Sonic Prime and indie games on Netflix

Netflix will stream Spiritfarer, Raji: An Ancient Epic, and Lucky Luna.

Netflix's Geeked Week brought a slew of announcements. The flurry of reveals for The Sandman, The Umbrella Academy season 3, One Piece, and more also included game and game-adjacent announcements.

Netflix released a teaser for Cuphead season 2 ahead of its August premiere, featuring more of Grey DeLisle's Ms. Chalice. DOTA: Dragon's Blood season 3 hits Netflix in August. Tekken, the fighting game that throws kids off cliffs, gets an anime, Tekken: Bloodline.

Netflix debuted a clip of Sonic Prime before Sonic Origins in June and Sonic Frontiers in 2022.

Castlevania: Nocturne will follow Richter Belmont.

Netflix is reviving licensed games with titles based on its shows. There's a Queen's Gambit chess game, a Shadow and Bone RPG, a La Casa de Papel heist adventure, and a Too Hot to Handle game where a pregnant woman must choose between stabbing her cheating ex or forgiving him.

Riot's rhythm platformer Hextech Mayhem debuted on Netflix last year, and now Netflix is adding games from Devolver Digital. Reigns: Three Kingdoms is a card game that lets players choose the fate of Three Kingdoms-era China by swiping left or right on cards. Spiritfarer, the "cozy game about death" from 2020, and Raji: An Ancient Epic are coming to Netflix. Poinpy, a vertical climber from the creator of Downwell, is now on Netflix.

Desta: The Memories Between is a turn-based strategy game set in dreams and memories.

Snowman's Lucky Luna will also be added soon.

With these games, Netflix is expanding beyond dinky mobile games — it plans to have 50 by the end of the year — and could be a serious platform for indies that want to expand into mobile. It takes gaming seriously.

More on Gaming

Chris Moyse

3 years ago

Sony and LEGO raise $2 billion for Epic Games' metaverse

‘Kid-friendly’ project holds $32 billion valuation

Epic Games announced today that it has raised $2 billion USD from Sony Group Corporation and KIRKBI (holding company of The LEGO Group). Both companies contributed $1 billion to Epic Games' upcoming ‘metaverse' project.

“We need partners who share our vision as we reimagine entertainment and play. Our partnership with Sony and KIRKBI has found this,” said Epic Games CEO Tim Sweeney. A new metaverse will be built where players can have fun with friends and brands create creative and immersive experiences, as well as creators thrive.

Last week, LEGO and Epic Games announced their plans to create a family-friendly metaverse where kids can play, interact, and create in digital environments. The service's users' safety and security will be prioritized.

With this new round of funding, Epic Games' project is now valued at $32 billion.

“Epic Games is known for empowering creators large and small,” said KIRKBI CEO Sren Thorup Srensen. “We invest in trends that we believe will impact the world we and our children will live in. We are pleased to invest in Epic Games to support their continued growth journey, with a long-term focus on the future metaverse.”

Epic Games is expected to unveil its metaverse plans later this year, including its name, details, services, and release date.

Matthew Cluff

3 years ago

GTO Poker 101

"GTO" (Game Theory Optimal) has been used a lot in poker recently. To clarify its meaning and application, the aim of this article is to define what it is, when to use it when playing, what strategies to apply for how to play GTO poker, for beginner and more advanced players!

Poker GTO

In poker, you can choose between two main winning strategies:

Exploitative play maximizes expected value (EV) by countering opponents' sub-optimal plays and weaker tendencies. Yes, playing this way opens you up to being exploited, but the weaker opponents you're targeting won't change their game to counteract this, allowing you to reap maximum profits over the long run.

GTO (Game-Theory Optimal): You try to play perfect poker, which forces your opponents to make mistakes (which is where almost all of your profit will be derived from). It mixes bluffs or semi-bluffs with value bets, clarifies bet sizes, and more.

GTO vs. Exploitative: Which is Better in Poker?

Before diving into GTO poker strategy, it's important to know which of these two play styles is more profitable for beginners and advanced players. The simple answer is probably both, but usually more exploitable.

Most players don't play GTO poker and can be exploited in their gameplay and strategy, allowing for more profits to be made using an exploitative approach. In fact, it’s only in some of the largest games at the highest stakes that GTO concepts are fully utilized and seen in practice, and even then, exploitative plays are still sometimes used.

Knowing, understanding, and applying GTO poker basics will create a solid foundation for your poker game. It's also important to understand GTO so you can deviate from it to maximize profits.

GTO Poker Strategy

According to Ed Miller's book "Poker's 1%," the most fundamental concept that only elite poker players understand is frequency, which could be in relation to cbets, bluffs, folds, calls, raises, etc.

GTO poker solvers (downloadable online software) give solutions for how to play optimally in any given spot and often recommend using mixed strategies based on select frequencies.

In a river situation, a solver may tell you to call 70% of the time and fold 30%. It may also suggest calling 50% of the time, folding 35% of the time, and raising 15% of the time (with a certain range of hands).

Frequencies are a fundamental and often unrecognized part of poker, but they run through these 5 GTO concepts.

1. Preflop ranges

To compensate for positional disadvantage, out-of-position players must open tighter hand ranges.

Premium starting hands aren't enough, though. Considering GTO poker ranges and principles, you want a good, balanced starting hand range from each position with at least some hands that can make a strong poker hand regardless of the flop texture (low, mid, high, disconnected, etc).

