War's Human Cost

War's Human Cost

I didn't start crying until I was outside a McDonald's in an Olempin, Poland rest area on highway S17.

Children pick toys at a refugee center, Olempin, Poland, March 4, 2022.

Refugee children, mostly alone with their mothers, but occasionally with a gray-haired grandfather or non-Ukrainian father, were coaxed into picking a toy from boxes provided by a kind-hearted company and volunteers.

I went to Warsaw to continue my research on my family's history during the Holocaust. In light of the ongoing Ukrainian conflict, I asked former colleagues in the US Department of Defense and Intelligence Community if it was safe to travel there. They said yes, as Poland was a NATO member.

I stayed in a hotel in the Warsaw Ghetto, where 90% of my mother's family was murdered in the Holocaust. Across the street was the first Warsaw Judenrat. It was two blocks away from the apartment building my mother's family had owned and lived in, now dilapidated and empty.

Building of my great-grandfather, December 2021.

A mass grave of thousands of rocks for those killed in the Warsaw Ghetto, I didn't cry when I touched its cold walls.

Warsaw Jewish Cemetery, 200,000–300,000 graves.

Mass grave, Warsaw Jewish Cemetery.

My mother's family had two homes, one in Warszawa and the rural one was a forest and sawmill complex in Western Ukraine. For the past half-year, a local Ukrainian historian had been helping me discover faint traces of her family’s life there — in fact, he had found some people still alive who remembered the sawmill and that it belonged to my mother’s grandfather. The historian was good at his job, and we had become close.

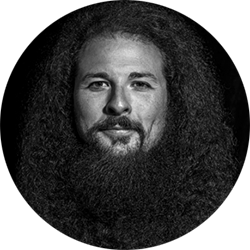

My historian friend, December 2021, talking to a Ukrainian.

With war raging, my second trip to Warsaw took on a different mission. To see his daughter and one-year-old grandson, I drove east instead of to Ukraine. They had crossed the border shortly after the war began, leaving men behind, and were now staying with a friend on Poland's eastern border.

I entered after walking up to the house and settling with the dog. The grandson greeted me with a huge smile and the Ukrainian word for “daddy,” “Tato!” But it was clear he was awaiting his real father's arrival, and any man he met would be so tentatively named.

After a few moments, the boy realized I was only a stranger. He had musical talent, like his mother and grandfather, both piano teachers, as he danced to YouTube videos of American children's songs dubbed in Ukrainian, picking the ones he liked and crying when he didn't.

Songs chosen by my historian friend's grandson, March 4, 2022

He had enough music and began crying regardless of the song. His mother picked him up and started nursing him, saying she was worried about him. She had no idea where she would live or how she would survive outside Ukraine. She showed me her father's family history of losses in the Holocaust, which matched my own research.

After an hour of drinking tea and trying to speak of hope, I left for the 3.5-hour drive west to Warsaw.

It was unlike my drive east. It was reminiscent of the household goods-filled carts pulled by horses and people fleeing war 80 years ago.

Jewish refugees relocating, USHMM Holocaust Encyclopaedia, 1939.

The carefully chosen trinkets by children to distract them from awareness of what is really happening and the anxiety of what lies ahead, made me cry despite all my research on the Holocaust. There is no way for them to communicate with their mothers, who are worried, absent, and without their fathers.

It's easy to see war as a contest of nations' armies, weapons, and land. The most costly aspect of war is its psychological toll. My father screamed in his sleep from nightmares of his own adolescent trauma in Warsaw 80 years ago.

Survivor father studying engineering, 1961.

In the airport, I waited to return home while Ukrainian public address systems announced refugee assistance. Like at McDonald's, many mothers were alone with their children, waiting for a flight to distant relatives.

That's when I had my worst trip experience.

A woman near me, clearly a refugee, answered her phone, cried out, and began wailing.

The human cost of war descended like a hammer, and I realized that while I was going home, she never would

More on Current Events

Jared A. Brock

3 years ago

Here is the actual reason why Russia invaded Ukraine

Democracy's demise

Our Ukrainian brothers and sisters are being attacked by a far superior force.

It's the biggest invasion since WWII.

