More on Entrepreneurship/Creators

Esteban

3 years ago

The Berkus Startup Valuation Method: What Is It?

What Is That?

Berkus is a pre-revenue valuation method based exclusively on qualitative criteria, like Scorecard.

Few firms match their financial estimates, especially in the early stages, so valuation methodologies like the Berkus method are a good way to establish a valuation when the economic measures are not reliable.

How does it work?

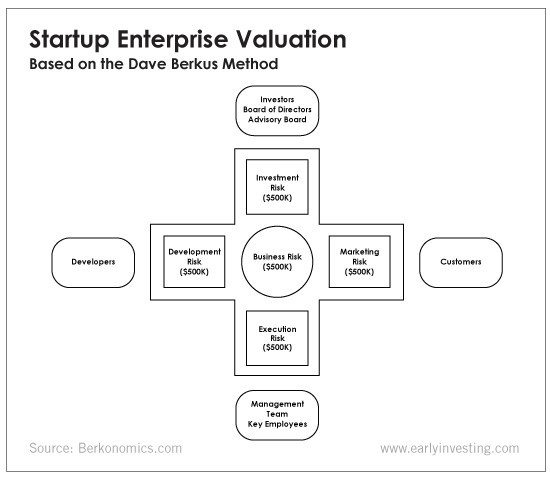

This technique evaluates five key success factors.

Fundamental principle

Technology

Execution

Strategic alliances in its primary market

Production, followed by sales

The Berkus technique values the business idea and four success factors. As seen in the matrix below, each of these dimensions poses a danger to the startup's success.

It assigns $0-$500,000 to each of these beginning regions. This approach enables a maximum $2.5M pre-money valuation.

This approach relies significantly on geography and uses the US as a baseline, as it differs in every country in Europe.

A set of standards for analyzing each dimension individually

Fundamental principle (or strength of the idea)

Ideas are worthless; execution matters. Most of us can relate to seeing a new business open in our area or a startup get funded and thinking, "I had this concept years ago!" Someone did it.

The concept remains. To assess the idea's viability, we must consider several criteria.

The concept's exclusivity It is necessary to protect a product or service's concept using patents and copyrights. Additionally, it must be capable of generating large profits.

Planned growth and growth that goes in a specific direction have a lot of potential, therefore incorporating them into a business is really advantageous.

The ability of a concept to grow A venture's ability to generate scalable revenue is a key factor in its emergence and continuation. A startup needs a scalable idea in order to compete successfully in the market.

The attraction of a business idea to a broad spectrum of people is significantly influenced by the current socio-political climate. Thus, the requirement for the assumption of conformity.

Concept Validation Ideas must go through rigorous testing with a variety of audiences in order to lower risk during the implementation phase.

Technology (Prototype)

This aspect reduces startup's technological risk. How good is the startup prototype when facing cyber threats, GDPR compliance (in Europe), tech stack replication difficulty, etc.?

Execution

Check the management team's efficacy. A potential angel investor must verify the founders' experience and track record with previous ventures. Good leadership is needed to chart a ship's course.

Strategic alliances in its primary market

Existing and new relationships will play a vital role in the development of both B2B and B2C startups. What are the startup's synergies? potential ones?

Production, followed by sales (product rollout)

Startup success depends on its manufacturing and product rollout. It depends on the overall addressable market, the startup's ability to market and sell their product, and their capacity to provide consistent, high-quality support.

Example

We're now founders of EyeCaramba, a machine vision-assisted streaming platform. My imagination always goes to poor puns when naming a startup.

Since we're first-time founders and the Berkus technique depends exclusively on qualitative methods and the evaluator's skill, we ask our angel-investor acquaintance for a pre-money appraisal of EyeCaramba.

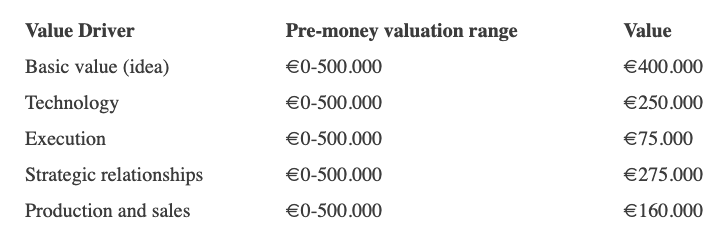

Our friend offers us the following table:

Because we're first-time founders, our pal lowered our Execution score. He knows the idea's value and that the gaming industry is red-hot, with worse startup ideas getting funded, therefore he gave the Basic value the highest value (idea).