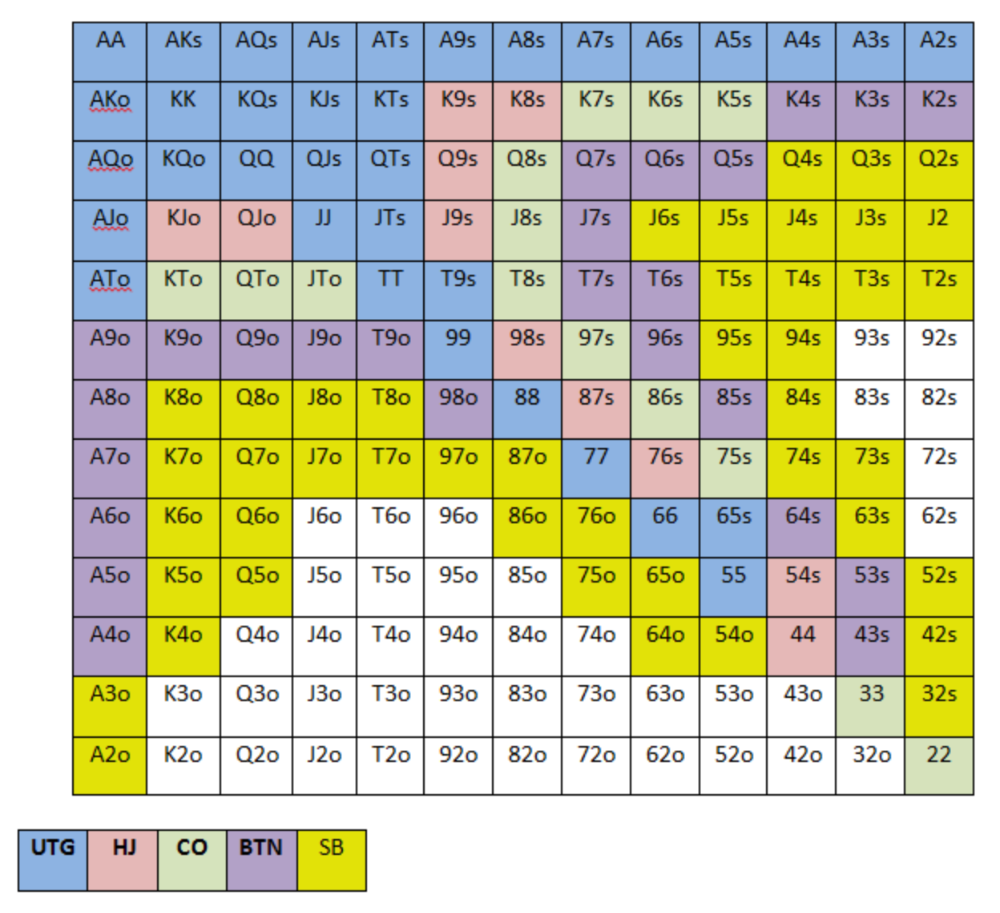

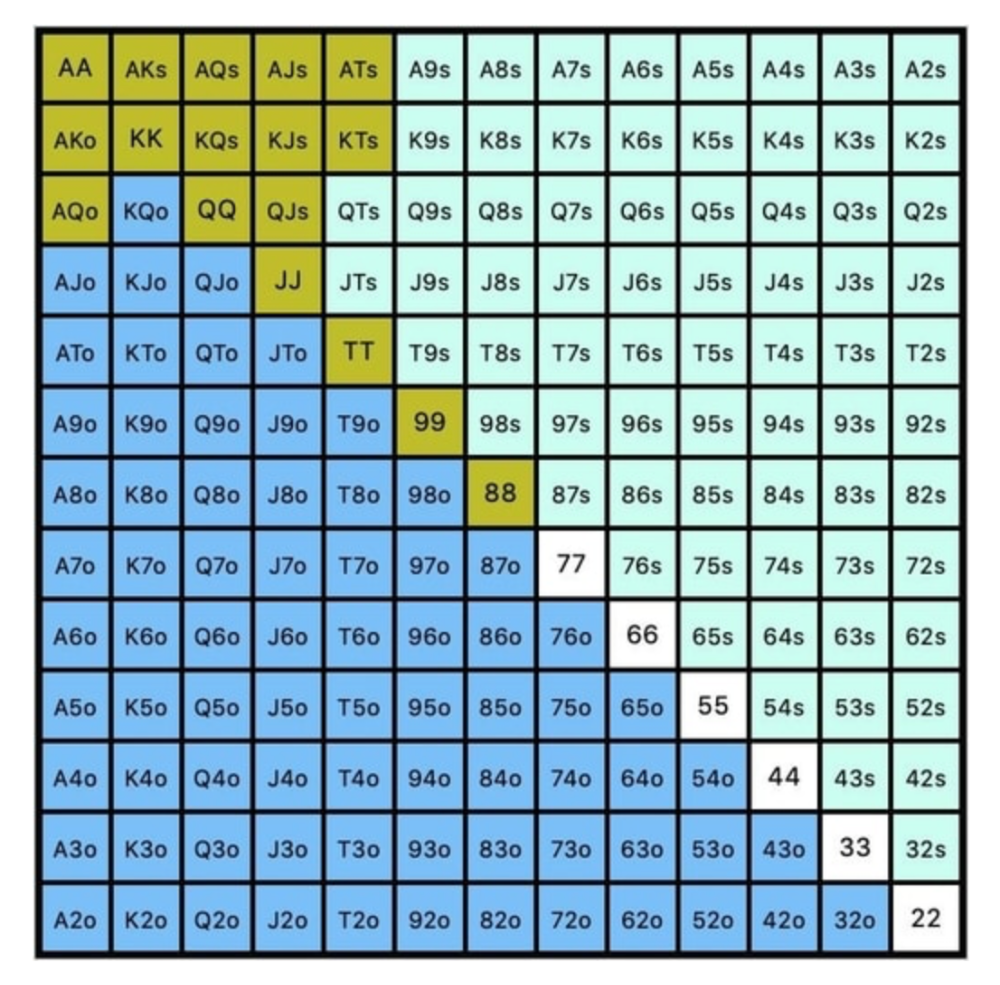

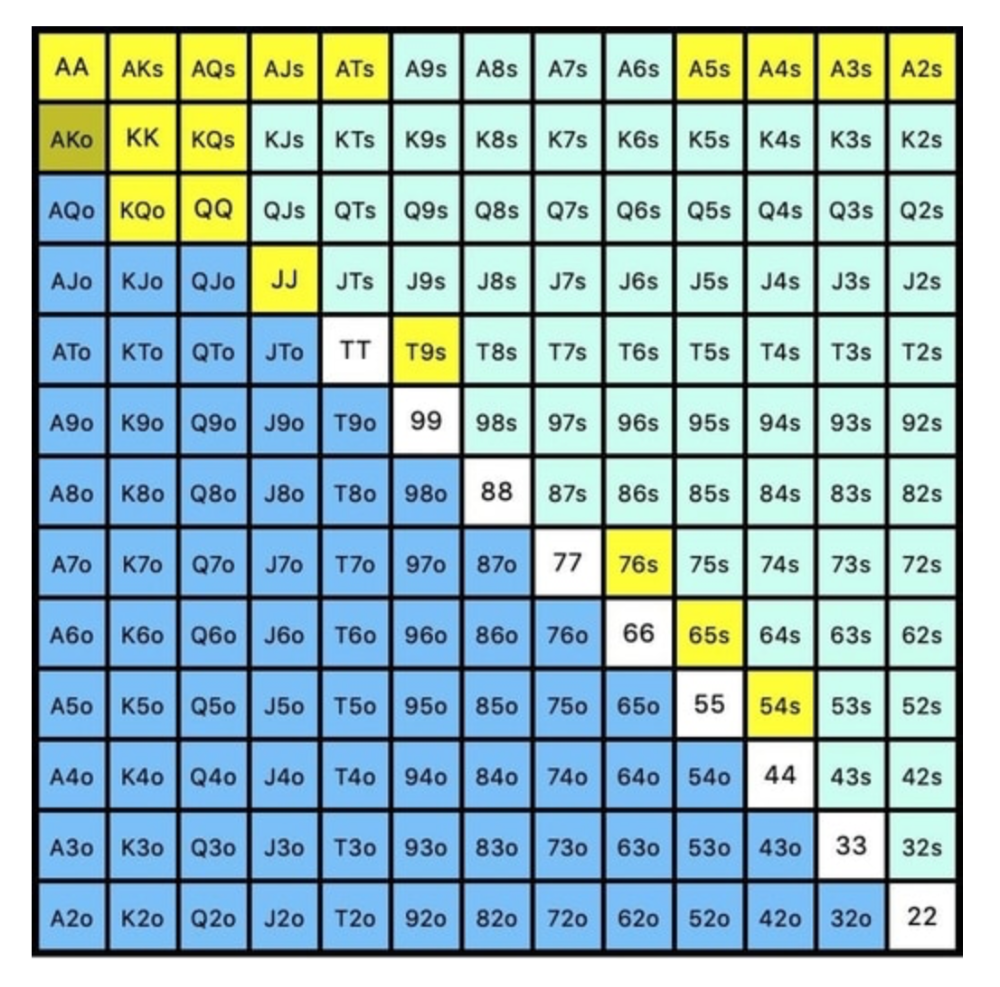

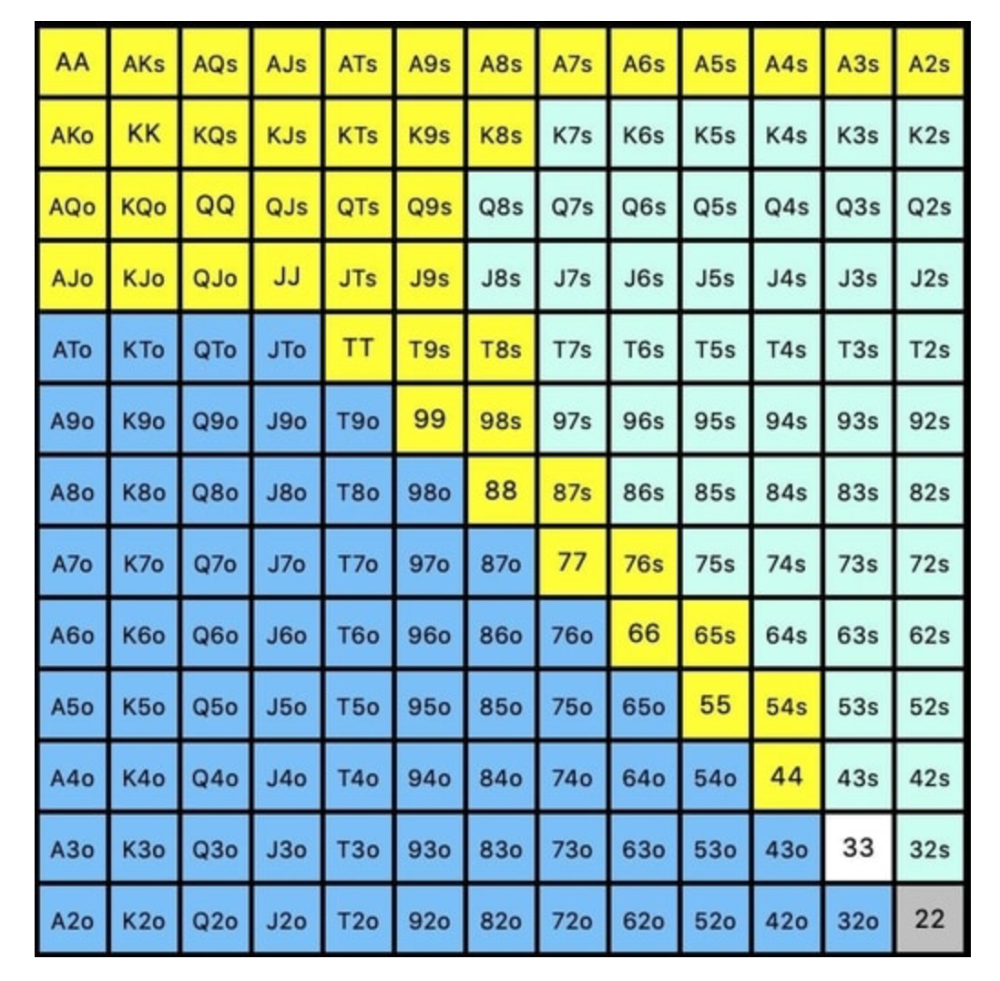

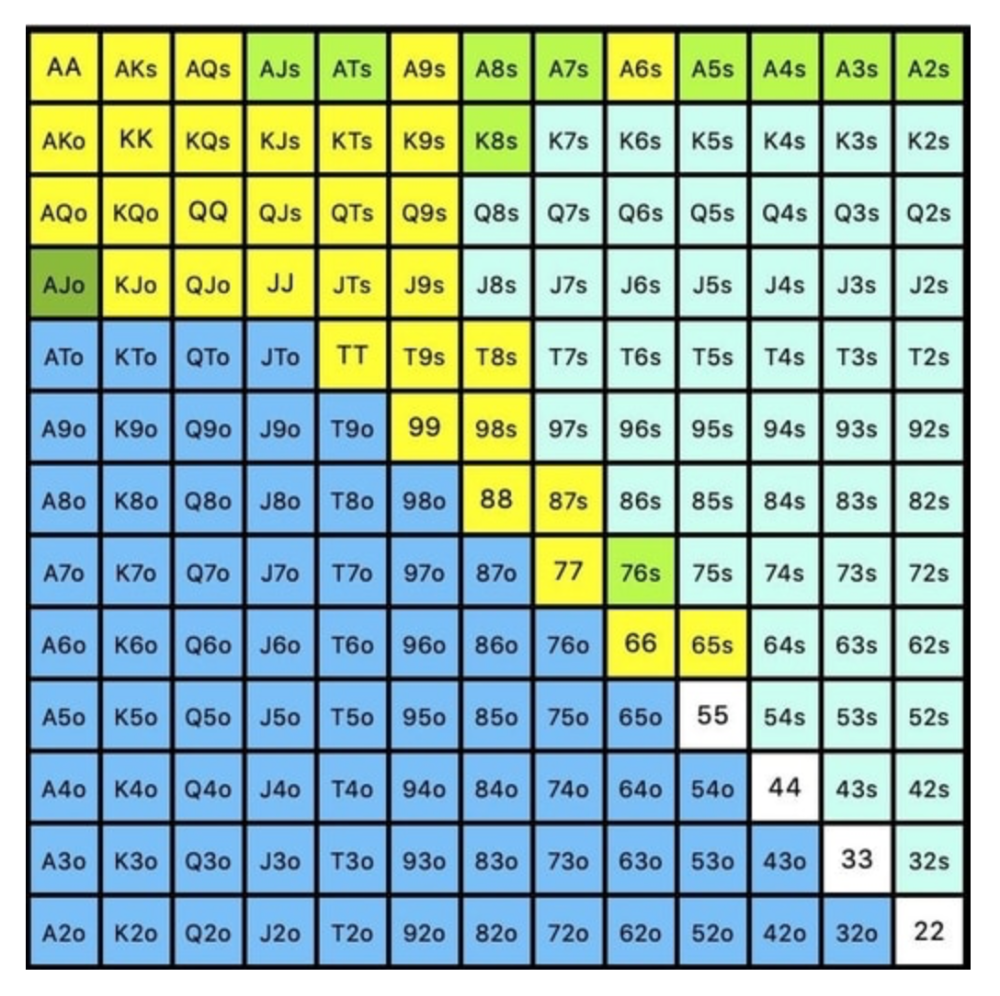

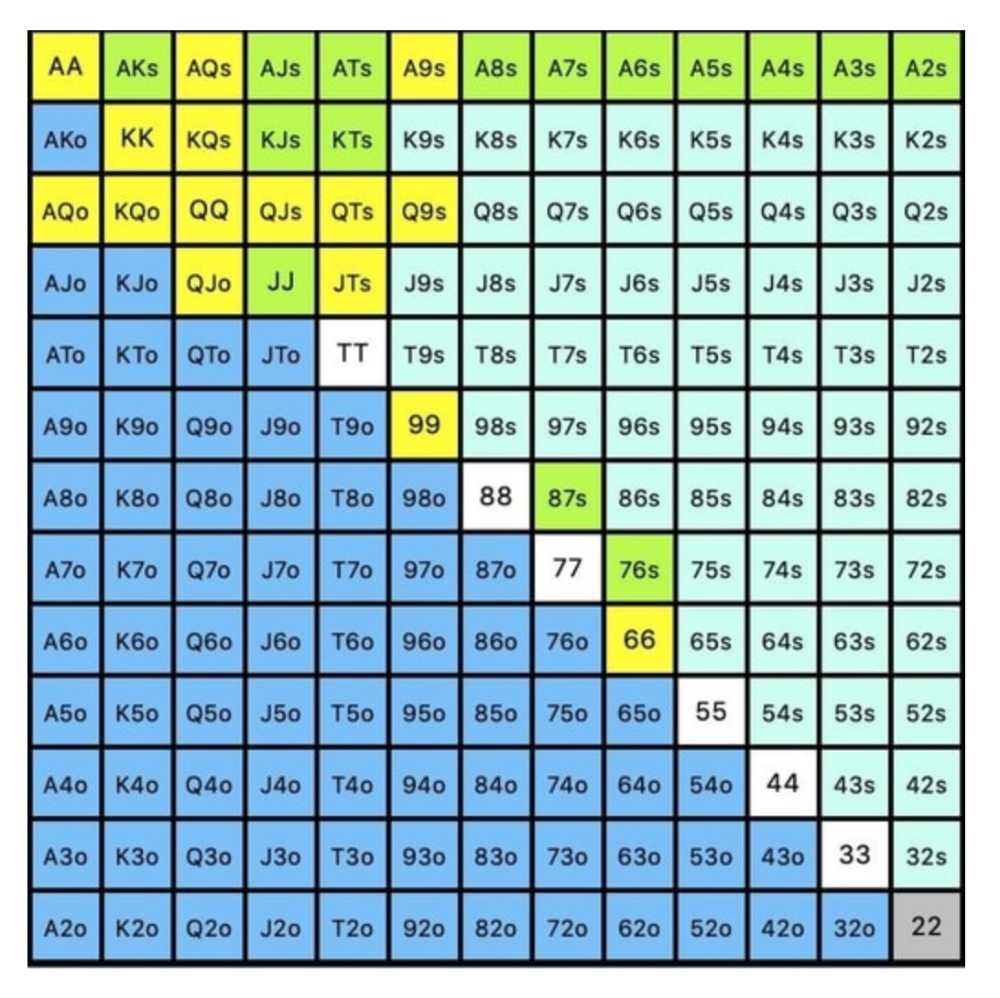

Below is a GTO preflop beginner poker chart for online 6-max play, showing which hand ranges one should open-raise with. Table positions are color-coded (see key below).

NOTE: For GTO play, it's advisable to use a mixed strategy for opening in the small blind, combining open-limps and open-raises for various hands. This cannot be illustrated with the color system used for the chart.

Choosing which hands to play is often a math problem, as discussed below.

Other preflop GTO poker charts include which hands to play after a raise, which to 3bet, etc. Solvers can help you decide which preflop hands to play (call, raise, re-raise, etc.).

2. Pot Odds

Always make +EV decisions that profit you as a poker player. Understanding pot odds (and equity) can help.

Postflop Pot Odds

Let’s say that we have JhTh on a board of 9h8h2s4c (open-ended straight-flush draw). We have $40 left and $50 in the pot. He has you covered and goes all-in. As calling or folding are our only options, playing GTO involves calculating whether a call is +EV or –EV. (The hand was empty.)

Any remaining heart, Queen, or 7 wins the hand. This means we can improve 15 of 46 unknown cards, or 32.6% of the time.

What if our opponent has a set? The 4h or 2h could give us a flush, but it could also give the villain a boat. If we reduce outs from 15 to 14.5, our equity would be 31.5%.

We must now calculate pot odds.

