More on Society & Culture

Hector de Isidro

3 years ago

Why can't you speak English fluently even though you understand it?

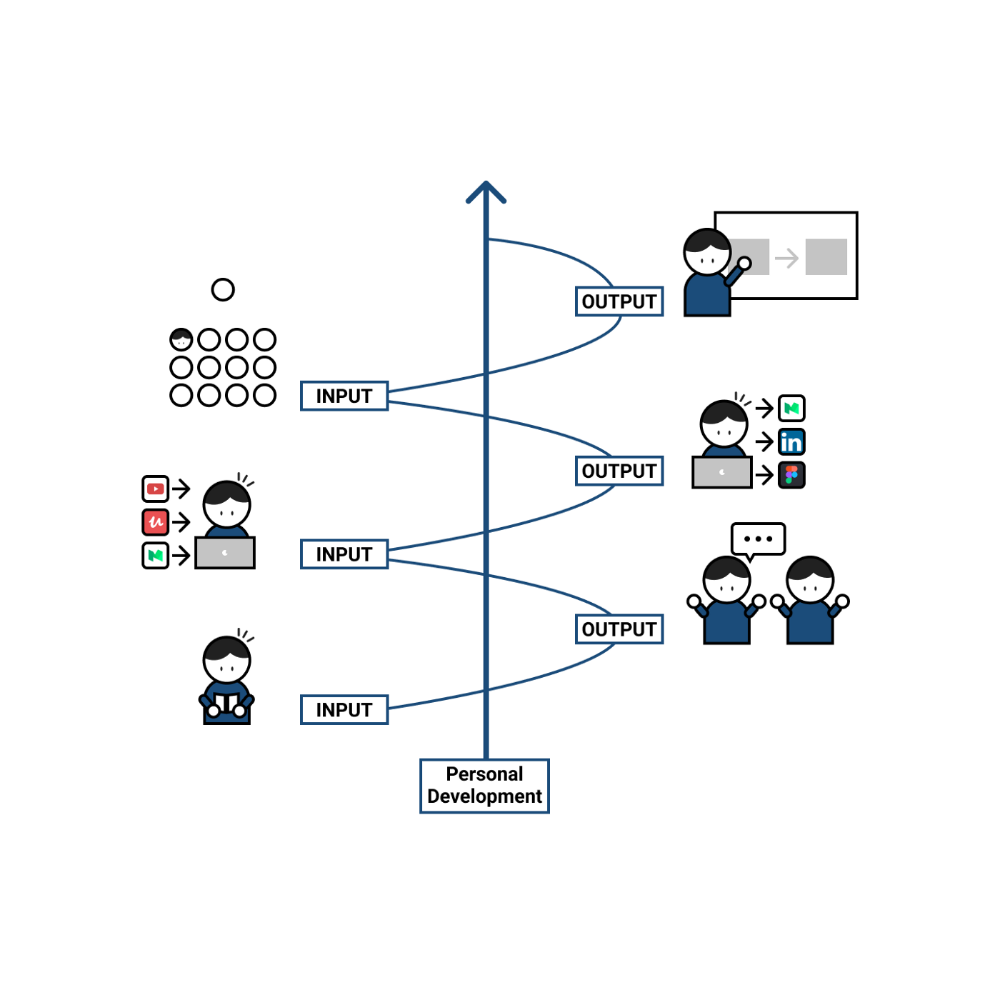

Many of us have struggled for years to master a second language (in my case, English). Because (at least in my situation) we've always used an input-based system or method.

I'll explain in detail, but briefly: We can understand some conversations or sentences (since we've trained), but we can't give sophisticated answers or speak fluently (because we have NOT trained at all).

What exactly is input-based learning?

Reading, listening, writing, and speaking are key language abilities (if you look closely at that list, it seems that people tend to order them in this way: inadvertently giving more priority to the first ones than to the last ones).

These talents fall under two learning styles:

Reading and listening are input-based activities (sometimes referred to as receptive skills or passive learning).

Writing and speaking are output-based tasks (also known as the productive skills and/or active learning).

What's the best learning style? To learn a language, we must master four interconnected skills. The difficulty is how much time and effort we give each.

According to Shion Kabasawa's books The Power of Input: How to Maximize Learning and The Power of Output: How to Change Learning to Outcome (available only in Japanese), we spend 7:3 more time on Input Based skills than Output Based skills when we should be doing the opposite, leaning more towards Output (Input: Output->3:7).

