More on Personal Growth

Datt Panchal

3 years ago

The Learning Habit

The Habit of Learning implies constantly learning something new. One daily habit will make you successful. Learning will help you succeed.

Most successful people continually learn. Success requires this behavior. Daily learning.

Success loves books. Books offer expert advice. Everything is online today. Most books are online, so you can skip the library. You must download it and study for 15-30 minutes daily. This habit changes your thinking.

Typical Successful People

Warren Buffett reads 500 pages of corporate reports and five newspapers for five to six hours each day.

Each year, Bill Gates reads 50 books.

Every two weeks, Mark Zuckerberg reads at least one book.

According to his brother, Elon Musk studied two books a day as a child and taught himself engineering and rocket design.

Learning & Making Money Online

No worries if you can't afford books. Everything is online. YouTube, free online courses, etc.

How can you create this behavior in yourself?

1) Consider what you want to know

Before learning, know what's most important. So, move together.

Set a goal and schedule learning.

After deciding what you want to study, create a goal and plan learning time.

3) GATHER RESOURCES

Get the most out of your learning resources. Online or offline.

Andy Murphy

3 years ago

Activating Your Vagus Nerve

11 science-backed ways to improve health, happiness, healing, relaxation, and mental clarity.

Vagus nerve is the main parasympathetic nervous system component.

It helps us rest and digest by slowing and stabilizing a resting heart rate, slowing and stabilizing the breath, promoting digestion, improving recovery and healing times, producing saliva, releasing endorphins and hormones like dopamine, oxytocin, and serotonin, and boosting the immune, digestive, and cardiovascular systems.

The vagus nerve sends anti-inflammatory signals to other parts of the body and is located behind the tongue, in the throat, neck, heart, lungs, abdomen, and brainstem.

Vagus means wandering in Latin. So, it's bold.

Here are 11 proven ways to boost health, happiness, and the vagus nerve.

1. Extend

“Yoga stimulates different nerves in your body, especially the vagus nerve that carries information from the brain to most of the body’s major organs, slows everything down and allows self-regulation. It’s the nerve that is associated with the parasympathetic system and emotions like love, joy, and compassion.” — Deepak Chopra

Stretching doesn't require a yoga background.

Listen to your body and ease into simple poses. This connects the mind and body.

If you're new to yoga or don't have access to an in-person class, try Yoga with Adrienne. Over 600 YouTube videos give her plenty of material.

2. Inhale

Because inhaling and exhaling activate the autonomic nervous system, we can breathe to relax.

Exhaling activates the parasympathetic nervous system (rest and digest). One inhales stress, the other exhales it.

So, faster or more intense breathing increases stress. Slower breathing relaxes us.

Breathe slowly, smoothly, and less.

Rhythmic breathing helps me relax.

What to do is as follows:

1. Take 4 smooth, forceless nose breaths.

2. Exhale smoothly and forcefully for 4 seconds

3. Don't pause at the inhale or exhale.

4. Continue for 5 minutes/40 breaths

5. Hold your breath as long as comfortable.

6. Breathe normally.

If four seconds is too long, try breathing in and out for two seconds, or in and out for three seconds, until your breath naturally relaxes. Once calmer, extend your breath.

Any consistent rhythm without force is good. Your heart will follow your lead and become coherent.

3. Chant/Hum

Singing, chanting, or humming activate the vagus nerve through the back of the throat.

Humming emits nitric oxide.

Nitric oxide improves blood circulation, blood flow, heart health, and blood pressure.

Antiviral, antibacterial, anti-inflammatory, antioxidant, and antimicrobial properties kill viruses and bacteria in the nose and throat.

Gargling water stimulates the vagus nerve.

Simple ways to heal, boost energy, and boost mood are often the healthiest. They're free and can be done anywhere.

4. Have more fun

Laughing stimulates the throat muscles, activating the vagus nerve. What's not to like? It releases dopamine.

Take time to enjoy life. Maybe it's a book, podcast, movie, socializing with friends, or laughing yoga.

Follow your bliss, as Joseph Campbell says.

Laugh at yourself

Actually. Really.

Gagging activates vagus nerve-connected muscles. Some doctors use the gag reflex to test the vagus nerve.

