Token taxonomy: Utility vs Security vs NFT

Let's examine the differences between the three main token types and their functions.

As Ethereum grew, the term "token" became a catch-all term for all assets built on the Ethereum blockchain. However, different tokens were grouped based on their applications and features, causing some confusion. Let's examine the modification of three main token types: security, utility, and non-fungible.

Utility tokens

They provide a specific utility benefit (or a number of such). A utility token is similar to a casino chip, a table game ticket, or a voucher. Depending on the terms of issuing, they can be earned and used in various ways. A utility token is a type of token that represents a tool or mechanism required to use the application in question. Like a service, a utility token's price is determined by supply and demand. Tokens can also be used as a bonus or reward mechanism in decentralized systems: for example, if you like someone's work, give them an upvote and they get a certain number of tokens. This is a way for authors or creators to earn money indirectly.

The most common way to use a utility token is to pay with them instead of cash for discounted goods or services.

Utility tokens are the most widely used by blockchain companies. Most cryptocurrency exchanges accept fees in native utility tokens.

Utility tokens can also be used as a reward. Companies tokenize their loyalty programs so that points can be bought and sold on blockchain exchanges. These tokens are widely used in decentralized companies as a bonus system. You can use utility tokens to reward creators for their contributions to a platform, for example. It also allows members to exchange tokens for specific bonuses and rewards on your site.

Unlike security tokens, which are subject to legal restrictions, utility tokens can be freely traded.

Security tokens

Security tokens are essentially traditional securities like shares, bonds, and investment fund units in a crypto token form.

The key distinction is that security tokens are typically issued by private firms (rather than public companies) that are not listed on stock exchanges and in which you can not invest right now. Banks and large venture funds used to be the only sources of funding. A person could only invest in private firms if they had millions of dollars in their bank account. Privately issued security tokens outperform traditional public stocks in terms of yield. Private markets grew 50% faster than public markets over the last decade, according to McKinsey Private Equity Research.

A security token is a crypto token whose value is derived from an external asset or company. So it is governed as security (read about the Howey test further in this article). That is, an ownership token derives its value from the company's valuation, assets on the balance sheet, or dividends paid to token holders.

Why are Security Tokens Important?

Cryptocurrency is a lucrative investment. Choosing from thousands of crypto assets can mean the difference between millionaire and bankrupt. Without security tokens, crypto investing becomes riskier and generating long-term profits becomes difficult. These tokens have lower risk than other cryptocurrencies because they are backed by real assets or business cash flows. So having them helps to diversify a portfolio and preserve the return on investment in riskier assets.

Security tokens open up new funding avenues for businesses. As a result, investors can invest in high-profit businesses that are not listed on the stock exchange.

The distinction between utility and security tokens isn't as clear as it seems. However, this increases the risk for token issuers, especially in the USA. The Howey test is the main pillar regulating judicial precedent in this area.

What is a Howey Test?

An "investment contract" is determined by the Howey Test, a lawsuit settled by the US Supreme Court. If it does, it's a security and must be disclosed and registered under the Securities Act of 1933 and the Securities Exchange Act of 1934.

If the SEC decides that a cryptocurrency token is a security, a slew of issues arise. In practice, this ensures that the SEC will decide when a token can be offered to US investors and if the project is required to file a registration statement with the SEC.

Due to the Howey test's extensive wording, most utility tokens will be classified as securities, even if not intended to be. Because of these restrictions, most ICOs are not available to US investors. When asked about ICOs in 2018, then-SEC Chairman Jay Clayton said they were securities. The given statement adds to the risk. If a company issues utility tokens without registering them as securities, the regulator may impose huge fines or even criminal charges.

What other documents regulate tokens?

Securities Act (1993) or Securities Exchange Act (1934) in the USA; MiFID directive and Prospectus Regulation in the EU. These laws require registering the placement of security tokens, limiting their transfer, but protecting investors.

Utility tokens have much less regulation. The Howey test determines whether a given utility token is a security. Tokens recognized as securities are now regulated as such. Having a legal opinion that your token isn't makes the implementation process much easier. Most countries don't have strict regulations regarding utility tokens except KYC (Know Your Client) and AML (Anti Money-Laundering).

As cryptocurrency and blockchain technologies evolve, more countries create UT regulations. If your company is based in the US, be aware of the Howey test and the Bank Secrecy Act. It classifies UTs and their issuance as money transmission services in most states, necessitating a license and strict regulations. Due to high regulatory demands, UT issuers try to avoid the United States as a whole. A new law separating utility tokens from bank secrecy act will be introduced in the near future, giving hope to American issuers.

The rest of the world has much simpler rules requiring issuers to create basic investor disclosures. For example, the latest European legislation (MiCA) allows businesses to issue utility tokens without regulator approval. They must also prepare a paper with all the necessary information for the investors.

A payment token is a utility token that is used to make a payment. They may be subject to electronic money laws.

Because non-fungible tokens are a new instrument, there is no regulating paper yet. However, if the NFT is fractionalized, the smaller tokens acquired may be seen as securities.

NFT Tokens

Collectible tokens are also known as non-fungible tokens. Their distinctive feature is that they denote unique items such as artwork, merch, or ranks. Unlike utility tokens, which are fungible, meaning that two of the same tokens are identical, NFTs represent a unit of possession that is strictly one of a kind. In a way, NFTs are like baseball cards, each one unique and valuable.

As for today, the most recognizable NFT function is to preserve the fact of possession. Owning an NFT with a particular gif, meme, or sketch does not transfer the intellectual right to the possessor, but is analogous to owning an original painting signed by the author.

