More on NFTs & Art

shivsak

3 years ago

A visual exploration of the REAL use cases for NFTs in the Future

In this essay, I studied REAL NFT use examples and their potential uses.

Knowledge of the Hype Cycle

Gartner's Hype Cycle.

It proposes 5 phases for disruptive technology.

1. Technology Trigger: the emergence of potentially disruptive technology.

2. Peak of Inflated Expectations: Early publicity creates hype. (Ex: 2021 Bubble)

3. Trough of Disillusionment: Early projects fail to deliver on promises and the public loses interest. I suspect NFTs are somewhere around this trough of disillusionment now.

4. Enlightenment slope: The tech shows successful use cases.

5. Plateau of Productivity: Mainstream adoption has arrived and broader market applications have proven themselves. Here’s a more detailed visual of the Gartner Hype Cycle from Wikipedia.

In the speculative NFT bubble of 2021, @beeple sold Everydays: the First 5000 Days for $69 MILLION in 2021's NFT bubble.

@nbatopshot sold millions in video collectibles.

This is when expectations peaked.

Let's examine NFTs' real-world applications.

Watch this video if you're unfamiliar with NFTs.

Online Art

Most people think NFTs are rich people buying worthless JPEGs and MP4s.

Digital artwork and collectibles are revolutionary for creators and enthusiasts.

NFT Profile Pictures

You might also have seen NFT profile pictures on Twitter.

My profile picture is an NFT I coined with @skogards factoria app, which helps me avoid bogus accounts.

Profile pictures are a good beginning point because they're unique and clearly yours.

NFTs are a way to represent proof-of-ownership. It’s easier to prove ownership of digital assets than physical assets, which is why artwork and pfps are the first use cases.

They can do much more.

NFTs can represent anything with a unique owner and digital ownership certificate. Domains and usernames.

Usernames & Domains

@unstoppableweb, @ensdomains, @rarible sell NFT domains.

NFT domains are transferable, which is a benefit.

Godaddy and other web2 providers have difficult-to-transfer domains. Domains are often leased instead of purchased.

Tickets

NFTs can also represent concert tickets and event passes.

There's a limited number, and entry requires proof.

NFTs can eliminate the problem of forgery and make it easy to verify authenticity and ownership.

NFT tickets can be traded on the secondary market, which allows for:

marketplaces that are uniform and offer the seller and buyer security (currently, tickets are traded on inefficient markets like FB & craigslist)

unbiased pricing

Payment of royalties to the creator

4. Historical ticket ownership data implies performers can airdrop future passes, discounts, etc.

5. NFT passes can be a fandom badge.

The $30B+ online tickets business is increasing fast.

NFT-based ticketing projects:

Gaming Assets

NFTs also help in-game assets.

Imagine someone spending five years collecting a rare in-game blade, then outgrowing or quitting the game. Gamers value that collectible.

The gaming industry is expected to make $200 BILLION in revenue this year, a significant portion of which comes from in-game purchases.

Royalties on secondary market trading of gaming assets encourage gaming businesses to develop NFT-based ecosystems.

Digital assets are the start. On-chain NFTs can represent real-world assets effectively.

Real estate has a unique owner and requires ownership confirmation.

Real Estate

Tokenizing property has many benefits.

1. Can be fractionalized to increase access, liquidity

2. Can be collateralized to increase capital efficiency and access to loans backed by an on-chain asset

3. Allows investors to diversify or make bets on specific neighborhoods, towns or cities +++

I've written about this thought exercise before.

I made an animated video explaining this.

We've just explored NFTs for transferable assets. But what about non-transferrable NFTs?

SBTs are Soul-Bound Tokens. Vitalik Buterin (Ethereum co-founder) blogged about this.

NFTs are basically verifiable digital certificates.

Diplomas & Degrees

That fits Degrees & Diplomas. These shouldn't be marketable, thus they can be non-transferable SBTs.

Anyone can verify the legitimacy of on-chain credentials, degrees, abilities, and achievements.

The same goes for other awards.

For example, LinkedIn could give you a verified checkmark for your degree or skills.

Authenticity Protection

NFTs can also safeguard against counterfeiting.

Counterfeiting is the largest criminal enterprise in the world, estimated to be $2 TRILLION a year and growing.

Anti-counterfeit tech is valuable.

This is one of @ORIGYNTech's projects.

Identity

Identity theft/verification is another real-world problem NFTs can handle.

In the US, 15 million+ citizens face identity theft every year, suffering damages of over $50 billion a year.

This isn't surprising considering all you need for US identity theft is a 9-digit number handed around in emails, documents, on the phone, etc.

