More on Current Events

Scott Galloway

3 years ago

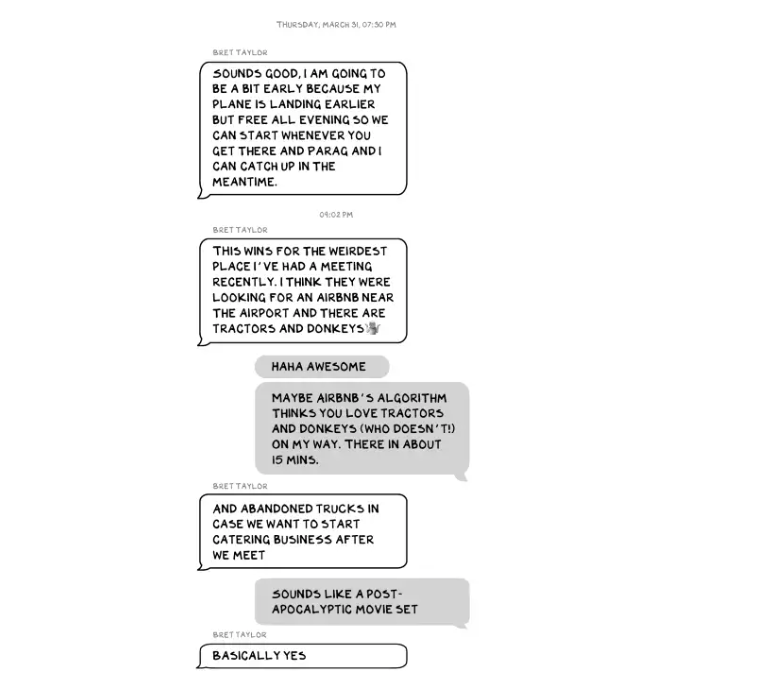

Text-ure

While we played checkers, we thought billionaires played 3D chess. They're playing the same game on a fancier board.

Every medium has nuances and norms. Texting is authentic and casual. A smaller circle has access, creating intimacy and immediacy. Most people read all their texts, but not all their email and mail. Many of us no longer listen to our voicemails, and calling your kids ages you.

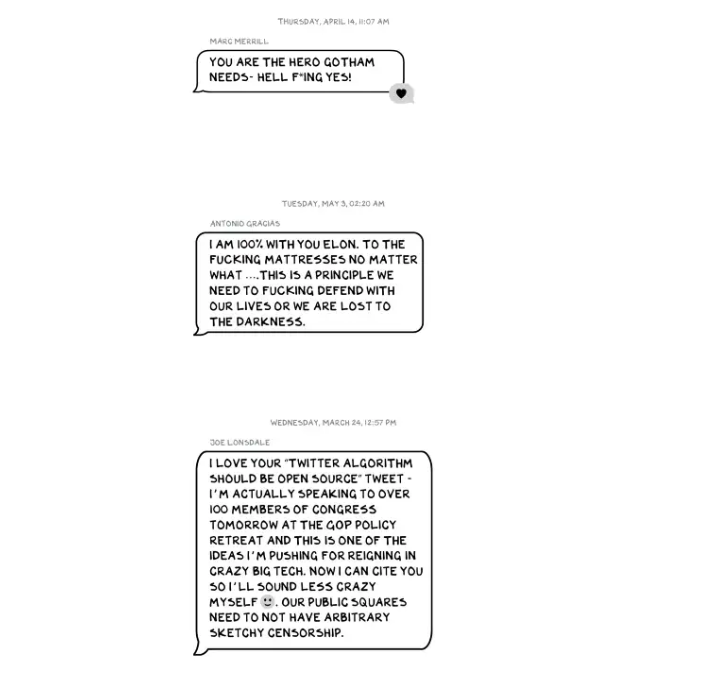

Live interviews and testimony under oath inspire real moments, rare in a world where communications departments sanitize everything powerful people say. When (some of) Elon's text messages became public in Twitter v. Musk, we got a glimpse into tech power. It's bowels.

These texts illuminate the tech community's upper caste.

Checkers, Not Chess

Elon texts with Larry Ellison, Joe Rogan, Sam Bankman-Fried, Satya Nadella, and Jack Dorsey. They reveal astounding logic, prose, and discourse. The world's richest man and his followers are unsophisticated, obtuse, and petty. Possibly. While we played checkers, we thought billionaires played 3D chess. They're playing the same game on a fancier board.

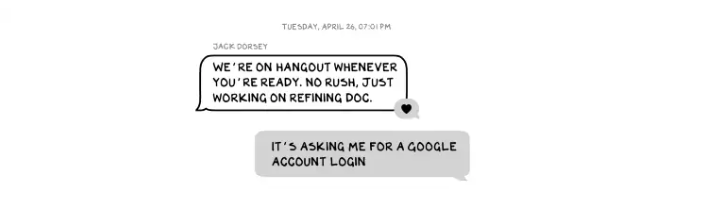

They fumble with their computers.

