You Misunderstand the Russian Nuclear Threat

Many believe Putin is simply sabre rattling and intimidating us. They see no threat of nuclear war. We can send NATO troops into Ukraine without risking a nuclear war.

I keep reading that Putin is just using nuclear blackmail and that a strong leader will call the bluff. That, in my opinion, misunderstands the danger of sending NATO into Ukraine.

It assumes that once NATO moves in, Putin can either push the red nuclear button or not.

Sure, Putin won't go nuclear if NATO invades Ukraine. So we're safe? Can't we just move NATO?

No, because history has taught us that wars often escalate far beyond our initial expectations. One domino falls, knocking down another. That's why having clear boundaries is vital. Crossing a seemingly harmless line can set off a chain of events that are unstoppable once started.

One example is WWI. The assassin of Archduke Franz Ferdinand could not have known that his actions would kill millions. They couldn't have known that invading Serbia to punish them for not handing over the accomplices would start a world war. Every action triggered a counter-action, plunging Europe into a brutal and bloody war. Each leader saw their actions as limited, not realizing how they kept the dominos falling.

Nobody can predict the future, but it's easy to imagine how NATO intervention could trigger a chain of events leading to a total war. Let me suggest some outcomes.

NATO creates a no-fly-zone. In retaliation, Russia bombs NATO airfields. Russia may see this as a limited counter-move that shouldn't cause further NATO escalation. They think it's a reasonable response to force NATO out of Ukraine. Nobody has yet thought to use the nuke.

Will NATO act? Polish airfields bombed, will they be stuck? Is this an article 5 event? If so, what should be done?

It could happen. Maybe NATO sends troops into Ukraine to punish Russia. Maybe NATO will bomb Russian airfields.

Putin's response Is bombing Russian airfields an invasion or an attack? Remember that Russia has always used nuclear weapons for defense, not offense. But let's not panic, let's assume Russia doesn't go nuclear.

Maybe Russia retaliates by attacking NATO military bases with planes. Maybe they use ships to attack military targets. How does NATO respond? Will they fight Russia in Ukraine or escalate? Will they invade Russia or attack more military installations there?

Seen the pattern? As each nation responds, smaller limited military operations can grow in scope.

So far, the Russian military has shown that they begin with less brutal methods. As losses and failures increase, brutal means are used. Syria had the same. Assad used chemical weapons and attacked hospitals, schools, residential areas, etc.

A NATO invasion of Ukraine would cost Russia dearly. “Oh, this isn't looking so good, better pull out and finish this war,” do you think? No way. Desperate, they will resort to more brutal tactics. If desperate, Russia has a huge arsenal of ugly weapons. They have nerve agents, chemical weapons, and other nasty stuff.

What happens if Russia uses chemical weapons? What if Russian nerve agents kill NATO soldiers horribly? West calls for retaliation will grow. Will we invade Russia? Will we bomb them?

We are angry and determined to punish war criminal Putin, so NATO tanks may be heading to Moscow. We want vengeance for his chemical attacks and bombing of our cities.

Do you think the distance between that red nuclear button and Putin's finger will be that far once NATO tanks are on their way to Moscow?

We might avoid a nuclear apocalypse. A NATO invasion force or even Western cities may be used by Putin. Not as destructive as ICBMs. Putin may think we won't respond to tactical nukes with a full nuclear counterattack. Why would we risk a nuclear Holocaust by launching ICBMs on Russia?

Maybe. My point is that at every stage of the escalation, one party may underestimate the other's response. This war is spiraling out of control and the chances of a nuclear exchange are increasing. Nobody really wants it.

Fear, anger, and resentment cause it. If Putin and his inner circle decide their time is up, they may no longer care about the rest of the world. We saw it with Hitler. Hitler, seeing the end of his empire, ordered the destruction of Germany. Nobody should win if he couldn't. He wanted to destroy everything, including Paris.

In other words, the danger isn't what happens after NATO intervenes The danger is the potential chain reaction. Gambling has a psychological equivalent. It's best to exit when you've lost less. We humans are willing to take small risks for big rewards. To avoid losses, we are willing to take high risks. Daniel Kahneman describes this behavior in his book Thinking, Fast and Slow.

And so bettors who have lost a lot begin taking bigger risks to make up for it. We get a snowball effect. NATO involvement in the Ukraine conflict is akin to entering a casino and placing a bet. We'll start taking bigger risks as we start losing to Russian retaliation. That's the game's psychology.

It's impossible to stop. So will politicians and citizens from both Russia and the West, until we risk the end of human civilization.

You can avoid spiraling into ever larger bets in the Casino by drawing a hard line and declaring “I will not enter that Casino.” We're doing it now. We supply Ukraine. We send money and intelligence but don't cross that crucial line.

It's difficult to watch what happened in Bucha without demanding NATO involvement. What should we do? Of course, I'm not in charge. I'm a writer. My hope is that people will think about the consequences of the actions we demand. My hope is that you think ahead not just one step but multiple dominos.

More and more, we are driven by our emotions. We cannot act solely on emotion in matters of life and death. If we make the wrong choice, more people will die.

Read the original post here.

More on Current Events

B Kean

3 years ago

Russia's greatest fear is that no one will ever fear it again.

When everyone laughs at him, he's powerless.

1-2-3: Fold your hands and chuckle heartily. Repeat until you're really laughing.

We're laughing at Russia's modern-day shortcomings, if you hadn't guessed.

Watch Good Fellas' laughing scene on YouTube. Ray Liotta, Joe Pesci, and others laugh hysterically in a movie. Laugh at that scene, then think of Putin's macho guy statement on February 24 when he invaded Ukraine. It's cathartic to laugh at his expense.

Right? It makes me feel great that he was convinced the military action will be over in a week. I love reading about Putin's morning speech. Many stupid people on Earth supported him. Many loons hailed his speech historic.

Russia preys on the weak. Strong Ukraine overcame Russia. Ukraine's right. As usual, Russia is in the wrong.

A so-called thought leader recently complained on Russian TV that the West no longer fears Russia, which is why Ukraine is kicking Russia's ass.

Let's simplify for this Russian intellectual. Except for nuclear missiles, the West has nothing to fear from Russia. Russia is a weak, morally-empty country whose DNA has degraded to the point that evolution is already working to flush it out.

The West doesn't fear Russia since he heads a prominent Russian institution. Russian universities are intellectually barren. I taught at St. Petersburg University till June (since February I was virtually teaching) and was astounded by the lack of expertise.

Russians excel in science, math, engineering, IT, and anything that doesn't demand critical thinking or personal ideas.

