How a $300K Bored Ape Yacht Club NFT was accidentally sold for $3K

The Bored Ape Yacht Club is one of the most prestigious NFT collections in the world. A collection of 10,000 NFTs, each depicting an ape with different traits and visual attributes, Jimmy Fallon, Steph Curry and Post Malone are among their star-studded owners. Right now the price of entry is 52 ether, or $210,000.

Which is why it's so painful to see that someone accidentally sold their Bored Ape NFT for $3,066.

Unusual trades are often a sign of funny business, as in the case of the person who spent $530 million to buy an NFT from themselves. In Saturday's case, the cause was a simple, devastating "fat-finger error." That's when people make a trade online for the wrong thing, or for the wrong amount. Here the owner, real name Max or username maxnaut, meant to list his Bored Ape for 75 ether, or around $300,000. Instead he accidentally listed it for 0.75. One hundredth the intended price.

It was bought instantaneously. The buyer paid an extra $34,000 to speed up the transaction, ensuring no one could snap it up before them. The Bored Ape was then promptly listed for $248,000. The transaction appears to have been done by a bot, which can be coded to immediately buy NFTs listed below a certain price on behalf of their owners in order to take advantage of these exact situations.

"How'd it happen? A lapse of concentration I guess," Max told me. "I list a lot of items every day and just wasn't paying attention properly. I instantly saw the error as my finger clicked the mouse but a bot sent a transaction with over 8 eth [$34,000] of gas fees so it was instantly sniped before I could click cancel, and just like that, $250k was gone."

"And here within the beauty of the Blockchain you can see that it is both honest and unforgiving," he added.

Fat finger trades happen sporadically in traditional finance -- like the Japanese trader who almost bought 57% of Toyota's stock in 2014 -- but most financial institutions will stop those transactions if alerted quickly enough. Since cryptocurrency and NFTs are designed to be decentralized, you essentially have to rely on the goodwill of the buyer to reverse the transaction.

Fat finger errors in cryptocurrency trades have made many a headline over the past few years. Back in 2019, the company behind Tether, a cryptocurrency pegged to the US dollar, nearly doubled its own coin supply when it accidentally created $5 billion-worth of new coins. In March, BlockFi meant to send 700 Gemini Dollars to a set of customers, worth roughly $1 each, but mistakenly sent out millions of dollars worth of bitcoin instead. Last month a company erroneously paid a $24 million fee on a $100,000 transaction.

Similar incidents are increasingly being seen in NFTs, now that many collections have accumulated in market value over the past year. Last month someone tried selling a CryptoPunk NFT for $19 million, but accidentally listed it for $19,000 instead. Back in August, someone fat finger listed their Bored Ape for $26,000, an error that someone else immediately capitalized on. The original owner offered $50,000 to the buyer to return the Bored Ape -- but instead the opportunistic buyer sold it for the then-market price of $150,000.

"The industry is so new, bad things are going to happen whether it's your fault or the tech," Max said. "Once you no longer have control of the outcome, forget and move on."

The Bored Ape Yacht Club launched back in April 2021, with 10,000 NFTs being sold for 0.08 ether each -- about $190 at the time. While NFTs are often associated with individual digital art pieces, collections like the Bored Ape Yacht Club, which allow owners to flaunt their NFTs by using them as profile pictures on social media, are becoming increasingly prevalent. The Bored Ape Yacht Club has since become the second biggest NFT collection in the world, second only to CryptoPunks, which launched in 2017 and is considered the "original" NFT collection.

More on Web3 & Crypto

Sam Hickmann

4 years ago

A quick guide to formatting your text on INTΞGRITY

[06/20/2022 update] We have now implemented a powerful text editor, but you can still use markdown.

Markdown:

Headers

SYNTAX:

# This is a heading 1

## This is a heading 2

### This is a heading 3

#### This is a heading 4

RESULT:

This is a heading 1

This is a heading 2

This is a heading 3

This is a heading 4

Emphasis

SYNTAX:

**This text will be bold**

~~Strikethrough~~

*You **can** combine them*

RESULT:

This text will be italic

This text will be bold

You can combine them

Images

SYNTAX:

RESULT:

Videos

SYNTAX:

https://www.youtube.com/watch?v=7KXGZAEWzn0

RESULT:

Links

SYNTAX:

[Int3grity website](https://www.int3grity.com)

RESULT:

Tweets

SYNTAX:

https://twitter.com/samhickmann/status/1503800505864130561

RESULT:

Blockquotes

SYNTAX:

> Human beings face ever more complex and urgent problems, and their effectiveness in dealing with these problems is a matter that is critical to the stability and continued progress of society. \- Doug Engelbart, 1961

RESULT:

Human beings face ever more complex and urgent problems, and their effectiveness in dealing with these problems is a matter that is critical to the stability and continued progress of society. - Doug Engelbart, 1961

Inline code

SYNTAX:

Text inside `backticks` on a line will be formatted like code.

RESULT:

Text inside backticks on a line will be formatted like code.

Code blocks

SYNTAX:

'''js

function fancyAlert(arg) {

if(arg) {

$.facebox({div:'#foo'})

}

}

'''

RESULT:

function fancyAlert(arg) {

if(arg) {

$.facebox({div:'#foo'})

}

}

Maths

We support LaTex to typeset math. We recommend reading the full documentation on the official website

SYNTAX:

$$[x^n+y^n=z^n]$$

RESULT:

[x^n+y^n=z^n]

Tables

SYNTAX:

| header a | header b |

| ---- | ---- |

| row 1 col 1 | row 1 col 2 |

RESULT:

| header a | header b | header c |

|---|---|---|

| row 1 col 1 | row 1 col 2 | row 1 col 3 |

David Z. Morris

3 years ago

FTX's crash was no accident, it was a crime

Sam Bankman Fried (SDBF) is a legendary con man. But the NYT might not tell you that...

Since SBF's empire was revealed to be a lie, mainstream news organizations and commentators have failed to give readers a straightforward assessment. The New York Times and Wall Street Journal have uncovered many key facts about the scandal, but they have also soft-peddled Bankman-Fried's intent and culpability.

It's clear that the FTX crypto exchange and Alameda Research committed fraud to steal money from users and investors. That’s why a recent New York Times interview was widely derided for seeming to frame FTX’s collapse as the result of mismanagement rather than malfeasance. A Wall Street Journal article lamented FTX's loss of charitable donations, bolstering Bankman's philanthropic pose. Matthew Yglesias, court chronicler of the neoliberal status quo, seemed to whitewash his own entanglements by crediting SBF's money with helping Democrats in 2020 – sidestepping the likelihood that the money was embezzled.

Many outlets have called what happened to FTX a "bank run" or a "run on deposits," but Bankman-Fried insists the company was overleveraged and disorganized. Both attempts to frame the fallout obscure the core issue: customer funds misused.

Because banks lend customer funds to generate returns, they can experience "bank runs." If everyone withdraws at once, they can experience a short-term cash crunch but there won't be a long-term problem.

Crypto exchanges like FTX aren't banks. They don't do bank-style lending, so a withdrawal surge shouldn't strain liquidity. FTX promised customers it wouldn't lend or use their crypto.