(bet/(our bet+pot)) = pot odds

= $50 / ($40 + $90)

= $40 / $130

= 30.7%

To make a profitable call, we need at least 30.7% equity. This is a profitable call as we have 31.5% equity (even if villain has a set). Yes, we will lose most of the time, but we will make a small profit in the long run, making a call correct.

Pot odds aren't just for draws, either. If an opponent bets 50% pot, you get 3 to 1 odds on a call, so you must win 25% of the time to be profitable. If your current hand has more than 25% equity against your opponent's perceived range, call.

Preflop Pot Odds

Preflop, you raise to 3bb and the button 3bets to 9bb. You must decide how to act. In situations like these, we can actually use pot odds to assist our decision-making.

This pot is:

(our open+3bet size+small blind+big blind)

(3bb+9bb+0.5bb+1bb)

= 13.5

This means we must call 6bb to win a pot of 13.5bb, which requires 30.7% equity against the 3bettor's range.

Three additional factors must be considered:

Being out of position on our opponent makes it harder to realize our hand's equity, as he can use his position to put us in tough spots. To profitably continue against villain's hand range, we should add 7% to our equity.

Implied Odds / Reverse Implied Odds: The ability to win or lose significantly more post-flop (than pre-flop) based on our remaining stack.

While statistics on 3bet stats can be gained with a large enough sample size (i.e. 8% 3bet stat from button), the numbers don't tell us which 8% of hands villain could be 3betting with. Both polarized and depolarized charts below show 8% of possible hands.

7.4% of hands are depolarized.

Polarized Hand range (7.54%):

Each hand range has different contents. We don't know if he 3bets some hands and calls or folds others.

Using an exploitable strategy can help you play a hand range correctly. The next GTO concept will make things easier.

3. Minimum Defense Frequency:

This concept refers to the % of our range we must continue with (by calling or raising) to avoid being exploited by our opponents. This concept is most often used off-table and is difficult to apply in-game.

These beginner GTO concepts will help your decision-making during a hand, especially against aggressive opponents.

MDF formula:

MDF = POT SIZE/(POT SIZE+BET SIZE)

Here's a poker GTO chart of common bet sizes and minimum defense frequency.

Take the number of hand combos in your starting hand range and use the MDF to determine which hands to continue with. Choose hands with the most playability and equity against your opponent's betting range.

Say you open-raise HJ and BB calls. Qh9h6c flop. Your opponent leads you for a half-pot bet. MDF suggests keeping 67% of our range.

Using the above starting hand chart, we can determine that the HJ opens 254 combos:

We must defend 67% of these hands, or 170 combos, according to MDF. Hands we should keep include:

Flush draws

Open-Ended Straight Draws

Gut-Shot Straight Draws

Overcards

Any Pair or better

So, our flop continuing range could be:

Some highlights:

Fours and fives have little chance of improving on the turn or river.

We only continue with AX hearts (with a flush draw) without a pair or better.

We'll also include 4 AJo combos, all of which have the Ace of hearts, and AcJh, which can block a backdoor nut flush combo.

Let's assume all these hands are called and the turn is blank (2 of spades). Opponent bets full-pot. MDF says we must defend 50% of our flop continuing range, or 85 of 170 combos, to be unexploitable. This strategy includes our best flush draws, straight draws, and made hands.

Here, we keep combining:

Nut flush draws

Pair + flush draws

GS + flush draws

Second Pair, Top Kicker+

One combo of JJ that doesn’t block the flush draw or backdoor flush draw.

On the river, we can fold our missed draws and keep our best made hands. When calling with weaker hands, consider blocker effects and card removal to avoid overcalling and decide which combos to continue.

4. Poker GTO Bet Sizing

To avoid being exploited, balance your bluffs and value bets. Your betting range depends on how much you bet (in relation to the pot). This concept only applies on the river, as draws (bluffs) on the flop and turn still have equity (and are therefore total bluffs).

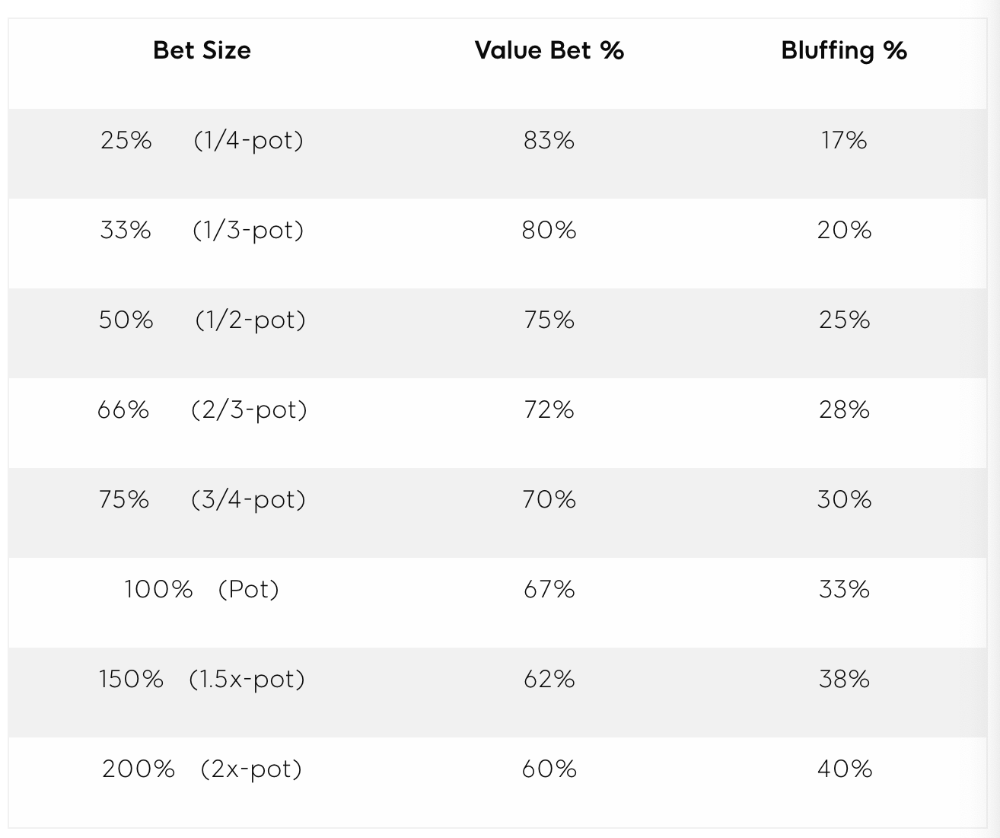

On the flop, you want a 2:1 bluff-to-value-bet ratio. On the flop, there won't be as many made hands as on the river, and your bluffs will usually contain equity. The turn should have a "bluffing" ratio of 1:1. Use the chart below to determine GTO river bluff frequencies (relative to your bet size):

This chart relates to your opponent's pot odds. If you bet 50% pot, your opponent gets 3:1 odds and must win 25% of the time to call. Poker GTO theory suggests including 25% bluff combinations in your betting range so you're indifferent to your opponent calling or folding.