I can't tell you how he got those numbers, but I think he's not far off because, for example, think of how many people say they're learning a second language and are satisfied bragging about it by only watching TV, series, or movies in VO (and/or reading a book or whatever) their Input is: 7:0 output!

You can't be good at a sport by watching TikTok videos about it; you must play.

“being pushed to produce language puts learners in a better position to notice the ‘gaps’ in their language knowledge”, encouraging them to ‘upgrade’ their existing interlanguage system. And, as they are pushed to produce language in real time and thereby forced to automate low-level operations by incorporating them into higher-level routines, it may also contribute to the development of fluency. — Scott Thornbury (P is for Push)

How may I practice output-based learning more?

I know that listening or reading is easy and convenient because we can do it on our own in a wide range of situations, even during another activity (although, as you know, it's not ideal), writing can be tedious/boring (it's funny that we almost always excuse ourselves in the lack of ideas), and speaking requires an interlocutor. But we must leave our comfort zone and modify our thinking to go from 3:7 to 7:3. (or at least balance it better to something closer). Gradually.

“You don’t have to do a lot every day, but you have to do something. Something. Every day.” — Callie Oettinger (Do this every day)

We can practice speaking like boxers shadow box.

Speaking out loud strengthens the mind-mouth link (otherwise, you will still speak fluently in your mind but you will choke when speaking out loud). This doesn't mean we should talk to ourselves on the way to work, while strolling, or on public transportation. We should try to do it without disturbing others, such as explaining what we've heard, read, or seen (the list is endless: you can TALK about what happened yesterday, your bedtime book, stories you heard at the office, that new kitten video you saw on Instagram, an experience you had, some new fact, that new boring episode you watched on Netflix, what you ate, what you're going to do next, your upcoming vacation, what’s trending, the news of the day)

Who will correct my grammar, vocabulary, or pronunciation with an imagined friend? We can't have everything, but tools and services can help [1].

Lack of bravery

Fear of speaking a language different than one's mother tongue in front of native speakers is global. It's easier said than done, because strangers, not your friends, will always make fun of your accent or faults. Accept it and try again. Karma will prevail.

Perfectionism is a trap. Stop self-sabotaging. Communication is key (and for that you have to practice the Output too ).

“Don’t forget to have fun and enjoy the process.” — Ruri Ohama

[1] Grammarly, Deepl, Google Translate, etc.

Sam Warain

3 years ago

The Brilliant Idea Behind Kim Kardashian's New Private Equity Fund

Kim Kardashian created Skky Partners. Consumer products, internet & e-commerce, consumer media, hospitality, and luxury are company targets.

Some call this another Kardashian publicity gimmick.

This maneuver is brilliance upon closer inspection. Why?

1) Kim has amassed a sizable social media fan base:

Over 320 million Instagram and 70 million Twitter users follow Kim Kardashian.

Kim Kardashian's Instagram account ranks 8th. Three Kardashians in top 10 is ridiculous.

This gives her access to consumer data. She knows what people are discussing. Investment firms need this data.

Quality, not quantity, of her followers matters. Studies suggest that her following are more engaged than Selena Gomez and Beyonce's.

Kim's followers are worth roughly $500 million to her brand, according to a research. They trust her and buy what she recommends.

2) She has a special aptitude for identifying trends.

Kim Kardashian can sense trends.

She's always ahead of fashion and beauty trends. She's always trying new things, too. She doesn't mind making mistakes when trying anything new. Her desire to experiment makes her a good business prospector.

Kim has also created a lifestyle brand that followers love. Kim is an entrepreneur, mom, and role model, not just a reality TV star or model. She's established a brand around her appearance, so people want to buy her things.

Her fragrance collection has sold over $100 million since its 2009 introduction, and her Sears apparel line did over $200 million in its first year.

SKIMS is her latest $3.2bn brand. She can establish multibillion-dollar firms with her enormous distribution platform.

Early founders would kill for Kim Kardashian's network.

Making great products is hard, but distribution is more difficult. — David Sacks, All-in-Podcast

3) She can delegate the financial choices to Jay Sammons, one of the greatest in the industry.

Jay Sammons is well-suited to develop Kim Kardashian's new private equity fund.

Sammons has 16 years of consumer investing experience at Carlyle. This will help Kardashian invest in consumer-facing enterprises.

