More on Web3 & Crypto

Yusuf Ibrahim

4 years ago

How to sell 10,000 NFTs on OpenSea for FREE (Puppeteer/NodeJS)

So you've finished your NFT collection and are ready to sell it. Except you can't figure out how to mint them! Not sure about smart contracts or want to avoid rising gas prices. You've tried and failed with apps like Mini mouse macro, and you're not familiar with Selenium/Python. Worry no more, NodeJS and Puppeteer have arrived!

Learn how to automatically post and sell all 1000 of my AI-generated word NFTs (Nakahana) on OpenSea for FREE!

My NFT project — Nakahana |

NOTE: Only NFTs on the Polygon blockchain can be sold for free; Ethereum requires an initiation charge. NFTs can still be bought with (wrapped) ETH.

If you want to go right into the code, here's the GitHub link: https://github.com/Yusu-f/nftuploader

Let's start with the knowledge and tools you'll need.

What you should know

You must be able to write and run simple NodeJS programs. You must also know how to utilize a Metamask wallet.

Tools needed

- NodeJS. You'll need NodeJs to run the script and NPM to install the dependencies.

- Puppeteer – Use Puppeteer to automate your browser and go to sleep while your computer works.

- Metamask – Create a crypto wallet and sign transactions using Metamask (free). You may learn how to utilize Metamask here.

- Chrome – Puppeteer supports Chrome.

Let's get started now!

Starting Out

Clone Github Repo to your local machine. Make sure that NodeJS, Chrome, and Metamask are all installed and working. Navigate to the project folder and execute npm install. This installs all requirements.

Replace the “extension path” variable with the Metamask chrome extension path. Read this tutorial to find the path.

Substitute an array containing your NFT names and metadata for the “arr” variable and the “collection_name” variable with your collection’s name.

Run the script.

After that, run node nftuploader.js.

Open a new chrome instance (not chromium) and Metamask in it. Import your Opensea wallet using your Secret Recovery Phrase or create a new one and link it. The script will be unable to continue after this but don’t worry, it’s all part of the plan.

Next steps

Open your terminal again and copy the route that starts with “ws”, e.g. “ws:/localhost:53634/devtools/browser/c07cb303-c84d-430d-af06-dd599cf2a94f”. Replace the path in the connect function of the nftuploader.js script.

const browser = await puppeteer.connect({ browserWSEndpoint: "ws://localhost:58533/devtools/browser/d09307b4-7a75-40f6-8dff-07a71bfff9b3", defaultViewport: null });

Rerun node nftuploader.js. A second tab should open in THE SAME chrome instance, navigating to your Opensea collection. Your NFTs should now start uploading one after the other! If any errors occur, the NFTs and errors are logged in an errors.log file.

Error Handling

The errors.log file should show the name of the NFTs and the error type. The script has been changed to allow you to simply check if an NFT has already been posted. Simply set the “searchBeforeUpload” setting to true.

We're done!

If you liked it, you can buy one of my NFTs! If you have any concerns or would need a feature added, please let me know.

Thank you to everyone who has read and liked. I never expected it to be so popular.

Modern Eremite

3 years ago

The complete, easy-to-understand guide to bitcoin

Introduction

Markets rely on knowledge.

The internet provided practically endless knowledge and wisdom. Humanity has never seen such leverage. Technology's progress drives us to adapt to a changing world, changing our routines and behaviors.

In a digital age, people may struggle to live in the analogue world of their upbringing. Can those who can't adapt change their lives? I won't answer. We should teach those who are willing to learn, nevertheless. Unravel the modern world's riddles and give them wisdom.

Adapt or die . Accept the future or remain behind.

This essay will help you comprehend Bitcoin better than most market participants and the general public. Let's dig into Bitcoin.

Join me.

Ascension

Bitcoin.org was registered in August 2008. Bitcoin whitepaper was published on 31 October 2008. The document intrigued and motivated people around the world, including technical engineers and sovereignty seekers. Since then, Bitcoin's whitepaper has been read and researched to comprehend its essential concept.

I recommend reading the whitepaper yourself. You'll be able to say you read the Bitcoin whitepaper instead of simply Googling "what is Bitcoin" and reading the fundamental definition without knowing the revolution's scope. The article links to Bitcoin's whitepaper. To avoid being overwhelmed by the whitepaper, read the following article first.