43.3 million peaceful Ukrainians awoke this morning to tanks, mortars, and missiles. Russia is already 15 miles away.

America and the West will not deploy troops.

They're sanctioning. Except railways. And luxuries. And energy. Diamonds. Their dependence on Russian energy exports means they won't even cut Russia off from SWIFT.

Ukraine is desperate enough to hand out guns on the street.

France, Austria, Turkey, and the EU are considering military aid, but Ukraine will fall without America or NATO.

The Russian goal is likely to encircle Kyiv and topple Zelenskyy's government. A proxy power will be reinstated once Russia has total control.

“Western security services believe Putin intends to overthrow the government and install a puppet regime,” says Financial Times foreign affairs commentator Gideon Rachman. This “decapitation” strategy includes municipalities. Ukrainian officials are being targeted for arrest or death.”

Also, Putin has never lost a war.

Why is Russia attacking Ukraine?

Putin, like a snowflake college student, “feels unsafe.”

Why?

Because Ukraine is full of “Nazi ideas.”

Putin claims he has felt threatened by Ukraine since the country's pro-Putin leader was ousted and replaced by a popular Jewish comedian.

Hee hee

He fears a full-scale enemy on his doorstep if Ukraine joins NATO. But he refuses to see it both ways. NATO has never invaded Russia, but Russia has always stolen land from its neighbors. Can you blame them for joining a mutual defense alliance when a real threat exists?

Nations that feel threatened can join NATO. That doesn't justify an attack by Russia. It allows them to defend themselves. But NATO isn't attacking Moscow. They aren't.

Russian President Putin's "special operation" aims to de-Nazify the Jewish-led nation.

To keep Crimea and the other two regions he has already stolen, he wants Ukraine undefended by NATO.

(Warlords have fought for control of the strategically important Crimea for over 2,000 years.)

Putin wants to own all of Ukraine.

Why?

The Black Sea is his goal.

Ports bring money and power, and Ukraine pipelines transport Russian energy products.

Putin wants their wheat, too — with 70% crop coverage, Ukraine would be their southern breadbasket, and Russia has no qualms about starving millions of Ukrainians to death to feed its people.

In the end, it's all about greed and power.

Putin wants to own everything Russia has ever owned. This year he turns 70, and he wants to be remembered like his hero Peter the Great.

In order to get it, he's willing to kill thousands of Ukrainians

Art imitates life

This story began when a Jewish TV comedian portrayed a teacher elected President after ranting about corruption.

Servant of the People, the hit sitcom, is now the leading centrist political party.

Right, President Zelenskyy won the hearts and minds of Ukrainians by imagining a fairer world.

A fair fight is something dictators, corporatists, monopolists, and warlords despise.

Now Zelenskyy and his people will die, allowing one of history's most corrupt leaders to amass even more power.

The poor always lose

Meanwhile, the West will impose economic sanctions on Russia.

China is likely to step in to help Russia — or at least the wealthy.

The poor and working class in Russia will suffer greatly if there is a hard crash or long-term depression.

Putin's friends will continue to drink champagne and eat caviar.

Russia cutting off oil, gas, and fertilizer could cause more inflation and possibly a recession if it cuts off supplies to the West. This causes more suffering and hardship for the Western poor and working class.

Why? a billionaire sociopath gets his dirt.

Yes, Russia is simply copying America. Some of us think all war is morally wrong, regardless of who does it.

But let's not kid ourselves right now.

The markets rallied after the biggest invasion in Europe since WWII.

Investors hope Ukraine collapses and Russian oil flows.

Unbridled capitalists value lifeless.

What we can do about Ukraine

When the Russian army invaded eastern Finland, my wife's grandmother fled as a child. 80 years later, Russia still has Karelia.

Russia invaded Ukraine today to retake two eastern provinces.

History has taught us nothing.

Past mistakes won't fix the future.

Instead, we should try:

- Pray and/or meditate on our actions with our families.

- Stop buying Russian products (vodka, obviously, but also pay more for hydro/solar/geothermal/etc.)

- Stop wasting money on frivolous items and donate it to Ukrainian charities.

Here are 35+ places to donate.

- To protest, gather a few friends, contact the media, and shake signs in front of the Russian embassy.