Sammons has invested in Supreme and Beats Electronics, both of which have grown significantly. Sammons' track record and competence make him the obvious choice.

Kim Kardashian and Jay Sammons have joined forces to create a new business endeavor. The agreement will increase Kardashian's commercial empire. Sammons can leverage one of the world's most famous celebrities.

“Together we hope to leverage our complementary expertise to build the next generation consumer and media private equity firm” — Kim Kardashian

Kim Kardashian is a successful businesswoman. She developed an empire by leveraging social media to connect with fans. By developing a global lifestyle brand, she has sold things and experiences that have made her one of the world's richest celebrities.

She's a shrewd entrepreneur who knows how to maximize on herself and her image.

Imagine how much interest Kim K will bring to private equity and venture capital.

I'm curious about the company's growth.

Enrique Dans

2 years ago

What happens when those without morals enter the economic world?

I apologize if this sounds basic, but throughout my career, I've always been clear that a company's activities are shaped by its founder(s)' morality.

I consider Palantir, owned by PayPal founder Peter Thiel, evil. He got $5 billion tax-free by hacking a statute to help middle-class savings. That may appear clever, but I think it demonstrates a shocking lack of solidarity with society. As a result of this and other things he has said and done, I early on dismissed Peter Thiel as someone who could contribute anything positive to society, and events soon proved me right: we are talking about someone who clearly considers himself above everyone else and who does not hesitate to set up a company, Palantir, to exploit the data of the little people and sell it to the highest bidder, whoever that is and whatever the consequences.

The German courts have confirmed my warnings concerning Palantir. The problem is that politicians love its surveillance tools because they think knowing more about their constituents gives them power. These are ideal for dictatorships who want to snoop on their populace. Hence, Silicon Valley's triumphalist dialectic has seduced many governments at many levels and collected massive volumes of data to hold forever.

Dangerous company. There are many more. My analysis of the moral principles that disclose company management changed my opinion of Facebook, now Meta, and anyone with a modicum of interest might deduce when that happened, a discovery that leaves you dumbfounded. TikTok was easy because its lack of morality was revealed early when I saw the videos it encouraged minors to post and the repercussions of sharing them through its content recommendation algorithm. When you see something like this, nothing can convince you that the firm can change its morals and become good. Nothing. You know the company is awful and will fail. Speak it, announce it, and change it. It's like a fingerprint—unchangeable.

Some of you who read me frequently make its Facebook today jokes when I write about these firms, and that's fine: they're my moral standards, those of an elderly professor with thirty-five years of experience studying corporations and discussing their cases in class, but you don't have to share them. Since I'm writing this and don't have to submit to any editorial review, that's what it is: when you continuously read a person, you have to assume that they have moral standards and that sometimes you'll agree with them and sometimes you won't. Morality accepts hierarchies, nuances, and even obsessions. I know not everyone shares my opinions, but at least I can voice them. One day, one of those firms may sue me (as record companies did some years ago).

Palantir is incredibly harmful. Limit its operations. Like Meta and TikTok, its business strategy is shaped by its founders' immorality. Such a procedure can never be beneficial.

You might also like

mbvissers.eth

3 years ago

Why does every smart contract seem to implement ERC165?

ERC165 (or EIP-165) is a standard utilized by various open-source smart contracts like Open Zeppelin or Aavegotchi.

What's it? You must implement? Why do we need it? I'll describe the standard and answer any queries.

What is ERC165

ERC165 detects and publishes smart contract interfaces. Meaning? It standardizes how interfaces are recognized, how to detect if they implement ERC165, and how a contract publishes the interfaces it implements. How does it work?

Why use ERC165? Sometimes it's useful to know which interfaces a contract implements, and which version.

Identifying interfaces

An interface function's selector. This verifies an ABI function. XORing all function selectors defines an interface in this standard. The following code demonstrates.

// SPDX-License-Identifier: UNLICENCED

pragma solidity >=0.8.0 <0.9.0;

interface Solidity101 {

function hello() external pure;

function world(int) external pure;

}

contract Selector {

function calculateSelector() public pure returns (bytes4) {

Solidity101 i;

return i.hello.selector ^ i.world.selector;

// Returns 0xc6be8b58

}

function getHelloSelector() public pure returns (bytes4) {

Solidity101 i;

return i.hello.selector;

// Returns 0x19ff1d21

}

function getWorldSelector() public pure returns (bytes4) {

Solidity101 i;

return i.world.selector;

// Returns 0xdf419679

}

}This code isn't necessary to understand function selectors and how an interface's selector can be determined from the functions it implements.