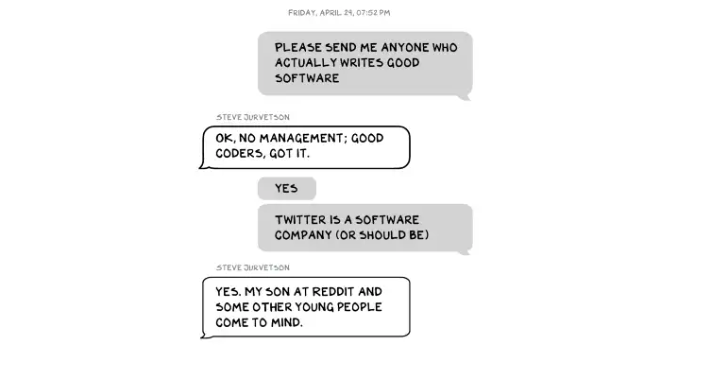

They lean on others to get jobs for their kids (no surprise).

No matter how rich, they always could use more (money).

Differences A social hierarchy exists. Among this circle, the currency of deference is... currency. Money increases sycophantry. Oculus and Elon's "friends'" texts induce nausea.

Autocorrect frustrates everyone.

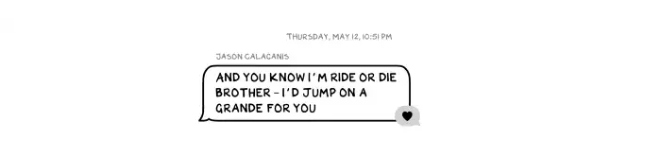

Elon doesn't stand out to me in these texts; he comes off mostly OK in my view. It’s the people around him. It seems our idolatry of innovators has infected the uber-wealthy, giving them an uncontrollable urge to kill the cool kid for a seat at his cafeteria table. "I'd grenade for you." If someone says this and they're not fighting you, they're a fan, not a friend.

Many powerful people are undone by their fake friends. Facilitators, not well-wishers. When Elon-Twitter started, I wrote about power. Unchecked power is intoxicating. This is a scientific fact, not a thesis. Power causes us to downplay risk, magnify rewards, and act on instincts more quickly. You lose self-control and must rely on others.

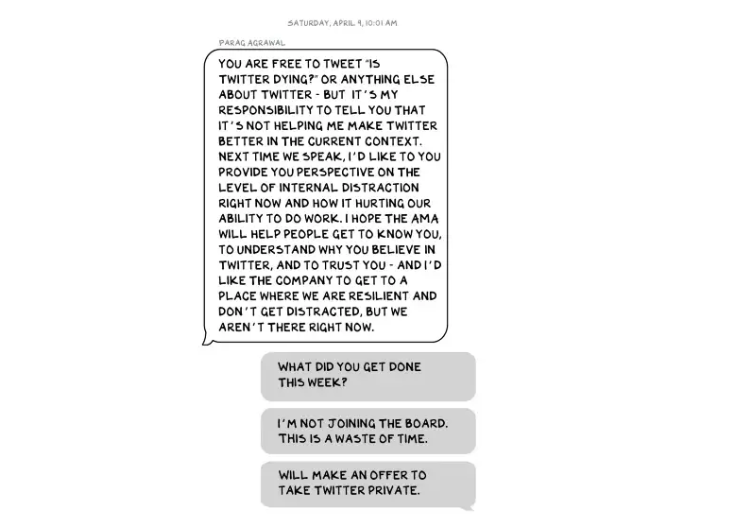

You'd hope the world's richest person has advisers who push back when necessary (i.e., not yes men). Elon's reckless, childish behavior and these texts show there is no truth-teller. I found just one pushback in the 151-page document. It came from Twitter CEO Parag Agrawal, who, in response to Elon’s unhelpful “Is Twitter dying?” tweet, let Elon know what he thought: It was unhelpful. Elon’s response? A childish, terse insult.

Scale

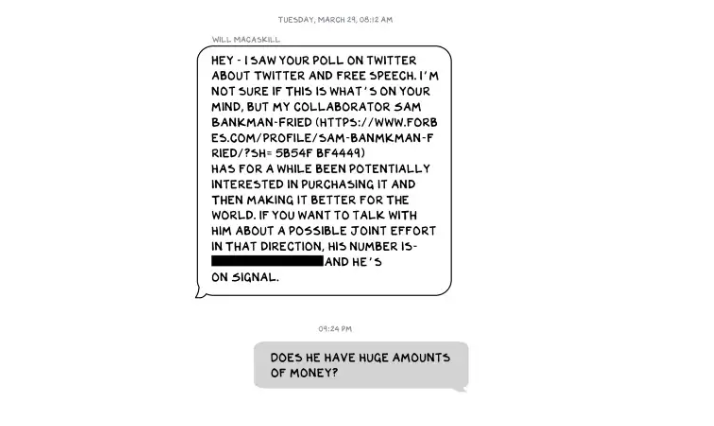

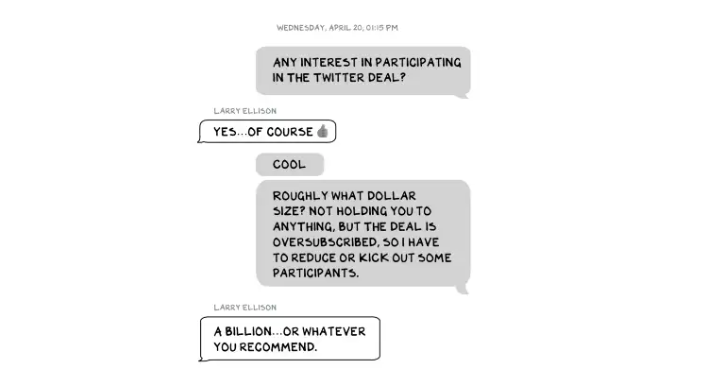

The texts are mostly unremarkable. There are some, however, that do remind us the (super-)rich are different. Specifically, the discussions of possible equity investments from crypto-billionaire Sam Bankman-Fried (“Does he have huge amounts of money?”) and this exchange with Larry Ellison:

Ellison, who co-founded $175 billion Oracle, is wealthy. Less clear is whether he can text a billion dollars. Who hasn't been texted $1 billion? Ellison offered 8,000 times the median American's net worth, enough to buy 3,000 Ferraris or the Chicago Blackhawks. It's a bedrock principle of capitalism to have incredibly successful people who are exponentially wealthier than the rest of us. It creates an incentive structure that inspires productivity and prosperity. When people offer billions over text to help a billionaire's vanity project in a country where 1 in 5 children are food insecure, isn't America messed up?

Elon's Morgan Stanley banker, Michael Grimes, tells him that Web3 ventures investor Bankman-Fried can invest $5 billion in the deal: “could do $5bn if everything vision lock... Believes in your mission." The message bothers Elon. In Elon's world, $5 billion doesn't warrant a worded response. $5 billion is more than many small nations' GDP, twice the SEC budget, and five times the NRC budget.

If income inequality worries you after reading this, trust your gut.

Billionaires aren't like the rich.

As an entrepreneur, academic, and investor, I've met modest-income people, rich people, and billionaires. Rich people seem different to me. They're smarter and harder working than most Americans. Monty Burns from The Simpsons is a cartoon about rich people. Rich people have character and know how to make friends. Success requires supporters.

I've never noticed a talent or intelligence gap between wealthy and ultra-wealthy people. Conflating talent and luck infects the tech elite. Timing is more important than incremental intelligence when going from millions to hundreds of millions or billions. Proof? Elon's texting. Any man who electrifies the auto industry and lands two rockets on barges is a genius. His mega-billions come from a well-regulated capital market, enforceable contracts, thousands of workers, and billions of dollars in government subsidies, including a $465 million DOE loan that allowed Tesla to produce the Model S. So, is Mr. Musk a genius or an impressive man in a unique time and place?

The Point

Elon's texts taught us more? He can't "fix" Twitter. For two weeks in April, he was all in on blockchain Twitter, brainstorming Dogecoin payments for tweets with his brother — i.e., paid speech — while telling Twitter's board he was going to make a hostile tender offer. Kimbal approved. By May, he was over crypto and "laborious blockchain debates." (Mood.)

Elon asked the Twitter CEO for "an update from the Twitter engineering team" No record shows if he got the meeting. It doesn't "fix" Twitter either. And this is Elon's problem. He's a grown-up child with all the toys and no boundaries. His yes-men encourage his most facile thoughts, and shitposts and errant behavior diminish his genius and ours.

Post-Apocalyptic

The universe's titans have a sense of humor.

Every day, we must ask: Who keeps me real? Who will disagree with me? Who will save me from my psychosis, which has brought down so many successful people? Elon Musk doesn't need anyone to jump on a grenade for him; he needs to stop throwing them because one will explode in his hand.

Cory Doctorow

3 years ago

The downfall of the Big Four accounting companies is just one (more) controversy away.

Economic mutual destruction.

Multibillion-dollar corporations never bothered with an independent audit, and they all lied about their balance sheets.

It's easy to forget that the Big Four accounting firms are lousy fraud enablers. Just because they sign off on your books doesn't mean you're not a hoax waiting to erupt.

This is *crazy* Capitalism depends on independent auditors. Rich folks need to know their financial advisers aren't lying. Rich folks usually succeed.

No accounting. EY, KPMG, PWC, and Deloitte make more money consulting firms than signing off on their accounts.

The Big Four sign off on phony books because failing to make friends with unscrupulous corporations may cost them consulting contracts.

The Big Four are the only firms big enough to oversee bankruptcy when they sign off on fraudulent books, as they did for Carillion in 2018. All four profited from Carillion's bankruptcy.

The Big Four are corrupt without any consequences for misconduct. Who can forget when KPMG's top management was fined millions for helping auditors cheat on ethics exams?

Consulting and auditing conflict. Consultants help a firm cover its evil activities, such as tax fraud or wage theft, whereas auditors add clarity to a company's finances. The Big Four make more money from cooking books than from uncooking them, thus they are constantly embroiled in scandals.

If a major scandal breaks, it may bring down the entire sector and substantial parts of the economy. Jim Peterson explains system risk for The Dig.

The Big Four are voluntary private partnerships where accountants invest their time, reputations, and money. If a controversy threatens the business, partners who depart may avoid scandal and financial disaster.

When disaster looms, each partner should bolt for the door, even if a disciplined stay-and-hold posture could weather the storm. This happened to Arthur Andersen during Enron's collapse, and a 2006 EU report recognized the risk to other corporations.

Each partner at a huge firm knows how much dirty laundry they've buried in the company's garden, and they have well-founded suspicions about what other partners have buried, too. When someone digs, everyone runs.

