More on Entrepreneurship/Creators

Jared Heyman

3 years ago

The survival and demise of Y Combinator startups

I've written a lot about Y Combinator's success, but as any startup founder or investor knows, many startups fail.

Rebel Fund invests in the top 5-10% of new Y Combinator startups each year, so we focus on identifying and supporting the most promising technology startups in our ecosystem. Given the power law dynamic and asymmetric risk/return profile of venture capital, we worry more about our successes than our failures. Since the latter still counts, this essay will focus on the proportion of YC startups that fail.

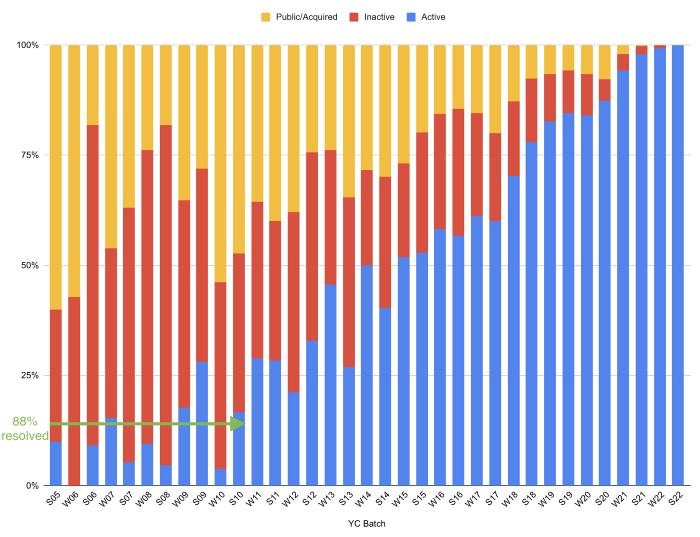

Since YC's launch in 2005, the figure below shows the percentage of active, inactive, and public/acquired YC startups by batch.

As more startups finish, the blue bars (active) decrease significantly. By 12 years, 88% of startups have closed or exited. Only 7% of startups reach resolution each year.

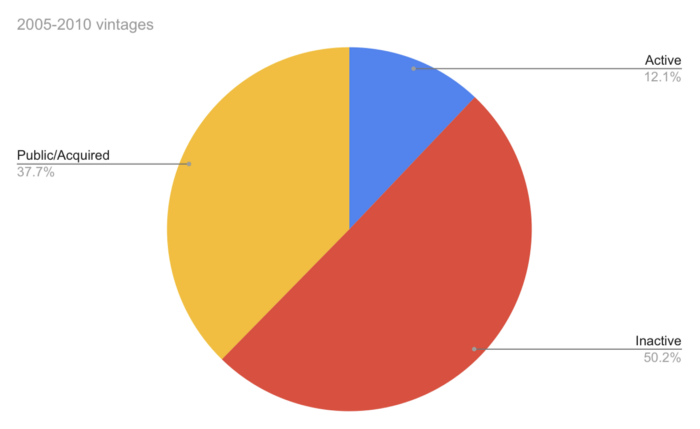

YC startups by status after 12 years:

Half the startups have failed, over one-third have exited, and the rest are still operating.

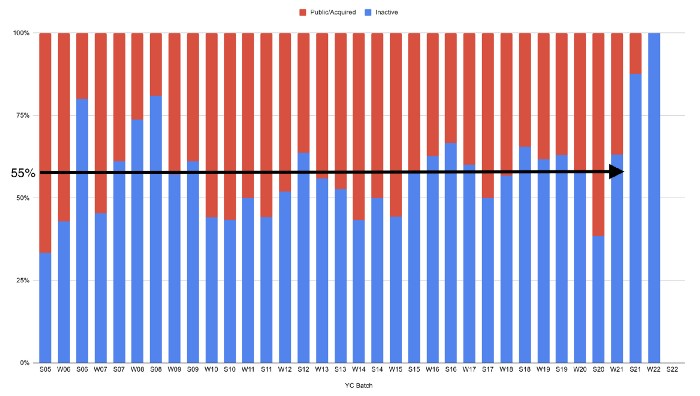

In venture investing, it's said that failed investments show up before successful ones. This is true for YC startups, but only in their early years.