Identity NFTs can fix this.

NFTs are one-of-a-kind and unforgeable.

NFTs offer a universal standard.

NFTs are simple to verify.

SBTs, or non-transferrable NFTs, are tied to a particular wallet.

In the event of wallet loss or theft, NFTs may be revoked.

This could be one of the biggest use cases for NFTs.

Imagine a global identity standard that is standardized across countries, cannot be forged or stolen, is digital, easy to verify, and protects your private details.

Since your identity is more than your government ID, you may have many NFTs.

@0xPolygon and @civickey are developing on-chain identity.

Memberships

NFTs can authenticate digital and physical memberships.

Voting

NFT IDs can verify votes.

If you remember 2020, you'll know why this is an issue.

Online voting's ease can boost turnout.

Informational property

NFTs can protect IP.

This can earn creators royalties.

NFTs have 2 important properties:

Verifiability IP ownership is unambiguously stated and publicly verified.

Platforms that enable authors to receive royalties on their IP can enter the market thanks to standardization.

Content Rights

Monetization without copyrighting = more opportunities for everyone.

This works well with the music.

Spotify and Apple Music pay creators very little.

Crowdfunding

Creators can crowdfund with NFTs.

NFTs can represent future royalties for investors.

This is particularly useful for fields where people who are not in the top 1% can’t make money. (Example: Professional sports players)

Mirror.xyz allows blog-based crowdfunding.

Financial NFTs

This introduces Financial NFTs (fNFTs). Unique financial contracts abound.

Examples:

a person's collection of assets (unique portfolio)

A loan contract that has been partially repaid with a lender

temporal tokens (ex: veCRV)

Legal Agreements

Not just financial contracts.

NFT can represent any legal contract or document.

Messages & Emails

What about other agreements? Verbal agreements through emails and messages are likewise unique, but they're easily lost and fabricated.

Health Records

Medical records or prescriptions are another types of documentation that has to be verified but isn't.

Medical NFT examples:

Immunization records

Covid test outcomes

Prescriptions

health issues that may affect one's identity

Observations made via health sensors

Existing systems of proof by paper / PDF have photoshop-risk.

I tried to include most use scenarios, but this is just the beginning.

NFTs have many innovative uses.

For example: @ShaanVP minted an NFT called “5 Minutes of Fame” 👇

Here are 2 Twitter threads about NFTs:

This piece of gold by @chriscantino

2. This conversation between @punk6529 and @RaoulGMI on @RealVision“The World According to @punk6529”

If you're wondering why NFTs are better than web2 databases for these use scenarios, see this Twitter thread I wrote:

If you liked this, please share it.

Yogita Khatri

3 years ago

Moonbirds NFT sells for $1 million in first week

On Saturday, Moonbird #2642, one of the collection's rarest NFTs, sold for a record 350 ETH (over $1 million) on OpenSea.

The Sandbox, a blockchain-based gaming company based in Hong Kong, bought the piece. The seller, "oscuranft" on OpenSea, made around $600,000 after buying the NFT for 100 ETH a week ago.

Owl avatars

Moonbirds is a 10,000 owl NFT collection. It is one of the quickest collections to achieve bluechip status. Proof, a media startup founded by renowned VC Kevin Rose, launched Moonbirds on April 16.

Rose is currently a partner at True Ventures, a technology-focused VC firm. He was a Google Ventures general partner and has 1.5 million Twitter followers.

Rose has an NFT podcast on Proof. It follows Proof Collective, a group of 1,000 NFT collectors and artists, including Beeple, who hold a Proof Collective NFT and receive special benefits.

These include early access to the Proof podcast and in-person events.

According to the Moonbirds website, they are "the official Proof PFP" (picture for proof).

Moonbirds NFTs sold nearly $360 million in just over a week, according to The Block Research and Dune Analytics. Its top ten sales range from $397,000 to $1 million.

In the current market, Moonbirds are worth 33.3 ETH. Each NFT is 2.5 ETH. Holders have gained over 12 times in just over a week.

Why was it so popular?

The Block Research's NFT analyst, Thomas Bialek, attributes Moonbirds' rapid rise to Rose's backing, the success of his previous Proof Collective project, and collectors' preference for proven NFT projects.

Proof Collective NFT holders have made huge gains. These NFTs were sold in a Dutch auction last December for 5 ETH each. According to OpenSea, the current floor price is 109 ETH.

According to The Block Research, citing Dune Analytics, Proof Collective NFTs have sold over $39 million to date.

Rose has bigger plans for Moonbirds. Moonbirds is introducing "nesting," a non-custodial way for holders to stake NFTs and earn rewards.