If a firm confronts substantial litigation damages or enforcement penalties, it could trigger the collapse of one of the Big Four. That would be bad news for the firm's clients, who would have trouble finding another big auditor.

Most of the world's auditing capacity is concentrated in four enormous, brittle, opaque, compromised organizations. If one of them goes bankrupt, the other three won't be able to take on its clients.

Peterson: Another collapse would strand many of the world's large public businesses, leaving them unable to obtain audit views for their securities listings and regulatory compliance.

Count Down: The Past, Present, and Uncertain Future of the Big Four Accounting Firms is in its second edition.

https://www.emerald.com/insight/publication/doi/10.1108/9781787147003

Jess Rifkin

3 years ago

As the world watches the Russia-Ukraine border situation, This bill would bar aid to Ukraine until the Mexican border is secured.

Although Mexico and Ukraine are thousands of miles apart, this legislation would link their responses.

Context

Ukraine was a Soviet republic until 1991. A significant proportion of the population, particularly in the east, is ethnically Russian. In February, the Russian military invaded Ukraine, intent on overthrowing its democratically elected government.

This could be the biggest European land invasion since WWII. In response, President Joe Biden sent 3,000 troops to NATO countries bordering Ukraine to help with Ukrainian refugees, with more troops possible if the situation worsened.

In July 2021, the US Border Patrol reported its highest monthly encounter total since March 2000. Some Republicans compare Biden's response to the Mexican border situation to his response to the Ukrainian border situation, though the correlation is unclear.

What the bills do

Two new Republican bills seek to link the US response to Ukraine to the situation in Mexico.

The Secure America's Borders First Act would prohibit federal funding for Ukraine until the US-Mexico border is “operationally controlled,” including a wall as promised by former President Donald Trump. (The bill even mandates a 30-foot-high wall.)

The USB (Ukraine and Southern Border) Act, introduced on February 8 by Rep. Matt Rosendale (R-MT0), would allow the US to support Ukraine, but only if the number of Armed Forces deployed there is less than the number deployed to the Mexican border. Madison Cawthorne introduced H.R. 6665 on February 9th (R-NC11).

What backers say

Supporters argue that even if the US should militarily assist Ukraine, our own domestic border situation should take precedence.

After failing to secure our own border and protect our own territorial integrity, ‘America Last' politicians on both sides of the aisle now tell us that we must do so for Ukraine. “Before rushing America into another foreign conflict over an Eastern European nation's border thousands of miles from our shores, they should first secure our southern border.”

“If Joe Biden truly cared about Americans, he would prioritize national security over international affairs,” Rep. Cawthorn said in a separate press release. The least we can do to secure our own country is send the same number of troops to the US-Mexico border to assist our border patrol agents working diligently to secure America.

What opponents say

The president has defended his Ukraine and Mexico policies, stating that both seek peace and diplomacy.

Our nations [the US and Mexico] have a long and complicated history, and we haven't always been perfect neighbors, but we have seen the power and purpose of cooperation,” Biden said in 2021. “We're safer when we work together, whether it's to manage our shared border or stop the pandemic. [In both the Obama and Biden administration], we made a commitment that we look at Mexico as an equal, not as somebody who is south of our border.”

No mistake: If Russia goes ahead with its plans, it will be responsible for a catastrophic and unnecessary war of choice. To protect our collective security, the United States and our allies are ready to defend every inch of NATO territory. We won't send troops into Ukraine, but we will continue to support the Ukrainian people... But, I repeat, Russia can choose diplomacy. It is not too late to de-escalate and return to the negotiating table.”

Odds of passage

The Secure America's Borders First Act has nine Republican sponsors. Either the House Armed Services or Foreign Affairs Committees may vote on it.

Rep. Paul Gosar, a Republican, co-sponsored the USB Act (R-AZ4). The House Armed Services Committee may vote on it.

With Republicans in control, passage is unlikely.

You might also like

Sanjay Priyadarshi

3 years ago

Using Ruby code, a programmer created a $48,000,000,000 product that Elon Musk admired.

Unexpected Success

Shopify CEO and co-founder Tobias Lutke. Shopify is worth $48 billion.

World-renowned entrepreneur Tobi

Tobi never expected his first online snowboard business to become a multimillion-dollar software corporation.

Tobi founded Shopify to establish a 20-person company.

The publicly traded corporation employs over 10,000 people.

Here's Tobi Lutke's incredible story.

Elon Musk tweeted his admiration for the Shopify creator.

30-October-2019.

Musk praised Shopify founder Tobi Lutke on Twitter.

Happened:

Explore this programmer's journey.

What difficulties did Tobi experience as a young child?

Germany raised Tobi.

Tobi's parents realized he was smart but had trouble learning as a toddler.

Tobi was learning disabled.

Tobi struggled with school tests.

Tobi's learning impairments were undiagnosed.

Tobi struggled to read as a dyslexic.

Tobi also found school boring.

Germany's curriculum didn't inspire Tobi's curiosity.

“The curriculum in Germany was taught like here are all the solutions you might find useful later in life, spending very little time talking about the problem…If I don’t understand the problem I’m trying to solve, it’s very hard for me to learn about a solution to a problem.”