Run that sample in Remix to see how interface function modifications affect contract function output.

Contracts publish their implemented interfaces.

We can identify interfaces. Now we must disclose the interfaces we're implementing. First, import IERC165 like so.

pragma solidity ^0.4.20;

interface ERC165 {

/// @notice Query if a contract implements an interface

/// @param interfaceID The interface identifier, as specified in ERC-165

/// @dev Interface identification is specified in ERC-165.

/// @return `true` if the contract implements `interfaceID` and

/// `interfaceID` is not 0xffffffff, `false` otherwise

function supportsInterface(bytes4 interfaceID) external view returns (bool);

}We still need to build this interface in our smart contract. ERC721 from OpenZeppelin is a good example.

// SPDX-License-Identifier: MIT

// OpenZeppelin Contracts (last updated v4.5.0) (token/ERC721/ERC721.sol)

pragma solidity ^0.8.0;

import "./IERC721.sol";

import "./extensions/IERC721Metadata.sol";

import "../../utils/introspection/ERC165.sol";

// ...

contract ERC721 is Context, ERC165, IERC721, IERC721Metadata {

// ...

function supportsInterface(bytes4 interfaceId) public view virtual override(ERC165, IERC165) returns (bool) {

return

interfaceId == type(IERC721).interfaceId ||

interfaceId == type(IERC721Metadata).interfaceId ||

super.supportsInterface(interfaceId);

}

// ...

}I deleted unnecessary code. The smart contract imports ERC165, IERC721 and IERC721Metadata. The is keyword at smart contract declaration implements all three.

Kind (interface).

Note that type(interface).interfaceId returns the same as the interface selector.

We override supportsInterface in the smart contract to return a boolean that checks if interfaceId is the same as one of the implemented contracts.

Super.supportsInterface() calls ERC165 code. Checks if interfaceId is IERC165.

function supportsInterface(bytes4 interfaceId) public view virtual override returns (bool) {

return interfaceId == type(IERC165).interfaceId;

}So, if we run supportsInterface with an interfaceId, our contract function returns true if it's implemented and false otherwise. True for IERC721, IERC721Metadata, andIERC165.

Conclusion

I hope this post has helped you understand and use ERC165 and why it's employed.

Have a great day, thanks for reading!

Matthew O'Riordan

3 years ago

Trends in SaaS Funding from 2016 to 2022

Christopher Janz of Point Nine Capital created the SaaS napkin in 2016. This post shows how founders have raised cash in the last 6 years. View raw data.

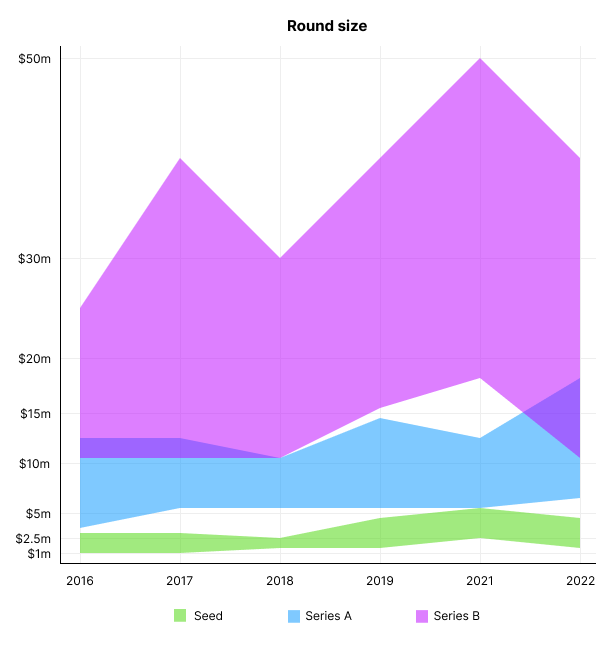

Round size

Unsurprisingly, round sizes have expanded and will taper down in 2022. In 2016, pre-seed rounds were $200k to $500k; currently, they're $1-$2m. Despite the macroeconomic scenario, Series A have expanded from $3m to $12m in 2016 to $6m and $18m in 2022.

