More on Web3 & Crypto

Sam Hickmann

3 years ago

Token taxonomy: Utility vs Security vs NFT

Let's examine the differences between the three main token types and their functions.

As Ethereum grew, the term "token" became a catch-all term for all assets built on the Ethereum blockchain. However, different tokens were grouped based on their applications and features, causing some confusion. Let's examine the modification of three main token types: security, utility, and non-fungible.

Utility tokens

They provide a specific utility benefit (or a number of such). A utility token is similar to a casino chip, a table game ticket, or a voucher. Depending on the terms of issuing, they can be earned and used in various ways. A utility token is a type of token that represents a tool or mechanism required to use the application in question. Like a service, a utility token's price is determined by supply and demand. Tokens can also be used as a bonus or reward mechanism in decentralized systems: for example, if you like someone's work, give them an upvote and they get a certain number of tokens. This is a way for authors or creators to earn money indirectly.

The most common way to use a utility token is to pay with them instead of cash for discounted goods or services.

Utility tokens are the most widely used by blockchain companies. Most cryptocurrency exchanges accept fees in native utility tokens.

Utility tokens can also be used as a reward. Companies tokenize their loyalty programs so that points can be bought and sold on blockchain exchanges. These tokens are widely used in decentralized companies as a bonus system. You can use utility tokens to reward creators for their contributions to a platform, for example. It also allows members to exchange tokens for specific bonuses and rewards on your site.

Unlike security tokens, which are subject to legal restrictions, utility tokens can be freely traded.

Security tokens

Security tokens are essentially traditional securities like shares, bonds, and investment fund units in a crypto token form.

The key distinction is that security tokens are typically issued by private firms (rather than public companies) that are not listed on stock exchanges and in which you can not invest right now. Banks and large venture funds used to be the only sources of funding. A person could only invest in private firms if they had millions of dollars in their bank account. Privately issued security tokens outperform traditional public stocks in terms of yield. Private markets grew 50% faster than public markets over the last decade, according to McKinsey Private Equity Research.

A security token is a crypto token whose value is derived from an external asset or company. So it is governed as security (read about the Howey test further in this article). That is, an ownership token derives its value from the company's valuation, assets on the balance sheet, or dividends paid to token holders.

Why are Security Tokens Important?

Cryptocurrency is a lucrative investment. Choosing from thousands of crypto assets can mean the difference between millionaire and bankrupt. Without security tokens, crypto investing becomes riskier and generating long-term profits becomes difficult. These tokens have lower risk than other cryptocurrencies because they are backed by real assets or business cash flows. So having them helps to diversify a portfolio and preserve the return on investment in riskier assets.

Security tokens open up new funding avenues for businesses. As a result, investors can invest in high-profit businesses that are not listed on the stock exchange.

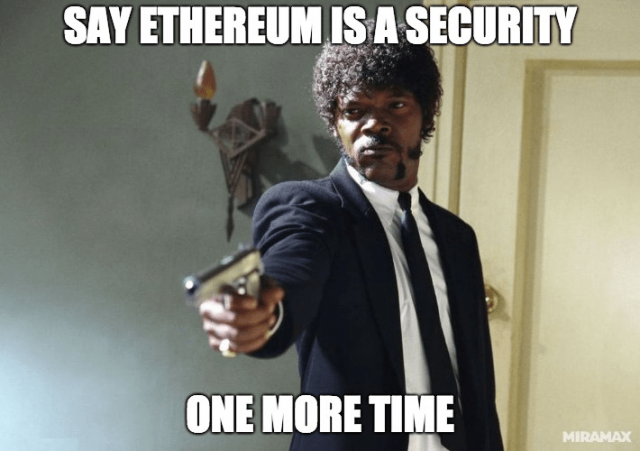

The distinction between utility and security tokens isn't as clear as it seems. However, this increases the risk for token issuers, especially in the USA. The Howey test is the main pillar regulating judicial precedent in this area.

What is a Howey Test?

An "investment contract" is determined by the Howey Test, a lawsuit settled by the US Supreme Court. If it does, it's a security and must be disclosed and registered under the Securities Act of 1933 and the Securities Exchange Act of 1934.

If the SEC decides that a cryptocurrency token is a security, a slew of issues arise. In practice, this ensures that the SEC will decide when a token can be offered to US investors and if the project is required to file a registration statement with the SEC.

Due to the Howey test's extensive wording, most utility tokens will be classified as securities, even if not intended to be. Because of these restrictions, most ICOs are not available to US investors. When asked about ICOs in 2018, then-SEC Chairman Jay Clayton said they were securities. The given statement adds to the risk. If a company issues utility tokens without registering them as securities, the regulator may impose huge fines or even criminal charges.

What other documents regulate tokens?

Securities Act (1993) or Securities Exchange Act (1934) in the USA; MiFID directive and Prospectus Regulation in the EU. These laws require registering the placement of security tokens, limiting their transfer, but protecting investors.

Utility tokens have much less regulation. The Howey test determines whether a given utility token is a security. Tokens recognized as securities are now regulated as such. Having a legal opinion that your token isn't makes the implementation process much easier. Most countries don't have strict regulations regarding utility tokens except KYC (Know Your Client) and AML (Anti Money-Laundering).

As cryptocurrency and blockchain technologies evolve, more countries create UT regulations. If your company is based in the US, be aware of the Howey test and the Bank Secrecy Act. It classifies UTs and their issuance as money transmission services in most states, necessitating a license and strict regulations. Due to high regulatory demands, UT issuers try to avoid the United States as a whole. A new law separating utility tokens from bank secrecy act will be introduced in the near future, giving hope to American issuers.

The rest of the world has much simpler rules requiring issuers to create basic investor disclosures. For example, the latest European legislation (MiCA) allows businesses to issue utility tokens without regulator approval. They must also prepare a paper with all the necessary information for the investors.

A payment token is a utility token that is used to make a payment. They may be subject to electronic money laws.

Because non-fungible tokens are a new instrument, there is no regulating paper yet. However, if the NFT is fractionalized, the smaller tokens acquired may be seen as securities.

NFT Tokens

Collectible tokens are also known as non-fungible tokens. Their distinctive feature is that they denote unique items such as artwork, merch, or ranks. Unlike utility tokens, which are fungible, meaning that two of the same tokens are identical, NFTs represent a unit of possession that is strictly one of a kind. In a way, NFTs are like baseball cards, each one unique and valuable.

As for today, the most recognizable NFT function is to preserve the fact of possession. Owning an NFT with a particular gif, meme, or sketch does not transfer the intellectual right to the possessor, but is analogous to owning an original painting signed by the author.

Collectible tokens can also be used as digital souvenirs, so to say. Businesses can improve their brand image by issuing their own branded NFTs, which represent ranks or achievements within the corporate ecosystem. Gamifying business ecosystems would allow people to connect with a brand and feel part of a community.

Which type of tokens is right for you as a business to raise capital?

For most businesses, it's best to raise capital with security tokens by selling existing shares to global investors. Utility tokens aren't meant to increase in value over time, so leave them for gamification and community engagement. In a blockchain-based business, however, a utility token is often the lifeblood of the operation, and its appreciation potential is directly linked to the company's growth. You can issue multiple tokens at once, rather than just one type. It exposes you to various investors and maximizes the use of digital assets.

Which tokens should I buy?

There are no universally best tokens. Their volatility, industry, and risk-reward profile vary. This means evaluating tokens in relation to your overall portfolio and personal preferences: what industries do you understand best, what excites you, how do you approach taxes, and what is your planning horizon? To build a balanced portfolio, you need to know these factors.

Conclusion

The three most common types of tokens today are security, utility, and NFT. Security tokens represent stocks, mutual funds, and bonds. Utility tokens can be perceived as an inside-product "currency" or "ignition key" that grants you access to goods and services or empowers with other perks. NFTs are unique collectible units that identify you as the owner of something.

Onchain Wizard

3 years ago

Three Arrows Capital & Celsius Updates

I read 1k+ page 3AC liquidation documentation so you don't have to. Also sharing revised Celsius recovery plans.

3AC's liquidation documents:

Someone disclosed 3AC liquidation records in the BVI courts recently. I'll discuss the leak's timeline and other highlights.

Three Arrows Capital began trading traditional currencies in emerging markets in 2012. They switched to equities and crypto, then purely crypto in 2018.

