More on Marketing

Rita McGrath

3 years ago

Flywheels and Funnels

Traditional sales organizations used the concept of a sales “funnel” to describe the process through which potential customers move, ending up with sales at the end. Winners today have abandoned that way of thinking in favor of building flywheels — business models in which every element reinforces every other.

Ah, the marketing funnel…

Prospective clients go through a predictable set of experiences, students learn in business school marketing classes. It looks like this:

Understanding the funnel helps evaluate sales success indicators. Gail Goodwin, former CEO of small business direct mail provider Constant Contact, said managing the pipeline was key to escaping the sluggish SaaS ramp of death.

Like the funnel concept. To predict how well your business will do, measure how many potential clients are aware of it (awareness) and how many take the next step. If 1,000 people heard about your offering and 10% showed interest, you'd have 100 at that point. If 50% of these people made buyer-like noises, you'd know how many were, etc. It helped model buying trends.

TV, magazine, and radio advertising are pricey for B2C enterprises. Traditional B2B marketing involved armies of sales reps, which was expensive and a barrier to entry.

Cracks in the funnel model

Digital has exposed the funnel's limitations. Hubspot was born at a time when buyers and sellers had huge knowledge asymmetries, according to co-founder Brian Halligan. Those selling a product could use the buyer's lack of information to become a trusted partner.

As the world went digital, getting information and comparing offerings became faster, easier, and cheaper. Buyers didn't need a seller to move through a funnel. Interactions replaced transactions, and the relationship didn't end with a sale.

Instead, buyers and sellers interacted in a constant flow. In many modern models, the sale is midway through the process (particularly true with subscription and software-as-a-service models). Example:

You're creating a winding journey with many touch points, not a funnel (and lots of opportunities for customers to get lost).

From winding journey to flywheel

Beyond this revised view of an interactive customer journey, a company can create what Jim Collins famously called a flywheel. Imagine rolling a heavy disc on its axis. The first few times you roll it, you put in a lot of effort for a small response. The same effort yields faster turns as it gains speed. Over time, the flywheel gains momentum and turns without your help.

Modern digital organizations have created flywheel business models, in which any additional force multiplies throughout the business. The flywheel becomes a force multiplier, according to Collins.

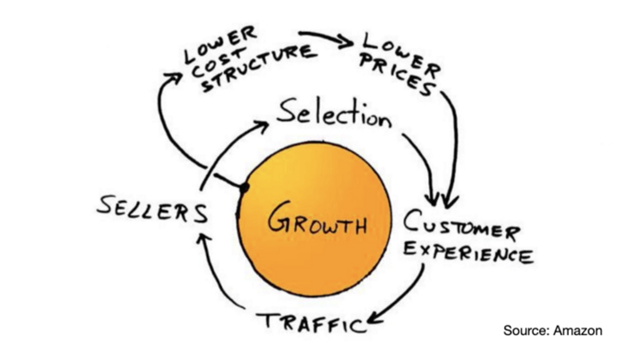

Amazon is a famous flywheel example. Collins explained the concept to Amazon CEO Jeff Bezos at a corporate retreat in 2001. In The Everything Store, Brad Stone describes in his book The Everything Store how he immediately understood Amazon's levers.

The result (drawn on a napkin):

Low prices and a large selection of products attracted customers, while a focus on customer service kept them coming back, increasing traffic. Third-party sellers then increased selection. Low-cost structure supports low-price commitment. It's brilliant! Every wheel turn creates acceleration.

Where from here?

Flywheel over sales funnel! Consider these business terms.

Sammy Abdullah

3 years ago

How to properly price SaaS

Price Intelligently put out amazing content on pricing your SaaS product. This blog's link to the whole report is worth reading. Our key takeaways are below.

Don't base prices on the competition. Competitor-based pricing has clear drawbacks. Their pricing approach is yours. Your company offers customers something unique. Otherwise, you wouldn't create it. This strategy is static, therefore you can't add value by raising prices without outpricing competitors. Look, but don't touch is the competitor-based moral. You want to know your competitors' prices so you're in the same ballpark, but they shouldn't guide your selections. Competitor-based pricing also drives down prices.

Value-based pricing wins. This is customer-based pricing. Value-based pricing looks outward, not inward or laterally at competitors. Your clients are the best source of pricing information. By valuing customer comments, you're focusing on buyers. They'll decide if your pricing and packaging are right. In addition to asking consumers about cost savings or revenue increases, look at data like number of users, usage per user, etc.

Value-based pricing increases prices. As you learn more about the client and your worth, you'll know when and how much to boost rates. Every 6 months, examine pricing.