Bitcoin isn't the first peer-to-peer digital currency. Hashcash or Bit Gold were once popular cryptocurrencies. These two Bitcoin precursors failed to gain traction and produce the network effect needed for general adoption. After many struggles, Bitcoin emerged as the most successful cryptocurrency, leading the way for others.

Satoshi Nakamoto, an active bitcointalk.org user, created Bitcoin. Satoshi's identity remains unknown. Satoshi's last bitcointalk.org login was 12 December 2010. Since then, he's officially disappeared. Thus, conspiracies and riddles surround Bitcoin's creators. I've heard many various theories, some insane and others well-thought-out.

It's not about who created it; it's about knowing its potential. Since its start, Satoshi's legacy has changed the world and will continue to.

Block-by-block blockchain

Bitcoin is a distributed ledger. What's the meaning?

Everyone can view all blockchain transactions, but no one can undo or delete them.

Imagine you and your friends routinely eat out, but only one pays. You're careful with money and what others owe you. How can everyone access the info without it being changed?

You'll keep a notebook of your evening's transactions. Everyone will take a page home. If one of you changed the page's data, the group would notice and reject it. The majority will establish consensus and offer official facts.

Miners add a new Bitcoin block to the main blockchain every 10 minutes. The appended block contains miner-verified transactions. Now that the next block has been added, the network will receive the next set of user transactions.

Bitcoin Proof of Work—prove you earned it

Any firm needs hardworking personnel to expand and serve clients. Bitcoin isn't that different.

Bitcoin's Proof of Work consensus system needs individuals to validate and create new blocks and check for malicious actors. I'll discuss Bitcoin's blockchain consensus method.

Proof of Work helps Bitcoin reach network consensus. The network is checked and safeguarded by CPU, GPU, or ASIC Bitcoin-mining machines (Application-Specific Integrated Circuit).

Every 10 minutes, miners are rewarded in Bitcoin for securing and verifying the network. It's unlikely you'll finish the block. Miners build pools to increase their chances of winning by combining their processing power.

In the early days of Bitcoin, individual mining systems were more popular due to high maintenance costs and larger earnings prospects. Over time, people created larger and larger Bitcoin mining facilities that required a lot of space and sophisticated cooling systems to keep machines from overheating.

Proof of Work is a vital part of the Bitcoin network, as network security requires the processing power of devices purchased with fiat currency. Miners must invest in mining facilities, which creates a new business branch, mining facilities ownership. Bitcoin mining is a topic for a future article.

More mining, less reward

Bitcoin is usually scarce.

Why is it rare? It all comes down to 21,000,000 Bitcoins.

Were all Bitcoins mined? Nope. Bitcoin's supply grows until it hits 21 million coins. Initially, 50BTC each block was mined, and each block took 10 minutes. Around 2140, the last Bitcoin will be mined.

But 50BTC every 10 minutes does not give me the year 2140. Indeed careful reader. So important is Bitcoin's halving process.

What is halving?

The block reward is halved every 210,000 blocks, which takes around 4 years. The initial payout was 50BTC per block and has been decreased to 25BTC after 210,000 blocks. First halving occurred on November 28, 2012, when 10,500,000 BTC (50%) had been mined. As of April 2022, the block reward is 6.25BTC and will be lowered to 3.125BTC by 19 March 2024.

The halving method is tied to Bitcoin's hashrate. Here's what "hashrate" means.

What if we increased the number of miners and hashrate they provide to produce a block every 10 minutes? Wouldn't we manufacture blocks faster?

Every 10 minutes, blocks are generated with little asymmetry. Due to the built-in adaptive difficulty algorithm, the overall hashrate does not affect block production time. With increased hashrate, it's harder to construct a block. We can estimate when the next halving will occur because 10 minutes per block is fixed.

Building with nodes and blocks

For someone new to crypto, the unusual terms and words may be overwhelming. You'll also find everyday words that are easy to guess or have a vague idea of what they mean, how they work, and what they do. Consider blockchain technology.

Nodes and blocks: Think about that for a moment. What is your first idea?

The blockchain is a chain of validated blocks added to the main chain. What's a "block"? What's inside?

The block is another page in the blockchain book that has been filled with transaction information and accepted by the majority.

We won't go into detail about what each block includes and how it's built, as long as you understand its purpose.

What about nodes?