Reflecting on many of the high-ranking individuals from around the West, Satanovsky said: “They are not interested in us. We only think we’re ‘big politics’ for them but for those guys we’re small politics. “We’re small politics, even though we think of ourselves as the descendants of the Russian Empire, of the USSR. We are not the Soviet Union, we don’t have enough weirdos and lunatics, we practically don’t have any (U.S. Has Stopped Fearing Us).”

Professor Dmitry Evstafiev, president of the Institute of the Middle East, praised Nikita Khrushchev's fiery nature because he made the world fear him, which made the Soviet Union great. If the world believes Putin is crazy, then Russia will be great, says this man. This is crazy.

Evstafiev covered his cowardice by saluting Putin. He praised his culture and Ukraine patience. This weakling professor ingratiates himself to Putin instead of calling him a cowardly, demonic shithead.

This is why we don't fear Russia, professor. Because you're all sycophantic weaklings who sold your souls to a Leningrad narcissist. Putin's nothing. He lacks intelligence. You've tied your country's fate and youth's future to this terrible monster. Disgraceful!

How can you loathe your country's youth so much to doom them to decades or centuries of ignominy? My son is half Russian and must now live with this portion of him.

We don't fear Russia because you don't realize that it should be appreciated, not frightened. That would need lobotomizing tens of millions of people like you.

Sadman. You let a Leningrad weakling castrate you and display your testicles. He shakes the container, saying, "Your balls are mine."

Why is Russia not feared?

Your self-inflicted national catastrophe is hilarious. Sadly, it's laugh-through-tears.

Steve QJ

3 years ago

Putin's War On Reality

The dictator's playbook.

Stalin's successor, Nikita Khrushchev, delivered a speech titled "On The Cult Of Personality And Its Consequences" in 1956, three years after Stalin’s death.

It was Stalin's grave abuse of power that caused untold harm to our party.

Stalin acted not by persuasion, explanation, or patient cooperation, but by imposing his ideas and demanding absolute obedience. […]

See where Stalin's mania for greatness led? He had lost all sense of reality.

The speech, which was never made public, shook the Soviet Union and the Soviet Bloc. After Stalin's "cult of personality" was exposed as a lie, only reality remained.

As I've watched the nightmare unfold in Ukraine, I'm reminded of that question. Primarily by Putin's repeated denials.

His odd claim that Ukraine is run by drug addicts and Nazis (especially strange given that Volodymyr Zelenskyy, the Ukrainian president, is Jewish). Others attempt to portray Russia as liberators rather than occupiers. For example, he portrays Luhansk and Donetsk as plucky, newly independent states when they have been totalitarian statelets for 8 years.

Putin seemed to have lost all sense of reality.

Maybe that's why his remarks to an oligarchs' gathering stood out:

Everything is a desperate measure. They gave us no choice. We couldn't do anything about their security risks. […] They could have put the country in jeopardy.

This is almost certainly true from Putin's perspective. Even for Putin, a military invasion seems unlikely. So, what exactly is putting Russia's security in jeopardy? How could Ukraine's independence endanger Russia's existence?

The truth is the only thing that truly terrifies leaders like these.

Trump, the president of “alternative facts,” "and “fake news” praised Putin's fabricated justifications for the Ukraine invasion. Russia tightened news censorship as news of their losses came in. It's no accident that modern dictatorships like Russia (and China and North Korea) restrict citizens' access to information.

Controlling what people see, hear, and think is the simplest method. And Ukraine's recent efforts to join the European Union showed a country whose thoughts Putin couldn't control. With the Russian and Ukrainian peoples so close, he could not control their reality.

He appears to think this is a threat worth fighting NATO over.

It's easy to disown history's great dictators. By the magnitude of their harm. But the strategy they used is still in use today, albeit not to the same devastating effect.

The Kim dynasty in North Korea has ruled for 74 years, Putin has ruled Russia for 19 years (using loopholes and even rewriting the constitution).

“Politicians and diapers must be changed frequently,” said Mark Twain. "And for the same reason.”

When their egos are threatened, they sabre-rattle, as in Kim Jong-un and Donald Trump's famous spat about the size of their...ahem, “nuclear buttons”." Or Putin's threats of mutual destruction this weekend.

Most importantly, they have cult-like control over their followers.

When a leader whose power is built on lies feels he is losing control of the narrative, things like Trump's Jan. 6 meltdown and Putin's current actions in Ukraine are unavoidable.

Leaders who try to control their people's reality will have to die to keep the illusion alive.

Long version of this post available here

B Kean

3 years ago

To prove his point, Putin is prepared to add 200,000 more dead soldiers.

What does Ukraine's murderous craziness mean?

Vladimir Putin expressed his patience to Israeli Prime Minister Naftali Bennet. Thousands, even hundreds of thousands of young and middle-aged males in his country have no meaning to him.

During a meeting in March with Prime Minister Naftali Bennett of Israel, Mr. Putin admitted that the Ukrainians were tougher “than I was told,” according to two people familiar with the exchange. “This will probably be much more difficult than we thought. But the war is on their territory, not ours. We are a big country and we have patience (The Inside Story of a Catastrophe).”

Putin should explain to Russian mothers how patient he is with his invasion of Ukraine.

Putin is rich. Even while sanctions have certainly limited Putin's access to his fortune, he has access to everything in Russia. Unlimited wealth.

The Russian leader's infrastructure was designed with his whims in mind. Vladimir Putin is one of the wealthiest and most catered-to people alive. He's also all-powerful, as his lack of opposition shows. His incredible wealth and power have isolated him from average people so much that he doesn't mind turning lives upside down to prove a point.

For many, losing a Russian spouse or son is painful. Whether the soldier was a big breadwinner or unemployed, the loss of a male figure leaves many families bewildered and anxious. Putin, Russia's revered president, seems unfazed.

People who know Mr. Putin say he is ready to sacrifice untold lives and treasure for as long as it takes, and in a rare face-to-face meeting with the Americans last month the Russians wanted to deliver a stark message to President Biden: No matter how many Russian soldiers are killed or wounded on the battlefield, Russia will not give up (The Inside Story of a Catastrophe).

Imagine a country's leader publicly admitting a mistake he's made. Imagine getting Putin's undivided attention.

So, I underestimated Ukrainians. I can't allow them make me appear terrible, so I'll utilize as many drunken dopes as possible to cover up my error. They'll die fulfilled and heroic.

Russia's human resources are limited, but its willingness to cause suffering is not. How many Russian families must die before the curse is broken? If mass protests started tomorrow, Russia's authorities couldn't stop them.

When Moscovites faced down tanks in August 1991, the Gorbachev coup ended in three days. Even though few city residents showed up, everything collapsed. This wicked disaster won't require many Russians.

