Fairness alternatives to selling below market clearing prices (or community sentiment, or fun)

When a seller has a limited supply of an item in high (or uncertain and possibly high) demand, they frequently set a price far below what "the market will bear." As a result, the item sells out quickly, with lucky buyers being those who tried to buy first. This has happened in the Ethereum ecosystem, particularly with NFT sales and token sales/ICOs. But this phenomenon is much older; concerts and restaurants frequently make similar choices, resulting in fast sell-outs or long lines.

Why do sellers do this? Economists have long wondered. A seller should sell at the market-clearing price if the amount buyers are willing to buy exactly equals the amount the seller has to sell. If the seller is unsure of the market-clearing price, they should sell at auction and let the market decide. So, if you want to sell something below market value, don't do it. It will hurt your sales and it will hurt your customers. The competitions created by non-price-based allocation mechanisms can sometimes have negative externalities that harm third parties, as we will see.

However, the prevalence of below-market-clearing pricing suggests that sellers do it for good reason. And indeed, as decades of research into this topic has shown, there often are. So, is it possible to achieve the same goals with less unfairness, inefficiency, and harm?

Selling at below market-clearing prices has large inefficiencies and negative externalities

An item that is sold at market value or at an auction allows someone who really wants it to pay the high price or bid high in the auction. So, if a seller sells an item below market value, some people will get it and others won't. But the mechanism deciding who gets the item isn't random, and it's not always well correlated with participant desire. It's not always about being the fastest at clicking buttons. Sometimes it means waking up at 2 a.m. (but 11 p.m. or even 2 p.m. elsewhere). Sometimes it's just a "auction by other means" that's more chaotic, less efficient, and has far more negative externalities.

There are many examples of this in the Ethereum ecosystem. Let's start with the 2017 ICO craze. For example, an ICO project would set the price of the token and a hard maximum for how many tokens they are willing to sell, and the sale would start automatically at some point in time. The sale ends when the cap is reached.

So what? In practice, these sales often ended in 30 seconds or less. Everyone would start sending transactions in as soon as (or just before) the sale started, offering higher and higher fees to encourage miners to include their transaction first. Instead of the token seller receiving revenue, miners receive it, and the sale prices out all other applications on-chain.

The most expensive transaction in the BAT sale set a fee of 580,000 gwei, paying a fee of $6,600 to get included in the sale.

Many ICOs after that tried various strategies to avoid these gas price auctions; one ICO notably had a smart contract that checked the transaction's gasprice and rejected it if it exceeded 50 gwei. But that didn't solve the issue. Buyers hoping to game the system sent many transactions hoping one would get through. An auction by another name, clogging the chain even more.

ICOs have recently lost popularity, but NFTs and NFT sales have risen in popularity. But the NFT space didn't learn from 2017; they do fixed-quantity sales just like ICOs (eg. see the mint function on lines 97-108 of this contract here). So what?

That's not the worst; some NFT sales have caused gas price spikes of up to 2000 gwei.

High gas prices from users fighting to get in first by sending higher and higher transaction fees. An auction renamed, pricing out all other applications on-chain for 15 minutes.

So why do sellers sometimes sell below market price?

Selling below market value is nothing new, and many articles, papers, and podcasts have written (and sometimes bitterly complained) about the unwillingness to use auctions or set prices to market-clearing levels.

Many of the arguments are the same for both blockchain (NFTs and ICOs) and non-blockchain examples (popular restaurants and concerts). Fairness and the desire not to exclude the poor, lose fans or create tension by being perceived as greedy are major concerns. The 1986 paper by Kahneman, Knetsch, and Thaler explains how fairness and greed can influence these decisions. I recall that the desire to avoid perceptions of greed was also a major factor in discouraging the use of auction-like mechanisms in 2017.

Aside from fairness concerns, there is the argument that selling out and long lines create a sense of popularity and prestige, making the product more appealing to others. Long lines should have the same effect as high prices in a rational actor model, but this is not the case in reality. This applies to ICOs and NFTs as well as restaurants. Aside from increasing marketing value, some people find the game of grabbing a limited set of opportunities first before everyone else is quite entertaining.

But there are some blockchain-specific factors. One argument for selling ICO tokens below market value (and one that persuaded the OmiseGo team to adopt their capped sale strategy) is community dynamics. The first rule of community sentiment management is to encourage price increases. People are happy if they are "in the green." If the price drops below what the community members paid, they are unhappy and start calling you a scammer, possibly causing a social media cascade where everyone calls you a scammer.

This effect can only be avoided by pricing low enough that post-launch market prices will almost certainly be higher. But how do you do this without creating a rush for the gates that leads to an auction?

Interesting solutions

It's 2021. We have a blockchain. The blockchain is home to a powerful decentralized finance ecosystem, as well as a rapidly expanding set of non-financial tools. The blockchain also allows us to reset social norms. Where decades of economists yelling about "efficiency" failed, blockchains may be able to legitimize new uses of mechanism design. If we could use our more advanced tools to create an approach that more directly solves the problems, with fewer side effects, wouldn't that be better than fiddling with a coarse-grained one-dimensional strategy space of selling at market price versus below market price?

Begin with the goals. We'll try to cover ICOs, NFTs, and conference tickets (really a type of NFT) all at the same time.

1. Fairness: don't completely exclude low-income people from participation; give them a chance. The goal of token sales is to avoid high initial wealth concentration and have a larger and more diverse initial token holder community.

2. Don’t create races: Avoid situations where many people rush to do the same thing and only a few get in (this is the type of situation that leads to the horrible auctions-by-another-name that we saw above).

3. Don't require precise market knowledge: the mechanism should work even if the seller has no idea how much demand exists.

4. Fun: The process of participating in the sale should be fun and game-like, but not frustrating.

5. Give buyers positive expected returns: in the case of a token (or an NFT), buyers should expect price increases rather than decreases. This requires selling below market value.

Let's start with (1). From Ethereum's perspective, there is a simple solution. Use a tool designed for the job: proof of personhood protocols! Here's one quick idea:

Mechanism 1 Each participant (verified by ID) can buy up to ‘’X’’ tokens at price P, with the option to buy more at an auction.

With the per-person mechanism, buyers can get positive expected returns for the portion sold through the per-person mechanism, and the auction part does not require sellers to understand demand levels. Is it race-free? The number of participants buying through the per-person pool appears to be high. But what if the per-person pool isn't big enough to accommodate everyone?

Make the per-person allocation amount dynamic.

Mechanism 2 Each participant can deposit up to X tokens into a smart contract to declare interest. Last but not least, each buyer receives min(X, N / buyers) tokens, where N is the total sold through the per-person pool (some other amount can also be sold by auction). The buyer gets their deposit back if it exceeds the amount needed to buy their allocation.

No longer is there a race condition based on the number of buyers per person. No matter how high the demand, it's always better to join sooner rather than later.

Here's another idea if you like clever game mechanics with fancy quadratic formulas.

Mechanism 3 Each participant can buy X units at a price P X 2 up to a maximum of C tokens per buyer. C starts low and gradually increases until enough units are sold.

The quantity allocated to each buyer is theoretically optimal, though post-sale transfers will degrade this optimality over time. Mechanisms 2 and 3 appear to meet all of the above objectives. They're not perfect, but they're good starting points.

One more issue. For fixed and limited supply NFTs, the equilibrium purchased quantity per participant may be fractional (in mechanism 2, number of buyers > N, and in mechanism 3, setting C = 1 may already lead to over-subscription). With fractional sales, you can offer lottery tickets: if there are N items available, you have a chance of N/number of buyers of getting the item, otherwise you get a refund. For a conference, groups could bundle their lottery tickets to guarantee a win or a loss. The certainty of getting the item can be auctioned.

