More on Leadership

Looi Qin En

3 years ago

I polled 52 product managers to find out what qualities make a great Product Manager

Great technology opens up an universe of possibilities.

Need a friend? WhatsApp, Telegram, Slack, etc.

Traveling? AirBnB, Expedia, Google Flights, etc.

Money transfer? Use digital banking, e-wallet, or crypto applications

Products inspire us. How do we become great?

I asked product managers in my network:

What does it take to be a great product manager?

52 product managers from 40+ prominent IT businesses in Southeast Asia responded passionately. Many of the PMs I've worked with have built fantastic products, from unicorns (Lazada, Tokopedia, Ovo) to incumbents (Google, PayPal, Experian, WarnerMedia) to growing (etaily, Nium, Shipper).

TL;DR:

Soft talents are more important than hard skills. Technical expertise was hardly ever stressed by product managers, and empathy was mentioned more than ten times. Janani from Xendit expertly recorded the moment. A superb PM must comprehend that their empathy for the feelings of their users must surpass all logic and data.

Constant attention to the needs of the user. Many people concur that the closer a PM gets to their customer/user, the more likely it is that the conclusion will be better. There were almost 30 references to customers and users. Focusing on customers has the advantage because it is hard to overshoot, as Rajesh from Lazada puts it best.

Setting priorities is invaluable. Prioritization is essential because there are so many problems that a PM must deal with every day. My favorite quotation on this is from Rakuten user Yee Jie. Viki, A competent product manager extinguishes fires. A good product manager lets things burn and then prioritizes.

This summary isn't enough to capture what excellent PMs claim it requires. Read below!

What qualities make a successful product manager?

Themed quotes are alphabetized by author.

Embrace your user/customer

Aeriel Dela Paz, Rainmaking Venture Architect, ex-GCash Product Head

Great PMs know what customers need even when they don’t say it directly. It’s about reading between the lines and going through the numbers to address that need.

Anders Nordahl, OrkestraSCS's Product Manager

Understanding the vision of your customer is as important as to get the customer to buy your vision

Angel Mendoza, MetaverseGo's Product Head

Most people think that to be a great product manager, you must have technical know-how. It’s textbook and I do think it is helpful to some extent, but for me the secret sauce is EMPATHY — the ability to see and feel things from someone else’s perspective. You can’t create a solution without deeply understanding the problem.

Senior Product Manager, Tokopedia

Focus on delivering value and helping people (consumer as well as colleague) and everything else will follow

Darren Lau, Deloitte Digital's Head of Customer Experience

Start with the users, and work backwards. Don’t have a solution looking for a problem

Darryl Tan, Grab Product Manager

I would say that a great product manager is able to identify the crucial problems to solve through strong user empathy and synthesis of insights

Diego Perdana, Kitalulus Senior Product Manager

I think to be a great product manager you need to be obsessed with customer problems and most important is solve the right problem with the right solution

Senior Product Manager, AirAsia

Lot of common sense + Customer Obsession. The most important role of a Product manager is to bring clarity of a solution. Your product is good if it solves customer problems. Your product is great if it solves an eco-system problem and disrupts the business in a positive way.

Edward Xie, Mastercard Managing Consultant, ex-Shopee Product Manager

Perfect your product, but be prepared to compromise for right users

AVP Product, Shipper

For me, a great product manager need to be rational enough to find the business opportunities while obsessing the customers.

Janani Gopalakrishnan is a senior product manager of a stealth firm.

While as a good PM it’s important to be data-driven, to be a great PM one needs to understand that their empathy for their users’ emotions must exceed all logic and data. Great PMs also make these product discussions thrive within the team by intently listening to all the members thoughts and influence the team’s skin in the game positively.

Director, Product Management, Indeed

Great product managers put their users first. They discover problems that matter most to their users and inspire their team to find creative solutions.

Grab's Senior Product Manager Lakshay Kalra

Product management is all about finding and solving most important user problems

Quipper's Mega Puji Saraswati

First of all, always remember the value of “user first” to solve what user really needs (the main problem) for guidance to arrange the task priority and develop new ideas. Second, ownership. Treat the product as your “2nd baby”, and the team as your “2nd family”. Third, maintain a good communication, both horizontally and vertically. But on top of those, always remember to have a work — life balance, and know exactly the priority in life :)

Senior Product Manager, Prosa.AI Miswanto Miswanto

A great Product Manager is someone who can be the link between customer needs with the readiness and flexibility of the team. So that it can provide, build, and produce a product that is useful and helps the community to carry out their daily activities. And He/She can improve product quality ongoing basis or continuous to help provide solutions for users or our customer.

