More on Marketing

Shruti Mishra

3 years ago

How to get 100k profile visits on Twitter each month without spending a dime

As a marketer, I joined Twitter on August 31, 2022 to use it.

Growth has been volatile, causing up-and-down engagements. 500 followers in 11 days.

I met amazing content creators, marketers, and people.

Those who use Twitter may know that one-liners win the algorithm, especially if they're funny or humorous, but as a marketer I can't risk posting content that my audience won't like.

I researched, learned some strategies, and A/B tested; some worked, some didn't.

In this article, I share what worked for me so you can do the same.

Thanks for reading!

Let's check my Twitter stats.

Tweets: how many tweets I sent in the first 28 days.

A user may be presented with a Tweet in their timeline or in search results.

In-person visits how many times my Twitter profile was viewed in the first 28 days.

Mentions: the number of times a tweet has mentioned my name.

Number of followers: People who were following me

Getting 500 Twitter followers isn't difficult.

Not easy, but doable.

Follow these steps to begin:

Determine your content pillars in step 1.

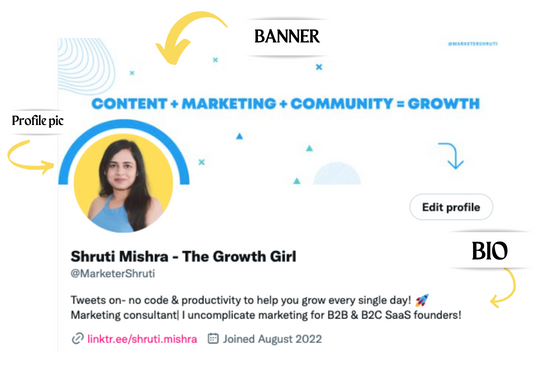

My formula is Growth = Content + Marketing + Community.

I discuss growth strategies.

My concept for growth is : 1. Content = creating / writing + sharing content in my niche. 2. Marketing = Marketing everything in business + I share my everyday learnings in business, marketing & entrepreneurship. 3. Community = Building community of like minded individuals (Also,I share how to’s) + supporting marketers to build & grow through community building.

Identify content pillars to create content for your audience.

2. Make your profile better

Create a profile picture. Your recognition factor is this.

Professional headshots are worthwhile.

This tool can help you create a free, eye-catching profile pic.

Use a niche-appropriate avatar if you don't want to show your face.

2. Create a bio that converts well mainly because first impressions count.

what you're sharing + why + +social proof what are you making

Be brief and precise. (155 characters)

3. Configure your banner

Banners complement profile pictures.

Use this space to explain what you do and how Twitter followers can benefit.

Canva's Twitter header maker is free.

Birdy can test multiple photo, bio, and banner combinations to optimize your profile.

Versions A and B of your profile should be completed.

Find the version that converts the best.

Use the profile that converts the best.

4. Special handle

If your username/handle is related to your niche, it will help you build authority and presence among your audience. Mine on Twitter is @marketershruti.

5. Participate expertly

Proficiently engage while you'll have no audience at first. Borrow your dream audience for free.

Steps:

Find a creator who has the audience you want.

Activate their post notifications and follow them.

Add a valuable comment first.

6. Create fantastic content

Use:

Medium (Read articles about your topic.)

Podcasts (Listen to experts on your topics)

YouTube (Follow channels in your niche)

Tweet what?

Listicle ( Hacks, Books, Tools, Podcasts)

Lessons (Teach your audience how to do 1 thing)

Inspirational (Inspire people to take action)

Consistent writing?

You MUST plan ahead and schedule your Tweets.

Use a scheduling tool that is effective for you; hypefury is mine.

Lastly, consistency is everything that attracts growth. After optimizing your profile, stay active to gain followers, engagements, and clients.

If you found this helpful, please like and comment below.

Mark Shpuntov

3 years ago

How to Produce a Month's Worth of Content for Social Media in a Day

New social media producers' biggest error

The Treadmill of Social Media Content

New creators focus on the wrong platforms.

They post to Instagram, Twitter, TikTok, etc.

They create daily material, but it's never enough for social media algorithms.

