Moonbirds NFT sells for $1 million in first week

On Saturday, Moonbird #2642, one of the collection's rarest NFTs, sold for a record 350 ETH (over $1 million) on OpenSea.

The Sandbox, a blockchain-based gaming company based in Hong Kong, bought the piece. The seller, "oscuranft" on OpenSea, made around $600,000 after buying the NFT for 100 ETH a week ago.

Owl avatars

Moonbirds is a 10,000 owl NFT collection. It is one of the quickest collections to achieve bluechip status. Proof, a media startup founded by renowned VC Kevin Rose, launched Moonbirds on April 16.

Rose is currently a partner at True Ventures, a technology-focused VC firm. He was a Google Ventures general partner and has 1.5 million Twitter followers.

Rose has an NFT podcast on Proof. It follows Proof Collective, a group of 1,000 NFT collectors and artists, including Beeple, who hold a Proof Collective NFT and receive special benefits.

These include early access to the Proof podcast and in-person events.

According to the Moonbirds website, they are "the official Proof PFP" (picture for proof).

Moonbirds NFTs sold nearly $360 million in just over a week, according to The Block Research and Dune Analytics. Its top ten sales range from $397,000 to $1 million.

In the current market, Moonbirds are worth 33.3 ETH. Each NFT is 2.5 ETH. Holders have gained over 12 times in just over a week.

Why was it so popular?

The Block Research's NFT analyst, Thomas Bialek, attributes Moonbirds' rapid rise to Rose's backing, the success of his previous Proof Collective project, and collectors' preference for proven NFT projects.

Proof Collective NFT holders have made huge gains. These NFTs were sold in a Dutch auction last December for 5 ETH each. According to OpenSea, the current floor price is 109 ETH.

According to The Block Research, citing Dune Analytics, Proof Collective NFTs have sold over $39 million to date.

Rose has bigger plans for Moonbirds. Moonbirds is introducing "nesting," a non-custodial way for holders to stake NFTs and earn rewards.

Holders of NFTs can earn different levels of status based on how long they keep their NFTs locked up.

"As you achieve different nest status levels, we can offer you different benefits," he said. "We'll have in-person meetups and events, as well as some crazy airdrops planned."

Rose went on to say that Proof is just the start of "a multi-decade journey to build a new media company."

More on NFTs & Art

Steffan Morris Hernandez

3 years ago

10 types of cognitive bias to watch out for in UX research & design

10 biases in 10 visuals

Cognitive biases are crucial for UX research, design, and daily life. Our biases distort reality.

After learning about biases at my UX Research bootcamp, I studied Erika Hall's Just Enough Research and used the Nielsen Norman Group's wealth of information. 10 images show my findings.

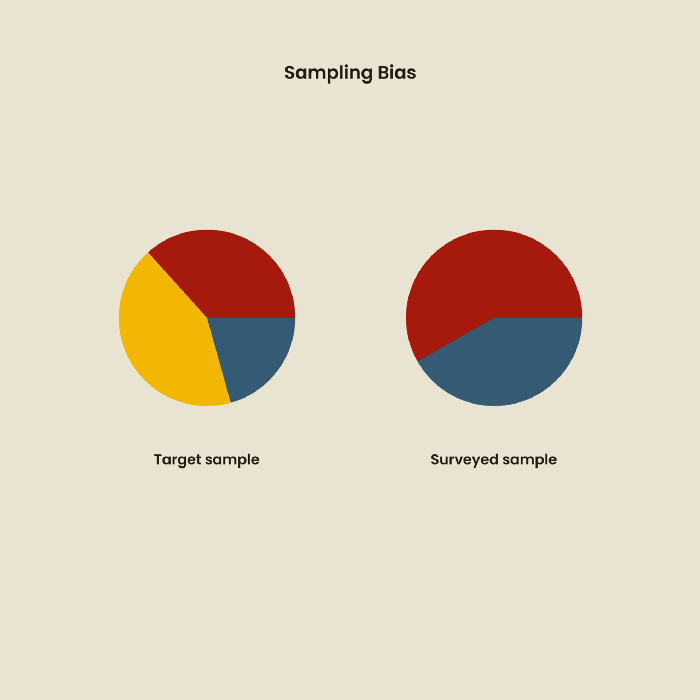

1. Bias in sampling

Misselection of target population members causes sampling bias. For example, you are building an app to help people with food intolerances log their meals and are targeting adult males (years 20-30), adult females (ages 20-30), and teenage males and females (ages 15-19) with food intolerances. However, a sample of only adult males and teenage females is biased and unrepresentative.

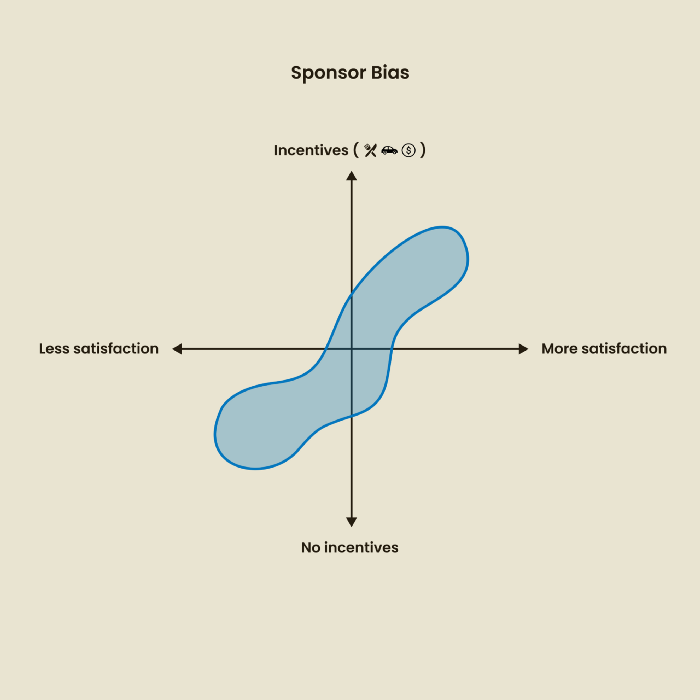

2. Sponsor Disparity

Sponsor bias occurs when a study's findings favor an organization's goals. Beware if X organization promises to drive you to their HQ, compensate you for your time, provide food, beverages, discounts, and warmth. Participants may endeavor to be neutral, but incentives and prizes may bias their evaluations and responses in favor of X organization.

In Just Enough Research, Erika Hall suggests describing the company's aims without naming it.