Below, we only present resolved companies from the first chart. Some companies fail soon after establishment, but after a few years, the inactive vs. public/acquired ratio stabilizes around 55:45. After a few years, a YC firm is roughly as likely to quit as fail, which is better than I imagined.

I prepared this post because Rebel investors regularly question me about YC startup failure rates and how long it takes for them to exit or shut down.

Early-stage venture investors can overlook it because 100x investments matter more than 0x investments.

YC founders can ignore it because it shouldn't matter if many of their peers succeed or fail ;)

Nick Nolan

3 years ago

In five years, starting a business won't be hip.

People are slowly recognizing entrepreneurship's downside.

Growing up, entrepreneurship wasn't common. High school class of 2012 had no entrepreneurs.

Businesses were different.

They had staff and a lengthy history of achievement.

I never wanted a business. It felt unattainable. My friends didn't care.

Weird.

People desired degrees to attain good jobs at big companies.

When graduated high school:

9 out of 10 people attend college

Earn minimum wage (7%) working in a restaurant or retail establishment

Or join the military (3%)

Later, entrepreneurship became a thing.

2014-ish

I was in the military and most of my high school friends were in college, so I didn't hear anything.

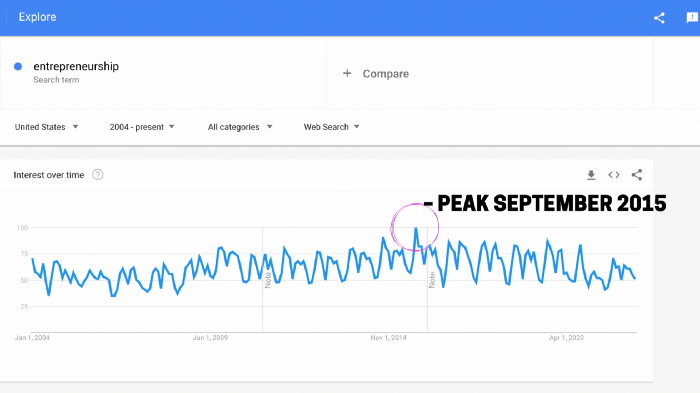

Entrepreneurship soared in 2015, according to Google Trends.

Then more individuals were interested. Entrepreneurship went from unusual to cool.

In 2015, it was easier than ever to build a website, run Facebook advertisements, and achieve organic social media reach.

There were several online business tools.

You didn't need to spend years or money figuring it out. Most entry barriers were gone.

Everyone wanted a side gig to escape the 95.

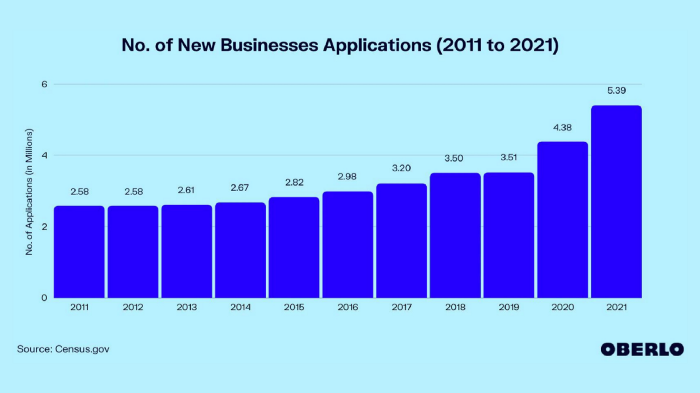

Small company applications have increased during the previous 10 years.

2011-2014 trend continues.

2015 adds 150,000 applications. 2016 adds 200,000. Plus 300,000 in 2017.

The graph makes it look little, but that's a considerable annual spike with no indications of stopping.

