More on Leadership

Julie Zhuo

2 years ago

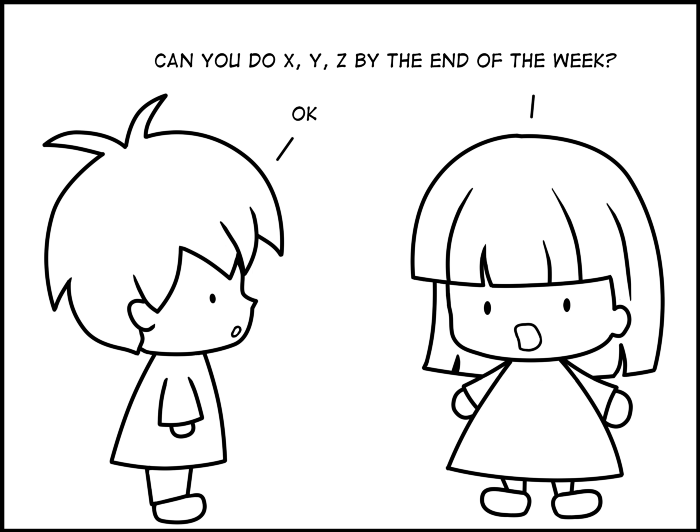

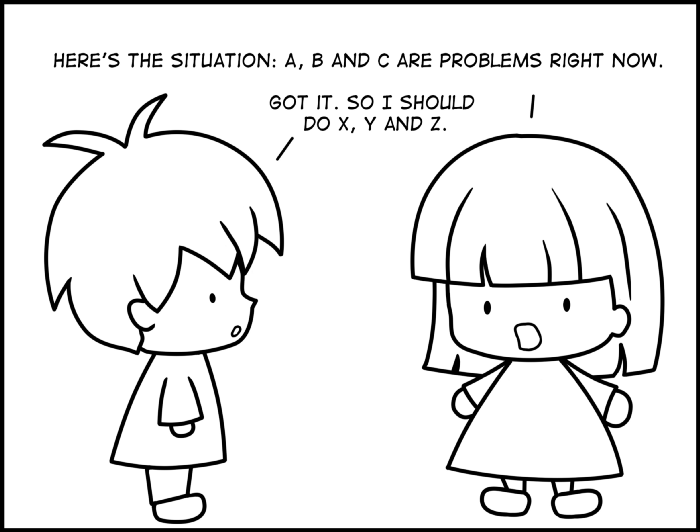

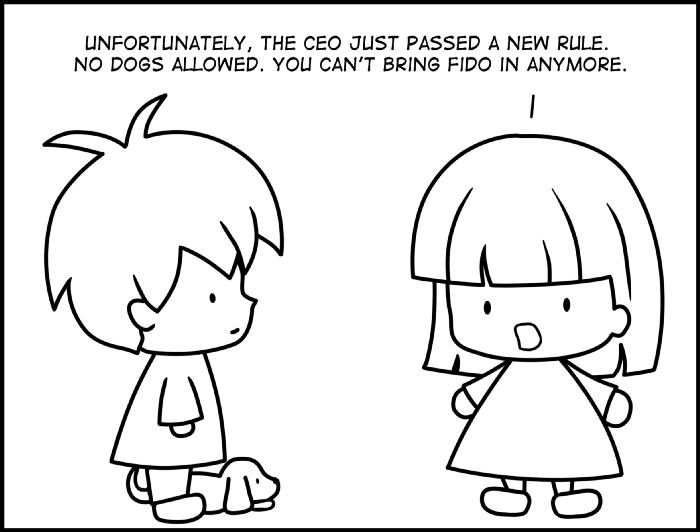

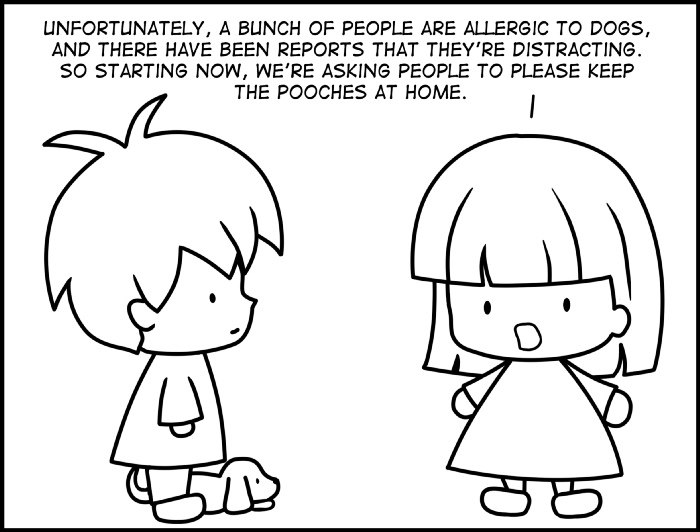

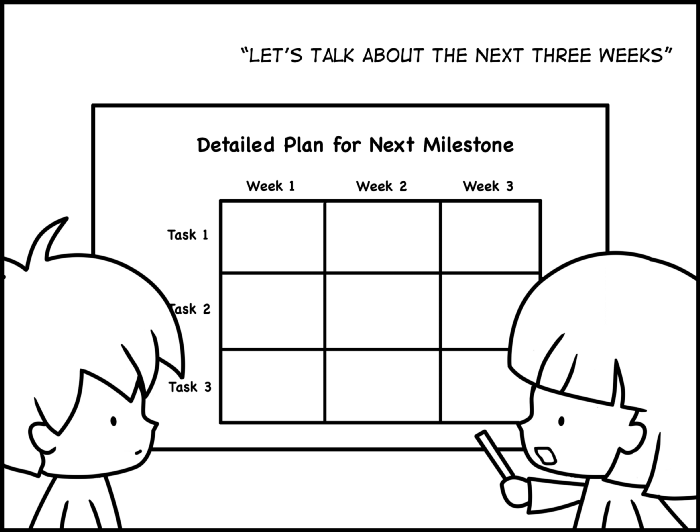

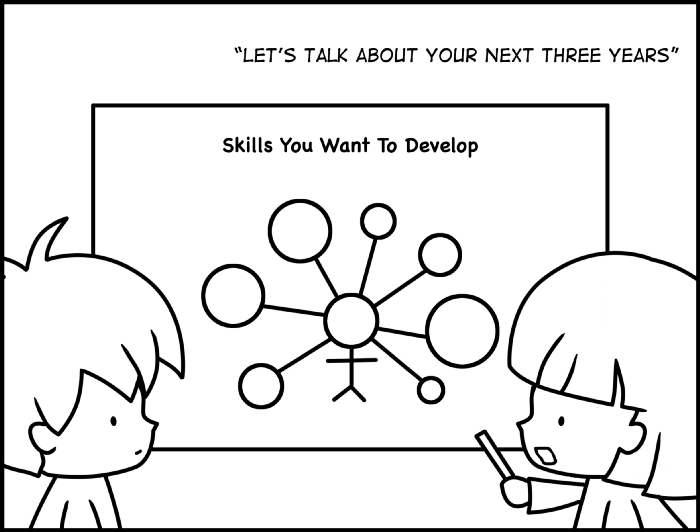

Comparing poor and excellent managers

10-sketch explanation

Choosing Tasks

Bringing News

carrying out 1:1s

providing critique

Managing Turbulence

Alexander Nguyen

3 years ago

A Comparison of Amazon, Microsoft, and Google's Compensation

Learn or earn

In 2020, I started software engineering. My base wage has progressed as follows:

Amazon (2020): $112,000

Microsoft (2021): $123,000

Google (2022): $169,000

I didn't major in math, but those jumps appear more than a 7% wage increase. Here's a deeper look at the three.

The Three Categories of Compensation

Most software engineering compensation packages at IT organizations follow this format.

Minimum Salary

Base salary is pre-tax income. Most organizations give a base pay. This is paid biweekly, twice monthly, or monthly.

Recruiting Bonus

Sign-On incentives are one-time rewards to new hires. Companies need an incentive to switch. If you leave early, you must pay back the whole cost or a pro-rated amount.

Equity

Equity is complex and requires its own post. A company will promise to give you a certain amount of company stock but when you get it depends on your offer. 25% per year for 4 years, then it's gone.

If a company gives you $100,000 and distributes 25% every year for 4 years, expect $25,000 worth of company stock in your stock brokerage on your 1 year work anniversary.

Performance Bonus

Tech offers may include yearly performance bonuses. Depends on performance and funding. I've only seen 0-20%.

Engineers' overall compensation usually includes:

Base Salary + Sign-On + (Total Equity)/4 + Average Performance Bonus

Amazon: (TC: 150k)

Base Pay System

Amazon pays Seattle employees monthly on the first work day. I'd rather have my money sooner than later, even if it saves processing and pay statements.

