More on Leadership

Joe Procopio

3 years ago

Provide a product roadmap that can withstand startup velocities

This is how to build a car while driving.

Building a high-growth startup is compared to building a car while it's speeding down the highway.

How to plan without going crazy? Or, without losing team, board, and investor buy-in?

I just delivered our company's product roadmap for the rest of the year. Complete. Thorough. Page-long. I'm optimistic about its chances of surviving as everything around us changes, from internal priorities to the global economy.

It's tricky. This isn't the first time I've created a startup roadmap. I didn't invent a document. It took time to deliver a document that will be relevant for months.

Goals matter.

Although they never change, goals are rarely understood.

This is the third in a series about a startup's unique roadmapping needs. Velocity is the intensity at which a startup must produce to survive.

A high-growth startup moves at breakneck speed, which I alluded to when I said priorities and economic factors can change daily or weekly.

At that speed, a startup's roadmap must be flexible, bend but not break, and be brief and to the point. I can't tell you how many startups and large companies develop a product roadmap every quarter and then tuck it away.

Big, wealthy companies can do this. It's suicide for a startup.

The drawer thing happens because startup product roadmaps are often valid for a short time. The roadmap is a random list of features prioritized by different company factions and unrelated to company goals.

It's not because the goals changed that a roadmap is shelved or ignored. Because the company's goals were never communicated or documented in the context of its product.

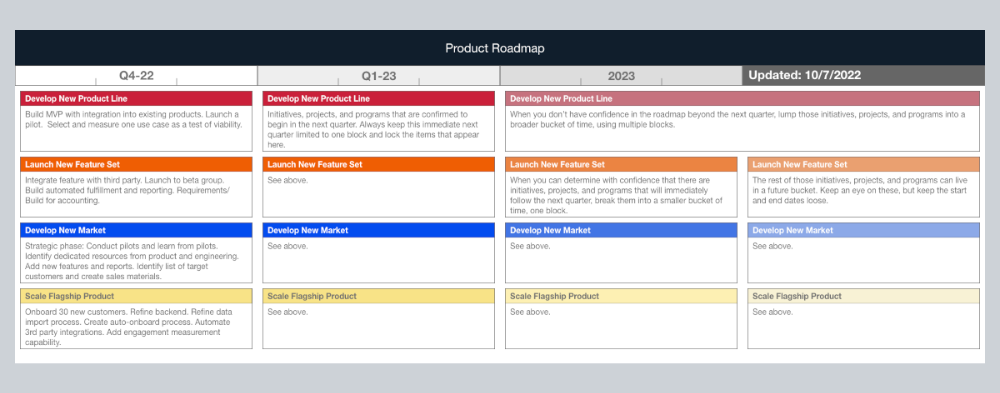

In the previous post, I discussed how to turn company goals into a product roadmap. In this post, I'll show you how to make a one-page startup roadmap.

In a future post, I'll show you how to follow this roadmap. This roadmap helps you track company goals, something a roadmap must do.

Be vague for growth, but direct for execution.

Here's my plan. The real one has more entries and more content in each.

Let's discuss smaller boxes.

Product developers and engineers know that the further out they predict, the more wrong they'll be. When developing the product roadmap, this rule is ignored. Then it bites us three, six, or nine months later when we haven't even started.

Why do we put everything in a product roadmap like a project plan?

Yes, I know. We use it when the product roadmap isn't goal-based.