By 2021, new business apps had doubled.

Entrepreneurship will return to its early 2010s level.

I think we'll go backward in 5 years.

Entrepreneurship is half as popular as it was in 2015.

In the late 2020s and 30s, entrepreneurship will again be obscure.

Entrepreneurship's decade-long splendor is fading. People will cease escaping 9-5 and launch fewer companies.

That’s not a bad thing.

I think people have a rose-colored vision of entrepreneurship. It's fashionable. People feel that they're missing out if they're not entrepreneurial.

Reality is showing up.

People say on social media, "I knew starting a business would be hard, but not this hard."

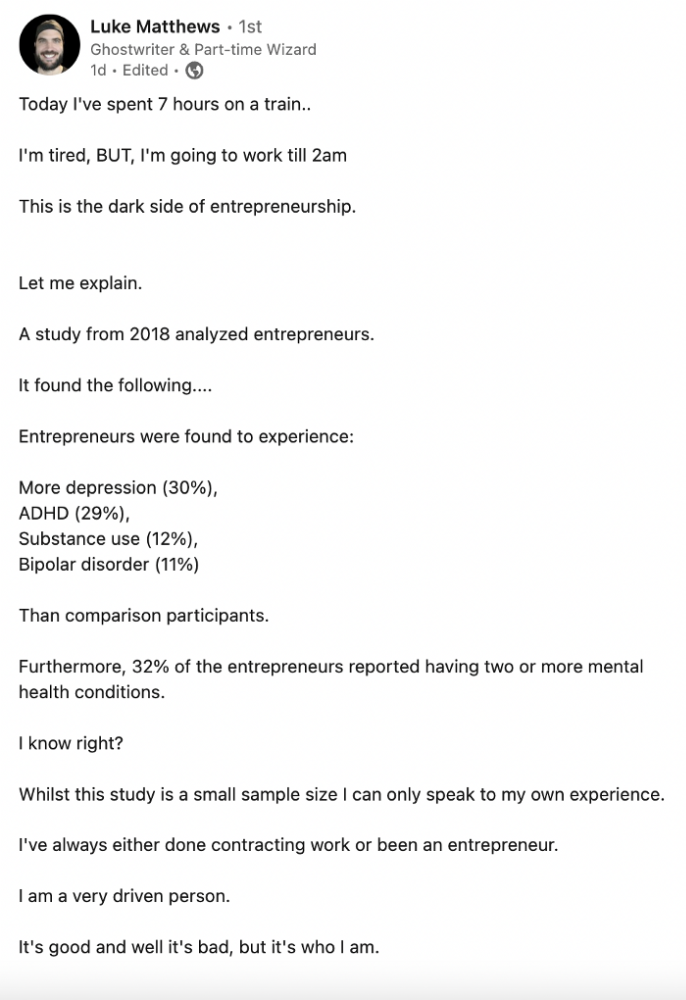

More negative posts on entrepreneurship:

Luke adds:

Is being an entrepreneur ‘healthy’? I don’t really think so. Many like Gary V, are not role models for a well-balanced life. Despite what feel-good LinkedIn tells you the odds are against you as an entrepreneur. You have to work your face off. It’s a tough but rewarding lifestyle. So maybe let’s stop glorifying it because it takes a lot of (bleepin) work to survive a pandemic, mental health battles, and a competitive market.

Entrepreneurship is no longer a pipe dream.

It’s hard.

I went full-time in March 2020. I was done by April 2021. I had a good-paying job with perks.

When that fell through (on my start date), I had to continue my entrepreneurial path. I needed money by May 1 to pay rent.

Entrepreneurship isn't as great as many think.

Entrepreneurship is a serious business.

If you have a 9-5, the grass isn't greener here. Most people aren't telling the whole story when they post on social media or quote successful entrepreneurs.

People prefer to communicate their victories than their defeats.

Is this a bad thing?

I don’t think so.

Over the previous decade, entrepreneurship went from impossible to the finest thing ever.

