More on Entrepreneurship/Creators

Tim Denning

3 years ago

Bills are paid by your 9 to 5. 6 through 12 help you build money.

40 years pass. After 14 years of retirement, you die. Am I the only one who sees the problem?

I’m the Jedi master of escaping the rat race.

Not to impress. I know this works since I've tried it. Quitting a job to make money online is worse than Kim Kardashian's internet-burning advice.

Let me help you rethink the move from a career to online income to f*ck you money.

To understand why a job is a joke, do some life math.

Without a solid why, nothing makes sense.

The retirement age is 65. Our processed food consumption could shorten our 79-year average lifespan.

You spend 40 years working.

After 14 years of retirement, you die.

Am I alone in seeing the problem?

Life is too short to work a job forever, especially since most people hate theirs. After-hours skills are vital.

Money equals unrestricted power, f*ck you.

F*ck you money is the answer.

Jack Raines said it first. He says we can do anything with the money. Jack, a young rebel straight out of college, can travel and try new foods.

F*ck you money signifies not checking your bank account before buying.

F*ck you” money is pure, unadulterated freedom with no strings attached.

Jack claims you're rich when you rarely think about money.

Avoid confusion.

This doesn't imply you can buy a Lamborghini. It indicates your costs, income, lifestyle, and bank account are balanced.

Jack established an online portfolio while working for UPS in Atlanta, Georgia. So he gained boundless power.

The portion that many erroneously believe

Yes, you need internet abilities to make money, but they're not different from 9-5 talents.

Sahil Lavingia, Gumroad's creator, explains.

A job is a way to get paid to learn.

Mistreat your boss 9-5. Drain his skills. Defuse him. Love and leave him (eventually).

Find another employment if yours is hazardous. Pick an easy job. Make sure nothing sneaks into your 6-12 time slot.

The dumb game that makes you a sheep

A 9-5 job requires many job interviews throughout life.

You email your résumé to employers and apply for jobs through advertisements. This game makes you a sheep.

You're competing globally. Work-from-home makes the competition tougher. If you're not the cheapest, employers won't hire you.