Cloning top customers. You clone your consumers by learning as much as you can about them and then reaching out to comparable people or organizations. You can't accomplish this without knowing your customers. Segmenting and reproducing them requires as much detail as feasible. Offer pricing plans and feature packages for 4 personas. The top plan should state Contact Us. Your highest-value customers want more advice and support.

Question your 4 personas. What's the one item you can't live without? Which integrations matter most? Do you do analytics? Is support important or does your company self-solve? What's too cheap? What's too expensive?

Not everyone likes per-user pricing. SaaS organizations often default to per-user analytics. About 80% of companies utilizing per-user pricing should use an alternative value metric because their goods don't give more value with more users, so charging for them doesn't make sense.

At least 3:1 LTV/CAC. Break even on the customer within 2 years, and LTV to CAC is greater than 3:1. Because customer acquisition costs are paid upfront but SaaS revenues accrue over time, SaaS companies face an early financial shortfall while paying back the CAC.

ROI should be >20:1. Indeed. Ensure the customer's ROI is 20x the product's cost. Microsoft Office costs $80 a year, but consumers would pay much more to maintain it.

A/B Testing. A/B testing is guessing. When your pricing page varies based on assumptions, you'll upset customers. You don't have enough customers anyway. A/B testing optimizes landing pages, design decisions, and other site features when you know the problem but not pricing.

Don't discount. It cheapens the product, makes it permanent, and increases churn. By discounting, you're ruining your pricing analysis.

Matthew Royse

3 years ago

5 Tips for Concise Writing

Here's how to be clear.

“I have only made this letter longer because I have not had the time to make it shorter.” — French mathematician, physicist, inventor, philosopher, and writer Blaise Pascal

Concise.

People want this. We tend to repeat ourselves and use unnecessary words.

Being vague frustrates readers. It focuses their limited attention span on figuring out what you're saying rather than your message.

Edit carefully.

“Examine every word you put on paper. You’ll find a surprising number that don’t serve any purpose.” — American writer, editor, literary critic, and teacher William Zinsser

How do you write succinctly?

Here are three ways to polish your writing.

1. Delete

Your readers will appreciate it if you delete unnecessary words. If a word or phrase is essential, keep it. Don't force it.

Many readers dislike bloated sentences. Ask yourself if cutting a word or phrase will change the meaning or dilute your message.

For example, you could say, “It’s absolutely essential that I attend this meeting today, so I know the final outcome.” It’s better to say, “It’s critical I attend the meeting today, so I know the results.”

Key takeaway

Delete actually, completely, just, full, kind of, really, and totally. Keep the necessary words, cut the rest.

2. Just Do It

Don't tell readers your plans. Your readers don't need to know your plans. Who are you?

Don't say, "I want to highlight our marketing's problems." Our marketing issues are A, B, and C. This cuts 5–7 words per sentence.

Keep your reader's attention on the essentials, not the fluff. What are you doing? You won't lose readers because you get to the point quickly and don't build up.

Key takeaway

Delete words that don't add to your message. Do something, don't tell readers you will.

3. Cut Overlap

You probably repeat yourself unintentionally. You may add redundant sentences when brainstorming. Read aloud to detect overlap.

Remove repetition from your writing. It's important to edit our writing and thinking to avoid repetition.

Key Takeaway

If you're repeating yourself, combine sentences to avoid overlap.

4. Simplify

Write as you would to family or friends. Communicate clearly. Don't use jargon. These words confuse readers.

Readers want specifics, not jargon. Write simply. Done.

Most adults read at 8th-grade level. Jargon and buzzwords make speech fluffy. This confuses readers who want simple language.

Key takeaway

Ensure all audiences can understand you. USA Today's 5th-grade reading level is intentional. They want everyone to understand.

5. Active voice

Subjects perform actions in active voice. When you write in passive voice, the subject receives the action.

For example, “the board of directors decided to vote on the topic” is an active voice, while “a decision to vote on the topic was made by the board of directors” is a passive voice.

Key takeaway

Active voice clarifies sentences. Active voice is simple and concise.

Bringing It All Together

Five tips help you write clearly. Delete, just do it, cut overlap, use simple language, and write in an active voice.

Clear writing is effective. It's okay to occasionally use unnecessary words or phrases. Realizing it is key. Check your writing.

Adding words costs.

Write more concisely. People will appreciate it and read your future articles, emails, and messages. Spending extra time will increase trust and influence.