- Prepare to welcome refugees.

More war won't save the planet or change hearts.

Only love can work.

Steve QJ

3 years ago

Putin's War On Reality

The dictator's playbook.

Stalin's successor, Nikita Khrushchev, delivered a speech titled "On The Cult Of Personality And Its Consequences" in 1956, three years after Stalin’s death.

It was Stalin's grave abuse of power that caused untold harm to our party.

Stalin acted not by persuasion, explanation, or patient cooperation, but by imposing his ideas and demanding absolute obedience. […]

See where Stalin's mania for greatness led? He had lost all sense of reality.

The speech, which was never made public, shook the Soviet Union and the Soviet Bloc. After Stalin's "cult of personality" was exposed as a lie, only reality remained.

As I've watched the nightmare unfold in Ukraine, I'm reminded of that question. Primarily by Putin's repeated denials.

His odd claim that Ukraine is run by drug addicts and Nazis (especially strange given that Volodymyr Zelenskyy, the Ukrainian president, is Jewish). Others attempt to portray Russia as liberators rather than occupiers. For example, he portrays Luhansk and Donetsk as plucky, newly independent states when they have been totalitarian statelets for 8 years.

Putin seemed to have lost all sense of reality.

Maybe that's why his remarks to an oligarchs' gathering stood out:

Everything is a desperate measure. They gave us no choice. We couldn't do anything about their security risks. […] They could have put the country in jeopardy.

This is almost certainly true from Putin's perspective. Even for Putin, a military invasion seems unlikely. So, what exactly is putting Russia's security in jeopardy? How could Ukraine's independence endanger Russia's existence?

The truth is the only thing that truly terrifies leaders like these.

Trump, the president of “alternative facts,” "and “fake news” praised Putin's fabricated justifications for the Ukraine invasion. Russia tightened news censorship as news of their losses came in. It's no accident that modern dictatorships like Russia (and China and North Korea) restrict citizens' access to information.

Controlling what people see, hear, and think is the simplest method. And Ukraine's recent efforts to join the European Union showed a country whose thoughts Putin couldn't control. With the Russian and Ukrainian peoples so close, he could not control their reality.

He appears to think this is a threat worth fighting NATO over.

It's easy to disown history's great dictators. By the magnitude of their harm. But the strategy they used is still in use today, albeit not to the same devastating effect.

The Kim dynasty in North Korea has ruled for 74 years, Putin has ruled Russia for 19 years (using loopholes and even rewriting the constitution).

“Politicians and diapers must be changed frequently,” said Mark Twain. "And for the same reason.”

When their egos are threatened, they sabre-rattle, as in Kim Jong-un and Donald Trump's famous spat about the size of their...ahem, “nuclear buttons”." Or Putin's threats of mutual destruction this weekend.

Most importantly, they have cult-like control over their followers.

When a leader whose power is built on lies feels he is losing control of the narrative, things like Trump's Jan. 6 meltdown and Putin's current actions in Ukraine are unavoidable.

Leaders who try to control their people's reality will have to die to keep the illusion alive.

Long version of this post available here

Isaiah McCall

3 years ago

There is a new global currency emerging, but it is not bitcoin.

America should avoid BRICS

Vladimir Putin has watched videos of Muammar Gaddafi's CIA-backed demise.

Gaddafi...

Thief.

Did you know Gaddafi wanted a gold-backed dinar for Africa? Because he considered our global financial system was a Ponzi scheme, he wanted to discontinue trading oil in US dollars.

Or, Gaddafi's Libya enjoyed Africa's highest quality of living before becoming freed. Pictured:

Vladimir Putin is a nasty guy, but he had his reasons for not mentioning NATO assisting Ukraine in resisting US imperialism. Nobody tells you. Sure.

The US dollar's corruption post-2008, debasement by quantitative easing, and lack of value are key factors. BRICS will replace the dollar.

BRICS aren't bricks.

Economy-related.

Brazil, Russia, India, China, and South Africa have cooperated for 14 years to fight U.S. hegemony with a new international currency: BRICS.

BRICS is mostly comical. Now. Saudi Arabia, the second-largest oil hegemon, wants to join.

So what?

