# DeaMau5’s PIXELYNX and Beatport Launch Festival NFTs

Pixelynx, a music metaverse gaming platform, has teamed up with Beatport, an online music retailer focusing in electronic music, to establish a Synth Heads non-fungible token (NFT) Collection.

Richie Hawtin, aka Deadmau5, and Joel Zimmerman, nicknamed Pixelynx, have invented a new music metaverse game platform called Pixelynx. In January 2022, they released their first Beatport NFT drop, which saw 3,030 generative NFTs sell out in seconds.

The limited edition Synth Heads NFTs will be released in collaboration with Junction 2, the largest UK techno festival, and having one will grant fans special access tickets and experiences at the London-based festival.

Membership in the Synth Head community, day passes to the Junction 2 Festival 2022, Junction 2 and Beatport apparel, special vinyl releases, and continued access to future ticket drops are just a few of the experiences available.

Five lucky NFT holders will also receive a Golden Ticket, which includes access to a backstage artist bar and tickets to Junction 2's next large-scale London event this summer, in addition to full festival entrance for both days.

The Junction 2 festival will take place at Trent Park in London on June 18th and 19th, and will feature performances from Four Tet, Dixon, Amelie Lens, Robert Hood, and a slew of other artists. Holders of the original Synth Head NFT will be granted admission to the festival's guestlist as well as line-jumping privileges.

The new Synth Heads NFTs collection contain 300 NFTs.

NFTs that provide IRL utility are in high demand.

The benefits of NFT drops related to In Real Life (IRL) utility aren't limited to Beatport and Pixelynx.

Coachella, a well-known music event, recently partnered with cryptocurrency exchange FTX to offer free NFTs to 2022 pass holders. Access to a dedicated entry lane, a meal and beverage pass, and limited-edition merchandise were all included with the NFTs.

Coachella also has its own NFT store on the Solana blockchain, where fans can buy Coachella NFTs and digital treasures that unlock exclusive on-site experiences, physical objects, lifetime festival passes, and "future adventures."

Individual artists and performers have begun taking advantage of NFT technology outside of large music festivals like Coachella.

DJ Tisto has revealed that he would release a VIP NFT for his upcoming "Eagle" collection during the EDC festival in Las Vegas in 2022. This NFT, dubbed "All Access Eagle," gives collectors the best chance to get NFTs from his first drop, as well as unique access to the music "Repeat It."

NFTs are one-of-a-kind digital assets that can be verified, purchased, sold, and traded on blockchains, opening up new possibilities for artists and businesses alike. Time will tell whether Beatport and Pixelynx's Synth Head NFT collection will be successful, but if it's anything like the first release, it's a safe bet.

More on NFTs & Art

Scott Duke Kominers

3 years ago

NFT Creators Go Creative Commons Zero (cc0)

On January 1, "Public Domain Day," thousands of creative works immediately join the public domain. The original creator or copyright holder loses exclusive rights to reproduce, adapt, or publish the work, and anybody can use it. It happens with movies, poems, music, artworks, books (where creative rights endure 70 years beyond the author's death), and sometimes source code.

Public domain creative works open the door to new uses. 400,000 sound recordings from before 1923, including Winnie-the-Pooh, were released this year. With most of A.A. Milne's 1926 Winnie-the-Pooh characters now available, we're seeing innovative interpretations Milne likely never planned. The ancient hyphenated version of the honey-loving bear is being adapted for a horror movie: "Winnie-the-Pooh: Blood and Honey"... with Pooh and Piglet as the baddies.

Counterintuitively, experimenting and recombination can occasionally increase IP value. Open source movements allow the public to build on (or fork and duplicate) existing technologies. Permissionless innovation helps Android, Linux, and other open source software projects compete. Crypto's success at attracting public development is also due to its support of open source and "remix culture," notably in NFT forums.

Production memes

NFT projects use several IP strategies to establish brands, communities, and content. Some preserve regular IP protections; others offer NFT owners the opportunity to innovate on connected IP; yet others have removed copyright and other IP safeguards.

By using the "Creative Commons Zero" (cc0) license, artists can intentionally select for "no rights reserved." This option permits anyone to benefit from derivative works without legal repercussions. There's still a lot of confusion between copyrights and NFTs, so nothing here should be considered legal, financial, tax, or investment advice. Check out this post for an overview of copyright vulnerabilities with NFTs and how authors can protect owners' rights. This article focuses on cc0.

Nouns, a 2021 project, popularized cc0 for NFTs. Others followed, including: A Common Place, Anonymice, Blitmap, Chain Runners, Cryptoadz, CryptoTeddies, Goblintown, Gradis, Loot, mfers, Mirakai, Shields, and Terrarium Club are cc0 projects.

Popular crypto artist XCOPY licensed their 1-of-1 NFT artwork "Right-click and Save As Guy" under cc0 in January, exactly one month after selling it. cc0 has spawned many derivatives.