The bottom tier of "sponsorships" can be used to sell conference tickets at market rate. You may end up with a sponsor board full of people's faces, but is that okay? After all, John Lilic was on EthCC's sponsor board!

Simply put, if you want to be reliably fair to people, you need an input that explicitly measures people. Authentication protocols do this (and if desired can be combined with zero knowledge proofs to ensure privacy). So we should combine the efficiency of market and auction-based pricing with the equality of proof of personhood mechanics.

Answers to possible questions

Q: Won't people who don't care about your project buy the item and immediately resell it?

A: Not at first. Meta-games take time to appear in practice. If they do, making them untradeable for a while may help mitigate the damage. Using your face to claim that your previous account was hacked and that your identity, including everything in it, should be moved to another account works because proof-of-personhood identities are untradeable.

Q: What if I want to make my item available to a specific community?

A: Instead of ID, use proof of participation tokens linked to community events. Another option, also serving egalitarian and gamification purposes, is to encrypt items within publicly available puzzle solutions.

Q: How do we know they'll accept? Strange new mechanisms have previously been resisted.

A: Having economists write screeds about how they "should" accept a new mechanism that they find strange is difficult (or even "equity"). However, abrupt changes in context effectively reset people's expectations. So the blockchain space is the best place to try this. You could wait for the "metaverse", but it's possible that the best version will run on Ethereum anyway, so start now.

More on Web3 & Crypto

CyberPunkMetalHead

3 years ago

Developed an automated cryptocurrency trading tool for nearly a year before unveiling it this month.

Overview

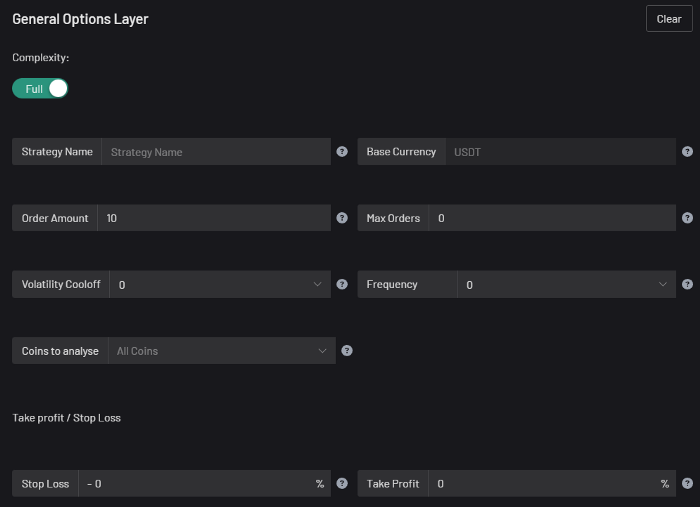

I'm happy to provide this important update. We've worked on this for a year and a half, so I'm glad to finally write it. We named the application AESIR because we’ve love Norse Mythology. AESIR automates and runs trading strategies.

Volatility, technical analysis, oscillators, and other signals are currently supported by AESIR.

Additionally, we enhanced AESIR's ability to create distinctive bespoke signals by allowing it to analyze many indicators and produce a single signal.

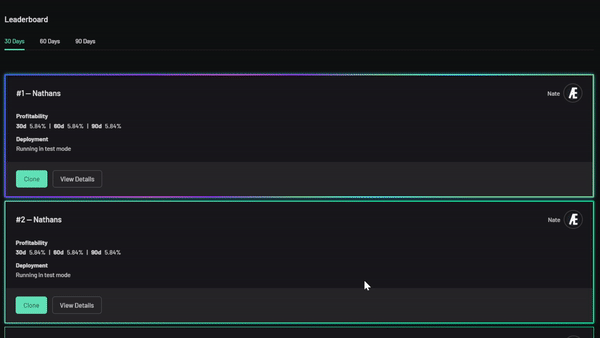

AESIR has a significant social component that allows you to copy the best-performing public setups and use them right away.

Enter your email here to be notified when AEISR launches.

Views on algorithmic trading

First, let me clarify. Anyone who claims algorithmic trading platforms are money-printing plug-and-play devices is a liar. Algorithmic trading platforms are a collection of tools.

A trading algorithm won't make you a competent trader if you lack a trading strategy and yolo your funds without testing. It may hurt your trade. Test and alter your plans to account for market swings, but comprehend market signals and trends.

Status Report

Throughout closed beta testing, we've communicated closely with users to design a platform they want to use.

To celebrate, we're giving you free Aesir Viking NFTs and we cover gas fees.

Why use a trading Algorithm?

Automating a successful manual approach

experimenting with and developing solutions that are impossible to execute manually

One AESIR strategy lets you buy any cryptocurrency that rose by more than x% in y seconds.

AESIR can scan an exchange for coins that have gained more than 3% in 5 minutes. It's impossible to manually analyze over 1000 trading pairings every 5 minutes. Auto buy dips or DCA around a Dip

Sneak Preview

Here's the Leaderboard, where you can clone the best public settings.

As a tiny, self-funded team, we're excited to unveil our product. It's a beta release, so there's still more to accomplish, but we know where we stand.

If this sounds like a project that you might want to learn more about, you can sign up to our newsletter and be notified when AESIR launches.

Useful Links:

Join the Discord | Join our subreddit | Newsletter | Mint Free NFT

William Brucee

3 years ago

This person is probably Satoshi Nakamoto.

Who founded bitcoin is the biggest mystery in technology today, not how it works.

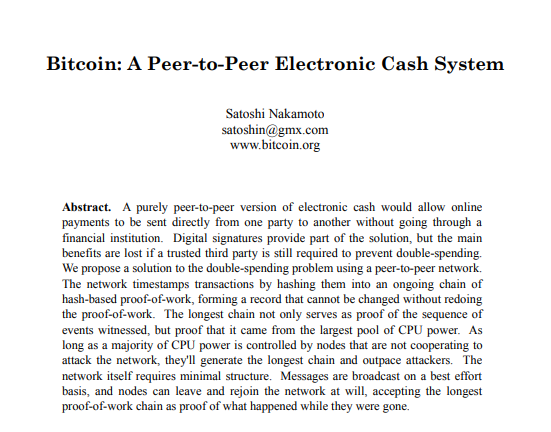

On October 31, 2008, Satoshi Nakamoto posted a whitepaper to a cryptography email list. Still confused by the mastermind who changed monetary history.

Journalists and bloggers have tried in vain to uncover bitcoin's creator. Some candidates self-nominated. We're still looking for the mystery's perpetrator because none of them have provided proof.

One person. I'm confident he invented bitcoin. Let's assess Satoshi Nakamoto before I reveal my pick. Or what he wants us to know.

Satoshi's P2P Foundation biography says he was born in 1975. He doesn't sound or look Japanese. First, he wrote the whitepaper and subsequent articles in flawless English. His sleeping habits are unusual for a Japanese person.

Stefan Thomas, a Bitcoin Forum member, displayed Satoshi's posting timestamps. Satoshi Nakamoto didn't publish between 2 and 8 p.m., Japanese time. Satoshi's identity may not be real.

Why would he disguise himself?

There is a legitimate explanation for this

Phil Zimmermann created PGP to give dissidents an open channel of communication, like Pretty Good Privacy. US government seized this technology after realizing its potential. Police investigate PGP and Zimmermann.