Nodes, along with miners, verify the blockchain's state independently. But why?

To create a full blockchain node, you must download the whole Bitcoin blockchain and check every transaction against Bitcoin's consensus criteria.

What's Bitcoin's size?

In April 2022, the Bitcoin blockchain was 389.72GB.

Bitcoin's blockchain has miners and node runners.

Let's revisit the US gold rush. Miners mine gold with their own power (physical and monetary resources) and are rewarded with gold (Bitcoin). All become richer with more gold, and so does the country.

Nodes are like sheriffs, ensuring everything is done according to consensus rules and that there are no rogue miners or network users.

Lost and held bitcoin

Does the Bitcoin exchange price match each coin's price? How many coins remain after 21,000,000? 21 million or less?

Common reason suggests a 21 million-coin supply.

What if I lost 1BTC from a cold wallet?

What if I saved 1000BTC on paper in 2010 and it was damaged?

What if I mined Bitcoin in 2010 and lost the keys?

Satoshi Nakamoto's coins? Since then, those coins haven't moved.

How many BTC are truly in circulation?

Many people are trying to answer this question, and you may discover a variety of studies and individual research on the topic. Be cautious of the findings because they can't be evaluated and the statistics are hazy guesses.

On the other hand, we have long-term investors who won't sell their Bitcoin or will sell little amounts to cover mining or living needs.

The price of Bitcoin is determined by supply and demand on exchanges using liquid BTC. How many BTC are left after subtracting lost and non-custodial BTC?

We have significantly less Bitcoin in circulation than you think, thus the price may not reflect demand if we knew the exact quantity of coins available.

True HODLers and diamond-hand investors won't sell you their coins, no matter the market.

What's UTXO?

Unspent (U) Transaction (TX) Output (O)

Imagine taking a $100 bill to a store. After choosing a drink and munchies, you walk to the checkout to pay. The cashier takes your $100 bill and gives you $25.50 in change. It's in your wallet.

Is it simply 100$? No way.

The $25.50 in your wallet is unrelated to the $100 bill you used. Your wallet's $25.50 is just bills and coins. Your wallet may contain these coins and bills:

2x 10$ 1x 10$

1x 5$ or 3x 5$

1x 0.50$ 2x 0.25$

Any combination of coins and bills can equal $25.50. You don't care, and I'd wager you've never ever considered it.

That is UTXO. Now, I'll detail the Bitcoin blockchain and how UTXO works, as it's crucial to know what coins you have in your (hopefully) cold wallet.

You purchased 1BTC. Is it all? No. UTXOs equal 1BTC. Then send BTC to a cold wallet. Say you pay 0.001BTC and send 0.999BTC to your cold wallet. Is it the 1BTC you got before? Well, yes and no. The UTXOs are the same or comparable as before, but the blockchain address has changed. It's like if you handed someone a wallet, they removed the coins needed for a network charge, then returned the rest of the coins and notes.

UTXO is a simple concept, but it's crucial to grasp how it works to comprehend dangers like dust attacks and how coins may be tracked.

Lightning Network: fast cash

You've probably heard of "Layer 2 blockchain" projects.

What does it mean?

Layer 2 on a blockchain is an additional layer that increases the speed and quantity of transactions per minute and reduces transaction fees.

Imagine going to an obsolete bank to transfer money to another account and having to pay a charge and wait. You can transfer funds via your bank account or a mobile app without paying a fee, or the fee is low, and the cash appear nearly quickly. Layer 1 and 2 payment systems are different.

Layer 1 is not obsolete; it merely has more essential things to focus on, including providing the blockchain with new, validated blocks, whereas Layer 2 solutions strive to offer Layer 1 with previously processed and verified transactions. The primary blockchain, Bitcoin, will only receive the wallets' final state. All channel transactions until shutting and balancing are irrelevant to the main chain.

Layer 2 and the Lightning Network's goal are now clear. Most Layer 2 solutions on multiple blockchains are created as blockchains, however Lightning Network is not. Remember the following remark, as it best describes Lightning.

Lightning Network connects public and private Bitcoin wallets.

Opening a private channel with another wallet notifies just two parties. The creation and opening of a public channel tells the network that anyone can use it.

Why create a public Lightning Network channel?

Every transaction through your channel generates fees.

Money, if you don't know.

See who benefits when in doubt.

Anonymity, huh?