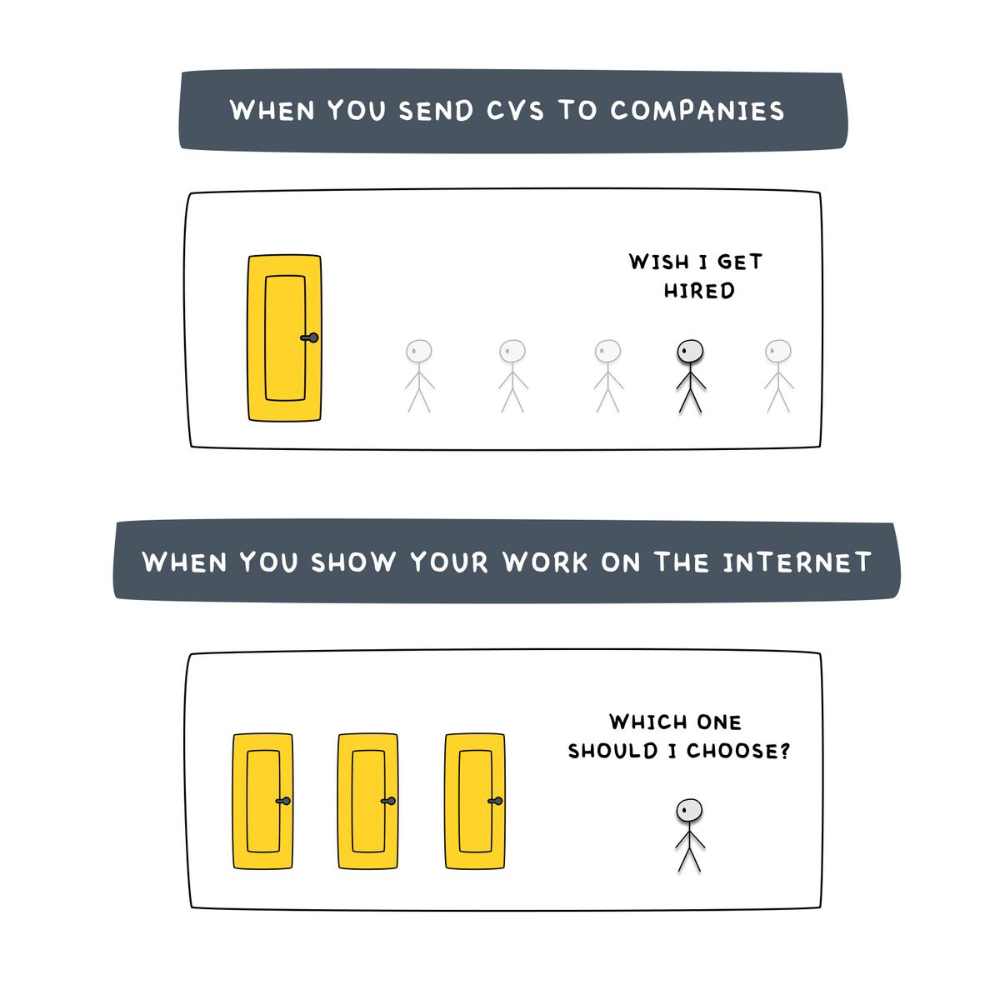

After-hours online talents (say, 6 pm-12 pm) change the game. This graphic explains it better:

Online talents boost after-hours opportunities.

You go from wanting to be picked to picking yourself. More chances equal more money. Your f*ck you fund gets the extra cash.

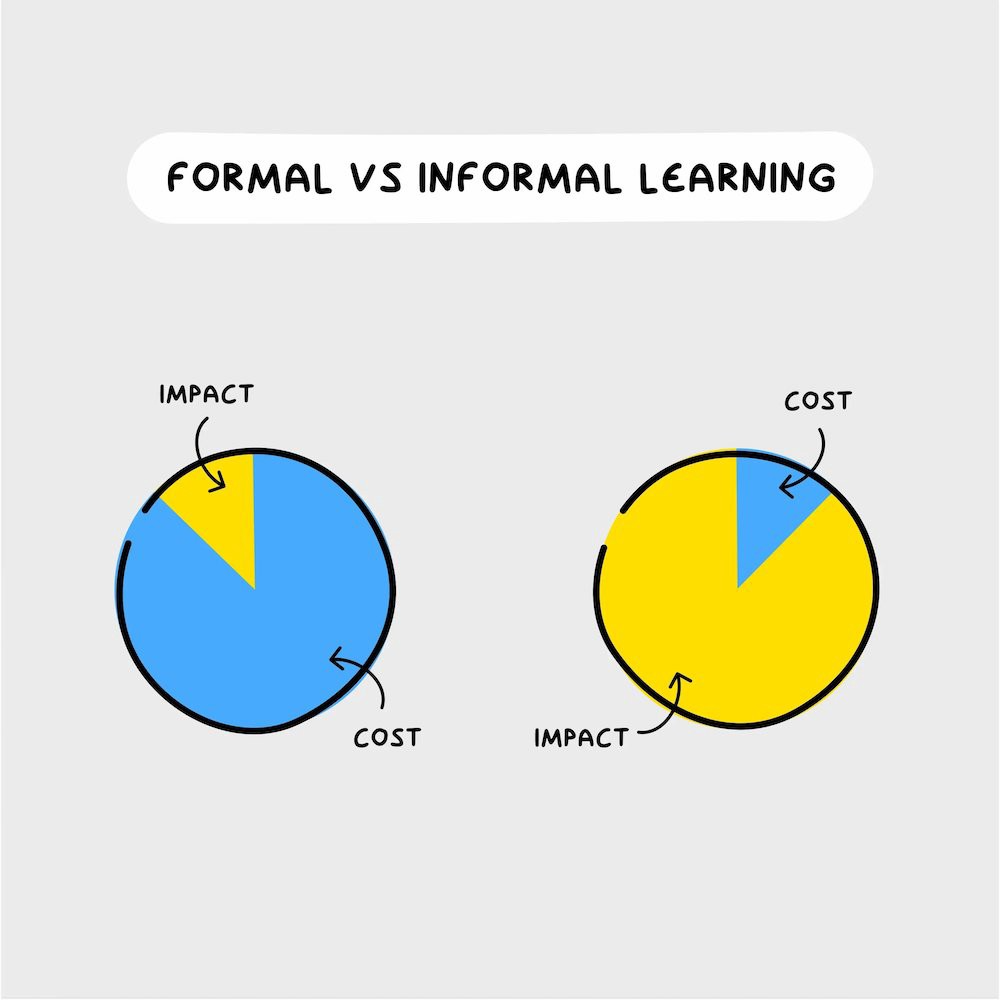

A novel method of learning is essential.