It peaked in 2020-21 and is returning to reality.

Startups aren't for everyone.

If you like your job, don't quit.

Entrepreneurship won't amaze people if you quit your job.

It's irrelevant.

You're doomed.

And you'll probably make less money.

If you hate your job, quit. Change jobs and bosses. Changing jobs could net you a greater pay or better perks.

When you go solo, your paycheck and perks vanish. Did I mention you'll fail, sleep less, and stress more?

Nobody will stop you from pursuing entrepreneurship. You'll face several challenges.

Possibly.

Entrepreneurship may be romanticized for years.

Based on what I see from entrepreneurs on social media and trends, entrepreneurship is challenging and few will succeed.

Athirah Syamimi

3 years ago

Here's How I Built A Business Offering Unlimited Design Services in Just One Weekend.

Weekend project: limitless design service. It was fun to see whether I could start a business quickly.

I use no-code apps to save time and resources.

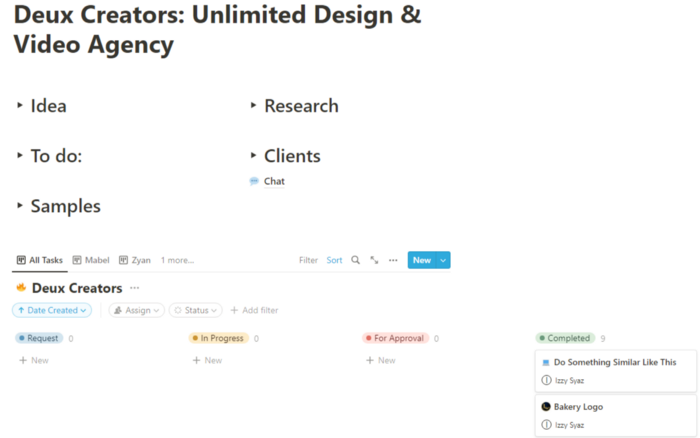

TL;DR I started a business utilizing EditorX for my website, Notion for client project management, and a few favors to finish my portfolio.

First step: research (Day 1)

I got this concept from a Kimp Instagram ad. The Minimalist Hustler Daily newsletter mentioned a similar and cheaper service (Graphically).

I Googled other unlimited design companies. Many provide different costs and services. Some supplied solely graphic design, web development, or copywriting.

Step 2: Brainstorming (Day 1)

I did something simple.

What benefits and services to provide

Price to charge

Since it's a one-person performance (for now), I'm focusing on graphic design. I can charge less.

So I don't overwhelm myself and can accommodate budget-conscious clientele.

Step 3: Construction (Day 1 & 2)

This project includes a management tool, a website, and a team procedure.

I built a project management tool and flow first. Once I had the flow and a Notion board, I tested it with design volunteers. They fake-designed while I built the website.

Tool for Project Management

I modified a Notion template. My goal is to keep clients and designers happy.

Team Approach

My sister, my partner, and I kept this business lean. I tweaked the Notion board to make the process smooth. By the end of Sunday, I’d say it’s perfect!

Website

I created the website after they finished the fake design demands. EditorX's drag-and-drop builder attracted me. I didn't need to learn code, and there are templates.

I used a template wireframe.

This project's hardest aspect is developing the site. It's my first time using EditorX and I'm no developer.

People answer all your inquiries in a large community forum.

As a first-time user developing a site in two days, I think I performed OK. Here's the site for feedback.

4th step: testing (Day 2)

Testing is frustrating because it works or doesn't. My testing day was split in two.

testing the workflow from payment to onboarding to the website

the demand being tested

It's working so far. If someone gets the trial, they can request design work.

I've gotten a couple of inquiries about demand. I’ll be working with them as a start.

Completion

Finally! I built my side project in one weekend. It's too early to tell if this is successful. I liked that I didn't squander months of resources testing out an idea.

You might also like

Josef Cruz

3 years ago

My friend worked in a startup scam that preys on slothful individuals.

