More on Technology

VIP Graphics

3 years ago

Leaked pitch deck for Metas' new influencer-focused live-streaming service

As part of Meta's endeavor to establish an interactive live-streaming platform, the company is testing with influencers.

The NPE (new product experimentation team) has been testing Super since late 2020.

Bloomberg defined Super as a Cameo-inspired FaceTime-like gadget in 2020. The tool has evolved into a Twitch-like live streaming application.

Less than 100 creators have utilized Super: Creators can request access on Meta's website. Super isn't an Instagram, Facebook, or Meta extension.

“It’s a standalone project,” the spokesperson said about Super. “Right now, it’s web only. They have been testing it very quietly for about two years. The end goal [of NPE projects] is ultimately creating the next standalone project that could be part of the Meta family of products.” The spokesperson said the outreach this week was part of a drive to get more creators to test Super.

A 2021 pitch deck from Super reveals the inner workings of Meta.

The deck gathered feedback on possible sponsorship models, with mockups of brand deals & features. Meta reportedly paid creators $200 to $3,000 to test Super for 30 minutes.

Meta's pitch deck for Super live streaming was leaked.

What were the slides in the pitch deck for Metas Super?

Embed not supported: see full deck & article here →

View examples of Meta's pitch deck for Super:

Product Slides, first

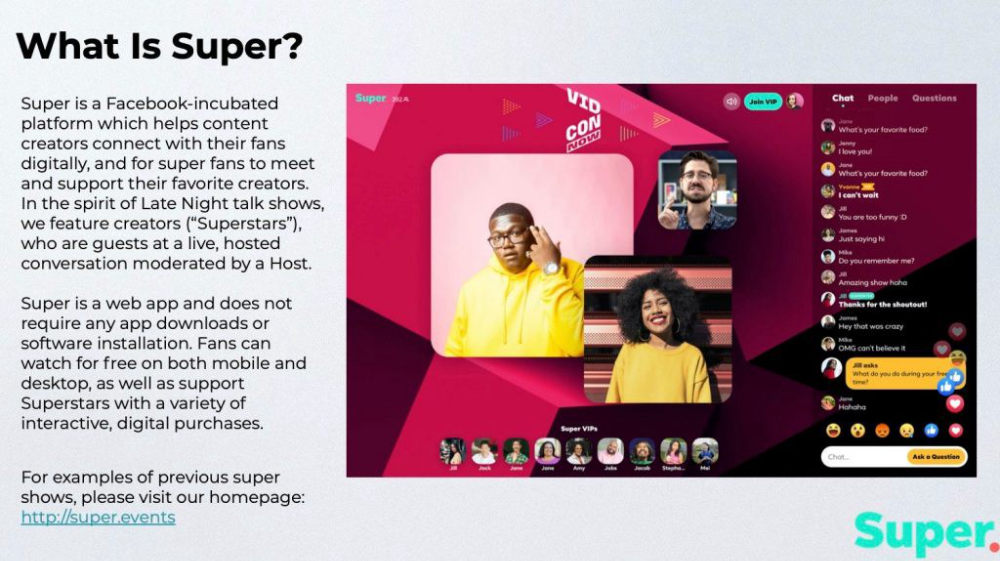

The pitch deck begins with Super's mission:

Super is a Facebook-incubated platform which helps content creators connect with their fans digitally, and for super fans to meet and support their favorite creators. In the spirit of Late Night talk shows, we feature creators (“Superstars”), who are guests at a live, hosted conversation moderated by a Host.

This slide (and most of the deck) is text-heavy, with few icons, bullets, and illustrations to break up the content. Super's online app status (which requires no download or installation) might be used as a callout (rather than paragraph-form).

