More on Entrepreneurship/Creators

Jenn Leach

3 years ago

What TikTok Paid Me in 2021 with 100,000 Followers

I thought it would be interesting to share how much TikTok paid me in 2021.

Onward!

Oh, you get paid by TikTok?

Yes.

They compensate thousands of creators. My Tik Tok account

I launched my account in March 2020 and generally post about money, finance, and side hustles.

TikTok creators are paid in several ways.

Fund for TikTok creators

Sponsorships (aka brand deals)

Affiliate promotion

My own creations

Only one, the TikTok Creator Fund, pays me.

The TikTok Creator Fund: What Is It?

TikTok's initiative pays creators.

YouTube's Shorts Fund, Snapchat Spotlight, and other platforms have similar programs.

Creator Fund doesn't pay everyone. Some prerequisites are:

age requirement of at least 18 years

In the past 30 days, there must have been 100,000 views.

a minimum of 10,000 followers

If you qualify, you can apply using your TikTok account, and once accepted, your videos can earn money.

My earnings from the TikTok Creator Fund

Since 2020, I've made $273.65. My 2021 payment is $77.36.

Yikes!

I made between $4.91 to around $13 payout each time I got paid.

TikTok reportedly pays 3 to 5 cents per thousand views.

To live off the Creator Fund, you'd need billions of monthly views.

Top personal finance creator Sara Finance has millions (if not billions) of views and over 700,000 followers yet only received $3,000 from the TikTok Creator Fund.

Goals for 2022

TikTok pays me in different ways, as listed above.

My largest TikTok account isn't my only one.

In 2022, I'll revamp my channel.

It's been a tumultuous year on TikTok for my account, from getting shadow-banned to being banned from the Creator Fund to being accepted back (not at my wish).

What I've experienced isn't rare. I've read about other creators' experiences.

So, some quick goals for this account…

200,000 fans by the year 2023

Consistent monthly income of $5,000

two brand deals each month

For now, that's all.

Grace Huang

3 years ago

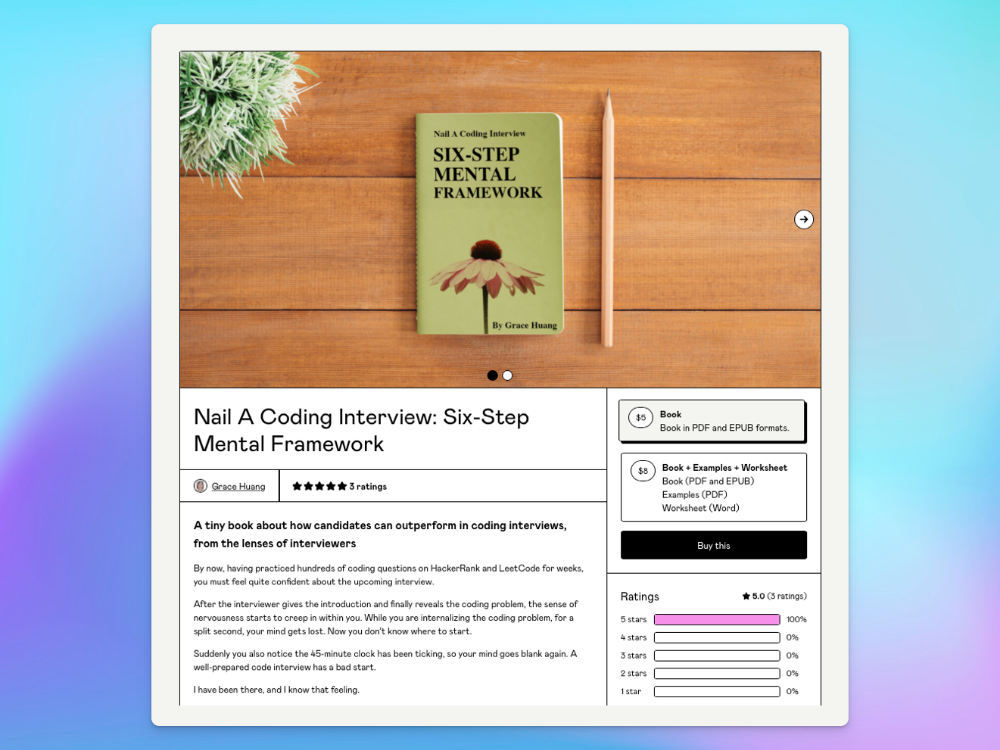

I sold 100 copies of my book when I had anticipated selling none.