He explained everything.

A drinking buddy confessed. Alexander. He says he works at a startup based on a scam, which appears too clever to be a lie.

Alexander (assuming he developed the story) or the startup's creator must have been a genius.

This is the story of an Internet scam that targets older individuals and generates tens of millions of dollars annually.

The business sells authentic things at 10% of their market value. This firm cannot be lucrative, but the entrepreneur has a plan: monthly subscriptions to a worthless service.

The firm can then charge the customer's credit card to settle the gap. The buyer must subscribe without knowing it. What's their strategy?

How does the con operate?

Imagine a website with a split homepage. On one page, the site offers an attractive goods at a ridiculous price (from 1 euro to 10% of the product's market worth).

Same product, but with a stupid monthly subscription. Business is unsustainable. They buy overpriced products and resell them too cheaply, hoping customers will subscribe to a useless service.

No customer will want this service. So they create another illegal homepage that hides the monthly subscription offer. After an endless scroll, a box says Yes, I want to subscribe to a service that costs x dollars per month.

Unchecking the checkbox bugs. When a customer buys a product on this page, he's enrolled in a monthly subscription. Not everyone should see it because it's illegal. So what does the startup do?

A page that varies based on the sort of website visitor, a possible consumer or someone who might be watching the startup's business

Startup technicians make sure the legal page is displayed when the site is accessed normally. Typing the web address in the browser, using Google, etc. The page crashes when buying a goods, preventing the purchase.

This avoids the startup from selling a product at a loss because the buyer won't subscribe to the worthless service and charge their credit card each month.

The illegal page only appears if a customer clicks on a Google ad, indicating interest in the offer.

Alexander says that a banker, police officer, or anyone else who visits the site (maybe for control) will only see a valid and buggy site as purchases won't be possible.

The latter will go to the site in the regular method (by typing the address in the browser, using Google, etc.) and not via an online ad.

Those who visit from ads are likely already lured by the site's price. They'll be sent to an illegal page that requires a subscription.

Laziness is humanity's secret weapon. The ordinary person ignores tiny monthly credit card charges. The subscription lasts around a year before the customer sees an unexpected deduction.

After-sales service (ASS) is useful in this situation.

After-sales assistance begins when a customer notices slight changes on his credit card, usually a year later.

The customer will search Google for the direct debit reference. How he'll complain to after-sales service.

It's crucial that ASS appears in the top 4/5 Google search results. This site must be clear, and offer chat, phone, etc., he argues.

The pigeon must be comforted after waking up. The customer learns via after-sales service that he subscribed to a service while buying the product, which justifies the debits on his card.

The customer will then clarify that he didn't intend to make the direct debits. The after-sales care professional will pretend to listen to the customer's arguments and complaints, then offer to unsubscribe him for free because his predicament has affected him.

In 99% of cases, the consumer is satisfied since the after-sales support unsubscribed him for free, and he forgets the debited amounts.

The remaining 1% is split between 0.99% who are delighted to be reimbursed and 0.01%. We'll pay until they're done. The customer should be delighted, not object or complain, and keep us beneath the radar (their situation is resolved, the rest, they don’t care).

It works, so we expand our thinking.

Startup has considered industrialization. Since this fraud is working, try another. Automate! So they used a site generator (only for product modifications), underpaid phone operators for after-sales service, and interns for fresh product ideas.

The company employed a data scientist. This has allowed the startup to recognize that specific customer profiles can be re-registered in the database and that it will take X months before they realize they're subscribing to a worthless service. Customers are re-subscribed to another service, then unsubscribed before realizing it.

Alexander took months to realize the deception and leave. Lawyers and others apparently threatened him and former colleagues who tried to talk about it.

The startup would have earned prizes and competed in contests. He adds they can provide evidence to any consumer group, media, police/gendarmerie, or relevant body. When I submitted my information to the FBI, I was told, "We know, we can't do much.", he says.

