More on Technology

Nick Babich

2 years ago

Is ChatGPT Capable of Generating a Complete Mobile App?

TL;DR: It'll be harder than you think.

Mobile app development is a complicated product design sector. You require broad expertise to create a mobile app. You must write Swift or Java code and consider mobile interactions.

When ChatGPT was released, many were amazed by its capabilities and wondered if it could replace designers and developers. This article will use ChatGPT to answer a specific query.

Can ChatGPT build an entire iOS app?

This post will use ChatGPT to construct an iOS meditation app. Video of the article is available.

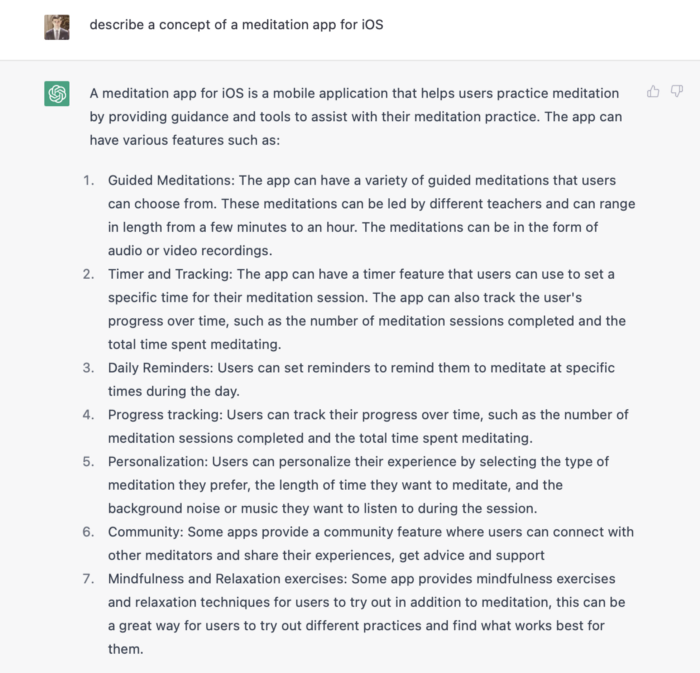

App concepts for meditation

After deciding on an app, think about the user experience. What should the app offer?

Let's ask ChatGPT for the answer.

ChatGPT described a solid meditation app with various exercises. Use this list to plan product design. Our first product iteration will have few features. A simple, one-screen software will let users set the timeframe and play music during meditation.

Structure of information

Information architecture underpins product design. Our app's navigation mechanism should be founded on strong information architecture, so we need to identify our mobile's screens first.

ChatGPT can define our future app's information architecture since we already know it.

ChatGPT uses the more complicated product's structure. When adding features to future versions of our product, keep this information picture in mind.

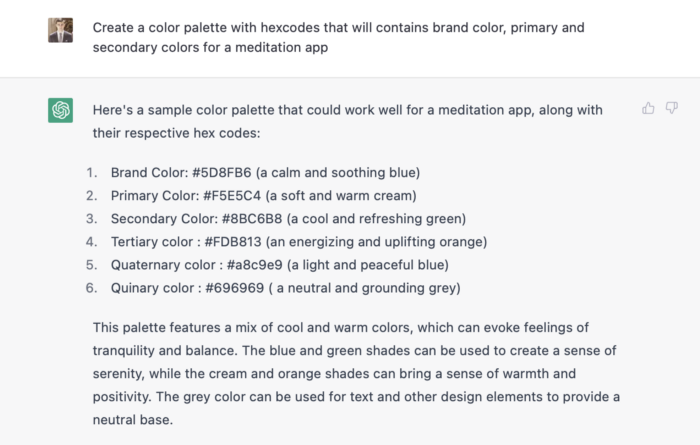

Color palette

Meditation apps need colors. We want to employ relaxing colors in a meditation app because colors affect how we perceive items. ChatGPT can suggest product colors.

See the hues in person:

Neutral colors dominate the color scheme. Playing with color opacity makes this scheme useful.

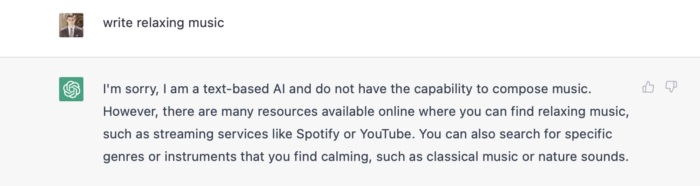

Ambiance music

Meditation involves music. Well-chosen music calms the user.

Let ChatGPT make music for us.

ChatGPT can only generate text. It directs us to Spotify or YouTube to look for such stuff and makes precise recommendations.

Fonts

Fonts can impress app users. Round fonts are easier on the eyes and make a meditation app look friendlier.

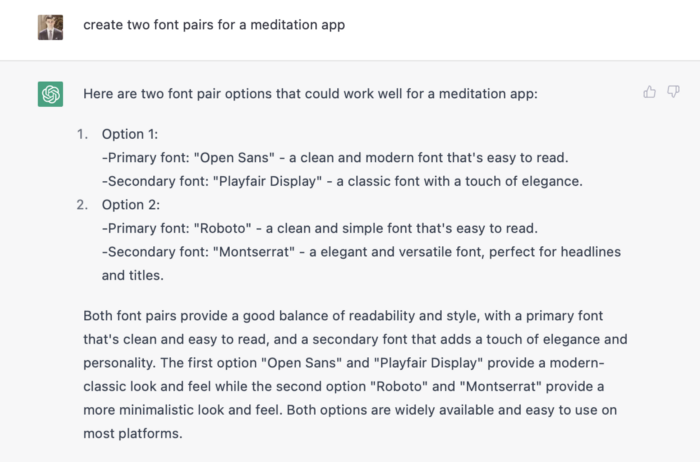

ChatGPT can suggest app typefaces. I compare two font pairs when making a product. I'll ask ChatGPT for two font pairs.

See the hues in person:

Despite ChatGPT's convincing font pairing arguments, the output is unattractive. The initial combo (Open Sans + Playfair Display) doesn't seem to work well for a mediation app.

Content

Meditation requires the script. Find the correct words and read them calmly and soothingly to help listeners relax and focus on each region of their body to enhance the exercise's effect.

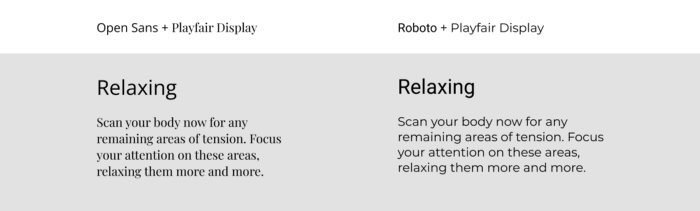

ChatGPT's offerings:

ChatGPT outputs code. My prompt's word script may cause it.

