More on Leadership

KonstantinDr

3 years ago

Early Adopters And the Fifth Reason WHY

Product management wizardry.

Early adopters buy a product even if it hasn't hit the market or has flaws.

Who are the early adopters?

Early adopters try a new technology or product first. Early adopters are interested in trying or buying new technologies and products before others. They're risk-tolerant and can provide initial cash flow and product reviews. They help a company's new product or technology gain social proof.

Early adopters are most common in the technology industry, but they're in every industry. They don't follow the crowd. They seek innovation and report product flaws before mass production. If the product works well, the first users become loyal customers, and colleagues value their opinion.

What to do with early adopters?

They can be used to collect feedback and initial product promotion, first sales, and product value validation.

How to find early followers?

Start with your immediate environment and target audience. Communicate with them to see if they're interested in your value proposition.

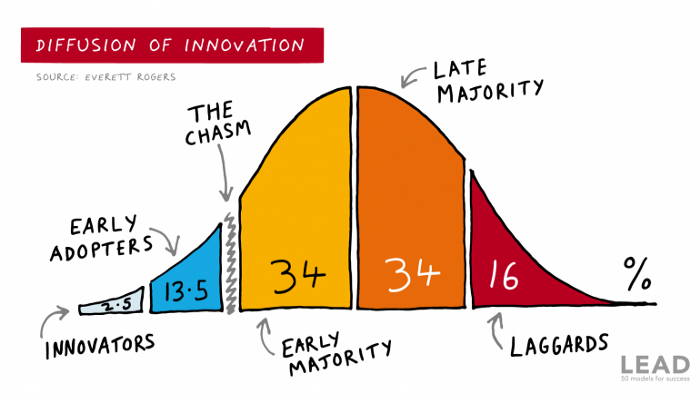

1) Innovators (2.5% of the population) are risk-takers seeking novelty. These people are the first to buy new and trendy items and drive social innovation. However, these people are usually elite;

Early adopters (13.5%) are inclined to accept innovations but are more cautious than innovators; they start using novelties when innovators or famous people do;

3) The early majority (34%) is conservative; they start using new products when many people have mastered them. When the early majority accepted the innovation, it became ingrained in people's minds.

4) Attracting 34% of the population later means the novelty has become a mass-market product. Innovators are using newer products;

5) Laggards (16%) are the most conservative, usually elderly people who use the same products.

Stages of new information acceptance

1. The information is strange and rejected by most. Accepted only by innovators;

2. When early adopters join, more people believe it's not so bad; when a critical mass is reached, the novelty becomes fashionable and most people use it.

3. Fascination with a novelty peaks, then declines; the majority and laggards start using it later; novelty becomes obsolete; innovators master something new.

Problems with early implementation

Early adopter sales have disadvantages.

Higher risk of defects

Selling to first-time users increases the risk of defects. Early adopters are often influential, so this can affect the brand's and its products' long-term perception.

Not what was expected

First-time buyers may be disappointed by the product. Marketing messages can mislead consumers, and if the first users believe the company misrepresented the product, this will affect future sales.

Compatibility issues

Some technological advances cause compatibility issues. Consumers may be disappointed if new technology is incompatible with their electronics.