The New World Currency is BRICS

Russia was kicked out of G8 for its aggressiveness in Crimea in 2014.

It's now G7.

No biggie, said Putin, he said, and I quote, “Bon appetite.”

He was prepared. China, India, and Brazil lead the New World Order.

Together, they constitute 40% of the world's population and, according to the IMF, 50% of the world's GDP by 2030.

Here’s what the BRICS president Marcos Prado Troyjo had to say earlier this year about no longer needing the US dollar: “We have implemented the mechanism of mutual settlements in rubles and rupees, and there is no need for our countries to use the dollar in mutual settlements. And today a similar mechanism of mutual settlements in rubles and yuan is being developed by China.”

Ick. That's D.C. and NYC warmongers licking their chops for WW3 nasty.

Here's a lovely picture of BRICS to relax you:

If Saudi Arabia joins BRICS, as President Mohammed Bin Salman has expressed interest, a majority of the Middle East will have joined forces to construct a new world order not based on the US currency.

I'm not sure of the new acronym.

SBRICSS? CIRBSS? CRIBSS?

The Reason America Is Harvesting What It Sowed

BRICS began 14 years ago.

14 years ago, what occurred? Concentrate. It involved CDOs, bad subprime mortgages, and Wall Street quants crunching numbers.

2008 recession

When two nations trade, they do so in US dollars, not Euros or gold.

What happened when 2008, an avoidable crisis caused by US banks' cupidity and ignorance, what happened?

Everyone WORLDWIDE felt the pain.

Mostly due to corporate America's avarice.

This should have been a warning that China and Russia had enough of our bs. Like when France sent a battleship to America after Nixon scrapped the gold standard. The US was warned to shape up or be dethroned (or at least try).

Nixon improved in 1971. Kinda. Invented PetroDollar.

Another BS system that unfairly favors America and possibly pushed Russia, China, and Saudi Arabia into BRICS.

The PetroDollar forces oil-exporting nations to trade in US dollars and invest in US Treasury bonds. Brilliant. Genius evil.

Our misdeeds are:

In conflicts that are not its concern, the USA uses the global reserve currency as a weapon.

Targeted nations abandon the dollar, and rightfully so, as do nations that depend on them for trade in vital resources.

The dollar's position as the world's reserve currency is in jeopardy, which could have disastrous economic effects.

Although we have actually sown our own doom, we appear astonished. According to the Bible, whomever sows to appease his sinful nature will reap destruction from that nature whereas whoever sows to appease the Spirit will reap eternal life from the Spirit.

Americans, even our leaders, lack caution and delayed pleasure. When our unsustainable systems fail, we double down. Bailouts of the banks in 2008 were myopic, puerile, and another nail in America's hegemony.

America has screwed everyone.

We're unpopular.

The BRICS's future

It's happened before.

Saddam Hussein sold oil in Euros in 2000, and the US invaded Iraq a month later. The media has devalued the word conspiracy. The Iraq conspiracy.

There were no WMDs, but NYT journalists like Judy Miller drove Americans into a warmongering frenzy because Saddam would ruin the PetroDollar. Does anyone recall that this war spawned ISIS?

I think America has done good for the world. You can make a convincing case that we're many people's villain.

Learn more in Confessions of an Economic Hitman, The Devil's Chessboard, or Tyranny of the Federal Reserve. Or ignore it. That's easier.

We, America, should extend an olive branch, ask for forgiveness, and learn from our faults, as the Tao Te Ching advises. Unlikely. Our population is apathetic and stupid, and our government is corrupt.

Argentina, Iran, Egypt, and Turkey have also indicated interest in joining BRICS. They're also considering making it gold-backed, making it a new world reserve currency.

You should pay attention.

Thanks for reading!

You might also like

Nick

3 years ago

This Is How Much Quora Paid Me For 23 Million Content Views

You’ll be surprised; I sure was

Blogging and writing online as a side income has now been around for a significant amount of time. Nowadays, it is a continuously rising moneymaker for prospective writers, with several writing platforms existing online. At the top of the list are Medium, Vocal Media, Newsbreak, and the biggest one of them, Quora, with 300 million active users.