Timer

After fonts, colors, and content, construct functional pieces. Timer is our first functional piece. The meditation will be timed.

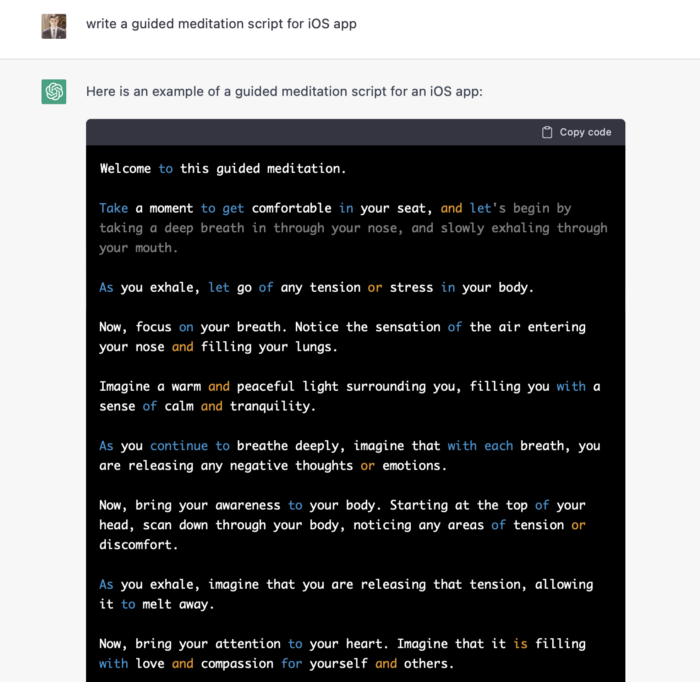

Let ChatGPT write Swift timer code (since were building an iOS app, we need to do it using Swift language).

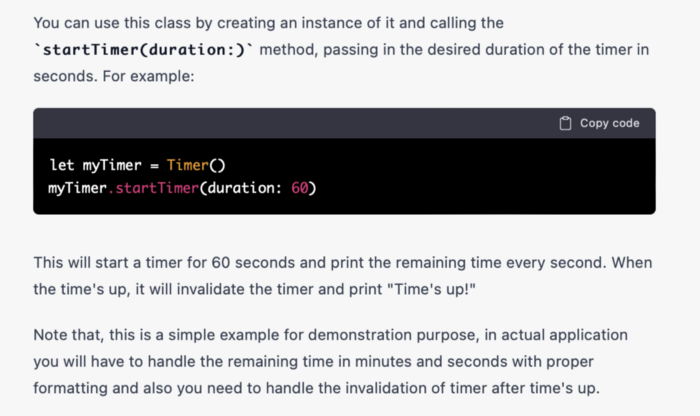

ChatGPT supplied a timer class, initializer, and usage guidelines.

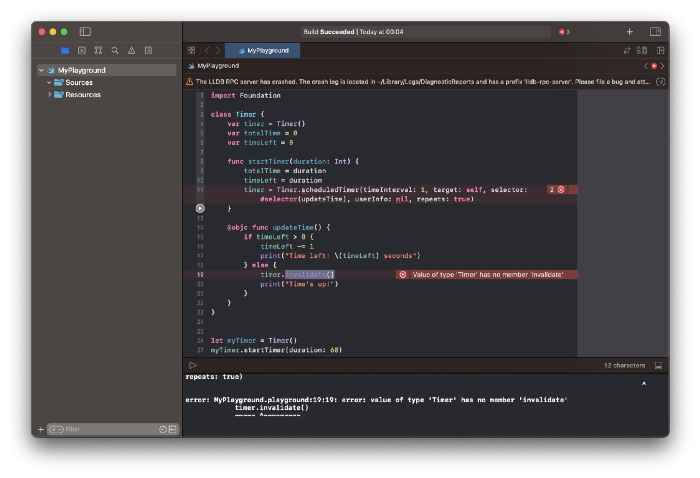

Apple Xcode requires a playground to test this code. Xcode will report issues after we paste the code to the playground.

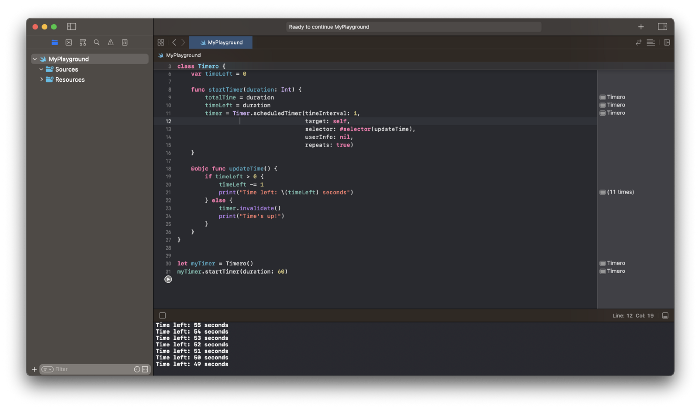

Fixing them is simple. Just change Timer to another class name (Xcode shows errors because it thinks that we access the properties of the class we’ve created rather than the system class Timer; it happens because both classes have the same name Timer). I titled our class Timero and implemented the project. After this quick patch, ChatGPT's code works.

Can ChatGPT produce a complete app?

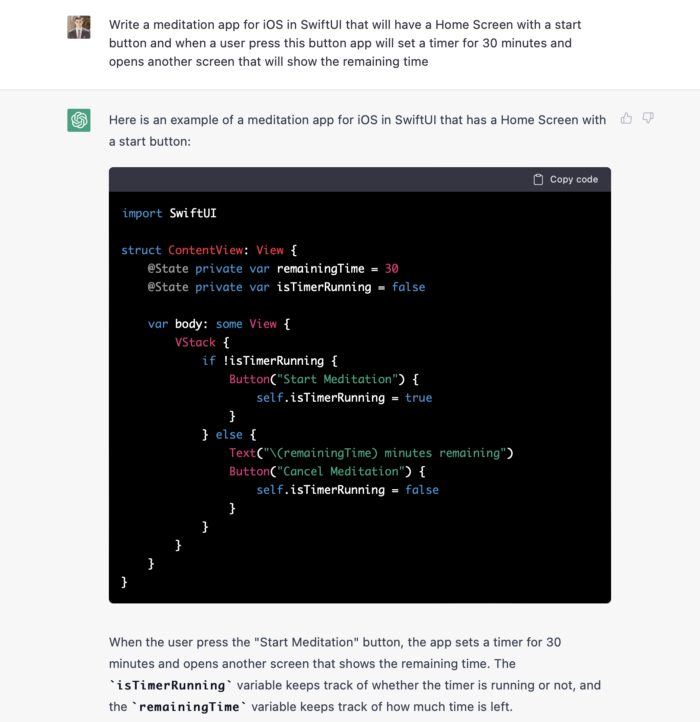

Since ChatGPT can help us construct app components, we may question if it can write a full app in one go.

