More on Entrepreneurship/Creators

Thomas Tcheudjio

3 years ago

If you don't crush these 3 metrics, skip the Series A.

I recently wrote about getting VCs excited about Marketplace start-ups. SaaS founders became envious!

Understanding how people wire tens of millions is the only Series A hack I recommend.

Few people understand the intellectual process behind investing.

VC is risk management.

Series A-focused VCs must cover two risks.

1. Market risk

You need a large market to cross a threshold beyond which you can build defensibilities. Series A VCs underwrite market risk.

They must see you have reached product-market fit (PMF) in a large total addressable market (TAM).

2. Execution risk

When evaluating your growth engine's blitzscaling ability, execution risk arises.

When investors remove operational uncertainty, they profit.

Series A VCs like businesses with derisked revenue streams. Don't raise unless you have a predictable model, pipeline, and growth.

Please beat these 3 metrics before Series A:

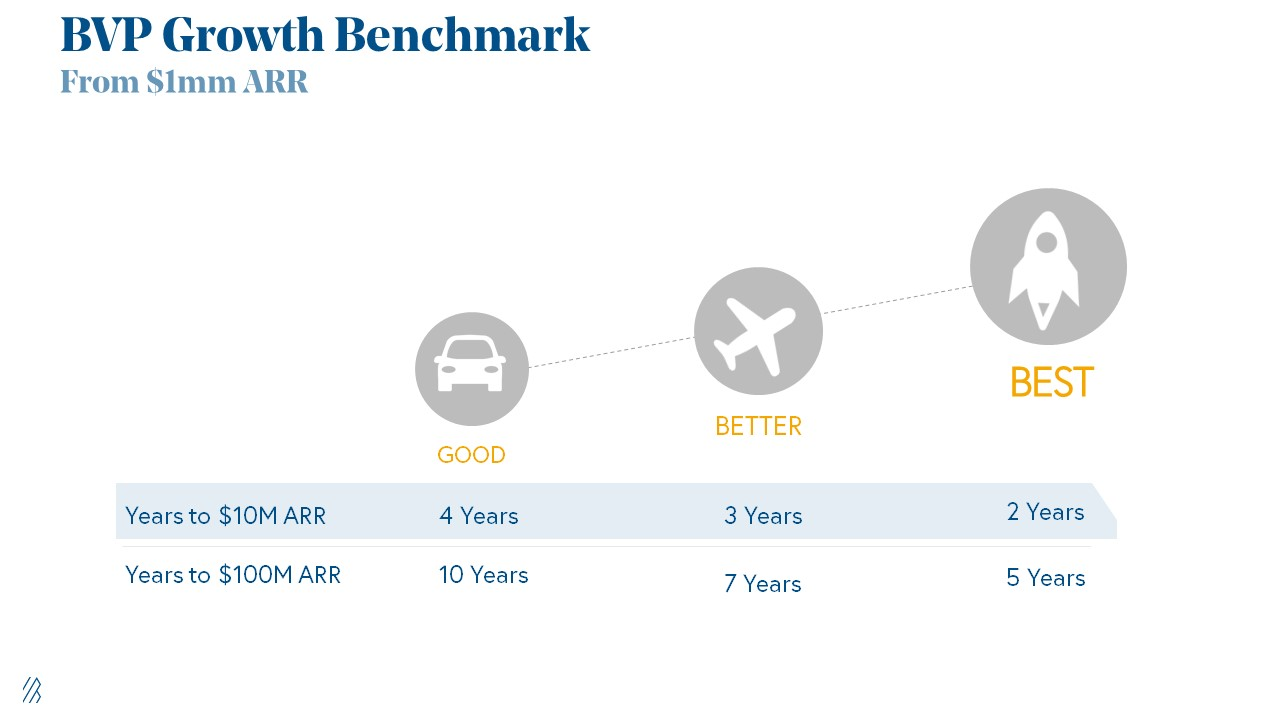

Achieve $1.5m ARR in 12-24 months (Market risk)

Above 100% Net Dollar Retention. (Market danger)

Lead Velocity Rate supporting $10m ARR in 2–4 years (Execution risk)

Hit the 3 and you'll raise $10M in 4 months. Discussing 2/3 may take 6–7 months.

If none, don't bother raising and focus on becoming a capital-efficient business (Topics for other posts).

Let's examine these 3 metrics for the brave ones.