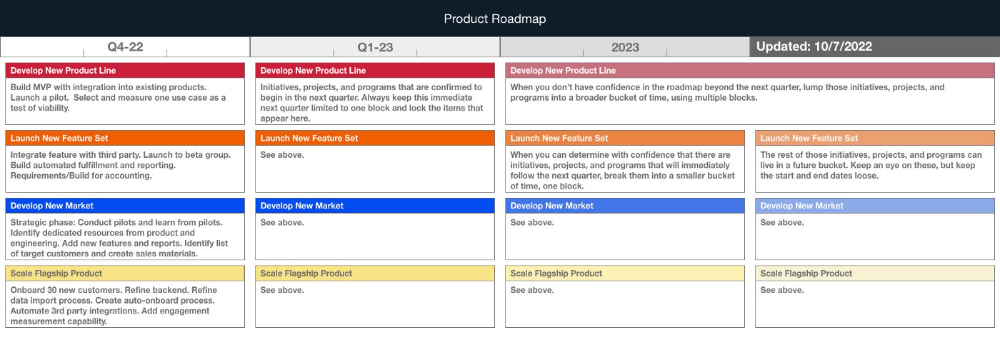

A goal-based roadmap begins with a document that outlines each goal's idea, execution, growth, and refinement.

Once the goals are broken down into epics, initiatives, projects, and programs, only the idea and execution phases should be modeled. Any goal growth or refinement items should be vague and loosely mapped.

Why? First, any idea or execution-phase goal will result in growth initiatives that are unimaginable today. Second, internal priorities and external factors will change, but the goals won't. Locking items into calendar slots reduces flexibility and forces deviation from the single source of truth.

No soothsayers. Predicting the future is pointless; just prepare.

A map is useless if you don't know where you're going.

As we speed down the road, the car and the road will change. Goals define the destination.

This quarter and next quarter's roadmap should be set. After that, you should track destination milestones, not how to get there.

When you do that, even the most critical investors will understand the roadmap and buy in. When you track progress at the end of the quarter and revise your roadmap, the destination won't change.

Jason Kottke

3 years ago

Lessons on Leadership from the Dancing Guy

This is arguably the best three-minute demonstration I've ever seen of anything. Derek Sivers turns a shaky video of a lone dancing guy at a music festival into a leadership lesson.

A leader must have the courage to stand alone and appear silly. But what he's doing is so straightforward that it's almost instructive. This is critical. You must be simple to follow!

Now comes the first follower, who plays an important role: he publicly demonstrates how to follow. The leader embraces him as an equal, so it's no longer about the leader — it's about them, plural. He's inviting his friends to join him. It takes courage to be the first follower! You stand out and dare to be mocked. Being a first follower is a style of leadership that is underappreciated. The first follower elevates a lone nut to the position of leader. If the first follower is the spark that starts the fire, the leader is the flint.

This link was sent to me by @ottmark, who noted its resemblance to Kurt Vonnegut's three categories of specialists required for revolution.

The rarest of these specialists, he claims, is an actual genius – a person capable generating seemingly wonderful ideas that are not widely known. "A genius working alone is generally dismissed as a crazy," he claims.

The second type of specialist is much easier to find: a highly intellectual person in good standing in his or her community who understands and admires the genius's new ideas and can attest that the genius is not insane. "A person like him working alone can only crave loudly for changes, but fail to say what their shapes should be," Slazinger argues.

Jeff Veen reduced the three personalities to "the inventor, the investor, and the evangelist" on Twitter.

KonstantinDr

3 years ago

Early Adopters And the Fifth Reason WHY

Product management wizardry.

Early adopters buy a product even if it hasn't hit the market or has flaws.

Who are the early adopters?

Early adopters try a new technology or product first. Early adopters are interested in trying or buying new technologies and products before others. They're risk-tolerant and can provide initial cash flow and product reviews. They help a company's new product or technology gain social proof.

Early adopters are most common in the technology industry, but they're in every industry. They don't follow the crowd. They seek innovation and report product flaws before mass production. If the product works well, the first users become loyal customers, and colleagues value their opinion.

What to do with early adopters?

They can be used to collect feedback and initial product promotion, first sales, and product value validation.

How to find early followers?

Start with your immediate environment and target audience. Communicate with them to see if they're interested in your value proposition.