Grossness isn't required. While brushing, gag quickly. My girlfriend's brother always does it.

I'm done brushing when I gag, he says.

6. Take in the outdoors

Nature relaxes body and mind. Better if you can walk barefoot.

Earthing is associated with hippies dancing in daisies.

Science now supports hippies.

7. Enter some chilly water.

The diving reflex activates the vagus nerve when exposed to cold water.

The diving reflex involves holding your breath in cold water. Cold showers work best.

Within minutes of being in cold water, parasympathetic nervous system activity, which calms the body, increases.

8. Workout

Exercise increases dopamine, blood circulation, and breathing. So we feel energized, calm, and well-rested.

After resting, the parasympathetic nervous system engages.

It's worth waiting for, though.

9. Play music with brainwaves

Brainwave music harmonizes brainwave activity, boosts productivity and mental clarity, and promotes peace and relaxation by stimulating the vagus nerve.

Simply play a song.

My favorite.

10. Make gentle eyes

Eyes, like breath, often reflect inner state. Sharp, dilated, focused eyes indicate alertness.

Soft, open eyes reflect relaxation and ease. Soft eyes relax the nervous system.

This practice reduces stress, anxiety, and body tension. It's a quick and effective way to enter a calm, peaceful state.

Wild animals can be hunted one minute and graze the next.

Put it into action:

Relax while seated.

Gaze at a distant object

Use peripheral vision while looking straight ahead

Without moving your eyes, look up and down. Connect side spaces to your vision.

Focus on everything as your eyes soften.

Keep breathing

Stay as long as you like

11. Be intimate

We kiss, moan, and breathe deeper during love. We get dopamine, oxytocin, serotonin, and vagus nerve stimulation.

Why not?

To sum up

Here are 11 vagus nerve resets:

Stretch

Breathe

Hum/Chant

More humor

Amuse yourself

Spend time outdoors

Leap into chilly water

Exercise

Play music with brainwaves.

Make gentle eyes.

Be intimate

If these words have inspired you, try my favorite breathwork technique. Combining breathing, chanting, and brainwave music. Win-win-win :)

The woman

3 years ago

The best lesson from Sundar Pichai is that success and stress don't mix.

His regular regimen teaches stress management.

In 1995, an Indian graduate visited the US. He obtained a scholarship to Stanford after graduating from IIT with a silver medal. First flight. His ticket cost a year's income. His head was full.

Pichai Sundararajan is his full name. He became Google's CEO and a world leader. Mr. Pichai transformed technology and inspired millions to dream big.

This article reveals his daily schedule.

Mornings

While many of us dread Mondays, Mr. Pichai uses the day to contemplate.

A typical Indian morning. He awakens between 6:30 and 7 a.m. He avoids working out in the mornings.

Mr. Pichai oversees the internet, but he reads a real newspaper every morning.

Pichai mentioned that he usually enjoys a quiet breakfast during which he reads the news to get a good sense of what’s happening in the world. Pichai often has an omelet for breakfast and reads while doing so. The native of Chennai, India, continues to enjoy his daily cup of tea, which he describes as being “very English.”

Pichai starts his day. BuzzFeed's Mat Honan called the CEO Banana Republic dad.

Overthinking in the morning is a bad idea. It's crucial to clear our brains and give ourselves time in the morning before we hit traffic.

Mr. Pichai's morning ritual shows how to stay calm. Wharton Business School found that those who start the day calmly tend to stay that way. It's worth doing regularly.

And he didn't forget his roots.

Afternoons

He has a busy work schedule, as you can imagine. Running one of the world's largest firm takes time, energy, and effort. He prioritizes his work. Monitoring corporate performance and guaranteeing worker efficiency.

Sundar Pichai spends 7-8 hours a day to improve Google. He's noted for changing the company's culture. He wants to boost employee job satisfaction and performance.

His work won him recognition within the company.

Pichai received a 96% approval rating from Glassdoor users in 2017.

Mr. Pichai stresses work satisfaction. Each day is a new canvas for him to find ways to enrich people's job and personal lives.

His work offers countless lessons. According to several profiles and press sources, the Google CEO is a savvy negotiator. Mr. Pichai's success came from his strong personality, work ethic, discipline, simplicity, and hard labor.