1. Lead Velocity Rate supporting €$10m ARR in 2 to 4 years

Last because it's the least discussed. LVR is the most reliable data when evaluating a growth engine, in my opinion.

SaaS allows you to see the future.

Monthly Sales and Sales Pipelines, two predictive KPIs, have poor data quality. Both are lagging indicators, and minor changes can cause huge modeling differences.

Analysts and Associates will trash your forecasts if they're based only on Monthly Sales and Sales Pipeline.

LVR, defined as month-over-month growth in qualified leads, is rock-solid. There's no lag. You can See The Future if you use Qualified Leads and a consistent formula and process to qualify them.

With this metric in your hand, scaling your company turns into an execution play on which VCs are able to perform calculations risk.

2. Above-100% Net Dollar Retention.

Net Dollar Retention is a better-known SaaS health metric than LVR.

Net Dollar Retention measures a SaaS company's ability to retain and upsell customers. Ask what $1 of net new customer spend will be worth in years n+1, n+2, etc.

Depending on the business model, SaaS businesses can increase their share of customers' wallets by increasing users, selling them more products in SaaS-enabled marketplaces, other add-ons, and renewing them at higher price tiers.

If a SaaS company's annualized Net Dollar Retention is less than 75%, there's a problem with the business.

Slack's ARR chart (below) shows how powerful Net Retention is. Layer chart shows how existing customer revenue grows. Slack's S1 shows 171% Net Dollar Retention for 2017–2019.

Slack S-1

3. $1.5m ARR in the last 12-24 months.

According to Point 9, $0.5m-4m in ARR is needed to raise a $5–12m Series A round.

Target at least what you raised in Pre-Seed/Seed. If you've raised $1.5m since launch, don't raise before $1.5m ARR.

Capital efficiency has returned since Covid19. After raising $2m since inception, it's harder to raise $1m in ARR.

P9's 2016-2021 SaaS Funding Napkin

In summary, less than 1% of companies VCs meet get funded. These metrics can help you win.

If there’s demand for it, I’ll do one on direct-to-consumer.

Cheers!

Micah Daigle

3 years ago

Facebook is going away. Here are two explanations for why it hasn't been replaced yet.

And tips for anyone trying.

We see the same story every few years.

BREAKING NEWS: [Platform X] launched a social network. With Facebook's reputation down, the new startup bets millions will switch.

Despite the excitement surrounding each new platform (Diaspora, Ello, Path, MeWe, Minds, Vero, etc.), no major exodus occurred.

Snapchat and TikTok attracted teens with fresh experiences (ephemeral messaging and rapid-fire videos). These features aren't Facebook, even if Facebook replicated them.

Facebook's core is simple: you publish items (typically text/images) and your friends (generally people you know IRL) can discuss them.

It's cool. Sometimes I don't want to, but sh*t. I like it.

Because, well, I like many folks I've met. I enjoy keeping in touch with them and their banter.

I dislike Facebook's corporation. I've been cautiously optimistic whenever a Facebook-killer surfaced.

None succeeded.

Why? Two causes, I think:

People couldn't switch quickly enough, which is reason #1

Your buddies make a social network social.

Facebook started in self-contained communities (college campuses) then grew outward. But a new platform can't.

If we're expected to leave Facebook, we want to know that most of our friends will too.

Most Facebook-killers had bottlenecks. You have to waitlist or jump through hoops (e.g. setting up a server).

Same outcome. Upload. Chirp.

After a week or two of silence, individuals returned to Facebook.

Reason #2: The fundamental experience was different.

Even when many of our friends joined in the first few weeks, it wasn't the same.

There were missing features or a different UX.

Want to reply with a meme? No photos in comments yet. (Trying!)

Want to tag a friend? Nope, sorry. 2019!

Want your friends to see your post? You must post to all your friends' servers. Good luck!

It's difficult to introduce a platform with 100% of the same features as one that's been there for 20 years, yet customers want a core experience.

If you can't, they'll depart.

The causes that led to the causes

Having worked on software teams for 14+ years, I'm not surprised by these challenges. They are a natural development of a few tech sector meta-problems:

Lean startup methodology

Silicon Valley worships lean startup. It's a way of developing software that involves testing a stripped-down version with a limited number of people before selecting what to build.