The company upped its base pay cap from $160,000 to $350,000 to compete with other tech companies.

Performance Bonus

Amazon has no performance bonus, so you can work as little or as much as you like and get paid the same. Amazon is savvy to avoid promising benefits it can't deliver.

Sign-On Bonus

Amazon gives two two-year sign-up bonuses. First-year workers could receive $20,000 and second-year workers $15,000. It's probably to make up for the company's strange equity structure.

If you leave during the first year, you'll owe the entire money and a prorated amount for the second year bonus.

Equity

Most organizations prefer a 25%, 25%, 25%, 25% equity structure. Amazon takes a different approach with end-heavy equity:

the first year, 5%

15% after one year.

20% then every six months

We thought it was constructed this way to keep staff longer.

Microsoft (TC: 185k)

Base Pay System

Microsoft paid biweekly.

Gainful Performance

My offer letter suggested a 0%-20% performance bonus. Everyone will be satisfied with a 10% raise at year's end.

But misleading press where the budget for the bonus is doubled can upset some employees because they won't earn double their expected bonus. Still barely 10% for 2022 average.

Sign-On Bonus

Microsoft's sign-on bonus is a one-time payout. The contract can require 2-year employment. You must negotiate 1 year. It's pro-rated, so that's fair.

Equity

Microsoft is one of those companies that has standard 25% equity structure. Except if you’re a new graduate.

In that case it’ll be

25% six months later

25% each year following that

New grads will acquire equity in 3.5 years, not 4. I'm guessing it's to keep new grads around longer.

Google (TC: 300k)

Base Pay Structure

Google pays biweekly.

Performance Bonus

Google's offer letter specifies a 15% bonus. It's wonderful there's no cap, but I might still get 0%. A little more than Microsoft’s 10% and a lot more than Amazon’s 0%.

Sign-On Bonus

Google gave a 1-year sign-up incentive. If the contract is only 1 year, I can move without any extra obligations.

Not as fantastic as Amazon's sign-up bonuses, but the remainder of the package might compensate.

Equity

We covered Amazon's tail-heavy compensation structure, so Google's front-heavy equity structure may surprise you.

Annual structure breakdown

33% Year 1

33% Year 2

22% Year 3

12% Year 4

The goal is to get them to Google and keep them there.

Final Thoughts

This post hopefully helped you understand the 3 firms' compensation arrangements.

There's always more to discuss, such as refreshers, 401k benefits, and business discounts, but I hope this shows a distinction between these 3 firms.

Alison Randel

3 years ago

Raising the Bar on Your 1:1s

Managers spend much time in 1:1s. Most team members meet with supervisors regularly. 1:1s can help create relationships and tackle tough topics. Few appreciate the 1:1 format's potential. Most of the time, that potential is spent on small talk, surface-level updates, and ranting (Ugh, the marketing team isn’t stepping up the way I want them to).

What if you used that time to have deeper conversations and important insights? What if change was easy?

This post introduces a new 1:1 format to help you dive deeper, faster, and develop genuine relationships without losing impact.

A 1:1 is a chat, you would assume. Why use structure to talk to a coworker? Go! I know how to talk to people. I can write. I've always written. Also, This article was edited by Zoe.

Before you discard something, ask yourself if there's a good reason not to try anything new. Is the 1:1 only a talk, or do you want extra benefits? Try the steps below to discover more.

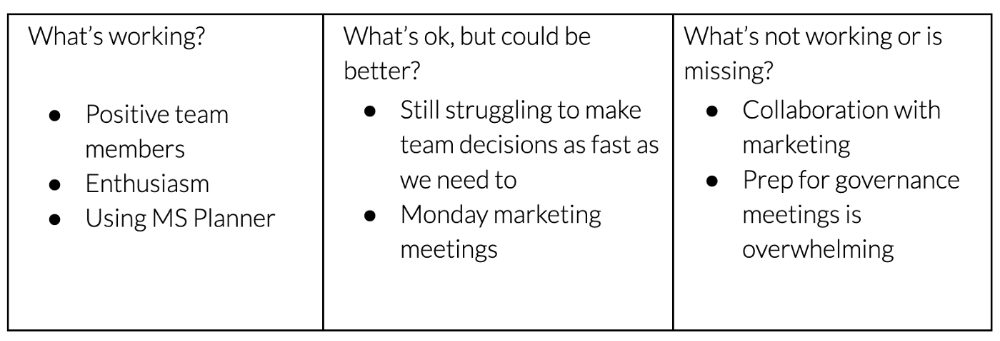

I. Reflection (5 minutes)

Context-free, broad comments waste time and are useless. Instead, give team members 5 minutes to write these 3 prompts.