EyeCaramba's pre-money valuation is $400,000 + $250,000 + $75,000 + $275,000 + $164,000 (1.16M). Good.

References

https://medium.com/humble-ventures/how-angel-investors-value-pre-revenue-startups-part-iii-8271405f0774#:~:text=pre%2Drevenue%20startups.-,Berkus%20Method,potential%20of%20the%20idea%20itself.%E2%80%9D

https://eqvista.com/berkus-valuation-method-for-startups/

https://www.venionaire.com/early-stage-startup-valuation-part-2-the-berkus-method/

Bradley Vangelder

3 years ago

How we started and then quickly sold our startup

From a simple landing where we tested our MVP to a platform that distributes 20,000 codes per month, we learned a lot.

Starting point

Kwotet was my first startup. Everyone might post book quotes online.

I wanted a change.

Kwotet lacked attention, thus I felt stuck. After experiencing the trials of starting Kwotet, I thought of developing a waitlist service, but I required a strong co-founder.

I knew Dries from school, but we weren't close. He was an entrepreneurial programmer who worked a lot outside school. I needed this.

We brainstormed throughout school hours. We developed features to put us first. We worked until 3 am to launch this product.

Putting in the hours is KEY when building a startup

The instant that we lost our spark

In Belgium, college seniors do their internship in their last semester.

As we both made the decision to pick a quite challenging company, little time was left for Lancero.

Eventually, we lost interest. We lost the spark…

The only logical choice was to find someone with the same spark we started with to acquire Lancero.

And we did @ MicroAcquire.

Sell before your product dies. Make sure to profit from all the gains.

What did we do following the sale?

Not far from selling Lancero I lost my dad. I was about to start a new company. It was focused on positivity. I got none left at the time.

We still didn’t let go of the dream of becoming full-time entrepreneurs. As Dries launched the amazing company Plunk, and I’m still in the discovering stages of my next journey!

Dream!

You’re an entrepreneur if:

You're imaginative.

You enjoy disassembling and reassembling things.

You're adept at making new friends.

YOU HAVE DREAMS.

You don’t need to believe me if I tell you “everything is possible”… I wouldn't believe it myself if anyone told me this 2 years ago.

Until I started doing, living my dreams.

Woo

3 years ago

How To Launch A Business Without Any Risk

> Say Hello To The Lean-Hedge Model

People think starting a business requires significant debt and investment. Like Shark Tank, you need a world-changing idea. I'm not saying to avoid investors or brilliant ideas.

Investing is essential to build a genuinely profitable company. Think Apple or Starbucks.

Entrepreneurship is risky because many people go bankrupt from debt. As starters, we shouldn't do it. Instead, use lean-hedge.

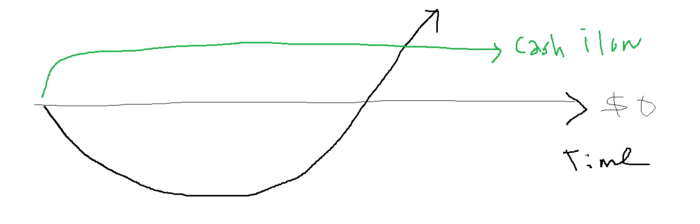

Simply defined, you construct a cash-flow business to hedge against long-term investment-heavy business expenses.

What the “fx!$rench-toast” is the lean-hedge model?

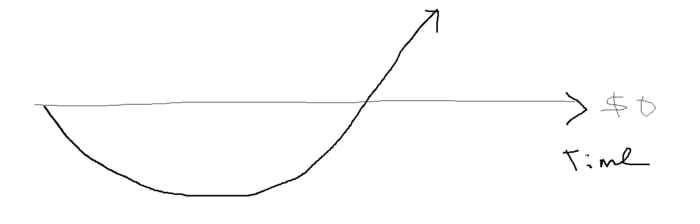

When you start a business, your money should move down, down, down, then up when it becomes profitable.