Alameda's balance sheet blurs SBF's crypto empire.

The funds were sent to Alameda Research, where they were apparently gambled away. This is massive theft. According to a bankruptcy document, up to 1 million customers could be affected.

In less than a month, reporting and the bankruptcy process have uncovered a laundry list of decisions and practices that would constitute financial fraud if FTX had been a U.S.-regulated entity, even without crypto-specific rules. These ploys may be litigated in U.S. courts if they enabled the theft of American property.

The list is very, very long.

The many crimes of Sam Bankman-Fried and FTX

At the heart of SBF's fraud are the deep and (literally) intimate ties between FTX and Alameda Research, a hedge fund he co-founded. An exchange makes money from transaction fees on user assets, but Alameda trades and invests its own funds.

Bankman-Fried called FTX and Alameda "wholly separate" and resigned as Alameda's CEO in 2019. The two operations were closely linked. Bankman-Fried and Alameda CEO Caroline Ellison were romantically linked.

These circumstances enabled SBF's sin. Within days of FTX's first signs of weakness, it was clear the exchange was funneling customer assets to Alameda for trading, lending, and investing. Reuters reported on Nov. 12 that FTX sent $10 billion to Alameda. As much as $2 billion was believed to have disappeared after being sent to Alameda. Now the losses look worse.

It's unclear why those funds were sent to Alameda or when Bankman-Fried betrayed his depositors. On-chain analysis shows most FTX to Alameda transfers occurred in late 2021, and bankruptcy filings show both lost $3.7 billion in 2021.

SBF's companies lost millions before the 2022 crypto bear market. They may have stolen funds before Terra and Three Arrows Capital, which killed many leveraged crypto players.

FTT loans and prints

CoinDesk's report on Alameda's FTT holdings ignited FTX and Alameda Research. FTX created this instrument, but only a small portion was traded publicly; FTX and Alameda held the rest. These holdings were illiquid, meaning they couldn't be sold at market price. Bankman-Fried valued its stock at the fictitious price.

FTT tokens were reportedly used as collateral for loans, including FTX loans to Alameda. Close ties between FTX and Alameda made the FTT token harder or more expensive to use as collateral, reducing the risk to customer funds.

This use of an internal asset as collateral for loans between clandestinely related entities is similar to Enron's 1990s accounting fraud. These executives served 12 years in prison.

Alameda's margin liquidation exemption

Alameda Research had a "secret exemption" from FTX's liquidation and margin trading rules, according to legal filings by FTX's new CEO.

FTX, like other crypto platforms and some equity or commodity services, offered "margin" or loans for trades. These loans are usually collateralized, meaning borrowers put up other funds or assets. If a margin trade loses enough money, the exchange will sell the user's collateral to pay off the initial loan.

Keeping asset markets solvent requires liquidating bad margin positions. Exempting Alameda would give it huge advantages while exposing other FTX users to hidden risks. Alameda could have kept losing positions open while closing out competitors. Alameda could lose more on FTX than it could pay back, leaving a hole in customer funds.

The exemption is criminal in multiple ways. FTX was fraudulently marketed overall. Instead of a level playing field, there were many customers.

Above them all, with shotgun poised, was Alameda Research.

Alameda front-running FTX listings

Argus says there's circumstantial evidence that Alameda Research had insider knowledge of FTX's token listing plans. Alameda was able to buy large amounts of tokens before the listing and sell them after the price bump.

If true, these claims would be the most brazenly illegal of Alameda and FTX's alleged shenanigans. Even if the tokens aren't formally classified as securities, insider trading laws may apply.

In a similar case this year, an OpenSea employee was charged with wire fraud for allegedly insider trading. This employee faces 20 years in prison for front-running monkey JPEGs.

Huge loans to executives

Alameda Research reportedly lent FTX executives $4.1 billion, including massive personal loans. Bankman-Fried received $1 billion in personal loans and $2.3 billion for an entity he controlled, Paper Bird. Nishad Singh, director of engineering, was given $543 million, and FTX Digital Markets co-CEO Ryan Salame received $55 million.

FTX has more smoking guns than a Texas shooting range, but this one is the smoking bazooka – a sign of criminal intent. It's unclear how most of the personal loans were used, but liquidators will have to recoup the money.

The loans to Paper Bird were even more worrisome because they created another related third party to shuffle assets. Forbes speculates that some Paper Bird funds went to buy Binance's FTX stake, and Paper Bird committed hundreds of millions to outside investments.

FTX Inner Circle: Who's Who

That included many FTX-backed VC funds. Time will tell if this financial incest was criminal fraud. It fits Bankman-pattern Fried's of using secret flows, leverage, and funny money to inflate asset prices.

FTT or loan 'bailouts'

Also. As the crypto bear market continued in 2022, Bankman-Fried proposed bailouts for bankrupt crypto lenders BlockFi and Voyager Digital. CoinDesk was among those deceived, welcoming SBF as a J.P. Morgan-style sector backstop.

In a now-infamous interview with CNBC's "Squawk Box," Bankman-Fried referred to these decisions as bets that may or may not pay off.

But maybe not. Bloomberg's Matt Levine speculated that FTX backed BlockFi with FTT money. This Monopoly bailout may have been intended to hide FTX and Alameda liabilities that would have been exposed if BlockFi went bankrupt sooner. This ploy has no name, but it echoes other corporate frauds.

Secret bank purchase

Alameda Research invested $11.5 million in the tiny Farmington State Bank, doubling its net worth. As a non-U.S. entity and an investment firm, Alameda should have cleared regulatory hurdles before acquiring a U.S. bank.

In the context of FTX, the bank's stake becomes "ominous." Alameda and FTX could have done more shenanigans with bank control. Compare this to the Bank for Credit and Commerce International's failed attempts to buy U.S. banks. BCCI was even nefarious than FTX and wanted to buy U.S. banks to expand its money-laundering empire.

The mainstream's mistakes

These are complex and nuanced forms of fraud that echo traditional finance models. This obscurity helped Bankman-Fried masquerade as an honest player and likely kept coverage soft after the collapse.

Bankman-Fried had a scruffy, nerdy image, like Mark Zuckerberg and Adam Neumann. In interviews, he spoke nonsense about an industry full of jargon and complicated tech. Strategic donations and insincere ideological statements helped him gain political and social influence.

SBF' s'Effective' Altruism Blew Up FTX

Bankman-Fried has continued to muddy the waters with disingenuous letters, statements, interviews, and tweets since his con collapsed. He's tried to portray himself as a well-intentioned but naive kid who made some mistakes. This is a softer, more pernicious version of what Trump learned from mob lawyer Roy Cohn. Bankman-Fried doesn't "deny, deny, deny" but "confuse, evade, distort."

It's mostly worked. Kevin O'Leary, who plays an investor on "Shark Tank," repeats Bankman-SBF's counterfactuals. O'Leary called Bankman-Fried a "savant" and "probably one of the most accomplished crypto traders in the world" in a Nov. 27 interview with Business Insider, despite recent data indicating immense trading losses even when times were good.