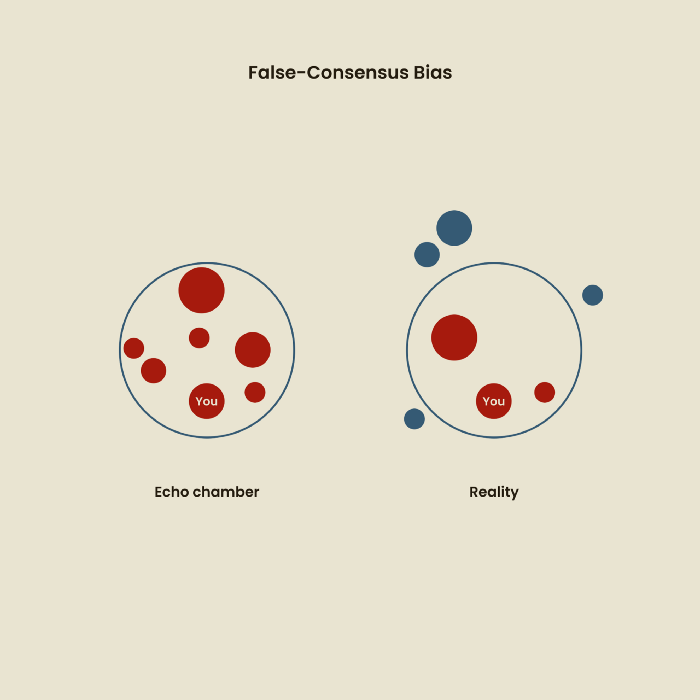

Third, False-Consensus Bias

False-consensus bias is when a person thinks others think and act the same way. For instance, if a start-up designs an app without researching end users' needs, it could fail since end users may have different wants. https://www.nngroup.com/videos/false-consensus-effect/

Working directly with the end user and employing many research methodologies to improve validity helps lessen this prejudice. When analyzing data, triangulation can boost believability.

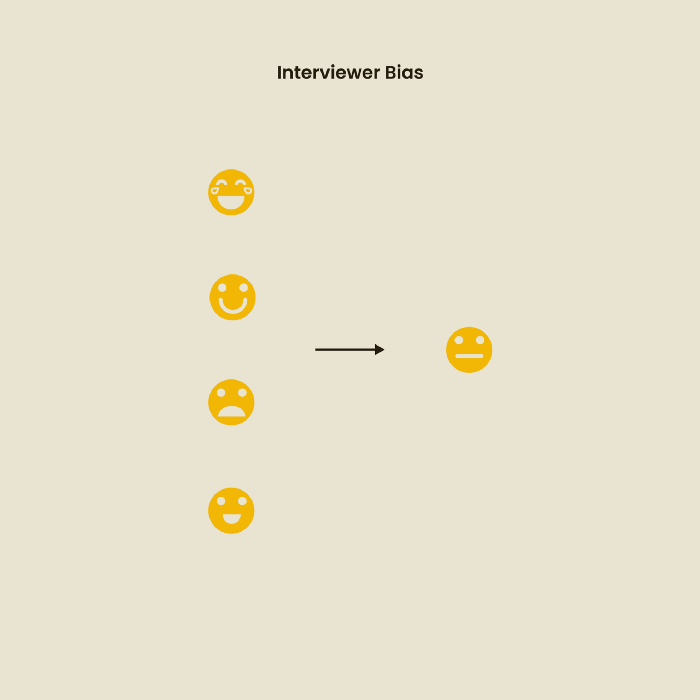

Bias of the interviewer

I struggled with this bias during my UX research bootcamp interviews. Interviewing neutrally takes practice and patience. Avoid leading questions that structure the story since the interviewee must interpret them. Nodding or smiling throughout the interview may subconsciously influence the interviewee's responses.

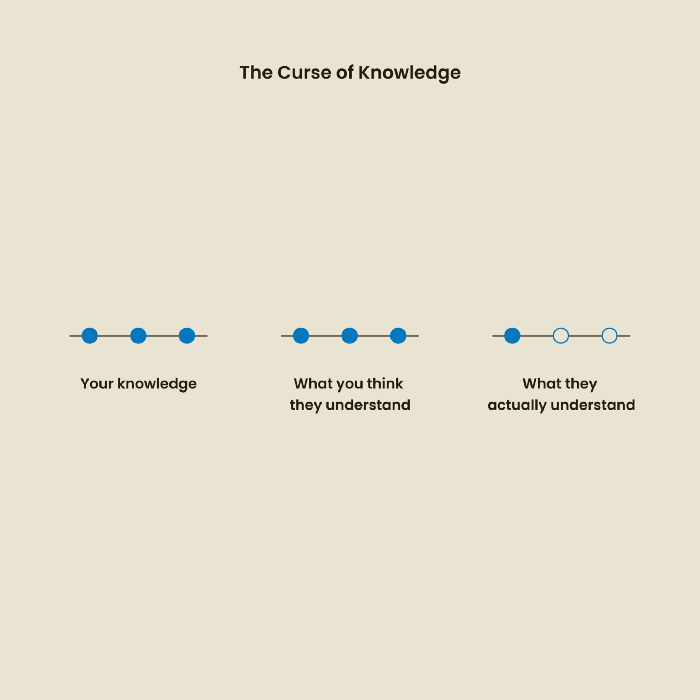

The Curse of Knowledge

The curse of knowledge occurs when someone expects others understand a subject as well as they do. UX research interviews and surveys should reduce this bias because technical language might confuse participants and harm the research. Interviewing participants as though you are new to the topic may help them expand on their replies without being influenced by the researcher's knowledge.

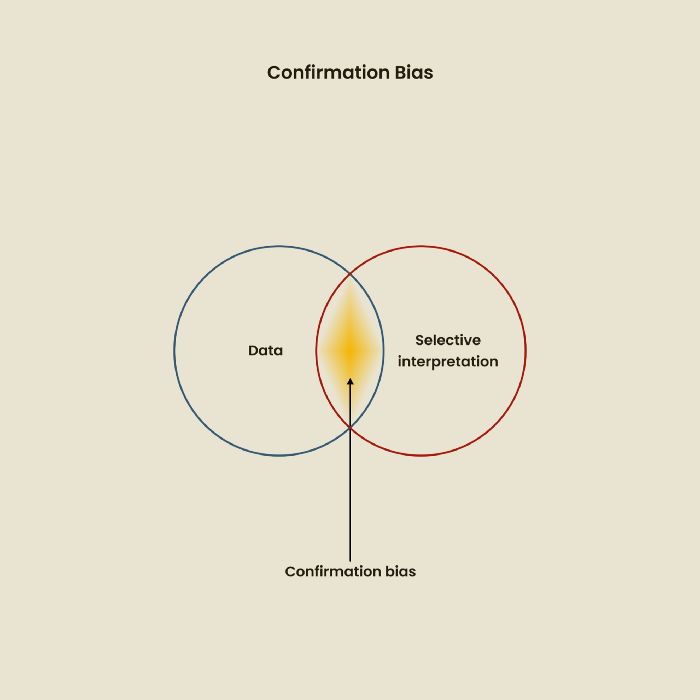

Confirmation Bias

Most prevalent bias. People highlight evidence that supports their ideas and ignore data that doesn't. The echo chamber of social media creates polarization by promoting similar perspectives.