Holders of NFTs can earn different levels of status based on how long they keep their NFTs locked up.

"As you achieve different nest status levels, we can offer you different benefits," he said. "We'll have in-person meetups and events, as well as some crazy airdrops planned."

Rose went on to say that Proof is just the start of "a multi-decade journey to build a new media company."

Jennifer Tieu

3 years ago

Why I Love Azuki

Azuki Banner (www.azuki.com)

Disclaimer: This is my personal viewpoint. I'm not on the Azuki team. Please keep in mind that I am merely a fan, community member, and holder. Please do your own research and pardon my grammar. Thanks!

Azuki has changed my view of NFTs.

When I first entered the NFT world, I had no idea what to expect. I liked the idea. So I invested in some projects, fought for whitelists, and discovered some cool NFTs projects (shout-out to CATC). I lost more money than I earned at one point, but I hadn't invested excessively (only put in what you can afford to lose). Despite my losses, I kept looking. I almost waited for the “ah-ha” moment. A NFT project that changed my perspective on NFTs. What makes an NFT project more than a work of art?

Answer: Azuki.

The Art

The Azuki art drew me in as an anime fan. It looked like something out of an anime, and I'd never seen it before in NFT.

The project was still new. The first two animated teasers were released with little fanfare, but I was impressed with their quality. You can find them on Instagram or in their earlier Tweets.

The teasers hinted that this project could be big and that the team could deliver. It was amazing to see Shao cut the Azuki posters with her katana. Especially at the end when she sheaths her sword and the music cues. Then the live action video of the young boy arranging the Azuki posters seemed movie-like. I felt like I was entering the Azuki story, brand, and dope theme.

The team did not disappoint with the Azuki NFTs. The level of detail in the art is stunning. There were Azukis of all genders, skin and hair types, and more. These 10,000 Azukis have so much representation that almost anyone can find something that resonates. Rather than me rambling on, I suggest you visit the Azuki gallery

The Team

If the art is meant to draw you in and be the project's face, the team makes it more. The NFT would be a JPEG without a good team leader. Not that community isn't important, but no community would rally around a bad team.

Because I've been rugged before, I'm very focused on the team when considering a project. While many project teams are anonymous, I try to find ones that are doxxed (public) or at least appear to be established. Unlike Azuki, where most of the Azuki team is anonymous, Steamboy is public. He is (or was) Overwatch's character art director and co-creator of Azuki. I felt reassured and could trust the project after seeing someone from a major game series on the team.

Then I tried to learn as much as I could about the team. Following everyone on Twitter, reading their tweets, and listening to recorded AMAs. I was impressed by the team's professionalism and dedication to their vision for Azuki, led by ZZZAGABOND.

I believe the phrase “actions speak louder than words” applies to Azuki. I can think of a few examples of what the Azuki team has done, but my favorite is ERC721A.

With ERC721A, Azuki has created a new algorithm that allows minting multiple NFTs for essentially the same cost as minting one NFT.

I was ecstatic when the dev team announced it. This fascinates me as a self-taught developer. Azuki released a product that saves people money, improves the NFT space, and is open source. It showed their love for Azuki and the NFT community.

The Community

Community, community, community. It's almost a chant in the NFT space now. A community, like a team, can make or break a project. We are the project's consumers, shareholders, core, and lifeblood. The team builds the house, and we fill it. We stay for the community.

When I first entered the Azuki Discord, I was surprised by the calm atmosphere. There was no news about the project. No release date, no whitelisting requirements. No grinding or spamming either. People just wanted to hangout, get to know each other, and talk. It was nice. So the team could pick genuine people for their mintlist (aka whitelist).

But nothing fundamental has changed since the release. It has remained an authentic, fun, and helpful community. I'm constantly logging into Discord to chat with others or follow conversations. I see the community's openness to newcomers. Everyone respects each other (barring a few bad apples) and the variety of people passing through is fascinating. This human connection and interaction is what I enjoy about this place. Being a part of a group that supports a cause.

Finally, I want to thank the amazing Azuki mod team and the kissaten channel for their contributions.

The Brand

So, what sets Azuki apart from other projects? They are shaping a brand or identity. The Azuki website, I believe, best captures their vision. (This is me gushing over the site.)

If you go to the website, turn on the dope playlist in the bottom left. The playlist features a mix of Asian and non-Asian hip-hop and rap artists, with some lo-fi thrown in. The songs on the playlist change, but I think you get the vibe Azuki embodies just by turning on the music.

The Garden is our next stop where we are introduced to Azuki.

A brand.

We're creating a new brand together.