Evenings

His evenings are spent with family after a busy day. Sundar Pichai's professional and personal lives are balanced. Sundar Pichai is a night owl who re-energizes about 9 p.m.

However, he claims to be most productive after 10 p.m., and he thinks doing a lot of work at that time is really useful. But he ensures he sleeps for around 7–8 hours every day. He enjoys long walks with his dog and enjoys watching NSDR on YouTube. It helps him in relaxing and sleep better.

His regular routine teaches us what? Work wisely, not hard, discipline, vision, etc. His stress management is key. Leading one of the world's largest firm with 85,000 employees is scary.

The pressure to achieve may ruin a day. Overworked employees are more likely to make mistakes or be angry with coworkers, according to the Family Work Institute. They can't handle daily problems, making the house more stressful than the office.

Walking your dog, having fun with friends, and having hobbies are as vital as your office.

You might also like

Victoria Kurichenko

3 years ago

What Happened After I Posted an AI-Generated Post on My Website

This could cost you.

Content creators may have heard about Google's "Helpful content upgrade."

This change is another Google effort to remove low-quality, repetitive, and AI-generated content.

Why should content creators care?

Because too much content manipulates search results.

My experience includes the following.

Website admins seek high-quality guest posts from me. They send me AI-generated text after I say "yes." My readers are irrelevant. Backlinks are needed.

Companies copy high-ranking content to boost their Google rankings. Unfortunately, it's common.

What does this content offer?

Nothing.

Despite Google's updates and efforts to clean search results, webmasters create manipulative content.

As a marketer, I knew about AI-powered content generation tools. However, I've never tried them.

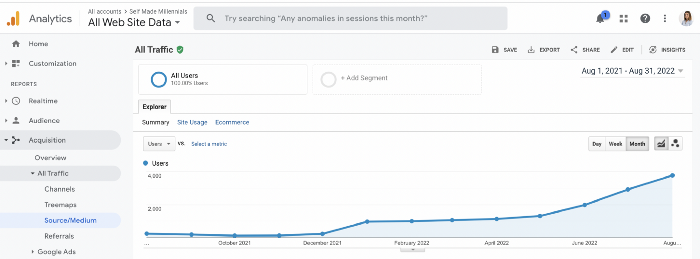

I use old-fashioned content creation methods to grow my website from 0 to 3,000 monthly views in one year.

Last year, I launched a niche website.

I do keyword research, analyze search intent and competitors' content, write an article, proofread it, and then optimize it.

This strategy is time-consuming.

But it yields results!

Here's proof from Google Analytics:

Proven strategies yield promising results.

To validate my assumptions and find new strategies, I run many experiments.

I tested an AI-powered content generator.

I used a tool to write this Google-optimized article about SEO for startups.

I wanted to analyze AI-generated content's Google performance.

Here are the outcomes of my test.

First, quality.

I dislike "meh" content. I expect articles to answer my questions. If not, I've wasted my time.

My essays usually include research, personal anecdotes, and what I accomplished and achieved.

AI-generated articles aren't as good because they lack individuality.

Read my AI-generated article about startup SEO to see what I mean.

It's dry and shallow, IMO.

It seems robotic.

I'd use quotes and personal experience to show how SEO for startups is different.

My article paraphrases top-ranked articles on a certain topic.

It's readable but useless. Similar articles abound online. Why read it?

AI-generated content is low-quality.

Let me show you how this content ranks on Google.

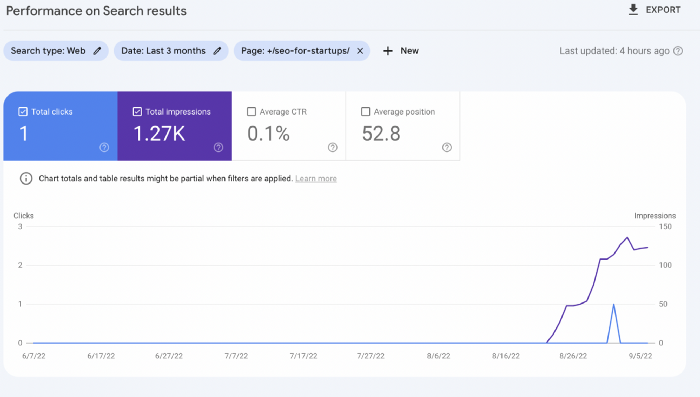

The Google Search Console report shows impressions, clicks, and average position.