One NATO member is warning allies that Mr. Putin is ready to accept the deaths or injuries of as many as 300,000 Russian troops — roughly three times his estimated losses so far.

If 100,000 Russians have died in Ukraine and Putin doesn't mind another 200,000 dying, why don't these 200,000 ghosts stand up and save themselves? Putin plays the role of concerned and benevolent leader effectively, but things aren't going well for Russia.

What would 300,000 or more missing men signify for Russia's future? How many kids will have broken homes? How many families won't form, and what will the economy do?

Putin reportedly cared about his legacy. His place in Russian history Putin's invasion of Ukraine settled his legacy. He has single-handedly weakened and despaired Russia since the 1980s.

Putin will be viewed by sensible people as one of Russia's worst adversaries, but Russians will think he was fantastic despite Ukraine.

The more setbacks Mr. Putin endures on the battlefield, the more fears grow over how far he is willing to go. He has killed tens of thousands in Ukraine, leveled cities, and targeted civilians for maximum pain — obliterating hospitals, schools, and apartment buildings while cutting off power and water to millions before winter. Each time Ukrainian forces score a major blow against Russia, the bombing of their country intensifies. And Mr. Putin has repeatedly reminded the world that he can use anything at his disposal, including nuclear arms, to pursue his notion of victory.

How much death and damage will there be in Ukraine if Putin sends 200,000 more Russians to the front? It's scary, sad, and sick.

Monster.

You might also like

shivsak

3 years ago

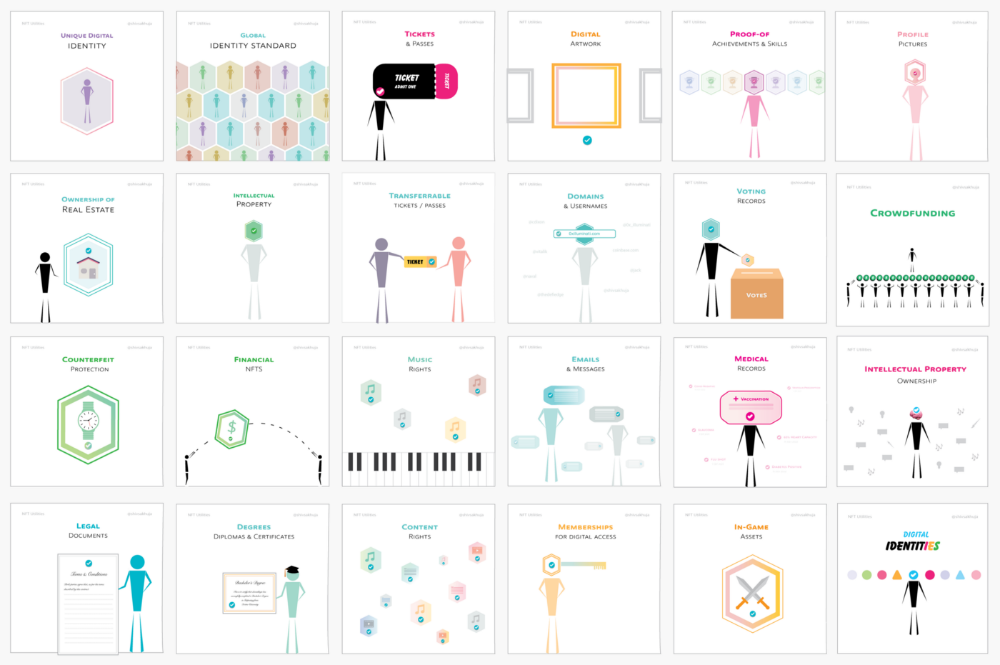

A visual exploration of the REAL use cases for NFTs in the Future

In this essay, I studied REAL NFT use examples and their potential uses.