After a decade in large tech, I know how software engineers were interviewed. I've seen outstanding engineers fail interviews because their responses were too vague.

So I wrote Nail A Coding Interview: Six-Step Mental Framework. Give candidates a mental framework for coding questions; help organizations better prepare candidates so they can calibrate traits.

Recently, I sold more than 100 books, something I never expected.

In this essay, I'll describe my publication journey, which included self-doubt and little triumphs. I hope this helps if you want to publish.

It was originally a Medium post.

How did I know to develop a coding interview book? Years ago, I posted on Medium.

Six steps to ace a coding interview Inhale. blog.devgenius.io

This story got a lot of attention and still gets a lot of daily traffic. It indicates this domain's value.

Converted the Medium article into an ebook

The Medium post contains strong bullet points, but it is missing the “flesh”. How to use these strategies in coding interviews, for example. I filled in the blanks and made a book.

I made the book cover for free. It's tidy.

Shared the article with my close friends on my social network WeChat.

I shared the book on Wechat's Friend Circle (朋友圈) after publishing it on Gumroad. Many friends enjoyed my post. It definitely triggered endorphins.

In Friend Circle, I presented a 100% off voucher. No one downloaded the book. Endorphins made my heart sink.

Several days later, my Apple Watch received a Gumroad notification. A friend downloaded it. I majored in finance, he subsequently said. My brother-in-law can get it? He downloaded it to cheer me up.

I liked him, but was disappointed that he didn't read it.

The Tipping Point: Reddit's Free Giving

I trusted the book. It's based on years of interviewing. I felt it might help job-hunting college students. If nobody wants it, it can still have value.

I posted the book's link on /r/leetcode. I told them to DM me for a free promo code.

Momentum shifted everything. Gumroad notifications kept coming when I was out with family. Following orders.

As promised, I sent DMs a promo code. Some consumers ordered without asking for a promo code. Some readers finished the book and posted reviews.

My book was finally on track.

A 5-Star Review, plus More

A reader afterwards DMed me and inquired if I had another book on system design interviewing. I said that was a good idea, but I didn't have one. If you write one, I'll be your first reader.

Later, I asked for a book review. Yes, but how? That's when I learned readers' reviews weren't easy. I built up an email pipeline to solicit customer reviews. Since then, I've gained credibility through ratings.

Learnings

I wouldn't have gotten 100 if I gave up when none of my pals downloaded. Here are some lessons.

Your friends are your allies, but they are not your clients.

Be present where your clients are

Request ratings and testimonials

gain credibility gradually

I did it, so can you. Follow me on Twitter @imgracehuang for my publishing and entrepreneurship adventure.

Rachel Greenberg

3 years ago

The Unsettling Fact VC-Backed Entrepreneurs Don't Want You to Know

What they'll do is scarier.

My acquaintance recently joined a VC-funded startup. Money, equity, and upside possibilities were nice, but he had a nagging dread.

They just secured a $40M round and are hiring like crazy to prepare for their IPO in two years. All signals pointed to this startup's (a B2B IT business in a stable industry) success, and its equity-holding workers wouldn't pass that up.

Five months after starting the work, my friend struggled with leaving. We might overlook the awful culture and long hours at the proper price. This price plus the company's fate and survival abilities sent my friend departing in an unpleasant unplanned resignation before jumping on yet another sinking ship.

This affects founders. This affects VC-backed companies (and all businesses). This affects anyone starting, buying, or running a business.

Here's the under-the-table approach that's draining VC capital, leaving staff terrified (or jobless), founders rattled, and investors upset. How to recognize, solve, and avoid it

The unsettling reality behind door #1

You can't raise money off just your looks, right? If "looks" means your founding team's expertise, then maybe. In my friend's case, the founding team's strong qualifications and track records won over investors before talking figures.

