More on Personal Growth

James White

3 years ago

Three Books That Can Change Your Life in a Day

I've summarized each.

Anne Lamott said books are important. Books help us understand ourselves and our behavior. They teach us about community, friendship, and death.

I read. One of my few life-changing habits. 100+ books a year improve my life. I'll list life-changing books you can read in a day. I hope you like them too.

Let's get started!

1) Seneca's Letters from a Stoic

One of my favorite philosophy books. Ryan Holiday, Naval Ravikant, and other prolific readers recommend it.

Seneca wrote 124 letters at the end of his life after working for Nero. Death, friendship, and virtue are discussed.

It's worth rereading. When I'm in trouble, I consult Seneca.

It's brief. The book could be read in one day. However, use it for guidance during difficult times.

My favorite book quotes:

Many men find that becoming wealthy only alters their problems rather than solving them.

You will never be poor if you live in harmony with nature; you will never be wealthy if you live according to what other people think.

We suffer more frequently in our imagination than in reality; there are more things that are likely to frighten us than to crush us.

2) Steven Pressfield's book The War of Art

I’ve read this book twice. I'll likely reread it before 2022 is over.

The War Of Art is the best productivity book. Steven offers procrastination-fighting tips.

Writers, musicians, and creative types will love The War of Art. Workplace procrastinators should also read this book.

My favorite book quotes:

The act of creation is what matters most in art. Other than sitting down and making an effort every day, nothing else matters.

Working creatively is not a selfish endeavor or an attempt by the actor to gain attention. It serves as a gift for all living things in the world. Don't steal your contribution from us. Give us everything you have.

Fear is healthy. Fear is a signal, just like self-doubt. Fear instructs us on what to do. The more terrified we are of a task or calling, the more certain we can be that we must complete it.

3) Darren Hardy's The Compound Effect

The Compound Effect offers practical tips to boost productivity by 10x.

The author believes each choice shapes your future. Pizza may seem harmless. However, daily use increases heart disease risk.

Positive outcomes too. Daily gym visits improve fitness. Reading an hour each night can help you learn. Writing 1,000 words per day would allow you to write a novel in under a year.

Your daily choices affect compound interest and your future. Thus, better habits can improve your life.

My favorite book quotes:

Until you alter a daily habit, you cannot change your life. The key to your success can be found in the actions you take each day.

The hundreds, thousands, or millions of little things are what distinguish the ordinary from the extraordinary; it is not the big things that add up in the end.

Don't worry about willpower. Time to use why-power. Only when you relate your decisions to your aspirations and dreams will they have any real meaning. The decisions that are in line with what you define as your purpose, your core self, and your highest values are the wisest and most inspiring ones. To avoid giving up too easily, you must want something and understand why you want it.

Samer Buna

2 years ago

The Errors I Committed As a Novice Programmer

Learn to identify them, make habits to avoid them

First, a clarification. This article is aimed to make new programmers aware of their mistakes, train them to detect them, and remind them to prevent them.

I learned from all these blunders. I'm glad I have coding habits to avoid them. Do too.

These mistakes are not ordered.

1) Writing code haphazardly

Writing good content is hard. It takes planning and investigation. Quality programs don't differ.

Think. Research. Plan. Write. Validate. Modify. Unfortunately, no good acronym exists. Create a habit of doing the proper quantity of these activities.

As a newbie programmer, my biggest error was writing code without thinking or researching. This works for small stand-alone apps but hurts larger ones.

Like saying anything you might regret, you should think before coding something you could regret. Coding expresses your thoughts.

When angry, count to 10 before you speak. If very angry, a hundred. — Thomas Jefferson.

My quote:

When reviewing code, count to 10 before you refactor a line. If the code does not have tests, a hundred. — Samer Buna

Programming is primarily about reviewing prior code, investigating what is needed and how it fits into the current system, and developing small, testable features. Only 10% of the process involves writing code.

Programming is not writing code. Programming need nurturing.

2) Making excessive plans prior to writing code

Yes. Planning before writing code is good, but too much of it is bad. Water poisons.

Avoid perfect plans. Programming does not have that. Find a good starting plan. Your plan will change, but it helped you structure your code for clarity. Overplanning wastes time.

Only planning small features. All-feature planning should be illegal! The Waterfall Approach is a step-by-step system. That strategy requires extensive planning. This is not planning. Most software projects fail with waterfall. Implementing anything sophisticated requires agile changes to reality.

Programming requires responsiveness. You'll add waterfall plan-unthinkable features. You will eliminate functionality for reasons you never considered in a waterfall plan. Fix bugs and adjust. Be agile.

Plan your future features, though. Do it cautiously since too little or too much planning can affect code quality, which you must risk.

3) Underestimating the Value of Good Code

Readability should be your code's exclusive goal. Unintelligible code stinks. Non-recyclable.

Never undervalue code quality. Coding communicates implementations. Coders must explicitly communicate solution implementations.

Programming quote I like:

Always code as if the guy who ends up maintaining your code will be a violent psychopath who knows where you live. — John Woods

John, great advice!

Small things matter. If your indentation and capitalization are inconsistent, you should lose your coding license.

Long queues are also simple. Readability decreases after 80 characters. To highlight an if-statement block, you might put a long condition on the same line. No. Just never exceed 80 characters.

Linting and formatting tools fix many basic issues like this. ESLint and Prettier work great together in JavaScript. Use them.

Code quality errors:

Multiple lines in a function or file. Break long code into manageable bits. My rule of thumb is that any function with more than 10 lines is excessively long.

Double-negatives. Don't.

Using double negatives is just very not not wrong

Short, generic, or type-based variable names. Name variables clearly.

There are only two hard things in Computer Science: cache invalidation and naming things. — Phil Karlton

Hard-coding primitive strings and numbers without descriptions. If your logic relies on a constant primitive string or numeric value, identify it.

Avoiding simple difficulties with sloppy shortcuts and workarounds. Avoid evasion. Take stock.

Considering lengthier code better. Shorter code is usually preferable. Only write lengthier versions if they improve code readability. For instance, don't utilize clever one-liners and nested ternary statements just to make the code shorter. In any application, removing unneeded code is better.

Measuring programming progress by lines of code is like measuring aircraft building progress by weight. — Bill Gates

Excessive conditional logic. Conditional logic is unnecessary for most tasks. Choose based on readability. Measure performance before optimizing. Avoid Yoda conditions and conditional assignments.