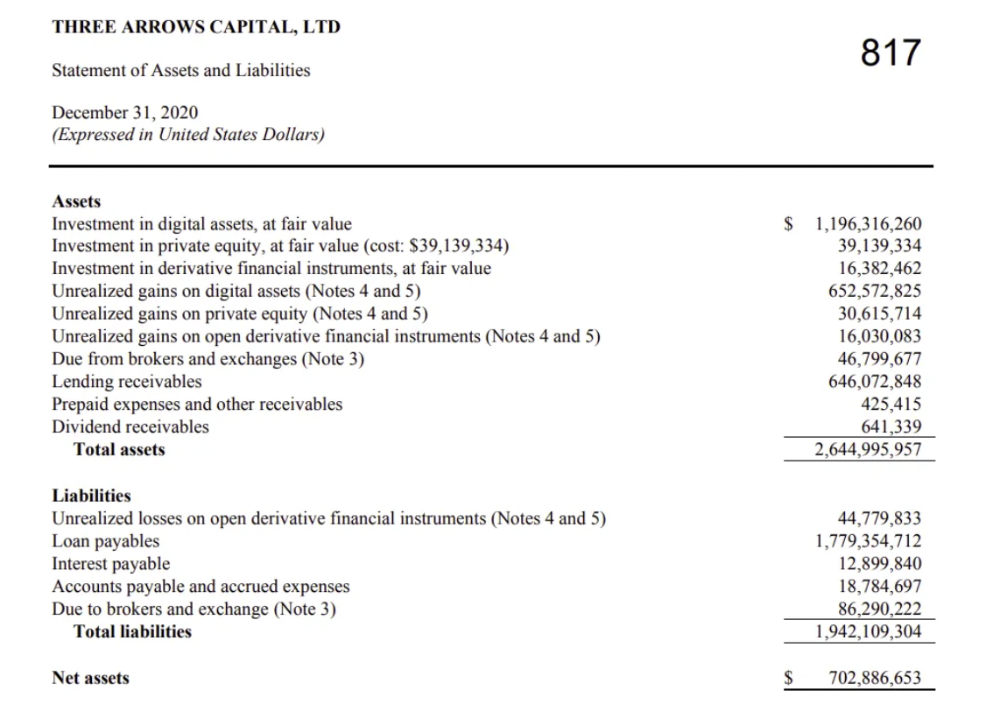

By 2020, the firm had $703mm in net assets and $1.8bn in loans (these guys really like debt).

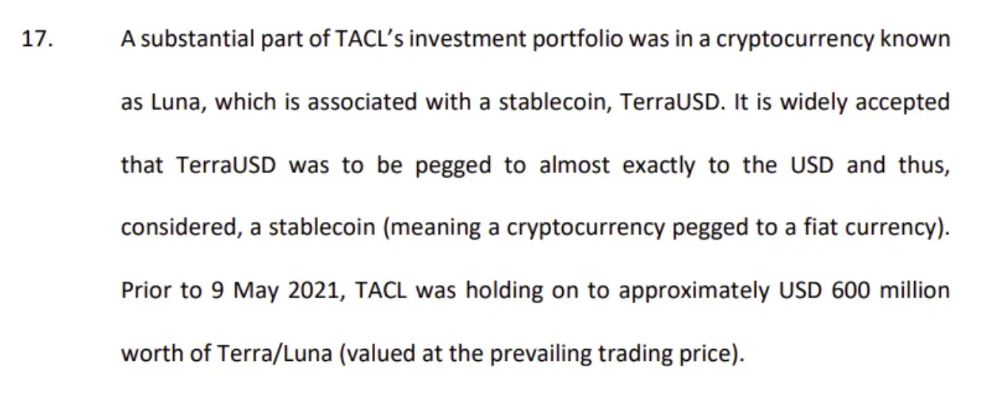

The firm's net assets under control reached $3bn in April 2022, according to the filings. 3AC had $600mm of LUNA/UST exposure before May 9th 2022, which put them over.

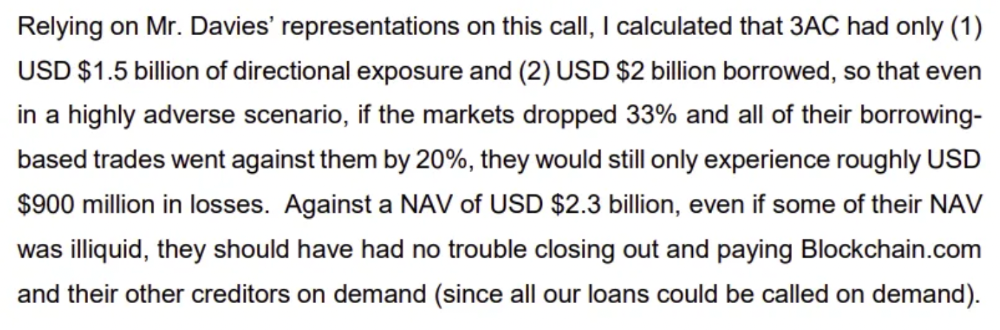

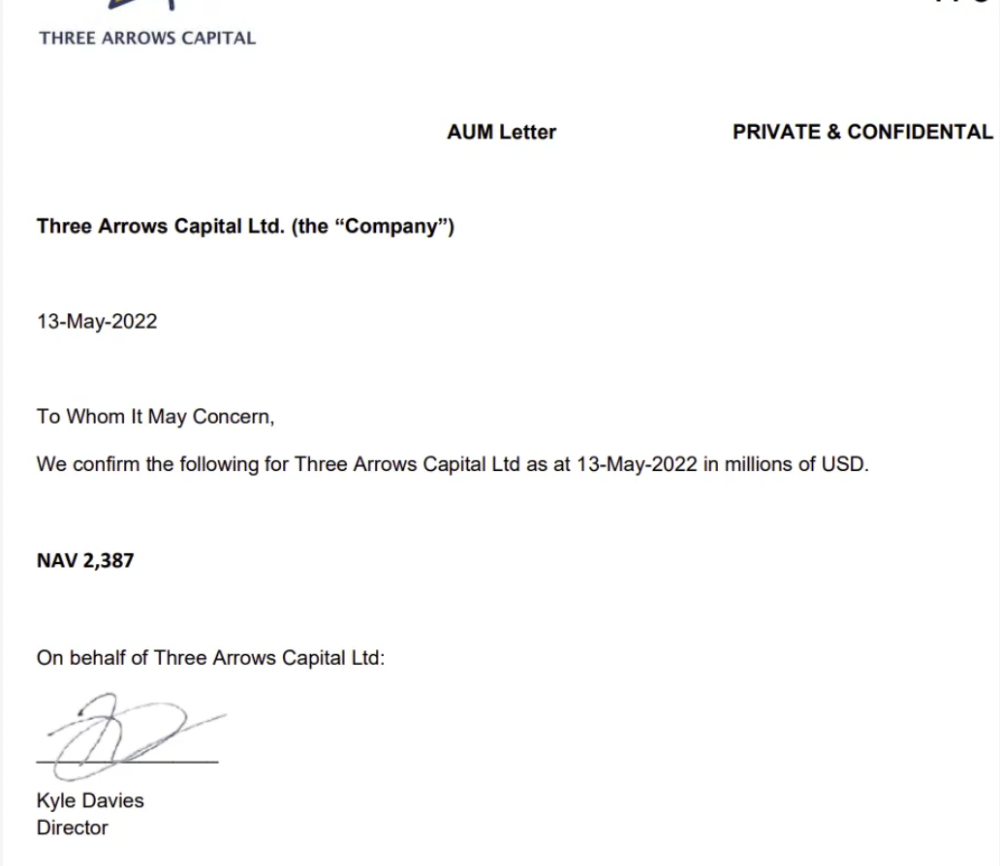

LUNA and UST go to zero quickly (I wrote about the mechanics of the blowup here). Kyle Davies, 3AC co-founder, told Blockchain.com on May 13 that they have $2.4bn in assets and $2.3bn NAV vs. $2bn in borrowings. As BTC and ETH plunged 33% and 50%, the company became insolvent by mid-2022.

3AC sent $32mm to Tai Ping Shen, a Cayman Islands business owned by Su Zhu and Davies' partner, Kelly Kaili Chen (who knows what is going on here).