A metaverse brand. By the people.

A collection of 10,000 avatars that grant Garden membership. It starts with exclusive streetwear collabs, NFT drops, live events, and more. Azuki allows for a new media genre that the world has yet to discover. Let's build together an Azuki, your metaverse identity.

The Garden is a magical internet corner where art, community, and culture collide. The boundaries between the physical and digital worlds are blurring.

Try a Red Bean.

The text begins with Azuki's intention in the space. It's a community-made metaverse brand. Then it goes into more detail about Azuki's plans. Initiation of a story or journey. "Would you like to take the red bean and jump down the rabbit hole with us?" I love the Matrix red pill or blue pill play they used. (Azuki in Japanese means red bean.)

Morpheus, the rebel leader, offers Neo the choice of a red or blue pill in The Matrix. “You take the blue pill... After the story, you go back to bed and believe whatever you want. Your red pill... Let me show you how deep the rabbit hole goes.” Aware that the red pill will free him from the enslaving control of the machine-generated dream world and allow him to escape into the real world, he takes it. However, living the “truth of reality” is harsher and more difficult.

It's intriguing and draws you in. Taking the red bean causes what? Where am I going? I think they did well in piqueing a newcomer's interest.

Not convinced by the Garden? Read the Manifesto. It reinforces Azuki's role.

Here comes a new wave…

And surfing here is different.

Breaking down barriers.

Building open communities.

Creating magic internet money with our friends.

To those who don’t get it, we tell them: gm.

They’ll come around eventually.

Here’s to the ones with the courage to jump down a peculiar rabbit hole.

One that pulls you away from a world that’s created by many and owned by few…

To a world that’s created by more and owned by all.

From The Garden come the human beans that sprout into your family.

We rise together.

We build together.

We grow together.

Ready to take the red bean?

Not to mention the Mindmap, it sets Azuki apart from other projects and overused Roadmaps. I like how the team recognizes that the NFT space is not linear. So many of us are still trying to figure it out. It is Azuki's vision to adapt to changing environments while maintaining their values. I admire their commitment to long-term growth.

Conclusion

To be honest, I have no idea what the future holds. Azuki is still new and could fail. But I'm a long-term Azuki fan. I don't care about quick gains. The future looks bright for Azuki. I believe in the team's output. I love being an Azuki.

Thank you! IKUZO!

Full post here

You might also like

Nabil Alouani

3 years ago

Why Cryptocurrency Is Not Dead Despite the FTX Scam

A fraud, free-market, antifragility tale

Crypto's only rival is public opinion.

In less than a week, mainstream media, bloggers, and TikTokers turned on FTX's founder.

While some were surprised, almost everyone with a keyboard and a Twitter account predicted the FTX collapse. These financial oracles should have warned the 1.2 million people Sam Bankman-Fried duped.

After happening, unexpected events seem obvious to our brains. It's a bug and a feature because it helps us cope with disasters and makes our reasoning suck.

Nobody predicted the FTX debacle. Bloomberg? Politicians. Non-famous. No cryptologists. Who?

When FTX imploded, taking billions of dollars with it, an outrage bomb went off, and the resulting shockwave threatens the crypto market's existence.

As someone who lost more than $78,000 in a crypto scam in 2020, I can only understand people’s reactions. When the dust settles and rationality returns, we'll realize this is a natural occurrence in every free market.

What specifically occurred with FTX? (Skip if you are aware.)

FTX is a cryptocurrency exchange where customers can trade with cash. It reached #3 in less than two years as the fastest-growing platform of its kind.

FTX's performance helped make SBF the crypto poster boy. Other reasons include his altruistic public image, his support for the Democrats, and his company Alameda Research.

Alameda Research made a fortune arbitraging Bitcoin.

Arbitrage trading uses small price differences between two markets to make money. Bitcoin costs $20k in Japan and $21k in the US. Alameda Research did that for months, making $1 million per day.

Later, as its capital grew, Alameda expanded its trading activities and began investing in other companies.

Let's now discuss FTX.

SBF's diabolic master plan began when he used FTX-created FTT coins to inflate his trading company's balance sheets. He used inflated Alameda numbers to secure bank loans.

SBF used money he printed himself as collateral to borrow billions for capital. Coindesk exposed him in a report.

One of FTX's early investors tweeted that he planned to sell his FTT coins over the next few months. This would be a minor event if the investor wasn't Binance CEO Changpeng Zhao (CZ).

The crypto space saw a red WARNING sign when CZ cut ties with FTX. Everyone with an FTX account and a brain withdrew money. Two events followed. FTT fell from $20 to $4 in less than 72 hours, and FTX couldn't meet withdrawal requests, spreading panic.