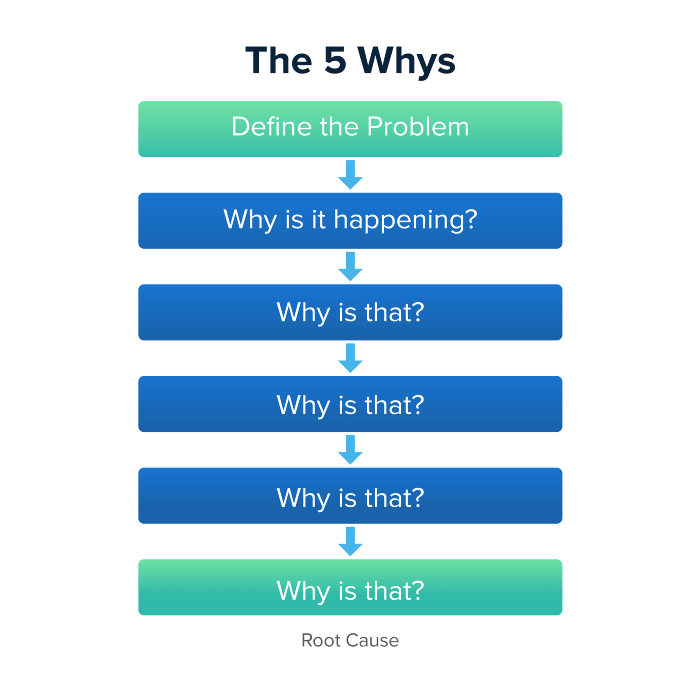

Method 5 WHY

Let's talk about 5 why, a good tool for finding project problems' root causes. This method is also known as the five why rule, method, or questions.

The 5 why technique came from Toyota's lean manufacturing and helps quickly determine a problem's root cause.

On one, two, and three, you simply do this:

We identify and frame the issue for which a solution is sought.

We frequently ponder this question. The first 2-3 responses are frequently very dull, making you want to give up on this pointless exercise. However, after that, things get interesting. And occasionally it's so fascinating that you question whether you really needed to know.

We consider the final response, ponder it, and choose a course of action.

Always do the 5 whys with the customer or team to have a reasonable discussion and better understand what's happening.

And the “five whys” is a wonderful and simplest tool for introspection. With the accumulated practice, it is used almost automatically in any situation like “I can’t force myself to work, the mood is bad in the morning” or “why did I decide that I have no life without this food processor for 20,000 rubles, which will take half of my rather big kitchen.”

An illustration of the five whys

A simple, but real example from my work practice that I think is very indicative, given the participants' low IT skills. Anonymized, of course.

Users spend too long looking for tender documents.

Why? Because they must search through many company tender documents.

Why? Because the system can't filter department-specific bids.

Why? Because our contract management system requirements didn't include a department-tender link. That's it, right? We'll add a filter and be happy. but still…

why? Because we based the system's requirements on regulations for working with paper tender documents (when they still had envelopes and autopsies), not electronic ones, and there was no search mechanism.

Why? We didn't consider how our work would change when switching from paper to electronic tenders when drafting the requirements.

Now I know what to do in the future. We add a filter, enter department data, and teach users to use it. This is tactical, but strategically we review the same forgotten requirements to make all the necessary changes in a package, plus we include it in the checklist for the acceptance of final requirements for the future.

Errors when using 5 why

Five whys seems simple, but it can be misused.

Popular ones:

The accusation of everyone and everything is then introduced. After all, the 5 why method focuses on identifying the underlying causes rather than criticizing others. As a result, at the third step, it is not a good idea to conclude that the system is ineffective because users are stupid and that we can therefore do nothing about it.

to fight with all my might so that the outcome would be exactly 5 reasons, neither more nor less. 5 questions is a typical number (it sounds nice, yes), but there could be 3 or 7 in actuality.

Do not capture in-between responses. It is difficult to overestimate the power of the written or printed word, so the result is so-so when the focus is lost. That's it, I suppose. Simple, quick, and brilliant, like other project management tools.

Conclusion

Today we analyzed important study elements:

Early adopters and 5 WHY We've analyzed cases and live examples of how these methods help with product research and growth point identification. Next, consider the HADI cycle.

Jano le Roux

3 years ago

The Real Reason Adobe Just Paid $20 billion for Figma

Sketch or Figma?

Designers are pissed.

The beast ate the beauty.

Figma deserves $20B.

Do designers deserve Adobe?

Adobe devours new creative tools and spits them out with a slimy Adobe aftertaste.

Frame.io — $1.3B

Magento — $1.7B

Macromedia — $3.6B

Nothing compares to the risky $20B acquisition.

If they can't be beaten, buy them.

And then make them boring.

Adobe's everywhere.