O'Leary's status as an FTX investor and former paid spokesperson explains his continued affection for Bankman-Fried despite contradictory evidence. He's not the only one promoting Bankman-Fried. The disgraced son of two Stanford law professors will defend himself at Wednesday's DealBook Summit.

SBF's fraud and theft rival those of Bernie Madoff and Jho Low. Whether intentionally or through malign ineptitude, the fraud echoes Worldcom and Enron.

The Perverse Impacts of Anti-Money-Laundering

The principals in all of those scandals wound up either sentenced to prison or on the run from the law. Sam Bankman-Fried clearly deserves to share their fate.

Read the full article here.

Vitalik

4 years ago

An approximate introduction to how zk-SNARKs are possible (part 2)

If tasked with the problem of coming up with a zk-SNARK protocol, many people would make their way to this point and then get stuck and give up. How can a verifier possibly check every single piece of the computation, without looking at each piece of the computation individually? But it turns out that there is a clever solution.

Polynomials

Polynomials are a special class of algebraic expressions of the form:

- x+5

- x^4

- x^3+3x^2+3x+1

- 628x^{271}+318x^{270}+530x^{269}+…+69x+381

i.e. they are a sum of any (finite!) number of terms of the form cx^k

There are many things that are fascinating about polynomials. But here we are going to zoom in on a particular one: polynomials are a single mathematical object that can contain an unbounded amount of information (think of them as a list of integers and this is obvious). The fourth example above contained 816 digits of tau, and one can easily imagine a polynomial that contains far more.

Furthermore, a single equation between polynomials can represent an unbounded number of equations between numbers. For example, consider the equation A(x)+ B(x) = C(x). If this equation is true, then it's also true that:

- A(0)+B(0)=C(0)

- A(1)+B(1)=C(1)

- A(2)+B(2)=C(2)

- A(3)+B(3)=C(3)

And so on for every possible coordinate. You can even construct polynomials to deliberately represent sets of numbers so you can check many equations all at once. For example, suppose that you wanted to check:

- 12+1=13

- 10+8=18

- 15+8=23

- 15+13=28

You can use a procedure called Lagrange interpolation to construct polynomials A(x) that give (12,10,15,15) as outputs at some specific set of coordinates (eg. (0,1,2,3)), B(x) the outputs (1,8,8,13) on thos same coordinates, and so forth. In fact, here are the polynomials:

- A(x)=-2x^3+\frac{19}{2}x^2-\frac{19}{2}x+12

- B(x)=2x^3-\frac{19}{2}x^2+\frac{29}{2}x+1

- C(x)=5x+13

Checking the equation A(x)+B(x)=C(x) with these polynomials checks all four above equations at the same time.

Comparing a polynomial to itself

You can even check relationships between a large number of adjacent evaluations of the same polynomial using a simple polynomial equation. This is slightly more advanced. Suppose that you want to check that, for a given polynomial F, F(x+2)=F(x)+F(x+1) with the integer range {0,1…89} (so if you also check F(0)=F(1)=1, then F(100) would be the 100th Fibonacci number)

As polynomials, F(x+2)-F(x+1)-F(x) would not be exactly zero, as it could give arbitrary answers outside the range x={0,1…98}. But we can do something clever. In general, there is a rule that if a polynomial P is zero across some set S=\{x_1,x_2…x_n\} then it can be expressed as P(x)=Z(x)*H(x), where Z(x)=(x-x_1)*(x-x_2)*…*(x-x_n) and H(x) is also a polynomial. In other words, any polynomial that equals zero across some set is a (polynomial) multiple of the simplest (lowest-degree) polynomial that equals zero across that same set.

Why is this the case? It is a nice corollary of polynomial long division: the factor theorem. We know that, when dividing P(x) by Z(x), we will get a quotient Q(x) and a remainder R(x) is strictly less than that of Z(x). Since we know that P is zero on all of S, it means that R has to be zero on all of S as well. So we can simply compute R(x) via polynomial interpolation, since it's a polynomial of degree at most n-1 and we know n values (the zeros at S). Interpolating a polynomial with all zeroes gives the zero polynomial, thus R(x)=0 and H(x)=Q(x).

Going back to our example, if we have a polynomial F that encodes Fibonacci numbers (so F(x+2)=F(x)+F(x+1) across x=\{0,1…98\}), then I can convince you that F actually satisfies this condition by proving that the polynomial P(x)=F(x+2)-F(x+1)-F(x) is zero over that range, by giving you the quotient:

H(x)=\frac{F(x+2)-F(x+1)-F(x)}{Z(x)}

Where Z(x) = (x-0)*(x-1)*…*(x-98).

You can calculate Z(x) yourself (ideally you would have it precomputed), check the equation, and if the check passes then F(x) satisfies the condition!

Now, step back and notice what we did here. We converted a 100-step-long computation into a single equation with polynomials. Of course, proving the N'th Fibonacci number is not an especially useful task, especially since Fibonacci numbers have a closed form. But you can use exactly the same basic technique, just with some extra polynomials and some more complicated equations, to encode arbitrary computations with an arbitrarily large number of steps.

see part 3

You might also like

Michael Salim

3 years ago

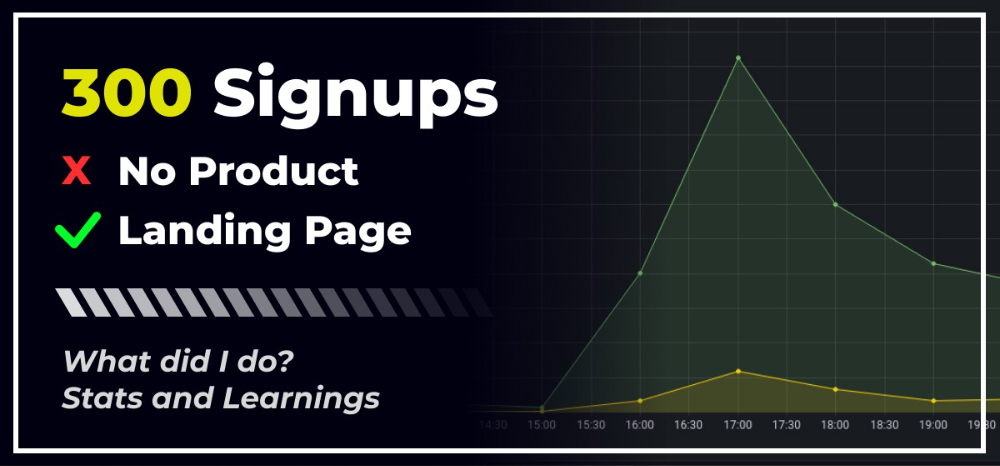

300 Signups, 1 Landing Page, 0 Products

I placed a link on HackerNews and got 300 signups in a week. This post explains what happened.