Jari Roomer

3 years ago

After 240 articles and 2.5M views on Medium, 9 Raw Writing Tips

Late in 2018, I published my first Medium article, but I didn't start writing seriously until 2019. Since then, I've written more than 240 articles, earned over $50,000 through Medium's Partner Program, and had over 2.5 million page views.

Write A Lot

Most people don't have the patience and persistence for this simple writing secret:

Write + Write + Write = possible success

Writing more improves your skills.

The more articles you publish, the more likely one will go viral.

If you only publish once a month, you have no views. If you publish 10 or 20 articles a month, your success odds increase 10- or 20-fold.

Tim Denning, Ayodeji Awosika, Megan Holstein, and Zulie Rane. Medium is their jam. How are these authors alike? They're productive and consistent. They're prolific.

80% is publishable

Many writers battle perfectionism.

To succeed as a writer, you must publish often. You'll never publish if you aim for perfection.

Adopt the 80 percent-is-good-enough mindset to publish more. It sounds terrible, but it'll boost your writing success.

Your work won't be perfect. Always improve. Waiting for perfection before publishing will take a long time.

Second, readers are your true critics, not you. What you consider "not perfect" may be life-changing for the reader. Don't let perfectionism hinder the reader.

Don't let perfectionism hinder the reader. ou don't want to publish mediocre articles. When the article is 80% done, publish it. Don't spend hours editing. Realize it. Get feedback. Only this will work.

Make Your Headline Irresistible

We all judge books by their covers, despite the saying. And headlines. Readers, including yourself, judge articles by their titles. We use it to decide if an article is worth reading.

Make your headlines irresistible. Want more article views? Then, whether you like it or not, write an attractive article title.

Many high-quality articles are collecting dust because of dull, vague headlines. It didn't make the reader click.

As a writer, you must do more than produce quality content. You must also make people click on your article. This is a writer's job. How to create irresistible headlines:

Curiosity makes readers click. Here's a tempting example...

Example: What Women Actually Look For in a Guy, According to a Huge Study by Luba Sigaud

Use Numbers: Click-bait lists. I mean, which article would you click first? ‘Some ways to improve your productivity’ or ’17 ways to improve your productivity.’ Which would I click?

Example: 9 Uncomfortable Truths You Should Accept Early in Life by Sinem Günel

Most headlines are dull. If you want clicks, get 'sexy'. Buzzword-ify. Invoke emotion. Trendy words.

Example: 20 Realistic Micro-Habits To Live Better Every Day by Amardeep Parmar

Concise paragraphs

Our culture lacks focus. If your headline gets a click, keep paragraphs short to keep readers' attention.

Some writers use 6–8 lines per paragraph, but I prefer 3–4. Longer paragraphs lose readers' interest.

A writer should help the reader finish an article, in my opinion. I consider it a job requirement. You can't force readers to finish an article, but you can make it 'snackable'

Help readers finish an article with concise paragraphs, interesting subheadings, exciting images, clever formatting, or bold attention grabbers.

Work And Move On

I've learned over the years not to get too attached to my articles. Many writers report a strange phenomenon:

The articles you're most excited about usually bomb, while the ones you're not tend to do well.

This isn't always true, but I've noticed it in my own writing. My hopes for an article usually make it worse. The more objective I am, the better an article does.

Let go of a finished article. 40 or 40,000 views, whatever. Now let the article do its job. Onward. Next story. Start another project.

Disregard Haters

Online content creators will encounter haters, whether on YouTube, Instagram, or Medium. More views equal more haters. Fun, right?

As a web content creator, I learned:

Don't debate haters. Never.

It's a mistake I've made several times. It's tempting to prove haters wrong, but they'll always find a way to be 'right'. Your response is their fuel.

I smile and ignore hateful comments. I'm indifferent. I won't enter a negative environment. I have goals, money, and a life to build. "I'm not paid to argue," Drake once said.

Use Grammarly

Grammarly saves me as a non-native English speaker. You know Grammarly. It shows writing errors and makes article suggestions.