College costs six figures and takes a lifetime to repay.

Informal learning is distinct. 6-12pm:

Observe the carefully controlled Twitter newsfeed.

Make use of Teachable and Gumroad's online courses.

Watch instructional YouTube videos

Look through the top Substack newsletters.

Informal learning is more effective because it's not obvious. It's fun to follow your curiosity and hobbies.

The majority of people lack one attitude. It's simple to learn.

One big impediment stands in the way of f*ck you money and time independence. So often.

Too many people plan after 6-12 hours. Dreaming. Big-thinkers. Strategically. They fill their calendar with meetings.

This is after-hours masturb*tion.

Sahil Bloom reminded me that a bias towards action will determine if this approach works for you.

The key isn't knowing what to do from 6-12 a.m. Trust yourself and develop abilities as you go. It's for building the parachute after you jump.

Sounds risky. We've eliminated the risk by finishing this process after hours while you work 9-5.

With no risk, you can have an I-don't-care attitude and still be successful.

When you choose to move forward, this occurs.

Once you try 9-5/6-12, you'll tell someone.

It's bad.

Few of us hang out with problem-solvers.

It's how much of society operates. So they make reasons so they can feel better about not giving you money.

Matthew Kobach told me chasing f*ck you money is easier with like-minded folks.

Without f*ck you money friends, loneliness will take over and you'll think you've messed up when you just need to keep going.

Steal this easy guideline

Let's act. No more fluffing and caressing.

1. Learn

If you detest your 9-5 talents or don't think they'll work online, get new ones. If you're skilled enough, continue.

Easlo recommends these skills:

Designer for Figma

Designer Canva

bubble creators

editor in Photoshop

Automation consultant for Zapier

Designer of Webflow

video editor Adobe

Ghostwriter for Twitter

Idea consultant

Artist in Blender Studio

2. Develop the ability

Every night from 6-12, apply the skill.

Practicing ghostwriting? Write someone's tweets for free. Do someone's website copy to learn copywriting. Get a website to the top of Google for a keyword to understand SEO.

Free practice is crucial. Your 9-5 pays the money, so work for free.

3. Take off stealthily like a badass

Another mistake. Sell to few. Don't be the best. Don't claim expertise.

Sell your new expertise to others behind you.

Two ways:

Using a digital good

By providing a service,

Point 1 also includes digital service examples. Digital products include eBooks, communities, courses, ad-supported podcasts, and templates. It's easy. Your 9-5 job involves one of these.

Take ideas from work.

Why? They'll steal your time for profit.

4. Iterate while feeling awful

First-time launches always fail. You'll feel terrible. Okay. Remember your 9-5?

Find improvements. Ask free and paying consumers what worked.

Multiple relaunches, each 1% better.

5. Discover more

Never stop learning. Improve your skill. Add a relevant skill. Learn copywriting if you write online.

After-hours students earn the most.

6. Continue

Repetition is key.

7. Make this one small change.

Consistently. The 6-12 momentum won't make you rich in 30 days; that's success p*rn.

Consistency helps wage slaves become f*ck you money. Most people can't switch between the two.

Putting everything together

It's easy. You're probably already doing some.

This formula explains why, how, and what to do. It's a 5th-grade-friendly blueprint. Good.

Reduce financial risk with your 9-to-5. Replace Netflix with 6-12 money-making talents.

Life is short; do whatever you want. Today.

Vanessa Karel

3 years ago

10 hard lessons from founding a startup.

Here is the ugly stuff, read this if you have a founder in your life or are trying to become one. Your call.

#1 You'll try to talk yourself to sleep, but it won't always work.

As founders, we're all driven. Good and bad, you're restless. Success requires resistance and discipline. Your startup will be on your mind 24/7, and not everyone will have the patience to listen to your worries, ideas, and coffee runs. You become more self-sufficient than ever before.