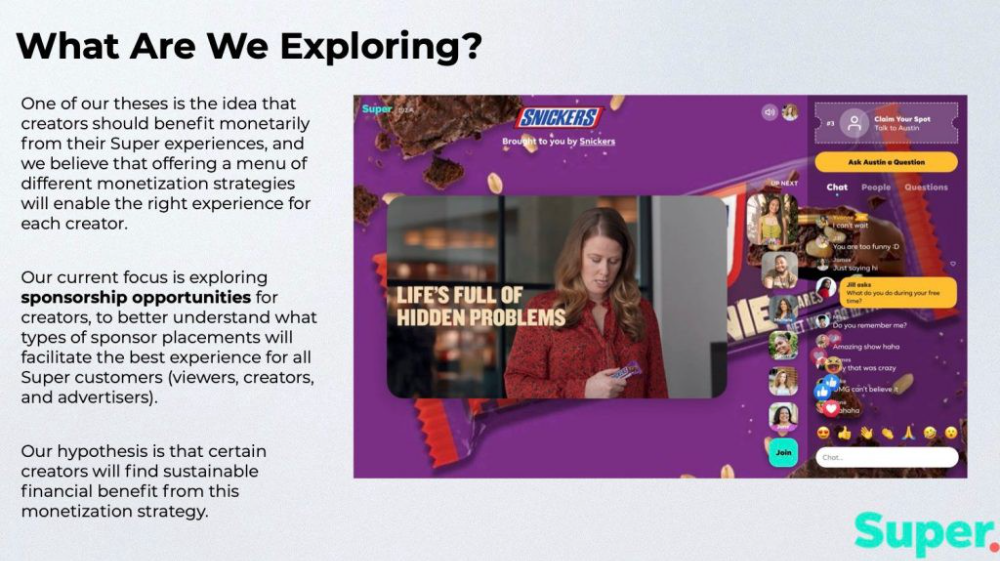

Meta's Super platform focuses on brand sponsorships and native placements, as shown in the slide above.

One of our theses is the idea that creators should benefit monetarily from their Super experiences, and we believe that offering a menu of different monetization strategies will enable the right experience for each creator. Our current focus is exploring sponsorship opportunities for creators, to better understand what types of sponsor placements will facilitate the best experience for all Super customers (viewers, creators, and advertisers).

Colorful mockups help bring Metas vision for Super to life.

2. Slide Features

Super's pitch deck focuses on the platform's features. The deck covers pre-show, pre-roll, and post-event for a Sponsored Experience.

Pre-show: active 30 minutes before the show's start

Pre-roll: Play a 15-minute commercial for the sponsor before the event (auto-plays once)

Meet and Greet: This event can have a branding, such as Meet & Greet presented by [Snickers]

Super Selfies: Makers and followers get a digital souvenir to post on social media.

Post-Event: Possibility to draw viewers' attention to sponsored content/links during the after-show

Almost every screen displays the Sponsor logo, link, and/or branded background. Viewers can watch sponsor video while waiting for the event to start.

Slide 3: Business Model

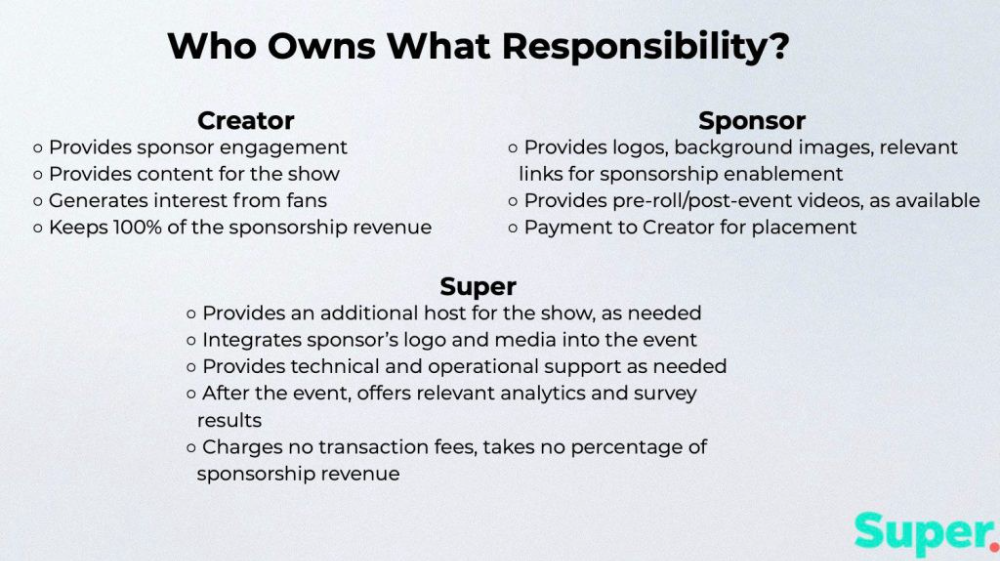

Meta's presentation for Super is incomplete without numbers. Super's first slide outlines the creator, sponsor, and Super's obligations. Super does not charge creators any fees or commissions on sponsorship earnings.

How to make a great pitch deck

We hope you can use the Super pitch deck to improve your business. Bestpitchdeck.com/super-meta is a bookmarkable link.

You can also use one of our expert-designed templates to generate a pitch deck.