Bitcoin anonymity? Bitcoin's anonymity was utilized to launder money.

Well… You've heard similar stories. When you ask why or how it permits people to remain anonymous, the conversation ends as if it were just a story someone heard.

Bitcoin isn't private. Pseudonymous.

What if someone tracks your transactions and discovers your wallet address? Where is your anonymity then?

Bitcoin is like bulletproof glass storage; you can't take or change the money. If you dig and analyze the data, you can see what's inside.

Every online action leaves a trace, and traces may be tracked. People often forget this guideline.

A tool like that can help you observe what the major players, or whales, are doing with their coins when the market is uncertain. Many people spend time analyzing on-chain data. Worth it?

Ask yourself a question. What are the big players' options? Do you think they're letting you see their wallets for a small on-chain data fee?

Instead of short-term behaviors, focus on long-term trends.

More wallet transactions leave traces. Having nothing to conceal isn't a defect. Can it lead to regulating Bitcoin so every transaction is tracked like in banks today?

But wait. How can criminals pay out Bitcoin? They're doing it, aren't they?

Mixers can anonymize your coins, letting you to utilize them freely. This is not a guide on how to make your coins anonymous; it could do more harm than good if you don't know what you're doing.

Remember, being anonymous attracts greater attention.

Bitcoin isn't the only cryptocurrency we can use to buy things. Using cryptocurrency appropriately can provide usability and anonymity. Monero (XMR), Zcash (ZEC), and Litecoin (LTC) following the Mimblewimble upgrade are examples.

Summary

Congratulations! You've reached the conclusion of the article and learned about Bitcoin and cryptocurrency. You've entered the future.

You know what Bitcoin is, how its blockchain works, and why it's not anonymous. I bet you can explain Lightning Network and UTXO to your buddies.

Markets rely on knowledge. Prepare yourself for success before taking the first step. Let your expertise be your edge.

This article is a summary of this one.

Alex Bentley

3 years ago

Why Bill Gates thinks Bitcoin, crypto, and NFTs are foolish

Microsoft co-founder Bill Gates assesses digital assets while the bull is caged.

Bill Gates is well-respected.

Reasonably. He co-founded and led Microsoft during its 1980s and 1990s revolution.

After leaving Microsoft, Bill Gates pursued other interests. He and his wife founded one of the world's largest philanthropic organizations, Bill & Melinda Gates Foundation. He also supports immunizations, population control, and other global health programs.

When Gates criticized Bitcoin, cryptocurrencies, and NFTs, it made news.

Bill Gates said at the 58th Munich Security Conference...

“You have an asset class that’s 100% based on some sort of greater fool theory that somebody’s going to pay more for it than I do.”

Gates means digital assets. Like many bitcoin critics, he says digital coins and tokens are speculative.

And he's not alone. Financial experts have dubbed Bitcoin and other digital assets a "bubble" for a decade.

Gates also made fun of Bored Ape Yacht Club and NFTs, saying, "Obviously pricey digital photographs of monkeys will help the world."

Why does Bill Gates dislike digital assets?

According to Gates' latest comments, Bitcoin, cryptos, and NFTs aren't good ways to hold value.

Bill Gates is a better investor than Elon Musk.

“I’m used to asset classes, like a farm where they have output, or like a company where they make products,” Gates said.

The Guardian claimed in April 2021 that Bill and Melinda Gates owned the most U.S. farms. Over 242,000 acres of farmland.

The Gates couple has enough farmland to cover Hong Kong.

Bill Gates is a classic investor. He wants companies with an excellent track record, strong fundamentals, and good management. Or tangible assets like land and property.

Gates prefers the "old economy" over the "new economy"

Gates' criticism of Bitcoin and cryptocurrency ventures isn't surprising. These digital assets lack all of Gates's investing criteria.

Volatile digital assets include Bitcoin. Their costs might change dramatically in a day. Volatility scares risk-averse investors like Gates.

Gates has a stake in the old financial system. As Microsoft's co-founder, Gates helped develop a dominant tech company.

Because of his business, he's one of the world's richest men.

Bill Gates is invested in protecting the current paradigm.

He won't invest in anything that could destroy the global economy.

When Gates criticizes Bitcoin, cryptocurrencies, and NFTs, he's suggesting they're a hoax. These soapbox speeches are one way he protects his interests.