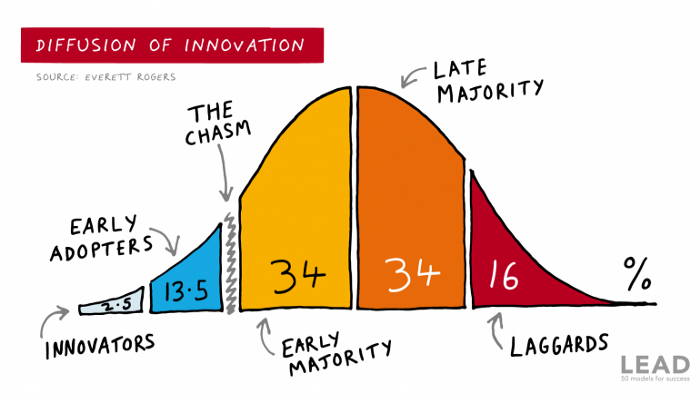

1) Innovators (2.5% of the population) are risk-takers seeking novelty. These people are the first to buy new and trendy items and drive social innovation. However, these people are usually elite;

Early adopters (13.5%) are inclined to accept innovations but are more cautious than innovators; they start using novelties when innovators or famous people do;

3) The early majority (34%) is conservative; they start using new products when many people have mastered them. When the early majority accepted the innovation, it became ingrained in people's minds.

4) Attracting 34% of the population later means the novelty has become a mass-market product. Innovators are using newer products;

5) Laggards (16%) are the most conservative, usually elderly people who use the same products.

Stages of new information acceptance

1. The information is strange and rejected by most. Accepted only by innovators;

2. When early adopters join, more people believe it's not so bad; when a critical mass is reached, the novelty becomes fashionable and most people use it.

3. Fascination with a novelty peaks, then declines; the majority and laggards start using it later; novelty becomes obsolete; innovators master something new.

Problems with early implementation

Early adopter sales have disadvantages.

Higher risk of defects

Selling to first-time users increases the risk of defects. Early adopters are often influential, so this can affect the brand's and its products' long-term perception.

Not what was expected

First-time buyers may be disappointed by the product. Marketing messages can mislead consumers, and if the first users believe the company misrepresented the product, this will affect future sales.

Compatibility issues

Some technological advances cause compatibility issues. Consumers may be disappointed if new technology is incompatible with their electronics.

Method 5 WHY

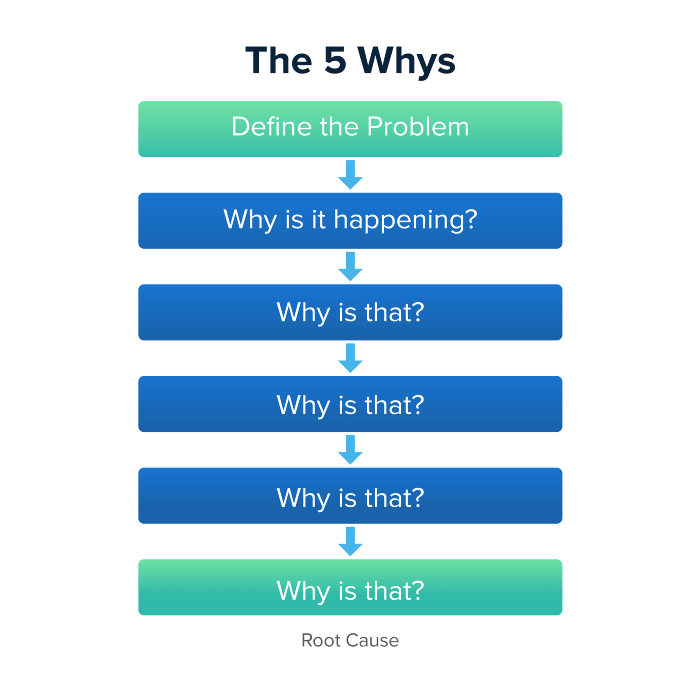

Let's talk about 5 why, a good tool for finding project problems' root causes. This method is also known as the five why rule, method, or questions.

The 5 why technique came from Toyota's lean manufacturing and helps quickly determine a problem's root cause.

On one, two, and three, you simply do this:

We identify and frame the issue for which a solution is sought.

We frequently ponder this question. The first 2-3 responses are frequently very dull, making you want to give up on this pointless exercise. However, after that, things get interesting. And occasionally it's so fascinating that you question whether you really needed to know.