Creators recognize they're on a content creation treadmill.

They have to keep publishing content daily just to stay on the algorithm’s good side and avoid losing the audience they’ve built on the platform.

This is exhausting and unsustainable, causing creator burnout.

They focus on short-lived platforms, which is an issue.

Comparing low- and high-return social media platforms

Social media networks are great for reaching new audiences.

Their algorithm is meant to viralize material.

Social media can use you for their aims if you're not careful.

To master social media, focus on the right platforms.

To do this, we must differentiate low-ROI and high-ROI platforms:

Low ROI platforms are ones where content has a short lifespan. High ROI platforms are ones where content has a longer lifespan.

A tweet may be shown for 12 days. If you write an article or blog post, it could get visitors for 23 years.

ROI is drastically different.

New creators have limited time and high learning curves.

Nothing is possible.

First create content for high-return platforms.

ROI for social media platforms

Here are high-return platforms:

Your Blog - A single blog article can rank and attract a ton of targeted traffic for a very long time thanks to the power of SEO.

YouTube - YouTube has a reputation for showing search results or sidebar recommendations for videos uploaded 23 years ago. A superb video you make may receive views for a number of years.

Medium - A platform dedicated to excellent writing is called Medium. When you write an article about a subject that never goes out of style, you're building a digital asset that can drive visitors indefinitely.

These high ROI platforms let you generate content once and get visitors for years.

This contrasts with low ROI platforms:

Twitter

Instagram

TikTok

LinkedIn

Facebook

The posts you publish on these networks have a 23-day lifetime. Instagram Reels and TikToks are exceptions since viral content can last months.

If you want to make content creation sustainable and enjoyable, you must focus the majority of your efforts on creating high ROI content first. You can then use the magic of repurposing content to publish content to the lower ROI platforms to increase your reach and exposure.

How To Use Your Content Again

So, you’ve decided to focus on the high ROI platforms.

Great!

You've published an article or a YouTube video.

You worked hard on it.

Now you have fresh stuff.

What now?

If you are not repurposing each piece of content for multiple platforms, you are throwing away your time and efforts.

You've created fantastic material, so why not distribute it across platforms?

Repurposing Content Step-by-Step

For me, it's writing a blog article, but you might start with a video or podcast.

The premise is the same regardless of the medium.

Start by creating content for a high ROI platform (YouTube, Blog Post, Medium). Then, repurpose, edit, and repost it to the lower ROI platforms.

Here's how to repurpose pillar material for other platforms:

Post the article on your blog.

Put your piece on Medium (use the canonical link to point to your blog as the source for SEO)

Create a video and upload it to YouTube using the talking points from the article.

Rewrite the piece a little, then post it to LinkedIn.

Change the article's format to a Thread and share it on Twitter.

Find a few quick quotes throughout the article, then use them in tweets or Instagram quote posts.

Create a carousel for Instagram and LinkedIn using screenshots from the Twitter Thread.

Go through your film and select a few valuable 30-second segments. Share them on LinkedIn, Facebook, Twitter, TikTok, YouTube Shorts, and Instagram Reels.

Your video's audio can be taken out and uploaded as a podcast episode.

If you (or your team) achieve all this, you'll have 20-30 pieces of social media content.

If you're just starting, I wouldn't advocate doing all of this at once.

Instead, focus on a few platforms with this method.

You can outsource this as your company expands. (If you'd want to learn more about content repurposing, contact me.)

You may focus on relevant work while someone else grows your social media on autopilot.

You develop high-ROI pillar content, and it's automatically chopped up and posted on social media.

This lets you use social media algorithms without getting sucked in.

Thanks for reading!

Victoria Kurichenko

3 years ago

What Happened After I Posted an AI-Generated Post on My Website

This could cost you.

Content creators may have heard about Google's "Helpful content upgrade."

This change is another Google effort to remove low-quality, repetitive, and AI-generated content.

Why should content creators care?

Because too much content manipulates search results.

My experience includes the following.

Website admins seek high-quality guest posts from me. They send me AI-generated text after I say "yes." My readers are irrelevant. Backlinks are needed.