Collectible tokens can also be used as digital souvenirs, so to say. Businesses can improve their brand image by issuing their own branded NFTs, which represent ranks or achievements within the corporate ecosystem. Gamifying business ecosystems would allow people to connect with a brand and feel part of a community.

Which type of tokens is right for you as a business to raise capital?

For most businesses, it's best to raise capital with security tokens by selling existing shares to global investors. Utility tokens aren't meant to increase in value over time, so leave them for gamification and community engagement. In a blockchain-based business, however, a utility token is often the lifeblood of the operation, and its appreciation potential is directly linked to the company's growth. You can issue multiple tokens at once, rather than just one type. It exposes you to various investors and maximizes the use of digital assets.

Which tokens should I buy?

There are no universally best tokens. Their volatility, industry, and risk-reward profile vary. This means evaluating tokens in relation to your overall portfolio and personal preferences: what industries do you understand best, what excites you, how do you approach taxes, and what is your planning horizon? To build a balanced portfolio, you need to know these factors.

Conclusion

The three most common types of tokens today are security, utility, and NFT. Security tokens represent stocks, mutual funds, and bonds. Utility tokens can be perceived as an inside-product "currency" or "ignition key" that grants you access to goods and services or empowers with other perks. NFTs are unique collectible units that identify you as the owner of something.

More on Web3 & Crypto

Percy Bolmér

3 years ago

Ethereum No Longer Consumes A Medium-Sized Country's Electricity To Run

The Merge cut Ethereum's energy use by 99.5%.

The Crypto community celebrated on September 15, 2022. This day, Ethereum Merged. The entire blockchain successfully merged with the Beacon chain, and it was so smooth you barely noticed.

Many have waited, dreaded, and longed for this day.

Some investors feared the network would break down, while others envisioned a seamless merging.

Speculators predict a successful Merge will lead investors to Ethereum. This could boost Ethereum's popularity.

What Has Changed Since The Merge

The merging transitions Ethereum mainnet from PoW to PoS.

PoW sends a mathematical riddle to computers worldwide (miners). First miner to solve puzzle updates blockchain and is rewarded.

The puzzles sent are power-intensive to solve, so mining requires a lot of electricity. It's sent to every miner competing to solve it, requiring duplicate computation.

PoS allows investors to stake their coins to validate a new transaction. Instead of validating a whole block, you validate a transaction and get the fees.

You can validate instead of mine. A validator stakes 32 Ethereum. After staking, the validator can validate future blocks.

Once a validator validates a block, it's sent to a randomly selected group of other validators. This group verifies that a validator is not malicious and doesn't validate fake blocks.

This way, only one computer needs to solve or validate the transaction, instead of all miners. The validated block must be approved by a small group of validators, causing duplicate computation.

PoS is more secure because validating fake blocks results in slashing. You lose your bet tokens. If a validator signs a bad block or double-signs conflicting blocks, their ETH is burned.

Theoretically, Ethereum has one block every 12 seconds, so a validator forging a block risks burning 1 Ethereum for 12 seconds of transactions. This makes mistakes expensive and risky.

What Impact Does This Have On Energy Use?

Cryptocurrency is a natural calamity, sucking electricity and eating away at the earth one transaction at a time.

Many don't know the environmental impact of cryptocurrencies, yet it's tremendous.

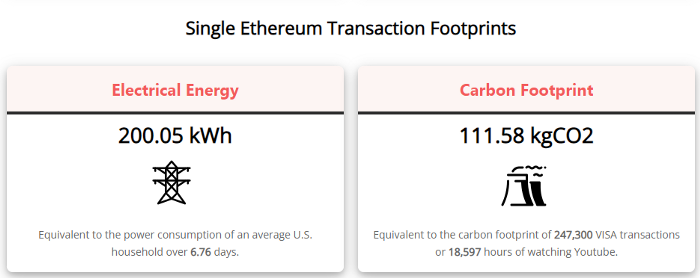

A single Ethereum transaction used to use 200 kWh and leave a large carbon imprint. This update reduces global energy use by 0.2%.

Ethereum will submit a challenge to one validator, and that validator will forward it to randomly selected other validators who accept it.

This reduces the needed computing power.

They expect a 99.5% reduction, therefore a single transaction should cost 1 kWh.

Carbon footprint is 0.58 kgCO2, or 1,235 VISA transactions.

This is a big Ethereum blockchain update.

I love cryptocurrency and Mother Earth.

Julie Plavnik

3 years ago

How to Become a Crypto Broker [Complying and Making Money]

Three options exist. The third one is the quickest and most fruitful.

You've mastered crypto trading and want to become a broker.

So you may wonder: Where to begin?

If so, keep reading.

Today I'll compare three different approaches to becoming a cryptocurrency trader.

What are cryptocurrency brokers, and how do they vary from stockbrokers?

A stockbroker implements clients' market orders (retail or institutional ones).

Brokerage firms are regulated, insured, and subject to regulatory monitoring.

Stockbrokers are required between buyers and sellers. They can't trade without a broker. To trade, a trader must open a broker account and deposit money. When a trader shops, he tells his broker what orders to place.

Crypto brokerage is trade intermediation with cryptocurrency.

In crypto trading, however, brokers are optional.

Crypto exchanges offer direct transactions. Open an exchange account (no broker needed) and make a deposit.

Question:

Since crypto allows DIY trading, why use a broker?

Let's compare cryptocurrency exchanges vs. brokers.

Broker versus cryptocurrency exchange

Most existing crypto exchanges are basically brokers.

Examine their primary services:

connecting purchasers and suppliers

having custody of clients' money (with the exception of decentralized cryptocurrency exchanges),

clearance of transactions.

Brokerage is comparable, don't you think?