4) Selecting the First Approach

When I started programming, I would solve an issue and move on. I would apply my initial solution without considering its intricacies and probable shortcomings.

After questioning all the solutions, the best ones usually emerge. If you can't think of several answers, you don't grasp the problem.

Programmers do not solve problems. Find the easiest solution. The solution must work well and be easy to read, comprehend, and maintain.

There are two ways of constructing a software design. One way is to make it so simple that there are obviously no deficiencies, and the other way is to make it so complicated that there are no obvious deficiencies. — C.A.R. Hoare

5) Not Giving Up

I generally stick with the original solution even though it may not be the best. The not-quitting mentality may explain this. This mindset is helpful for most things, but not programming. Program writers should fail early and often.

If you doubt a solution, toss it and rethink the situation. No matter how much you put in that solution. GIT lets you branch off and try various solutions. Use it.

Do not be attached to code because of how much effort you put into it. Bad code needs to be discarded.

6) Avoiding Google

I've wasted time solving problems when I should have researched them first.

Unless you're employing cutting-edge technology, someone else has probably solved your problem. Google It First.

Googling may discover that what you think is an issue isn't and that you should embrace it. Do not presume you know everything needed to choose a solution. Google surprises.

But Google carefully. Newbies also copy code without knowing it. Use only code you understand, even if it solves your problem.

Never assume you know how to code creatively.

The most dangerous thought that you can have as a creative person is to think that you know what you’re doing. — Bret Victor

7) Failing to Use Encapsulation

Not about object-oriented paradigm. Encapsulation is always useful. Unencapsulated systems are difficult to maintain.

An application should only handle a feature once. One object handles that. The application's other objects should only see what's essential. Reducing application dependencies is not about secrecy. Following these guidelines lets you safely update class, object, and function internals without breaking things.

Classify logic and state concepts. Class means blueprint template. Class or Function objects are possible. It could be a Module or Package.

Self-contained tasks need methods in a logic class. Methods should accomplish one thing well. Similar classes should share method names.

As a rookie programmer, I didn't always establish a new class for a conceptual unit or recognize self-contained units. Newbie code has a Util class full of unrelated code. Another symptom of novice code is when a small change cascades and requires numerous other adjustments.

Think before adding a method or new responsibilities to a method. Time's needed. Avoid skipping or refactoring. Start right.

High Cohesion and Low Coupling involves grouping relevant code in a class and reducing class dependencies.

8) Arranging for Uncertainty

Thinking beyond your solution is appealing. Every line of code will bring up what-ifs. This is excellent for edge cases but not for foreseeable needs.

Your what-ifs must fall into one of these two categories. Write only code you need today. Avoid future planning.

Writing a feature for future use is improper. No.

Write only the code you need today for your solution. Handle edge-cases, but don't introduce edge-features.

Growth for the sake of growth is the ideology of the cancer cell. — Edward Abbey

9) Making the incorrect data structure choices

Beginner programmers often overemphasize algorithms when preparing for interviews. Good algorithms should be identified and used when needed, but memorizing them won't make you a programming genius.

However, learning your language's data structures' strengths and shortcomings will make you a better developer.

The improper data structure shouts "newbie coding" here.

Let me give you a few instances of data structures without teaching you:

Managing records with arrays instead of maps (objects).

Most data structure mistakes include using lists instead of maps to manage records. Use a map to organize a list of records.

This list of records has an identifier to look up each entry. Lists for scalar values are OK and frequently superior, especially if the focus is pushing values to the list.

Arrays and objects are the most common JavaScript list and map structures, respectively (there is also a map structure in modern JavaScript).

Lists over maps for record management often fail. I recommend always using this point, even though it only applies to huge collections. This is crucial because maps are faster than lists in looking up records by identifier.

Stackless

Simple recursive functions are often tempting when writing recursive programming. In single-threaded settings, optimizing recursive code is difficult.

Recursive function returns determine code optimization. Optimizing a recursive function that returns two or more calls to itself is harder than optimizing a single call.

Beginners overlook the alternative to recursive functions. Use Stack. Push function calls to a stack and start popping them out to traverse them back.

10) Worsening the current code

Imagine this:

Add an item to that room. You might want to store that object anywhere as it's a mess. You can finish in seconds.

Not with messy code. Do not worsen! Keep the code cleaner than when you started.

Clean the room above to place the new object. If the item is clothing, clear a route to the closet. That's proper execution.

The following bad habits frequently make code worse:

code duplication You are merely duplicating code and creating more chaos if you copy/paste a code block and then alter just the line after that. This would be equivalent to adding another chair with a lower base rather than purchasing a new chair with a height-adjustable seat in the context of the aforementioned dirty room example. Always keep abstraction in mind, and use it when appropriate.

utilizing configuration files not at all. A configuration file should contain the value you need to utilize if it may differ in certain circumstances or at different times. A configuration file should contain a value if you need to use it across numerous lines of code. Every time you add a new value to the code, simply ask yourself: "Does this value belong in a configuration file?" The most likely response is "yes."

using temporary variables and pointless conditional statements. Every if-statement represents a logic branch that should at the very least be tested twice. When avoiding conditionals doesn't compromise readability, it should be done. The main issue with this is that branch logic is being used to extend an existing function rather than creating a new function. Are you altering the code at the appropriate level, or should you go think about the issue at a higher level every time you feel you need an if-statement or a new function variable?

This code illustrates superfluous if-statements:

function isOdd(number) {

if (number % 2 === 1) {

return true;

} else {

return false;

}

}Can you spot the biggest issue with the isOdd function above?

Unnecessary if-statement. Similar code:

function isOdd(number) {

return (number % 2 === 1);

};11) Making remarks on things that are obvious

I've learnt to avoid comments. Most code comments can be renamed.

instead of:

// This function sums only odd numbers in an array

const sum = (val) => {

return val.reduce((a, b) => {

if (b % 2 === 1) { // If the current number is odd

a+=b; // Add current number to accumulator

}

return a; // The accumulator

}, 0);

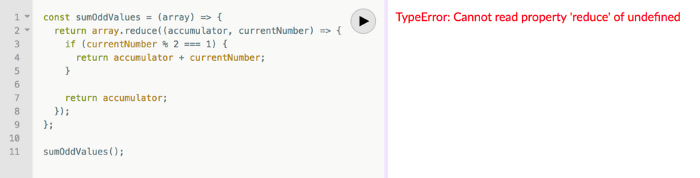

};Commentless code looks like this:

const sumOddValues = (array) => {

return array.reduce((accumulator, currentNumber) => {

if (isOdd(currentNumber)) {

return accumulator + currentNumber;

}

return accumulator;

}, 0);

};Better function and argument names eliminate most comments. Remember that before commenting.