Our team has helped close $100M+ in agreements and funding for premier companies and VC firms. Use our presentation templates, one-pagers, or financial models to launch your pitch.

Every pitch must be audience-specific. Our team has prepared pitch decks for various sectors and fundraising phases.

Pitch Deck Software VIP.graphics produced a popular SaaS & Software Pitch Deck based on decks that closed millions in transactions & investments for orgs of all sizes, from high-growth startups to Fortune 100 enterprises. This easy-to-customize PowerPoint template includes ready-made features and key slides for your software firm.

Accelerator Pitch Deck The Accelerator Pitch Deck template is for early-stage founders seeking funding from pitch contests, accelerators, incubators, angels, or VC companies. Winning a pitch contest or getting into a top accelerator demands a strategic investor pitch.

Pitch Deck Template Series Startup and founder pitch deck template: Workable, smart slides. This pitch deck template is for companies, entrepreneurs, and founders raising seed or Series A finance.

M&A Pitch Deck Perfect Pitch Deck is a template for later-stage enterprises engaging more sophisticated conversations like M&A, late-stage investment (Series C+), or partnerships & funding. Our team prepared this presentation to help creators confidently pitch to investment banks, PE firms, and hedge funds (and vice versa).

Browse our growing variety of industry-specific pitch decks.

Nicolas Tresegnie

3 years ago

Launching 10 SaaS applications in 100 days

Apocodes helps entrepreneurs create SaaS products without writing code. This post introduces micro-SaaS and outlines its basic strategy.

Strategy

Vision and strategy differ when starting a startup.

The company's long-term future state is outlined in the vision. It establishes the overarching objectives the organization aims to achieve while also justifying its existence. The company's future is outlined in the vision.

The strategy consists of a collection of short- to mid-term objectives, the accomplishment of which will move the business closer to its vision. The company gets there through its strategy.

The vision should be stable, but the strategy must be adjusted based on customer input, market conditions, or previous experiments.

Begin modestly and aim high.

Be truthful. It's impossible to automate SaaS product creation from scratch. It's like climbing Everest without running a 5K. Physical rules don't prohibit it, but it would be suicide.

Apocodes 5K equivalent? Two options:

(A) Create a feature that includes every setting option conceivable. then query potential clients “Would you choose us to build your SaaS solution if we offered 99 additional features of the same caliber?” After that, decide which major feature to implement next.

(B) Build a few straightforward features with just one or two configuration options. Then query potential clients “Will this suffice to make your product?” What's missing if not? Finally, tweak the final result a bit before starting over.

(A) is an all-or-nothing approach. It's like training your left arm to climb Mount Everest. My right foot is next.

(B) is a better method because it's iterative and provides value to customers throughout.

Focus on a small market sector, meet its needs, and expand gradually. Micro-SaaS is Apocode's first market.

What is micro-SaaS.

Micro-SaaS enterprises have these characteristics:

A limited range: They address a specific problem with a small number of features.

A small group of one to five individuals.

Low external funding: The majority of micro-SaaS companies have Total Addressable Markets (TAM) under $100 million. Investors find them unattractive as a result. As a result, the majority of micro-SaaS companies are self-funded or bootstrapped.

Low competition: Because they solve problems that larger firms would rather not spend time on, micro-SaaS enterprises have little rivalry.

Low upkeep: Because of their simplicity, they require little care.

Huge profitability: Because providing more clients incurs such a small incremental cost, high profit margins are possible.

Micro-SaaS enterprises created with no-code are Apocode's ideal first market niche.

We'll create our own micro-SaaS solutions to better understand their needs. Although not required, we believe this will improve community discussions.

The challenge

In 100 days (September 12–December 20, 2022), we plan to build 10 micro-SaaS enterprises using Apocode.

They will be:

Self-serve: Customers will be able to use the entire product experience without our manual assistance.

Real: They'll deal with actual issues. They won't be isolated proofs of concept because we'll keep up with them after the challenge.

Both free and paid options: including a free plan and a free trial period. Although financial success would be a good result, the challenge's stated objective is not financial success.

This will let us design Apocodes features, showcase them, and talk to customers.

(Edit: The first micro-SaaS was launched!)

Follow along

If you want to follow the story of Apocode or our progress in this challenge, you can subscribe here.

If you are interested in using Apocode, sign up here.

If you want to provide feedback, discuss the idea further or get involved, email me at nicolas.tresegnie@gmail.com

Liz Martin

3 years ago

A Search Engine From Apple?