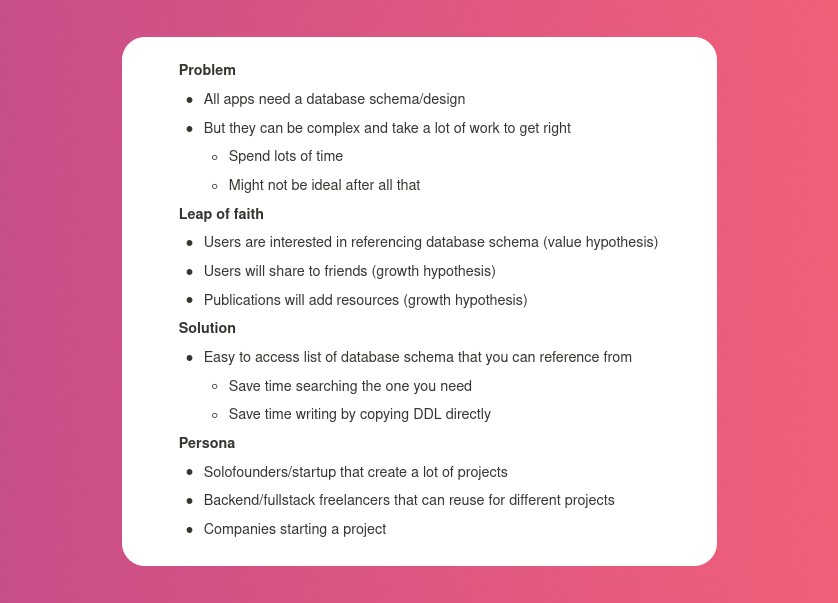

Product Concept

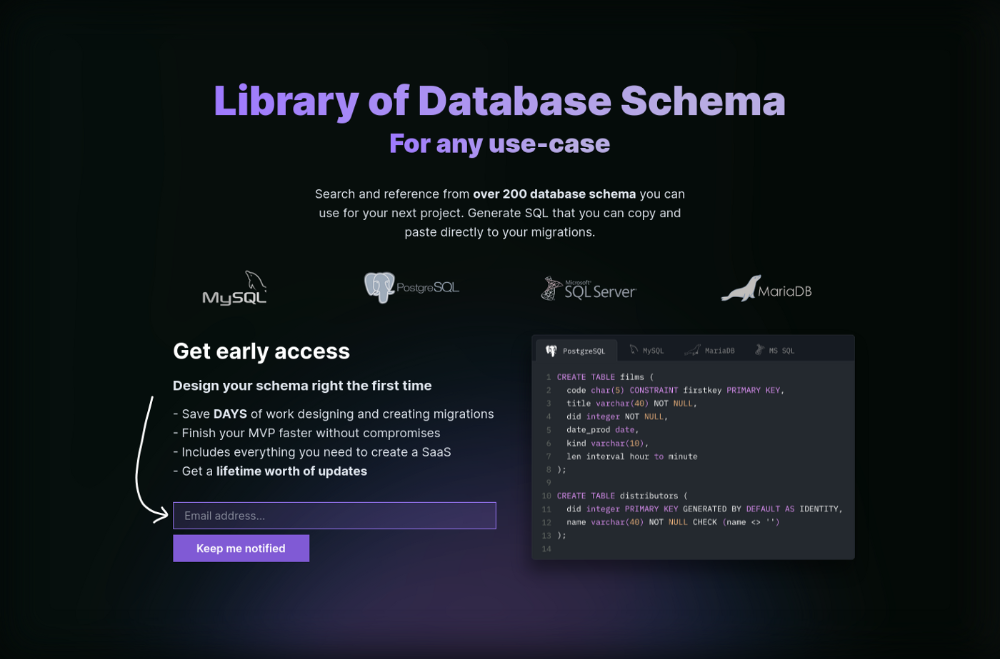

The product is DbSchemaLibrary. A library of Database Schema.

I'm not sure where this idea originated from. Very fast. Build fast, fail fast, test many ideas, and one will be a hit. I tried it. Let's try it anyway, even though it'll probably fail. I finished The Lean Startup book and wanted to use it.

Database job bores me. Important! I get drowsy working on it. Someone must do it. I remember this happening once. I needed examples at the time. Something similar to Recall (my other project) that I can copy — or at least use as a reference.

Frequently googled. Many tabs open. The results were useless. I raised my hand and agreed to construct the database myself.

It resurfaced. I decided to do something.

Due Diligence

Lean Startup emphasizes validated learning. Everything the startup does should result in learning. I may build something nobody wants otherwise. That's what happened to Recall.

So, I wrote a business plan document. This happens before I code. What am I solving? What is my proposed solution? What is the leap of faith between the problem and solution? Who would be my target audience?

My note:

In my previous project, I did the opposite!

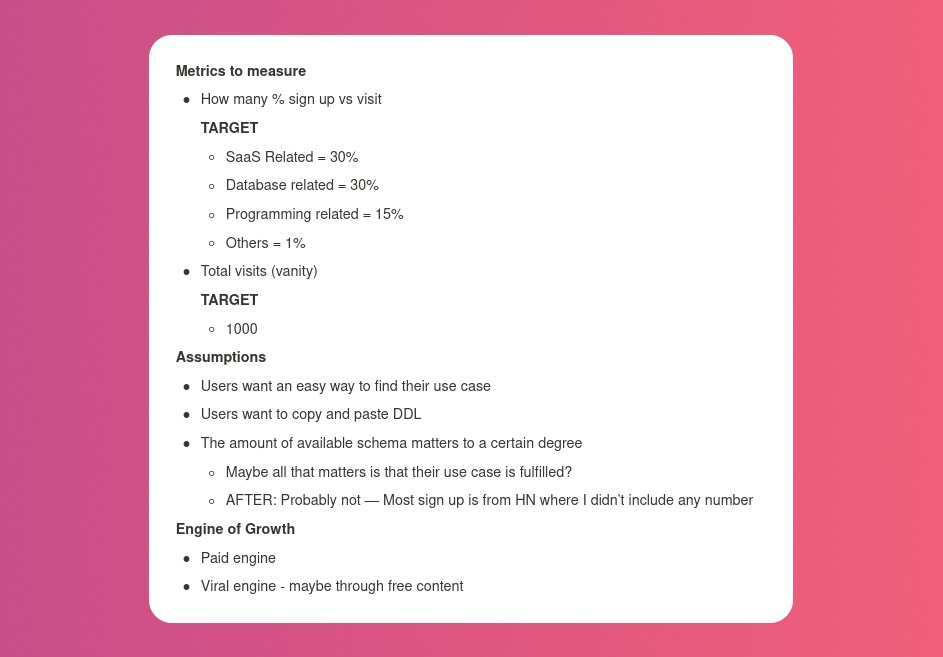

I wrote my expectations after reading the book's advice.

“Failure is a prerequisite to learning. The problem with the notion of shipping a product and then seeing what happens is that you are guaranteed to succeed — at seeing what happens.” — The Lean Startup book

These are successful metrics. If I don't reach them, I'll drop the idea and try another. I didn't understand numbers then. Below are guesses. But it’s a start!

I then wrote the project's What and Why. I'll use this everywhere. Before, I wrote a different pitch each time. I thought certain words would be better. I felt the audience might want something unusual.

Occasionally, this works. I'm unsure if it's a good idea. No stats, just my writing-time opinion. Writing every time is time-consuming and sometimes hazardous. Having a copy saved me duplication.

I can measure and learn from performance.

