More on Personal Growth

Joseph Mavericks

3 years ago

The world's 36th richest man uses a 5-step system to get what he wants.

Ray Dalio's super-effective roadmap

Ray Dalio's $22 billion net worth ranks him 36th globally. From 1975 to 2011, he built the world's most successful hedge fund, never losing more than 4% from 1991 to 2020. (and only doing so during 3 calendar years).

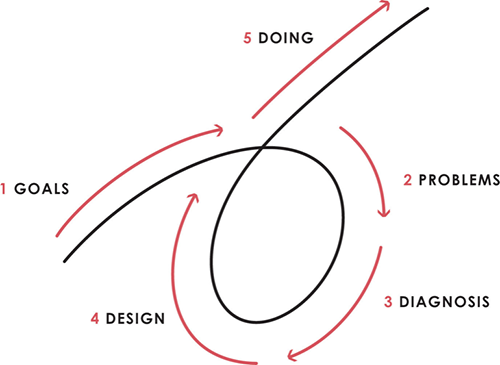

Dalio describes a 5-step process in his best-selling book Principles. It's the playbook he's used to build his hedge fund, beat the markets, and face personal challenges.

This 5-step system is so valuable and well-explained that I didn't edit or change anything; I only added my own insights in the parts I found most relevant and/or relatable as a young entrepreneur. The system's overview:

Have clear goals

Identify and don’t tolerate problems

Diagnose problems to get at their root causes

Design plans that will get you around those problems

Do what is necessary to push through the plans to get results

If you follow these 5 steps in a virtuous loop, you'll almost always see results. Repeat the process for each goal you have.

1. Have clear goals

a) Prioritize: You can have almost anything, but not everything.

I started and never launched dozens of projects for 10 years because I was scattered. I opened a t-shirt store, traded algorithms, sold art on Instagram, painted skateboards, and tinkered with electronics. I decided to try blogging for 6 months to see where it took me. Still going after 3 years.

b) Don’t confuse goals with desires.

A goal inspires you to act. Unreasonable desires prevent you from achieving your goals.

c) Reconcile your goals and desires to decide what you want.

d) Don't confuse success with its trappings.

e) Never dismiss a goal as unattainable.

Always one path is best. Your perception of what's possible depends on what you know now. I never thought I'd make money writing online so quickly, and now I see a whole new horizon of business opportunities I didn't know about before.

f) Expectations create abilities.

Don't limit your abilities. More you strive, the more you'll achieve.

g) Flexibility and self-accountability can almost guarantee success.

Flexible people accept what reality or others teach them. Self-accountability is the ability to recognize your mistakes and be more creative, flexible, and determined.

h) Handling setbacks well is as important as moving forward.

Learn when to minimize losses and when to let go and move on.

2. Don't ignore problems

a) See painful problems as improvement opportunities.

Every problem, painful situation, and challenge is an opportunity. Read The Art of Happiness for more.

b) Don't avoid problems because of harsh realities.

Recognizing your weaknesses isn't the same as giving in. It's the first step in overcoming them.

c) Specify your issues.

There is no "one-size-fits-all" solution.

d) Don’t mistake a cause of a problem with the real problem.

"I can't sleep" is a cause, not a problem. "I'm underperforming" could be a problem.

e) Separate big from small problems.

You have limited time and energy, so focus on the biggest problems.

f) Don't ignore a problem.

Identifying a problem and tolerating it is like not identifying it.

3. Identify problems' root causes

a) Decide "what to do" after assessing "what is."

"A good diagnosis takes 15 to 60 minutes, depending on its accuracy and complexity. [...] Like principles, root causes recur in different situations.

b) Separate proximate and root causes.

"You can only solve problems by removing their root causes, and to do that, you must distinguish symptoms from disease."

c) Knowing someone's (or your own) personality can help you predict their behavior.

4. Design plans that will get you around the problems

a) Retrace your steps.

Analyze your past to determine your future.

b) Consider your problem a machine's output.

Consider how to improve your machine. It's a game then.

c) There are many ways to reach your goals.

Find a solution.

d) Visualize who will do what in your plan like a movie script.

Consider your movie's actors and script's turning points, then act accordingly. The game continues.

e) Document your plan so others can judge your progress.