A researcher with confirmation bias may dismiss data that contradicts their research goals. Thus, the research or product may not serve end users.

Design biases

UX Research design bias pertains to study construction and execution. Design bias occurs when data is excluded or magnified based on human aims, assumptions, and preferences.

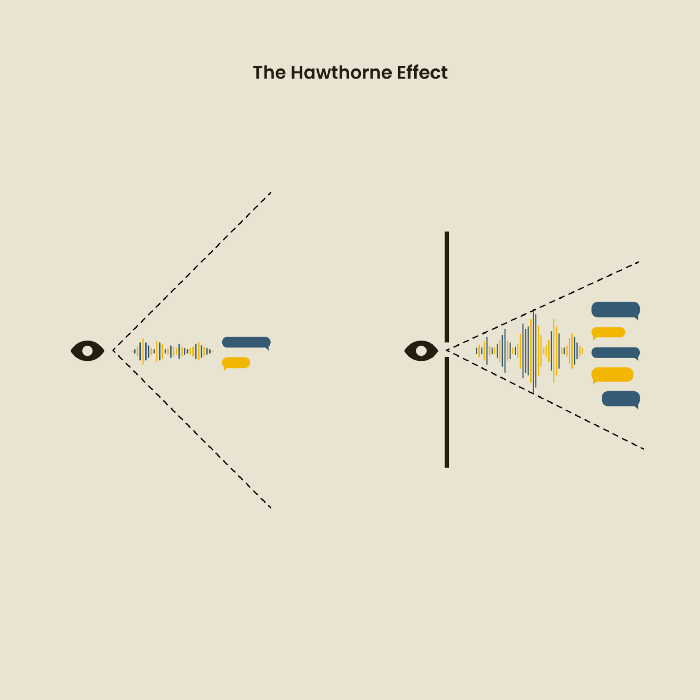

The Hawthorne Impact

Remember when you behaved differently while the teacher wasn't looking? When you behaved differently without your parents watching? A UX research study's Hawthorne Effect occurs when people modify their behavior because you're watching. To escape judgment, participants may act and speak differently.

To avoid this, researchers should blend into the background and urge subjects to act alone.

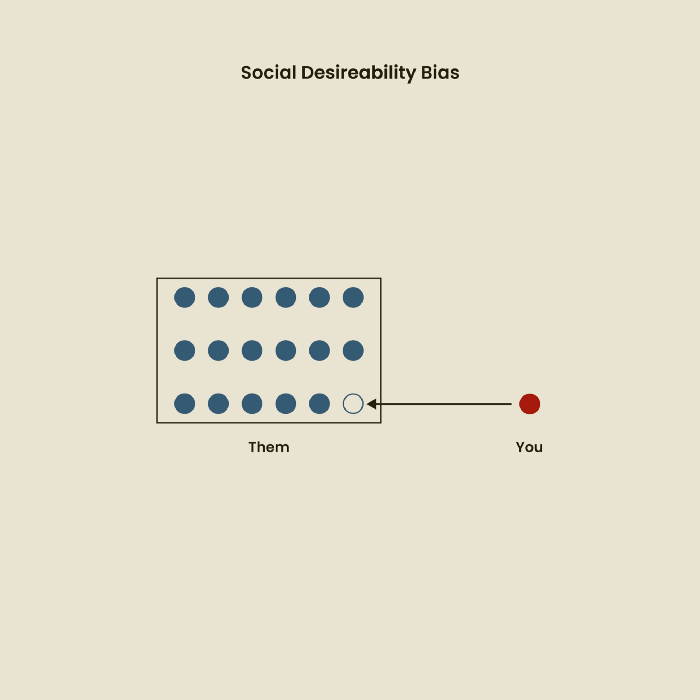

The bias against social desire

People want to belong to escape rejection and hatred. Research interviewees may mislead or slant their answers to avoid embarrassment. Researchers should encourage honesty and confidentiality in studies to address this. Observational research may reduce bias better than interviews because participants behave more organically.

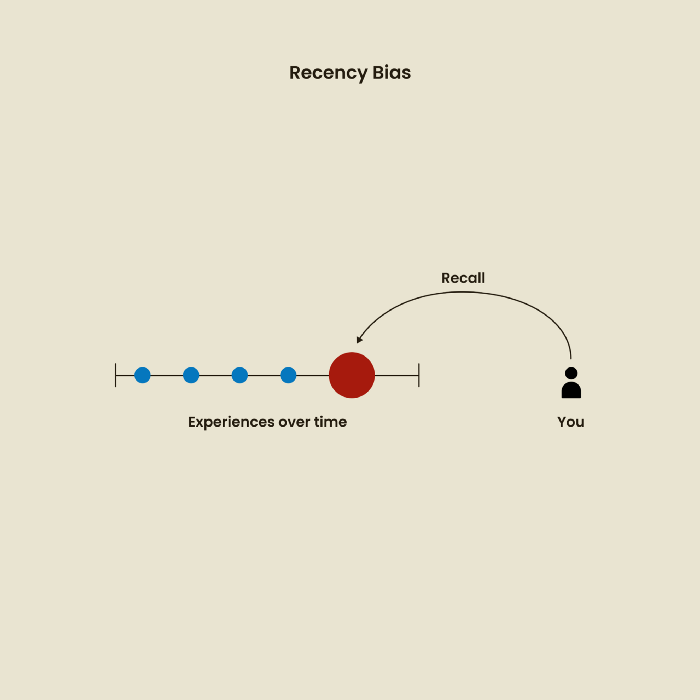

Relative Time Bias

Humans tend to appreciate recent experiences more. Consider school. Say you failed a recent exam but did well in the previous 7 exams. Instead, you may vividly recall the last terrible exam outcome.

If a UX researcher relies their conclusions on the most recent findings instead of all the data and results, recency bias might occur.

I hope you liked learning about UX design, research, and real-world biases.

Sea Launch

3 years ago

A guide to NFT pre-sales and whitelists

Before we dig through NFT whitelists and pre-sales, if you know absolutely nothing about NFTs, check our NFT Glossary.

What are pre-sales and whitelists on NFTs?

