More on Society & Culture

Julie Plavnik

3 years ago

Why the Creator Economy needs a Web3 upgrade

Looking back into the past can help you understand what's happening today and why.

"Creator economy" conjures up images of originality, sincerity, and passion. Where do Michelangelos and da Vincis push advancement with their gifts without battling for bread and proving themselves posthumously?

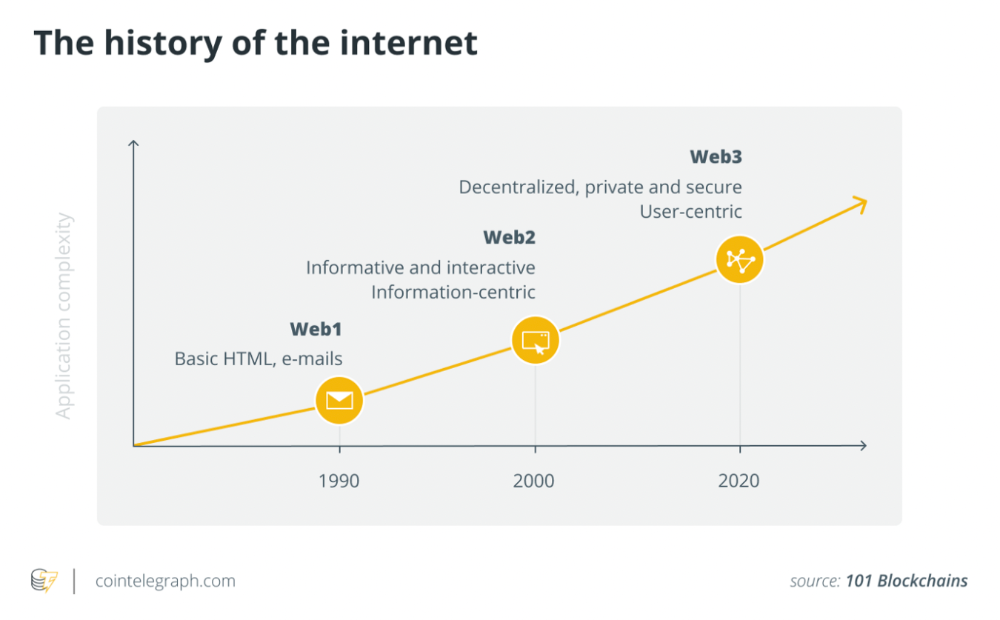

Creativity has been as long as humanity, but it's just recently become a new economic paradigm. We even talk about Web3 now.

Let's examine the creative economy's history to better comprehend it. What brought us here? Looking back can help you understand what's happening now.

No yawning, I promise 😉.

Creator Economy's history

Long, uneven transition to creator economy. Let's examine the economic and societal changes that led us there.

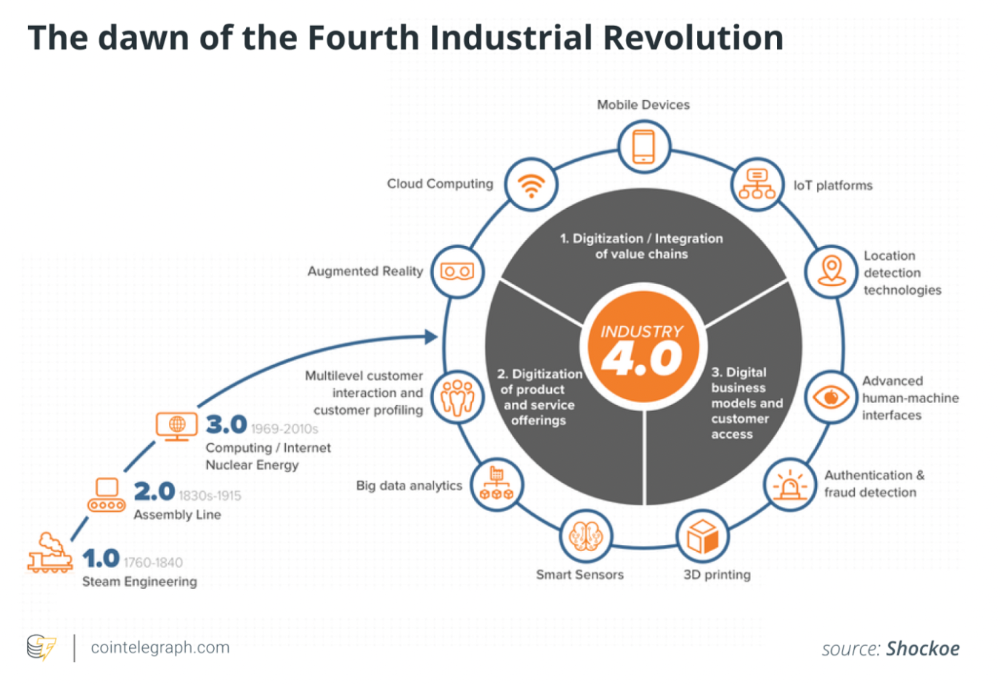

1. Agriculture to industry

Mid-18th-century Industrial Revolution led to shift from agriculture to manufacturing. The industrial economy lasted until World War II.

