More on NFTs & Art

Anton Franzen

3 years ago

This is the driving force for my use of NFTs, which will completely transform the world.

Its not a fuc*ing fad.

It's not about boring monkeys or photos as nfts; that's just what's been pushed up and made a lot of money. The technology underlying those ridiculous nft photos will one day prove your house and automobile ownership and tell you where your banana came from. Are you ready for web3? Soar!

People don't realize that absolutely anything can and will be part of the blockchain and smart contracts, making them even better. I'll tell you a secret: it will and is happening.

Why?

Why is something blockchain-based a good idea? So let’s speak about cars!

So a new Tesla car is manufactured, and when you buy it, it is bound to an NFT on the blockchain that proves current ownership. The NFT in the smart contract can contain some data about the current owner of the car and some data about the car's status, such as the number of miles driven, the car's overall quality, and so on, as well as a reference to a digital document bound to the NFT that has more information.

Now, 40 years from now, if you want to buy a used automobile, you can scan the car's serial number to view its NFT and see all of its history, each owner, how long they owned it, if it had damages, and more. Since it's on the blockchain, it can't be tampered with.

When you're ready to buy it, the owner posts it for sale, you buy it, and it's sent to your wallet. 5 seconds to change owner, 100% safe and verifiable.

Incorporate insurance logic into the car contract. If you crashed, your car's smart contract would take money from your insurance contract and deposit it in an insurance company wallet.

It's limitless. Your funds may be used by investors to provide insurance as they profit from everyone's investments.

Or suppose all car owners in a country deposit a fixed amount of money into an insurance smart contract that promises if something happens, we'll take care of it. It could be as little as $100-$500 per year, and in a country with 10 million people, maybe 3 million would do that, which would be $500 000 000 in that smart contract and it would be used by the insurance company to invest in assets or take a cut, literally endless possibilities.

Instead of $300 per month, you may pay $300 per year to be covered if something goes wrong, and that may include multiple insurances.

What about your grocery store banana, though?

Yes that too.

You can scan a banana to learn its complete history. You'll be able to see where it was cultivated, every middleman in the supply chain, and hopefully the banana's quality, farm, and ingredients used.

If you want locally decent bananas, you can only buy them, offering you transparency and options. I believe it will be an online marketplace where farmers publish their farms and products for trust and transparency. You might also buy bananas from the farmer.

And? Food security to finish the article. If an order of bananas included a toxin, you could easily track down every banana from the same origin and supply chain and uncover the root cause. This is a tremendous thing that will save lives and have a big impact; did you realize that 1 in 6 Americans gets poisoned by food every year? This could lower the number.

To summarize:

Smart contracts can issue nfts as proof of ownership and include functionality.

Protos

3 years ago

Plagiarism on OpenSea: humans and computers

OpenSea, a non-fungible token (NFT) marketplace, is fighting plagiarism. A new “two-pronged” approach will aim to root out and remove copies of authentic NFTs and changes to its blue tick verified badge system will seek to enhance customer confidence.

According to a blog post, the anti-plagiarism system will use algorithmic detection of “copymints” with human reviewers to keep it in check.

Last year, NFT collectors were duped into buying flipped images of the popular BAYC collection, according to The Verge. The largest NFT marketplace had to remove its delay pay minting service due to an influx of copymints.

80% of NFTs removed by the platform were minted using its lazy minting service, which kept the digital asset off-chain until the first purchase.

NFTs copied from popular collections are opportunistic money-grabs. Right-click, save, and mint the jacked JPEGs that are then flogged as an authentic NFT.

The anti-plagiarism system will scour OpenSea's collections for flipped and rotated images, as well as other undescribed permutations. The lack of detail here may be a deterrent to scammers, or it may reflect the new system's current rudimentary nature.

Thus, human detectors will be needed to verify images flagged by the detection system and help train it to work independently.

“Our long-term goal with this system is two-fold: first, to eliminate all existing copymints on OpenSea, and second, to help prevent new copymints from appearing,” it said.

“We've already started delisting identified copymint collections, and we'll continue to do so over the coming weeks.”

It works for Twitter, why not OpenSea

OpenSea is also changing account verification. Early adopters will be invited to apply for verification if their NFT stack is worth $100 or more. OpenSea plans to give the blue checkmark to people who are active on Twitter and Discord.