There are exceptions. I mean a few large crypto exchanges that follow the stock exchange paradigm. They outsource brokerage, custody, and clearing operations. Classic exchange setups are rare in today's bitcoin industry.

Back to our favorite “standard” crypto exchanges. All-in-one exchanges and brokers. And usually, they operate under a broker or a broker-dealer license, save for the exchanges registered somewhere in a free-trade offshore paradise. Those don’t bother with any licensing.

What’s the sense of having two brokers at a time?

Better liquidity and trading convenience.

The crypto business is compartmentalized.

We have CEXs, DEXs, hybrid exchanges, and semi-exchanges (those that aggregate liquidity but do not execute orders on their sides). All have unique regulations and act as sovereign states.

There are about 18k coins and hundreds of blockchain protocols, most of which are heterogeneous (i.e., different in design and not interoperable).

A trader must register many accounts on different exchanges, deposit funds, and manage them all concurrently to access global crypto liquidity.

It’s extremely inconvenient.

Crypto liquidity fragmentation is the largest obstacle and bottleneck blocking crypto from mass adoption.

Crypto brokers help clients solve this challenge by providing one-gate access to deep and diverse crypto liquidity from numerous exchanges and suppliers. Professionals and institutions need it.

Another killer feature of a brokerage may be allowing clients to trade crypto with fiat funds exclusively, without fiat/crypto conversion. It is essential for professional and institutional traders.

Who may work as a cryptocurrency broker?

Apparently, not anyone. Brokerage requires high-powered specialists because it involves other people's money.

Here's the essentials:

excellent knowledge, skills, and years of trading experience

high-quality, quick, and secure infrastructure

highly developed team

outstanding trading capital

High-ROI network: long-standing, trustworthy connections with customers, exchanges, liquidity providers, payment gates, and similar entities

outstanding marketing and commercial development skills.

What about a license for a cryptocurrency broker? Is it necessary?

Complex question.

If you plan to play in white-glove jurisdictions, you may need a license. For example, in the US, as a “money transmitter” or as a CASSP (crypto asset secondary services provider) in Australia.

Even in these jurisdictions, there are no clear, holistic crypto brokerage and licensing policies.

Your lawyer will help you decide if your crypto brokerage needs a license.

Getting a license isn't quick. Two years of patience are needed.

How can you turn into a cryptocurrency broker?

Finally, we got there! 🎉

Three actionable ways exist:

To kickstart a regulated stand-alone crypto broker

To get a crypto broker franchise, and

To become a liquidity network broker.

Let's examine each.

1. Opening a regulated cryptocurrency broker

It's difficult. Especially If you're targeting first-world users.

You must comply with many regulatory, technical, financial, HR, and reporting obligations to keep your organization running. Some are mentioned above.

The licensing process depends on the products you want to offer (spots or derivatives) and the geographic areas you plan to service. There are no general rules for that.

In an overgeneralized way, here are the boxes you will have to check:

capital availability (usually a large amount of capital c is required)

You will have to move some of your team members to the nation providing the license in order to establish an office presence there.

the core team with the necessary professional training (especially applies to CEO, Head of Trading, Assistant to Head of Trading, etc.)

insurance

infrastructure that is trustworthy and secure

adopted proper AML/KYC/financial monitoring policies, etc.

Assuming you passed, what's next?

I bet it won’t be mind-blowing for you that the license is just a part of the deal. It won't attract clients or revenue.

To bring in high-dollar clientele, you must be a killer marketer and seller. It's not easy to convince people to give you money.

You'll need to be a great business developer to form successful, long-term agreements with exchanges (ideally for no fees), liquidity providers, banks, payment gates, etc. Persuade clients.

It's a tough job, isn't it?

I expect a Quora-type question here:

Can I start an unlicensed crypto broker?

Well, there is always a workaround with crypto!

You can register your broker in a free-trade zone like Seychelles to avoid US and other markets with strong watchdogs.

This is neither wise nor sustainable.

First, such experiments are illegal.

Second, you'll have trouble attracting clients and strategic partners.

A license equals trust. That’s it.

Even a pseudo-license from Mauritius matters.

Here are this method's benefits and downsides.

Cons first.

As you navigate this difficult and expensive legal process, you run the risk of missing out on business prospects. It's quite simple to become excellent compliance yet unable to work. Because your competitors are already courting potential customers while you are focusing all of your effort on paperwork.

Only God knows how long it will take you to pass the break-even point when everything with the license has been completed.

It is a money-burning business, especially in the beginning when the majority of your expenses will go toward marketing, sales, and maintaining license requirements. Make sure you have the fortitude and resources necessary to face such a difficult challenge.

Pros

It may eventually develop into a tool for making money. Because big guys who are professionals at trading require a white-glove regulated brokerage. You have every possibility if you work hard in the areas of sales, marketing, business development, and wealth. Simply put, everything must align.

Launching a regulated crypto broker is analogous to launching a crypto exchange. It's ROUGH. Sure you can take it?

2. Franchise for Crypto Broker (Crypto Sub-Brokerage)

A broker franchise is easier and faster than becoming a regulated crypto broker. Not a traditional brokerage.

A broker franchisee, often termed a sub-broker, joins with a broker (a franchisor) to bring them new clients. Sub-brokers market a broker's products and services to clients.

Sub-brokers are the middlemen between a broker and an investor.

Why is sub-brokering easier?

less demanding qualifications and legal complexity. All you need to do is keep a few certificates on hand (each time depends on the jurisdiction).

No significant investment is required

there is no demand that you be a trading member of an exchange, etc.

As a sub-broker, you can do identical duties without as many rights and certifications.

What about the crypto broker franchise?

Sub-brokers aren't common in crypto.