Accountability boosts success.

f) Know that a good plan doesn't take much time.

The execution is usually the hardest part, but most people either don't have a plan or keep changing it. Don't drive while building the car. Build it first, because it'll be bumpy.

5. Do what is necessary to push through the plans to get results

a) Great planners without execution fail.

Life is won with more than just planning. Similarly, practice without talent beats talent without practice.

b) Work ethic is undervalued.

Hyper-productivity is praised in corporate America, even if it leads nowhere. To get things done, use checklists, fewer emails, and more desk time.

c) Set clear metrics to ensure plan adherence.

I've written about the OKR strategy for organizations with multiple people here. If you're on your own, I recommend the Wheel of Life approach. Both systems start with goals and tasks to achieve them. Then start executing on a realistic timeline.

If you find solutions, weaknesses don't matter.

Everyone's weak. You, me, Gates, Dalio, even Musk. Nobody will be great at all 5 steps of the system because no one can think in all the ways required. Some are good at analyzing and diagnosing but bad at executing. Some are good planners but poor communicators. Others lack self-discipline.

Stay humble and ask for help when needed. Nobody has ever succeeded 100% on their own, without anyone else's help. That's the paradox of individual success: teamwork is the only way to get there.

Most people won't have the skills to execute even the best plan. You can get missing skills in two ways:

Self-taught (time-consuming)

Others' (requires humility) light

On knowing what to do with your life

“Some people have good mental maps and know what to do on their own. Maybe they learned them or were blessed with common sense. They have more answers than others. Others are more humble and open-minded. […] Open-mindedness and mental maps are most powerful.” — Ray Dalio

I've always known what I wanted to do, so I'm lucky. I'm almost 30 and have always had trouble executing. Good thing I never stopped experimenting, but I never committed to anything long-term. I jumped between projects. I decided 3 years ago to stick to one project for at least 6 months and haven't looked back.

Maybe you're good at staying focused and executing, but you don't know what to do. Maybe you have none of these because you haven't found your purpose. Always try new projects and talk to as many people as possible. It will give you inspiration and ideas and set you up for success.

There is almost always a way to achieve a crazy goal or idea.

Enjoy the journey, whichever path you take.

Khyati Jain

3 years ago

By Engaging in these 5 Duplicitous Daily Activities, You Rapidly Kill Your Brain Cells

No, it’s not smartphones, overeating, or sugar.

Everyday practices affect brain health. Good brain practices increase memory and cognition.

Bad behaviors increase stress, which destroys brain cells.

Bad behaviors can reverse evolution and diminish the brain. So, avoid these practices for brain health.

1. The silent assassin

Introverts appreciated quarantine.

Before the pandemic, they needed excuses to remain home; thereafter, they had enough.

I am an introvert, and I didn’t hate quarantine. There are billions of people like me who avoid people.

Social relationships are important for brain health. Social anxiety harms your brain.

Antisocial behavior changes brains. It lowers IQ and increases drug abuse risk.

What you can do is as follows:

Make a daily commitment to engage in conversation with a stranger. Who knows, you might turn out to be your lone mate.

Get outside for at least 30 minutes each day.

Shop for food locally rather than online.

Make a call to a friend you haven't spoken to in a while.

2. Try not to rush things.

People love hustle culture. This economy requires a side gig to save money.

Long hours reduce brain health. A side gig is great until you burn out.

Work ages your wallet and intellect. Overworked brains age faster and lose cognitive function.

Working longer hours can help you make extra money, but it can harm your brain.

Side hustle but don't overwork.

What you can do is as follows:

Decide what hour you are not permitted to work after.

Three hours prior to night, turn off your laptop.

Put down your phone and work.

Assign due dates to each task.

3. Location is everything!

The environment may cause brain fog. High pollution can cause brain damage.

Air pollution raises Alzheimer's risk. Air pollution causes cognitive and behavioral abnormalities.

Polluted air can trigger early development of incurable brain illnesses, not simply lung harm.

Your city's air quality is uncontrollable. You may take steps to improve air quality.

In Delhi, schools and colleges are closed to protect pupils from polluted air. So I've adapted.

What you can do is as follows:

To keep your mind healthy and young, make an investment in a high-quality air purifier.