This technology let only two people speak privately. Bitcoin technology makes it possible to send money for free without a bank or other intermediary, removing it from government control.

How much do we know about the person who invented bitcoin?

Here's what we know about Satoshi Nakamoto now that I've covered my doubts about his personality.

Satoshi Nakamoto first appeared with a whitepaper on metzdowd.com. On Halloween 2008, he presented a nine-page paper on a new peer-to-peer electronic monetary system.

Using the nickname satoshi, he created the bitcointalk forum. He kept developing bitcoin and created bitcoin.org. Satoshi mined the genesis block on January 3, 2009.

Satoshi Nakamoto worked with programmers in 2010 to change bitcoin's protocol. He engaged with the bitcoin community. Then he gave Gavin Andresen the keys and codes and transferred community domains. By 2010, he'd abandoned the project.

The bitcoin creator posted his goodbye on April 23, 2011. Mike Hearn asked Satoshi if he planned to rejoin the group.

“I’ve moved on to other things. It’s in good hands with Gavin and everyone.”

Nakamoto Satoshi

The man who broke the banking system vanished. Why?

Satoshi's wallets held 1,000,000 BTC. In December 2017, when the price peaked, he had over US$19 billion. Nakamoto had the 44th-highest net worth then. He's never cashed a bitcoin.

This data suggests something happened to bitcoin's creator. I think Hal Finney is Satoshi Nakamoto .

Hal Finney had ALS and died in 2014. I suppose he created the future of money, then he died, leaving us with only rumors about his identity.

Hal Finney, who was he?

Hal Finney graduated from Caltech in 1979. Student peers voted him the smartest. He took a doctoral-level gravitational field theory course as a freshman. Finney's intelligence meets the first requirement for becoming Satoshi Nakamoto.

Students remember Finney holding an Ayn Rand book. If he'd read this, he may have developed libertarian views.

His beliefs led him to a small group of freethinking programmers. In the 1990s, he joined Cypherpunks. This action promoted the use of strong cryptography and privacy-enhancing technologies for social and political change. Finney helped them achieve a crypto-anarchist perspective as self-proclaimed privacy defenders.

Zimmermann knew Finney well.

Hal replied to a Cypherpunk message about Phil Zimmermann and PGP. He contacted Phil and became PGP Corporation's first member, retiring in 2011. Satoshi Nakamoto quit bitcoin in 2011.

Finney improved the new PGP protocol, but he had to do so secretly. He knew about Phil's PGP issues. I understand why he wanted to hide his identity while creating bitcoin.

Why did he pretend to be from Japan?

His envisioned persona was spot-on. He resided near scientist Dorian Prentice Satoshi Nakamoto. Finney could've assumed Nakamoto's identity to hide his. Temple City has 36,000 people, so what are the chances they both lived there? A cryptographic genius with the same name as Bitcoin's creator: coincidence?

Things went differently, I think.

I think Hal Finney sent himself Satoshis messages. I know it's odd. If you want to conceal your involvement, do as follows. He faked messages and transferred the first bitcoins to himself to test the transaction mechanism, so he never returned their money.

Hal Finney created the first reusable proof-of-work system. The bitcoin protocol. In the 1990s, Finney was intrigued by digital money. He invented CRypto cASH in 1993.

Legacy

Hal Finney's contributions should not be forgotten. Even if I'm wrong and he's not Satoshi Nakamoto, we shouldn't forget his bitcoin contribution. He helped us achieve a better future.

Julie Plavnik

3 years ago

How to Become a Crypto Broker [Complying and Making Money]

Three options exist. The third one is the quickest and most fruitful.

You've mastered crypto trading and want to become a broker.

So you may wonder: Where to begin?

If so, keep reading.

Today I'll compare three different approaches to becoming a cryptocurrency trader.

What are cryptocurrency brokers, and how do they vary from stockbrokers?

A stockbroker implements clients' market orders (retail or institutional ones).

Brokerage firms are regulated, insured, and subject to regulatory monitoring.

Stockbrokers are required between buyers and sellers. They can't trade without a broker. To trade, a trader must open a broker account and deposit money. When a trader shops, he tells his broker what orders to place.

Crypto brokerage is trade intermediation with cryptocurrency.

In crypto trading, however, brokers are optional.

Crypto exchanges offer direct transactions. Open an exchange account (no broker needed) and make a deposit.

Question:

Since crypto allows DIY trading, why use a broker?

Let's compare cryptocurrency exchanges vs. brokers.

Broker versus cryptocurrency exchange

Most existing crypto exchanges are basically brokers.

Examine their primary services:

connecting purchasers and suppliers

having custody of clients' money (with the exception of decentralized cryptocurrency exchanges),

clearance of transactions.

Brokerage is comparable, don't you think?

There are exceptions. I mean a few large crypto exchanges that follow the stock exchange paradigm. They outsource brokerage, custody, and clearing operations. Classic exchange setups are rare in today's bitcoin industry.

Back to our favorite “standard” crypto exchanges. All-in-one exchanges and brokers. And usually, they operate under a broker or a broker-dealer license, save for the exchanges registered somewhere in a free-trade offshore paradise. Those don’t bother with any licensing.

What’s the sense of having two brokers at a time?

Better liquidity and trading convenience.

The crypto business is compartmentalized.

We have CEXs, DEXs, hybrid exchanges, and semi-exchanges (those that aggregate liquidity but do not execute orders on their sides). All have unique regulations and act as sovereign states.

There are about 18k coins and hundreds of blockchain protocols, most of which are heterogeneous (i.e., different in design and not interoperable).

A trader must register many accounts on different exchanges, deposit funds, and manage them all concurrently to access global crypto liquidity.

It’s extremely inconvenient.

Crypto liquidity fragmentation is the largest obstacle and bottleneck blocking crypto from mass adoption.

Crypto brokers help clients solve this challenge by providing one-gate access to deep and diverse crypto liquidity from numerous exchanges and suppliers. Professionals and institutions need it.

Another killer feature of a brokerage may be allowing clients to trade crypto with fiat funds exclusively, without fiat/crypto conversion. It is essential for professional and institutional traders.

Who may work as a cryptocurrency broker?

Apparently, not anyone. Brokerage requires high-powered specialists because it involves other people's money.

Here's the essentials:

excellent knowledge, skills, and years of trading experience

high-quality, quick, and secure infrastructure

highly developed team

outstanding trading capital

High-ROI network: long-standing, trustworthy connections with customers, exchanges, liquidity providers, payment gates, and similar entities

outstanding marketing and commercial development skills.

What about a license for a cryptocurrency broker? Is it necessary?

Complex question.

If you plan to play in white-glove jurisdictions, you may need a license. For example, in the US, as a “money transmitter” or as a CASSP (crypto asset secondary services provider) in Australia.

Even in these jurisdictions, there are no clear, holistic crypto brokerage and licensing policies.

Your lawyer will help you decide if your crypto brokerage needs a license.

Getting a license isn't quick. Two years of patience are needed.

How can you turn into a cryptocurrency broker?

Finally, we got there! 🎉

Three actionable ways exist:

To kickstart a regulated stand-alone crypto broker

To get a crypto broker franchise, and

To become a liquidity network broker.

Let's examine each.

1. Opening a regulated cryptocurrency broker

It's difficult. Especially If you're targeting first-world users.

You must comply with many regulatory, technical, financial, HR, and reporting obligations to keep your organization running. Some are mentioned above.

The licensing process depends on the products you want to offer (spots or derivatives) and the geographic areas you plan to service. There are no general rules for that.

