More on Leadership

Sammy Abdullah

3 years ago

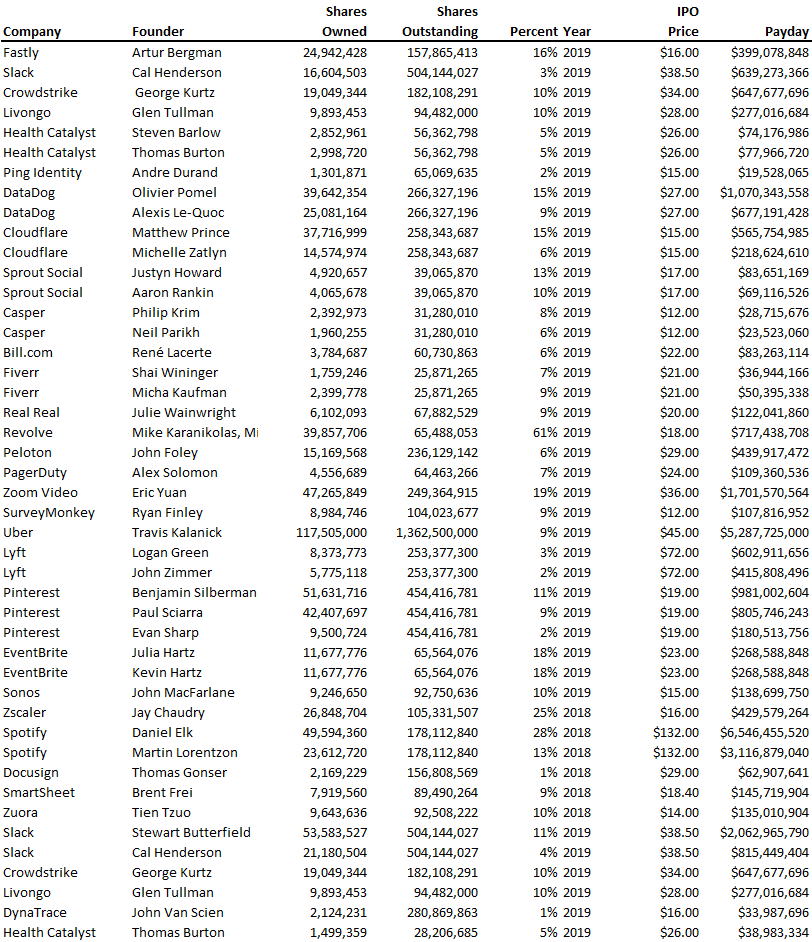

Payouts to founders at IPO

How much do startup founders make after an IPO? We looked at 2018's major tech IPOs. Paydays aren't what founders took home at the IPO (shares are normally locked up for 6 months), but what they were worth at the IPO price on the day the firm went public. It's not cash, but it's nice. Here's the data.

Several points are noteworthy.

Huge payoffs. Median and average pay were $399m and $918m. Average and median homeownership were 9% and 12%.

Coinbase, Uber, UI Path. Uber, Zoom, Spotify, UI Path, and Coinbase founders raised billions. Zoom's founder owned 19% and Spotify's 28% and 13%. Brian Armstrong controlled 20% of Coinbase at IPO and was worth $15bn. Preserving as much equity as possible by staying cash-efficient or raising at high valuations also helps.

The smallest was Ping. Ping's compensation was the smallest. Andre Duand owned 2% but was worth $20m at IPO. That's less than some billion-dollar paydays, but still good.

IPOs can be lucrative, as you can see. Preserving equity could be the difference between a $20mm and $15bln payday (Coinbase).

Will Lockett

3 years ago

Tesla recently disclosed its greatest secret.

The VP has revealed a secret that should frighten the rest of the EV world.

Tesla led the EV revolution. Elon Musk's invention offers a viable alternative to gas-guzzlers. Tesla has lost ground in recent years. VW, BMW, Mercedes, and Ford offer EVs with similar ranges, charging speeds, performance, and cost. Tesla's next-generation 4680 battery pack, Roadster, Cybertruck, and Semi were all delayed. CATL offers superior batteries than the 4680. Martin Viecha, Tesla's Vice President, recently told Business Insider something that startled the EV world and will establish Tesla as the EV king.