What's effective?

What is decent but could be improved?

What is broken or missing?

Why these? They encourage people to be honest about all their experiences. Answering these questions helps people realize something isn't working. These prompts let people consider what's working.

Why take notes? Because you get more in less time. Will you feel awkward sitting quietly while your coworker writes? Probably. Persevere. Multi-task. Take a break from your afternoon meeting marathon. Any awkwardness will pay off.

What happens? After a few minutes of light conversation, create a template like the one given here and have team members fill in their replies. You can pre-share the template (with the caveat that this isn’t meant to take much prep time). Do this with your coworker: Answer the prompts. Everyone can benefit from pondering and obtaining guidance.

This step's output.

Part II: Talk (10-20 minutes)

Most individuals can explain what they see but not what's behind an answer. You don't like a meeting. Why not? Marketing partnership is difficult. What makes working with them difficult? I don't recommend slandering coworkers. Consider how your meetings, decisions, and priorities make work harder. The excellent stuff too. You want to know what's humming so you can reproduce the magic.

First, recognize some facts.

Real power dynamics exist. To encourage individuals to be honest, you must provide a safe environment and extend clear invites. Even then, it may take a few 1:1s for someone to feel secure enough to go there in person. It is part of your responsibility to admit that it is normal.

Curiosity and self-disclosure are crucial. Most leaders have received training to present themselves as the authorities. However, you will both benefit more from the dialogue if you can be open and honest about your personal experience, ask questions out of real curiosity, and acknowledge the pertinent sacrifices you're making as a leader.

Honesty without bias is difficult and important. Due to concern for the feelings of others, people frequently hold back. Or if they do point anything out, they do so in a critical manner. The key is to be open and unapologetic about what you observe while not presuming that your viewpoint is correct and that of the other person is incorrect.

Let's go into some prompts (based on genuine conversations):

“What do you notice across your answers?”

“What about the way you/we/they do X, Y, or Z is working well?”

“ Will you say more about item X in ‘What’s not working?’”

“I’m surprised there isn’t anything about Z. Why is that?”

“All of us tend to play some role in maintaining certain patterns. How might you/we be playing a role in this pattern persisting?”

“How might the way we meet, make decisions, or collaborate play a role in what’s currently happening?”

Consider the preceding example. What about the Monday meeting isn't working? Why? or What about the way we work with marketing makes collaboration harder? Remember to share your honest observations!

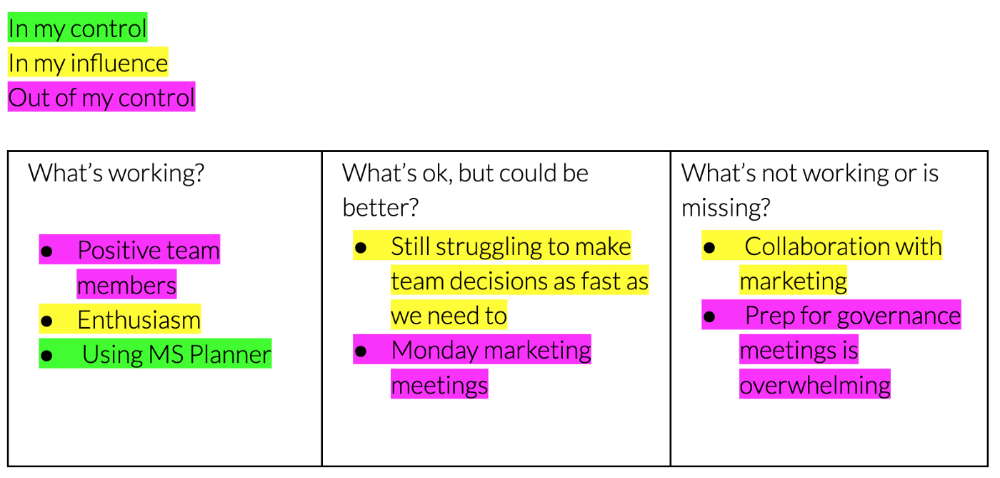

Third section: observe patterns (10-15 minutes)

Leaders desire to empower their people but don't know how. We also have many preconceptions about what empowerment means to us and how it works. The next phase in this 1:1 format will assist you and your team member comprehend team power and empowerment. This understanding can help you support and shift your team member's behavior, especially where you disagree.