Best river bluffs don't block hands you want your opponent to have (or not have). For example, betting with missed Ace-high flush draws is often a mistake because you block a missed flush draw you want your opponent to have when bluffing on the river (meaning that it would subsequently be less likely he would have it, if you held two of the flush draw cards). Ace-high usually has some river showdown value.

If you had a 3-flush on the river and wanted to raise, you could bluff raise with AX combos holding the bluff suit Ace. Blocking the nut flush prevents your opponent from using that combo.

5. Bet Sizes and Frequency

GTO beginner strategies aren't just bluffs and value bets. They show how often and how much to bet in certain spots. Top players have benefited greatly from poker solvers, which we'll discuss next.

GTO Poker Software

In recent years, various poker GTO solvers have been released to help beginner, intermediate, and advanced players play balanced/GTO poker in various situations.

PokerSnowie and PioSolver are popular GTO and poker study programs.

While you can't compute players' hand ranges and what hands to bet or check with in real time, studying GTO play strategies with these programs will pay off. It will improve your poker thinking and understanding.

Solvers can help you balance ranges, choose optimal bet sizes, and master cbet frequencies.

GTO Poker Tournament

Late-stage tournaments have shorter stacks than cash games. In order to follow GTO poker guidelines, Nash charts have been created, tweaked, and used for many years (and also when to call, depending on what number of big blinds you have when you find yourself shortstacked).

The charts are for heads-up push/fold. In a multi-player game, the "pusher" chart can only be used if play is folded to you in the small blind. The "caller" chart can only be used if you're in the big blind and assumes a small blind "pusher" (with a much wider range than if a player in another position was open-shoving).

Divide the pusher chart's numbers by 2 to see which hand to use from the Button. Divide the original chart numbers by 4 to find the CO's pushing range. Some of the figures will be impossible to calculate accurately for the CO or positions to the right of the blinds because the chart's highest figure is "20+" big blinds, which is also used for a wide range of hands in the push chart.

Both of the GTO charts below are ideal for heads-up play, but exploitable HU shortstack strategies can lead to more +EV decisions against certain opponents. Following the charts will make your play GTO and unexploitable.

Poker pro Max Silver created the GTO push/fold software SnapShove. (It's accessible online at www.snapshove.com or as iOS or Android apps.)

Players can access GTO shove range examples in the full version. (You can customize the number of big blinds you have, your position, the size of the ante, and many other options.)

In Conclusion

Due to the constantly changing poker landscape, players are always improving their skills. Exploitable strategies often yield higher profit margins than GTO-based approaches, but knowing GTO beginner and advanced concepts can give you an edge for a few reasons.

It creates a solid gameplay base.

Having a baseline makes it easier to exploit certain villains.

You can avoid leveling wars with your opponents by making sound poker decisions based on GTO strategy.

It doesn't require assuming opponents' play styles.

Not results-oriented.

This is just the beginning of GTO and poker theory. Consider investing in the GTO poker solver software listed above to improve your game.

Luke Plunkett

3 years ago

Gran Turismo 7 Update Eases Up On The Grind After Fan Outrage

Polyphony Digital has changed the game after apologizing in March.

To make amends for some disastrous downtime, Gran Turismo 7 director Kazunori Yamauchi announced a credits handout and promised to “dramatically change GT7's car economy to help make amends” last month. The first of these has arrived.

The game's 1.11 update includes the following concessions to players frustrated by the economy and its subsequent grind:

-

The last half of the World Circuits events have increased in-game credit rewards.

-

Modified Arcade and Custom Race rewards

-

Clearing all circuit layouts with Gold or Bronze now rewards In-game Credits. Exiting the Sector selection screen with the Exit button will award Credits if an event has already been cleared.

-

Increased Credits Rewards in Lobby and Daily Races

-

Increased the free in-game Credits cap from 20,000,000 to 100,000,000.

Additionally, “The Human Comedy” missions are one-hour endurance races that award “up to 1,200,000” credits per event.

This isn't everything Yamauchi promised last month; he said it would take several patches and updates to fully implement the changes. Here's a list of everything he said would happen, some of which have already happened (like the World Cup rewards and credit cap):

- Increase rewards in the latter half of the World Circuits by roughly 100%.

- Added high rewards for all Gold/Bronze results clearing the Circuit Experience.

- Online Races rewards increase.

- Add 8 new 1-hour Endurance Race events to Missions. So expect higher rewards.

- Increase the non-paid credit limit in player wallets from 20M to 100M.

- Expand the number of Used and Legend cars available at any time.

- With time, we will increase the payout value of limited time rewards.

- New World Circuit events.

- Missions now include 24-hour endurance races.

- Online Time Trials added, with rewards based on the player's time difference from the leader.

- Make cars sellable.

The full list of updates and changes can be found here.

Read the original post.

You might also like

Startup Journal

3 years ago

The Top 14 Software Business Ideas That Are Sure To Succeed in 2023

Software can change any company.

Software is becoming essential. Everyone should consider how software affects their lives and others'.

Software on your phone, tablet, or computer offers many new options. We're experts in enough ways now.

Software Business Ideas will be popular by 2023.

ERP Programs

ERP software meets rising demand.

ERP solutions automate and monitor tasks that large organizations, businesses, and even schools would struggle to do manually.

ERP software could reach $49 billion by 2024.

CRM Program

CRM software is a must-have for any customer-focused business.

Having an open mind about your business services and products allows you to change platforms.

Another company may only want your CRM service.

Medical software

Healthcare facilities need reliable, easy-to-use software.

EHRs, MDDBs, E-Prescribing, and more are software options.

The global medical software market could reach $11 billion by 2025, and mobile medical apps may follow.

Presentation Software in the Cloud

SaaS presentation tools are great.

They're easy to use, comprehensive, and full of traditional Software features.

In today's cloud-based world, these solutions make life easier for people. We don't know about you, but we like it.

Software for Project Management

People began working remotely without signs or warnings before the 2020 COVID-19 pandemic.