Viecha mentioned that Tesla's production costs have dropped 57% since 2017. This isn't due to cheaper batteries or devices like Model 3. No, this is due to amazing factory efficiency gains.

Musk wasn't crazy to want a nearly 100% automated production line, and Tesla's strategy of sticking with one model and improving it has paid off. Others change models every several years. This implies they must spend on new R&D, set up factories, and modernize service and parts systems. All of this costs a ton of money and prevents them from refining production to cut expenses.

Meanwhile, Tesla updates its vehicles progressively. Everything from the backseats to the screen has been enhanced in a 2022 Model 3. Tesla can refine, standardize, and cheaply produce every part without changing the production line.

In 2017, Tesla's automobile production averaged $84,000. In 2022, it'll be $36,000.

Mr. Viecha also claimed that new factories in Shanghai and Berlin will be significantly cheaper to operate once fully operating.

Tesla's hand is visible. Tesla selling $36,000 cars for $60,000 This barely beats the competition. Model Y long-range costs just over $60,000. Tesla makes $24,000+ every sale, giving it a 40% profit margin, one of the best in the auto business.

VW I.D4 costs about the same but makes no profit. Tesla's rivals face similar challenges. Their EVs make little or no profit.

Tesla costs the same as other EVs, but they're in a different league.

But don't forget that the battery pack accounts for 40% of an EV's cost. Tesla may soon fully utilize its 4680 battery pack.

The 4680 battery pack has larger cells and a unique internal design. This means fewer cells are needed for a car, making it cheaper to assemble and produce (per kWh). Energy density and charge speeds increase slightly.

Tesla underestimated the difficulty of making this revolutionary new cell. Each time they try to scale up production, quality drops and rejected cells rise.

Tesla recently installed this battery pack in Model Ys and is scaling production. If they succeed, Tesla battery prices will plummet.

Tesla's Model Ys 2170 battery costs $11,000. The same size pack with 4680 cells costs $3,400 less. Once scaled, it could be $5,500 (50%) less. The 4680 battery pack could reduce Tesla production costs by 20%.

With these cost savings, Tesla could sell Model Ys for $40,000 while still making a profit. They could offer a $25,000 car.

Even with new battery technology, it seems like other manufacturers will struggle to make EVs profitable.

Teslas cost about the same as competitors, so don't be fooled. Behind the scenes, they're still years ahead, and the 4680 battery pack and new factories will only increase that lead. Musk faces a first. He could sell Teslas at current prices and make billions while other manufacturers struggle. Or, he could massively undercut everyone and crush the competition once and for all. Tesla and Elon win.

Florian Wahl

3 years ago

An Approach to Product Strategy

I've been pondering product strategy and how to articulate it. Frameworks helped guide our thinking.

If your teams aren't working together or there's no clear path to victory, your product strategy may not be well-articulated or communicated (if you have one).

