More on Entrepreneurship/Creators

Jenn Leach

3 years ago

I created a faceless TikTok account. Six months later.

Follower count, earnings, and more

I created my 7th TikTok account six months ago. TikTok's great. I've developed accounts for Amazon products, content creators/brand deals education, website flipping, and more.

Introverted or shy people use faceless TikTok accounts.

Maybe they don't want millions of people to see their face online, or they want to remain anonymous so relatives and friends can't locate them.

Going faceless on TikTok can help you grow a following, communicate your message, and make money online.

Here are 6 steps I took to turn my Tik Tok account into a $60,000/year side gig.

From nothing to $60K in 6 months

It's clickbait, but it’s true. Here’s what I did to get here.

Quick context:

I've used social media before. I've spent years as a social creator and brand.

I've built Instagram, TikTok, and YouTube accounts to nearly 100K.

How I did it

First, select a niche.

If you can focus on one genre on TikTok, you'll have a better chance of success, however lifestyle creators do well too.

Niching down is easier, in my opinion.

Examples:

Travel

Food

Kids

Earning cash

Finance

You can narrow these niches if you like.

During the pandemic, a travel blogger focused on Texas-only tourism and gained 1 million subscribers.

Couponing might be a finance specialization.

One of my finance TikTok accounts gives credit tips and grants and has 23K followers.

Tons of ways you can get more specific.

Consider how you'll monetize your TikTok account. I saw many enormous TikTok accounts that lose money.

Why?

They can't monetize their niche. Not impossible to commercialize, but tough enough to inhibit action.

First, determine your goal.

In this first step, consider what your end goal is.

Are you trying to promote your digital products or social media management services?

You want brand deals or e-commerce sales.

This will affect your TikTok specialty.

This is the first step to a TikTok side gig.

Step 2: Pick a content style

Next, you want to decide on your content style.

Do you do voiceover and screenshots?

You'll demonstrate a product?

Will you faceless vlog?

Step 3: Look at the competition

Find anonymous accounts and analyze what content works, where they thrive, what their audience wants, etc.

This can help you make better content.

Like the skyscraper method for TikTok.

Step 4: Create a content strategy.

Your content plan is where you sit down and decide:

How many videos will you produce each day or each week?

Which links will you highlight in your biography?

What amount of time can you commit to this project?

You may schedule when to post videos on a calendar. Make videos.

5. Create videos.

No video gear needed.

Using a phone is OK, and I think it's preferable than posting drafts from a computer or phone.

TikTok prefers genuine material.

Use their app, tools, filters, and music to make videos.

And imperfection is preferable. Tik okers like to see videos made in a bedroom, not a film studio.

Make sense?

When making videos, remember this.

I personally use my phone and tablet.

Step 6: Monetize

Lastly, it’s time to monetize How will you make money? You decided this in step 1.

Time to act!

For brand agreements

Include your email in the bio.

Share several sites and use a beacons link in your bio.

Make cold calls to your favorite companies to get them to join you in a TikTok campaign.

For e-commerce

Include a link to your store's or a product's page in your bio.

For client work

Include your email in the bio.

Use a beacons link to showcase your personal website, portfolio, and other resources.

For affiliate marketing

Include affiliate product links in your bio.

Join the Amazon Influencer program and provide a link to your storefront in your bio.

$60,000 per year from Tik Tok?

Yes, and some creators make much more.

Tori Dunlap (herfirst100K) makes $100,000/month on TikTok.

My TikTok adventure took 6 months, but by month 2 I was making $1,000/month (or $12K/year).

By year's end, I want this account to earn $100K/year.

Imagine if my 7 TikTok accounts made $100K/year.

7 Tik Tok accounts X $100K/yr = $700,000/year

Micah Daigle

3 years ago

Facebook is going away. Here are two explanations for why it hasn't been replaced yet.

And tips for anyone trying.

We see the same story every few years.

BREAKING NEWS: [Platform X] launched a social network. With Facebook's reputation down, the new startup bets millions will switch.

Despite the excitement surrounding each new platform (Diaspora, Ello, Path, MeWe, Minds, Vero, etc.), no major exodus occurred.