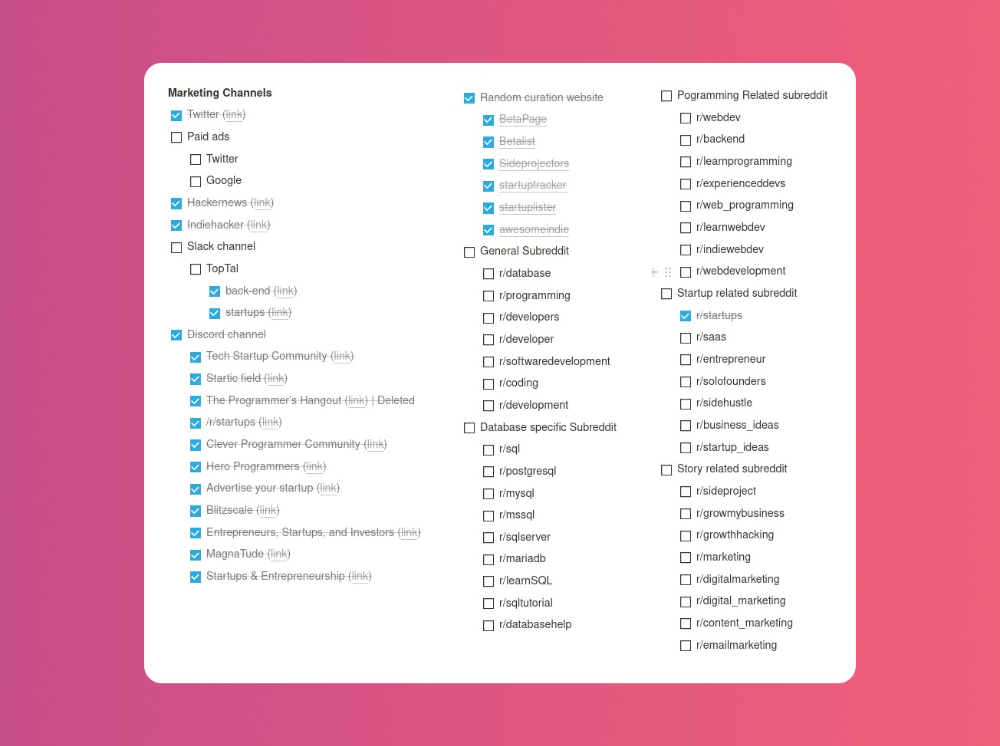

Last, I identified communities that might demand the product. This became an exercise in creativity.

The MVP

So now it’s time to build.

A MVP can test my assumptions. Business may learn from it. Not low-quality. We should learn from the tiniest thing.

I like the example of how Dropbox did theirs. They assumed that if the product works, people will utilize it. How can this be tested without a quality product? They made a movie demonstrating the software's functionality. Who knows how much functionality existed?

So I tested my biggest assumption. Users want schema references. How can I test if users want to reference another schema? I'd love this. Recall taught me that wanting something doesn't mean others do.

I made an email-collection landing page. Describe it briefly. Reference library. Each email sender wants a reference. They're interested in the product. Few other reasons exist.

Header and footer were skipped. No name or logo. DbSchemaLibrary is a name I thought of after the fact. 5-minute logo. I expected a flop. Recall has no users after months of labor. What could happen to a 2-day project?

I didn't compromise learning validation. How many visitors sign up? To draw a conclusion, I must track these results.

Posting Time

Now that the job is done, gauge interest. The next morning, I posted on all my channels. I didn't want to be spammy, therefore it required more time.

I made sure each channel had at least one fan of this product. I also answer people's inquiries in the channel.

My list stinks. Several channels wouldn't work. The product's target market isn't there. Posting there would waste our time. This taught me to create marketing channels depending on my persona.

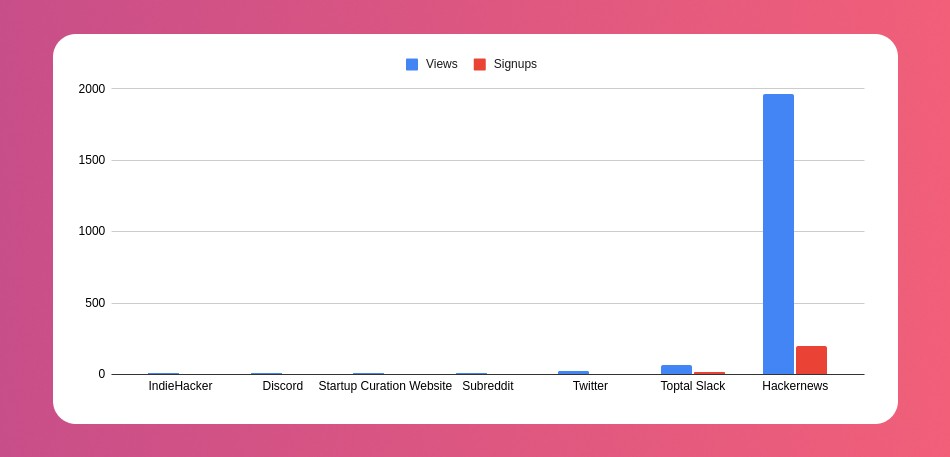

Statistics! What actually happened

My favorite part! 23 channels received the link.

I stopped posting to Discord despite its high conversion rate. I eliminated some channels because they didn't fit. According to the numbers, some users like it. Most users think it's spam.

I was skeptical. And 12 people viewed it.

I didn't expect much attention on a startup subreddit. I'll likely examine Reddit further in the future. As I have enough info, I didn't post much. Time for the next validated learning

No comment. The post had few views, therefore the numbers are low.

The targeted people come next.

I'm a Toptal freelancer. There's a member-only Slack channel. Most people can't use this marketing channel, but you should! It's not as spectacular as discord's 27% conversion rate. But I think the users here are better.

I don’t really have a following anywhere so this isn’t something I can leverage.

The best yet. 10% is converted. With more data, I expect to attain a 10% conversion rate from other channels. Stable number.

This number required some work. Did you know that people use many different clients to read HN?

Unknowns

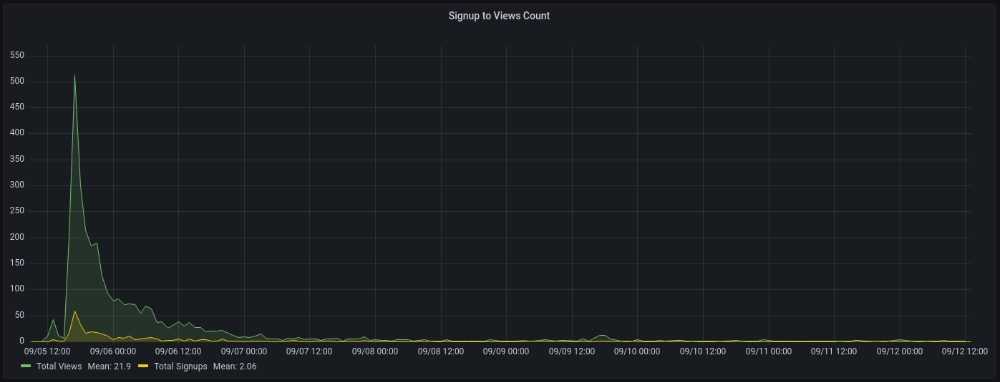

Untrackable views and signups abound. 1136 views and 135 signups are untraceable. It's 11%. I bet much of that came from Hackernews.