The industrial economy's principal goal was to provide more affordable, accessible commodities.

Unlike today, products were scarce and inaccessible.

To fulfill its goals, industrialization triggered enormous economic changes, moving power from agrarians to manufacturers. Industrialization brought hard work, rivalry, and new ideas connected to production and automation. Creative thinkers focused on that then.

It doesn't mean music, poetry, or painting had no place back then. They weren't top priority. Artists were independent. The creative field wasn't considered a different economic subdivision.

2. The consumer economy

Manufacturers produced more things than consumers desired after World War II. Stuff was no longer scarce.

The economy must make customers want to buy what the market offers.

The consumer economic paradigm supplanted the industrial one. Customers (or consumers) replaced producers as the new economic center.

Salesmen, marketing, and journalists also played key roles (TV, radio, newspapers, etc.). Mass media greatly boosted demand for goods, defined trends, and changed views regarding nearly everything.

Mass media also gave rise to pop culture, which focuses on mass-market creative products. Design, printing, publishing, multi-media, audio-visual, cinematographic productions, etc. supported pop culture.

The consumer paradigm generated creative occupations and activities, unlike the industrial economy. Creativity was limited by the need for wide appeal.

Most creators were corporate employees.

Creating a following and making a living from it were difficult.

Paul Saffo said that only journalists and TV workers were known. Creators who wished to be known relied on producers, publishers, and other gatekeepers. To win their favor was crucial. Luck was the best tactic.

3. The creative economy

Consumer economy was digitized in the 1990s. IT solutions transformed several economic segments. This new digital economy demanded innovative, digital creativity.

Later, states declared innovation a "valuable asset that creates money and jobs." They also introduced the "creative industries" and the "creative economy" (not creator!) and tasked themselves with supporting them. Australia and the UK were early adopters.

Individual skill, innovation, and intellectual property fueled the creative economy. Its span covered design, writing, audio, video material, etc. The creative economy required IT-powered activity.

The new challenge was to introduce innovations to most economic segments and meet demand for digital products and services.

Despite what the title "creative economy" may imply, it was primarily oriented at meeting consumer needs. It didn't provide inventors any new options to become entrepreneurs. Instead of encouraging innovators to flourish on their own, the creative economy emphasized "employment-based creativity."

4. The creator economy

Next, huge IT platforms like Google, Facebook, YouTube, and others competed with traditional mainstream media.

During the 2008 global financial crisis, these mediums surpassed traditional media. People relied on them for information, knowledge, and networking. That was a digital media revolution. The creator economy started there.

The new economic paradigm aimed to engage and convert clients. The creator economy allowed customers to engage, interact, and provide value, unlike the consumer economy. It gave them instruments to promote themselves as "products" and make money.

Writers, singers, painters, and other creators have a great way to reach fans. Instead of appeasing old-fashioned gatekeepers (producers, casting managers, publishers, etc.), they can use the platforms to express their talent and gain admirers. Barriers fell.

It's not only for pros. Everyone with a laptop and internet can now create.

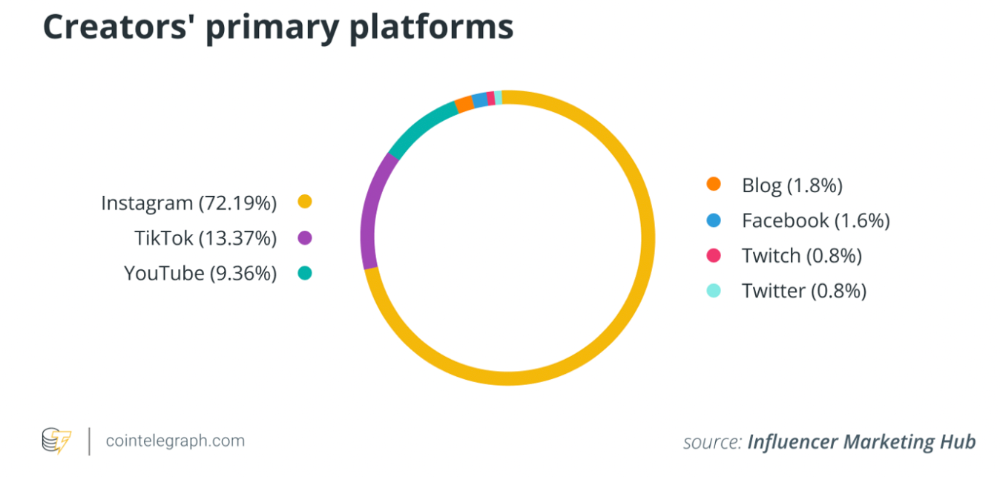

2022 creator economy:

Since there is no academic description for the current creator economy, we can freestyle.