Digital assets aren't a bad investment, though. Many think they're the future.

Changpeng Zhao and Brian Armstrong are two digital asset billionaires. Two crypto exchange CEOs. Binance/Coinbase.

Digital asset revolution won't end soon.

If you disagree with Bill Gates and plan to invest in Bitcoin, cryptocurrencies, or NFTs, do your own research and understand the risks.

But don’t take Bill Gates’ word for it.

He’s just an old rich guy with a lot of farmland.

He has a lot to lose if Bitcoin and other digital assets gain global popularity.

This post is a summary. Read the full article here.

You might also like

Bob Service

3 years ago

Did volcanic 'glasses' play a role in igniting early life?

Quenched lava may have aided in the formation of long RNA strands required by primitive life.

It took a long time for life to emerge. Microbes were present 3.7 billion years ago, just a few hundred million years after the 4.5-billion-year-old Earth had cooled enough to sustain biochemistry, according to fossils, and many scientists believe RNA was the genetic material for these first species. RNA, while not as complicated as DNA, would be difficult to forge into the lengthy strands required to transmit genetic information, raising the question of how it may have originated spontaneously.

Researchers may now have a solution. They demonstrate how basaltic glasses assist individual RNA letters, also known as nucleoside triphosphates, join into strands up to 200 letters long in lab studies. The glasses are formed when lava is quenched in air or water, or when melted rock generated by asteroid strikes cools rapidly, and they would have been plentiful in the early Earth's fire and brimstone.

The outcome has caused a schism among top origin-of-life scholars. "This appears to be a great story that finally explains how nucleoside triphosphates react with each other to create RNA strands," says Thomas Carell, a scientist at Munich's Ludwig Maximilians University. However, Harvard University's Jack Szostak, an RNA expert, says he won't believe the results until the study team thoroughly describes the RNA strands.

Researchers interested in the origins of life like the idea of a primordial "RNA universe" since the molecule can perform two different functions that are essential for life. It's made up of four chemical letters, just like DNA, and can carry genetic information. RNA, like proteins, can catalyze chemical reactions that are necessary for life.

However, RNA can cause headaches. No one has yet discovered a set of plausible primordial conditions that would cause hundreds of RNA letters—each of which is a complicated molecule—to join together into strands long enough to support the intricate chemistry required to kick-start evolution.

Basaltic glasses may have played a role, according to Stephen Mojzsis, a geologist at the University of Colorado, Boulder. They're high in metals like magnesium and iron, which help to trigger a variety of chemical reactions. "Basaltic glass was omnipresent on Earth at the time," he adds.

He provided the Foundation for Applied Molecular Evolution samples of five different basalt glasses. Each sample was ground into a fine powder, sanitized, and combined with a solution of nucleoside triphosphates by molecular biologist Elisa Biondi and her colleagues. The RNA letters were unable to link up without the presence of glass powder. However, when the molecules were mixed with the glass particles, they formed long strands of hundreds of letters, according to the researchers, who published their findings in Astrobiology this week. There was no need for heat or light. Biondi explains, "All we had to do was wait." After only a day, little RNA strands produced, yet the strands continued to grow for months. Jan Paek, a molecular biologist at Firebird Biomolecular Sciences, says, "The beauty of this approach is its simplicity." "Mix the components together, wait a few days, and look for RNA."

Nonetheless, the findings pose a slew of problems. One of the questions is how nucleoside triphosphates came to be in the first place. Recent study by Biondi's colleague Steven Benner suggests that the same basaltic glasses may have aided in the creation and stabilization of individual RNA letters.

The form of the lengthy RNA strands, according to Szostak, is a significant challenge. Enzymes in modern cells ensure that most RNAs form long linear chains. RNA letters, on the other hand, can bind in complicated branching sequences. Szostak wants the researchers to reveal what kind of RNA was produced by the basaltic glasses. "It irritates me that the authors made an intriguing initial finding but then chose to follow the hype rather than the research," Szostak says.

Biondi acknowledges that her team's experiment almost probably results in some RNA branching. She does acknowledge, however, that some branched RNAs are seen in species today, and that analogous structures may have existed before the origin of life. Other studies carried out by the study also confirmed the presence of lengthy strands with connections, indicating that they are most likely linear. "It's a healthy argument," says Dieter Braun, a Ludwig Maximilian University origin-of-life chemist. "It will set off the next series of tests."