Like that friend who dabbles in everything creatively, there's not enough time to master one thing.

Figma was Adobe's thigh-mounted battle axe.

a UX design instrument with a sizable free tier.

a UX design tool with a simple and quick user interface.

a tool for fluid collaboration in user experience design.

a web-based UX design tool that functions well.

a UX design tool with a singular goal of perfection.

UX design software that replaced Adobe XD.

Adobe XD could do many of Figma's things, but it didn't focus on the details. This is a major issue when working with detail-oriented professionals.

UX designers.

Design enthusiasts first used Figma. More professionals used it. Institutions taught it. Finally, major brands adopted Figma.

Adobe hated that.

Adobe dispatched a team of lawyers to resolve the Figma issue, as big companies do. Figma didn’t bite for months.

Oh no.

Figma resisted.

Figma helped designers leave Adobe. Figma couldn't replace Photoshop, but most designers used it to remove backgrounds.

Online background removal tools improved.

The Figma problem grew into a thorn, a knife, and a battle ax in Adobe's soft inner thigh.

Figma appeared to be going public. Adobe couldn’t allow that. It bought Figma for $20B during the IPO drought.

Adobe has a new issue—investors are upset.

The actual cause of investors' ire toward Adobe

Spoiler: The math just doesn’t add up.

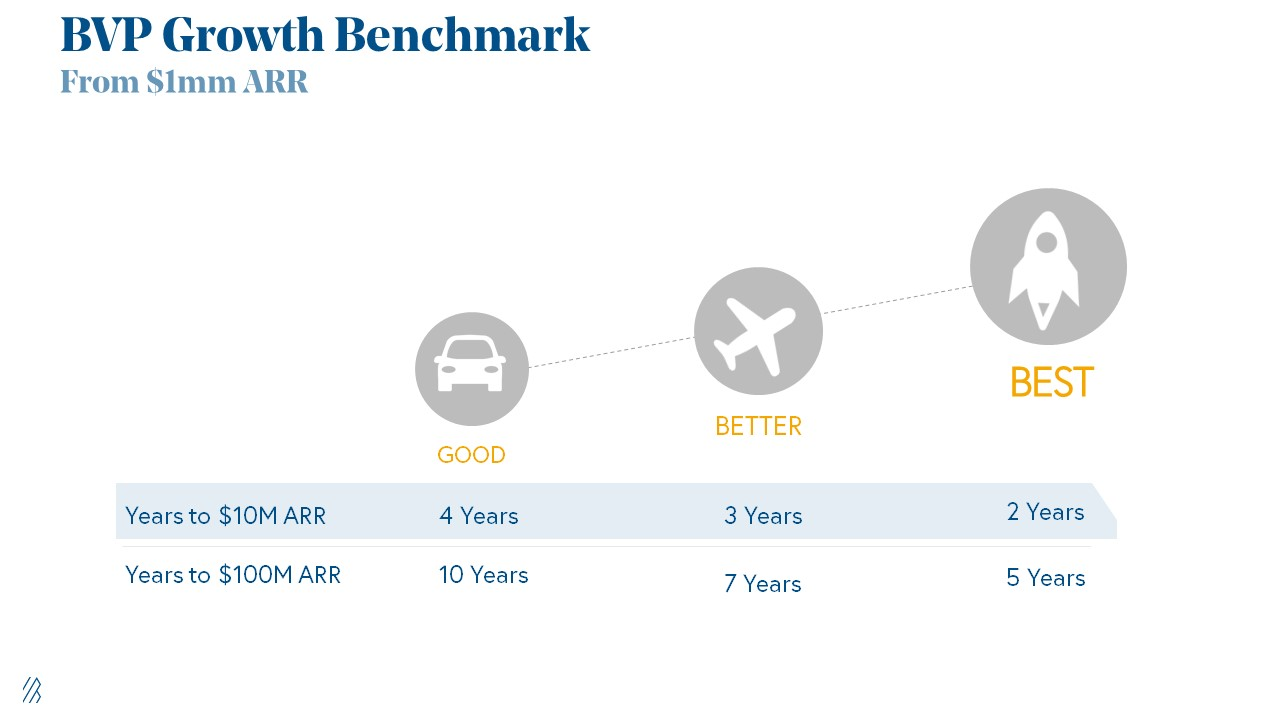

According to Adobe's press release, Figma's annual recurring revenue (ARR) is $400M and growing rapidly.

