More on Personal Growth

The woman

3 years ago

The best lesson from Sundar Pichai is that success and stress don't mix.

His regular regimen teaches stress management.

In 1995, an Indian graduate visited the US. He obtained a scholarship to Stanford after graduating from IIT with a silver medal. First flight. His ticket cost a year's income. His head was full.

Pichai Sundararajan is his full name. He became Google's CEO and a world leader. Mr. Pichai transformed technology and inspired millions to dream big.

This article reveals his daily schedule.

Mornings

While many of us dread Mondays, Mr. Pichai uses the day to contemplate.

A typical Indian morning. He awakens between 6:30 and 7 a.m. He avoids working out in the mornings.

Mr. Pichai oversees the internet, but he reads a real newspaper every morning.

Pichai mentioned that he usually enjoys a quiet breakfast during which he reads the news to get a good sense of what’s happening in the world. Pichai often has an omelet for breakfast and reads while doing so. The native of Chennai, India, continues to enjoy his daily cup of tea, which he describes as being “very English.”

Pichai starts his day. BuzzFeed's Mat Honan called the CEO Banana Republic dad.

Overthinking in the morning is a bad idea. It's crucial to clear our brains and give ourselves time in the morning before we hit traffic.

Mr. Pichai's morning ritual shows how to stay calm. Wharton Business School found that those who start the day calmly tend to stay that way. It's worth doing regularly.

And he didn't forget his roots.

Afternoons

He has a busy work schedule, as you can imagine. Running one of the world's largest firm takes time, energy, and effort. He prioritizes his work. Monitoring corporate performance and guaranteeing worker efficiency.

Sundar Pichai spends 7-8 hours a day to improve Google. He's noted for changing the company's culture. He wants to boost employee job satisfaction and performance.

His work won him recognition within the company.

Pichai received a 96% approval rating from Glassdoor users in 2017.

Mr. Pichai stresses work satisfaction. Each day is a new canvas for him to find ways to enrich people's job and personal lives.

His work offers countless lessons. According to several profiles and press sources, the Google CEO is a savvy negotiator. Mr. Pichai's success came from his strong personality, work ethic, discipline, simplicity, and hard labor.

Evenings

His evenings are spent with family after a busy day. Sundar Pichai's professional and personal lives are balanced. Sundar Pichai is a night owl who re-energizes about 9 p.m.

However, he claims to be most productive after 10 p.m., and he thinks doing a lot of work at that time is really useful. But he ensures he sleeps for around 7–8 hours every day. He enjoys long walks with his dog and enjoys watching NSDR on YouTube. It helps him in relaxing and sleep better.

His regular routine teaches us what? Work wisely, not hard, discipline, vision, etc. His stress management is key. Leading one of the world's largest firm with 85,000 employees is scary.

The pressure to achieve may ruin a day. Overworked employees are more likely to make mistakes or be angry with coworkers, according to the Family Work Institute. They can't handle daily problems, making the house more stressful than the office.

Walking your dog, having fun with friends, and having hobbies are as vital as your office.

Darius Foroux

2 years ago

My financial life was changed by a single, straightforward mental model.

Prioritize big-ticket purchases

I've made several spending blunders. I get sick thinking about how much money I spent.

My financial mental model was poor back then.

Stoicism and mindfulness keep me from attaching to those feelings. It still hurts.

Until four or five years ago, I bought a new winter jacket every year.

Ten years ago, I spent twice as much. Now that I have a fantastic, warm winter parka, I don't even consider acquiring another one. No more spending. I'm not looking for jackets either.

Saving time and money by spending well is my thinking paradigm.

The philosophy is expressed in most languages. Cheap is expensive in the Netherlands. This applies beyond shopping.

In this essay, I will offer three examples of how this mental paradigm transformed my financial life.

Publishing books

In 2015, I presented and positioned my first book poorly.

I called the book Huge Life Success and made a funny Canva cover in 30 minutes. This:

That looks nothing like my present books. No logo or style. The book felt amateurish.

The book started bothering me a few weeks after publication. The advice was good, but it didn't appear professional. I studied the book business extensively.

I created a style for all my designs. Branding. Win Your Inner Wars was reissued a year later.

Title, cover, and description changed. Rearranging the chapters improved readability.

Seven years later, the book sells hundreds of copies a month. That taught me a lot.

Rushing to finish a project is enticing. Send it and move forward.