The current (or Web2) creator economy is fueled by interactive digital platforms, marketplaces, and tools that allow users to access, produce, and monetize content.

No entry hurdles or casting in the creative economy. Sign up and follow platforms' rules. Trick: A platform's algorithm aggregates your data and tracks you. This is the payment for participation.

The platforms offer content creation, design, and ad distribution options. This is platforms' main revenue source.

The creator economy opens many avenues for creators to monetize their work. Artists can now earn money through advertising, tipping, brand sponsorship, affiliate links, streaming, and other digital marketing activities.

Even if your content isn't digital, you can utilize platforms to promote it, interact and convert your audience, and more. No limits. However, some of your income always goes to a platform (well, a huge one).

The creator economy aims to empower online entrepreneurship by offering digital marketing tools and reducing impediments.

Barriers remain. They are just different. Next articles will examine these.

Why update the creator economy for Web3?

I could address this question by listing the present creator economy's difficulties that led us to contemplate a Web3 upgrade.

I don't think these difficulties are the main cause. The mentality shift made us see these challenges and understand there was a better reality without them.

Crypto drove this thinking shift. It promoted disintermediation, independence from third-party service providers, 100% data ownership, and self-sovereignty. Crypto has changed the way we view everyday things.

Crypto's disruptive mission has migrated to other economic segments. It's now called Web3. Web3's creator economy is unique.

Here's the essence of the Web3 economy:

Eliminating middlemen between creators and fans.

100% of creators' data, brand, and effort.

Business and money-making transparency.

Authentic originality above ad-driven content.

In the next several articles, I'll explain. We'll also discuss the creator economy and Web3's remedies.

Final thoughts

The creator economy is the organic developmental stage we've reached after all these social and economic transformations.

The Web3 paradigm of the creator economy intends to allow creators to construct their own independent "open economy" and directly monetize it without a third party.

If this approach succeeds, we may enter a new era of wealth creation where producers aren't only the products. New economies will emerge.

This article is a summary. To read the full post, click here.

Liz Martin

3 years ago

What Motivated Amazon to Spend $1 Billion for The Rings of Power?

Amazon's Rings of Power is the most costly TV series ever made. This is merely a down payment towards Amazon's grand goal.

Here's a video:

Amazon bought J.R.R. Tolkien's fantasy novels for $250 million in 2017. This agreement allows Amazon to create a Tolkien series for Prime Video.

The business spent years developing and constructing a Lord of the Rings prequel. Rings of Power premiered on September 2, 2022.

It drew 25 million global viewers in 24 hours. Prime Video's biggest debut.

An Exorbitant Budget

The most expensive. First season cost $750 million to $1 billion, making it the most costly TV show ever.

Jeff Bezos has spent years looking for the next Game of Thrones, a critically and commercially successful original series. Rings of Power could help.

Why would Amazon bet $1 billion on one series?

It's Not Just About the Streaming War

It's simple to assume Amazon just wants to win. Since 2018, the corporation has been fighting Hulu, Netflix, HBO, Apple, Disney, and NBC. Each wants your money, talent, and attention. Amazon's investment goes beyond rivalry.

Subscriptions Are the Bait

Audible, Amazon Music, and Prime Video are subscription services, although the company's fundamental business is retail. Amazon's online stores contribute over 50% of company revenue. Subscription services contribute 6.8%. The company's master plan depends on these subscriptions.

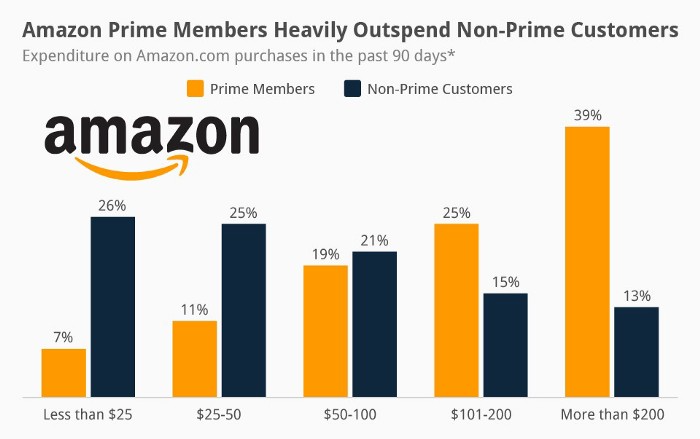

Streaming videos on Prime increases membership renewals. Free trial participants are more likely to join. Members buy twice as much as non-members.

Amazon Studios doesn't generate original programming to earn from Prime Video subscriptions. It aims to retain and attract clients.

Amazon can track what you watch and buy. Its algorithm recommends items and services. Mckinsey says you'll use more Amazon products, shop at Amazon stores, and watch Amazon entertainment.