Question ChatGPT:

ChatGPT supplied basic code and instructions. It's unclear if ChatGPT purposely limits output or if my prompt wasn't good enough, but the tool cannot produce an entire app from a single prompt.

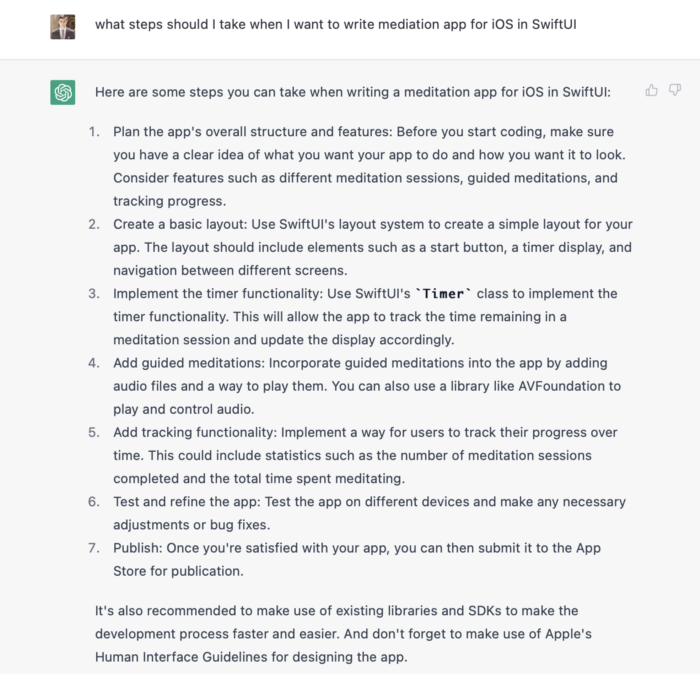

However, we can contact ChatGPT for thorough Swift app construction instructions.

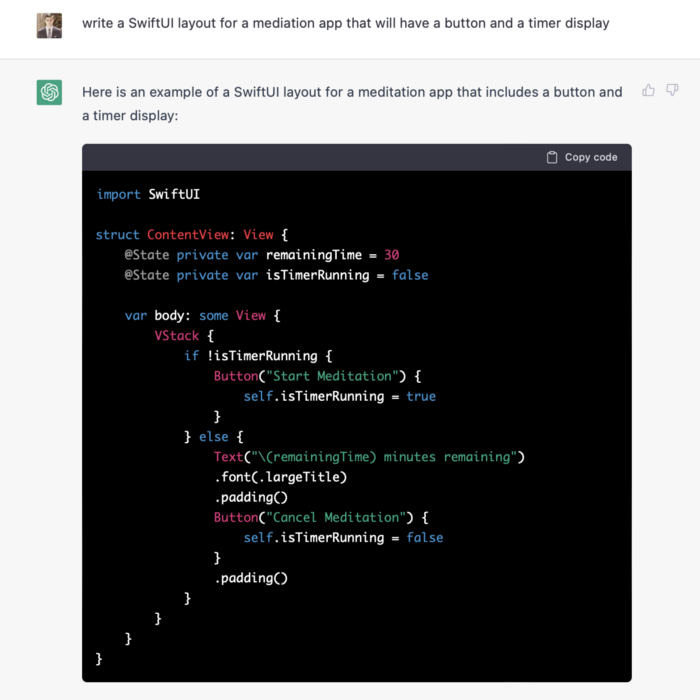

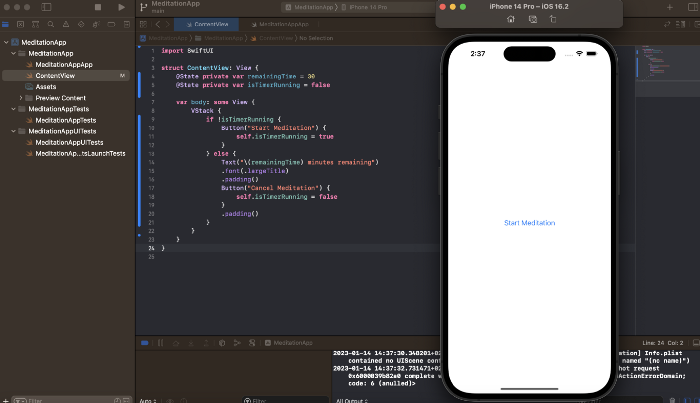

We can ask ChatGPT for step-by-step instructions now that we know what to do. Request a basic app layout from ChatGPT.

Copying this code to an Xcode project generates a functioning layout.

Takeaways

ChatGPT may provide step-by-step instructions on how to develop an app for a specific system, and individual steps can be utilized as prompts to ChatGPT. ChatGPT cannot generate the source code for the full program in one go.

The output that ChatGPT produces needs to be examined by a human. The majority of the time, you will need to polish or adjust ChatGPT's output, whether you develop a color scheme or a layout for the iOS app.

ChatGPT is unable to produce media material. Although ChatGPT cannot be used to produce images or sounds, it can assist you build prompts for programs like midjourney or Dalle-2 so that they can provide the appropriate images for you.

James Brockbank

3 years ago

Canonical URLs for Beginners

Canonicalization and canonical URLs are essential for SEO, and improper implementation can negatively impact your site's performance.

Canonical tags were introduced in 2009 to help webmasters with duplicate or similar content on multiple URLs.

To use canonical tags properly, you must understand their purpose, operation, and implementation.

Canonical URLs and Tags

Canonical tags tell search engines that a certain URL is a page's master copy. They specify a page's canonical URL. Webmasters can avoid duplicate content by linking to the "canonical" or "preferred" version of a page.

How are canonical tags and URLs different? Can these be specified differently?

Tags

Canonical tags are found in an HTML page's head></head> section.

<link rel="canonical" href="https://www.website.com/page/" />These can be self-referencing or reference another page's URL to consolidate signals.

Canonical tags and URLs are often used interchangeably, which is incorrect.

The rel="canonical" tag is the most common way to set canonical URLs, but it's not the only way.

Canonical URLs

What's a canonical link? Canonical link is the'master' URL for duplicate pages.

In Google's own words:

A canonical URL is the page Google thinks is most representative of duplicate pages on your site.

— Google Search Console Help

You can indicate your preferred canonical URL. For various reasons, Google may choose a different page than you.

When set correctly, the canonical URL is usually your specified URL.

Canonical URLs determine which page will be shown in search results (unless a duplicate is explicitly better for a user, like a mobile version).

Canonical URLs can be on different domains.

Other ways to specify canonical URLs

Canonical tags are the most common way to specify a canonical URL.

You can also set canonicals by:

Setting the HTTP header rel=canonical.

All pages listed in a sitemap are suggested as canonicals, but Google decides which pages are duplicates.