How to? After discussing the stated responses, ask each team member what they can control, influence, and not control. Mark their replies. You can do the same, adding colors where you disagree.

This step's output.

Next, consider the color constellation. Discuss these questions:

Is one color much more prevalent than the other? Why, if so?

Are the colors for the "what's working," "what's fine," and "what's not working" categories clearly distinct? Why, if so?

Do you have any disagreements? If yes, specifically where does your viewpoint differ? What activities do you object to? (Remember, there is no right or wrong in this. Give explicit details and ask questions with curiosity.)

Example: Based on the colors, you can ask, Is the marketing meeting's quality beyond your control? Were our marketing partners consulted? Are there any parts of team decisions we can control? We can't control people, but have we explored another decision-making method? How can we collaborate and generate governance-related information to reduce work, even if the requirement for prep can't be eliminated?

Consider the top one or two topics for this conversation. No 1:1 can cover everything, and that's OK. Focus on the present.

Part IV: Determine the next step (5 minutes)

Last, examine what this conversation means for you and your team member. It's easy to think we know the next moves when we don't.

Like what? You and your teammate answer these questions.

What does this signify moving ahead for me? What can I do to change this? Make requests, for instance, and see how people respond before thinking they won't be responsive.

What demands do I have on other people or my partners? What should I do first? E.g. Make a suggestion to marketing that we hold a monthly retrospective so we can address problems and exchange input more frequently. Include it on the meeting's agenda for next Monday.

Close the 1:1 by sharing what you noticed about the chat. Observations? Learn anything?

Yourself, you, and the 1:1

As a leader, you either reinforce or disrupt habits. Try this template if you desire greater ownership, empowerment, or creativity. Consider how you affect surrounding dynamics. How can you expect others to try something new in high-stakes scenarios, like meetings with cross-functional partners or senior stakeholders, if you won't? How can you expect deep thought and relationship if you don't encourage it in 1:1s? What pattern could this new format disrupt or reinforce?

Fight reluctance. First attempts won't be ideal, and that's OK. You'll only learn by trying.

You might also like

Tim Denning

3 years ago

In this recession, according to Mark Cuban, you need to outwork everyone

Here’s why that’s baloney

Mark Cuban popularized entrepreneurship.

Shark Tank (which made Mark famous) made starting a business glamorous to attract more entrepreneurs. First off

This isn't an anti-billionaire rant.

Mark Cuban has done excellent. He's a smart, principled businessman. I enjoy his Web3 work. But Mark's work and productivity theories are absurd.

You don't need to outwork everyone in this recession to live well.

You won't be able to outwork me.

Yuck! Mark's words made me gag.

Why do boys think working is a football game where the winner wins a Super Bowl trophy? To outwork you.

Hard work doesn't equal intelligence.

Highly clever professionals spend 4 hours a day in a flow state, then go home to relax with family.

If you don't put forth the effort, someone else will.

- Mark.

He'll burn out. He's delusional and doesn't understand productivity. Boredom or disconnection spark our best thoughts.

TikTok outlaws boredom.

In a spare minute, we check our phones because we can't stand stillness.

All this work p*rn makes things worse. When is it okay to feel again? Because I can’t feel anything when I’m drowning in work and haven’t had a holiday in 2 years.

Your rivals are actively attempting to undermine you.

Ohhh please Mark…seriously.

This isn't a Tom Hanks war film. Relax. Not everyone is a rival. Only yourself is your competitor. To survive the recession, be better than a year ago.

If you get rich, great. If not, there's more to life than Lambos and angel investments.

Some want to relax and enjoy life. No competition. We witness people with lives trying to endure the recession and record-high prices.

This fictitious rival worsens life and work.

If you are truly talented, you will motivate others to work more diligently and effectively.

No Mark. Soz.

If you're a good leader, you won't brag about working hard and treating others like cogs. Treat them like humans. You'll have EQ.

Silly statements like this are caused by an out-of-control ego. No longer watch Shark Tank.

Ego over humanity.

Good leaders will urge people to keep together during the recession. Good leaders support those who are laid off and need a reference.

Not harder, quicker, better. That created my mental health problems 10 years ago.

Truth: we want to work less.

The promotion of entrepreneurship is ludicrous.