This is just the beginning. We are committed to a future where authentic creators can be verified, keeping scammers out.

Also, collections with a lot of hype and sales will get a blue checkmark. For example, a new NFT collection sold by the verified BAYC account will have a blue badge to verify its legitimacy.

New requests will be responded to within seven days, according to OpenSea.

These programs and products help protect creators and collectors while ensuring our community can confidently navigate the world of NFTs.

By elevating authentic content and removing plagiarism, these changes improve trust in the NFT ecosystem, according to OpenSea.

OpenSea is indeed catching up with the digital art economy. Last August, DevianArt upgraded its AI image recognition system to find stolen tokenized art on marketplaces like OpenSea.

It scans all uploaded art and compares it to “public blockchain events” like Ethereum NFTs to detect stolen art.

middlemarch.eth

3 years ago

ERC721R: A new ERC721 contract for random minting so people don’t snipe all the rares!

That is, how to snipe all the rares without using ERC721R!

Introduction: Blessed and Lucky

Mphers was the first mfers derivative, and as a Phunks derivative, I wanted one.

I wanted an alien. And there are only 8 in the 6,969 collection. I got one!

In case it wasn't clear from the tweet, I meant that I was lucky to have figured out how to 100% guarantee I'd get an alien without any extra luck.

Read on to find out how I did it, how you can too, and how developers can avoid it!

How to make rare NFTs without luck.

# How to mint rare NFTs without needing luck

The key to minting a rare NFT is knowing the token's id ahead of time.

For example, once I knew my alien was #4002, I simply refreshed the mint page until #3992 was minted, and then mint 10 mphers.

How did I know #4002 was extraterrestrial? Let's go back.

First, go to the mpher contract's Etherscan page and look up the tokenURI of a previously issued token, token #1:

As you can see, mphers creates metadata URIs by combining the token id and an IPFS hash.

This method gives you the collection's provenance in every URI, and while that URI can be changed, it affects everyone and is public.

Consider a token URI without a provenance hash, like https://mphers.art/api?tokenId=1.

As a collector, you couldn't be sure the devs weren't changing #1's metadata at will.

The API allows you to specify “if #4002 has not been minted, do not show any information about it”, whereas IPFS does not allow this.

It's possible to look up the metadata of any token, whether or not it's been minted.

Simply replace the trailing “1” with your desired id.

Mpher #4002

These files contain all the information about the mpher with the specified id. For my alien, we simply search all metadata files for the string “alien mpher.”

Take a look at the 6,969 meta-data files I'm using OpenSea's IPFS gateway, but you could use ipfs.io or something else.

Use curl to download ten files at once. Downloading thousands of files quickly can lead to duplicates or errors. But with a little tweaking, you should be able to get everything (and dupes are fine for our purposes).

Now that you have everything in one place, grep for aliens:

The numbers are the file names that contain “alien mpher” and thus the aliens' ids.

The entire process takes under ten minutes. This technique works on many NFTs currently minting.

In practice, manually minting at the right time to get the alien is difficult, especially when tokens mint quickly. Then write a bot to poll totalSupply() every second and submit the mint transaction at the exact right time.

You could even look for the token you need in the mempool before it is minted, and get your mint into the same block!

However, in my experience, the “big” approach wins 95% of the time—but not 100%.

“Am I being set up all along?”

Is a question you might ask yourself if you're new to this.

It's disheartening to think you had no chance of minting anything that someone else wanted.

But, did you have no opportunity? You had an equal chance as everyone else!

Take me, for instance: I figured this out using open-source tools and free public information. Anyone can do this, and not understanding how a contract works before minting will lead to much worse issues.

The mpher mint was fair.

While a fair game, “snipe the alien” may not have been everyone's cup of tea.

People may have had more fun playing the “mint lottery” where tokens were distributed at random and no one could gain an advantage over someone simply clicking the “mint” button.

How might we proceed?

Minting For Fashion Hats Punks, I wanted to create a random minting experience without sacrificing fairness. In my opinion, a predictable mint beats an unfair one. Above all, participants must be equal.