Redirects 301.

Google recommends these methods, but they aren't all appropriate for every situation, as we'll see below. Each has its own recommended uses.

Setting canonical URLs isn't required; if you don't, Google will use other signals to determine the best page version.

To control how your site appears in search engines and to avoid duplicate content issues, you should use canonicalization effectively.

Why Duplicate Content Exists

Before we discuss why you should use canonical URLs and how to specify them in popular CMSs, we must first explain why duplicate content exists. Nobody intentionally duplicates website content.

Content management systems create multiple URLs when you launch a page, have indexable versions of your site, or use dynamic URLs.

Assume the following URLs display the same content to a user:

A search engine sees eight duplicate pages, not one.

URLs #1 and #2: the CMS saves product URLs with and without the category name.

#3, #4, and #5 result from the site being accessible via HTTP, HTTPS, www, and non-www.

#6 is a subdomain mobile-friendly URL.

URL #7 lacks URL #2's trailing slash.

URL #8 uses a capital "A" instead of a lowercase one.

Duplicate content may also exist in URLs like:

https://www.website.com

https://www.website.com/index.php

Duplicate content is easy to create.

Canonical URLs help search engines identify different page variations as a single URL on many sites.

SEO Canonical URLs

Canonical URLs help you manage duplicate content that could affect site performance.

Canonical URLs are a technical SEO focus area for many reasons.

Specify URL for search results

When you set a canonical URL, you tell Google which page version to display.

Which would you click?

https://www.domain.com/page-1/

https://www.domain.com/index.php?id=2

First, probably.

Canonicals tell search engines which URL to rank.

Consolidate link signals on similar pages

When you have duplicate or nearly identical pages on your site, the URLs may get external links.

Canonical URLs consolidate multiple pages' link signals into a single URL.

This helps your site rank because signals from multiple URLs are consolidated into one.

Syndication management

Content is often syndicated to reach new audiences.

Canonical URLs consolidate ranking signals to prevent duplicate pages from ranking and ensure the original content ranks.

Avoid Googlebot duplicate page crawling

Canonical URLs ensure that Googlebot crawls your new pages rather than duplicated versions of the same one across mobile and desktop versions, for example.

Crawl budgets aren't an issue for most sites unless they have 100,000+ pages.

How to Correctly Implement the rel=canonical Tag

Using the header tag rel="canonical" is the most common way to specify canonical URLs.

Adding tags and HTML code may seem daunting if you're not a developer, but most CMS platforms allow canonicals out-of-the-box.

These URLs each have one product.

How to Correctly Implement a rel="canonical" HTTP Header

A rel="canonical" HTTP header can replace canonical tags.

This is how to implement a canonical URL for PDFs or non-HTML documents.

You can specify a canonical URL in your site's.htaccess file using the code below.

<Files "file-to-canonicalize.pdf"> Header add Link "< http://www.website.com/canonical-page/>; rel=\"canonical\"" </Files>301 redirects for canonical URLs

Google says 301 redirects can specify canonical URLs.

Only the canonical URL will exist if you use 301 redirects. This will redirect duplicates.

This is the best way to fix duplicate content across:

HTTPS and HTTP

Non-WWW and WWW

Trailing-Slash and Non-Trailing Slash URLs

On a single page, you should use canonical tags unless you can confidently delete and redirect the page.

Sitemaps' canonical URLs

Google assumes sitemap URLs are canonical, so don't include non-canonical URLs.

This does not guarantee canonical URLs, but is a best practice for sitemaps.

Best-practice Canonical Tag

Once you understand a few simple best practices for canonical tags, spotting and cleaning up duplicate content becomes much easier.

Always include:

One canonical URL per page

If you specify multiple canonical URLs per page, they will likely be ignored.

Correct Domain Protocol

If your site uses HTTPS, use this as the canonical URL. It's easy to reference the wrong protocol, so check for it to catch it early.

Trailing slash or non-trailing slash URLs

Be sure to include trailing slashes in your canonical URL if your site uses them.

Specify URLs other than WWW

Search engines see non-WWW and WWW URLs as duplicate pages, so use the correct one.

Absolute URLs

To ensure proper interpretation, canonical tags should use absolute URLs.

So use:

<link rel="canonical" href="https://www.website.com/page-a/" />And not:

<link rel="canonical" href="/page-a/" />If not canonicalizing, use self-referential canonical URLs.

When a page isn't canonicalizing to another URL, use self-referencing canonical URLs.

Canonical tags refer to themselves here.

Common Canonical Tags Mistakes

Here are some common canonical tag mistakes.

301 Canonicalization

Set the canonical URL as the redirect target, not a redirected URL.

Incorrect Domain Canonicalization

If your site uses HTTPS, don't set canonical URLs to HTTP.

Irrelevant Canonicalization

Canonicalize URLs to duplicate or near-identical content only.

SEOs sometimes try to pass link signals via canonical tags from unrelated content to increase rank. This isn't how canonicalization should be used and should be avoided.

Multiple Canonical URLs

Only use one canonical tag or URL per page; otherwise, they may all be ignored.

When overriding defaults in some CMSs, you may accidentally include two canonical tags in your page's <head>.

Pagination vs. Canonicalization

Incorrect pagination can cause duplicate content. Canonicalizing URLs to the first page isn't always the best solution.

Canonicalize to a 'view all' page.

How to Audit Canonical Tags (and Fix Issues)

Audit your site's canonical tags to find canonicalization issues.

SEMrush Site Audit can help. You'll find canonical tag checks in your website's site audit report.

Let's examine these issues and their solutions.

No Canonical Tag on AMP

Site Audit will flag AMP pages without canonical tags.

Canonicalization between AMP and non-AMP pages is important.

Add a rel="canonical" tag to each AMP page's head>.

No HTTPS redirect or canonical from HTTP homepage

Duplicate content issues will be flagged in the Site Audit if your site is accessible via HTTPS and HTTP.

You can fix this by 301 redirecting or adding a canonical tag to HTTP pages that references HTTPS.

Broken canonical links

Broken canonical links won't be considered canonical URLs.

This error could mean your canonical links point to non-existent pages, complicating crawling and indexing.

Update broken canonical links to the correct URLs.

Multiple canonical URLs

This error occurs when a page has multiple canonical URLs.

Remove duplicate tags and leave one.

Canonicalization is a key SEO concept, and using it incorrectly can hurt your site's performance.

Once you understand how it works, what it does, and how to find and fix issues, you can use it effectively to remove duplicate content from your site.

Canonicalization SEO Myths

caroline sinders

3 years ago

Holographic concerts are the AI of the Future.

A few days ago, I was discussing dall-e with two art and tech pals. One artist acquaintance said she knew a frightened illustrator. Would the ability to create anything with a click derail her career? The artist feared this. My curator friend smiled and said this has always been a dread among artists. When the camera was invented, didn't painters say this? Even in the Instagram era, painting exists.