As a writer, you need Grammarly. I have a paid plan, but their free version works. It improved my writing greatly.

Put The Reader First, Not Yourself

Many writers write for themselves. They focus on themselves rather than the reader.

Ask yourself:

This article teaches what? How can they be entertained or educated?

Personal examples and experiences improve writing quality. Don't focus on yourself.

It's not about you, the content creator. Reader-focused. Putting the reader first will change things.

Extreme ownership: Stop blaming others

I remember writing a lot on Medium but not getting many views. I blamed Medium first. Poor algorithm. Poor publishing. All sucked.

Instead of looking at what I could do better, I blamed others.

When you blame others, you lose power. Owning your results gives you power.

As a content creator, you must take full responsibility. Extreme ownership means 100% responsibility for work and results.

You don’t blame others. You don't blame the economy, president, platform, founders, or audience. Instead, you look for ways to improve. Few people can do this.

Blaming is useless. Zero. Taking ownership of your work and results will help you progress. It makes you smarter, better, and stronger.

Instead of blaming others, you'll learn writing, marketing, copywriting, content creation, productivity, and other skills. Game-changer.

Isaac Benson

3 years ago

What's the difference between Proof-of-Time and Proof-of-History?

Blockchain validates transactions with consensus algorithms. Bitcoin and Ethereum use Proof-of-Work, while Polkadot and Cardano use Proof-of-Stake.

Other consensus protocols are used to verify transactions besides these two. This post focuses on Proof-of-Time (PoT), used by Analog, and Proof-of-History (PoH), used by Solana as a hybrid consensus protocol.

PoT and PoH may seem similar to users, but they are actually very different protocols.

Proof-of-Time (PoT)

Analog developed Proof-of-Time (PoT) based on Delegated Proof-of-Stake (DPoS). Users select "delegates" to validate the next block in DPoS. PoT uses a ranking system, and validators stake an equal amount of tokens. Validators also "self-select" themselves via a verifiable random function."

The ranking system gives network validators a performance score, with trustworthy validators with a long history getting higher scores. System also considers validator's fixed stake. PoT's ledger is called "Timechain."

Voting on delegates borrows from DPoS, but there are changes. PoT's first voting stage has validators (or "time electors" putting forward a block to be included in the ledger).

Validators are chosen randomly based on their ranking score and fixed stake. One validator is chosen at a time using a Verifiable Delay Function (VDF).

Validators use a verifiable delay function to determine if they'll propose a Timechain block. If chosen, they validate the transaction and generate a VDF proof before submitting both to other Timechain nodes.

This leads to the second process, where the transaction is passed through 1,000 validators selected using the same method. Each validator checks the transaction to ensure it's valid.

If the transaction passes, validators accept the block, and if over 2/3 accept it, it's added to the Timechain.

Proof-of-History (PoH)

Proof-of-History is a consensus algorithm that proves when a transaction occurred. PoH uses a VDF to verify transactions, like Proof-of-Time. Similar to Proof-of-Work, VDFs use a lot of computing power to calculate but little to verify transactions, similar to (PoW).

This shows users and validators how long a transaction took to verify.

PoH uses VDFs to verify event intervals. This process uses cryptography to prevent determining output from input.

The outputs of one transaction are used as inputs for the next. Timestamps record the inputs' order. This checks if data was created before an event.

PoT vs. PoH

PoT and PoH differ in that:

PoT uses VDFs to select validators (or time electors), while PoH measures time between events.

PoH uses a VDF to validate transactions, while PoT uses a ranking system.

PoT's VDF-elected validators verify transactions proposed by a previous validator. PoH uses a VDF to validate transactions and data.

Conclusion

Both Proof-of-Time (PoT) and Proof-of-History (PoH) validate blockchain transactions differently. PoT uses a ranking system to randomly select validators to verify transactions.

PoH uses a Verifiable Delay Function to validate transactions, verify how much time has passed between two events, and allow validators to quickly verify a transaction without malicious actors knowing the input.