Sadly, the most common method of creating a random experience—the post-mint “reveal”—is deeply unfair. It works as follows:

- During the mint, token metadata is unavailable. Instead, tokenURI() returns a blank JSON file for each id.

- An IPFS hash is updated once all tokens are minted.

- You can't tell how the contract owner chose which token ids got which metadata, so it appears random.

Because they alone decide who gets what, the person setting the metadata clearly has a huge unfair advantage over the people minting. Unlike the mpher mint, you have no chance of winning here.

But what if it's a well-known, trusted, doxxed dev team? Are reveals okay here?

No! No one should be trusted with such power. Even if someone isn't consciously trying to cheat, they have unconscious biases. They might also make a mistake and not realize it until it's too late, for example.

You should also not trust yourself. Imagine doing a reveal, thinking you did it correctly (nothing is 100%! ), and getting the rarest NFT. Isn't that a tad odd Do you think you deserve it? An NFT developer like myself would hate to be in this situation.

Reveals are bad*

UNLESS they are done without trust, meaning everyone can verify their fairness without relying on the developers (which you should never do).

An on-chain reveal powered by randomness that is verifiably outside of anyone's control is the most common way to achieve a trustless reveal (e.g., through Chainlink).

Tubby Cats did an excellent job on this reveal, and I highly recommend their contract and launch reflections. Their reveal was also cool because it was progressive—you didn't have to wait until the end of the mint to find out.

In his post-launch reflections, @DefiLlama stated that he made the contract as trustless as possible, removing as much trust as possible from the team.

In my opinion, everyone should know the rules of the game and trust that they will not be changed mid-stream, while trust minimization is critical because smart contracts were designed to reduce trust (and it makes it impossible to hack even if the team is compromised). This was a huge mistake because it limited our flexibility and our ability to correct mistakes.

And @DefiLlama is a superstar developer. Imagine how much stress maximizing trustlessness will cause you!

That leaves me with a bad solution that works in 99 percent of cases and is much easier to implement: random token assignments.

Introducing ERC721R: A fully compliant IERC721 implementation that picks token ids at random.

ERC721R implements the opposite of a reveal: we mint token ids randomly and assign metadata deterministically.

This allows us to reveal all metadata prior to minting while reducing snipe chances.

Then import the contract and use this code:

What is ERC721R and how does it work

First, a disclaimer: ERC721R isn't truly random. In this sense, it creates the same “game” as the mpher situation, where minters compete to exploit the mint. However, ERC721R is a much more difficult game.

To game ERC721R, you need to be able to predict a hash value using these inputs:

This is impossible for a normal person because it requires knowledge of the block timestamp of your mint, which you do not have.

To do this, a miner must set the timestamp to a value in the future, and whatever they do is dependent on the previous block's hash, which expires in about ten seconds when the next block is mined.

This pseudo-randomness is “good enough,” but if big money is involved, it will be gamed. Of course, the system it replaces—predictable minting—can be manipulated.

The token id is chosen in a clever implementation of the Fisher–Yates shuffle algorithm that I copied from CryptoPhunksV2.

Consider first the naive solution: (a 10,000 item collection is assumed):

- Make an array with 0–9999.

- To create a token, pick a random item from the array and use that as the token's id.

- Remove that value from the array and shorten it by one so that every index corresponds to an available token id.

This works, but it uses too much gas because changing an array's length and storing a large array of non-zero values is expensive.

How do we avoid them both? What if we started with a cheap 10,000-zero array? Let's assign an id to each index in that array.

Assume we pick index #6500 at random—#6500 is our token id, and we replace the 0 with a 1.

But what if we chose #6500 again? A 1 would indicate #6500 was taken, but then what? We can't just "roll again" because gas will be unpredictable and high, especially later mints.

This allows us to pick a token id 100% of the time without having to keep a separate list. Here's how it works:

- Make a 10,000 0 array.

- Create a 10,000 uint numAvailableTokens.

- Pick a number between 0 and numAvailableTokens. -1

- Think of #6500—look at index #6500. If it's 0, the next token id is #6500. If not, the value at index #6500 is your next token id (weird!)

- Examine the array's last value, numAvailableTokens — 1. If it's 0, move the value at #6500 to the end of the array (#9999 if it's the first token). If the array's last value is not zero, update index #6500 to store it.