When art and technology collide, there's room for innovation, experimentation, and fear — especially if the technology replicates or replaces art making. What is art's future with dall-e? How does technology affect music, beyond visual art? Recently, I saw "ABBA Voyage," a holographic ABBA concert in London.

"Abba voyage?" my phone asked in early March. A Gen X friend I met through a fashion blogging ring texted me.

"What's abba Voyage?" I asked while opening my front door with keys and coffee.

We're going! Marti, visiting London, took me to a show.

"Absolutely no ABBA songs here." I responded.

My parents didn't play ABBA much, so I don't know much about them. Dad liked Jimi Hendrix, Cream, Deep Purple, and New Orleans jazz. Marti told me ABBA Voyage was a holographic ABBA show with a live band.

The show was fun, extraordinary fun. Nearly everyone on the dance floor wore wigs, ankle-breaking platforms, sequins, and bellbottoms. I saw some millennials and Zoomers among the boomers.

I was intoxicated by the experience.

Automatons date back to the 18th-century mechanical turk. The mechanical turk was a chess automaton operated by a person. The mechanical turk seemed to perform like a human without human intervention, but it required a human in the loop to work properly.

Humans have used non-humans in entertainment for centuries, such as puppets, shadow play, and smoke and mirrors. A show can have animatronic, technological, and non-technological elements, and a live show can blur real and illusion. From medieval puppet shows to mechanical turks to AI filters, bots, and holograms, entertainment has evolved over time.

I'm not a hologram skeptic, but I'm skeptical of technology, especially since I work with it. I love live performances, I love hearing singers breathe, forget lines, and make jokes. Live shows are my favorite because I love watching performers make mistakes or interact with the audience. ABBA Voyage was different.

Marti and I traveled to Manchester after ABBA Voyage to see Liam Gallagher. Similar but different vibe. Similar in that thousands dressed up for the show. ABBA's energy was dizzying. 90s chic replaced sequins in the crowd. Doc Martens, nylon jackets, bucket hats, shaggy hair. The Charlatans and Liam Gallagher opened and closed, respectively. Fireworks. Incredible. People went crazy. Yelling exhausted my voice.

This week in music featured AI-enabled holograms and a decades-old rocker. Both are warm and gooey in our memories.

After seeing both, I'm wondering if we need AI hologram shows. Why? Is it good?

Like everything tech-related, my answer is "maybe." Because context and performance matter. Liam Gallagher and ABBA both had great, different shows.

For a hologram to work, it must be impossible and big. It must be big, showy, and improbable to justify a hologram. It must feel...expensive, like a stadium pop show. According to a quick search, ABBA broke up on bad terms. Reuniting is unlikely. This is also why Prince or Tupac hologram shows work. We can only engage with their legacy through covers or...holograms.

I drove around listening to the radio a few weeks ago. "Dreaming of You" by Selena played. Selena's music defined my childhood. I sang along and turned up the volume (or as loud as my husband would allow me while driving on the highway).

I discovered Selena's music six months after her death, so I never saw her perform live. My babysitter Melissa played me her album after I moved to Houston. Melissa took me to see the Selena movie five times when it came out. I quickly wore out my VHS copy. I constantly sang "Bibi Bibi Bom Bom" and "Como la Flor." I love Selena. A Selena hologram? Yes, probably.

Instagram advertised a cellist's Arthur Russell tribute show. Russell is another deceased artist I love. I almost walked down the aisle to "This is How We Walk on the Moon," but our cellist couldn't find it. Instead, I walked to Magnetic Fields' "The Book of Love." I "discovered" Russell after a friend introduced me to his music a few years ago.

I use these as analogies for the Liam Gallagher and ABBA concerts.

You have no idea how much I'd pay to see a hologram of Selena's 1995 Houston Livestock Show and Rodeo concert. Arthur Russell's hologram is unnecessary. Russell's work was intimate and performance-based. We can't separate his life from his legacy; popular audiences overlooked his genius. He died of AIDS broke. Like Selena, he died prematurely. Given his music and history, another performer would be a better choice than a hologram. He's no Selena. Selena could have rivaled Beyonce.

Pop shows' size works for holograms. Along with ABBA holograms, there was an anime movie and a light show that would put Tron to shame. ABBA created a tourable stadium show. The event was lavish, expensive, and well-planned. Pop, unlike rock, isn't gritty. Liam Gallagher hologram? No longer impossible, it wouldn't work. He's touring. I'm not sure if a rockstar alone should be rendered as a hologram; it was the show that made ABBA a hologram.

Holograms, like AI, are part of the future of entertainment, but not all of it. Because only modern interpretations of Arthur Russell's work reveal his legacy. That's his legacy.

Large-scale arena performers may use holograms in the future, but the experience must be impossible. A teacher once said that the only way to convey emotion in opera is through song, and I feel the same way about holograms, AR, VR, and mixed reality. A story's impossibility must make sense, like in opera. Impossibility and bombastic performance must be present for an immersive element to "work." ABBA was an impossible and improbable experience, which made it magical. It helped the holographic show work.

Marti told me about ABBA Voyage. She said it was a great concert. Marti has worked in music since the 1990s. She's a music expert; she's seen many shows.

Ai isn't a god or sentient, and the ABBA holograms aren't real. The renderings were glassy-eyed, flat, and robotic, like the Polar Express or the Jaws shark. Even today, the uncanny valley is insurmountable. We know it's not real because it's not about reality. It was about a suspended moment and performance feelings.

I knew this was impossible, an 'unreal' experience, but the emotions I felt were real, like watching a movie or tv show. Perhaps this is one of the better uses of AI, like CGI and special effects, like the beauty of entertainment- we were enraptured and entertained for hours. I've been playing ABBA since then.

You might also like

Alison Randel

3 years ago

Raising the Bar on Your 1:1s

Managers spend much time in 1:1s. Most team members meet with supervisors regularly. 1:1s can help create relationships and tackle tough topics. Few appreciate the 1:1 format's potential. Most of the time, that potential is spent on small talk, surface-level updates, and ranting (Ugh, the marketing team isn’t stepping up the way I want them to).

What if you used that time to have deeper conversations and important insights? What if change was easy?

This post introduces a new 1:1 format to help you dive deeper, faster, and develop genuine relationships without losing impact.

A 1:1 is a chat, you would assume. Why use structure to talk to a coworker? Go! I know how to talk to people. I can write. I've always written. Also, This article was edited by Zoe.

Before you discard something, ask yourself if there's a good reason not to try anything new. Is the 1:1 only a talk, or do you want extra benefits? Try the steps below to discover more.