Lead Product Manager, Tokopedia, Oriza Wahyu Utami

Be a great listener, be curious and be determined. every great product manager have the ability to listen the pain points and understand the problems, they are always curious on the users feedback, and they also very determined to look for the solutions that benefited users and the business.

99 Group CPO Rajesh Sangati

The advantage of focusing on customers: it’s impossible to overshoot

Ray Jang, founder of Scenius, formerly of ByteDance

The difference between good and great product managers is that great product managers are willing to go the unsexy and unglamorous extra mile by rolling up their sleeves and ironing out all minutiae details of the product such that when the user uses the product, they can’t help but say “This was made for me.”

BCG Digital Ventures' Sid Narayanan

Great product managers ensure that what gets built and shipped is at the intersection of what creates value for the customer and for the business that’s building the product…often times, especially in today’s highly liquid funding environment, the unit economics, aka ensuring that what gets shipped creates value for the business and is sustainable, gets overlooked

Stephanie Brownlee, BCG Digital Ventures Product Manager

There is software in the world that does more harm than good to people and society. Great Product Managers build products that solve problems not create problems

Experiment constantly

Delivery Hero's Abhishek Muralidharan

Embracing your failure is the key to become a great Product Manager

DeliveryHero's Anuraag Burman

Product Managers should be thick skinned to deal with criticism and the stomach to take risk and face failures.

DataSpark Product Head Apurva Lawale

Great product managers enjoy the creative process with their team to deliver intuitive user experiences to benefit users.

Dexter Zhuang, Xendit Product Manager

The key to creating winning products is building what customers want as quickly as you can — testing and learning along the way.

PayPal's Jay Ko

To me, great product managers always remain relentlessly curious. They are empathetic leaders and problem solvers that glean customer insights into building impactful products

Home Credit Philippines' Jedd Flores

Great Product Managers are the best dreamers; they think of what can be possible for the customers, for the company and the positive impact that it will have in the industry that they’re part of

Set priorities first, foremost, foremost.

HBO Go Product Manager Akshay Ishwar

Good product managers strive to balance the signal to noise ratio, Great product managers know when to turn the dials for each up exactly

Zuellig Pharma's Guojie Su

Have the courage to say no. Managing egos and request is never easy and rejecting them makes it harder but necessary to deliver the best value for the customers.

Ninja Van's John Prawira

(1) PMs should be able to ruthlessly prioritize. In order to be effective, PMs should anchor their product development process with their north stars (success metrics) and always communicate with a purpose. (2) User-first when validating assumptions. PMs should validate assumptions early and often to manage risk when leading initiatives with a focus on generating the highest impact to solving a particular user pain-point. We can’t expect a product/feature launch to be perfect (there might be bugs or we might not achieve our success metric — which is where iteration comes in), but we should try our best to optimize on user-experience earlier on.

Nium Product Manager Keika Sugiyama

I’d say a great PM holds the ability to balance ruthlessness and empathy at the same time. It’s easier said than done for sure!

ShopBack product manager Li Cai

Great product managers are like great Directors of movies. They do not create great products/movies by themselves. They deliver it by Defining, Prioritising, Energising the team to deliver what customers love.

Quincus' Michael Lim

A great product manager, keeps a pulse on the company’s big picture, identifies key problems, and discerns its rightful prioritization, is able to switch between the macro perspective to micro specifics, and communicates concisely with humility that influences naturally for execution

Mathieu François-Barseghian, SVP, Citi Ventures

“You ship your org chart”. This is Conway’s Law short version (1967!): the fundamental socio-technical driver behind innovation successes (Netflix) and failures (your typical bank). The hype behind micro-services is just another reflection of Conway’s Law

Mastercard's Regional Product Manager Nikhil Moorthy

A great PM should always look to build products which are scalable & viable , always keep the end consumer journey in mind. Keeping things simple & having a MVP based approach helps roll out products faster. One has to test & learn & then accordingly enhance / adapt, these are key to success

Rendy Andi, Tokopedia Product Manager

Articulate a clear vision and the path to get there, Create a process that delivers the best results and Be serious about customers.