- numAvailableTokens is decreased by 1.

- Repeat 3–6 for the next token id.

So there you go! The array stays the same size, but we can choose an available id reliably. The Solidity code is as follows:

Unfortunately, this algorithm uses more gas than the leading sequential mint solution, ERC721A.

This is most noticeable when minting multiple tokens in one transaction—a 10 token mint on ERC721R costs 5x more than on ERC721A. That said, ERC721A has been optimized much further than ERC721R so there is probably room for improvement.

Conclusion

Listed below are your options:

- ERC721A: Minters pay lower gas but must spend time and energy devising and executing a competitive minting strategy or be comfortable with worse minting results.

- ERC721R: Higher gas, but the easy minting strategy of just clicking the button is optimal in all but the most extreme cases. If miners game ERC721R it’s the worst of both worlds: higher gas and a ton of work to compete.

- ERC721A + standard reveal: Low gas, but not verifiably fair. Please do not do this!

- ERC721A + trustless reveal: The best solution if done correctly, highly-challenging for dev, potential for difficult-to-correct errors.

Did I miss something? Comment or tweet me @dumbnamenumbers.

Check out the code on GitHub to learn more! Pull requests are welcome—I'm sure I've missed many gas-saving opportunities.

Thanks!

Read the original post here

You might also like

JEFF JOHN ROBERTS

3 years ago

What just happened in cryptocurrency? A plain-English Q&A about Binance's FTX takedown.

Crypto people have witnessed things. They've seen big hacks, mind-boggling swindles, and amazing successes. They've never seen a day like Tuesday, when the world's largest crypto exchange murdered its closest competition.

Here's a primer on Binance and FTX's lunacy and why it matters if you're new to crypto.

What happened?

CZ, a shrewd Chinese-Canadian billionaire, runs Binance. FTX, a newcomer, has challenged Binance in recent years. SBF (Sam Bankman-Fried)—a young American with wild hair—founded FTX (initials are a thing in crypto).

Last weekend, CZ complained about SBF's lobbying and then exploited Binance's market power to attack his competition.

How did CZ do that?

CZ invested in SBF's new cryptocurrency exchange when they were friends. CZ sold his investment in FTX for FTT when he no longer wanted it. FTX clients utilize those tokens to get trade discounts, although they are less liquid than Bitcoin.

SBF made a mistake by providing CZ just too many FTT tokens, giving him control over FTX. It's like Pepsi handing Coca-Cola a lot of stock it could sell at any time. CZ got upset with SBF and flooded the market with FTT tokens.

SBF owns a trading fund with many FTT tokens, therefore this was catastrophic. SBF sought to defend FTT's worth by selling other assets to buy up the FTT tokens flooding the market, but it didn't succeed, and as FTT's value plummeted, his liabilities exceeded his assets. By Tuesday, his companies were insolvent, so he sold them to his competition.

Crazy. How could CZ do that?

CZ likely did this to crush a rising competition. It was also personal. In recent months, regulators have been tough toward the crypto business, and Binance and FTX have been trying to stay on their good side. CZ believed SBF was poisoning U.S. authorities by saying CZ was linked to China, so CZ took retribution.

“We supported previously, but we won't pretend to make love after divorce. We're neutral. But we won't assist people that push against other industry players behind their backs," CZ stated in a tragic tweet on Sunday. He crushed his rival's company two days later.

So does Binance now own FTX?

No. Not yet. CZ has only stated that Binance signed a "letter of intent" to acquire FTX. CZ and SBF say Binance will protect FTX consumers' funds.

Who’s to blame?

You could blame CZ for using his control over FTX to destroy it. SBF is also being criticized for not disclosing the full overlap between FTX and his trading company, which controlled plenty of FTT. If he had been upfront, someone might have warned FTX about this vulnerability earlier, preventing this mess.

Others have alleged that SBF utilized customer monies to patch flaws in his enterprises' balance accounts. That happened to multiple crypto startups that collapsed this spring, which is unfortunate. These are allegations, not proof.

Why does this matter? Isn't this common in crypto?

Crypto is notorious for shady executives and pranks. FTX is the second-largest crypto business, and SBF was largely considered as the industry's golden boy who would help it get on authorities' good side. Thus far.