In 2015, the firm launched the first season of The Man in the High Castle, a dystopian alternate history TV series depicting a world ruled by Nazi Germany and Japan after World War II.

This $72 million production earned two Emmys. It garnered 1.15 million new Prime users globally.

When asked about his Hollywood investment, Bezos said, "A Golden Globe helps us sell more shoes."

Selling more footwear

Amazon secured a deal with DirecTV to air Thursday Night Football in restaurants and bars. First streaming service to have exclusive NFL games.

This isn't just about Thursday night football, says media analyst Ritchie Greenfield. This sells t-shirts. This may be a ticket. Amazon does more than stream games.

The Rings of Power isn't merely a production showcase, either. This sells Tolkien's fantasy novels such Lord of the Rings, The Hobbit, and The Silmarillion.

This tiny commitment keeps you in Amazon's ecosystem.

Andy Walker

3 years ago

Why personal ambition and poor leadership caused Google layoffs

Google announced 6% layoffs recently (or 12,000 people). This aligns it with most tech companies. A publicly contrite CEO explained that they had overhired during the COVID-19 pandemic boom and had to address it, but they were sorry and took full responsibility. I thought this was "bullshit" too. Meta, Amazon, Microsoft, and others must feel similarly. I spent 10 years at Google, and these things don't reflect well on the company's leaders.

All publicly listed companies have a fiduciary duty to act in the best interests of their shareholders. Dodge vs. Ford Motor Company established this (1919). Henry Ford wanted to reduce shareholder payments to offer cheaper cars and better wages. Ford stated.

My ambition is to employ still more men, to spread the benefits of this industrial system to the greatest possible number, to help them build up their lives and their homes. To do this we are putting the greatest share of our profits back in the business.

The Dodge brothers, who owned 10% of Ford, opposed this and sued Ford for the payments to start their own company. They won, preventing Ford from raising prices or salaries. If you have a vocal group of shareholders with the resources to sue you, you must prove you are acting in their best interests. Companies prioritize shareholders. Giving activist investors a stick to threaten you almost enshrines short-term profit over long-term thinking.

This underpins Google's current issues. Institutional investors who can sue Google see it as a wasteful company they can exploit. That doesn't mean you have to maximize profits (thanks to those who pointed out my ignorance of US corporate law in the comments and on HN), but it allows pressure. I feel for those navigating this. This is about unrestrained capitalism.

When Google went public, Larry Page and Sergey Brin knew the risks and worked hard to keep control. In their Founders' Letter to investors, they tried to set expectations for the company's operations.

Our long-term focus as a private company has paid off. Public companies do the same. We believe outside pressures lead companies to sacrifice long-term opportunities to meet quarterly market expectations.

The company has transformed since that letter. The company has nearly 200,000 full-time employees and a trillion-dollar market cap. Large investors have bought company stock because it has been a good long-term bet. Why are they restless now?

Other big tech companies emerged and fought for top talent. This has caused rising compensation packages. Google has also grown rapidly (roughly 22,000 people hired to the end of 2022). At $300,000 median compensation, those 22,000 people added $6.6 billion in salary overheads in 2022. Exorbitant. If the company still makes $16 billion every quarter, maybe not. Investors wonder if this value has returned.

Investors are right. Google uses people wastefully. However, by bluntly reducing headcount, they're not addressing the root causes and hurting themselves. No studies show that downsizing this way boosts productivity. There is plenty of evidence that they'll lose out because people will be risk-averse and distrust their leadership.

The company's approach also stinks. Finding out that you no longer have a job because you can’t log in anymore (sometimes in cases where someone is on call for protecting your production systems) is no way to fire anyone. Being with a narcissistic sociopath is like being abused. First, you receive praise and fancy perks for making the cut. You're fired by text and ghosted. You're told to appreciate the generous severance package. This firing will devastate managers and teams. This type of firing will take years to recover self-esteem. Senior management contributed to this. They chose the expedient answer, possibly by convincing themselves they were managing risk and taking the Macbeth approach of “If it were done when ’tis done, then ’twere well It were done quickly”.

Recap. Google's leadership did a stupid thing—mass firing—in a stupid way. How do we get rid of enough people to make investors happier? and "have 6% less people." Empathetic leaders should not emulate Elon Musk. There is no humane way to fire 12,000 people, but there are better ways. Why is Google so wasteful?

Ambition answers this. There aren't enough VP positions for a group of highly motivated, ambitious, and (increasingly) ruthless people. I’ve loitered around the edges of this world and a large part of my value was to insulate my teams from ever having to experience it. It’s like Game of Thrones played out through email and calendar and over video call.

Your company must look a certain way to be promoted to director or higher. You need the right people at the right levels under you. Long-term, growing your people will naturally happen if you're working on important things. This takes time, and you're never more than 6–18 months from a reorg that could start you over. Ambitious people also tend to be impatient. So, what do you do?