“Not that the story need be long, but it will take a long while to make it short.” — Naturalist, essayist, poet, and philosopher Henry David Thoreau

You might also like

Tim Denning

3 years ago

Elon Musk’s Rich Life Is a Nightmare

I'm sure you haven't read about Elon's other side.

Elon divorced badly.

Nobody's surprised.

Imagine you're a parent. Someone isn't home year-round. What's next?

That’s what happened to YOLO Elon.

He can do anything. He can intervene in wars, shoot his mouth off, bang anyone he wants, avoid tax, make cool tech, buy anything his ego desires, and live anywhere exotic.

Few know his billionaire backstory. I'll tell you so you don't worship his lifestyle. It’s a cult.

Only his career succeeds. His life is a nightmare otherwise.

Psychopaths' schedule

Elon has said he works 120-hour weeks.

As he told the reporter about his job, he choked up, which was unusual for him.

His crazy workload and lack of sleep forced him to scold innocent Wall Street analysts. Later, he apologized.

In the same interview, he admits he hadn't taken more than a week off since 2001, when he was bedridden with malaria. Elon stays home after a near-death experience.

He's rarely outside.

Elon says he sometimes works 3 or 4 days straight.

He admits his crazy work schedule has cost him time with his kids and friends.

Elon's a slave

Elon's birthday description made him emotional.

Elon worked his entire birthday.

"No friends, nothing," he said, stuttering.

His brother's wedding in Catalonia was 48 hours after his birthday. That meant flying there from Tesla's factory prison.

He arrived two hours before the big moment, barely enough time to eat and change, let alone see his brother.

Elon had to leave after the bouquet was tossed to a crowd of billionaire lovers. He missed his brother's first dance with his wife.

Shocking.

He went straight to Tesla's prison.

The looming health crisis

Elon was asked if overworking affected his health.

Not great. Friends are worried.

Now you know why Elon tweets dumb things. Working so hard has probably caused him mental health issues.

Mental illness removed my reality filter. You do stupid things because you're tired.

Astronauts pelted Elon

Elon's overwork isn't the first time his life has made him emotional.

When asked about Neil Armstrong and Gene Cernan criticizing his SpaceX missions, he got emotional. Elon's heroes.

They're why he started the company, and they mocked his work. In another interview, we see how Elon’s business obsession has knifed him in the heart.

Once you have a company, you must feed, nurse, and care for it, even if it destroys you.

"Yep," Elon says, tearing up.

In the same interview, he's asked how Tesla survived the 2008 recession. Elon stopped the interview because he was crying. When Tesla and SpaceX filed for bankruptcy in 2008, he nearly had a nervous breakdown. He called them his "children."

All the time, he's risking everything.

Jack Raines explains best:

Too much money makes you a slave to your net worth.

Elon's emotions are admirable. It's one of the few times he seems human, not like an alien Cyborg.

Stop idealizing Elon's lifestyle

Building a side business that becomes a billion-dollar unicorn startup is a nightmare.

"Billionaire" means financially wealthy but otherwise broke. A rich life includes more than business and money.

This post is a summary. Read full article here

Edward Williams

3 years ago

I currently manage 4 profitable online companies. I find all the generic advice and garbage courses very frustrating. The only advice you need is this.

This is for young entrepreneurs, especially in tech.

People give useless success advice on TikTok and Reddit. Early risers, bookworms, etc. Entrepreneurship courses. Work hard and hustle.

False. These aren't successful traits.

I mean, organization is good. As someone who founded several businesses and now works at a VC firm, I find these tips to be clichés.

Based on founding four successful businesses and working with other successful firms, here's my best actionable advice:

1. Choose a sector or a niche and become an expert in it.

This is more generic than my next tip, but it's a must-do that's often overlooked. Become an expert in the industry or niche you want to enter. Discover everything.

Buy (future) competitors' products. Understand consumers' pain points. Market-test. Target keyword combos. Learn technical details.

The most successful businesses I've worked with were all formed by 9-5 employees. They knew the industry's pain points. They started a business targeting these pain points.

2. Choose a niche or industry crossroads to target.

How do you choose an industry or niche? What if your industry is too competitive?

List your skills and hobbies. Randomness is fine. Find an intersection between two interests or skills.

Say you build websites well. You like cars.

Web design is a *very* competitive industry. Cars and web design?

Instead of web design, target car dealers and mechanics. Build a few fake demo auto mechanic websites, then cold call shops with poor websites. Verticalize.

I've noticed a pattern:

Person works in a particular industry for a corporation.

Person gains expertise in the relevant industry.

Person quits their job and launches a small business to address a problem that their former employer was unwilling to address.