Studying computer programming

After tenth grade, Tobi decided school wasn't for him and joined a German apprenticeship program.

This curriculum taught Tobi software engineering.

He was an apprentice in a small Siemens subsidiary team.

Tobi worked with rebellious Siemens employees.

Team members impressed Tobi.

Tobi joined the team for this reason.

Tobi was pleased to get paid to write programming all day.

His life could not have been better.

Devoted to snowboarding

Tobi loved snowboarding.

He drove 5 hours to ski at his folks' house.

His friends traveled to the US to snowboard when he was older.

However, the cheap dollar conversion rate led them to Canada.

2000.

Tobi originally decided to snowboard instead than ski.

Snowboarding captivated him in Canada.

On the trip to Canada, Tobi encounters his wife.

Tobi meets his wife Fiona McKean on his first Canadian ski trip.

They maintained in touch after the trip.

Fiona moved to Germany after graduating.

Tobi was a startup coder.

Fiona found work in Germany.

Her work included editing, writing, and academics.

“We lived together for 10 months and then she told me that she need to go back for the master's program.”

With Fiona, Tobi immigrated to Canada.

Fiona invites Tobi.

Tobi agreed to move to Canada.

Programming helped Tobi move in with his girlfriend.

Tobi was an excellent programmer, therefore what he did in Germany could be done anywhere.

He worked remotely for his German employer in Canada.

Tobi struggled with remote work.

Due to poor communication.

No slack, so he used email.

Programmers had trouble emailing.

Tobi's startup was developing a browser.

After the dot-com crash, individuals left that startup.

It ended.

Tobi didn't intend to work for any major corporations.

Tobi left his startup.

He believed he had important skills for any huge corporation.

He refused to join a huge corporation.

Because of Siemens.

Tobi learned to write professional code and about himself while working at Siemens in Germany.

Siemens culture was odd.

Employees were distrustful.

Siemens' rigorous dress code implies that the corporation doesn't trust employees' attire.

It wasn't Tobi's place.

“There was so much bad with it that it just felt wrong…20-year-old Tobi would not have a career there.”

Focused only on snowboarding

Tobi lived in Ottawa with his girlfriend.

Canada is frigid in winter.

Ottawa's winters last.

Almost half a year.

Tobi wanted to do something worthwhile now.

So he snowboarded.

Tobi began snowboarding seriously.

He sought every snowboarding knowledge.

He researched the greatest snowboarding gear first.

He created big spreadsheets for snowboard-making technologies.

Tobi grew interested in selling snowboards while researching.

He intended to sell snowboards online.

He had no choice but to start his own company.

A small local company offered Tobi a job.

Interested.

He must sign papers to join the local company.

He needed a work permit when he signed the documents.

Tobi had no work permit.

He was allowed to stay in Canada while applying for permanent residency.

“I wasn’t illegal in the country, but my state didn’t give me a work permit. I talked to a lawyer and he told me it’s going to take a while until I get a permanent residency.”

Tobi's lawyer told him he cannot get a work visa without permanent residence.

His lawyer said something else intriguing.

Tobis lawyer advised him to start a business.

Tobi declined this local company's job offer because of this.

Tobi considered opening an internet store with his technical skills.

He sold snowboards online.

“I was thinking of setting up an online store software because I figured that would exist and use it as a way to sell snowboards…make money while snowboarding and hopefully have a good life.”

What brought Tobi and his co-founder together, and how did he support Tobi?

Tobi lived with his girlfriend's parents.

In Ottawa, Tobi encounters Scott Lake.

Scott was Tobis girlfriend's family friend and worked for Tobi's future employer.

Scott and Tobi snowboarded.

Tobi pitched Scott his snowboard sales software idea.

Scott liked the idea.

They planned a business together.

“I was looking after the technology and Scott was dealing with the business side…It was Scott who ended up developing relationships with vendors and doing all the business set-up.”

Issues they ran into when attempting to launch their business online

Neither could afford a long-term lease.

That prompted their online business idea.

They would open a store.

Tobi anticipated opening an internet store in a week.

Tobi seeks open-source software.

Most existing software was pricey.

Tobi and Scott couldn't afford pricey software.

“In 2004, I was sitting in front of my computer absolutely stunned realising that we hadn’t figured out how to create software for online stores.”

They required software to:

to upload snowboard images to the website.

people to look up the types of snowboards that were offered on the website. There must be a search feature in the software.

Online users transmit payments, and the merchant must receive them.

notifying vendors of the recently received order.

No online selling software existed at the time.

Online credit card payments were difficult.

How did they advance the software while keeping expenses down?

Tobi and Scott needed money to start selling snowboards.

Tobi and Scott funded their firm with savings.

“We both put money into the company…I think the capital we had was around CAD 20,000(Canadian Dollars).”

Despite investing their savings.

They minimized costs.

They tried to conserve.

No office rental.

They worked in several coffee shops.

Tobi lived rent-free at his girlfriend's parents.

He installed software in coffee cafes.

How were the software issues handled?

Tobi found no online snowboard sales software.

Two choices remained:

Change your mind and try something else.

Use his programming expertise to produce something that will aid in the expansion of this company.

Tobi knew he was the sole programmer working on such a project from the start.