Overall Statistics

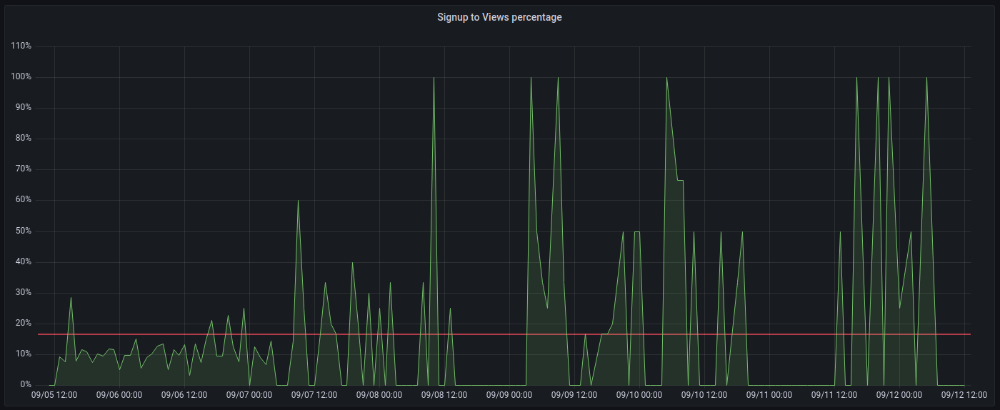

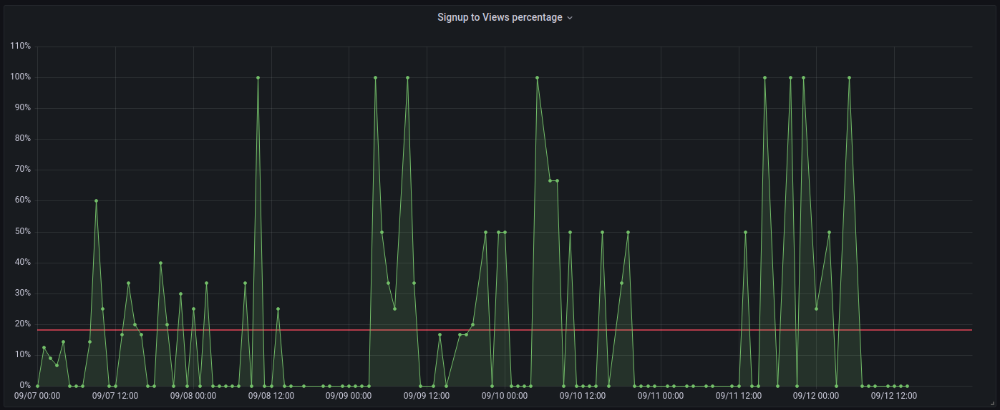

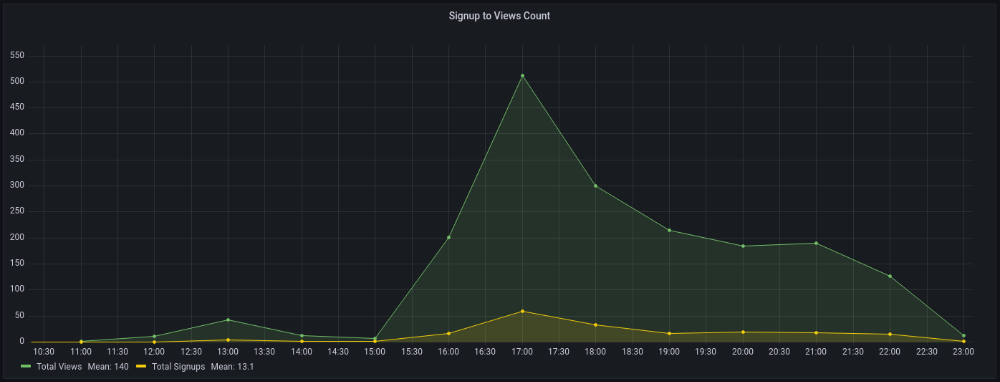

The 7-day signup-to-visit ratio was 17%. (Hourly data points)

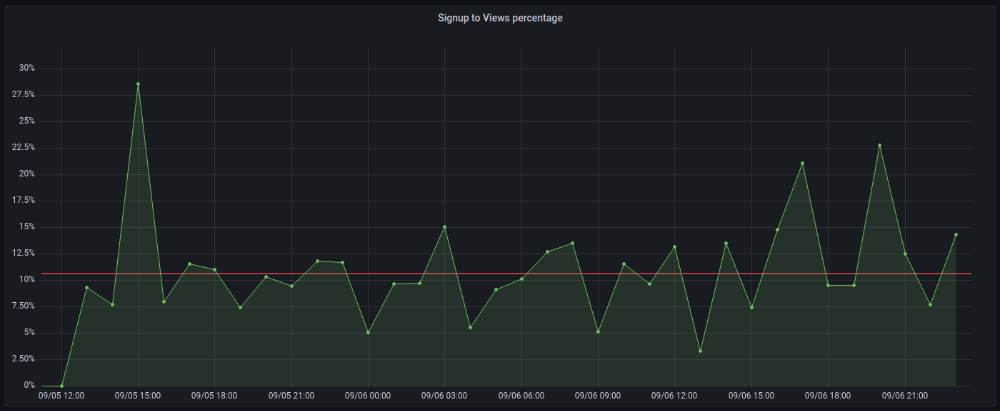

First-day percentages were lower, which is noteworthy. Initially, it was little above 10%. The HN post started getting views then.

When traffic drops, the number reaches just around 20%. More individuals are interested in the connection. hn.algolia.com sent 2 visitors. This means people are searching and finding my post.

Interesting discoveries

1. HN post struggled till the US woke up.

11am UTC. After an hour, it lost popularity. It seemed over. 7 signups converted 13%. Not amazing, but I would've thought ahead.

After 4pm UTC, traffic grew again. 4pm UTC is 9am PDT. US awakened. 10am PDT saw 512 views.

2. The product was highlighted in a newsletter.

I found Revue references when gathering data. Newsletter platform. Someone posted the newsletter link. 37 views and 3 registrations.

3. HN numbers are extremely reliable

I don't have a time-lapse graph (yet). The statistics were constant all day.

2717 views later 272 new users, or 10.1%

With 293 signups at 2856 views, 10.25%

At 306 signups at 2965 views, 10.32%

Learnings

1. My initial estimations were wildly inaccurate

I wrote 30% conversion. Reading some articles, looks like 10% is a good number to aim for.

2. Paying attention to what matters rather than vain metrics

The Lean Startup discourages vanity metrics. Feel-good metrics that don't measure growth or traction. Considering the proportion instead of the total visitors made me realize there was something here.

What’s next?

There are lots of work to do. Data aggregation, display, website development, marketing, legal issues. Fun! It's satisfying to solve an issue rather than investigate its cause.