Avoid rushing everything. Relax. Develop your projects. Perform well. Perform the job well.

My first novel was underfunded and underworked. A bad book arrived. I then invested time and money in writing the greatest book I could.

That book still sells.

Traveling

I hate travel. Airports, flights, trains, and lines irritate me.

But, I enjoy traveling to beautiful areas.

I do it strangely. I make up travel rules. I never go to airports in summer. I hate being near airports on holidays. Unworthy.

No vacation packages for me. Those airline packages with a flight, shuttle, and hotel. I've had enough.

I try to avoid crowds and popular spots. July Paris? Nuts and bolts, please. Christmas in NYC? No, please keep me sane.

I fly business class behind. I accept upgrades upon check-in. I prefer driving. I drove from the Netherlands to southern Spain.

Thankfully, no lines. What if travel costs more? Thus? I enjoy it from the start. I start traveling then.

I rarely travel since I'm so difficult. One great excursion beats several average ones.

Personal effectiveness

New apps, tools, and strategies intrigue most productivity professionals.

No.

I researched years ago. I spent years investigating productivity in university.

I bought books, courses, applications, and tools. It was expensive and time-consuming.

Im finished. Productivity no longer costs me time or money. OK. I worked on it once and now follow my strategy.

I avoid new programs and systems. My stuff works. Why change winners?

Spending wisely saves time and money.

Spending wisely means spending once. Many people ignore productivity. It's understudied. No classes.

Some assume reading a few articles or a book is enough. Productivity is personal. You need a personal system.

Time invested is one-time. You can trust your system for life once you find it.

Concentrate on the expensive choices.

Life's short. Saving money quickly is enticing.

Spend less on groceries today. True. That won't fix your finances.

Adopt a lifestyle that makes you affluent over time. Consider major choices.

Are they causing long-term poverty? Are you richer?

Leasing cars comes to mind. The automobile costs a fortune today. The premium could accomplish a million nice things.

Focusing on important decisions makes life easier. Consider your future. You want to improve next year.

Aparna Jain

3 years ago

Negative Effects of Working for a FAANG Company

Consider yourself lucky if your last FAANG interview was rejected.

FAANG—Facebook, Apple, Amazon, Netflix, Google

(I know its manga now, but watch me not care)

These big companies offer many benefits.

large salaries and benefits

Prestige

high expectations for both you and your coworkers.

However, these jobs may have major drawbacks that only become apparent when you're thrown to the wolves, so it's up to you whether you see them as drawbacks or opportunities.

I know most college graduates start working at big tech companies because of their perceived coolness.

I've worked in these companies for years and can tell you what to expect if you get a job here.

Little fish in a vast ocean

The most obvious. Most billion/trillion-dollar companies employ thousands.

You may work on a small, unnoticed product part.

Directors and higher will sometimes make you redo projects they didn't communicate well without respecting your time, talent, or will to work on trivial stuff that doesn't move company needles.

Peers will only say, "Someone has to take out the trash," even though you know company resources are being wasted.

The power imbalance is frustrating.

What you can do about it

Know your WHY. Consider long-term priorities. Though riskier, I stayed in customer-facing teams because I loved building user-facing products.

This increased my impact. However, if you enjoy helping coworkers build products, you may be better suited for an internal team.

I told the Directors and Vice Presidents that their actions could waste Engineering time, even though it was unpopular. Some were receptive, some not.

I kept having tough conversations because they were good for me and the company.

However, some of my coworkers praised my candor but said they'd rather follow the boss.

An outdated piece of technology can take years to update.

Apple introduced Swift for iOS development in 2014. Most large tech companies adopted the new language after five years.

This is frustrating if you want to learn new skills and increase your market value.

Knowing that my lack of Swift practice could hurt me if I changed jobs made writing verbose Objective C painful.

What you can do about it

Work on the new technology in side projects; one engineer rewrote the Lyft app in Swift over the course of a weekend and promoted its adoption throughout the entire organization.

To integrate new technologies and determine how to combine legacy and modern code, suggest minor changes to the existing codebase.

Most managers spend their entire day in consecutive meetings.

After their last meeting, the last thing they want is another meeting to discuss your career goals.

Sometimes a manager has 15-20 reports, making it hard to communicate your impact.

Misunderstandings and stress can result.

Especially when the manager should focus on selfish parts of the team. Success won't concern them.