Companies copy high-ranking content to boost their Google rankings. Unfortunately, it's common.

What does this content offer?

Nothing.

Despite Google's updates and efforts to clean search results, webmasters create manipulative content.

As a marketer, I knew about AI-powered content generation tools. However, I've never tried them.

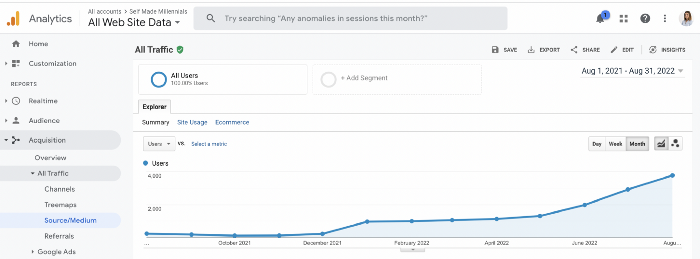

I use old-fashioned content creation methods to grow my website from 0 to 3,000 monthly views in one year.

Last year, I launched a niche website.

I do keyword research, analyze search intent and competitors' content, write an article, proofread it, and then optimize it.

This strategy is time-consuming.

But it yields results!

Here's proof from Google Analytics:

Proven strategies yield promising results.

To validate my assumptions and find new strategies, I run many experiments.

I tested an AI-powered content generator.

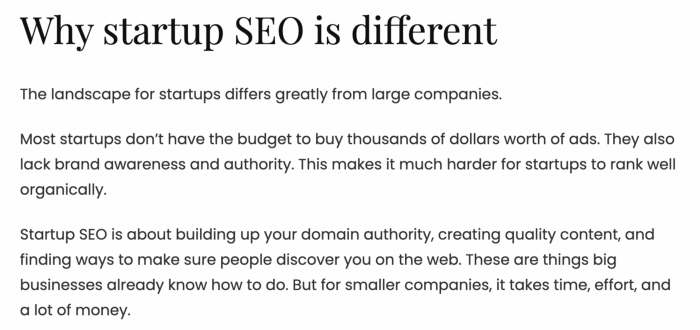

I used a tool to write this Google-optimized article about SEO for startups.

I wanted to analyze AI-generated content's Google performance.

Here are the outcomes of my test.

First, quality.

I dislike "meh" content. I expect articles to answer my questions. If not, I've wasted my time.

My essays usually include research, personal anecdotes, and what I accomplished and achieved.

AI-generated articles aren't as good because they lack individuality.

Read my AI-generated article about startup SEO to see what I mean.

It's dry and shallow, IMO.

It seems robotic.

I'd use quotes and personal experience to show how SEO for startups is different.

My article paraphrases top-ranked articles on a certain topic.

It's readable but useless. Similar articles abound online. Why read it?

AI-generated content is low-quality.

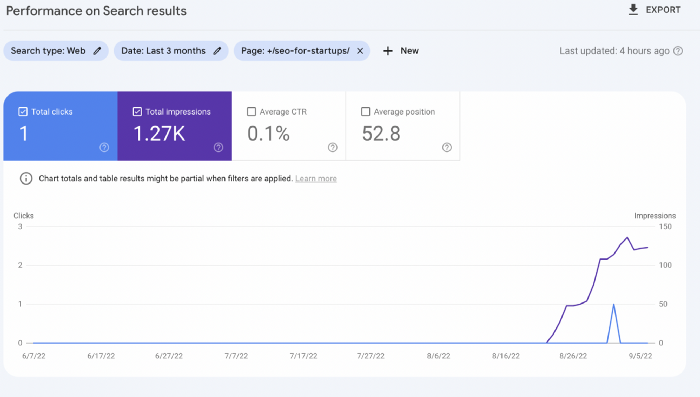

Let me show you how this content ranks on Google.