Low numbers.

No one opens the 5th Google search result page to read the article. Too far!

You may say the new article will improve.

Marketing-wise, I doubt it.

This article is shorter and less comprehensive than top-ranking pages. It's unlikely to win because of this.

AI-generated content's terrible reality.

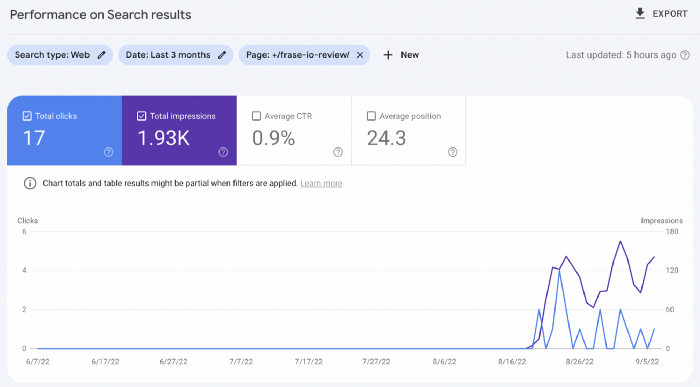

I'll compare how this content I wrote for readers and SEO performs.

Both the AI and my article are fresh, but trends are emerging.

My article's CTR and average position are higher.

I spent a week researching and producing that piece, unlike AI-generated content. My expert perspective and unique consequences make it interesting to read.

Human-made.

In summary

No content generator can duplicate a human's tone, writing style, or creativity. Artificial content is always inferior.

Not "bad," but inferior.

Demand for content production tools will rise despite Google's efforts to eradicate thin content.

Most won't spend hours producing link-building articles. Costly.

As guest and sponsored posts, artificial content will thrive.

Before accepting a new arrangement, content creators and website owners should consider this.

Sam Warain

3 years ago

Sam Altman, CEO of Open AI, foresees the next trillion-dollar AI company

“I think if I had time to do something else, I would be so excited to go after this company right now.”

Sam Altman, CEO of Open AI, recently discussed AI's present and future.

Open AI is important. They're creating the cyberpunk and sci-fi worlds.

They use the most advanced algorithms and data sets.

GPT-3...sound familiar? Open AI built most copyrighting software. Peppertype, Jasper AI, Rytr. If you've used any, you'll be shocked by the quality.

Open AI isn't only GPT-3. They created DallE-2 and Whisper (a speech recognition software released last week).

What will they do next? What's the next great chance?

Sam Altman, CEO of Open AI, recently gave a lecture about the next trillion-dollar AI opportunity.

Who is the organization behind Open AI?

Open AI first. If you know, skip it.

Open AI is one of the earliest private AI startups. Elon Musk, Greg Brockman, and Rebekah Mercer established OpenAI in December 2015.

OpenAI has helped its citizens and AI since its birth.

They have scary-good algorithms.

Their GPT-3 natural language processing program is excellent.

The algorithm's exponential growth is astounding. GPT-2 came out in November 2019. May 2020 brought GPT-3.

Massive computation and datasets improved the technique in just a year. New York Times said GPT-3 could write like a human.

Same for Dall-E. Dall-E 2 was announced in April 2022. Dall-E 2 won a Colorado art contest.

Open AI's algorithms challenge jobs we thought required human innovation.

So what does Sam Altman think?

The Present Situation and AI's Limitations

During the interview, Sam states that we are still at the tip of the iceberg.

So I think so far, we’ve been in the realm where you can do an incredible copywriting business or you can do an education service or whatever. But I don’t think we’ve yet seen the people go after the trillion dollar take on Google.

He's right that AI can't generate net new human knowledge. It can train and synthesize vast amounts of knowledge, but it simply reproduces human work.

“It’s not going to cure cancer. It’s not going to add to the sum total of human scientific knowledge.”