What you can do about it

Tell your manager that you are a self-starter and that you will pro-actively update them on your progress, especially if they aren't present at the meetings you regularly attend.

Keep being proactive and look for mentorship elsewhere if you believe your boss doesn't have enough time to work on your career goals.

Alternately, look for a team where the manager has more authority to assist you in making career decisions.

After a certain point, company loyalty can become quite harmful.

Because big tech companies create brand loyalty, too many colleagues stayed in unhealthy environments.

When you work for a well-known company and strangers compliment you, it's fun to tell your friends.

Work defines you. This can make you stay too long even though your career isn't progressing and you're unhappy.

Google may become your surname.

Workplaces are not families.

If you're unhappy, don't stay just because they gave you the paycheck to buy your first home and make you feel like you owe your life to them.

Many employees stayed too long. Though depressed and suicidal.

What you can do about it

Your life is not worth a company.

Do you want your job title and workplace to be listed on your gravestone? If not, leave if conditions deteriorate.

Recognize that change can be challenging. It's difficult to leave a job you've held for a number of years.

Ask those who have experienced this change how they handled it.

You still have a bright future if you were rejected from FAANG interviews.

Rejections only lead to amazing opportunities. If you're young and childless, work for a startup.

Companies may pay more than FAANGs. Do your research.

Ask recruiters and hiring managers tough questions about how the company and teams prioritize respectful working hours and boundaries for workers.

I know many 15-year-olds who have a lifelong dream of working at Google, and it saddens me that they're chasing a name on their resume instead of excellence.

This article is not meant to discourage you from working at these companies, but to share my experience about what HR/managers will never mention in interviews.

Read both sides before signing the big offer letter.

You might also like

Adrien Book

3 years ago

What is Vitalik Buterin's newest concept, the Soulbound NFT?

Decentralizing Web3's soul

Our tech must reflect our non-transactional connections. Web3 arose from a lack of social links. It must strengthen these linkages to get widespread adoption. Soulbound NFTs help.

This NFT creates digital proofs of our social ties. It embodies G. Simmel's idea of identity, in which individuality emerges from social groups, just as social groups evolve from people.

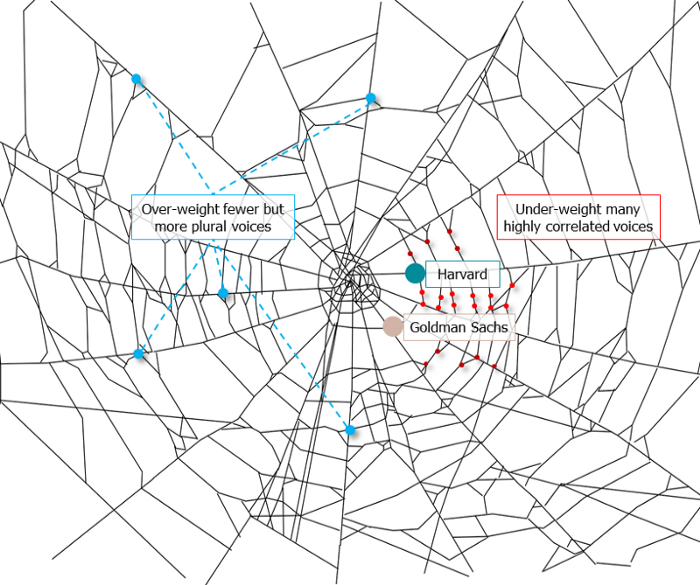

It's multipurpose. First, gather online our distinctive social features. Second, highlight and categorize social relationships between entities and people to create a spiderweb of networks.

1. 🌐 Reducing online manipulation: Only socially rich or respectable crypto wallets can participate in projects, ensuring that no one can create several wallets to influence decentralized project governance.

2. 🤝 Improving social links: Some sectors of society lack social context. Racism, sexism, and homophobia do that. Public wallets can help identify and connect distinct social groupings.

3. 👩❤️💋👨 Increasing pluralism: Soulbound tokens can ensure that socially connected wallets have less voting power online to increase pluralism. We can also overweight a minority of numerous voices.

4. 💰Making more informed decisions: Taking out an insurance policy requires a life review. Why not loans? Character isn't limited by income, and many people need a chance.

5. 🎶 Finding a community: Soulbound tokens are accessible to everyone. This means we can find people who are like us but also different. This is probably rare among your friends and family.

NFTs are dangerous, and I don't like them. Social credit score, privacy, lost wallet. We must stay informed and keep talking to innovators.