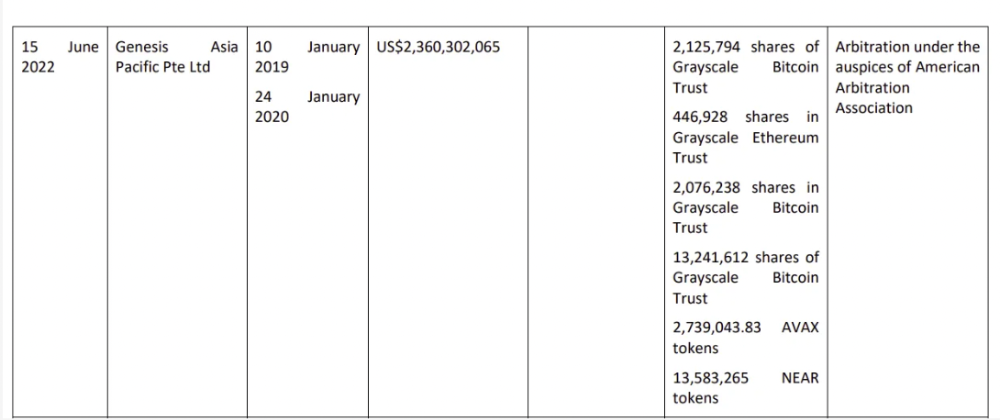

3AC had borrowed over $3.5bn in notional principle, with Genesis ($2.4bn) and Voyager ($650mm) having the most exposure.

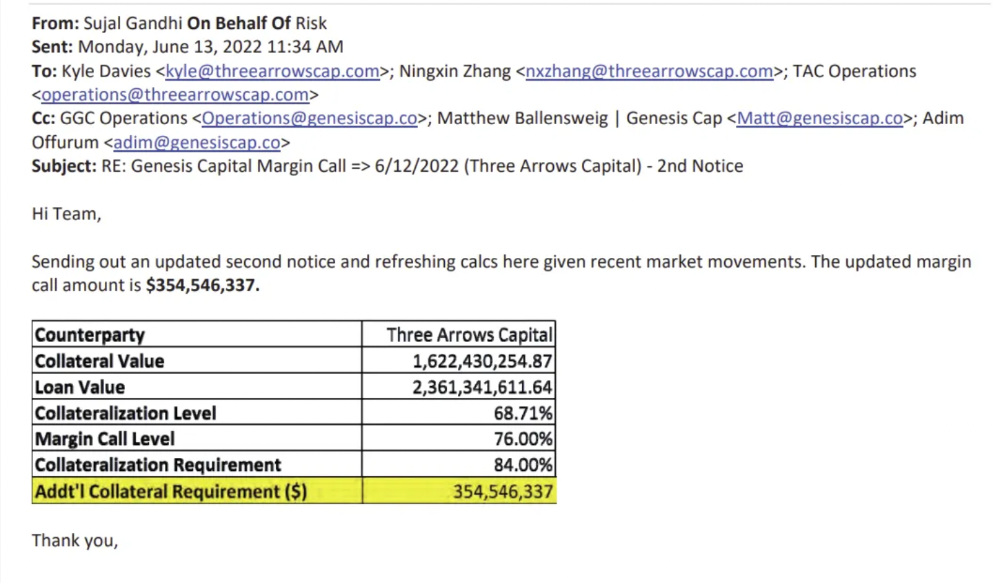

Genesis demanded $355mm in further collateral in June.

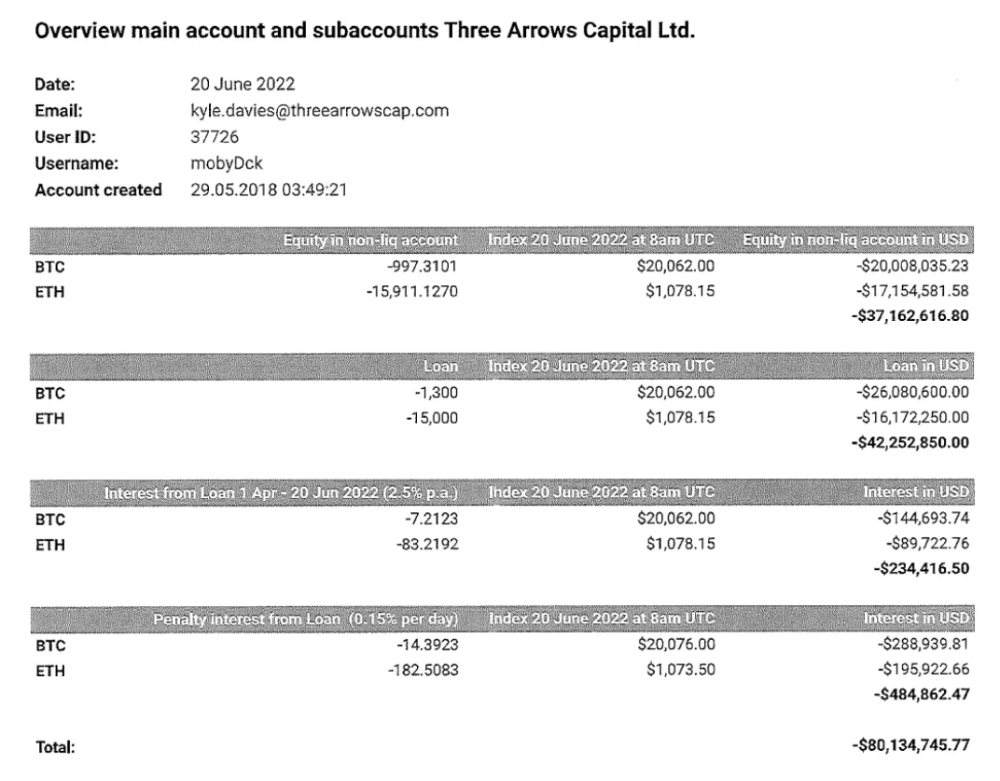

Deribit (another 3AC investment) called for $80 million in mid-June.

Even in mid-June, the corporation was trying to borrow more money to stay afloat. They approached Genesis for another $125mm loan (to pay another lender) and HODLnauts for BTC & ETH loans.

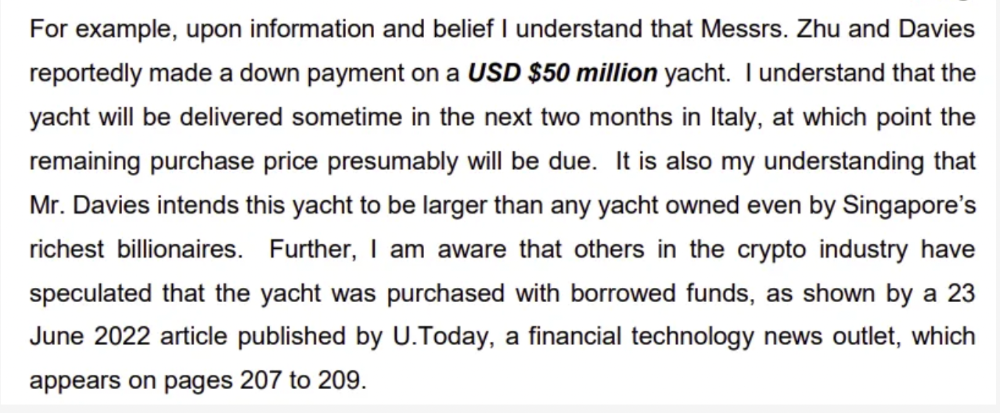

Pretty crazy. 3AC founders used borrowed money to buy a $50 million boat, according to the leak.

Su requesting for $5m + Chen Kaili Kelly asserting they loaned $65m unsecured to 3AC are identified as creditors.