Senior Product Manager, DANA Indonesia

Own the problem, not the solution — Great PMs are outstanding problem preventers. Great PMs are discerning about which problems to prevent, which problems to solve, and which problems not to solve

Tat Leong Seah, LionsBot International Senior UX Engineer, ex-ViSenze Product Manager

Prioritize outcomes for your users, not outputs of your system” or more succinctly “be agile in delivering value; not features”

Senior Product Manager, Rakuten Viki

A good product manager puts out fires. A great product manager lets fires burn and prioritize from there

acquire fundamental soft skills

Oracle NetSuite's Astrid April Dominguez

Personally, i believe that it takes grit, empathy, and optimistic mindset to become a great PM

Ovo Lead Product Manager Boy Al Idrus

Contrary to popular beliefs, being a great product manager doesn’t have anything to do with technicals, it sure plays a part but most important weapons are: understanding pain points of users, project management, sympathy in leadership and business critical skills; these 4 aspects would definitely help you to become a great product manager.

PwC Product Manager Eric Koh

Product managers need to be courageous to be successful. Courage is required to dive deep, solving big problems at its root and also to think far and dream big to achieve bold visions for your product

Ninja Van's Product Director

In my opinion the two most important ingredients to become a successful product manager is: 1. Strong critical thinking 2. Strong passion for the work. As product managers, we typically need to solve very complex problems where the answers are often very ambiguous. The work is tough and at times can be really frustrating. The 2 ingredients I mentioned earlier will be critical towards helping you to slowly discover the solution that may become a game changer.

PayPal's Lead Product Manager

A great PM has an eye of a designer, the brain of an engineer and the tongue of a diplomat

Product Manager Irene Chan

A great Product Manager is able to think like a CEO of the company. Visionary with Agile Execution in mind

Isabella Yamin, Rakuten Viki Product Manager

There is no one model of being a great product person but what I’ve observed from people I’ve had the privilege working with is an overflowing passion for the user problem, sprinkled with a knack for data and negotiation

Google product manager Jachin Cheng

Great product managers start with abundant intellectual curiosity and grow into a classic T-shape. Horizontally: generalists who range widely, communicate fluidly and collaborate easily cross-functionally, connect unexpected dots, and have the pulse both internally and externally across users, stakeholders, and ecosystem players. Vertically: deep product craftsmanship comes from connecting relentless user obsession with storytelling, business strategy with detailed features and execution, inspiring leadership with risk mitigation, and applying the most relevant tools to solving the right problems.

Jene Lim, Experian's Product Manager

3 Cs and 3 Rs. Critical thinking , Customer empathy, Creativity. Resourcefulness, Resilience, Results orientation.

Nirenj George, Envision Digital's Security Product Manager

A great product manager is someone who can lead, collaborate and influence different stakeholders around the product vision, and should be able to execute the product strategy based on customer insights, as well as take ownership of the product roadmap to create a greater impact on customers.

Grab's Lead Product Manager

Product Management is a multi-dimensional role that looks very different across each product team so each product manager has different challenges to deal with but what I have found common among great product managers is ability to create leverage through their efforts to drive outsized impacts for their products. This leverage is built using data with intuition, building consensus with stakeholders, empowering their teams and focussed efforts on needle moving work.

NCS Product Manager Umar Masagos

To be a great product manager, one must master both the science and art of Product Management. On one hand, you need have a strong understanding of the tools, metrics and data you need to drive your product. On the other hand, you need an in-depth understanding of your organization, your target market and target users, which is often the more challenging aspect to master.

M1 product manager Wei Jiao Keong

A great product manager is multi-faceted. First, you need to have the ability to see the bigger picture, yet have a keen eye for detail. Secondly, you are empathetic and is able to deliver products with exceptional user experience while being analytical enough to achieve business outcomes. Lastly, you are highly resourceful and independent yet comfortable working cross-functionally.

Yudha Utomo, ex-Senior Product Manager, Tokopedia

A great Product Manager is essentially an effective note-taker. In order to achieve the product goals, It is PM’s job to ensure objective has been clearly conveyed, efforts are assessed, and tasks are properly tracked and managed. PM can do this by having top-notch documentation skills.