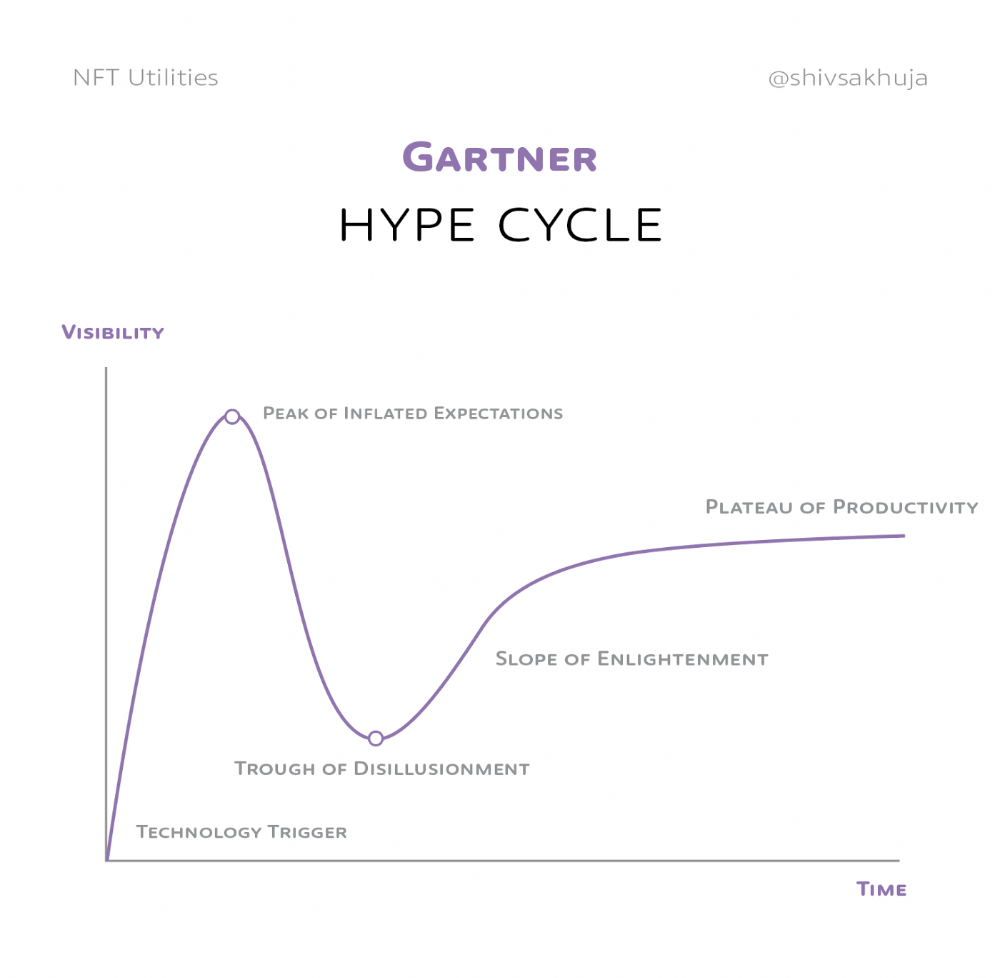

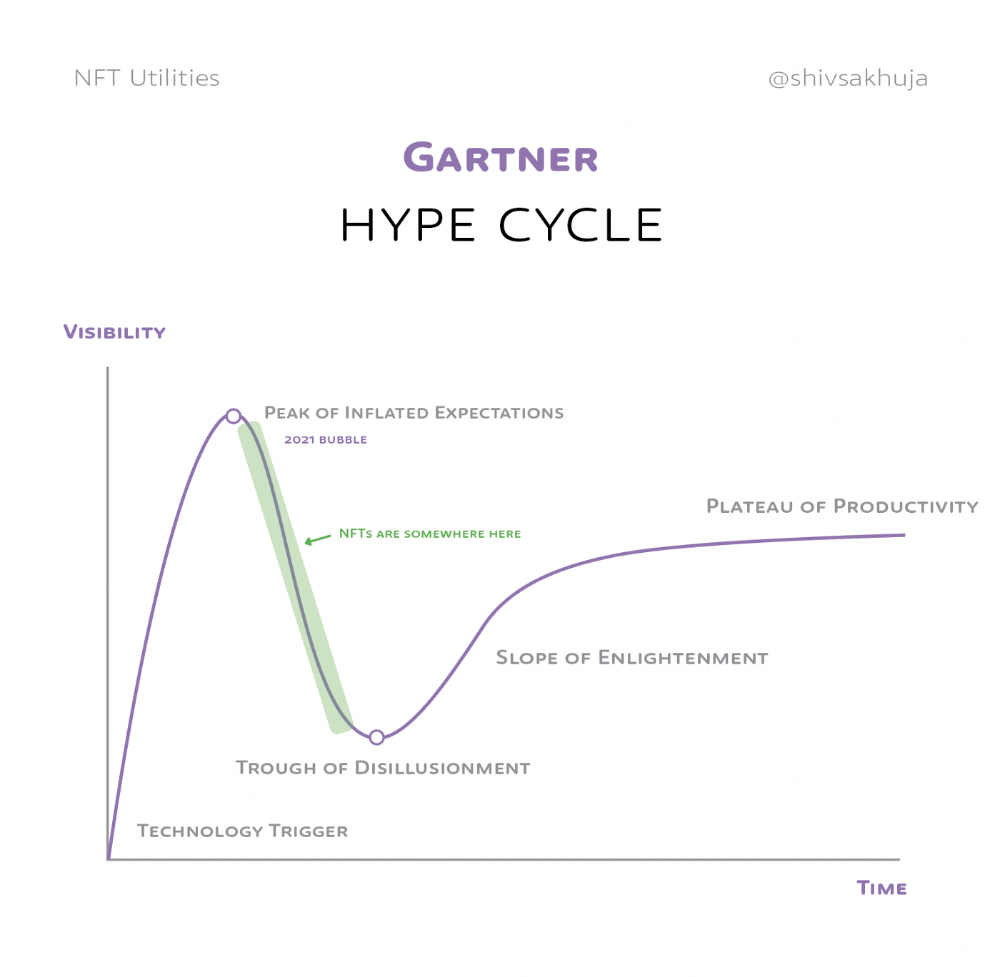

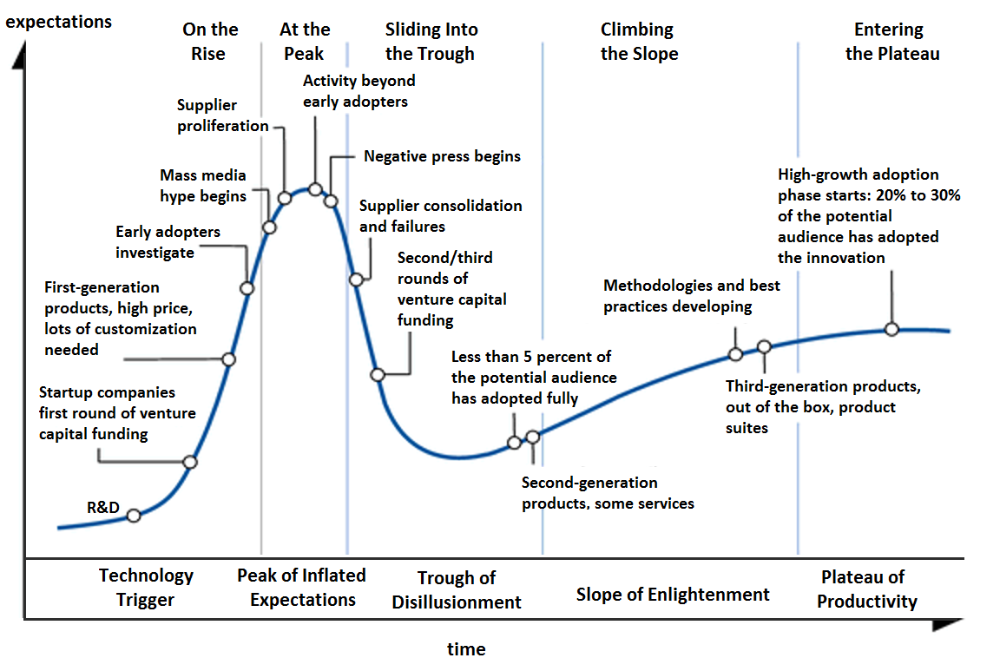

Knowledge of the Hype Cycle

Gartner's Hype Cycle.

It proposes 5 phases for disruptive technology.

1. Technology Trigger: the emergence of potentially disruptive technology.

2. Peak of Inflated Expectations: Early publicity creates hype. (Ex: 2021 Bubble)

3. Trough of Disillusionment: Early projects fail to deliver on promises and the public loses interest. I suspect NFTs are somewhere around this trough of disillusionment now.

4. Enlightenment slope: The tech shows successful use cases.

5. Plateau of Productivity: Mainstream adoption has arrived and broader market applications have proven themselves. Here’s a more detailed visual of the Gartner Hype Cycle from Wikipedia.

In the speculative NFT bubble of 2021, @beeple sold Everydays: the First 5000 Days for $69 MILLION in 2021's NFT bubble.

@nbatopshot sold millions in video collectibles.

This is when expectations peaked.

Let's examine NFTs' real-world applications.

Watch this video if you're unfamiliar with NFTs.