Celsius:

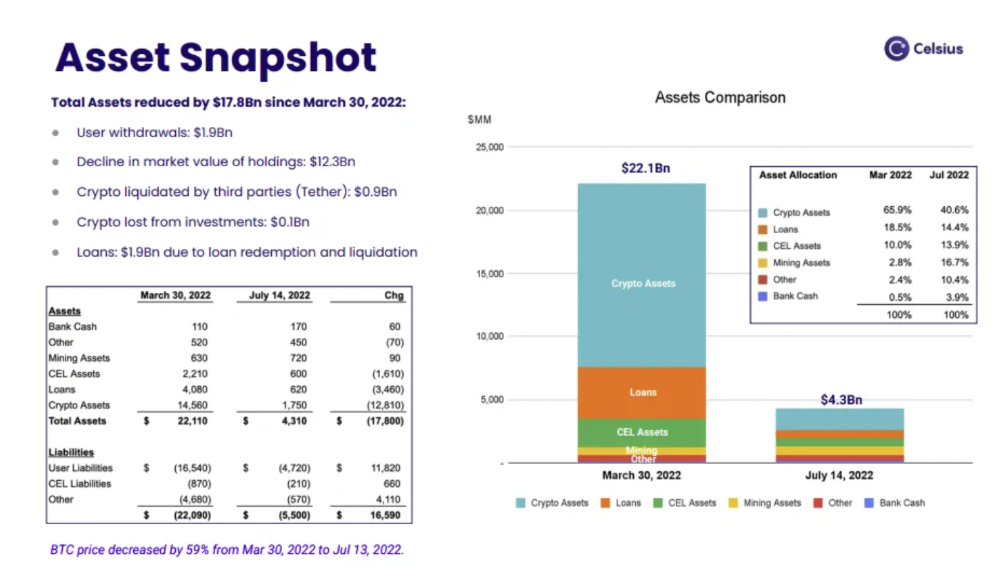

This bankruptcy presentation shows the Celsius breakdown from March to July 14, 2022. From $22bn to $4bn, crypto assets plummeted from $14.6bn to $1.8bn (ouch). $16.5bn in user liabilities dropped to $4.72bn.

In my recent post, I examined if "forced selling" is over, with Celsius' crypto assets being a major overhang. In this presentation, it looks that Chapter 11 will provide clients the opportunity to accept cash at a discount or remain long crypto. Provided that a fresh source of money is unlikely to enter the Celsius situation, cash at a discount or crypto given to customers will likely remain a near-term market risk - cash at a discount will likely come from selling crypto assets, while customers who receive crypto could sell at any time. I'll share any Celsius updates I find.

Conclusion

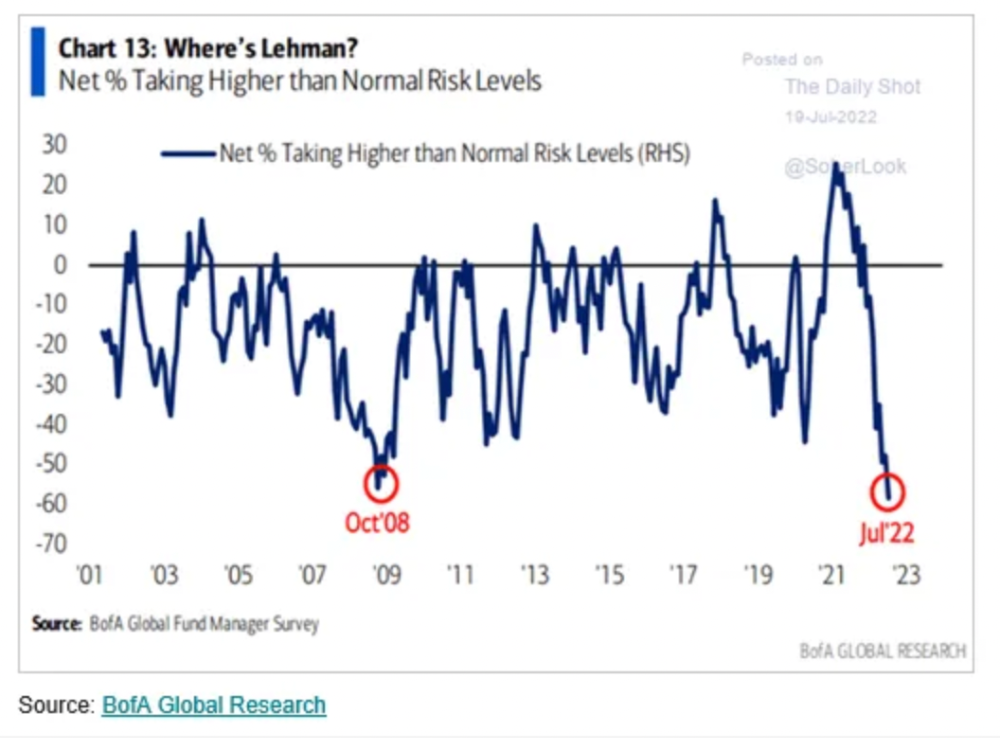

Only Celsius and the Mt Gox BTC unlock remain as forced selling catalysts. While everything went through a "relief" pump, with ETH up 75% from the bottom and numerous alts multiples higher, there are still macro dangers to equities + risk assets. There's a lot of wealth waiting to be deployed in crypto ($153bn in stables), but fund managers are risk apprehensive (lower than 2008 levels).

We're hopefully over crypto's "bottom," with peak anxiety and forced selling behind us, but we may chop around.

To see the full article, click here.

Matt Ward

3 years ago

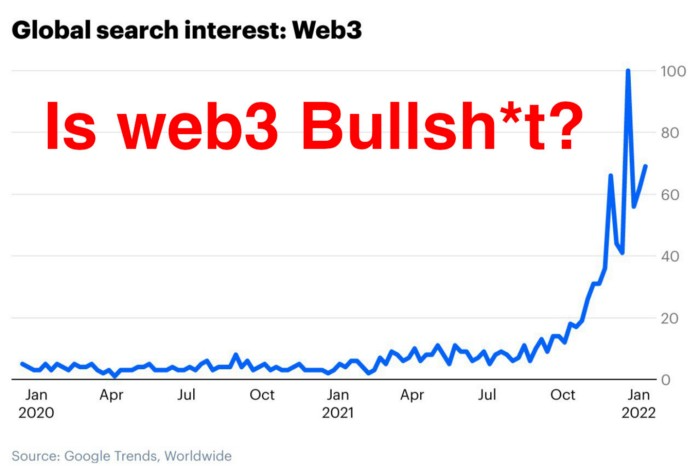

Is Web3 nonsense?

Crypto and blockchain have rebranded as web3. They probably thought it sounded better and didn't want the baggage of scam ICOs, STOs, and skirted securities laws.

It was like Facebook becoming Meta. Crypto's biggest players wanted to change public (and regulator) perception away from pump-and-dump schemes.

After the 2018 ICO gold rush, it's understandable. Every project that raised millions (or billions) never shipped a meaningful product.

Like many crazes, charlatans took the money and ran.

Despite its grifter past, web3 is THE hot topic today as more founders, venture firms, and larger institutions look to build the future decentralized internet.

Supposedly.

How often have you heard: This will change the world, fix the internet, and give people power?

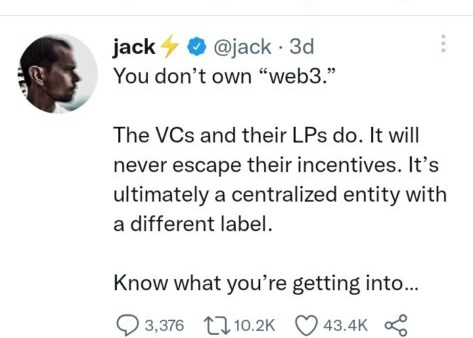

Why are most of web3's biggest proponents (and beneficiaries) the same rich, powerful players who built and invested in the modern internet? It's like they want to remake and own the internet.

Something seems off about that.

Why are insiders getting preferential presale terms before the public, allowing early investors and proponents to flip dirt cheap tokens and advisors shares almost immediately after the public sale?

It's a good gig with guaranteed markups, no risk or progress.

If it sounds like insider trading, it is, at least practically. This is clear when people talk about blockchain/web3 launches and tokens.

Fast money, quick flips, and guaranteed markups/returns are common.

Incentives-wise, it's hard to blame them. Who can blame someone for following the rules to win? Is it their fault or regulators' for not leveling the playing field?

It's similar to oil companies polluting for profit, Instagram depressing you into buying a new dress, or pharma pushing an unnecessary pill.

All of that is fair game, at least until we change the playbook, because people (and corporations) change for pain or love. Who doesn't love money?

belief based on money gain

Sinclair:

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

Bitcoin, blockchain, and web3 analogies?

Most blockchain and web3 proponents are true believers, not cynical capitalists. They believe blockchain's inherent transparency and permissionless trust allow humanity to evolve beyond our reptilian ways and build a better decentralized and democratic world.