Many organizations found it difficult to track projects and set deadlines.

With PMP software tools, teams can manage remote units and collaborate effectively.

App for Blockchain-Based Invoicing

This advanced billing and invoicing solution is for businesses and freelancers.

These blockchain-based apps can calculate taxes, manage debts, and manage transactions.

Intelligent contracts help blockchain track transactions more efficiently. It speeds up and improves invoice generation.

Software for Business Communications

Internal business messaging is tricky.

Top business software tools for communication can share files, collaborate on documents, host video conferences, and more.

Payroll Automation System

Software development also includes developing an automated payroll system.

These software systems reduce manual tasks for timely employee payments.

These tools help enterprise clients calculate total wages quickly, simplify tax calculations, improve record-keeping, and support better financial planning.

System for Detecting Data Leaks

Both businesses and individuals value data highly. Yahoo's data breach is dangerous because of this.

This area of software development can help people protect their data.

You can design an advanced data loss prevention system.

AI-based Retail System

AI-powered shopping systems are popular. The systems analyze customers' search and purchase patterns and store history and are equipped with a keyword database.

These systems offer many customers pre-loaded products.

AI-based shopping algorithms also help users make purchases.

Software for Detecting Plagiarism

Software can help ensure your projects are original and not plagiarized.

These tools detect plagiarized content that Google, media, and educational institutions don't like.

Software for Converting Audio to Text

Machine Learning converts speech to text automatically.

These programs can quickly transcribe cloud-based files.

Software for daily horoscopes

Daily and monthly horoscopes will continue to be popular.

Software platforms that can predict forecasts, calculate birth charts, and other astrology resources are good business ideas.

E-learning Programs

Traditional study methods are losing popularity as virtual schools proliferate and physical space shrinks.

Khan Academy online courses are the best way to keep learning.

Online education portals can boost your learning. If you want to start a tech startup, consider creating an e-learning program.

Conclusion

Software is booming. There's never been a better time to start a software development business, with so many people using computers and smartphones. This article lists eight business ideas for 2023. Consider these ideas if you're just starting out or looking to expand.

wordsmithwriter

3 years ago

2023 Will Be the Year of Evernote and Craft Notetaking Apps.

Note-taking is a vital skill. But it's mostly learned.

Recently, innovative note-taking apps have flooded the market.

In the next few years, Evernote and Craft will be important digital note-taking companies.

Evernote is a 2008 note-taking program. It can capture ideas, track tasks, and organize information on numerous platforms.

It's one of the only note-taking app that lets users input text, audio, photos, and videos. It's great for collecting research notes, brainstorming, and remaining organized.

Craft is a popular note-taking app.

Craft is a more concentrated note-taking application than Evernote. It organizes notes into subjects, tags, and relationships, making it ideal for technical or research notes.

Craft's search engine makes it easy to find what you need.

Both Evernote and Craft are likely to be the major players in digital note-taking in the years to come.

Their concentration on gathering and organizing information lets users generate notes quickly and simply. Multimedia elements and a strong search engine make them the note-taking apps of the future.

Evernote and Craft are great note-taking tools for staying organized and tracking ideas and projects.

With their focus on acquiring and organizing information, they'll dominate digital note-taking in 2023.

Pros

Concentrate on gathering and compiling information

special features including a strong search engine and multimedia components

Possibility of subject, tag, and relationship structuring

enables users to incorporate multimedia elements

Excellent tool for maintaining organization, arranging research notes, and brainstorming

Cons

Software may be difficult for folks who are not tech-savvy to utilize.

Limited assistance for hardware running an outdated operating system

Subscriptions could be pricey.

Data loss risk because of security issues

Evernote and Craft both have downsides.

The risk of data loss as a result of security flaws and software defects comes first.

Additionally, their subscription fees could be high, and they might restrict support for hardware that isn't running the newest operating systems.

Finally, folks who need to be tech-savvy may find the software difficult.

Evernote versus. Productivity Titans Evernote will make Notion more useful. medium.com

Cory Doctorow

3 years ago

The current inflation is unique.

New Stiglitz just dropped.

Here's the inflation story everyone believes (warning: it's false): America gave the poor too much money during the recession, and now the economy is awash with free money, which made them so rich they're refusing to work, meaning the economy isn't making anything. Prices are soaring due to increased cash and missing labor.

Lawrence Summers says there's only one answer. We must impoverish the poor: raise interest rates, cause a recession, and eliminate millions of jobs, until the poor are stripped of their underserved fortunes and return to work.

https://pluralistic.net/2021/11/20/quiet-part-out-loud/#profiteering

This is nonsense. Countries around the world suffered inflation during and after lockdowns, whether they gave out humanitarian money to keep people from starvation. America has slightly greater inflation than other OECD countries, but it's not due to big relief packages.

The Causes of and Responses to Today's Inflation, a Roosevelt Institute report by Nobel-winning economist Joseph Stiglitz and macroeconomist Regmi Ira, debunks this bogus inflation story and offers a more credible explanation for inflation.

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI CausesofandResponsestoTodaysInflation Report 202212.pdf

Sharp interest rate hikes exacerbate the slump and increase inflation, the authors argue. They compare monetary policy inflation cures to medieval bloodletting, where doctors repeated the same treatment until the patient recovered (for which they received credit) or died (which was more likely).

Let's discuss bloodletting. Inflation hawks warn of the wage price spiral, when inflation rises and powerful workers bargain for higher pay, driving up expenses, prices, and wages. This is the fairy-tale narrative of the 1970s, and it's true except that OPEC's embargo drove up oil prices, which produced inflation. Oh well.

Let's be generous to seventies-haunted inflation hawks and say we're worried about a wage-price spiral. Fantastic! No. Real wages are 2.3% lower than they were in Oct 2021 after peaking in June at 4.8%.

Why did America's powerful workers take a paycut rather than demand inflation-based pay? Weak unions, globalization, economic developments.

Workers don't expect inflation to rise, so they're not requesting inflationary hikes. Inflationary expectations have remained moderate, consistent with our data interpretation.

https://www.newyorkfed.org/microeconomics/sce#/

Neither are workers. Working people see surplus savings as wealth and spend it gradually over their lives, despite rising demand. People may have saved money by staying in during the lockdown, but they don't eat out every night to make up for it. Instead, they keep those savings as precautionary balances. This is why the economy is lagging.