Sometimes you have to use comments to clarify the code. This is when your comments should answer WHY this code rather than WHAT it does.

Do not write a WHAT remark to clarify the code. Here are some unnecessary comments that clutter code:

// create a variable and initialize it to 0

let sum = 0;

// Loop over array

array.forEach(

// For each number in the array

(number) => {

// Add the current number to the sum variable

sum += number;

}

);Avoid that programmer. Reject that code. Remove such comments if necessary. Most importantly, teach programmers how awful these remarks are. Tell programmers who publish remarks like this that they may lose their jobs. That terrible.

12) Skipping tests

I'll simplify. If you develop code without tests because you think you're an excellent programmer, you're a rookie.

If you're not writing tests in code, you're probably testing manually. Every few lines of code in a web application will be refreshed and interacted with. Also. Manual code testing is fine. To learn how to automatically test your code, manually test it. After testing your application, return to your code editor and write code to automatically perform the same interaction the next time you add code.

Human. After each code update, you will forget to test all successful validations. Automate it!

Before writing code to fulfill validations, guess or design them. TDD is real. It improves your feature design thinking.

If you can use TDD, even partially, do so.

13) Making the assumption that if something is working, it must be right.

See this sumOddValues function. Is it flawed?

const sumOddValues = (array) => {

return array.reduce((accumulator, currentNumber) => {

if (currentNumber % 2 === 1) {

return accumulator + currentNumber;

}

return accumulator;

});

};

console.assert(

sumOddValues([1, 2, 3, 4, 5]) === 9

);Verified. Good life. Correct?

Code above is incomplete. It handles some scenarios correctly, including the assumption used, but it has many other issues. I'll list some:

#1: No empty input handling. What happens when the function is called without arguments? That results in an error revealing the function's implementation:

TypeError: Cannot read property 'reduce' of undefined.

Two main factors indicate faulty code.

Your function's users shouldn't come across implementation-related information.

The user cannot benefit from the error. Simply said, they were unable to use your function. They would be aware that they misused the function if the error was more obvious about the usage issue. You might decide to make the function throw a custom exception, for instance:

TypeError: Cannot execute function for empty list.Instead of returning an error, your method should disregard empty input and return a sum of 0. This case requires action.

Problem #2: No input validation. What happens if the function is invoked with a text, integer, or object instead of an array?

The function now throws:

sumOddValues(42);

TypeError: array.reduce is not a functionUnfortunately, array. cut's a function!

The function labels anything you call it with (42 in the example above) as array because we named the argument array. The error says 42.reduce is not a function.

See how that error confuses? An mistake like:

TypeError: 42 is not an array, dude.Edge-cases are #1 and #2. These edge-cases are typical, but you should also consider less obvious ones. Negative numbers—what happens?

sumOddValues([1, 2, 3, 4, 5, -13]) // => still 9-13's unusual. Is this the desired function behavior? Error? Should it sum negative numbers? Should it keep ignoring negative numbers? You may notice the function should have been titled sumPositiveOddNumbers.

This decision is simple. The more essential point is that if you don't write a test case to document your decision, future function maintainers won't know if you ignored negative values intentionally or accidentally.

It’s not a bug. It’s a feature. — Someone who forgot a test case

#3: Valid cases are not tested. Forget edge-cases, this function mishandles a straightforward case:

sumOddValues([2, 1, 3, 4, 5]) // => 11The 2 above was wrongly included in sum.

The solution is simple: reduce accepts a second input to initialize the accumulator. Reduce will use the first value in the collection as the accumulator if that argument is not provided, like in the code above. The sum included the test case's first even value.

This test case should have been included in the tests along with many others, such as all-even numbers, a list with 0 in it, and an empty list.

Newbie code also has rudimentary tests that disregard edge-cases.

14) Adhering to Current Law

Unless you're a lone supercoder, you'll encounter stupid code. Beginners don't identify it and assume it's decent code because it works and has been in the codebase for a while.

Worse, if the terrible code uses bad practices, the newbie may be enticed to use them elsewhere in the codebase since they learnt them from good code.

A unique condition may have pushed the developer to write faulty code. This is a nice spot for a thorough note that informs newbies about that condition and why the code is written that way.

Beginners should presume that undocumented code they don't understand is bad. Ask. Enquire. Blame it!

If the code's author is dead or can't remember it, research and understand it. Only after understanding the code can you judge its quality. Before that, presume nothing.

15) Being fixated on best practices

Best practices damage. It suggests no further research. Best practice ever. No doubts!

No best practices. Today's programming language may have good practices.

Programming best practices are now considered bad practices.

Time will reveal better methods. Focus on your strengths, not best practices.

Do not do anything because you read a quote, saw someone else do it, or heard it is a recommended practice. This contains all my article advice! Ask questions, challenge theories, know your options, and make informed decisions.

16) Being preoccupied with performance

Premature optimization is the root of all evil (or at least most of it) in programming — Donald Knuth (1974)

I think Donald Knuth's advice is still relevant today, even though programming has changed.

Do not optimize code if you cannot measure the suspected performance problem.

Optimizing before code execution is likely premature. You may possibly be wasting time optimizing.

There are obvious optimizations to consider when writing new code. You must not flood the event loop or block the call stack in Node.js. Remember this early optimization. Will this code block the call stack?

Avoid non-obvious code optimization without measurements. If done, your performance boost may cause new issues.

Stop optimizing unmeasured performance issues.

17) Missing the End-User Experience as a Goal

How can an app add a feature easily? Look at it from your perspective or in the existing User Interface. Right? Add it to the form if the feature captures user input. Add it to your nested menu of links if it adds a link to a page.

Avoid that developer. Be a professional who empathizes with customers. They imagine this feature's consumers' needs and behavior. They focus on making the feature easy to find and use, not just adding it to the software.

18) Choosing the incorrect tool for the task

Every programmer has their preferred tools. Most tools are good for one thing and bad for others.

The worst tool for screwing in a screw is a hammer. Do not use your favorite hammer on a screw. Don't use Amazon's most popular hammer on a screw.

A true beginner relies on tool popularity rather than problem fit.

You may not know the best tools for a project. You may know the best tool. However, it wouldn't rank high. You must learn your tools and be open to new ones.