Quora, unlike Medium, is a question-and-answer format platform. On Medium you are permitted to write what you want, while on Quora, you answer questions on topics that you have expertise about. Quora, like Medium, now compensates its authors for the answers they provide in comparison to the previous, in which you had to be admitted to the partner program and were paid to ask questions.

Quora just recently went live with this new partner program, Quora Plus, and the way it works is that it is a subscription for $5 a month which provides you access to metered/monetized stories, in turn compensating the writers for part of that subscription for their answers.

I too on Quora have found a lot of success on the platform, gaining 23 Million Content Views, and 300,000 followers for my space, which is kind of the Quora equivalent of a Medium article. The way in which I was able to do this was entirely thanks to a hack that I uncovered to the Quora algorithm.

In this article, I plan on discussing how much money I received from 23 million content views on Quora, and I bet you’ll be shocked; I know I was.

A Brief Explanation of How I Got 23 Million Views and How You Can Do It Too

On Quora, everything in terms of obtaining views is about finding the proper question, which I only understood quite late into the game. I published my first response in 2019 but never actually wrote on Quora until the summer of 2020, and about a month into posting consistently I found out how to find the perfect question. Here’s how:

The Process

Go to your Home Page and start scrolling… While browsing, check for the following things…

Answers from people you follow or your followers.

Advertisements

These two things are the two things you want to ignore, you don’t want to answer those questions or look at the ads. You should now be left with a couple of recommended answers. To discover which recommended answer is the best to answer as well, look at these three important aspects.

Date of the answer: Was it in the past few days, preferably 2–3 days, even better, past 24 hours?

Views: Are they in the ten thousands or hundred thousands?

Upvotes: Are they in the hundreds or thousands?

Now, choose an answer to a question which you think you could answer as well that satisfies the requirements above. Once you click on it, as all answers on Quora works, it will redirect you to the page for that question, in which you will have to select once again if you should answer the question.

Amount of answers: How many responses are there to the given question? This tells you how much competition you have. My rule is beyond 25 answers, you shouldn’t answer, but you can change it anyway you’d like.

Answerers: Who did the answering for the question? If the question includes a bunch of renowned, extremely well-known people on Quora, there’s a good possibility your essay is going to get drowned out.

Views: Check for a constant quantity of high views on each answer for the question; this is what will guarantee that your answer gets a lot of views!

The Income Reveal! How Much I Made From 23 Million Content Views

DRUM ROLL, PLEASE!

8.97 USD. Yes, not even ten dollars, not even nine. Just eight dollars and ninety-seven cents.

Possible Reasons for My Low Earnings

Quora Plus and the answering partner program are newer than my Quora views.

Few people use Quora+, therefore revenues are low.

I haven't been writing much on Quora, so I'm only making money from old answers and a handful since Quora Plus launched.

Quora + pays poorly...

Should You Try Quora and Quora For Money?

My answer depends on your needs. I never got invited to Quora's question partner program due to my late start, but other writers have made hundreds. Due to Quora's new and competitive answering partner program, you may not make much money.

If you want a fun writing community, try Quora. Quora was fun when I only made money from my space. Quora +'s paywalls and new contributors eager to make money have made the platform less fun for me.

This article is a summary to save you time. You can read my full, more detailed article, here.

Alexandra Walker-Jones

3 years ago

These are the 15 foods you should eat daily and why.

Research on preventing disease, extending life, and caring for your body from the inside out

Grapefruit and pomegranates aren't on the list, so ignore that. Mostly, I enjoyed the visual, but those fruits are healthful, too.

15 (or 17 if you consider the photo) different foods a day sounds like a lot. If you're not used to it — it is.

These lists don't aim for perfection. Instead, use this article and the science below to eat more of these foods. If you can eat 5 foods one day and 5 the next, you're doing well. This list should be customized to your requirements and preferences.

“Every time you eat or drink, you are either feeding disease or fighting it” -Heather Morgan.

The 15 Foods That You Should Consume Daily and Why:

1. Dark/Red Berries

(blueberries, blackberries, acai, goji, cherries, strawberries, raspberries)

The 2010 Global Burden of Disease Study is the greatest definitive analysis of death and disease risk factors in history. They found the primary cause of both death, disability, and disease inside the United States was diet.