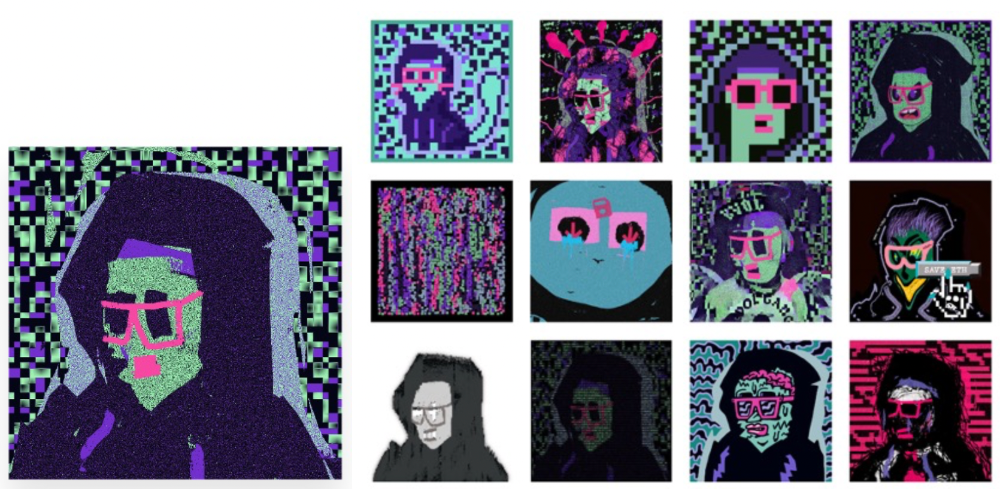

"Right-click Save As Guy" by XCOPY (1)/derivative works (2)

XCOPY said Monday he would apply cc0 to "all his existing art." "We haven't seen a cc0 summer yet, but I think it's approaching," said the artist. - predicting a "DeFi summer" in 2020, when decentralized finance gained popularity.

Why do so many NFT authors choose "no rights"?

Promoting expansions of the original project to create a more lively and active community is one rationale. This makes sense in crypto, where many value open sharing and establishing community.

Creativity depends on cultural significance. NFTs may allow verifiable ownership of any digital asset, regardless of license, but cc0 jumpstarts "meme-ability" by actively, not passively, inviting derivative works. As new derivatives are made and shared, attention might flow back to the original, boosting its reputation. This may inspire new interpretations, leading in a flywheel effect where each derivative adds to the original's worth - similar to platform network effects, where platforms become more valuable as more users join them.

cc0 licence allows creators "seize production memes."

Physical items are also using cc0 NFT assets, thus it's not just a digital phenomenon. The Nouns Vision initiative turned the square-framed spectacles shown on each new NounsDAO NFT ("one per day, forever") into luxury sunglasses. Blitmap's pixel-art has been used on shoes, apparel, and caps. In traditional IP regimes, a single owner controls creation, licensing, and production.

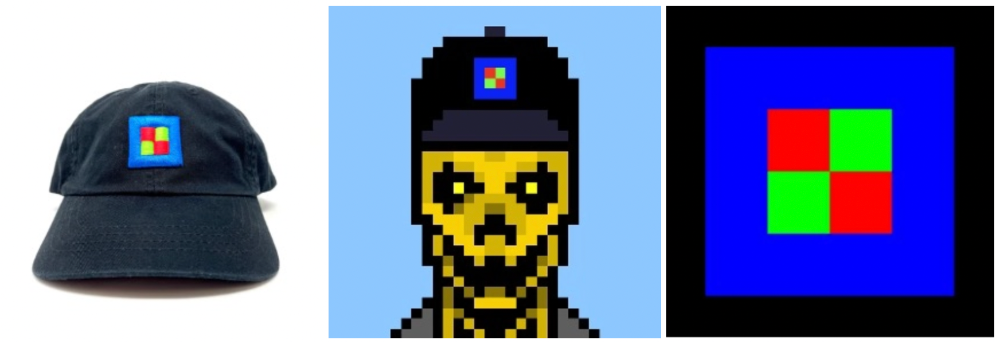

The physical "blitcap" (3rd level) is a descendant of the trait in the cc0 Chain Runners collection (2nd), which uses the "logo" from cc0 Blitmap (1st)! The Logo is Blitmap token #84 and has been used as a trait in various collections. The "Dom Rose" is another popular token. These homages reference Blitmap's influence as a cc0 leader, as one of the earliest NFT projects to proclaim public domain intents. A new collection, Citizens of Tajigen, emerged last week with a Blitcap characteristic.

These derivatives can be a win-win for everyone, not just the original inventors, especially when using NFT assets to establish unique brands. As people learn about the derivative, they may become interested in the original. If you see someone wearing Nouns glasses on the street (or in a Super Bowl ad), you may desire a pair, but you may also be interested in buying an original NounsDAO NFT or related derivative.

Blitmap Logo Hat (1), Chain Runners #780 ft. Hat (2), and Blitmap Original "Logo #87" (3)

Co-creating open source

NFTs' power comes from smart contract technology's intrinsic composability. Many smart contracts can be integrated or stacked to generate richer applications.

"Money Legos" describes how decentralized finance ("DeFi") smart contracts interconnect to generate new financial use cases. Yearn communicates with MakerDAO's stablecoin $DAI and exchange liquidity provider Curve by calling public smart contract methods. NFTs and their underlying smart contracts can operate as the base-layer framework for recombining and interconnecting culture and creativity.

cc0 gives an NFT's enthusiast community authority to develop new value layers whenever, wherever, and however they wish.