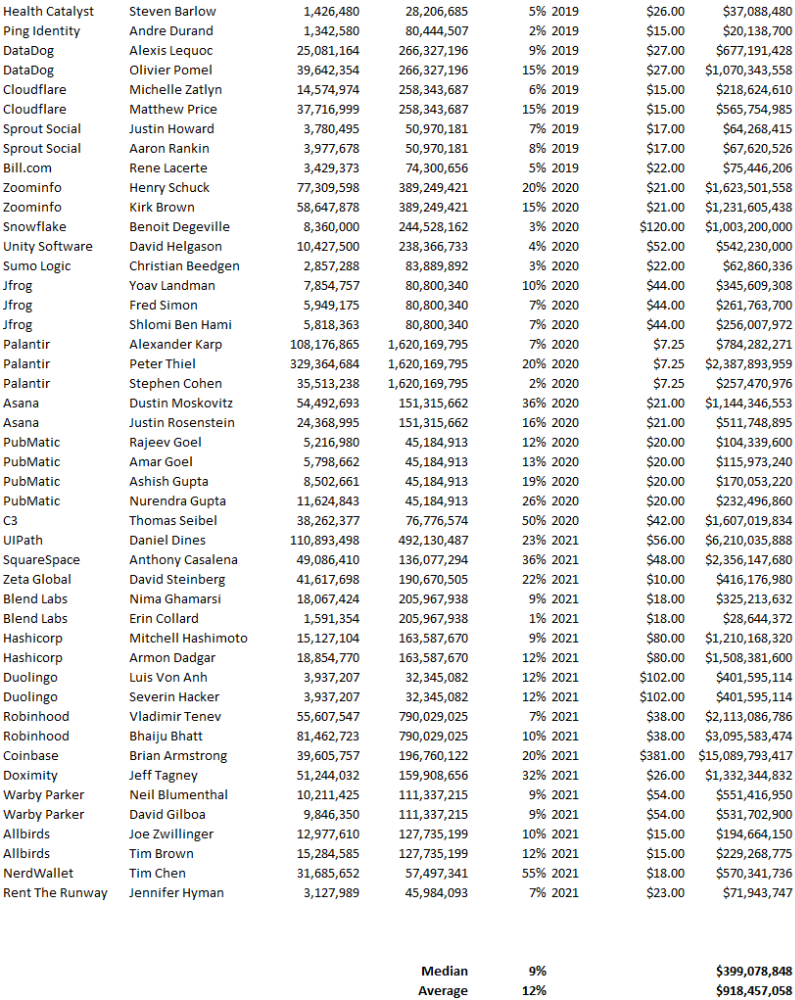

Before diving into a product strategy's details, it's important to understand its role in the bigger picture — the pieces that move your organization forward.

the overall picture

A product strategy is crucial, in my opinion. It's part of a successful product or business. It's the showpiece.

To simplify, we'll discuss four main components:

Vision

Product Management

Goals

Roadmap

Vision

Your company's mission? Your company/product in 35 years? Which headlines?

The vision defines everything your organization will do in the long term. It shows how your company impacted the world. It's your organization's rallying cry.

An ambitious but realistic vision is needed.

Without a clear vision, your product strategy may be inconsistent.

Product Management

Our main subject. Product strategy connects everything. It fulfills the vision.

In Part 2, we'll discuss product strategy.

Goals

This component can be goals, objectives, key results, targets, milestones, or whatever goal-tracking framework works best for your organization.

These product strategy metrics will help your team prioritize strategies and roadmaps.

Your company's goals should be unified. This fuels success.

Roadmap

The roadmap is your product strategy's timeline. It provides a prioritized view of your team's upcoming deliverables.

A roadmap is time-bound and includes measurable goals for your company. Your team's steps and capabilities for executing product strategy.

If your team has trouble prioritizing or defining a roadmap, your product strategy or vision is likely unclear.