Jason Kottke

3 years ago

Lessons on Leadership from the Dancing Guy

This is arguably the best three-minute demonstration I've ever seen of anything. Derek Sivers turns a shaky video of a lone dancing guy at a music festival into a leadership lesson.

A leader must have the courage to stand alone and appear silly. But what he's doing is so straightforward that it's almost instructive. This is critical. You must be simple to follow!

Now comes the first follower, who plays an important role: he publicly demonstrates how to follow. The leader embraces him as an equal, so it's no longer about the leader — it's about them, plural. He's inviting his friends to join him. It takes courage to be the first follower! You stand out and dare to be mocked. Being a first follower is a style of leadership that is underappreciated. The first follower elevates a lone nut to the position of leader. If the first follower is the spark that starts the fire, the leader is the flint.

This link was sent to me by @ottmark, who noted its resemblance to Kurt Vonnegut's three categories of specialists required for revolution.

The rarest of these specialists, he claims, is an actual genius – a person capable generating seemingly wonderful ideas that are not widely known. "A genius working alone is generally dismissed as a crazy," he claims.

The second type of specialist is much easier to find: a highly intellectual person in good standing in his or her community who understands and admires the genius's new ideas and can attest that the genius is not insane. "A person like him working alone can only crave loudly for changes, but fail to say what their shapes should be," Slazinger argues.

Jeff Veen reduced the three personalities to "the inventor, the investor, and the evangelist" on Twitter.

William Anderson

3 years ago

When My Remote Leadership Skills Took Off

4 Ways To Manage Remote Teams & Employees

The wheels hit the ground as I landed in Rochester.

Our six-person satellite office was now part of my team.

Their manager only reported to me the day before, but I had my ticket booked ahead of time.

I had managed remote employees before but this was different. Engineers dialed into headquarters for every meeting.

So when I learned about the org chart change, I knew a strong first impression would set the tone for everything else.

I was either their boss, or their boss's boss, and I needed them to know I was committed.

Managing a fleet of satellite freelancers or multiple offices requires treating others as more than just a face behind a screen.

You must comprehend each remote team member's perspective and daily interactions.

The good news is that you can start using these techniques right now to better understand and elevate virtual team members.

1. Make Visits To Other Offices

If budgeted, visit and work from offices where teams and employees report to you. Only by living alongside them can one truly comprehend their problems with communication and other aspects of modern life.

2. Have Others Come to You

• Having remote, distributed, or satellite employees and teams visit headquarters every quarter or semi-quarterly allows the main office culture to rub off on them.

When remote team members visit, more people get to meet them, which builds empathy.

If you can't afford to fly everyone, at least bring remote managers or leaders. Hopefully they can resurrect some culture.

3. Weekly Work From Home

No home office policy?

Make one.

WFH is a team-building, problem-solving, and office-viewing opportunity.

For dial-in meetings, I started working from home on occasion.

It also taught me which teams “forget” or “skip” calls.

As a remote team member, you experience all the issues first hand.

This isn't as accurate for understanding teams in other offices, but it can be done at any time.

4. Increase Contact Even If It’s Just To Chat

Don't underestimate office banter.

Sometimes it's about bonding and trust, other times it's about business.

If you get all this information in real-time, please forward it.

Even if nothing critical is happening, call remote team members to check in and chat.

I guarantee that building relationships and rapport will increase both their job satisfaction and yours.

You might also like

Keagan Stokoe

3 years ago

Generalists Create Startups; Specialists Scale Them

There’s a funny part of ‘Steve Jobs’ by Walter Isaacson where Jobs says that Bill Gates was more a copier than an innovator:

“Bill is basically unimaginative and has never invented anything, which is why I think he’s more comfortable now in philanthropy than technology. He just shamelessly ripped off other people’s ideas….He’d be a broader guy if he had dropped acid once or gone off to an ashram when he was younger.”

Gates lacked flavor. Nobody ever got excited about a Microsoft launch, despite their good products. Jobs had the world's best product taste. Apple vs. Microsoft.

A CEO's core job functions are all driven by taste: recruiting, vision, and company culture all require good taste. Depending on the type of company you want to build, know where you stand between Microsoft and Apple.

How can you improve your product judgment? How to acquire taste?