Hiring and vanity projects. To shape your company, you hire at the right levels. You value vanity metrics like active users over product utility. Your promo candidates get through by subverting the promotion process. In your quest for growth, you avoid performance managing people out. You avoid confronting toxic peers because you need their support for promotion. Your cargo cult gets you there.

Its ease makes Google wasteful. Since they don't face market forces, the employees don't see it as a business. Why would you do when the ads business is so profitable? Complacency causes senior leaders to prioritize their own interests. Empires collapse. Personal ambition often trumped doing the right thing for users, the business, or employees. Leadership's ambition over business is the root cause. Vanity metrics, mass hiring, and vague promises have promoted people to VP. Google goes above and beyond to protect senior leaders.

The decision-makers and beneficiaries are not the layoffees. Stock price increase beneficiaries. The people who will post on LinkedIn how it is about misjudging the market and how they’re so sorry and take full responsibility. While accumulating wealth, the dark room dwellers decide who stays and who goes. The billionaire investors. Google should start by addressing its bloated senior management, but — as they say — turkeys don't vote for Christmas. It should examine its wastefulness and make tough choices to fix it. A 6% cut is a blunt tool that admits you're not running your business properly. why aren’t the people running the business the ones shortly to be entering the job market?

This won't fix Google's wastefulness. The executives may never regain trust after their approach. Suppressed creativity. Business won't improve. Google will have lost its founding vision and us all. Large investors know they can force Google's CEO to yield. The rich will get richer and rationalize leaving 12,000 people behind. Cycles repeat.

It doesn’t have to be this way. In 2013, Nintendo's CEO said he wouldn't fire anyone for shareholders. Switch debuted in 2017. Nintendo's stock has increased by nearly five times, or 19% a year (including the drop most of the stock market experienced last year). Google wasted 12,000 talented people. To please rich people.

You might also like

Christian Soschner

3 years ago

Steve Jobs' Secrets Revealed

From 1984 until 2011, he ran Apple using the same template.

What is a founder CEO's most crucial skill?

Presentation, communication, and sales

As a Business Angel Investor, I saw many pitch presentations and met with investors one-on-one to promote my companies.

There is always the conception of “Investors have to invest,” so there is no need to care about the presentation.

It's false. Nobody must invest. Many investors believe that entrepreneurs must convince them to invest in their business.

Sometimes — like in 2018–2022 — too much money enters the market, and everyone makes good money.

Do you recall the Buy Now, Pay Later Movement? This amazing narrative had no return potential. Only buyers who couldn't acquire financing elsewhere shopped at these companies.

Klarna's failing business concept led to high valuations.

Investors become more cautious when the economy falters. 2022 sees rising inflation, interest rates, wars, and civil instability. It's like the apocalypse's four horsemen have arrived.

Storytelling is important in rough economies.

When investors draw back, how can entrepreneurs stand out?

In Q2/2022, every study I've read said:

Investors cease investing

Deals are down in almost all IT industries from previous quarters.

What do founders need to do?

Differentiate yourself.

Storytelling talents help.

The Steve Jobs Way

Every time I watch a Steve Jobs presentation, I'm enthralled.

I'm a techie. Everything technical interests me. But, I skim most presentations.

What's Steve Jobs's secret?

Steve Jobs created Apple in 1976 and made it a profitable software and hardware firm in the 1980s. Macintosh goods couldn't beat IBM's. This mistake sacked him in 1985.

Before rejoining Apple in 1997, Steve Jobs founded Next Inc. and Pixar.

From then on, Apple became America's most valuable firm.

Steve Jobs understood people's needs. He said:

“People don’t know what they want until you show it to them. That’s why I never rely on market research. Our task is to read things that are not yet on the page.”

In his opinion, people talk about problems. A lot. Entrepreneurs must learn what the population's pressing problems are and create a solution.

Steve Jobs showed people what they needed before they realized it.

I'll explain:

Present a Big Vision

Steve Jobs starts every presentation by describing his long-term goals for Apple.

1984's Macintosh presentation set up David vs. Goliath. In a George Orwell-style dystopia, IBM computers were bad. It was 1984.

Apple will save the world, like Jedis.

Why do customers and investors like Big Vision?

People want a wider perspective, I think. Humans love improving the planet.

Apple users often cite emotional reasons for buying the brand.

Revolutionizing several industries with breakthrough inventions

Establish Authority

Everyone knows Apple in 2022. It's hard to find folks who confuse Apple with an apple around the world.

Apple wasn't as famous as it is today until Steve Jobs left in 2011.

Most entrepreneurs lack experience. They may market their company or items to folks who haven't heard of it.

Steve Jobs presented the company's historical accomplishments to overcome opposition.

In his presentation of the first iPhone, he talked about the Apple Macintosh, which altered the computing sector, and the iPod, which changed the music industry.