Joseph Mavericks

3 years ago

You Don't Have to Spend $250 on TikTok Ads Because I Did

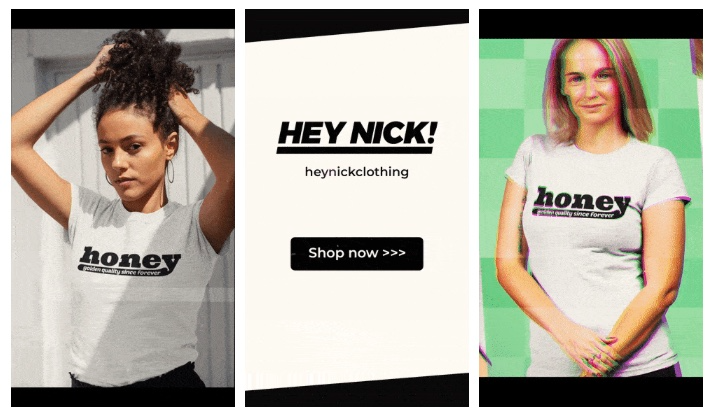

900K impressions, 8K clicks, and $$$ orders…

I recently started dropshipping. Now that I own my business and can charge it as a business expense, it feels less like money wasted if it doesn't work. I also made t-shirts to sell. I intended to open a t-shirt store and had many designs on a hard drive. I read that Tiktok advertising had a high conversion rate and low cost because they were new. According to many, the advertising' cost/efficiency ratio would plummet and become as bad as Google or Facebook Ads. Now felt like the moment to try Tiktok marketing and dropshipping. I work in marketing for a SaaS firm and have seen how poorly ads perform. I wanted to try it alone.

I set up $250 and ran advertising for a week. Before that, I made my own products, store, and marketing. In this post, I'll show you my process and results.

Setting up the store

Dropshipping is a sort of retail business in which the manufacturer ships the product directly to the client through an online platform maintained by a seller. The seller takes orders but has no stock. The manufacturer handles all orders. This no-stock concept increases profitability and flexibility.

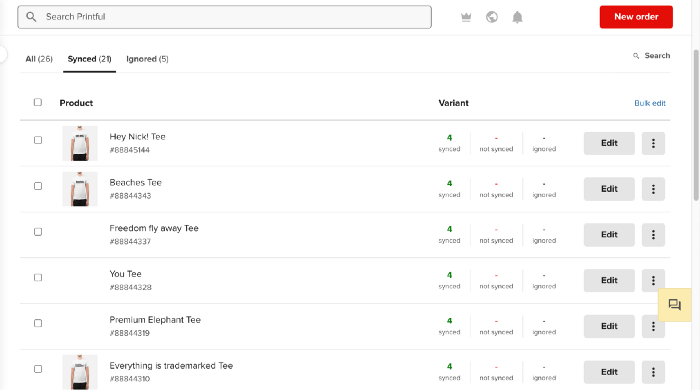

In my situation, I used previous t-shirt designs to make my own product. I didn't want to handle order fulfillment logistics, so I looked for a way to print my designs on demand, ship them, and handle order tracking/returns automatically. So I found Printful.

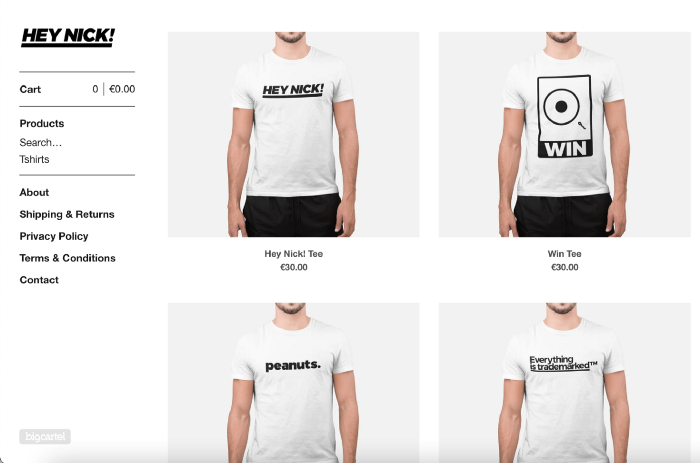

I needed to connect my backend and supplier to a storefront so visitors could buy. 99% of dropshippers use Shopify, but I didn't want to master the difficult application. I wanted a one-day project. I'd previously worked with Big Cartel, so I chose them.