Some coders shun new tools. They like their tools and don't want to learn new ones. I can relate, but it's wrong.

You can build a house slowly with basic tools or rapidly with superior tools. You must learn and use new tools.

19) Failing to recognize that data issues are caused by code issues

Programs commonly manage data. The software will add, delete, and change records.

Even the simplest programming errors can make data unpredictable. Especially if the same defective application validates all data.

Code-data relationships may be confusing for beginners. They may employ broken code in production since feature X is not critical. Buggy coding may cause hidden data integrity issues.

Worse, deploying code that corrected flaws without fixing minor data problems caused by these defects will only collect more data problems that take the situation into the unrecoverable-level category.

How do you avoid these issues? Simply employ numerous data integrity validation levels. Use several interfaces. Front-end, back-end, network, and database validations. If not, apply database constraints.

Use all database constraints when adding columns and tables:

If a column has a NOT NULL constraint, null values will be rejected for that column. If your application expects that field has a value, your database should designate its source as not null.

If a column has a UNIQUE constraint, the entire table cannot include duplicate values for that column. This is ideal for a username or email field on a Users table, for instance.

For the data to be accepted, a CHECK constraint, or custom expression, must evaluate to true. For instance, you can apply a check constraint to ensure that the values of a normal % column must fall within the range of 0 and 100.

With a PRIMARY KEY constraint, the values of the columns must be both distinct and not null. This one is presumably what you're utilizing. To distinguish the records in each table, the database needs have a primary key.

A FOREIGN KEY constraint requires that the values in one database column, typically a primary key, match those in another table column.

Transaction apathy is another data integrity issue for newbies. If numerous actions affect the same data source and depend on each other, they must be wrapped in a transaction that can be rolled back if one fails.

20) Reinventing the Wheel

Tricky. Some programming wheels need reinvention. Programming is undefined. New requirements and changes happen faster than any team can handle.

Instead of modifying the wheel we all adore, maybe we should rethink it if you need a wheel that spins at varied speeds depending on the time of day. If you don't require a non-standard wheel, don't reinvent it. Use the darn wheel.

Wheel brands can be hard to choose from. Research and test before buying! Most software wheels are free and transparent. Internal design quality lets you evaluate coding wheels. Try open-source wheels. Debug and fix open-source software simply. They're easily replaceable. In-house support is also easy.

If you need a wheel, don't buy a new automobile and put your maintained car on top. Do not include a library to use a few functions. Lodash in JavaScript is the finest example. Import shuffle to shuffle an array. Don't import lodash.

21) Adopting the incorrect perspective on code reviews

Beginners often see code reviews as criticism. Dislike them. Not appreciated. Even fear them.

Incorrect. If so, modify your mindset immediately. Learn from every code review. Salute them. Observe. Most crucial, thank reviewers who teach you.

Always learning code. Accept it. Most code reviews teach something new. Use these for learning.

You may need to correct the reviewer. If your code didn't make that evident, it may need to be changed. If you must teach your reviewer, remember that teaching is one of the most enjoyable things a programmer can do.

22) Not Using Source Control

Newbies often underestimate Git's capabilities.

Source control is more than sharing your modifications. It's much bigger. Clear history is source control. The history of coding will assist address complex problems. Commit messages matter. They are another way to communicate your implementations, and utilizing them with modest commits helps future maintainers understand how the code got where it is.

Commit early and often with present-tense verbs. Summarize your messages but be detailed. If you need more than a few lines, your commit is too long. Rebase!

Avoid needless commit messages. Commit summaries should not list new, changed, or deleted files. Git commands can display that list from the commit object. The summary message would be noise. I think a big commit has many summaries per file altered.

Source control involves discoverability. You can discover the commit that introduced a function and see its context if you doubt its need or design. Commits can even pinpoint which code caused a bug. Git has a binary search within commits (bisect) to find the bug-causing commit.

Source control can be used before commits to great effect. Staging changes, patching selectively, resetting, stashing, editing, applying, diffing, reversing, and others enrich your coding flow. Know, use, and enjoy them.

I consider a Git rookie someone who knows less functionalities.

23) Excessive Use of Shared State

Again, this is not about functional programming vs. other paradigms. That's another article.

Shared state is problematic and should be avoided if feasible. If not, use shared state as little as possible.

As a new programmer, I didn't know that all variables represent shared states. All variables in the same scope can change its data. Global scope reduces shared state span. Keep new states in limited scopes and avoid upward leakage.

When numerous resources modify common state in the same event loop tick, the situation becomes severe (in event-loop-based environments). Races happen.

This shared state race condition problem may encourage a rookie to utilize a timer, especially if they have a data lock issue. Red flag. No. Never accept it.

24) Adopting the Wrong Mentality Toward Errors

Errors are good. Progress. They indicate a simple way to improve.

Expert programmers enjoy errors. Newbies detest them.

If these lovely red error warnings irritate you, modify your mindset. Consider them helpers. Handle them. Use them to advance.

Some errors need exceptions. Plan for user-defined exceptions. Ignore some mistakes. Crash and exit the app.

25) Ignoring rest periods

Humans require mental breaks. Take breaks. In the zone, you'll forget breaks. Another symptom of beginners. No compromises. Make breaks mandatory in your process. Take frequent pauses. Take a little walk to plan your next move. Reread the code.

This has been a long post. You deserve a break.

James White

3 years ago

I read three of Elon Musk's suggested books (And His Taste Is Incredible)

A reading list for successful people

Elon Musk reads and talks. So, one learns. Many brilliant individuals & amazing literature.

This article recommends 3 Elon Musk novels. All of them helped me succeed. Hope they'll help you.

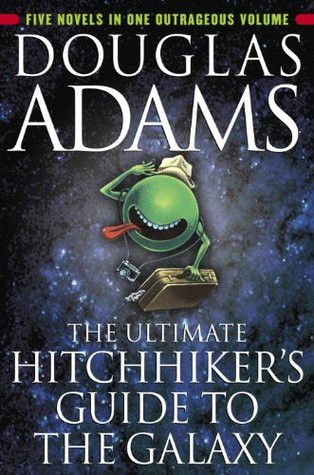

Douglas Adams's The Hitchhiker's Guide to the Galaxy

Page Count: 193

Rating on Goodreads: 4.23

Arthur Dent is pulled off Earth by a buddy seconds before it's razed for a cosmic motorway. The trio hitchhikes through space and gets into problems.