In most existing examples (PayBito, PCEX, etc.), franchises are offered by crypto exchanges, not brokers. Though we remember that crypto exchanges are, in fact, brokers, do we?

Similarly:

For a commission, a franchiser crypto broker receives new leads from a crypto sub-broker.

See above for why enrolling is easy.

Finding clients is difficult. Most crypto traders prefer to buy-sell on their own or through brokers over sub-broker franchises.

3. Broker of the Crypto Trading Network (or a Network Broker)

It's the greatest approach to execute crypto brokerage, based on effort/return.

Network broker isn't an established word. I wrote it for clarity.

Remember how we called crypto liquidity fragmentation the current crypto finance paradigm's main bottleneck?

Where there's a challenge, there's progress.

Several well-funded projects are aiming to fix crypto liquidity fragmentation. Instead of launching another crypto exchange with siloed trading, the greatest minds create trading networks that aggregate crypto liquidity from desynchronized sources and enable quick, safe, and affordable cross-blockchain transactions. Each project offers a distinct option for users.

Crypto liquidity implies:

One-account access to cryptocurrency liquidity pooled from network participants' exchanges and other liquidity sources

compiled price feeds

Cross-chain transactions that are quick and inexpensive, even for HFTs

link between participants of all kinds, and

interoperability among diverse blockchains

Fast, diversified, and cheap global crypto trading from one account.

How does a trading network help cryptocurrency brokers?

I’ll explain it, taking Yellow Network as an example.

Yellow provides decentralized Layer-3 peer-to-peer trading.

trade across chains globally with real-time settlement and

Between cryptocurrency exchanges, brokers, trading companies, and other sorts of network members, there is communication and the exchange of financial information.

Have you ever heard about ECN (electronic communication network)? If not, it's an automated system that automatically matches buy and sell orders. Yellow is a decentralized digital asset ECN.

Brokers can:

Start trading right now without having to meet stringent requirements; all you need to do is integrate with Yellow Protocol and successfully complete some KYC verification.

Access global aggregated crypto liquidity through a single point.

B2B (Broker to Broker) liquidity channels that provide peer liquidity from other brokers. Orders from the other broker will appear in the order book of a broker who is peering with another broker on the market. It will enable a broker to broaden his offer and raise the total amount of liquidity that is available to his clients.

Select a custodian or use non-custodial practices.

Comparing network crypto brokerage to other types:

A licensed stand-alone brokerage business is much more difficult and time-consuming to launch than network brokerage, and

Network brokerage, in contrast to crypto sub-brokerage, is scalable, independent, and offers limitless possibilities for revenue generation.

Yellow Network Whitepaper. has more details on how to start a brokerage business and what rewards you'll obtain.

Final thoughts

There are three ways to become a cryptocurrency broker, including the non-conventional liquidity network brokerage. The last option appears time/cost-effective.

Crypto brokerage isn't crowded yet. Act quickly to find your right place in this market.

Choose the way that works for you best and see you in crypto trading.

Discover Web3 & DeFi with Yellow Network!

Yellow, powered by Openware, is developing a cross-chain P2P liquidity aggregator to unite the crypto sector and provide global remittance services that aid people.

Join the Yellow Community and plunge into this decade's biggest product-oriented crypto project.

Observe Yellow Twitter

Enroll in Yellow Telegram

Visit Yellow Discord.

On Hacker Noon, look us up.

Yellow Network will expose development, technology, developer tools, crypto brokerage nodes software, and community liquidity mining.

Caleb Naysmith

3 years ago Draft

A Myth: Decentralization

It’s simply not conceivable, or at least not credible.

One of the most touted selling points of Crypto has always been this grandiose idea of decentralization. Bitcoin first arose in 2009 after the housing crisis and subsequent crash that came with it. It aimed to solve this supposed issue of centralization. Nobody “owns” Bitcoin in theory, so the idea then goes that it won’t be subject to the same downfalls that led to the 2008 crash or similarly speculative events that led to the 2008 disaster. The issue is the banks, not the human nature associated with the greedy individuals running them.

Subsequent blockchains have attempted to fix many of the issues of Bitcoin by increasing capacity, decreasing the costs and processing times associated with Bitcoin, and expanding what can be done with their blockchains. Since nobody owns Bitcoin, it hasn’t really been able to be expanded on. You have people like Vitalk Buterin, however, that actively work on Ethereum though.

The leap from Bitcoin to Ethereum was a massive leap toward centralization, and the trend has only gotten worse. In fact, crypto has since become almost exclusively centralized in recent years.

Decentralization is only good in theory

It’s a good idea. In fact, it’s a wonderful idea. However, like other utopian societies, individuals misjudge human nature and greed. In a perfect world, decentralization would certainly be a wonderful idea because sure, people may function as their own banks, move payments immediately, remain anonymous, and so on. However, underneath this are a couple issues:

You can already send money instantaneously today.

They are not decentralized.

Decentralization is a bad idea.

Being your own bank is a stupid move.

Let’s break these down. Some are quite simple, but lets have a look.

Sending money right away

One thing with crypto is the idea that you can send payments instantly. This has pretty much been entirely solved in current times. You can transmit significant sums of money instantly for a nominal cost and it’s instantaneously cleared. Venmo was launched in 2009 and has since increased to prominence, and currently is on most people's phones. I can directly send ANY amount of money quickly from my bank to another person's Venmo account.

Comparing that with ETH and Bitcoin, Venmo wins all around. I can send money to someone for free instantly in dollars and the only fee paid is optional depending on when you want it.

Both Bitcoin and Ethereum are subject to demand. If the blockchains have a lot of people trying to process transactions fee’s go up, and the time that it takes to receive your crypto takes longer. When Ethereum gets bad, people have reported spending several thousand of dollars on just 1 transaction.