Enclose your windows during the day.

Use a N95 mask every day.

4. Don't skip this meal.

Fasting intermittently is trendy. Delaying breakfast to finish fasting is frequent.

Some skip breakfast and have a hefty lunch instead.

Skipping breakfast might affect memory and focus. Skipping breakfast causes low cognition, delayed responsiveness, and irritation.

Breakfast affects mood and productivity.

Intermittent fasting doesn't prevent healthy breakfasts.

What you can do is as follows:

Try to fast for 14 hours, then break it with a nutritious breakfast.

So that you can have breakfast in the morning, eat dinner early.

Make sure your breakfast is heavy in fiber and protein.

5. The quickest way to damage the health of your brain

Brain health requires water. 1% dehydration can reduce cognitive ability by 5%.

Cerebral fog and mental clarity might result from 2% brain dehydration. Dehydration shrinks brain cells.

Dehydration causes midday slumps and unproductivity. Water improves work performance.

Dehydration can harm your brain, so drink water throughout the day.

What you can do is as follows:

Always keep a water bottle at your desk.

Enjoy some tasty herbal teas.

With a big glass of water, begin your day.

Bring your own water bottle when you travel.

Conclusion

Bad habits can harm brain health. Low cognition reduces focus and productivity.

Unproductive work leads to procrastination, failure, and low self-esteem.

Avoid these harmful habits to optimize brain health and function.

Tim Denning

3 years ago

Read These Books on Personal Finance to Boost Your Net Worth

And retire sooner.

Books can make you filthy rich.

If you apply what you learn. In 2011, I was broke and had broken dreams.

Someone suggested I read finance books. One Up On Wall Street was his first recommendation.

Finance books were my crack.

I've read every money book since then. Some are good, but most stink.

These books will make you rich.

The Almanack of Naval Ravikant by Eric Jorgenson

This isn't a cliche book.

This book was inspired by a How to Get Rich tweet thread.

It’s one of the best tweets I’ve ever read.

Naval thinks differently. He nukes ordinary ideas. I've never heard better money advice.

Eric Jorgenson wrote a book about this tweet thread with Navals permission. A must-read, easy-to-digest book.

Best quote

Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. Status is your place in the social hierarchy — Naval

Morgan Housel's The Psychology of Money

Many finance books advise investing like a dunce.

They almost all peddle the buy an index fund BS. Different book.

It's about money-making psychology. Because any fool can get rich and drunk on their ego. Few can consistently make money.

Each chapter is short. A single-page chapter breaks all book publishing rules.

Best quote

Spending money to show people how much money you have is the fastest way to have less money — Morgan Housel

J.L. Collins' The Simple Path to Wealth

Most of the best money books were written by bloggers.

JL Collins blogs. This easy-to-read book was written for his daughter.

This book popularized the phrase F You Money. With enough money in your bank account and investment portfolio, you can say F You more.

A bad boss is an example. You can leave instead of enduring his wrath.

You can then sit at home and look for another job while financially secure. JL says its mind-freedom is powerful.

Best phrasing

You own the things you own and they in turn own you — J.L. Collins

Tony Robbins' Unshakeable

I like Tony. This book makes me sweaty.

Tony interviews the world's top financiers. He interviews people who rarely do so.

This book taught me all-weather portfolio. It's a way to invest in different asset classes in good, bad, recession, or depression times.

Look at it:

Investing isn’t about buying one big winner — that’s gambling. It’s about investing in a diversified portfolio of assets.

Best phrasing

The best opportunities come in times of maximum pessimism — Tony Robbins

Ben Graham's The Intelligent Investor

This book helped me distinguish between a spectator and an investor.

Spectators are those who shout that crypto, NFTs, or XYZ platform will die.

Tourists. They want attention and to say "I told you so." They make short-term and long-term predictions like fortunetellers. LOL. Idiots.

Benjamin Graham teaches smart investing. You'll buy a long-term asset. To be confident in recessions, use dollar-cost averaging.

Best phrasing

Those who do not remember the past are condemned to repeat it. — Benjamin Graham

The Napoleon Hill book Think and Grow Rich

This classic book introduced positive thinking to modern self-help.