Apple's search engine has long been rumored. Recent Google developments may confirm the rumor. Is Apple about to become Google's biggest rival?

Here's a video:

People noted Apple's changes in 2020. AppleBot, a web crawler that downloads and caches Internet content, was more active than in the last five years.

Apple hired search engine developers, including ex-Googlers, such as John Giannandrea, Google's former search chief.

Apple also changed the way iPhones search. With iOS 14, Apple's search results arrived before Google's.

These facts fueled rumors that Apple was developing a search engine.

Apple and Google Have a Contract

Many skeptics said Apple couldn't compete with Google. This didn't affect the company's competitiveness.

Apple is the only business with the resources and scale to be a Google rival, with 1.8 billion active devices and a $2 trillion market cap.

Still, people doubted that due to a license deal. Google pays Apple $8 to $12 billion annually to be the default iPhone and iPad search engine.

Apple can't build an independent search product under this arrangement.

Why would Apple enter search if it's being paid to stay out?

Ironically, this partnership has many people believing Apple is getting into search.

A New Default Search Engine May Be Needed

Google was sued for antitrust in 2020. It is accused of anticompetitive and exclusionary behavior. Justice wants to end Google's monopoly.

Authorities could restrict Apple and Google's licensing deal due to its likely effect on market competitiveness. Hence Apple needs a new default search engine.

Apple Already Has a Search Engine

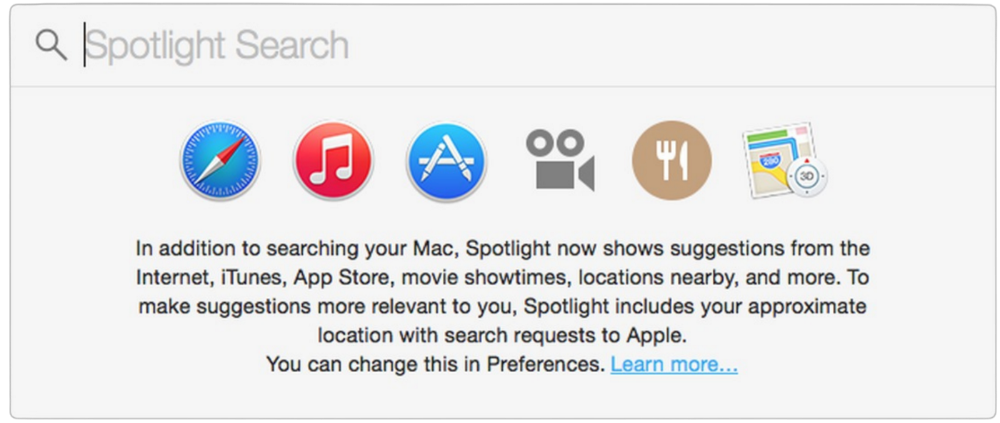

The company already has a search engine, Spotlight.

Since 2004, Spotlight has aired. It was developed to help users find photos, documents, apps, music, and system preferences.

Apple's search engine could do more than organize files, texts, and apps.

Spotlight Search was updated in 2014 with iOS 8. Web, App Store, and iTunes searches became available. You could find nearby places, movie showtimes, and news.

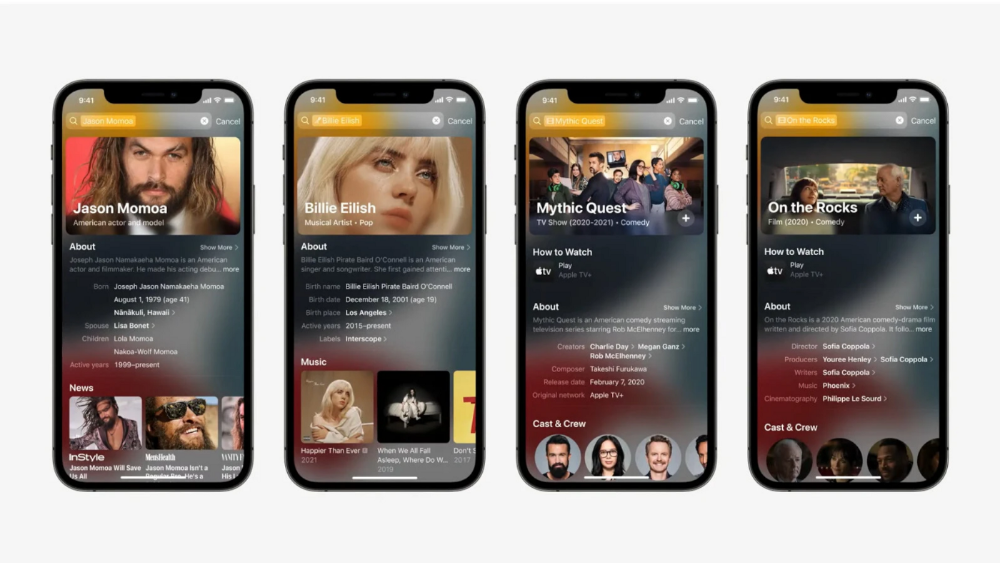

This search engine has subsequently been updated and improved. Spotlight added rich search results last year.