An NFT pre-sale, as the name implies, allows community members or early supporters of an NFT project to mint before the public, usually via a whitelist or mint pass.

Coin collectors can use mint passes to claim NFTs during the public sale. Because the mint pass is executed by “burning” an NFT into a specific crypto wallet, the collector is not concerned about gas price spikes.

A whitelist is used to approve a crypto wallet address for an NFT pre-sale. In a similar way to an early access list, it guarantees a certain number of crypto wallets can mint one (or more) NFT.

New NFT projects can do a pre-sale without a whitelist, but whitelists are good practice to avoid gas wars and a fair shot at minting an NFT before launching in competitive NFT marketplaces like Opensea, Magic Eden, or CNFT.

Should NFT projects do pre-sales or whitelists? 👇

The reasons to do pre-sales or a whitelist for NFT creators:

Time the market and gain traction.

Pre-sale or whitelists can help NFT projects gauge interest early on.

Whitelist spots filling up quickly is usually a sign of a successful launch, though it does not guarantee NFT longevity (more on that later). Also, full whitelists create FOMO and momentum for the public sale among non-whitelisted NFT collectors.

If whitelist signups are low or slow, projects may need to work on their vision, community, or product. Or the market is in a bear cycle. In either case, it aids NFT projects in market timing.

Reward the early NFT Community members.

Pre-sale and whitelists can help NFT creators reward early supporters.

First, by splitting the minting process into two phases, early adopters get a chance to mint one or more NFTs from their collection at a discounted or even free price.

Did you know that BAYC started at 0.08 eth each? A serum that allowed you to mint a Mutant Ape has become as valuable as the original BAYC.

(2) Whitelists encourage early supporters to help build a project's community in exchange for a slot or status. If you invite 10 people to the NFT Discord community, you get a better ranking or even a whitelist spot.

Pre-sale and whitelisting have become popular ways for new projects to grow their communities and secure future buyers.

Prevent gas wars.

Most new NFTs are created on the Ethereum blockchain, which has the highest transaction fees (also known as gas) (Solana, Cardano, Polygon, Binance Smart Chain, etc).

An NFT public sale is a gas war when a large number of NFT collectors (or bots) try to mint an NFT at the same time.

Competing collectors are willing to pay higher gas fees to prioritize their transaction and out-price others when upcoming NFT projects are hyped and very popular.

Pre-sales and whitelisting prevent gas wars by breaking the minting process into smaller batches of members or season launches.

The reasons to do pre-sales or a whitelists for NFT collectors:

How do I get on an NFT whitelist?

- Popular NFT collections act as a launchpad for other new or hyped NFT collections.

Example: Interfaces NFTs gives out 100 whitelist spots to Deadfellaz NFTs holders. Both NFT projects win. Interfaces benefit from Deadfellaz's success and brand equity.

In this case, to get whitelisted NFT collectors need to hold that specific NFT that is acting like a launchpad.

- A NFT studio or collection that launches a new NFT project and rewards previous NFT holders with whitelist spots or pre-sale access.

The whitelist requires previous NFT holders or community members.

NFT Alpha Groups are closed, small, tight-knit Discord servers where members share whitelist spots or giveaways from upcoming NFTs.

The benefit of being in an alpha group is getting information about new NFTs first and getting in on pre-sale/whitelist before everyone else.

There are some entry barriers to alpha groups, but if you're active in the NFT community, you'll eventually bump into, be invited to, or form one.

- A whitelist spot is awarded to members of an NFT community who are the most active and engaged.

This participation reward is the most democratic. To get a chance, collectors must work hard and play to their strengths.

Whitelisting participation examples:

- Raffle, games and contest: NFT Community raffles, games, and contests. To get a whitelist spot, invite 10 people to X NFT Discord community.

- Fan art: To reward those who add value and grow the community by whitelisting the best fan art and/or artists is only natural.

- Giveaways: Lucky number crypto wallet giveaways promoted by an NFT community. To grow their communities and for lucky collectors, NFT projects often offer free NFT.

- Activate your voice in the NFT Discord Community. Use voice channels to get NFT teams' attention and possibly get whitelisted.

The advantage of whitelists or NFT pre-sales.

Chainalysis's NFT stats quote is the best answer:

“Whitelisting isn’t just some nominal reward — it translates to dramatically better investing results. OpenSea data shows that users who make the whitelist and later sell their newly-minted NFT gain a profit 75.7% of the time, versus just 20.8% for users who do so without being whitelisted. Not only that, but the data suggests it’s nearly impossible to achieve outsized returns on minting purchases without being whitelisted.” Full report here.

Sure, it's not all about cash. However, any NFT collector should feel secure in their investment by owning a piece of a valuable and thriving NFT project. These stats help collectors understand that getting in early on an NFT project (via whitelist or pre-sale) will yield a better and larger return.

The downsides of pre-sales & whitelists for NFT creators.

Pre-sales and whitelist can cause issues for NFT creators and collectors.

NFT flippers

NFT collectors who only want to profit from early minting (pre-sale) or low mint cost (via whitelist). To sell the NFT in a secondary market like Opensea or Solanart, flippers go after the discounted price.

For example, a 1000 Solana NFT collection allows 100 people to mint 1 Solana NFT at 0.25 SOL. The public sale price for the remaining 900 NFTs is 1 SOL. If an NFT collector sells their discounted NFT for 0.5 SOL, the secondary market floor price is below the public mint.

This may deter potential NFT collectors. Furthermore, without a cap in the pre-sale minting phase, flippers can get as many NFTs as possible to sell for a profit, dumping them in secondary markets and driving down the floor price.

Hijacking NFT sites, communities, and pre-sales phase

People try to scam the NFT team and their community by creating oddly similar but fake websites, whitelist links, or NFT's Discord channel.

Established and new NFT projects must be vigilant to always make sure their communities know which are the official links, how a whitelist or pre-sale rules and how the team will contact (or not) community members.

Another way to avoid the scams around the pre-sale phase, NFT projects opt to create a separate mint contract for the whitelisted crypto wallets and then another for the public sale phase.

Scam NFT projects

We've seen a lot of mid-mint or post-launch rug pulls, indicating that some bad NFT projects are trying to scam NFT communities and marketplaces for quick profit. What happened to Magic Eden's launchpad recently will help you understand the scam.

We discussed the benefits and drawbacks of NFT pre-sales and whitelists for both projects and collectors.

Finally, some practical tools and tips for finding new NFTs 👇

Tools & resources to find new NFT on pre-sale or to get on a whitelist:

In order to never miss an update, important pre-sale dates, or a giveaway, create a Tweetdeck or Tweeten Twitter dashboard with hyped NFT project pages, hashtags ( #NFTGiveaways , #NFTCommunity), or big NFT influencers.