Lazy pessimists can't become rich. No way.

Napoleon said, "Thoughts create reality."

No surprise that he discusses obsession and focus in this book. They are the fastest ways to make more money to invest in time and wealth-protecting assets.

Best phrasing

The starting point of all achievement is DESIRE. Keep this constantly in mind. Weak desire brings weak results, just as a small fire makes a small amount of heat — Napoleon Hill

Ramit Sethi's book I Will Teach You To Be Rich

This book is mostly good. The part about credit cards is trash.

Avoid credit card temptations. I don't care about their airline points.

This book teaches you to master money basics (that many people mess up) then automate it so your monkey brain doesn't ruin your financial future.

The book includes great negotiation tactics to help you make more money in less time.

Best quote

The 85 Percent Solution: Getting started is more important than becoming an expert — Ramit Sethi

David Bach's The Automatic Millionaire

You've probably met a six- or seven-figure earner who's broke. All their money goes to useless things like cars.

Money isn't as essential as what you do with it. David teaches how to automate your earnings for more money.

Compounding works once investing is automated. So you get rich.

His strategy eliminates luck and (almost) guarantees millionaire status.

Best phrasing

Every time you earn one dollar, make sure to pay yourself first — David Bach

Thomas J. Stanley's The Millionaire Next Door

Thomas defies the definition of rich.

He spends much of the book highlighting millionaire traits he's studied.

Rich people are quiet, so you wouldn't know they're wealthy. They don't earn much money or drive a BMW.

Thomas will give you the math to get started.

Best phrasing

I am not impressed with what people own. But I’m impressed with what they achieve. I’m proud to be a physician. Always strive to be the best in your field…. Don’t chase money. If you are the best in your field, money will find you. — Thomas J. Stanley

by Bill Perkins "Die With Zero"

Let’s end with one last book.

Bill's book angered many people. He says we spend too much time saving for retirement and die rich. That bank money is lost time.

Your grandkids could use the money. When children inherit money, they become lazy, entitled a-holes.

Bill wants us to spend our money on life-enhancing experiences. Stop saving money like monopoly monkeys.

Best phrasing

You should be focusing on maximizing your life enjoyment rather than on maximizing your wealth. Those are two very different goals. Money is just a means to an end: Having money helps you to achieve the more important goal of enjoying your life. But trying to maximize money actually gets in the way of achieving the more important goal — Bill Perkins

You might also like

Evgenii Nelepko

3 years ago

My 3 biggest errors as a co-founder and CEO

Reflections on the closed company Hola! Dating app

I'll discuss my fuckups as an entrepreneur and CEO. All of them refer to the dating app Hola!, which I co-founded and starred in.

Spring 2021 was when we started. Two techies and two non-techies created a dating app. Pokemon Go and Tinder were combined.

Online dating is a business, and it takes two weeks from a like to a date. We questioned online dating app users if they met anyone offline last year.

75% replied yes, 50% sometimes, 25% usually.

Offline dating is popular, yet people have concerns.

Men are reluctant to make mistakes in front of others.

Women are curious about the background of everyone who approaches them.

We designed unique mechanics that let people date after a match. No endless chitchat. Women would be safe while men felt like cowboys.

I wish to emphasize three faults that lead to founders' estrangement.

This detachment ultimately led to us shutting down the company.

The wrong technology stack

Situation

Instead of generating a faster MVP and designing an app in a universal stack for iOS and Android, I argued we should pilot the app separately for iOS and Android. Technical founders' expertise made this possible.

Self-reflection

Mistaken strategy. We lost time and resources developing two apps at once. We chose iOS since it's more profitable. Apple took us out after the release, citing Guideline 4.3 Spam. After 4 months, we had nothing. We had a long way to go to get the app on Android and the Store.

I suggested creating a uniform platform for the company's growth. This makes parallel product development easier. The strategist's lack of experience and knowledge made it a piece of crap.

What would I have changed if I could?

We should have designed an Android universal stack. I expected Apple to have issues with a dating app.

Our approach should have been to launch something and subsequently improve it, but prejudice won.

The lesson

Discuss the IT stack with your CTO. It saves time and money. Choose the easiest MVP method.