Snapchat and TikTok attracted teens with fresh experiences (ephemeral messaging and rapid-fire videos). These features aren't Facebook, even if Facebook replicated them.

Facebook's core is simple: you publish items (typically text/images) and your friends (generally people you know IRL) can discuss them.

It's cool. Sometimes I don't want to, but sh*t. I like it.

Because, well, I like many folks I've met. I enjoy keeping in touch with them and their banter.

I dislike Facebook's corporation. I've been cautiously optimistic whenever a Facebook-killer surfaced.

None succeeded.

Why? Two causes, I think:

People couldn't switch quickly enough, which is reason #1

Your buddies make a social network social.

Facebook started in self-contained communities (college campuses) then grew outward. But a new platform can't.

If we're expected to leave Facebook, we want to know that most of our friends will too.

Most Facebook-killers had bottlenecks. You have to waitlist or jump through hoops (e.g. setting up a server).

Same outcome. Upload. Chirp.

After a week or two of silence, individuals returned to Facebook.

Reason #2: The fundamental experience was different.

Even when many of our friends joined in the first few weeks, it wasn't the same.

There were missing features or a different UX.

Want to reply with a meme? No photos in comments yet. (Trying!)

Want to tag a friend? Nope, sorry. 2019!

Want your friends to see your post? You must post to all your friends' servers. Good luck!

It's difficult to introduce a platform with 100% of the same features as one that's been there for 20 years, yet customers want a core experience.

If you can't, they'll depart.

The causes that led to the causes

Having worked on software teams for 14+ years, I'm not surprised by these challenges. They are a natural development of a few tech sector meta-problems:

Lean startup methodology

Silicon Valley worships lean startup. It's a way of developing software that involves testing a stripped-down version with a limited number of people before selecting what to build.

Billion people use Facebook's functions. They aren't tested. It must work right away*

*This may seem weird to software people, but it's how non-software works! You can't sell a car without wheels.

2. Creativity

Startup entrepreneurs build new things, not copies. I understand. Reinventing the wheel is boring.

We know what works. Different experiences raise adoption friction. Once millions have transferred, more features (and a friendlier UX) can be implemented.

3. Cost scaling

True. Building a product that can sustain hundreds of millions of users in weeks is expensive and complex.

Your lifeboats must have the same capacity as the ship you're evacuating. It's required.

4. Pure ideologies

People who work on Facebook-alternatives are (understandably) critical of Facebook.

They build an open-source, fully-distributed, data-portable, interface-customizable, offline-capable, censorship-proof platform.

Prioritizing these aims can prevent replicating the straightforward experience users expect. Github, not Facebook, is for techies only.

What about the business plan, though?

Facebook-killer attempts have followed three models.

Utilize VC funding to increase your user base, then monetize them later. (If you do this, you won't kill Facebook; instead, Facebook will become you.)

Users must pay to utilize it. (This causes a huge bottleneck and slows the required quick expansion, preventing it from seeming like a true social network.)

Make it a volunteer-run, open-source endeavor that is free. (This typically denotes that something is cumbersome, difficult to operate, and is only for techies.)

Wikipedia is a fourth way.

Wikipedia is one of the most popular websites and a charity. No ads. Donations support them.

A Facebook-killer managed by a good team may gather millions (from affluent contributors and the crowd) for their initial phase of development. Then it might sustain on regular donations, ethical transactions (e.g. fees on commerce, business sites, etc.), and government grants/subsidies (since it would essentially be a public utility).

When you're not aiming to make investors rich, it's remarkable how little money you need.

If you want to build a Facebook competitor, follow these tips:

Drop the lean startup philosophy. Wait until you have a finished product before launching. Build it, thoroughly test it for bugs, and then release it.

Delay innovating. Wait till millions of people have switched before introducing your great new features. Make it nearly identical for now.

Spend money climbing. Make sure that guests can arrive as soon as they are invited. Never keep them waiting. Make things easy for them.

Make it accessible to all. Even if doing so renders it less philosophically pure, it shouldn't require technical expertise to utilize.

Constitute a nonprofit. Additionally, develop community ownership structures. Profit maximization is not the only strategy for preserving valued assets.

Last thoughts

Nobody has killed Facebook, but Facebook is killing itself.