Billion people use Facebook's functions. They aren't tested. It must work right away*

*This may seem weird to software people, but it's how non-software works! You can't sell a car without wheels.

2. Creativity

Startup entrepreneurs build new things, not copies. I understand. Reinventing the wheel is boring.

We know what works. Different experiences raise adoption friction. Once millions have transferred, more features (and a friendlier UX) can be implemented.

3. Cost scaling

True. Building a product that can sustain hundreds of millions of users in weeks is expensive and complex.

Your lifeboats must have the same capacity as the ship you're evacuating. It's required.

4. Pure ideologies

People who work on Facebook-alternatives are (understandably) critical of Facebook.

They build an open-source, fully-distributed, data-portable, interface-customizable, offline-capable, censorship-proof platform.

Prioritizing these aims can prevent replicating the straightforward experience users expect. Github, not Facebook, is for techies only.

What about the business plan, though?

Facebook-killer attempts have followed three models.

Utilize VC funding to increase your user base, then monetize them later. (If you do this, you won't kill Facebook; instead, Facebook will become you.)

Users must pay to utilize it. (This causes a huge bottleneck and slows the required quick expansion, preventing it from seeming like a true social network.)

Make it a volunteer-run, open-source endeavor that is free. (This typically denotes that something is cumbersome, difficult to operate, and is only for techies.)

Wikipedia is a fourth way.

Wikipedia is one of the most popular websites and a charity. No ads. Donations support them.

A Facebook-killer managed by a good team may gather millions (from affluent contributors and the crowd) for their initial phase of development. Then it might sustain on regular donations, ethical transactions (e.g. fees on commerce, business sites, etc.), and government grants/subsidies (since it would essentially be a public utility).

When you're not aiming to make investors rich, it's remarkable how little money you need.

If you want to build a Facebook competitor, follow these tips:

Drop the lean startup philosophy. Wait until you have a finished product before launching. Build it, thoroughly test it for bugs, and then release it.

Delay innovating. Wait till millions of people have switched before introducing your great new features. Make it nearly identical for now.

Spend money climbing. Make sure that guests can arrive as soon as they are invited. Never keep them waiting. Make things easy for them.

Make it accessible to all. Even if doing so renders it less philosophically pure, it shouldn't require technical expertise to utilize.

Constitute a nonprofit. Additionally, develop community ownership structures. Profit maximization is not the only strategy for preserving valued assets.

Last thoughts

Nobody has killed Facebook, but Facebook is killing itself.

The startup is burying the newsfeed to become a TikTok clone. Meta itself seems to be ditching the platform for the metaverse.

I wish I was happy, but I'm not. I miss (understandably) removed friends' postings and remarks. It could be a ghost town in a few years. My dance moves aren't TikTok-worthy.

Who will lead? It's time to develop a social network for the people.

Greetings if you're working on it. I'm not a company founder, but I like to help hard-working folks.

Dani Herrera

3 years ago

What prevents companies from disclosing salary information?

Yes, salary details ought to be mentioned in job postings. Recruiters and candidates both agree, so why doesn't it happen?

The short answer is “Unfortunately, it’s not the Recruiter’s decision”. The longer answer is well… A LOT.

Starting in November 2022, NYC employers must include salary ranges in job postings. It should have started in May, but companies balked.

I'm thrilled about salary transparency. This decision will promote fair, inclusive, and equitable hiring practices, and I'm sure other states will follow suit. Good news!

Candidates, recruiters, and ED&I practitioners have advocated for pay transparency for years. Why the opposition?

Let's quickly review why companies have trouble sharing salary bands.

💰 Pay Parity

Many companies and leaders still oppose pay parity. Yes, even in 2022.

💰 Pay Equity

Many companies believe in pay parity and have reviewed their internal processes and systems to ensure equality.

However, Pay Equity affects who gets roles/promotions/salary raises/bonuses and when. Enter the pay gap!

💰Pay Transparency and its impact on Talent Retention

Sharing salary bands with external candidates (and the world) means current employees will have access to that information, which is one of the main reasons companies don't share salary data.

If a company has Pay Parity and Pay Equity issues, they probably have a Pay Transparency policy as well.

Sharing salary information with external candidates without ensuring current employees understand their own salary bands and how promotions/raises are decided could impact talent retention strategies.

This information should help clarify recent conversations.