Multiple cc0 projects are playable characters in HyperLoot, a Loot Project knockoff.

Open source and Linux's rise are parallels. When the internet was young, Microsoft dominated the OS market with Windows. Linux (and its developer Linus Torvalds) championed a community-first mentality, freely available the source code without restrictions. This led to developers worldwide producing new software for Linux, from web servers to databases. As people (and organizations) created world-class open source software, Linux's value proposition grew, leading to explosive development and industry innovation. According to Truelist, Linux powers 96.3% of the top 1 million web servers and 85% of smartphones.

With cc0 licensing empowering NFT community builders, one might hope for long-term innovation. Combining cc0 with NFTs "turns an antagonistic game into a co-operative one," says NounsDAO cofounder punk4156. It's important on several levels. First, decentralized systems from open source to crypto are about trust and coordination, therefore facilitating cooperation is crucial. Second, the dynamics of this cooperation work well in the context of NFTs because giving people ownership over their digital assets allows them to internalize the results of co-creation through the value that accrues to their assets and contributions, which incentivizes them to participate in co-creation in the first place.

Licensed to create

If cc0 projects are open source "applications" or "platforms," then NFT artwork, metadata, and smart contracts provide the "user interface" and the underlying blockchain (e.g., Ethereum) is the "operating system." For these apps to attain Linux-like potential, more infrastructure services must be established and made available so people may take advantage of cc0's remixing capabilities.

These services are developing. Zora protocol and OpenSea's open source Seaport protocol enable open, permissionless NFT marketplaces. A pixel-art-rendering engine was just published on-chain to the Ethereum blockchain and integrated into OKPC and ICE64. Each application improves blockchain's "out-of-the-box" capabilities, leading to new apps created from the improved building blocks.

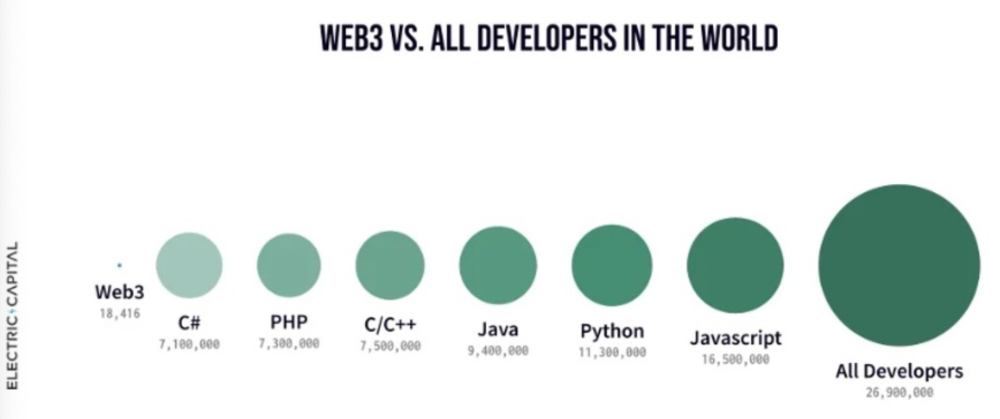

Web3 developer growth is at an all-time high, yet it's still a small fraction of active software developers globally. As additional developers enter the field, prospective NFT projects may find more creative and infrastructure Legos for cc0 and beyond.

Electric Capital Developer Report (2021), p. 122

Growth requires composability. Users can easily integrate digital assets developed on public standards and compatible infrastructure into other platforms. The Loot Project is one of the first to illustrate decentralized co-creation, worldbuilding, and more in NFTs. This example was low-fi or "incomplete" aesthetically, providing room for imagination and community co-creation.

Loot began with a series of Loot bag NFTs, each listing eight "adventure things" in white writing on a black backdrop (such as Loot Bag #5726's "Katana, Divine Robe, Great Helm, Wool Sash, Divine Slippers, Chain Gloves, Amulet, Gold Ring"). Dom Hofmann's free Loot bags served as a foundation for the community.

Several projects have begun metaphorical (lore) and practical (game development) world-building in a short time, with artists contributing many variations to the collective "Lootverse." They've produced games (Realms & The Crypt), characters (Genesis Project, Hyperloot, Loot Explorers), storytelling initiatives (Banners, OpenQuill), and even infrastructure (The Rift).

Why cc0 and composability? Because consumers own and control Loot bags, they may use them wherever they choose by connecting their crypto wallets. This allows users to participate in multiple derivative projects, such as Genesis Adventurers, whose characters appear in many others — creating a decentralized franchise not owned by any one corporation.

Genesis Project's Genesis Adventurer (1) with HyperLoot (2) and Loot Explorer (3) versions

When to go cc0

There are several IP development strategies NFT projects can use. When it comes to cc0, it’s important to be realistic. The public domain won't make a project a runaway success just by implementing the license. cc0 works well for NFT initiatives that can develop a rich, enlarged ecosystem.