Online Art

Most people think NFTs are rich people buying worthless JPEGs and MP4s.

Digital artwork and collectibles are revolutionary for creators and enthusiasts.

NFT Profile Pictures

You might also have seen NFT profile pictures on Twitter.

My profile picture is an NFT I coined with @skogards factoria app, which helps me avoid bogus accounts.

Profile pictures are a good beginning point because they're unique and clearly yours.

NFTs are a way to represent proof-of-ownership. It’s easier to prove ownership of digital assets than physical assets, which is why artwork and pfps are the first use cases.

They can do much more.

NFTs can represent anything with a unique owner and digital ownership certificate. Domains and usernames.

Usernames & Domains

@unstoppableweb, @ensdomains, @rarible sell NFT domains.

NFT domains are transferable, which is a benefit.

Godaddy and other web2 providers have difficult-to-transfer domains. Domains are often leased instead of purchased.

Tickets

NFTs can also represent concert tickets and event passes.

There's a limited number, and entry requires proof.

NFTs can eliminate the problem of forgery and make it easy to verify authenticity and ownership.

NFT tickets can be traded on the secondary market, which allows for:

marketplaces that are uniform and offer the seller and buyer security (currently, tickets are traded on inefficient markets like FB & craigslist)

unbiased pricing

Payment of royalties to the creator

4. Historical ticket ownership data implies performers can airdrop future passes, discounts, etc.

5. NFT passes can be a fandom badge.

The $30B+ online tickets business is increasing fast.

NFT-based ticketing projects:

Gaming Assets

NFTs also help in-game assets.

Imagine someone spending five years collecting a rare in-game blade, then outgrowing or quitting the game. Gamers value that collectible.

The gaming industry is expected to make $200 BILLION in revenue this year, a significant portion of which comes from in-game purchases.

Royalties on secondary market trading of gaming assets encourage gaming businesses to develop NFT-based ecosystems.

Digital assets are the start. On-chain NFTs can represent real-world assets effectively.

Real estate has a unique owner and requires ownership confirmation.

Real Estate

Tokenizing property has many benefits.

1. Can be fractionalized to increase access, liquidity

2. Can be collateralized to increase capital efficiency and access to loans backed by an on-chain asset

3. Allows investors to diversify or make bets on specific neighborhoods, towns or cities +++

I've written about this thought exercise before.

I made an animated video explaining this.

We've just explored NFTs for transferable assets. But what about non-transferrable NFTs?

SBTs are Soul-Bound Tokens. Vitalik Buterin (Ethereum co-founder) blogged about this.

NFTs are basically verifiable digital certificates.

Diplomas & Degrees

That fits Degrees & Diplomas. These shouldn't be marketable, thus they can be non-transferable SBTs.

Anyone can verify the legitimacy of on-chain credentials, degrees, abilities, and achievements.

The same goes for other awards.

For example, LinkedIn could give you a verified checkmark for your degree or skills.

Authenticity Protection

NFTs can also safeguard against counterfeiting.

Counterfeiting is the largest criminal enterprise in the world, estimated to be $2 TRILLION a year and growing.

Anti-counterfeit tech is valuable.

This is one of @ORIGYNTech's projects.

Identity

Identity theft/verification is another real-world problem NFTs can handle.

In the US, 15 million+ citizens face identity theft every year, suffering damages of over $50 billion a year.

This isn't surprising considering all you need for US identity theft is a 9-digit number handed around in emails, documents, on the phone, etc.

Identity NFTs can fix this.

NFTs are one-of-a-kind and unforgeable.

NFTs offer a universal standard.

NFTs are simple to verify.

SBTs, or non-transferrable NFTs, are tied to a particular wallet.

In the event of wallet loss or theft, NFTs may be revoked.

This could be one of the biggest use cases for NFTs.

Imagine a global identity standard that is standardized across countries, cannot be forged or stolen, is digital, easy to verify, and protects your private details.

Since your identity is more than your government ID, you may have many NFTs.

@0xPolygon and @civickey are developing on-chain identity.

Memberships

NFTs can authenticate digital and physical memberships.

Voting

NFT IDs can verify votes.

If you remember 2020, you'll know why this is an issue.

Online voting's ease can boost turnout.

Informational property

NFTs can protect IP.

This can earn creators royalties.

NFTs have 2 important properties:

Verifiability IP ownership is unambiguously stated and publicly verified.

Platforms that enable authors to receive royalties on their IP can enter the market thanks to standardization.

Content Rights

Monetization without copyrighting = more opportunities for everyone.

This works well with the music.

Spotify and Apple Music pay creators very little.

Crowdfunding

Creators can crowdfund with NFTs.

NFTs can represent future royalties for investors.

This is particularly useful for fields where people who are not in the top 1% can’t make money. (Example: Professional sports players)

Mirror.xyz allows blog-based crowdfunding.

Financial NFTs

This introduces Financial NFTs (fNFTs). Unique financial contracts abound.

Examples:

a person's collection of assets (unique portfolio)

A loan contract that has been partially repaid with a lender

temporal tokens (ex: veCRV)

Legal Agreements

Not just financial contracts.

NFT can represent any legal contract or document.