You might also like

Rishi Dean

3 years ago

Coinbase's web3 app

Use popular Ethereum dapps with Coinbase’s new dapp wallet and browser

Tl;dr: This post highlights the ability to access web3 directly from your Coinbase app using our new dapp wallet and browser.

Decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) have gained popularity in the last year (DAOs). The total value locked (TVL) of DeFi investments on the Ethereum blockchain has grown to over $110B USD, while NFTs sales have grown to over $30B USD in the last 12 months (LTM). New innovative real-world applications are emerging every day.

Today, a small group of Coinbase app users can access Ethereum-based dapps. Buying NFTs on Coinbase NFT and OpenSea, trading on Uniswap and Sushiswap, and borrowing and lending on Curve and Compound are examples.

Our new dapp wallet and dapp browser enable you to access and explore web3 directly from your Coinbase app.

Web3 in the Coinbase app

Users can now access dapps without a recovery phrase. This innovative dapp wallet experience uses Multi-Party Computation (MPC) technology to secure your on-chain wallet. This wallet's design allows you and Coinbase to share the 'key.' If you lose access to your device, the key to your dapp wallet is still safe and Coinbase can help recover it.

Set up your new dapp wallet by clicking the "Browser" tab in the Android app's navigation bar. Once set up, the Coinbase app's new dapp browser lets you search, discover, and use Ethereum-based dapps.

Looking forward

We want to enable everyone to seamlessly and safely participate in web3, and today’s launch is another step on that journey. We're rolling out the new dapp wallet and browser in the US on Android first to a small subset of users and plan to expand soon. Stay tuned!

Zuzanna Sieja

3 years ago

In 2022, each data scientist needs to read these 11 books.

Non-technical talents can benefit data scientists in addition to statistics and programming.

As our article 5 Most In-Demand Skills for Data Scientists shows, being business-minded is useful. How can you get such a diverse skill set? We've compiled a list of helpful resources.

Data science, data analysis, programming, and business are covered. Even a few of these books will make you a better data scientist.

Ready? Let’s dive in.

Best books for data scientists

1. The Black Swan

Author: Nassim Taleb

First, a less obvious title. Nassim Nicholas Taleb's seminal series examines uncertainty, probability, risk, and decision-making.

Three characteristics define a black swan event:

It is erratic.

It has a significant impact.

Many times, people try to come up with an explanation that makes it seem more predictable than it actually was.

People formerly believed all swans were white because they'd never seen otherwise. A black swan in Australia shattered their belief.

Taleb uses this incident to illustrate how human thinking mistakes affect decision-making. The book teaches readers to be aware of unpredictability in the ever-changing IT business.

Try multiple tactics and models because you may find the answer.

2. High Output Management

Author: Andrew Grove

Intel's former chairman and CEO provides his insights on developing a global firm in this business book. We think Grove would choose “management” to describe the talent needed to start and run a business.

That's a skill for CEOs, techies, and data scientists. Grove writes on developing productive teams, motivation, real-life business scenarios, and revolutionizing work.

Five lessons:

Every action is a procedure.

Meetings are a medium of work

Manage short-term goals in accordance with long-term strategies.

Mission-oriented teams accelerate while functional teams increase leverage.

Utilize performance evaluations to enhance output.

So — if the above captures your imagination, it’s well worth getting stuck in.

3. The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers

Author: Ben Horowitz

Few realize how difficult it is to run a business, even though many see it as a tremendous opportunity.

Business schools don't teach managers how to handle the toughest difficulties; they're usually on their own. So Ben Horowitz wrote this book.

It gives tips on creating and maintaining a new firm and analyzes the hurdles CEOs face.

Find suggestions on:

create software

Run a business.

Promote a product

Obtain resources

Smart investment

oversee daily operations

This book will help you cope with tough times.

4. Obviously Awesome: How to Nail Product Positioning

Author: April Dunford

Your job as a data scientist is a product. You should be able to sell what you do to clients. Even if your product is great, you must convince them.

How to? April Dunford's advice: Her book explains how to connect with customers by making your offering seem like a secret sauce.

You'll learn:

Select the ideal market for your products.

Connect an audience to the value of your goods right away.

Take use of three positioning philosophies.

Utilize market trends to aid purchasers

5. The Mom test

Author: Rob Fitzpatrick

The Mom Test improves communication. Client conversations are rarely predictable. The book emphasizes one of the most important communication rules: enquire about specific prior behaviors.