Many people don't survive the business's initial losses and debt. What if, we created a cash-flow business BEFORE we started our Starbucks to hedge against its initial expenses?

Lean-hedge has two sections. Start a cash-flow business. A cash-flow business takes minimal investment and usually involves sweat and time.

Let’s take a look at some examples:

A Translation company

Personal portfolio website (you make a site then you do cold e-mail marketing)

FREELANCE (UpWork, Fiverr).

Educational business.

Infomarketing. (You design a knowledge-based product. You sell the info).

Online fitness/diet/health coaching ($50-$300/month, calls, training plan)

Amazon e-book publishing. (Medium writers do this)

YouTube, cash-flow channel

A web development agency (I'm a dev, but if you're not, a graphic design agency, etc.) (Sell your time.)

Digital Marketing

Online paralegal (A million lawyers work in the U.S).

Some dropshipping (Organic Tik Tok dropshipping, where you create content to drive traffic to your shopify store instead of spend money on ads).

(Disclaimer: My first two cash-flow enterprises, which were language teaching, failed terribly. My translation firm is now booming because B2B e-mail marketing is easy.)

Crossover occurs. Your long-term business starts earning more money than your cash flow business.

My cash-flow business (freelancing, translation) makes $7k+/month.

I’ve decided to start a slightly more investment-heavy digital marketing agency

Here are the anticipated business's time- and money-intensive investments:

($$$) Top Front-End designer's Figma/UI-UX design (in negotiation)

(Time): A little copywriting (I will do this myself)

($$) Creating an animated webpage with HTML (in negotiation)

Backend Development (Duration) (I'll carry out this myself using Laravel.)

Logo Design ($$)

Logo Intro Video for $

Video Intro (I’ll edit this myself with Premiere Pro)

etc.

Then evaluate product, place, price, and promotion. Consider promotion and pricing.

The lean-hedge model's point is:

Don't gamble. Avoid debt. First create a cash-flow project, then grow it steadily.

Check read my previous posts on “Nightmare Mode” (which teaches you how to make work as interesting as video games) and Why most people can't escape a 9-5 to learn how to develop a cash-flow business.

You might also like

Shruti Mishra

3 years ago

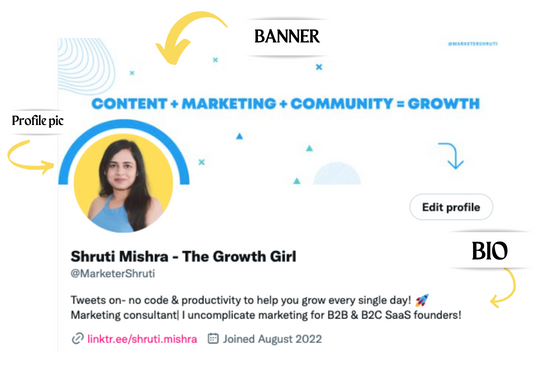

How to get 100k profile visits on Twitter each month without spending a dime

As a marketer, I joined Twitter on August 31, 2022 to use it.

Growth has been volatile, causing up-and-down engagements. 500 followers in 11 days.

I met amazing content creators, marketers, and people.

Those who use Twitter may know that one-liners win the algorithm, especially if they're funny or humorous, but as a marketer I can't risk posting content that my audience won't like.

I researched, learned some strategies, and A/B tested; some worked, some didn't.

In this article, I share what worked for me so you can do the same.

Thanks for reading!

Let's check my Twitter stats.

Tweets: how many tweets I sent in the first 28 days.

A user may be presented with a Tweet in their timeline or in search results.

In-person visits how many times my Twitter profile was viewed in the first 28 days.

Mentions: the number of times a tweet has mentioned my name.

Number of followers: People who were following me

Getting 500 Twitter followers isn't difficult.

Not easy, but doable.

Follow these steps to begin:

Determine your content pillars in step 1.

My formula is Growth = Content + Marketing + Community.

I discuss growth strategies.

My concept for growth is : 1. Content = creating / writing + sharing content in my niche. 2. Marketing = Marketing everything in business + I share my everyday learnings in business, marketing & entrepreneurship. 3. Community = Building community of like minded individuals (Also,I share how to’s) + supporting marketers to build & grow through community building.

Identify content pillars to create content for your audience.