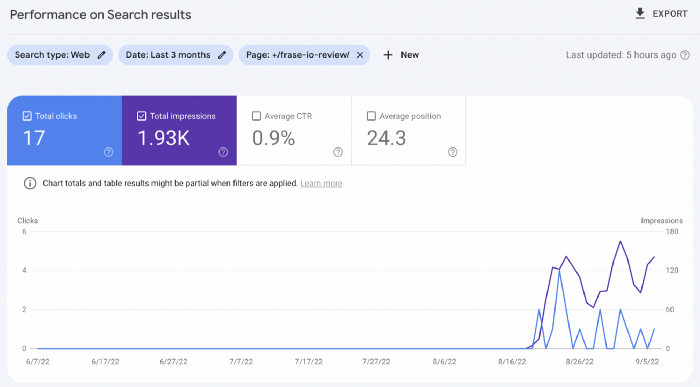

The Google Search Console report shows impressions, clicks, and average position.

Low numbers.

No one opens the 5th Google search result page to read the article. Too far!

You may say the new article will improve.

Marketing-wise, I doubt it.

This article is shorter and less comprehensive than top-ranking pages. It's unlikely to win because of this.

AI-generated content's terrible reality.

I'll compare how this content I wrote for readers and SEO performs.

Both the AI and my article are fresh, but trends are emerging.

My article's CTR and average position are higher.

I spent a week researching and producing that piece, unlike AI-generated content. My expert perspective and unique consequences make it interesting to read.

Human-made.

In summary

No content generator can duplicate a human's tone, writing style, or creativity. Artificial content is always inferior.

Not "bad," but inferior.

Demand for content production tools will rise despite Google's efforts to eradicate thin content.

Most won't spend hours producing link-building articles. Costly.

As guest and sponsored posts, artificial content will thrive.

Before accepting a new arrangement, content creators and website owners should consider this.

You might also like

Darius Foroux

2 years ago

My financial life was changed by a single, straightforward mental model.

Prioritize big-ticket purchases

I've made several spending blunders. I get sick thinking about how much money I spent.

My financial mental model was poor back then.

Stoicism and mindfulness keep me from attaching to those feelings. It still hurts.

Until four or five years ago, I bought a new winter jacket every year.

Ten years ago, I spent twice as much. Now that I have a fantastic, warm winter parka, I don't even consider acquiring another one. No more spending. I'm not looking for jackets either.

Saving time and money by spending well is my thinking paradigm.

The philosophy is expressed in most languages. Cheap is expensive in the Netherlands. This applies beyond shopping.

In this essay, I will offer three examples of how this mental paradigm transformed my financial life.

Publishing books

In 2015, I presented and positioned my first book poorly.

I called the book Huge Life Success and made a funny Canva cover in 30 minutes. This:

That looks nothing like my present books. No logo or style. The book felt amateurish.

The book started bothering me a few weeks after publication. The advice was good, but it didn't appear professional. I studied the book business extensively.

I created a style for all my designs. Branding. Win Your Inner Wars was reissued a year later.

Title, cover, and description changed. Rearranging the chapters improved readability.

Seven years later, the book sells hundreds of copies a month. That taught me a lot.

Rushing to finish a project is enticing. Send it and move forward.

Avoid rushing everything. Relax. Develop your projects. Perform well. Perform the job well.

My first novel was underfunded and underworked. A bad book arrived. I then invested time and money in writing the greatest book I could.

That book still sells.

Traveling

I hate travel. Airports, flights, trains, and lines irritate me.

But, I enjoy traveling to beautiful areas.

I do it strangely. I make up travel rules. I never go to airports in summer. I hate being near airports on holidays. Unworthy.

No vacation packages for me. Those airline packages with a flight, shuttle, and hotel. I've had enough.

I try to avoid crowds and popular spots. July Paris? Nuts and bolts, please. Christmas in NYC? No, please keep me sane.

I fly business class behind. I accept upgrades upon check-in. I prefer driving. I drove from the Netherlands to southern Spain.

Thankfully, no lines. What if travel costs more? Thus? I enjoy it from the start. I start traveling then.

I rarely travel since I'm so difficult. One great excursion beats several average ones.

Personal effectiveness

New apps, tools, and strategies intrigue most productivity professionals.

No.

I researched years ago. I spent years investigating productivity in university.

I bought books, courses, applications, and tools. It was expensive and time-consuming.

Im finished. Productivity no longer costs me time or money. OK. I worked on it once and now follow my strategy.