Big Cartel doesn't collect commissions on sales, simply a monthly flat price ($9.99 to $19.99 depending on your plan).

After opening a Big Cartel account, I uploaded 21 designs and product shots, then synced each product with Printful.

Developing the ads

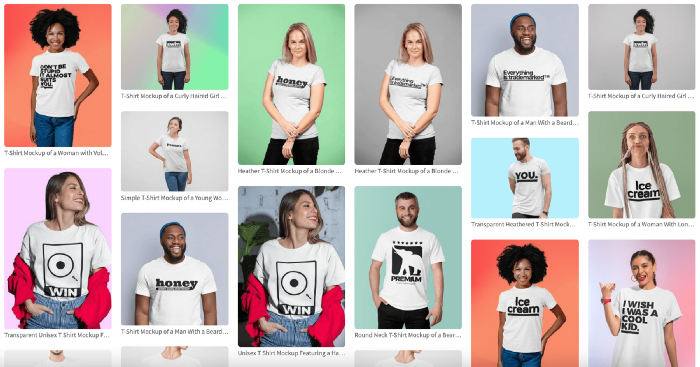

I mocked up my designs on cool people photographs from placeit.net, a great tool for creating product visuals when you don't have a studio, camera gear, or models to wear your t-shirts.

I opened an account on the website and had advertising visuals within 2 hours.

Because my designs are simple (black design on white t-shirt), I chose happy, stylish people on plain-colored backdrops. After that, I had to develop an animated slideshow.

Because I'm a graphic designer, I chose to use Adobe Premiere to create animated Tiktok advertising.

Premiere is a fancy video editing application used for more than advertisements. Premiere is used to edit movies, not social media marketing. I wanted this experiment to be quick, so I got 3 social media ad templates from motionarray.com and threw my visuals in. All the transitions and animations were pre-made in the files, so it only took a few hours to compile. The result:

I downloaded 3 different soundtracks for the videos to determine which would convert best.

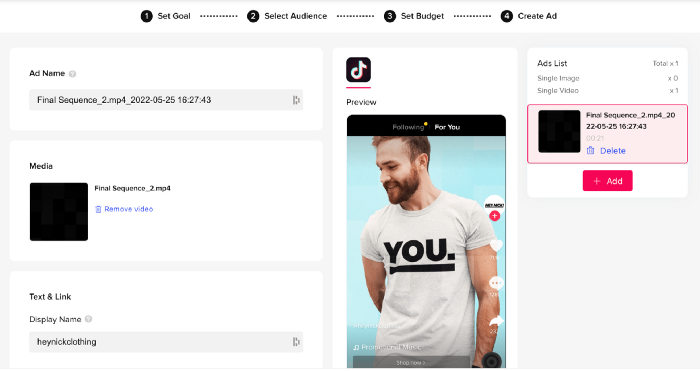

After that, I opened a Tiktok business account, uploaded my films, and inserted ad info. They went live within one hour.

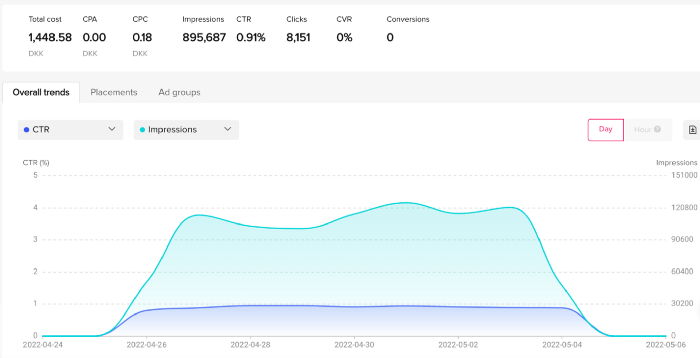

The (poor) outcomes

As a European company, I couldn't deliver ads in the US. All of my advertisements' material (title, description, and call to action) was in English, hence they continued getting rejected in Europe for countries that didn't speak English. There are a lot of them:

I lost a lot of quality traffic, but I felt that if the images were engaging, people would check out the store and buy my t-shirts. I was wrong.