2. Make your profile better

Create a profile picture. Your recognition factor is this.

Professional headshots are worthwhile.

This tool can help you create a free, eye-catching profile pic.

Use a niche-appropriate avatar if you don't want to show your face.

2. Create a bio that converts well mainly because first impressions count.

what you're sharing + why + +social proof what are you making

Be brief and precise. (155 characters)

3. Configure your banner

Banners complement profile pictures.

Use this space to explain what you do and how Twitter followers can benefit.

Canva's Twitter header maker is free.

Birdy can test multiple photo, bio, and banner combinations to optimize your profile.

Versions A and B of your profile should be completed.

Find the version that converts the best.

Use the profile that converts the best.

4. Special handle

If your username/handle is related to your niche, it will help you build authority and presence among your audience. Mine on Twitter is @marketershruti.

5. Participate expertly

Proficiently engage while you'll have no audience at first. Borrow your dream audience for free.

Steps:

Find a creator who has the audience you want.

Activate their post notifications and follow them.

Add a valuable comment first.

6. Create fantastic content

Use:

Medium (Read articles about your topic.)

Podcasts (Listen to experts on your topics)

YouTube (Follow channels in your niche)

Tweet what?

Listicle ( Hacks, Books, Tools, Podcasts)

Lessons (Teach your audience how to do 1 thing)

Inspirational (Inspire people to take action)

Consistent writing?

You MUST plan ahead and schedule your Tweets.

Use a scheduling tool that is effective for you; hypefury is mine.

Lastly, consistency is everything that attracts growth. After optimizing your profile, stay active to gain followers, engagements, and clients.

If you found this helpful, please like and comment below.

Coinbase

4 years ago

10 Predictions for Web3 and the Cryptoeconomy for 2022

By Surojit Chatterjee, Chief Product Officer

2021 proved to be a breakout year for crypto with BTC price gaining almost 70% yoy, Defi hitting $150B in value locked, and NFTs emerging as a new category. Here’s my view through the crystal ball into 2022 and what it holds for our industry:

1. Eth scalability will improve, but newer L1 chains will see substantial growth — As we welcome the next hundred million users to crypto and Web3, scalability challenges for Eth are likely to grow. I am optimistic about improvements in Eth scalability with the emergence of Eth2 and many L2 rollups. Traction of Solana, Avalanche and other L1 chains shows that we’ll live in a multi-chain world in the future. We’re also going to see newer L1 chains emerge that focus on specific use cases such as gaming or social media.

2. There will be significant usability improvements in L1-L2 bridges — As more L1 networks gain traction and L2s become bigger, our industry will desperately seek improvements in speed and usability of cross-L1 and L1-L2 bridges. We’re likely to see interesting developments in usability of bridges in the coming year.

3. Zero knowledge proof technology will get increased traction — 2021 saw protocols like ZkSync and Starknet beginning to get traction. As L1 chains get clogged with increased usage, ZK-rollup technology will attract both investor and user attention. We’ll see new privacy-centric use cases emerge, including privacy-safe applications, and gaming models that have privacy built into the core. This may also bring in more regulator attention to crypto as KYC/AML could be a real challenge in privacy centric networks.

4. Regulated Defi and emergence of on-chain KYC attestation — Many Defi protocols will embrace regulation and will create separate KYC user pools. Decentralized identity and on-chain KYC attestation services will play key roles in connecting users’ real identity with Defi wallet endpoints. We’ll see more acceptance of ENS type addresses, and new systems from cross chain name resolution will emerge.

5. Institutions will play a much bigger role in Defi participation — Institutions are increasingly interested in participating in Defi. For starters, institutions are attracted to higher than average interest-based returns compared to traditional financial products. Also, cost reduction in providing financial services using Defi opens up interesting opportunities for institutions. However, they are still hesitant to participate in Defi. Institutions want to confirm that they are only transacting with known counterparties that have completed a KYC process. Growth of regulated Defi and on-chain KYC attestation will help institutions gain confidence in Defi.

6. Defi insurance will emerge — As Defi proliferates, it also becomes the target of security hacks. According to London-based firm Elliptic, total value lost by Defi exploits in 2021 totaled over $10B. To protect users from hacks, viable insurance protocols guaranteeing users’ funds against security breaches will emerge in 2022.