If you search for a TV show, movie, or song, photos and carousels will appear at the top of the page.

This resembles Google's rich search results.

When Will the Apple Search Engine Be Available?

When will Apple's search launch? Robert Scoble says it's near.

Scoble tweeted a number of hints before this year's Worldwide Developer Conference.

Scoble bases his prediction on insider information and deductive reasoning. January 2023 is expected.

Will you use Apple's search engine?

You might also like

Theo Seeds

3 years ago

The nine novels that have fundamentally altered the way I view the world

I read 53 novels last year and hope to do so again.

Books are best if you love learning. You get a range of perspectives, unlike podcasts and YouTube channels where you get the same ones.

Book quality varies. I've read useless books. Most books teach me something.

These 9 novels have changed my outlook in recent years. They've made me rethink what I believed or introduced me to a fresh perspective that changed my worldview.

You can order these books yourself. Or, read my summaries to learn what I've synthesized.

Enjoy!

Fooled By Randomness

Nassim Taleb worked as a Wall Street analyst. He used options trading to bet on unlikely events like stock market crashes.

Using financial models, investors predict stock prices. The models assume constant, predictable company growth.

These models base their assumptions on historical data, so they assume the future will be like the past.

Fooled By Randomness argues that the future won't be like the past. We often see impossible market crashes like 2008's housing market collapse. The world changes too quickly to use historical data: by the time we understand how it works, it's changed.

Most people don't live to see history unfold. We think our childhood world will last forever. That goes double for stable societies like the U.S., which hasn't seen major turbulence in anyone's lifetime.

Fooled By Randomness taught me to expect the unexpected. The world is deceptive and rarely works as we expect. You can't always trust your past successes or what you've learned.

Antifragile

More Taleb. Some things, like the restaurant industry and the human body, improve under conditions of volatility and turbulence.

We didn't have a word for this counterintuitive concept until Taleb wrote Antifragile. The human body (which responds to some stressors, like exercise, by getting stronger) and the restaurant industry both benefit long-term from disorder (when economic turbulence happens, bad restaurants go out of business, improving the industry as a whole).

Many human systems are designed to minimize short-term variance because humans don't understand it. By eliminating short-term variation, we increase the likelihood of a major disaster.

Once, we put out every forest fire we found. Then, dead wood piled up in forests, causing catastrophic fires.

We don't like price changes, so politicians prop up markets with stimulus packages and printing money. This leads to a bigger crash later. Two years ago, we printed a ton of money for stimulus checks, and now we have double-digit inflation.

Antifragile taught me how important Plan B is. A system with one or two major weaknesses will fail. Make large systems redundant, foolproof, and change-responsive.

Reality is broken

We dread work. Work is tedious. Right?

Wrong. Work gives many people purpose. People are happiest when working. (That's why some are workaholics.)

Factory work saps your soul, office work is boring, and working for a large company you don't believe in and that operates unethically isn't satisfying.

Jane McGonigal says in Reality Is Broken that meaningful work makes us happy. People love games because they simulate good work. McGonigal says work should be more fun.

Some think they'd be happy on a private island sipping cocktails all day. That's not true. Without anything to do, most people would be bored. Unemployed people are miserable. Many retirees die within 2 years, much more than expected.

Instead of complaining, find meaningful work. If you don't like your job, it's because you're in the wrong environment. Find the right setting.

The Lean Startup

Before the airplane was invented, Harvard scientists researched flying machines. Who knew two North Carolina weirdos would beat them?

The Wright Brothers' plane design was key. Harvard researchers were mostly theoretical, designing an airplane on paper and trying to make it fly in theory. They'd build it, test it, and it wouldn't fly.

The Wright Brothers were different. They'd build a cheap plane, test it, and it'd crash. Then they'd learn from their mistakes, build another plane, and it'd crash.

They repeated this until they fixed all the problems and one of their planes stayed aloft.