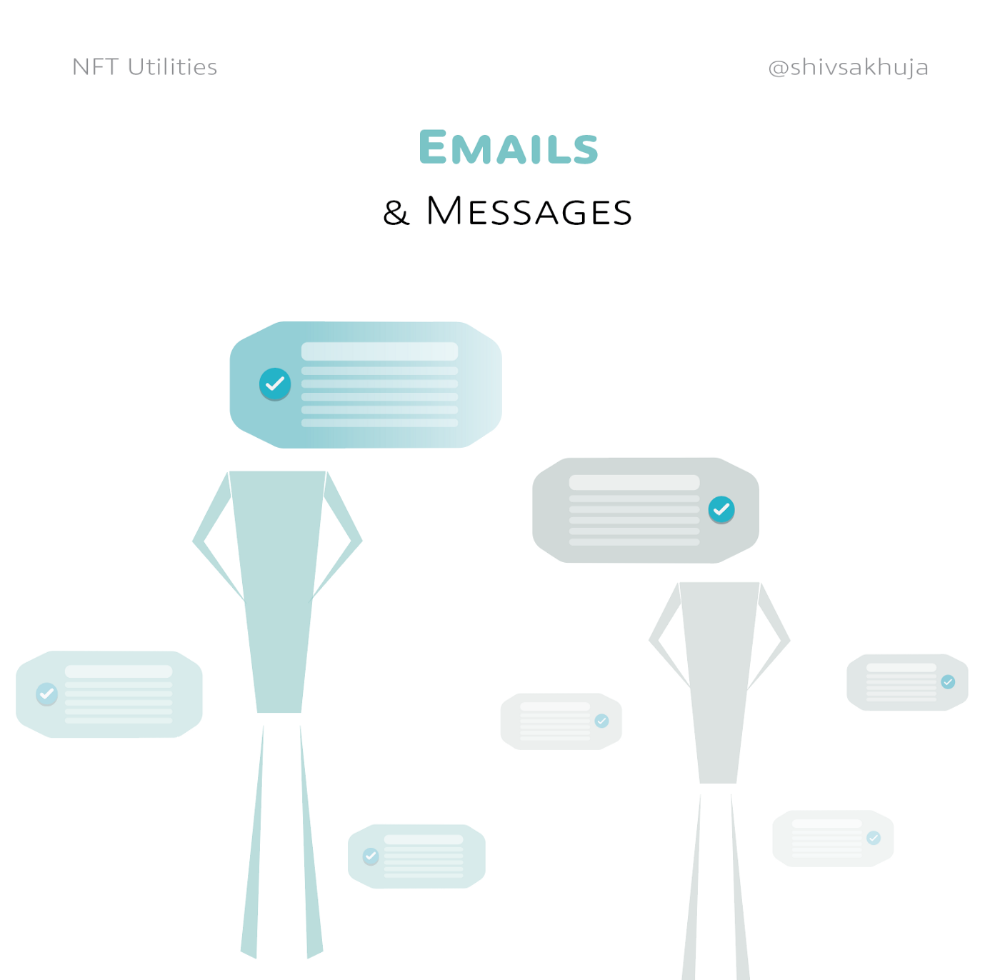

Messages & Emails

What about other agreements? Verbal agreements through emails and messages are likewise unique, but they're easily lost and fabricated.

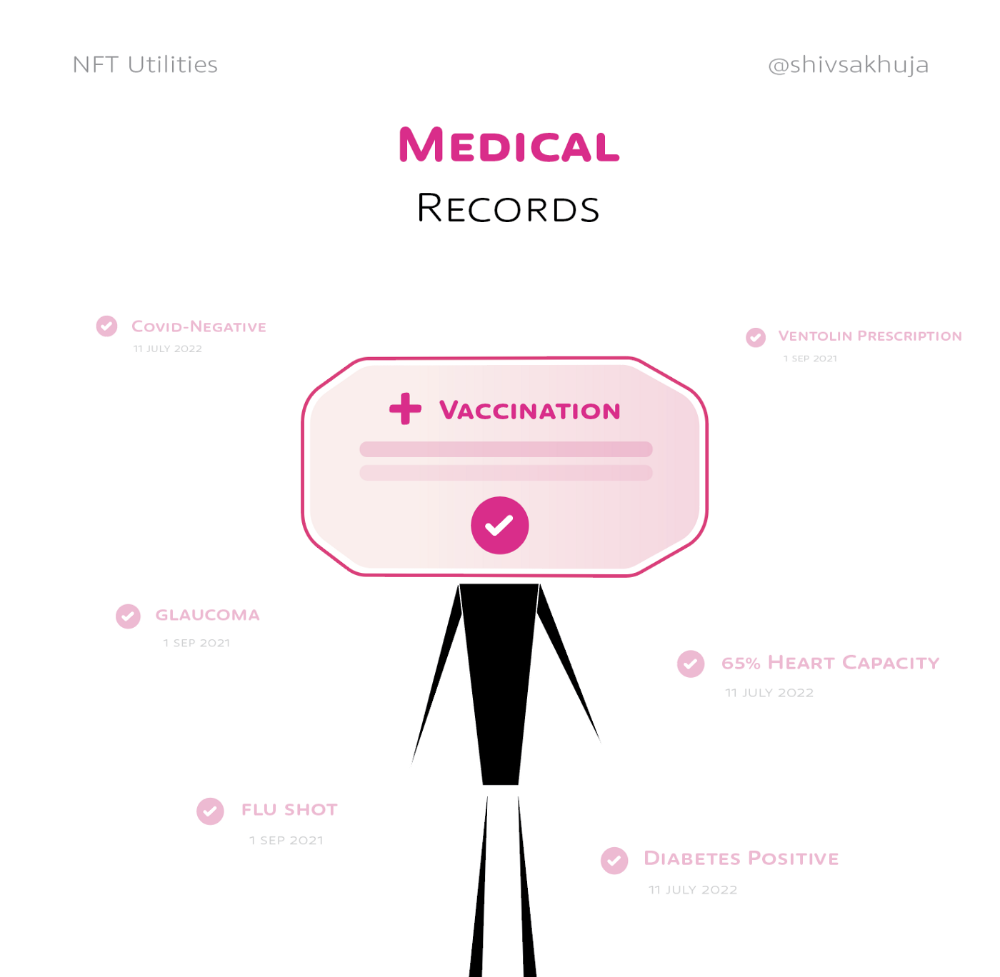

Health Records

Medical records or prescriptions are another types of documentation that has to be verified but isn't.

Medical NFT examples:

Immunization records

Covid test outcomes

Prescriptions

health issues that may affect one's identity

Observations made via health sensors

Existing systems of proof by paper / PDF have photoshop-risk.

I tried to include most use scenarios, but this is just the beginning.

NFTs have many innovative uses.

For example: @ShaanVP minted an NFT called “5 Minutes of Fame” 👇

Here are 2 Twitter threads about NFTs:

This piece of gold by @chriscantino

2. This conversation between @punk6529 and @RaoulGMI on @RealVision“The World According to @punk6529”

If you're wondering why NFTs are better than web2 databases for these use scenarios, see this Twitter thread I wrote:

If you liked this, please share it.

Tim Denning

3 years ago

Bills are paid by your 9 to 5. 6 through 12 help you build money.

40 years pass. After 14 years of retirement, you die. Am I the only one who sees the problem?

I’m the Jedi master of escaping the rat race.

Not to impress. I know this works since I've tried it. Quitting a job to make money online is worse than Kim Kardashian's internet-burning advice.

Let me help you rethink the move from a career to online income to f*ck you money.

To understand why a job is a joke, do some life math.

Without a solid why, nothing makes sense.

The retirement age is 65. Our processed food consumption could shorten our 79-year average lifespan.

You spend 40 years working.

After 14 years of retirement, you die.

Am I alone in seeing the problem?

Life is too short to work a job forever, especially since most people hate theirs. After-hours skills are vital.

Money equals unrestricted power, f*ck you.

F*ck you money is the answer.

Jack Raines said it first. He says we can do anything with the money. Jack, a young rebel straight out of college, can travel and try new foods.