But the key word is yet.

And that is what I think will turn out to be wrong that most surprises the current experts in the field.

Reinforcing his point that massive innovations are yet to come.

But where?

The Next $1 Trillion AI Company

Sam predicts a bio or genomic breakthrough.

There’s been some promising work in genomics, but stuff on a bench top hasn’t really impacted it. I think that’s going to change. And I think this is one of these areas where there will be these new $100 billion to $1 trillion companies started, and those areas are rare.

Avoid human trials since they take time. Bio-materials or simulators are suitable beginning points.

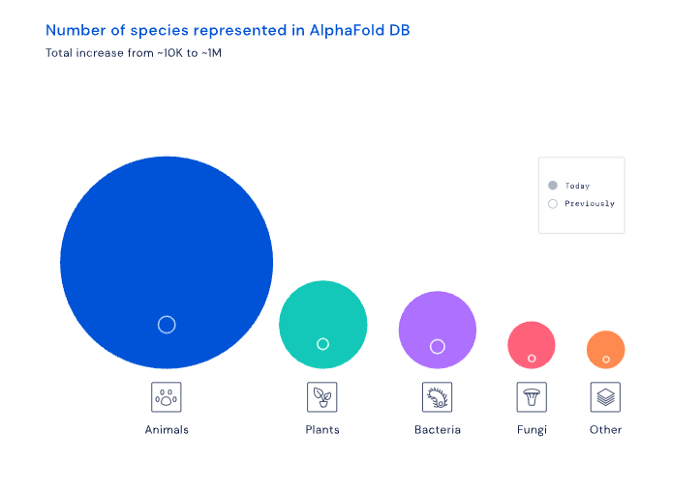

AI may have a breakthrough. DeepMind, an OpenAI competitor, has developed AlphaFold to predict protein 3D structures.

It could change how we see proteins and their function. AlphaFold could provide fresh understanding into how proteins work and diseases originate by revealing their structure. This could lead to Alzheimer's and cancer treatments. AlphaFold could speed up medication development by revealing how proteins interact with medicines.

Deep Mind offered 200 million protein structures for scientists to download (including sustainability, food insecurity, and neglected diseases).

Being in AI for 4+ years, I'm amazed at the progress. We're past the hype cycle, as evidenced by the collapse of AI startups like C3 AI, and have entered a productive phase.

We'll see innovative enterprises that could replace Google and other trillion-dollar companies.

What happens after AI adoption is scary and unpredictable. How will AGI (Artificial General Intelligence) affect us? Highly autonomous systems that exceed humans at valuable work (Open AI)

My guess is that the things that we’ll have to figure out are how we think about fairly distributing wealth, access to AGI systems, which will be the commodity of the realm, and governance, how we collectively decide what they can do, what they don’t do, things like that. And I think figuring out the answer to those questions is going to just be huge. — Sam Altman CEO

Liam Vaughan

3 years ago

Investors can bet big on almost anything on a new prediction market.

Kalshi allows five-figure bets on the Grammys, the next Covid wave, and future SEC commissioners. Worst-case scenario

On Election Day 2020, two young entrepreneurs received a call from the CFTC chairman. Luana Lopes Lara and Tarek Mansour spent 18 months trying to start a new type of financial exchange. Instead of betting on stock prices or commodity futures, people could trade instruments tied to real-world events, such as legislation, the weather, or the Oscar winner.

Heath Tarbert, a Trump appointee, shouted "Congratulations." "You're competing with 1840s-era markets. I'm sure you'll become a powerhouse too."

Companies had tried to introduce similar event markets in the US for years, but Tarbert's agency, the CFTC, said no, arguing they were gambling and prone to cheating. Now the agency has reversed course, approving two 24-year-olds who will have first-mover advantage in what could become a huge new asset class. Kalshi Inc. raised $30 million from venture capitalists within weeks of Tarbert's call, his representative says. Mansour, 26, believes this will be bigger than crypto.

Anyone who's read The Wisdom of Crowds knows prediction markets' potential. Well-designed markets can help draw out knowledge from disparate groups, and research shows that when money is at stake, people make better predictions. Lopes Lara calls it a "bullshit tax." That's why Google, Microsoft, and even the US Department of Defense use prediction markets internally to guide decisions, and why university-linked political betting sites like PredictIt sometimes outperform polls.