People who have never heard of Apple feel like they're seeing a winner. It raises expectations that the new product will be game-changing and must-have.

The Big Reveal

A pitch or product presentation always has something new.

Steve Jobs doesn't only demonstrate the product. I don't think he'd skip the major point of a company presentation.

He consistently discusses present market solutions, their faults, and a better consumer solution.

No solution exists yet.

It's a multi-faceted play:

It's comparing the new product to something familiar. This makes novelty and the product more relatable.

Describe a desirable solution.

He's funny. He demonstrated an iPod with an 80s phone dial in his iPhone presentation.

Then he reveals the new product. Macintosh presented itself.

Show the benefits

He outlines what Apple is doing differently after demonstrating the product.

How do you distinguish from others? The Big Breakthrough Presentation.

A few hundred slides might list all benefits.

Everyone would fall asleep. Have you ever had similar presentations?

When the brain is overloaded with knowledge, the limbic system changes to other duties, like lunch planning.

What should a speaker do? There's a classic proverb:

“Tell me and I forget, teach me and I may remember, involve me and I learn” (— Not Benjamin Franklin).

Steve Jobs showcased the product live.

Again, using ordinary scenarios to highlight the product's benefits makes it relatable.

The 2010 iPad Presentation uses this technique.

Invite the Team and Let Them Run the Presentation

CEOs spend most time outside the organization. Many companies elect to have only one presenter.

It sends the incorrect message to investors. Product presentations should always include the whole team.

Let me explain why.

Companies needing investment money frequently have shaky business strategies or no product-market fit or robust corporate structure.

Investors solely bet on a team's ability to implement ideas and make a profit.

Early team involvement helps investors understand the company's drivers. Travel costs are worthwhile.

But why for product presentations?

Presenters of varied ages, genders, social backgrounds, and skillsets are relatable. CEOs want relatable products.

Some customers may not believe a white man's message. A black woman's message may be more accepted.

Make the story relatable when you have the best product that solves people's concerns.

Best example: 1984 Macintosh presentation with development team panel.

What is the largest error people make when companies fail?

Saving money on the corporate and product presentation.

Invite your team to five partner meetings when five investors are shortlisted.

Rehearse the presentation till it's natural. Let the team speak.

Successful presentations require structure, rehearsal, and a team. Steve Jobs nailed it.

Pat Vieljeux

3 years ago

Your entrepreneurial experience can either be a beautiful adventure or a living hell with just one decision.

Choose.

DNA makes us distinct.

We act alike. Most people follow the same road, ignoring differences. We remain quiet about our uniqueness for fear of exclusion (family, social background, religion). We live a more or less imposed life.

Off the beaten path, we stand out from the others. We obey without realizing we're sewing a shroud. We're told to do as everyone else and spend 40 years dreaming of a golden retirement and regretting not living.

“One of the greatest regrets in life is being what others would want you to be, rather than being yourself.” - Shannon L. Alder

Others dare. Again, few are creative; most follow the example of those who establish a business for the sake of entrepreneurship. To live.

They pick a potential market and model their MVP on an existing solution. Most mimic others, alter a few things, appear to be original, and end up with bland products, adding to an already crowded market.

SaaS, PaaS, etc. followed suit. It's reduced pricing, profitability, and product lifespan.

As competitors become more aggressive, their profitability diminishes, making life horrible for them and their employees. They fail to innovate, cut costs, and close their company.

Few of them look happy and fulfilled.

How did they do it?

The answer is unsettlingly simple.

They are themselves.

They start their company, propelled at first by a passion or maybe a calling.

Then, at their own pace, they create it with the intention of resolving a dilemma.

They assess what others are doing and consider how they might improve it.

In contrast to them, they respond to it in their own way by adding a unique personal touch. Therefore, it is obvious.

Originals, like their DNA, can't be copied. Or if they are, they're poorly printed. Originals are unmatched. Artist-like. True collectors only buy Picasso paintings by the master, not forgeries, no matter how good.

Imaginative people are constantly ahead. Copycats fall behind unless they innovate. They watch their competition continuously. Their solution or product isn't sexy. They hope to cash in on their copied product by flooding the market.

They're mostly pirates. They're short-sighted, unlike creators.

Creators see further ahead and have no rivals. They use copiers to confirm a necessity. To maintain their individuality, creators avoid copying others. They find copying boring. It's boring. They oppose plagiarism.

It's thrilling and inspiring.

It will also make them more able to withstand their opponents' tension. Not to mention roadblocks. For creators, impediments are games.

Others fear it. They race against the clock and fear threats that could interrupt their momentum since they lack inventiveness and their product has a short life cycle.

Creators have time on their side. They're dedicated. Clearly. Passionate booksellers will have their own bookstore. Their passion shows in their book choices. Only the ones they love.