I initially read Hitchhiker's as a child. To evade my mum, I'd read with a flashlight under the covers. She'd scold at me for not sleeping on school nights when she found out. Oops.

The Hitchhiker's Guide to the Galaxy is lighthearted science fiction.

My favorite book quotes are:

“Space is big. You won’t believe how vastly, hugely, mind-bogglingly big it is. I mean, you may think it’s a long way down the road to the chemist’s, but that’s just peanuts to space.”

“Far out in the uncharted backwaters of the unfashionable end of the western spiral arm of the Galaxy lies a small unregarded yellow sun. Orbiting this at a distance of roughly ninety-two million miles is an utterly insignificant little blue-green planet whose ape-descended life forms are so amazingly primitive that they still think digital watches are a pretty neat idea.”

“On planet Earth, man had always assumed that he was more intelligent than dolphins because he had achieved so much — the wheel, New York, wars, and so on — whilst all the dolphins had ever done was muck about in the water having a good time. But conversely, the dolphins had always believed that they were far more intelligent than man — for precisely the same reasons.”

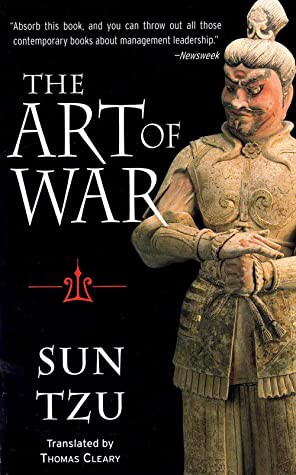

the Sun Tzu book The Art Of War

Page Count: 273

Rating on Goodreads: 3.97

It's a classic. You may apply The Art of War's ideas to (nearly) every facet of life. Ex:

Pick your fights.

Keep in mind that timing is crucial.

Create a backup plan in case something goes wrong.

Obstacles provide us a chance to adapt and change.

This book was my first. Since then, I'm a more strategic entrepreneur. Excellent book. And read it ASAP!

My favorite book quotes are:

“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.”

“Engage people with what they expect; it is what they are able to discern and confirms their projections. It settles them into predictable patterns of response, occupying their minds while you wait for the extraordinary moment — that which they cannot anticipate.”

“If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained, you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

Peter Thiel's book Zero to One

Page Count: 195

Rating on Goodreads: 4.18

Peter argues the best money-making strategies are typically unproven. Entrepreneurship should never have a defined path to success. Whoever says differently is lying.

Zero to One explores technology and society. Peter is a philosophy major and law school graduate, which informs the work.

Peters' ideas, depth, and intellect stood out in Zero to One. It's a top business book.

My favorite book quotes are:

“The most valuable businesses of coming decades will be built by entrepreneurs who seek to empower people rather than try to make them obsolete.”

“The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them.”

“If your goal is to never make a mistake in your life, you shouldn’t look for secrets. The prospect of being lonely but right — dedicating your life to something that no one else believes in — is already hard. The prospect of being lonely and wrong can be unbearable.”

You might also like

Scott Duke Kominers

3 years ago

NFT Creators Go Creative Commons Zero (cc0)

On January 1, "Public Domain Day," thousands of creative works immediately join the public domain. The original creator or copyright holder loses exclusive rights to reproduce, adapt, or publish the work, and anybody can use it. It happens with movies, poems, music, artworks, books (where creative rights endure 70 years beyond the author's death), and sometimes source code.

Public domain creative works open the door to new uses. 400,000 sound recordings from before 1923, including Winnie-the-Pooh, were released this year. With most of A.A. Milne's 1926 Winnie-the-Pooh characters now available, we're seeing innovative interpretations Milne likely never planned. The ancient hyphenated version of the honey-loving bear is being adapted for a horror movie: "Winnie-the-Pooh: Blood and Honey"... with Pooh and Piglet as the baddies.

Counterintuitively, experimenting and recombination can occasionally increase IP value. Open source movements allow the public to build on (or fork and duplicate) existing technologies. Permissionless innovation helps Android, Linux, and other open source software projects compete. Crypto's success at attracting public development is also due to its support of open source and "remix culture," notably in NFT forums.

Production memes

NFT projects use several IP strategies to establish brands, communities, and content. Some preserve regular IP protections; others offer NFT owners the opportunity to innovate on connected IP; yet others have removed copyright and other IP safeguards.

By using the "Creative Commons Zero" (cc0) license, artists can intentionally select for "no rights reserved." This option permits anyone to benefit from derivative works without legal repercussions. There's still a lot of confusion between copyrights and NFTs, so nothing here should be considered legal, financial, tax, or investment advice. Check out this post for an overview of copyright vulnerabilities with NFTs and how authors can protect owners' rights. This article focuses on cc0.

Nouns, a 2021 project, popularized cc0 for NFTs. Others followed, including: A Common Place, Anonymice, Blitmap, Chain Runners, Cryptoadz, CryptoTeddies, Goblintown, Gradis, Loot, mfers, Mirakai, Shields, and Terrarium Club are cc0 projects.

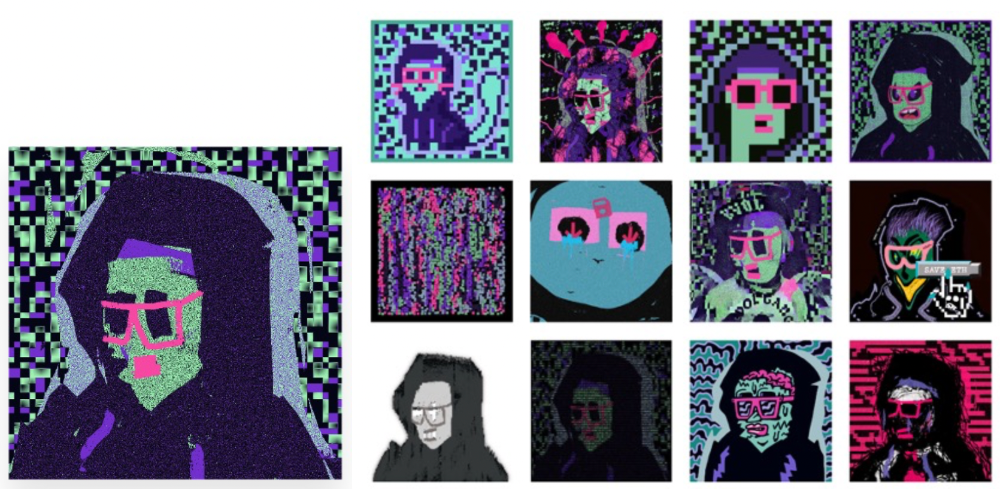

Popular crypto artist XCOPY licensed their 1-of-1 NFT artwork "Right-click and Save As Guy" under cc0 in January, exactly one month after selling it. cc0 has spawned many derivatives.