In an overgeneralized way, here are the boxes you will have to check:

capital availability (usually a large amount of capital c is required)

You will have to move some of your team members to the nation providing the license in order to establish an office presence there.

the core team with the necessary professional training (especially applies to CEO, Head of Trading, Assistant to Head of Trading, etc.)

insurance

infrastructure that is trustworthy and secure

adopted proper AML/KYC/financial monitoring policies, etc.

Assuming you passed, what's next?

I bet it won’t be mind-blowing for you that the license is just a part of the deal. It won't attract clients or revenue.

To bring in high-dollar clientele, you must be a killer marketer and seller. It's not easy to convince people to give you money.

You'll need to be a great business developer to form successful, long-term agreements with exchanges (ideally for no fees), liquidity providers, banks, payment gates, etc. Persuade clients.

It's a tough job, isn't it?

I expect a Quora-type question here:

Can I start an unlicensed crypto broker?

Well, there is always a workaround with crypto!

You can register your broker in a free-trade zone like Seychelles to avoid US and other markets with strong watchdogs.

This is neither wise nor sustainable.

First, such experiments are illegal.

Second, you'll have trouble attracting clients and strategic partners.

A license equals trust. That’s it.

Even a pseudo-license from Mauritius matters.

Here are this method's benefits and downsides.

Cons first.

As you navigate this difficult and expensive legal process, you run the risk of missing out on business prospects. It's quite simple to become excellent compliance yet unable to work. Because your competitors are already courting potential customers while you are focusing all of your effort on paperwork.

Only God knows how long it will take you to pass the break-even point when everything with the license has been completed.

It is a money-burning business, especially in the beginning when the majority of your expenses will go toward marketing, sales, and maintaining license requirements. Make sure you have the fortitude and resources necessary to face such a difficult challenge.

Pros

It may eventually develop into a tool for making money. Because big guys who are professionals at trading require a white-glove regulated brokerage. You have every possibility if you work hard in the areas of sales, marketing, business development, and wealth. Simply put, everything must align.

Launching a regulated crypto broker is analogous to launching a crypto exchange. It's ROUGH. Sure you can take it?

2. Franchise for Crypto Broker (Crypto Sub-Brokerage)

A broker franchise is easier and faster than becoming a regulated crypto broker. Not a traditional brokerage.

A broker franchisee, often termed a sub-broker, joins with a broker (a franchisor) to bring them new clients. Sub-brokers market a broker's products and services to clients.

Sub-brokers are the middlemen between a broker and an investor.

Why is sub-brokering easier?

less demanding qualifications and legal complexity. All you need to do is keep a few certificates on hand (each time depends on the jurisdiction).

No significant investment is required

there is no demand that you be a trading member of an exchange, etc.

As a sub-broker, you can do identical duties without as many rights and certifications.

What about the crypto broker franchise?

Sub-brokers aren't common in crypto.

In most existing examples (PayBito, PCEX, etc.), franchises are offered by crypto exchanges, not brokers. Though we remember that crypto exchanges are, in fact, brokers, do we?

Similarly:

For a commission, a franchiser crypto broker receives new leads from a crypto sub-broker.

See above for why enrolling is easy.

Finding clients is difficult. Most crypto traders prefer to buy-sell on their own or through brokers over sub-broker franchises.

3. Broker of the Crypto Trading Network (or a Network Broker)

It's the greatest approach to execute crypto brokerage, based on effort/return.

Network broker isn't an established word. I wrote it for clarity.

Remember how we called crypto liquidity fragmentation the current crypto finance paradigm's main bottleneck?

Where there's a challenge, there's progress.

Several well-funded projects are aiming to fix crypto liquidity fragmentation. Instead of launching another crypto exchange with siloed trading, the greatest minds create trading networks that aggregate crypto liquidity from desynchronized sources and enable quick, safe, and affordable cross-blockchain transactions. Each project offers a distinct option for users.

Crypto liquidity implies:

One-account access to cryptocurrency liquidity pooled from network participants' exchanges and other liquidity sources

compiled price feeds

Cross-chain transactions that are quick and inexpensive, even for HFTs

link between participants of all kinds, and

interoperability among diverse blockchains

Fast, diversified, and cheap global crypto trading from one account.

How does a trading network help cryptocurrency brokers?

I’ll explain it, taking Yellow Network as an example.

Yellow provides decentralized Layer-3 peer-to-peer trading.

trade across chains globally with real-time settlement and

Between cryptocurrency exchanges, brokers, trading companies, and other sorts of network members, there is communication and the exchange of financial information.

Have you ever heard about ECN (electronic communication network)? If not, it's an automated system that automatically matches buy and sell orders. Yellow is a decentralized digital asset ECN.

Brokers can:

Start trading right now without having to meet stringent requirements; all you need to do is integrate with Yellow Protocol and successfully complete some KYC verification.

Access global aggregated crypto liquidity through a single point.

B2B (Broker to Broker) liquidity channels that provide peer liquidity from other brokers. Orders from the other broker will appear in the order book of a broker who is peering with another broker on the market. It will enable a broker to broaden his offer and raise the total amount of liquidity that is available to his clients.

Select a custodian or use non-custodial practices.

Comparing network crypto brokerage to other types:

A licensed stand-alone brokerage business is much more difficult and time-consuming to launch than network brokerage, and

Network brokerage, in contrast to crypto sub-brokerage, is scalable, independent, and offers limitless possibilities for revenue generation.

Yellow Network Whitepaper. has more details on how to start a brokerage business and what rewards you'll obtain.

Final thoughts

There are three ways to become a cryptocurrency broker, including the non-conventional liquidity network brokerage. The last option appears time/cost-effective.

Crypto brokerage isn't crowded yet. Act quickly to find your right place in this market.

Choose the way that works for you best and see you in crypto trading.

Discover Web3 & DeFi with Yellow Network!

Yellow, powered by Openware, is developing a cross-chain P2P liquidity aggregator to unite the crypto sector and provide global remittance services that aid people.

Join the Yellow Community and plunge into this decade's biggest product-oriented crypto project.

Observe Yellow Twitter

Enroll in Yellow Telegram

Visit Yellow Discord.

On Hacker Noon, look us up.

Yellow Network will expose development, technology, developer tools, crypto brokerage nodes software, and community liquidity mining.

You might also like

VIP Graphics

3 years ago

Leaked pitch deck for Metas' new influencer-focused live-streaming service

As part of Meta's endeavor to establish an interactive live-streaming platform, the company is testing with influencers.

The NPE (new product experimentation team) has been testing Super since late 2020.

Bloomberg defined Super as a Cameo-inspired FaceTime-like gadget in 2020. The tool has evolved into a Twitch-like live streaming application.

Less than 100 creators have utilized Super: Creators can request access on Meta's website. Super isn't an Instagram, Facebook, or Meta extension.

“It’s a standalone project,” the spokesperson said about Super. “Right now, it’s web only. They have been testing it very quietly for about two years. The end goal [of NPE projects] is ultimately creating the next standalone project that could be part of the Meta family of products.” The spokesperson said the outreach this week was part of a drive to get more creators to test Super.

A 2021 pitch deck from Super reveals the inner workings of Meta.

The deck gathered feedback on possible sponsorship models, with mockups of brand deals & features. Meta reportedly paid creators $200 to $3,000 to test Super for 30 minutes.

Meta's pitch deck for Super live streaming was leaked.

What were the slides in the pitch deck for Metas Super?