Many of the most successful cc0 projects have introduced flexible intellectual property. The Nouns brand is as obvious for a beer ad as for real glasses; Loot bags are simple primitives that make sense in all adventure settings; and the Goblintown visual style looks good on dwarfs, zombies, and cranky owls as it does on Val Kilmer.

The ideal cc0 NFT project gives builders the opportunity to add value:

vertically, by stacking new content and features directly on top of the original cc0 assets (for instance, as with games built on the Loot ecosystem, among others), and

horizontally, by introducing distinct but related intellectual property that helps propagate the original cc0 project’s brand (as with various Goblintown derivatives, among others).

These actions can assist cc0 NFT business models. Because cc0 NFT projects receive royalties from secondary sales, third-party extensions and derivatives can boost demand for the original assets.

Using cc0 license lowers friction that could hinder brand-reinforcing extensions or lead to them bypassing the original. Robbie Broome recently argued (in the context of his cc0 project A Common Place) that giving away his IP to cc0 avoids bad rehashes down the line. If UrbanOutfitters wanted to put my design on a tee, they could use the actual work instead of hiring a designer. CC0 can turn competition into cooperation.

Community agreement about core assets' value and contribution can help cc0 projects. Cohesion and engagement are key. Using the above examples: Developers can design adventure games around whatever themes and item concepts they desire, but many choose Loot bags because of the Lootverse's community togetherness. Flipmap shared half of its money with the original Blitmap artists in acknowledgment of that project's core role in the community. This can build a healthy culture within a cc0 project ecosystem. Commentator NiftyPins said it was smart to acknowledge the people that constructed their universe. Many OG Blitmap artists have popped into the Flipmap discord to share information.

cc0 isn't a one-size-fits-all answer; NFTs formed around well-established brands may prefer more restrictive licenses to preserve their intellectual property and reinforce exclusivity. cc0 has some superficial similarities to permitting NFT owners to market the IP connected with their NFTs (à la Bored Ape Yacht Club), but there is a significant difference: cc0 holders can't exclude others from utilizing the same IP. This can make it tougher for holders to develop commercial brands on cc0 assets or offer specific rights to partners. Holders can still introduce enlarged intellectual property (such as backstories or derivatives) that they control.

Blockchain technologies and the crypto ethos are decentralized and open-source. This makes it logical for crypto initiatives to build around cc0 content models, which build on the work of the Creative Commons foundation and numerous open source pioneers.

NFT creators that choose cc0 must select how involved they want to be in building the ecosystem. Some cc0 project leaders, like Chain Runners' developers, have kept building on top of the initial cc0 assets, creating an environment derivative projects can plug into. Dom Hofmann stood back from Loot, letting the community lead. (Dom is also working on additional cc0 NFT projects for the company he formed to build Blitmap.) Other authors have chosen out totally, like sartoshi, who announced his exit from the cc0 project he founded, mfers, and from the NFT area by publishing a final edition suitably named "end of sartoshi" and then deactivating his Twitter account. A multi-signature wallet of seven mfers controls the project's smart contract.

cc0 licensing allows a robust community to co-create in ways that benefit all members, regardless of original creators' continuous commitment. We foresee more organized infrastructure and design patterns as NFT matures. Like open source software, value capture frameworks may see innovation. (We could imagine a variant of the "Sleepycat license," which requires commercial software to pay licensing fees when embedding open source components.) As creators progress the space, we expect them to build unique rights and licensing strategies. cc0 allows NFT producers to bootstrap ideas that may take off.

xuanling11

3 years ago

Reddit NFT Achievement

Reddit's NFT market is alive and well.

NFT owners outnumber OpenSea on Reddit.

Reddit NFTs flip in OpenSea in days:

Fast-selling.

NFT sales will make Reddit's current communities more engaged.

I don't think NFTs will affect existing groups, but they will build hype for people to acquire them.

The first season of Collectibles is unique, but many missed the first season.

Second-season NFTs are less likely to be sold for a higher price than first-season ones.

If you use Reddit, it's fun to own NFTs.

Stephen Moore

3 years ago

Trading Volume on OpenSea Drops by 99% as the NFT Boom Comes to an End

Wasn't that a get-rich-quick scheme?

OpenSea processed $2.7 billion in NFT transactions in May 2021.

Fueled by a crypto bull run, rumors of unfathomable riches, and FOMO, Bored Apes, Crypto Punks, and other JPEG-format trash projects flew off the virtual shelves, snatched up by retail investors and celebrities alike.

Over a year later, those shelves are overflowing and warehouses are backlogged. Since March, I've been writing less. In May and June, the bubble was close to bursting.

Apparently, the boom has finally peaked.

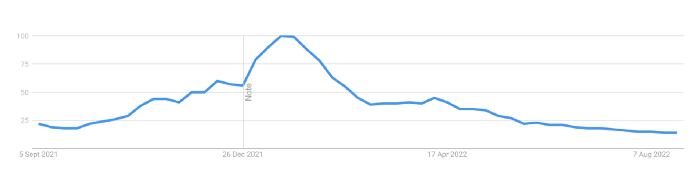

This bubble has punctured, and deflation has begun. On Aug. 28, OpenSea processed $9.34 million.