Both ways work. If a client has suggestions or demands, listen carefully and ensure everyone understands. The book is packed with client-speaking tips.

6. Introduction to Machine Learning with Python: A Guide for Data Scientists

Authors: Andreas C. Müller, Sarah Guido

Now, technical documents.

This book is for Python-savvy data scientists who wish to learn machine learning. Authors explain how to use algorithms instead of math theory.

Their technique is ideal for developers who wish to study machine learning basics and use cases. Sci-kit-learn, NumPy, SciPy, pandas, and Jupyter Notebook are covered beyond Python.

If you know machine learning or artificial neural networks, skip this.

7. Python Data Science Handbook: Essential Tools for Working with Data

Author: Jake VanderPlas

Data work isn't easy. Data manipulation, transformation, cleansing, and visualization must be exact.

Python is a popular tool. The Python Data Science Handbook explains everything. The book describes how to utilize Pandas, Numpy, Matplotlib, Scikit-Learn, and Jupyter for beginners.

The only thing missing is a way to apply your learnings.

8. Python for Data Analysis: Data Wrangling with Pandas, NumPy, and IPython

Author: Wes McKinney

The author leads you through manipulating, processing, cleaning, and analyzing Python datasets using NumPy, Pandas, and IPython.

The book's realistic case studies make it a great resource for Python or scientific computing beginners. Once accomplished, you'll uncover online analytics, finance, social science, and economics solutions.

9. Data Science from Scratch

Author: Joel Grus

Here's a title for data scientists with Python, stats, maths, and algebra skills (alongside a grasp of algorithms and machine learning). You'll learn data science's essential libraries, frameworks, modules, and toolkits.

The author works through all the key principles, providing you with the practical abilities to develop simple code. The book is appropriate for intermediate programmers interested in data science and machine learning.

Not that prior knowledge is required. The writing style matches all experience levels, but understanding will help you absorb more.

10. Machine Learning Yearning

Author: Andrew Ng

Andrew Ng is a machine learning expert. Co-founded and teaches at Stanford. This free book shows you how to structure an ML project, including recognizing mistakes and building in complex contexts.

The book delivers knowledge and teaches how to apply it, so you'll know how to:

Determine the optimal course of action for your ML project.

Create software that is more effective than people.

Recognize when to use end-to-end, transfer, and multi-task learning, and how to do so.

Identifying machine learning system flaws

Ng writes easy-to-read books. No rigorous math theory; just a terrific approach to understanding how to make technical machine learning decisions.

11. Deep Learning with PyTorch Step-by-Step

Author: Daniel Voigt Godoy

The last title is also the most recent. The book was revised on 23 January 2022 to discuss Deep Learning and PyTorch, a Python coding tool.

It comprises four parts:

Fundamentals (gradient descent, training linear and logistic regressions in PyTorch)

Machine Learning (deeper models and activation functions, convolutions, transfer learning, initialization schemes)

Sequences (RNN, GRU, LSTM, seq2seq models, attention, self-attention, transformers)

Automatic Language Recognition (tokenization, embeddings, contextual word embeddings, ELMo, BERT, GPT-2)

We admire the book's readability. The author avoids difficult mathematical concepts, making the material feel like a conversation.

Is every data scientist a humanist?

Even as a technological professional, you can't escape human interaction, especially with clients.

We hope these books will help you develop interpersonal skills.

Pen Magnet

3 years ago

Why Google Staff Doesn't Work

Sundar Pichai unveiled Simplicity Sprint at Google's latest all-hands conference.

To boost employee efficiency.

Not surprising. Few envisioned Google declaring a productivity drive.

Sunder Pichai's speech:

“There are real concerns that our productivity as a whole is not where it needs to be for the head count we have. Help me create a culture that is more mission-focused, more focused on our products, more customer focused. We should think about how we can minimize distractions and really raise the bar on both product excellence and productivity.”

The primary driver driving Google's efficiency push is:

Google's efficiency push follows 13% quarterly revenue increase. Last year in the same quarter, it was 62%.

Market newcomers may argue that the previous year's figure was fuelled by post-Covid reopening and growing consumer spending. Investors aren't convinced. A promising company like Google can't afford to drop so quickly.

Google’s quarterly revenue growth stood at 13%, against 62% in last year same quarter.