SBF reassured FTX users on Twitter. Good assets.

He lied.

SBF falsely claimed FTX had a liquidity crunch. At the time of his initial claims, FTX owed about $8 billion to its customers. Liquidity shortages are usually minor. To get cash, sell assets. In the case of FTX, the main asset was printed FTT coins.

Sam wouldn't get out of trouble even if he slashed the discount (from $20 to $4) and sold every FTT. He'd flood the crypto market with his homemade coins, causing the price to crash.

SBF was trapped. He approached Binance about a buyout, which seemed good until Binance looked at FTX's books.

Binance's tweet ended SBF, and he had to apologize, resign as CEO, and file for bankruptcy.

Bloomberg estimated Sam's net worth to be zero by the end of that week. 0!

But that's not all. Twitter investigations exposed fraud at FTX and Alameda Research. SBF used customer funds to trade and invest in other companies.

Thanks to the Twitter indie reporters who made the mainstream press look amateurish. Some Twitter detectives didn't sleep for 30 hours to find answers. Others added to existing threads. Memes were hilarious.

One question kept repeating in my bald head as I watched the Blue Bird. Sam, WTF?

Then I understood.

SBF wanted that FTX becomes a bank.

Think about this. FTX seems healthy a few weeks ago. You buy 2 bitcoins using FTX. You'd expect the platform to take your dollars and debit your wallet, right?

No. They give I-Owe-Yous.

FTX records owing you 2 bitcoins in its internal ledger but doesn't credit your account. Given SBF's tricks, I'd bet on nothing.

What happens if they don't credit my account with 2 bitcoins? Your money goes into FTX's capital, where SBF and his friends invest in marketing, political endorsements, and buying other companies.

Over its two-year existence, FTX invested in 130 companies. Once they make a profit on their purchases, they'll pay you and keep the rest.

One detail makes their strategy dumb. If all FTX customers withdraw at once, everything collapses.

Financially savvy people think FTX's collapse resembles a bank run, and they're right. SBF designed FTX to operate like a bank.

You expect your bank to open a drawer with your name and put $1,000 in it when you deposit $1,000. They deposit $100 in your drawer and create an I-Owe-You for $900. What happens to $900?

Let's sum it up: It's boring and headache-inducing.

When you deposit money in a bank, they can keep 10% and lend the rest. Fractional Reserve Banking is a popular method. Fractional reserves operate within and across banks.

Fractional reserve banking generates $10,000 for every $1,000 deposited. People will pay off their debt plus interest.

As long as banks work together and the economy grows, their model works well.

SBF tried to replicate the system but forgot two details. First, traditional banks need verifiable collateral like real estate, jewelry, art, stocks, and bonds, not digital coupons. Traditional banks developed a liquidity buffer. The Federal Reserve (or Central Bank) injects massive cash into troubled banks.

Massive cash injections come from taxpayers. You and I pay for bankers' mistakes and annual bonuses. Yes, you may think banking is rigged. It's rigged, but it's the best financial game in 150 years. We accept its flaws, including bailouts for too-big-to-fail companies.

Anyway.

SBF wanted Binance's bailout. Binance said no, which was good for the crypto market.

Free markets are resilient.

Nassim Nicholas Taleb coined the term antifragility.

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.”

The easiest way to understand how antifragile systems behave is to compare them with other types of systems.

Glass is like a fragile system. It snaps when shocked.

Similar to rubber, a resilient system. After a stressful episode, it bounces back.

A system that is antifragile is similar to a muscle. As it is torn in the gym, it gets stronger.

Time-changed things are antifragile. Culture, tech innovation, restaurants, revolutions, book sales, cuisine, economic success, and even muscle shape. These systems benefit from shocks and randomness in different ways, but they all pay a price for antifragility.

Same goes for the free market and financial institutions. Taleb's book uses restaurants as an example and ends with a reference to the 2008 crash.

“Restaurants are fragile. They compete with each other. But the collective of local restaurants is antifragile for that very reason. Had restaurants been individually robust, hence immortal, the overall business would be either stagnant or weak and would deliver nothing better than cafeteria food — and I mean Soviet-style cafeteria food. Further, it [the overall business] would be marred with systemic shortages, with once in a while a complete crisis and government bailout.”

Imagine the same thing with banks.

Independent banks would compete to offer the best services. If one of these banks fails, it will disappear. Customers and investors will suffer, but the market will recover from the dead banks' mistakes.

This idea underpins a free market. Bitcoin and other cryptocurrencies say this when criticizing traditional banking.