#2 No one will understand what you're going through unless they've been a founder.

Some of my closest friends don't understand the work that goes into starting a business, and we can't blame them.

#3 You'll feel alienated.

Your problems aren't common; calling your bestie won't help. You must search hard for the right resources. It alienates you from conversations you no longer relate to. (No 4th of July, no long weekends!)

#4 Since you're your "own boss," people assume you have lots of free time.

Do you agree? I was on a webinar with lots of new entrepreneurs, and one woman said, "I started my own business so I could have more time for myself." This may be true for some lucky people, and you can be flexible with your schedule. If you want your business to succeed, you'll probably be its slave for a while.

#5 No time for illness or family emergencies.

Both last month. Oh, no! Physically and emotionally withdrawing at the worst times will give you perspective. I learned this the hard way because I was too stubborn to postpone an important interview. I thought if I rested all day and only took one call, I'd be fine. Nope. I had a fever and my mind wasn't as sharp, so my performance and audience interaction suffered. Nope. Better to delay than miss out.

Oh, and setting a "OoO" makes you cringe.

#6 Good luck with your mental health, perfectionists.

When building a startup, it's difficult to accept that there won't be enough time to do everything. You can't make them all, not perfectly. You must learn to accept things that are done but not perfect.

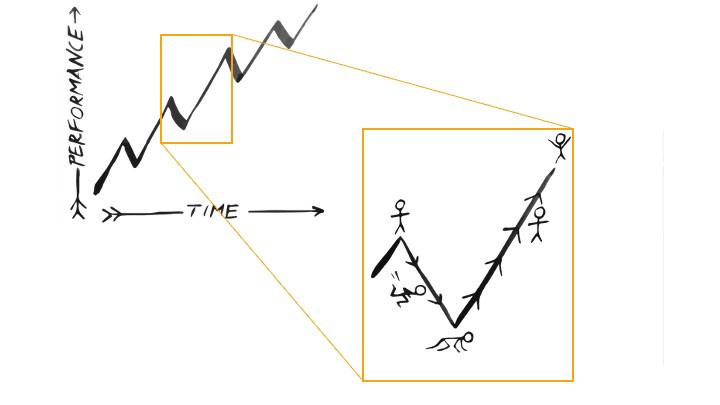

#7 As a founder, you'll make mistakes, but you'll want to make them quickly so you can learn.

Hard lessons are learned quicker. You'll need to pivot and try new things often; some won't work, and it's best to discover them sooner rather than later.

#8 Pyramid schemes abound.

I didn't realize how bad it was until I started a company. You must spy and constantly research. As a founder, you'll receive many emails from people claiming to "support" you. Be wary and keep your eyes open. When it's too good to be true. Some "companies" will try to get you to pay for "competitions" to "pitch at events." Don't do it.

#9 Keep your competitor research to a minimum.

Actually, competition is good. It means there's a market for those solutions. However, this can be mentally exhausting too. Learn about their geography and updates, but that's it.

#10 You'll feel guilty taking vacation.

I don't know what to say, but I no longer enjoy watching TV, and that's okay. Pay attention to things that enrich you, bring you joy, and have fun. It boosts creativity.

Being a startup founder may be one of the hardest professional challenges you face, but it's also a great learning experience. Your passion will take you places you never imagined and open doors to opportunities you wouldn't have otherwise. You'll meet amazing people. No regrets, no complaints. It's a roller coaster, but the good days are great.

Miss anything? Comment below

Jerry Keszka

3 years ago

10 Crazy Useful Free Websites No One Told You About But You Needed

The internet is a massive information resource. With so much stuff, it's easy to forget about useful websites. Here are five essential websites you may not have known about.

1. Companies.tools

Companies.tools are what successful startups employ. This website offers a curated selection of design, research, coding, support, and feedback resources. Ct has the latest app development platform and greatest client feedback method.

2. Excel Formula Bot

Excel Formula Bot can help if you forget a formula. Formula Bot uses AI to convert text instructions into Excel formulas, so you don't have to remember them.

Just tell the Bot what to do, and it will do it. Excel Formula Bot can calculate sales tax and vacation days. When you're stuck, let the Bot help.