In the meantime, I’ve already written the first project update in another post. Continue reading it if you’d like to know more about the project itself! Shifting from Quantity to Quality — DbSchemaLibrary

Camilla Dudley

3 years ago

How to gain Twitter followers: A 101 Guide

No wonder brands use Twitter to reach their audience. 53% of Twitter users buy new products first.

Twitter growth does more than make your brand look popular. It helps clients trust your business. It boosts your industry standing. It shows clients, prospects, and even competitors you mean business.

How can you naturally gain Twitter followers?

Share useful information

Post visual content

Tweet consistently

Socialize

Spread your @name everywhere.

Use existing customers

Promote followers

Share useful information

Twitter users join conversations and consume material. To build your followers, make sure your material appeals to them and gives value, whether it's sales, product lessons, or current events.

Use Twitter Analytics to learn what your audience likes.

Explore popular topics by utilizing relevant keywords and hashtags. Check out this post on how to use Twitter trends.

Post visual content

97% of Twitter users focus on images, so incorporating media can help your Tweets stand out. Visuals and videos make content more engaging and memorable.

Tweet often

Your audience should expect regular content updates. Plan your ideas and tweet during crucial seasons and events with a content calendar.

Socialize

Twitter connects people. Do more than tweet. Follow industry leaders. Retweet influencers, engage with thought leaders, and reply to mentions and customers to boost engagement.

Micro-influencers can promote your brand or items. They can help you gain new audiences' trust.

Spread your @name everywhere.

Maximize brand exposure. Add a follow button on your website, link to it in your email signature and newsletters, and promote it on business cards or menus.

Use existing customers

Emails can be used to find existing Twitter clients. Upload your email contacts and follow your customers on Twitter to start a dialogue.

Promote followers

Run a followers campaign to boost your organic growth. Followers campaigns promote your account to a particular demographic, and you only pay when someone follows you.

Consider short campaigns to enhance momentum or an always-on campaign to gain new followers.

Increasing your brand's Twitter followers takes effort and experimentation, but the payback is huge.

👋 Follow me on twitter

Zuzanna Sieja

3 years ago

In 2022, each data scientist needs to read these 11 books.

Non-technical talents can benefit data scientists in addition to statistics and programming.

As our article 5 Most In-Demand Skills for Data Scientists shows, being business-minded is useful. How can you get such a diverse skill set? We've compiled a list of helpful resources.

Data science, data analysis, programming, and business are covered. Even a few of these books will make you a better data scientist.

Ready? Let’s dive in.

Best books for data scientists

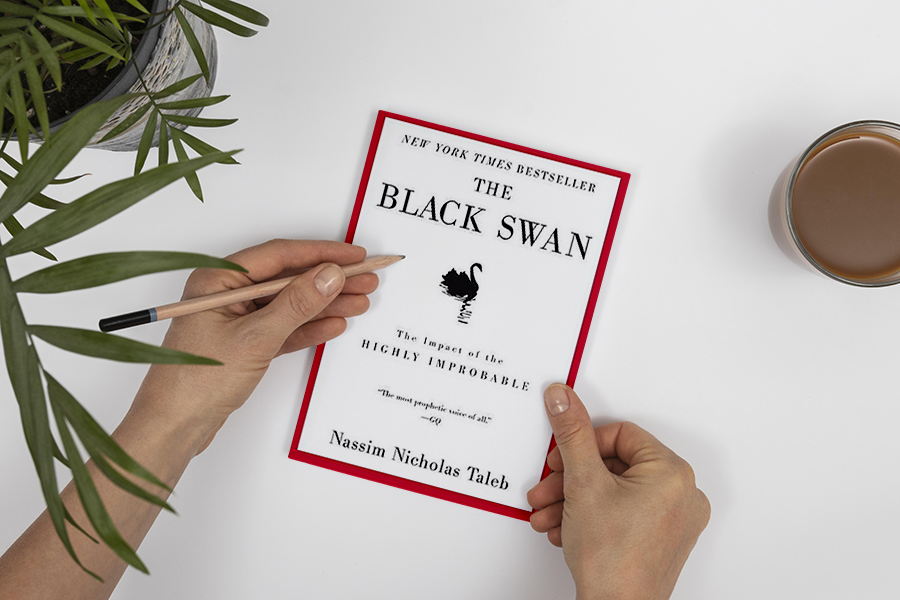

1. The Black Swan

Author: Nassim Taleb

First, a less obvious title. Nassim Nicholas Taleb's seminal series examines uncertainty, probability, risk, and decision-making.

Three characteristics define a black swan event:

It is erratic.

It has a significant impact.

Many times, people try to come up with an explanation that makes it seem more predictable than it actually was.

People formerly believed all swans were white because they'd never seen otherwise. A black swan in Australia shattered their belief.

Taleb uses this incident to illustrate how human thinking mistakes affect decision-making. The book teaches readers to be aware of unpredictability in the ever-changing IT business.

Try multiple tactics and models because you may find the answer.

2. High Output Management

Author: Andrew Grove

Intel's former chairman and CEO provides his insights on developing a global firm in this business book. We think Grove would choose “management” to describe the talent needed to start and run a business.

That's a skill for CEOs, techies, and data scientists. Grove writes on developing productive teams, motivation, real-life business scenarios, and revolutionizing work.

Five lessons:

Every action is a procedure.

Meetings are a medium of work

Manage short-term goals in accordance with long-term strategies.

Mission-oriented teams accelerate while functional teams increase leverage.

Utilize performance evaluations to enhance output.

So — if the above captures your imagination, it’s well worth getting stuck in.

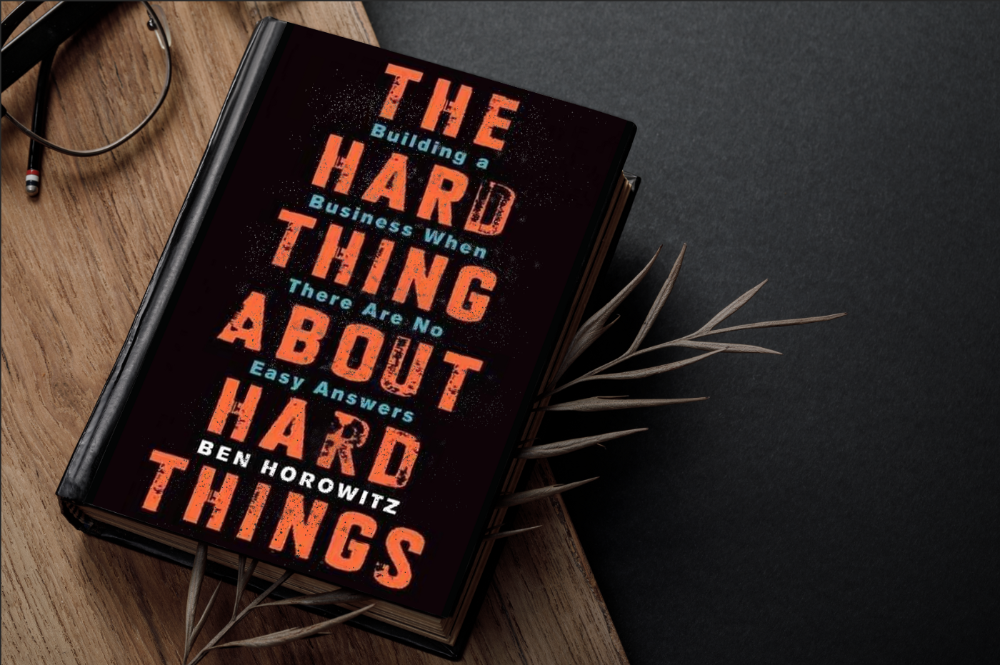

3. The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers

Author: Ben Horowitz

Few realize how difficult it is to run a business, even though many see it as a tremendous opportunity.