E. Glen Weyl, Puja Ohlhaver and Vitalik Buterin get all the credit for these ideas, having written the very accessible white paper “Decentralized Society: Finding Web3’s Soul”.

Jano le Roux

3 years ago

Apple Quietly Introduces A Revolutionary Savings Account That Kills Banks

Would you abandon your bank for Apple?

Banks are struggling.

not as a result of inflation

not due to the economic downturn.

not due to the conflict in Ukraine.

But because they’re underestimating Apple.

Slowly but surely, Apple is looking more like a bank.

An easy new savings account like Apple

Apple has a new savings account.

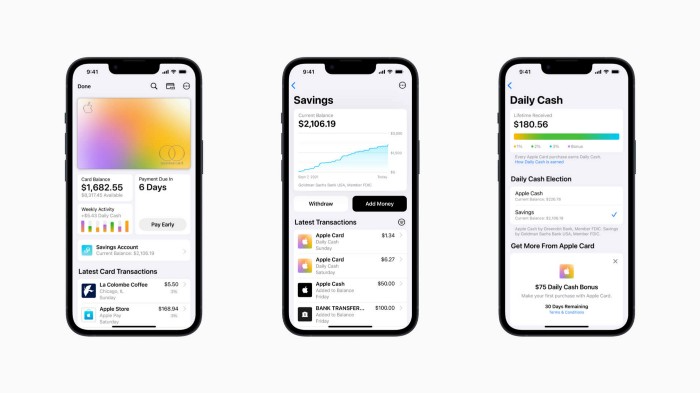

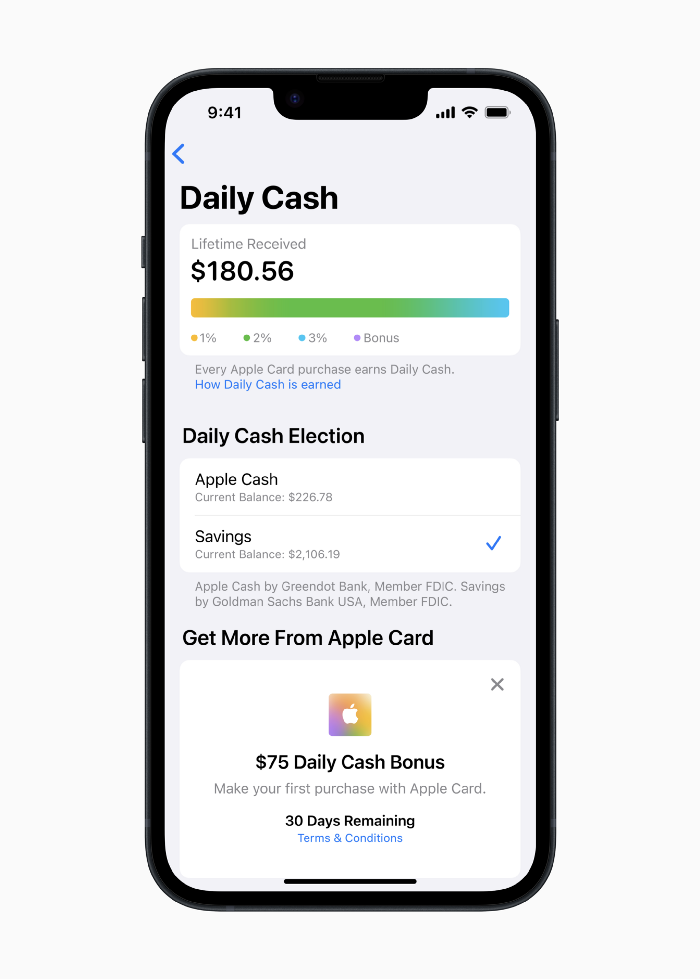

Apple says Apple Card users may set up and manage savings straight in Wallet.

No more charges

Colorfully high yields

With no minimum balance

No minimal down payments

Most consumer-facing banks will have to match Apple's offer or suffer disruption.

Users may set it up from their iPhones without traveling to a bank or filling out paperwork.

It’s built into the iPhone in your pocket.

So now more waiting for slow approval processes.

Once the savings account is set up, Apple will automatically transfer all future Daily Cash into it. Users may also add these cash to an Apple Cash card in their Apple Wallet app and adjust where Daily Cash is paid at any time.