These transactions take place via “miners” bundling and confirming transactions, then recording them on the blockchain to confirm that the transaction did indeed happen. They charge fees to do this and are also paid in Bitcoin/ETH. When a transaction is confirmed, it's then sent to the other users wallet. This within itself is subject to lots of controversy because each transaction needs to be confirmed 6 times, this takes massive amounts of power, and most of the power is wasted because this is an adversarial system in which the person that mines the transaction gets paid, and everyone else is out of luck. Also, these could theoretically be subject to a “51% attack” in which anyone with over 51% of the mining hash rate could effectively control all of the transactions, and reverse transactions while keeping the BTC resulting in “double spending”.

There are tons of other issues with this, but essentially it means: They rely on these third parties to confirm the transactions. Without people confirming these transactions, Bitcoin stalls completely, and if anyone becomes too dominant they can effectively control bitcoin.

Not to mention, these transactions are in Bitcoin and ETH, not dollars. So, you need to convert them to dollars still, and that's several more transactions, and likely to take several days anyway as the centralized exchange needs to send you the money by traditional methods.

They are not distributed

That takes me to the following point. This isn’t decentralized, at all. Bitcoin is the closest it gets because Satoshi basically closed it to new upgrades, although its still subject to:

Whales

Miners

It’s vital to realize that these are often the same folks. While whales aren’t centralized entities typically, they can considerably effect the price and outcome of Bitcoin. If the largest wallets holding as much as 1 million BTC were to sell, it’d effectively collapse the price perhaps beyond repair. However, Bitcoin can and is pretty much controlled by the miners. Further, Bitcoin is more like an oligarchy than decentralized. It’s been effectively used to make the rich richer, and both the mining and price is impacted by the rich. The overwhelming minority of those actually using it are retail investors. The retail investors are basically never the ones generating money from it either.

As far as ETH and other cryptos go, there is realistically 0 case for them being decentralized. Vitalik could not only kill it but even walking away from it would likely lead to a significant decline. It has tons of issues right now that Vitalik has promised to fix with the eventual Ethereum 2.0., and stepping away from it wouldn’t help.

Most tokens as well are generally tied to some promise of future developments and creators. The same is true for most NFT projects. The reason 99% of crypto and NFT projects fail is because they failed to deliver on various promises or bad dev teams, or poor innovation, or the founders just straight up stole from everyone. I could go more in-depth than this but go find any project and if there is a dev team, company, or person tied to it then it's likely, not decentralized. The success of that project is directly tied to the dev team, and if they wanted to, most hold large wallets and could sell it all off effectively killing the project. Not to mention, any crypto project that doesn’t have a locked contract can 100% be completely rugged and they can run off with all of the money.

Decentralization is undesirable

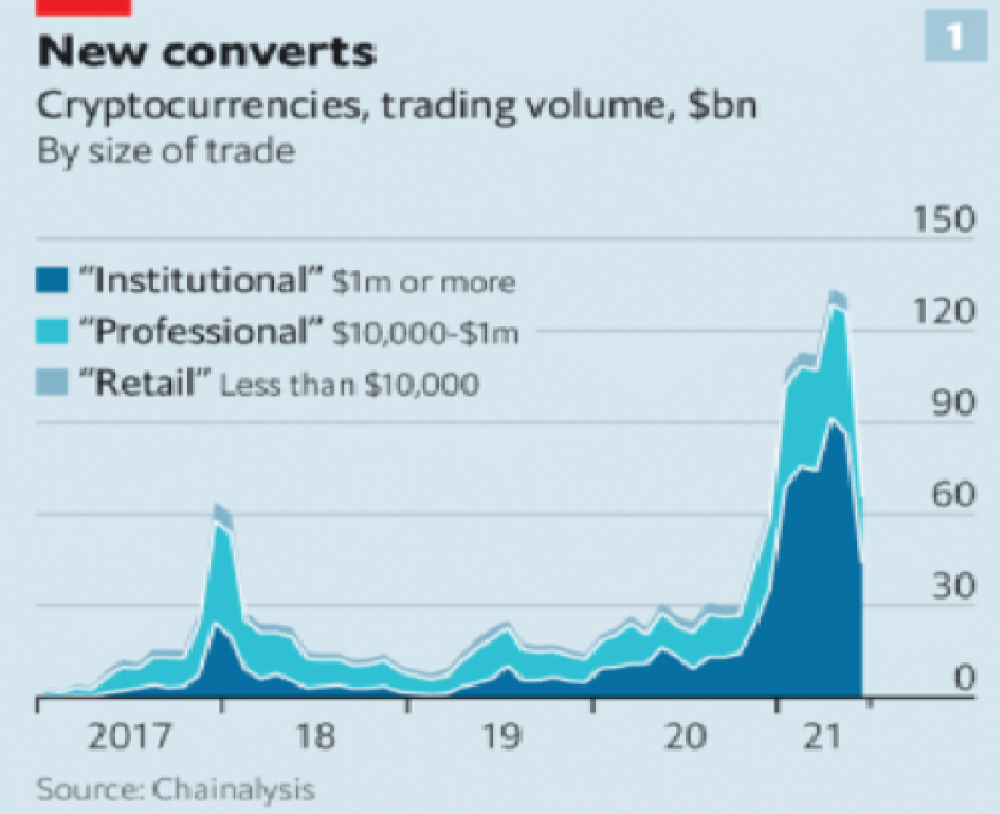

Even if they were decentralized then it would not be a good thing. The graphic above indicates this is effectively a rich person’s unregulated playground… so it’s exactly like… the very issue it tried to solve?