Not eating enough fruit, and specifically berries, was one of the best predictors of disease (1).

What's special about berries? It's their color! Berries have the most antioxidants of any fruit, second only to spices. The American Cancer Society found that those who ate the most berries were less likely to die of cardiovascular disease.

2. Beans

Soybeans, black beans, kidney beans, lentils, split peas, chickpeas.

Beans are one of the most important predictors of survival in older people, according to global research (2).

For every 20 grams (2 tablespoons) of beans consumed daily, the risk of death is reduced by 8%.

Soybeans and soy foods are high in phytoestrogen, which reduces breast and prostate cancer risks. Phytoestrogen blocks the receptors' access to true estrogen, mitigating the effects of weight gain, dairy (high in estrogen), and hormonal fluctuations (3).

3. Nuts

(almonds, walnuts, pecans, pistachios, Brazil nuts, cashews, hazelnuts, macadamia nuts)

Eating a handful of nuts every day reduces the risk of chronic diseases like heart disease and diabetes. Nuts also reduce oxidation, blood sugar, and LDL (bad) cholesterol, improving arterial function (4).

Despite their high-fat content, studies have linked daily nut consumption to a slimmer waistline and a lower risk of obesity (5).

4. Flaxseed

(milled flaxseed)

2013 research found that ground flaxseed had one of the strongest anti-hypertensive effects of any food. A few tablespoons (added to a smoothie or baked goods) lowered blood pressure and stroke risk 23 times more than daily aerobic exercise (6).

Flax shouldn't replace exercise, but its nutritional punch is worth adding to your diet.

5. Other seeds

(chia seeds, hemp seeds, pumpkin seeds, sesame seeds, fennel seeds)

Seeds are high in fiber and omega-3 fats and can be added to most dishes without being noticed.

When eaten with or after a meal, chia seeds moderate blood sugar and reduce inflammatory chemicals in the blood (7). Overall, a great daily addition.

6. Dates

Dates are one of the world's highest sugar foods, with 80% sugar by weight. Pure cake frosting is 60%, maple syrup is 66%, and cotton-candy jelly beans are 70%.

Despite their high sugar content, dates have a low glycemic index, meaning they don't affect blood sugar levels dramatically. They also improve triglyceride and antioxidant stress levels (8).

Dates are a great source of energy and contain high levels of dietary fiber and polyphenols, making 3-10 dates a great way to fight disease, support gut health with prebiotics, and satisfy a sweet tooth (9).

7. Cruciferous Veggies

(broccoli, Brussel sprouts, horseradish, kale, cauliflower, cabbage, boy choy, arugula, radishes, turnip greens)

Cruciferous vegetables contain an active ingredient that makes them disease-fighting powerhouses. Sulforaphane protects our brain, eyesight, against free radicals and environmental hazards, and treats and prevents cancer (10).

Unless you eat raw cruciferous vegetables daily, you won't get enough sulforaphane (and thus, its protective nutritional benefits). Cooking destroys the enzyme needed to create this super-compound.

If you chop broccoli, cauliflower, or turnip greens and let them sit for 45 minutes before cooking them, the enzyme will have had enough time to work its sulforaphane magic, allowing the vegetables to retain the same nutritional value as if eaten raw. Crazy, right? For more on this, see What Chopping Your Vegetables Has to Do with Fighting Cancer.

8. Whole grains

(barley, brown rice, quinoa, oats, millet, popcorn, whole-wheat pasta, wild rice)

Whole-grains are one of the healthiest ways to consume your daily carbs and help maintain healthy gut flora.

This happens when fibre is broken down in the colon and starts a chain reaction, releasing beneficial substances into the bloodstream and reducing the risk of Type 2 Diabetes and inflammation (11).

9. Spices

(turmeric, cumin, cinnamon, ginger, saffron, cloves, cardamom, chili powder, nutmeg, coriander)

7% of a person's cells will have DNA damage. This damage is caused by tiny breaks in our DNA caused by factors like free-radical exposure.

Free radicals cause mutations that damage lipids, proteins, and DNA, increasing the risk of disease and cancer. Free radicals are unavoidable because they result from cellular metabolism, but they can be avoided by consuming anti-oxidant and detoxifying foods.