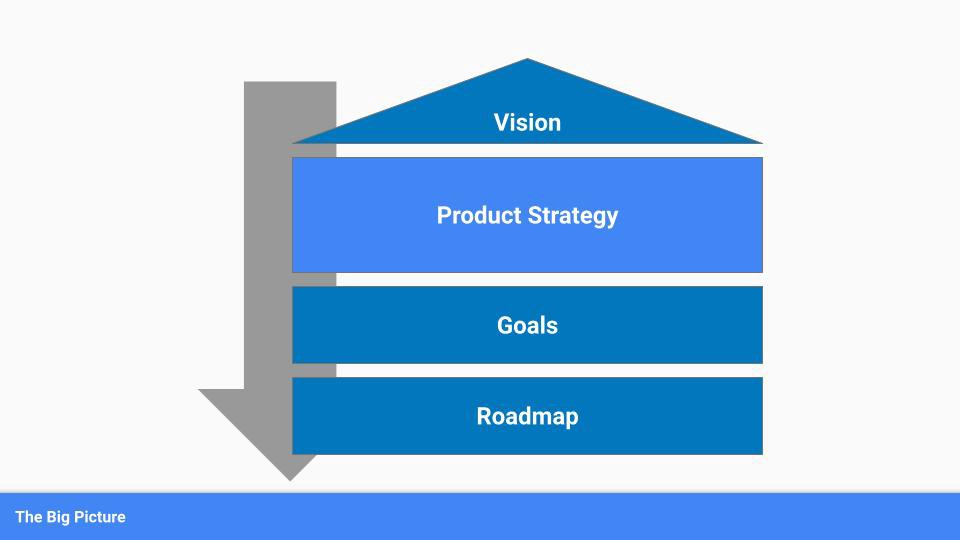

Formulation of a Product Strategy

Now that we've discussed where your product strategy fits in the big picture, let's look at a framework.

A product strategy should include challenges, an approach, and actions.

Challenges

First, analyze the problems/situations you're solving. It can be customer- or company-focused.

The analysis should explain the problems and why they're important. Try to simplify the situation and identify critical aspects.

Some questions:

What issues are we attempting to resolve?

What obstacles—internal or otherwise—are we attempting to overcome?

What is the opportunity, and why should we pursue it, in your opinion?

Decided Method

Second, describe your approach. This can be a set of company policies for handling the challenge. It's the overall approach to the first part's analysis.

The approach can be your company's bets, the solutions you've found, or how you'll solve the problems you've identified.

Again, these questions can help:

What is the value that we hope to offer to our clients?

Which market are we focusing on first?

What makes us stand out? Our benefit over rivals?

Actions

Third, identify actions that result from your approach. Second-part actions should be these.

Coordinate these actions. You may need to add products or features to your roadmap, acquire new capabilities through partnerships, or launch new marketing campaigns. Whatever fits your challenges and strategy.

Final questions:

What skills do we need to develop or obtain?

What is the chosen remedy? What are the main outputs?

What else ought to be added to our road map?

Put everything together

… and iterate!

Strategy isn't one-and-done. Changes occur. Economies change. Competitors emerge. Customer expectations change.

One unexpected event can make strategies obsolete quickly. Muscle it. Review, evaluate, and course-correct your strategies with your teams. Quarterly works. In a new or unstable industry, more often.

You might also like

Desiree Peralta

3 years ago

Why Now Is Your Chance To Create A Millionaire Career

People don’t believe in influencers anymore; they need people like you.

Social media influencers have dominated for years. We've seen videos, images, and articles of *famous* individuals unwrapping, reviewing, and endorsing things.

This industry generates billions. This year, marketers spent $2.23 billion on Instagram, $1 million on Youtube, and $775 million on Tiktok. This marketing has helped start certain companies.

Influencers are dying, so ordinary people like us may take over this billion-dollar sector. Why?

Why influencers are perishing

Most influencers lie to their fans, especially on Instagram. Influencers' first purpose was to make their lives so flawless that others would want to buy their stuff.

In 2015, an Australian influencer with 600,000 followers went viral for revealing all her photos and everything she did to seem great before deleting her account.

“I dramatically edited the pictures, I manipulated the environements, and made my life look perfect in social media… I remember I obsessively checked the like count for a full week since uploading it, a selfie that now has close to 2,500 likes. It got 5 likes. This was when I was so hungry for social media validation … This was the reason why I quit social media: for me, personally, it consumed me. I wasn’t living in a 3D world.”

Influencers then lost credibility.

Influencers seem to live in a bubble, separate from us. Thanks to self-popularity love's and constant awareness campaigns, people find these people ridiculous.

Influencers are praised more for showing themselves as natural and common than for showing luxuries and lies.

Little by little, they are dying, making room for a new group to take advantage of this multi-million dollar business, which gives us (ordinary people) a big opportunity to grow on any content creation platform we want.

Why this is your chance to develop on any platform for creating content

In 2021, I wrote “Not everyone who talks about money is a Financial Advisor, be careful of who you take advice from,”. In it, I warned that not everyone with a large following is a reputable source of financial advice.

Other writers hated this post and said I was wrong.