We consider the final response, ponder it, and choose a course of action.

Always do the 5 whys with the customer or team to have a reasonable discussion and better understand what's happening.

And the “five whys” is a wonderful and simplest tool for introspection. With the accumulated practice, it is used almost automatically in any situation like “I can’t force myself to work, the mood is bad in the morning” or “why did I decide that I have no life without this food processor for 20,000 rubles, which will take half of my rather big kitchen.”

An illustration of the five whys

A simple, but real example from my work practice that I think is very indicative, given the participants' low IT skills. Anonymized, of course.

Users spend too long looking for tender documents.

Why? Because they must search through many company tender documents.

Why? Because the system can't filter department-specific bids.

Why? Because our contract management system requirements didn't include a department-tender link. That's it, right? We'll add a filter and be happy. but still…

why? Because we based the system's requirements on regulations for working with paper tender documents (when they still had envelopes and autopsies), not electronic ones, and there was no search mechanism.

Why? We didn't consider how our work would change when switching from paper to electronic tenders when drafting the requirements.

Now I know what to do in the future. We add a filter, enter department data, and teach users to use it. This is tactical, but strategically we review the same forgotten requirements to make all the necessary changes in a package, plus we include it in the checklist for the acceptance of final requirements for the future.

Errors when using 5 why

Five whys seems simple, but it can be misused.

Popular ones:

The accusation of everyone and everything is then introduced. After all, the 5 why method focuses on identifying the underlying causes rather than criticizing others. As a result, at the third step, it is not a good idea to conclude that the system is ineffective because users are stupid and that we can therefore do nothing about it.

to fight with all my might so that the outcome would be exactly 5 reasons, neither more nor less. 5 questions is a typical number (it sounds nice, yes), but there could be 3 or 7 in actuality.

Do not capture in-between responses. It is difficult to overestimate the power of the written or printed word, so the result is so-so when the focus is lost. That's it, I suppose. Simple, quick, and brilliant, like other project management tools.

Conclusion

Today we analyzed important study elements:

Early adopters and 5 WHY We've analyzed cases and live examples of how these methods help with product research and growth point identification. Next, consider the HADI cycle.

You might also like

Akshad Singi

3 years ago

Four obnoxious one-minute habits that help me save more than 30 hours each week

These four, when combined, destroy procrastination.

You're not rushed. You waste it on busywork.

You'll accept this eventually.

In 2022, the daily average usage of a user on social media is 2.5 hours.

By 2020, 6 billion hours of video were watched each month by Netflix's customers, who used the service an average of 3.2 hours per day.

When we see these numbers, we think "Wow!" People squander so much time as though they don't contribute. True. These are yours. Likewise.

We don't lack time; we just waste it. Once you realize this, you can change your habits to save time. This article explains. If you adopt ALL 4 of these simple behaviors, you'll see amazing benefits.

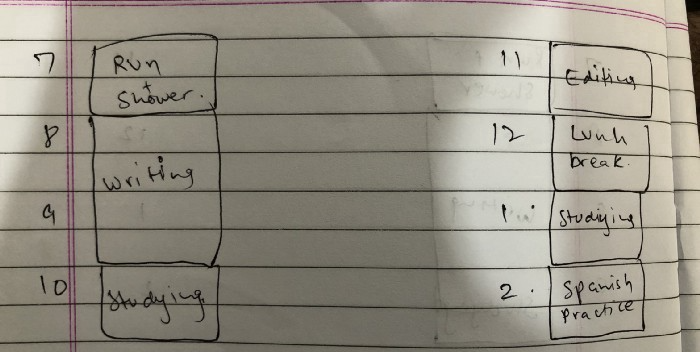

Time-blocking

Cal Newport's time-blocking trick takes a minute but improves your day's clarity.

Divide the next day into 30-minute (or 5-minute, if you're Elon Musk) segments and assign responsibilities. As seen.