Search for upcoming NFT launches that have been vetted by the marketplace and try to get whitelisted before the public launch.

Save-timing discovery platforms like sealaunch.xyz for NFT pre-sales and upcoming launches. How can we help 100x NFT collectors get projects? A project's official social media links, description, pre-sale or public sale dates, price and supply. We're also working with Dune on NFT data analysis to help NFT collectors make better decisions.

Don't invest what you can't afford to lose because a) the project may fail or become rugged. Find NFTs projects that you want to be a part of and support.

Read original post here

Eric Esposito

3 years ago

$100M in NFT TV shows from Fox

Fox executives will invest $100 million in NFT-based TV shows. Fox brought in "Rick and Morty" co-creator Dan Harmon to create "Krapopolis"

Fox's Blockchain Creative Labs (BCL) will develop these NFT TV shows with Bento Box Entertainment. BCL markets Fox's WWE "Moonsault" NFT.

Fox said it would use the $100 million to build a "creative community" and "brand ecosystem." The media giant mentioned using these funds for NFT "benefits."

"Krapopolis" will be a Greek-themed animated comedy, per Rarity Sniper. Initial reports said NFT buyers could collaborate on "character development" and get exclusive perks.

Fox Entertainment may drop "Krapopolis" NFTs on Ethereum, according to new reports. Fox says it will soon release more details on its NFT plans for "Krapopolis."

Media Giants Favor "NFT Storytelling"

"Krapopolis" is one of the largest "NFT storytelling" experiments due to Dan Harmon's popularity and Fox Entertainment's reach. Many celebrities have begun exploring Web3 for TV shows.

Mila Kunis' animated sitcom "The Gimmicks" lets fans direct the show. Any "Gimmick" NFT holder could contribute to episode plots.

"The Gimmicks" lets NFT holders write fan fiction about their avatars. If show producers like what they read, their NFT may appear in an episode.

Rob McElhenney recently launched "Adimverse," a Web3 writers' community. Anyone with a "Adimverse" NFT can collaborate on creative projects and share royalties.

Many blue-chip NFTs are appearing in movies and TV shows. Coinbase will release Bored Ape Yacht Club shorts at NFT. NYC. Reese Witherspoon is working on a World of Women NFT series.

PFP NFT collections have Hollywood media partners. Guy Oseary manages Madonna's World of Women and Bored Ape Yacht Club collections. The Doodles signed with Billboard's Julian Holguin and the Cool Cats with CAA.

Web3 and NFTs are changing how many filmmakers tell stories.

You might also like

SAHIL SAPRU

3 years ago

Growth tactics that grew businesses from 1 to 100

Everyone wants a scalable startup.

Innovation helps launch a startup. The secret to a scalable business is growth trials (from 1 to 100).

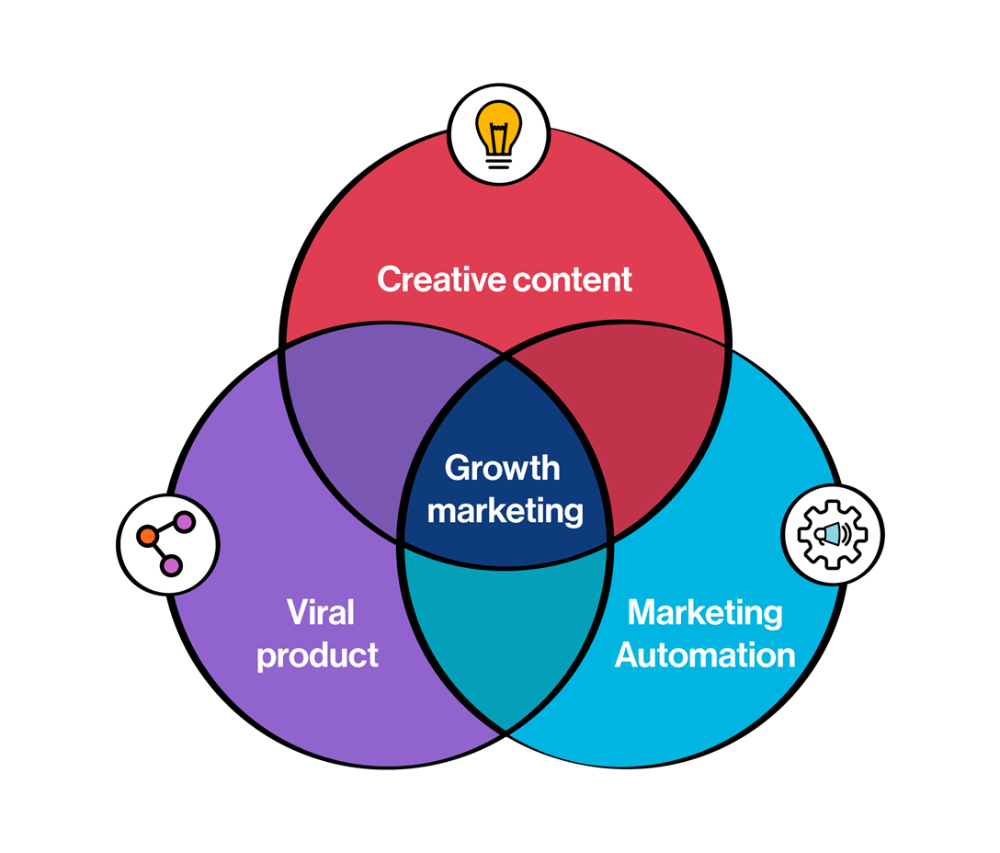

Growth marketing combines marketing and product development for long-term growth.

Today, I'll explain growth hacking strategies popular startups used to scale.

1/ A Facebook user's social value is proportional to their friends.

Facebook built its user base using content marketing and paid ads. Mark and his investors feared in 2007 when Facebook's growth stalled at 90 million users.

Chamath Palihapitiya was brought in by Mark.

The team tested SEO keywords and MAU chasing. The growth team introduced “people you may know”

This feature reunited long-lost friends and family. Casual users became power users as the retention curve flattened.

Growth Hack Insights: With social network effect the value of your product or platform increases exponentially if you have users you know or can relate with.

2/ Airbnb - Focus on your value propositions

Airbnb nearly failed in 2009. The company's weekly revenue was $200 and they had less than 2 months of runway.

Enter Paul Graham. The team noticed a pattern in 40 listings. Their website's property photos sucked.

Why?

Because these photos were taken with regular smartphones. Users didn't like the first impression.

Graham suggested traveling to New York to rent a camera, meet with property owners, and replace amateur photos with high-resolution ones.