3.TypeLit

TypeLit helps you improve your typing abilities while reading great literature.

TypeLit.io lets you type any book or dozens of preset classics. TypeLit provides real-time feedback on accuracy and speed.

Goals and progress can be tracked. Why not improve your typing and learn great literature with TypeLit?

4. Calm Schedule

Finding a meeting time that works for everyone is difficult. Personal and business calendars might be difficult to coordinate.

Synchronize your two calendars to save time and avoid problems. You may avoid searching through many calendars for conflicts and keep your personal information secret. Having one source of truth for personal and work occasions will help you never miss another appointment.

https://calmcalendar.com/

5. myNoise

myNoise makes the outside world quieter. myNoise is the right noise for a noisy office or busy street.

If you can't locate the right noise, make it. MyNoise unlocks the world. Shut out distractions. Thank your ears.

6. Synthesia

Professional videos require directors, filmmakers, editors, and animators. Now, thanks to AI, you can generate high-quality videos without video editing experience.

AI avatars are crucial. You can design a personalized avatar using a web-based software like synthesia.io. Our avatars can lip-sync in over 60 languages, so you can make worldwide videos. There's an AI avatar for every video goal.

Not free. Amazing service, though.

7. Cleaning-up-images

Have you shot a wonderful photo just to notice something in the background? You may have a beautiful headshot but wish to erase an imperfection.

Cleanup.pictures removes undesirable objects from photos. Our algorithms will eliminate the selected object.

Cleanup.pictures can help you obtain the ideal shot every time. Next time you take images, let Cleanup.pictures fix any flaws.

8. PDF24 Tools

Editing a PDF can be a pain. Most of us don't know Adobe Acrobat's functionalities. Why buy something you'll rarely use? Better options exist.

PDF24 is an online PDF editor that's free and subscription-free. Rotate, merge, split, compress, and convert PDFs in your browser. PDF24 makes document signing easy.

Upload your document, sign it (or generate a digital signature), and download it. It's easy and free. PDF24 is a free alternative to pricey PDF editing software.

9. Class Central

Finding online classes is much easier. Class Central has classes from Harvard, Stanford, Coursera, Udemy, and Google, Amazon, etc. in one spot.

Whether you want to acquire a new skill or increase your knowledge, you'll find something. New courses bring variety.

10. Rome2rio

Foreign travel offers countless transport alternatives. How do you get from A to B? It’s easy!

Rome2rio will show you the best method to get there, including which mode of transport is ideal.

Plane

Car

Train

Bus

Ferry

Driving

Shared bikes

Walking

Do you know any free, useful websites?

You might also like

Sara_Mednick

3 years ago

Since I'm a scientist, I oppose biohacking

Understanding your own energy depletion and restoration is how to truly optimize

Hack has meant many bad things for centuries. In the 1800s, a hack was a meager horse used to transport goods.

Modern usage describes a butcher or ax murderer's cleaver chop. The 1980s programming boom distinguished elegant code from "hacks". Both got you to your goal, but the latter made any programmer cringe and mutter about changing the code. From this emerged the hacker trope, the friendless anti-villain living in a murky hovel lit by the computer monitor, eating junk food and breaking into databases to highlight security system failures or steal hotdog money.

Now, start-a-billion-dollar-business-from-your-garage types have shifted their sights from app development to DIY biology, coining the term "bio-hack". This is a required keyword and meta tag for every fitness-related podcast, book, conference, app, or device.

Bio-hacking involves bypassing your body and mind's security systems to achieve a goal. Many biohackers' initial goals were reasonable, like lowering blood pressure and weight. Encouraged by their own progress, self-determination, and seemingly exquisite control of their biology, they aimed to outsmart aging and death to live 180 to 1000 years (summarized well in this vox.com article).

With this grandiose north star, the hunt for novel supplements and genetic engineering began.

Companies selling do-it-yourself biological manipulations cite lab studies in mice as proof of their safety and success in reversing age-related diseases or promoting longevity in humans (the goal changes depending on whether a company is talking to the federal government or private donors).

The FDA is slower than science, they say. Why not alter your biochemistry by buying pills online, editing your DNA with a CRISPR kit, or using a sauna delivered to your home? How about a microchip or electrical stimulator?