The $20B valuation requires a 50X revenue multiple, which is unheard of.

Venture capitalists typically use:

10% to 29% growth per year: ARR multiplied by 1 to 5

30% to 99% growth per year: ARR multiplied by 6 to 10

100% to 400% growth per year: ARR multiplied by 10 to 20

Showing an investor a 50x multiple is like telling friends you saw a UFO. They'll think you're crazy.

Adobe's stock fell immediately after the acquisition because it didn't make sense to a number-cruncher.

Designers started a Tweet storm in the digital town hall where VCs and designers often meet.

Adobe acquired Workfront for $1.5 billion at the end of 2020. This purchase made sense for investors.

Many investors missed the fact that Adobe is acquiring Figma not only for its ARR but also for its brilliant collaboration tech.

Adobe could use Figmas web app technology to make more products web-based to compete with Canva.

Figma's high-profile clients could switch to Adobe's enterprise software.

However, questions arise:

Will Adobe make Figma boring?

Will Adobe tone down Figma to boost XD?

Would you ditch Adobe and Figma for Sketch?

Al Anany

2 years ago

Because of this covert investment that Bezos made, Amazon became what it is today.

He kept it under wraps for years until he legally couldn’t.

His shirt is incomplete. I can’t stop thinking about this…

Actually, ignore the article. Look at it. JUST LOOK at it… It’s quite disturbing, isn’t it?

Ughh…

Me: “Hey, what up?” Friend: “All good, watching lord of the rings on amazon prime video.” Me: “Oh, do you know how Amazon grew and became famous?” Friend: “Geek alert…Can I just watch in peace?” Me: “But… Bezos?” Friend: “Let it go, just let it go…”

I can question you, the reader, and start answering instantly without his consent. This far.

Reader, how did Amazon succeed? You'll say, Of course, it was an internet bookstore, then it sold everything.

Mistaken. They moved from zero to one because of this. How did they get from one to thousand? AWS-some. Understand? It's geeky and lame. If not, I'll explain my geekiness.

Over an extended period of time, Amazon was not profitable.

Business basics. You want customers if you own a bakery, right?

Well, 100 clients per day order $5 cheesecakes (because cheesecakes are awesome.)

$5 x 100 consumers x 30 days Equals $15,000 monthly revenue. You proudly work here.

Now you have to pay the barista (unless ChatGPT is doing it haha? Nope..)

The barista is requesting $5000 a month.

Each cheesecake costs the cheesecake maker $2.5 ($2.5 × 100 x 30 = $7500).

The monthly cost of running your bakery, including power, is about $5000.

Assume no extra charges. Your operating costs are $17,500.

Just $15,000? You have income but no profit. You might make money selling coffee with your cheesecake next month.

Is losing money bad? You're broke. Losing money. It's bad for financial statements.

It's almost a business ultimatum. Most startups fail. Amazon took nine years.

I'm reading Amazon Unbound: Jeff Bezos and the Creation of a Global Empire to comprehend how a company has a $1 trillion market cap.

Many things made Amazon big. The book claims that Bezos and Amazon kept a specific product secret for a long period.

Clouds above the bald head.