A week later, the team's weekly revenue doubled to $400, indicating they were on track.

Growth Hack Insights: When selling an “online experience” ensure that your value proposition is aesthetic enough for users to enjoy being associated with them.

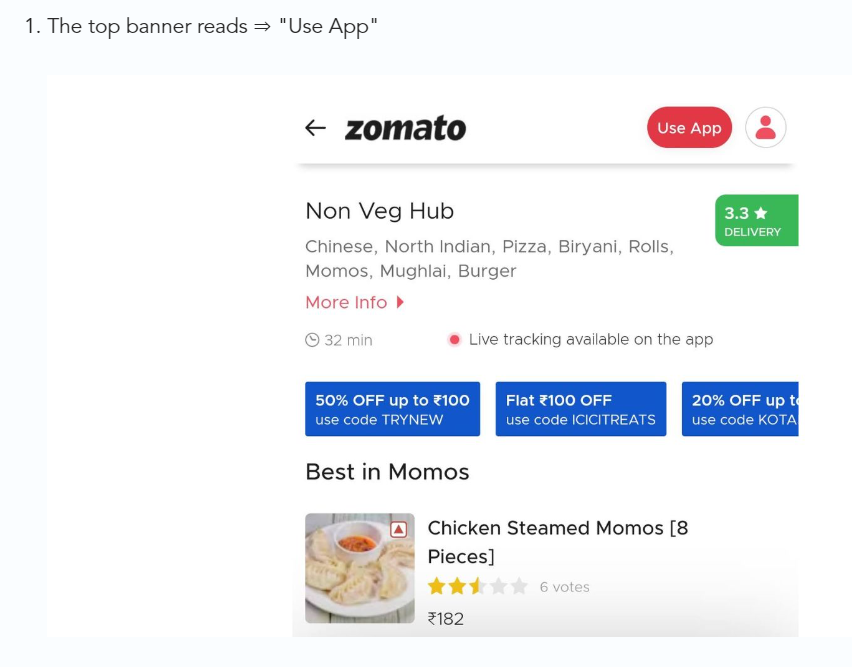

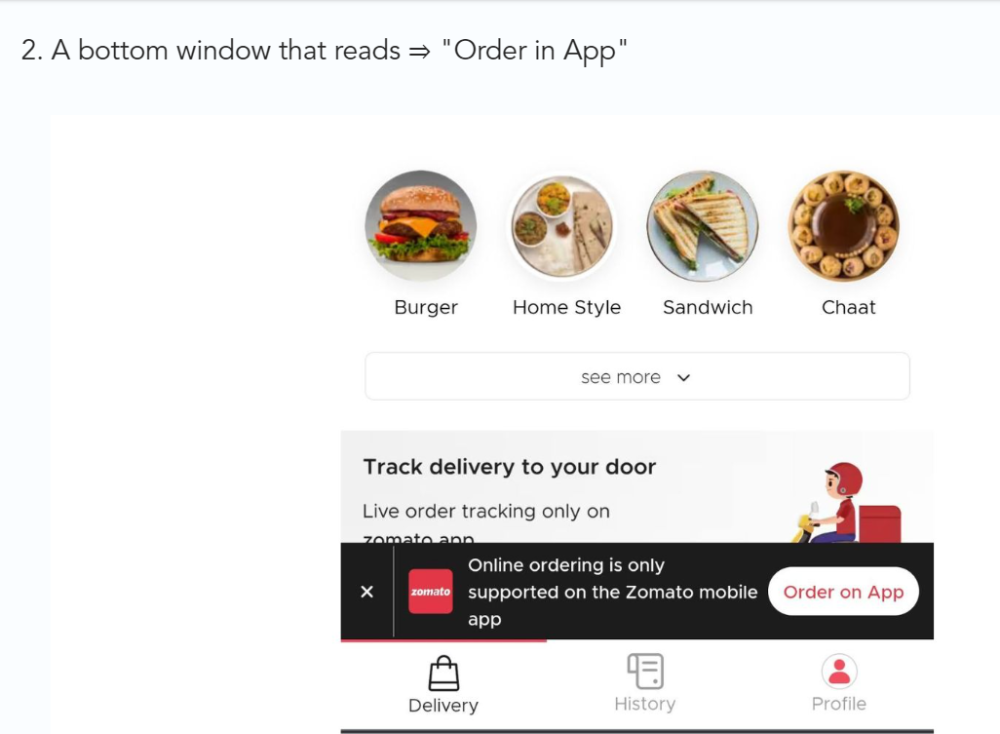

3/ Zomato - A company's smartphone push ensured growth.

Zomato delivers food. User retention was a challenge for the founders. Indian food customers are notorious for switching brands at the drop of a hat.

Zomato wanted users to order food online and repeat orders throughout the week.

Zomato created an attractive website with “near me” keywords for SEO indexing.

Zomato gambled to increase repeat orders. They only allowed mobile app food orders.

Zomato thought mobile apps were stickier. Product innovations in search/discovery/ordering or marketing campaigns like discounts/in-app notifications/nudges can improve user experience.

Zomato went public in 2021 after users kept ordering food online.

Growth Hack Insights: To improve user retention try to build platforms that build user stickiness. Your product and marketing team will do the rest for them.

4/ Hotmail - Signaling helps build premium users.

Ever sent or received an email or tweet with a sign — sent from iPhone?

Hotmail did it first! One investor suggested Hotmail add a signature to every email.

Overnight, thousands joined the company. Six months later, the company had 1 million users.

When serving an existing customer, improve their social standing. Signaling keeps the top 1%.

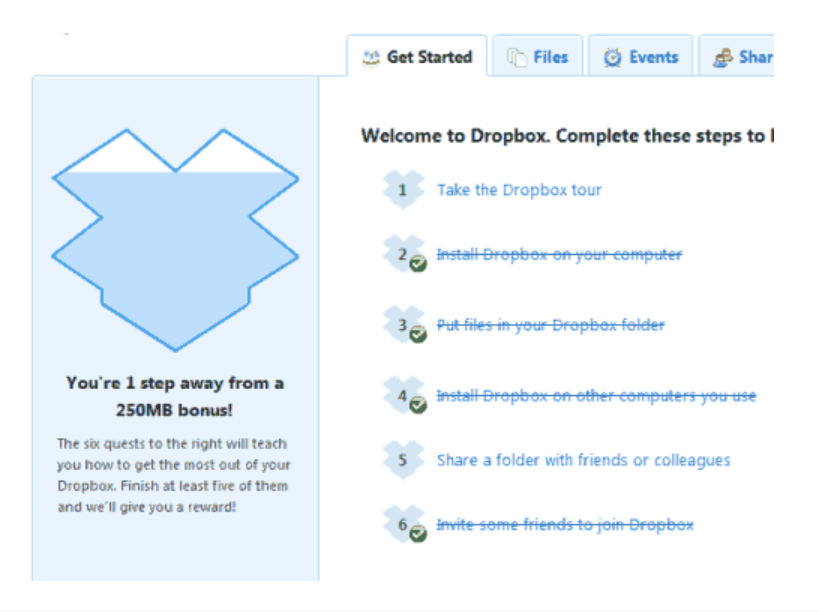

5/ Dropbox - Respect loyal customers

Dropbox is a company that puts people over profits. The company prioritized existing users.