They're hardly the only startup to raise money without a profitable customer acquisition strategy. Another firm raised money for an expensive sleep product because it's eco-friendly. They were off to the races with a few keywords and key players.

Both companies, along with numerous others, elected to invest on product development first. Company A employed all the tech, then courted half their market (they’re a tech marketplace that connects two parties). Company B spent millions on R&D to create a palatable product, then flooded the world with marketing.

My friend is on Company B's financial team, and he's seen where they've gone wrong. It's terrible.

Company A (tech market): Growing? Not quite. To achieve the ambitious expansion they (and their investors) demand, they've poured much of their little capital into salespeople: Cold-calling commission and salary salesmen. Is it working? Considering attrition and companies' dwindling capital, I don't think so.

Company B (green sleep) has been hiring, digital marketing, and opening new stores like crazy. Growing expenses should result in growing revenues and a favorable return on investment; if you grow too rapidly, you may neglect to check that ROI.

Once Company A cut headcount and Company B declared “going concerned”, my friend realized both startups had the same ailment and didn't recognize it.

I shouldn't have to ask a friend to verify a company's cash reserves and profitability to spot a financial problem. It happened anyhow.

The frightening part isn't that investors were willing to invest millions without product-market fit, CAC, or LTV estimates. That's alarming, but not as scary as the fact that startups aren't understanding the problem until VC rounds have dried up.

When they question consultants if their company will be around in 6 months. It’s a red flag. How will they stretch $20M through a 2-year recession with a $3M/month burn rate and no profitability? Alarms go off.

Who's in danger?

In a word, everyone who raised money without a profitable client acquisition strategy or enough resources to ride out dry spells.

Money mismanagement and poor priorities affect every industry (like sinking all your capital into your product, team, or tech, at the expense of probing what customer acquisition really takes and looks like).

This isn't about tech, real estate, or recession-proof luxury products. Fast, cheap, easy money flows into flashy-looking teams with buzzwords, trending industries, and attractive credentials.

If these companies can't show progress or get a profitable CAC, they can't raise more money. They die if they can't raise more money (or slash headcount and find shoestring budget solutions until they solve the real problem).

The kiss of death (and how to avoid it)

If you're running a startup and think raising VC is the answer, pause and evaluate. Do you need the money now?

I'm not saying VC is terrible or has no role. Founders have used it as a Band-Aid for larger, pervasive problems. Venture cash isn't a crutch for recruiting consumers profitably; it's rocket fuel to get you what and who you need.

Pay-to-play isn't a way to throw money at the wall and hope for a return. Pay-to-play works until you run out of money, and if you haven't mastered client acquisition, your cash will diminish quickly.

How can you avoid this bottomless pit? Tips:

Understand your burn rate

Keep an eye on your growth or profitability.

Analyze each and every marketing channel and initiative.

Make lucrative customer acquisition strategies and satisfied customers your top two priorities. not brand-new products. not stellar hires. avoid the fundraising rollercoaster to save time. If you succeed in these two tasks, investors will approach you with their thirsty offers rather than the other way around, and your cash reserves won't diminish as a result.

Not as much as your grandfather

My family friend always justified expensive, impractical expenditures by saying it was only monopoly money. In business, startups, and especially with money from investors expecting a return, that's not true.

More founders could understand that there isn't always another round if they viewed VC money as their own limited pool. When the well runs dry, you must refill it or save the day.

Venture financing isn't your grandpa's money. A discerning investor has entrusted you with dry powder in the hope that you'll use it wisely, strategically, and thoughtfully. Use it well.

You might also like

Will Lockett

2 years ago

The world will be changed by this molten salt battery.

Four times the energy density and a fraction of lithium-cost ion's

As the globe abandons fossil fuels, batteries become more important. EVs, solar, wind, tidal, wave, and even local energy grids will use them. We need a battery revolution since our present batteries are big, expensive, and detrimental to the environment. A recent publication describes a battery that solves these problems. But will it be enough?