They highlight issues with the modern internet and monopoly players like Google, Facebook, and Apple. Decentralization fixes everything

If we could give power back to the people and get governments/corporations/individuals out of the way, we'd fix everything.

Blockchain solves supply chain and child labor issues in China.

To meet Paris climate goals, reduce emissions. Create a carbon token.

Fixing online hatred and polarization Web3 Twitter and Facebook replacement.

Web3 must just be the answer for everything… your “perfect” silver bullet.

Nothing fits everyone. Blockchain has pros and cons like everything else.

Blockchain's viral, ponzi-like nature has an MLM (mid level marketing) feel. If you bought Taylor Swift's NFT, your investment is tied to her popularity.

Probably makes you promote Swift more. Play music loudly.

Here's another example:

Imagine if Jehovah’s Witnesses (or evangelical preachers…) got paid for every single person they converted to their cause.

It becomes a self-fulfilling prophecy as their faith and wealth grow.

Which breeds extremism? Ultra-Orthodox Jews are an example. maximalists

Bitcoin and blockchain are causes, religions. It's a money-making movement and ideal.

We're good at convincing ourselves of things we want to believe, hence filter bubbles.

I ignore anything that doesn't fit my worldview and seek out like-minded people, which algorithms amplify.

Then what?

Is web3 merely a new scam?

No, never!

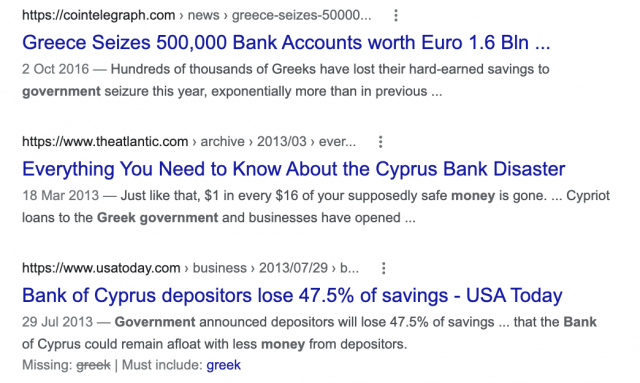

Blockchain has many crucial uses.

Sending money home/abroad without bank fees;

Like fleeing a war-torn country and converting savings to Bitcoin;

Like preventing Twitter from silencing dissidents.

Permissionless, trustless databases could benefit society and humanity. There are, however, many limitations.

Lost password?

What if you're cheated?

What if Trump/Putin/your favorite dictator incites a coup d'état?

What-ifs abound. Decentralization's openness brings good and bad.

No gatekeepers or firefighters to rescue you.

ISIS's fundraising is also frictionless.

Community-owned apps with bad interfaces and service.

Trade-offs rule.

So what compromises does web3 make?

What are your trade-offs? Decentralization has many strengths and flaws. Like Bitcoin's wasteful proof-of-work or Ethereum's political/wealth-based proof-of-stake.

To ensure the survival and veracity of the network/blockchain and to safeguard its nodes, extreme measures have been designed/put in place to prevent hostile takeovers aimed at altering the blockchain, i.e., adding money to your own wallet (account), etc.

These protective measures require significant resources and pose challenges. Reduced speed and throughput, high gas fees (cost to submit/write a transaction to the blockchain), and delayed development times, not to mention forked blockchain chains oops, web3 projects.

Protecting dissidents or rogue regimes makes sense. You need safety, privacy, and calm.

First-world life?

What if you assumed EVERYONE you saw was out to rob/attack you? You'd never travel, trust anyone, accomplish much, or live fully. The economy would collapse.

It's like an ant colony where half the ants do nothing but wait to be attacked.

Waste of time and money.

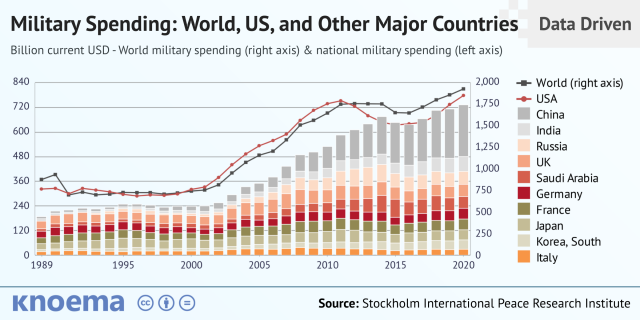

11% of the US budget goes to the military. Imagine what we could do with the $766B+ we spend on what-ifs annually.

Is so much hypothetical security needed?

Blockchain and web3 are similar.

Does your app need permissionless decentralization? Does your scooter-sharing company really need a proof-of-stake system and 1000s of nodes to avoid Russian hackers? Why?

Worst-case scenario? It's not life or death, unless you overstate the what-ifs. Web3 proponents find improbable scenarios to justify decentralization and tokenization.

Do I need a token to prove ownership of my painting? Unless I'm a master thief, I probably bought it.

despite losing the receipt.

I do, however, love Web 3.

Enough Web3 bashing for now. Understand? Decentralization isn't perfect, but it has huge potential when applied to the right problems.

I see many of the right problems as disrupting big tech's ruthless monopolies. I wrote several years ago about how tokenized blockchains could be used to break big tech's stranglehold on platforms, marketplaces, and social media.

Tokenomics schemes can be used for good and are powerful. Here’s how.

Before the ICO boom, I made a series of predictions about blockchain/crypto's future. It's still true.

Here's where I was then and where I see web3 going:

My 11 Big & Bold Predictions for Blockchain

In the near future, people may wear crypto cash rings or bracelets.

While some governments repress cryptocurrency, others will start to embrace it.

Blockchain will fundamentally alter voting and governance, resulting in a more open election process.

Money freedom will lead to a more geographically open world where people will be more able to leave when there is unrest.

Blockchain will make record keeping significantly easier, eliminating the need for a significant portion of government workers whose sole responsibility is paperwork.

Overrated are smart contracts.

6. Tokens will replace company stocks.

7. Blockchain increases real estate's liquidity, value, and volatility.

8. Healthcare may be most affected.

9. Crypto could end privacy and lead to Minority Report.

10. New companies with network effects will displace incumbents.

11. Soon, people will wear rings or bracelets with crypto cash.

Some have already happened, while others are still possible.

Time will tell if they happen.

And finally:

What will web3 be?

Who will be in charge?

Closing remarks

Hope you enjoyed this web3 dive. There's much more to say, but that's for another day.

We're writing history as we go.

Tech regulation, mergers, Bitcoin surge How will history remember us?

What about web3 and blockchain?

Is this a revolution or a tulip craze?

Remember, actions speak louder than words (share them in the comments).

Your turn.

You might also like

Samer Buna

2 years ago

The Errors I Committed As a Novice Programmer

Learn to identify them, make habits to avoid them

First, a clarification. This article is aimed to make new programmers aware of their mistakes, train them to detect them, and remind them to prevent them.

I learned from all these blunders. I'm glad I have coding habits to avoid them. Do too.

These mistakes are not ordered.

1) Writing code haphazardly

Writing good content is hard. It takes planning and investigation. Quality programs don't differ.

Think. Research. Plan. Write. Validate. Modify. Unfortunately, no good acronym exists. Create a habit of doing the proper quantity of these activities.

As a newbie programmer, my biggest error was writing code without thinking or researching. This works for small stand-alone apps but hurts larger ones.

Like saying anything you might regret, you should think before coding something you could regret. Coding expresses your thoughts.

When angry, count to 10 before you speak. If very angry, a hundred. — Thomas Jefferson.

My quote:

When reviewing code, count to 10 before you refactor a line. If the code does not have tests, a hundred. — Samer Buna

Programming is primarily about reviewing prior code, investigating what is needed and how it fits into the current system, and developing small, testable features. Only 10% of the process involves writing code.

Programming is not writing code. Programming need nurturing.

2) Making excessive plans prior to writing code

Yes. Planning before writing code is good, but too much of it is bad. Water poisons.

Avoid perfect plans. Programming does not have that. Find a good starting plan. Your plan will change, but it helped you structure your code for clarity. Overplanning wastes time.

Only planning small features. All-feature planning should be illegal! The Waterfall Approach is a step-by-step system. That strategy requires extensive planning. This is not planning. Most software projects fail with waterfall. Implementing anything sophisticated requires agile changes to reality.