Embed not supported: see full deck & article here →

View examples of Meta's pitch deck for Super:

Product Slides, first

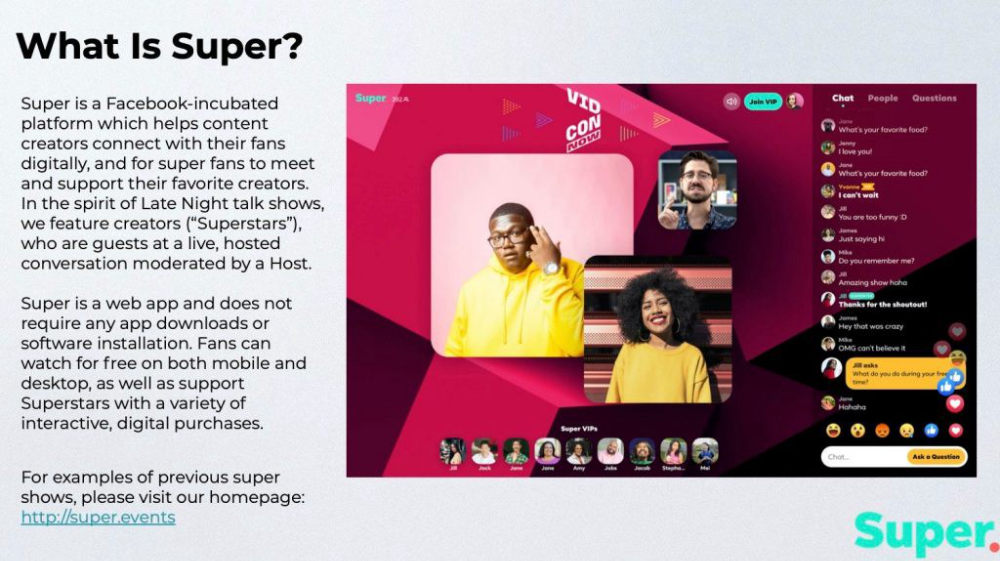

The pitch deck begins with Super's mission:

Super is a Facebook-incubated platform which helps content creators connect with their fans digitally, and for super fans to meet and support their favorite creators. In the spirit of Late Night talk shows, we feature creators (“Superstars”), who are guests at a live, hosted conversation moderated by a Host.

This slide (and most of the deck) is text-heavy, with few icons, bullets, and illustrations to break up the content. Super's online app status (which requires no download or installation) might be used as a callout (rather than paragraph-form).

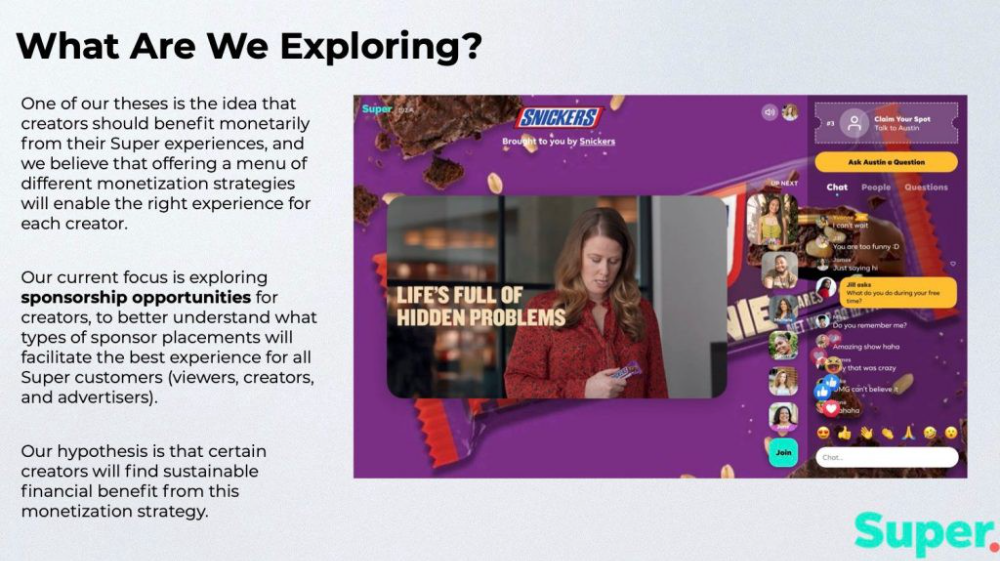

Meta's Super platform focuses on brand sponsorships and native placements, as shown in the slide above.

One of our theses is the idea that creators should benefit monetarily from their Super experiences, and we believe that offering a menu of different monetization strategies will enable the right experience for each creator. Our current focus is exploring sponsorship opportunities for creators, to better understand what types of sponsor placements will facilitate the best experience for all Super customers (viewers, creators, and advertisers).

Colorful mockups help bring Metas vision for Super to life.

2. Slide Features

Super's pitch deck focuses on the platform's features. The deck covers pre-show, pre-roll, and post-event for a Sponsored Experience.

Pre-show: active 30 minutes before the show's start

Pre-roll: Play a 15-minute commercial for the sponsor before the event (auto-plays once)

Meet and Greet: This event can have a branding, such as Meet & Greet presented by [Snickers]

Super Selfies: Makers and followers get a digital souvenir to post on social media.

Post-Event: Possibility to draw viewers' attention to sponsored content/links during the after-show

Almost every screen displays the Sponsor logo, link, and/or branded background. Viewers can watch sponsor video while waiting for the event to start.

Slide 3: Business Model

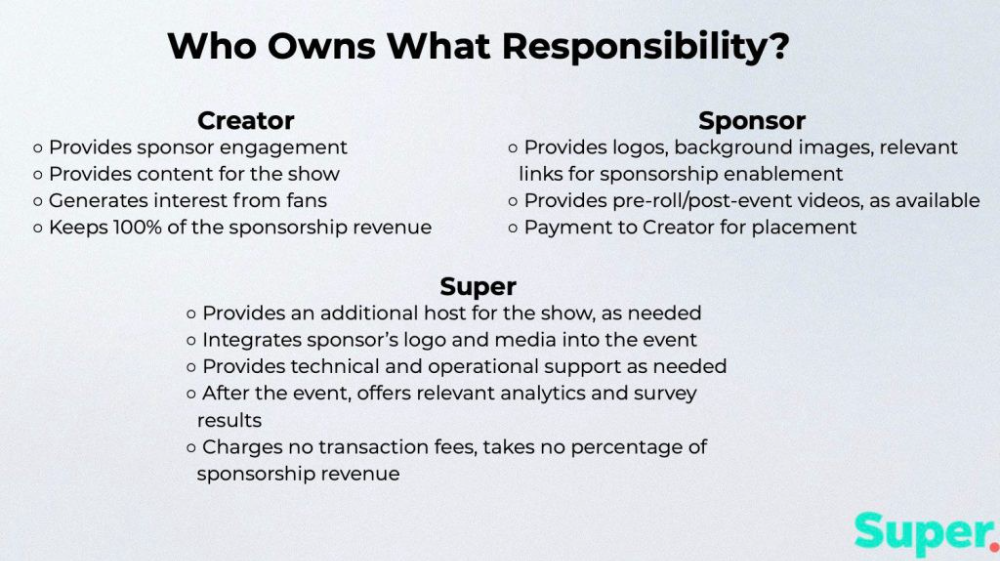

Meta's presentation for Super is incomplete without numbers. Super's first slide outlines the creator, sponsor, and Super's obligations. Super does not charge creators any fees or commissions on sponsorship earnings.

How to make a great pitch deck

We hope you can use the Super pitch deck to improve your business. Bestpitchdeck.com/super-meta is a bookmarkable link.