Test and refine

Product development follows two parallel paths: the ‘customer obsession’ path and the ‘taste and iterate’ path.

The customer obsession path involves solving customer problems. Lean Startup frameworks show you what to build at each step.

Taste-and-iterate doesn't involve the customer. You iterate internally and rely on product leaders' taste and judgment.

Creative Selection by Ken Kocienda explains this method. In Creative Selection, demos are iterated and presented to product leaders. Your boss presents to their boss, and so on up to Steve Jobs. If you have good product taste, you can be a panelist.

The iPhone follows this path. Before seeing an iPhone, consumers couldn't want one. Customer obsession wouldn't have gotten you far because iPhone buyers didn't know they wanted one.

In The Hard Thing About Hard Things, Ben Horowitz writes:

“It turns out that is exactly what product strategy is all about — figuring out the right product is the innovator’s job, not the customer’s job. The customer only knows what she thinks she wants based on her experience with the current product. The innovator can take into account everything that’s possible, but often must go against what she knows to be true. As a result, innovation requires a combination of knowledge, skill, and courage.“

One path solves a problem the customer knows they have, and the other doesn't. Instead of asking a person what they want, observe them and give them something they didn't know they needed.

It's much harder. Apple is the world's most valuable company because it's more valuable. It changes industries permanently.

If you want to build superior products, use the iPhone of your industry.

How to Improve Your Taste

I. Work for a company that has taste.

People with the best taste in products, markets, and people are rewarded for building great companies. Tasteful people know quality even when they can't describe it. Taste isn't writable. It's feel-based.

Moving into a community that's already doing what you want to do may be the best way to develop entrepreneurial taste. Most company-building knowledge is tacit.

Joining a company you want to emulate allows you to learn its inner workings. It reveals internal patterns intuitively. Many successful founders come from successful companies.

Consumption determines taste. Excellence will refine you. This is why restauranteurs visit the world's best restaurants and serious painters visit Paris or New York. Joining a company with good taste is beneficial.

2. Possess a wide range of interests

“Edwin Land of Polaroid talked about the intersection of the humanities and science. I like that intersection. There’s something magical about that place… The reason Apple resonates with people is that there’s a deep current of humanity in our innovation. I think great artists and great engineers are similar, in that they both have a desire to express themselves.” — Steve Jobs

I recently discovered Edwin Land. Jobs modeled much of his career after Land's. It makes sense that Apple was inspired by Land.

A Triumph of Genius: Edwin Land, Polaroid, and the Kodak Patent War notes:

“Land was introverted in person, but supremely confident when he came to his ideas… Alongside his scientific passions, lay knowledge of art, music, and literature. He was a cultured person growing even more so as he got older, and his interests filtered into the ethos of Polaroid.”

Founders' philosophies shape companies. Jobs and Land were invested. It showed in the products their companies made. Different. His obsession was spreading Microsoft software worldwide. Microsoft's success is why their products are bland and boring.

Experience is important. It's probably why startups are built by generalists and scaled by specialists.

Jobs combined design, typography, storytelling, and product taste at Apple. Some of the best original Mac developers were poets and musicians. Edwin Land liked broad-minded people, according to his biography. Physicist-musicians or physicist-photographers.

Da Vinci was a master of art, engineering, architecture, anatomy, and more. He wrote and drew at the same desk. His genius is remembered centuries after his death. Da Vinci's statue would stand at the intersection of humanities and science.

We find incredibly creative people here. Superhumans. Designers, creators, and world-improvers. These are the people we need to navigate technology and lead world-changing companies. Generalists lead.

SAHIL SAPRU

3 years ago

Growth tactics that grew businesses from 1 to 100

Everyone wants a scalable startup.

Innovation helps launch a startup. The secret to a scalable business is growth trials (from 1 to 100).