Apple Pay and Apple Wallet VP Jennifer Bailey:

Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future.

Bailey says Savings adds value to Apple Card's Daily Cash benefit and offers another easy-to-use tool to help people lead healthier financial lives.

Transfer money from a linked bank account or Apple Cash to a Savings account. Users can withdraw monies to a connected bank account or Apple Cash card without costs.

Once set up, Apple Card customers can track their earnings via Wallet's Savings dashboard. This dashboard shows their account balance and interest.

This product targets younger people as the easiest way to start a savings account on the iPhone.

Why would a Gen Z account holder travel to the bank if their iPhone could be their bank?

Using this concept, Apple will transform the way we think about banking by 2030.

Two other nightmares keep bankers awake at night

Apple revealed two new features in early 2022 that banks and payment gateways hated.

Tap to Pay with Apple

Late Apple Pay

They startled the industry.

Tap To Pay converts iPhones into mobile POS card readers. Apple Pay Later is pushing the BNPL business in a consumer-friendly direction, hopefully ending dodgy lending practices.

Tap to Pay with Apple

iPhone POS

Millions of US merchants, from tiny shops to huge establishments, will be able to accept Apple Pay, contactless credit and debit cards, and other digital wallets with a tap.

No hardware or payment terminal is needed.

Revolutionary!

Stripe has previously launched this feature.

Tap to Pay on iPhone will provide companies with a secure, private, and quick option to take contactless payments and unleash new checkout experiences, said Bailey.

Apple's solution is ingenious. Brilliant!

Bailey says that payment platforms, app developers, and payment networks are making it easier than ever for businesses of all sizes to accept contactless payments and thrive.

I admire that Apple is offering this up to third-party services instead of closing off other functionalities.

Slow POS terminals, farewell.

Late Apple Pay

Pay Apple later.

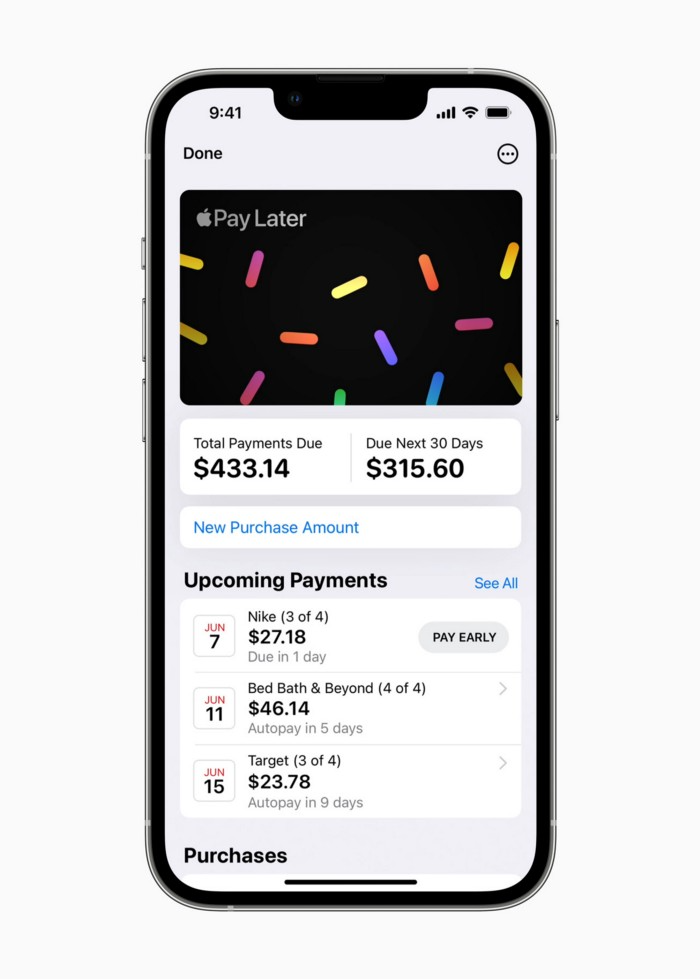

Apple Pay Later enables US consumers split Apple Pay purchases into four equal payments over six weeks with no interest or fees.

The Apple ecosystem integration makes this BNPL scheme unique. Nonstick. No dumb forms.

Frictionless.

Just double-tap the button.

Apple Pay Later was designed with users' financial well-being in mind. Apple makes it easy to use, track, and pay back Apple Pay Later from Wallet.