Dropbox rewarded loyal users by offering 250 MB of free storage to anyone who referred a friend. The referral hack helped Dropbox get millions of downloads in its first few months.

Growth Hack Insights: Think of ways to improve the social positioning of your end-user when you are serving an existing customer. Signaling goes a long way in attracting the top 1% to stay.

These experiments weren’t hacks. Hundreds of failed experiments and user research drove these experiments. Scaling up experiments is difficult.

Contact me if you want to grow your startup's user base.

Micah Daigle

3 years ago

Facebook is going away. Here are two explanations for why it hasn't been replaced yet.

And tips for anyone trying.

We see the same story every few years.

BREAKING NEWS: [Platform X] launched a social network. With Facebook's reputation down, the new startup bets millions will switch.

Despite the excitement surrounding each new platform (Diaspora, Ello, Path, MeWe, Minds, Vero, etc.), no major exodus occurred.

Snapchat and TikTok attracted teens with fresh experiences (ephemeral messaging and rapid-fire videos). These features aren't Facebook, even if Facebook replicated them.

Facebook's core is simple: you publish items (typically text/images) and your friends (generally people you know IRL) can discuss them.

It's cool. Sometimes I don't want to, but sh*t. I like it.

Because, well, I like many folks I've met. I enjoy keeping in touch with them and their banter.

I dislike Facebook's corporation. I've been cautiously optimistic whenever a Facebook-killer surfaced.

None succeeded.

Why? Two causes, I think:

People couldn't switch quickly enough, which is reason #1

Your buddies make a social network social.

Facebook started in self-contained communities (college campuses) then grew outward. But a new platform can't.

If we're expected to leave Facebook, we want to know that most of our friends will too.

Most Facebook-killers had bottlenecks. You have to waitlist or jump through hoops (e.g. setting up a server).

Same outcome. Upload. Chirp.

After a week or two of silence, individuals returned to Facebook.

Reason #2: The fundamental experience was different.

Even when many of our friends joined in the first few weeks, it wasn't the same.

There were missing features or a different UX.

Want to reply with a meme? No photos in comments yet. (Trying!)

Want to tag a friend? Nope, sorry. 2019!

Want your friends to see your post? You must post to all your friends' servers. Good luck!

It's difficult to introduce a platform with 100% of the same features as one that's been there for 20 years, yet customers want a core experience.

If you can't, they'll depart.

The causes that led to the causes

Having worked on software teams for 14+ years, I'm not surprised by these challenges. They are a natural development of a few tech sector meta-problems:

Lean startup methodology

Silicon Valley worships lean startup. It's a way of developing software that involves testing a stripped-down version with a limited number of people before selecting what to build.

Billion people use Facebook's functions. They aren't tested. It must work right away*

*This may seem weird to software people, but it's how non-software works! You can't sell a car without wheels.

2. Creativity

Startup entrepreneurs build new things, not copies. I understand. Reinventing the wheel is boring.

We know what works. Different experiences raise adoption friction. Once millions have transferred, more features (and a friendlier UX) can be implemented.

3. Cost scaling

True. Building a product that can sustain hundreds of millions of users in weeks is expensive and complex.

Your lifeboats must have the same capacity as the ship you're evacuating. It's required.

4. Pure ideologies

People who work on Facebook-alternatives are (understandably) critical of Facebook.

They build an open-source, fully-distributed, data-portable, interface-customizable, offline-capable, censorship-proof platform.

Prioritizing these aims can prevent replicating the straightforward experience users expect. Github, not Facebook, is for techies only.

What about the business plan, though?

Facebook-killer attempts have followed three models.

Utilize VC funding to increase your user base, then monetize them later. (If you do this, you won't kill Facebook; instead, Facebook will become you.)

Users must pay to utilize it. (This causes a huge bottleneck and slows the required quick expansion, preventing it from seeming like a true social network.)

Make it a volunteer-run, open-source endeavor that is free. (This typically denotes that something is cumbersome, difficult to operate, and is only for techies.)

Wikipedia is a fourth way.

Wikipedia is one of the most popular websites and a charity. No ads. Donations support them.

A Facebook-killer managed by a good team may gather millions (from affluent contributors and the crowd) for their initial phase of development. Then it might sustain on regular donations, ethical transactions (e.g. fees on commerce, business sites, etc.), and government grants/subsidies (since it would essentially be a public utility).

When you're not aiming to make investors rich, it's remarkable how little money you need.

If you want to build a Facebook competitor, follow these tips:

Drop the lean startup philosophy. Wait until you have a finished product before launching. Build it, thoroughly test it for bugs, and then release it.

Delay innovating. Wait till millions of people have switched before introducing your great new features. Make it nearly identical for now.

Spend money climbing. Make sure that guests can arrive as soon as they are invited. Never keep them waiting. Make things easy for them.

Make it accessible to all. Even if doing so renders it less philosophically pure, it shouldn't require technical expertise to utilize.

Constitute a nonprofit. Additionally, develop community ownership structures. Profit maximization is not the only strategy for preserving valued assets.

Last thoughts

Nobody has killed Facebook, but Facebook is killing itself.

The startup is burying the newsfeed to become a TikTok clone. Meta itself seems to be ditching the platform for the metaverse.

I wish I was happy, but I'm not. I miss (understandably) removed friends' postings and remarks. It could be a ghost town in a few years. My dance moves aren't TikTok-worthy.

Who will lead? It's time to develop a social network for the people.

Greetings if you're working on it. I'm not a company founder, but I like to help hard-working folks.

obimy.app

3 years ago

How TikTok helped us grow to 6 million users

This resulted to obimy's new audience.

Hi! obimy's official account. Here, we'll teach app developers and marketers. In 2022, our downloads increased dramatically, so we'll share what we learned.