Does this affect cryptocurrency prices?

Short-term, it's bad. Prices fell on suspicions that FTX was in peril, then rallied when Binance rescued it, only to fall again later on Tuesday.

These occurrences have hurt FTT and SBF's Solana token. It appears like a huge token selloff is affecting the rest of the market. Bitcoin fell 10% and Ethereum 15%, which is bad but not catastrophic for the two largest coins by market cap.

James White

3 years ago

I read three of Elon Musk's suggested books (And His Taste Is Incredible)

A reading list for successful people

Elon Musk reads and talks. So, one learns. Many brilliant individuals & amazing literature.

This article recommends 3 Elon Musk novels. All of them helped me succeed. Hope they'll help you.

Douglas Adams's The Hitchhiker's Guide to the Galaxy

Page Count: 193

Rating on Goodreads: 4.23

Arthur Dent is pulled off Earth by a buddy seconds before it's razed for a cosmic motorway. The trio hitchhikes through space and gets into problems.

I initially read Hitchhiker's as a child. To evade my mum, I'd read with a flashlight under the covers. She'd scold at me for not sleeping on school nights when she found out. Oops.

The Hitchhiker's Guide to the Galaxy is lighthearted science fiction.

My favorite book quotes are:

“Space is big. You won’t believe how vastly, hugely, mind-bogglingly big it is. I mean, you may think it’s a long way down the road to the chemist’s, but that’s just peanuts to space.”

“Far out in the uncharted backwaters of the unfashionable end of the western spiral arm of the Galaxy lies a small unregarded yellow sun. Orbiting this at a distance of roughly ninety-two million miles is an utterly insignificant little blue-green planet whose ape-descended life forms are so amazingly primitive that they still think digital watches are a pretty neat idea.”

“On planet Earth, man had always assumed that he was more intelligent than dolphins because he had achieved so much — the wheel, New York, wars, and so on — whilst all the dolphins had ever done was muck about in the water having a good time. But conversely, the dolphins had always believed that they were far more intelligent than man — for precisely the same reasons.”

the Sun Tzu book The Art Of War

Page Count: 273

Rating on Goodreads: 3.97

It's a classic. You may apply The Art of War's ideas to (nearly) every facet of life. Ex:

Pick your fights.

Keep in mind that timing is crucial.

Create a backup plan in case something goes wrong.

Obstacles provide us a chance to adapt and change.

This book was my first. Since then, I'm a more strategic entrepreneur. Excellent book. And read it ASAP!

My favorite book quotes are:

“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.”

“Engage people with what they expect; it is what they are able to discern and confirms their projections. It settles them into predictable patterns of response, occupying their minds while you wait for the extraordinary moment — that which they cannot anticipate.”

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained, you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

Peter Thiel's book Zero to One

Page Count: 195

Rating on Goodreads: 4.18

Peter argues the best money-making strategies are typically unproven. Entrepreneurship should never have a defined path to success. Whoever says differently is lying.

Zero to One explores technology and society. Peter is a philosophy major and law school graduate, which informs the work.

Peters' ideas, depth, and intellect stood out in Zero to One. It's a top business book.

My favorite book quotes are:

“The most valuable businesses of coming decades will be built by entrepreneurs who seek to empower people rather than try to make them obsolete.”

“The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them.”

“If your goal is to never make a mistake in your life, you shouldn’t look for secrets. The prospect of being lonely but right — dedicating your life to something that no one else believes in — is already hard. The prospect of being lonely and wrong can be unbearable.”

Hudson Rennie

3 years ago

Meet the $5 million monthly controversy-selling King of Toxic Masculinity.

Trigger warning — Andrew Tate is running a genius marketing campaign

Andrew Tate is a 2022 internet celebrity.

Kickboxing world champion became rich playboy with controversial views on gender roles.

Andrew's get-rich-quick scheme isn't new. His social media popularity is impressive.

He’s currently running one of the most genius marketing campaigns in history.

He pulls society's pendulum away from diversity and inclusion and toward diversion and exclusion. He's unstoppable.

Here’s everything you need to know about Andrew Tate. And how he’s playing chess while the world plays checkers.

Cobra Tate is the name he goes by.

American-born, English-raised entrepreneur Andrew Tate lives in Romania.