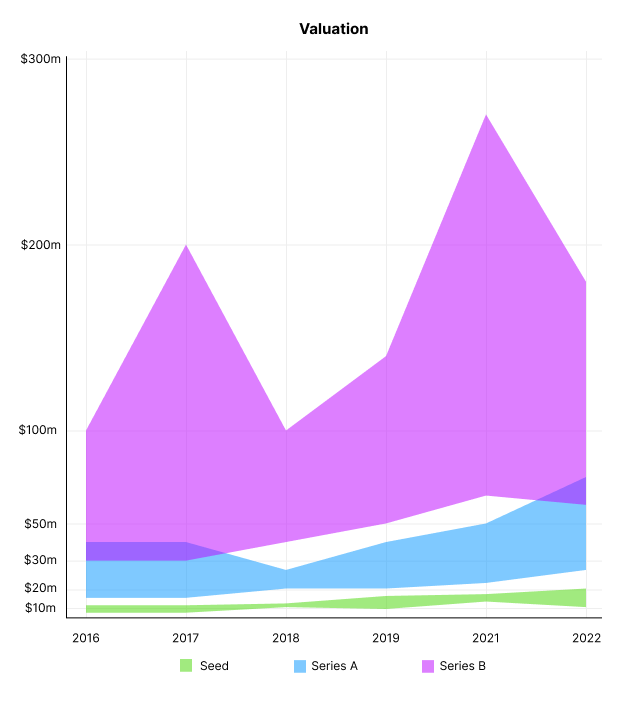

Valuation

There are hints that valuations are rebounding this year. Pre-seed valuations in 2022 are $12m from $3m in 2016, and Series B prices are $270m from $100m in 2016.

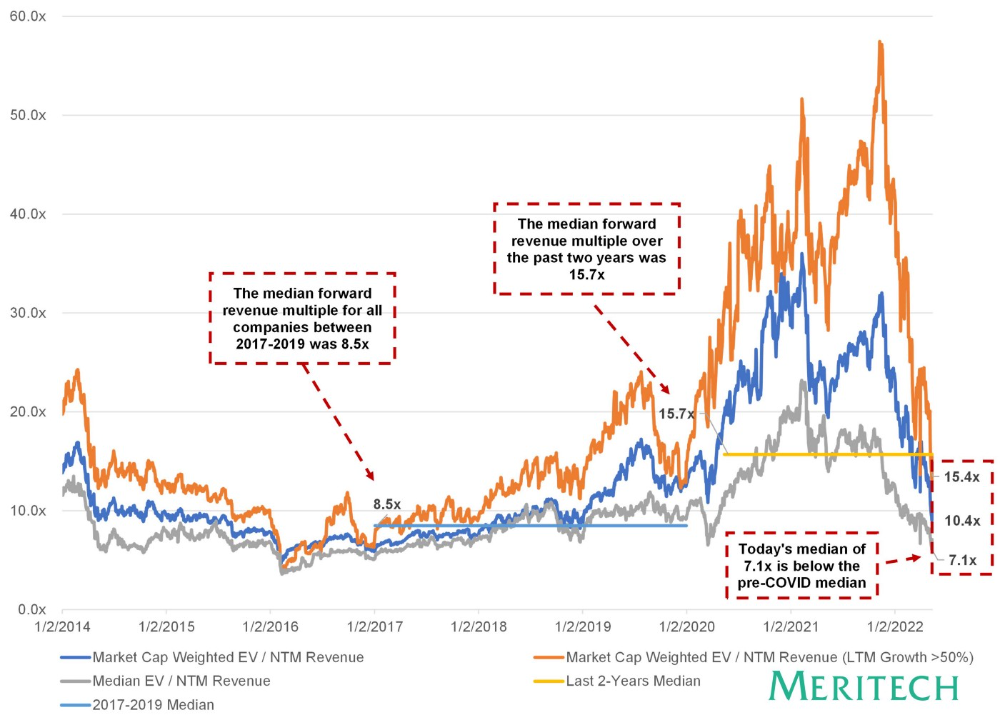

Compared to public SaaS multiples, Series B valuations more closely reflect the market, but Seed and Series A prices seem to be inflated regardless of the market.

I'd like to know how each annual cohort performed for investors, based on the year they invested and the valuations. I can't access this information.