I. Reflection (5 minutes)

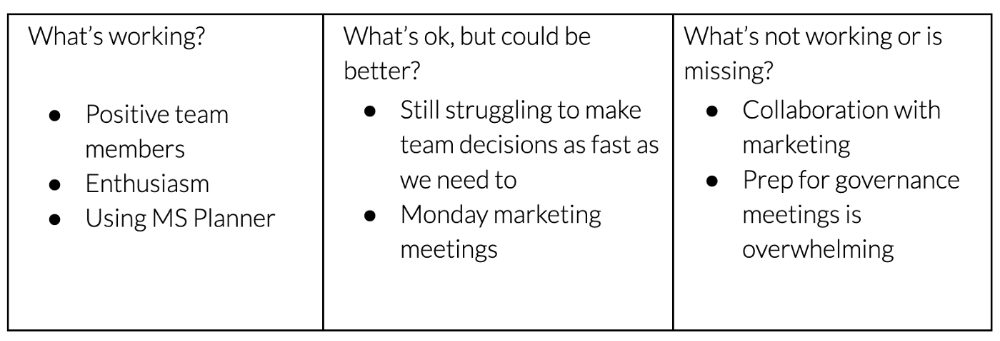

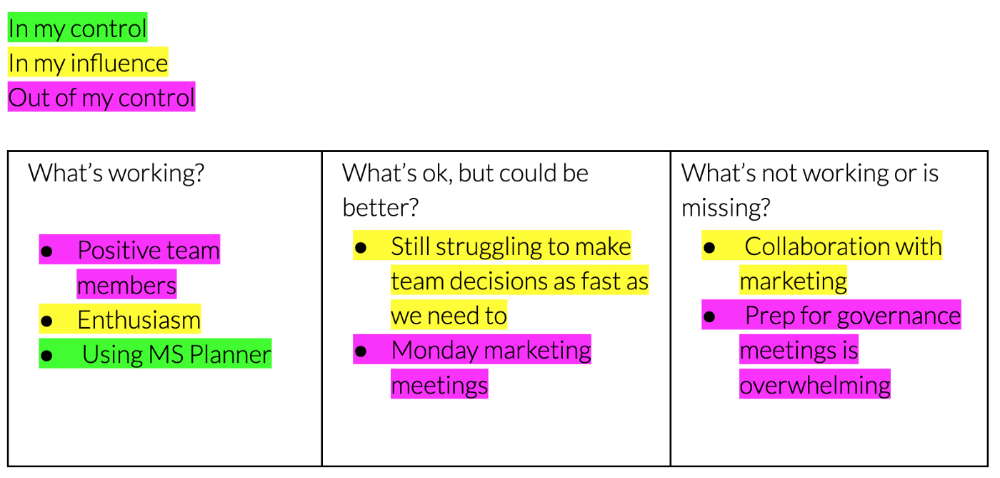

Context-free, broad comments waste time and are useless. Instead, give team members 5 minutes to write these 3 prompts.

What's effective?

What is decent but could be improved?

What is broken or missing?

Why these? They encourage people to be honest about all their experiences. Answering these questions helps people realize something isn't working. These prompts let people consider what's working.

Why take notes? Because you get more in less time. Will you feel awkward sitting quietly while your coworker writes? Probably. Persevere. Multi-task. Take a break from your afternoon meeting marathon. Any awkwardness will pay off.

What happens? After a few minutes of light conversation, create a template like the one given here and have team members fill in their replies. You can pre-share the template (with the caveat that this isn’t meant to take much prep time). Do this with your coworker: Answer the prompts. Everyone can benefit from pondering and obtaining guidance.

This step's output.

Part II: Talk (10-20 minutes)

Most individuals can explain what they see but not what's behind an answer. You don't like a meeting. Why not? Marketing partnership is difficult. What makes working with them difficult? I don't recommend slandering coworkers. Consider how your meetings, decisions, and priorities make work harder. The excellent stuff too. You want to know what's humming so you can reproduce the magic.

First, recognize some facts.

Real power dynamics exist. To encourage individuals to be honest, you must provide a safe environment and extend clear invites. Even then, it may take a few 1:1s for someone to feel secure enough to go there in person. It is part of your responsibility to admit that it is normal.

Curiosity and self-disclosure are crucial. Most leaders have received training to present themselves as the authorities. However, you will both benefit more from the dialogue if you can be open and honest about your personal experience, ask questions out of real curiosity, and acknowledge the pertinent sacrifices you're making as a leader.

Honesty without bias is difficult and important. Due to concern for the feelings of others, people frequently hold back. Or if they do point anything out, they do so in a critical manner. The key is to be open and unapologetic about what you observe while not presuming that your viewpoint is correct and that of the other person is incorrect.

Let's go into some prompts (based on genuine conversations):

“What do you notice across your answers?”

“What about the way you/we/they do X, Y, or Z is working well?”

“ Will you say more about item X in ‘What’s not working?’”

“I’m surprised there isn’t anything about Z. Why is that?”

“All of us tend to play some role in maintaining certain patterns. How might you/we be playing a role in this pattern persisting?”

“How might the way we meet, make decisions, or collaborate play a role in what’s currently happening?”

Consider the preceding example. What about the Monday meeting isn't working? Why? or What about the way we work with marketing makes collaboration harder? Remember to share your honest observations!

Third section: observe patterns (10-15 minutes)

Leaders desire to empower their people but don't know how. We also have many preconceptions about what empowerment means to us and how it works. The next phase in this 1:1 format will assist you and your team member comprehend team power and empowerment. This understanding can help you support and shift your team member's behavior, especially where you disagree.

How to? After discussing the stated responses, ask each team member what they can control, influence, and not control. Mark their replies. You can do the same, adding colors where you disagree.

This step's output.

Next, consider the color constellation. Discuss these questions:

Is one color much more prevalent than the other? Why, if so?

Are the colors for the "what's working," "what's fine," and "what's not working" categories clearly distinct? Why, if so?

Do you have any disagreements? If yes, specifically where does your viewpoint differ? What activities do you object to? (Remember, there is no right or wrong in this. Give explicit details and ask questions with curiosity.)

Example: Based on the colors, you can ask, Is the marketing meeting's quality beyond your control? Were our marketing partners consulted? Are there any parts of team decisions we can control? We can't control people, but have we explored another decision-making method? How can we collaborate and generate governance-related information to reduce work, even if the requirement for prep can't be eliminated?

Consider the top one or two topics for this conversation. No 1:1 can cover everything, and that's OK. Focus on the present.

Part IV: Determine the next step (5 minutes)

Last, examine what this conversation means for you and your team member. It's easy to think we know the next moves when we don't.

Like what? You and your teammate answer these questions.

What does this signify moving ahead for me? What can I do to change this? Make requests, for instance, and see how people respond before thinking they won't be responsive.

What demands do I have on other people or my partners? What should I do first? E.g. Make a suggestion to marketing that we hold a monthly retrospective so we can address problems and exchange input more frequently. Include it on the meeting's agenda for next Monday.

Close the 1:1 by sharing what you noticed about the chat. Observations? Learn anything?