Including spices and herbs like rosemary or ginger in our diet may cut DNA damage by 25%. Yes, this damage can be improved through diet. Turmeric worked better at a lower dose (just a pinch, daily). For maximum free-radical fighting (and anti-inflammatory) effectiveness, use 1.5 tablespoons of similar spices (12).

10. Leafy greens

(spinach, collard greens, lettuce, other salad greens, swiss chard)

Studies show that people who eat more leafy greens perform better on cognitive tests and slow brain aging by a year or two (13).

As we age, blood flow to the brain drops due to a decrease in nitric oxide, which prevents blood vessels from dilatation. Daily consumption of nitrate-rich vegetables like spinach and swiss chard may prevent dementia and Alzheimer's.

11. Fermented foods

(sauerkraut, tempeh, kombucha, plant-based kefir)

Miso, kimchi, and sauerkraut contain probiotics that support gut microbiome.

Probiotics balance the good and bad bacteria in our bodies and offer other benefits. Fermenting fruits and vegetables increases their antioxidant and vitamin content, preventing disease in multiple ways (14).

12. Sea vegetables

(seaweed, nori, dulse flakes)

A population study found that eating one sheet of nori seaweed per day may cut breast cancer risk by more than half (15).

Seaweed and sea vegetables may help moderate estrogen levels in the metabolism, reducing cancer and disease risk.

Sea vegetables make up 30% of the world's edible plants and contain unique phytonutrients. A teaspoon of these super sea-foods on your dinner will help fight disease from the inside out.

13. Water

I'm less concerned about whether you consider water food than whether you drink enough. If this list were ranked by what single item led to the best health outcomes, water would be first.

Research shows that people who drink 5 or more glasses of water per day have a 50% lower risk of dying from heart disease than those who drink 2 or less (16).

Drinking enough water boosts energy, improves skin, mental health, and digestion, and reduces the risk of various health issues, including obesity.

14. Tea

All tea consumption is linked to a lower risk of stroke, heart disease, and early death, with green tea leading for antioxidant content and immediate health benefits.

Green tea leaves may also be able to interfere with each stage of cancer formation, from the growth of the first mutated cell to the spread and progression of cancer in the body. Green tea is a quick and easy way to support your long-term and short-term health (17).

15. Supplemental B12 vitamin

B12, or cobalamin, is a vitamin responsible for cell metabolism. Not getting enough B12 can have serious consequences.

Historically, eating vegetables from untreated soil helped humans maintain their vitamin B12 levels. Due to modern sanitization, our farming soil lacks B12.

B12 is often cited as a problem only for vegetarians and vegans (as animals we eat are given B12 supplements before slaughter), but recent studies have found that plant-based eaters have lower B12 deficiency rates than any other diet (18).

Article Sources:

Ezra Reguerra

3 years ago

Yuga Labs’ Otherdeeds NFT mint triggers backlash from community

Unhappy community members accuse Yuga Labs of fraud, manipulation, and favoritism over Otherdeeds NFT mint.

Following the Otherdeeds NFT mint, disgruntled community members took to Twitter to criticize Yuga Labs' handling of the event.

Otherdeeds NFTs were a huge hit with the community, selling out almost instantly. Due to high demand, the launch increased Ethereum gas fees from 2.6 ETH to 5 ETH.

But the event displeased many people. Several users speculated that the mint was “planned to fail” so the group could advertise launching its own blockchain, as the team mentioned a chain migration in one tweet.

Others like Mark Beylin tweeted that he had "sold out" on all Ape-related NFT investments after Yuga Labs "revealed their true colors." Beylin also advised others to assume Yuga Labs' owners are “bad actors.”

Some users who failed to complete transactions claim they lost ETH. However, Yuga Labs promised to refund lost gas fees.

CryptoFinally, a Twitter user, claimed Yuga Labs gave BAYC members better land than non-members. Others who wanted to participate paid for shittier land, while BAYCS got the only worthwhile land.

The Otherdeed NFT drop also increased Ethereum's burn rate. Glassnode and Data Always reported nearly 70,000 ETH burned on mint day.