“I had this realisation that I’m going to be the only programmer who has ever worked on this, so I don’t have to choose something that lots of people know. I can choose just the best tool for the job…There is been this programming language called Ruby which I just absolutely loved ”

Ruby was open-source and only had Japanese documentation.

Latin is the source code.

Tobi used Ruby twice.

He assumed he could pick the tool this time.

Why not build with Ruby?

How did they find their first time operating a business?

Tobi writes applications in Ruby.

He wrote the initial software version in 2.5 months.

Tobi and Scott founded Snowdevil to sell snowboards.

Tobi coded for 16 hours a day.

His lifestyle was unhealthy.

He enjoyed pizza and coke.

“I would never recommend this to anyone, but at the time there was nothing more interesting to me in the world.”

Their initial purchase and encounter with it

Tobi worked in cafes then.

“I was working in a coffee shop at this time and I remember everything about that day…At some time, while I was writing the software, I had to type the email that the software would send to tell me about the order.”

Tobi recalls everything.

He checked the order on his laptop at the coffee shop.

Pennsylvanian ordered snowboard.

Tobi walked home and called Scott. Tobi told Scott their first order.

They loved the order.

How were people made aware about Snowdevil?

2004 was very different.

Tobi and Scott attempted simple website advertising.

Google AdWords was new.

Ad clicks cost 20 cents.

Online snowboard stores were scarce at the time.

Google ads propelled the snowdevil brand.

Snowdevil prospered.

They swiftly recouped their original investment in the snowboard business because to its high profit margin.

Tobi and Scott struggled with inventories.

“Snowboards had really good profit margins…Our biggest problem was keeping inventory and getting it back…We were out of stock all the time.”

Selling snowboards returned their investment and saved them money.

They did not appoint a business manager.

They accomplished everything alone.

Sales dipped in the spring, but something magical happened.

Spring sales plummeted.

They considered stocking different boards.

They naturally wanted to add boards and grow the business.

However, magic occurred.

Tobi coded and improved software while running Snowdevil.

He modified software constantly. He wanted speedier software.

He experimented to make the software more resilient.

Tobi received emails requesting the Snowdevil license.

They intended to create something similar.

“I didn’t stop programming, I was just like Ok now let me try things, let me make it faster and try different approaches…Increasingly I got people sending me emails and asking me If I would like to licence snowdevil to them. People wanted to start something similar.”

Software or skateboards, your choice

Scott and Tobi had to choose a hobby in 2005.

They might sell alternative boards or use software.

The software was a no-brainer from demand.

Daniel Weinand is invited to join Tobi's business.

Tobis German best friend is Daniel.

Tobi and Scott chose to use the software.

Tobi and Scott kept the software service.

Tobi called Daniel to invite him to Canada to collaborate.

Scott and Tobi had quit snowboarding until then.

How was Shopify launched, and whence did the name come from?

The three chose Shopify.

Named from two words.

First:

Shop

Final part:

Simplify

Shopify

Shopify's crew has always had one goal:

creating software that would make it simple and easy for people to launch online storefronts.

Launched Shopify after raising money for the first time.

Shopify began fundraising in 2005.

First, they borrowed from family and friends.

They needed roughly $200k to run the company efficiently.

$200k was a lot then.

When questioned why they require so much money. Tobi told them to trust him with their goals. The team raised seed money from family and friends.

Shopify.com has a landing page. A demo of their goal was on the landing page.

In 2006, Shopify had about 4,000 emails.

Shopify rented an Ottawa office.

“We sent a blast of emails…Some people signed up just to try it out, which was exciting.”

How things developed after Scott left the company

Shopify co-founder Scott Lake left in 2008.

Scott was CEO.

“He(Scott) realized at some point that where the software industry was going, most of the people who were the CEOs were actually the highly technical person on the founding team.”

Scott leaving the company worried Tobi.

Tobis worried about finding a new CEO.

To Tobi:

A great VC will have the network to identify the perfect CEO for your firm.

Tobi started visiting Silicon Valley to meet with venture capitalists to recruit a CEO.

Initially visiting Silicon Valley

Tobi came to Silicon Valley to start a 20-person company.

This company creates eCommerce store software.

Tobi never wanted a big corporation. He desired a fulfilling existence.

“I stayed in a hostel in the Bay Area. I had one roommate who was also a computer programmer. I bought a bicycle on Craiglist. I was there for a week, but ended up staying two and a half weeks.”

Tobi arrived unprepared.

When venture capitalists asked him business questions.

He answered few queries.

Tobi didn't comprehend VC meetings' terminology.

He wrote the terms down and looked them up.

Some were fascinated after he couldn't answer all these queries.

“I ended up getting the kind of term sheets people dream about…All the offers were conditional on moving our company to Silicon Valley.”

Canada received Tobi.

He wanted to consult his team before deciding. Shopify had five employees at the time.

2008.

A global recession greeted Tobi in Canada. The recession hurt the market.

His term sheets were useless.

The economic downturn in the world provided Shopify with a fantastic opportunity.

The global recession caused significant job losses.

Fired employees had several ideas.

They wanted online stores.

Entrepreneurship was desired. They wanted to quit work.

People took risks and tried new things during the global slump.

Shopify subscribers skyrocketed during the recession.

“In 2009, the company reached neutral cash flow for the first time…We were in a position to think about long-term investments, such as infrastructure projects.”