I avoid new programs and systems. My stuff works. Why change winners?

Spending wisely saves time and money.

Spending wisely means spending once. Many people ignore productivity. It's understudied. No classes.

Some assume reading a few articles or a book is enough. Productivity is personal. You need a personal system.

Time invested is one-time. You can trust your system for life once you find it.

Concentrate on the expensive choices.

Life's short. Saving money quickly is enticing.

Spend less on groceries today. True. That won't fix your finances.

Adopt a lifestyle that makes you affluent over time. Consider major choices.

Are they causing long-term poverty? Are you richer?

Leasing cars comes to mind. The automobile costs a fortune today. The premium could accomplish a million nice things.

Focusing on important decisions makes life easier. Consider your future. You want to improve next year.

Ari Joury, PhD

3 years ago

7 ways to turn into a major problem-solver

For some people, the glass is half empty. For others, it’s half full. And for some, the question is, How do I get this glass totally full again?

Problem-solvers are the last group. They're neutral. Pragmatists.

Problems surround them. They fix things instead of judging them. Problem-solvers improve the world wherever they go.

Some fail. Sometimes their good intentions have terrible results. Like when they try to help a grandma cross the road because she can't do it alone but discover she never wanted to.

Most programmers, software engineers, and data scientists solve problems. They use computer code to fix problems they see.

Coding is best done by understanding and solving the problem.

Despite your best intentions, building the wrong solution may have negative consequences. Helping an unwilling grandma cross the road.

How can you improve problem-solving?

1. Examine your presumptions.

Don’t think There’s a grandma, and she’s unable to cross the road. Therefore I must help her over the road. Instead think This grandma looks unable to cross the road. Let’s ask her whether she needs my help to cross it.

Maybe the grandma can’t cross the road alone, but maybe she can. You can’t tell for sure just by looking at her. It’s better to ask.

Maybe the grandma wants to cross the road. But maybe she doesn’t. It’s better to ask!

Building software is similar. Do only I find this website ugly? Who can I consult?

We all have biases, mental shortcuts, and worldviews. They simplify life.

Problem-solving requires questioning all assumptions. They might be wrong!

Think less. Ask more.

Secondly, fully comprehend the issue.

Grandma wants to cross the road? Does she want flowers from the shop across the street?

Understanding the problem advances us two steps. Instead of just watching people and their challenges, try to read their intentions.

Don't ask, How can I help grandma cross the road? Why would this grandma cross the road? What's her goal?

Understand what people want before proposing solutions.

3. Request more information. This is not a scam!

People think great problem solvers solve problems immediately. False!

Problem-solvers study problems. Understanding the problem makes solving it easy.

When you see a grandma struggling to cross the road, you want to grab her elbow and pull her over. However, a good problem solver would ask grandma what she wants. So:

Problem solver: Excuse me, ma’am? Do you wish to get over the road? Grandma: Yes indeed, young man! Thanks for asking. Problem solver: What do you want to do on the other side? Grandma: I want to buy a bouquet of flowers for my dear husband. He loves flowers! I wish the shop wasn’t across this busy road… Problem solver: Which flowers does your husband like best? Grandma: He loves red dahlia. I usually buy about 20 of them. They look so pretty in his vase at the window! Problem solver: I can get those dahlia for you quickly. Go sit on the bench over here while you’re waiting; I’ll be back in five minutes. Grandma: You would do that for me? What a generous young man you are!

A mediocre problem solver would have helped the grandma cross the road, but he might have forgotten that she needs to cross again. She must watch out for cars and protect her flowers on the way back.

A good problem solver realizes that grandma's husband wants 20 red dahlias and completes the task.

4- Rapid and intense brainstorming

Understanding a problem makes solutions easy. However, you may not have all the information needed to solve the problem.

Additionally, retrieving crucial information can be difficult.

You could start a blog. You don't know your readers' interests. You can't ask readers because you don't know who they are.

Brainstorming works here. Set a stopwatch (most smartphones have one) to ring after five minutes. In the remaining time, write down as many topics as possible.

No answer is wrong. Note everything.