Here's why:

The procrastination that results from attempting to determine when to begin working is eliminated. Procrastination is a given if you choose when to begin working in real-time. Even if you may assume you'll start working in five minutes, it won't take you long to realize that five minutes have turned into an hour. But if you've already determined to start working at 2:00 the next day, your odds of procrastinating are greatly decreased, if not eliminated altogether.

You'll also see that you have a lot of time in a day when you plan your day out on paper and assign chores to each hour. Doing this daily will permanently eliminate the lack of time mindset.

5-4-3-2-1: Have breakfast with the frog!

“If it’s your job to eat a frog, it’s best to do it first thing in the morning. And If it’s your job to eat two frogs, it’s best to eat the biggest one first.”

Eating the frog means accomplishing the day's most difficult chore. It's better to schedule it first thing in the morning when time-blocking the night before. Why?

The day's most difficult task is also the one that causes the most postponement. Because of the stress it causes, the later you schedule it, the more time you risk wasting by procrastinating.

However, if you do it right away in the morning, you'll feel good all day. This is the reason it was set for the morning.

Mel Robbins' 5-second rule can help. Start counting backward 54321 and force yourself to start at 1. If you acquire the urge to work on a goal, you must act within 5 seconds or your brain will destroy it. If you're scheduled to eat your frog at 9, eat it at 8:59. Start working.

Micro-visualisation

You've heard of visualizing to enhance the future. Visualizing a bright future won't do much if you're not prepared to focus on the now and develop the necessary habits. Alexander said:

People don’t decide their futures. They decide their habits and their habits decide their future.

I visualize the next day's schedule every morning. My day looks like this

“I’ll start writing an article at 7:30 AM. Then, I’ll get dressed up and reach the medicine outpatient department by 9:30 AM. After my duty is over, I’ll have lunch at 2 PM, followed by a nap at 3 PM. Then, I’ll go to the gym at 4…”

etc.

This reinforces the day you planned the night before. This makes following your plan easy.

Set the timer.

It's the best iPhone productivity app. A timer is incredible for increasing productivity.

Set a timer for an hour or 40 minutes before starting work. Your call. I don't believe in techniques like the Pomodoro because I can focus for varied amounts of time depending on the time of day, how fatigued I am, and how cognitively demanding the activity is.

I work with a timer. A timer keeps you focused and prevents distractions. Your mind stays concentrated because of the timer. Timers generate accountability.

To pee, I'll pause my timer. When I sit down, I'll continue. Same goes for bottle refills. To use Twitter, I must pause the timer. This creates accountability and focuses work.

Connecting everything

If you do all 4, you won't be disappointed. Here's how:

Plan out your day's schedule the night before.

Next, envision in your mind's eye the same timetable in the morning.

Speak aloud 54321 when it's time to work: Eat the frog! In the morning, devour the largest frog.

Then set a timer to ensure that you remain focused on the task at hand.

Jano le Roux

3 years ago

Apple Quietly Introduces A Revolutionary Savings Account That Kills Banks

Would you abandon your bank for Apple?

Banks are struggling.

not as a result of inflation

not due to the economic downturn.

not due to the conflict in Ukraine.

But because they’re underestimating Apple.

Slowly but surely, Apple is looking more like a bank.

An easy new savings account like Apple

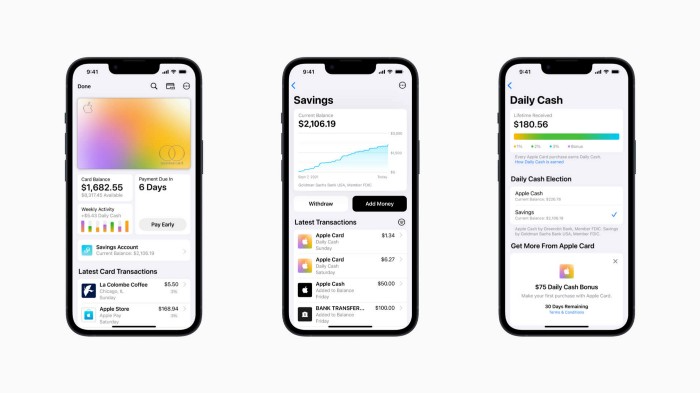

Apple has a new savings account.