Regulators feared Wall Street-scale trading would encourage investors to manipulate reality. If the stakes are high enough, traders could pressure congressional staffers to stall a bill or bet on whether Kanye West's new album will drop this week. When Lopes Lara and Mansour pitched the CFTC, senior regulators raised these issues. Politically appointed commissioners overruled their concerns, and one later joined Kalshi's board.

Will Kanye’s new album come out next week? Yes or no?

Kalshi's victory was due more to lobbying and legal wrangling than to Silicon Valley-style innovation. Lopes Lara and Mansour didn't invent anything; they changed a well-established concept's governance. The result could usher in a new era of market-based enlightenment or push Wall Street's destructive tendencies into the real world.

If Kalshi's founders lacked experience to bolster their CFTC application, they had comical youth success. Lopes Lara studied ballet at the Brazilian Bolshoi before coming to the US. Mansour won France's math Olympiad. They bonded over their work ethic in an MIT computer science class.

Lopes Lara had the idea for Kalshi while interning at a New York hedge fund. When the traders around her weren't working, she noticed they were betting on the news: Would Apple hit a trillion dollars? Kylie Jenner? "It was anything," she says.

Are mortgage rates going up? Yes or no?

Mansour saw the business potential when Lopes Lara suggested it. He interned at Goldman Sachs Group Inc., helping investors prepare for the UK leaving the EU. Goldman sold clients complex stock-and-derivative combinations. As he discussed it with Lopes Lara, they agreed that investors should hedge their risk by betting on Brexit itself rather than an imperfect proxy.

Lopes Lara and Mansour hypothesized how a marketplace might work. They settled on a "event contract," a binary-outcome instrument like "Will inflation hit 5% by the end of the month?" The contract would settle at $1 (if the event happened) or zero (if it didn't), but its price would fluctuate based on market sentiment. After a good debate, a politician's election odds may rise from 50 to 55. Kalshi would charge a commission on every trade and sell data to traders, political campaigns, businesses, and others.

In October 2018, five months after graduation, the pair flew to California to compete in a hackathon for wannabe tech founders organized by the Silicon Valley incubator Y Combinator. They built a website in a day and a night and presented it to entrepreneurs the next day. Their prototype barely worked, but they won a three-month mentorship program and $150,000. Michael Seibel, managing director of Y Combinator, said of their idea, "I had to take a chance!"

Will there be another moon landing by 2025?

Seibel's skepticism was rooted in America's historical wariness of gambling. Roulette, poker, and other online casino games are largely illegal, and sports betting was only legal in a few states until May 2018. Kalshi as a risk-hedging platform rather than a bookmaker seemed like a good idea, but convincing the CFTC wouldn't be easy. In 2012, the CFTC said trading on politics had no "economic purpose" and was "contrary to the public interest."

Lopes Lara and Mansour cold-called 60 Googled lawyers during their time at Y Combinator. Everyone advised quitting. Mansour recalls the pain. Jeff Bandman, a former CFTC official, helped them navigate the agency and its characters.

When they weren’t busy trying to recruit lawyers, Lopes Lara and Mansour were meeting early-stage investors. Alfred Lin of Sequoia Capital Operations LLC backed Airbnb, DoorDash, and Uber Technologies. Lin told the founders their idea could capitalize on retail trading and challenge how the financial world manages risk. "Come back with regulatory approval," he said.

In the US, even small bets on most events were once illegal. Under the Commodity Exchange Act, the CFTC can stop exchanges from listing contracts relating to "terrorism, assassination, war" and "gaming" if they are "contrary to the public interest," which was often the case.

Will subway ridership return to normal? Yes or no?

In 1988, as academic interest in the field grew, the agency allowed the University of Iowa to set up a prediction market for research purposes, as long as it didn't make a profit or advertise and limited bets to $500. PredictIt, the biggest and best-known political betting platform in the US, also got an exemption thanks to an association with Victoria University of Wellington in New Zealand. Today, it's a sprawling marketplace with its own subculture and lingo. PredictIt users call it "Rules Cuck Panther" when they lose on a technicality. Major news outlets cite PredictIt's odds on Discord and the Star Spangled Gamblers podcast.