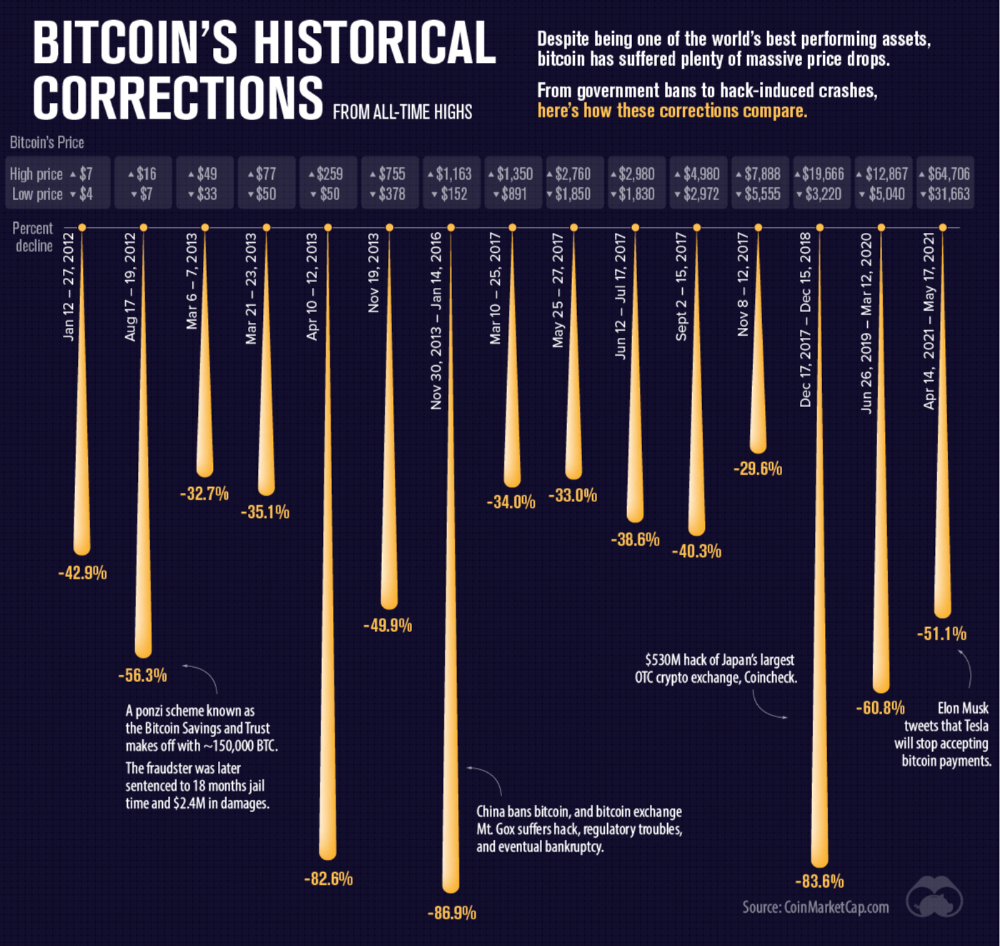

Not to mention, it’s supposedly meant to prevent things like 2008, but is regularly subjected to 50–90% drawdowns in value? Back when Bitcoin was only known in niche parts of the dark web and illegal markets, it would regularly drop as much as 90% and has a long history of massive drawdowns.

The majority of crypto is blatant scams, and ALL of crypto is a “zero” or “negative” sum game in that it relies on the next person buying for people to make money. This is not a good thing. This has yet to solve any issues around what caused the 2008 crisis. Rather, it seemingly amplified all of the bad parts of it actually. Crypto is the ultimate speculative asset and realistically has no valuation metric. People invest in Apple because it has revenue and cash on hand. People invest in crypto purely for speculation. The lack of regulation or accountability means this is amplified to the most extreme degree where anything goes: Fraud, deception, pump and dumps, scams, etc. This results in a pure speculative madhouse where, unsurprisingly, only the rich win. Not only that but the deck is massively stacked in against the everyday investor because you can’t do a pump and dump without money.

At the heart of all of this is still the same issues: greed and human nature. However, in setting out to solve the issues that allowed 2008 to happen, they made something that literally took all of the bad parts of 2008 and then amplified it. 2008, similarly, was due to greed and human nature but was allowed to happen due to lack of oversite, rich people's excessive leverage over the poor, and excessive speculation. Crypto trades SOLELY on human emotion, has 0 oversite, is pure speculation, and the power dynamic is just as bad or worse.

Why should each individual be their own bank?

This is the last one, and it's short and basic. Why do we want people functioning as their own bank? Everything we do relies on another person. Without the internet, and internet providers there is no crypto. We don’t have people functioning as their own home and car manufacturers or internet service providers. Sure, you might specialize in some of these things, but masquerading as your own bank is a horrible idea.

I am not in the banking industry so I don’t know all the issues with banking. Most people aren’t in banking or crypto, so they don’t know the ENDLESS scams associated with it, and they are bound to lose their money eventually.

If you appreciate this article and want to read more from me and authors like me, without any limits, consider buying me a coffee: buymeacoffee.com/calebnaysmith

You might also like

CyberPunkMetalHead

2 years ago

Why Bitcoin NFTs Are Incomprehensible yet Likely Here to Stay

I'm trying to understand why Bitcoin NFTs aren't ready.