Marvel superheroes. Seriously, relax Max.

I used to write about entrepreneurship, then I quit. Many WeWork Adam Neumanns. Carelessness.

I now utilize the side hustle title when writing about online company or entrepreneurship. Humanizes.

Stop glorifying. Thinking we'll all be Elon Musks who send rockets to Mars is delusional. Most of us won't create companies employing hundreds.

OK.

The true epidemic is glorification. fewer selfies Little birdy needs less bank account screenshots. Less Uber talk.

We're exhausted.

Fun, ego-free business can transform the world. Take a relax pill.

Work as if someone were attempting to take everything from you.

I've seen people lose everything.

Myself included. My 20s startup failed. I was almost bankrupt. I thought I'd never recover. Nope.

Best thing ever.

Losing everything reveals your true self. Unintelligent entrepreneur egos perish instantly. Regaining humility revitalizes relationships.

Money's significance shifts. Stop chasing it like a puppy with a bone.

Fearing loss is unfounded.

Here is a more effective approach than outworking nobody.

(You'll thrive in the recession and become wealthy.)

Smarter work

Overworking is donkey work.

You don't want to be a career-long overworker. Instead than wasting time, write down what you do. List tasks and processes.

Keep doing/outsource the list. Step-by-step each task. Continuously systematize.

Then recruit a digital employee like Zapier or a virtual assistant in the same country.

Intelligent, not difficult.

If your big break could burn in hell, diversify like it will.

People err by focusing on one chance.

Chances can vanish. All-in risky. Instead of working like a Mark Cuban groupie, diversify your income.

If you're employed, your customer is your employer.

Sell the same abilities twice and add 2-3 contract clients. Reduce your hours at your main job and take on more clients.

Leave brand loyalty behind

Mark desires his employees' worship.

That's stupid. When times are bad, layoffs multiply. The problem is the false belief that companies care. No. A business maximizes profit and pays you the least.

To care or overpay is anti-capitalist (that run the world). Be honest.

I was a banker. Then the bat virus hit and jobs disappeared faster than I urinate after a night of drinking.

Start being disloyal now since your company will cheerfully replace you with a better applicant. Meet recruiters and hiring managers on LinkedIn. Whenever something goes wrong at work, act.

Loyalty to self and family. Nobody.

Outwork this instead

Mark doesn't suggest outworking inflation instead of people.

Inflation erodes your time on earth. If you ignore inflation, you'll work harder for less pay every minute.

Financial literacy beats inflation.

Get a side job and earn money online

So you can stop outworking everyone.

Internet leverages time. Same effort today yields exponential results later. There are still whole places not online.

Instead of working forever, generate money online.

Final Words

Overworking is stupid. Don't listen to wealthy football jocks.

Work isn't everything. Prioritize diversification, internet income streams, boredom, and financial knowledge throughout the recession.

That’s how to get wealthy rather than burnout-rich.

Sylvain Saurel

3 years ago

A student trader from the United States made $110 million in one month and rose to prominence on Wall Street.

Genius or lucky?

From the title, you might think I'm selling advertising for a financial influencer, a dubious trading site, or a training organization to attract clients. I'm suspicious. Better safe than sorry.

But not here.

Jake Freeman, 20, made $110 million in a month, according to the Financial Times. At 18, he ran for president. He made his name in markets, not politics. Two years later, he's Wall Street's prince. Interview requests flood the prodigy.