The startup is burying the newsfeed to become a TikTok clone. Meta itself seems to be ditching the platform for the metaverse.

I wish I was happy, but I'm not. I miss (understandably) removed friends' postings and remarks. It could be a ghost town in a few years. My dance moves aren't TikTok-worthy.

Who will lead? It's time to develop a social network for the people.

Greetings if you're working on it. I'm not a company founder, but I like to help hard-working folks.

Victoria Kurichenko

3 years ago

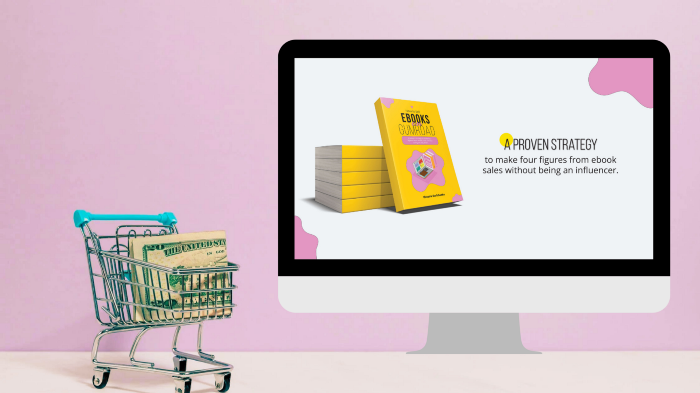

Here's what happened after I launched my second product on Gumroad.

One-hour ebook sales, affiliate relationships, and more.

If you follow me, you may know I started a new ebook in August 2022.

Despite publishing on this platform, my website, and Quora, I'm not a writer.

My writing speed is slow, 2,000 words a day, and I struggle to communicate cohesively.

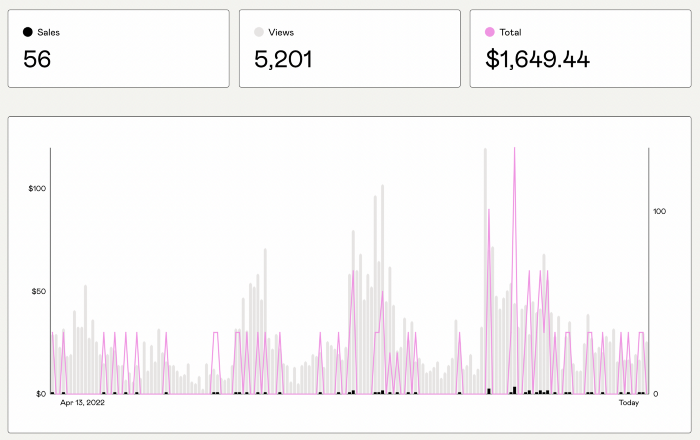

In April 2022, I wrote a successful guide on How to Write Google-Friendly Blog Posts.

I had no email list or social media presence. I've made $1,600+ selling ebooks.

Evidence:

My first digital offering isn't a book.

It's an actionable guide with my tried-and-true process for writing Google-friendly content.

I'm not bragging.

Established authors like Tim Denning make more from my ebook sales with one newsletter.

This experience taught me writing isn't a privilege.

Writing a book and making money online doesn't require expertise.

Many don't consult experts. They want someone approachable.

Two years passed before I realized my own limits.

I have a brain, two hands, and Internet to spread my message.

I wrote and published a second ebook after the first's success.

On Gumroad, I released my second digital product.

Here's my complete Gumroad evaluation.

Gumroad is a marketplace for content providers to develop and sell sales pages.

Gumroad handles payments and client requests. It's helpful when someone sends a bogus payment receipt requesting an ebook (actual story!).

You'll forget administrative concerns after your first ebook sale.

After my first ebook sale, I did this: I made additional cash!

After every sale, I tell myself, "I built a new semi-passive revenue source."

This thinking shift helps me become less busy while increasing my income and quality of life.

Besides helping others, folks sell evergreen digital things to earn passive money.

It's in my second ebook.

I explain how I built and sold 50+ copies of my SEO writing ebook without being an influencer.

I show how anyone can sell ebooks on Gumroad and automate their sales process.

This is my ebook.

After publicizing the ebook release, I sold three copies within an hour.

Wow, or meh?

I don’t know.