You can also use one of our expert-designed templates to generate a pitch deck.

Our team has helped close $100M+ in agreements and funding for premier companies and VC firms. Use our presentation templates, one-pagers, or financial models to launch your pitch.

Every pitch must be audience-specific. Our team has prepared pitch decks for various sectors and fundraising phases.

Pitch Deck Software VIP.graphics produced a popular SaaS & Software Pitch Deck based on decks that closed millions in transactions & investments for orgs of all sizes, from high-growth startups to Fortune 100 enterprises. This easy-to-customize PowerPoint template includes ready-made features and key slides for your software firm.

Accelerator Pitch Deck The Accelerator Pitch Deck template is for early-stage founders seeking funding from pitch contests, accelerators, incubators, angels, or VC companies. Winning a pitch contest or getting into a top accelerator demands a strategic investor pitch.

Pitch Deck Template Series Startup and founder pitch deck template: Workable, smart slides. This pitch deck template is for companies, entrepreneurs, and founders raising seed or Series A finance.

M&A Pitch Deck Perfect Pitch Deck is a template for later-stage enterprises engaging more sophisticated conversations like M&A, late-stage investment (Series C+), or partnerships & funding. Our team prepared this presentation to help creators confidently pitch to investment banks, PE firms, and hedge funds (and vice versa).

Browse our growing variety of industry-specific pitch decks.

Erik Engheim

3 years ago

You Misunderstand the Russian Nuclear Threat

Many believe Putin is simply sabre rattling and intimidating us. They see no threat of nuclear war. We can send NATO troops into Ukraine without risking a nuclear war.

I keep reading that Putin is just using nuclear blackmail and that a strong leader will call the bluff. That, in my opinion, misunderstands the danger of sending NATO into Ukraine.

It assumes that once NATO moves in, Putin can either push the red nuclear button or not.

Sure, Putin won't go nuclear if NATO invades Ukraine. So we're safe? Can't we just move NATO?

No, because history has taught us that wars often escalate far beyond our initial expectations. One domino falls, knocking down another. That's why having clear boundaries is vital. Crossing a seemingly harmless line can set off a chain of events that are unstoppable once started.

One example is WWI. The assassin of Archduke Franz Ferdinand could not have known that his actions would kill millions. They couldn't have known that invading Serbia to punish them for not handing over the accomplices would start a world war. Every action triggered a counter-action, plunging Europe into a brutal and bloody war. Each leader saw their actions as limited, not realizing how they kept the dominos falling.

Nobody can predict the future, but it's easy to imagine how NATO intervention could trigger a chain of events leading to a total war. Let me suggest some outcomes.

NATO creates a no-fly-zone. In retaliation, Russia bombs NATO airfields. Russia may see this as a limited counter-move that shouldn't cause further NATO escalation. They think it's a reasonable response to force NATO out of Ukraine. Nobody has yet thought to use the nuke.

Will NATO act? Polish airfields bombed, will they be stuck? Is this an article 5 event? If so, what should be done?

It could happen. Maybe NATO sends troops into Ukraine to punish Russia. Maybe NATO will bomb Russian airfields.

Putin's response Is bombing Russian airfields an invasion or an attack? Remember that Russia has always used nuclear weapons for defense, not offense. But let's not panic, let's assume Russia doesn't go nuclear.

Maybe Russia retaliates by attacking NATO military bases with planes. Maybe they use ships to attack military targets. How does NATO respond? Will they fight Russia in Ukraine or escalate? Will they invade Russia or attack more military installations there?

Seen the pattern? As each nation responds, smaller limited military operations can grow in scope.

So far, the Russian military has shown that they begin with less brutal methods. As losses and failures increase, brutal means are used. Syria had the same. Assad used chemical weapons and attacked hospitals, schools, residential areas, etc.

A NATO invasion of Ukraine would cost Russia dearly. “Oh, this isn't looking so good, better pull out and finish this war,” do you think? No way. Desperate, they will resort to more brutal tactics. If desperate, Russia has a huge arsenal of ugly weapons. They have nerve agents, chemical weapons, and other nasty stuff.

What happens if Russia uses chemical weapons? What if Russian nerve agents kill NATO soldiers horribly? West calls for retaliation will grow. Will we invade Russia? Will we bomb them?

We are angry and determined to punish war criminal Putin, so NATO tanks may be heading to Moscow. We want vengeance for his chemical attacks and bombing of our cities.

Do you think the distance between that red nuclear button and Putin's finger will be that far once NATO tanks are on their way to Moscow?

We might avoid a nuclear apocalypse. A NATO invasion force or even Western cities may be used by Putin. Not as destructive as ICBMs. Putin may think we won't respond to tactical nukes with a full nuclear counterattack. Why would we risk a nuclear Holocaust by launching ICBMs on Russia?

Maybe. My point is that at every stage of the escalation, one party may underestimate the other's response. This war is spiraling out of control and the chances of a nuclear exchange are increasing. Nobody really wants it.

Fear, anger, and resentment cause it. If Putin and his inner circle decide their time is up, they may no longer care about the rest of the world. We saw it with Hitler. Hitler, seeing the end of his empire, ordered the destruction of Germany. Nobody should win if he couldn't. He wanted to destroy everything, including Paris.

In other words, the danger isn't what happens after NATO intervenes The danger is the potential chain reaction. Gambling has a psychological equivalent. It's best to exit when you've lost less. We humans are willing to take small risks for big rewards. To avoid losses, we are willing to take high risks. Daniel Kahneman describes this behavior in his book Thinking, Fast and Slow.

And so bettors who have lost a lot begin taking bigger risks to make up for it. We get a snowball effect. NATO involvement in the Ukraine conflict is akin to entering a casino and placing a bet. We'll start taking bigger risks as we start losing to Russian retaliation. That's the game's psychology.

It's impossible to stop. So will politicians and citizens from both Russia and the West, until we risk the end of human civilization.

You can avoid spiraling into ever larger bets in the Casino by drawing a hard line and declaring “I will not enter that Casino.” We're doing it now. We supply Ukraine. We send money and intelligence but don't cross that crucial line.

It's difficult to watch what happened in Bucha without demanding NATO involvement. What should we do? Of course, I'm not in charge. I'm a writer. My hope is that people will think about the consequences of the actions we demand. My hope is that you think ahead not just one step but multiple dominos.

More and more, we are driven by our emotions. We cannot act solely on emotion in matters of life and death. If we make the wrong choice, more people will die.

Read the original post here.

John Rampton

3 years ago

Ideas for Samples of Retirement Letters

Ready to quit full-time? No worries.

Baby Boomer retirement has accelerated since COVID-19 began. In 2020, 29 million boomers retire. Over 3 million more than in 2019. 75 million Baby Boomers will retire by 2030.

First, quit your work to enjoy retirement. Leave a professional legacy. Your retirement will start well. It all starts with a retirement letter.

Retirement Letter

Retirement letters are formal resignation letters. Different from other resignation letters, these don't tell your employer you're leaving. Instead, you're quitting.

Since you're not departing over grievances or for a better position or higher income, you may usually terminate the relationship amicably. Consulting opportunities are possible.

Thank your employer for their support and give them transition information.

Resignation letters aren't merely a formality. This method handles wages, insurance, and retirement benefits.

Retirement letters often accompany verbal notices to managers. Schedule a meeting before submitting your retirement letter to discuss your plans. The letter will be stored alongside your start date, salary, and benefits in your employee file.

Retirement is typically well-planned. Employers want 6-12 months' notice.