The copier wants to display as many as possible, including mediocre authors, and will cut costs. All this to dominate the market. They're digging their own grave.

The bookseller is just one example. I could give you tons of them.

Closing remarks

Entrepreneurs might follow others or be themselves. They risk exhaustion trying to predict what their followers will do.

It's true.

Life offers choices.

Being oneself or doing as others do, with the possibility of regretting not expressing our uniqueness and not having lived.

“Be yourself; everyone else is already taken”. Oscar Wilde

The choice is yours.

Ren & Heinrich

3 years ago

200 DeFi Projects were examined. Here is what I learned.

I analyze the top 200 DeFi crypto projects in this article.

This isn't a study. The findings benefit crypto investors.

Let’s go!

A set of data

I analyzed data from defillama.com. In my analysis, I used the top 200 DeFis by TVL in October 2022.

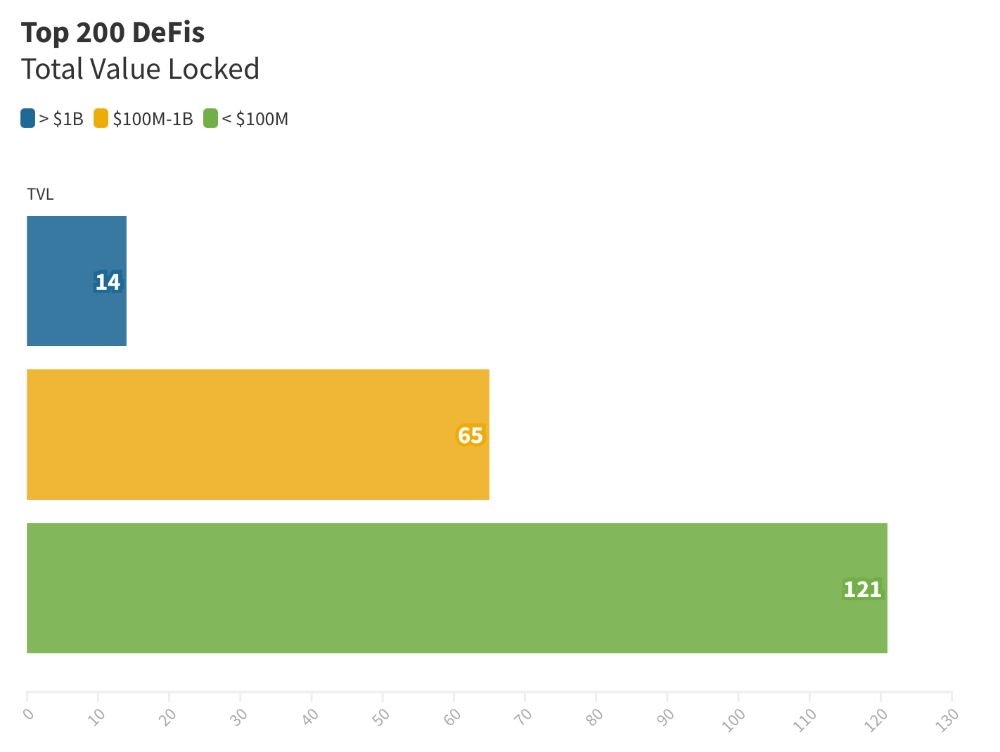

Total Locked Value

The chart below shows platform-specific locked value.

14 platforms had $1B+ TVL. 65 platforms have $100M-$1B TVL. The remaining 121 platforms had TVLs below $100 million, with the lowest being $23 million.

TVLs are distributed Pareto. Top 40% of DeFis account for 80% of TVLs.