Yourself, you, and the 1:1

As a leader, you either reinforce or disrupt habits. Try this template if you desire greater ownership, empowerment, or creativity. Consider how you affect surrounding dynamics. How can you expect others to try something new in high-stakes scenarios, like meetings with cross-functional partners or senior stakeholders, if you won't? How can you expect deep thought and relationship if you don't encourage it in 1:1s? What pattern could this new format disrupt or reinforce?

Fight reluctance. First attempts won't be ideal, and that's OK. You'll only learn by trying.

DANIEL CLERY

3 years ago

Can space-based solar power solve Earth's energy problems?

Better technology and lower launch costs revive science-fiction tech.

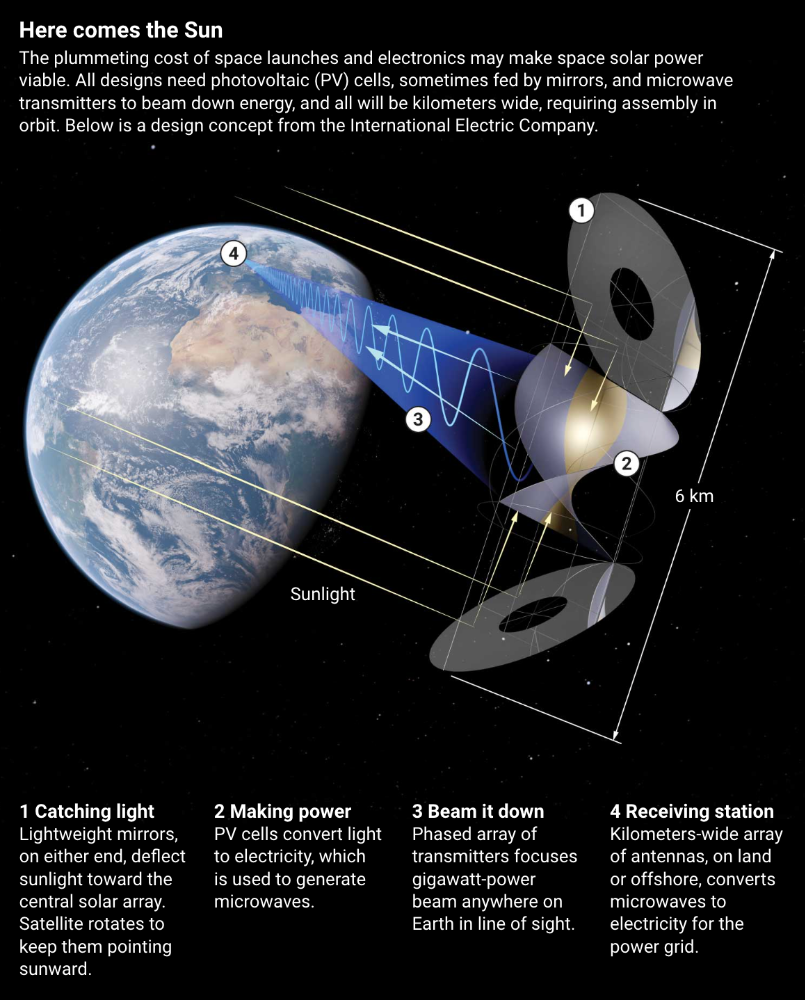

Airbus engineers showed off sustainable energy's future in Munich last month. They captured sunlight with solar panels, turned it into microwaves, and beamed it into an airplane hangar, where it lighted a city model. The test delivered 2 kW across 36 meters, but it posed a serious question: Should we send enormous satellites to capture solar energy in space? In orbit, free of clouds and nighttime, they could create power 24/7 and send it to Earth.

Airbus engineer Jean-Dominique Coste calls it an engineering problem. “But it’s never been done at [large] scale.”

Proponents of space solar power say the demand for green energy, cheaper space access, and improved technology might change that. Once someone invests commercially, it will grow. Former NASA researcher John Mankins says it might be a trillion-dollar industry.

Myriad uncertainties remain, including whether beaming gigawatts of power to Earth can be done efficiently and without burning birds or people. Concept papers are being replaced with ground and space testing. The European Space Agency (ESA), which supported the Munich demo, will propose ground tests to member nations next month. The U.K. government offered £6 million to evaluate innovations this year. Chinese, Japanese, South Korean, and U.S. agencies are working. NASA policy analyst Nikolai Joseph, author of an upcoming assessment, thinks the conversation's tone has altered. What formerly appeared unattainable may now be a matter of "bringing it all together"

NASA studied space solar power during the mid-1970s fuel crunch. A projected space demonstration trip using 1970s technology would have cost $1 trillion. According to Mankins, the idea is taboo in the agency.

Space and solar power technology have evolved. Photovoltaic (PV) solar cell efficiency has increased 25% over the past decade, Jones claims. Telecoms use microwave transmitters and receivers. Robots designed to repair and refuel spacecraft might create solar panels.

Falling launch costs have boosted the idea. A solar power satellite large enough to replace a nuclear or coal plant would require hundreds of launches. ESA scientist Sanjay Vijendran: "It would require a massive construction complex in orbit."

SpaceX has made the idea more plausible. A SpaceX Falcon 9 rocket costs $2600 per kilogram, less than 5% of what the Space Shuttle did, and the company promised $10 per kilogram for its giant Starship, slated to launch this year. Jones: "It changes the equation." "Economics rules"

Mass production reduces space hardware costs. Satellites are one-offs made with pricey space-rated parts. Mars rover Perseverance cost $2 million per kilogram. SpaceX's Starlink satellites cost less than $1000 per kilogram. This strategy may work for massive space buildings consisting of many identical low-cost components, Mankins has long contended. Low-cost launches and "hypermodularity" make space solar power economical, he claims.

Better engineering can improve economics. Coste says Airbus's Munich trial was 5% efficient, comparing solar input to electricity production. When the Sun shines, ground-based solar arrays perform better. Studies show space solar might compete with existing energy sources on price if it reaches 20% efficiency.

Lighter parts reduce costs. "Sandwich panels" with PV cells on one side, electronics in the middle, and a microwave transmitter on the other could help. Thousands of them build a solar satellite without heavy wiring to move power. In 2020, a team from the U.S. Naval Research Laboratory (NRL) flew on the Air Force's X-37B space plane.

NRL project head Paul Jaffe said the satellite is still providing data. The panel converts solar power into microwaves at 8% efficiency, but not to Earth. The Air Force expects to test a beaming sandwich panel next year. MIT will launch its prototype panel with SpaceX in December.

As a satellite orbits, the PV side of sandwich panels sometimes faces away from the Sun since the microwave side must always face Earth. To maintain 24-hour power, a satellite needs mirrors to keep that side illuminated and focus light on the PV. In a 2012 NASA study by Mankins, a bowl-shaped device with thousands of thin-film mirrors focuses light onto the PV array.