"Right-click Save As Guy" by XCOPY (1)/derivative works (2)

XCOPY said Monday he would apply cc0 to "all his existing art." "We haven't seen a cc0 summer yet, but I think it's approaching," said the artist. - predicting a "DeFi summer" in 2020, when decentralized finance gained popularity.

Why do so many NFT authors choose "no rights"?

Promoting expansions of the original project to create a more lively and active community is one rationale. This makes sense in crypto, where many value open sharing and establishing community.

Creativity depends on cultural significance. NFTs may allow verifiable ownership of any digital asset, regardless of license, but cc0 jumpstarts "meme-ability" by actively, not passively, inviting derivative works. As new derivatives are made and shared, attention might flow back to the original, boosting its reputation. This may inspire new interpretations, leading in a flywheel effect where each derivative adds to the original's worth - similar to platform network effects, where platforms become more valuable as more users join them.

cc0 licence allows creators "seize production memes."

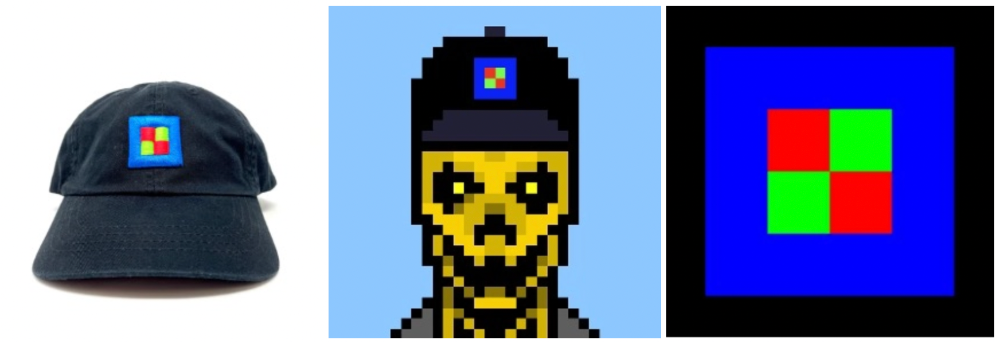

Physical items are also using cc0 NFT assets, thus it's not just a digital phenomenon. The Nouns Vision initiative turned the square-framed spectacles shown on each new NounsDAO NFT ("one per day, forever") into luxury sunglasses. Blitmap's pixel-art has been used on shoes, apparel, and caps. In traditional IP regimes, a single owner controls creation, licensing, and production.

The physical "blitcap" (3rd level) is a descendant of the trait in the cc0 Chain Runners collection (2nd), which uses the "logo" from cc0 Blitmap (1st)! The Logo is Blitmap token #84 and has been used as a trait in various collections. The "Dom Rose" is another popular token. These homages reference Blitmap's influence as a cc0 leader, as one of the earliest NFT projects to proclaim public domain intents. A new collection, Citizens of Tajigen, emerged last week with a Blitcap characteristic.

These derivatives can be a win-win for everyone, not just the original inventors, especially when using NFT assets to establish unique brands. As people learn about the derivative, they may become interested in the original. If you see someone wearing Nouns glasses on the street (or in a Super Bowl ad), you may desire a pair, but you may also be interested in buying an original NounsDAO NFT or related derivative.

Blitmap Logo Hat (1), Chain Runners #780 ft. Hat (2), and Blitmap Original "Logo #87" (3)

Co-creating open source

NFTs' power comes from smart contract technology's intrinsic composability. Many smart contracts can be integrated or stacked to generate richer applications.

"Money Legos" describes how decentralized finance ("DeFi") smart contracts interconnect to generate new financial use cases. Yearn communicates with MakerDAO's stablecoin $DAI and exchange liquidity provider Curve by calling public smart contract methods. NFTs and their underlying smart contracts can operate as the base-layer framework for recombining and interconnecting culture and creativity.

cc0 gives an NFT's enthusiast community authority to develop new value layers whenever, wherever, and however they wish.

Multiple cc0 projects are playable characters in HyperLoot, a Loot Project knockoff.

Open source and Linux's rise are parallels. When the internet was young, Microsoft dominated the OS market with Windows. Linux (and its developer Linus Torvalds) championed a community-first mentality, freely available the source code without restrictions. This led to developers worldwide producing new software for Linux, from web servers to databases. As people (and organizations) created world-class open source software, Linux's value proposition grew, leading to explosive development and industry innovation. According to Truelist, Linux powers 96.3% of the top 1 million web servers and 85% of smartphones.

With cc0 licensing empowering NFT community builders, one might hope for long-term innovation. Combining cc0 with NFTs "turns an antagonistic game into a co-operative one," says NounsDAO cofounder punk4156. It's important on several levels. First, decentralized systems from open source to crypto are about trust and coordination, therefore facilitating cooperation is crucial. Second, the dynamics of this cooperation work well in the context of NFTs because giving people ownership over their digital assets allows them to internalize the results of co-creation through the value that accrues to their assets and contributions, which incentivizes them to participate in co-creation in the first place.

Licensed to create

If cc0 projects are open source "applications" or "platforms," then NFT artwork, metadata, and smart contracts provide the "user interface" and the underlying blockchain (e.g., Ethereum) is the "operating system." For these apps to attain Linux-like potential, more infrastructure services must be established and made available so people may take advantage of cc0's remixing capabilities.

These services are developing. Zora protocol and OpenSea's open source Seaport protocol enable open, permissionless NFT marketplaces. A pixel-art-rendering engine was just published on-chain to the Ethereum blockchain and integrated into OKPC and ICE64. Each application improves blockchain's "out-of-the-box" capabilities, leading to new apps created from the improved building blocks.