2. A tardy search for investments

Situation

Though the universe and other founders encouraged me to locate investors first, I started pitching when we almost had an app.

When angels arrived, it was time to close. The app was banned, war broke out, I left the country, and the other co-founders stayed. We had no savings.

Self-reflection

I loved interviewing users. I'm proud of having done 1,000 interviews. I wanted to understand people's pain points and improve the product.

Interview results no longer affected the product. I was terrified to start pitching. I filled out accelerator applications and redid my presentation. You must go through that so you won't be terrified later.

What would I have changed if I could?

Get an external or internal mentor to help me with my first pitch as soon as possible. I'd be supported if criticized. He'd cheer with me if there was enthusiasm.

In 99% of cases, I'm comfortable jumping into the unknown, but there are exceptions. The mentor's encouragement would have prompted me to act sooner.

The lesson

Begin fundraising immediately. Months may pass. Show investors your pre-MVP project. Draw inferences from feedback.

3. Role ambiguity

Situation

My technical co-founders were also part-time lead developers, which produced communication issues. As co-founders, we communicated well and recognized the problems. Stakes, vesting, target markets, and approach were agreed upon.

We were behind schedule. Technical debt and strategic gap grew.

Bi-daily and weekly reviews didn't help. Each time, there were explanations. Inside, I was freaking out.

Self-reflection

I am a fairly easy person to talk to. I always try to stick to agreements; otherwise, my head gets stuffed with unnecessary information, interpretations, and emotions.

Sit down -> talk -> decide -> do -> evaluate the results. Repeat it.

If I don't get detailed comments, I start ruining everyone's mood. If there's a systematic violation of agreements without a good justification, I won't join the project or I'll end the collaboration.

What would I have done otherwise?

This is where it’s scariest to draw conclusions. Probably the most logical thing would have been not to start the project as we started it. But that was already a completely different project. So I would not have done anything differently and would have failed again.

But I drew conclusions for the future.

The lesson

First-time founders should find an adviser or team coach for a strategic session. It helps split the roles and responsibilities.

Al Anany

3 years ago

Notion AI Might Destroy Grammarly and Jasper

The trick Notion could use is simply Facebook-ing the hell out of them.

*Time travel to fifteen years ago.* Future-Me: “Hey! What are you up to?” Old-Me: “I am proofreading an article. It’s taking a few hours, but I will be done soon.” Future-Me: “You know, in the future, you will be using a google chrome plugin called Grammarly that will help you easily proofread articles in half that time.” Old-Me: “What is… Google Chrome?” Future-Me: “Gosh…”

I love Grammarly. It’s one of those products that I personally feel the effects of. I mean, Space X is a great company. But I am not a rocket writing this article in space (or am I?)…

No, I’m not. So I don’t personally feel a connection to Space X. So, if a company collapse occurs in the morning, I might write about it. But I will have zero emotions regarding it.

Yet, if Grammarly fails tomorrow, I will feel 1% emotionally distressed. So looking at the title of this article, you’d realize that I am betting against them. This is how much I believe in the critical business model that’s taking over the world, the one of Notion.

Notion How frequently do you go through your notes?

Grammarly is everywhere, which helps its success. Grammarly is available when you update LinkedIn on Chrome. Grammarly prevents errors in Google Docs.

My internal concentration isn't apparent in the previous paragraph. Not Grammarly. I should have used Chrome to make a Google doc and LinkedIn update. Without this base, Grammarly will be useless.

So, welcome to this business essay.

Grammarly provides a solution.

Another issue is resolved by Jasper.

Your entire existence is supposed to be contained within Notion.

New Google Chrome is offline. It's an all-purpose notepad (in the near future.)

How should I start my blog? Enter it in Note.

an update on LinkedIn? If you mention it, it might be automatically uploaded there (with little help from another app.)

An advanced thesis? You can brainstorm it with your coworkers.

This ad sounds great! I won't cry if Notion dies tomorrow.

I'll reread the following passages to illustrate why I think Notion could kill Grammarly and Jasper.

Notion is a fantastic app that incubates your work.

Smartly, they began with note-taking.

Hopefully, your work will be on Notion. Grammarly and Jasper are still must-haves.

Grammarly will proofread your typing while Jasper helps with copywriting and AI picture development.