From that euphoric high of $2.7 billion, $9.34 million represents a spectacular decline of 99%.

OpenSea contradicts the data. A trading platform spokeswoman stated the comparison is unfair because it compares the site's highest and lowest trading days. They're the perfect two data points to assess the drop. OpenSea chooses to use ETH volume measures, which ignore crypto's shifting price. Since January 2022, monthly ETH volume has dropped 140%, according to Dune.

Unconvincing counterargument.

Further OpenSea indicators point to declining NFT demand:

Since January 2022, daily user visits have decreased by 50%.

Daily transactions have decreased by 50% since the beginning of the year in the same manner.

Off-platform, the floor price of Bored Apes has dropped from 145 ETH to 77 ETH. (At $4,800, a reduction from $700,000 to $370,000). Google search data shows waning popular interest.

It is a trend that will soon vanish, just like laser eyes.

NFTs haven't moved since the new year. Eminem and Snoop Dogg can utilize their apes in music videos or as 3D visuals to perform at the VMAs, but the reality is that NFTs have lost their public appeal and the market is trying to regain its footing.

They've lost popularity because?

Breaking records. The technology still lacks genuine use cases a year and a half after being popular.

They're pricey prestige symbols that have made a few people rich through cunning timing or less-than-savory scams or rug pulling. Over $10.5 billion has been taken through frauds, most of which are NFT enterprises promising to be the next Bored Apes, according to Web3 is going wonderfully. As the market falls, many ordinary investors realize they purchased into a self-fulfilling ecosystem that's halted. Many NFTs are sold between owner-held accounts to boost their price, data suggests. Most projects rely on social media excitement to debut with a high price before the first owners sell and chuckle to the bank. When they don't, the initiative fails, leaving investors high and dry.

NFTs are fading like laser eyes. Most people pushing the technology don't believe in it or the future it may bring. No, they just need a Kool-Aid-drunk buyer.

Everybody wins. When your JPEGs are worth 99% less than when you bought them, you've lost.

When demand reaches zero, many will lose.

You might also like

Mark Schaefer

3 years ago

20 Fun Uses for ChatGPT

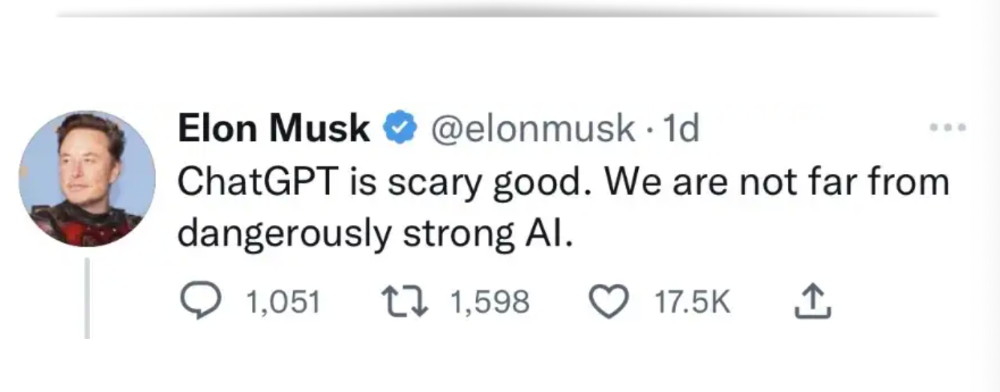

Our RISE community is stoked on ChatGPT. ChatGPT has countless uses.

Early on. Companies are figuring out the legal and ethical implications of AI's content revolution. Using AI for everyday tasks is cool.

So I challenged RISE friends... Let's have fun and share non-obvious uses.

Onward!

1. Tweet

Jim MacLeod requested a design-themed Twitter thread from ChatGPT.

2. Novelize

Giuseppe Fratoni writes novels.

"This is amazing!" Impotent. I asked about writing, mystery novels, and jazz.

"Develop a mystery novel plot in which a disillusioned homicide detective hunts a serial killer who targets jazz musicians who play Autumn Leaves."

"I have:

Detective James Thompson is a seasoned veteran of the Homicide department, but lately he’s been feeling burnt out and disillusioned. His latest case, the murder of a young jazz pianist who was found brutally killed in his home, only serves to deepen his sense of despair … (much more provided)

3. Question-and-answer sessions

Bliss recommends:

You have a guest speaker and want to ask audience questions.

Pre-generate questions with ChatGPT. "And here's a question from our AI?"

The conference is about Western water scarcity. Water management expert. My AI question was...

Which desalination-related questions should I ask an expert?

ChatGPT said...

How is desalination currently being used around the world, and in what types of locations is it most effective?

What are the potential advantages and disadvantages of using desalination to provide fresh water?

What are some of the key challenges and limitations of desalination technology, and how are they being addressed?

4. Game-making

Richard's a board game expert. He suggests using ChatGPT to plan games. Note: Some people have started getting help solving crossword puzzle clues.

5. Matchmaking

Tanya Thompson thinks it helps dating. ChatGPT:

Here are some flirty first-message ideas for dating apps:

I noticed you from afar. I had to say hi and see if we clicked.

Your profile picture is gorgeous. I'm obsessed with your [Feature] and want to know you better.