The answer is different for everyone.

These three sales came from a small email list of 40 motivated fans waiting for my ebook release.

I had bigger plans.

I'll market my ebook on Medium, my website, Quora, and email.

I'm testing affiliate partnerships this time.

One of my ebook buyers is now promoting it for 40% commission.

Become my affiliate if you think your readers would like my ebook.

My ebook is a few days old, but I'm interested to see where it goes.

My SEO writing book started without an email list, affiliates, or 4,000 website visitors. I've made four figures.

I'm slowly expanding my communication avenues to have more impact.

Even a small project can open doors you never knew existed.

So began my writing career.

In summary

If you dare, every concept can become a profitable trip.

Before, I couldn't conceive of creating an ebook.

How to Sell eBooks on Gumroad is my second digital product.

Marketing and writing taught me that anything can be sold online.

You might also like

Luke Plunkett

3 years ago

Gran Turismo 7 Update Eases Up On The Grind After Fan Outrage

Polyphony Digital has changed the game after apologizing in March.

To make amends for some disastrous downtime, Gran Turismo 7 director Kazunori Yamauchi announced a credits handout and promised to “dramatically change GT7's car economy to help make amends” last month. The first of these has arrived.

The game's 1.11 update includes the following concessions to players frustrated by the economy and its subsequent grind:

-

The last half of the World Circuits events have increased in-game credit rewards.

-

Modified Arcade and Custom Race rewards

-

Clearing all circuit layouts with Gold or Bronze now rewards In-game Credits. Exiting the Sector selection screen with the Exit button will award Credits if an event has already been cleared.

-

Increased Credits Rewards in Lobby and Daily Races

-

Increased the free in-game Credits cap from 20,000,000 to 100,000,000.

Additionally, “The Human Comedy” missions are one-hour endurance races that award “up to 1,200,000” credits per event.

This isn't everything Yamauchi promised last month; he said it would take several patches and updates to fully implement the changes. Here's a list of everything he said would happen, some of which have already happened (like the World Cup rewards and credit cap):

- Increase rewards in the latter half of the World Circuits by roughly 100%.

- Added high rewards for all Gold/Bronze results clearing the Circuit Experience.

- Online Races rewards increase.

- Add 8 new 1-hour Endurance Race events to Missions. So expect higher rewards.

- Increase the non-paid credit limit in player wallets from 20M to 100M.

- Expand the number of Used and Legend cars available at any time.

- With time, we will increase the payout value of limited time rewards.

- New World Circuit events.

- Missions now include 24-hour endurance races.

- Online Time Trials added, with rewards based on the player's time difference from the leader.

- Make cars sellable.

The full list of updates and changes can be found here.

Read the original post.

nft now

3 years ago

A Guide to VeeFriends and Series 2

VeeFriends is one of the most popular and unique NFT collections. VeeFriends launched around the same time as other PFP NFTs like Bored Ape Yacht Club.

Vaynerchuk (GaryVee) took a unique approach to his large-scale project, which has influenced the NFT ecosystem. GaryVee's VeeFriends is one of the most successful NFT membership use-cases, allowing him to build a community around his creative and business passions.

What is VeeFriends?

GaryVee's NFT collection, VeeFriends, was released on May 11, 2021. VeeFriends [Mini Drops], Book Games, and a forthcoming large-scale "Series 2" collection all stem from the initial drop of 10,255 tokens.

In "Series 1," there are G.O.O. tokens (Gary Originally Owned). GaryVee reserved 1,242 NFTs (over 12% of the supply) for his own collection, so only 9,013 were available at the Series 1 launch.

Each Series 1 token represents one of 268 human traits hand-drawn by Vaynerchuk. Gary Vee's NFTs offer owners incentives.

Who made VeeFriends?

Gary Vaynerchuk, AKA GaryVee, is influential in NFT. Vaynerchuk is the chairman of New York-based communications company VaynerX. Gary Vee, CEO of VaynerMedia, VaynerSports, and bestselling author, is worth $200 million.

GaryVee went from NFT collector to creator, launching VaynerNFT to help celebrities and brands.

Vaynerchuk's influence spans the NFT ecosystem as one of its most prolific voices. He's one of the most influential NFT figures, and his VeeFriends ecosystem keeps growing.