People don't buy non-traded goods with pandemic savings (basically, imports). Imports don't multiply like domestic purchases. If you buy a loaf of bread from the corner baker for $1 and they spend it at the tavern across the street, that dollar generates $3 in economic activity. Spending a dollar on foreign goods leaves the country and any multiplier effect happens there, not in the US.

Only marginally higher wages. The ECI is up 1.6% from 2019. Almost all gains went to the 25% lowest-paid Americans. Contrary to the inflation worry about too much savings, these workers don't make enough to save, even post-pandemic.

Recreation and transit spending are at or below pre-pandemic levels. Higher food and hotel prices (which doesn’t mean we’re buying more food than we were in 2019, just that it costs more).

What causes inflation if not greedy workers, free money, and high demand? The most expensive domestic goods produce the biggest revenues for their manufacturers. They charge you more without paying their workers or suppliers more.

The largest price-gougers are funneling their earnings to rich people who store it offshore through stock buybacks and dividends. A $1 billion stock buyback doesn't buy $1 billion in bread.

Five factors influence US inflation today:

I. Price rises for energy and food

II. shifts in consumer tastes

III. supply interruptions (mainly autos);

IV. increased rents (due to telecommuting);

V. monopoly (AKA price-gouging).

None can be remedied by raising interest rates or laying off workers.

Russia's invasion of Ukraine, omicron, and China's Zero Covid policy all disrupted the flow of food, energy, and production inputs. The price went higher because we made less.

After Russia invaded Ukraine, oil prices spiked, and sanctions made it worse. But that was February. By October, oil prices had returned to pre-pandemic, 2015 levels attributable to global economic adjustments, including a shift to renewables. Every new renewable installation reduces oil consumption and affects oil prices.

High food prices have a simple solution. The US and EU have bribed farmers not to produce for 50 years. If the war continues, this program may end, and food prices may decline.

Demand changes. We want different things than in 2019, not more. During the lockdown, people substituted goods. Half of the US toilet-paper supply in 2019 was on commercial-sized rolls. This is created from different mills and stock than our toilet paper.

Lockdown pushed toilet paper demand to residential rolls, causing shortages (the TP hoarding story was just another pandemic urban legend). Because supermarket stores don't have accounts with commercial paper distributors, ordering from languishing stores was difficult. Kleenex and paper towel substitutions caused greater shortages.

All that drove increased costs in numerous product categories, and there were more cases. These increases are transient, caused by supply chain inefficiencies that are resolving.

Demand for frontline staff saw a one-time repricing of pay, which is being recouped as we speak.

Illnesses. Brittle, hollowed-out global supply chains aggravated this. The constant pursuit of cheap labor and minimal regulation by monopolies that dominate most sectors means things are manufactured in far-flung locations. Financialization means any surplus capital assets were sold off years ago, leaving firms with little production slack. After the epidemic, several of these systems took years to restart.

Automobiles are to blame. Financialization and monopolization consolidated microchip and auto production in Taiwan and China. When the lockdowns came, these worldwide corporations cancelled their chip orders, and when they placed fresh orders, they were at the back of the line.

That drove up car prices, which is why the US has slightly higher inflation than other wealthy countries: the economy is car-centric. Automobile prices account for 9% of the CPI. France: 3.6%

Rent shocks and telecommuting. After the epidemic, many professionals moved to exurbs, small towns, and the countryside to work from home. As commercial properties were vacated, it was impractical to adapt them for residential use due to planning restrictions. Addressing these restrictions will cut rent prices more than raising inflation rates, which halts housing construction.

Statistical mirages cause some rent inflation. The CPI estimates what homeowners would pay to rent their properties. When rents rise in your neighborhood, the CPI believes you're spending more on rent even if you have a 30-year fixed-rate mortgage.

Market dominance. Almost every area of the US economy is dominated by monopolies, whose CEOs disclose on investor calls that they use inflation scares to jack up prices and make record profits.

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#overinflated

Long-term profit margins are rising. Markups averaged 26% from 1960-1980. 2021: 72%. Market concentration explains 81% of markup increases (e.g. monopolization). Profit margins reach a 70-year high in 2022. These elements interact. Monopolies thin out their sectors, making them brittle and sensitive to shocks.

If we're worried about a shrinking workforce, there are more humanitarian and sensible solutions than causing a recession and mass unemployment. Instead, we may boost US production capacity by easing workers' entry into the workforce.

https://pluralistic.net/2022/06/01/factories-to-condos-pipeline/#stuff-not-money

US female workforce participation ranks towards the bottom of developed countries. Many women can't afford to work due to America's lack of daycare, low earnings, and bad working conditions in female-dominated fields. If America doesn't have enough workers, childcare subsidies and minimum wages can help.

By contrast, driving the country into recession with interest-rate hikes will reduce employment, and the last recruited (women, minorities) are the first fired and the last to be rehired. Forcing America into recession won't enhance its capacity to create what its people want; it will degrade it permanently.

Nothing the Fed does can stop price hikes from international markets, lack of supply chain investment, COVID-19 disruptions, climate change, the Ukraine war, or market power. They can worsen it. When supply problems generate inflation, raising interest rates decreases investments that can remedy shortages.

Increasing interest rates won't cut rents since landlords pass on the expenses and high rates restrict investment in new dwellings where tenants could escape the costs.

Fixing the supply fixes supply-side inflation. Increase renewables investment (as the Inflation Reduction Act does). Monopolies can be busted (as the IRA does). Reshore key goods (as the CHIPS Act does). Better pay and child care attract employees.

Windfall taxes can claw back price-gouging corporations' monopoly earnings.

https://pluralistic.net/2022/03/15/sanctions-financing/#soak-the-rich

In 2008, we ruled out fiscal solutions (bailouts for debtors) and turned to monetary policy (bank bailouts). This preserved the economy but increased inequality and eroded public trust.

Monetary policy won't help. Even monetary policy enthusiasts recognize an 18-month lag between action and result. That suggests monetary tightening is unnecessary. Like the medieval bloodletter, central bankers whose interest rate hikes don't work swiftly may do more of the same, bringing the economy to its knees.

Interest rates must rise. Zero-percent interest fueled foolish speculation and financialization. Increasing rates will stop this. Increasing interest rates will destroy the economy and dampen inflation.

Then what? All recent evidence indicate to inflation decreasing on its own, as the authors argue. Supply side difficulties are finally being overcome, evidence shows. Energy and food prices are showing considerable mean reversion, which is disinflationary.

The authors don't recommend doing nothing. Best case scenario, they argue, is that the Fed won't keep raising interest rates until morale improves.