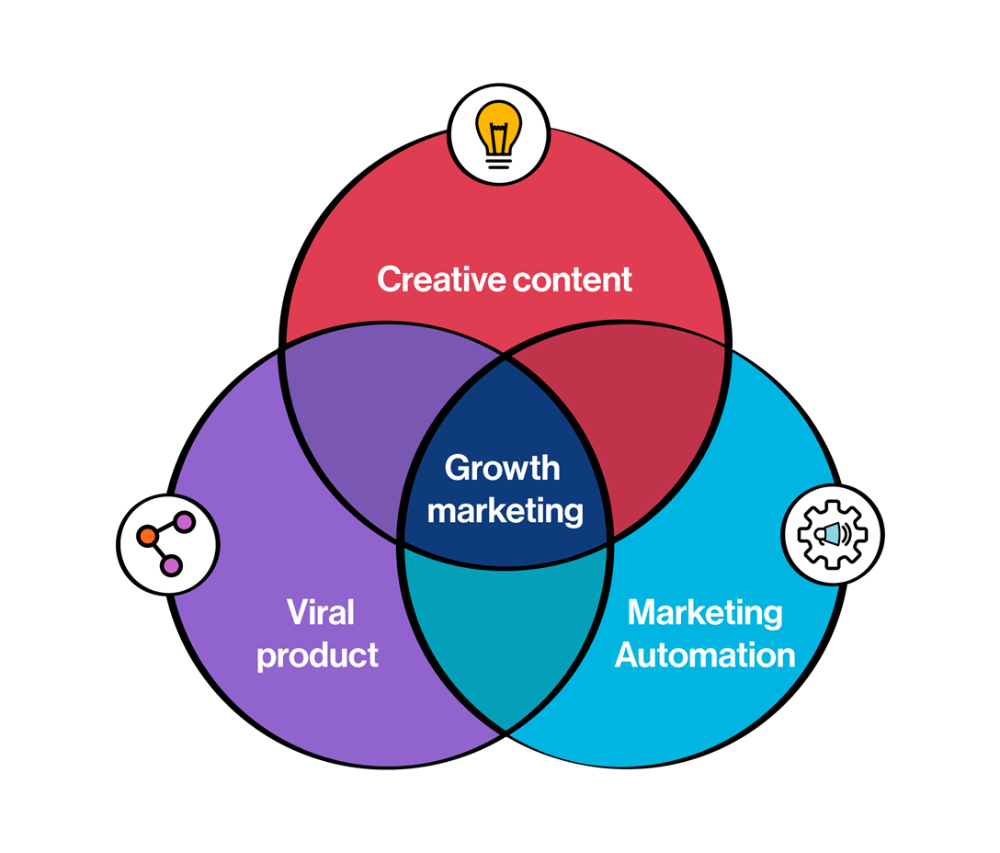

Growth marketing combines marketing and product development for long-term growth.

Today, I'll explain growth hacking strategies popular startups used to scale.

1/ A Facebook user's social value is proportional to their friends.

Facebook built its user base using content marketing and paid ads. Mark and his investors feared in 2007 when Facebook's growth stalled at 90 million users.

Chamath Palihapitiya was brought in by Mark.

The team tested SEO keywords and MAU chasing. The growth team introduced “people you may know”

This feature reunited long-lost friends and family. Casual users became power users as the retention curve flattened.

Growth Hack Insights: With social network effect the value of your product or platform increases exponentially if you have users you know or can relate with.

2/ Airbnb - Focus on your value propositions

Airbnb nearly failed in 2009. The company's weekly revenue was $200 and they had less than 2 months of runway.

Enter Paul Graham. The team noticed a pattern in 40 listings. Their website's property photos sucked.

Why?

Because these photos were taken with regular smartphones. Users didn't like the first impression.

Graham suggested traveling to New York to rent a camera, meet with property owners, and replace amateur photos with high-resolution ones.

A week later, the team's weekly revenue doubled to $400, indicating they were on track.

Growth Hack Insights: When selling an “online experience” ensure that your value proposition is aesthetic enough for users to enjoy being associated with them.