7. NFT Based Communities will give material competition to Web 2.0 social networks — NFTs will continue to expand in how they are perceived. We’ll see creator tokens or fan tokens take more of a first class seat. NFTs will become the next evolution of users’ digital identity and passport to the metaverse. Users will come together in small and diverse communities based on types of NFTs they own. User created metaverses will be the future of social networks and will start threatening the advertising driven centralized versions of social networks of today.

8. Brands will start actively participating in the metaverse and NFTs — Many brands are realizing that NFTs are great vehicles for brand marketing and establishing brand loyalty. Coca-Cola, Campbell’s, Dolce & Gabbana and Charmin released NFT collectibles in 2021. Adidas recently launched a new metaverse project with Bored Ape Yacht Club. We’re likely to see more interesting brand marketing initiatives using NFTs. NFTs and the metaverse will become the new Instagram for brands. And just like on Instagram, many brands may start as NFT native. We’ll also see many more celebrities jumping in the bandwagon and using NFTs to enhance their personal brand.

9. Web2 companies will wake up and will try to get into Web3 — We’re already seeing this with Facebook trying to recast itself as a Web3 company. We’re likely to see other big Web2 companies dipping their toes into Web3 and metaverse in 2022. However, many of them are likely to create centralized and closed network versions of the metaverse.

10. Time for DAO 2.0 — We’ll see DAOs become more mature and mainstream. More people will join DAOs, prompting a change in definition of employment — never receiving a formal offer letter, accepting tokens instead of or along with fixed salaries, and working in multiple DAO projects at the same time. DAOs will also confront new challenges in terms of figuring out how to do M&A, run payroll and benefits, and coordinate activities in larger and larger organizations. We’ll see a plethora of tools emerge to help DAOs execute with efficiency. Many DAOs will also figure out how to interact with traditional Web2 companies. We’re likely to see regulators taking more interest in DAOs and make an attempt to educate themselves on how DAOs work.

Thanks to our customers and the ecosystem for an incredible 2021. Looking forward to another year of building the foundations for Web3. Wagmi.

Jano le Roux

3 years ago

My Top 11 Tools For Building A Modern Startup, With A Free Plan

The best free tools are probably unknown to you.

Modern startups are easy to build.

Start with free tools.

Let’s go.

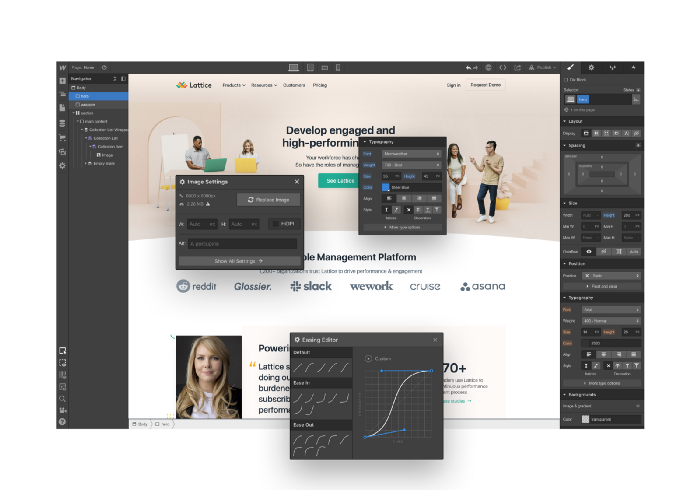

Web development — Webflow

Code-free HTML, CSS, and JS.

Webflow isn't like Squarespace, Wix, or Shopify.

It's a super-fast no-code tool for professionals to construct complex, highly-responsive websites and landing pages.

Webflow can help you add animations like those on Apple's website to your own site.

I made the jump from WordPress a few years ago and it changed my life.

No damn plugins. No damn errors. No damn updates.

The best, you can get started on Webflow for free.

Data tracking — Airtable

Spreadsheet wings.

Airtable combines spreadsheet flexibility with database power without code.

Airtable is modern.

Airtable has modularity.

Scaling Airtable is simple.

Airtable, one of the most adaptable solutions on this list, is perfect for client data management.

Clients choose customized service packages. Airtable consolidates data so you can automate procedures like invoice management and focus on your strengths.

Airtable connects with so many tools that rarely creates headaches. Airtable scales when you do.