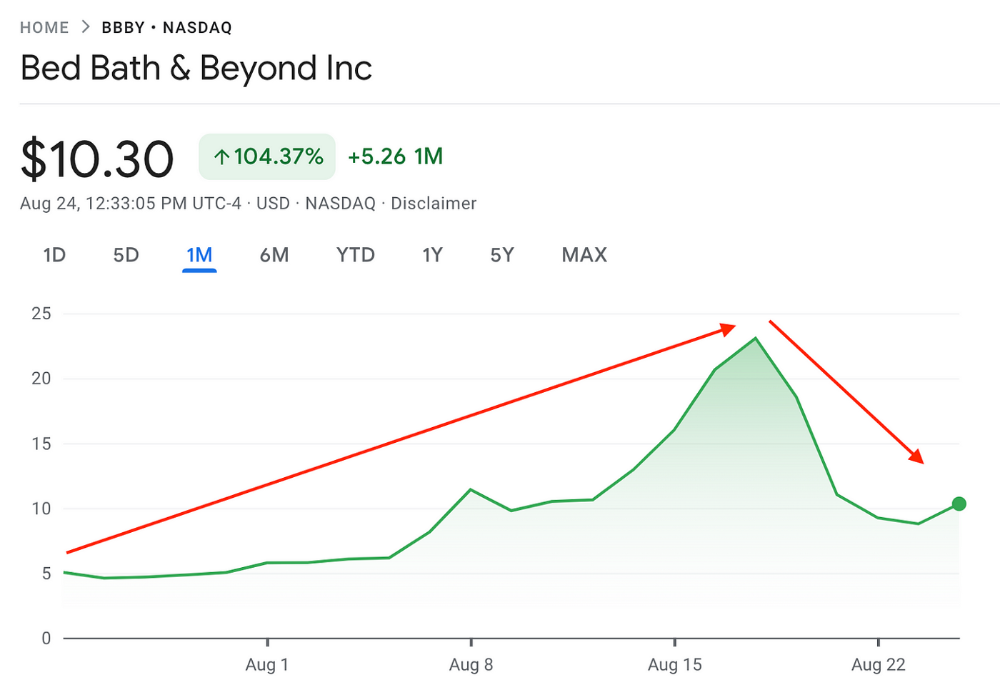

Jake Freeman bought 5 million Bed Bath & Beyond Group shares for $5.5 in July 2022 and sold them for $27 a month later. He thought the stock might double. Since speculation died down, he sold well. The stock fell 40.5% to 11 dollars on Friday, 19 August 2022. On August 22, 2022, it fell 16% to $9.

Smallholders have been buying the stock for weeks and will lose heavily if it falls further. Bed Bath & Beyond is the second most popular stock after Foot Locker, ahead of GameStop and Apple.

Jake Freeman earned $110 million thanks to a significant stock market flurry.

Online broker customers aren't the only ones with jitters. By June 2022, Ken Griffin's Citadel and Stephen Mandel's Lone Pine Capital held nearly a third of the company's capital. Did big managers sell before the stock plummeted?

Recent stock movements (derivatives) and rumors could prompt a SEC investigation.

Jake Freeman wrote to the board of directors after his investment to call for a turnaround, given the company's persistent problems and short sellers. The bathroom and kitchen products distribution group's stock soared in July 2022 due to renewed buying by private speculators, who made it one of their meme stocks with AMC and GameStop.

Second-quarter 2022 results and financial health worsened. He didn't celebrate his miraculous operation in a nightclub. He told a British newspaper, "I'm shocked." His parents dined in New York. He returned to Los Angeles to study math and economics.

Jake Freeman founded Freeman Capital Management with his savings and $25 million from family, friends, and acquaintances. They are the ones who are entitled to the $110 million he raised in one month. Will his investors pocket and withdraw all or part of their profits or will they trust the young prodigy for new stunts on Wall Street?

His operation should attract new clients. Well-known hedge funds may hire him.

Jake Freeman didn't listen to gurus or former traders. At 17, he interned at a quantitative finance and derivatives hedge fund, Volaris. At 13, he began investing with his pharmaceutical executive uncle. All countries have increased their Google searches for the young trader in the last week.

Naturally, his success has inspired resentment.

His success stirs jealousy, and he's attacked on social media. On Reddit, people who lost money on Bed Bath & Beyond, Jake Freeman's fortune, are mourning.

Several conspiracy theories circulate about him, including that he doesn't exist or is working for a Taiwanese amusement park.

If all 20 million American students had the same trading skills, they would have generated $1.46 trillion. Jake Freeman is unique. Apprentice traders' careers are often short, disillusioning, and tragic.

Two years ago, 20-year-old Robinhood client Alexander Kearns committed suicide after losing $750,000 trading options. Great traders start young. Michael Platt of BlueCrest invested in British stocks at age 12 under his grandmother's supervision and made a £30,000 fortune. Paul Tudor Jones started trading before he turned 18 with his uncle. Warren Buffett, at age 10, was discussing investments with Goldman Sachs' head. Oracle of Omaha tells all.

obimy.app

3 years ago

How TikTok helped us grow to 6 million users

This resulted to obimy's new audience.

Hi! obimy's official account. Here, we'll teach app developers and marketers. In 2022, our downloads increased dramatically, so we'll share what we learned.

obimy is what we call a ‘senseger’. It's a new method to communicate digitally. Instead of text, obimy users connect through senses and moods. Feeling playful? Flirt with your partner, pat a pal, or dump water on a classmate. Each feeling is an interactive animation with vibration. It's a wordless app. App Store and Google Play have obimy.