Sodium-sulfur molten salt battery. It has existed for a long time and uses molten salt as an electrolyte (read more about molten salt batteries here). These batteries are cheaper, safer, and more environmentally friendly because they use less eco-damaging materials, are non-toxic, and are non-flammable.

Previous molten salt batteries used aluminium-sulphur chemistries, which had a low energy density and required high temperatures to keep the salt liquid. This one uses a revolutionary sodium-sulphur chemistry and a room-temperature-melting salt, making it more useful, affordable, and eco-friendly. To investigate this, researchers constructed a button-cell prototype and tested it.

First, the battery was 1,017 mAh/g. This battery is four times as energy dense as high-density lithium-ion batteries (250 mAh/g).

No one knows how much this battery would cost. A more expensive molten-salt battery costs $15 per kWh. Current lithium-ion batteries cost $132/kWh. If this new molten salt battery costs the same as present cells, it will be 90% cheaper.

This room-temperature molten salt battery could be utilized in an EV. Cold-weather heaters just need a modest backup battery.

The ultimate EV battery? If used in a Tesla Model S, you could install four times the capacity with no weight gain, offering a 1,620-mile range. This huge battery pack would cost less than Tesla's. This battery would nearly perfect EVs.

Or would it?

The battery's capacity declined by 50% after 1,000 charge cycles. This means that our hypothetical Model S would suffer this decline after 1.6 million miles, but for more cheap vehicles that use smaller packs, this would be too short. This test cell wasn't supposed to last long, so this is shocking. Future versions of this cell could be modified to live longer.

This affordable and eco-friendly cell is best employed as a grid-storage battery for renewable energy. Its safety and affordable price outweigh its short lifespan. Because this battery is made of easily accessible materials, it may be utilized to boost grid-storage capacity without causing supply chain concerns or EV battery prices to skyrocket.

Researchers are designing a bigger pouch cell (like those in phones and laptops) for this purpose. The battery revolution we need could be near. Let’s just hope it isn’t too late.

Cory Doctorow

2 years ago

The downfall of the Big Four accounting companies is just one (more) controversy away.

Economic mutual destruction.

Multibillion-dollar corporations never bothered with an independent audit, and they all lied about their balance sheets.

It's easy to forget that the Big Four accounting firms are lousy fraud enablers. Just because they sign off on your books doesn't mean you're not a hoax waiting to erupt.

This is *crazy* Capitalism depends on independent auditors. Rich folks need to know their financial advisers aren't lying. Rich folks usually succeed.

No accounting. EY, KPMG, PWC, and Deloitte make more money consulting firms than signing off on their accounts.

The Big Four sign off on phony books because failing to make friends with unscrupulous corporations may cost them consulting contracts.

The Big Four are the only firms big enough to oversee bankruptcy when they sign off on fraudulent books, as they did for Carillion in 2018. All four profited from Carillion's bankruptcy.

The Big Four are corrupt without any consequences for misconduct. Who can forget when KPMG's top management was fined millions for helping auditors cheat on ethics exams?

Consulting and auditing conflict. Consultants help a firm cover its evil activities, such as tax fraud or wage theft, whereas auditors add clarity to a company's finances. The Big Four make more money from cooking books than from uncooking them, thus they are constantly embroiled in scandals.

If a major scandal breaks, it may bring down the entire sector and substantial parts of the economy. Jim Peterson explains system risk for The Dig.

The Big Four are voluntary private partnerships where accountants invest their time, reputations, and money. If a controversy threatens the business, partners who depart may avoid scandal and financial disaster.

When disaster looms, each partner should bolt for the door, even if a disciplined stay-and-hold posture could weather the storm. This happened to Arthur Andersen during Enron's collapse, and a 2006 EU report recognized the risk to other corporations.

Each partner at a huge firm knows how much dirty laundry they've buried in the company's garden, and they have well-founded suspicions about what other partners have buried, too. When someone digs, everyone runs.