I don't usually message first, but I had to. You're [Attractive Quality] and I can't wait to talk.”

Hello. Your profile intimidates me. I'm starstruck by your [Attractiveness]. (Many instances)

5. Solitude/anxiety

ChatGPT excels at one-on-one conversations.

PepperBrooks: "I'm sad and lonely."

ChatGPT: I’m sorry to hear that you’re feeling sad and lonely. It’s natural to feel down sometimes, but it’s important to remember that you’re not alone. There are many people who care about you and want to help you. It can be helpful to talk to someone about your feelings, whether it’s a close friend, family member, or mental health professional.

Sometimes, just expressing your thoughts and emotions to someone else can help to alleviate your sadness and loneliness. It’s also important to take care of yourself and do things that make you happy, such as spending time with loved ones, pursuing a hobby, or exercising. These things can help to improve your mood and make you feel more connected to others. Remember that you are strong and capable, and that you can get through this difficult time.

Daniel Nestle asked ChatGPT to generate journal prompts to help him deal with anxiety.

Write down the things that are causing you anxiety at the moment.

Describe a situation in which you felt anxious and how you coped with it.

Reflect on how your thoughts and beliefs contribute to your anxiety.

Write a letter to your anxiety, expressing your feelings and concerns

Imagine yourself in a calm and peaceful place, and describe it in detail.

(many more items followed)

6. Names

Continued Daniel:

Also, naming ideas.

Me: Name this drink. Japanese gin, unsweetened tonic, lime, Szechuan pepper, grapefruit.

ChatGPT: How about “Sakura Sunrise?” The name incorporates the Japanese gin and the citrus flavors of grapefruit and lime, and the word “sunrise” suggests a fresh and invigorating start to the day. Alternatively, you could go with something like “Peppered Grapefruit Gin Fizz” to emphasize the unique flavor combination of Szechuan pepper and grapefruit.

7. Translation on the go

Monks recommends: ChatGPT is a perfect mobile translation tool. Say you need help in Italy.

ME: Translate to Italian

Where is the nearest gas station?

ChatGPT: “La mia auto sta per esaurire il carburante, mi puoi dire dove si trova la stazione di servizio più vicina?”

8. Fitness

Monks added:

ME: In 3 months, I want to run 5km. Plan out how I can do this.

ChatGPT: Here's a 3-month plan to run 5km.

Start by walking for 15–20 minutes each day to build up your endurance and get your body used to regular exercise.

After a week of walking, begin incorporating short jogs into your routine. Start by jogging for 1–2 minutes at a time, with walking breaks in between. Gradually increase the length of your jogs and reduce the amount of time you spend walking.

Once you can jog for 10 minutes without stopping, start increasing the distance of your runs. Aim to run 1km without stopping and then gradually increase the distance over time.

In addition to your regular runs, incorporate strength training and stretching into your routine to improve your overall fitness and reduce the risk of injury.

(more details continued on)

9. Integrations and coding

10. Teacher lesson plans

Spencer Crandall saved time.

This morning, I wondered who has the hardest job. Teachers.

Many students, little time. ChatGPT could handle lesson planning. I tried it and got this.

Lesson Title: The History and Impact of Artificial Intelligence

Students will understand the history and development of AI and the potential positive and negative impacts on society.

AI timeline AI technologies and applications

Overview:

Introduce the topic of artificial intelligence, and explain that it refers to the development of computer systems and algorithms that can simulate human intelligence and behavior.

Show the timeline of significant events in the history of AI, and discuss the key milestones and developments in the field.

Show examples of AI technologies and applications, and explain how they are used in various industries and fields.

Discuss the potential positive and negative impacts of AI on society, including its potential to improve productivity, efficiency, and safety, as well as its potential to create new challenges and concerns, such as job displacement and ethical issues.

(many more details followed)

11. Find podcast guests.

Joeri Billast suggested:

Who should be on my Web3 podcast?

ChatGPT: Web3 marketing experts, influencers, and thought leaders make great podcast guests. These include Web3 marketers, content creators, business owners, entrepreneurs, and technologists. You could invite Web3 startups and organizations to your podcast.

Please give examples.

ChatGPT: Ideal Web3 marketing podcast guests include:

Tim Berner-Lee, inventor of the World Wide Web

Chris Dixon, general partner at Andreessen Horowitz

Vitalik Buterin, founder of Ethereum

Joe Lubin, founder of ConsenSys

Susan Fowler, author of Whistleblower

(many other suggestions)

12. Comments and reviews on social media

Lisa Monk thinks ChatGPT can help retail staff with social media.

She asked ChatGPT to "review this restaurant"

POSITIVE CUSTOMER REVIEW: I absolutely love this place. We eat out a lot however this place has topped it all. Perfect meals, amazing staff and the timing for it all was great! Special thanks to Sophie B (you rock) From your guests all the way from the Gold Coast, THANK YOU

ChatGPT REPLY: Thank you so much for your kind words and for taking the time to write a review. We are delighted to hear that you had such a great experience at our restaurant. We are thrilled that you enjoyed your meal and the service provided by Sophie. It’s always a pleasure to serve guests visiting from the Gold Coast and we are grateful for your support. We look forward to welcoming you back again soon. Thank you again for your positive review.