CFTC limits PredictIt bets to $850. To keep traders happy, PredictIt will often run multiple variations of the same question, listing separate contracts for two dozen Democratic primary candidates, for example. A trader could have more than $10,000 riding on a single outcome. Some of the site's traders are current or former campaign staffers who can answer questions like "How many tweets will Donald Trump post from Nov. 20 to 27?" and "When will Anthony Scaramucci's role as White House communications director end?"

According to PredictIt co-founder John Phillips, politicians help explain the site's accuracy. "Prediction markets work well and are accurate because they attract people with superior information," he said in a 2016 podcast. “In the financial stock market, it’s called inside information.”

Will Build Back Better pass? Yes or no?

Trading on nonpublic information is illegal outside of academia, which presented a dilemma for Lopes Lara and Mansour. Kalshi's forecasts needed to be accurate. Kalshi must eliminate insider trading as a regulated entity. Lopes Lara and Mansour wanted to build a high-stakes PredictIt without the anarchy or blurred legal lines—a "New York Stock Exchange for Events." First, they had to convince regulators event trading was safe.

When Lopes Lara and Mansour approached the CFTC in the spring of 2019, some officials in the Division of Market Oversight were skeptical, according to interviews with people involved in the process. For all Kalshi's talk of revolutionizing finance, this was just a turbocharged version of something that had been rejected before.

The DMO couldn't see the big picture. The staff review was supposed to ensure Kalshi could complete a checklist, "23 Core Principles of a Designated Contract Market," which included keeping good records and having enough money. The five commissioners decide. With Trump as president, three of them were ideologically pro-market.

Lopes Lara, Mansour, and their lawyer Bandman, an ex-CFTC official, answered the DMO's questions while lobbying the commissioners on Zoom about the potential of event markets to mitigate risks and make better decisions. Before each meeting, they would write a script and memorize it word for word.

Will student debt be forgiven? Yes or no?

Several prediction markets that hadn't sought regulatory approval bolstered Kalshi's case. Polymarket let customers bet hundreds of thousands of dollars anonymously using cryptocurrencies, making it hard to track. Augur, which facilitates private wagers between parties using blockchain, couldn't regulate bets and hadn't stopped users from betting on assassinations. Kalshi, by comparison, argued it was doing everything right. (The CFTC fined Polymarket $1.4 million for operating an unlicensed exchange in January 2022. Polymarket says it's now compliant and excited to pioneer smart contract-based financial solutions with regulators.

Kalshi was approved unanimously despite some DMO members' concerns about event contracts' riskiness. "Once they check all the boxes, they're in," says a CFTC insider.

Three months after CFTC approval, Kalshi announced funding from Sequoia, Charles Schwab, and Henry Kravis. Sequoia's Lin, who joined the board, said Tarek, Luana, and team created a new way to invest and engage with the world.

The CFTC hadn't asked what markets the exchange planned to run since. After approval, Lopes Lara and Mansour had the momentum. Kalshi's March list of 30 proposed contracts caused chaos at the DMO. The division handles exchanges that create two or three new markets a year. Kalshi’s business model called for new ones practically every day.

Uncontroversial proposals included weather and GDP questions. Others, on the initial list and later, were concerning. DMO officials feared Covid-19 contracts amounted to gambling on human suffering, which is why war and terrorism markets are banned. (Similar logic doomed ex-admiral John Poindexter's Policy Analysis Market, a Bush-era plan to uncover intelligence by having security analysts bet on Middle East events.) Regulators didn't see how predicting the Grammy winners was different from betting on the Patriots to win the Super Bowl. Who, other than John Legend, would need to hedge the best R&B album winner?

Event contracts raised new questions for the DMO's product review team. Regulators could block gaming contracts that weren't in the public interest under the Commodity Exchange Act, but no one had defined gaming. It was unclear whether the CFTC had a right or an obligation to consider whether a contract was in the public interest. How was it to determine public interest? Another person familiar with the CFTC review says, "It was a mess." The agency didn't comment.