If a firm confronts substantial litigation damages or enforcement penalties, it could trigger the collapse of one of the Big Four. That would be bad news for the firm's clients, who would have trouble finding another big auditor.

Most of the world's auditing capacity is concentrated in four enormous, brittle, opaque, compromised organizations. If one of them goes bankrupt, the other three won't be able to take on its clients.

Peterson: Another collapse would strand many of the world's large public businesses, leaving them unable to obtain audit views for their securities listings and regulatory compliance.

Count Down: The Past, Present, and Uncertain Future of the Big Four Accounting Firms is in its second edition.

https://www.emerald.com/insight/publication/doi/10.1108/9781787147003

Jari Roomer

3 years ago

Successful people have this one skill.

Without self-control, you'll waste time chasing dopamine fixes.

I found a powerful quote in Tony Robbins' Awaken The Giant Within:

“Most of the challenges that we have in our personal lives come from a short-term focus” — Tony Robbins

Most people are short-term oriented, but highly successful people are long-term oriented.

Successful people act in line with their long-term goals and values, while the rest are distracted by short-term pleasures and dopamine fixes.

Instant gratification wrecks lives

Instant pleasure is fleeting. Quickly fading effects leave you craving more stimulation.

Before you know it, you're in a cycle of quick fixes. This explains binging on food, social media, and Netflix.

These things cause a dopamine spike, which is entertaining. This dopamine spike crashes quickly, leaving you craving more stimulation.

It's fine to watch TV or play video games occasionally. Problems arise when brain impulses aren't controlled. You waste hours chasing dopamine fixes.

Instant gratification becomes problematic when it interferes with long-term goals, happiness, and life fulfillment.

Most rewarding things require delay

Life's greatest rewards require patience and delayed gratification. They must be earned through patience, consistency, and effort.

Ex:

A fit, healthy body

A deep connection with your spouse

A thriving career/business

A healthy financial situation

These are some of life's most rewarding things, but they take work and patience. They all require the ability to delay gratification.

To have a healthy bank account, you must save (and invest) a large portion of your monthly income. This means no new tech or clothes.

If you want a fit, healthy body, you must eat better and exercise three times a week. So no fast food and Netflix.

It's a battle between what you want now and what you want most.

Successful people choose what they want most over what they want now. It's a major difference.

Instant vs. delayed gratification

Most people subconsciously prefer instant rewards over future rewards, even if the future rewards are more significant.

We humans aren't logical. Emotions and instincts drive us. So we act against our goals and values.

Fortunately, instant gratification bias can be overridden. This is a modern superpower. Effective methods include:

#1: Train your brain to handle overstimulation

Training your brain to function without constant stimulation is a powerful change. Boredom can lead to long-term rewards.

Unlike impulsive shopping, saving money is boring. Having lots of cash is amazing.

Compared to video games, deep work is boring. A successful online business is rewarding.

Reading books is boring compared to scrolling through funny videos on social media. Knowledge is invaluable.

You can't do these things if your brain is overstimulated. Your impulses will control you. To reduce overstimulation addiction, try:

Daily meditation (10 minutes is enough)

Daily study/work for 90 minutes (no distractions allowed)

First hour of the day without phone, social media, and Netflix

Nature walks, journaling, reading, sports, etc.

#2: Make Important Activities Less Intimidating

Instant gratification helps us cope with stress. Starting a book or business can be intimidating. Video games and social media offer a quick escape in such situations.

Make intimidating tasks less so. Break them down into small tasks. Start a new business/side-hustle by:

Get domain name

Design website

Write out a business plan

Research competition/peers

Approach first potential client

Instead of one big mountain, divide it into smaller sub-tasks. This makes a task easier and less intimidating.

#3: Plan ahead for important activities

Distractions will invade unplanned time. Your time is dictated by your impulses, which are usually Netflix, social media, fast food, and video games. It wants quick rewards and dopamine fixes.

Plan your days and be proactive with your time. Studies show that scheduling activities makes you 3x more likely to do them.

To achieve big goals, you must plan. Don't gamble.

Want to get fit? Schedule next week's workouts. Want a side-job? Schedule your work time.