Then, Tobi Lutke became CEO.

How did Tobi perform as the company's CEO?

“I wasn’t good. My team was very patient with me, but I had a lot to learn…It’s a very subtle job.”

2009–2010.

Tobi limited the company's potential.

He deliberately restrained company growth.

Tobi had one costly problem:

Whether Shopify is a venture or a lifestyle business.

The company's annual revenue approached $1 million.

Tobi battled with the firm and himself despite good revenue.

His wife was supportive, but the responsibility was crushing him.

“It’s a crushing responsibility…People had families and kids…I just couldn’t believe what was going on…My father-in-law gave me money to cover the payroll and it was his life-saving.”

Throughout this trip, everyone supported Tobi.

They believed it.

$7 million in donations received

Tobi couldn't decide if this was a lifestyle or a business.

Shopify struggled with marketing then.

Later, Tobi tried 5 marketing methods.

He told himself that if any marketing method greatly increased their growth, he would call it a venture, otherwise a lifestyle.

The Shopify crew brainstormed and voted on marketing concepts.

Tested.

“Every single idea worked…We did Adwords, published a book on the concept, sponsored a podcast and all the ones we tracked worked.”

To Silicon Valley once more

Shopify marketing concepts worked once.

Tobi returned to Silicon Valley to pitch investors.

He raised $7 million, valuing Shopify at $25 million.

All investors had board seats.

“I find it very helpful…I always had a fantastic relationship with everyone who’s invested in my company…I told them straight that I am not going to pretend I know things, I want you to help me.”

Tobi developed skills via running Shopify.

Shopify had 20 employees.

Leaving his wife's parents' home

Tobi left his wife's parents in 2014.

Tobi had a child.

Shopify has 80,000 customers and 300 staff in 2013.

Public offering in 2015

Shopify investors went public in 2015.

Shopify powers 4.1 million e-Commerce sites.

Shopify stores are 65% US-based.

It is currently valued at $48 billion.

Scott Stockdale

3 years ago

A Day in the Life of Lex Fridman Can Help You Hit 6-Month Goals

The Lex Fridman podcast host has interviewed Elon Musk.

Lex is a minimalist YouTuber. His videos are sloppy. Suits are his trademark.

In a video, he shares a typical day. I've smashed my 6-month goals using its ideas.

Here's his schedule.

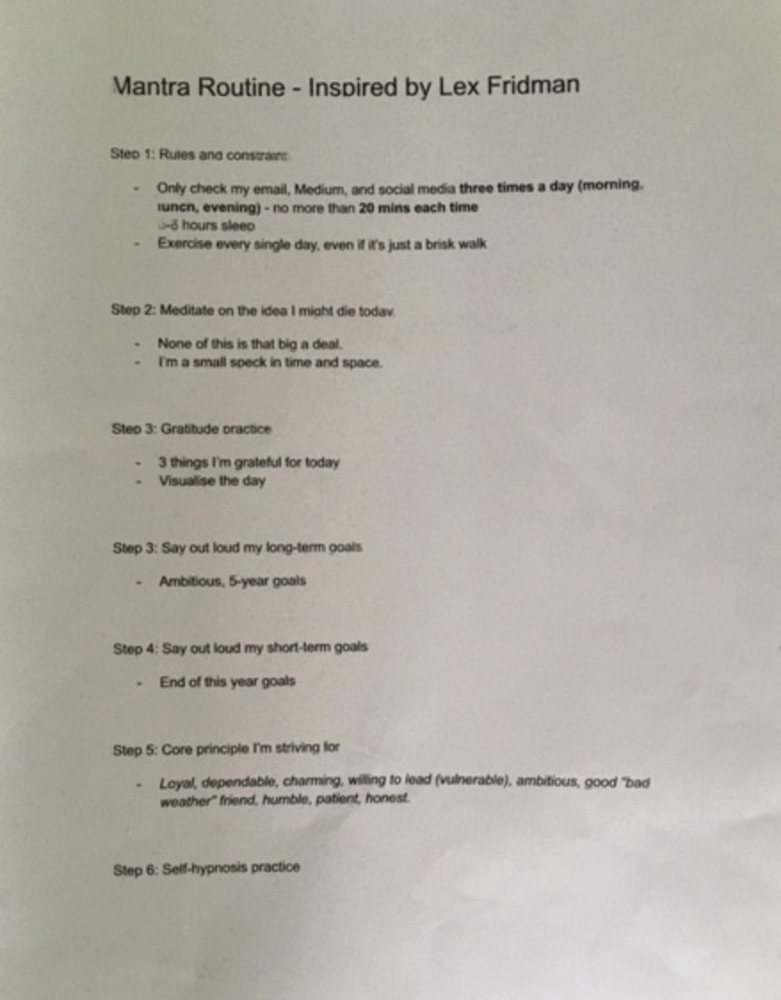

Morning Mantra

Not woo-woo. Lex's mantra reflects his practicality.

Four parts.

Rulebook

"I remember the game's rules," he says.

Among them:

Sleeping 6–8 hours nightly

1–3 times a day, he checks social media.

Every day, despite pain, he exercises. "I exercise uninjured body parts."

Visualize

He imagines his day. "Like Sims..."