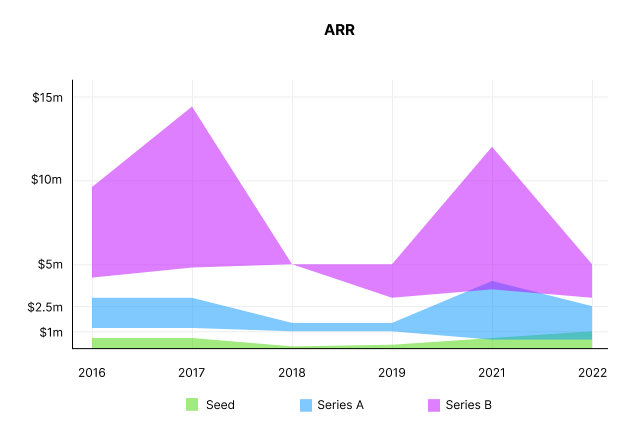

ARR

Seed firms' ARR forecasts have risen from $0 to $0.6m to $0 to $1m. 2016 expected $1.2m to $3m, 2021 $0.5m to $4m, and this year $0.5m to $2.5m, suggesting that Series A firms may raise with less ARR today. Series B minutes fell from $4.2m to $3m.

Capitalization Rate

2022 is the year that VCs start discussing capital efficiency in portfolio meetings. Given the economic shift in the markets and the stealthy VC meltdown, it's not surprising. Christopher Janz added capital efficiency to the SaaS Napkin as a new statistic for Series A (3.5x) and Series B. (2.5x). Your investors must live under a rock if they haven't asked about capital efficiency. If you're unsure:

The Capital Efficiency Ratio is the ratio of how much a company has spent growing revenue and how much they’re receiving in return. It is the broadest measure of company effectiveness in generating ARR

What next?

No one knows what's next, including me. All startup and growing enterprises around me are tightening their belts and extending their runways in anticipation of a difficult fundraising ride. If you're wanting to raise money but can wait, wait till the market is more stable and access to money is easier.

Julie Zhuo

2 years ago

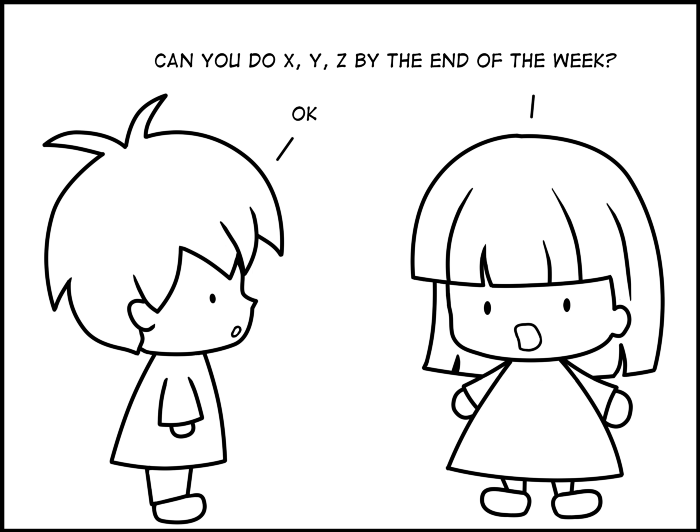

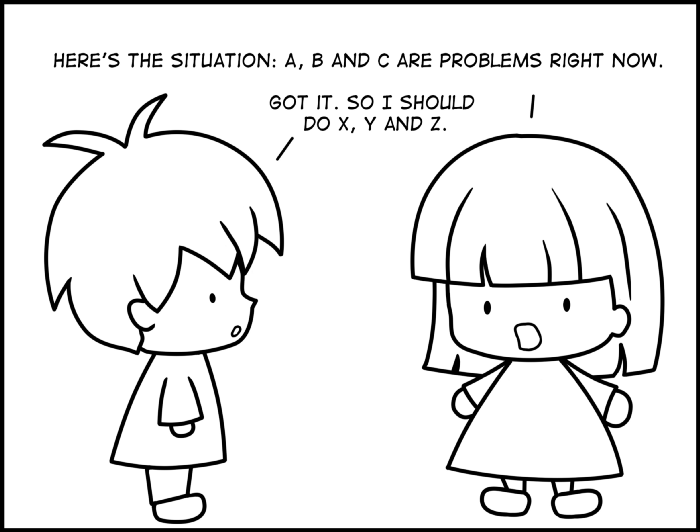

Comparing poor and excellent managers

10-sketch explanation

Choosing Tasks

Bringing News

carrying out 1:1s

providing critique

Managing Turbulence