Programming requires responsiveness. You'll add waterfall plan-unthinkable features. You will eliminate functionality for reasons you never considered in a waterfall plan. Fix bugs and adjust. Be agile.

Plan your future features, though. Do it cautiously since too little or too much planning can affect code quality, which you must risk.

3) Underestimating the Value of Good Code

Readability should be your code's exclusive goal. Unintelligible code stinks. Non-recyclable.

Never undervalue code quality. Coding communicates implementations. Coders must explicitly communicate solution implementations.

Programming quote I like:

Always code as if the guy who ends up maintaining your code will be a violent psychopath who knows where you live. — John Woods

John, great advice!

Small things matter. If your indentation and capitalization are inconsistent, you should lose your coding license.

Long queues are also simple. Readability decreases after 80 characters. To highlight an if-statement block, you might put a long condition on the same line. No. Just never exceed 80 characters.

Linting and formatting tools fix many basic issues like this. ESLint and Prettier work great together in JavaScript. Use them.

Code quality errors:

Multiple lines in a function or file. Break long code into manageable bits. My rule of thumb is that any function with more than 10 lines is excessively long.

Double-negatives. Don't.

Using double negatives is just very not not wrong

Short, generic, or type-based variable names. Name variables clearly.

There are only two hard things in Computer Science: cache invalidation and naming things. — Phil Karlton

Hard-coding primitive strings and numbers without descriptions. If your logic relies on a constant primitive string or numeric value, identify it.

Avoiding simple difficulties with sloppy shortcuts and workarounds. Avoid evasion. Take stock.

Considering lengthier code better. Shorter code is usually preferable. Only write lengthier versions if they improve code readability. For instance, don't utilize clever one-liners and nested ternary statements just to make the code shorter. In any application, removing unneeded code is better.

Measuring programming progress by lines of code is like measuring aircraft building progress by weight. — Bill Gates

Excessive conditional logic. Conditional logic is unnecessary for most tasks. Choose based on readability. Measure performance before optimizing. Avoid Yoda conditions and conditional assignments.

4) Selecting the First Approach

When I started programming, I would solve an issue and move on. I would apply my initial solution without considering its intricacies and probable shortcomings.

After questioning all the solutions, the best ones usually emerge. If you can't think of several answers, you don't grasp the problem.

Programmers do not solve problems. Find the easiest solution. The solution must work well and be easy to read, comprehend, and maintain.

There are two ways of constructing a software design. One way is to make it so simple that there are obviously no deficiencies, and the other way is to make it so complicated that there are no obvious deficiencies. — C.A.R. Hoare

5) Not Giving Up

I generally stick with the original solution even though it may not be the best. The not-quitting mentality may explain this. This mindset is helpful for most things, but not programming. Program writers should fail early and often.

If you doubt a solution, toss it and rethink the situation. No matter how much you put in that solution. GIT lets you branch off and try various solutions. Use it.

Do not be attached to code because of how much effort you put into it. Bad code needs to be discarded.

6) Avoiding Google

I've wasted time solving problems when I should have researched them first.

Unless you're employing cutting-edge technology, someone else has probably solved your problem. Google It First.

Googling may discover that what you think is an issue isn't and that you should embrace it. Do not presume you know everything needed to choose a solution. Google surprises.

But Google carefully. Newbies also copy code without knowing it. Use only code you understand, even if it solves your problem.

Never assume you know how to code creatively.

The most dangerous thought that you can have as a creative person is to think that you know what you’re doing. — Bret Victor

7) Failing to Use Encapsulation

Not about object-oriented paradigm. Encapsulation is always useful. Unencapsulated systems are difficult to maintain.

An application should only handle a feature once. One object handles that. The application's other objects should only see what's essential. Reducing application dependencies is not about secrecy. Following these guidelines lets you safely update class, object, and function internals without breaking things.

Classify logic and state concepts. Class means blueprint template. Class or Function objects are possible. It could be a Module or Package.

Self-contained tasks need methods in a logic class. Methods should accomplish one thing well. Similar classes should share method names.

As a rookie programmer, I didn't always establish a new class for a conceptual unit or recognize self-contained units. Newbie code has a Util class full of unrelated code. Another symptom of novice code is when a small change cascades and requires numerous other adjustments.

Think before adding a method or new responsibilities to a method. Time's needed. Avoid skipping or refactoring. Start right.

High Cohesion and Low Coupling involves grouping relevant code in a class and reducing class dependencies.

8) Arranging for Uncertainty

Thinking beyond your solution is appealing. Every line of code will bring up what-ifs. This is excellent for edge cases but not for foreseeable needs.

Your what-ifs must fall into one of these two categories. Write only code you need today. Avoid future planning.

Writing a feature for future use is improper. No.

Write only the code you need today for your solution. Handle edge-cases, but don't introduce edge-features.

Growth for the sake of growth is the ideology of the cancer cell. — Edward Abbey

9) Making the incorrect data structure choices

Beginner programmers often overemphasize algorithms when preparing for interviews. Good algorithms should be identified and used when needed, but memorizing them won't make you a programming genius.

However, learning your language's data structures' strengths and shortcomings will make you a better developer.

The improper data structure shouts "newbie coding" here.

Let me give you a few instances of data structures without teaching you:

Managing records with arrays instead of maps (objects).

Most data structure mistakes include using lists instead of maps to manage records. Use a map to organize a list of records.

This list of records has an identifier to look up each entry. Lists for scalar values are OK and frequently superior, especially if the focus is pushing values to the list.

Arrays and objects are the most common JavaScript list and map structures, respectively (there is also a map structure in modern JavaScript).

Lists over maps for record management often fail. I recommend always using this point, even though it only applies to huge collections. This is crucial because maps are faster than lists in looking up records by identifier.

Stackless

Simple recursive functions are often tempting when writing recursive programming. In single-threaded settings, optimizing recursive code is difficult.

Recursive function returns determine code optimization. Optimizing a recursive function that returns two or more calls to itself is harder than optimizing a single call.

Beginners overlook the alternative to recursive functions. Use Stack. Push function calls to a stack and start popping them out to traverse them back.

10) Worsening the current code

Imagine this:

Add an item to that room. You might want to store that object anywhere as it's a mess. You can finish in seconds.

Not with messy code. Do not worsen! Keep the code cleaner than when you started.

Clean the room above to place the new object. If the item is clothing, clear a route to the closet. That's proper execution.

The following bad habits frequently make code worse:

code duplication You are merely duplicating code and creating more chaos if you copy/paste a code block and then alter just the line after that. This would be equivalent to adding another chair with a lower base rather than purchasing a new chair with a height-adjustable seat in the context of the aforementioned dirty room example. Always keep abstraction in mind, and use it when appropriate.

utilizing configuration files not at all. A configuration file should contain the value you need to utilize if it may differ in certain circumstances or at different times. A configuration file should contain a value if you need to use it across numerous lines of code. Every time you add a new value to the code, simply ask yourself: "Does this value belong in a configuration file?" The most likely response is "yes."

using temporary variables and pointless conditional statements. Every if-statement represents a logic branch that should at the very least be tested twice. When avoiding conditionals doesn't compromise readability, it should be done. The main issue with this is that branch logic is being used to extend an existing function rather than creating a new function. Are you altering the code at the appropriate level, or should you go think about the issue at a higher level every time you feel you need an if-statement or a new function variable?

This code illustrates superfluous if-statements:

function isOdd(number) {

if (number % 2 === 1) {

return true;

} else {

return false;

}

}Can you spot the biggest issue with the isOdd function above?

Unnecessary if-statement. Similar code:

function isOdd(number) {

return (number % 2 === 1);

};11) Making remarks on things that are obvious

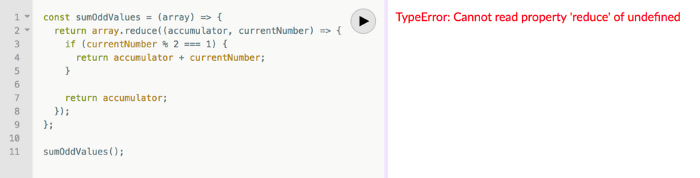

I've learnt to avoid comments. Most code comments can be renamed.

instead of:

// This function sums only odd numbers in an array

const sum = (val) => {

return val.reduce((a, b) => {

if (b % 2 === 1) { // If the current number is odd

a+=b; // Add current number to accumulator

}

return a; // The accumulator

}, 0);

};Commentless code looks like this:

const sumOddValues = (array) => {

return array.reduce((accumulator, currentNumber) => {

if (isOdd(currentNumber)) {

return accumulator + currentNumber;

}

return accumulator;

}, 0);

};Better function and argument names eliminate most comments. Remember that before commenting.

