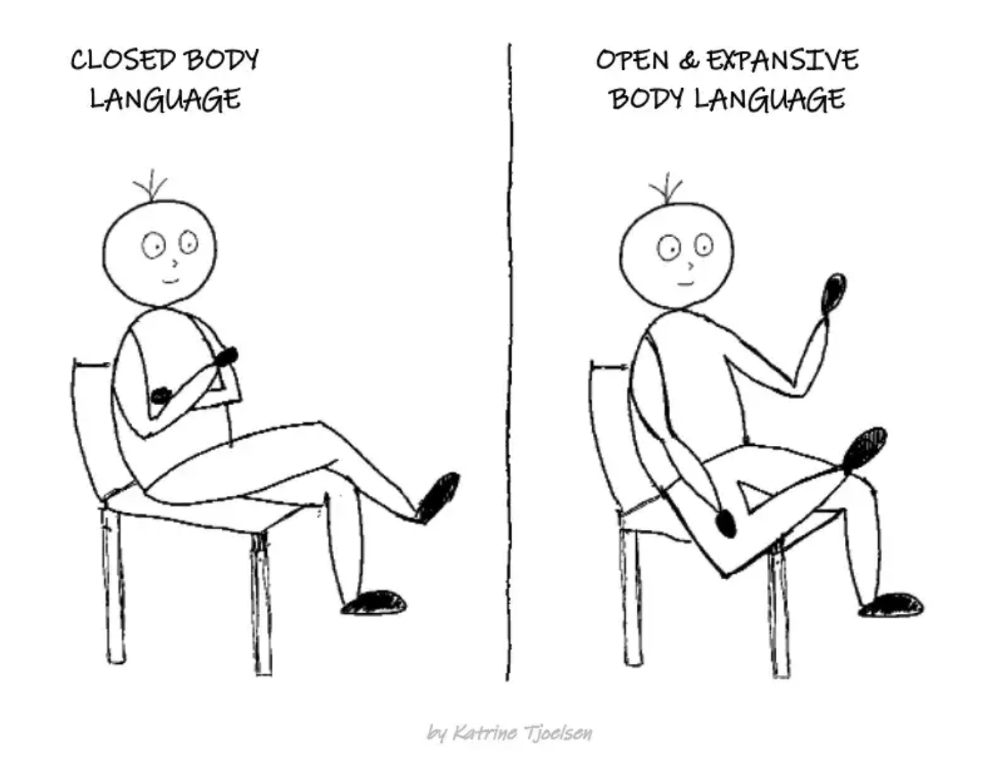

"Playing high" means having an open, relaxed body, says Stanford professor and author Deborah Gruenfield.

Crossed legs or looking small? Relax. Get bigger.