Business schools don't teach managers how to handle the toughest difficulties; they're usually on their own. So Ben Horowitz wrote this book.

It gives tips on creating and maintaining a new firm and analyzes the hurdles CEOs face.

Find suggestions on:

create software

Run a business.

Promote a product

Obtain resources

Smart investment

oversee daily operations

This book will help you cope with tough times.

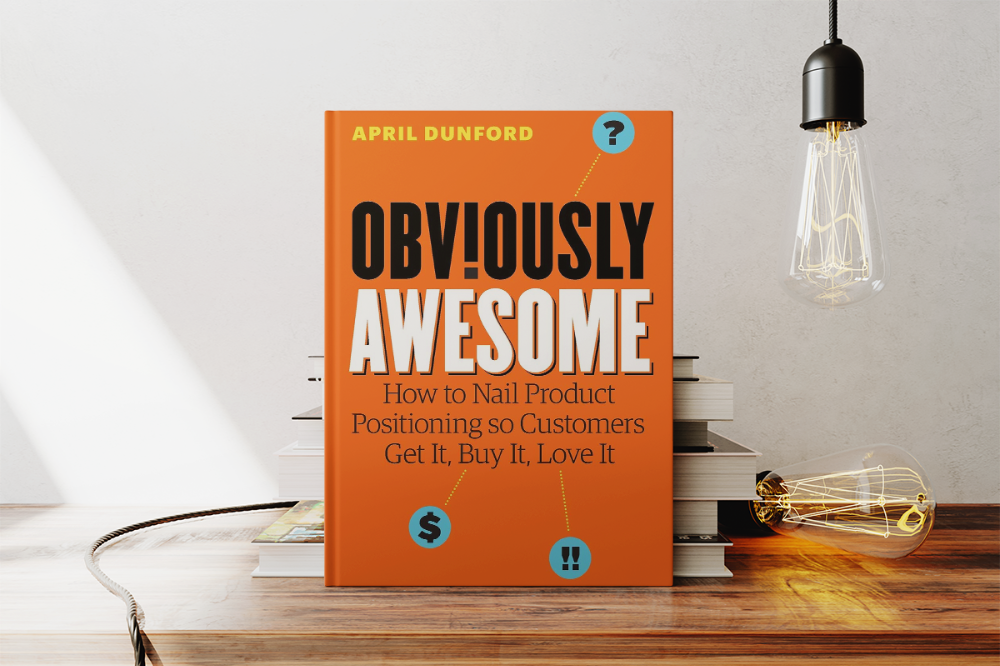

4. Obviously Awesome: How to Nail Product Positioning

Author: April Dunford

Your job as a data scientist is a product. You should be able to sell what you do to clients. Even if your product is great, you must convince them.

How to? April Dunford's advice: Her book explains how to connect with customers by making your offering seem like a secret sauce.

You'll learn:

Select the ideal market for your products.

Connect an audience to the value of your goods right away.

Take use of three positioning philosophies.

Utilize market trends to aid purchasers

5. The Mom test

Author: Rob Fitzpatrick

The Mom Test improves communication. Client conversations are rarely predictable. The book emphasizes one of the most important communication rules: enquire about specific prior behaviors.

Both ways work. If a client has suggestions or demands, listen carefully and ensure everyone understands. The book is packed with client-speaking tips.

6. Introduction to Machine Learning with Python: A Guide for Data Scientists

Authors: Andreas C. Müller, Sarah Guido

Now, technical documents.

This book is for Python-savvy data scientists who wish to learn machine learning. Authors explain how to use algorithms instead of math theory.

Their technique is ideal for developers who wish to study machine learning basics and use cases. Sci-kit-learn, NumPy, SciPy, pandas, and Jupyter Notebook are covered beyond Python.

If you know machine learning or artificial neural networks, skip this.

7. Python Data Science Handbook: Essential Tools for Working with Data

Author: Jake VanderPlas

Data work isn't easy. Data manipulation, transformation, cleansing, and visualization must be exact.

Python is a popular tool. The Python Data Science Handbook explains everything. The book describes how to utilize Pandas, Numpy, Matplotlib, Scikit-Learn, and Jupyter for beginners.

The only thing missing is a way to apply your learnings.

8. Python for Data Analysis: Data Wrangling with Pandas, NumPy, and IPython

Author: Wes McKinney

The author leads you through manipulating, processing, cleaning, and analyzing Python datasets using NumPy, Pandas, and IPython.

The book's realistic case studies make it a great resource for Python or scientific computing beginners. Once accomplished, you'll uncover online analytics, finance, social science, and economics solutions.

9. Data Science from Scratch

Author: Joel Grus

Here's a title for data scientists with Python, stats, maths, and algebra skills (alongside a grasp of algorithms and machine learning). You'll learn data science's essential libraries, frameworks, modules, and toolkits.

The author works through all the key principles, providing you with the practical abilities to develop simple code. The book is appropriate for intermediate programmers interested in data science and machine learning.

Not that prior knowledge is required. The writing style matches all experience levels, but understanding will help you absorb more.

10. Machine Learning Yearning

Author: Andrew Ng

Andrew Ng is a machine learning expert. Co-founded and teaches at Stanford. This free book shows you how to structure an ML project, including recognizing mistakes and building in complex contexts.

The book delivers knowledge and teaches how to apply it, so you'll know how to:

Determine the optimal course of action for your ML project.

Create software that is more effective than people.

Recognize when to use end-to-end, transfer, and multi-task learning, and how to do so.

Identifying machine learning system flaws

Ng writes easy-to-read books. No rigorous math theory; just a terrific approach to understanding how to make technical machine learning decisions.

11. Deep Learning with PyTorch Step-by-Step

Author: Daniel Voigt Godoy

The last title is also the most recent. The book was revised on 23 January 2022 to discuss Deep Learning and PyTorch, a Python coding tool.

It comprises four parts:

Fundamentals (gradient descent, training linear and logistic regressions in PyTorch)

Machine Learning (deeper models and activation functions, convolutions, transfer learning, initialization schemes)

Sequences (RNN, GRU, LSTM, seq2seq models, attention, self-attention, transformers)

Automatic Language Recognition (tokenization, embeddings, contextual word embeddings, ELMo, BERT, GPT-2)

We admire the book's readability. The author avoids difficult mathematical concepts, making the material feel like a conversation.

Is every data scientist a humanist?

Even as a technological professional, you can't escape human interaction, especially with clients.

We hope these books will help you develop interpersonal skills.