Mistakes are considered bad. On the African savannah, one mistake meant death. Even today, if you make a costly mistake at work, you'll be fired as a scapegoat. Most people avoid failing.

In reality, making mistakes is the best way to learn.

Eric Reis offers an unintuitive recipe in The Lean Startup: come up with a hypothesis, test it, and fail. Then, try again with a new hypothesis. Keep trying, learning from each failure.

This is a great startup strategy. Startups are new businesses. Startups face uncertainty. Run lots of low-cost experiments to fail, learn, and succeed.

Don't fear failing. Low-cost failure is good because you learn more from it than you lose. As long as your worst-case scenario is acceptable, risk-taking is good.

The Sovereign Individual

Today, nation-states rule the world. The UN recognizes 195 countries, and they claim almost all land outside of Antarctica.

We agree. For the past 2,000 years, much of the world's territory was ungoverned.

Why today? Because technology has created incentives for nation-states for most of the past 500 years. The logic of violence favors nation-states, according to James Dale Davidson, author of the Sovereign Individual. Governments have a lot to gain by conquering as much territory as possible, so they do.

Not always. During the Dark Ages, Europe was fragmented and had few central governments. Partly because of armor. With armor, a sword, and a horse, you couldn't be stopped. Large states were hard to form because they rely on the threat of violence.

When gunpowder became popular in Europe, violence changed. In a world with guns, assembling large armies and conquest are cheaper.

James Dale Davidson says the internet will make nation-states obsolete. Most of the world's wealth will be online and in people's heads, making capital mobile.

Nation-states rely on predatory taxation of the rich to fund large militaries and welfare programs.

When capital is mobile, people can live anywhere in the world, Davidson says, making predatory taxation impossible. They're not bound by their job, land, or factory location. Wherever they're treated best.

Davidson says that over the next century, nation-states will collapse because they won't have enough money to operate as they do now. He imagines a world of small city-states, like Italy before 1900. (or Singapore today).

We've already seen some movement toward a more Sovereign Individual-like world. The pandemic proved large-scale remote work is possible, freeing workers from their location. Many cities and countries offer remote workers incentives to relocate.

Many Western businesspeople live in tax havens, and more people are renouncing their US citizenship due to high taxes. Increasing globalization has led to poor economic conditions and resentment among average people in the West, which is why politicians like Trump and Sanders rose to popularity with angry rhetoric, even though Obama rose to popularity with a more hopeful message.

The Sovereign Individual convinced me that the future will be different than Nassim Taleb's. Large countries like the U.S. will likely lose influence in the coming decades, while Portugal, Singapore, and Turkey will rise. If the trend toward less freedom continues, people may flee the West en masse.

So a traditional life of college, a big firm job, hard work, and corporate advancement may not be wise. Young people should learn as much as possible and develop flexible skills to adapt to the future.

Sapiens

Sapiens is a history of humanity, from proto-humans in Ethiopia to our internet society today, with some future speculation.

Sapiens views humans (and Homo sapiens) as a unique species on Earth. We were animals 100,000 years ago. We're slowly becoming gods, able to affect the climate, travel to every corner of the Earth (and the Moon), build weapons that can kill us all, and wipe out thousands of species.

Sapiens examines what makes Homo sapiens unique. Humans can believe in myths like religion, money, and human-made entities like countries and LLCs.

These myths facilitate large-scale cooperation. Ants from the same colony can cooperate. Any two humans can trade, though. Even if they're not genetically related, large groups can bond over religion and nationality.

Combine that with intelligence, and you have a species capable of amazing feats.

Sapiens may make your head explode because it looks at the world without presupposing values, unlike most books. It questions things that aren't usually questioned and says provocative things.

It also shows how human history works. It may help you understand and predict the world. Maybe.

The 4-hour Workweek

Things can be done better.

Tradition, laziness, bad bosses, or incentive structures cause complacency. If you're willing to make changes and not settle for the status quo, you can do whatever you do better and achieve more in less time.

The Four-Hour Work Week advocates this. Tim Ferriss explains how he made more sales in 2 hours than his 8-hour-a-day colleagues.

By firing 2 of his most annoying customers and empowering his customer service reps to make more decisions, he was able to leave his business and travel to Europe.

Ferriss shows how to escape your 9-to-5, outsource your life, develop a business that feeds you with little time, and go on mini-retirement adventures abroad.

Don't accept the status quo. Instead, level up. Find a way to improve your results. And try new things.

Why Nations Fail

Nogales, Arizona and Mexico were once one town. The US/Mexico border was arbitrarily drawn.