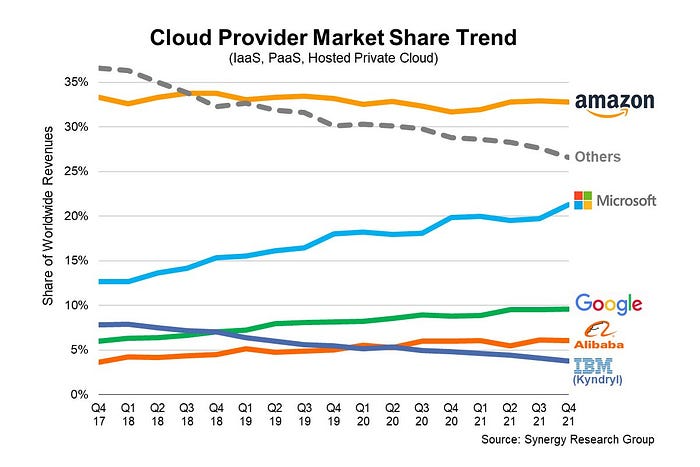

In 2006, Bezos started a cloud computing initiative. They believed many firms like Snapchat would pay for reliable servers.

In 2006, cloud computing was not what it is today. I'll simplify. 2006 had no iPhone.

Bezos invested in Amazon Web Services (AWS) without disclosing its revenue. That's permitted till a certain degree.

Google and Microsoft would realize Amazon is heavily investing in this market and worry.

Bezos anticipated high demand for this product. Microsoft built its cloud in 2010, and Google in 2008.

If you managed Google or Microsoft, you wouldn't know how much Amazon makes from their cloud computing service. It's enough. Yet, Amazon is an internet store, so they'll focus on that.

All but Bezos were wrong.

Time to come clean now.

They revealed AWS revenue in 2015. Two things were apparent:

Bezos made the proper decision to bet on the cloud and keep it a secret.

In this race, Amazon is in the lead.

They continued. Let me list some AWS users today.

Netflix

Airbnb

Twitch

More. Amazon was unprofitable for nine years, remember? This article's main graph.

AWS accounted for 74% of Amazon's profit in 2021. This 74% might not exist if they hadn't invested in AWS.

Bring this with you home.

Amazon predated AWS. Yet, it helped the giant reach $1 trillion. Bezos' secrecy? Perhaps, until a time machine is invented (they might host the time machine software on AWS, though.)

Without AWS, Amazon would have been profitable but unimpressive. They may have invested in anything else that would have returned more (like crypto? No? Ok.)

Bezos has business flaws. His success. His failures include:

introducing the Fire Phone and suffering a $170 million loss.

Amazon's failure in China In 2011, Amazon had a about 15% market share in China. 2019 saw a decrease of about 1%.

not offering a higher price to persuade the creator of Netflix to sell the company to him. He offered a rather reasonable $15 million in his proposal. But what if he had offered $30 million instead (Amazon had over $100 million in revenue at the time)? He might have owned Netflix, which has a $156 billion market valuation (and saved billions rather than invest in Amazon Prime Video).

Some he could control. Some were uncontrollable. Nonetheless, every action he made in the foregoing circumstances led him to invest in AWS.

You might also like

Thomas Tcheudjio

3 years ago

If you don't crush these 3 metrics, skip the Series A.

I recently wrote about getting VCs excited about Marketplace start-ups. SaaS founders became envious!

Understanding how people wire tens of millions is the only Series A hack I recommend.

Few people understand the intellectual process behind investing.

VC is risk management.

Series A-focused VCs must cover two risks.

1. Market risk

You need a large market to cross a threshold beyond which you can build defensibilities. Series A VCs underwrite market risk.

They must see you have reached product-market fit (PMF) in a large total addressable market (TAM).

2. Execution risk

When evaluating your growth engine's blitzscaling ability, execution risk arises.

When investors remove operational uncertainty, they profit.

Series A VCs like businesses with derisked revenue streams. Don't raise unless you have a predictable model, pipeline, and growth.

Please beat these 3 metrics before Series A:

Achieve $1.5m ARR in 12-24 months (Market risk)

Above 100% Net Dollar Retention. (Market danger)

Lead Velocity Rate supporting $10m ARR in 2–4 years (Execution risk)

Hit the 3 and you'll raise $10M in 4 months. Discussing 2/3 may take 6–7 months.

If none, don't bother raising and focus on becoming a capital-efficient business (Topics for other posts).