CUSTOMER REVIEW: Most average food, there is a nice view, But that’s about it

ChatGPT: Thank you for your review. We apologize if your dining experience was not up to your expectations. We strive to provide top-quality food and service to all of our customers, and we will take your feedback into consideration as we continue to improve. Thank you for letting us know about your experience.

13. Crime-fighting

Zack Seipert said, "I researched some famous unsolved murders, and ChatGPT laid out the crime, suspects, clues, and more." I bet experienced detectives could solve some of these cold cases.

14. Reduce bias

Joanne Taylor struggles to remove biases from her writing. She asked ChatGPT for ideas.

I asked ChatGPT to check a text for racial bias, and it did well.

15. Furnishings

I designed a small, unique table using ChatGPT and MidJourney. I edited ChatGPT's idea for clarity and brevity before entering it in MidJourney.

Results:

16. Serialize a novel

Scott Scowcoft led ChatCPT through iterations of a story text to create serialized novel frames. You can view this here.

17. Interview preparation

I was on a sales podcast. Although this is marketing-related, it's not my forte. I asked ChatGPT for help with a sales interview. Response:

Here are some interview questions about the future of sales and how to answer them.

How will technology affect sales in the future?

Technology will impact sales in the coming years. Automation and AI could be used to handle routine tasks, and data analysis and CRM could become more important. E-commerce and online sales channels are also reshaping the sales landscape.

How will the salesperson's role change?

Future sales roles may change in response to changing customer needs and expectations. Salespeople must be knowledgeable and consultative to help customers navigate complex products and services. Increasing importance of data analysis and CRM tools will require salespeople to understand and use technology effectively.

Future sales professionals will need what skills?

Future salespeople will need many skills. Sales professionals must have strong communication and interpersonal skills, as well as product and service knowledge and the ability to use data analysis and CRM tools effectively. Adapting to changing customer needs and staying current on industry trends will also be important for sales success.

18. Gift ideas

I need Christmas gift ideas for my wife. I asked:

Suggest a gift idea under $200 for a middle-aged woman who loves The Eagles.

A middle-aged woman who loves The Eagles might like a vinyl record of "Hotel California" or "The Long Run." Many music fans enjoy the unique sound and experience of vinyl records.

Pair the record with a high-quality record player for a complete gift. The vinyl record and record player should fit within your $200 budget for an Eagles fan.

19. Explaining complex concepts

I entered: Explain quantum physics to me as if I were 10 years old.

Quantum physics is a branch of science that studies how tiny particles, like atoms and subatomic particles, behave. These particles are so small that they don’t always follow the same rules as the things we can see and touch every day.

For example, sometimes they can be in two places at the same time, or they can be friends with each other even if they are far apart. This might sound strange, but it’s what scientists have learned from studying these tiny particles. Quantum physics helps us understand how the world works at a very small scale, and it can also help us make new technologies, like computers that are much faster than the ones we have today.

20. AP-style editing

Blogs, journals, and books follow AP Style. I asked ChatGPT to "edit using AP Style" and it did a great job.

And then... "Write a catchy headline for a blog post about 16 ChatGPT uses"

Here are some possible blog post titles for 20 creative ChatGPT uses:

“20 Fun and Creative Ways to Use ChatGPT: From Games to Quizzes and More”

“The Ultimate Guide to Using ChatGPT for Entertainment and Creativity”

“20 Reasons to Use ChatGPT: How it Can Enhance Your Gaming, Storytelling, and More”

20 Entertaining Uses for ChatGPT You Never Knew Were Possible”

“Unleash Your Imagination with ChatGPT: 16 Creative and Fun Ways to Use it”

In a previous post, I said ChatGPT will change marketing careers forever. I have never made a statement like that in my life. Even in the early days of the internet, people were cautious.

This technology was just released two weeks ago, and over a million people are already using it. This is the fastest technology adoption in history.

Today's post offers inventive and entertaining ideas, but it's just the beginning. ChatGPT writes code, music, and papers.

Eve Arnold

3 years ago

Your Ideal Position As a Part-Time Creator

Inspired by someone I never met

Inspiration is good and bad.

Paul Jarvis inspires me. He's a web person and writer who created his own category by being himself.

Paul said no thank you when everyone else was developing, building, and assuming greater responsibilities. This isn't success. He rewrote the rules. Working for himself, expanding at his own speed, and doing what he loves were his definitions of success.

Play with a problem that you have

The biggest problem can be not recognizing a problem.

Acceptance without question is deception. When you don't push limits, you forget how. You start thinking everything must be as it is.

For example: working. Paul worked a 9-5 agency work with little autonomy. He questioned whether the 9-5 was a way to live, not the way.

Another option existed. So he chipped away at how to live in this new environment.

Don't simply jump

Internet writers tell people considering quitting 9-5 to just quit. To throw in the towel. To do what you like.

The advice is harmful, despite the good intentions. People think quitting is hard. Like courage is the issue. Like handing your boss a resignation letter.

Nope. The tough part comes after. It’s easy to jump. Landing is difficult.