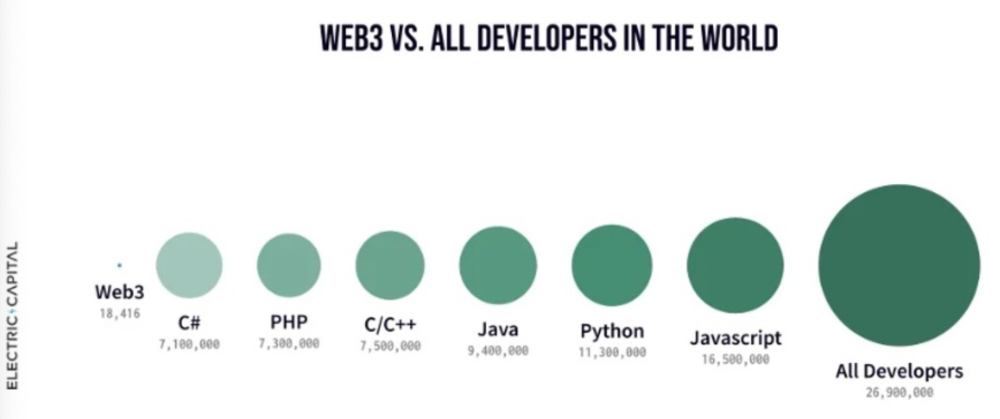

Web3 developer growth is at an all-time high, yet it's still a small fraction of active software developers globally. As additional developers enter the field, prospective NFT projects may find more creative and infrastructure Legos for cc0 and beyond.

Electric Capital Developer Report (2021), p. 122

Growth requires composability. Users can easily integrate digital assets developed on public standards and compatible infrastructure into other platforms. The Loot Project is one of the first to illustrate decentralized co-creation, worldbuilding, and more in NFTs. This example was low-fi or "incomplete" aesthetically, providing room for imagination and community co-creation.

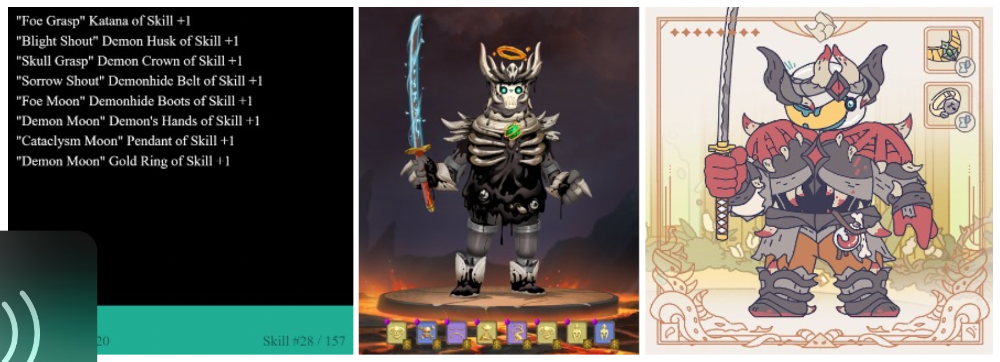

Loot began with a series of Loot bag NFTs, each listing eight "adventure things" in white writing on a black backdrop (such as Loot Bag #5726's "Katana, Divine Robe, Great Helm, Wool Sash, Divine Slippers, Chain Gloves, Amulet, Gold Ring"). Dom Hofmann's free Loot bags served as a foundation for the community.

Several projects have begun metaphorical (lore) and practical (game development) world-building in a short time, with artists contributing many variations to the collective "Lootverse." They've produced games (Realms & The Crypt), characters (Genesis Project, Hyperloot, Loot Explorers), storytelling initiatives (Banners, OpenQuill), and even infrastructure (The Rift).

Why cc0 and composability? Because consumers own and control Loot bags, they may use them wherever they choose by connecting their crypto wallets. This allows users to participate in multiple derivative projects, such as Genesis Adventurers, whose characters appear in many others — creating a decentralized franchise not owned by any one corporation.

Genesis Project's Genesis Adventurer (1) with HyperLoot (2) and Loot Explorer (3) versions

When to go cc0

There are several IP development strategies NFT projects can use. When it comes to cc0, it’s important to be realistic. The public domain won't make a project a runaway success just by implementing the license. cc0 works well for NFT initiatives that can develop a rich, enlarged ecosystem.

Many of the most successful cc0 projects have introduced flexible intellectual property. The Nouns brand is as obvious for a beer ad as for real glasses; Loot bags are simple primitives that make sense in all adventure settings; and the Goblintown visual style looks good on dwarfs, zombies, and cranky owls as it does on Val Kilmer.

The ideal cc0 NFT project gives builders the opportunity to add value:

vertically, by stacking new content and features directly on top of the original cc0 assets (for instance, as with games built on the Loot ecosystem, among others), and

horizontally, by introducing distinct but related intellectual property that helps propagate the original cc0 project’s brand (as with various Goblintown derivatives, among others).

These actions can assist cc0 NFT business models. Because cc0 NFT projects receive royalties from secondary sales, third-party extensions and derivatives can boost demand for the original assets.

Using cc0 license lowers friction that could hinder brand-reinforcing extensions or lead to them bypassing the original. Robbie Broome recently argued (in the context of his cc0 project A Common Place) that giving away his IP to cc0 avoids bad rehashes down the line. If UrbanOutfitters wanted to put my design on a tee, they could use the actual work instead of hiring a designer. CC0 can turn competition into cooperation.

Community agreement about core assets' value and contribution can help cc0 projects. Cohesion and engagement are key. Using the above examples: Developers can design adventure games around whatever themes and item concepts they desire, but many choose Loot bags because of the Lootverse's community togetherness. Flipmap shared half of its money with the original Blitmap artists in acknowledgment of that project's core role in the community. This can build a healthy culture within a cc0 project ecosystem. Commentator NiftyPins said it was smart to acknowledge the people that constructed their universe. Many OG Blitmap artists have popped into the Flipmap discord to share information.

cc0 isn't a one-size-fits-all answer; NFTs formed around well-established brands may prefer more restrictive licenses to preserve their intellectual property and reinforce exclusivity. cc0 has some superficial similarities to permitting NFT owners to market the IP connected with their NFTs (à la Bored Ape Yacht Club), but there is a significant difference: cc0 holders can't exclude others from utilizing the same IP. This can make it tougher for holders to develop commercial brands on cc0 assets or offer specific rights to partners. Holders can still introduce enlarged intellectual property (such as backstories or derivatives) that they control.

Blockchain technologies and the crypto ethos are decentralized and open-source. This makes it logical for crypto initiatives to build around cc0 content models, which build on the work of the Creative Commons foundation and numerous open source pioneers.