The traditional banking system's components never die. When a bank fails, the Federal Reserve steps in with a big taxpayer-funded check. This hinders bank evolution. If you don't let banking cells die and be replaced, your financial system won't be antifragile.

The interdependence of banks (centralization) means that one bank's mistake can sink the entire fleet, which brings us to SBF's ultimate travesty with FTX.

FTX has left the cryptocurrency gene pool.

FTX should be decentralized and independent. The super-star scammer invested in more than 130 crypto companies and linked them, creating a fragile banking-like structure. FTX seemed to say, "We exist because centralized banks are bad." But we'll be good, unlike the centralized banking system.

FTX saved several companies, including BlockFi and Voyager Digital.

FTX wanted to be a crypto bank conglomerate and Federal Reserve. SBF wanted to monopolize crypto markets. FTX wanted to be in bed with as many powerful people as possible, so SBF seduced politicians and celebrities.

Worst? People who saw SBF's plan flaws praised him. Experts, newspapers, and crypto fans praised FTX. When billions pour in, it's hard to realize FTX was acting against its nature.

Then, they act shocked when they realize FTX's fall triggered a domino effect. Some say the damage could wipe out the crypto market, but that's wrong.

Cell death is different from body death.

FTX is out of the game despite its size. Unfit, it fell victim to market natural selection.

Next?

The challengers keep coming. The crypto economy will improve with each failure.

Free markets are antifragile because their fragile parts compete, fostering evolution. With constructive feedback, evolution benefits customers and investors.

FTX shows that customers don't like being scammed, so the crypto market's health depends on them. Charlatans and con artists are eliminated quickly or slowly.

Crypto isn't immune to collapse. Cryptocurrencies can go extinct like biological species. Antifragility isn't immortality. A few more decades of evolution may be enough for humans to figure out how to best handle money, whether it's bitcoin, traditional banking, gold, or something else.

Keep your BS detector on. Start by being skeptical of this article's finance-related claims. Even if you think you understand finance, join the conversation.

We build a better future through dialogue. So listen, ask, and share. When you think you can't find common ground with the opposing view, remember:

Sam Bankman-Fried lied.

Josh Chesler

3 years ago

10 Sneaker Terms Every Beginner Should Know

So you want to get into sneakers? Buying a few sneakers and figuring it out seems simple. Then you miss out on the weekend's instant-sellout releases, so you head to eBay, Twitter, or your local sneaker group to see what's available, since you're probably not ready to pay Flight Club prices just yet.

That's when you're bombarded with new nicknames, abbreviations, and general sneaker slang. It would take months to explain every word and sneaker, so here's a starter kit of ten simple terms to get you started. (Yeah, mostly Jordan. Does anyone really start with Kith or Nike SB?)

10. Colorways

Colorways are a common term in fashion, design, and other visual fields. It's just the product's color scheme. In the case of sneakers, the colorway is often as important as the actual model. Are this year's "Chicago" Air Jordan 1s more durable than last year's "Black/Gum" colorway? Because of their colorway and rarity, the Chicagos are worth roughly three pairs of the Black/Gum kicks.

Pro Tip: A colorway with a well-known nickname is almost always worth more than one without, and the same goes for collaborations.

9. Beaters

A “beater” is a well-worn, likely older model of shoe that has significant wear and tear on it. Rarely sold with the original box or extra laces, beaters rarely sell for much. Unlike most “worn” sneakers, beaters are used for rainy days and the gym. It's exactly what it sounds like, a box full of beaters, and they're a good place to start if you're looking for some cheap old kicks.

Pro Tip: Know which shoes clean up nicely. The shape of lower top sneakers with wider profiles, like SB Dunk Lows and Air Jordan 3s, tends to hold better over time than their higher and narrower cousins.

8. Retro

In the world of Jordan Brand, a “Retro” release is simply a release (or re-release) of a colorway after the shoe model's initial release. For example, the original Air Jordan 7 was released in 1992, but the Bordeaux colorway was re-released in 2011 and recently (2015). An Air Jordan model is released every year, and while half of them are unpopular and unlikely to be Retroed soon, any of them could be re-released whenever Nike and Jordan felt like it.

Pro Tip: Now that the Air Jordan line has been around for so long, the model that tends to be heavily retroed in a year is whichever shoe came out 23 (Michael Jordan’s number during the prime of his career) years ago. The Air Jordan 6 (1991) got new colorways last year, the Air Jordan 7 this year, and more Air Jordan 8s will be released later this year and early next year (1993).