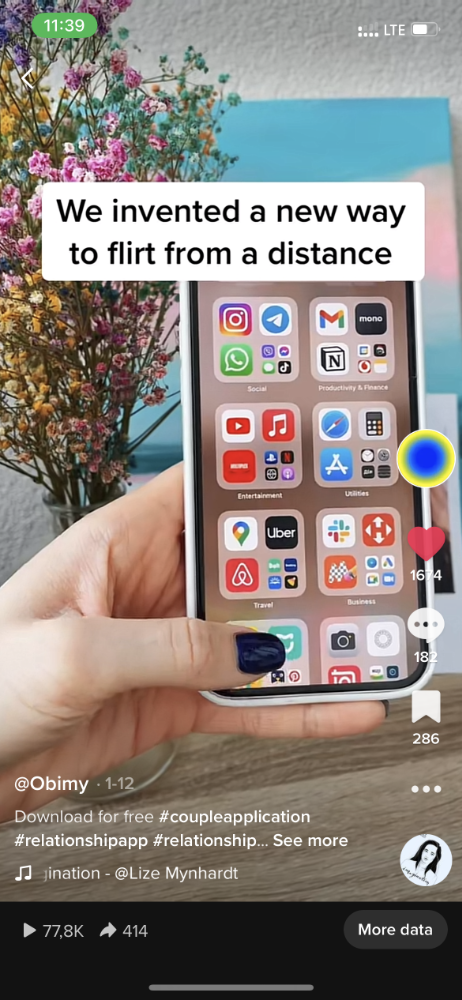

obimy is what we call a ‘senseger’. It's a new method to communicate digitally. Instead of text, obimy users connect through senses and moods. Feeling playful? Flirt with your partner, pat a pal, or dump water on a classmate. Each feeling is an interactive animation with vibration. It's a wordless app. App Store and Google Play have obimy.

We had 20,000 users in 2022. Two to five thousand of them opened the app monthly. Our DAU metric was 500.

We have 6 million users after 6 months. 500,000 individuals use obimy daily. obimy was the top lifestyle app this week in the U.S.

And TikTok helped.

TikTok fuels obimys' growth. It's why our app exploded. How and what did we learn? Our Head of Marketing, Anastasia Avramenko, knows.

our actions prior to TikTok

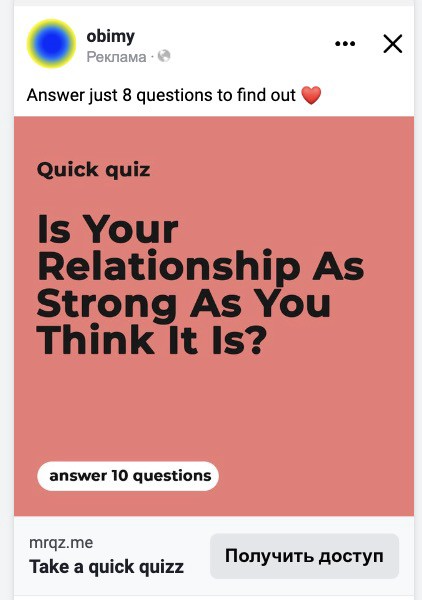

We wanted to achieve product-market fit through organic expansion. Quora, Reddit, Facebook Groups, Facebook Ads, Google Ads, Apple Search Ads, and social media activity were tested. Nothing worked. Our CPI was sometimes $4, so unit economics didn't work.

We studied our markets and made audience hypotheses. We promoted our goods and studied our audience through social media quizzes. Our target demographic was Americans in long-distance relationships. I designed quizzes like Test the Strength of Your Relationship to better understand the user base. After each quiz, we encouraged users to download the app to enhance their connection and bridge the distance.

We got 1,000 responses for $50. This helped us comprehend the audience's grief and coping strategies (aka our rivals). I based action items on answers given. If you can't embrace a loved one, use obimy.

We also tried Facebook and Google ads. From the start, we knew it wouldn't work.

We were desperate to discover a free way to get more users.

Our journey to TikTok

TikTok is a great venue for emerging creators. It also helped reach people. Before obimy, my TikTok videos garnered 12 million views without sponsored promotion.

We had to act. TikTok was required.

I wasn't a TikTok user before obimy. Initially, I uploaded promotional content. Call-to-actions appear strange next to dancing challenges and my money don't jiggle jiggle. I learned TikTok. Watch TikTok for an hour was on my to-do list. What a dream job!

Our most popular movies presented the app alongside text outlining what it does. We started promoting them in Europe and the U.S. and got a 16% CTR and $1 CPI, an improvement over our previous efforts.

Somehow, we were expanding. So we came up with new hypotheses, calls to action, and content.

Four months passed, yet we saw no organic growth.

Russia attacked Ukraine.

Our app aimed to be helpful. For now, we're focusing on our Ukrainian audience. I posted sloppy TikToks illustrating how obimy can help during shelling or air raids.

In two hours, Kostia sent me our visitor count. Our servers crashed.

Initially, we had several thousand daily users. Over 200,000 users joined obimy in a week. They posted obimy videos on TikTok, drawing additional users. We've also resumed U.S. video promotion.

We gained 2,000,000 new members with less than $100 in ads, primarily in the U.S. and U.K.

TikTok helped.

The figures

We were confident we'd chosen the ideal tool for organic growth.

Over 45 million people have viewed our own videos plus a ton of user-generated content with the hashtag #obimy.

About 375 thousand people have liked all of our individual videos.

The number of downloads and the virality of videos are directly correlated.

Where are we now?

TikTok fuels our organic growth. We post 56 videos every week and pay to promote viral content.

We use UGC and influencers. We worked with Universal Music Italy on Eurovision. They offered to promote us through their million-follower TikTok influencers. We thought their followers would improve our audience, but it didn't matter. Integration didn't help us. Users that share obimy videos with their followers can reach several million views, which affects our download rate.

After the dust settled, we determined our key audience was 13-18-year-olds. They want to express themselves, but it's sometimes difficult. We're searching for methods to better engage with our users. We opened a Discord server to discuss anime and video games and gather app and content feedback.

TikTok helps us test product updates and hypotheses. Example: I once thought we might raise MAU by prompting users to add strangers as friends. Instead of asking our team to construct it, I made a TikTok urging users to share invite URLs. Users share links under every video we upload, embracing people worldwide.

Key lessons

Don't direct-sell. TikTok isn't for Instagram, Facebook, or YouTube promo videos. Conventional advertisements don't fit. Most users will swipe up and watch humorous doggos.

More product videos are better. Finally. So what?

Encourage interaction. Tagging friends in comments or making videos with the app promotes it more than any marketing spend.

Be odd and risqué. A user mistakenly sent a French kiss to their mom in one of our most popular videos.

TikTok helps test hypotheses and build your user base. It also helps develop apps. In our upcoming blog, we'll guide you through obimy's design revisions based on TikTok. Follow us on Twitter, Instagram, and TikTok.