Vaynerchuk, a trend expert, thinks NFTs will be around for the rest of his life and VeeFriends will be a landmark project.

Why use VeeFriends NFTs?

The first VeeFriends collection has sold nearly $160 million via OpenSea. GaryVee insisted that the first 10,255 VeeFriends were just the beginning.

Book Games were announced to the VeeFriends community in August 2021. Mini Drops joined VeeFriends two months later.

Book Games

GaryVee's book "Twelve and a Half: Leveraging the Emotional Ingredients for Business Success" inspired Book Games. Even prior to the announcement Vaynerchuk had mapped out the utility of the book on an NFT scale. Book Games tied his book to the VeeFriends ecosystem and solidified its place in the collection.

GaryVee says Book Games is a layer 2 NFT project with 125,000 burnable tokens. Vaynerchuk's NFT fans were incentivized to buy as many copies of his new book as possible to receive NFT rewards later.

First, a bit about “layer 2.”

Layer 2 blockchain solutions help scale applications by routing transactions away from Ethereum Mainnet (layer 1). These solutions benefit from Mainnet's decentralized security model but increase transaction speed and reduce gas fees.

Polygon (integrated into OpenSea) and Immutable X are popular Ethereum layer 2 solutions. GaryVee chose Immutable X to reduce gas costs (transaction fees). Given the large supply of Book Games tokens, this decision will likely benefit the VeeFriends community, especially if the games run forever.

What's the strategy?

The VeeFriends patriarch announced on Aug. 27, 2021, that for every 12 books ordered during the Book Games promotion, customers would receive one NFT via airdrop. After nearly 100 days, GV sold over a million copies and announced that Book Games would go gamified on Jan. 10, 2022.

Immutable X's trading options make Book Games a "game." Book Games players can trade NFTs for other NFTs, sports cards, VeeCon tickets, and other prizes. Book Games can also whitelist other VeeFirends projects, which we'll cover in Series 2.

VeeFriends Mini Drops

GaryVee launched VeeFriends Mini Drops two months after Book Games, focusing on collaboration, scarcity, and the characters' "cultural longevity."

Spooky Vees, a collection of 31 1/1 Halloween-themed VeeFriends, was released on Halloween. First-come, first-served VeeFriend owners could claim these NFTs.

Mini Drops includes Gift Goat NFTs. By holding the Gift Goat VeeFriends character, collectors will receive 18 exclusive gifts curated by GaryVee and the team. Each gifting experience includes one physical gift and one NFT out of 555, to match the 555 Gift Goat tokens.

Gift Goat holders have gotten NFTs from Danny Cole (Creature World), Isaac "Drift" Wright (Where My Vans Go), Pop Wonder, and more.

GaryVee is poised to release the largest expansion of the VeeFriends and VaynerNFT ecosystem to date with VeeFriends Series 2.

VeeCon 101

By owning VeeFriends NFTs, collectors can join the VeeFriends community and attend VeeCon in 2022. The conference is only open to VeeCon NFT ticket holders (VeeFreinds + possibly more TBA) and will feature Beeple, Steve Aoki, and even Snoop Dogg.

The VeeFreinds floor in 2022 Q1 has remained at 16 ETH ($52,000), making VeeCon unattainable for most NFT enthusiasts. Why would someone spend that much crypto on a Minneapolis "superconference" ticket? Because of Gary Vaynerchuk.

Everything to know about VeeFriends Series 2

Vaynerchuk revealed in April 2022 that the VeeFriends ecosystem will grow by 55,555 NFTs after months of teasing.

With VeeFriends Series 2, each token will cost $995 USD in ETH, allowing NFT enthusiasts to join at a lower cost. The new series will be released on multiple dates in April.

Book Games NFT holders on the Friends List (whitelist) can mint Series 2 NFTs on April 12. Book Games holders have 32,000 NFTs.

VeeFriends Series 1 NFT holders can claim Series 2 NFTs on April 12. This allotment's supply is 10,255, like Series 1's.

On April 25, the public can buy 10,000 Series 2 NFTs. Unminted Friends List NFTs will be sold on this date, so this number may change.