Google isn't alone. In my recent essay regarding 2025 programmers, I warned about the economic downturn's effects on FAAMG's workforce. Facebook had suspended hiring, and Microsoft had promised hefty bonuses for loyal staff.

In the same article, I predicted Google's troubles. Online advertising, especially the way Google and Facebook sell it using user data, is over.

FAAMG and 2nd rung IT companies could be the first to fall without Post-COVID revival and uncertain global geopolitics.

Google has hardly ever discussed effectiveness:

Apparently openly.

Amazon treats its employees like robots, even in software positions. It has significant turnover and a terrible reputation as a result. Because of this, it rarely loses money due to staff productivity.

Amazon trumps Google. In reality, it treats its employees poorly.

Google was the founding father of the modern-day open culture.

Larry and Sergey Google founded the IT industry's Open Culture. Silicon Valley called Google's internal democracy and transparency near anarchy. Management rarely slammed decisions on employees. Surveys and internal polls ensured everyone knew the company's direction and had a vote.

20% project allotment (weekly free time to build own project) was Google's open-secret innovation component.

After Larry and Sergey's exit in 2019, this is Google's first profitability hurdle. Only Google insiders can answer these questions.

Would Google's investors compel the company's management to adopt an Amazon-style culture where the developers are treated like circus performers?

If so, would Google follow suit?

If so, how does Google go about doing it?

Before discussing Google's likely plan, let's examine programming productivity.

What determines a programmer's productivity is simple:

How would we answer Google's questions?

As a programmer, I'm more concerned about Simplicity Sprint's aftermath than its economic catalysts.

Large organizations don't care much about quarterly and annual productivity metrics. They have 10-year product-launch plans. If something seems horrible today, it's likely due to someone's lousy judgment 5 years ago who is no longer in the blame game.

Deconstruct our main question.

How exactly do you change the culture of the firm so that productivity increases?

How can you accomplish that without affecting your capacity to profit? There are countless ways to increase output without decreasing profit.

How can you accomplish this with little to no effect on employee motivation? (While not all employers care about it, in this case we are discussing the father of the open company culture.)

How do you do it for a 10-developer IT firm that is losing money versus a 1,70,000-developer organization with a trillion-dollar valuation?

When implementing a large-scale organizational change, success must be carefully measured.

The fastest way to do something is to do it right, no matter how long it takes.

You require clearly-defined group/team/role segregation and solid pass/fail matrices to:

You can give performers rewards.

Ones that are average can be inspired to improve

Underachievers may receive assistance or, in the worst-case scenario, rehabilitation

As a 20-year programmer, I associate productivity with greatness.

Doing something well, no matter how long it takes, is the fastest way to do it.

Let's discuss a programmer's productivity.

Why productivity is a strange term in programming:

Productivity is work per unit of time.

Money=time This is an economic proverb. More hours worked, more pay. Longer projects cost more.

As a buyer, you desire a quick supply. As a business owner, you want employees who perform at full capacity, creating more products to transport and boosting your profits.

All economic matrices encourage production because of our obsession with it. Productivity is the only organic way a nation may increase its GDP.

Time is money — is not just a proverb, but an economical fact.

Applying the same productivity theory to programming gets problematic. An automating computer. Its capacity depends on the software its master writes.

Today, a sophisticated program can process a billion records in a few hours. Creating one takes a competent coder and the necessary infrastructure. Learning, designing, coding, testing, and iterations take time.

Programming productivity isn't linear, unlike manufacturing and maintenance.

Average programmers produce code every day yet miss deadlines. Expert programmers go days without coding. End of sprint, they often surprise themselves by delivering fully working solutions.

Reversing the programming duties has no effect. Experts aren't needed for productivity.

These patterns remind me of an XKCD comic.

Programming productivity depends on two factors:

The capacity of the programmer and his or her command of the principles of computer science

His or her productive bursts, how often they occur, and how long they last as they engineer the answer

At some point, productivity measurement becomes Schrödinger’s cat.

Product companies measure productivity using use cases, classes, functions, or LOCs (lines of code). In days of data-rich source control systems, programmers' merge requests and/or commits are the most preferred yardstick. Companies assess productivity by tickets closed.

Every organization eventually has trouble measuring productivity. Finer measurements create more chaos. Every measure compares apples to oranges (or worse, apples with aircraft.) On top of the measuring overhead, the endeavor causes tremendous and unnecessary stress on teams, lowering their productivity and defeating its purpose.