Both towns have similar cultures and populations. Nogales, Arizona is well-developed and has a high standard of living. Nogales, Mexico is underdeveloped and has a low standard of living. Whoa!

Why Nations Fail explains how government-created institutions affect country development. Strong property rights, capitalism, and non-corrupt governments promote development. Countries without capitalism, strong property rights, or corrupt governments don't develop.

Successful countries must also embrace creative destruction. They must offer ordinary citizens a way to improve their lot by creating value for others, not reducing them to slaves, serfs, or peasants. Authors say that ordinary people could get rich on trading expeditions in 11th-century Venice.

East and West Germany and North and South Korea have different economies because their citizens are motivated differently. It explains why Chile, China, and Singapore grow so quickly after becoming market economies.

People have spent a lot of money on third-world poverty. According to Why Nations Fail, education and infrastructure aren't the answer. Developing nations must adopt free-market economic policies.

Elon Musk

Elon Musk is the world's richest man, but that’s not a good way to describe him. Elon Musk is the world's richest man, which is like calling Steve Jobs a turtleneck-wearer or Benjamin Franklin a printer.

Elon Musk does cool sci-fi stuff to help humanity avoid existential threats.

Oil will run out. We've delayed this by developing better extraction methods. We only have so much nonrenewable oil.

Our society is doomed if it depends on oil. Elon Musk invested heavily in Tesla and SolarCity to speed the shift to renewable energy.

Musk worries about AI: we'll build machines smarter than us. We won't be able to stop these machines if something goes wrong, just like cows can't fight humans. Neuralink: we need to be smarter to compete with AI when the time comes.

If Earth becomes uninhabitable, we need a backup plan. Asteroid or nuclear war could strike Earth at any moment. We may not have much time to react if it happens in a few days. We must build a new civilization while times are good and resources are plentiful.

Short-term problems dominate our politics, but long-term issues are more important. Long-term problems can cause mass casualties and homelessness. Musk demonstrates how to think long-term.

The main reason people are impressed by Elon Musk, and why Ashlee Vances' biography influenced me so much, is that he does impossible things.

Electric cars were once considered unprofitable, but Tesla has made them mainstream. SpaceX is the world's largest private space company.

People lack imagination and dismiss ununderstood ideas as impossible. Humanity is about pushing limits. Don't worry if your dreams seem impossible. Try it.

Thanks for reading.

Todd Lewandowski

3 years ago

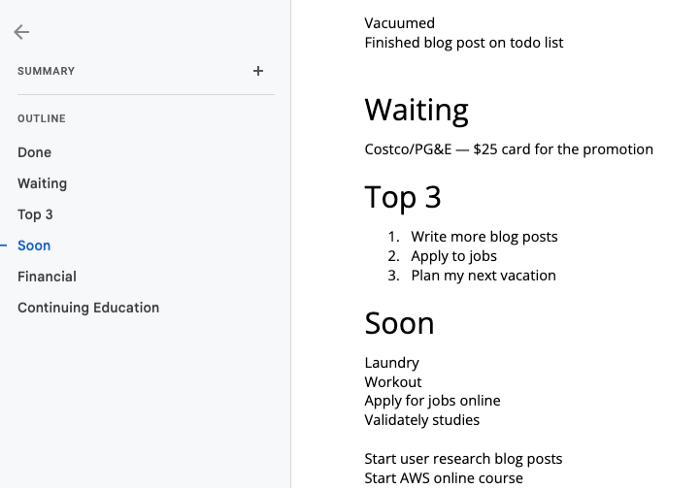

DWTS: How to Organize Your To-Do List Quickly

Don't overcomplicate to-do lists. DWTS (Done, Waiting, Top 3, Soon) organizes your to-dos.

How Are You Going to Manage Everything?

Modern America is busy. Work involves meetings. Anytime, Slack communications arrive. Many software solutions offer a @-mention notification capability. Emails.

Work obligations continue. At home, there are friends, family, bills, chores, and fun things.

How are you going to keep track of it all? Enter the todo list. It’s been around forever. It’s likely to stay forever in some way, shape, or form.

Everybody has their own system. You probably modified something from middle school. Post-its? Maybe it’s an app? Maybe both, another system, or none.

I suggest a format that has worked for me in 15 years of professional and personal life.

Try it out and see if it works for you. If not, no worries. You do you! Hopefully though you can learn a thing or two, and I from you too.

It is merely a Google Doc, yes.

It's a giant list. One task per line. Indent subtasks on a new line. Add or move new tasks as needed.