They're the best, therefore you'll need them. Correct? Nah.

Notion might bombard them with Facebook posts.

Notion: “Hi Grammarly, do you want to sell your product to us?” Grammarly: “Dude, we are more valuable than you are. We’ve even raised $400m, while you raised $342m. Our last valuation round put us at $13 billion, while yours put you at $10 billion. Go to hell.” Notion: “Okay, we’ll speak again in five years.”

Notion: “Jasper, wanna sell?” Jasper: “Nah, we’re deep into AI and the field. You can’t compete with our people.” Notion: “How about you either sell or you turn into a Snapchat case?” Jasper: “…”

Notion is your home. Grammarly is your neighbor. Your track is Jasper.

What if you grew enough vegetables in your backyard to avoid the supermarket? No more visits.

What if your home had a beautiful treadmill? You won't rush outside as much (I disagree with my own metaphor). (You get it.)

It's Facebooking. Instagram Stories reduced your Snapchat usage. Notion will reduce your need to use Grammarly.

The Final Piece of the AI Puzzle

Let's talk about Notion first, since you've probably read about it everywhere.

They raised $343 million, as I previously reported, and bought four businesses

According to Forbes, Notion will have more than 20 million users by 2022. The number of users is up from 4 million in 2020.

If raising $1.8 billion was impressive, FTX wouldn't have fallen.

This article compares the basic product to two others. Notion is a day-long app.

Notion has released Notion AI to support writers. It's early, so it's not as good as Jasper. Then-Jasper isn't now-Jasper. In five years, Notion AI will be different.

With hard work, they may construct a Jasper-like writing assistant. They have resources and users.

At this point, it's all speculation. Jasper's copywriting is top-notch. Grammarly's proofreading is top-notch. Businesses are constrained by user activities.

If Notion's future business movements are strategic, they might become a blue ocean shark (or get acquired by an unbelievable amount.)

I love business mental teasers, so tell me:

How do you feel? Are you a frequent Notion user?

Do you dispute my position? I enjoy hearing opposing viewpoints.

Ironically, I proofread this with Grammarly.

nft now

3 years ago

A Guide to VeeFriends and Series 2

VeeFriends is one of the most popular and unique NFT collections. VeeFriends launched around the same time as other PFP NFTs like Bored Ape Yacht Club.

Vaynerchuk (GaryVee) took a unique approach to his large-scale project, which has influenced the NFT ecosystem. GaryVee's VeeFriends is one of the most successful NFT membership use-cases, allowing him to build a community around his creative and business passions.

What is VeeFriends?

GaryVee's NFT collection, VeeFriends, was released on May 11, 2021. VeeFriends [Mini Drops], Book Games, and a forthcoming large-scale "Series 2" collection all stem from the initial drop of 10,255 tokens.

In "Series 1," there are G.O.O. tokens (Gary Originally Owned). GaryVee reserved 1,242 NFTs (over 12% of the supply) for his own collection, so only 9,013 were available at the Series 1 launch.

Each Series 1 token represents one of 268 human traits hand-drawn by Vaynerchuk. Gary Vee's NFTs offer owners incentives.

Who made VeeFriends?

Gary Vaynerchuk, AKA GaryVee, is influential in NFT. Vaynerchuk is the chairman of New York-based communications company VaynerX. Gary Vee, CEO of VaynerMedia, VaynerSports, and bestselling author, is worth $200 million.

GaryVee went from NFT collector to creator, launching VaynerNFT to help celebrities and brands.

Vaynerchuk's influence spans the NFT ecosystem as one of its most prolific voices. He's one of the most influential NFT figures, and his VeeFriends ecosystem keeps growing.

Vaynerchuk, a trend expert, thinks NFTs will be around for the rest of his life and VeeFriends will be a landmark project.

Why use VeeFriends NFTs?

The first VeeFriends collection has sold nearly $160 million via OpenSea. GaryVee insisted that the first 10,255 VeeFriends were just the beginning.

Book Games were announced to the VeeFriends community in August 2021. Mini Drops joined VeeFriends two months later.