I originally posted this on Reddit and it seemed to have taken off so I decided to share it with you all.

Focus on the product. When someone buys from you, you convince them the product's value exceeds the price. It's not fair and favors the buyer.

Creating a superior product or service will win. Narrowing this helps you outcompete others.

You may be their only (lucky) option.

Tim Denning

3 years ago

I gave up climbing the corporate ladder once I realized how deeply unhappy everyone at the top was.

Restructuring and layoffs cause career reevaluation. Your career can benefit.

Once you become institutionalized, the corporate ladder is all you know.

You're bubbled. Extremists term it the corporate Matrix. I'm not so severe because the business world brainwashed me, too.

This boosted my corporate career.

Until I hit bottom.

15 months later, I view my corporate life differently. You may wish to advance professionally. Read this before you do.

Your happiness in the workplace may be deceptive.

I've been fortunate to spend time with corporate aces.

Working for 2.5 years in banking social media gave me some of these experiences. Earlier in my career, I recorded interviews with business leaders.

These people have titles like Chief General Manager and Head Of. New titles brought life-changing salaries.

They seemed happy.

I’d pass them in the hallway and they’d smile or shake my hand. I dreamt of having their life.

The ominous pattern

Unfiltered talks with some of them revealed a different world.

They acted well. They were skilled at smiling and saying the correct things. All had the same dark pattern, though.

Something felt off.

I found my conversations with them were generally for their benefit. They hoped my online antics as a writer/coach would shed light on their dilemma.

They'd tell me they wanted more. When you're one position away from CEO, it's hard not to wonder if this next move will matter.

What really displeased corporate ladder chasers

Before ascending further, consider these.

Zero autonomy

As you rise in a company, your days get busier.

Many people and initiatives need supervision. Everyone expects you to know business details. Weak when you don't. A poor leader is fired during the next restructuring and left to pursue their corporate ambition.

Full calendars leave no time for reflection. You can't have a coffee with a friend or waste a day.

You’re always on call. It’s a roll call kinda life.

Unable to express oneself freely

My 8 years of LinkedIn writing helped me meet these leaders.

I didn't think they'd care. Mistake.

Corporate leaders envied me because they wanted to talk freely again without corporate comms or a PR firm directing them what to say.

They couldn't share their flaws or inspiring experiences.

They wanted to.

Every day they were muzzled eroded by their business dream.

Limited family time

Top leaders had families.

They've climbed the corporate ladder. Nothing excellent happens overnight.

Corporate dreamers rarely saw their families.

Late meetings, customer functions, expos, training, leadership days, team days, town halls, and product demos regularly occurred after work.

Or they had to travel interstate or internationally for work events. They used bags and motel showers.

Initially, they said business class flights and hotels were nice. They'd get bored. 5-star hotels become monotonous.

No hotel beats home.

One leader said he hadn't seen his daughter much. They used to Facetime, but now that he's been gone so long, she rarely wants to talk to him.

So they iPad-parented.

You're miserable without your family.

Held captive by other job titles

Going up the business ladder seems like a battle.

Leaders compete for business gains and corporate advancement.

I saw shocking filthy tricks. Leaders would lie to seem nice.

Captives included top officials.

A different section every week. If they ran technology, the Head of Sales would argue their CRM cost millions. Or an Operations chief would battle a product team over support requests.

After one conflict, another began.

Corporate echelons are antagonistic. Huge pay and bonuses guarantee bad behavior.

Overly centered on revenue

As you rise, revenue becomes more prevalent. Most days, you'd believe revenue was everything. Here’s the problem…

Numbers drain us.

Unless you're a closet math nerd, contemplating and talking about numbers drains your creativity.

Revenue will never substitute impact.

Incapable of taking risks

Corporate success requires taking fewer risks.

Risks can cause dismissal. Risks can interrupt business. Keep things moving so you may keep getting paid your enormous salary and bonus.

Restructuring or layoffs are inevitable. All corporate climbers experience it.

On this fateful day, a small few realize the game they’ve been trapped in and escape. Most return to play for a new company, but it takes time.

Addiction keeps them trapped. You know nothing else. The rest is strange.

You start to think “I’m getting old” or “it’s nearly retirement.” So you settle yet again for the trappings of the corporate ladder game to nowhere.

Should you climb the corporate ladder?

Let me end on a surprising note.

Young people should ascend the corporate ladder. It teaches you business skills and helps support your side gig and (potential) online business.

Don't get trapped, shackled, or muzzled.

Your ideas and creativity become stifled after too much gaming play.

Corporate success won't bring happiness.

Find fulfilling employment that matters. That's it.