I recommend using Google Docs. It's easy to use and flexible for structuring.

Prioritizing these tasks is key. I organize them using DWTS (Done, Waiting, Top 3, Soon). Chronologically is good because it implicitly provides both a priority (high, medium, low) and an ETA (now, soon, later).

Yes, I recognize the similarities to DWTS (Dancing With The Stars) TV Show. Although I'm not a fan, it's entertaining. The acronym is easy to remember and adds fun to something dull.

What each section contains

Done

All tasks' endpoint. Finish here. Don't worry about it again.

Waiting

You're blocked and can't continue. Blocked tasks usually need someone. Write Person Task so you know who's waiting.

Blocking tasks shouldn't last long. After a while, remind them kindly. If people don't help you out of kindness, they will if you're persistent.

Top 3

Mental focus areas. These can be short- to mid-term goals or recent accomplishments. 2 to 5 is a good number to stay focused.

Top 3 reminds us to prioritize. If they don't fit your Top 3 goals, delay them.

Every 1:1 at work is a project update. Another chance to list your top 3. You should know your Top 3 well and be able to discuss them confidently.

Soon

Here's your short-term to-do list. Rank them from highest to lowest.

I usually subdivide it with empty lines. First is what I have to do today, then week, then month. Subsections can be arranged however you like.

Inventories by Concept

Tasks that aren’t in your short or medium future go into the backlog.

Eventually you’ll complete these tasks, assign them to someone else, or mark them as “wont’ do” (like done but in another sense).

Backlog tasks don't need to be organized chronologically because their timing and priority may change. Theme-organize them. When planning/strategic, you can choose themes to focus on, so future top 3 topics.

More Tips on Todos

Decide Upon a Morning Goal

Morning routines are universal. Coffee and Wordle. My to-do list is next. Two things:

As needed, update the to-do list: based on the events of yesterday and any fresh priorities.

Pick a few jobs to complete today: Pick a few goals that you know you can complete today. Push the remainder below and move them to the top of the Soon section. I typically select a few tasks I am confident I can complete along with one stretch task that might extend into tomorrow.

Finally. By setting and achieving small goals every day, you feel accomplished and make steady progress on medium and long-term goals.

Tech companies call this a daily standup. Everyone shares what they did yesterday, what they're doing today, and any blockers. The name comes from a tradition of holding meetings while standing up to keep them short. Even though it's virtual, everyone still wants a quick meeting.

Your team may or may not need daily standups. Make a daily review a habit with your coffee.

Review Backwards & Forwards on a regular basis

While you're updating your to-do list daily, take time to review it.

Review your Done list. Remember things you're proud of and things that could have gone better. Your Done list can be long. Archive it so your main to-do list isn't overwhelming.

Future-gaze. What you considered important may no longer be. Reorder tasks. Backlog grooming is a workplace term.

Backwards-and-forwards reviews aren't required often. Every 3-6 months is fine. They help you see the forest as often as the trees.

Final Remarks

Keep your list simple. Done, Waiting, Top 3, Soon. These are the necessary sections. If you like, add more subsections; otherwise, keep it simple.

I recommend a morning review. By having clear goals and an action-oriented attitude, you'll be successful.

Ezra Reguerra

3 years ago

Yuga Labs’ Otherdeeds NFT mint triggers backlash from community

Unhappy community members accuse Yuga Labs of fraud, manipulation, and favoritism over Otherdeeds NFT mint.

Following the Otherdeeds NFT mint, disgruntled community members took to Twitter to criticize Yuga Labs' handling of the event.

Otherdeeds NFTs were a huge hit with the community, selling out almost instantly. Due to high demand, the launch increased Ethereum gas fees from 2.6 ETH to 5 ETH.

But the event displeased many people. Several users speculated that the mint was “planned to fail” so the group could advertise launching its own blockchain, as the team mentioned a chain migration in one tweet.

Others like Mark Beylin tweeted that he had "sold out" on all Ape-related NFT investments after Yuga Labs "revealed their true colors." Beylin also advised others to assume Yuga Labs' owners are “bad actors.”

Some users who failed to complete transactions claim they lost ETH. However, Yuga Labs promised to refund lost gas fees.

CryptoFinally, a Twitter user, claimed Yuga Labs gave BAYC members better land than non-members. Others who wanted to participate paid for shittier land, while BAYCS got the only worthwhile land.

The Otherdeed NFT drop also increased Ethereum's burn rate. Glassnode and Data Always reported nearly 70,000 ETH burned on mint day.