F*ck you money signifies not checking your bank account before buying.

F*ck you” money is pure, unadulterated freedom with no strings attached.

Jack claims you're rich when you rarely think about money.

Avoid confusion.

This doesn't imply you can buy a Lamborghini. It indicates your costs, income, lifestyle, and bank account are balanced.

Jack established an online portfolio while working for UPS in Atlanta, Georgia. So he gained boundless power.

The portion that many erroneously believe

Yes, you need internet abilities to make money, but they're not different from 9-5 talents.

Sahil Lavingia, Gumroad's creator, explains.

A job is a way to get paid to learn.

Mistreat your boss 9-5. Drain his skills. Defuse him. Love and leave him (eventually).

Find another employment if yours is hazardous. Pick an easy job. Make sure nothing sneaks into your 6-12 time slot.

The dumb game that makes you a sheep

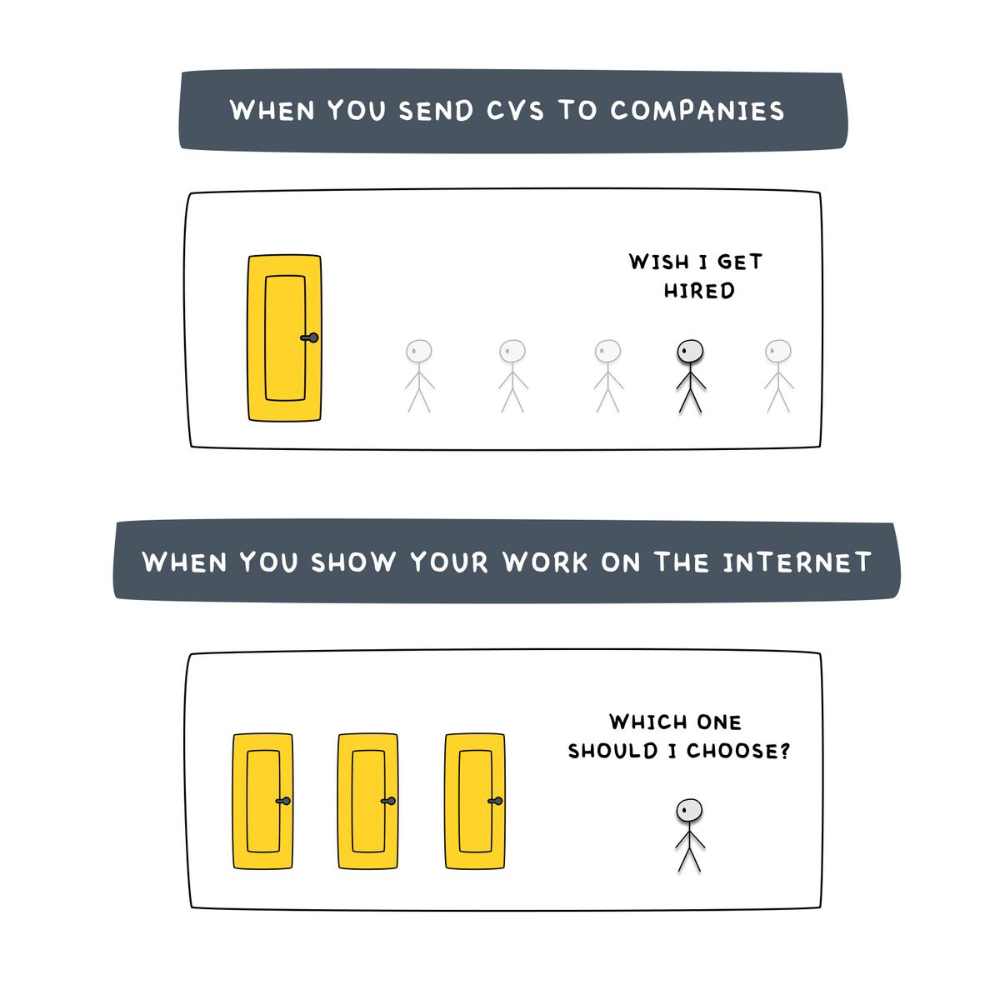

A 9-5 job requires many job interviews throughout life.

You email your résumé to employers and apply for jobs through advertisements. This game makes you a sheep.

You're competing globally. Work-from-home makes the competition tougher. If you're not the cheapest, employers won't hire you.

After-hours online talents (say, 6 pm-12 pm) change the game. This graphic explains it better:

Online talents boost after-hours opportunities.

You go from wanting to be picked to picking yourself. More chances equal more money. Your f*ck you fund gets the extra cash.