Airtable's flexibility makes it a potential backend database.

Design — Figma

Better, faster, easier user interface design.

Figma rocks!

It’s fast.

It's free.

It's adaptable

First, design in Figma.

Iterate.

Export development assets.

Figma lets you add more team members as your company grows to work on each iteration simultaneously.

Figma is web-based, so you don't need a powerful PC or Mac to start.

Task management — Trello

Unclock jobs.

Tacky and terrifying task management products abound. Trello isn’t.

Those that follow Marie Kondo will appreciate Trello.

Everything is clean.

Nothing is complicated.

Everything has a place.

Compared to other task management solutions, Trello is limited. And that’s good. Too many buttons lead to too many decisions lead to too many hours wasted.

Trello is a must for teamwork.

Domain email — Zoho

Free domain email hosting.

Professional email is essential for startups. People relied on monthly payments for too long. Nope.

Zoho offers 5 free professional emails.

It doesn't have Google's UI, but it works.

VPN — Proton VPN

Fast Swiss VPN protects your data and privacy.

Proton VPN is secure.

Proton doesn't record any data.

Proton is based in Switzerland.

Swiss privacy regulation is among the most strict in the world, therefore user data are protected. Switzerland isn't a 14 eye country.

Journalists and activists trust Proton to secure their identities while accessing and sharing information authoritarian governments don't want them to access.

Web host — Netlify

Free fast web hosting.

Netlify is a scalable platform that combines your favorite tools and APIs to develop high-performance sites, stores, and apps through GitHub.

Serverless functions and environment variables preserve API keys.

Netlify's free tier is unmissable.

100GB of free monthly bandwidth.

Free 125k serverless operations per website each month.

Database — MongoDB

Create a fast, scalable database.

MongoDB is for small and large databases. It's a fast and inexpensive database.

Free for the first million reads.

Then, for each million reads, you must pay $0.10.

MongoDB's free plan has:

Encryption from end to end

Continual authentication

field-level client-side encryption

If you have a large database, you can easily connect MongoDB to Webflow to bypass CMS limits.

Automation — Zapier

Time-saving tip: automate repetitive chores.

Zapier simplifies life.

Zapier syncs and connects your favorite apps to do impossibly awesome things.

If your online store is connected to Zapier, a customer's purchase can trigger a number of automated actions, such as:

The customer is being added to an email chain.

Put the information in your Airtable.

Send a pre-programmed postcard to the customer.

Alexa, set the color of your smart lights to purple.

Zapier scales when you do.

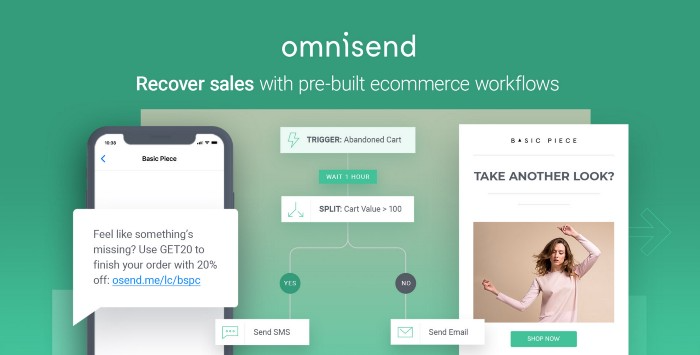

Email & SMS marketing — Omnisend

Email and SMS marketing campaigns.

This is an excellent Mailchimp option for magical emails. Omnisend's processes simplify email automation.

I love the interface's cleanliness.

Omnisend's free tier includes web push notifications.

Send up to:

500 emails per month

60 maximum SMSs

500 Web Push Maximum

Forms and surveys — Tally

Create flexible forms that people enjoy.

Typeform is clean but restricting. Sometimes you need to add many questions. Tally's needed sometimes.

Tally is flexible and cheaper than Typeform.

99% of Tally's features are free and unrestricted, including:

Unlimited forms

Countless submissions

Collect payments

File upload

Tally lets you examine what individuals contributed to forms before submitting them to see where they get stuck.

Airtable and Zapier connectors automate things further. If you pay, you can apply custom CSS to fit your brand.

See.

Free tools are the greatest.

Let's use them to launch a startup.