Let's examine these 3 metrics for the brave ones.

1. Lead Velocity Rate supporting €$10m ARR in 2 to 4 years

Last because it's the least discussed. LVR is the most reliable data when evaluating a growth engine, in my opinion.

SaaS allows you to see the future.

Monthly Sales and Sales Pipelines, two predictive KPIs, have poor data quality. Both are lagging indicators, and minor changes can cause huge modeling differences.

Analysts and Associates will trash your forecasts if they're based only on Monthly Sales and Sales Pipeline.

LVR, defined as month-over-month growth in qualified leads, is rock-solid. There's no lag. You can See The Future if you use Qualified Leads and a consistent formula and process to qualify them.

With this metric in your hand, scaling your company turns into an execution play on which VCs are able to perform calculations risk.

2. Above-100% Net Dollar Retention.

Net Dollar Retention is a better-known SaaS health metric than LVR.

Net Dollar Retention measures a SaaS company's ability to retain and upsell customers. Ask what $1 of net new customer spend will be worth in years n+1, n+2, etc.

Depending on the business model, SaaS businesses can increase their share of customers' wallets by increasing users, selling them more products in SaaS-enabled marketplaces, other add-ons, and renewing them at higher price tiers.

If a SaaS company's annualized Net Dollar Retention is less than 75%, there's a problem with the business.

Slack's ARR chart (below) shows how powerful Net Retention is. Layer chart shows how existing customer revenue grows. Slack's S1 shows 171% Net Dollar Retention for 2017–2019.

Slack S-1

3. $1.5m ARR in the last 12-24 months.

According to Point 9, $0.5m-4m in ARR is needed to raise a $5–12m Series A round.

Target at least what you raised in Pre-Seed/Seed. If you've raised $1.5m since launch, don't raise before $1.5m ARR.

Capital efficiency has returned since Covid19. After raising $2m since inception, it's harder to raise $1m in ARR.

P9's 2016-2021 SaaS Funding Napkin

In summary, less than 1% of companies VCs meet get funded. These metrics can help you win.

If there’s demand for it, I’ll do one on direct-to-consumer.

Cheers!

Vishal Chawla

3 years ago

5 Bored Apes borrowed to claim $1.1 million in APE tokens

Takeaway

Unknown user took advantage of the ApeCoin airdrop to earn $1.1 million.

He used a flash loan to borrow five BAYC NFTs, claim the airdrop, and repay the NFTs.

Yuga Labs, the creators of BAYC, airdropped ApeCoin (APE) to anyone who owns one of their NFTs yesterday.

For the Bored Ape Yacht Club and Mutant Ape Yacht Club collections, the team allocated 150 million tokens, or 15% of the total ApeCoin supply, worth over $800 million. Each BAYC holder received 10,094 tokens worth $80,000 to $200,000.

But someone managed to claim the airdrop using NFTs they didn't own. They used the airdrop's specific features to carry it out. And it worked, earning them $1.1 million in ApeCoin.

The trick was that the ApeCoin airdrop wasn't based on who owned which Bored Ape at a given time. Instead, anyone with a Bored Ape at the time of the airdrop could claim it. So if you gave someone your Bored Ape and you hadn't claimed your tokens, they could claim them.

The person only needed to get hold of some Bored Apes that hadn't had their tokens claimed to claim the airdrop. They could be returned immediately.

So, what happened?

The person found a vault with five Bored Ape NFTs that hadn't been used to claim the airdrop.

A vault tokenizes an NFT or a group of NFTs. You put a bunch of NFTs in a vault and make a token. This token can then be staked for rewards or sold (representing part of the value of the collection of NFTs). Anyone with enough tokens can exchange them for NFTs.

This vault uses the NFTX protocol. In total, it contained five Bored Apes: #7594, #8214, #9915, #8167, and #4755. Nobody had claimed the airdrop because the NFTs were locked up in the vault and not controlled by anyone.