People don't want Jeff Bezos or Elon Musk's counsel, they said. They prefer to hear about their neighbor's restroom problems or his closest friend's terrible business.

Real advice from regular folks.

And I found this was true when I returned to my independent YouTube channel and had more than 1000 followers after having abandoned it with fewer than 30 videos in 2021 since there were already many personal finance and travel channels and I thought mine wasn't special.

People appreciated my videos because I was a 20-something girl trying to make money online, and they believed my advice more than that of influencers with thousands of followers.

I think today is the greatest time to grow on any platform as an ordinary person. Normal individuals give honest recommendations about what works for them and look easier to make because they have the same options as us.

Nobody cares how a millionaire acquired a Lamborghini unless it's entertaining. Education works now. Real counsel from average people is replicable.

Many individuals don't appreciate how false influencers seem (unreal bodies and excessive surgery and retouching) since it makes them feel uneasy.

That's why body-positive advertisements have been so effective, but they've lost ground in places like Tiktok, where the audience wants more content from everyday people than influencers living amazing lives. More people will relate to your content if you appear genuine.

Last thoughts

Influencers are dwindling. People want more real people to give real advice and demonstrate an ordinary life.

People will enjoy anything you tell about your daily life as long as you provide value, and you can build a following rapidly if you're honest.

This is a millionaire industry that is getting more expensive and will go with what works, so stand out immediately.

Aaron Dinin, PhD

3 years ago

I'll Never Forget the Day a Venture Capitalist Made Me Feel Like a Dunce

Are you an idiot at fundraising?

Humans undervalue what they don't grasp. Consider NASCAR. How is that a sport? ask uneducated observers. Circular traffic. Driving near a car's physical limits is different from daily driving. When driving at 200 mph, seemingly simple things like changing gas weight or asphalt temperature might be life-or-death.

Venture investors do something similar in entrepreneurship. Most entrepreneurs don't realize how complex venture finance is.

In my early startup days, I didn't comprehend venture capital's intricacy. I thought VCs were rich folks looking for the next Mark Zuckerberg. I was meant to be a sleek, enthusiastic young entrepreneur who could razzle-dazzle investors.

Finally, one of the VCs I was trying to woo set me straight. He insulted me.

How I learned that I was approaching the wrong investor

I was constructing a consumer-facing, pre-revenue marketplace firm. I looked for investors in my old university's alumni database. My city had one. After some research, I learned he was a partner at a growth-stage, energy-focused VC company with billions under management.

Billions? I thought. Surely he can write a million-dollar cheque. He'd hardly notice.

I emailed the VC about our shared alumni status, explaining that I was building a startup in the area and wanted advice. When he agreed to meet the next week, I prepared my pitch deck.

First error.

The meeting seemed like a funding request. Imagine the awkwardness.

His assistant walked me to the firm's conference room and told me her boss was running late. While waiting, I prepared my pitch. I connected my computer to the projector, queued up my PowerPoint slides, and waited for the VC.

He didn't say hello or apologize when he entered a few minutes later. What are you doing?

Hi! I said, Confused but confident. Dinin Aaron. My startup's pitch.

Who? Suspicious, he replied. Your email says otherwise. You wanted help.

I said, "Isn't that a euphemism for contacting investors?" Fundraising I figured I should pitch you.

As he sat down, he smiled and said, "Put away your computer." You need to study venture capital.

Recognizing the business aspects of venture capital

The VC taught me venture capital in an hour. Young entrepreneur me needed this lesson. I assume you need it, so I'm sharing it.

Most people view venture money from an entrepreneur's perspective, he said. They envision a world where venture capital serves entrepreneurs and startups.

As my VC indicated, VCs perceive their work differently. Venture investors don't serve entrepreneurs. Instead, they run businesses. Their product doesn't look like most products. Instead, the VCs you're proposing have recognized an undervalued market segment. By investing in undervalued companies, they hope to profit. It's their investment thesis.