7. PP/Inv

In spite of the fact that eBay takes roughly 10% of the final price, many sneaker buyers and sellers prefer to work directly with PayPal. Selling sneakers for $100 via PayPal invoice or $100 via PayPal friends/family is common on social media. Because no one wants their eBay account suspended for promoting PayPal deals, many eBay sellers will simply state “Message me for a better price.”

Pro Tip: PayPal invoices protect buyers well, but gifting or using Google Wallet does not. Unless you're certain the seller is legitimate, only use invoiced goods/services payments.

6. Yeezy

Kanye West and his sneakers are known as Yeezys. The rapper's first two Yeezys were made by Nike before switching to Adidas. Everything Yeezy-related will be significantly more expensive (and therefore have significantly more fakes made). Not only is the Nike Air Yeezy 2 “Red October” one of the most sought-after sneakers, but the Yeezy influence can be seen everywhere.

Pro Tip: If you're going to buy Yeezys, make sure you buy them from a reputable retailer or reseller. With so many fakes out there, it's not worth spending a grand on something you're not 100% sure is real.

5. GR/Limited

Regardless of how visually repulsive, uncomfortable, and/or impractical a sneaker is, if it’s rare enough, people will still want it. GR stands for General Release, which means they're usually available at retail. Reselling a “Limited Edition” release is costly. Supply and demand, but in this case, the limited supply drives up demand. If you want to get some of the colorways made for rappers, NBA players (Player Exclusive or PE models), and other celebrities, be prepared to pay a premium.

Pro Tip: Limited edition sneakers, like the annual Doernbecher Freestyle sneakers Nike creates with kids from Portland's Doernbecher Children's Hospital, will always be more expensive and limited. Or, you can use automated sneaker-buying software.

4. Grails

A “grail” is a pair of sneakers that someone desires above all others. To obtain their personal grails, people are willing to pay significantly more than the retail price. There doesn't have to be any rhyme or reason why someone chose a specific pair as their grails.

Pro Tip: For those who don't have them, the OG "Bred" or "Royal" Air Jordan 1s, the "Concord" Air Jordan 11s, etc., are all grails.

3. Bred

Anything released in “Bred” (black and red) will sell out quickly. Most resale Air Jordans (and other sneakers) come in the Bred colorway, which is a fan favorite. Bred is a good choice for a first colorway, especially on a solid sneaker silhouette.

Pro Tip: Apart from satisfying the world's hypebeasts, Bred sneakers will probably match a lot of your closet.

2. DS

DS = Deadstock = New. That's it. If something has been worn or tried on, it is no longer DS. Very Near Deadstock (VNDS) Pass As Deadstock It's a cute way of saying your sneakers have been worn but are still in good shape. In the sneaker world, “worn” means they are no longer new, but not too old or beat up.

Pro Tip: Ask for photos of any marks or defects to see what you’re getting before you buy used shoes, also find out if they come with the original box and extra laces, because that can be a sign that they’re in better shape.

1. Fake/Unauthorized

The words “Unauthorized,” “Replica,” “B-grades,” and “Super Perfect” all mean the shoes are fake. It means they aren't made by the actual company, no matter how close or how good the quality. If that's what you want, go ahead and get them. Do not wear them if you do not want the rest of the sneaker world to mock them.

Pro Tip: If you’re not sure if shoes are real or not, do a “Legit Check” on Twitter or Facebook. You'll get dozens of responses in no time.

Isaiah McCall

3 years ago

Is TikTok slowly destroying a new generation?

It's kids' digital crack

TikTok is a destructive social media platform.

The interface shortens attention spans and dopamine receptors.

TikTok shares more data than other apps.

Seeing an endless stream of dancing teens on my glowing box makes me feel like a Blade Runner extra.

TikTok did in one year what MTV, Hollywood, and Warner Music tried to do in 20 years. TikTok has psychotized the two-thirds of society Aldous Huxley said were hypnotizable.

Millions of people, mostly kids, are addicted to learning a new dance, lip-sync, or prank, and those who best dramatize this collective improvisation get likes, comments, and shares.

TikTok is a great app. So what?

The Commercial Magnifying Glass TikTok made me realize my generation's time was up and the teenage Zoomers were the target.

I told my 14-year-old sister, "Enjoy your time under the commercial magnifying glass."

TikTok sells your every move, gesture, and thought. Data is the new oil. If you tell someone, they'll say, "Yeah, they collect data, but who cares? I have nothing to hide."

It's a George Orwell novel's beginning. Look up Big Brother Award winners to see if TikTok won.

TikTok shares your data more than any other social media app, and where it goes is unclear. TikTok uses third-party trackers to monitor your activity after you leave the app.