The person wanted to unlock the NFTs to claim the airdrop but didn't want to buy them outright s o they used a flash loan, a common tool for large DeFi hacks. Flash loans are a low-cost way to borrow large amounts of crypto that are repaid in the same transaction and block (meaning that the funds are never at risk of not being repaid).

With a flash loan of under $300,000 they bought a Bored Ape on NFT marketplace OpenSea. A large amount of the vault's token was then purchased, allowing them to redeem the five NFTs. The NFTs were used to claim the airdrop, before being returned, the tokens sold back, and the loan repaid.

During this process, they claimed 60,564 ApeCoin airdrops. They then sold them on Uniswap for 399 ETH ($1.1 million). Then they returned the Bored Ape NFT used as collateral to the same NFTX vault.

Attack or arbitrage?

However, security firm BlockSecTeam disagreed with many social media commentators. A flaw in the airdrop-claiming mechanism was exploited, it said.

According to BlockSecTeam's analysis, the user took advantage of a "vulnerability" in the airdrop.

"We suspect a hack due to a flaw in the airdrop mechanism. The attacker exploited this vulnerability to profit from the airdrop claim" said BlockSecTeam.

For example, the airdrop could have taken into account how long a person owned the NFT before claiming the reward.

Because Yuga Labs didn't take a snapshot, anyone could buy the NFT in real time and claim it. This is probably why BAYC sales exploded so soon after the airdrop announcement.

Hasan AboulHasan

3 years ago

High attachment products can help you earn money automatically.

Affiliate marketing is a popular online moneymaker. You promote others' products and get commissions. Affiliate marketing requires constant product promotion.

Affiliate marketing can be profitable even without much promotion. Yes, this is Autopilot Money.

How to Pick an Affiliate Program to Generate Income Autonomously

Autopilot moneymaking requires a recurring affiliate marketing program.

Finding the best product and testing it takes a lot of time and effort.

Here are three ways to choose the best service or product to promote:

Find a good attachment-rate product or service.

When choosing a product, ask if you can easily switch to another service. Attachment rate is how much people like a product.

Higher attachment rates mean better Autopilot products.

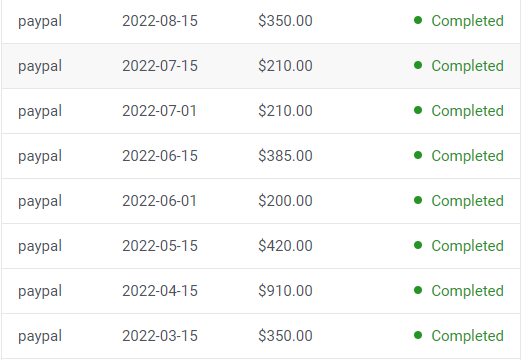

Consider promoting GetResponse. It's a 33% recurring commission email marketing tool. This means you get 33% of the customer's plan as long as he pays.

GetResponse has a high attachment rate because it's hard to leave and start over with another tool.

2. Pick a good or service with a lot of affiliate assets.

Check if a program has affiliate assets or creatives before joining.

Images and banners to promote the product in your business.

They save time; I look for promotional creatives. Creatives or affiliate assets are website banners or images. This reduces design time.

3. Select a service or item that consumers already adore.

New products are hard to sell. Choosing a trusted company's popular product or service is helpful.

As a beginner, let people buy a product they already love.

Online entrepreneurs and digital marketers love Systeme.io. It offers tools for creating pages, email marketing, funnels, and more. This product guarantees a high ROI.

Make the product known!

Affiliate marketers struggle to get traffic. Using affiliate marketing to make money is easier than you think if you have a solid marketing strategy.

Your plan should include:

1- Publish affiliate-related blog posts and SEO-optimize them

2- Sending new visitors product-related emails

3- Create a product resource page.

4-Review products

5-Make YouTube videos with links in the description.

6- Answering FAQs about your products and services on your blog and Quora.

7- Create an eCourse on how to use this product.

8- Adding Affiliate Banners to Your Website.

With these tips, you can promote your products and make money on autopilot.