What could go wrong?

I'm not the neo-police, making citizen's arrests every time someone introduces a new plumbing gadget or extrapolates from animal research on resveratrol or catechins that we should drink more red wine or eat more chocolate. As a scientist who's spent her career asking, "Can we get better?" I've come to view bio-hacking as misguided, profit-driven, and counterproductive to its followers' goals.

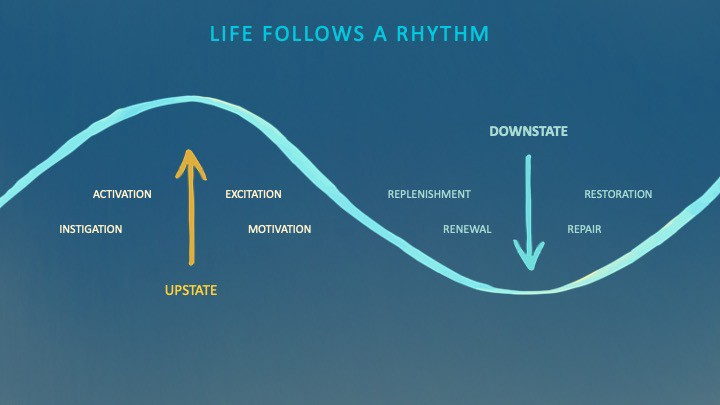

We're creatures of nature. Despite all the new gadgets and bio-hacks, we still use Roman plumbing technology, and the best way to stay fit, sharp, and happy is to follow a recipe passed down since the beginning of time. Bacteria, plants, and all natural beings are rhythmic, with alternating periods of high activity and dormancy, whether measured in seconds, hours, days, or seasons. Nature repeats successful patterns.

During the Upstate, every cell in your body is naturally primed and pumped full of glycogen and ATP (your cells' energy currencies), as well as cortisol, which supports your muscles, heart, metabolism, cognitive prowess, emotional regulation, and general "get 'er done" attitude. This big energy release depletes your batteries and requires the Downstate, when your subsystems recharge at the cellular level.

Downstates are when you give your heart a break from pumping nutrient-rich blood through your body; when you give your metabolism a break from inflammation, oxidative stress, and sympathetic arousal caused by eating fast food — or just eating too fast; or when you give your mind a chance to wander, think bigger thoughts, and come up with new creative solutions. When you're responding to notifications, emails, and fires, you can't relax.

Downstates aren't just for consistently recharging your battery. By spending time in the Downstate, your body and brain get extra energy and nutrients, allowing you to grow smarter, faster, stronger, and more self-regulated. This state supports half-marathon training, exam prep, and mediation. As we age, spending more time in the Downstate is key to mental and physical health, well-being, and longevity.

When you prioritize energy-demanding activities during Upstate periods and energy-replenishing activities during Downstate periods, all your subsystems, including cardiovascular, metabolic, muscular, cognitive, and emotional, hum along at their optimal settings. When you synchronize the Upstates and Downstates of these individual rhythms, their functioning improves. A hard workout causes autonomic stress, which triggers Downstate recovery.

By choosing the right timing and type of exercise during the day, you can ensure a deeper recovery and greater readiness for the next workout by working with your natural rhythms and strengthening your autonomic and sleep Downstates.

Morning cardio workouts increase deep sleep compared to afternoon workouts. Timing and type of meals determine when your sleep hormone melatonin is released, ushering in sleep.

Rhythm isn't a hack. It's not a way to cheat the system or the boss. Nature has honed its optimization wisdom over trillions of days and nights. Stop looking for quick fixes. You're a whole system made of smaller subsystems that must work together to function well. No one pill or subsystem will make it all work. Understanding and coordinating your rhythms is free, easy, and only benefits you.

Dr. Sara C. Mednick is a cognitive neuroscientist at UC Irvine and author of The Power of the Downstate (HachetteGO)

Maria Stepanova

3 years ago

How Elon Musk Picks Things Up Quicker Than Anyone Else

Adopt Elon Musk's learning strategy to succeed.

Medium writers rank first and second when you Google “Elon Musk's learning approach”.

My article idea seems unoriginal. Lol

Musk is brilliant.

No doubt here.

His name connotes success and intelligence.