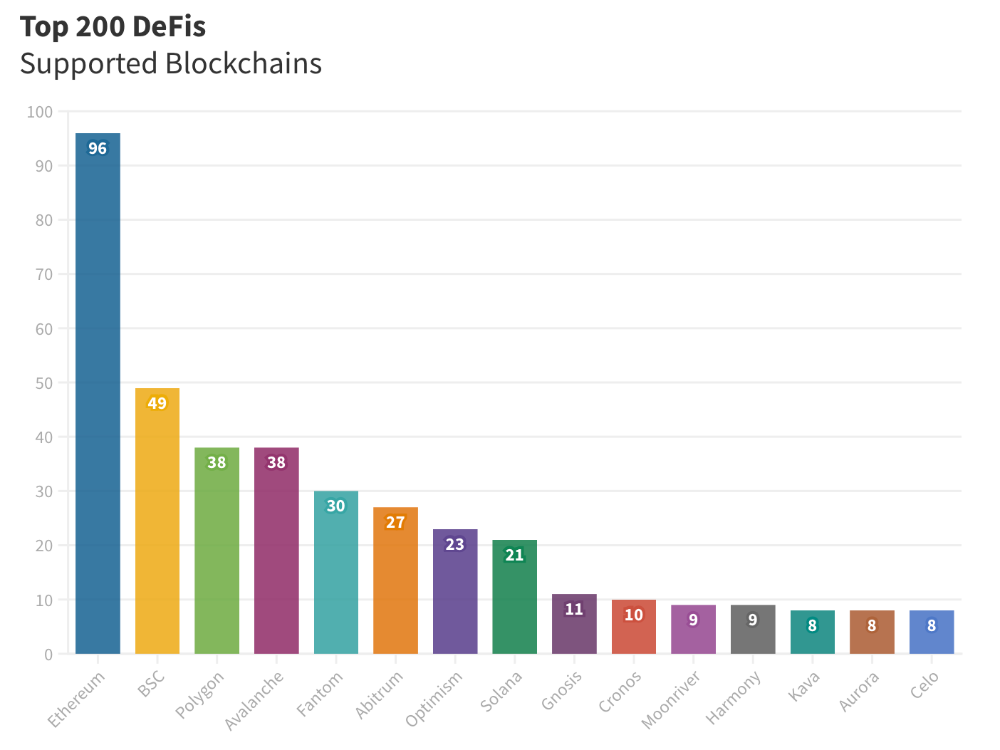

Compliant Blockchains

Ethereum's blockchain leads DeFi. 96 of the examined projects offer services on Ethereum. Behind BSC, Polygon, and Avalanche.

Five platforms used 10+ blockchains. 36 between 2-10 159 used 1 blockchain.

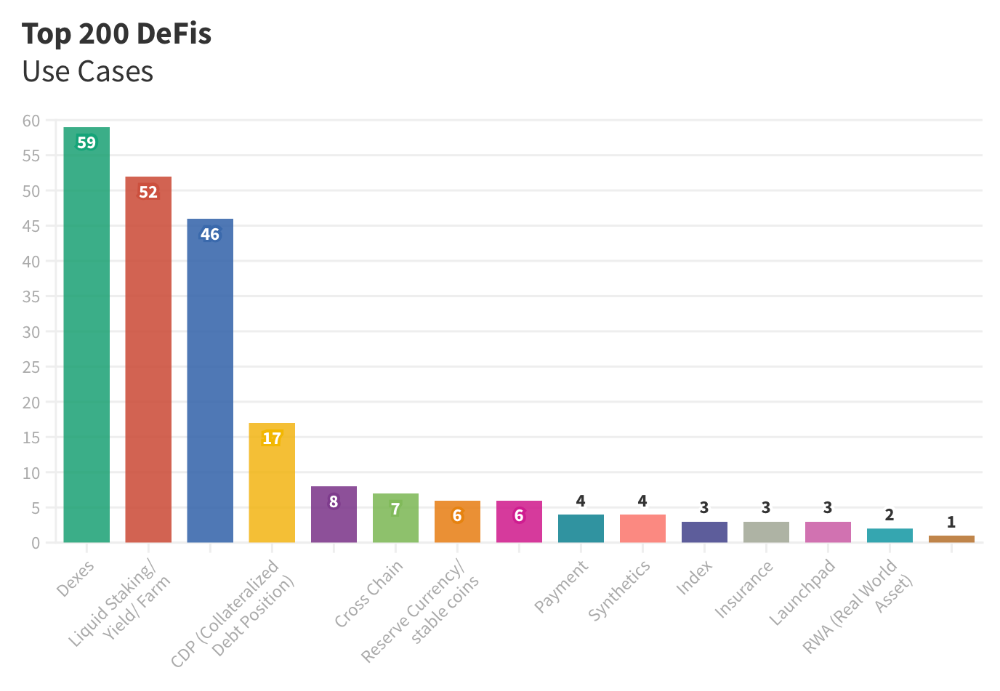

Use Cases for DeFi

The chart below shows platform use cases. Each platform has decentralized exchanges, liquid staking, yield farming, and lending.

These use cases are DefiLlama's main platform features.

Which use case costs the most? Chart explains. Collateralized debt, liquid staking, dexes, and lending have high TVLs.

The DeFi Industry

I compared three high-TVL platforms (Maker DAO, Balancer, AAVE). The columns show monthly TVL and token price changes. The graph shows monthly Bitcoin price changes.

Each platform's market moves similarly.

Probably because most DeFi deposits are cryptocurrencies. Since individual currencies are highly correlated with Bitcoin, it's not surprising that they move in unison.

Takeaways

This analysis shows that the most common DeFi services (decentralized exchanges, liquid staking, yield farming, and lending) also have the highest average locked value.

Some projects run on one or two blockchains, while others use 15 or 20. Our analysis shows that a project's blockchain count has no correlation with its success.

It's hard to tell if certain use cases are rising. Bitcoin's price heavily affects the entire DeFi market.

TVL seems to be a good indicator of a DeFi platform's success and quality. Higher TVL platforms are cheaper. They're a better long-term investment because they gain or lose less value than DeFis with lower TVLs.