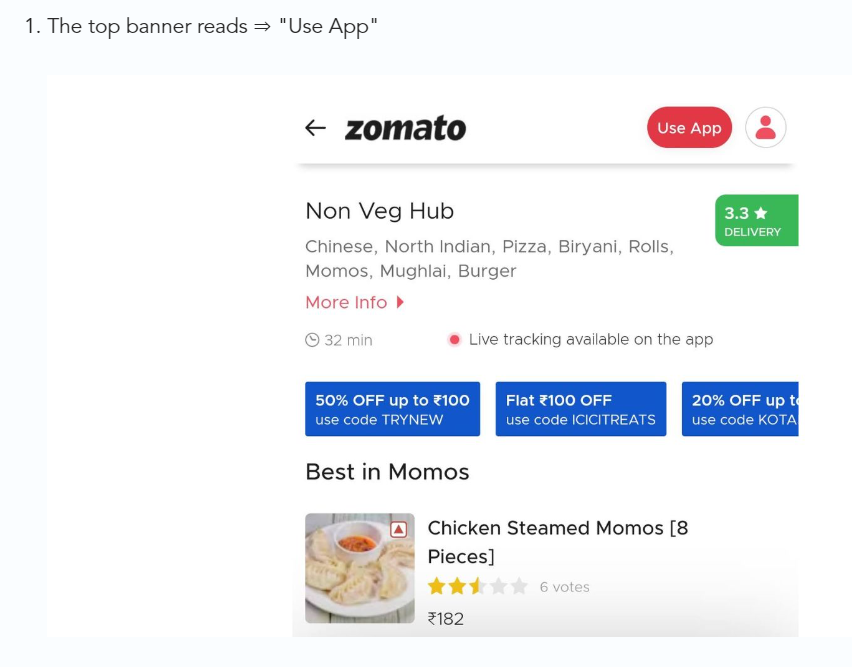

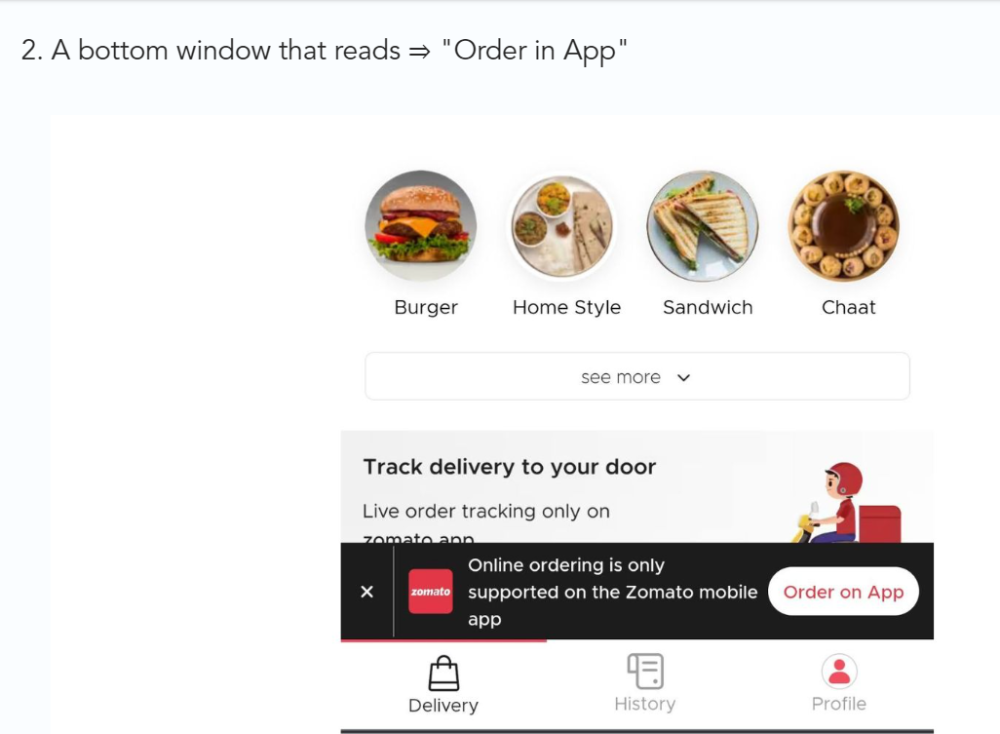

3/ Zomato - A company's smartphone push ensured growth.

Zomato delivers food. User retention was a challenge for the founders. Indian food customers are notorious for switching brands at the drop of a hat.

Zomato wanted users to order food online and repeat orders throughout the week.

Zomato created an attractive website with “near me” keywords for SEO indexing.

Zomato gambled to increase repeat orders. They only allowed mobile app food orders.

Zomato thought mobile apps were stickier. Product innovations in search/discovery/ordering or marketing campaigns like discounts/in-app notifications/nudges can improve user experience.

Zomato went public in 2021 after users kept ordering food online.