Your company doesn't fit my investment thesis, the venture capitalist told me. Your pitch won't beat my investing theory. I invest in multimillion-dollar clean energy companies. Asking me to invest in you is like ordering a breakfast burrito at a fancy steakhouse. They could, but why? They don't do that.

Yeah, I’m not a fine steak yet, I laughed, feeling like a fool for pitching a growth-stage VC used to looking at energy businesses with millions in revenues on my pre-revenue, consumer startup.

He stressed that it's not necessary. There are investors targeting your company. Not me. Find investors and pitch them.

Remember this when fundraising. Your investors aren't philanthropists who want to help entrepreneurs realize their company goals. Venture capital is a sophisticated investment strategy, and VC firm managers are industry experts. They're looking for companies that meet their investment criteria. As a young entrepreneur, I didn't grasp this, which is why I struggled to raise money. In retrospect, I probably seemed like an idiot. Hopefully, you won't after reading this.

Dr Mehmet Yildiz

3 years ago

How I train my brain daily for clarity and productivity.

I use a conceptual and practical system I developed decades ago as an example.

Since childhood, I've been interested in the brain-mind connection, so I developed a system using scientific breakthroughs, experiments, and the experiences of successful people in my circles.

This story provides a high-level overview of a custom system to inform and inspire readers. Creating a mind gym was one of my best personal and professional investments.

Such a complex system may not be possible for everyone or appear luxurious at first. However, the process and approach may help you find more accessible and viable solutions.

Visualizing the brain as a muscle, I learned to stimulate it with physical and mental exercises, applying a new mindset and behavioral changes.

My methods and practices may not work for others because we're all different. I focus on the approach's principles and highlights so you can create your own program.

Some create a conceptual and practical system intuitively, and others intellectually. Both worked. I see intellect and intuition as higher selves.

The mental tools I introduce are based on lifestyle changes and can be personalized by anyone, barring physical constraints or underlying health conditions.

Some people can't meditate despite wanting to due to mental constraints. This story lacks exceptions.

People's systems may vary. Many have used my tools successfully. All have scientific backing because their benefits attracted scientists. None are unethical or controversial.

My focus is cognition, which is the neocortex's ability. These practices and tools can affect the limbic and reptilian brain regions.

A previous article discussed brain health's biological aspects. This article focuses on psychology.

Thinking, learning, and remembering are cognitive abilities. Cognitive abilities determine our health and performance.

Cognitive health is the ability to think, concentrate, learn, and remember. Cognitive performance boosting involves various tools and processes. My system and protocols address cognitive health and performance.

As a biological organ, the brain's abilities decline with age, especially if not used regularly. Older people have more neurodegenerative disorders like dementia.

As aging is inevitable, I focus on creating cognitive reserves to remain mentally functional as we age and face mental decline or cognitive impairment.

My protocols focus on neurogenesis, or brain growth and maintenance. Neurons and connections can grow at any age.

Metacognition refers to knowing our cognitive abilities, like thinking about thinking and learning how to learn.

In the following sections, I provide an overview of my system, mental tools, and protocols.

This system summarizes my 50-year career. Some may find it too abstract, so I give examples.

First, explain the system. Section 2 introduces activities. Third, how to measure and maintain mental growth.

1 — Developed a practical mental gym.

The mental gym is a metaphor for the physical fitness gym to improve our mental muscles.

This concept covers brain and mind functionality. Integrated biological and psychological components.

I'll describe my mental gym so my other points make sense. My mental gym has physical and mental tools.

Mindfulness, meditation, visualization, self-conversations, breathing exercises, expressive writing, working in a flow state, reading, music, dance, isometric training, barefoot walking, cold/heat exposure, CBT, and social engagements are regular tools.

Dancing, walking, and thermogenesis are body-related tools. As the brain is part of the body and houses the mind, these tools can affect mental abilities such as attention, focus, memory, task switching, and problem-solving.

Different people may like different tools. I chose these tools based on my needs, goals, and lifestyle. They're just examples. You can choose tools that fit your goals and personality.

2 — Performed tasks regularly.

These tools gave me clarity. They became daily hobbies. Some I did alone, others with others.