The VeeFriends ecosystem will add 15 new characters (220 tokens each) on April 27. One character will be released per day for 15 days, and the only way to get one is to enter a daily raffle with Book Games tokens.

Series 2 NFTs won't give owners VeeCon access, but they will offer other benefits within the VaynerNFT ecosystem. Book Games and Series 2 will get new token burn mechanics in the upcoming drop.

Visit the VeeFriends blog for the latest collection info.

Where can you buy Gary Vee’s NFTs?

Need a VeeFriend NFT? Gary Vee recommends doing "50 hours of homework" before buying. OpenSea sells VeeFriends NFTs.

Will Lockett

3 years ago

Russia's nukes may be useless

Russia's nuclear threat may be nullified by physics.

Putin seems nostalgic and wants to relive the Cold War. He's started a deadly war to reclaim the old Soviet state of Ukraine and is threatening the West with nuclear war. NATO can't risk starting a global nuclear war that could wipe out humanity to support Ukraine's independence as much as they want to. Fortunately, nuclear physics may have rendered Putin's nuclear weapons useless. However? How will Ukraine and NATO react?

To understand why Russia's nuclear weapons may be ineffective, we must first know what kind they are.

Russia has the world's largest nuclear arsenal, with 4,447 strategic and 1,912 tactical weapons (all of which are ready to be rolled out quickly). The difference between these two weapons is small, but it affects their use and logistics. Strategic nuclear weapons are ICBMs designed to destroy a city across the globe. Russia's ICBMs have many designs and a yield of 300–800 kilotonnes. 300 kilotonnes can destroy Washington. Tactical nuclear weapons are smaller and can be fired from artillery guns or small truck-mounted missile launchers, giving them a 1,500 km range. Instead of destroying a distant city, they are designed to eliminate specific positions, bases, or military infrastructure. They produce 1–50 kilotonnes.

These two nuclear weapons use different nuclear reactions. Pure fission bombs are compact enough to fit in a shell or small missile. All early nuclear weapons used this design for their fission bombs. This technology is inefficient for bombs over 50 kilotonnes. Larger bombs are thermonuclear. Thermonuclear weapons use a small fission bomb to compress and heat a hydrogen capsule, which undergoes fusion and releases far more energy than ignition fission reactions, allowing for effective giant bombs.

Here's Russia's issue.

A thermonuclear bomb needs deuterium (hydrogen with one neutron) and tritium (hydrogen with two neutrons). Because these two isotopes fuse at lower energies than others, the bomb works. One problem. Tritium is highly radioactive, with a half-life of only 12.5 years, and must be artificially made.

Tritium is made by irradiating lithium in nuclear reactors and extracting the gas. Tritium is one of the most expensive materials ever made, at $30,000 per gram.

Why does this affect Putin's nukes?

Thermonuclear weapons need tritium. Tritium decays quickly, so they must be regularly refilled at great cost, which Russia may struggle to do.

Russia has a smaller economy than New York, yet they are running an invasion, fending off international sanctions, and refining tritium for 4,447 thermonuclear weapons.

The Russian military is underfunded. Because the state can't afford it, Russian troops must buy their own body armor. Arguably, Putin cares more about the Ukraine conflict than maintaining his nuclear deterrent. Putin will likely lose power if he loses the Ukraine war.

It's possible that Putin halted tritium production and refueling to save money for Ukraine. His threats of nuclear attacks and escalating nuclear war may be a bluff.

This doesn't help Ukraine, sadly. Russia's tactical nuclear weapons don't need expensive refueling and will help with the invasion. So Ukraine still risks a nuclear attack. The bomb that destroyed Hiroshima was 15 kilotonnes, and Russia's tactical Iskander-K nuclear missile has a 50-kiloton yield. Even "little" bombs are deadly.

We can't guarantee it's happening in Russia. Putin may prioritize tritium. He knows the power of nuclear deterrence. Russia may have enough tritium for this conflict. Stockpiling a material with a short shelf life is unlikely, though.

This means that Russia's most powerful weapons may be nearly useless, but they may still be deadly. If true, this could allow NATO to offer full support to Ukraine and push the Russian tyrant back where he belongs. If Putin withholds funds from his crumbling military to maintain his nuclear deterrent, he may be willing to sink the ship with him. Let's hope the former.