CFTC staff feared some event contracts could be cheated. Kalshi wanted to run a bee-endangerment market. The DMO pushed back, saying it saw two problems symptomatic of the asset class: traders could press government officials for information, and officials could delay adding the insects to the list to cash in.

The idea that traders might manipulate prediction markets wasn't paranoid. In 2013, academics David Rothschild and Rajiv Sethi found that an unidentified party lost $7 million buying Mitt Romney contracts on Intrade, a now-defunct, unlicensed Irish platform, in the runup to the 2012 election. The authors speculated that the trader, whom they dubbed the “Romney Whale,” may have been looking to boost morale and keep donations coming in.

Kalshi said manipulation and insider trading are risks for any market. It built a surveillance system and said it would hire a team to monitor it. "People trade on events all the time—they just use options and other instruments. This brings everything into the open, Mansour says. Kalshi didn't include election contracts, a red line for CFTC Democrats.

Lopes Lara and Mansour were ready to launch kalshi.com that summer, but the DMO blocked them. Product reviewers were frustrated by spending half their time on an exchange that represented a tiny portion of the derivatives market. Lopes Lara and Mansour pressed politically appointed commissioners during the impasse.

Tarbert, the chairman, had moved on, but Kalshi found a new supporter in Republican Brian Quintenz, a crypto-loving former hedge fund manager. He was unmoved by the DMO's concerns, arguing that speculation on Kalshi's proposed events was desirable and the agency had no legal standing to prevent it. He supported a failed bid to allow NFL futures earlier this year. Others on the commission were cautious but supportive. Given the law's ambiguity, they worried they'd be on shaky ground if Kalshi sued if they blocked a contract. Without a permanent chairman, the agency lacked leadership.

To block a contract, DMO staff needed a majority of commissioners' support, which they didn't have in all but a few cases. "We didn't have the votes," a reviewer says, paraphrasing Hamilton. By the second half of 2021, new contract requests were arriving almost daily at the DMO, and the demoralized and overrun division eventually accepted defeat and stopped fighting back. By the end of the year, three senior DMO officials had left the agency, making it easier for Kalshi to list its contracts unimpeded.

Today, Kalshi is growing. 32 employees work in a SoHo office with big windows and exposed brick. Quintenz, who left the CFTC 10 months after Kalshi was approved, is on its board. He joined because he was interested in the market's hedging and risk management opportunities.

Mid-May, the company's website had 75 markets, such as "Will Q4 GDP be negative?" Will NASA land on the moon by 2025? The exchange recently reached 2 million weekly contracts, a jump from where it started but still a small number compared to other futures exchanges. Early adopters are PredictIt and Polymarket fans. Bets on the site are currently capped at $25,000, but Kalshi hopes to increase that to $100,000 and beyond.

With the regulatory drawbridge down, Lopes Lara and Mansour must move quickly. Chicago's CME Group Inc. plans to offer index-linked event contracts. Kalshi will release a smartphone app to attract customers. After that, it hopes to partner with a big brokerage. Sequoia is a major investor in Robinhood Markets Inc. Robinhood users could have access to Kalshi so that after buying GameStop Corp. shares, they'd be prompted to bet on the Oscars or the next Fed commissioner.

Some, like Illinois Democrat Sean Casten, accuse Robinhood and its competitors of gamifying trading to encourage addiction, but Kalshi doesn't seem worried. Mansour says Kalshi's customers can't bet more than they've deposited, making debt difficult. Eventually, he may introduce leveraged bets.

Tension over event contracts recalls another CFTC episode. Brooksley Born proposed regulating the financial derivatives market in 1994. Alan Greenspan and others in the government opposed her, saying it would stifle innovation and push capital overseas. Unrestrained, derivatives grew into a trillion-dollar industry until 2008, when they sparked the financial crisis.

Today, with a midterm election looming, it seems reasonable to ask whether Kalshi plans to get involved. Elections have historically been the biggest draw in prediction markets, with 125 million shares traded on PredictIt for 2020. “We can’t discuss specifics,” Mansour says. “All I can say is, you know, we’re always working on expanding the universe of things that people can trade on.”

Any election contracts would need CFTC approval, which may be difficult with three Democratic commissioners. A Republican president would change the equation.