Consumers can't see what data is shared or how it will be used. — Genius URL

32.5 percent of Tiktok's users are 10 to 19 and 29.5% are 20 to 29.

TikTok is the greatest digital marketing opportunity in history, and they'll use it to sell you things, track you, and control your thoughts. Any of its users will tell you, "I don't care, I just want to be famous."

TikTok manufactures mental illness

TikTok's effect on dopamine and the brain is absurd. Dopamine controls the brain's pleasure and reward centers. It's like a switch that tells your brain "this feels good, repeat."

Dr. Julie Albright, a digital culture and communication sociologist, said TikTok users are "carried away by dopamine." It's hypnotic, you'll keep watching."

TikTok constantly releases dopamine. A guy on TikTok recently said he didn't like books because they were slow and boring.

The US didn't ban Tiktok.

Biden and Trump agree on bad things. Both agree that TikTok threatens national security and children's mental health.

The Chinese Communist Party owns and operates TikTok, but that's not its only problem.

There’s borderline child porn on TikTok

It's unsafe for children and violated COPPA.

It's also Chinese spyware. I'm not a Trump supporter, but I was glad he wanted TikTok regulated and disappointed when he failed.

Full-on internet censorship is rare outside of China, so banning it may be excessive. US should regulate TikTok more.

We must reject a low-quality present for a high-quality future.

TikTok vs YouTube

People got mad when I wrote about YouTube's death.

They didn't like when I said TikTok was YouTube's first real challenger.

Indeed. TikTok is the fastest-growing social network. In three years, the Chinese social media app TikTok has gained over 1 billion active users. In the first quarter of 2020, it had the most downloads of any app in a single quarter.

TikTok is the perfect social media app in many ways. It's brief and direct.

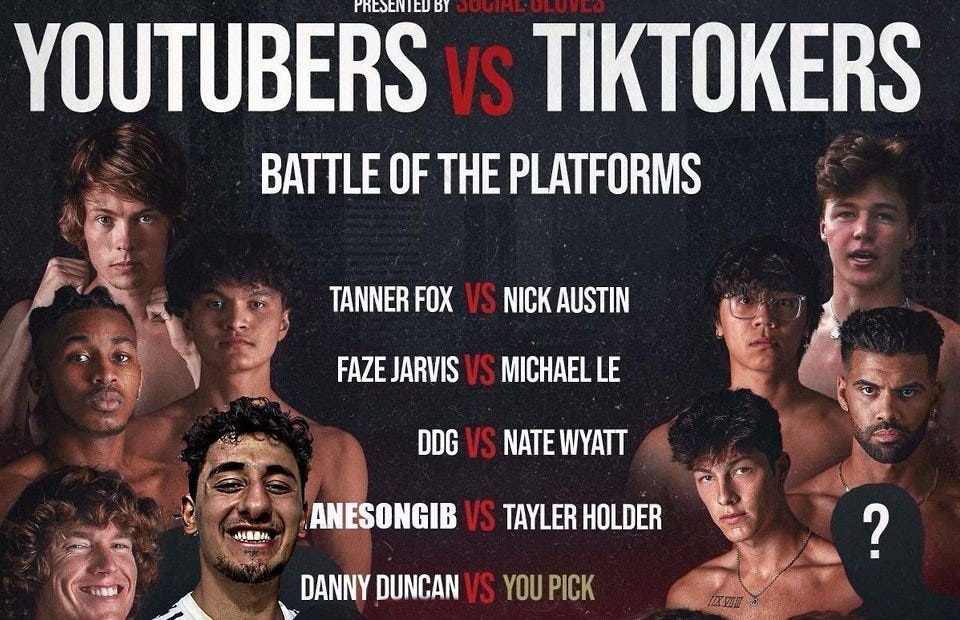

Can you believe they had a YouTube vs TikTok boxing match? We are doomed as a species.

YouTube hosts my favorite videos. That’s why I use it. That’s why you use it. New users expect more. They want something quicker, more addictive.

TikTok's impact on other social media platforms frustrates me. YouTube copied TikTok to compete.

It's all about short, addictive content.

I'll admit I'm probably wrong about TikTok. My friend says his feed is full of videos about food, cute animals, book recommendations, and hot lesbians.

Whatever.

TikTok makes us bad

TikTok is the opposite of what the Ancient Greeks believed about wisdom.

It encourages people to be fake. It's like a never-ending costume party where everyone competes.

It does not mean that Gen Z is doomed.

They could be the saviors of the world for all I know.

TikTok feels like a step towards Mike Judge's "Idiocracy," where the average person is a pleasure-seeking moron.