The landing

Paul didn't quit. Intelligent individuals don't. Smart folks focus on landing. They imagine life after 9-5.

Paul had been a web developer for a long time, had solid clients, and was respected. Hence if he pushed the limits and discovered another route, he had the potential to execute.

Working on the side

Society loves polarization. It’s left or right. Either way. Or chaos. It's 9-5 or entrepreneurship.

But like Paul, you can stretch polarization's limits. In-between exists.

You can work a 9-5 and side jobs (as I do). A mix of your favorites. The 9-5's stability and creativity. Fire and routine.

Remember you can't have everything but anything. You can create and work part-time.

My hybrid lifestyle

Not selling books doesn't destroy my world. My globe keeps spinning if my new business fails or if people don't like my Tweets. Unhappy algorithm? Cool. I'm not bothered (okay maybe a little).

The mix gives me the best of both worlds. To create, hone my skill, and grasp big-business basics. I like routine, but I also appreciate spending 4 hours on Saturdays writing.

Some days I adore leaving work at 5 pm and disconnecting. Other days, I adore having a place to write if inspiration strikes during a run or a discussion.

I’m a part-time creator

I’m a part-time creator. No, I'm not trying to quit. I don't work 5 pm - 2 am on the side. No, I'm not at $10,000 MRR.

I work part-time but enjoy my 9-5. My 9-5 has goodies. My side job as well.

It combines both to meet my lifestyle. I'm satisfied.

Join the Part-time Creators Club for free here. I’ll send you tips to enhance your creative game.

Jenn Leach

3 years ago

I created a faceless TikTok account. Six months later.

Follower count, earnings, and more

I created my 7th TikTok account six months ago. TikTok's great. I've developed accounts for Amazon products, content creators/brand deals education, website flipping, and more.

Introverted or shy people use faceless TikTok accounts.

Maybe they don't want millions of people to see their face online, or they want to remain anonymous so relatives and friends can't locate them.

Going faceless on TikTok can help you grow a following, communicate your message, and make money online.

Here are 6 steps I took to turn my Tik Tok account into a $60,000/year side gig.

From nothing to $60K in 6 months

It's clickbait, but it’s true. Here’s what I did to get here.

Quick context:

I've used social media before. I've spent years as a social creator and brand.

I've built Instagram, TikTok, and YouTube accounts to nearly 100K.

How I did it

First, select a niche.

If you can focus on one genre on TikTok, you'll have a better chance of success, however lifestyle creators do well too.

Niching down is easier, in my opinion.

Examples:

Travel

Food

Kids

Earning cash

Finance

You can narrow these niches if you like.

During the pandemic, a travel blogger focused on Texas-only tourism and gained 1 million subscribers.

Couponing might be a finance specialization.

One of my finance TikTok accounts gives credit tips and grants and has 23K followers.

Tons of ways you can get more specific.

Consider how you'll monetize your TikTok account. I saw many enormous TikTok accounts that lose money.

Why?

They can't monetize their niche. Not impossible to commercialize, but tough enough to inhibit action.

First, determine your goal.

In this first step, consider what your end goal is.

Are you trying to promote your digital products or social media management services?

You want brand deals or e-commerce sales.

This will affect your TikTok specialty.

This is the first step to a TikTok side gig.

Step 2: Pick a content style

Next, you want to decide on your content style.

Do you do voiceover and screenshots?

You'll demonstrate a product?

Will you faceless vlog?

Step 3: Look at the competition

Find anonymous accounts and analyze what content works, where they thrive, what their audience wants, etc.

This can help you make better content.

Like the skyscraper method for TikTok.

Step 4: Create a content strategy.

Your content plan is where you sit down and decide:

How many videos will you produce each day or each week?

Which links will you highlight in your biography?

What amount of time can you commit to this project?

You may schedule when to post videos on a calendar. Make videos.

5. Create videos.

No video gear needed.

Using a phone is OK, and I think it's preferable than posting drafts from a computer or phone.

TikTok prefers genuine material.

Use their app, tools, filters, and music to make videos.

And imperfection is preferable. Tik okers like to see videos made in a bedroom, not a film studio.

Make sense?

When making videos, remember this.

I personally use my phone and tablet.

Step 6: Monetize

Lastly, it’s time to monetize How will you make money? You decided this in step 1.

Time to act!

For brand agreements

Include your email in the bio.

Share several sites and use a beacons link in your bio.

Make cold calls to your favorite companies to get them to join you in a TikTok campaign.

For e-commerce

Include a link to your store's or a product's page in your bio.

For client work

Include your email in the bio.

Use a beacons link to showcase your personal website, portfolio, and other resources.

For affiliate marketing

Include affiliate product links in your bio.

Join the Amazon Influencer program and provide a link to your storefront in your bio.

$60,000 per year from Tik Tok?

Yes, and some creators make much more.

Tori Dunlap (herfirst100K) makes $100,000/month on TikTok.

My TikTok adventure took 6 months, but by month 2 I was making $1,000/month (or $12K/year).

By year's end, I want this account to earn $100K/year.

Imagine if my 7 TikTok accounts made $100K/year.

7 Tik Tok accounts X $100K/yr = $700,000/year