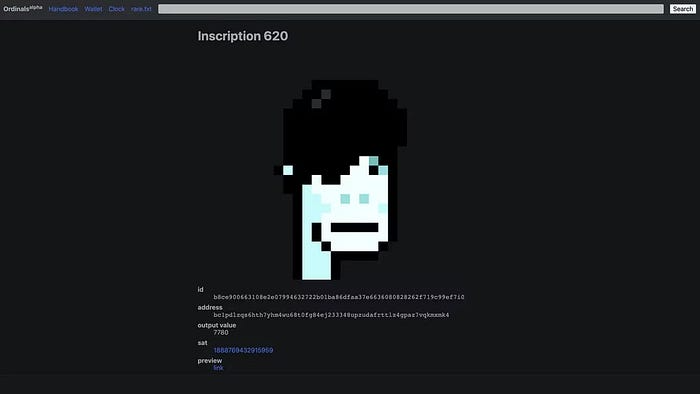

Ordinals, a new Bitcoin protocol, has been controversial. NFTs can be added to Bitcoin transactions using the protocol. They are not tokens or fungible. Bitcoin NFTs are transaction metadata. Yes. They're not owned.

In January, the Ordinals protocol allowed data like photos to be directly encoded onto sats, the smallest units of Bitcoin worth 0.00000001 BTC, on the Bitcoin blockchain. Ordinals does not need a sidechain or token like other techniques. The Ordinals protocol has encoded JPEG photos, digital art, new profile picture (PFP) projects, and even 1993 DOOM onto the Bitcoin network.

Ordinals inscriptions are permanent digital artifacts preserved on the Bitcoin blockchain. It differs from Ethereum, Solana, and Stacks NFT technologies that allow smart contract creators to change information. Ordinals store the whole image or content on the blockchain, not just a link to an external server, unlike centralized databases, which can change the linked image, description, category, or contract identifier.

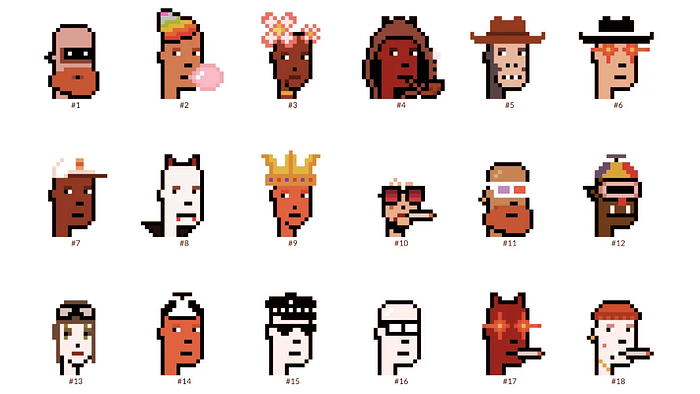

So far, more than 50,000 ordinals have been produced on the Bitcoin blockchain, and some of them have already been sold for astronomical amounts. The Ethereum-based CryptoPunks NFT collection spawned Ordinal Punk. Inscription 620 sold for 9.5 BTC, or $218,000, the most.

Segwit and Taproot, two important Bitcoin blockchain updates, enabled this. These protocols store transaction metadata, unlike Ethereum, where the NFT is the token. Bitcoin's NFT is a sat's transaction details.

What effects do ordinary values and NFTs have on the Bitcoin blockchain?

Ordinals will likely have long-term effects on the Bitcoin Ecosystem since they store, transact, and compute more data.

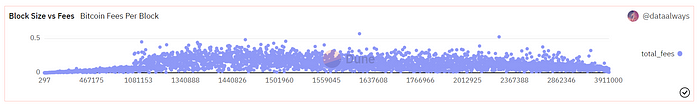

Charges Ordinals introduce scalability challenges. The Bitcoin network has limited transaction throughput and increased fees during peak demand. NFTs could make network transactions harder and more expensive. Ordinals currently occupy over 50% of block space, according to Glassnode.

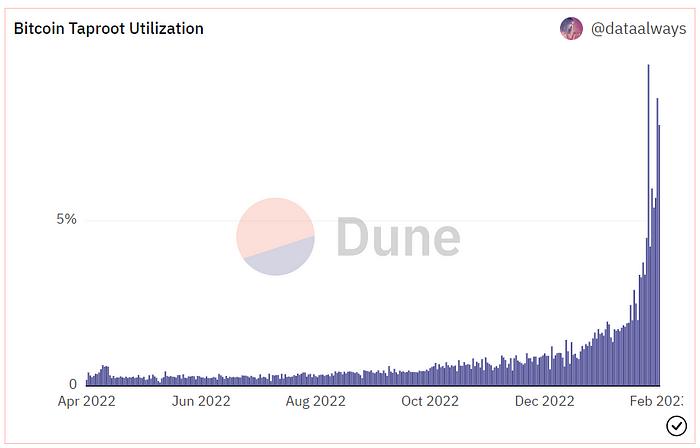

One of the protocols that supported Ordinals Taproot has also seen a huge uptick:

Taproot use increases block size and transaction costs.

This could cause network congestion but also support more L2s with Ordinals-specific use cases. Dune info here.

Storage Needs The Bitcoin blockchain would need to store more data to store NFT data directly. Since ordinals were introduced, blocksize has tripled from 0.7mb to over 2.2mb, which could increase storage costs and make it harder for nodes to join the network.

Use Case Diversity On the other hand, NFTs on the Bitcoin blockchain could broaden Bitcoin's use cases beyond storage and payment. This could expand Bitcoin's user base. This is two-sided. Bitcoin was designed to be trustless, decentralized, peer-to-peer money.

Chain to permanently store NFTs as ordinals will change everything.

Popularity rise This new use case will boost Bitcoin appeal, according to some. This argument fails since Bitcoin is the most popular cryptocurrency. Popularity doesn't require a new use case. Cryptocurrency adoption boosts Bitcoin. It need not compete with Ethereum or provide extra benefits to crypto investors. If there was a need for another chain that supports NFTs (there isn't), why would anyone choose the slowest and most expensive network? It appears contradictory and unproductive.