Apple says Apple Card users may set up and manage savings straight in Wallet.

No more charges

Colorfully high yields

With no minimum balance

No minimal down payments

Most consumer-facing banks will have to match Apple's offer or suffer disruption.

Users may set it up from their iPhones without traveling to a bank or filling out paperwork.

It’s built into the iPhone in your pocket.

So now more waiting for slow approval processes.

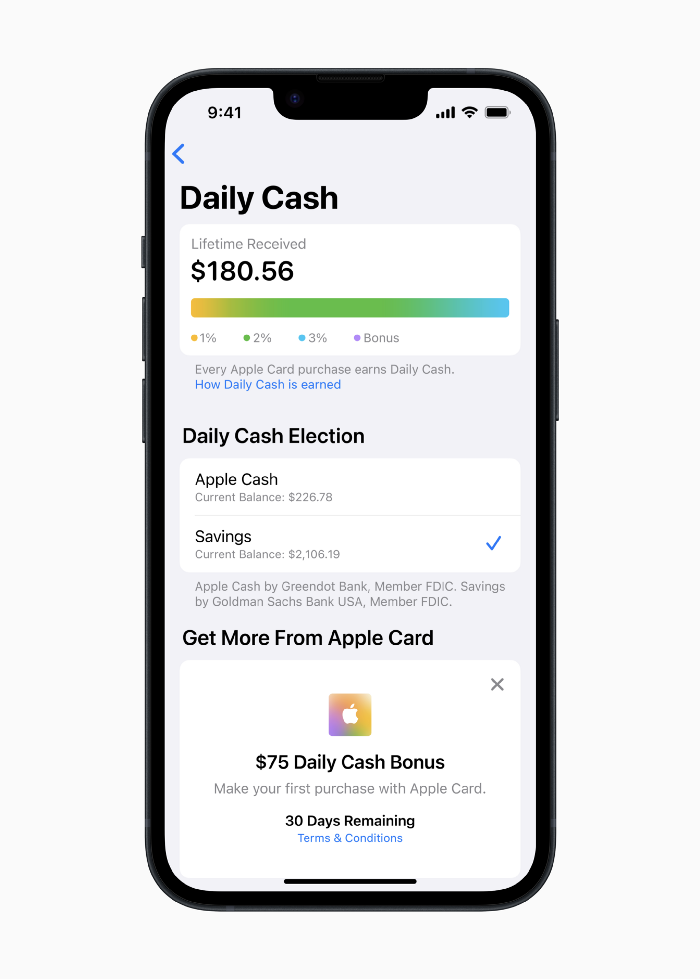

Once the savings account is set up, Apple will automatically transfer all future Daily Cash into it. Users may also add these cash to an Apple Cash card in their Apple Wallet app and adjust where Daily Cash is paid at any time.

Apple Pay and Apple Wallet VP Jennifer Bailey:

Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future.

Bailey says Savings adds value to Apple Card's Daily Cash benefit and offers another easy-to-use tool to help people lead healthier financial lives.

Transfer money from a linked bank account or Apple Cash to a Savings account. Users can withdraw monies to a connected bank account or Apple Cash card without costs.

Once set up, Apple Card customers can track their earnings via Wallet's Savings dashboard. This dashboard shows their account balance and interest.

This product targets younger people as the easiest way to start a savings account on the iPhone.

Why would a Gen Z account holder travel to the bank if their iPhone could be their bank?

Using this concept, Apple will transform the way we think about banking by 2030.

Two other nightmares keep bankers awake at night

Apple revealed two new features in early 2022 that banks and payment gateways hated.

Tap to Pay with Apple

Late Apple Pay

They startled the industry.

Tap To Pay converts iPhones into mobile POS card readers. Apple Pay Later is pushing the BNPL business in a consumer-friendly direction, hopefully ending dodgy lending practices.

Tap to Pay with Apple

iPhone POS

Millions of US merchants, from tiny shops to huge establishments, will be able to accept Apple Pay, contactless credit and debit cards, and other digital wallets with a tap.