International Electric Company's Ian Cash has a new strategy. His proposed satellite uses enormous, fixed mirrors to redirect light onto a PV and microwave array while the structure spins (see graphic, above). 1 billion minuscule perpendicular antennas act as a "phased array" to electronically guide the beam toward Earth, regardless of the satellite's orientation. This design, argues Cash, is "the most competitive economically"

If a space-based power plant ever flies, its power must be delivered securely and efficiently. Jaffe's team at NRL just beamed 1.6 kW over 1 km, and teams in Japan, China, and South Korea have comparable attempts. Transmitters and receivers lose half their input power. Vijendran says space solar beaming needs 75% efficiency, "preferably 90%."

Beaming gigawatts through the atmosphere demands testing. Most designs aim to produce a beam kilometers wide so every ship, plane, human, or bird that strays into it only receives a tiny—hopefully harmless—portion of the 2-gigawatt transmission. Receiving antennas are cheap to build but require a lot of land, adds Jones. You could grow crops under them or place them offshore.

Europe's public agencies currently prioritize space solar power. Jones: "There's a devotion you don't see in the U.S." ESA commissioned two solar cost/benefit studies last year. Vijendran claims it might match ground-based renewables' cost. Even at a higher price, equivalent to nuclear, its 24/7 availability would make it competitive.

ESA will urge member states in November to fund a technical assessment. If the news is good, the agency will plan for 2025. With €15 billion to €20 billion, ESA may launch a megawatt-scale demonstration facility by 2030 and a gigawatt-scale facility by 2040. "Moonshot"

Christian Soschner

3 years ago

Steve Jobs' Secrets Revealed

From 1984 until 2011, he ran Apple using the same template.

What is a founder CEO's most crucial skill?

Presentation, communication, and sales

As a Business Angel Investor, I saw many pitch presentations and met with investors one-on-one to promote my companies.

There is always the conception of “Investors have to invest,” so there is no need to care about the presentation.

It's false. Nobody must invest. Many investors believe that entrepreneurs must convince them to invest in their business.

Sometimes — like in 2018–2022 — too much money enters the market, and everyone makes good money.

Do you recall the Buy Now, Pay Later Movement? This amazing narrative had no return potential. Only buyers who couldn't acquire financing elsewhere shopped at these companies.

Klarna's failing business concept led to high valuations.

Investors become more cautious when the economy falters. 2022 sees rising inflation, interest rates, wars, and civil instability. It's like the apocalypse's four horsemen have arrived.

Storytelling is important in rough economies.

When investors draw back, how can entrepreneurs stand out?

In Q2/2022, every study I've read said:

Investors cease investing

Deals are down in almost all IT industries from previous quarters.

What do founders need to do?

Differentiate yourself.

Storytelling talents help.

The Steve Jobs Way

Every time I watch a Steve Jobs presentation, I'm enthralled.

I'm a techie. Everything technical interests me. But, I skim most presentations.

What's Steve Jobs's secret?

Steve Jobs created Apple in 1976 and made it a profitable software and hardware firm in the 1980s. Macintosh goods couldn't beat IBM's. This mistake sacked him in 1985.

Before rejoining Apple in 1997, Steve Jobs founded Next Inc. and Pixar.

From then on, Apple became America's most valuable firm.

Steve Jobs understood people's needs. He said:

“People don’t know what they want until you show it to them. That’s why I never rely on market research. Our task is to read things that are not yet on the page.”

In his opinion, people talk about problems. A lot. Entrepreneurs must learn what the population's pressing problems are and create a solution.

Steve Jobs showed people what they needed before they realized it.

I'll explain:

Present a Big Vision

Steve Jobs starts every presentation by describing his long-term goals for Apple.

1984's Macintosh presentation set up David vs. Goliath. In a George Orwell-style dystopia, IBM computers were bad. It was 1984.

Apple will save the world, like Jedis.

Why do customers and investors like Big Vision?

People want a wider perspective, I think. Humans love improving the planet.

Apple users often cite emotional reasons for buying the brand.

Revolutionizing several industries with breakthrough inventions

Establish Authority

Everyone knows Apple in 2022. It's hard to find folks who confuse Apple with an apple around the world.

Apple wasn't as famous as it is today until Steve Jobs left in 2011.

Most entrepreneurs lack experience. They may market their company or items to folks who haven't heard of it.

Steve Jobs presented the company's historical accomplishments to overcome opposition.

In his presentation of the first iPhone, he talked about the Apple Macintosh, which altered the computing sector, and the iPod, which changed the music industry.

People who have never heard of Apple feel like they're seeing a winner. It raises expectations that the new product will be game-changing and must-have.

The Big Reveal

A pitch or product presentation always has something new.

Steve Jobs doesn't only demonstrate the product. I don't think he'd skip the major point of a company presentation.

He consistently discusses present market solutions, their faults, and a better consumer solution.

No solution exists yet.

It's a multi-faceted play:

It's comparing the new product to something familiar. This makes novelty and the product more relatable.

Describe a desirable solution.

He's funny. He demonstrated an iPod with an 80s phone dial in his iPhone presentation.

Then he reveals the new product. Macintosh presented itself.

Show the benefits

He outlines what Apple is doing differently after demonstrating the product.

How do you distinguish from others? The Big Breakthrough Presentation.

A few hundred slides might list all benefits.

Everyone would fall asleep. Have you ever had similar presentations?

When the brain is overloaded with knowledge, the limbic system changes to other duties, like lunch planning.

What should a speaker do? There's a classic proverb:

“Tell me and I forget, teach me and I may remember, involve me and I learn” (— Not Benjamin Franklin).

Steve Jobs showcased the product live.

Again, using ordinary scenarios to highlight the product's benefits makes it relatable.

The 2010 iPad Presentation uses this technique.

Invite the Team and Let Them Run the Presentation

CEOs spend most time outside the organization. Many companies elect to have only one presenter.

It sends the incorrect message to investors. Product presentations should always include the whole team.

Let me explain why.

Companies needing investment money frequently have shaky business strategies or no product-market fit or robust corporate structure.

Investors solely bet on a team's ability to implement ideas and make a profit.

Early team involvement helps investors understand the company's drivers. Travel costs are worthwhile.

But why for product presentations?

Presenters of varied ages, genders, social backgrounds, and skillsets are relatable. CEOs want relatable products.

Some customers may not believe a white man's message. A black woman's message may be more accepted.

Make the story relatable when you have the best product that solves people's concerns.

Best example: 1984 Macintosh presentation with development team panel.

What is the largest error people make when companies fail?

Saving money on the corporate and product presentation.

Invite your team to five partner meetings when five investors are shortlisted.

Rehearse the presentation till it's natural. Let the team speak.

Successful presentations require structure, rehearsal, and a team. Steve Jobs nailed it.