Nonetheless, holding an NFT on the Bitcoin blockchain is more secure than any other blockchain, but this has little utility.

Bitcoin NFTs are undoubtedly controversial. NFTs are strange and perhaps harmful to Bitcoin's mission. If Bitcoin NFTs are here to stay, I hope a sidechain or rollup solution will take over and leave the base chain alone.

Taher Batterywala

3 years ago

Do You Have Focus Issues? Use These 5 Simple Habits

Many can't concentrate. The first 20% of the day isn't optimized.

Elon Musk, Tony Robbins, and Bill Gates share something:

Morning Routines.

A repeatable morning ritual saves time.

The result?

Time for hobbies.

I'll discuss 5 easy morning routines you can use.

1. Stop pressing snooze

Waking up starts the day. You disrupt your routine by hitting snooze.

One sleep becomes three. Your morning routine gets derailed.

Fix it:

Hide your phone. This disables snooze and wakes you up.

Once awake, staying awake is 10x easier. Simple trick, big results.

2. Drink water

Chronic dehydration is common. Mostly urban, air-conditioned workers/residents.

2% cerebral dehydration causes short-term memory loss.

Dehydration shrinks brain cells.

Drink 3-4 liters of water daily to avoid this.

3. Improve your focus

How to focus better?

Meditation.

Improve your mood

Enhance your memory

increase mental clarity

Reduce blood pressure and stress

Headspace helps with the habit.

Here's a meditation guide.

Sit comfortably

Shut your eyes.

Concentrate on your breathing

Breathe in through your nose

Breathe out your mouth.

5 in, 5 out.

Repeat for 1 to 20 minutes.

Here's a beginner's video:

4. Workout

Exercise raises:

Mental Health

Effort levels

focus and memory

15-60 minutes of fun:

Exercise Lifting

Running

Walking

Stretching and yoga

This helps you now and later.

5. Keep a journal

You have countless thoughts daily. Many quietly steal your focus.

Here’s how to clear these:

Write for 5-10 minutes.

You'll gain 2x more mental clarity.

Recap

5 morning practices for 5x more productivity:

Say no to snoozing

Hydrate

Improve your focus

Exercise

Journaling

Conclusion

One step starts a thousand-mile journey. Try these easy yet effective behaviors if you have trouble concentrating or have too many thoughts.

Start with one of these behaviors, then add the others. Its astonishing results are instant.

Nitin Sharma

3 years ago

Quietly Create a side business that will revolutionize everything in a year.

Quitting your job for a side gig isn't smart.

A few years ago, I would have laughed at the idea of starting a side business.

I never thought a side gig could earn more than my 9-to-5. My side gig pays more than my main job now.

You may then tell me to leave your job. But I don't want to gamble, and my side gig is important. Programming and web development help me write better because of my job.

Yes, I share work-related knowledge. Web development, web3, programming, money, investment, and side hustles are key.

Let me now show you how to make one.

Create a side business based on your profession or your interests.

I'd be direct.

Most people don't know where to start or which side business to pursue.

You can make money by taking online surveys, starting a YouTube channel, or playing web3 games, according to several blogs.

You won't make enough money and will waste time.

Nitin directs our efforts. My friend, you've worked and have talent. Profit from your talent.

Example:

College taught me web development. I soon created websites, freelanced, and made money. First year was hardest for me financially and personally.

As I worked, I became more skilled. Soon after, I got more work, wrote about web development on Medium, and started selling products.

I've built multiple income streams from web development. It wasn't easy. Web development skills got me a 9-to-5 job.

Focus on a specific skill and earn money in many ways. Most people start with something they hate or are bad at; the rest is predictable.

Result? They give up, frustrated.

Quietly focus for a year.

I started my side business in college and never told anyone. My parents didn't know what I did for fun.

The only motivation is time constraints. So I focused.

As I've said, I focused on my strengths (learned skills) and made money. Yes, I was among Medium's top 500 authors in a year and got a bonus.

How did I succeed? Since I know success takes time, I never imagined making enough money in a month. I spent a year concentrating.

I became wealthy. Now that I have multiple income sources, some businesses pay me based on my skill.

I recommend learning skills and working quietly for a year. You can do anything with this.

The hardest part will always be the beginning.

When someone says you can make more money working four hours a week. Leave that, it's bad advice.

If someone recommends a paid course to help you succeed, think twice.

The beginning is always the hardest.

I made many mistakes learning web development. When I started my technical content side gig, it was tough. I made mistakes and changed how I create content, which helped.

And it’s applicable everywhere.

Don't worry if you face problems at first. Time and effort heal all wounds.

Quitting your job to work a side job is not a good idea.

Some honest opinions.

Most online gurus encourage side businesses. It takes time to start and grow a side business.

Suppose you quit and started a side business.

After six months, what happens? Your side business won't provide enough money to survive.

Indeed. Later, you'll become demotivated and tense and look for work.

Instead, work 9-5, and start a side business. You decide. Stop watching Netflix and focus on your side business.

I know you're busy, but do it.

Next? It'll succeed or fail in six months. You can continue your side gig for another six months because you have a job and have tried it.

You'll probably make money, but you may need to change your side gig.

That’s it.

You've created a new revenue stream.

Remember.

Starting a side business, a company, or finding work is difficult. There's no free money in a competitive world. You'll only succeed with skill.

Read it again.

Focusing silently for a year can help you succeed.

I studied web development and wrote about it. First year was tough. I went viral, hit the top 500, and other firms asked me to write for them. So, my life changed.

Yours can too. One year of silence is required.

Enjoy!