No hardware or payment terminal is needed.

Revolutionary!

Stripe has previously launched this feature.

Tap to Pay on iPhone will provide companies with a secure, private, and quick option to take contactless payments and unleash new checkout experiences, said Bailey.

Apple's solution is ingenious. Brilliant!

Bailey says that payment platforms, app developers, and payment networks are making it easier than ever for businesses of all sizes to accept contactless payments and thrive.

I admire that Apple is offering this up to third-party services instead of closing off other functionalities.

Slow POS terminals, farewell.

Late Apple Pay

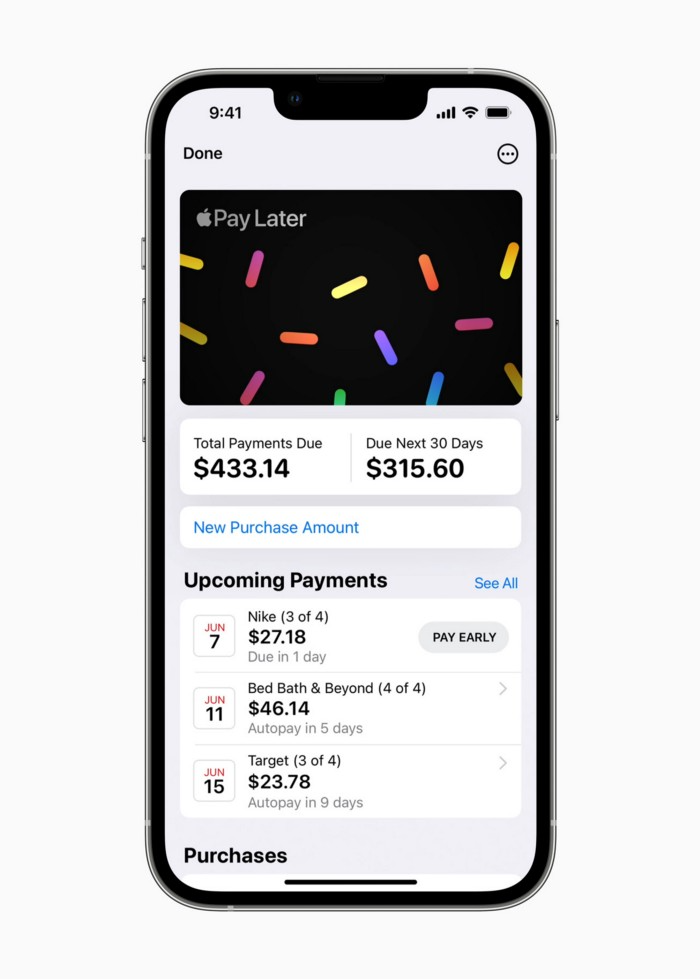

Pay Apple later.

Apple Pay Later enables US consumers split Apple Pay purchases into four equal payments over six weeks with no interest or fees.

The Apple ecosystem integration makes this BNPL scheme unique. Nonstick. No dumb forms.

Frictionless.

Just double-tap the button.

Apple Pay Later was designed with users' financial well-being in mind. Apple makes it easy to use, track, and pay back Apple Pay Later from Wallet.

Apple Pay Later can be signed up in Wallet or when using Apple Pay. Apple Pay Later can be used online or in an app that takes Apple Pay and leverages the Mastercard network.

Apple Pay Order Tracking helps consumers access detailed receipts and order tracking in Wallet for Apple Pay purchases at participating stores.

Bad BNPL suppliers, goodbye.

Most bankers will be caught in Apple's eye playing mini golf in high-rise offices.

The big problem:

Banks still think about features and big numbers just like other smartphone makers did not too long ago.

Apple thinks about effortlessness, seamlessness, and frictionlessness that just work through integrated hardware and software.

Let me know what you think Apple’s next power moves in the banking industry could be.

Jayden Levitt

3 years ago

The country of El Salvador's Bitcoin-obsessed president lost $61.6 million.

It’s only a loss if you sell, right?