Book Games

GaryVee's book "Twelve and a Half: Leveraging the Emotional Ingredients for Business Success" inspired Book Games. Even prior to the announcement Vaynerchuk had mapped out the utility of the book on an NFT scale. Book Games tied his book to the VeeFriends ecosystem and solidified its place in the collection.

GaryVee says Book Games is a layer 2 NFT project with 125,000 burnable tokens. Vaynerchuk's NFT fans were incentivized to buy as many copies of his new book as possible to receive NFT rewards later.

First, a bit about “layer 2.”

Layer 2 blockchain solutions help scale applications by routing transactions away from Ethereum Mainnet (layer 1). These solutions benefit from Mainnet's decentralized security model but increase transaction speed and reduce gas fees.

Polygon (integrated into OpenSea) and Immutable X are popular Ethereum layer 2 solutions. GaryVee chose Immutable X to reduce gas costs (transaction fees). Given the large supply of Book Games tokens, this decision will likely benefit the VeeFriends community, especially if the games run forever.

What's the strategy?

The VeeFriends patriarch announced on Aug. 27, 2021, that for every 12 books ordered during the Book Games promotion, customers would receive one NFT via airdrop. After nearly 100 days, GV sold over a million copies and announced that Book Games would go gamified on Jan. 10, 2022.

Immutable X's trading options make Book Games a "game." Book Games players can trade NFTs for other NFTs, sports cards, VeeCon tickets, and other prizes. Book Games can also whitelist other VeeFirends projects, which we'll cover in Series 2.

VeeFriends Mini Drops

GaryVee launched VeeFriends Mini Drops two months after Book Games, focusing on collaboration, scarcity, and the characters' "cultural longevity."

Spooky Vees, a collection of 31 1/1 Halloween-themed VeeFriends, was released on Halloween. First-come, first-served VeeFriend owners could claim these NFTs.

Mini Drops includes Gift Goat NFTs. By holding the Gift Goat VeeFriends character, collectors will receive 18 exclusive gifts curated by GaryVee and the team. Each gifting experience includes one physical gift and one NFT out of 555, to match the 555 Gift Goat tokens.

Gift Goat holders have gotten NFTs from Danny Cole (Creature World), Isaac "Drift" Wright (Where My Vans Go), Pop Wonder, and more.

GaryVee is poised to release the largest expansion of the VeeFriends and VaynerNFT ecosystem to date with VeeFriends Series 2.

VeeCon 101

By owning VeeFriends NFTs, collectors can join the VeeFriends community and attend VeeCon in 2022. The conference is only open to VeeCon NFT ticket holders (VeeFreinds + possibly more TBA) and will feature Beeple, Steve Aoki, and even Snoop Dogg.

The VeeFreinds floor in 2022 Q1 has remained at 16 ETH ($52,000), making VeeCon unattainable for most NFT enthusiasts. Why would someone spend that much crypto on a Minneapolis "superconference" ticket? Because of Gary Vaynerchuk.

Everything to know about VeeFriends Series 2

Vaynerchuk revealed in April 2022 that the VeeFriends ecosystem will grow by 55,555 NFTs after months of teasing.

With VeeFriends Series 2, each token will cost $995 USD in ETH, allowing NFT enthusiasts to join at a lower cost. The new series will be released on multiple dates in April.

Book Games NFT holders on the Friends List (whitelist) can mint Series 2 NFTs on April 12. Book Games holders have 32,000 NFTs.

VeeFriends Series 1 NFT holders can claim Series 2 NFTs on April 12. This allotment's supply is 10,255, like Series 1's.

On April 25, the public can buy 10,000 Series 2 NFTs. Unminted Friends List NFTs will be sold on this date, so this number may change.

The VeeFriends ecosystem will add 15 new characters (220 tokens each) on April 27. One character will be released per day for 15 days, and the only way to get one is to enter a daily raffle with Book Games tokens.

Series 2 NFTs won't give owners VeeCon access, but they will offer other benefits within the VaynerNFT ecosystem. Book Games and Series 2 will get new token burn mechanics in the upcoming drop.

Visit the VeeFriends blog for the latest collection info.

Where can you buy Gary Vee’s NFTs?

Need a VeeFriend NFT? Gary Vee recommends doing "50 hours of homework" before buying. OpenSea sells VeeFriends NFTs.