Sometimes you have to use comments to clarify the code. This is when your comments should answer WHY this code rather than WHAT it does.

Do not write a WHAT remark to clarify the code. Here are some unnecessary comments that clutter code:

// create a variable and initialize it to 0

let sum = 0;

// Loop over array

array.forEach(

// For each number in the array

(number) => {

// Add the current number to the sum variable

sum += number;

}

);Avoid that programmer. Reject that code. Remove such comments if necessary. Most importantly, teach programmers how awful these remarks are. Tell programmers who publish remarks like this that they may lose their jobs. That terrible.

12) Skipping tests

I'll simplify. If you develop code without tests because you think you're an excellent programmer, you're a rookie.

If you're not writing tests in code, you're probably testing manually. Every few lines of code in a web application will be refreshed and interacted with. Also. Manual code testing is fine. To learn how to automatically test your code, manually test it. After testing your application, return to your code editor and write code to automatically perform the same interaction the next time you add code.

Human. After each code update, you will forget to test all successful validations. Automate it!

Before writing code to fulfill validations, guess or design them. TDD is real. It improves your feature design thinking.

If you can use TDD, even partially, do so.

13) Making the assumption that if something is working, it must be right.

See this sumOddValues function. Is it flawed?

const sumOddValues = (array) => {

return array.reduce((accumulator, currentNumber) => {

if (currentNumber % 2 === 1) {

return accumulator + currentNumber;

}

return accumulator;

});

};

console.assert(

sumOddValues([1, 2, 3, 4, 5]) === 9

);Verified. Good life. Correct?

Code above is incomplete. It handles some scenarios correctly, including the assumption used, but it has many other issues. I'll list some:

#1: No empty input handling. What happens when the function is called without arguments? That results in an error revealing the function's implementation:

TypeError: Cannot read property 'reduce' of undefined.

Two main factors indicate faulty code.

Your function's users shouldn't come across implementation-related information.

The user cannot benefit from the error. Simply said, they were unable to use your function. They would be aware that they misused the function if the error was more obvious about the usage issue. You might decide to make the function throw a custom exception, for instance:

TypeError: Cannot execute function for empty list.Instead of returning an error, your method should disregard empty input and return a sum of 0. This case requires action.

Problem #2: No input validation. What happens if the function is invoked with a text, integer, or object instead of an array?

The function now throws:

sumOddValues(42);

TypeError: array.reduce is not a functionUnfortunately, array. cut's a function!

The function labels anything you call it with (42 in the example above) as array because we named the argument array. The error says 42.reduce is not a function.

See how that error confuses? An mistake like:

TypeError: 42 is not an array, dude.Edge-cases are #1 and #2. These edge-cases are typical, but you should also consider less obvious ones. Negative numbers—what happens?

sumOddValues([1, 2, 3, 4, 5, -13]) // => still 9-13's unusual. Is this the desired function behavior? Error? Should it sum negative numbers? Should it keep ignoring negative numbers? You may notice the function should have been titled sumPositiveOddNumbers.

This decision is simple. The more essential point is that if you don't write a test case to document your decision, future function maintainers won't know if you ignored negative values intentionally or accidentally.

It’s not a bug. It’s a feature. — Someone who forgot a test case

#3: Valid cases are not tested. Forget edge-cases, this function mishandles a straightforward case:

sumOddValues([2, 1, 3, 4, 5]) // => 11The 2 above was wrongly included in sum.

The solution is simple: reduce accepts a second input to initialize the accumulator. Reduce will use the first value in the collection as the accumulator if that argument is not provided, like in the code above. The sum included the test case's first even value.

This test case should have been included in the tests along with many others, such as all-even numbers, a list with 0 in it, and an empty list.

Newbie code also has rudimentary tests that disregard edge-cases.

14) Adhering to Current Law

Unless you're a lone supercoder, you'll encounter stupid code. Beginners don't identify it and assume it's decent code because it works and has been in the codebase for a while.

Worse, if the terrible code uses bad practices, the newbie may be enticed to use them elsewhere in the codebase since they learnt them from good code.

A unique condition may have pushed the developer to write faulty code. This is a nice spot for a thorough note that informs newbies about that condition and why the code is written that way.

Beginners should presume that undocumented code they don't understand is bad. Ask. Enquire. Blame it!

If the code's author is dead or can't remember it, research and understand it. Only after understanding the code can you judge its quality. Before that, presume nothing.

15) Being fixated on best practices

Best practices damage. It suggests no further research. Best practice ever. No doubts!

No best practices. Today's programming language may have good practices.

Programming best practices are now considered bad practices.

Time will reveal better methods. Focus on your strengths, not best practices.

Do not do anything because you read a quote, saw someone else do it, or heard it is a recommended practice. This contains all my article advice! Ask questions, challenge theories, know your options, and make informed decisions.

16) Being preoccupied with performance

Premature optimization is the root of all evil (or at least most of it) in programming — Donald Knuth (1974)

I think Donald Knuth's advice is still relevant today, even though programming has changed.

Do not optimize code if you cannot measure the suspected performance problem.

Optimizing before code execution is likely premature. You may possibly be wasting time optimizing.

There are obvious optimizations to consider when writing new code. You must not flood the event loop or block the call stack in Node.js. Remember this early optimization. Will this code block the call stack?

Avoid non-obvious code optimization without measurements. If done, your performance boost may cause new issues.

Stop optimizing unmeasured performance issues.

17) Missing the End-User Experience as a Goal

How can an app add a feature easily? Look at it from your perspective or in the existing User Interface. Right? Add it to the form if the feature captures user input. Add it to your nested menu of links if it adds a link to a page.

Avoid that developer. Be a professional who empathizes with customers. They imagine this feature's consumers' needs and behavior. They focus on making the feature easy to find and use, not just adding it to the software.

18) Choosing the incorrect tool for the task

Every programmer has their preferred tools. Most tools are good for one thing and bad for others.

The worst tool for screwing in a screw is a hammer. Do not use your favorite hammer on a screw. Don't use Amazon's most popular hammer on a screw.

A true beginner relies on tool popularity rather than problem fit.

You may not know the best tools for a project. You may know the best tool. However, it wouldn't rank high. You must learn your tools and be open to new ones.

Some coders shun new tools. They like their tools and don't want to learn new ones. I can relate, but it's wrong.

You can build a house slowly with basic tools or rapidly with superior tools. You must learn and use new tools.

19) Failing to recognize that data issues are caused by code issues

Programs commonly manage data. The software will add, delete, and change records.

Even the simplest programming errors can make data unpredictable. Especially if the same defective application validates all data.

Code-data relationships may be confusing for beginners. They may employ broken code in production since feature X is not critical. Buggy coding may cause hidden data integrity issues.

Worse, deploying code that corrected flaws without fixing minor data problems caused by these defects will only collect more data problems that take the situation into the unrecoverable-level category.

How do you avoid these issues? Simply employ numerous data integrity validation levels. Use several interfaces. Front-end, back-end, network, and database validations. If not, apply database constraints.

Use all database constraints when adding columns and tables:

If a column has a NOT NULL constraint, null values will be rejected for that column. If your application expects that field has a value, your database should designate its source as not null.

If a column has a UNIQUE constraint, the entire table cannot include duplicate values for that column. This is ideal for a username or email field on a Users table, for instance.

For the data to be accepted, a CHECK constraint, or custom expression, must evaluate to true. For instance, you can apply a check constraint to ensure that the values of a normal % column must fall within the range of 0 and 100.

With a PRIMARY KEY constraint, the values of the columns must be both distinct and not null. This one is presumably what you're utilizing. To distinguish the records in each table, the database needs have a primary key.

A FOREIGN KEY constraint requires that the values in one database column, typically a primary key, match those in another table column.

Transaction apathy is another data integrity issue for newbies. If numerous actions affect the same data source and depend on each other, they must be wrapped in a transaction that can be rolled back if one fails.

20) Reinventing the Wheel

Tricky. Some programming wheels need reinvention. Programming is undefined. New requirements and changes happen faster than any team can handle.