Nayib Bukele proclaimed himself “the world’s coolest dictator”.

His jokes aren't clear.

El Salvador's 43rd president self-proclaimed “CEO of El Salvador” couldn't be less presidential.

His thin jeans, aviator sunglasses, and baseball caps like a cartel lord.

He's popular, though.

Bukele won 53% of the vote by fighting violent crime and opposition party corruption.

El Salvador's 6.4 million inhabitants are riding the cryptocurrency volatility wave.

They were powerless.

Their autocratic leader, a former Yamaha Motors salesperson and Bitcoin believer, wants to help 70% unbanked locals.

He intended to give the citizens a way to save money and cut the country's $200 million remittance cost.

Transfer and deposit costs.

This makes logical sense when the president’s theatrics don’t blind you.

El Salvador's Bukele revealed plans to make bitcoin legal tender.

Remittances total $5.9 billion (23%) of the country's expenses.

Anything that reduces costs could boost the economy.

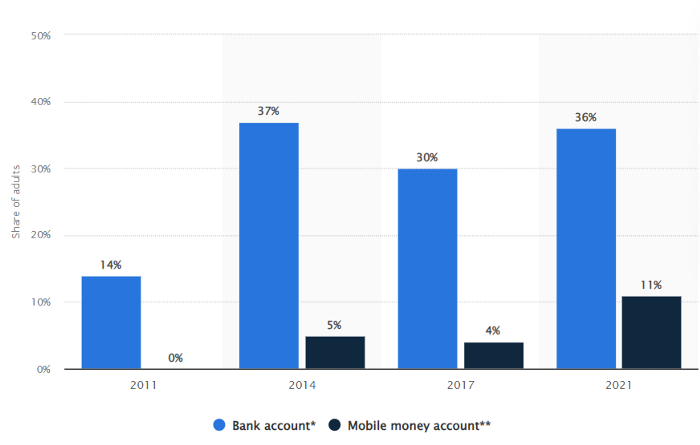

The country’s unbanked population is staggering. Here’s the data by % of people who either have a bank account (Blue) or a mobile money account (Black).

According to Bukele, 46% of the population has downloaded the Chivo Bitcoin Wallet.

In 2021, 36% of El Salvadorans had bank accounts.

Large rural countries like Kenya seem to have resolved their unbanked dilemma.

An economy surfaced where village locals would sell, trade and store network minutes and data as a store of value.

Kenyan phone networks realized unbanked people needed a safe way to accumulate wealth and have an emergency fund.

96% of Kenyans utilize M-PESA, which doesn't require a bank account.

The software involves human agents who hang out with cash and a phone.

These people are like ATMs.

You offer them cash to deposit money in your mobile money account or withdraw cash.

In a country with a faulty banking system, cash availability and a safe place to deposit it are important.

William Jack and Tavneet Suri found that M-PESA brought 194,000 Kenyan households out of poverty by making transactions cheaper and creating a safe store of value.

Mobile money, a service that allows monetary value to be stored on a mobile phone and sent to other users via text messages, has been adopted by most Kenyan households. We estimate that access to the Kenyan mobile money system M-PESA increased per capita consumption levels and lifted 194,000 households, or 2% of Kenyan households, out of poverty.

The impacts, which are more pronounced for female-headed households, appear to be driven by changes in financial behaviour — in particular, increased financial resilience and saving. Mobile money has therefore increased the efficiency of the allocation of consumption over time while allowing a more efficient allocation of labour, resulting in a meaningful reduction of poverty in Kenya.

Currently, El Salvador has 2,301 Bitcoin.

At publication, it's worth $44 million. That remains 41% of Bukele's original $105.6 million.

Unknown if the country has sold Bitcoin, but Bukeles keeps purchasing the dip.

It's still falling.

This might be a fantastic move for the impoverished country over the next five years, if they can live economically till Bitcoin's price recovers.

The evidence demonstrates that a store of value pulls individuals out of poverty, but others say Bitcoin is premature.

You may regard it as an aggressive endeavor to front run the next wave of adoption, offering El Salvador a financial upside.