Apple Pay Later can be signed up in Wallet or when using Apple Pay. Apple Pay Later can be used online or in an app that takes Apple Pay and leverages the Mastercard network.

Apple Pay Order Tracking helps consumers access detailed receipts and order tracking in Wallet for Apple Pay purchases at participating stores.

Bad BNPL suppliers, goodbye.

Most bankers will be caught in Apple's eye playing mini golf in high-rise offices.

The big problem:

Banks still think about features and big numbers just like other smartphone makers did not too long ago.

Apple thinks about effortlessness, seamlessness, and frictionlessness that just work through integrated hardware and software.

Let me know what you think Apple’s next power moves in the banking industry could be.

Gill Pratt

3 years ago

War's Human Cost

War's Human Cost

I didn't start crying until I was outside a McDonald's in an Olempin, Poland rest area on highway S17.

Children pick toys at a refugee center, Olempin, Poland, March 4, 2022.

Refugee children, mostly alone with their mothers, but occasionally with a gray-haired grandfather or non-Ukrainian father, were coaxed into picking a toy from boxes provided by a kind-hearted company and volunteers.

I went to Warsaw to continue my research on my family's history during the Holocaust. In light of the ongoing Ukrainian conflict, I asked former colleagues in the US Department of Defense and Intelligence Community if it was safe to travel there. They said yes, as Poland was a NATO member.

I stayed in a hotel in the Warsaw Ghetto, where 90% of my mother's family was murdered in the Holocaust. Across the street was the first Warsaw Judenrat. It was two blocks away from the apartment building my mother's family had owned and lived in, now dilapidated and empty.

Building of my great-grandfather, December 2021.

A mass grave of thousands of rocks for those killed in the Warsaw Ghetto, I didn't cry when I touched its cold walls.

Warsaw Jewish Cemetery, 200,000–300,000 graves.

Mass grave, Warsaw Jewish Cemetery.

My mother's family had two homes, one in Warszawa and the rural one was a forest and sawmill complex in Western Ukraine. For the past half-year, a local Ukrainian historian had been helping me discover faint traces of her family’s life there — in fact, he had found some people still alive who remembered the sawmill and that it belonged to my mother’s grandfather. The historian was good at his job, and we had become close.

My historian friend, December 2021, talking to a Ukrainian.

With war raging, my second trip to Warsaw took on a different mission. To see his daughter and one-year-old grandson, I drove east instead of to Ukraine. They had crossed the border shortly after the war began, leaving men behind, and were now staying with a friend on Poland's eastern border.

I entered after walking up to the house and settling with the dog. The grandson greeted me with a huge smile and the Ukrainian word for “daddy,” “Tato!” But it was clear he was awaiting his real father's arrival, and any man he met would be so tentatively named.

After a few moments, the boy realized I was only a stranger. He had musical talent, like his mother and grandfather, both piano teachers, as he danced to YouTube videos of American children's songs dubbed in Ukrainian, picking the ones he liked and crying when he didn't.

Songs chosen by my historian friend's grandson, March 4, 2022

He had enough music and began crying regardless of the song. His mother picked him up and started nursing him, saying she was worried about him. She had no idea where she would live or how she would survive outside Ukraine. She showed me her father's family history of losses in the Holocaust, which matched my own research.

After an hour of drinking tea and trying to speak of hope, I left for the 3.5-hour drive west to Warsaw.

It was unlike my drive east. It was reminiscent of the household goods-filled carts pulled by horses and people fleeing war 80 years ago.

Jewish refugees relocating, USHMM Holocaust Encyclopaedia, 1939.

The carefully chosen trinkets by children to distract them from awareness of what is really happening and the anxiety of what lies ahead, made me cry despite all my research on the Holocaust. There is no way for them to communicate with their mothers, who are worried, absent, and without their fathers.

It's easy to see war as a contest of nations' armies, weapons, and land. The most costly aspect of war is its psychological toll. My father screamed in his sleep from nightmares of his own adolescent trauma in Warsaw 80 years ago.

Survivor father studying engineering, 1961.

In the airport, I waited to return home while Ukrainian public address systems announced refugee assistance. Like at McDonald's, many mothers were alone with their children, waiting for a flight to distant relatives.

That's when I had my worst trip experience.

A woman near me, clearly a refugee, answered her phone, cried out, and began wailing.

The human cost of war descended like a hammer, and I realized that while I was going home, she never would