Romania? Says Andrew,

“I prefer a country in which corruption is available to everyone.”

Andrew was a professional kickboxer with the ring moniker Cobra before starting Hustlers University.

Before that, he liked chess and worshipped his father.

Emory Andrew Tate III is named after his grandmaster chess player father.

Emory was the first black-American chess champion. He was military, martial arts-trained, and multilingual. A superhuman.

He lived in his car to make ends meet.

Andrew and Tristan relocated to England with their mother when their parents split.

It was there that Andrew began his climb toward becoming one of the internet’s greatest villains.

Andrew fell in love with kickboxing.

Andrew spent his 20s as a professional kickboxer and reality TV star, featuring on Big Brother UK and The Ultimate Traveller.

These 3 incidents, along with a chip on his shoulder, foreshadowed Andrews' social media breakthrough.

Chess

Combat sports

Reality television

A dangerous trio.

Andrew started making money online after quitting kickboxing in 2017 due to an eye issue.

Andrew didn't suddenly become popular.

Andrew's web work started going viral in 2022.

Due to his contentious views on patriarchy and gender norms, he's labeled the King of Toxic Masculinity. His most contentious views (trigger warning):

“Women are intrinsically lazy.”

“Female promiscuity is disgusting.”

“Women shouldn’t drive cars or fly planes.”

“A lot of the world’s problems would be solved if women had their body count tattooed on their foreheads.”

Andrew's two main beliefs are:

“These are my personal opinions based on my experiences.”

2. “I believe men are better at some things and women are better at some things. We are not equal.”

Andrew intentionally offends.

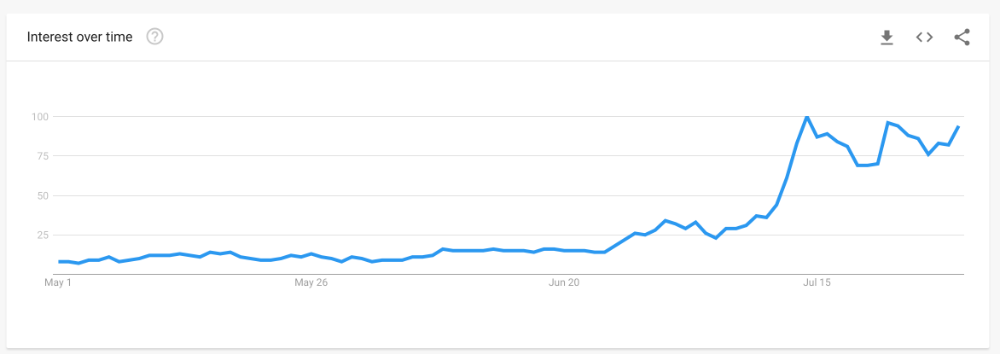

Andrew's thoughts began circulating online in 2022.

In July 2022, he was one of the most Googled humans, surpassing:

Joe Biden

Donald Trump

Kim Kardashian

Andrews' rise is a mystery since no one can censure or suppress him. This is largely because Andrew nor his team post his clips.

But more on that later.

Andrew's path to wealth.

Andrew Tate is a self-made millionaire. His morality is uncertain.

Andrew and Tristan needed money soon after retiring from kickboxing.

“I owed some money to some dangerous people. I had $70K and needed $100K to stay alive.”

Andrews lost $20K on roulette at a local casino.

Andrew had one week to make $50,000, so he started planning. Andrew locked himself in a chamber like Thomas Edison to solve an energy dilemma.

He listed his assets.

Physical strength (but couldn’t fight)

a BMW (worth around $20K)

Intelligence (but no outlet)

A lightbulb.

He had an epiphany after viewing a webcam ad. He sought aid from women, ironically. His 5 international girlfriends are assets.

Then, a lightbulb.

Andrew and Tristan messaged and flew 7 women to a posh restaurant. Selling desperation masked as opportunity, Andrew pitched his master plan:

A webcam business — with a 50/50 revenue split.

5 women left.

2 stayed.

Andrew Tate, a broke kickboxer, became Top G, Cobra Tate.

The business model was simple — yet sad.

Andrew's girlfriends moved in with him and spoke online for 15+ hours a day. Andrew handled ads and equipment as the women posed.