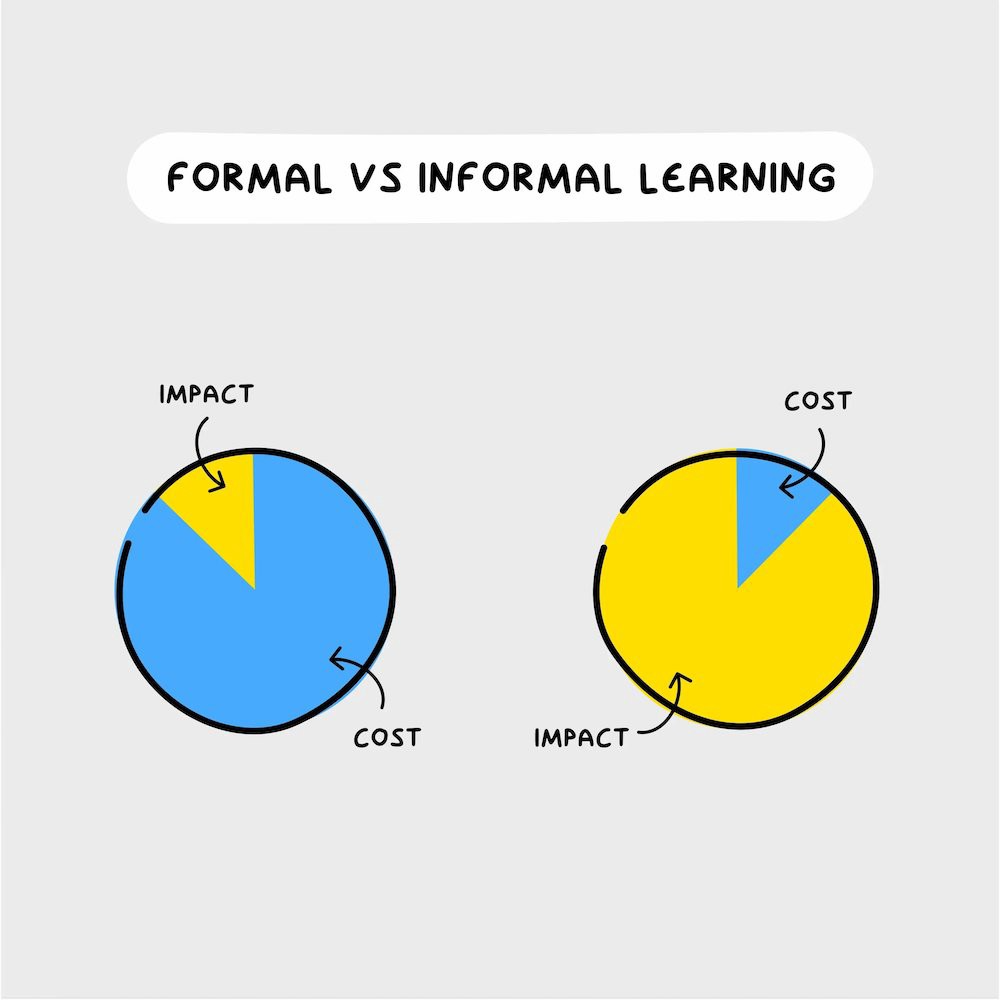

A novel method of learning is essential.

College costs six figures and takes a lifetime to repay.

Informal learning is distinct. 6-12pm:

Observe the carefully controlled Twitter newsfeed.

Make use of Teachable and Gumroad's online courses.

Watch instructional YouTube videos

Look through the top Substack newsletters.

Informal learning is more effective because it's not obvious. It's fun to follow your curiosity and hobbies.

The majority of people lack one attitude. It's simple to learn.

One big impediment stands in the way of f*ck you money and time independence. So often.

Too many people plan after 6-12 hours. Dreaming. Big-thinkers. Strategically. They fill their calendar with meetings.

This is after-hours masturb*tion.

Sahil Bloom reminded me that a bias towards action will determine if this approach works for you.

The key isn't knowing what to do from 6-12 a.m. Trust yourself and develop abilities as you go. It's for building the parachute after you jump.

Sounds risky. We've eliminated the risk by finishing this process after hours while you work 9-5.

With no risk, you can have an I-don't-care attitude and still be successful.

When you choose to move forward, this occurs.

Once you try 9-5/6-12, you'll tell someone.

It's bad.

Few of us hang out with problem-solvers.

It's how much of society operates. So they make reasons so they can feel better about not giving you money.

Matthew Kobach told me chasing f*ck you money is easier with like-minded folks.

Without f*ck you money friends, loneliness will take over and you'll think you've messed up when you just need to keep going.

Steal this easy guideline

Let's act. No more fluffing and caressing.

1. Learn

If you detest your 9-5 talents or don't think they'll work online, get new ones. If you're skilled enough, continue.

Easlo recommends these skills:

Designer for Figma

Designer Canva

bubble creators

editor in Photoshop

Automation consultant for Zapier

Designer of Webflow

video editor Adobe

Ghostwriter for Twitter

Idea consultant

Artist in Blender Studio

2. Develop the ability

Every night from 6-12, apply the skill.

Practicing ghostwriting? Write someone's tweets for free. Do someone's website copy to learn copywriting. Get a website to the top of Google for a keyword to understand SEO.

Free practice is crucial. Your 9-5 pays the money, so work for free.

3. Take off stealthily like a badass

Another mistake. Sell to few. Don't be the best. Don't claim expertise.

Sell your new expertise to others behind you.

Two ways:

Using a digital good

By providing a service,

Point 1 also includes digital service examples. Digital products include eBooks, communities, courses, ad-supported podcasts, and templates. It's easy. Your 9-5 job involves one of these.

Take ideas from work.

Why? They'll steal your time for profit.

4. Iterate while feeling awful

First-time launches always fail. You'll feel terrible. Okay. Remember your 9-5?

Find improvements. Ask free and paying consumers what worked.

Multiple relaunches, each 1% better.

5. Discover more

Never stop learning. Improve your skill. Add a relevant skill. Learn copywriting if you write online.

After-hours students earn the most.

6. Continue

Repetition is key.

7. Make this one small change.

Consistently. The 6-12 momentum won't make you rich in 30 days; that's success p*rn.

Consistency helps wage slaves become f*ck you money. Most people can't switch between the two.

Putting everything together

It's easy. You're probably already doing some.

This formula explains why, how, and what to do. It's a 5th-grade-friendly blueprint. Good.

Reduce financial risk with your 9-to-5. Replace Netflix with 6-12 money-making talents.

Life is short; do whatever you want. Today.

Nik Nicholas

3 years ago

A simple go-to-market formula

“Poor distribution, not poor goods, is the main reason for failure” — Peter Thiel.

Here's an easy way to conceptualize "go-to-market" for your distribution plan.

One equation captures the concept:

Distribution = Ecosystem Participants + Incentives

Draw your customers' ecosystem. Set aside your goods and consider your consumer's environment. Who do they deal with daily?

First, list each participant. You want an exhaustive list, but here are some broad categories.

In-person media services

Websites

Events\Networks

Financial education and banking

Shops

Staff

Advertisers

Twitter influencers

Draw influence arrows. Who's affected? I'm not just talking about Instagram selfie-posters. Who has access to your consumer and could promote your product if motivated?

The thicker the arrow, the stronger the relationship. Include more "influencers" if needed. Customer ecosystems are complex.

3. Incentivize ecosystem players. “Show me the incentive and I will show you the result.“, says Warren Buffet's business partner Charlie Munger.

Strong distribution strategies encourage others to promote your product to your target market by incentivizing the most prominent players. Incentives can be financial or non-financial.

Financial rewards

Usually, there's money. If you pay Facebook, they'll run your ad. Salespeople close deals for commission. Giving customers bonus credits will encourage referrals.

Most businesses underuse non-financial incentives.

Non-cash incentives

Motivate key influencers without spending money to expand quickly and cheaply. What can you give a client-connector for free?

Here are some ideas:

Are there any other features or services available?

Titles or status? Tinder paid college "ambassadors" for parties to promote its dating service.

Can I get early/free access? Facebook gave a select group of developers "exclusive" early access to their AR platform.

Are you a good host? Pharell performed at YPlan's New York launch party.

Distribution? Apple's iPod earphones are white so others can see them.

Have an interesting story? PR rewards journalists by giving them a compelling story to boost page views.

Prioritize distribution.

More time spent on distribution means more room in your product design and business plan. Once you've identified the key players in your customer's ecosystem, talk to them.

Money isn't your only resource. Creative non-monetary incentives may be more effective and scalable. Give people something useful and easy to deliver.