Macro productivity measurements make sense. Amazon's factory-era management has done it, but at great cost.

Google can pull it off if it wants to.

What Google meant in reality when it said that employee productivity has decreased:

When Google considers its employees unproductive, it doesn't mean they don't complete enough work in the allotted period.

They can't multiply their work's influence over time.

Programmers who produce excellent modules or products are unsure on how to use them.

The best data scientists are unable to add the proper parameters in their models.

Despite having a great product backlog, managers struggle to recruit resources with the necessary skills.

Product designers who frequently develop and A/B test newer designs are unaware of why measures are inaccurate or whether they have already reached the saturation point.

Most ignorant: All of the aforementioned positions are aware of what to do with their deliverables, but neither their supervisors nor Google itself have given them sufficient authority.

So, Google employees aren't productive.

How to fix it?

Business analysis: White suits introducing novel items can interact with customers from all regions. Track analytics events proactively, especially the infrequent ones.

SOLID, DRY, TEST, and AUTOMATION: Do less + reuse. Use boilerplate code creation. If something already exists, don't implement it yourself.

Build features-building capabilities: N features are created by average programmers in N hours. An endless number of features can be built by average programmers thanks to the fact that expert programmers can produce 1 capability in N hours.

Work on projects that will have a positive impact: Use the same algorithm to search for images on YouTube rather than the Mars surface.

Avoid tasks that can only be measured in terms of time linearity at all costs (if a task can be completed in N minutes, then M copies of the same task would cost M*N minutes).

In conclusion:

Software development isn't linear. Why should the makers be measured?

Notation for The Big O

I'm discussing a new way to quantify programmer productivity. (It applies to other professions, but that's another subject)

The Big O notation expresses the paradigm (the algorithmic performance concept programmers rot to ace their Google interview)

Google (or any large corporation) can do this.

Sort organizational roles into categories and specify their impact vs. time objectives. A CXO role's time vs. effect function, for instance, has a complexity of O(log N), meaning that if a CEO raises his or her work time by 8x, the result only increases by 3x.

Plot the influence of each employee over time using the X and Y axes, respectively.

Add a multiplier for Y-axis values to the productivity equation to make business objectives matter. (Example values: Support = 5, Utility = 7, and Innovation = 10).

Compare employee scores in comparable categories (developers vs. devs, CXOs vs. CXOs, etc.) and reward or help employees based on whether they are ahead of or behind the pack.

After measuring every employee's inventiveness, it's straightforward to help underachievers and praise achievers.

Example of a Big(O) Category:

If I ran Google (God forbid, its worst days are far off), here's how I'd classify it. You can categorize Google employees whichever you choose.

The Google interview truth:

O(1) < O(log n) < O(n) < O(n log n) < O(n^x) where all logarithmic bases are < n.

O(1): Customer service workers' hours have no impact on firm profitability or customer pleasure.

CXOs Most of their time is spent on travel, strategic meetings, parties, and/or meetings with minimal floor-level influence. They're good at launching new products but bad at pivoting without disaster. Their directions are being followed.

Devops, UX designers, testers Agile projects revolve around deployment. DevOps controls the levers. Their automation secures results in subsequent cycles.

UX/UI Designers must still prototype UI elements despite improved design tools.

All test cases are proportional to use cases/functional units, hence testers' work is O(N).

Architects Their effort improves code quality. Their right/wrong interference affects product quality and rollout decisions even after the design is set.

Core Developers Only core developers can write code and own requirements. When people understand and own their labor, the output improves dramatically. A single character error can spread undetected throughout the SDLC and cost millions.

Core devs introduce/eliminate 1000x bugs, refactoring attempts, and regression. Following our earlier hypothesis.

The fastest way to do something is to do it right, no matter how long it takes.

Conclusion:

Google is at the liberal extreme of the employee-handling spectrum

Microsoft faced an existential crisis after 2000. It didn't choose Amazon's data-driven people management to revitalize itself.

Instead, it entrusted developers. It welcomed emerging technologies and opened up to open source, something it previously opposed.

Google is too lax in its employee-handling practices. With that foundation, it can only follow Amazon, no matter how carefully.

Any attempt to redefine people's measurements will affect the organization emotionally.

The more Google compares apples to apples, the higher its chances for future rebirth.