We had 20,000 users in 2022. Two to five thousand of them opened the app monthly. Our DAU metric was 500.

We have 6 million users after 6 months. 500,000 individuals use obimy daily. obimy was the top lifestyle app this week in the U.S.

And TikTok helped.

TikTok fuels obimys' growth. It's why our app exploded. How and what did we learn? Our Head of Marketing, Anastasia Avramenko, knows.

our actions prior to TikTok

We wanted to achieve product-market fit through organic expansion. Quora, Reddit, Facebook Groups, Facebook Ads, Google Ads, Apple Search Ads, and social media activity were tested. Nothing worked. Our CPI was sometimes $4, so unit economics didn't work.

We studied our markets and made audience hypotheses. We promoted our goods and studied our audience through social media quizzes. Our target demographic was Americans in long-distance relationships. I designed quizzes like Test the Strength of Your Relationship to better understand the user base. After each quiz, we encouraged users to download the app to enhance their connection and bridge the distance.

We got 1,000 responses for $50. This helped us comprehend the audience's grief and coping strategies (aka our rivals). I based action items on answers given. If you can't embrace a loved one, use obimy.

We also tried Facebook and Google ads. From the start, we knew it wouldn't work.

We were desperate to discover a free way to get more users.

Our journey to TikTok

TikTok is a great venue for emerging creators. It also helped reach people. Before obimy, my TikTok videos garnered 12 million views without sponsored promotion.

We had to act. TikTok was required.

I wasn't a TikTok user before obimy. Initially, I uploaded promotional content. Call-to-actions appear strange next to dancing challenges and my money don't jiggle jiggle. I learned TikTok. Watch TikTok for an hour was on my to-do list. What a dream job!

Our most popular movies presented the app alongside text outlining what it does. We started promoting them in Europe and the U.S. and got a 16% CTR and $1 CPI, an improvement over our previous efforts.

Somehow, we were expanding. So we came up with new hypotheses, calls to action, and content.

Four months passed, yet we saw no organic growth.

Russia attacked Ukraine.

Our app aimed to be helpful. For now, we're focusing on our Ukrainian audience. I posted sloppy TikToks illustrating how obimy can help during shelling or air raids.

In two hours, Kostia sent me our visitor count. Our servers crashed.

Initially, we had several thousand daily users. Over 200,000 users joined obimy in a week. They posted obimy videos on TikTok, drawing additional users. We've also resumed U.S. video promotion.

We gained 2,000,000 new members with less than $100 in ads, primarily in the U.S. and U.K.

TikTok helped.

The figures

We were confident we'd chosen the ideal tool for organic growth.

Over 45 million people have viewed our own videos plus a ton of user-generated content with the hashtag #obimy.

About 375 thousand people have liked all of our individual videos.

The number of downloads and the virality of videos are directly correlated.

Where are we now?

TikTok fuels our organic growth. We post 56 videos every week and pay to promote viral content.

We use UGC and influencers. We worked with Universal Music Italy on Eurovision. They offered to promote us through their million-follower TikTok influencers. We thought their followers would improve our audience, but it didn't matter. Integration didn't help us. Users that share obimy videos with their followers can reach several million views, which affects our download rate.

After the dust settled, we determined our key audience was 13-18-year-olds. They want to express themselves, but it's sometimes difficult. We're searching for methods to better engage with our users. We opened a Discord server to discuss anime and video games and gather app and content feedback.

TikTok helps us test product updates and hypotheses. Example: I once thought we might raise MAU by prompting users to add strangers as friends. Instead of asking our team to construct it, I made a TikTok urging users to share invite URLs. Users share links under every video we upload, embracing people worldwide.

Key lessons

Don't direct-sell. TikTok isn't for Instagram, Facebook, or YouTube promo videos. Conventional advertisements don't fit. Most users will swipe up and watch humorous doggos.

More product videos are better. Finally. So what?

Encourage interaction. Tagging friends in comments or making videos with the app promotes it more than any marketing spend.

Be odd and risqué. A user mistakenly sent a French kiss to their mom in one of our most popular videos.

TikTok helps test hypotheses and build your user base. It also helps develop apps. In our upcoming blog, we'll guide you through obimy's design revisions based on TikTok. Follow us on Twitter, Instagram, and TikTok.