Andrew eventually took over their keyboards, believing he knew what men wanted more than women.

Andrew detailed on the Full Send Podcast how he emotionally manipulated men for millions. They sold houses, automobiles, and life savings to fuel their companionship addiction.

When asked if he felt bad, Andrew said,

“F*ck no.“

Andrew and Tristan wiped off debts, hired workers, and diversified.

Tristan supervised OnlyFans models.

Andrew bought Romanian casinos and MMA league RXF (Real Xtreme Fighting).

Pandemic struck suddenly.

Andrew couldn't run his 2 businesses without a plan. Another easy moneymaker.

He banked on Hustlers University.

The actual cause of Andrew's ubiquity.

On a Your Mom’s House episode Andrew's 4 main revenue sources:

Hustler’s University

2. Owning casinos in Romania

3. Owning 10% of the Romanian MMA league “RXF”

4. “The War Room” — a society of rich and powerful men

When the pandemic hit, 3/4 became inoperable.

So he expanded Hustlers University.

But what is Hustler’s University?

Andrew says Hustlers University teaches 18 wealth-building tactics online. Examples:

Real estate

Copywriting

Amazon FBA

Dropshipping

Flipping Cryptos

How to swiftly become wealthy.

Lessons are imprecise, rudimentary, and macro-focused, say reviews. Invest wisely, etc. Everything is free online.

You pay for community. One unique income stream.

The only money-making mechanism that keeps the course from being a scam.

The truth is, many of Andrew’s students are actually making money. Maybe not from the free YouTube knowledge Andrew and his professors teach in the course, but through Hustler’s University’s affiliate program.

Affiliates earn 10% commission for each new student = $5.

Students can earn $10 for each new referral in the first two months.

Andrew earns $50 per membership per month.

This affiliate program isn’t anything special — in fact, it’s on the lower end of affiliate payouts. Normally, it wouldn’t be very lucrative.

But it has one secret weapon— Andrew and his viral opinions.

Andrew is viral. Andrew went on a media tour in January 2022 after appearing on Your Mom's House.

And many, many more…

He chatted with Twitch streamers. Hustlers University wanted more controversy (and clips).

Here’s the strategy behind Hustler’s University that has (allegedly) earned students upwards of $10K per month:

Make a social media profile with Andrew Tates' name and photo.

Post any of the online videos of Andrews that have gone viral.

Include a referral link in your bio.

Effectively simple.

Andrew's controversy attracts additional students. More student clips circulate as more join. Andrew's students earn more and promote the product as he goes viral.

A brilliant plan that's functioning.

At the beginning of his media tour, Hustler’s University had 5,000 students. 6 months in, and he now has over 100,000.

One income stream generates $5 million every month.

Andrew's approach is not new.

But it is different.

In the early 2010s, Tai Lopez dominated the internet.

His viral video showed his house.

“Here in my garage. Just bought this new Lamborghini.”

Tais' marketing focused on intellect, not strength, power, and wealth to attract women.

How reading quicker leads to financial freedom in 67 steps.

Years later, it was revealed that Tai Lopez rented the mansion and Lamborghini as a marketing ploy to build social proof. Meanwhile, he was living in his friend’s trailer.

Faked success is an old tactic.

Andrew is doing something similar. But with one major distinction.

Andrew outsources his virality — making him nearly impossible to cancel.

In 2022, authorities searched Andrews' estate over human trafficking suspicions. Investigation continues despite withdrawn charges.

Andrew's divisive nature would normally get him fired. Andrew's enterprises and celebrity don't rely on social media.

He doesn't promote or pay for ads. Instead, he encourages his students and anyone wishing to get rich quick to advertise his work.

Because everything goes through his affiliate program. Old saying:

“All publicity is good publicity.”

Final thoughts: it’s ok to feel triggered.

Tate is divisive.

His emotionally charged words are human nature. Andrews created the controversy.

It's non-personal.

His opinions are those of one person. Not world nor generational opinion.

Briefly:

It's easy to understand why Andrews' face is ubiquitous. Money.

The world wide web is a chessboard. Misdirection is part of it.

It’s not personal, it’s business.

Controversy sells

Sometimes understanding the ‘why’, can help you deal with the ‘what.’