He knows rocket science, engineering, AI, and solar power.

Musk is a Unicorn, but his skills aren't special.

How does he manage it?

Elon Musk has two learning rules that anyone may use.

You can apply these rules and become anyone you want.

You can become a rocket scientist or a surgeon. If you want, of course.

The learning process is key.

Make sure you are creating a Tree of Knowledge according to Rule #1.

Musk told Reddit how he learns:

“It is important to view knowledge as sort of a semantic tree — make sure you understand the fundamental principles, i.e. the trunk and big branches, before you get into the leaves/details or there is nothing for them to hang onto.”

Musk understands the essential ideas and mental models of each of his business sectors.

He starts with the tree's trunk, making sure he learns the basics before going on to branches and leaves.

We often act otherwise. We memorize small details without understanding how they relate to the whole. Our minds are stuffed with useless data.

Cramming isn't learning.

Start with the basics to learn faster. Before diving into minutiae, grasp the big picture.

Rule #2: You can't connect what you can't remember.

Elon Musk transformed industries this way. As his expertise grew, he connected branches and leaves from different trees.

Musk read two books a day as a child. He didn't specialize like most people. He gained from his multidisciplinary education. It helped him stand out and develop billion-dollar firms.

He gained skills in several domains and began connecting them. World-class performances resulted.

Most of us never learn the basics and only collect knowledge. We never really comprehend information, thus it's hard to apply it.

Learn the basics initially to maximize your chances of success. Then start learning.

Learn across fields and connect them.

This method enabled Elon Musk to enter and revolutionize a century-old industry.

Neeramitra Reddy

3 years ago

The best life advice I've ever heard could very well come from 50 Cent.

He built a $40M hip-hop empire from street drug dealing.

50 Cent was nearly killed by 9mm bullets.

Before 50 Cent, Curtis Jackson sold drugs.

He sold coke to worried addicts after being orphaned at 8.

Pursuing police. Murderous hustlers and gangs. Unwitting informers.

Despite his hard life, his hip-hop career was a success.

An assassination attempt ended his career at the start.

What sane producer would want to deal with a man entrenched in crime?

Most would have drowned in self-pity and drank themselves to death.

But 50 Cent isn't most people. Life on the streets had given him fearlessness.

“Having a brush with death, or being reminded in a dramatic way of the shortness of our lives, can have a positive, therapeutic effect. So it is best to make every moment count, to have a sense of urgency about life.” ― 50 Cent, The 50th Law

50 released a series of mixtapes that caught Eminem's attention and earned him a $50 million deal!

50 Cents turned death into life.

Things happen; that is life.

We want problems solved.

Every human has problems, whether it's Jeff Bezos swimming in his billions, Obama in his comfortable retirement home, or Dan Bilzerian with his hired bikini models.

All problems.

Problems churn through life. solve one, another appears.

It's harsh. Life's unfair. We can face reality or run from it.

The latter will worsen your issues.

“The firmer your grasp on reality, the more power you will have to alter it for your purposes.” — 50 Cent, The 50th Law

In a fantasy-obsessed world, 50 Cent loves reality.

Wish for better problem-solving skills rather than problem-free living.

Don't wish, work.

We All Have the True Power of Alchemy

Humans are arrogant enough to think the universe cares about them.

That things happen as if the universe notices our nanosecond existences.

Things simply happen. Period.

By changing our perspective, we can turn good things bad.

The alchemists' search for the philosopher's stone may have symbolized the ability to turn our lead-like perceptions into gold.

Negativity bias tints our perceptions.

Normal sparring broke your elbow? Rest and rethink your training. Fired? You can improve your skills and get a better job.

Consider Curtis if he had fallen into despair.

The legend we call 50 Cent wouldn’t have existed.

The Best Lesson in Life Ever?

Neither avoid nor fear your reality.

That simple sentence contains every self-help tip and life lesson on Earth.

When reality is all there is, why fear it? avoidance?

Or worse, fleeing?

To accept reality, we must eliminate the words should be, could be, wish it were, and hope it will be.

It is. Period.

Only by accepting reality's chaos can you shape your life.

“Behind me is infinite power. Before me is endless possibility, around me is boundless opportunity. My strength is mental, physical and spiritual.” — 50 Cent