Growth Hack Insights: To improve user retention try to build platforms that build user stickiness. Your product and marketing team will do the rest for them.

4/ Hotmail - Signaling helps build premium users.

Ever sent or received an email or tweet with a sign — sent from iPhone?

Hotmail did it first! One investor suggested Hotmail add a signature to every email.

Overnight, thousands joined the company. Six months later, the company had 1 million users.

When serving an existing customer, improve their social standing. Signaling keeps the top 1%.

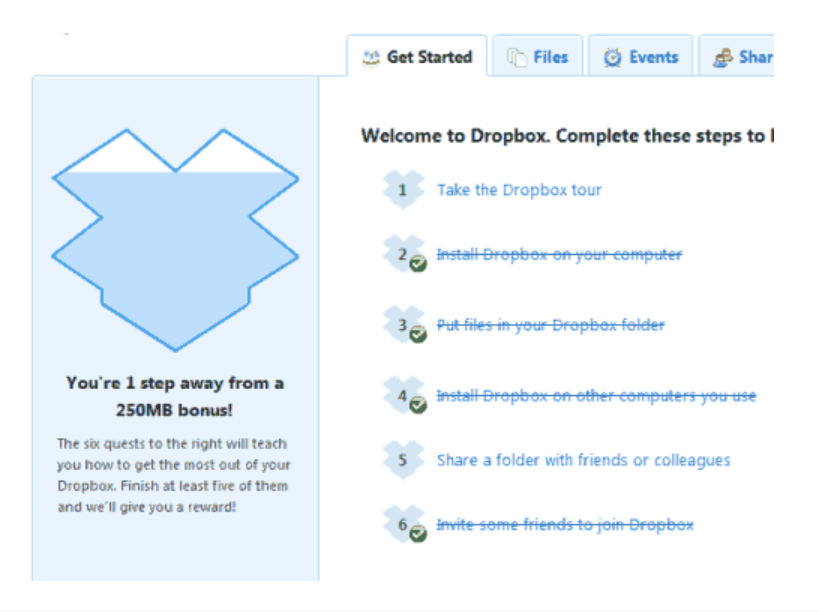

5/ Dropbox - Respect loyal customers

Dropbox is a company that puts people over profits. The company prioritized existing users.

Dropbox rewarded loyal users by offering 250 MB of free storage to anyone who referred a friend. The referral hack helped Dropbox get millions of downloads in its first few months.

Growth Hack Insights: Think of ways to improve the social positioning of your end-user when you are serving an existing customer. Signaling goes a long way in attracting the top 1% to stay.

These experiments weren’t hacks. Hundreds of failed experiments and user research drove these experiments. Scaling up experiments is difficult.

Contact me if you want to grow your startup's user base.

Alex Mathers

25 years ago

400 articles later, nobody bothered to read them.

Writing for readers:

14 years of daily writing.

I post practically everything on social media. I authored hundreds of articles, thousands of tweets, and numerous volumes to almost no one.

Tens of thousands of readers regularly praise me.

I despised writing. I'm stuck now.

I've learned what readers like and what doesn't.

Here are some essential guidelines for writing with impact:

Readers won't understand your work if you can't.

Though obvious, this slipped me up. Share your truths.

Stories engage human brains.

Showing the journey of a person from worm to butterfly inspires the human spirit.

Overthinking hinders powerful writing.

The best ideas come from inner understanding in between thoughts.

Avoid writing to find it. Write.

Writing a masterpiece isn't motivating.

Write for five minutes to simplify. Step-by-step, entertaining, easy steps.

Good writing requires a willingness to make mistakes.

So write loads of garbage that you can edit into a good piece.

Courageous writing.

A courageous story will move readers. Personal experience is best.

Go where few dare.

Templates, outlines, and boundaries help.

Limitations enhance writing.

Excellent writing is straightforward and readable, removing all the unnecessary fat.

Use five words instead of nine.

Use ordinary words instead of uncommon ones.

Readers desire relatability.

Too much perfection will turn it off.

Write to solve an issue if you can't think of anything to write.

Instead, read to inspire. Best authors read.

Every tweet, thread, and novel must have a central idea.

What's its point?

This can make writing confusing.

️ Don't direct your reader.

Readers quit reading. Demonstrate, describe, and relate.

Even if no one responds, have fun. If you hate writing it, the reader will too.