Summary

Guidelines for Giving Retirement Notice

Components of a Successful Retirement Letter

Template for Retirement Letter

Ideas for Samples of Retirement Letters

First Example of Retirement Letter

Second Example of Retirement Letter

Third Example of Retirement Letter

Fourth Example of Retirement Letter

Fifth Example of Retirement Letter

Sixth Example of Retirement Letter

Seventh Example of Retirement Letter

Eighth Example of Retirement Letter

Ninth Example of Retirement Letter

Tenth Example of Retirement Letter

Frequently Asked Questions

1. What is a letter of retirement?

2. Why should you include a letter of retirement?

3. What information ought to be in your retirement letter?

4. Must I provide notice?

5. What is the ideal retirement age?

Guidelines for Giving Retirement Notice

While starting a new phase, you're also leaving a job you were qualified for. You have years of experience. So, it may not be easy to fill a retirement-related vacancy.

Talk to your boss in person before sending a letter. Notice is always appreciated. Properly announcing your retirement helps you and your organization transition.

How to announce retirement:

Learn about the retirement perks and policies offered by the company. The first step in figuring out whether you're eligible for retirement benefits is to research your company's retirement policy.

Don't depart without providing adequate notice. You should give the business plenty of time to replace you if you want to retire in a few months.

Help the transition by offering aid. You could be a useful resource if your replacement needs training.

Contact the appropriate parties. The original copy should go to your boss. Give a copy to HR because they will manage your 401(k), pension, and health insurance.

Investigate the option of working as a consultant or part-time. If you desire, you can continue doing some limited work for the business.

Be nice to others. Describe your achievements and appreciation. Additionally, express your gratitude for giving you the chance to work with such excellent coworkers.

Make a plan for your future move. Simply updating your employer on your goals will help you maintain a good working relationship.

Use a formal letter or email to formalize your plans. The initial step is to speak with your supervisor and HR in person, but you must also give written notice.

Components of a Successful Retirement Letter

To write a good retirement letter, keep in mind the following:

A formal salutation. Here, the voice should be deliberate, succinct, and authoritative.

Be specific about your intentions. The key idea of your retirement letter is resignation. Your decision to depart at this time should be reflected in your letter. Remember that your intention must be clear-cut.

Your deadline. This information must be in resignation letters. Laws and corporate policies may both stipulate a minimum amount of notice.

A kind voice. Your retirement letter shouldn't contain any resentments, insults, or other unpleasantness. Your letter should be a model of professionalism and grace. A straightforward thank you is a terrific approach to accomplish that.

Your ultimate goal. Chaos may start to happen as soon as you turn in your resignation letter. Your position will need to be filled. Additionally, you will have to perform your obligations up until a successor is found. Your availability during the interim period should be stated in your resignation letter.

Give us a way to reach you. Even if you aren't consulting, your company will probably get in touch with you at some point. They might send you tax documents and details on perks. By giving your contact information, you can make this process easier.

Template for Retirement Letter

Identify

Title you held

Address

Supervisor's name

Supervisor’s position

Company name

HQ address

Date

[SUPERVISOR],

1.

Inform that you're retiring. Include your last day worked.

2.

Employer thanks. Mention what you're thankful for. Describe your accomplishments and successes.

3.

Helping moves things ahead. Plan your retirement. Mention your consultancy interest.

Sincerely,

[Signature]

First and last name

Phone number

Personal Email

Ideas for Samples of Retirement Letters

First Example of Retirement Letter

Martin D. Carey

123 Fleming St

Bloomfield, New Jersey 07003

(555) 555-1234

June 6th, 2022

Willie E. Coyote

President

Acme Co

321 Anvil Ave

Fairfield, New Jersey 07004

Dear Mr. Coyote,

This letter notifies Acme Co. of my retirement on August 31, 2022.

There has been no other organization that has given me that sense of belonging and purpose.

My fifteen years at the helm of the Structural Design Division have given me a strong sense of purpose. I’ve been fortunate to have your support, and I’ll be always grateful for the opportunity you offered me.

I had a difficult time making this decision. As a result of finding a small property in Arizona where we will be able to spend our remaining days together, my wife and I have decided to officially retire.

In spite of my regret at being unable to contribute to the firm we’ve built, I believe it is wise to move on.

My heart will always belong to Acme Co. Thank you for the opportunity and best of luck in the years to come.

Sincerely,

Martin D. Carey

Second Example of Retirement Letter

Gustavo Fring

Los Pollas Hermanos

12000–12100 Coors Rd SW,

Albuquerque, New Mexico 87045

Dear Mr. Fring,

I write this letter to announce my formal retirement from Los Pollas Hermanos as manager, effective October 15.

As an employee at Los Pollas Hermanos, I appreciate all the great opportunities you have given me. It has been a pleasure to work with and learn from my colleagues for the past 10 years, and I am looking forward to my next challenge.

If there is anything I can do to assist during this time, please let me know.

Sincerely,

Linda T. Crespo

Third Example of Retirement Letter

William M. Arviso

4387 Parkview Drive

Tustin, CA 92680

May 2, 2023

Tony Stark

Owner

Stark Industries

200 Industrial Avenue

Long Beach, CA 90803

Dear Tony:

I’m writing to inform you that my final day of work at Stark Industries will be May14, 2023. When that time comes, I intend to retire.

As I embark on this new chapter in my life, I would like to thank you and the entire Stark Industries team for providing me with so many opportunities. You have all been a pleasure to work with and I will miss you all when I retire.

I am glad to assist you with the transition in any way I can to ensure your new hire has a seamless experience. All ongoing projects will be completed until my retirement date, and all key information will be handed over to the team.

Once again, thank you for the opportunity to be part of the Stark Industries team. All the best to you and the team in the days to come.

Please do not hesitate to contact me if you require any additional information. In order to finalize my retirement plans, I’ll meet with HR and can provide any details that may be necessary.

Sincerely,

(Signature)

William M. Arviso

Fourth Example of Retirement Letter

Garcia, Barbara

First Street, 5432

New York City, NY 10001

(1234) (555) 123–1234

1 October 2022

Gunther

Owner

Central Perk

199 Lafayette St.

New York City, NY 10001

Mr. Gunther,

The day has finally arrived. As I never imagined, I will be formally retiring from Central Perk on November 1st, 2022.

Considering how satisfied I am with my current position, this may surprise you. It would be best if I retired now since my health has deteriorated, so I think this is a good time to do so.

There is no doubt that the past two decades have been wonderful. Over the years, I have seen a small coffee shop grow into one of the city’s top destinations.

It will be hard for me to leave this firm without wondering what more success we could have achieved. But I’m confident that you and the rest of the Central Perk team will achieve great things.

My family and I will never forget what you’ve done for us, and I am grateful for the chance you’ve given me. My house is always open to you.

Sincerely Yours

Garcia, Barbara

Fifth Example of Retirement Letter

Pat Williams

618 Spooky Place

Monstropolis, 23221

123–555–0031

pwilliams@email.com

Feb. 16, 2022

Mike Wazowski

Co-CEO

Monters, Inc.

324 Scare Road

Monstropolis

Dear Mr. Wazowski,

As a formal notice of my upcoming retirement, I am submitting this letter. I will be leaving Monters, Inc. on April 13.

These past 10 years as a marketing associate have provided me with many opportunities. Since we started our company a decade ago, we have seen the face of harnessing screams change dramatically into harnessing laughter. During my time working with this dynamic marketing team, I learned a lot about customer behavior and marketing strategies. Working closely with some of our long-standing clients, such as Boo, was a particular pleasure.