51,071 impressions on Day 1. 0 orders after 411 clicks

114,053 impressions on Day 2. 1.004 clicks and no orders

Day 3: 987 clicks, 103,685 impressions, and 0 orders

101,437 impressions on Day 4. 0 orders after 963 clicks

115,053 impressions on Day 5. 1,050 clicks and no purchases

125,799 impressions on day 6. 1,184 clicks, no purchases

115,547 impressions on Day 7. 1,050 clicks and no purchases

121,456 impressions on day 8. 1,083 clicks, no purchases

47,586 impressions on Day 9. 419 Clicks. No orders

My overall conversion rate for video advertisements was 0.9%. TikTok's paid ad formats all result in strong engagement rates (ads average 3% to 12% CTR to site), therefore a 1 to 2% CTR should have been doable.

My one-week experiment yielded 8,151 ad clicks but no sales. Even if 0.1% of those clicks converted, I should have made 8 sales. Even companies with horrible web marketing would get one download or trial sign-up for every 8,151 clicks. I knew that because my advertising were in English, I had no impressions in the main EU markets (France, Spain, Italy, Germany), and that this impacted my conversion potential. I still couldn't believe my numbers.

I dug into the statistics and found that Tiktok's stats didn't match my store traffic data.

Looking more closely at the numbers

My ads were approved on April 26 but didn't appear until April 27. My store dashboard showed 440 visitors but 1,004 clicks on Tiktok. This happens often while tracking campaign results since different platforms handle comparable user activities (click, view) differently. In online marketing, residual data won't always match across tools.

My data gap was too large. Even if half of the 1,004 persons who clicked closed their browser or left before the store site loaded, I would have gained 502 visitors. The significant difference between Tiktok clicks and Big Cartel store visits made me suspicious. It happened all week:

Day 1: 440 store visits and 1004 ad clicks

Day 2: 482 store visits, 987 ad clicks

3rd day: 963 hits on ads, 452 store visits

443 store visits and 1,050 ad clicks on day 4.

Day 5: 459 store visits and 1,184 ad clicks

Day 6: 430 store visits and 1,050 ad clicks

Day 7: 409 store visits and 1,031 ad clicks

Day 8: 166 store visits and 418 ad clicks

The disparity wasn't related to residual data or data processing. The disparity between visits and clicks looked regular, but I couldn't explain it.

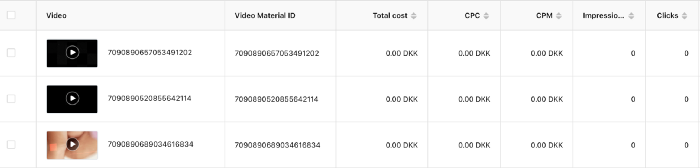

After the campaign concluded, I discovered all my creative assets (the videos) had a 0% CTR and a $0 expenditure in a separate dashboard. Whether it's a dashboard reporting issue or a budget allocation bug, online marketers shouldn't see this.

Tiktok can present any stats they want on their dashboard, just like any other platform that runs advertisements to promote content to its users. I can't verify that 895,687 individuals saw and clicked on my ad. I invested $200 for what appears to be around 900K impressions, which is an excellent ROI. No one bought a t-shirt, even an unattractive one, out of 900K people?

Would I do it again?

Nope. Whether I didn't make sales because Tiktok inflated the dashboard numbers or because I'm horrible at producing advertising and items that sell, I’ll stick to writing content and making videos. If setting up a business and ads in a few days was all it took to make money online, everyone would do it.

Video advertisements and dropshipping aren't dead. As long as the internet exists, people will click ads and buy stuff. Converting ads and selling stuff takes a lot of work, and I want to focus on other things.

I had always wanted to try dropshipping and I’m happy I did, I just won’t stick to it because that’s not something I’m interested in getting better at.

If I want to sell t-shirts again, I'll avoid Tiktok advertisements and find another route.

xuanling11

3 years ago

Reddit NFT Achievement

Reddit's NFT market is alive and well.

NFT owners outnumber OpenSea on Reddit.

Reddit NFTs flip in OpenSea in days:

Fast-selling.

NFT sales will make Reddit's current communities more engaged.

I don't think NFTs will affect existing groups, but they will build hype for people to acquire them.

The first season of Collectibles is unique, but many missed the first season.

Second-season NFTs are less likely to be sold for a higher price than first-season ones.

If you use Reddit, it's fun to own NFTs.