Instead of modifying the wheel we all adore, maybe we should rethink it if you need a wheel that spins at varied speeds depending on the time of day. If you don't require a non-standard wheel, don't reinvent it. Use the darn wheel.

Wheel brands can be hard to choose from. Research and test before buying! Most software wheels are free and transparent. Internal design quality lets you evaluate coding wheels. Try open-source wheels. Debug and fix open-source software simply. They're easily replaceable. In-house support is also easy.

If you need a wheel, don't buy a new automobile and put your maintained car on top. Do not include a library to use a few functions. Lodash in JavaScript is the finest example. Import shuffle to shuffle an array. Don't import lodash.

21) Adopting the incorrect perspective on code reviews

Beginners often see code reviews as criticism. Dislike them. Not appreciated. Even fear them.

Incorrect. If so, modify your mindset immediately. Learn from every code review. Salute them. Observe. Most crucial, thank reviewers who teach you.

Always learning code. Accept it. Most code reviews teach something new. Use these for learning.

You may need to correct the reviewer. If your code didn't make that evident, it may need to be changed. If you must teach your reviewer, remember that teaching is one of the most enjoyable things a programmer can do.

22) Not Using Source Control

Newbies often underestimate Git's capabilities.

Source control is more than sharing your modifications. It's much bigger. Clear history is source control. The history of coding will assist address complex problems. Commit messages matter. They are another way to communicate your implementations, and utilizing them with modest commits helps future maintainers understand how the code got where it is.

Commit early and often with present-tense verbs. Summarize your messages but be detailed. If you need more than a few lines, your commit is too long. Rebase!

Avoid needless commit messages. Commit summaries should not list new, changed, or deleted files. Git commands can display that list from the commit object. The summary message would be noise. I think a big commit has many summaries per file altered.

Source control involves discoverability. You can discover the commit that introduced a function and see its context if you doubt its need or design. Commits can even pinpoint which code caused a bug. Git has a binary search within commits (bisect) to find the bug-causing commit.

Source control can be used before commits to great effect. Staging changes, patching selectively, resetting, stashing, editing, applying, diffing, reversing, and others enrich your coding flow. Know, use, and enjoy them.

I consider a Git rookie someone who knows less functionalities.

23) Excessive Use of Shared State

Again, this is not about functional programming vs. other paradigms. That's another article.

Shared state is problematic and should be avoided if feasible. If not, use shared state as little as possible.

As a new programmer, I didn't know that all variables represent shared states. All variables in the same scope can change its data. Global scope reduces shared state span. Keep new states in limited scopes and avoid upward leakage.

When numerous resources modify common state in the same event loop tick, the situation becomes severe (in event-loop-based environments). Races happen.

This shared state race condition problem may encourage a rookie to utilize a timer, especially if they have a data lock issue. Red flag. No. Never accept it.

24) Adopting the Wrong Mentality Toward Errors

Errors are good. Progress. They indicate a simple way to improve.

Expert programmers enjoy errors. Newbies detest them.

If these lovely red error warnings irritate you, modify your mindset. Consider them helpers. Handle them. Use them to advance.

Some errors need exceptions. Plan for user-defined exceptions. Ignore some mistakes. Crash and exit the app.

25) Ignoring rest periods

Humans require mental breaks. Take breaks. In the zone, you'll forget breaks. Another symptom of beginners. No compromises. Make breaks mandatory in your process. Take frequent pauses. Take a little walk to plan your next move. Reread the code.

This has been a long post. You deserve a break.

William Anderson

3 years ago

When My Remote Leadership Skills Took Off

4 Ways To Manage Remote Teams & Employees

The wheels hit the ground as I landed in Rochester.

Our six-person satellite office was now part of my team.

Their manager only reported to me the day before, but I had my ticket booked ahead of time.

I had managed remote employees before but this was different. Engineers dialed into headquarters for every meeting.

So when I learned about the org chart change, I knew a strong first impression would set the tone for everything else.

I was either their boss, or their boss's boss, and I needed them to know I was committed.

Managing a fleet of satellite freelancers or multiple offices requires treating others as more than just a face behind a screen.

You must comprehend each remote team member's perspective and daily interactions.

The good news is that you can start using these techniques right now to better understand and elevate virtual team members.

1. Make Visits To Other Offices

If budgeted, visit and work from offices where teams and employees report to you. Only by living alongside them can one truly comprehend their problems with communication and other aspects of modern life.

2. Have Others Come to You

• Having remote, distributed, or satellite employees and teams visit headquarters every quarter or semi-quarterly allows the main office culture to rub off on them.

When remote team members visit, more people get to meet them, which builds empathy.

If you can't afford to fly everyone, at least bring remote managers or leaders. Hopefully they can resurrect some culture.

3. Weekly Work From Home

No home office policy?

Make one.

WFH is a team-building, problem-solving, and office-viewing opportunity.

For dial-in meetings, I started working from home on occasion.

It also taught me which teams “forget” or “skip” calls.

As a remote team member, you experience all the issues first hand.

This isn't as accurate for understanding teams in other offices, but it can be done at any time.

4. Increase Contact Even If It’s Just To Chat

Don't underestimate office banter.

Sometimes it's about bonding and trust, other times it's about business.

If you get all this information in real-time, please forward it.

Even if nothing critical is happening, call remote team members to check in and chat.

I guarantee that building relationships and rapport will increase both their job satisfaction and yours.

Alex Mathers

3 years ago

8 guidelines to help you achieve your objectives 5x fast

If you waste time every day, even though you're ambitious, you're not alone.

Many of us could use some new time-management strategies, like these:

Focus on the following three.

You're thinking about everything at once.

You're overpowered.

It's mental. We just have what's in front of us. So savor the moment's beauty.

Prioritize 1-3 things.

To be one of the most productive people you and I know, follow these steps.

Get along with boredom.

Many of us grow bored, sweat, and turn on Netflix.

We shout, "I'm rarely bored!" Look at me! I'm happy.

Shut it, Sally.

You're not making wonderful things for the world. Boredom matters.

If you can sit with it for a second, you'll get insight. Boredom? Breathe.

Go blank.

Then watch your creativity grow.

Check your MacroVision once more.

We don't know what to do with our time, which contributes to time-wasting.

Nobody does, either. Jeff Bezos won't hand-deliver that crap to you.

Daily vision checks are required.

Also:

What are 5 things you'd love to create in the next 5 years?

You're soul-searching. It's food.

Return here regularly, and you'll adore the high you get from doing valuable work.

Improve your thinking.

What's Alex's latest nonsense?

I'm talking about overcoming our own thoughts. Worrying wastes so much time.

Too many of us are assaulted by lies, myths, and insecurity.

Stop letting your worries massage you into a worried coma like a Thai woman.

Optimizing your thoughts requires accepting what you can't control.

It means letting go of unhelpful thoughts and returning to the moment.

Keep your blood sugar level.

I gave up gluten, donuts, and sweets.

This has really boosted my energy.

Blood-sugar-spiking carbs make us irritable and tired.

These day-to-day ups and downs aren't productive. It's crucial.

Know how your diet affects insulin levels. Now I have more energy and can do more without clenching my teeth.

Reduce harmful carbs to boost energy.

Create a focused setting for yourself.

When we optimize the mind, we have more energy and use our time better because we're not tense.

Changing our environment can also help us focus. Disabling alerts is one example.

Too hot makes me procrastinate and irritable.

List five items that hinder your productivity.

You may be amazed at how much you may improve by removing distractions.

Be responsible.

Accountability is a time-saver.

Creating an emotional pull to finish things.

Writing down our goals makes us accountable.

We can engage a coach or work with an accountability partner to feel horrible if we don't show up and finish on time.

‘Hey Jake, I’m going to write 1000 words every day for 30 days — you need to make sure I do.’ ‘Sure thing, Nathan, I’ll be making sure you check in daily with me.’

Tick.

You might also blog about your ambitions to show your dedication.

Now you can't hide when you promised to appear.

Acquire a liking for bravery.

Boldness changes everything.

I sometimes feel lazy and wonder why. If my food and sleep are in order, I should assess my footing.

Most of us live backward. Doubtful. Uncertain. Feelings govern us.

Backfooting isn't living. It's lame, and you'll soon melt. Live boldly now.

Be assertive.

Get disgustingly into everything. Expand.

Even if it's hard, stop being a b*tch.

Those that make Mr. Bold Bear their spirit animal benefit. Save time to maximize your effect.