NFT creators that choose cc0 must select how involved they want to be in building the ecosystem. Some cc0 project leaders, like Chain Runners' developers, have kept building on top of the initial cc0 assets, creating an environment derivative projects can plug into. Dom Hofmann stood back from Loot, letting the community lead. (Dom is also working on additional cc0 NFT projects for the company he formed to build Blitmap.) Other authors have chosen out totally, like sartoshi, who announced his exit from the cc0 project he founded, mfers, and from the NFT area by publishing a final edition suitably named "end of sartoshi" and then deactivating his Twitter account. A multi-signature wallet of seven mfers controls the project's smart contract.

cc0 licensing allows a robust community to co-create in ways that benefit all members, regardless of original creators' continuous commitment. We foresee more organized infrastructure and design patterns as NFT matures. Like open source software, value capture frameworks may see innovation. (We could imagine a variant of the "Sleepycat license," which requires commercial software to pay licensing fees when embedding open source components.) As creators progress the space, we expect them to build unique rights and licensing strategies. cc0 allows NFT producers to bootstrap ideas that may take off.

Bob Service

3 years ago

Did volcanic 'glasses' play a role in igniting early life?

Quenched lava may have aided in the formation of long RNA strands required by primitive life.

It took a long time for life to emerge. Microbes were present 3.7 billion years ago, just a few hundred million years after the 4.5-billion-year-old Earth had cooled enough to sustain biochemistry, according to fossils, and many scientists believe RNA was the genetic material for these first species. RNA, while not as complicated as DNA, would be difficult to forge into the lengthy strands required to transmit genetic information, raising the question of how it may have originated spontaneously.

Researchers may now have a solution. They demonstrate how basaltic glasses assist individual RNA letters, also known as nucleoside triphosphates, join into strands up to 200 letters long in lab studies. The glasses are formed when lava is quenched in air or water, or when melted rock generated by asteroid strikes cools rapidly, and they would have been plentiful in the early Earth's fire and brimstone.

The outcome has caused a schism among top origin-of-life scholars. "This appears to be a great story that finally explains how nucleoside triphosphates react with each other to create RNA strands," says Thomas Carell, a scientist at Munich's Ludwig Maximilians University. However, Harvard University's Jack Szostak, an RNA expert, says he won't believe the results until the study team thoroughly describes the RNA strands.

Researchers interested in the origins of life like the idea of a primordial "RNA universe" since the molecule can perform two different functions that are essential for life. It's made up of four chemical letters, just like DNA, and can carry genetic information. RNA, like proteins, can catalyze chemical reactions that are necessary for life.

However, RNA can cause headaches. No one has yet discovered a set of plausible primordial conditions that would cause hundreds of RNA letters—each of which is a complicated molecule—to join together into strands long enough to support the intricate chemistry required to kick-start evolution.

Basaltic glasses may have played a role, according to Stephen Mojzsis, a geologist at the University of Colorado, Boulder. They're high in metals like magnesium and iron, which help to trigger a variety of chemical reactions. "Basaltic glass was omnipresent on Earth at the time," he adds.

He provided the Foundation for Applied Molecular Evolution samples of five different basalt glasses. Each sample was ground into a fine powder, sanitized, and combined with a solution of nucleoside triphosphates by molecular biologist Elisa Biondi and her colleagues. The RNA letters were unable to link up without the presence of glass powder. However, when the molecules were mixed with the glass particles, they formed long strands of hundreds of letters, according to the researchers, who published their findings in Astrobiology this week. There was no need for heat or light. Biondi explains, "All we had to do was wait." After only a day, little RNA strands produced, yet the strands continued to grow for months. Jan Paek, a molecular biologist at Firebird Biomolecular Sciences, says, "The beauty of this approach is its simplicity." "Mix the components together, wait a few days, and look for RNA."

Nonetheless, the findings pose a slew of problems. One of the questions is how nucleoside triphosphates came to be in the first place. Recent study by Biondi's colleague Steven Benner suggests that the same basaltic glasses may have aided in the creation and stabilization of individual RNA letters.

The form of the lengthy RNA strands, according to Szostak, is a significant challenge. Enzymes in modern cells ensure that most RNAs form long linear chains. RNA letters, on the other hand, can bind in complicated branching sequences. Szostak wants the researchers to reveal what kind of RNA was produced by the basaltic glasses. "It irritates me that the authors made an intriguing initial finding but then chose to follow the hype rather than the research," Szostak says.

Biondi acknowledges that her team's experiment almost probably results in some RNA branching. She does acknowledge, however, that some branched RNAs are seen in species today, and that analogous structures may have existed before the origin of life. Other studies carried out by the study also confirmed the presence of lengthy strands with connections, indicating that they are most likely linear. "It's a healthy argument," says Dieter Braun, a Ludwig Maximilian University origin-of-life chemist. "It will set off the next series of tests."

Kaitlin Fritz

3 years ago

The Entrepreneurial Chicken and Egg

University entrepreneurship is like a Willy Wonka Factory of ideas. Classes, roommates, discussions, and the cafeteria all inspire new ideas. I've seen people establish a business without knowing its roots.

Chicken or egg? On my mind: I've asked university founders around the world whether the problem or solution came first.

The Problem

One African team I met started with the “instant noodles” problem in their academic ecosystem. Many of us have had money issues in college, which may have led to poor nutritional choices.

Many university students in a war-torn country ate quick noodles or pasta for dinner.

Noodles required heat, water, and preparation in the boarding house. Unreliable power from one hot plate per blue moon. What's healthier, easier, and tastier than sodium-filled instant pots?

BOOM. They were fixing that. East African kids need affordable, nutritious food.

This is a real difficulty the founders faced every day with hundreds of comrades.

This sparked their serendipitous entrepreneurial journey and became their business's cornerstone.

The Solution

I asked a UK team about their company idea. They said the solution fascinated them.

The crew was fiddling with social media algorithms. Why are some people more popular? They were studying platforms and social networks, which offered a way for them.

Solving a problem? Yes. Long nights of university research lead them to it. Is this like world hunger? Social media influencers confront this difficulty regularly.

It made me ponder something. Is there a correct response?

In my heart, yes, but in my head…maybe?

I believe you should lead with empathy and embrace the problem, not the solution. Big or small, businesses should solve problems. This should be your focus. This is especially true when building a social company with an audience in mind.

Philosophically, invention and innovation are occasionally accidental. Also not penalized. Think about bugs and the creation of Velcro, or the inception of Teflon. They tackle difficulties we overlook. The route to the problem may look different, but there is a path there.

There's no golden ticket to the Chicken-Egg debate, but I'll keep looking this summer.