Some examples: I meditate daily. Even though my overactive mind made daily meditation difficult at first, I now enjoy it. Meditation three times a day sharpens my mind.

Self-talk is used for self-therapy and creativity. Self-talk was initially difficult, but neurogenesis rewired my brain to make it a habit.

Cold showers, warm baths with Epsom salts, fasting, barefoot walks on the beach or grass, dancing, calisthenics, trampoline hopping, and breathing exercises increase my mental clarity, creativity, and productivity.

These exercises can increase BDNF, which promotes nervous system growth. They improve mental capacity and performance by increasing blood flow and brain oxygenation.

I use weekly and occasional activities like dry saunas, talking with others, and community activities.

These activities stimulate the brain and mind, improving performance and cognitive capacity.

3 — Measured progress, set growth goals.

Measuring progress helps us stay on track. Without data, it's hard to stay motivated. When we face inevitable setbacks, we may abandon our dreams.

I created a daily checklist for a spreadsheet with macros. I tracked how often and long I did each activity.

I measured my progress objectively and subjectively. In the progress spreadsheet, I noted my meditation hours and subjective feelings.

In another column, I used good, moderate, and excellent to get qualitative data. It took time and effort. Later, I started benefiting from this automated structure.

Creating a page for each activity, such as meditation, self-talk, cold showers, walking, expressive writing, personal interactions, etc., gave me empirical data I could analyze, modify, and graph to show progress.

Colored charts showed each area's strengths and weaknesses.

Strengths motivate me to continue them. Identifying weaknesses helped me improve them.

As the system matured, data recording became a habit and took less time. I saw the result immediately because I automated the charts when I entered daily data. Early time investment paid off later.

Mind Gym Benefits, Effective Use, and Progress Measuring

This concept helped me move from comfort to risk. I accept things as they are.

Turnarounds were made. I stopped feeling "Fight-Flight-Freeze" and maintained self-control.

I tamed my overactive amygdala by strengthening my brain. Stress and anxiety decreased. With these shifts, I accepted criticism and turned envy into admiration. Clarity improved.

When the cognitive part of the brain became stronger and the primitive part was tamed, managing thoughts and emotions became easier. My AQ increased. I learned to tolerate people, physical, mental, and emotional obstacles.

Accessing vast information sources in my subconscious mind through an improved RAS allowed me to easily tap into my higher self and recognize flaws in my lower self.

Summary

The brain loves patterns and routines, so habits help. Observing, developing, and monitoring habits mindfully can be beneficial. Mindfulness helps us achieve this goal systematically.

As body and mind are connected, we must consider both when building habits. Consistent and joyful practices can strengthen neurons and neural connections.

Habits help us accomplish more with less effort. Regularly using mental tools and processes can improve our cognitive health and performance as we age.

Creating daily habits to improve cognitive abilities can sharpen our minds and boost our well-being.

Some apps monitor our activities and behavior to help build habits. If you can't replicate my system, try these apps. Some smartwatches and fitness devices include them.

Set aside time each day for mental activities you enjoy. Regular scheduling and practice can strengthen brain regions and form habits. Once you form habits, tasks become easy.

Improving our minds is a lifelong journey. It's easier and more sustainable to increase our efforts daily, weekly, monthly, or annually.

Despite life's ups and downs, many want to remain calm and cheerful.

This valuable skill is unrelated to wealth or fame. It's about our mindset, fueled by our biological and psychological needs.

Here are some lessons I've learned about staying calm and composed despite challenges and setbacks.

1 — Tranquillity starts with observing thoughts and feelings.

2 — Clear the mental clutter and emotional entanglements with conscious breathing and gentle movements.

3 — Accept situations and events as they are with no resistance.

4 — Self-love can lead to loving others and increasing compassion.

5 — Count your blessings and cultivate gratitude.

Clear thinking can bring joy and satisfaction. It's a privilege to wake up with a healthy body and clear mind, ready to connect with others and serve them.

Thank you for reading my perspectives. I wish you a healthy and happy life.