I would be happy to assist with the transition following my retirement. It would be my pleasure to assist in the hiring or training of my replacement. In order to spend more time with my family, I will also be able to offer part-time consulting services.

After I retire, I plan to cash out the eight unused vacation days I’ve accumulated and take my pension as a lump sum.

Thank you for the opportunity to work with Monters, Inc. In the years to come, I wish you all the best!

Sincerely,

Paul Williams

Sixth Example of Retirement Letter

Dear Micheal,

As In my tenure at Dunder Mifflin Paper Company, I have given everything I had. It has been an honor to work here. But I have decided to move on to new challenges and retire from my position — mainly bears, beets, and Battlestar Galactia.

I appreciate the opportunity to work here and learn so much. During my time at this company, I will always remember the good times and memories we shared. Wishing you all the best in the future.

Sincerely,

Dwight K. Shrute

Your signature

May 16

Seventh Example of Retirement Letter

Greetings, Bill

I am announcing my retirement from Initech, effective March 15, 2023.

Over the course of my career here, I’ve had the privilege of working with so many talented and inspiring people.

In 1999, when I began working as a customer service representative, we were a small organization located in a remote office park.

The fact that we now occupy a floor of the Main Street office building with over 150 employees continues to amaze me.

I am looking forward to spending more time with family and traveling the country in our RV. Although I will be sad to leave.

Please let me know if there are any extra steps I can take to facilitate this transfer.

Sincerely,

Frankin, RenitaEighth Example of Retirement Letter

Height Example of Retirement Letter

Bruce,

Please accept my resignation from Wayne Enterprises as Marketing Communications Director. My last day will be August 1, 2022.

The decision to retire has been made after much deliberation. Now that I have worked in the field for forty years, I believe it is a good time to begin completing my bucket list.

It was not easy for me to decide to leave the company. Having worked at Wayne Enterprises has been rewarding both professionally and personally. There are still a lot of memories associated with my first day as a college intern.

My intention was not to remain with such an innovative company, as you know. I was able to see the big picture with your help, however. Today, we are a force that is recognized both nationally and internationally.

In addition to your guidance, the bold, visionary leadership of our company contributed to the growth of our company.

My departure from the company coincides with a particularly hectic time. Despite my best efforts, I am unable to postpone my exit.

My position would be well served by an internal solution. I have a more than qualified marketing manager in Caroline Crown. It would be a pleasure to speak with you about this.

In case I can be of assistance during the switchover, please let me know. Contact us at (555)555–5555. As part of my responsibilities, I am responsible for making sure all work is completed to Wayne Enterprise’s stringent requirements. Having the opportunity to work with you has been a pleasure. I wish you continued success with your thriving business.

Sincerely,

Cash, Cole

Marketing/Communications

Ninth Example of Retirement Letter

Norman, Jamie

2366 Hanover Street

Whitestone, NY 11357

555–555–5555

15 October 2022

Mr. Lippman

Head of Pendant Publishing

600 Madison Ave.

New York, New York

Respected Mr. Lippman,

Please accept my resignation effective November 1, 2022.

Over the course of my ten years at Pendant Publishing, I’ve had a great deal of fun and I’m quite grateful for all the assistance I’ve received.

It was a pleasure to wake up and go to work every day because of our outstanding corporate culture and the opportunities for promotion and professional advancement available to me.

While I am excited about retiring, I am going to miss being part of our team. It’s my hope that I’ll be able to maintain the friendships I’ve formed here for a long time to come.

In case I can be of assistance prior to or following my departure, please let me know. If I can assist in any way to ensure a smooth transfer to my successor, I would be delighted to do so.

Sincerely,

Signed (hard copy letter)

Norman, Jamie

Tenth Example of Retirement Letter

17 January 2023

Greg S. Jackson

Cyberdyne Systems

18144 El Camino Real,

Sunnyvale, CA

Respected Mrs. Duncan,

I am writing to inform you that I will be resigning from Cyberdyne Systems as of March 1, 2023. I’m grateful to have had this opportunity, and it was a difficult decision to make.

My development as a programmer and as a more seasoned member of the organization has been greatly assisted by your coaching.

I have been proud of Cyberdyne Systems’ ethics and success throughout my 25 years at the company. Starting as a mailroom clerk and currently serving as head programmer.

The portfolios of our clients have always been handled with the greatest care by my colleagues. It is our employees and services that have made Cyberdyne Systems the success it is today.

During my tenure as head of my division, I’ve increased our overall productivity by 800 percent, and I expect that trend to continue after I retire.

In light of the fact that the process of replacing me may take some time, I would like to offer my assistance in any way I can.

The greatest contender for this job is Troy Ledford, my current assistant.

Also, before I leave, I would be willing to teach any partners how to use the programmer I developed to track and manage the development of Skynet.

Over the next few months, I’ll be enjoying vacations with my wife as well as my granddaughter moving to college.

If Cyberdyne Systems has any openings for consultants, please let me know. It has been a pleasure working with you over the last 25 years. I appreciate your concern and care.

Sincerely,

Greg S, Jackson

Questions and Answers

1. What is a letter of retirement?

Retirement letters tell your supervisor you're retiring. This informs your employer that you're departing, like a letter. A resignation letter also requests retirement benefits.

Supervisors frequently receive retirement letters and verbal resignations. Before submitting your retirement letter, meet to discuss your plans. This letter will be filed with your start date, salary, and benefits.

2. Why should you include a letter of retirement?

Your retirement letter should explain why you're leaving. When you quit, your manager and HR department usually know. Regardless, a retirement letter might help you leave on a positive tone. It ensures they have the necessary papers.

In your retirement letter, you tell the firm your plans so they can find your replacement. You may need to stay in touch with your company after sending your retirement letter until a successor is identified.

3. What information ought to be in your retirement letter?

Format it like an official letter. Include your retirement plans and retirement-specific statistics. Date may be most essential.

In some circumstances, benefits depend on when you resign and retire. A date on the letter helps HR or senior management verify when you gave notice and how long.

In addition to your usual salutation, address your letter to your manager or supervisor.

The letter's body should include your retirement date and transition arrangements. Tell them whether you plan to help with the transition or train a new employee. You may have a three-month time limit.

Tell your employer your job title, how long you've worked there, and your biggest successes. Personalize your letter by expressing gratitude for your career and outlining your retirement intentions. Finally, include your contact info.

4. Must I provide notice?

Two-week notice isn't required. Your company may require it. Some state laws contain exceptions.

Check your contract, company handbook, or HR to determine your retirement notice. Resigning may change the policy.

Regardless of your company's policy, notification is standard. Entry-level or junior jobs can be let go so the corporation can replace them.

Middle managers, high-level personnel, and specialists may take months to replace. Two weeks' notice is a courtesy. Start planning months ahead.

You can finish all jobs at that period. Prepare transition documents for coworkers and your replacement.

5. What is the ideal retirement age?

Depends on finances, state, and retirement plan. The average American retires at 62. The average retirement age is 66, according to Gallup's 2021 Economy and Personal Finance Survey.

Remember:

Before the age of 59 1/2, withdrawals from pre-tax retirement accounts, such as 401(k)s and IRAs, are subject to a penalty.

Benefits from Social Security can be accessed as early as age 62.

Medicare isn't available to you till you're 65,

Depending on the year of your birth, your Full Retirement Age (FRA) will be between 66 and 67 years old.

If you haven't taken them already, your Social Security benefits increase by 8% annually between ages 6 and 77.