He says three things he's grateful for and contemplates death.

"Today may be my last"

Objectives

Then he visualizes his goals. He starts big. Five-year goals.

Short-term goals follow. Lex says they're year-end goals.

Near but out of reach.

Principles

He lists his principles. Assertions. His goals.

He acknowledges his cliche beliefs. Compassion, empathy, and strength are key.

Here's my mantra routine:

Four-Hour Deep Work

Lex begins a four-hour deep work session after his mantra routine. Today's toughest.

AI is Lex's specialty. His video doesn't explain what he does.

Clearly, he works hard.

Before starting, he has water, coffee, and a bathroom break.

"During deep work sessions, I minimize breaks."

He's distraction-free. Phoneless. Silence. Nothing. Any loose ideas are typed into a Google doc for later. He wants to work.

"Just get the job done. Don’t think about it too much and feel good once it’s complete." — Lex Fridman

30-Minute Social Media & Music

After his first deep work session, Lex rewards himself.

10 minutes on social media, 20 on music. Upload content and respond to comments in 10 minutes. 20 minutes for guitar or piano.

"In the real world, I’m currently single, but in the music world, I’m in an open relationship with this beautiful guitar. Open relationship because sometimes I cheat on her with the acoustic." — Lex Fridman

Two-hour exercise

Then exercise for two hours.

Daily runs six miles. Then he chooses how far to go. Run time is an hour.

He does bodyweight exercises. Every minute for 15 minutes, do five pull-ups and ten push-ups. It's David Goggins-inspired. He aims for an hour a day.

He's hungry. Before running, he takes a salt pill for electrolytes.

He'll then take a one-minute cold shower while listening to cheesy songs. Afterward, he might eat.

Four-Hour Deep Work

Lex's second work session.

He works 8 hours a day.

Again, zero distractions.

Eating

The video's meal doesn't look appetizing, but it's healthy.

It's ground beef with vegetables. Cauliflower is his "ground-floor" veggie. "Carrots are my go-to party food."

Lex's keto diet includes 1800–2000 calories.

He drinks a "nutrient-packed" Atheltic Greens shake and takes tablets. It's:

One daily tablet of sodium.

Magnesium glycinate tablets stopped his keto headaches.

Potassium — "For electrolytes"

Fish oil: healthy joints

“So much of nutrition science is barely a science… I like to listen to my own body and do a one-person, one-subject scientific experiment to feel good.” — Lex Fridman

Four-hour shallow session

This work isn't as mentally taxing.

Lex planned to:

Finish last session's deep work (about an hour)

Adobe Premiere podcasting (about two hours).

Email-check (about an hour). Three times a day max. First, check for emergencies.

If he's sick, he may watch Netflix or YouTube documentaries or visit friends.

“The possibilities of chaos are wide open, so I can do whatever the hell I want.” — Lex Fridman

Two-hour evening reading

Nonstop work.

Lex ends the day reading academic papers for an hour. "Today I'm skimming two machine learning and neuroscience papers"

This helps him "think beyond the paper."

He reads for an hour.

“When I have a lot of energy, I just chill on the bed and read… When I’m feeling tired, I jump to the desk…” — Lex Fridman

Takeaways

Lex's day-in-the-life video is inspiring.

He has positive energy and works hard every day.

Schedule:

Mantra Routine includes rules, visualizing, goals, and principles.

Deep Work Session #1: Four hours of focus.

10 minutes social media, 20 minutes guitar or piano. "Music brings me joy"

Six-mile run, then bodyweight workout. Two hours total.

Deep Work #2: Four hours with no distractions. Google Docs stores random thoughts.

Lex supplements his keto diet.

This four-hour session is "open to chaos."

Evening reading: academic papers followed by fiction.

"I value some things in life. Work is one. The other is loving others. With those two things, life is great." — Lex Fridman

Alex Mathers

3 years ago

12 habits of the zenith individuals I know

Calmness is a vital life skill.

It aids communication. It boosts creativity and performance.

I've studied calm people's habits for years. Commonalities:

Have mastered the art of self-humor.

Protectors take their job seriously, draining the room's energy.

They are fixated on positive pursuits like making cool things, building a strong physique, and having fun with others rather than on depressing influences like the news and gossip.

Every day, spend at least 20 minutes moving, whether it's walking, yoga, or lifting weights.

Discover ways to take pleasure in life's challenges.

Since perspective is malleable, they change their view.

Set your own needs first.

Stressed people neglect themselves and wonder why they struggle.

Prioritize self-care.

Don't ruin your life to please others.

Make something.

Calm people create more than react.

They love creating beautiful things—paintings, children, relationships, and projects.

Don’t hold their breath.

If you're stressed or angry, you may be surprised how much time you spend holding your breath and tightening your belly.

Release, breathe, and relax to find calm.

Stopped rushing.

Rushing is disadvantageous.

Calm people handle life better.

Are aware of their own dietary requirements.

They avoid junk food and eat foods that keep them healthy, happy, and calm.

Don’t take anything personally.

Stressed people control everything.

Self-conscious.

Calm people put others and their work first.

Keep their surroundings neat.

Maintaining an uplifting and clutter-free environment daily calms the mind.

Minimise negative people.

Calm people are ruthless with their boundaries and avoid negative and drama-prone people.