Sort these topics later. Programming or data science? What might readers scroll past—are these your socks this morning?

Rank your ideas intuitively and logically. Write Medium stories using the top 35 ideas.

5 - Google it.

Doctor Google may answer this seemingly insignificant question. If you understand your problem, try googling or binging.

Someone has probably had your problem before. The problem-solver may have posted their solution online.

Use others' experiences. If you're social, ask a friend or coworker for help.

6 - Consider it later

Rest your brain.

Reread. Your brain needs rest to function.

Hustle culture encourages working 24/7. It doesn't take a neuroscientist to see that this is mental torture.

Leave an unsolvable problem. Visit friends, take a hot shower, or do whatever you enjoy outside of problem-solving.

Nap.

I get my best ideas in the morning after working on a problem. I couldn't have had these ideas last night.

Sleeping subconsciously. Leave it alone and you may be surprised by the genius it produces.

7 - Learn to live with frustration

There are problems that you’ll never solve.

Mathematicians are world-class problem-solvers. The brightest minds in history have failed to solve many mathematical problems.

A Gordian knot problem can frustrate you. You're smart!

Frustration-haters don't solve problems well. They choose simple problems to avoid frustration.

No. Great problem solvers want to solve a problem but know when to give up.

Frustration initially hurts. You adapt.

Famous last words

If you read this article, you probably solve problems. We've covered many ways to improve, so here's a summary:

Test your presumptions. Is the issue the same for everyone else when you see one? Or are your prejudices and self-judgments misguiding you?

Recognize the issue completely. On the surface, a problem may seem straightforward, but what's really going on? Try to see what the current situation might be building up to by thinking two steps ahead of the current situation.

Request more information. You are no longer a high school student. A two-sentence problem statement is not sufficient to provide a solution. Ask away if you need more details!

Think quickly and thoroughly. In a constrained amount of time, try to write down all your thoughts. All concepts are worthwhile! Later, you can order them.

Google it. There is a purpose for the internet. Use it.

Consider it later at night. A rested mind is more creative. It might seem counterintuitive to leave a problem unresolved. But while you're sleeping, your subconscious will handle the laborious tasks.

Accept annoyance as a normal part of life. Don't give up if you're feeling frustrated. It's a step in the procedure. It's also perfectly acceptable to give up on a problem because there are other, more pressing issues that need to be addressed.

You might feel stupid sometimes, but that just shows that you’re human. You care about the world and you want to make it better.

At the end of the day, that’s all there is to problem solving — making the world a little bit better.

Katherine Kornei

3 years ago

The InSight lander from NASA has recorded the greatest tremor ever felt on Mars.

The magnitude 5 earthquake was responsible for the discharge of energy that was 10 times greater than the previous record holder.

Any Martians who happen to be reading this should quickly learn how to duck and cover.

NASA's Jet Propulsion Laboratory in Pasadena, California, reported that on May 4, the planet Mars was shaken by an earthquake of around magnitude 5, making it the greatest Marsquake ever detected to this point. The shaking persisted for more than six hours and unleashed more than ten times as much energy as the earthquake that had previously held the record for strongest.

The event was captured on record by the InSight lander, which is operated by the United States Space Agency and has been researching the innards of Mars ever since it touched down on the planet in 2018 (SN: 11/26/18). The epicenter of the earthquake was probably located in the vicinity of Cerberus Fossae, which is located more than 1,000 kilometers away from the lander.

The surface of Cerberus Fossae is notorious for being broken up and experiencing periodic rockfalls. According to geophysicist Philippe Lognonné, who is the lead investigator of the Seismic Experiment for Interior Structure, the seismometer that is onboard the InSight lander, it is reasonable to assume that the ground is moving in that area. "This is an old crater from a volcanic eruption."

Marsquakes, which are similar to earthquakes in that they give information about the interior structure of our planet, can be utilized to investigate what lies beneath the surface of Mars (SN: 7/22/21). And according to Lognonné, who works at the Institut de Physique du Globe in Paris, there is a great deal that can be gleaned from analyzing this massive earthquake. Because the quality of the signal is so high, we will be able to focus on the specifics.